Attached files

| file | filename |

|---|---|

| EX-21.1 - EXHIBIT 21.1 - DXP ENTERPRISES INC | exhibi21-1_10k2009.htm |

| EX-31.1 - EXHIBIT 31.1 - DXP ENTERPRISES INC | exhibit31-1_10k2009.htm |

| EX-23.1 - EXHIBIT 23.1 - DXP ENTERPRISES INC | exhibit23-1_10k2009.htm |

| EX-32.2 - EXHIBIT 32.2 - DXP ENTERPRISES INC | exhibit32-2_10k2009.htm |

| EX-32.1 - EXHIBIT 32.1 - DXP ENTERPRISES INC | exhibit32-1_10k2009.htm |

| EX-31.2 - EXHIBIT 31.2 - DXP ENTERPRISES INC | exhibit31-2_10k2009.htm |

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

Form 10-K

(Mark One)

|

|

[X]

|

ANNUAL REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934. For the fiscal year ended December 31, 2009

|

or

|

|

[ ]

|

TRANSITION REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934.

|

For the transition period from

|

to

|

Commission file number 0-21513

DXP Enterprises, Inc.

(Exact name of registrant as specified in its charter)

|

Texas

|

76-0509661

|

|||

|

(State or other jurisdiction

of incorporation or organization)

|

(I.R.S. Employer Identification Number)

|

|||

|

7272 Pinemont, Houston, Texas

|

77040

|

(713) 996-4700

|

||

|

(Address of principal executive offices)

|

(Zip Code)

|

(Registrant’s telephone number,

including area code)

|

Securities registered pursuant to Section 12(b) of the Act: None

Securities registered pursuant to Section 12(g) of the Act:

|

Common Stock, $0.01 Par Value

|

NASDAQ

|

|

|

(Title of Class)

|

(Name of exchange on which registered)

|

Indicate by check mark if the registrant is a well-known seasoned issuer, as defined in Rule 405 of the Securities Act. Yes [ ] No [X]

Indicate by check mark if the registrant is not required to file reports pursuant to Section 13 or Section 15(d) of the Act. Yes [ ] No [X]

Indicate by check mark whether the registrant (1) has filed all reports required to be filed by Section 13 or 15(d) of the Securities Exchange Act of 1934 during the preceding 12 months (or for such shorter period that the registrant was required to file such reports), and (2) has been subject to such filing requirements for the past 90 days. Yes [X] No [ ]

Indicate by check mark whether the registrant has submitted electronically and posted on its corporate Web site, if any, every Interactive Data File required to be submitted and posted pursuant to Rule 405 of Regulation S-T during the preceding 12 months (or for such shorter period that the registrant was required to submit and post such files).

[ ] Yes [ ] No

Indicate by check mark if disclosure of delinquent filers pursuant to Item 405 of Regulation S-K is not contained herein, and will not be contained, to the best of registrant's knowledge, in definitive proxy or information statements incorporated by reference in Part III of this Form 10-K or any amendment to this Form 10-K. [ ]

1

Indicate by check mark whether the registrant is a large accelerated filer, an accelerated filer, a non-accelerated filer, or a smaller reporting company. (See definitions of “large accelerated filer”, “accelerated filer”, and “smaller reporting company” in Rule 12b-2 of the Exchange Act).

Large accelerated filer [ ] Accelerated filer [X]

Non-accelerated filer [ ] (Do not check if a smaller reporting company) Smaller reporting company [ ]

Indicate by check mark whether the registrant is a shell company (as defined in Rule 12b-2 of the Act). Yes [ ] No [X]

Aggregate market value of the registrant's Common Stock held by non-affiliates of registrant as of June 30, 2009: $99,953,629.

Number of shares of registrant's Common Stock outstanding as of March 19, 2010: 12,945,981.

Documents incorporated by reference: Portions of the definitive proxy statement for the annual meeting of shareholders to be held in 2010 are incorporated by reference into Part III hereof.

2

|

TABLE OF CONTENTS

|

|||

|

DESCRIPTION

|

|||

|

Item

|

Page

|

||

|

PART 1

|

|||

|

1.

|

Business

|

4

|

|

|

1A.

|

Risk Factors

|

9

|

|

|

1B.

|

Unresolved Staff Comments

|

11

|

|

|

2.

|

Properties

|

11

|

|

|

3.

|

Legal Proceedings

|

11

|

|

|

4.

|

Submission of Matters to a Vote of Security Holders

|

11

|

|

|

PART II

|

|||

|

5.

|

Market for the Registrant's Common Equity, Related Stockholder Matters and Issuer Purchases of Equity Securities

|

12

|

|

|

6.

|

Selected Financial Data

|

13

|

|

|

7.

|

Management's Discussion and Analysis of Financial Condition and Results of Operations

|

14

|

|

|

7A.

|

Quantitative and Qualitative Disclosures about Market Risk

|

24

|

|

|

8.

|

Financial Statements and Supplementary Data

|

25

|

|

|

9.

|

Changes in and Disagreements with Accountants on Accounting and Financial Disclosure

|

52

|

|

|

9B.

|

Other Information

|

53

|

|

|

PART III

|

|||

|

10.

|

Directors, Executive Officers, and Corporate Governance

|

54

|

|

|

11.

|

Executive Compensation

|

54

|

|

|

12.

|

Security Ownership of Certain Beneficial Owners and Management

|

||

|

and Related Stockholder Matters

|

54

|

||

|

13.

|

Certain Relationships and Related Transactions, and Director Independence

|

54

|

|

|

14.

|

Principal Accountant Fees and Services

|

54

|

|

|

PART IV

|

|||

|

15.

|

Exhibits, Financial Statement Schedules

|

55

|

|

|

Signatures

|

59

|

||

DISCLOSURE REGARDING FORWARD-LOOKING STATEMENTS

This Annual Report on Form 10-K contains statements that constitute “forward-looking statements” within the meaning of the Private Securities Litigation Reform Act of 1995. Such statements can be identified by the use of forward-looking terminology such as “believes”, “expects”, “may”, “estimates”, “will”, “should”, “plans” or “anticipates” or the negative thereof or other variations thereon or comparable terminology, or by discussions of strategy. Any such forward-looking statements are not guarantees of future performance and involve significant risks and uncertainties, and actual results may vary materially from those discussed in the forward-looking statements as a result of various factors. These factors include the effectiveness of management’s strategies and decisions, our ability to affect our internal growth strategy, general economic and business conditions, developments in technology, our ability to effectively integrate businesses we may acquire, new or modified statutory or regulatory requirements and changing prices and market conditions. This report identifies other factors that could cause such differences. We cannot assure you that these are all of the factors that could cause actual results to vary materially from the forward-looking statements. We assume no obligation and do not intend to update these forward-looking statements.

3

PART I

This Annual Report on Form 10-K (this “Report”) contains, in addition to historical information, “forward-looking statements” that involve risks and uncertainties. DXP Enterprises, Inc.'s actual results could differ materially from those discussed in the forward-looking statements. Factors that could cause or contribute to such differences include, but are not limited to, those discussed in "Risk Factors", and elsewhere in this Annual Report on Form 10-K. Unless the context otherwise requires, references in this Report to the "Company" or "DXP" shall mean DXP Enterprises, Inc., a Texas corporation, together with its subsidiaries.

ITEM 1. Business

DXP was incorporated in Texas in 1996 to be the successor to a company founded in 1908. Since our predecessor company was founded, we have primarily been engaged in the business of distributing maintenance, repair and operating (“MRO”) products, equipment and service to industrial customers. We are organized into two segments: MRO and Electrical Contractor. Sales and operating income for 2007, 2008 and 2009, and identifiable assets at the close of such years for our business segments are presented in Note 16 of the Notes to the Consolidated Financial Statements.

