Attached files

| file | filename |

|---|---|

| 8-K - FORM 8-K - General Finance CORP | form_8-k.htm |

| EX-99.1 - EXHIBIT 99.1 - General Finance CORP | exhibit_99-1.htm |

Exhibit 99.2

Rights Offering Presentation

May 2010

Safe Harbor Statement 1

Background 2

Strategy and Plan 3

Management Track Record - Successful History in Sector 4

Management Track Record - Summary 5

Royal Wolf - Overview 6

Royal Wolf - Footprint 7

Royal Wolf - Fleet 8

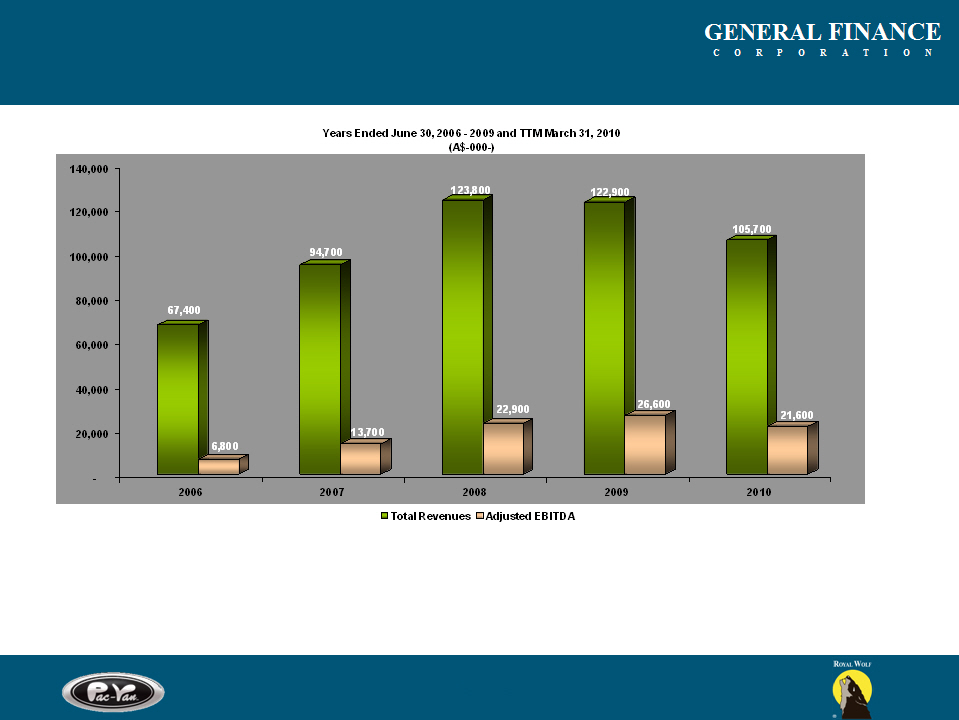

Royal Wolf - Revenues and Adjusted EBITDA 9

Pac-Van - Overview 10

Pac-Van - Footprint 11

Pac-Van - Fleet 12

Pac-Van - Revenues and Adjusted EBITDA 13

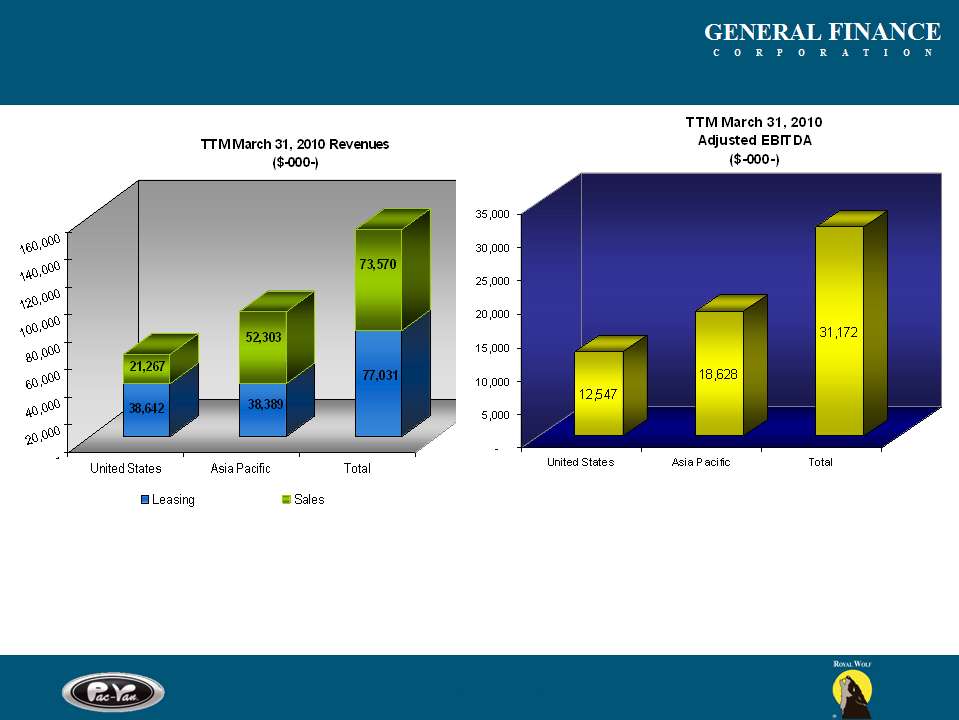

TTM Revenues and Adjusted EBITDA 14

Key Financial Highlights 15

Valuation Comparison 16

Other Business and Financial Information 17

Investment Summary 18

Rights Offering Summary 19

Unit Valuation 20

Key Dates and Contacts 21

Rights Offering Presentation

Table of Contents

Description Pages

i

Rights Offering Presentation

Safe Harbor Statement

1

Statements in this presentation that are not historical facts are forward-looking statements. Such forward-looking statements include, but are not limited to, prospects of General Finance, Pac-Van and Royal Wolf. We believe that the expectations represented by our forward looking statements are reasonable, yet there can be no assurance that such expectations will prove to be correct. Furthermore, unless otherwise stated, the forward looking statements contained in this presentation or made in conjunction with this presentation are made as of the date of the presentation, and we do not undertake any obligation to update publicly or to revise any of the included forward-looking statements, whether as a result of new information, future events or otherwise unless required by applicable legislation or regulation. The forward-looking statements contained in this presentation expressly qualified by this cautionary statement. Interested parties are cautioned that these forward-looking statements involve certain risks and uncertainties, including those contained in filings with the Securities and Exchange Commission; such as General Finance’s Annual Report on Form 10-K for the fiscal year ended June 30, 2009, the Quarterly Reports on Form 10-Q filed during the fiscal year ending June 30, 2010 and the prospectus for the rights offering.

General Finance Corporation is a holding company that:

4 Acquired Royal Wolf in September 2007

4 Acquired Pac-Van in October 2008

4 Is traded on the NASDAQ Global Market

• Common stock (GFN)

• Units (GFNU)

