Attached files

| file | filename |

|---|---|

| EXCEL - IDEA: XBRL DOCUMENT - DXP ENTERPRISES INC | Financial_Report.xls |

| EX-32.1 - DXPE 2014 10-K EXHIBIT 32.1 - DXP ENTERPRISES INC | dxpe201410k-ex321.htm |

| EX-23.1 - DXPE 2014 10-K EXHIBIT 23.1 - DXP ENTERPRISES INC | dxpe201410k-ex231.htm |

| EX-31.2 - DXPE 2014 10-K EXHIBIT 31.2 - DXP ENTERPRISES INC | dxpe201410k-ex312.htm |

| EX-32.2 - DXPE 2014 10-K EXHIBIT 32.2 - DXP ENTERPRISES INC | dxpe201410k-ex322.htm |

| EX-31.1 - DXPE 2014 10-K EXHIBIT 31.1 - DXP ENTERPRISES INC | dxpe201410k-ex311.htm |

| EX-23.2 - DXPE 2014 10-K EXHIBIT 23.2 - DXP ENTERPRISES INC | dxpe201410k-ex232.htm |

| EX-21.1 - DXPE 2014 10-K EXHIBIT 21.1 - DXP ENTERPRISES INC | dxpe201410k-ex211.htm |

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

Form 10-K

(Mark One)

|

|

[X]

|

ANNUAL REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934. For the fiscal year ended December 31, 2014

|

or

|

|

[ ]

|

TRANSITION REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934.

|

For the transition period from

|

to

|

Commission file number 0-21513

DXP Enterprises, Inc.

(Exact name of registrant as specified in its charter)

|

Texas

|

76-0509661

|

|||

|

(State or other jurisdiction

of incorporation or organization)

|

(I.R.S. Employer Identification Number)

|

|||

|

|

||||

|

7272 Pinemont, Houston, Texas

|

77040 |

(713) 996-4700

|

||

|

(Address of principal executive offices)

|

(Zip Code) |

(Registrant’s telephone number,

including area code)

|

Securities registered pursuant to Section 12(b) of the Act:

|

Common Stock, $0.01 Par Value

|

NASDAQ

|

|

| (Title of Class) | (Name of exchange on which registered) |

Securities registered pursuant to Section 12(g) of the Act: None

Indicate by check mark if the registrant is a well-known seasoned issuer, as defined in Rule 405 of the Securities Act. Yes [ ] No [X]

Indicate by check mark if the registrant is not required to file reports pursuant to Section 13 or Section 15(d) of the Act. Yes [ ] No [X]

Indicate by check mark whether the registrant (1) has filed all reports required to be filed by Section 13 or 15(d) of the Securities Exchange Act of 1934 during the preceding 12 months (or for such shorter period that the registrant was required to file such reports), and (2) has been subject to such filing requirements for the past 90 days. Yes [X] No [ ]

Indicate by check mark whether the registrant has submitted electronically and posted on its corporate Web site, if any, every Interactive Data File required to be submitted and posted pursuant to Rule 405 of Regulation S-T during the preceding 12 months (or for such shorter period that the registrant was required to submit and post such files).

[X] Yes [ ] No

Indicate by check mark if disclosure of delinquent filers pursuant to Item 405 of Regulation S-K is not contained herein, and will not be contained, to the best of registrant's knowledge, in definitive proxy or information statements incorporated by reference in Part III of this Form 10-K or any amendment to this Form 10-K. [ ]

1

Indicate by check mark whether the registrant is a large accelerated filer, an accelerated filer, a non-accelerated filer, or a smaller reporting company. (See definitions of “large accelerated filer”, “accelerated filer”, and “smaller reporting company” in Rule 12b-2 of the Exchange Act).

Large accelerated filer [X] Accelerated filer [ ]

Non-accelerated filer [ ] (Do not check if a smaller reporting company)Smaller reporting company [ ]

Indicate by check mark whether the registrant is a shell company (as defined in Rule 12b-2 of the Act). Yes [ ] No [X]

Aggregate market value of the registrant's Common Stock held by non-affiliates of registrant as of June 30, 2014: $969,791,207

Number of shares of registrant's Common Stock outstanding as of March 16, 2015: 14,216,952.

Documents incorporated by reference: Portions of the definitive proxy statement for the annual meeting of shareholders to be held in 2015 are incorporated by reference into Part III hereof.

