Attached files

| file | filename |

|---|---|

| EX-31.2 - EX-31.2 - General Finance CORP | d939869dex312.htm |

| EX-32.2 - EX-32.2 - General Finance CORP | d939869dex322.htm |

| EX-32.1 - EX-32.1 - General Finance CORP | d939869dex321.htm |

| EX-31.1 - EX-31.1 - General Finance CORP | d939869dex311.htm |

| EX-23.1 - EX-23.1 - General Finance CORP | d939869dex231.htm |

| EX-21.1 - EX-21.1 - General Finance CORP | d939869dex211.htm |

Table of Contents

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 10-K

| ☒ | ANNUAL REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934 |

For the Fiscal Year Ended June 30, 2020

OR

| ☐ | TRANSITION REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934 |

Commission file number 001-32845

(Exact name of registrant as specified in its charter)

| Delaware | 32-0163571 | |

| (State or other Jurisdiction of Incorporation or Organization) |

(I.R.S. Employer Identification No.) | |

| 39 East Union Street Pasadena, California 91103 |

(626) 584-9722 | |

| (Address of Principal Executive Offices) | (Registrant’s telephone number, including area code) | |

Securities registered pursuant to Section 12(b) of the Act:

| Title of Each Class |

Trading Symbols(s) |

Name of Each Exchange On

Which | ||

| Common Stock, $0.0001 par value | GFN | NASDAQ Global Market | ||

| 9.00% Series C Cumulative Redeemable Perpetual Preferred Stock (Liquidation Preference $100 per share) | GFNCP | NASDAQ Global Market | ||

| 8.125% Senior Notes due 2021 | GFNSL | NASDAQ Global Market | ||

Securities registered pursuant to Section 12(g) of the Act:

None

Indicate by check mark if the registrant is a well-known seasoned issuer, as defined in Rule 405 the Securities Act. Yes ☐ No ☒

Indicate by check mark if the registrant is not required to file reports pursuant to Section 13 or Section 15(d) of the Act. Yes ☐ No ☒

Indicate by check mark whether the registrant: (1) has filed all reports required to be filed by Section 13 or 15(d) of the Securities Exchange Act of 1934 during the preceding 12 months (or for such shorter period that the registrant was required to file such reports) and (2) has been subject to such filing requirements for the last 90 days. Yes ☒ No ☐

Indicate by check mark whether the registrant has submitted electronically and posted on its corporate Web site, if any, every Interactive Data File required to be submitted and posted pursuant to Rule 405 of Regulation S-T (§232.405 of this chapter) during the preceding 12 months (or for such shorter period that the registrant was required to submit and post such files).

Yes ☒ No ☐

Indicate by check mark if disclosure of delinquent filers pursuant to Item 405 of Regulation S-K is not contained herein, and will not be contained, to the best of registrant’s knowledge, in definitive proxy or information statements incorporated by reference in Part III of this Form 10-K or any amendment to this Form 10-K. ☒

Indicate by check mark whether the registrant is a large accelerated filer, an accelerated filer, a non-accelerated filer, a smaller reporting company, or an emerging growth company. See definition of “large accelerated filer,” “accelerated filer,” non-accelerated filer,” “smaller reporting company” and “emerging growth company” in Rule 12b-2 of the Exchange Act.

| Large accelerated filer ☐ | Accelerated filer | ☒ | ||||

| Non-accelerated filer ☐ | Smaller reporting company | ☐ | ||||

| Emerging growth company | ☐ | |||||

Indicate by check mark whether the registrant is a shell company (as defined in Rule 12b-2 of the Exchange Act). Yes ☐ No ☒

Indicate by check mark whether the registrant has filed a report on and attestation to its management’s assessment of the effectiveness of its internal control over financial reporting under Section 404(b) of the Sarbanes-Oxley Act (15 U.S.C. 7262(b)) by the registered public accounting firm that prepared or issued its audit report. ☒

The aggregate market value of Common Stock held by non-affiliates of the Registrant on December 31, 2019 was approximately $165,555,000 based on a closing price of $11.07 for the Common Stock on such date. For purposes of this computation, all executive officers and directors have been deemed to be affiliates. Such determination should not be deemed to be an admission that such executive officers and directors are, in fact, affiliates of the Registrant.

There were 30,166,938 shares of the Registrant’s Common Stock outstanding as of September 3, 2020.

DOCUMENTS INCORPORATED BY REFERENCE

Portions of the Registrant’s Proxy Statement for its 2020 Annual Meeting of Stockholders are incorporated by reference into Part III of this Annual Report on Form 10-K. In addition, certain exhibits are incorporated into Part IV, Item 15. of this Annual Report on Form 10-K by reference to other reports and registration statements of the Registrant, which have been filed with the Securities and Exchange Commission.

Table of Contents

GENERAL FINANCE CORPORATION

2020 ANNUAL REPORT ON FORM 10-K

| Page | ||||

| ii | ||||

| I-1 | ||||

| I-24 | ||||

| I-47 | ||||

| I-47 | ||||

| I-50 | ||||

| I-50 | ||||

| II-1 | ||||

| II-3 | ||||

| Item 7. Management’s Discussion and Analysis of Financial Condition and Results of Operations |

II-5 | |||

| Item 7A. Quantitative and Qualitative Disclosures About Market Risk |

II-25 | |||

| II-25 | ||||

| Item 9. Changes in and Disagreements with Accountants on Accounting and Financial Disclosure |

II-25 | |||

| II-25 | ||||

| II-27 | ||||

| Item 10. Directors, Executive Officers and Corporate Governance |

III-1 | |||

| III-1 | ||||

| III-1 | ||||

| Item 13. Certain Relationships and Related Transactions, and Director Independence |

III-1 | |||

| III-1 | ||||

| IV-1 | ||||

| IV-6 | ||||

| SIG | ||||

i

Table of Contents

This Annual Report on Form 10-K, including the documents incorporated by reference into this Annual Report on Form 10-K, contains forward-looking statements within the meaning of Section 27A of the Securities Act of 1933, as amended, referred to in this Annual Report on Form 10-K as the Securities Act, and Section 21E of the Securities Exchange Act of 1934, as amended, referred to in this Annual Report on Form 10-K as the Exchange Act. Forward-looking statements involve risks and uncertainties that could cause results or outcomes to differ materially from those expressed in the forward-looking statements. Forward-looking statements may include, without limitation, statements relating to our plans, strategies, objectives, expectations and intentions and are intended to be made pursuant to the safe harbor provisions of the Private Securities Litigation Reform Act of 1995. Some of the forward-looking statements can be identified by the use of forward-looking terms such as “believes,” “expects,” “may,” “will,” “should,” “could,” “seek,” “intends,” “plans,” “estimates,” “anticipates” or other comparable terms. A number of important factors could cause actual results to differ materially from those in the forward-looking statements. The risks and uncertainties discussed in “Risk Factors” should be considered in evaluating our forward-looking statements. You should not place undue reliance on our forward-looking statements. Further, any forward-looking statement speaks only as of the date on which it is made, and we undertake no obligation to update or revise any forward-looking statements.

ii

Table of Contents

References to “we,” “us,” “our” or the “Company” refer to General Finance Corporation, a Delaware corporation (“GFN”), and its consolidated subsidiaries. These subsidiaries include GFN U.S. Australasia Holdings, Inc., a Delaware corporation (“GFN U.S.”); GFN Insurance Corporation, an Arizona corporation (“GFNI”); GFN North America Leasing Corporation, a Delaware corporation (“GFNNA Leasing”); GFN North America Corp., a Delaware corporation (“GFNNA”); GFN Realty Company, LLC, a Delaware limited liability company (“GFNRC”); GFN Manufacturing Corporation, a Delaware corporation (“GFNMC”), and its subsidiary, Southern Frac, LLC, a Texas limited liability company (collectively “Southern Frac”); Pac-Van, Inc., an Indiana corporation, and its Canadian subsidiary, PV Acquisition Corp., an Alberta corporation (collectively “Pac-Van”); and Lone Star Tank Rental Inc., a Delaware corporation (“Lone Star”); GFN Asia Pacific Holdings Pty Ltd, an Australian corporation (“GFNAPH”), and its subsidiaries, Royal Wolf Trading Australia Pty Limited and Royalwolf Trading New Zealand Limited, a New Zealand Corporation (collectively, “Royal Wolf”).

