Attached files

| file | filename |

|---|---|

| EX-99.2 - TRANSCRIPT TO THE 2010 ANNUAL MEETING - TIDEWATER INC | dex992.htm |

| 8-K - FORM 8-K - TIDEWATER INC | d8k.htm |

FISCAL

2010 ANNUAL FISCAL 2010 ANNUAL

SHAREHOLDERS MEETING

SHAREHOLDERS MEETING

July 22, 2010

July 22, 2010

Jeffrey M. Platt

Jeffrey M. Platt

Chief Operations Officer

Chief Operations Officer

Dean E. Taylor

Dean E. Taylor

Chairman, President and

Chairman, President and

Chief Executive Officer

Chief Executive Officer

Quinn P. Fanning

Quinn P. Fanning

Executive Vice President

Executive Vice President

and Chief Financial Officer

and Chief Financial Officer

Exhibit 99.1 |

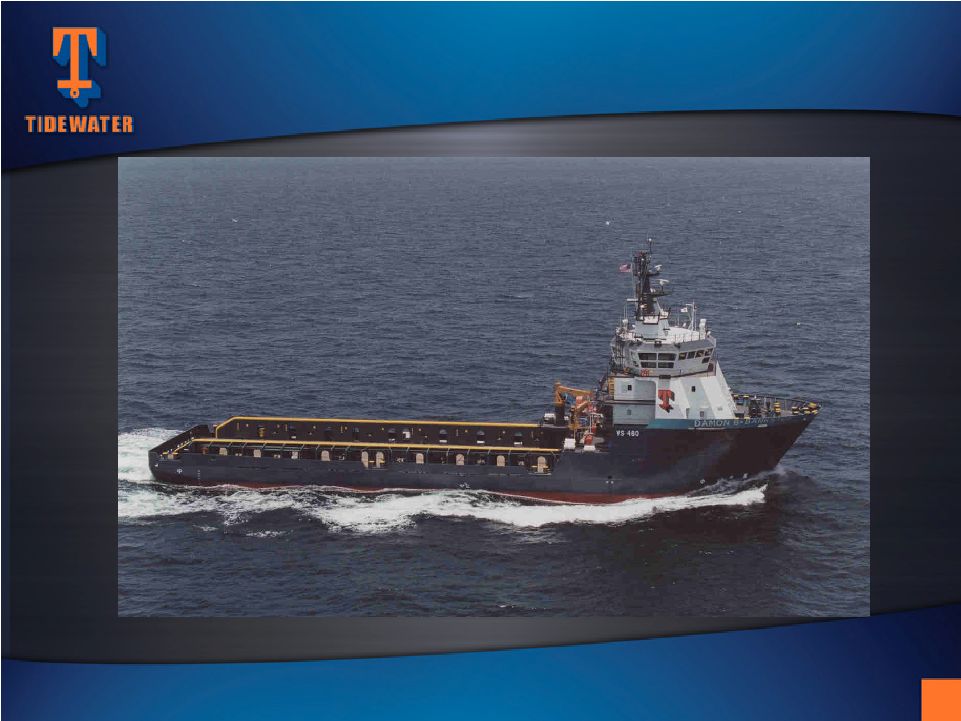

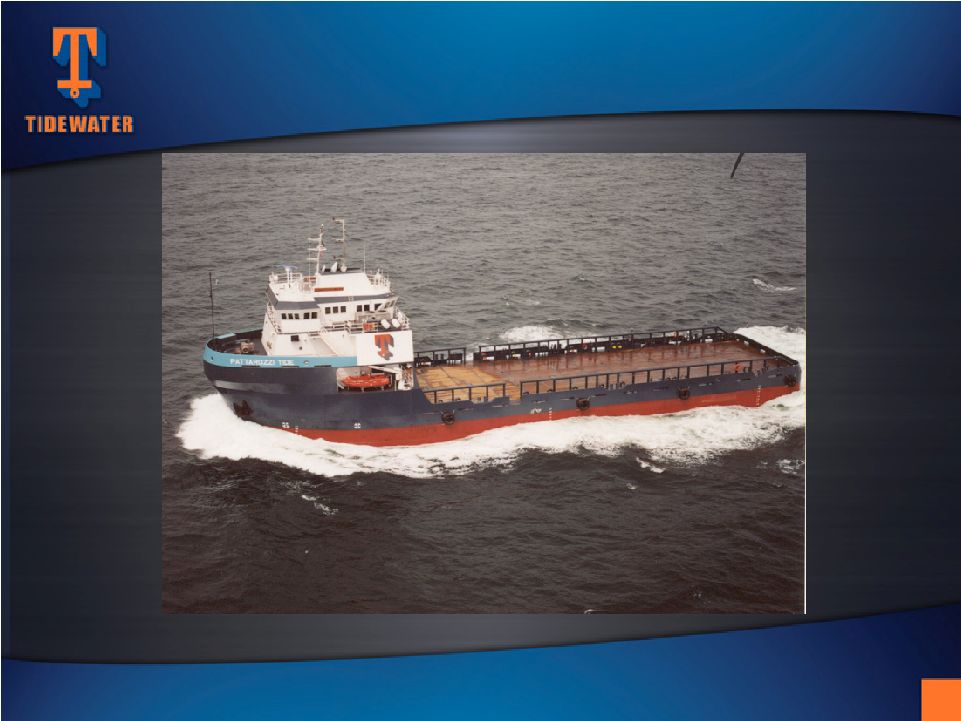

M/V

DAMON B. BANKSTON M/V DAMON B. BANKSTON

2 |

“Terror, daring rescue in Gulf of

Mexico oil rig explosion recounted”

May 7, 2010

“Sea captain tells of rig blast in gritty detail”

May 11, 2010

“Horizon hero hits the U.S.”