2

|

TABLE OF CONTENTS

|

|||

|

DESCRIPTION

|

|||

|

Item

|

Page

|

||

|

PART I

|

|||

|

1.

|

Business

|

4

|

|

|

1A.

|

Risk Factors

|

13

|

|

|

1B.

|

Unresolved Staff Comments

|

18

|

|

|

2.

|

Properties

|

18

|

|

|

3.

|

Legal Proceedings

|

19

|

|

|

4.

|

Mine Safety Disclosures

|

19

|

|

|

PART II

|

|||

|

5.

|

Market for the Registrant's Common Equity, Related Shareholder Matters and Issuer Purchases of Equity Securities

|

19

|

|

|

6.

|

Selected Financial Data

|

22

|

|

|

7.

|

Management's Discussion and Analysis of Financial Condition and Results of Operations

|

23

|

|

|

7A.

|

Quantitative and Qualitative Disclosures about Market Risk

|

38

|

|

|

8.

|

Financial Statements and Supplementary Data

|

38

|

|

|

9.

|

Changes in and Disagreements with Accountants on Accounting and Financial Disclosure

|

68

|

|

|

9A.

|

Controls and Procedures

|

68

|

|

|

9B.

|

Other Information

|

68

|

|

|

PART III

|

|||

|

10.

|

Directors, Executive Officers, and Corporate Governance

|

69

|

|

|

11.

|

Executive Compensation

|

69

|

|

|

12.

|

Security Ownership of Certain Beneficial Owners and Management and Related Shareholder Matters

|

69

|

|

|

13.

|

Certain Relationships and Related Transactions, and Director Independence

|

69

|

|

|

14.

|

Principal Accounting Fees and Services

|

69

|

|

|

PART IV

|

|||

|

15.

|

Exhibits, Financial Statement Schedules

|

70

|

|

|

Signatures

|

73

|

||

DISCLOSURE REGARDING FORWARD-LOOKING STATEMENTS

This Annual Report on Form 10-K (this “Report”) contains statements that constitute “forward-looking statements” within the meaning of the Private Securities Litigation Reform Act of 1995, as amended. Such statements can be identified by the use of forward-looking terminology such as “believes”, “expects”, “may”, “might”, “estimates”, “will”, “should”, “could”, “plans” or “anticipates” or the negative thereof or other variations thereon or comparable terminology, or by discussions of strategy. Any such forward-looking statements are not guarantees of future performance and may involve significant risks and uncertainties, and actual results may vary materially from those discussed in the forward-looking statements as a result of various factors. These factors include the effectiveness of management’s strategies and decisions, our ability to implement our internal growth and acquisition growth strategies, general economic and business condition specific to our primary customers, changes in government regulations, our ability to effectively integrate businesses we may acquire, new or modified statutory or regulatory requirements and changing prices and market conditions. This Report identifies other factors that could cause such differences. We cannot assure that these are all of the factors that could cause actual results to vary materially from the forward-looking statements. Factors that could cause or contribute to such differences include, but are not limited to, those discussed in "Risk Factors", and elsewhere in this Report. We assume no obligation and do not intend to update these forward-looking statements. Unless the context otherwise requires, references in this Report to the "Company", "DXP", “we” or “our” shall mean DXP Enterprises, Inc., a Texas corporation, together with its subsidiaries.

3

PART I

ITEM 1. Business

Company Overview

DXP was incorporated in Texas in 1996 to be the successor to SEPCO Industries, Inc., founded in 1908. Since our predecessor company was founded, we have primarily been engaged in the business of distributing maintenance, repair and operating (MRO) products, equipment and service to industrial customers. The Company is organized into three business segments: Service Centers, Supply Chain Services and Innovative Pumping Solutions. Sales, operating income, and other financial information for 2012, 2013 and 2014, and identifiable assets at the close of such years for our business segments are presented in Note 17 of the Notes to Consolidated Financial Statements “financial statements” in Item 8 of this Report.

Our total sales have increased from $125 million in 1996 to $1.5 billion in 2014 through a combination of internal growth and business acquisitions. At December 31, 2014 we operated from 185 locations in forty-two states in the U.S., nine provinces in Canada, Dubai and one state in Mexico, serving more than 50,000 customers engaged in a variety of industrial end markets. We have grown sales and profitability by adding additional products, services, locations and becoming customer driven experts in maintenance, repair and operating solutions.

Our principal executive office is located at 7272 Pinemont Houston, Texas 77040, and our telephone number is (713) 996-4700. Our website address on the Internet is www.dxpe.com and emails may be sent to info@dxpe.com. The reference to our website address does not constitute incorporation by reference of the information contained on the website and such information should not be considered part of this Report.