The industrial distribution market is highly fragmented. Based on 2008 sales as reported by industry sources, we were the 16th largest distributor of MRO products in the United States. Most industrial customers currently purchase their industrial supplies through numerous local distribution and supply companies. These distributors generally provide the customer with repair and maintenance services, technical support and application expertise with respect to one product category. Products typically are purchased by the distributor for resale directly from the manufacturer and warehoused at distribution facilities of the distributor until sold to the customer. The customer also typically will purchase an amount of product inventory for its near term anticipated needs and store those products at its industrial site until the products are used.

We believe that the distribution system for industrial products in the United States, described in the preceding paragraph, creates inefficiencies at both the customer and the distributor levels through excess inventory requirements and duplicative cost structures. To compete more effectively, our customers and other users of MRO products are seeking ways to enhance efficiencies and lower MRO product and procurement costs. In response to this customer desire, three primary trends have emerged in the industrial supply industry:

|

·

|

Industry Consolidation. Industrial customers have reduced the number of supplier relationships they maintain to lower total purchasing costs, improve inventory management, assure consistently high levels of customer service and enhance purchasing power. This focus on fewer suppliers has led to consolidation within the fragmented industrial distribution industry.

|

|

·

|

Customized Integrated Service. As industrial customers focus on their core manufacturing or other production competencies, they increasingly are demanding customized integration services, ranging from value-added traditional distribution to integrated supply and system design, fabrication, installation and repair and maintenance services.

|

|

·

|

Single Source, First-Tier Distribution. As industrial customers continue to address cost containment, there is a trend toward reducing the number of suppliers and eliminating multiple tiers of distribution. Therefore, to lower overall costs to the MRO customer, some MRO distributors are expanding their product coverage to eliminate second-tier distributors and the difficulties associated with alliances.

|

Recent Acquisitions

Our growth strategy includes effecting acquisitions of businesses with complementary or desirable product lines, locations or customers. We completed 13 acquisitions since the beginning of 2005.

On August 20, 2005, we paid approximately $2.4 million to purchase the assets of a pump remanufacturer. We made this acquisition to enhance our ability to meet customer needs for shorter lead times on selected pumps. We assumed $1.0 million of liabilities and gave a $0.5 million credit to the seller to use to purchase maintenance, repair and operating supplies from us.

4

On December 1, 2005, we purchased 100% of R. A. Mueller, Inc. to expand geographically into Ohio, Indiana, Kentucky and West Virginia. DXP paid $7.3 million ($3.65 million cash and $3.65 million in promissory notes payable to the former owners) and assumed approximately $1.6 million of debt and $1.9 million of accounts payable and other liabilities.

On May 31, 2006, DXP purchased the businesses of Production Pump and Machine Tech. DXP acquired these businesses to strengthen DXP’s position with upstream oil and gas and pipeline customers. DXP paid approximately $8.9 million for the acquired businesses and assumed approximately $1.2 million worth of liabilities. The purchase price consisted of approximately $5.4 million paid in cash and $3.5 million in the form of promissory notes payable to the former owners of the acquired businesses. In addition, DXP may pay up to an additional $1.2 million contingent upon future earnings.

On October 11, 2006, we completed the acquisition of the business of Safety International. DXP acquired this business to strengthen DXP’s expertise in safety products and services. DXP paid $2.2 million in cash for the business of Safety International.

On October 19, 2006, DXP completed the acquisition of the business of Gulf Coast Torch & Regulator. DXP acquired this business to strengthen DXP’s expertise in the distribution of welding supplies. DXP paid approximately $5.5 million, net of $0.5 million of acquired cash, for the business of Gulf Coast Torch & Regulator, and assumed approximately $0.2 million worth of debt. Approximately $2.0 million of the purchase price was paid by issuing promissory notes payable to the former owners of Gulf Coast Torch & Regulator.

On November 1, 2006, DXP completed the acquisition of the business of Safety Alliance. DXP acquired this business to strengthen DXP’s expertise in safety products. DXP paid $2.3 million in cash for the business of Safety Alliance.

On May 4, 2007, DXP completed the acquisition of the business of Delta Process Equipment. DXP paid $10 million in cash for this business. DXP acquired this business to diversify DXP’s customer base in the municipal, wastewater and downstream industrial pump markets. The purchase price was funded by utilizing available capacity under DXP’s credit facility.

On September 10, 2007, DXP completed the acquisition of Precision Industries, Inc. DXP acquired this business to expand DXP’s geographic presence and strengthen DXP’s integrated supply offering. The Company paid $106 million in cash for Precision Industries, Inc. The purchase price was funded using approximately $24 million of cash on hand and approximately $82 million borrowed from a new credit facility.

On October 19, 2007, DXP completed the acquisition of the business of Indian Fire & Safety. DXP acquired this business to strengthen DXP’s expertise in safety products and services in New Mexico and Texas. DXP paid $6.0 million in cash, $3.0 million in the form of a promissory note and up to $3.0 million in future payments contingent upon future earnings.

On January 31, 2008, DXP completed the acquisition of the business of Rocky Mtn. Supply. DXP acquired this business to expand DXP’s presence in the Colorado area. DXP paid $3.9 million in cash and $0.7 million in seller notes.

On August 28, 2008, DXP completed the acquisition of PFI, LLC (“PFI”). DXP acquired this business to strengthen DXP’s expertise in the distribution of fasteners. DXP paid $66.4 million in cash for this business.

On December 1, 2008, DXP completed the acquisition of the business of Falcon Pump. DXP acquired this business to strengthen DXP’s pump offering in the Rocky Mountain area. DXP paid $3.1 million in cash, $0.8 million in seller notes and up to $1.0 million in future payments contingent upon future earnings of the acquired business.

5

MRO Segment

The MRO segment provides MRO products, equipment and integrated services, including technical design expertise and logistics capabilities, to industrial customers. We provide a wide range of MRO products in the fluid handling equipment, bearing, power transmission equipment, general mill, safety supply and electrical products categories. We offer our customers a single source of integrated services and supply on an efficient and competitive basis by being a first-tier distributor that can purchase products directly from the manufacturer. We also provide integrated services such as system design, fabrication, installation, repair and maintenance for our customers. We offer a wide range of industrial MRO products, equipment and services through a complete continuum of customized and efficient MRO solutions, ranging from traditional distribution to fully integrated supply contracts. The integrated solution is tailored to satisfy our customers’ unique needs.

SmartSourceSM, one of our proprietary integrated supply programs, allows a more effective and efficient way to manage the customer’s supply chain needs for MRO products. SmartSourceSM effectively lowers costs by outsourcing the customer’s purchasing, accounting and on-site supply/warehouse management to DXP, which reduces the duplication of effort by the customer and supplier. The program allows the customer to transfer all or part of their supply chain needs to DXP, so the customer can focus on their core business. DXP has a broad range of first-tier products to support a successful integrated supply offering. The program provides a productive, measurable solution to reduce cost and streamline procurement and sourcing operations.

We currently serve as a first-tier distributor of more than 1,000,000 items of which more than 45,000 are stock keeping units ("SKUs") for use primarily by customers engaged in the general manufacturing, oil and gas, petrochemical, service and repair and wood products industries. Other industries served by our MRO segment include mining, construction, chemical, municipal, food and beverage, agriculture and pulp and paper. Our MRO products include a wide range of products in the fluid handling equipment, bearing, power transmission equipment, general mill, safety products and electrical products. Our products are distributed from 112 service centers, 50 supply chain locations and 6 distribution centers.