Overview

Founded in 2005, we are a leading specialty rental services company offering portable storage, modular space and liquid containment solutions, with a diverse and expanding lease fleet of 100,645 units as of June 30, 2020. Our primary 105 branch locations across North America and the Asia-Pacific area offer a wide range of portable storage units, including our core 20-feet and 40-feet steel containers, office container, mobile office and modular space products and steel tanks that provide our customers a flexible, cost-effective and convenient way to meet their temporary storage and space needs. Our units are easily customized to satisfy our customers’ specific application needs and include numerous value-added components. We provide our storage solutions to a diverse base of approximately 50,000 customers across a broad range of industries, including the commercial, construction, transportation, industrial, energy, manufacturing, mining, retail, consumer, education and government sectors. Our customers utilize our storage and space units for a wide variety of applications, including the temporary storage of materials, supplies, equipment, retail merchandise inventories, documents and liquid storage and for office use.

We focus on leasing rather than selling our units. Approximately 65% of our total non-manufacturing revenues for the year ended June 30, 2020 (“FY 2020”) were derived from leasing activities. We believe our business model is compelling because it is driven by lease fleet assets that:

| • | generate a recurring revenue stream with average lease durations of over 9—16 months; |

| • | possess long useful lives of 20 to 30 years with high residual values; |

| • | return the original equipment cost through revenue within four years on average; |

| • | operate at high lease fleet utilization levels, historically between 70% and 85%; |

| • | require low maintenance expenditures; and |

| • | earn attractive margins. |

Our lease fleet is comprised of three distinct specialty rental equipment categories that possess attractive asset characteristics and serve our customers’ on-site temporary needs and applications. These categories match the sectors we serve and which we collectively refer to as the “portable services industry” —portable (or mobile) storage, modular space and liquid containment.

Our portable storage category is segmented into two products: (1) storage containers, which primarily consist of new and used steel shipping containers under International Organization for Standardization (“ISO”) standards, that provide a flexible, low cost alternative to warehousing, while offering greater security, convenience and immediate accessibility; and (2) freight containers, which are designed for either transport of products by road and rail and are only offered in our Asia-Pacific territory.

I-1

Table of Contents

Our modular space category is segmented into three products: (1) office containers, which are referred to as portable container buildings in the Asia-Pacific, are either modified or specifically manufactured containers that provide self-contained office space with maximum design flexibility. Office containers in the United States are oftentimes referred to as ground level offices (“GLOs”); (2) modular buildings, which provide customers with flexible space solutions and are often modified to customer specifications and (3) mobile offices, which are re-locatable units with aluminum or wood exteriors and wood (or steel) frames on a steel carriage fitted with axles, and which allow for an assortment of “add-ons” to provide convenient temporary space solutions.

Our liquid containment category includes portable liquid storage tanks that are manufactured 500-barrel capacity steel containers with fixed axles for transport. These units can be utilized for a variety of applications across a wide range of industries, including refinery, petrochemical and industrial plant maintenance, oil and gas services, environmental remediation and field services, infrastructure building construction, marine services, pipeline construction and maintenance, tank terminal services, waste management, wastewater treatment and landfill services.

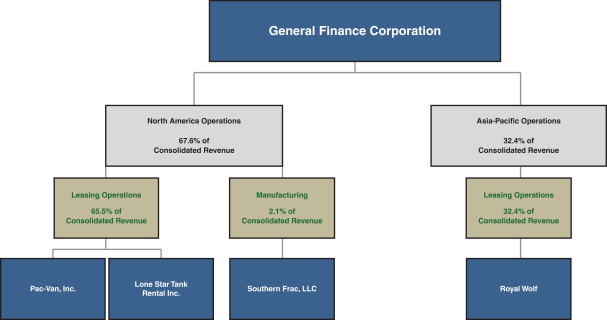

Summary Organization Chart (1) (2)

| (1) | Summary organization chart is illustrative and does not reflect our legal operating structure. |

| (2) | Reflects consolidated revenues for FY 2020. |

Industry Overview

We compete in three distinct, but related, sectors of the specialty rental services industry: portable storage, modular space and liquid containment, which we refer to collectively as the “portable services industry.”

Portable Storage

The storage industry includes two principal markets, fixed self-storage and portable storage. The fixed self-storage market consists of permanent structures located away from customer locations used primarily by consumers to temporarily store excess household goods. We do not participate in the fixed self-storage market

I-2

Table of Contents

with permanent structures. The portable storage market, in which we primarily operate, differs from the fixed self-storage market in that it brings the storage solution to the customer’s location and addresses the need for secure, temporary storage with immediate access to the storage unit. The advantages of portable storage include convenience, immediate accessibility, improved security and lower costs. In contrast to fixed self-storage, the portable storage market is primarily used by businesses and offers a flexible, secure, cost-effective and convenient alternative to constructing permanent warehouse space or storing items at an offsite facility. A broad range of industries, including the construction, industrial, commercial, retail and government sectors, utilize portable storage equipment to meet both their short-term and permanent storage needs.

The portable storage industry is fragmented in each of our geographic markets, with numerous participants in local markets leasing and selling portable storage units. While we are not aware of any published third-party analysis of either the Asia-Pacific or North American portable storage markets, we believe the portable storage sector has experienced steady growth since the 1990s and is achieving increased market share compared to other storage alternatives because of an increasing awareness of the benefits that portable storage units offer, including the availability, convenience, security and cost benefits of portable storage, as well as an increasing number of new applications for portable storage units.

Modular Space

Modular space solutions, including modular buildings, mobile offices and portable container buildings, are used primarily by businesses to address either temporary or permanent space needs. We believe modular space delivers four core benefits compared to permanent buildings or structures: reusability, timely solutions, lower costs and flexibility. Modular buildings may offer customers significant cost savings over permanent construction and can generally be installed more quickly because site work and fabrication can take place concurrently. In addition, modular solutions are not site specific and can be configured in a number of ways to meet multiple needs. Finally, modular buildings are reusable and will generally serve a wide variety of uses during their life span. A variety of industries utilize modular space solutions, including construction, resources, government, education, retail and special events, among others.

The Modular Building Institute, in its 2020 Relocatable Buildings Annual Data Report, stated that the North American modular space (or relocatable) sector, as reported by its members only, generated approximately $2.5 billion in annual revenues and management believes that the total sector to be approximately $4.0 billion. The sector has evolved in recent years as the number of applications for modular space has expanded and recognition of the product’s positive attributes has grown. By outsourcing their space needs, customers are able to achieve flexibility, preserve capital for core operations, and convert fixed costs into variable costs. The IBIS World Industry Report published in November 2019 estimated that the portable container buildings market in Australia generated revenue of AUS$2.1 billion ($1.4 billion), of which approximately AUS$1.3 billion ($0.9 billion) related to the markets in which we offer a competing product. We believe that we are well positioned to benefit from any growth in the North American and Asia-Pacific modular space markets.

We expect that the modular space market will grow over the long-term, driven in part by increasing awareness of the advantages of modular space. Additionally, we believe that the advantages of modular space over permanent buildings and structures of reusability, timely solutions, lower costs, and flexibility are highly valued in many of the end markets we serve. We further believe the increased penetration of modular space solutions in additional end markets will also continue to drive market growth.