May 21, 2010

“Boom”

July 2010

“U.S. rig witness recalls

rain of mud, green flash”

May 11, 2010

“In the Gulf of Mexico, what went wrong

with the Deepwater Horizon oil drilling rig?”

May 9, 2010

“Oil crew rescuer opens

up about explosion”

May 13, 2010

“MEDIA COVERAGE OF HEROIC EFFORTS”

“MEDIA COVERAGE OF HEROIC EFFORTS”

3 |

THE CREW

OF THE THE CREW OF THE

DAMON B. BANKSTON

DAMON B. BANKSTON

4 |

CHAIRMAN’S AWARD

CHAIRMAN’S AWARD

5 |

“CHAIRMAN’S AWARD”

“CHAIRMAN’S AWARD”

PLAQUE

PLAQUE

6 |

OPERATIONS REVIEW

OPERATIONS REVIEW

Jeff Platt –

Jeff Platt –

Chief Operations Officer

Chief Operations Officer

7 |

FORWARD-LOOKING STATEMENTS

FORWARD-LOOKING STATEMENTS

8

Phone:

504.568.1010

Fax:

504.566.4580

Web:

www.tdw.com

Email:

connect@tdw.com

In accordance with the safe harbor provisions of the Private Securities Litigation Reform

Act

of

1995,

the

Company

notes

that

certain

statements

set

forth

in

this

presentation

provide other than historical information and are forward looking. The actual

achievement of any forecasted results, or the unfolding of future economic or business

developments in a way anticipated or projected by the Company, involve numerous risks

and uncertainties that may cause the Company’s actual performance to be materially

different from that stated or implied in the forward-looking statement. Among those risks

and uncertainties, many of which are beyond the control of the Company, include,

without limitation, fluctuations in worldwide energy demand and oil and gas prices;

fleet additions by competitors and industry overcapacity; changes in capital spending

by customers in the energy industry for offshore exploration, development and

production; changing customer demands for vessel specifications, which may make some of

our older vessels technologically obsolete for certain customer projects or in certain

markets; instability of global financial markets and difficulty accessing

credit or capital; acts of

terrorism and piracy; significant weather conditions; unsettled political conditions, war,

civil unrest and governmental actions, such as expropriation, especially in higher risk

countries of operations; foreign currency fluctuations; labor influences proposed by

international conventions; and enforcement of laws related to the environment, labor

and foreign corrupt practices. Participants should consider all of these risk factors

as well as other information contained in the Company’s form 10-K’s and

10-Q’s. |

SM

SAFETY –

SAFETY –

A TOP PRIORITY

A TOP PRIORITY

9 |

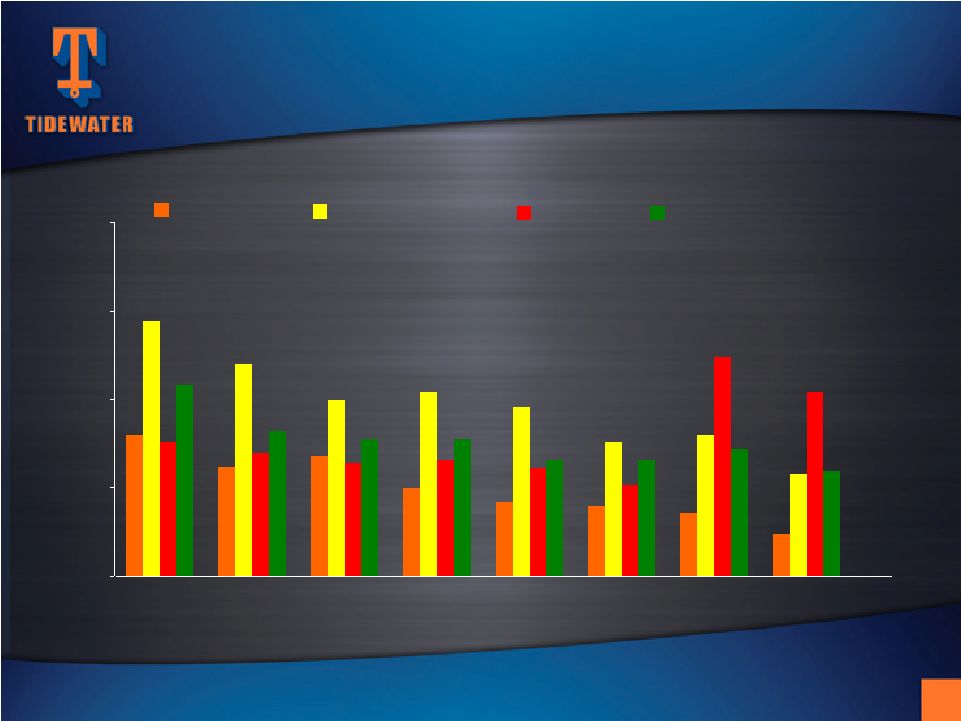

0.00

0.25

0.50

0.75

1.00

Total Recordable Incident Rates

Calendar Years

2002

2003

2004

2005

2006

2007

2008

2009

TIDEWATER

DUPONT

DOW CHEMICAL

EXXON MOBIL

SAFETY RECORD RIVALS

SAFETY RECORD RIVALS

LEADING COMPANIES

LEADING COMPANIES

10 |

August 12, 2008

Over 700 days worked since

Over 70,000,000 man hours worked since

First Time in Tidewater History

ZERO LOST TIME ACCIDENTS

ZERO LOST TIME ACCIDENTS

IN FISCAL 2010

IN FISCAL 2010

11 |

International / U.S.