Our fluid handling equipment line includes a full line of centrifugal pumps for transfer and process service applications, such as petrochemicals, refining and crude oil production; rotary gear pumps for low- to medium-pressure service applications, such as pumping lubricating oils and other viscous liquids; plunger and piston pumps for high-pressure service applications such as salt water injection and crude oil pipeline service; and air-operated diaphragm pumps. We also provide various pump accessories. Our bearing products include several types of mounted and unmounted bearings for a variety of applications. The hose products we distribute include a large selection of industrial fittings and stainless steel hoses, hydraulic hoses, Teflon hoses and expansion joints, as well as hoses for chemical, petroleum, air and water applications. We distribute seal products for downhole, wellhead, valve and completion equipment to oilfield service companies. The power transmission products we distribute include speed reducers, flexible-coupling drives, chain drives, sprockets, gears, conveyors, clutches, brakes and hoses. We offer a broad range of general mill supplies, such as abrasives, tapes and adhesive products, coatings and lubricants, cutting tools, fasteners, hand tools, janitorial products, pneumatic tools, welding supplies and welding equipment. We offer a broad range of fluid power and hydraulics solutions. Our safety products include eye and face protection products, first aid products, hand protection products, hazardous material handling products, instrumentation and respiratory protection products. We distribute a broad range of electrical products, such as wire conduit, wiring devices, electrical fittings and boxes, signaling devices, heaters, tools, switch gear, lighting, lamps, tape, lugs, wire nuts, batteries, fans and fuses.

In addition to distributing MRO products, we provide innovative pumping solutions. DXP provides fabrication and technical design to meet the capital equipment needs of our customers. DXP provides these solutions by utilizing manufacturer- authorized equipment and certified personnel. Pump packages require MRO and original equipment manufacturer, or OEM, equipment and parts such as pumps, motors and valves, and consumable products such as welding supplies. DXP leverages its MRO inventories and breadth of authorized products to lower the total cost and maintain the quality of our innovative pumping solutions.

Our operations managers support the sales efforts through direct customer contact and manage the efforts of the outside and direct sales representatives. We have structured compensation to provide incentives to our sales representatives, through the use of commissions, to increase sales. Our outside sales representatives focus on building long-term rela-

6

tionships with customers and, through their product and industry expertise, providing customers with product application, engineering and after-the sale services. The direct sales representatives support the outside sales representatives and are responsible for entering product orders and providing technical support with respect to our products. Because we offer a broad range of products, our outside and direct sales representatives are able to use their existing customer relationships with respect to one product line to cross-sell our other product lines. In addition, geographic locations in which certain products are sold also are being utilized to sell products not historically sold at such locations. As we expand our product lines and geographical presence through hiring experienced sales representatives, we assess the opportunities and appropriate timing of introducing existing products to new customers and new products to existing customers. Prior to implementing such cross-selling efforts, we provide the appropriate sales training and product expertise to our sales force.

Unlike many of our competitors, we market our products primarily as a first-tier distributor, generally procuring products directly from the manufacturers, rather than from other distributors. As a first-tier distributor, we are able to reduce our customers' costs and improve efficiencies in the supply chain.

We believe we have increased our competitive advantage through our traditional and integrated supply programs, which are designed to address the customer's specific product and procurement needs. We offer our customers various options for the integration of their supply needs, ranging from serving as a single source of supply for all or specific lines of products and product categories to offering a fully integrated supply package in which we assume the procurement and management functions, including ownership of inventory, at the customer's location. Our approach to integrated supply allows us to design a program that best fits the needs of the customer. For those customers purchasing a number of products in large quantities, the customer is able to outsource all or most of those needs to us. For customers with smaller supply needs, we are able to combine our traditional distribution capabilities with our broad product categories and advanced ordering systems to allow the customer to engage in one-stop shopping without the commitment required under an integrated supply contract.

We acquire our products through numerous original equipment manufacturers, or OEMs. We are authorized to distribute the manufacturers' products in specific geographic areas. All of our distribution authorizations are subject to cancellation by the manufacturer upon one-year notice or less. No manufacturer provided products that accounted for 10% or more or our revenues. We believe that alternative sources of supply could be obtained in a timely manner if any distribution authorization were canceled. Accordingly, we do not believe that the loss of any one distribution authorization would have a material adverse effect on our business, financial condition or results of operations. Representative manufacturers of our products include BACOU/DALLOZ, Baldor Electric, Emerson, Falk, G&L, Gates, Gould's, INA/Fag Bearing, LaCross Rainfair Safety Products, Martin Sprocket, National Oilwell, Norton Abrasives, NTN, Rexnord, SKF, ULTRA, 3M, Timken, Tyco, Union Butterfield, Viking and Wilden.

All of the segment’s long-lived assets are located in the U. S. and virtually all sales are recognized in the U. S.

At December 31, 2009, the MRO Segment had 1,687 full-time employees.

Electrical Contractor Segment

The Electrical Contractor segment was formed in 1998 with the acquisition of substantially all of the assets of an electrical supply business. The Electrical Contractor segment sells a broad range of electrical products, such as wire conduit, wiring devices, electrical fittings and boxes, signaling devices, heaters, tools, switch gear, lighting, lamps, tape, lugs, wire nuts, batteries, fans and fuses, to electrical contractors. The segment has one owned warehouse/sales facility in Memphis, Tennessee.

We acquire our electrical products through numerous OEMs. We are authorized to distribute the manufacturers' products in specific geographic areas. All of our distribution authorizations are subject to cancellation by the manufacturer upon one-year notice or less. No one manufacturer provides products that account for 10% or more of our revenues. We believe that alternative sources of supply could be obtained in a timely manner if any distribution authorization were canceled. Accordingly, we do not believe that the loss of any one distribution authorization would have a material adverse effect on our business, financial condition or results of operations. Significant vendors include Cutler-Hammer, Cooper, Killark, 3M, General Electric and Allied. To meet prompt delivery demands of its customers, this segment maintains large inventories.

7

All of the segment’s long-lived assets are located in the U. S. and virtually all sales are recognized in the U. S.

At December 31, 2009, the Electrical Contractor segment had 10 full-time employees.

On March 5, 2010, the Company sold all of the assets of the Electrical Contractor segment for approximately $1.4 million.

Competition

Our business is highly competitive. In the MRO segment we compete with a variety of industrial supply distributors, many of which may have greater financial and other resources than we do. Many of our competitors are small enterprises selling to customers in a limited geographic area. We also compete with larger distributors that provide integrated supply programs and outsourcing services similar to those offered through our SmartSourceSM program, some of which might be able to supply their products in a more efficient and cost-effective manner than we can provide. We also compete with catalog distributors, large warehouse stores and, to a lesser extent, manufacturers. While many of our competitors offer traditional distribution of some of the product groupings that we offer, we are not aware of any major competitor that offers on a non-catalog basis a product grouping as broad as our offering. Further, while certain catalog distributors provide product offerings as broad as ours, these competitors do not offer the product application, technical design and after-the-sale services that we provide. In the Electrical Contractor segment we compete against a variety of suppliers of electrical products, many of which may have greater financial and other resources than we do. We generally compete on service and price.

Insurance

We maintain liability and other insurance that we believe to be customary and generally consistent with industry practice. We retain a portion of the risk for medical claims, general liability, worker’s compensation and property losses. The various deductibles of our insurance policies generally do not exceed $200,000 per occurrence. There are also certain risks for which we do not maintain insurance. There can be no assurance that such insurance will be adequate for the risks involved, that coverage limits will not be exceeded or that such insurance will apply to all liabilities. The occurrence of an adverse claim in excess of the coverage limits that we maintain could have a material adverse effect on our financial condition and results of operations. The premiums for insurance have increased significantly over the past three years. This trend could continue. Additionally, we are partially self-insured for our group health plan, worker’s compensation, auto liability and general liability insurance. The cost of claims for the group health plan has increased over the past three years. This trend is expected to continue.

Government Regulation and Environmental Matters

We are subject to various laws and regulations relating to our business and operations, and various health and safety regulations as established by the Occupational Safety and Health Administration.

Certain of our operations are subject to federal, state and local laws and regulations controlling the discharge of materials into or otherwise relating to the protection of the environment. Although we believe that we have adequate procedures to comply with applicable discharge and other environmental laws, the risks of accidental contamination or injury from the discharge of controlled or hazardous materials and chemicals cannot be eliminated completely. In the event of such a discharge, we could be held liable for any damages that result, and any such liability could have a material adverse effect on us. We are not currently aware of any situation or condition that we believe is likely to have a material adverse effect on our results of operations or financial condition.