Industry Overview

The industrial distribution market is highly fragmented. Based on 2013 sales as reported by Industrial Distribution magazine, we were the 19th largest distributor of MRO products in the United States. Most industrial customers currently purchase their industrial supplies through numerous local distribution and supply companies. These distributors generally provide the customer with repair and maintenance services, technical support and application expertise with respect to one product category. Products typically are purchased by the distributor for resale directly from the manufacturer and warehoused at distribution facilities of the distributor until sold to the customer. The customer also typically will purchase an amount of product inventory for its near term anticipated needs and store those products at its industrial site until the products are used.

We believe that the distribution system for industrial products, as described in the preceding paragraph, creates inefficiencies at both the customer and the distributor levels through excess inventory requirements and duplicative cost structures. To compete more effectively, our customers and other users of MRO products are seeking ways to enhance efficiencies and lower MRO product and procurement costs. In response to this customer desire, three primary trends have emerged in the industrial supply industry:

|

·

|

Industry Consolidation. Industrial customers have reduced the number of supplier relationships they maintain to lower total purchasing costs, improve inventory management, assure consistently high levels of customer service and enhance purchasing power. This focus on fewer suppliers has led to consolidation within the fragmented industrial distribution industry.

|

|

·

|

Customized Integrated Service. As industrial customers focus on their core manufacturing or other production competencies, they increasingly are demanding customized integration services, consisting of value-added traditional distribution, supply chain services, modular equipment and repair and maintenance services.

|

4

|

·

|

Single Source, First-Tier Distribution. As industrial customers continue to address cost containment, there is a trend toward reducing the number of suppliers and eliminating multiple tiers of distribution. Therefore, to lower overall costs to the customer, some MRO product distributors are expanding their product coverage to eliminate second-tier distributors and become a “one stop source”.

|

We believe we have increased our competitive advantage through our traditional fabrication of integrated system pump packages and integrated supply programs, which are designed to address our customers’ specific product and procurement needs. We offer our customers various options for the integration of their supply needs, ranging from serving as a single source of supply for all or specific lines of products and product categories to offering a fully integrated supply package in which we assume the procurement and management functions, which can include ownership of inventory, at the customer's location. Our approach to integrated supply allows us to design a program that best fits the needs of the customer. Customers purchasing large quantities of product are able to outsource all or most of those needs to us. For customers with smaller supply needs, we are able to combine our traditional distribution capabilities with our broad product categories and advanced ordering systems to allow the customer to engage in one-stop sourcing without the commitment required under an integrated supply contract.

Business Segments

The Company is organized into three business segments: Service Centers (SC), Supply Chain Services (SCS) and Innovative Pumping Solutions (IPS). Our segments provide management with a comprehensive financial view of our key businesses. The segments enable the alignment of strategies and objectives and provide a framework for timely and rational allocation of resources within our businesses.

|

Segment

|

2014 Sales

|

% of Sales

|

End-Markets

|

Locations

|

Employees

|

|

SC

|

987,560

|

65.9%

|

Oil & Gas, Food & Beverage,

General Industrial, Chemical & Petrochemical, Transportation

|

177 service centers

8 distribution centers

|

2,460

|

|

SCS

|

163,968

|

10.9%

|

Oil & Gas

Food & Beverage,

Mining & Transportation

|

74 customer facilities

|

274

|

|

IPS

|

348,134

|

23.2%

|

Oil & Gas

Mining

Utilities

|

12 fabrication facilities

|

698

|

Service Centers

The Service Centers are engaged in providing MRO products, equipment and integrated services, including technical expertise and logistics capabilities, to industrial customers with the ability to provide same day delivery. We offer our customers a single source of supply on an efficient and competitive basis by being a first-tier distributor that can purchase products directly from manufacturers. As a first-tier distributor, we are able to reduce our customers' costs and improve efficiencies in the supply chain. We also provide services such as field safety supervision, in-house and field repair and predictive maintenance. We offer a wide range of industrial MRO products, equipment and integrated services through a continuum of customized and efficient MRO solutions.

A majority of our Service Center segment sales are derived from customer purchase orders. Sales are directly solicited from customers by our sales force. DXP Service Centers are stocked and staffed with knowledgeable sales associates and backed by a centralized customer service team of experienced industry professionals. At December 31, 2014, our Service Centers’ products and services were distributed from 177 service centers and 8 distribution centers.