• Warrants (GFNCW)

4 Has its corporate headquarters in Pasadena, California

Rights Offering Presentation

Background

2

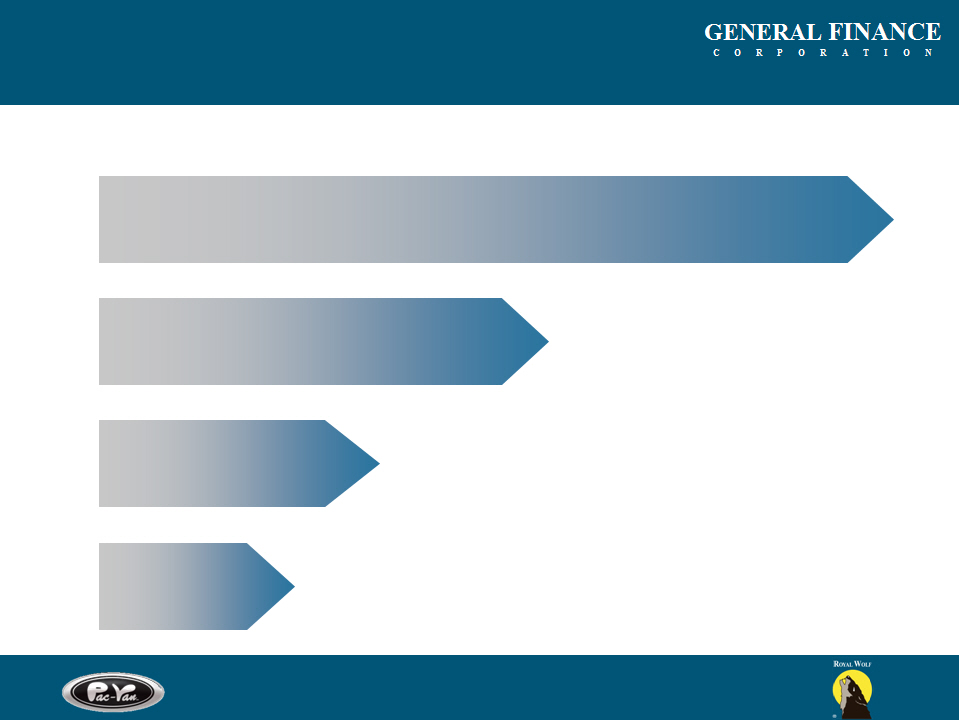

Our short-term strategy is to reduce our indebtedness and maximize cash flows.

Our long-term strategy and business plan is to acquire and operate rental services

and specialty finance businesses in North America, Europe and Asia-Pacific in the

modular space and mobile storage industries (“portable services”) with the

following characteristics:

and specialty finance businesses in North America, Europe and Asia-Pacific in the

modular space and mobile storage industries (“portable services”) with the

following characteristics:

4Existing or potential market leadership

4Strong management teams at each region

4Mobile storage (containers) fleet

4Strong leasing revenues

Rights Offering Presentation

Strategy and Plan

3

Rights Offering Presentation

Management Track Record - Successful History in Sector

Mobile Storage Group

4 Ron Valenta founded one of the largest lessors /sellers of portable storage containers,

trailers, and portable office units throughout the United States and the United

Kingdom

trailers, and portable office units throughout the United States and the United

Kingdom

4 Ron’s successful track record demonstrates experience in implementing operational

changes and cost controls combined with acquisitions

changes and cost controls combined with acquisitions

• Increased utilization rates and lease rates, created national accounts program

and implemented an acquisition program

and implemented an acquisition program

• Effective cost controls

• Over 80 acquisitions ranging up to $65 million

• Fifteen year CAGR of 40% for revenue, 33% for EBITDA and 101% ROI

Other Rental Services - portable sanitation, document storage, temp fencing

4 Ron also founded the largest west coast provider of portable sanitation services prior

to its sale, in October 1998

to its sale, in October 1998

• Consolidated fragmented industry through aggressive acquisition campaign

complemented by operational changes and strong organic growth

complemented by operational changes and strong organic growth

• Nine acquisitions totaling $28 million and 17% per annum organic growth

• Investors contributed $1.4 million over 6 years and netted an IRR of 76%

4 Key aspect of rental services is the quality of local operations and management

4

Rights Offering Presentation

Management Track Record - Summary

4 During the past 15 years, members of management have completed over 84 acquisitions

Mobile Storage Group Inc.