Employees

At December 31, 2009, we had 1,697 full-time employees. We believe that our relationship with our employees is good.

8

Available Information

Our Annual Report on Form 10-K, Quarterly Reports on Form 10-Q, Current Reports on Form 8-K, and amendments to those reports filed or furnished pursuant to Section 13(a) or 15(d) of the Securities Exchange Act of 1934 as amended (the “Exchange Act”), are available free of charge through our Internet website (www.dxpe.com) as soon as reasonably practicable after we electronically file such material with, or furnish it to, the Securities and Exchange Commission.

ITEM 1A. Risk Factors

The following is a discussion of significant risk factors relevant to DXP’s business that could adversely affect its business, financial condition or results of operations.

Our future results will be impacted by our ability to implement our internal growth strategy.

Our future results will depend in part on our success in implementing our internal growth strategy, which includes expanding our existing geographic areas, selling additional products to existing customers and adding new customers. Our ability to implement this strategy will depend on our success in selling more products and services to existing customers, acquiring new customers, hiring qualified sales persons, and marketing integrated forms of supply management such as those being pursued by us through our SmartSourceSM program. Although we intend to increase sales and product offerings to existing customers, there can be no assurance that we will be successful in these efforts.

Risks Associated With Acquisition Strategy

Our future results will depend in part on our ability to successfully implement our acquisition strategy. This strategy includes taking advantage of a consolidation trend in the industry and effecting acquisitions of businesses with complementary or desirable new product lines, strategic distribution locations, attractive customer bases or manufacturer relationships. Our ability to implement this strategy successfully will depend on our ability to identify, consummate and successfully assimilate acquisitions on economically favorable terms. Although DXP is actively seeking acquisitions that would meet its strategic objectives, there can be no assurance that we will be successful in these efforts. In addition, acquisitions involve a number of special risks, including possible adverse effects on our operating results, diversion of management’s attention, failure to retain key personnel of the acquired business, risks associated with unanticipated events or liabilities, expenses associated with obsolete inventory of an acquired business and amortization of acquired intangible assets, some or all of which could have a material adverse effect on our business, financial condition and results of operations. There can be no assurance that DXP or other businesses acquired in the future will achieve anticipated revenues and earnings. In addition, our credit agreement with our bank lenders contains certain restrictions that could adversely affect our ability to implement our acquisition strategy. Such restrictions include a provision prohibiting us from merging or consolidating with, or acquiring all or a substantial part of the properties or capital stock of, any other entity without the prior written consent of the lenders. There can be no assurance that we will be able to obtain the lender’s consent to any of our proposed acquisitions.

Risks Related to Acquisition Financing

We may need to finance acquisitions by using shares of Common Stock for a portion or all of the consideration to be paid. In the event that the Common Stock does not maintain a sufficient market value, or potential acquisition candidates are otherwise unwilling to accept Common Stock as part of the consideration for the sale of their businesses, we may be required to use more of our cash resources, if available, to maintain our acquisition program. These cash resources may include borrowings under our credit agreement or equity or debt financings. If we do not have sufficient cash resources, our growth could be limited unless we are able to obtain additional capital through debt or equity financings.

9

Ability to Comply with Financial Covenants of Credit Facility

Our credit facility requires the Company to comply with certain specified covenants, restrictions, financial ratios and other financial and operating tests. The Company’s ability to comply with any of the foregoing restrictions will depend on its future performance, which will be subject to prevailing economic conditions and other factors, including factors beyond the Company’s control. A failure to comply with any of these obligations could result in an event of default under the credit facility, which could permit acceleration of the Company’s indebtedness under the credit facility. The Company from time to time has been unable to comply with some of the financial covenants contained in the credit facility (relating to, among other things, the maintenance of prescribed financial ratios) and has, when necessary, obtained waivers or amendments to the covenants from its lenders. Although the company expects to be able to comply with the covenants, including the financial covenants, of the credit facility, there can be no assurance that in the future the Company will be able to do so or that its lenders will be willing to waive such compliance or further amend such covenants.

Our business has substantial competition and competition could adversely affect our results.

Our business is highly competitive. We compete with a variety of industrial supply distributors, some of which may have greater financial and other resources than us. Although many of our traditional distribution competitors are small enterprises selling to customers in a limited geographic area, we also compete with larger distributors that provide integrated supply programs such as those offered through outsourcing services similar to those that are offered by our SmartSourceSM program. Some of these large distributors may be able to supply their products in a more timely and cost-efficient manner than us. Our competitors include catalog suppliers, large warehouse stores and, to a lesser extent, certain manufacturers. Competitive pressures could adversely affect DXP’s sales and profitability.

The loss of or the failure to attract and retain key personnel could adversely impact our results of operations.

We will continue to be dependent to a significant extent upon the efforts and ability of David R. Little, our Chairman of the Board, President and Chief Executive Officer. The loss of the services of Mr. Little or any other executive officer of our Company could have a material adverse effect on our financial condition and results of operations. In addition, our ability to grow successfully will be dependent upon our ability to attract and retain qualified management and technical and operational personnel. The failure to attract and retain such persons could materially adversely affect our financial condition and results of operations.

The loss of any key supplier could adversely affect DXP’s sales and profitability.

We have distribution rights for certain product lines and depend on these distribution rights for a substantial portion of our business. Many of these distribution rights are pursuant to contracts that are subject to cancellation upon little or no prior notice. Although we believe that we could obtain alternate distribution rights in the event of such a cancellation, the termination or limitation by any key supplier of its relationship with the Company could result in a temporary disruption of our business and, in turn, could adversely affect our results of operations and financial condition.

A slowdown in the economy could negatively impact DXP’s sales growth.

Economic and industry trends affect DXP’s business. Demand for our products is subject to economic trends affecting our customers and the industries in which they compete in particular. Many of these industries, such as the oil and gas industry, are subject to volatility while others, such as the petrochemical industry, are cyclical and materially affected by changes in the economy. As a result, demand for our products could be adversely impacted by changes in the markets of our customers.

Interruptions in the proper functioning of our information systems could disrupt operations and cause increases in costs and/or decreases in revenues.

The proper functioning of DXP’s information systems is critical to the successful operation of our business. Although DXP’s information systems are protected through physical and software safeguards and remote processing capabilities exist, our information systems are still vulnerable to natural disasters, power losses, telecommunication failures and other

10

problems. If critical information systems fail or are otherwise unavailable, DXP’s ability to procure products to sell, process and ship customer orders, identify business opportunities, maintain proper levels of inventories, collect accounts receivable and pay accounts payable and expenses could be adversely affected.

ITEM 1B. Unresolved Staff Comments

None.

ITEM 2. Properties

We own our headquarters facility in Houston, Texas, which has 48,000 square feet of office space. The MRO segment owns or leases 112 facilities located in Alabama, Arkansas, California, Colorado, Florida, Georgia, Idaho, Illinois, Indiana, Iowa, Kansas, Kentucky, Louisiana, Maryland, Massachusetts, Minnesota, Missouri, Montana, Nebraska, New Jersey, New Mexico, New York, North Carolina, North Dakota, Ohio, Oklahoma, Pennsylvania, South Dakota, Tennessee, Texas, Utah, Virginia and Wyoming. In addition, we operate supply chain installations in 50 of our customers’ facilities in Arkansas, Arizona, California, Florida, Georgia, Illinois, Indiana, Louisiana, Maryland, Massachusetts, Michigan, Missouri, Nebraska, New Jersey, New York, Ohio, Oklahoma, Oregon, Pennsylvania, South Carolina, Tennessee, Texas and Virginia, and as well as in Ontario, Canada. The Electrical Contractor segment owns one service center facility in Tennessee. Our owned facilities range from 5,000 square feet to 65,000 square feet in size. We lease facilities for terms generally ranging from one to seven years. The leased facilities range from 1,500 square feet to 170,000 square feet in size. The leases provide for periodic specified rental payments and certain leases are renewable at our option. We believe that our facilities are suitable and adequate for the needs of our existing business. We believe that if the leases for any of our facilities were not renewed, other suitable facilities could be leased with no material adverse effect on our business, financial condition or results of operations. One of the facilities owned by us is pledged to secure our indebtedness.

