Attached files

| file | filename |

|---|---|

| 8-K - CTWS FORM 8-K - CONNECTICUT WATER SERVICE INC / CT | form_8-k.htm |

Connecticut Water Service, Inc

New York Society of Security Analysts

December 1, 2010

Forward Looking Statements

Except for the historical statements and

discussions, some statements contained in this

report constitute “forward looking statements”

within the meaning of Section 27A of the Securities

Act of 1933 and Section 21E of the Securities

Exchange Act of 1934. These forward looking

statements are based on current expectations and

rely on a number of assumptions concerning future

events, and are subject to a number of

uncertainties and other factors, many of which are

outside our control, that could cause actual results

to differ materially from such statements.

discussions, some statements contained in this

report constitute “forward looking statements”

within the meaning of Section 27A of the Securities

Act of 1933 and Section 21E of the Securities

Exchange Act of 1934. These forward looking

statements are based on current expectations and

rely on a number of assumptions concerning future

events, and are subject to a number of

uncertainties and other factors, many of which are

outside our control, that could cause actual results

to differ materially from such statements.

• NASDAQ: CTWS

• Subsidiaries:

– Connecticut Water Company (Regulated)

– New England Water Utility Services, Inc.

(Unregulated)

(Unregulated)

• Market Capitalization: $215 Million

• Current Dividend and Yield:

$0.93, 3.8%

• S&P Rating: A Stable

Connecticut Water Service, Inc.

• Organized in 1956

• 55 Towns

• Serving 300,000 people

• 200 Employees

Connecticut Water Company

Service Area Profile

• 4 Regions in Connecticut

– Non-contiguous

– Unregulated penetration

– Consolidation opportunities

• 500 community systems

• 100 municipal/public authority

• 75% serve less than 500 people

• 6 month regulatory lag

• Active commissioners

• WICA

• Regulatory strategy - engage & educate

Connecticut DPUC

Water Touches Everything

We Care About…

We Care About…

Water Touches Everything

We Care About…

We Care About…

Our Strategy…

• Infrastructure Investment

• Acquisitions

• Utility Services

Infrastructure

Philosophy:

– Invest capital in

infrastructure

infrastructure

– Minimize investment vs.

recovery time

recovery time

– Seek to leverage with

growth

growth

– Manage operating costs

efficiently

efficiently

Infrastructure

• Traditional Rate Cases

– $10.9 million (22%) 2006

• 2006 marked 1st case in 15

years

years

• 2006 case allowed for

re-opener

$15 million capital

improvement in 2007

improvement in 2007

– $8 million (13%) 2010

WICA

(Water Infrastructure Conservation Adjustment)

(Water Infrastructure Conservation Adjustment)

• DSIC - type infrastructure

recovery mechanism

– 5% annual cap

– 7.5% maximum adjustment

• $13 - 15 million per year in

pipeline replacement

• Pending surcharge anticipated 1.6% (1/11)