101% IRR over 12 years

$95.8

million

million

$300,000

Portosan Company LLC

76% IRR over 6 years

$30.3

million

million

$1.4

million

million

Portosan Company Inc.

2,933% IRR over 2 years

$1.8

million

million

$60,000

Portoshred LLC

67% IRR over 3 years

$768,000

$165,000

5

Rights Offering Presentation

Royal Wolf - Overview

4 We acquired 86.2% of Royal Wolf, the largest mobile storage container company in Australia in September 2007 as

our first operating company

our first operating company

4 Royal Wolf has an experienced management team and a base for the Asia-Pacific theater

4 Royal Wolf New Zealand, the largest portable storage provider in New Zealand, was acquired in April 2008

4 Five other acquisitions completed

4 Storage Containers: Royal Wolf leases and sells:

• Portable containers for on-site storage

• Portable container buildings as site offices and for temporary accommodations

• Freight containers specifically designed for the transport of products by road and rail

6

Rights Offering Presentation

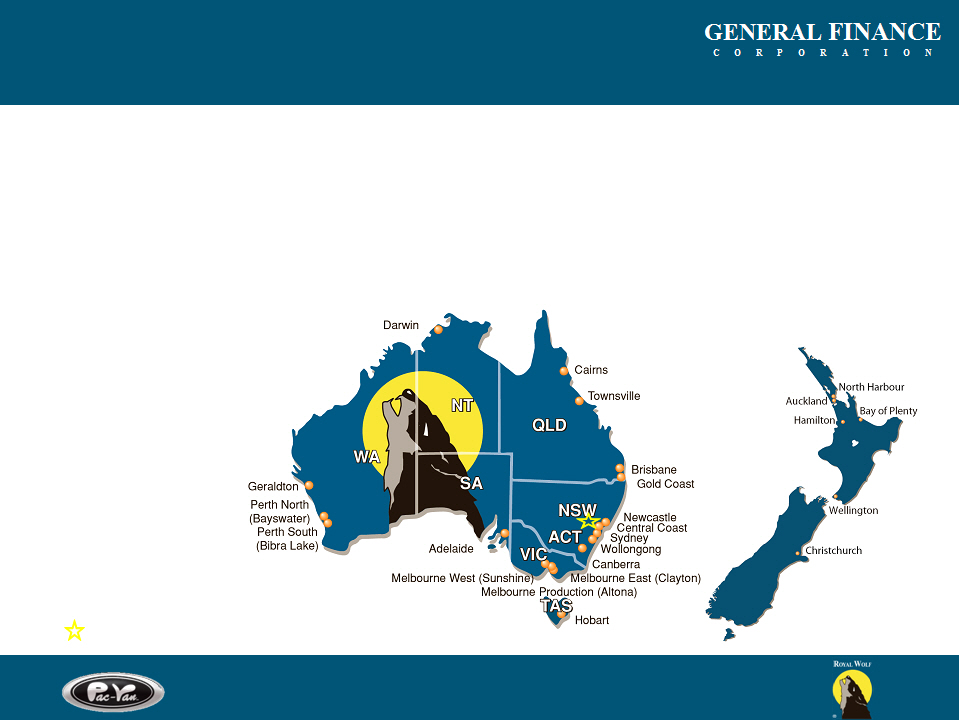

Royal Wolf - Footprint

= Hornsby, NSW Headquarters

4 Serves customers through Retail (small to mid-sized businesses) and National Accounts

4 Retail operated through an Australia and New Zealand-wide network of 24 customer service

centers or CSC’s

centers or CSC’s

4 National Accounts sells or leases containers to specific industry sectors, primarily the following :

• Mining and Defense

• Transport (Road & Rail)

• Moving and Storage (Removals)

7

Rights Offering Presentation

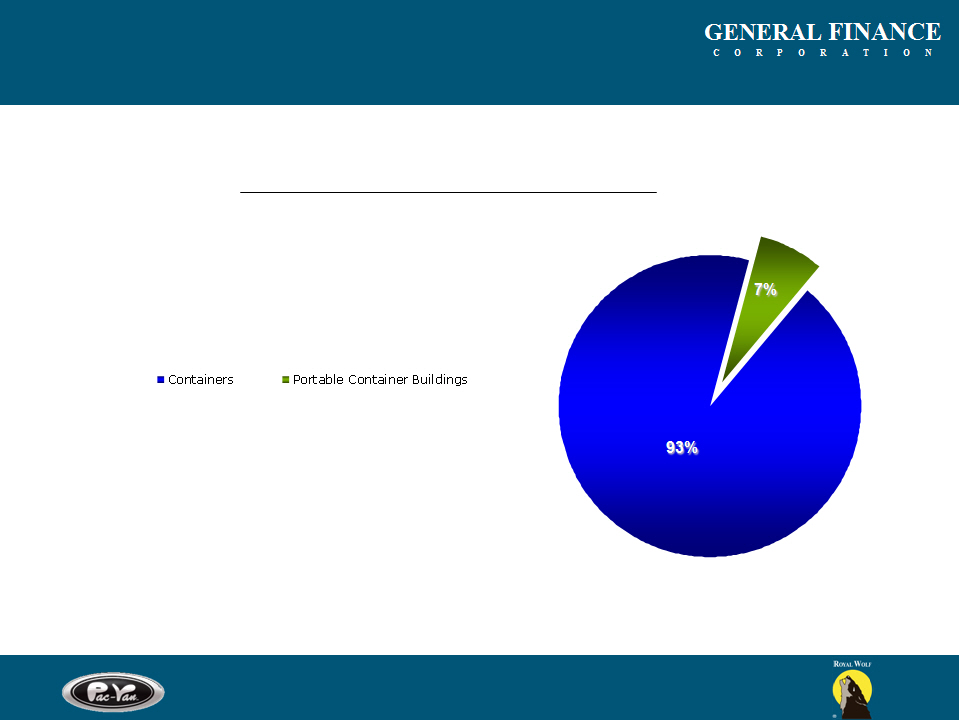

Royal Wolf - Fleet

Fleet Composition

At March 31, 2010 (in 000’s)