5

DXP Service Centers provide a wide range of MRO products in the rotating equipment, bearing, power transmission, hose, fluid power, metal working, industrial supply and safety product and service categories. We currently serve as a first-tier distributor of more than 1,000,000 items of which more than 60,000 are stock keeping units (SKUs) for use primarily by customers engaged in the oil and gas, food and beverage, petrochemical, transportation and other general industrial industries. Other industries served by our Service Centers include mining, construction, chemical, municipal, agriculture and pulp and paper.

The Service Centers segment’s long-lived assets are located in the United States, Canada and Mexico. Approximately 16.4% of the Service Centers segment’s revenues were in Canada and the remainder was virtually all in the U.S.

At December 31, 2014, the Service Centers segment had approximately 2,460 full-time employees.

Supply Chain Services

DXP’s Supply Chain Services (SCS) segment manages all or part of its customers’ supply chains, including procurement and inventory management. The SCS segment enters into long-term contracts with its customers that can be cancelled on little or no notice under certain circumstances. The SCS segment provides fully outsourced MRO solutions including, but not limited to, the following: inventory optimization and management; store room management; transaction consolidation and control; vendor oversight and procurement cost optimization; productivity improvement services; and customized reporting. Our mission is to help our customers become more competitive by reducing their indirect material costs and order cycle time by increasing productivity and by creating enterprise-wide inventory and procurement visibility and control.

DXP has developed assessment tools and master plan templates aimed at taking cost out of supply chain processes, streamlining operations and boosting productivity. This multi-faceted approach allows us to manage the entire channel for maximum efficiency and optimal control, which ultimately provides our customers with a low-cost solution.

DXP takes a consultative approach to determine the strengths and opportunities for improvement within a customer’s indirect supply chain. This assessment determines if and how we can best streamline operations, drive value within the procurement process, and increase control in storeroom management.

Decades of supply chain inventory management experience and comprehensive research, as well as a thorough understanding of our customers’ businesses and industries have allowed us to design standardized programs that are flexible enough to be fully adaptable to address our customers’ unique supply chain challenges. These standardized programs include:

|

·

|

SmartAgreement, a planned, pro-active procurement solution for MRO categories leveraging DXP’s local Service Centers.

|

|

·

|

SmartBuy, DXP’s on-site or centralized MRO procurement solution.

|

|

·

|

SmartSourceSM, DXP’s on-site procurement and storeroom management by DXP personnel.

|

|

·

|

SmartStore, DXP’s customized e-Catalog solution.

|

|

·

|

SmartVend, DXP’s industrial dispensing solution. It allows for inventory-level optimization, user accountability and item usage reduction by 20-40%.

|

|

·

|

SmartServ, DXP’s integrated service pump solution. It provides a more efficient way to manage the entire life cycle of pumping systems and rotating equipment.

|

DXP’s SmartSolutions programs help customers to cut product costs, improve supply chain efficiencies and obtain expert technical support. DXP represents manufacturers of up to 90% of all the maintenance, repair and operating products of our customers. Unlike many other distributors who buy products from second-tier sources, DXP takes customers to the source of the products they need.

6

At December 31, 2014, the Supply Chain Services segment operated supply chain installations in seventy-four (74) of our customers’ facilities.

At December 31, 2014, all of the Supply Chain Services segment’s long-lived assets are located in the U.S. and all of 2014 sales were recognized in the U.S.

At December 31, 2014, the Supply Chain Services segment had approximately 274 full-time employees.

Innovative Pumping Solutions

DXP’s Innovative Pumping Solutions® (IPS) segment provides integrated, custom pump skid packages, pump remanufacturing and manufactures branded private label pumps to meet the capital equipment needs of our global customer base. Our IPS segment provides a single source for engineering, systems design and fabrication for unique customer specifications.

Our sales of integrated pump packages, remanufactured pumps or branded private label pumps are generally derived from customer purchase orders containing the customers’ unique specifications. Sales are directly solicited from customers by our dedicated sales force.

DXP’s engineering staff can design a complete custom pump package to meet our customers’ project specifications. Drafting programs such as Solidworks® and AutoCAD® allow our engineering team to verify the design and layout of packages with our customers prior to the start of fabrication. Finite Elemental Analysis programs such as Cosmos Professional® are used to design the package to meet all normal and future loads and forces. This process helps maximize the pump packages’ life and minimizes any impact to the environment.