ITEM 3. Legal Proceedings

On July 22, 2004, DXP and Ameron International Corporation, DXP’s vendor of fiberglass reinforced pipe, were sued in the Twenty-Fourth Judicial District Court, Parish of Jefferson, State of Louisiana by BP America Production Company regarding the failure of Bondstrand PSX JFC pipe, a recently introduced type of fiberglass reinforced pipe which had been installed on four energy production platforms. BP American Production Company alleges negligence, breach of contract, breach of warranty and that damages exceed $20 million. DXP believes the failures were caused by the failure of the pipe itself and not by work performed by DXP. We intend to vigorously defend these claims. Our insurance carrier has agreed, under a reservation of rights to deny coverage, to provide a defense against these claims. The maximum amount of our insurance coverage, if any, is $6 million. Under certain circumstances, our insurance may not cover this claim. DXP currently believes that this claim is without merit.

In 2003, we were notified that we had been sued in various state courts in Nueces County, Texas. The twelve suits allege personal injury resulting from products containing asbestos allegedly sold by us. The suits do not specify what products or the dates we allegedly sold the products. The plaintiffs’ attorney has agreed to a global settlement of all suits for a nominal amount to be paid by our insurance carriers. Settlement has been consummated as to more than 85% of the 133 plaintiffs, and the remaining settlements are in process. The cases are all dismissed or dormant pending the remaining settlements.

From time to time, the Company is a party to various legal proceedings arising in the ordinary course of its business. The Company believes that the outcome of any of these various proceedings will not have a material adverse effect on its business, financial condition or results of operations.

ITEM 4. Submission of Matters to a Vote of Security Holders

None.

11

PART II

|

ITEM 5.

|

Market for the Registrant's Common Equity, Related Stockholder Matters and Issuer Purchases of Equity Securities

|

Our common stock trades on The NASDAQ Global Market under the symbol "DXPE".

The following table sets forth on a per share basis the high and low sales prices for our common stock as reported by NASDAQ for the periods indicated.

|

High

|

Low

|

||

|

2009

|

|||

|

First Quarter

|

$ 15.84

|

$ 8.47

|

|

|

Second Quarter

|

$ 16.40

|

$ 9.52

|

|

|

Third Quarter

|

$ 12.44

|

$ 9.21

|

|

|

Fourth Quarter

|

$ 13.36

|

$ 10.48

|

|

|

2008

|

|||

|

First Quarter

|

$ 23.74

|

$ 14.80

|

|

|

Second Quarter

|

$ 22.82

|

$ 18.83

|

|

|

Third Quarter

|

$ 34.14

|

$ 18.72

|

|

|

Fourth Quarter

|

$ 28.89

|

$ 9.67

|

On March 19, 2010, we had approximately 541 holders of record for outstanding shares of our common stock. This number does not include shareholders for whom shares are held in “nominee” or “street name”.

We anticipate that future earnings will be retained to finance the continuing development of our business. In addition, our bank credit facility prohibits us from declaring or paying any cash dividends or other distributions on our capital stock except for the monthly $0.50 per share dividend on our Series B convertible preferred stock, which amounts to $90,000 in the aggregate per year. Accordingly, we do not anticipate paying cash dividends on our common stock in the foreseeable future. The payment of any future dividends will be at the discretion of our Board of Directors and will depend upon, among other things, future earnings, the success of our business activities, regulatory and capital requirements, our lenders, our general financial condition and general business conditions.

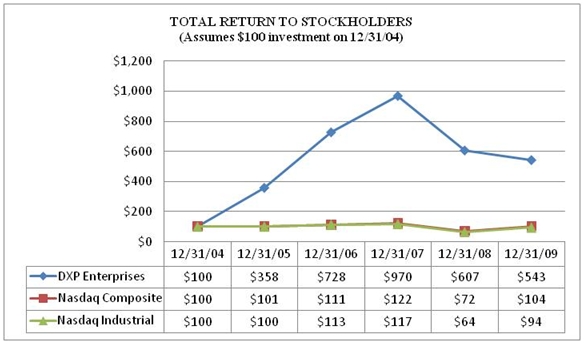

Stock Performance

The following performance graph compares the performance of DXP Common Stock to the NASDAQ Industrial Index and the NASDAQ Composite (US). The graph assumes that the value of the investment in DXP Common Stock and in each index was $100 at December 31, 2004 and that all dividends were reinvested.

12

Equity Compensation Table

The following table provides information regarding shares covered by the Company’s equity compensation plans as of December 31, 2009:

|

Plan category

|

Number

of Shares

to be issued

on exercise of outstanding options

|

Weighted

average

exercise price of outstanding options

|

Non-vested restricted shares outstanding

|

Weighted average

grant price

|

Number of securities remaining available for future issuance under equity compensation

plans

|

|

Equity compensation plans

approved by shareholders

|

50,000

|

$ 2.50

|

223,448

|

$ 15.29

|

221,883(1)

|

|

Equity compensation plans not

approved by shareholders

|

N/A

|

N/A

|

N/A

|

N/A

|

N/A

|

|

Total

|

50,000

|

$ 2.50

|

223,448

|

$ 15.29

|

221,883(1)

|

|

(1) Represents shares of common stock authorized for issuance under the 2005 Restricted Stock Plan. Does not include shares to be issued upon exercise of outstanding options.

|

|||||

ITEM 6. Selected Financial Data

The selected historical consolidated financial data set forth below for each of the years in the five-year period ended December 31, 2009 has been derived from our audited consolidated financial statements. This information should be read in conjunction with "Management's Discussion and Analysis of Financial Condition and Results of Operations" and the consolidated financial statements and notes thereto included elsewhere in this Report.

13

|

Years Ended December 31,

|

|||||

|

2005

|

2006

Restated(1)

|

2007

Restated(1)

|

2008

Restated(1)

|

2009(2)

|

|

|

(in thousands, except per share amounts)

|

|||||

|

Consolidated Statement of Earnings Data:

|

|||||

|

Sales

|

$ 185,364

|

$ 279,820

|

$ 444,547

|

$ 736,883

|

$ 583,226

|

|

Gross Profit

|

49,714

|

78,622

|

125,692

|

206,988

|

151,414

|

|

Operating income

|

9,404

|

20,678

|

31,892

|

48,191

|

(49,332)

|

|

Income (loss) before income taxes

|

8,615

|

19,404

|

28,897

|

42,284

|

(54,482)

|

|

Net income (loss)

|

5,467

|

11,922

|

17,347

|

25,887

|

(42,412)

|

|

Per share amounts

|

|||||

|

Basic earnings (loss) per common share

|

$ 0.62

|

$ 1.17

|

$ 1.46

|

$ 1.99

|

$ (3.24)

|

|

Common shares outstanding

|

8,698

|

10,127

|

11,811

|

12,945

|

13,117

|

|

Diluted earnings (loss) per share

|

$ 0.47

|

$ 1.04

|

$ 1.35

|

$ 1.87

|

$ (3.24)

|

|

Common and common equivalent shares

outstanding

|

11,578

|

11,450

|

12,860

|

13,869

|

13,117

|

|

(1) Basic and diluted earnings per share amounts have been restated due to adoption in the first quarter of 2009 of authoritative guidance which requires awards of unvested restricted stock to be treated as if outstanding in the calculation of earnings per share.