2010: 93% / 7%

2000: 62% / 38%

North America

20

(7%)

Central/South America

69

(23%)

Europe / M.E.

32

(11%)

Far East

42

(14%)

West Africa

131

(45%)

VESSEL DISTRIBUTION BY REGION

(excludes

stacked

vessels

–

as

of

3/31/10)

12 |

Unique global footprint; 50+ years of Int’l experience

Unmatched scale and scope of operations

International market opportunities

•

Growth

•

Longer contracts

•

Better utilization

•

Higher dayrates

Solid customer base of NOC’s

and IOC’s

INTERNATIONAL STRENGTH

INTERNATIONAL STRENGTH

13 |

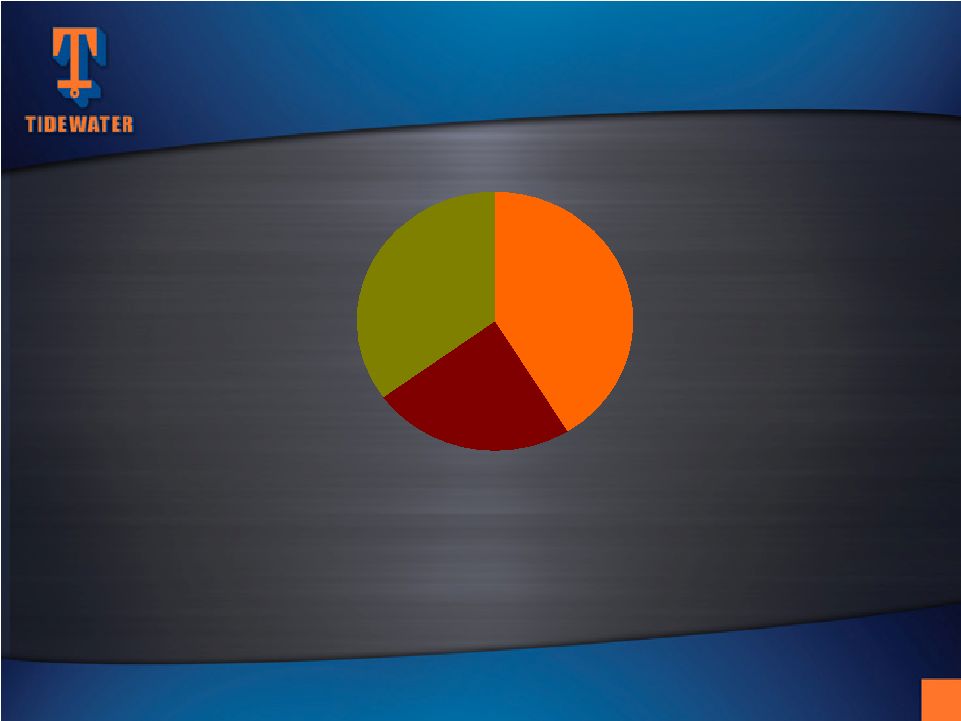

NOC's

24%

Others

35%

Super Majors

41%

Our top 10 customers in Fiscal 2010 (6 Super Majors,

3 NOC’s

and one large independent) accounted for 63% of our revenue

CURRENT REVENUE MIX

CURRENT REVENUE MIX

Quality of Customer Base

Quality of Customer Base

14 |

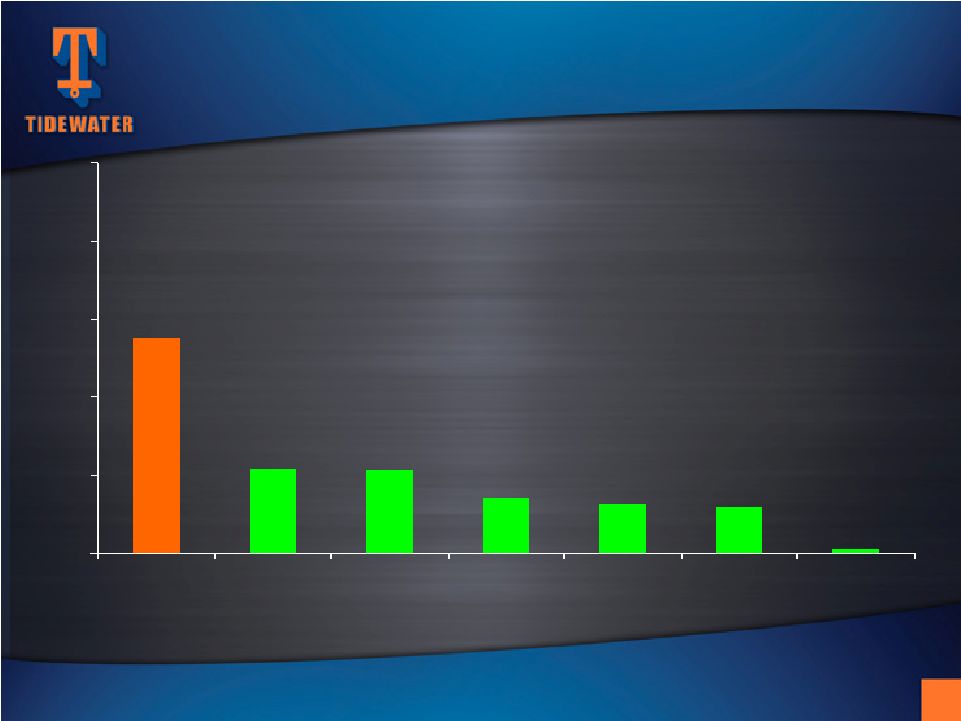

5

60

63

71

107

108

276

0

100

200

300

400

500

Source:

ODS-Petrodata

and

Tidewater

Tidewater

Competitor #2

Competitor #3

Competitor #4

Competitor # 5

Competitor #1

Avg.