With over 100 years of fabrication experience, DXP has acquired the technical expertise to ensure that our pumps and pump packages are built to meet the highest standards. DXP utilizes manufacturer authorized equipment and manufacturer certified personnel. Pump packages require MRO products and original equipment manufacturers’ (OEM) equipment such as pumps, motors, valves, and consumable products, such as welding supplies. DXP leverages its MRO product inventories and breadth of authorized products to lower the total cost and maintain the quality of our pump packages.

DXP’s fabrication facilities provide convenient technical support and pump repair services. The facilities contain state of the art equipment to provide the technical services our customers require including, but not limited to, the following:

|

·

|

Structural welding

|

|

·

|

Pipe welding

|

|

·

|

Custom skid assembly

|

|

·

|

Custom coatings

|

|

·

|

Hydrostatic pressure testing

|

|

·

|

Mechanical string testing

|

Examples of our innovative pump packages include, but are not limited to:

|

·

|

Diesel and electric driven firewater packages

|

|

·

|

Pipeline booster packages

|

|

·

|

Potable water packages

|

|

·

|

Pigging pump packages

|

|

·

|

Lease Automatic Custody Transfer (LACT) charge units

|

|

·

|

Chemical injection pump packages wash down units

|

|

·

|

Seawater lift pump packages

|

|

·

|

Jockey pump packages

|

|

·

|

Condensate pump packages

|

|

·

|

Cooling water packages

|

|

·

|

Seawater/produced water injection packages

|

|

·

|

Variety of packages to meet customer required industry specifications such as API, ANSI and NFPA

|

7

At December 31, 2014, the Innovative Pumping Solutions segment operated out of twelve facilities, ten of which are located in the United States and two in Canada.

Approximately 1.9% of the IPS segment’s long-lived assets are located in Canada and the remainder were located in the U.S. Approximately 9.6% of the IPS segment’s 2014 revenues were recognized in Canada and 89.4% were in the U.S.

At December 31, 2014, the IPS segment had approximately 698 full-time employees.

Products

Most industrial customers currently purchase their MRO products through local or national distribution companies that are focused on single or unique product categories. As a first-tier distributor, our network of service and distribution centers stock more than 60,000 SKUs and provide customers with access to more than 1,000,000 items. Given our breadth of product and our industrial distribution customers’ focus around specific product categories, we have become customer driven experts in five key product categories. As such, our three business segments are supported by the following five key product categories: rotating equipment, bearings & power transmission, industrial supplies, metal working and safety products & services. Each business segment tailors its inventory and leverages product experts to meet the needs of its local customers.

Key product categories that we offer include:

|

·

|

Rotating Equipment. Our rotating equipment products include a full line of centrifugal pumps for transfer and process service applications, such as petrochemicals, refining and crude oil production; rotary gear pumps for low- to- medium pressure service applications, such as pumping lubricating oils and other viscous liquids; plunger and piston pumps for high-pressure service applications such as disposal of produced water and crude oil pipeline service; and air-operated diaphragm pumps. We also provide a large variety of pump accessories.

|

|

·

|

Bearings & Power Transmission. Our bearing products include several types of mounted and un-mounted bearings for a variety of applications. The power transmission products we distribute include speed reducers, flexible-coupling drives, chain drives, sprockets, gears, conveyors, clutches, brakes and hoses.

|

|

·

|

Industrial Supplies. We offer a broad range of industrial supplies, such as abrasives, tapes and adhesive products, coatings and lubricants, fasteners, hand tools, janitorial products, pneumatic tools, welding supplies and welding equipment.

|

|

·

|

Metal Working. Our metal working products include a broad range of cutting tools, abrasives, coolants, gauges, industrial tools and machine shop supplies.

|

|

·

|

Safety Products & Services. We provide safety services including hydrogen sulfide (H2S) gas protection and safety, specialized and standby fire protection, safety supervision, training, monitoring, equipment rental and consulting. Our safety services include safety supervision, medic services, safety audits, instrument repair and calibration, training, monitoring, equipment rental and consulting. Additionally, we sell safety products including eye and face protection, first aid, hand protection, hazardous material handling, instrumentation and respiratory protection products.

|

We acquire our products through numerous OEMs. We are authorized to distribute certain manufacturers' products only in specific geographic areas. All of our oral or written distribution authorizations are subject to cancellation by the manufacturer, some upon little or no notice. For the last three fiscal years, no manufacturer provided products that accounted for 10% or more of our revenues. We believe that alternative sources of supply could be obtained in a timely manner if any distribution authorization were canceled. Accordingly, we do not believe that the loss of any one distribution authorization would have a material adverse effect on our business, financial condition or results of operations.