8

|

|

|

|

|

Total Units

Total Leased Units

Utilization

|

25,347

20,027

79.0%

|

1,859

1,506

81.0%

|

Rights Offering Presentation

Royal Wolf - Revenues and Adjusted EBITDA (a)

9

(a) Earnings before interest expense, income tax, depreciation and amortization and other non-operating costs and income (EBITDA and adjusted EBITDA) are a supplemental measure

of performance that is not required by, or presented in accordance with U.S. generally accepted accounting principles (“U.S. GAAP”). Adjusted EBITDA (which adds back share-based

compensation expense and non-operating costs and income) is a non-U.S. GAAP measure, is not a measurement of our financial performance under U.S. GAAP and should not be

considered as an alternative to net income, income from operations or any other performance measures derived in accordance with U.S. GAAP or as an alternative to cash flow from

operating, investing or financing activities as a measure of liquidity. We present adjusted EBITDA because we consider it to be an important supplemental measure of our performance

and because it is frequently used by securities analysts, investors and other interested parties in the evaluation of companies in our industry, many of which present EBITDA and a

form of our adjusted EBITDA when reporting their results.

of performance that is not required by, or presented in accordance with U.S. generally accepted accounting principles (“U.S. GAAP”). Adjusted EBITDA (which adds back share-based

compensation expense and non-operating costs and income) is a non-U.S. GAAP measure, is not a measurement of our financial performance under U.S. GAAP and should not be

considered as an alternative to net income, income from operations or any other performance measures derived in accordance with U.S. GAAP or as an alternative to cash flow from

operating, investing or financing activities as a measure of liquidity. We present adjusted EBITDA because we consider it to be an important supplemental measure of our performance

and because it is frequently used by securities analysts, investors and other interested parties in the evaluation of companies in our industry, many of which present EBITDA and a

form of our adjusted EBITDA when reporting their results.

Rights Offering Presentation

Pac-Van - Overview

4 We acquired Pac-Van in October 2008

4 Pac-Van operates 26 branch locations across 18 states in the U.S.

4 Pac-Van’s experienced management team has been in place for an average of over ten years and have

managed through prior economic downturns

managed through prior economic downturns

4 Pac-Van leases and sells:

• Modular buildings

• Mobile offices

• Portable storage containers

to primarily the commercial, industrial, construction, government and education sectors

4 Pac-Van also provides ancillary services such as steps, furniture, security systems and other items

10

Rights Offering Presentation

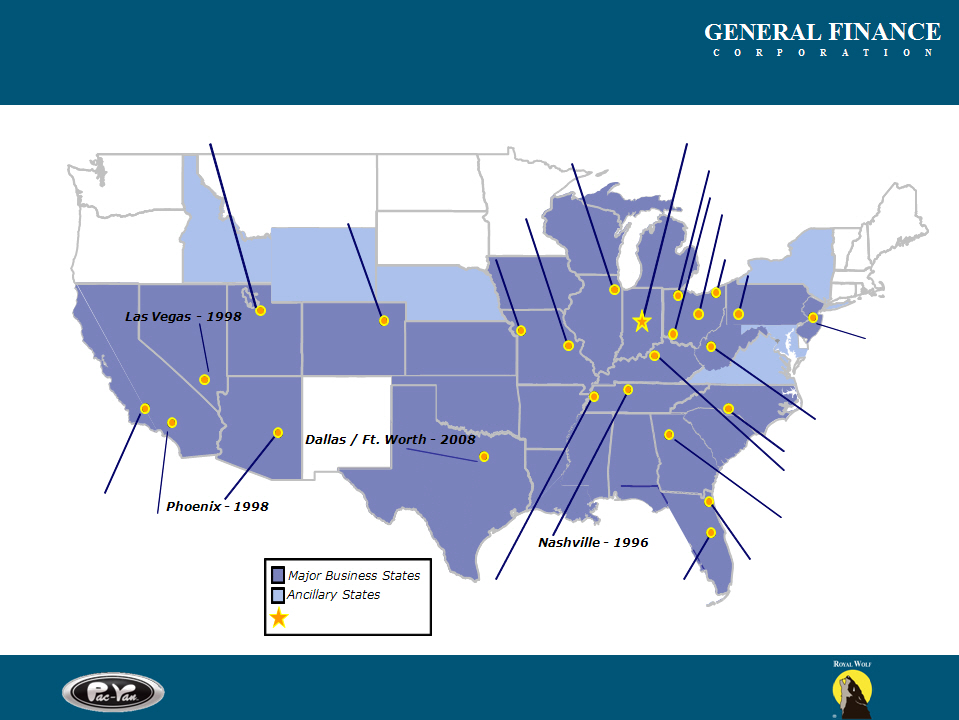

Pac-Van - Footprint

Denver - 1999

Kansas City - 2000

St. Louis - 1996

Chicago - 1998

Indianapolis - 1993

Cincinnati - 1997

Columbus - 1993

Cleveland - 1995

Pittsburgh - 1998

Memphis - 1997

Orlando - 1997

Louisville - 1994

Charlotte - 1999

Charleston - 1998

Toledo - 1996

Jacksonville - 2007

Bakersfield - 2008

L.A. Fontana - 2008

Atlanta - 2008

Trenton - 2008

Headquarters

Salt Lake City - 2008

11

Nashville - 1996 Dallas / Ft. Worth – 2008 Phoenix – 1998 Las Vegas – 1998 Major Business States Ancillary States