All Others

(1,752 total

vessels for

300+ owners)

VESSEL POPULATION BY OWNER

(includes

AHTS’s

and

PSV’s

only)

Estimated

as

of

3/31/10

15 |

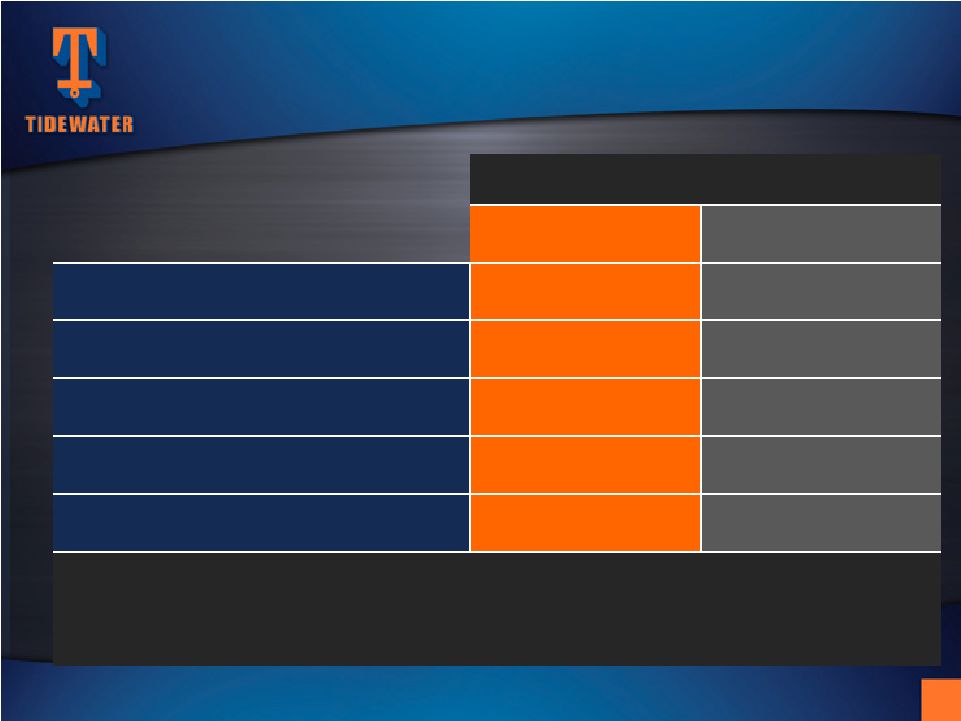

Vessel Count

Estimated Cost

AHTS

80

$1,426m

PSV’s

74

$1,449m

Crewboats

& Tugs

67

$289m

TOTALS:

221

$3,164m

At 3/31/10, 170 new vessels in fleet with ~5 year average age

Vessel Commitments

Jan. ’00 –

March ‘10

28 vessels delivered during Fiscal 2010

THE LARGEST MODERN FLEET

THE LARGEST MODERN FLEET

IN THE INDUSTRY . . . .

IN THE INDUSTRY . . . .

16 |

Count

AHTS

18

PSV

16

Crew and Tug

2

Total

36

Vessels Under Construction*

As of March 31, 2010

* Includes five new vessels committed to purchase as of 3/31/10

21 of these vessels are expected to be delivered during Fiscal 2011

…. AND OUR LEAD IS GROWING

…. AND OUR LEAD IS GROWING

17 |

FINANCIAL REVIEW

FINANCIAL REVIEW

Quinn Fanning –

Quinn Fanning –

EVP & CFO

EVP & CFO

18 |

Positive longer-term fundamentals

•

Global economy stabilizing; however, recovery may be slow and

choppy

•

Credit markets healthier, despite European debt crisis

•

Commodity prices support higher E&P spending (up ~12% in

2010

1

)

•

Offshore rig count recovering (ex-US GoM)

•

Market conditions require continued fleet rebalancing

1) Source: Barclays

A VIEW FROM THE BRIDGE

A VIEW FROM THE BRIDGE

19 |

History of earnings growth and solid, through-cycle

returns

Well positioned to optimize expected market

recovery

World’s largest new fleet

•

Global operating footprint

•

High quality customer base

•

Strong financial profile

A VIEW FROM THE BRIDGE (cont.)

A VIEW FROM THE BRIDGE (cont.)

