Attached files

| file | filename |

|---|---|

| 8-K - CURRENT REPORT - Santaro Interactive Entertainment Co | santaro-8k_1012.htm |

| EX-99.2 - UNAUDITED PRO FORMA - Santaro Interactive Entertainment Co | ex-99_2.htm |

Exhibit 99.1

Beijing Sntaro Technology Co., Ltd.

(A Development Stage Company)

Consolidated Balance Sheets

|

June 30, 2010

|

December 31, 2009

|

|||||||

|

(Unaudited)

|

|

|||||||

|

ASSETS

|

||||||||

|

Current assets

|

||||||||

|

Cash and cash equivalents

|

$ | 46,508 | $ | 12,722 | ||||

|

Prepaid expense

|

36,563 | 35,406 | ||||||

|

Other receivables

|

39,412 | 41,420 | ||||||

|

Total current assets

|

122,483 | 89,548 | ||||||

|

Property and equipment, net

|

208,279 | 242,169 | ||||||

|

Deferred tax asset

|

866,955 | 611,022 | ||||||

| $ | 1,197,717 | $ | 942,739 | |||||

|

LIABILITIES AND EQUITY (DEFICIENCY)

|

||||||||

|

Current liabilities

|

||||||||

|

Other payables and accrued expenses

|

$ | 48,799 | $ | 43,577 | ||||

|

Due to a related party

|

3,670,652 | 2,653,425 | ||||||

|

Total current liabilities

|

3,719,451 | 2,697,002 | ||||||

|

Equity (Deficiency)

|

||||||||

|

Paid-in capital

|

1,371,496 | 1,371,496 | ||||||

|

Deficit accumulated during the development stage

|

(3,871,407 | ) | (3,248,141 | ) | ||||

|

Accumulated other comprehensive income

|

8,197 | 17,655 | ||||||

|

Total equity (deficiency)

|

(2,491,714 | ) | (1,858,990 | ) | ||||

|

Noncontrolling interests

|

(30,020 | ) | 104,727 | |||||

| (2,521,734 | ) | (1,754,263 | ) | |||||

|

Total equity (deficiency)

|

||||||||

| $ | 1,197,717 | $ | 942,739 | |||||

See notes to the consolidated financial statements.

Beijing Sntaro Technology Co., Ltd.

(A Development Stage Company)

Consolidated Statements of Operations and Comprehensive Loss

|

For the Six months ended June 30,

|

||||||||||||

|

2010

|

2009

|

August 9, 2006

(Inception) through

June 30, 2010

|

||||||||||

|

(Unaudited)

|

(Unaudited)

|

(Unaudited)

|

||||||||||

|

Operating expenses

|

||||||||||||

|

Research and development expenses

|

$ | 811,630 | $ | 785,943 | $ | 3,211,884 | ||||||

|

Sales and marketing expenses

|

13,616 | 76,184 | 151,177 | |||||||||

|

General and administrative expenses

|

184,347 | 370,933 | 1,399,871 | |||||||||

|

Loss from operations

|

(1,009,593 | ) | (1,233,060 | ) | (4,762,932 | ) | ||||||

|

Non-operating expenses

|

36,578 | 438,389 | 475,118 | |||||||||

|

Loss before income tax expense and non-controlling interests

|

(1,046,171 | ) | (1,671,449 | ) | (5,238,050 | ) | ||||||

|

Deferred tax benefit

|

252,398 | 308,265 | 863,092 | |||||||||

|

Net loss before allocation to non-controlling interests

|

(793,773 | ) | (1,363,184 | ) | (4,374,958 | ) | ||||||

|

Less: Net loss attributable to the Noncontrolling interests

|

(170,507 | ) | (149,629 | ) | (503,551 | ) | ||||||

|

Net loss attributable to Sntaro Tech Co., Ltd

|

(623,266 | ) | (1,213,555 | ) | (3,871,407 | ) | ||||||

|

Other comprehensive income

|

||||||||||||

|

Foreign currency translation adjustment

|

(10,179 | ) | 18,615 | 7,476 | ||||||||

|

Comprehensive loss

|

(803,952 | ) | (1,344,569 | ) | (4,367,482 | ) | ||||||

|

Less: Comprehensive loss attributable to non-controlling interests

|

(171,228 | ) | (149,595 | ) | (504,272 | ) | ||||||

|

Comprehensive loss attributable to Sntaro Tech Co., Ltd

|

$ | (632,724 | ) | $ | (1,194,974 | ) | (3,863,210 | ) | ||||

See notes to the consolidated financial statements.

