Attached files

| file | filename |

|---|---|

| 8-K - 180 DEGREE CAPITAL CORP. /NY/ | v202019_8-k.htm |

| EX-99.2 - 180 DEGREE CAPITAL CORP. /NY/ | v202019_ex99-2.htm |

Venture

Capital for Nanotechnology and Microsystems

THIRD

QUARTER REPORT 2010

FELLOW

SHAREHOLDERS:

Please read this letter in conjunction

with our September 30, 2010, Quarterly Report on Form 10-Q and our third quarter

call on November 12, 2010, at 10:00 a.m. (EST). Details for the

quarterly call can be found on our website at www.hhvc.com.

On

September 30, 2010, Charles E. Harris, the founder of Harris & Harris Group,

passed away. We believe one of the overarching goals that Charlie had

was to make sure his life had meaning, that it made a difference. On

November 3, 2010, Charlie’s wife, Susan, hosted a celebration of Charlie’s

life. Speaking with many of the entrepreneurs, researchers, business

colleagues, shareholders and friends of Charlie that gathered that afternoon, it

was evident that Charlie’s life had meaning. Charlie did not just

touch lives, he impacted them deeply. He was a teacher, a mentor and

an example of what many of us aspire to become. There was no doubt

that his life had meaning. Thank you, Charlie.

Over the

past two years, we have taken to passing forward some of the lessons Charlie

compiled and taught us over his 42 years in business. We would like

to take this opportunity to quote one more that helps guide us as a

firm. “‘Pessimists are usually right. But optimists change the

world.’ The art of venture capital is to help the optimists while

being aware of the worries of the pessimists.”

Currently,

there is much to be excited about at Harris & Harris Group. The

optimists in which we have invested are beginning to change their industries by

bringing nanotechnology-enabled products to the market

successfully.

First,

our most mature companies, as defined on page 52 of our September 30, 2010,

Quarterly Report on Form 10-Q, continue to grow and execute on their respective

businesses. For example:

|

|

·

|

As

of the end of the third quarter, Solazyme, Xradia, NeoPhotonics, Bridgelux

and Metabolon each expect revenues for 2010 to exceed record revenues

achieved in 2009. BioVex is on schedule to complete its Phase

III trial in malignant melanoma during the second half of

2011.

|

|

|

·

|

On

November 8, 2010, Solazyme announced a joint venture agreement with

Roquette Frères, a global starch and starch-derivatives company

headquartered in France. The joint venture will be operational

by the beginning of 2011 and will launch an entirely new category of

natural, healthy and functional ingredients based on

microalgae. In addition to this financially significant deal

with Roquette, during the third quarter, Solazyme announced deals with

Bunge, Unilever, Ecopetrol and an order for 150,000 gallons of oil from

the Navy.

|

|

|

·

|

NeoPhotonics

reported record third quarter revenue after previously announcing record

second quarter revenue. Additionally, NeoPhotonics continued to

generate positive net income.

|

|

|

·

|

During

the third quarter, Nanosys and Samsung Electronics announced a strategic

alliance and licensing agreement to co-develop products. With

this agreement came a $15 million equity investment from Samsung and an

additional $16 million in fresh capital from existing

investors. This deal follows another commercial agreement

signed with LG Innotek earlier in the year. Both agreements

should result in rapidly increasing commercial revenue for Nanosys in

2011.

|

1

Second,

the companies we classify as mid-stage and early-stage companies on page 52 of

our September 30, 2010, Quarterly Report on Form 10-Q and that have a material

value to our portfolio also continue to execute on their

businesses. For example:

|

|

·

|

On

October 20, 2010, SiOnyx announced it had completed a $12.5 million Series

B financing that was oversubscribed with interest from new

investors. Strategic partner, Coherent Inc., joined new

financial investors, Crosslink Capital and Vulcan Capital, and existing

investors in this financing.

|

|

|

·

|

Innovalight

consummated commercial agreements with three Chinese solar

manufacturers: JA Solar, Yingli Green Energy and

Solarfun. These agreements should drive commercial revenue into

2011. Innovalight also opened its offices in

China.

|

|

|

·

|

Laser

Light Engines closed a $13 million Series B financing, including

participation by IMAX Corporation. The two companies also

signed a strategic partnership in conjunction with this

financing.

|

|

|

·

|

Contour

Energy Systems announced the availability of its first product in the

fourth quarter of 2010, a next-generation lithium coin cell battery based

on its patented Fluorinetic™ battery

technology.

|

On page

53 of our September 30, 2010, Quarterly Report on Form 10-Q, we include a new

slide with a matrix titled, “Pipeline of Investment Maturities.” The

purpose of this matrix is to demonstrate that our portfolio is comprised of a

pipeline of investments that includes companies at various stages of maturity

and that are impacting a variety of different industries. We believe

the distribution of companies across this pipeline provides us with

opportunities for exits in both the near term and in the longer term in multiple

industries.