20 |

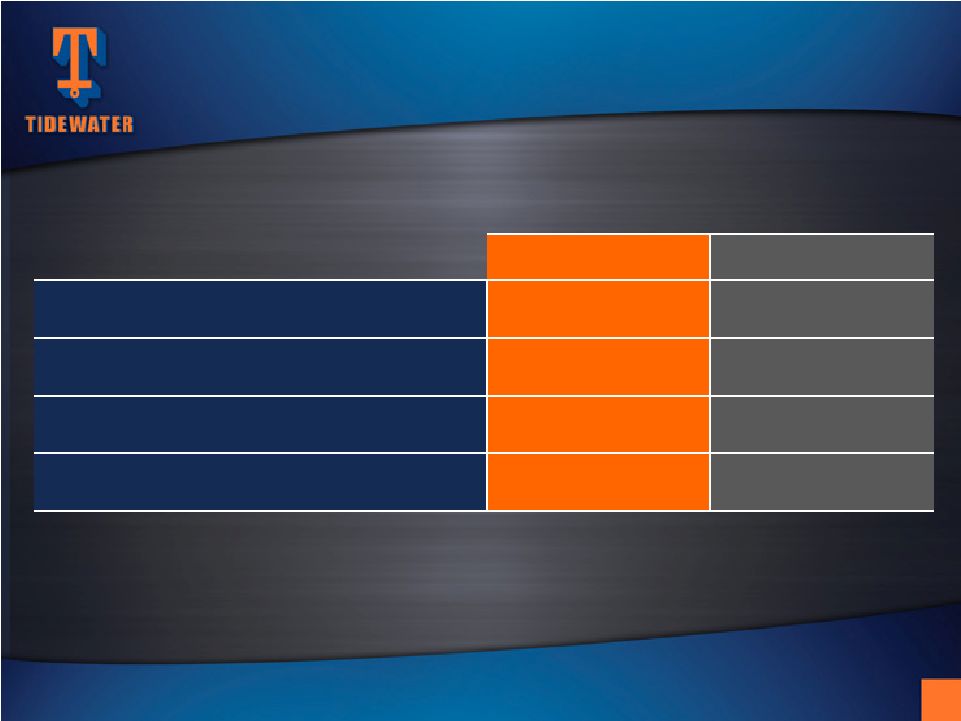

Year Ended

3/31/10

3/31/09

Revenues

$1,169

$1,391

Adjusted Net Earnings*

$279

$407

Adjusted EPS*

$5.41

$7.89

Net Cash from Operations

$328

$526

Capital Expenditures

$452

$474

* Adjusted Net Earnings and Adjusted EPS for the year ended 3/31/10 excludes

$44.6 million, or $0.87 per share, related to provision for Venezuelan operations;

$36.1 million, or $0.70 per share, tax benefit related to favorable

resolution of tax litigation; and $11.4 million, or $0.22 per share, charge

associated with proposed settlement with the SEC. $ in Millions,

Except Per Share Data

SELECTED FINANCIAL HIGHLIGHTS

SELECTED FINANCIAL HIGHLIGHTS

21 |

March 2010

March 2009

Cash

$223

$251

Stockholders’

Equity

$2,464

$2,245

Long-term Debt

$275

$300

Net Debt to Total Cap

2.1%

2.1%

($ in Millions)

~ $675 million of Available Liquidity at 3/31/10

(Cash plus $450m Revolver)

STRONG FINANCIAL PROFILE;

STRONG FINANCIAL PROFILE;