Rights Offering Presentation

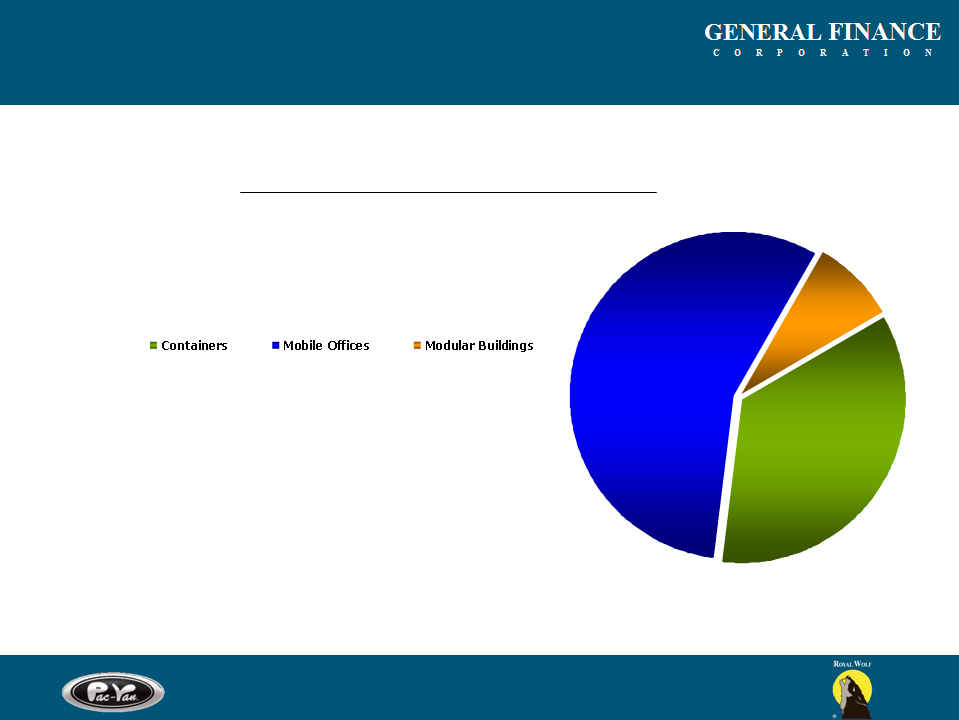

Pac-Van - Fleet

9%

33%

Fleet Composition

At March 31, 2010 (in 000’s)

58%

12

|

Total Units

Total Leased Units

Utilization

|

3,810

3,002

78.8%

|

6,143

3,881

63.2%

|

994

761

76.6%

|

Rights Offering Presentation

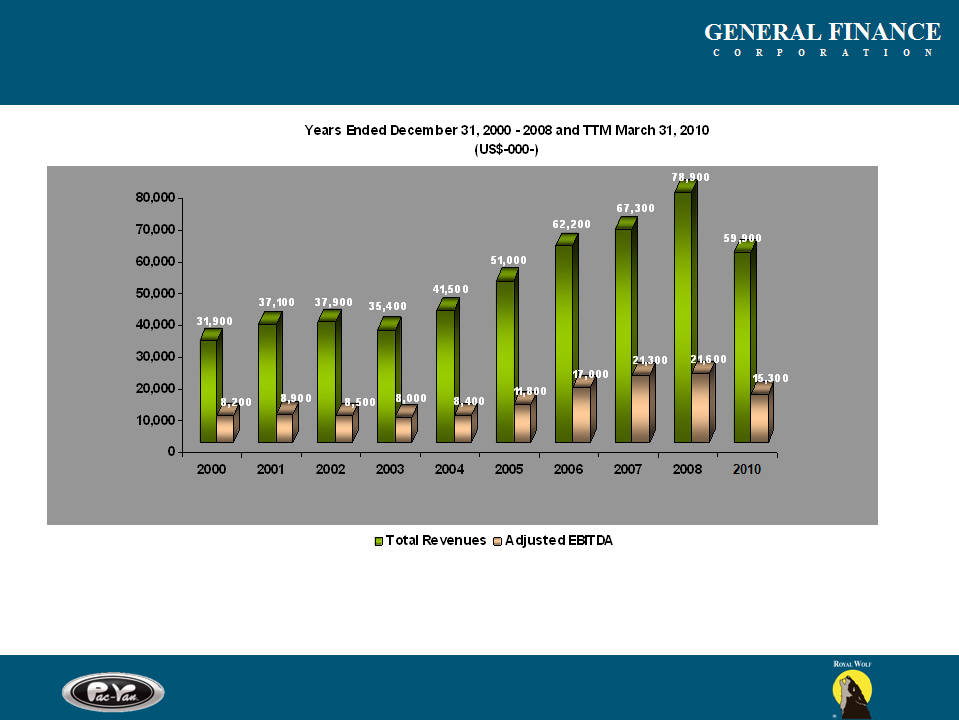

Pac-Van - Revenues and Adjusted EBITDA (a)