Beijing Sntaro Technology Co., Ltd.

(A Development Stage Company)

Consolidated Statements of Cash Flows

|

For the Six months ended June 30,

|

||||||||||||

|

2010

|

2009

|

August 9, 2006

(Inception) through June 30, 2010

|

||||||||||

|

(Unaudited)

|

(Unaudited)

|

(Unaudited)

|

||||||||||

|

Cash flows from operating activities:

|

||||||||||||

|

Net loss before allocation to non-controlling interests

|

$ | (793,773 | ) | $ | (1,363,184 | ) | $ | (4,374,958 | ) | |||

|

Adjustments to reconcile net loss before non-controlling interests to net cash used by operating activities:

|

||||||||||||

|

Stock returned to Company

|

36,578 | - | 36,578 | |||||||||

|

Depreciation

|

42,844 | 40,301 | 177,179 | |||||||||

|

Deferred tax asset

|

(252,398 | ) | (308,265 | ) | (848,817 | ) | ||||||

|

Changes in operating assets and liabilities:

|

||||||||||||

|

Prepaid expenses

|

(1,004 | ) | (20,422 | ) | (35,564 | ) | ||||||

|

Other receivables

|

2,174 | 174,402 | (38,256 | ) | ||||||||

|

Other payables and accrued expenses

|

5,020 | 10,112 | 47,554 | |||||||||

|

Due to a related party

|

- | - | 18,845 | |||||||||

|

Net cash used in operating activities

|

(960,559 | ) | (1,467,056 | ) | (5,017,439 | ) | ||||||

|

Cash flows from investing activities:

|

||||||||||||

|

Purchase of property and equipment

|

(8,070 | ) | (104,414 | ) | (378,787 | ) | ||||||

|

Net cash used in investing activities

|

(8,070 | ) | (104,414 | ) | (378,787 | ) | ||||||

|

Cash flows from financing activities:

|

||||||||||||

|

Proceeds from paid-in capital

|

- | - | 1,371,496 | |||||||||

|

Capital contributed by non-controlling interest owner

|

- | 438,389 | 428,290 | |||||||||

|

Due to a related party

|

1,002,233 | 1,185,150 | 3,573,400 | |||||||||

|

Net cash provided by financing activities

|

1,002,233 | 1,623,539 | 5,373,186 | |||||||||

|

Effect of exchange rate changes on cash and cash equivalents

|

183 | 9 | 69,548 | |||||||||

|

Net increase in cash and cash equivalents

|

33,787 | 52,078 | 46,508 | |||||||||

|

Cash and cash equivalents at the beginning of period

|

12,722 | 15,269 | - | |||||||||

|

Cash and cash equivalents at the end of period

|

$ | 46,508 | $ | 67,347 | $ | 46,508 | ||||||

|

Supplemental disclosure for cash flow

|

||||||||||||

|

Information

|

||||||||||||

|

Interest paid

|

$ | - | $ | - | $ | - | ||||||

|

Income taxes paid

|

$ | - | $ | - | $ | - | ||||||

See notes to the consolidated financial statements.

Beijing Sntaro Technology Co., Ltd.

(A Development Stage Company)

Notes to the Consolidated Financial Statements

|

1.

|

ORGANIZATION AND DISCRIPTION OF BUSINESS

|

Beijing Sntaro Technology Co., Ltd. (the “Sntaro” or “Company”), and its subsidiary, Beijing Sntaro Free Land Network Co., Ltd. (the “FL Network”) are collectively referred to as the “Group”.

Sntaro was organized under the laws of People’s Republic of China (the “PRC”) on August 9, 2006 with paid-in capital of $139,580, which was 80% owned by Mr. Zhilian Chen, the Company’s chairman; the other 20% of the equity was held by Mr. Wenjie Lu. Sntaro is engaged in investing in and the development and operations of online games. At present Sntaro is in a development stage and does not conduct any substantive sale of its online games.