SIGNIFICANT AVAILABLE LIQUIDITY

SIGNIFICANT AVAILABLE LIQUIDITY

22 |

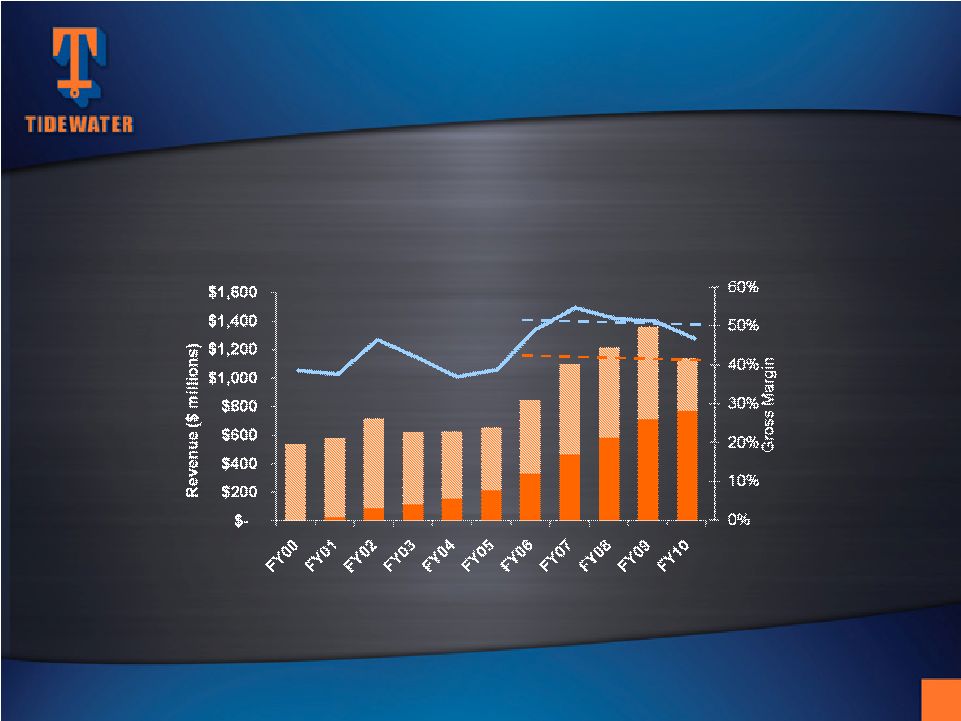

5-year average Revenue: $1,131 million

5-year average Gross Margin: 51%

5-year CAGR in New vessel revenue: ~29%

VESSEL REVENUE AND GROSS MARGINS

VESSEL REVENUE AND GROSS MARGINS

23 |

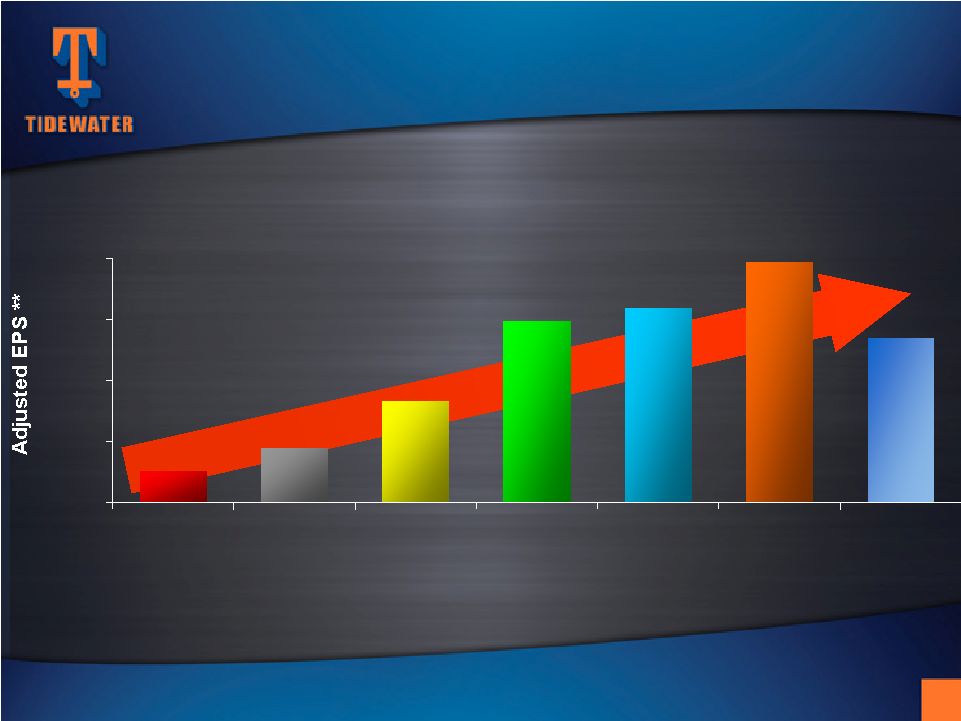

32%

Six-Year Compounded Annual Earnings Growth Rate

**

EPS

in

Fiscal

2004

is

exclusive

of

the

$.30

per

share

after

tax

impairment

charge.

EPS

in

Fiscal

2006

is

exclusive

of

the

$.74

per

share

after

tax

gain

from

the

sale

of

six

KMAR

vessels.

EPS

in

Fiscal

2007

is

exclusive

of

$.37

per

share

of

after

tax

gains

from

the

sale

of

14

offshore

tugs.

EPS

in

Fiscal

2010

is

exclusive

of

$.87

per

share

Venezuelan

provision,

a

$.70

per

share

tax

benefit

related

to

favorable

resolution

of

tax

litigation

and

a

$0.22

per

share

charge

for

the

proposed

settlement

with

the

SEC

of

the

company’s

FCPA

matter.

Adjusted Return

On Avg. Equity

4.3% 7.2%

12.4%

18.5%

18.3%

19.5%

11.9% SIGNIFICANT EARNINGS GROWTH

SIGNIFICANT EARNINGS GROWTH

24

$5.41

$7.89

$1.03

$1.78

$3.33

$5.94

$6.39

$0.00

$2.00

$4.00

$6.00

$8.00

Fiscal 2004

Fiscal 2005

Fiscal 2006

Fiscal 2007

Fiscal 2008

Fiscal 2009

Fiscal 2010 |

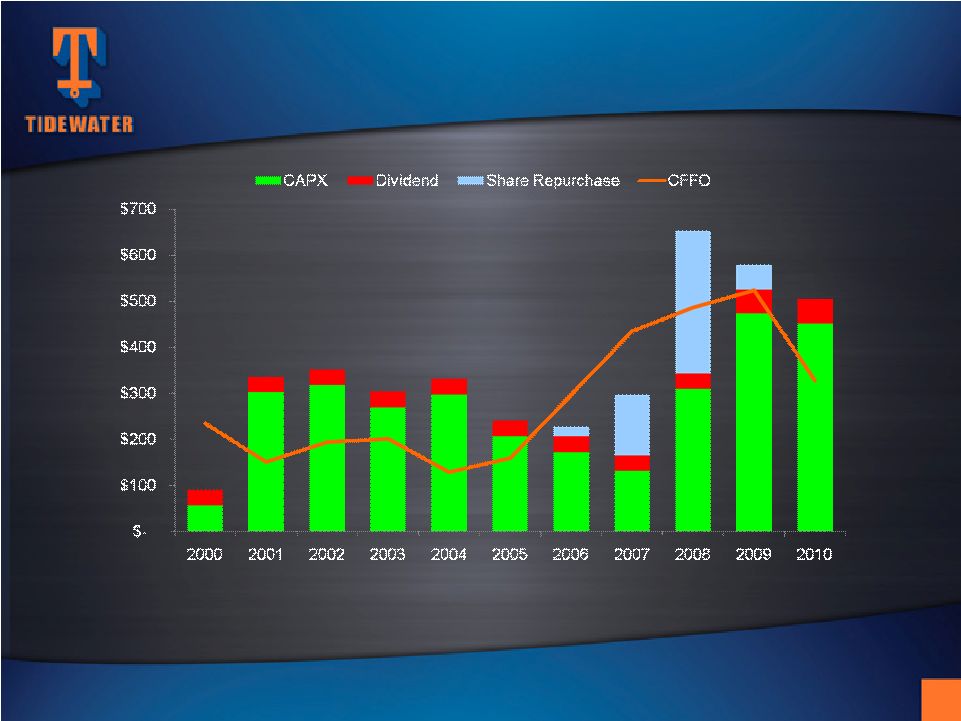

Over

an 11-year period, Tidewater invested $3.2 billion in CAPX ($2.8 billion in the “new”