(2) The goodwill and other intangibles impairment charge and the Precision inventory impairment charge in 2009 reduced operating income by $66.8 million and increased basic and diluted loss per share by $3.82.

|

|||||

|

Consolidated Balance Sheet Data

|

As of December 31,

|

||||

|

2005

|

2006

|

2007

|

2008

|

2009

|

|

|

Total assets

|

$ 74,924

|

$ 118,811

|

$ 288,170

|

$ 397,856

|

$ 270,927

|

|

Long-term debt obligations

|

25,109

|

35,174

|

101,989

|

154,591

|

102,916

|

|

Shareholders’ equity

|

20,791

|

36,920

|

102,713

|

130,188

|

90,213

|

ITEM 7. Management's Discussion and Analysis of Financial Condition and Results of Operations

The following discussion and analysis should be read in conjunction with the Consolidated Financial Statements and related notes contained elsewhere in this Report.

General Overview

Our products and services are marketed in at least 37 states in the United States and one province in Canada to over 40,000 customers that are engaged in a variety of industries, many of which may be countercyclical to each other. Demand for our products generally is subject to changes in the United States and global economy and economic trends affecting our customers and the industries in which they compete in particular. Certain of these industries, such as the oil and gas industry, are subject to volatility while others, such as the petrochemical industry and the construction industry, are cyclical and materially affected by changes in the United States and global economy. As a result, we may experience changes in demand within particular markets, segments and product categories as changes occur in our customers' respective markets.

During 2005 the general economy and the oil and gas exploration and production business continued to improve. Our employee headcount increased by 17.9% as a result of two acquisitions and hiring additional personnel to support increased sales. The majority of the 2005 sales increase came from a broad-based increase in sales of pumps, bearings, safety products and mill supplies to customers engaged in oilfield service, oil and gas production, mining, electricity generation and petrochemical processing. Sales by the two businesses acquired in 2005 accounted for $7.3 million of the $24.8 million 2005 sales increase.

14

During 2006 the general economy and the oil and gas exploration and production business continued to be positive. Our employee headcount increased by 45% a result of four acquisitions and hiring additional personnel to support increased sales. The majority of the 2006 sales increase came from a broad-based increase in sales of pumps, bearings, safety products and mill supplies to customers engaged in oilfield service, oil and gas production, mining, electricity generation and petrochemical processing. Sales by the four businesses acquired in 2006 accounted for $11.8 million of the $94.5 million 2006 sales increase.

During 2007 the general economy and the oil and gas exploration and production business continued to be positive. During 2007 our headcount increased by 112% primarily as a result of three acquisitions. Sales by the three businesses acquired in 2007 accounted for $92.3 million of the $164.7 million sales increase. The 2007 sales increase, excluding sales of businesses acquired in 2007, resulted from a broad based increase in sales by our service centers, innovative pumping solution locations and supply chain locations.

During 2008 the general economy weakened. However, the oil and gas exploration and production business continued to be positive during the first half of 2008, before declining during the second half of 2008. During 2008 our headcount increased by 18% primarily as a result of three acquisitions. Sales by the three businesses acquired in 2008 accounted for $33.4 million of the $292.3 million 2008 sales increase. The 2008 sales increase, excluding sales of businesses acquired in 2008, resulted from a broad-based increase in sales by our service centers, innovative pumping solution locations and supply chain locations.

During 2009 the general economy and the oil and gas exploration and production business declined significantly. During 2009 our headcount decreased by approximately 10% as a result of actions taken to reduce operating costs. Sales for 2009 declined by 20.9% from 2008. Sales by businesses acquired during 2008, on a same store sales basis, accounted for $36.1 million of 2009 sales. Excluding these sales by acquired businesses, sales declined by 25.8% from 2008. The 2009 sales decline is primarily due to a broad-based decline in the sales of pumps, bearings, safety products and mill supplies in connection with a broad-based decline in the U.S. economy. This economic decline led to the impairment of goodwill and other intangibles. During the fourth quarter of 2009 the Company recognized an impairment charge of $53.0 million for goodwill and other intangibles and an impairment charge of $13.8 million to reduce the valuation of inventory acquired in the acquisition of Precision. The impairment charges did not result in any cash expenditures, did not adversely affect compliance with covenants under our credit facility, and did not affect our cash position or cash flows from operating activities.

Our sales growth strategy in recent years has focused on internal growth and acquisitions. Key elements of our sales strategy include leveraging existing customer relationships by cross-selling new products, expanding product offerings to new and existing customers, and increasing business-to-business solutions using system agreements and supply chain solutions for our integrated supply customers. We will continue to review opportunities to grow through the acquisition of distributors and other businesses that would expand our geographic breadth and/or add additional products and services. Our results will depend on our success in executing our internal growth strategy and, to the extent we complete any acquisitions, our ability to integrate such acquisitions effectively.

Our strategies to increase productivity include consolidated purchasing programs, centralizing product distribution centers, centralizing certain customer service and inside sales functions, converting selected locations from full warehouse and customer service operations to service centers, and using information technology to increase employee productivity.

15

Results of Operations

|

Years Ended December 31,

|

||||||

|

2007

Restated(1)

|

%

|

2008

Restated(1)

|

%

|

2009(2)

|

%

|

|

|

(in millions, except percentages and per share amounts)

|

||||||

|

Sales

|

$ 444.5

|

100.0

|

$ 736.9

|

100.0

|

$ 583.2

|

100.0

|

|

Cost of sales

|

318.8

|

71.7

|

529.9

|

71.9

|

431.8

|

74.0

|

|

Gross profit

|

125.7

|

28.3

|

207.0

|

28.1

|

151.4

|

26.0

|

|

Selling, general & administrative expense

|

93.8

|

21.1

|

158.8

|

21.6

|

147.8

|

25.3

|

|

Goodwill and other intangibles impairment

|

53.0

|

9.1

|

||||

|

Operating income (loss)

|

31.9

|

7.2

|

48.2

|

6.5

|

(49.3)

|

(8.5)

|

|

Interest expense

|

3.3

|

0.7

|

6.1

|

0.8

|

5.2

|

0.9

|

|

Other income

|

(0.3)

|

-

|

(0.2)

|

-

|

(0.1)

|

-

|

|

Income (loss) before income taxes

|

28.9

|

6.5

|

42.3

|

5.7

|

(54.5)

|

(9.3)

|

|

Provision (benefit) for income taxes

|

11.6

|

2.6

|

16.4

|

2.2

|

(12.1)

|

(2.1)

|

|

Net income (loss)

|

$ 17.3

|

3.9%

|

$ 25.9

|

3.5%

|

$(42.4)

|

(7.3%)

|

|

Per share

|

||||||

|

Basic earnings (loss) per share

|

$ 1.46

|

$ 1.99

|

$(3.24)

|

|||

|

Diluted earnings (loss) per share

|

$ 1.35

|

$ 1.87

|

$(3.24)

|

|||

|

(1) Basic and diluted earnings per share amounts have been restated due to adoption in the first quarter of 2009 of authoritative guidance which requires awards of unvested restricted stock to be treated as if standing in the calculation of earnings per share.

(2) The goodwill and other intangibles impairment charge and the Precision inventory impairment charge in 2009 reduced operating income by $66.8 million and increased basic and diluted loss per share by $3.82.

|

||||||

Year Ended December 31, 2009 Compared to Year Ended December 31, 2008

SALES. Sales for the year ended December 31, 2009 decreased $153.7 million, or 20.9%, to approximately $583.2 million from $736.9 million in 2008. Sales for the MRO segment decreased $152.8 million, or 20.8%, to $580.5 million for the year ended December 31, 2009, from $733.3 million for 2008. Sales by businesses acquired in 2008, on a same store sales basis, accounted for $36.1 million of 2009 sales. Excluding these sales by the acquired businesses, sales for the MRO segment decreased 25.8%. This sales decrease is primarily due to a broad-based decrease in sales of pumps, bearings, safety products and mill supplies in connection with a broad-based decline in the U. S. economy. Sales for the Electrical Contractor segment decreased by $0.9 million, or 24.4%, to $2.7 million for the year ended December 31, 2009 from $3.6 million for 2008, resulting from the decline in the U. S. economy. Sales of commodity and specialty type electrical products declined.