Liquid Containment

Portable liquid storage tank containers are used in environmental and industrial applications to temporarily store hazardous and nonhazardous liquids and semi-solids. The tanks are used by customers across a wide variety of end markets, including chemical, refinery and industrial plant maintenance, environmental remediation, infrastructure building construction, marine services, oil and gas exploration and field services, pipeline

I-3

Table of Contents

construction and maintenance, tank terminal services, wastewater treatment and waste management and landfill services. Liquid containment end market demand is recurring and is driven by the non-discretionary nature of required customer maintenance cycles, an increasing enforcement of existing environmental regulations, a growing outsourcing of liquid containment solutions and an increasing level of vendor consolidation. We are not aware of any published third-part analysis of the industry, but believe that the rental industry in the U.S. for liquid containment equipment is fragmented. As a result of the decline in oil and gas prices during the latter part of our year ended June 30, 2015, the size of the liquid containment sector has contracted. However, oil and gas drilling and production activity, particularly in the Permian Basin of Texas, increased in the year ended June 30, 2018 (“FY 2018”), stabilized in the year ended June 30, 2019 (“FY 2019”) and decreased in the latter part of FY 2020 primarily due to the decrease in demand caused by the COVID-19 pandemic and political tensions between several large oil-producing countries. We believe that we can leverage our branch network, existing relationships and operating philosophies to successfully compete in this sector. Our research indicates that many of the companies that used containment solutions also used portable storage and mobile office products.

Competitive Strengths

Leading Provider with Strong Presence in Served Markets

We believe we are a leading provider of portable storage, modular space and liquid containment solutions in all of the territories we serve. In North America, Pac-Van is a recognized national provider of portable storage, modular buildings and mobile offices. Lone Star is a market leader in portable liquid storage tank rental and related services in the Permian Basin in West Texas and the Eagle Ford Shale in South Texas. In the Asia-Pacific area, we believe Royal Wolf is the leading provider in Australia and New Zealand of portable storage containers, portable container buildings and freight containers. Royal Wolf is represented in all major metropolitan areas, and we believe it maintains the largest branch network and container fleet, with an estimated 35% market share in Australia and 50% market share in New Zealand, and is estimated to be at least twice the size of the next closest competitor in Australia and New Zealand.

Superior Service Focus

Our operating infrastructure in each of our markets is designed to ensure that we consistently meet or exceed customer expectations. Our scalable management information systems and administrative support services enhance our customer service capabilities by enabling our operating management teams to access real time information on product availability, customer reservations, customer usage history and rates on a national, regional and local level. We believe these capabilities enable us to provide superior customer service, allowing us to attract new and retain existing customers. With the goal of delivering “best in class” customer service, we began collecting customer responses on net promoter scores (“NPS”) in North America at Pac-Van, which track customer willingness to recommend our products and services, and for FY 2020 our customers gave us an NPS of 85. In the Asia Pacific at Royal Wolf our customers there gave us an NPS of 74 in FY 2020. In addition, approximately 90% of our consolidated total leasing revenues in FY 2020 were derived from repeat customers, which we believe is a result of our superior customer service.

Extensive Reach and Capabilities

Through our expansive primary branch network of 105 locations, we maintain national service capabilities in our markets. In North America, our branches serve 52 of the top 100 U.S. Metropolitan Statistical Areas, or MSAs. With our presence in Alberta and British Columbia, we are also able to serve the western provinces in Canada. Our Lone Star branches are strategically positioned to be able to respond quickly and maximize service opportunities with customers in the Permian Basin and Eagle Ford Shale. We also have branch offices located in every state in Australia and on both the North and South Islands of New Zealand. We are the only portable storage container company in these Asia-Pacific markets with a national infrastructure and workforce.

I-4

Table of Contents

Geographic, Product and End Market Diversification

Our specialty rental units are used in a wide variety of applications, and we have established strong relationships with a diversified customer base in both our North American and Asia-Pacific venues. Our customers range from large companies with a national presence to small local businesses. On a consolidated basis, during FY 2020 we served approximately 50,000 customers across a broad range of industries. In FY 2020, our largest customer in each venue accounted for less than 6% of the respective venue’s revenues and our 20 largest customers in each venue accounted for less than 26% of the respective venue’s revenues. We believe that the breadth of our products and services limits the impact of changes within any given customer or industry.

High Quality Fleet with Attractive Asset Characteristics

Our branch offices maintain our lease fleet to consistent quality standards. Maintenance costs are expensed as incurred and branch managers and operations staff are responsible for managing a maintenance program aimed at providing equipment to customers that meets or exceeds customer expectations and industry standards. All of our lease fleet carries signage reflecting its respective brands, which is important to ongoing name recognition in our markets. Our lease fleet possesses attractive asset characteristics, including long economic useful lives with high residual values, predictable and recurring revenue streams, low maintenance expense, rapid payback periods, high incremental leasing margins and favorable tax attributes. We believe these characteristics allow us to generate high returns on invested capital relative to other rental services sectors and a level of discretion in investing this capital.

Experienced Management Team

We believe our management team’s experience and long tenure with our company and within the industry give us a strong competitive advantage. Our current senior executive management team led by Jody Miller, Chief Executive Officer and President, has over the years successfully entered new markets, expanded the customer base and integrated a number of meaningful acquisitions. Jody became our Chief Executive Officer in January 2018, our President in January 2017 and has been Chief Executive Officer of GFNNA Leasing since June 2015. He has spent over 25 years in the equipment rental industry. Jody took over as Chief Executive Officer from Ronald F. Valenta, who is one of our founders. Ron is our Executive Chairman of the Board.

Neil Littlewood, who became Chief Executive Officer of Royal Wolf in July 2016, has over 19 years of senior experience in the rental/hire industry and Pac-Van’s Chief Executive Officer and President, Theodore M. Mourouzis, joined Pac-Van in 1997 and has been integral to our successful growth in North America.

Lone Star’s management team has extensive experience in the oil and gas industry and emphasizes service and safety training and monitoring for all employees.

Our senior management, as well as corporate, regional and branch managers across all of our operating companies, has been integral in developing and maintaining our high level of customer service, deploying technology to improve operational efficiencies and successfully integrating acquisitions.

Business Strategy

Our business strategy consists of the following:

Focus on High Margin Core Leasing Business

We focus on growing our core leasing business because it provides recurring revenues from specialty rental assets that (1) have long useful lives of over 20 years; (2) generate rapid payback of unit investment through revenue in less than four years on average; and (3) have high residual values of up to 70% of original equipment

I-5

Table of Contents

cost. We have successfully increased leasing revenues as a percentage of our consolidated non-manufacturing revenues from 29% in fiscal year 2007 to 65% for FY 2020. We believe that we can continue to generate substantial demand for our leasing products as the industry is still relatively underdeveloped in our markets. With new uses for our products continually emerging, we believe many more applications for our specialty rental solutions are still yet to be developed.

Generate Organic Growth

We define organic growth as an increase in lease revenues on a year-over-year basis at our branches in operation for at least one year, excluding leasing revenue attributed to same-market acquisitions. We continue to focus on increasing the number of our lease fleet units. We believe that our high quality lease fleet and superior customer service enable us to increase our lease rates and utilization rates over time. We generate organic growth within our existing markets through sales and marketing programs designed to increase brand recognition, expand market awareness of the uses of our specialty rental units and differentiate our products from our competitors.

Leverage Our Infrastructure

Our branch network infrastructure covers a broad geographic area and is capable of serving significant additional customer volume while incurring a minimal amount of incremental fixed costs. With our established branch network and infrastructure we generate significant adjusted earnings before interest, income taxes, impairment, depreciation and amortization and other non-operating costs and income (“Adjusted EBITDA”) margins on incremental units deployed. Our objective is to add volume by organically growing the lease fleet across our locations and through strategic acquisitions. Asset purchases of “tuck-in” competitors and adding new units to our fleet allow us to more effectively leverage our infrastructure. Between June 30, 2007 and June 30, 2020, our lease fleet grew from approximately 16,000 units to over 100,600 units, representing an over 15% compound annual growth rate, and our Adjusted EBITDA margin expanded from 17% in the fiscal year ended June 30, 2008 to over 27% in FY 2020.

Opportunistically Enter New Geographic Markets

We believe a long-term opportunity exists for us to significantly expand the size of our branch network in North America by opening up to 30 new locations in attractive markets. Additionally, we expect to open select satellite branch locations in our Asia-Pacific territory to expand our service reach to attractive but more remote areas of Australia and New Zealand.