The Company completed a series of changes in ownership which was necessary to comply with the Company’s development. In April 2007, pursuant to a Board of Directors’ resolution, the Company has changed its ownership percentage. Mr. Zhilian Chen, Mr. Xiaobo Li and Mr. Wenjie Lu became the shareholders of the Company, with the percentage of ownership of 60%, 20%, 20% respectively, and paid-in capital of $379,033, $126,344, $126,344, respectively

In May 2008, the Company entered into its second change of ownership percentage. According to the equity agreement in May 2008, Mr. Zhilian Chen, Mr. Xiaobo Li, Mr.Xianhua Shen and Miss Yingnv Sun became the shareholders of the Company, with the percentage of ownership of 60%, 20%, 10%, 10%, respectively, and paid-in capital $822,897, $274,299, $137, 150, $137,150, respectively.

On March 9, 2009, the Company established Beijing Sntaro Free Land Network Co., Ltd, (the “FL Network”), a subsidiary that is engaged in the business of online games development and operation, mainly focuses on technology research, FL Network is 70% owned by Sntaro, and 30% by Beijing East Free Land Media & Film Co., Ltd (the “FL Media”).

In April 2010 the Company went into its third change of ownership percentage. According to the amended equity agreement in December 2009, Mr. Xiaobo Li transferred his ownership in the Company to Mr. Zhilian Chen, another shareholder of the Company, and increased Mr. Chen’s percentage of ownership to 80%, with paid-in capital of $1,097,196. Mr.Xianhua Shen and Miss Yingnv Sun equity remained unchanged, with the percentage of ownership of 10%, 10%, respectively, and paid-in capital $137, 150, $137,150, respectively.

In June, 2010, FL Network, the subsidiary of the company, also completed a change in its ownership. Ms. Yu Bai was transferred 2.5% shares by the Company and 2.5% shares by FL Media for no consideration. Ms. Yu Bai became a new shareholder of company, with a percentage of ownership of 5%, Sntaro and FL Media changed their percentage of ownership from 70% and 30% to 67.5% and 27.5%, respectively.

The Company is principally engaged in the development and operation of online games, and has a core product development team that is responsible for developing new games. San Guo Online and UU Rowing are the two Massive Multiplayer Online Role Playing Game (“MMORPG”) games that will be launched when finished.

|

2.

|

SUMMARY OF SIGNIFICANT ACCOUNTING POLICIES

|

Principles of consolidation and basis of presentation

The accompanying unaudited consolidated financial statements have been prepared in accordance with accounting principles generally accepted in the United States of America (“U.S. GAAP”). Certain information and footnote disclosures normally included in financial statements prepared in accordance with U.S. GAAP have been condensed or omitted as permitted by rules and regulations of the U.S. Securities and Exchange Commission (“SEC”). The consolidated balance sheet was derived from the audited consolidated financial statements of the Company. The accompanying unaudited consolidated financial statements should be read in conjunction with the audited consolidated financial statements as of December 31, 2009 of the Company.

In the opinion of management, all adjustments (which include normal recurring adjustments) necessary to present a fair statement of the financial position as of June 30, 2010, and the results of operations and cash flows for the six months ended June 30, 2009 and 2010, have been made. The results of operations for the six months ended June 30, 2010 are not necessarily indicative of the results for the full fiscal year ending December 31, 2010.

Recent issued accounting pronouncements

FASB Establishes Accounting Standards Codification

In February 2010, the FASB issued Accounting Standards Update (ASU) 2010-09 to amend ASC 855, Subsequent Events. As a result of the ASU, SEC registrants will not disclose the date through which management evaluated subsequent events in the financial statements - either in originally issued financial statements or reissued financial statements. This change addresses practice issues for SEC registrants with respect to processes around issuing financial statements and SEC registration requirements (e.g., incorporation by reference of previously issued financial statements).