GROSS PROFIT. Gross profit as a percentage of sales decreased by approximately 2.1% for 2009, to 26.0% from 28.1% for 2008. Gross profit as a percentage of sales for the MRO segment decreased to 25.9% for 2009, from 28.1% for 2008. This decrease is the result of the $13.8 million charge in the fourth quarter of 2009 to reduce the value of inventory acquired in connection with the acquisition of Precision on September 10, 2007. Gross profit as a percentage of sales for the Electrical Contractor segment decreased to 35.4% for 2009, from 35.9% for 2008. This decrease resulted from sales of higher margin specialty-type electrical products decreasing more than sales of commodity products decreased.

SELLING, GENERAL AND ADMINISTRATIVE. Selling, general and administrative expense for 2009 decreased by approximately $11.0 million to $147.8 million from $158.8 million for 2008. Selling, general and administrative expense associated with the three businesses acquired in 2008, on a same store basis, accounted for $11.2 million of the 2009 expense. On a same store basis, selling, general and administrative expense decreased approximately $36.5 million. This decrease primarily resulted from reduced salaries, incentive compensation, employee benefits and travel expenses compared to 2008. As a percentage of sales, the 2009 expense increased by approximately 3.8%, to 25.3% for 2009 from 21.6% for 2008. This increase is primarily the result of sales decreasing more than selling, general and administrative expenses decreased combined with the effect of accruing $1.8 million of future rent and related expenses associated with locations closed during 2009.

16

GOODWILL AND OTHER INTANGIBLES IMPAIRMENT. During the fourth quarter of 2009, the Company performed the annual goodwill impairment test based on current and expected market conditions, including reduced operating results. As a result of this test, the Company determined that goodwill and other intangibles associated with the MRO segment were impaired as of December 31, 2009. Accordingly, the Company recognized an impairment charge of $53.0 million for goodwill and other intangibles in the fourth quarter of 2009.

OPERATING INCOME (LOSS). Operating loss for 2009 was $49.3 million compared to $48.2 million of income for 2008. Operating loss for the MRO segment was $49.6 million for 2009 compared to $47.7 million of income for 2008 as a result of a $55.2 million decrease in gross profit and the $53.0 million impairment charge, partially offset by a $10.9 million decrease in selling, general and administrative expense. Operating income for the Electrical Contractor segment decreased 46.2%, to $0.3 million for 2009, from $0.5 million for 2008, primarily as a result of decreased gross profit due to decreased sales.

INTEREST EXPENSE. Interest expense for 2009 decreased by 14.4% from 2008. This decrease primarily resulted from decreased market interest rates.

OTHER INCOME. Other income for 2009 decreased to $0.1 million from $0.2 million for 2008 as a result of reduced interest income.

INCOME TAXES. Our provision for income taxes differed from the U. S. statutory rate of 35% due to state income taxes and non-deductible expenses. Our effective tax rate for 2009 decreased from 38.8% for 2008 primarily as a result of the non-deductible impairment charge for PFI, LLC goodwill.

Year Ended December 31, 2008 Compared to Year Ended December 31, 2007

SALES. Sales for 2008 increased $292.3 million, or 65.8%, to approximately $736.9 million from $444.5 million in 2007. Sales for the MRO segment increased $292.0 million, or 66.2% primarily due to sales by businesses acquired in 2007 and 2008 and partially due to a broad-based increase in sales of pumps, safety products and mill supplies to companies engaged in oilfield service, oil and gas production, food processing, agriculture, mining, electricity generation and petrochemical processing. Sales by businesses acquired during 2007 and 2008, on a same store sales basis, accounted for $233.8 million of the 2008 MRO sales increase. Excluding sales of the acquired businesses, on a same store sales basis, sales for the MRO segment increased 13.2%. Sales for the Electrical Contractor segment increased $0.3 million, or 9.5%, to $3.6 million from $3.3 million for 2007. The sales increase for the Electrical Contractor segment resulted from the sale of more commodity type electrical products.

GROSS PROFIT. Gross profit for 2008 increased 64.7% compared to 2007. Gross profit, as a percentage of sales, decreased by approximately 0.2% for 2008, when compared to 2007. Gross profit as a percentage of sales for the MRO segment decreased to 28.1% in 2008 from 28.2% in 2007. This decrease can be primarily attributed to the lower gross profit on sales by Precision Industries, Inc., which was acquired on September 7, 2007. Gross profit as a percentage of sales for the Electrical Contractor segment decreased to 35.9% for 2008, from 37.1% in 2007. This decrease resulted from the sale of more lower margin commodity type electrical products.

SELLING, GENERAL AND ADMINISTRATIVE. Selling, general and administrative expense for 2008 increased by approximately $65.0 million, or 69.3%, when compared to 2007. The increase is primarily attributed to selling, general and administrative expenses of acquired businesses and increased compensation expense related to increased gross profit. The majority of our employees receive incentive compensation, which is based upon gross profit. As a percentage of revenue, the 2008 expense increased by approximately 0.5% to 21.6% from 21.1% for 2007. This increase resulted from the $3.7 million increase in the amortization of intangibles associated with acquisitions.

OPERATING INCOME. Operating income for 2008 increased by approximately $16.3 million, or 51.1%, when compared to 2007. This increase was the net of a 51.5% increase in operating income for the MRO segment and a 20.8% increase in operating income for the Electrical Contractor segment. Operating income for the MRO segment increased as a result of increased gross profit, partially offset by increased selling, general, and administrative expense. Operating income for the Electrical Contractor segment increased as a result of increased gross profit combined with stable selling, general and administrative costs.

17

INTEREST EXPENSE. Interest expense for 2008 increased by 83.3% from 2007. This increase primarily resulted from increased debt to fund acquisitions and internal growth.

OTHER INCOME. Other income for 2008 decreased to $0.2 million from $0.3 million for 2007 as a result of reduced interest income.

INCOME TAXES. Our provision for income taxes differed from the U. S. statutory rate of 35% due to state income taxes and non-deductible expenses. Our effective tax rate for 2008 decreased to 38.8% from 40.0% for 2007 primarily as a result of a decreased effective state income tax rate.

Liquidity and Capital Resources

General Overview

As a distributor of MRO products and Electrical Contractor products, we require significant amounts of working capital to fund inventories and accounts receivable. Additional cash is required for capital items such as information technology and warehouse equipment. We also require cash to pay our lease obligations and to service our debt.

We generated approximately $51.6 million of cash in operating activities in 2009 as compared to generating $18.5 million in 2008. This change between the two years was primarily attributable to the $24.1 million decrease in accounts receivable and the $46.5 million reduction in inventories in 2009 compared to a $10.9 million increase in accounts receivable and a $11.2 million increase in inventories in 2008.

During 2009 we paid $0.5 million of cash related to the purchase of businesses acquired in earlier years compared to paying $73.9 million for acquisitions in 2008.

We purchased approximately $1.6 million of capital assets during 2009 compared to $5.1 million for 2008. Capital expenditures during 2009 and 2008 were related primarily to computer equipment, computer software, production equipment, inventory handling equipment, safety rental equipment and building improvements. Capital expenditures for 2010 are expected to be more than the 2009 amount.

At December 31, 2009, our total long-term debt, including the current portion, was $115.5 million compared to total capitalization (total long-term debt plus shareholders’ equity) of $205.7 million. Approximately $113.5 million of this outstanding debt bears interest at various floating rates. Therefore, as an example, a 200 basis point increase in interest rates would increase our annual interest expense by approximately $2.3 million.