The

second reason to be optimistic is that, currently, we continue to have enough

capital to execute on our business without the need to raise additional capital

through the sale of our shares. We ended the third quarter with

approximately $44 million in cash and U.S. Treasuries. In our first

quarter letter to shareholders, we said, “We believe we have adequate capital to

get our portfolio companies to cash flow breakeven or to exit without raising

additional capital.” We believe this assessment remains

true.

2

We

believe many of our companies are well financed for the near

future. Fewer rounds of additional financing translate to a reduced

risk of significant dilution of our ownership in these companies and a reduced

risk of non-performance related to raising additional capital. In our

top 10 investments by value, there are three companies that we believe may need

to raise capital over the next year. Our values of these companies

include a significant discount for non-performance risk applied to the price

paid for shares of those companies in the most recent round of

financing. At the current time it is difficult to know if these three

companies will be able to raise capital at the price per share paid by investors

in the previous round of financing, above the price per share paid by investors

in the previous round of financing or below the price per share paid by

investors in the previous round of financing.

The third

reason to be optimistic is that we have developed and have begun executing on a

business plan that we believe is critical for our success in the venture capital

business and the public market environment we will face over the coming

years. Over the past two years we have discussed the structural

issues facing micro-capitalization and nano-capitalization public

companies. We have also discussed the structural issues facing the

venture capital industry. We detailed a plan that we believe provides

us the best opportunity to take advantage of these structural

problems.

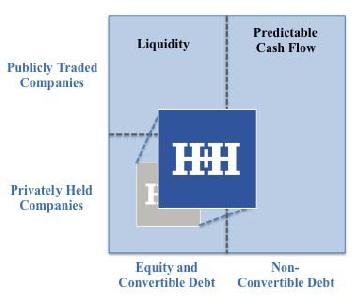

As the

image above demonstrates, since we focused the company on investing in companies

enabled by nanotechnology and microsystems, we have focused our efforts

primarily on making equity or convertible debt investments in privately held

companies. Looking forward, we will continue to focus most of our

efforts in this quadrant, as we believe our team is well qualified to identify

and invest in these opportunities. These opportunities have

tremendous return potential when they are successful.

However,

the holding periods for these types of investments have been lengthening, while

the holding period of both institutional and retail investors in Harris &

Harris Group has been decreasing dramatically. Currently, at the

other end of the spectrum, holding cash in treasuries is yielding practically no

return. Thus, we believe it is important to generate some portion of

our returns more frequently and with greater predictability than our historic

strategy affords. These more frequent and predictable returns can be

used to begin offsetting our annual expenses. This strategy permits

us to reduce our annual cash burn thus providing us with the necessary time to

realize the option value on the high-risk, high-return nature of early-stage

technology investments in nanotechnology and microsystems. This

option value remains our primary expected source of growth. This

strategy should also increase the after-expenses net return to our investors if

we are successful.

Towards

this goal, as the slide below depicts and as we have discussed previously, we

have begun to identify investment opportunities in nano-capitalization public

companies where we believe there is an opportunity for more frequent

exits. We also have identified and have begun investing in venture

debt opportunities where the returns are both more frequent and more

predictable. The deal sourcing, the diligence and the expertise for

both these additional investment opportunities are substantially similar to

privately held equity investments. All of these investment

opportunities will be focused on companies enabled by nanotechnology and

microsystems. Other than the structure of the investment, one key

difference is that these investments tend to be a bit later stage than our

initial privately held equity investments. We are typically looking

for mid- and late-stage companies that are beginning to generate revenue for our

risk profile in these types of investments.

3

We made

our first investment in venture debt in the third quarter of 2010 in GEO

Semiconductor (GeoSemi). The company purchased two assets from a

failed venture capital-backed company. These assets enable the

correction of distortions and non-uniformities in displays and smartphone

cameras and enable the use of nanotechnology-enabled products such as

light-emitting diodes and high-resolution image sensors,

respectively. GeoSemi’s chips can resolve issues that plague both

technologies using geometry processing. The chips negate the need for

expensive, complex optics or correction circuitry. GeoSemi is

shipping chips to customers and has secured design wins that incorporate its

chips into products that are expected to hit the commercial market in

2011.

We

invested through a participation agreement with Montage Capital, a venture debt

provider whose principals have over 15 years of experience providing debt

capital to high-growth companies. In addition to an interest rate of

13.75 percent, we received an up-front fee, warrants to purchase shares of the

company at a set price in the future and pre-emptive rights to invest in a

future round of financing. The term of this debt is 21

months. We were able to secure favorable terms as a result of the

limited availability of capital to small businesses and the high cost of equity

investments from venture capital firms in semiconductor-related

companies.