Pursue Select Strategic Acquisitions

Acquisitions represent an attractive means for us to further leverage our infrastructure, add complementary product lines, enter new geographic regions and accelerate our growth and margin expansion opportunities. We operate in fragmented industries, and we seek to identify acquisition candidates that we believe would be earnings accretive. We have a proven integration model that we have effectively used to integrate 58 acquisitions since June 30, 2005.

Continue New Product Innovation

We have a history of developing innovative new product concepts to better service our customers’ needs. Our in-house capabilities and third party modification capabilities allow us to customize units to meet customer specifications. We have introduced many new product innovations, including temporary prison holding cells, hoarding units, blast-resistant units, workforce living accommodations, temporary retail frontage units and observatory units customized from storage containers. In the Asia-Pacific area we offer over 100 container-based designs for the portable services industry. We believe these innovative new product offerings differentiate us in the market.

I-6

Table of Contents

Products and Services

Portable Storage

Our portable storage products primarily consist of steel storage containers and freight containers. Storage containers are weathering (cor-ten) steel structures, which are generally eight feet wide and eight and one-half feet high; and are built to ISO standards for carrying ocean cargo. They typically vary in size from 10 feet to 48 feet in length, with 20-foot and 40-foot length containers being the most common. Storage containers consist of new and used shipping containers that provide a flexible, low cost alternative to warehousing, while offering greater security, convenience and immediate accessibility. Storage containers include general purpose dry storage, refrigerated and specialty containers in a range of standard and modified sizes, designs and capacities. Specialty containers include solar lit, blast-resistant, hoarding and hazardous waste units. In FY2018 we introduced our patent-pending safety containers, marketed as PV3 Safety Containers in the United States, CK3 Safety Containers in Canada and the Wolf Lock Premium Container in the Asia/Pacific region. Our freight containers are specifically designed for transport of products by road and rail, and include curtain-side, refrigerated and bulk cargo containers, together with a range of standard and industry-specific dry freight containers. Freight container products are only offered in our Asia-Pacific territory. These products are designed for long useful lives. A portion of our fleet consists of used storage containers of at least eight to thirteen years in age, a time at which their useful life as ocean-going shipping containers is over according to the standards promulgated by the ISO. Because we do not have the same stacking and strength requirements that apply in the ocean-going shipping industry, we have no need for these containers to meet ISO standards. We purchase these containers in large quantities, refurbish them by removing any rust and paint them with a rust inhibiting paint, further customize them, and add our decals and branding.

Modular Space

Our modular space products include office container products, modular buildings and mobile offices. Our office container products (portable building containers and ground level office containers, or GLOs) are either modified or specifically-manufactured containers that provide secure and convenient office space with maximum design flexibility. Floor plans can either be all office space, with features similar to those found in mobile offices, or a combination of office and storage space. Due to their construction, office containers provide greater security than traditional field offices, and since they sit at ground level they do not require stairs for entry and exit. In FY2020, Pac-Van introduced a new office container with a restroom – Gotta Go GLO™. Modular buildings are factory-built, highly customizable portable structures constructed for diverse applications, ranging from schools to restaurants to medical offices and ranging in size from 1,000 to over 50,000 square feet. Mobile offices are factory built, single-unit structures that are re-locatable and used primarily for temporary office space. Mobile offices are generally built on frames that are connected to axles and wheels and have either a fixed or removable hitch for easy transportation. Mobile offices can be equipped with HVAC systems, restrooms, lighting, electrical wiring, phone jacks, desk tops, shelving and other features normally associated with basic office space. Mobile sales offices generally have wood siding, carpeting, high ceilings, custom windows and glass storefront doors, which provide a professional, customer-friendly building in which to conduct business. In addition to offering modular buildings for rent, in the Asia-Pacific area, we also provide customers with the ability to customize buildings using our in-house engineering team.

Liquid Containment

Our liquid containment products, primarily portable liquid storage tanks, are manufactured steel containers with fixed steel axles and rear wheels for transport designed to hold liquids and semi-solids. Our product line currently focuses on 500-barrel capacity steel tanks, but also includes acid, gas buster, oil test tanks and various specially-built tanks. Products typically include features such as guardrails, safety stairways, multiple entry ways, a sloped bottom for easy cleaning, an epoxy lining and various feed and drain lines. A number of value-added services are offered with liquid containment products, including transportation, on-site setup and the servicing of equipment 24 hours a day, 7 days a week.

I-7

Table of Contents

The tables below provide details of our lease fleet by product category and unit types at June 30, 2020, 2019 and 2018; and for FY 2020, FY 2019 and FY 2018.

| FY 2020 | ||||||||||||||||

| Product Category |

Unit Type | Description | Industry Applications | Number of Units as of June 30, 2020 |

Average Monthly Lease Rate |

Average Utilization | ||||||||||

| North

|

Asia-

|

North

|

Asia-

| |||||||||||||

|

Storage Containers |

Dry storage, refrigerated and specialty containers | Classroom equipment storage, Construction equipment and tool storage, Disaster shelters, Landscaping sheds, Recreational equipment storage, Retail inventory storage | 68,751 | $121 | A$147 | 73% | 84% | ||||||||

| Freight Containers |

Dry freight, curtain-side, refrigerated, bulk cargo containers | Distribution and Logistics, Moving and Transportation, Road and Rail | 8,735 | NA | A$122 | NA | 72% | |||||||||

|

Office or Portable Building Containers, and GLOs |

Storage containers, modified to include office space | General administrative office space, Military installations, Workforce living accommodations, Bank branches, Classrooms /Education, Construction offices, Daycare facilities, Dormitories, General administrative office space, Healthcare facilities, Rental facilities, Retail space, Shelters | 13,501 | $390 | A$332 | 81% | 67% | ||||||||

| Modular Buildings |

Portable structures used for a variety of applications |

1,173 | $882 | NA | 81% | NA | ||||||||||

| Mobile Offices |

Relocatable wood-framed temporary office space | 4,291 | $371 | NA | 83% | NA | ||||||||||

|

Portable Liquid Storage Tanks |

Steel tanks, acid tanks, gas buster tanks and oil test tanks |

Well-site liquid containment needs, Expansion / upgrade projects, Highway construction/Groundwater sewage, Infrastructure projects, Major industrial projects, Mining pit pump work, Municipal sewer and water projects, Non-residential construction projects, Pipeline construction and maintenance, Refinery turnarounds | 4,194 | $801 | NA | 50% | NA | ||||||||

I-8

Table of Contents

| FY 2019 | ||||||||||||||||

| Product Category |

Unit Type | Description | Industry Applications | Number of Units as of June 30, 2019 |

Average Monthly Lease Rate |

Average Utilization | ||||||||||

| North

|

Asia-

|

North

|

Asia-

| |||||||||||||

|

Storage

|

68,027 | $119 | A$141 | 79% | 86% | ||||||||||

|

Freight

|

8,893 | NA | A$130 | NA | 75% | |||||||||||

|

Office

or

|

SEE PRECEDING CHART | 12,993 | $361 | A$317 | 84% | 67% | |||||||||

|

Modular

|

1,179 | $786 | NA | 85% | NA | |||||||||||

|

Mobile

|

4,436 | $320 | NA | 86% | NA | |||||||||||

|

Portable

|

4,215 | $964 | NA | 76% | NA | ||||||||||

I-9

Table of Contents

| FY 2018 | ||||||||||||||||

| Product Category |

Unit Type | Description | Industry Applications | Number of Units as of June 30, 2018 |

Average Monthly Lease Rate |

Average Utilization | ||||||||||

| North

|

Asia-

|

North

|

Asia-

| |||||||||||||

|

Storage

|

56,524 | $122 | A$138 | 77% | 88% | ||||||||||

|

Freight

|

7,501 | NA | A$135 | NA | 75% | |||||||||||

|

Office

or

|

12,014 | $340 | A$286 | 83% | 70% | ||||||||||

|

Modular

|

SEE PRECEDING CHART | 1,179 | $767 | NA | 84% | NA | ||||||||||

|

Mobile

|

4,447 | $292 | NA | 82% | NA | |||||||||||

|

Portable

|

4,147 | $783 | NA | 78% | NA | ||||||||||

Ancillary Products and Services

We deliver and, where necessary, install our products directly on customers’ premises. These services are either provided by our in-house personnel and transportation equipment or outsourced to third parties. We also provide ancillary products such as steps, ramps, furniture, portable toilets, security systems, shelving, mud pumps, hoses, splitter valves, tee connectors and other items to our customers for their use in connection with leased equipment. In addition, with our liquid containment products, a variety of spill prevention and secondary containment products are rented to our customers to ensure compliance with the Environmental Protection Agency’s Spill Prevention, Control and Countermeasure (SPCC) rule/regulations. Spill containment systems, or berms, are designed to protect against leaks or spills by covering the land under a steel tank with an impermeable plastic that has barrier walls. In the case of a spill, the liquid is captured within the containment system, thereby limiting danger to the environment.