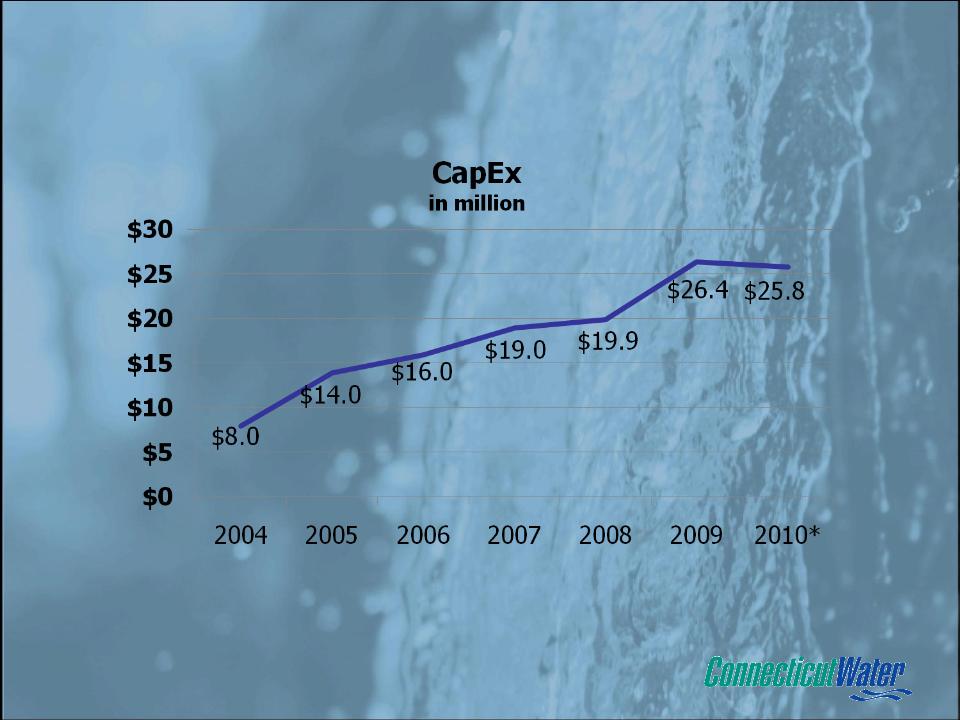

Capital Expenditures

* 2010 Estimated

• Acquire Water &

Waste Water Systems

• Connecticut

• Atlantic Coast States

• Fair Regulation

• 60 Acquisitions in 20 years

Utility Services

• 80 client contracts

– O&M

– Leak Detection

– Compliance Reporting

• University of Connecticut

Linebacker®

Service Line Protection

Service Line Protection

Renewal Rate

>90%

Percent of residential

customers enrolled

customers enrolled

• High Quality Water

• Responsive and Courteous Service

• Efficient & Effectively

Delivered

• Environmental Stewardship

• Customer Satisfaction!

• Investment in Technology

• H2O Assistance Program

• Temporary Rate Reduction

• World Class Customer Service -

>85% satisfaction 4 years in a row

Customer Service

• Leadership is a privilege

• Trust based

• Team & service oriented

• Professionals

• “Satisfied Employees

Satisfy Customers”

• Employee Satisfaction

– Executive Compensation Metric

Employee Strategy

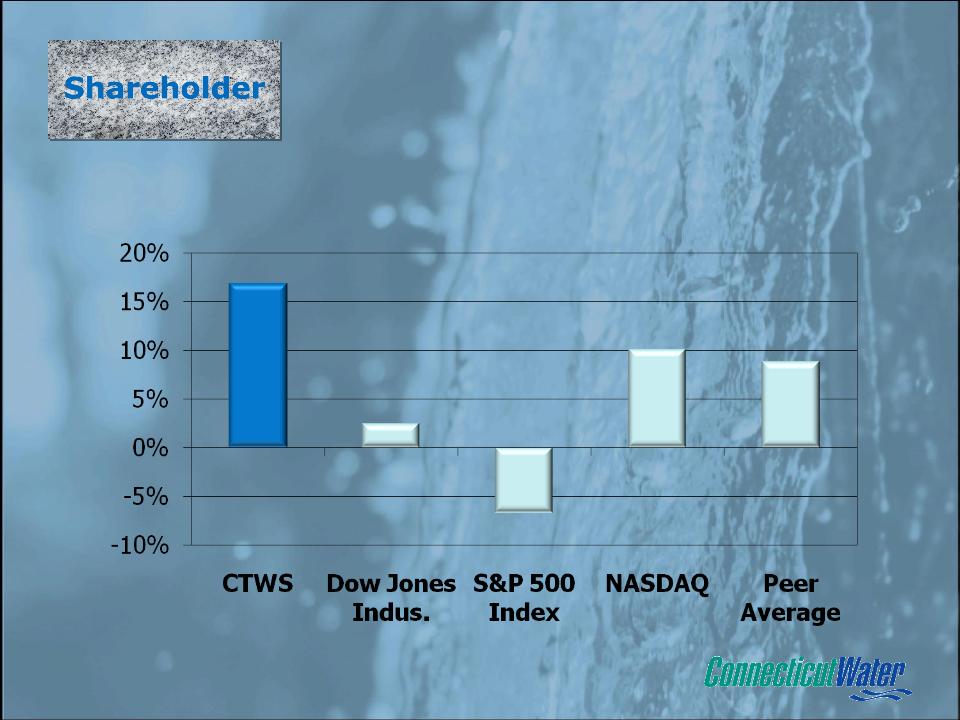

Shareholder Strategy

• Strong Dividend Yield

• High Earnings Quality

• Strong Balance Sheet

Performance

• High Earnings Quality

– 90% of Revenues, 95% of

Earnings from regulated business

• Strong Balance Sheet

– LTD 5.5% Embedded Cost

– Balanced Debt-Equity ratio

– Access to Capital Doubled

– S & P Rating “A”