Even as

we are optimistic about the prospects of business success for our portfolio

companies, we are fully aware of our existing circumstances: The

current economic environment remains uncertain; the capital markets remain

volatile and uncertain; and, we must begin to realize exit events within our

portfolio to provide us with access to future liquidity. These are

the challenges in which we remain focused.

In order

to extend our cash runway and in order to have more capital available for new

investments, our 2011 cash budget is currently 8 percent, or $500,000, less than

the cash budget proposed in 2010. This decrease reflects the steps

taken to reduce future expenses discussed in prior letters to shareholders,

primarily the consolidation of the majority of our operations in our offices in

New York City, a reduction in headcount, reductions in professional fees, and

reductions in office-related fees. Additionally, non-cash

compensation expenses have decreased in 2010 and are likely to continue to

decrease in 2011. As we announced previously, we will not issue

options to employees until after June of 2011 at the earliest.

This

proposed budget equates to a level of annual expenses of 4.1 percent based on

our net assets as of September 30, 2010. Based on our calculation from financial

statements filed with the Securities and Exchange Commission, this percentage of

net assets is less than the average and median ratio of annual expenses to net

assets of nine business development companies (BDCs) with less than $1 billion

in net assets of approximately 4.3 percent and 4.4 percent,

respectively. Additionally, management fees paid by investors in a

private fund to the general partners or by an externally managed BDC to its

investment manager commonly range from 2 to 2.5 percent of the total committed

capital in a private fund and 1.5 to 2 percent of net assets for an externally

managed BDC. We estimate expenses in our budget for 2011 that would

be covered by these management fees if we were a private fund or an externally

managed BDC to be approximately 2 percent of our net assets as of September 30,

2010.

4

As we

look forward, we will continue to focus our companies on successful exit

opportunities. As we detailed on page 54 of our September 30, 2010,

Quarterly Report on Form 10-Q:

On April

15, 2010, NeoPhotonics Corporation filed a registration statement on Form S-1 to

register its shares of common stock for an initial public offering

(IPO). We believe that in the next 6 to 12 months one or more of our

other late-stage portfolio companies could take steps toward the filing of a

registration statement on Form S-1 for an IPO. There can be no

assurance that these companies will successfully complete IPOs, and a variety of

factors, including stock market and general business conditions, could lead them

to terminate such IPOs.

During

the third quarter of 2010, two of our privately held companies retained bankers

to explore opportunities to sell those companies. There can be no

assurance that these companies will successfully complete a sale. A

variety of factors, including general business conditions, could lead them to

terminate such efforts.

In

addition to focusing on opportunities to generate returns from our existing

portfolio, currently we are focused on finding and researching new opportunities

for investments across the spectrum of structures we described

above. There remains a tremendous vibrancy from entrepreneurs to

bring exciting new nanotechnology-enabled breakthroughs to the market, and there

remains a tremendous disconnect between the financing community and these

opportunities. We enjoy operating in this

environment. Additionally, as our visibility to liquidity continues

to increase, we will reach out and tell our story to a wider audience of

institutional and retail investors. Our credibility is

important. We want to be certain that the story we tell begins to

unfold as we describe it and within the timeframe we describe. Thank

you.

|

/s/

Douglas W. Jamison

|

/s/

Daniel B. Wolfe

|

|

Douglas

W. Jamison

|

Daniel

B. Wolfe

|

|

Chairman,

Chief Executive Officer

|

President,

Chief Operating Officer,

|

|

and

Managing Director

|

Chief

Financial Officer and Managing

Director

|

|

/s/

Alexei A. Andreev

|

/s/

Misti Ushio

|

|

Alexei

A. Andreev

|

Misti

Ushio

|

|

Executive

Vice President and

|

Vice

President and Principal

|

|

Managing

Director

|

November

12, 2010

|

This

letter may contain statements of a forward-looking nature relating to

future events. These forward-looking statements are subject to

the inherent uncertainties in predicting future results and

conditions. These statements reflect the Company's current

beliefs, and a number of important factors could cause actual results to

differ materially from those expressed in this letter. Please

see the Company's Annual Report on Form 10-K for the fiscal year ended

December 31, 2009, as well as subsequent filings, filed with the

Securities and Exchange Commission for a more detailed discussion of the

risks and uncertainties associated with the Company's business, including

but not limited to the risks and uncertainties associated with venture

capital investing and other significant factors that could affect the

Company's actual results. Except as otherwise required by

Federal securities laws, the Company undertakes no obligation to update or

revise these forward-looking statements to reflect new events or

uncertainties. The reference to the website www.HHVC.com has

been provided as a convenience, and the information contained on such

website is not incorporated by reference into this

letter.

|

5