In April 2010, the FASB issued ASU 2010-13, Compensation-Stock Compensation (Topic 718): Effect of Denominating the Exercise Price of a Share-Based Payment Award in the Currency of the Market in Which the Underlying Equity Security Trades - a consensus of the FASB Emerging Issues Task Force. The amendments in this Update are effective for fiscal years, and interim periods within those fiscal years, beginning on or after December 15, 2010. Earlier application is permitted. The Company does not expect the provisions of ASU 2010-13 to have a material effect on the financial position, results of operations or cash flows of the Company.

The FASB issued ASU 2010-17, Revenue Recognition - Milestone Method (Topic 605): Milestone Method of Revenue Recognition. This ASU codifies the consensus reached in EITF Issue No. 08-9, “Milestone Method of Revenue Recognition.” The amendments to the Codification provide guidance on defining a milestone and determining when it may be appropriate to apply the milestone method of revenue recognition for research or development transactions. Consideration that is contingent on achievement of a milestone in its entirety may be recognized as revenue in the period in which the milestone is achieved only if the milestone is judged to meet certain criteria to be considered substantive. Milestones should be considered substantive in their entirety and may not be bifurcated. An arrangement may contain both substantive and nonsubstantive milestones, and each milestone should be evaluated individually to determine if it is substantive.

ASU 2010-17 is effective on a prospective basis for milestones achieved in fiscal years, and interim periods within those years, beginning on or after June 15, 2010. Early adoption is permitted. If a vendor elects early adoption and the period of adoption is not the beginning of the entity’s fiscal year, the entity should apply 2010-17 retrospectively from the beginning of the year of adoption. Vendors may also elect to adopt the amendments in this ASU retrospectively for all prior periods. The Company does not expect the provisions of ASU 2010-19 to have a material effect on the financial position, results of operations or cash flows of the Company

In May 2010, the FASB issued ASU 2010-19, Foreign Currency (Topic 830): Foreign Currency Issues: Multiple Foreign Currency Exchange Rates. The amendments in this Update are effective as of the announcement date of March 18, 2010. The Company does not expect the provisions of ASU 2010-19 to have a material effect on the financial position, results of operations or cash flows of the Company.

Other accounting standards that have been issued or proposed by FASB that do not require adoption until a future date are not expected to have a material impact on the consolidated financial statements upon adoption.

|

3.

|

GOING CONCERN

|

The accompanying unaudited interim financial statements are presented on a going concern basis. The Company is in a development stage and has no revenue to date and has generated a net loss attributable to Sntaro Tech Co., Ltd of $623,266 for the six months ended June 30, 2010, and a net loss attributable to Sntaro Tech Co., Ltd of $3,871,407 from inception (August 9, 2006) through June 30, 2010, incurring an owners’ deficiency. This condition raises substantial doubt about the Company’s ability to continue as a going concern. The company plans to improve its financial condition by obtaining new financing from related parties and new investors. However, there is no assurance that the Company will be successful in accomplishing this objective. The financial statements do not include any adjustments that might be necessary should the Company be unable to continue as a going concern.

|

4.

|

OTHER RECEIVABLES

|

Other receivables of $39,412 and $41,420 as of June 30, 2010 and December 31, 2009 consisted of cash advances given to certain employees for use during business operations and are recognized as General and Administration expenses when expended. It also includes some rental deposit and prepayment for the establishment of FL Network.

|

5.