13

(a) Earnings before interest expense, income tax, depreciation and amortization and other non-operating costs and income (EBITDA and adjusted EBITDA) are a supplemental measure of

performance that is not required by, or presented in accordance with U.S. generally accepted accounting principles (“U.S. GAAP”). Adjusted EBITDA (which adds back share-based

compensation expense and non-operating costs and income) is a non-U.S. GAAP measure, is not a measurement of our financial performance under U.S. GAAP and should not be

considered as an alternative to net income, income from operations or any other performance measures derived in accordance with U.S. GAAP or as an alternative to cash flow from

operating, investing or financing activities as a measure of liquidity. We present adjusted EBITDA because we consider it to be an important supplemental measure of our performance

and because it is frequently used by securities analysts, investors and other interested parties in the evaluation of companies in our industry, many of which present EBITDA and a form of

our adjusted EBITDA when reporting their results.

performance that is not required by, or presented in accordance with U.S. generally accepted accounting principles (“U.S. GAAP”). Adjusted EBITDA (which adds back share-based

compensation expense and non-operating costs and income) is a non-U.S. GAAP measure, is not a measurement of our financial performance under U.S. GAAP and should not be

considered as an alternative to net income, income from operations or any other performance measures derived in accordance with U.S. GAAP or as an alternative to cash flow from

operating, investing or financing activities as a measure of liquidity. We present adjusted EBITDA because we consider it to be an important supplemental measure of our performance

and because it is frequently used by securities analysts, investors and other interested parties in the evaluation of companies in our industry, many of which present EBITDA and a form of

our adjusted EBITDA when reporting their results.

Rights Offering Presentation

TTM Revenues and Adjusted EBITDA (a)

(a) Earnings before interest expense, income tax, depreciation and amortization and other non-operating costs and income (EBITDA and adjusted EBITDA) are a

supplemental measure of performance that is not required by, or presented in accordance with U.S. generally accepted accounting principles (“U.S. GAAP”).

Adjusted EBITDA (which adds back share-based compensation expense and non-operating costs and income) is a non-U.S. GAAP measure, is not a measurement of

our financial performance under U.S. GAAP and should not be considered as an alternative to net income, income from operations or any other performance

measures derived in accordance with U.S. GAAP or as an alternative to cash flow from operating, investing or financing activities as a measure of liquidity. We

present adjusted EBITDA because we consider it to be an important supplemental measure of our performance and because it is frequently used by securities analysts,

investors and other interested parties in the evaluation of companies in our industry, many of which present EBITDA and a form of our adjusted EBITDA when

reporting their results.

supplemental measure of performance that is not required by, or presented in accordance with U.S. generally accepted accounting principles (“U.S. GAAP”).

Adjusted EBITDA (which adds back share-based compensation expense and non-operating costs and income) is a non-U.S. GAAP measure, is not a measurement of

our financial performance under U.S. GAAP and should not be considered as an alternative to net income, income from operations or any other performance

measures derived in accordance with U.S. GAAP or as an alternative to cash flow from operating, investing or financing activities as a measure of liquidity. We

present adjusted EBITDA because we consider it to be an important supplemental measure of our performance and because it is frequently used by securities analysts,

investors and other interested parties in the evaluation of companies in our industry, many of which present EBITDA and a form of our adjusted EBITDA when

reporting their results.

14

51%

49%

58%

65%

42%

35%

Rights Offering Presentation

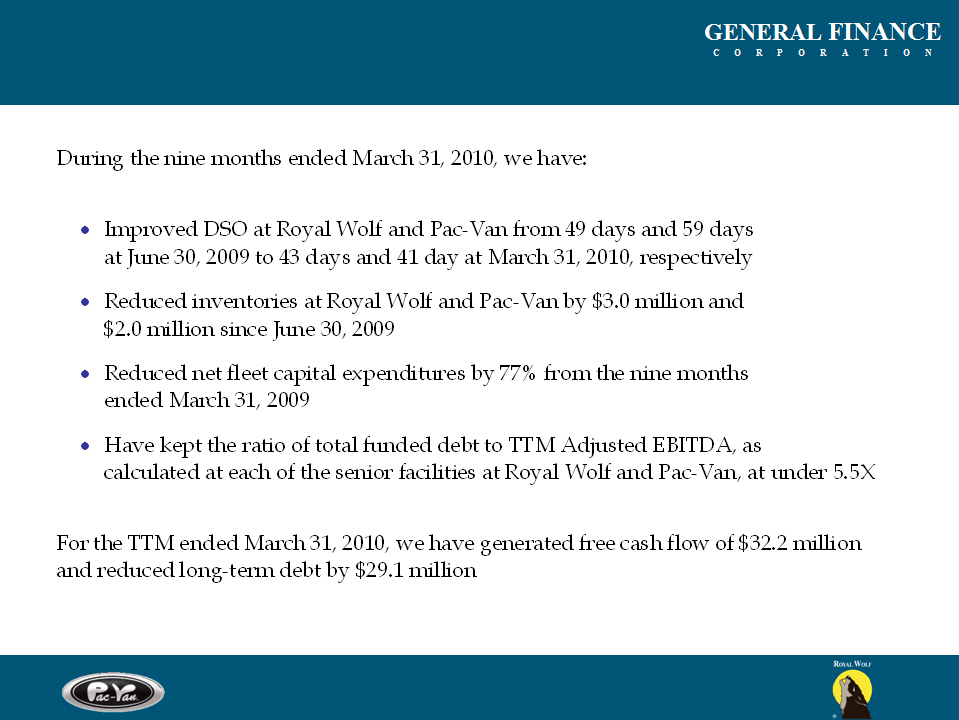

Key Financial Highlights

15

During the nine months ended March 31, 2010, we have: improved dso at royal wolf and pac-van from 49 days and 59 days at june 30, 2009 to 43 days and 41 day at march 31, 2010, respectively reduced inventories at royal wolf and pac-van by $3.0 million and $2.0 million since june 30, 2009 reduced net fleet capital expenditures by 77% from the nine months ended march 31, 2009 have kept the ratio of total funded debt to ttm adjusted ebitda, as calculated at each of the senior facilities at royal wolf and pac-van, at under 5.5x for the ttm ended march 31, 2010, we have generated free cash flow of $32.2 million and reduced long-term debt by $29.1 million