In response to the reduced demand of its portable liquid storage tanks, our North American manufacturing operations began manufacturing a variety of other steel-based products, including:

| • | Shipping Container Modifications |

I-10

Table of Contents

| • | Specialty Trailers |

| • | Specialty Tanks |

| • | Chassis |

| • | Storm Shelters |

| • | Trash Hoppers |

Shipping Container Modifications consist primarily of GLO’s produced for Pac-Van’s rental fleet and other modifications designed to meet customer specifications.

Specialty Trailers are designed to meet customer specifications and have primarily focused on the defense sector to date.

Specialty tanks consist primarily of portable fuel tanks and tanks used in the agriculture industry to store chemicals. In particular, portable fuel tanks allow the end user to work more efficiently and can reduce costs by accessing fleet fuel on the job site. Specialty tanks are manufactured similar to liquid containment tanks for the oil and gas industry using a structural steel understructure.

Designed for transporting containers safely on the road, the chassis are made with high quality components, are fully customizable and all chassis sales are backed with both a five-year limited warranty on axles as well as a five-year warranty on workmanship.

Storm shelters are designed for above ground installation, thereby protecting homeowners from a natural disaster. The shelters come in two different wall designs (corrugated or smooth) and in two different standard sizes. Custom sizes are also available to accommodate specific needs. All storm shelters are Texas Tech Wind Institute Certified and compliant with ICC 500 2014 and FEMA 361.

Ideal for any industry needing to process, dispose or relocate materials, trash hoppers work well in multi-story building construction applications, as they can be attached to a telehandler and elevated to accept discarded materials or trash. These trash hoppers are constructed of 3/16” corrugated plate steel, making them stronger and more durable than our competitors.

Sales

We complement our core leasing business by selling existing lease fleet assets or assets purchased specifically for resale. The sale of lease fleet units has historically been a cost effective method of replenishing and upgrading the lease fleet. We also provide additional services when selling units. These services range from delivery to full scale turnkey solutions. In a turnkey solution, we provide not only the underlying equipment but also a full range of project related services, which may include foundation, specialty interior finishes, subleasing generators and landscaping, as may be necessary to make the equipment fully operational for the customer.

Product Lives and Durability

Our portable storage, modular space and liquid containment units have long estimated useful lives of 20-30 years. The age of our rental equipment, which can be a key price factor in some rental businesses, has only a modest impact on rental rates. This high value retention is due to the fact that our lease fleet units have virtually no technology obsolescence risk, do not possess engines, have few moving parts, have low maintenance requirements and are used in non-destructive applications, all differentiating characteristics from many other classes of rental equipment.

I-11

Table of Contents

Ongoing maintenance to our fleet is performed on an as-needed basis and is intended to maintain the value and rental-ready condition of our units. Maintenance requirements on portable storage units can include removing rust and dents, patching small holes, repairing floors, painting and replacing seals around the doors. Maintenance requirements for modular space units can include repairs of floors, doors, air conditioning units, windows, roofs and electric wiring. Maintenance requirements for liquid containment units include cleaning the unit to eliminate any residual material and inspecting and repairing the lining, if needed. Maintenance is performed by in-house fleet technicians and third-party vendors, depending on the branch and complexity of the work. Maintenance and repair costs of our lease fleet are included as direct costs of leasing operations and expensed as incurred whether performed by in house technicians or by third party vendors. We believe our maintenance program ensures a high quality fleet that supports both leasing and sales operations.

Our lease fleet units are recorded at cost and depreciated on the straight-line basis, in accordance with accounting principles generally accepted in the United States, up to 20 years after the date they are put in service, down to their estimated residual values. Because we have a history of selling units for gains, we believe our lease fleet’s estimated residual value is at or below net realizable value.

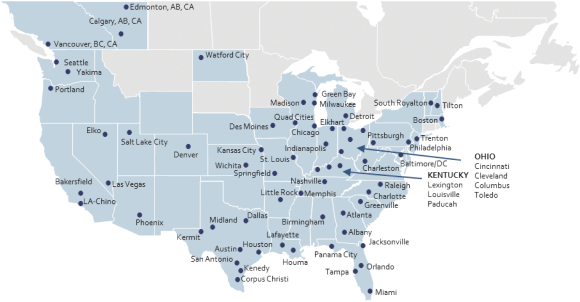

Geographic Network

Our service locations are segmented into two operating areas: North America and Asia-Pacific. In North America, these service locations are called branches and in our Asia-Pacific area they are referred to as Customer Service Centers, or “CSCs.” Our primary North American branch network consists of 63 branch locations in the United States and three in Canada, and our primary Asia-Pacific network consists of 24 CSCs in Australia and 15 in New Zealand.

Our network enables us to maintain product availability and provide customer service within regional and local markets. Customers benefit because they are provided with improved service availability, reduced time to occupancy, better access to sales representatives, and the ability to inspect units prior to rental and lower freight costs. We, in turn, benefit because we are able to spread regional overhead and marketing costs over a large lease base, redeploy units within our network to optimize utilization, discourage potential competitors by providing ample local supply and service local customers in a more cost efficient manner. Through our network, we develop local market knowledge and strong customer relationships while our corporate-based marketing group manages our brand image, web presence and lead generation programs.

I-12

Table of Contents

The following maps show our existing branch and CSC locations as of June 30, 2020.

North America

In North America, branch offices are generally headed by a branch manager and are organized into four regions, which are managed by four regional vice presidents each with more than 15 years of experience in the industry. In addition to a branch manager, each branch may also have its own sales force and a transportation department that will deliver and pick up lease fleet units from customers in certain remote areas. Branch managers are integral to our success and performance-based incentive bonuses are a portion of their compensation.

Our two Lone Star branch locations allow us to be near our customers’ production and drilling sites. In addition to benefitting from greater product availability and timely service, these branch locations enable many of our customers to realize lower transportation costs, which is a significant value proposition as they aim to control costs. These locations are managed by a general manager working closely with the organization’s Department of Transportation (“DOT”) compliance and safety officer. Each location also has a superintendent that oversees the operations and yard foremen, who are responsible for the drivers and mechanics.

I-13

Table of Contents

Asia-Pacific

We believe that our Asia-Pacific CSC network is the largest of any storage container company in Australia and New Zealand, and management estimates that we have approximately 35% market share in Australia and approximately 50% market share in New Zealand. We are represented in all major metropolitan areas and are the only container leasing and sales company with a nationally integrated infrastructure and workforce. A typical CSC consists of a leased site of approximately two to six acres with a sales office, forklifts and all-weather container repair workshop. CSC office staffing ranges from one to 15 people and include a branch manager supported by the appropriate level of sales, operations and administrative personnel. Yard and workshop staffing may have up to 12 people and can consist of welders, spray painters, boilermakers, forklift drivers and production supervisors. CSC inventory usually ranges between 30 and 700 storage containers at any one time, depending on market size and throughput demand. Each CSC has a branch manager who has overall supervisory responsibility for all activities of the CSC. Branch managers report to one of our Regional Managers for Australia and New Zealand who in turn report to an Executive General Manager who reports to the CEO. Performance-based incentive bonuses are a portion of the compensation for the CSC, Regional and Branch managers. Branches have the facilities to load and unload containers and the capacity to bulk stack containers up to four-high to maximize usable ground area. Our larger branches also have a fleet maintenance department to make modifications to the containers and maintain the branch’s forklifts and other equipment. Our smaller branches perform preventative maintenance tasks and outsource major repairs.