fleet),

and paid out $923 million through dividends and share repurchases. Over the

same period, CFFO and proceeds from dispositions were $3.1 billion and $640

million, respectively PRIMARY USES OF CASH

PRIMARY USES OF CASH

25 |

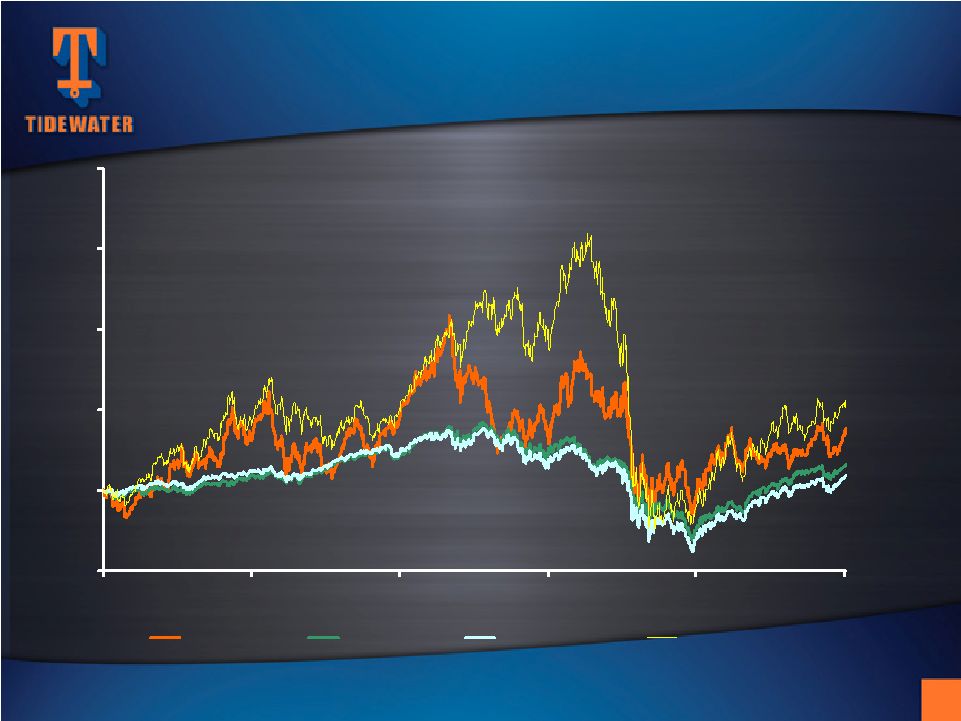

-50%

0%

50%

100%

150%

200%

Mar-05

Mar-06

Mar-07

Mar-08

Mar-09

Mar-10

TDW

DJIA

S&P500

OSX

OSX 52%

S&P 500 9%

DJIA 16%

TDW 36%

RETURNS vs

RETURNS vs

the MARKET

the MARKET

FIVE YEAR STOCKHOLDER RETURN

FIVE YEAR STOCKHOLDER RETURN

26 |

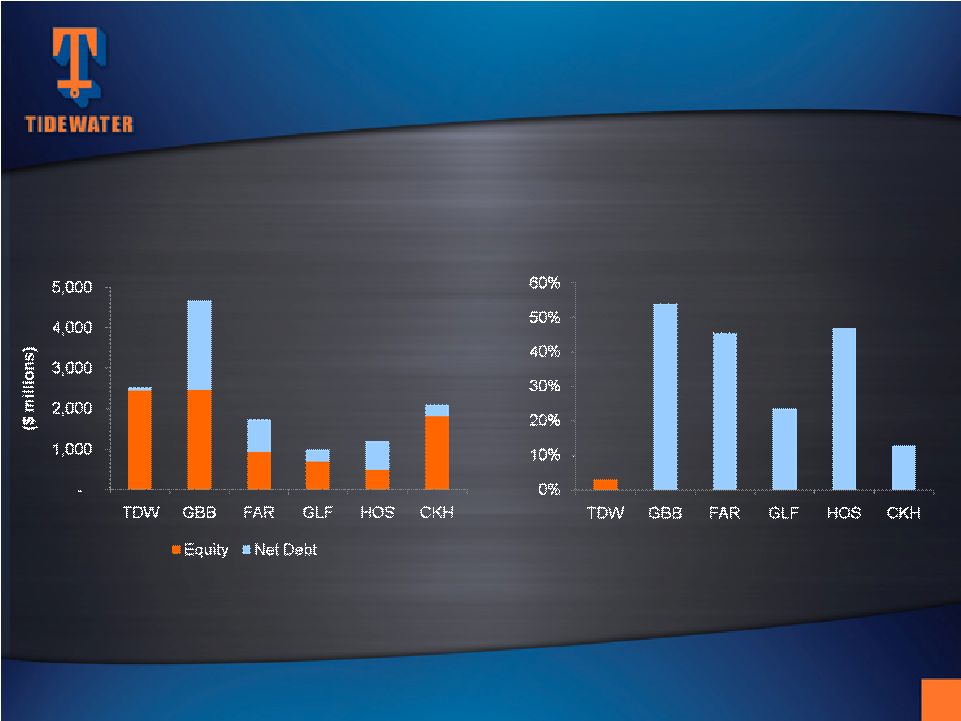

Balance Sheet data as of March 31, 2010, except GBB (12/31/09)

Net Debt = ST + LT Debt, Less Cash

Equity = Share price (in USD) at 3/31 times shares outstanding at 3/31, except GBB

(12/31) USD/EUR = 1.263; USD/NOK = 0.156

Capitalization (Market)