Performance

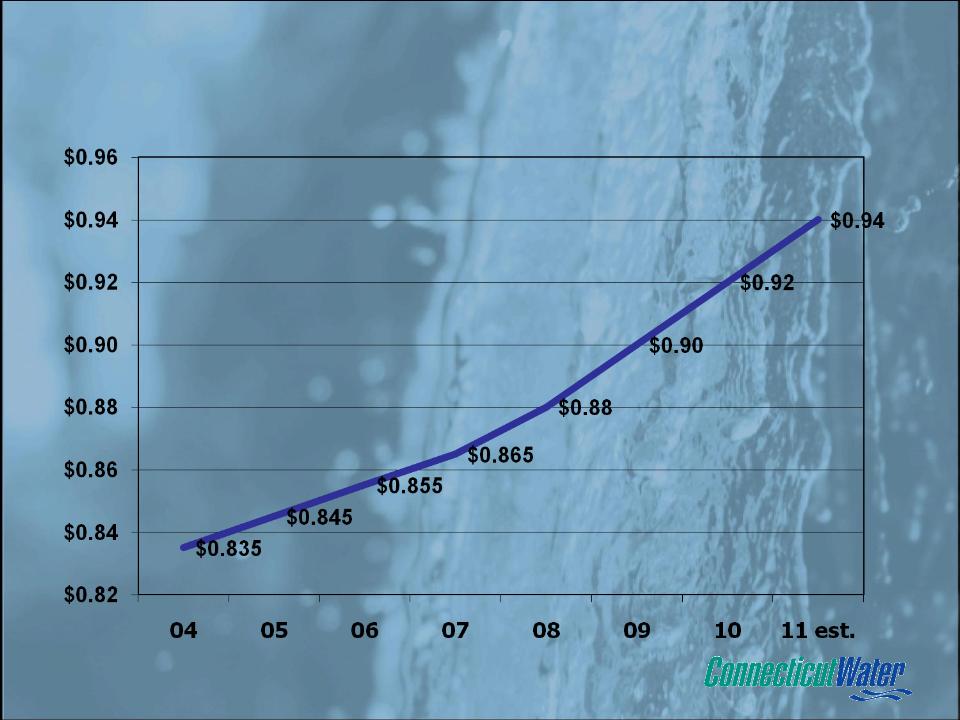

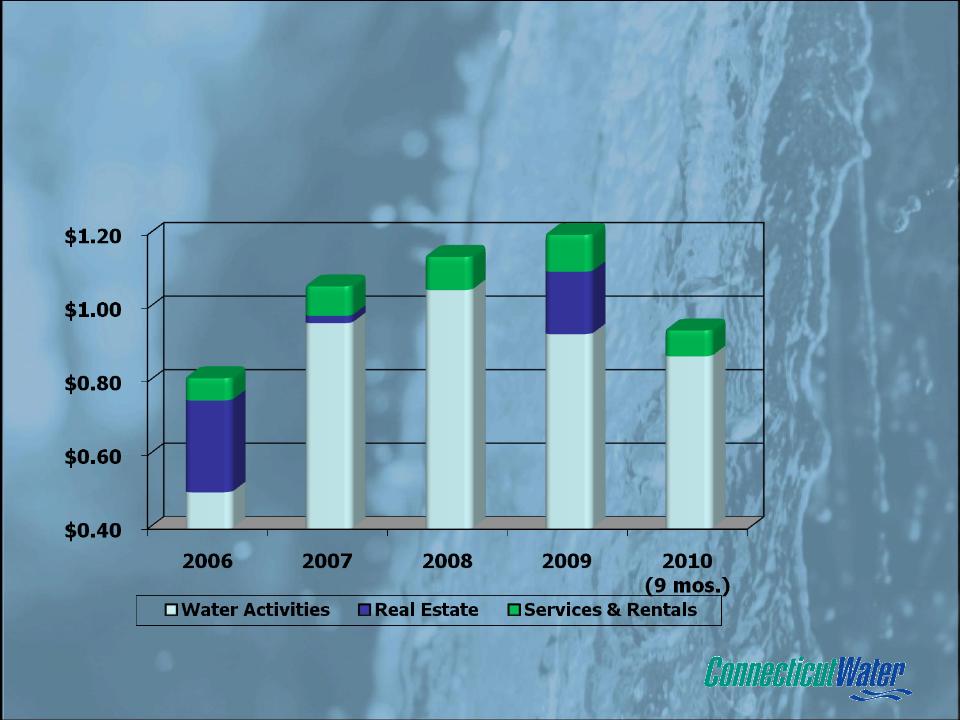

5 Year Financial Performance

Total Return

Dividend Growth

Segment Earnings

2006 - 2010

2006 - 2010

EPS

$0.81

$1.06

$1.12

$1.20

$0.94

2010 - $50.7M

2009 - $45.2M

2009 - $7.8M

2010 - $0.94

2009 - $0.92

Revenue

Net Income

EPS

Thank -You

Questions?

Questions?