Because of our leverage in the current economic environment, we believe the financial markets have

depressed our equity valuation. Below is a comparison of our current valuation to a valuation based

on the historical multiple of 8.0x Adjusted EBITDA (in $-000-):

depressed our equity valuation. Below is a comparison of our current valuation to a valuation based

on the historical multiple of 8.0x Adjusted EBITDA (in $-000-):

Rights Offering Presentation

Valuation Comparison

16

Cash Long-term debt and obligations Preferred Stock Noncontrolling Interest Number of common shares issued and outstanding Stock price Market Cap TEV TTM Adjusted EBITDA Multiple (a) Minimum value of Bison put option exercisable on July 1, 2011 (b) Actual at May 14, 2010 (c) Derived assuming historical multiple of 8.0x Adjusted EBITDA

Rights Offering Presentation

Other Business and Financial Information

17

Other and more detailed business and financial information about us are included in periodic and current documents filed with the Securities and Exchange Commission (“SEC”) that are available on the SEC’s EDGAR system website, including our Annual Report on Form 10-K for the fiscal year ended June 30, 2009, the Quarterly Reports on Form 10-Q for the year ending June 30, 2010 and the prospectus for the rights offering. We maintain a web site at www.generalfinance.com that makes available, through a link to the SEC’s EDGAR system website, our filings that we have made with the SEC; as well as news releases to the public.

Rights Offering Presentation

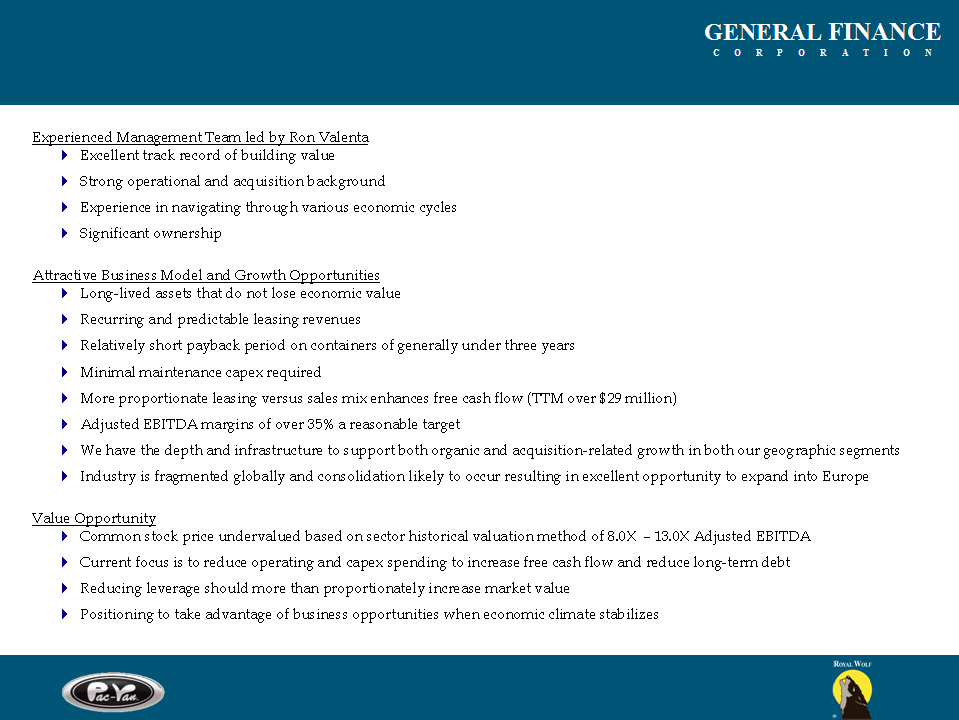

Investment Summary

18

Experienced Management Team led by Ron Valenta Excellent track record of building value Strong operational and acquisition background Experience in navigating through various economic cycles Significant ownership Attractive Business Model and Growth Opportunities Long-lived assets that do not lose economic value Recurring and predictable leasing revenues Relatively short payback period on containers of generally under three years Minimal maintenance capex required More proportionate leasing versus sales mix enhances free cash flow (TTM over $29 million) Adjusted EBITDA margins of over 35% a reasonable target We have the depth and infrastructure to support both organic and acquisition-related growth in both our geographic segments Industry is fragmented globally and consolidation likely to occur resulting in excellent opportunity to expand into Europe Value Opportunity Common stock price undervalued based on sector historical valuation method of 8.0X – 13.0X Adjusted EBITDA Current focus is to reduce operating and capex spending to increase free cash flow and reduce long-term debt Reducing leverage should more than proportionately increase market value Positioning to take advantage of business opportunities when economic climate stabilizes