We lease all of our branch locations and Royal Wolf’s corporate and administrative offices in Gordon, New South Wales. All of our major leased properties have remaining lease terms of up to 28 years and we believe that satisfactory alternative properties can be found in all of our markets, if we do not renew these existing leased properties.

Reference is made to “Item 2. Properties” for a more detailed description of our geographic locations.

Customers and End Markets

We have a diverse customer base consisting of approximately 50,000 customers, who operate in a broad variety of industries in our North American and Asia-Pacific venues. Our customers consist of large national corporations, as well as many local companies and organizations. As a result, in each venue no customer

I-14

Table of Contents

contributed more than 6% of the respective venue’s FY 2020 revenues. Our end markets include construction, commercial, transportation, industrial, energy, manufacturing, mining, retail, consumer, education and government. We believe the end market and geographic diversification of our customer base reduces the business exposure to a significant downturn in any particular industry or geography.

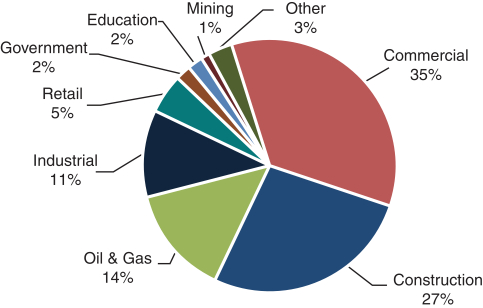

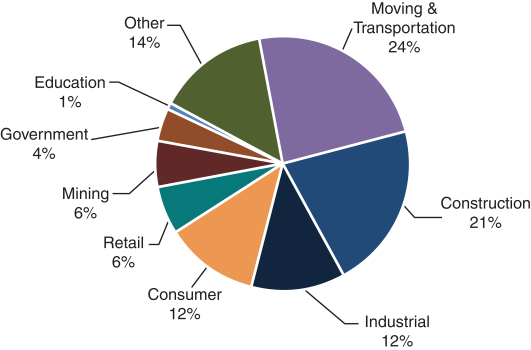

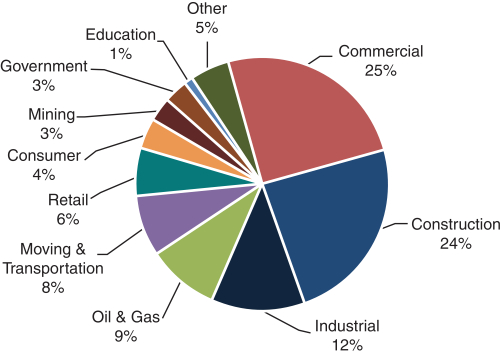

The diversity for our leasing operations is depicted in the following charts showing total revenue breakdown by end markets for FY 2020:

North America Leasing Operations

I-15

Table of Contents

Asia-Pacific Leasing Operations

Combined Leasing Operations

The following provides an overview of the end markets served by our leasing operations:

| • | Construction - general contractors, residential homebuilders and subcontractors |

I-16

Table of Contents

| • | Industrial - industrial and manufacturing customers including a broad array of manufacturers, telecommunications, distribution, utilities, refuse, recycling and bottling companies |

| • | Commercial - businesses that provide services to both commercial businesses and individual consumers, including wholesalers, health care facilities, veterinary offices, entertainment companies, religious institutions and lodging facilities |

| • | Oil and Gas and Mining - Customers in specific sectors of the extractive industries |

| • | Government - federal agencies, state and local governments, fire departments, correctional institutions, and the U.S. military |

| • | Retail - large national chains, small local stores, shopping centers and restaurants |

| • | Education - public schools, private schools and day care facilities |

| • | Consumer – mass market of individuals or groups, not businesses, such as families, sporting teams and community groups in the Asia-Pacific area |

| • | Moving and Transportation - freight providers for primarily road and rail transport in the Asia-Pacific area |

| • | Other - all other customers |

We differentiate ourselves from competitors in several ways. In our portable storage and modular space businesses, we provide a diverse set of competitively priced products and, in our Asia-Pacific market, we leverage our engineering team to provide customized units upon customer request. In our liquid containment business, we leverage long-standing customer relationships and not only provide liquid containment units, but also bundle units with transportation, on-site set-up, and the servicing of equipment 24 hours a day, 7 days a week. Our customer-centric approach is designed to ensure that our businesses consistently meet or exceed customer expectations. We believe this focus on customer service attracts new and retains existing customers. With the goal of delivering “best in class” customer service, we began collecting customer responses on NPS in North America at Pac-Van during the year ended June 30, 2015, which track customer willingness to recommend our products and services. In FY 2018 and FY 2019, our customers gave us an NPS of 85 and 84, respectively. In FY 2020, our customers at Pac-Van gave us an NPS of 85. In the year ended June 30, 2017 (“FY 2017”), we began collecting customer responses on NPS in the Asia Pacific at Royal Wolf and in FY 2018 and FY 2019 our customers there gave us an NPS of 61 and 69, respectively. In FY 2020, our customers at Royal Wolf gave us an NPS of 74. In addition, approximately 90% of our consolidated total leasing revenues in FY 2020 were derived from repeat customers, which we believe is a result of our superior customer service.

Sales and Marketing

In North America, members of our sales teams act as primary customer service representatives and are responsible for prospecting new customers, fielding calls, obtaining credit applications, quoting prices, following up on quotes and handling orders. Our sales teams are responsible for developing and managing local relationships, as well as handling both inbound and outbound calls. They also assist customers in defining their space needs, assess potential opportunities, quote deals, close transactions and obtain the necessary documentation. Upon completing a lease or a sale, the sales team works closely with the local branch operations team to ensure that customer expectations are met or exceeded, relative to equipment quality and delivery timing. Our marketing group is primarily responsible for lead generation, digital marketing, advertising campaigns, producing company literature, creating promotional sales tools and oversight of customer relationship management systems. We market services through a number of promotional vehicles, including website, search engine optimization (SEO), search engine marketing (SEM), signage on our equipment, outbound sales efforts, targeted mailings, trade shows, live chat and online ordering portal, which rolled out in FY 2019. We believe this targeted approach to marketing is consistent with the local nature of our business and allows each branch to employ a customized marketing plan that fosters growth within its particular market. As a result of our national

I-17

Table of Contents

footprint and strong service levels, we continue to seek and secure national account agreements with large retailers, industrial organizations, hospitality entities, construction companies and other large businesses. We provide ongoing training to our sales teams, monitor call quality and survey our customers to ensure that customer interactions meet our quality and service standards. Our lease fleet carries signage reflecting our brands, which is important to ongoing name recognition.

Our sales and marketing strategy in the Asia-Pacific is designed to reach thousands of potential customers. Communication with potential customers is predominantly generated through a combination of digital marketing, including SEO and SEM advertising, print media advertising, telemarketing, website, customer referrals, signage and decal awareness, direct mail, video, television, radio, social media and live chat. The customer hiring or buying process is being driven by customer awareness of the products combined with price shopping. We believe that while a typical customer may shop a limited number of suppliers, the customer does not spend much time doing so because the potential cost savings is relatively low compared to the value of their time. Our goals are to be the first suppliers that potential customers call and to make the experience as easy as possible for that customer.

Fleet Management and Information Systems

Fleet Management

Fleet information is updated daily at the branch level, which provides management with the ability to monitor branch operations on a daily, weekly, monthly and ad hoc basis with on-line access to utilization, leasing and sale fleet unit levels and revenues by branch or geographic region. In managing our fleet, we regularly relocate containers between branches to meet changes in regional demand and optimize inventory levels. We have close relationships with the national road and rail hauling companies that enable us to transport the majority of containers interstate at attractive rates.