Our normal trade terms for our customers require payment within 30 days of invoice date. In response to competition and customer demands we will offer extended terms to selected customers with good credit history. Customers that are financially strong tend to request extended terms more often than customers that are not financially strong. Many of our customers, including companies listed in the Fortune 500, do not pay us within stated terms for a variety of reasons, including a general business philosophy to pay vendors as late as possible. We generally collect the amounts due from these large, slow-paying customers.

During 2009, the amount available to be borrowed under our credit facility increased from $37.0 million at December 31, 2008, to $37.3 million at December 31, 2009. The increase in availability is primarily the result of the effect of reduced borrowings on the loan covenant ratios. Our total long-term debt decreased $53.0 million during 2009. Management believes that the liquidity of our balance sheet at December 31, 2009, provides us with the ability to meet our working capital needs, scheduled principal payments, capital expenditures and Series B convertible preferred stock dividend payments during 2010.

To hedge a portion of our floating rate debt, as of January 10, 2008, DXP entered into an interest rate swap agreement with the lead bank of our Facility. Through January 11, 2010, this interest rate swap effectively fixed the interest rate on $40 million of floating rate LIBOR borrowings under the Facility at 3.68% plus the margin (1.75% at December 31, 2009) in effect under the Facility.

18

Credit Facility

On August 28, 2008, DXP entered into a credit agreement with Wells Fargo Bank, National Association, as lead arranger and administrative agent for the lenders (the “Facility). The Facility was amended on March 15, 2010. The Facility consists of a $50 million term loan and a revolving credit facility that provides a $150 million line of credit to the Company. The term loan requires principal payments of $2.5 million per quarter beginning on December 31, 2008. The Facility matures on August 11, 2013. The Facility contains financial covenants defining various financial measures and levels of these measures with which the Company must comply. Covenant compliance is assessed as of each quarter end and certain month ends for the asset test. The asset test is defined under the Facility as the sum of 85% of the Company’s net accounts receivable, 60% of net inventory, and 50% of the net book value of non real estate property and equipment. The Company’s borrowing and letter of credit capacity under the revolving credit portion of the Facility at any given time is $150 million less borrowings under the revolving credit portion of the facility and letters of credit outstanding, subject to the asset test described above.

On December 31, 2009, the LIBOR based rate on the revolving credit portion of the Facility was LIBOR plus l.75%, the prime based rate on the revolving credit portion of the Facility was prime plus 0.25%, the commitment fee was 0.25%, the LIBOR based rate for the term loan was LIBOR plus 2.50% and the prime based rate for the term loan was prime plus 1.00%. At December 31, 2009, $110.5 million was borrowed under the Facility at a weighted average interest rate of approximately 3.5% under the LIBOR options, including the effect of the interest rate swap, and nothing was borrowed under the prime options under the Facility. Beginning on March 15, 2010, the March 15, 2010 amendment to the Facility significantly increases the interest rates and commitment fees applicable at various leverage ratios from levels in effect before March 15, 2010. The revolving credit portion of the Facility provides the option of interest at LIBOR plus a margin ranging from 2.25% to 4.00% or prime plus a margin of 1.25% to 3.00%. If the increased rates had been in effect on December 31, 2009, the LIBOR based rate on the revolving credit portion of the Facility would have been LIBOR plus 4.00%. If the increased rates had been in effect on December 31, 2009 the prime based rate on the revolving credit portion of the Facility would have been prime plus 3.00%. Commitment fees of 0.25% to 0.625% per annum are payable on the portion of the Facility capacity not in use for borrowings or letters of credit at any given time. If the increased rates had been in effect on December 31, 2009, the commitment fee would have been 0.625%. The term loan provides the option of interest at LIBOR plus a margin ranging from 2.75% to 4.50% or prime plus a margin of 1.75% to 3.50%. If the increased rates had been in effect on December 31, 2009, the LIBOR based rate for the term loan would have been LIBOR plus 4.50%. If the increased rates had been in effect on December 31, 2009, the prime based rate for the term loan would have been prime plus 3.50%. Borrowings under the Facility are secured by all of the Company’s accounts receivable, inventory, general intangibles and non real estate property and equipment. The Facility was amended to waive the Fixed Charge Coverage Ratio for the period ended December 31, 2009, and modify the Leverage Ratio for the period ended December 31, 2009, to allow DXP to be in compliance with all financial covenants. DXP would not have been in compliance with the Fixed Charge Coverage Ratio or the Leverage Ratio without the amendment. At December 31, 2009, we had $37.3 million available for borrowing under the most restrictive covenant of the Facility.

The Facility’s principal financial covenants include:

Fixed Charge Coverage Ratio – For the 12 month period ending December 31, 2009, the Fixed Charge Coverage Ratio has been waived. The Facility requires that the Fixed Charge Coverage Ratio for the 12 month period ending on the last day of each quarter from March 31, 2010 through September 30, 2010 be not less than 1.0 to 1.0, stepping up to 1.25 to 1.0 for the quarter ending December 31, 2010 and to 1.50 to 1.0 for the quarter ending March 31, 2011, with “Fixed Charge Coverage Ratio” defined as the ratio of (a) EBITDA for the 12 months ending on such date minus cash taxes, minus Capital Expenditures for such period (excluding acquisitions) to (b) the aggregate of interest expense paid in cash, scheduled principal payments in respect of long-term debt and current portion of capital leases for such 12-month period, determined in each case on a consolidated basis for DXP and its subsidiaries.

19

Leverage Ratio – The Facility requires that the Company’s Leverage Ratio, determined at the end of each fiscal quarter, not exceed 3.75 to 1.0 as of December 31, 2009, 4.25 to 1.0 as of March 31, 2010, 4.00 to 1.00 as of June 30, 2010, 3.75 to 1.0 as of September 30, 2010, and 3.25 to 1.0 as of the last day of each quarter thereafter. Leverage Ratio is defined as the outstanding Indebtedness divided by EBITDA for the twelve months then ended. Indebtedness is defined under the Facility for financial covenant purposes as: (a) all obligations of DXP for borrowed money including but not limited to senior bank debt, senior notes, and subordinated debt; (b) capital leases; (c) issued and outstanding letters of credit; and (d) contingent obligations for funded indebtedness.

EBITDA as defined under the Facility for financial covenant purposes means, without duplication, for any period the consolidated net income (excluding any extraordinary gains or losses) of DXP plus, to the extent deducted in calculating consolidated net income, depreciation, amortization, other non-cash items and non-recurring items (including, without limitation, impairment charges, or asset write-offs and accruals in respect of closed locations), interest expense, and tax expense for taxes based on income and minus, to the extent added in calculating consolidated net income, any non-cash items and non-recurring items; provided that, if DXP acquires the equity interests or assets of any person during such period under circumstances permitted under the Facility, EBITDA shall be adjusted to give pro forma effect to such acquisition assuming that such transaction had occurred on the first day of such period and provided further that, if DXP divests the equity interests or assets of any person during such period under circumstances permitted under this Facility, EBITDA shall be adjusted to give pro forma effect to such divestiture assuming that such transaction had occurred on the first day of such period. Add-backs allowed pursuant to Article 11, Regulation S-X, of the Securities Act of 1933, as amended, will also be included in the calculation of EBITDA.

|

|

Borrowings

|

|

December 31,

|

Increase

(Decrease)

|

||

|

2008

|

2009

|

||

|

(in thousands)

|

|||

|

Current portion of long-term debt

|

$ 13,965

|

$ 12,595

|

$ (1,370)

|

|

Long-term debt, less current portion

|

154,591

|

102,916

|

(51,675)

|

|

Total long-term debt

|

$ 168,556

|

$ 115,511

|

$ (53,045)(2)

|

|

Amount available (1)

|

$ 36,951

|

$ 37,276

|

$ 325(3)

|

|

(1) Represents amount available to be borrowed under the Facility at the indicated date.