Rights Offering Presentation

Rights Offering Summary

19

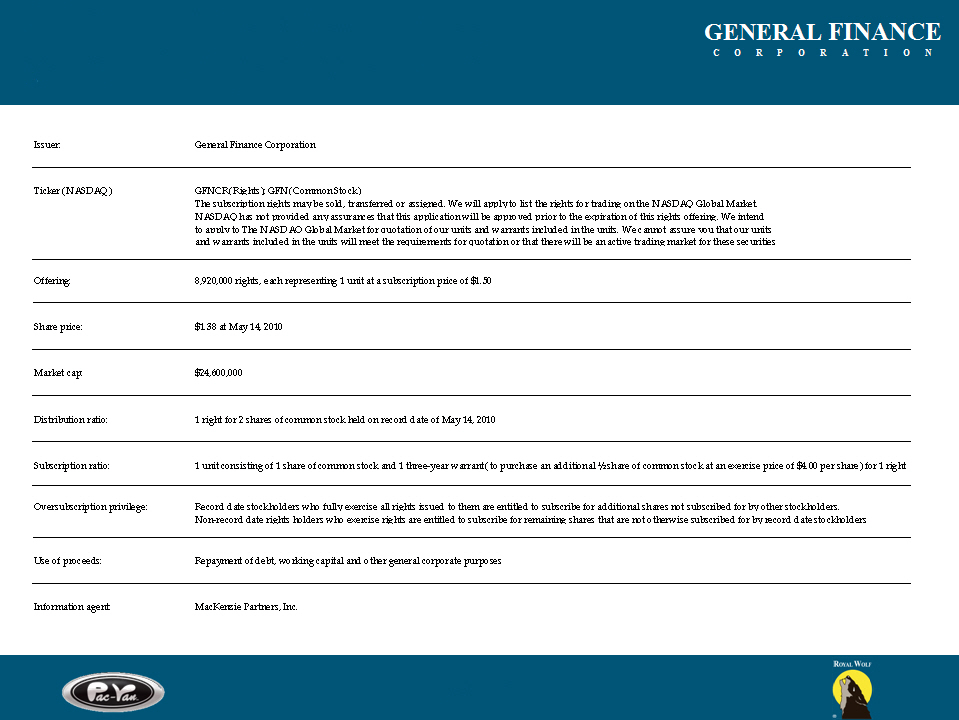

Issuer: General Finance Corporation Ticker (NASDAQ): GFNCR (Rights); GFN (Common Stock) The subscription rights may be sold, transferred or assigned. We will apply to list the rights for trading on the NASDAQ Global Market. NASDAQ has not provided any assurances that this application will be approved prior to the expiration of this rights offering. We intend to apply to The NASDAQ Global Market for quotation of our units and warrants included in the units. We cannot assure you that our units and warrants included in the units will meet the requirements for quotation or that there will be an active trading market for these securities Offering: 8,920,000 rights, each representing 1 unit at a subscription price of $1.50 Share price: $1.38 at May 14, 2010 Market cap: $24,600,000 Distribution ratio: 1 right for 2 shares of common stock held on record date of May 14, 2010 Subscription ratio: 1 unit consisting of 1 share of common stock and 1 three-year warrant (to purchase an additional ½ share of common stock at an exercise price of $4.00 per share) for 1 right Oversubscription privilege: Record date stockholders who fully exercise all rights issued to them are entitled to subscribe for additional shares not subscribed for by other stockholders. Non-record date rights holders who exercise rights are entitled to subscribe for remaining shares that are not otherwise subscribed for by record date stockholders Use of proceeds: Repayment of debt, working capital and other general corporate purposes Information agent: MacKenzie Partners, Inc.

Rights Offering Presentation

Unit Valuation

20

The $1.50 per Unit subscription price was determined by the Rights Offering Committee of our Board of Directors based, in part, on the per share value of our common stock. In determining the subscription price, our rights offering committee considered many factors, including the historical and current market price of our common stock, the terms and expenses of this offering relative to other alternatives to raising capital, the size of this offering and the general condition of the securities markets. Applying a Black-Scholes valuation and using a benchmark date of April 20th, each warrant was valued at approximately $0.23 and the per share value of the common stock was determined at $1.27, which represented a discount of up to 15% to our recent historical per share prices up to that date. We did not seek or obtain an opinion of financial advisors in establishing the subscription price. The subscription price will not necessarily be related to our book value, tangible book value, net worth or any other established criteria of fair value and may or may not be considered the fair value of our common stock to be offered in the rights offering. You should not assume or expect that, after the rights offering, our shares of common stock will trade at or above the equivalent component of the subscription price in any given time period.

This presentation does not constitute an offer to sell or the solicitation of an offer to buy the securities in the rights offering, nor

shall there be any sale of these securities in any state in which such offer, solicitation or sale would be unlawful prior to

registration or qualification under the securities laws of any such state. The securities may only be offered by means of a

prospectus; additional copies of which may be obtained, when available, by contacting the information agent, MacKenzie

Partners, Inc.:

shall there be any sale of these securities in any state in which such offer, solicitation or sale would be unlawful prior to

registration or qualification under the securities laws of any such state. The securities may only be offered by means of a

prospectus; additional copies of which may be obtained, when available, by contacting the information agent, MacKenzie

Partners, Inc.:

105 Madison Avenue

New York, NY 10016

Collect: (212) 929-5500

Toll-free: (800) 322-2885

E-mail: generalfinancerights@mackenziepartners.com

or to the General Finance’s principal executive offices:

Attn: Corporate Secretary

39 East Union Street

Pasadena, CA 91103

(626) 584-9722

E-mail: info@generalfinance.com

Record Date…………..………………………………………… …... . .. .……….. May 14, 2010

Subscription Period Begins……………………………………………… . . .….… May 14, 2010

Expiration Date (unless the offer is extended)……………………… . …. . .…. . . ...June 15, 2010

Rights Offering Presentation

Key Dates and Contacts

21