Ongoing maintenance to our North American leasing fleet is performed on an as-needed basis and is intended to maintain the value and rental-ready condition of our units. We use both in-house fleet technicians and third-party vendors to perform maintenance, depending on the branch and complexity of the work. Maintenance requirements on containers are generally minor and include removing rust and dents, patching small holes, repairing floors, painting and replacing seals around the doors. Maintenance requirements for container offices, mobile offices and modular buildings tend to be more significant than for storage equipment and may involve repairs of floors, doors, air conditioning units, windows, roofs and electric wiring. Portable liquid storage tanks require simple maintenance, including cleaning the unit to eliminate any residual material and inspecting and repairing the lining, if needed. Whether performed by us or a third party, the cost of maintenance and repair of our lease fleet is included as direct costs of leasing operations and is expensed as incurred. We believe our maintenance program ensures a high quality fleet that supports both leasing and sales operations.

In the Asia-Pacific, most of our fleet is comprised of new and refurbished and customized storage containers, manufactured steel containers and record storage units, along with our freight and accommodation units. These products are designed for long useful lives. A portion of our fleet consists of used storage containers of at least eight to thirteen years in age, a time at which their useful life as ocean-going shipping containers is over according to the standards promulgated by ISO. Because we do not have the same stacking and strength requirements that apply in the ocean-going shipping industry, we have no need for these containers to meet ISO standards. We purchase these containers in large quantities, refurbish them by removing any rust and paint them with a rust inhibiting paint, further customize them and add our decals and branding. We maintain our steel containers on a regular basis by painting them on average once every three to five years, removing rust, spot welding and occasionally replacing the wooden floor or other parts. This periodic maintenance keeps the container in good condition and is designed to maintain the unit’s value and rental rates comparable to new units.

I-18

Table of Contents

Information Systems

We utilize management information systems across each of our businesses to support fleet management and targeted marketing efforts, and we believe they are tailored to satisfactorily meet each of our businesses’ specific needs for efficient operation.

In our North American portable storage and modular space business, we utilize Microsoft Dynamics Navision and a rental module Armada at all of our branches to monitor operations at branches on a daily, weekly, monthly and ad hoc basis. Lease fleet information is updated daily at the branch level and verified through routine physical inventories by branch personnel, providing management with online access to utilization, lease fleet unit detail and rental revenues by branch and geographic region. In addition, an electronic file for each unit showing its lease history and current location and status is maintained in the information system. Branch salespeople utilize the system to obtain information regarding unit condition and availability. The database tracks individual units by serial number and provides comprehensive information including cost, condition and other financial and unit specific information. In FY 2018 we added a business intelligence corporate performance management software package, Microsoft SQL Server Reporting Services, or SSRS, to our information system platform.

In our Asia-Pacific portable storage and modular space businesses, our management information systems, including Microsoft Dynamics Navision and CRM, Armada, TCM and Power BI, are scalable and provide us with critical information to manage our business. Utilizing our systems, we track a number of key operating and financial metrics including utilization, lease rates, profitability, customer trends and fleet data. All our branches use the CRM Platform for surveying and enhanced customer relationship management and “cradle to grave” quoting, and Navision and Armada for day to day processing. TCM, Power BI and Navision provide branch managers with vital data for financial, inventory and customer reports. In the year ending June 30, 2021, we intend to refine and further automate reporting, roll-out an e-commerce platform for business interaction and continue to provide efficiency through system improvements and mobility solutions.

Our North American manufacturing business utilizes the enterprise resource planning (ERP) business system, Infor CloudSuite Industrial, which provides comprehensive functionality, including order processing, inventory, purchasing, planning and scheduling, production, cost management, project tracking, accounting and customer service.

Product Procurement

North America

Our North American leasing operations closely monitor fleet capital expenditures, which include fleet purchases and any capitalized improvements to existing units. Pac-Van’s top ten suppliers of units for FY 2020 represented approximately 59% of all fleet purchases and the top ten suppliers represented approximately 68% of all fleet purchases. We purchase our Pac-Van lease fleet from a network of third-party suppliers. All of our mobile offices are built by an established network of manufacturing partners to standard specifications, which may vary depending on regional preferences. In addition, we build these units to meet state building code requirements and generally obtain multi-state certificates enabling us to move equipment among our branch network to meet changing demand and supply conditions. Like mobile offices, we procure modular buildings from an established network of manufacturing partners to meet state building requirements and generally obtain multiple state certificates for each unit.

On October 1, 2012, we acquired 90% of the membership interests of Southern Frac. Southern Frac at that time manufactured primarily portable liquid storage containers in Waxahachie, Texas for oil and gas exploration and production, as well as for, among others, the chemical and industrial, environmental remediation, waste water treatment and waste management sectors. Prior to FY 2017, Southern Frac introduced other high-quality steel-based products, including container chassis, under the name “Southern Fabrication Specialties.”

I-19

Table of Contents

Our North American leasing operations has historically purchased its tank fleet from several manufacturers but expects Southern Frac to be its primary supplier of steel tanks going forward. However, if needed, we have an established network of steel tank manufacturing partners located throughout the United States. Lone Star purchases its other containment solutions, pumps and hoses from a network of other manufacturing providers.

We believe that Southern Frac will continue to provide a substantial portion of the portable liquid storage containers requirements to our North American leasing operations, including a portion of their GLO requirements, as well as generate leasing referrals.

Capital investments are adjusted to match business needs and to respond to changing economic conditions. We do not generally enter into long-term purchase contracts with manufacturers, and we can modify our capital investment activities in response to market conditions. Our North American leasing operations supplement fleet spending with acquisitions. Although the timing and amount of acquisitions are difficult to predict, management considers its acquisition strategy to be opportunistic and attempts to adjust its fleet spending patterns as favorable acquisition opportunities become available.

Asia-Pacific

In the Asia-Pacific area, we purchase marine cargo containers from a wide variety of international shipping lines and container leasing companies and new container products directly from storage container manufacturers in China. We believe we are the largest buyer of both new and used storage container products for the Australia and New Zealand markets. The majority of used storage containers purchased is standard 20-foot and 40-foot units which we convert, refurbish or customize. We purchase new storage container products in the Asia-Pacific area under purchase orders issued to container manufacturers, which the manufacturers may or may not accept or be able to fill. There are several alternative sources of supply for storage containers. Though we are not dependent upon any one manufacturer in purchasing storage container products, if one or more suppliers did not timely fill our purchase orders or did not properly manufacture the ordered products, our reputation and financial condition also could be harmed. The top ten suppliers represented approximately 82% and 93% of all fleet purchases in Australia and New Zealand, respectively, during FY 2020.

Competition

Portable Storage

The portable storage markets in North America, Australia and New Zealand are highly fragmented. In most locations within its markets, Pac-Van and Royal Wolf compete with several national and regional competitors. Our largest competitors in the portable storage sector in North America are WillScot Mobile Mini Holdings, which was formed on July 1, 2020 by the merger between WillScot Corporation and Mobile Mini, Inc. (“WillScot”), McGrath RentCorp, Haulaway Storage Containers, Eagle Leasing, PODS, 1-800-PACK-RAT and other national, regional and local companies. We believe we are the market share leader in Australia and New Zealand. Our primary competitors in these markets include the Tradecorp Group and the SCF Group (Simply Containers) in Australia and CSL Containers, Boxman Containers and ContainerCo in New Zealand, as well as smaller, full and part-time operators. Local competitors are regionally focused, and are usually more capital-constrained. Therefore, in general, they are heavily reliant on monthly sales performance, have slow growing rental fleets and have limited ability to handle larger volume contracts or customer accounts. We believe that participants in this sector compete on the basis of customer relationships, price, service, as well as breadth and quality of equipment offered.