Net Debt / Net Book Capital

CAPITALIZATION OF KEY

CAPITALIZATION OF KEY

OSV COMPANIES

OSV COMPANIES

27 |

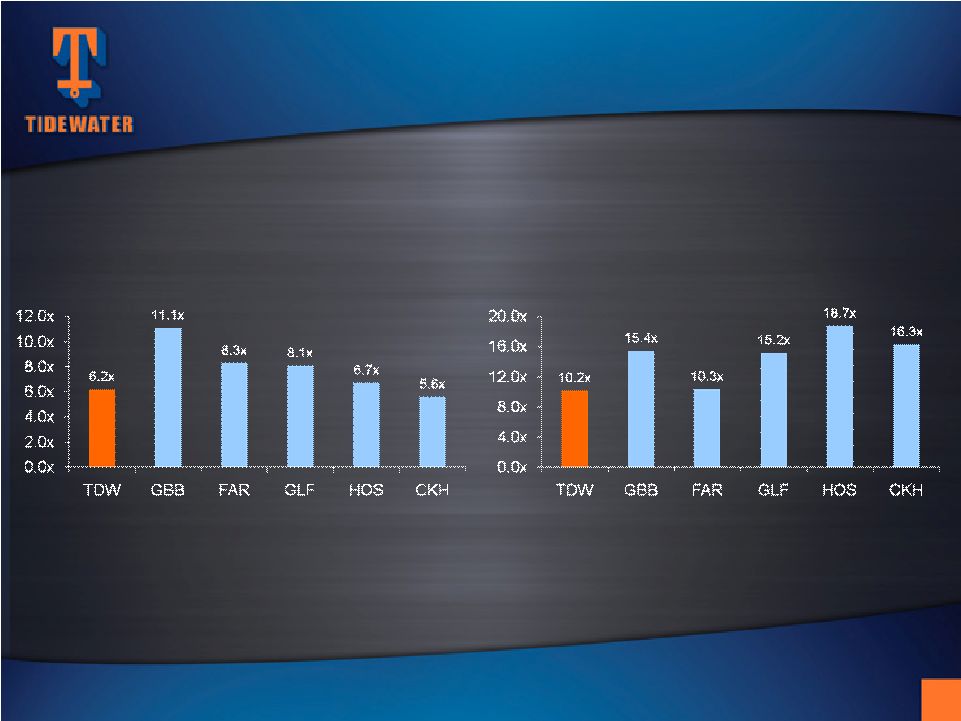

Enterprise Value / EBITDA

Price / Earnings

Source: FBR Capital Markets Corporation

Maritime Comparable Company Analysis

June 28, 2010

RELATIVE VALUATIONS

RELATIVE VALUATIONS

28

Dividend Yield

2.5%

2.6%

2.6%

--

--

-- |

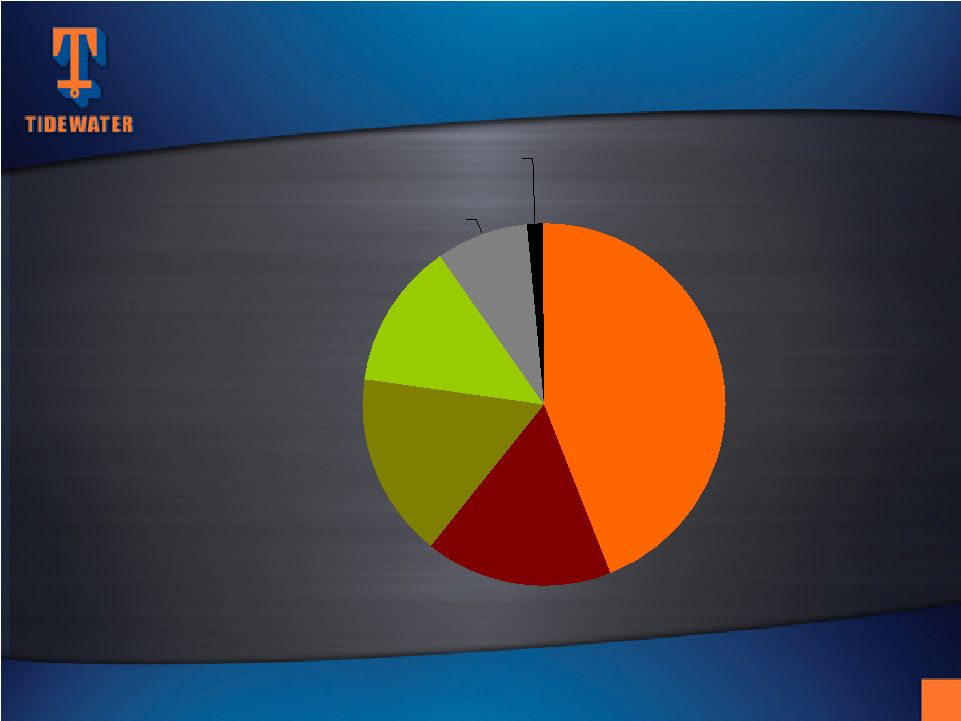

Source: Thomson Reuters

As of June 28, 2010

~71% of non-index investors

focused on long-term value creation

STOCK OWNERSHIP

STOCK OWNERSHIP

BY INVESTMENT STYLE

BY INVESTMENT STYLE

29

GARP

17%

Index

17%

Growth

13%

Income

8%

Specialty

1%

Value

43% |

Maintain

Financial Strength

EVA-Based Investments

On Through-cycle Basis

Deliver Results

FINANCIAL STRATEGY FOCUSED ON

FINANCIAL STRATEGY FOCUSED ON

CREATING LONG-TERM SHAREHOLDER VALUE

CREATING LONG-TERM SHAREHOLDER VALUE

30 |

FISCAL

2010 ANNUAL FISCAL 2010 ANNUAL

SHAREHOLDERS MEETING

SHAREHOLDERS MEETING

July 22, 2010

July 22, 2010

Jeffrey M. Platt

Jeffrey M. Platt

Chief Operations Officer

Chief Operations Officer

Dean E. Taylor

Dean E. Taylor

Chairman, President and

Chairman, President and

Chief Executive Officer

Chief Executive Officer

Quinn P. Fanning

Quinn P. Fanning

Executive Vice President

Executive Vice President

and Chief Financial Officer

and Chief Financial Officer |