|

PROPERTY AND EQUIPMENT

|

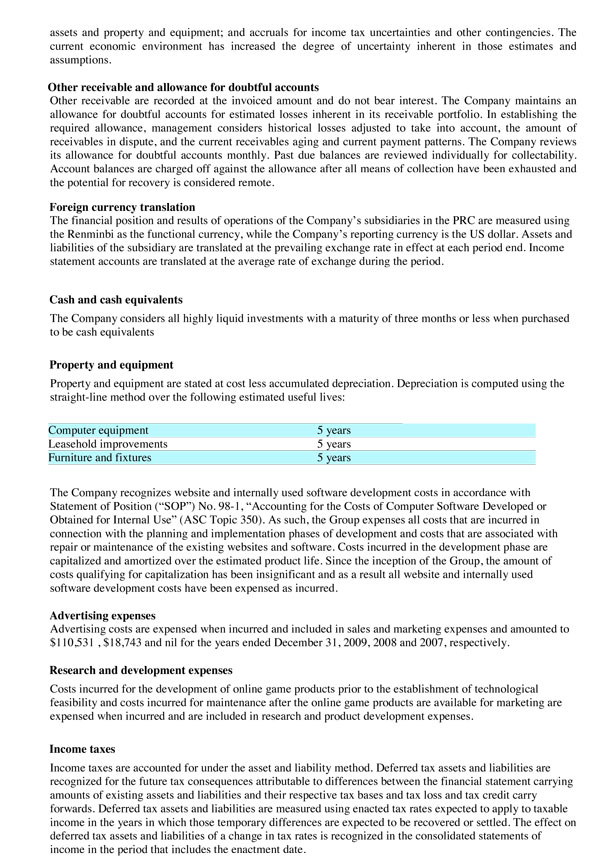

Property and equipment are summarized as follows:

|

June 30,

|

December 31,

|

|||||||

|

2010

|

2009

|

|||||||

|

(Unaudited)

|

||||||||

|

Computer equipment

|

$ | 281,630 | $ | 272,384 | ||||

|

Furniture and fixtures

|

42,262 | 42,085 | ||||||

|

Leasehold improvement

|

65,598 | 65,324 | ||||||

| 389,490 | 379,793 | |||||||

|

Less: Accumulated depreciation

|

(181,211 | ) | (137,624 | ) | ||||

|

|

|

|||||||

|

Property and equipment, net

|

$ | 208,279 | $ | 242,169 | ||||

Depreciation expenses for six months ended June 30, 2010 and 2009 were $42,844 and $40,301, respectively.

|

6.

|

OTHER PAYABLES AND ACCRUED EXPENSES

|

Other payables and accrued expenses consist of the following:

|

June 30,

|

December 31,

|

|||||||

|

2010

|

2009

|

|||||||

|

(Unaudited)

|

|

|||||||

|

Payroll and welfare payables

|

$ | - | $ | 933 | ||||

|

Other payables

|

48,799 | 42,644 | ||||||

|

|

|

|||||||

|

Total

|

$ | 48,799 | $ | 43,577 | ||||

|

7.

|

INCOME TAX EXPENSES

|

Beijing Sntaro Technology Co., Ltd and Beijing Sntaro Freeland Network Co., Ltd. (Beijing Sntaro Technology Co., Ltd. has 67.50% ownership interest in Beijing Sntaro Freeland Network Co., Ltd. as of June 31, 2010.) All of above enterprises were organized under the laws of the People’s Republic of China (“PRC”) which are subject to Enterprise Income Tax (“EIT”) on the taxable income as reported in their respective statutory financial statements adjusted in accordance with the Enterprise Income Tax Law. Pursuant to the PRC Income Tax Laws, the Company and subsidiary are subject to EIT at a statutory rate of 25%.

The Company had deferred tax assets of approximately $712,235 and $576,657 as of June 30, 2010 and December 31, 2009, respectively, which consisted of a tax loss carry-forward. The Company had no other temporary differences as of June 30, 2010 and December 31, 2009. A full valuation allowance was provided against the deferred tax assets recognized before December 31, 2008. As of June 30, 2010, the valuation allowance of $392,634 was provided for against the deferred tax assets, and deferred tax asset of $319,602 was recognized. As of December 31, 2009, valuation allowance of $327,642 was provided against the deferred tax assets, and deferred tax asset of $240,773 was recognized.

FL Network had deferred tax assets of approximately $547,354 and $370,249 as of June 30, 2010 and December 31, 2009 that consisted of tax loss carry-forwards. It had no other temporary differences as of June 30, 2010 and December, 31, 2009.

The Company had net deferred tax assets of approximately $866,955 and $611,022 as of June 30, 2010 and December 31, 2009 that consisted of a tax loss carry-forward.

In assessing the realizability of deferred tax assets, the Company considers projected future taxable income and tax planning strategies in making its assessment, as of June 30, 2010, and 2009, for PRC income tax purposes, the Company had a gross tax loss carry-forward which would expire in future years; management determines it is more likely than not that all of the deferred tax assets will be realized by company. And therefore, deferred tax benefits of $77,519 and $142,010 were recognized for six months ended June, 2010 and 2009 by the Company, respectively.