Modular Space

The modular space sector is highly competitive and fragmented as a whole. We typically compete with one or more local providers in all of our markets, as well as with a limited number of national and regional

I-20

Table of Contents

companies. Our largest North American competitors, WillScot and Mobile McGrath RentCorp have greater market share or product availability in some markets, as well as greater financial resources and pricing flexibility. Other regional competitors include ATCO Structures & Logistics, BOXX Modular, Vanguard Modular, Design Space and Satellite Shelters. In the Australian portable container buildings market, Royal Wolf maintains a small presence and competes primarily with three large participants who manufacture their own units and most of whom offer units for both lease and sale to customers. These competitors are Coates Hire, Atco Structures & Logistics and Ausco Modular (Algeco Scotsman). We believe we compete on the basis of service, quality, customer relationships and price. We believe that our reputation for customer service and a wide selection of units allow us to compete effectively. The major barrier to entry for new participants is the degree of market penetration necessary to create a wide profile with contractors and clients. Penetrating and competing with the range of products and number of depots and agencies offered by incumbent operators tend to inhibit new entrants. As we already maintain a national sale and distribution network, established supply channels and a strong profile in our target markets, many of the barriers to entry applicable to other new entrants are not applicable to us.

Liquid Containment

The liquid containment sector is highly competitive. We compete in this sector based upon product availability, product quality, price, service and reliability. As with the other industries we serve, the competition consists of national, regional and local companies. Some of the national competitors, notably BakerCorp (United Rentals), Rain For Rent and Adler Tanks (McGrath RentCorp), have significantly larger tank lease fleet and may have greater financial and marketing resources, more established relationships and greater name recognition in the market than we do. As a result, the competitors with these advantages may be better able to attract customers and provide their products and services at lower rental rates.

Employees

As of June 30, 2020, we had a total of 934 employees. None of our employees are covered by a collective bargaining agreement and management believes its relationship with employees is good. We have never experienced any material labor disruption and are unaware of any efforts or ongoing plans to organize our employees. The employee groups are as follows:

| North America | Asia- Pacific |

|||||||||||||||

| Leasing | Manufacturing | Corporate | Leasing | |||||||||||||

| Corporate executive |

— | — | 5 | — | ||||||||||||

| Regional executive and administrative staff |

66 | 10 | 2 | 30 | ||||||||||||

| Senior and branch management |

75 | — | — | 23 | ||||||||||||

| Sales and marketing |

99 | — | — | 86 | ||||||||||||

| Branch operations and administration |

378 | — | — | 128 | ||||||||||||

| Manufacturing |

— | 32 | — | — | ||||||||||||

|

|

|

|

|

|

|

|

|

|||||||||

| 618 | 42 | 7 | 267 | |||||||||||||

|

|

|

|

|

|

|

|

|

|||||||||

I-21

Table of Contents

Executive Officers of the Registrant

The following information is provided as of June 30, 2020 regarding our executive officers. No family relationship exists between any executive officer.

| Name |

Age | Position | ||||

| Ronald F. Valenta |

61 | Executive Chairman of the Board | ||||

| Jody Miller |

53 | President and Chief Executive Officer | ||||

| Charles E. Barrantes |

68 | Executive Vice President and Chief Financial Officer | ||||

| Christopher A. Wilson |

53 | General Counsel, Vice President and Secretary | ||||

| Jeffrey A. Kluckman |

59 | Executive Vice President of Global Business Development | ||||

| Neil Littlewood |

59 | Chief Executive Officer of Royal Wolf Trading Australia Pty Limited | ||||

| Theodore M. Mourouzis |

57 | Chief Executive Officer and President of Pac-Van, Inc. | ||||

Ronald F. Valenta assumed the title of Executive Chairman of the Board in January 2018. Mr. Valenta has served as a director since our inception and our Chairman of the Board since June 2014. He was our President from inception until January 2017 and Chief Executive Officer from inception until January 2018. From May 2011 to October 2017, Mr. Valenta served as a director of Royal Wolf Holdings Limited when it was an Australian public reporting company. From 1988 to 2003, Mr. Valenta served as the President and Chief Executive Officer of Mobile Services Group, Inc., a portable storage company he founded, and from 2003 to 2006, Mr. Valenta was a director of the National Portable Storage Association, a storage industry non-profit organization that he co-founded. From 1985 to 1989, Mr. Valenta was a Senior Vice President of Public Storage, Inc., and from 1980 to 1985, Mr. Valenta was employed by the accounting firm of Arthur Andersen & Co. in Los Angeles.

Jody Miller became our Chief Executive Officer in January 2018 and has served as our President since January 2017. Mr. Miller was our Executive Vice President from June 2015 to January 2017and has been the Chief Executive Officer of GFN North America Leasing Corporation since June 2015 and has served on the board of Royal Wolf Holdings Limited and subsequently Royal Wolf since 2016. Prior to joining us, Mr. Miller spent over 25 years in the equipment rental industry, including at Mobile Mini, Inc. as Executive Vice President and Chief Operations Officer for five years, Mobile Services Group, Inc. as Senior Vice President for five years, and RSC Holdings, Inc. for fifteen years; where he held many positions, including Regional Vice President for seven years. Mr. Miller is a 1990 graduate of Central Missouri State University.

Charles E. Barrantes has served as our Executive Vice President and Chief Financial Officer since September 2006. Prior to joining us, Mr. Barrantes was Vice President and Chief Financial Officer for Royce Medical Company from early 2005 to its sale in late 2005. From 1999 to early 2005, he was Chief Financial Officer of Earl Scheib, Inc., a public company that operated over 100 retail paint and body shops. Mr. Barrantes has over 40 years of experience in accounting and finance, starting with more than a decade with Arthur Andersen & Co.

Christopher A. Wilson has served as our General Counsel, Vice President and Secretary since December 2007. Prior to joining us, Mr. Wilson was the general counsel and assistant secretary of Mobile Services Group, Inc. from February 2002 to December 2007. Mr. Wilson practiced corporate law as an associate at Paul, Hastings, Janofsky & Walker LLP from 1998 to February 2002. Mr. Wilson graduated with a B.A. from Duke University in 1989 and a J.D. from Loyola Law School of Los Angeles in 1993.

Jeffrey A. Kluckman is our Executive Vice President of Global Business Development. Jeff started with us in September 2011. Prior to joining us, among other things, he held the role of vice president of mergers and acquisitions for portable storage solutions provider Mobile Mini, Inc. and, earlier, similar positions with Mobile Services Group, Inc., which was acquired by Mobile Mini in 2008, and RSC Equipment Rental, Inc. In his over 20-year background in the rental services sector, including the mobile storage, modular space and equipment rental industries, Mr. Kluckman successfully completed almost 160 transactions. Mr. Kluckman received an accounting degree from Northern Illinois University.

I-22

Table of Contents

Neil Littlewood became Chief Executive Officer of Royal Wolf in July 2016. He joined Royal Wolf in March 2013 in the role of Executive General Manager, North East. Neil has over 19 years of senior experience in the rental/hire industry including executive roles at Coates Hire and Australian Temporary Fencing. Prior to this, Neil spent 20 years as an Army Officer including being in charge of recruiting for the Australian Army and retiring as Lieutenant Colonel. He is a graduate of the Royal Military College Duntroon and holds a Bachelor of Arts and Masters in Management from the University of New South Wales.

Theodore M. Mourouzis became Chief Executive Officer of Pac-Van, Inc. in April 2017 and has served as its President since August 2006. He previously served as its Chief Operating Officer since 1999 and as its Vice President of Finance from 1997 until 1999. Prior to his employment with Pac-Van, Mr. Mourouzis was a controller for a 3M joint venture, served four years in management consulting with Deloitte & Touche, and was president of a picture framing distributor. He received his undergraduate degree from Stanford University in 1985 and a Masters of Business Administration from The Wharton School of the University of Pennsylvania in 1991.

Trademarks

North America

We own trademarks important to our North American leasing operations, including Pac-Van®, “We’ve Put Thousands of U.S. Businesses In Space®,” “Expect More. We’ll Deliver®” and the “Container King” logo in Canada. Material trademarks are registered in the U.S. Patent and Trademark Office (“USPTO”). On April 13, 2020, we filed an application for the mark “GOTTA GO GLO,” which promotes a Pac-Van’s new ground-level office which features a built-in restroom, and on August 24, 2020 we filed an application for the mark “PV 3 Safety Container,” that promotes Pac-Van innovative locking system for storage containers. Registrations for such trademarks in the U.S. will last indefinitely as long as we continue to use and maintain the trademarks and renew filings with the applicable governmental offices.

Asia-Pacific