As of June 30, 2010, for PRC income tax purposes, FL Network had $2,179,711 gross loss carryforwards of which $1,480,196 would expire on December 31, 2014 and $699,515 would expire on December 31, 2015. Management projected that it is more likely than not that FL Network would generate sufficient taxable income in 5 years to realize the deferred tax assets. Deferred tax benefits of $174,879 and $166,255were recognized for six months ended June 30, 2010 and 2009 by FL Network, respectively.

|

8.

|

EMPLOYEE BENEFITS

|

The full-time employees of the Company and its subsidiary that are incorporated in the PRC are entitled to staff welfare benefits, including medical care, unemployment insurance and pension benefits. These companies are required to accrue for these benefits based on percentages of 10%, 1% and 12% of the employees’ salaries in accordance with the relevant regulations, and to make contributions to the state-sponsored pension and medical plans out of the amounts accrued for medical and pension benefits. The total amounts expensed for such employee benefits amounted to $60,763 and $22,507 for six months ended June 30, 2010 and 2009, respectively. The PRC government is responsible for the medical benefits and ultimate pension liability to these employees.

|

9.

|

RELATED PARTY TRANSACTIONS AND BALANCES

|

In the year ended December 31, 2009, Cixi Yide Auto Company (the “Cixi Yide”), a company 97% owned by the Company’s 80% owner Mr. Zhilian Chen, made $2,281,636 loan to the Company. And in the six months ended June 30, 2010, Cixi Yide made additional $1,017,145, loans to the Company. The amounts are unsecured, interest free, and payable on demand. Due to Cixi Yide was $3,670,652 and $2,653,425 as of June 30, 2010 and December 31, 2009, respectively.

|

10.

|

LEASE COMMITMENTS

|

The Company has entered into a on-cancelable operating lease arrangement from September 18, 2008 to September 17, 2010 relating to its office premises. Future minimum lease payment for this operating lease as of December 31, 2010 is $23,532.

Total rental expense is $116,507 and $167,069 for six months ended June 30, 2010 and 2009, respectively.

|

11.

|

NON-OPERATING EXPENSES

|

During the six months ended June 30, 2010, the Company transferred its 2.5% ownership in FL Network to Mrs. Yu Bai, on April 22, 2010 for no consideration to obtain the support from Ms. Yu Bai on technical and management respects for $36,578.

During the six months ended June 30, 2009, the company abandoned a claim due from FL Media to obtain FL Media’s support to San Guo Online in the game’s future development and promotion for $438,389.

|

12.

|

SUBSEQUENT EVENT

|

On September 9, 2010, Ningbo Sntaro Network Technology Co., Ltd., (“Sntaro Ningbo”) a Wholly Foreign Owned Enterprise (WFOE) organized under the laws of the People’s Republic of China (“PRC”) and the Company signed an exclusive cooperation agreement (the “Agreement”).Under the Agreement Sntaro Ningbo will provide complete business support and technical and consulting services to the Company as an exclusive service provider. As compensation for provided services, the Company will pay a service fee to Sntaro Ningbo equal to 100% of its net income.

Through the above arrangements, Sntaro Ningbo is the primary beneficiary of Sntaro. Accordingly, under the requirement of FIN46(R), the Company has become a variable interest entity of the Ningbo Sntaro. The financial statements of the Company would be consolidated by the Ningbo Sntaro since the closing date. The transaction was accounted for as a reverse takeover, equivalent to the issuance of equity interest by the Company for the net assets of Ningbo Sntaro accompanied by a recapitalization.

On August 18, 2010, FL Network’s non-controlling shareholders, FL Media and Ms. Yu Bai signed an agreement with the Company, in which FL Media and Mrs. Yu Bai transferred all their ownership in FL Network, 27.5% and 5%, respectively, to the Company and the Company became 100% owner of FL Network. Sntaro Interactive Entertainment Company, a company registered in Las Vegas, issued 6,400,000 and 2,000,000 common shares to FL Media and Ms. Yu Bai, respectively, for their transfer of FL Network’s ownership.

Management has considered all events occurring through September 15, 2010, the date the financial statements have been issued, and has determined that there are no other events than above mentioned matter that are material to the financial statements, or all such material events have been fully disclosed.