8

The Company has operations in the United States of America, Canada, Dubai, and Mexico. Information regarding financial data by geographic areas is set forth in Note 17 of the Notes to Consolidated Financial Statements.

Recent Acquisitions

A key component of our growth strategy includes effecting acquisitions of businesses with complementary or desirable product lines, locations or customers. Since 2004, we have completed 31 acquisitions across our three business segments. Below is a summary of recent acquisitions since the beginning of 2010.

On April 1, 2010, DXP acquired substantially all the assets of Quadna, Inc. (“Quadna”). The purchase price of approximately $25.0 million (net of $3.0 million of acquired cash) consisted of $11 million paid in cash, $10 million in the form of convertible promissory notes bearing interest at a rate of 10% and approximately $4.0 million in the form of 343,337 shares of DXP common stock. The $11 million cash portion of the purchase price was funded by borrowings under DXP’s existing credit facility. DXP completed this acquisition to expand its pump business in the Western U.S. On April 9, 2010, $4.5 million principal amount of the convertible promissory notes, along with accrued interest, were converted into 376,417 shares of DXP’s common stock. On August 18, 2010, $3.7 million of the convertible promissory notes were paid off using funds obtained from DXP’s credit facility and $1.8 million of the convertible promissory notes were converted to 117,374 shares of DXP common stock.

On November 30, 2010, DXP acquired substantially all of the assets of D&F Distributors, Inc. (“D&F”). The purchase price of $13.4 million consisted of approximately $7.4 million paid in cash, approximately $2.9 million in the form of promissory notes bearing interest at a rate of 5%, and approximately $3.1 million in the form of 155,393 shares of DXP common stock. The cash portion of the purchase price was funded by borrowings under DXP’s existing credit facility. DXP completed this acquisition to expand its pump business in Indiana, Kentucky, Tennessee and Ohio.

On October 10, 2011, DXP acquired substantially all of the assets of Kenneth Crosby ("KC"). DXP acquired this business to expand DXP's geographic presence in the eastern U.S. and strengthen DXP's metal working and supply chain services offerings. DXP paid approximately $15.6 million for KC, which was borrowed under our existing credit facility.

On December 30, 2011, DXP acquired substantially all of the assets of C.W. Rod Tool Company ("CW Rod"). DXP acquired this business to strengthen DXP's metal working offering in Texas and Louisiana. DXP paid approximately $1.1 million of DXP's common stock (35,714 shares) and approximately $42 million in cash for CW Rod, which was borrowed during 2011 and 2012 under our existing credit facility.

On January 31, 2012, DXP acquired substantially all of the assets of Mid-Continent Safety ("Mid-Continent"). DXP acquired this business to expand DXP's geographic presence in the Midwestern U.S. and strengthen DXP's safety products offering. DXP paid approximately $3.7 million for Mid-Continent, which was borrowed under our existing credit facility.

On February 29, 2012, DXP acquired substantially all of the assets of Pump & Power Equipment, Inc. ("Pump & Power"). DXP acquired this business to expand DXP's geographic presence in the Midwestern U.S. and strengthen DXP's municipal pump products and services offering. DXP paid approximately $1.9 million for Pump & Power which was borrowed under our existing credit facility.

On April 2, 2012, DXP acquired the stock of Aledco, Inc. ("Aledco") and Force Engineered Products, Inc. (“Force”). DXP acquired this business to establish a presence within the Marcellus Shale, as well as the Northeast United States industrial rotating equipment market. DXP paid approximately $8.1 million for Aledco and Force which was borrowed under our existing credit facility.

9

On May 1, 2012, DXP completed the acquisition of Industrial Paramedic Services through its wholly owned subsidiary, DXP Canada Enterprises Ltd. Industrial Paramedic Services is a provider of industrial medical and safety services to industrial customers operating in remote locations and large facilities in western Canada. DXP acquired this business to expand DXP's geographic presence into Canada and to expand our safety services offering. Industrial Paramedic Services is headquartered in Calgary, Alberta and operates out of three locations in Calgary, Nisku and Dawson Creek. The $25.3 million purchase price was financed with $20.6 million of borrowings under DXP's existing credit facility, $2.5 million of promissory notes bearing a 5% interest rate and 19,685 shares of DXP common stock.

On May 31, 2012, DXP completed the acquisition of Austin and Denholm Industrial Sales Alberta, Inc (“ADI”). DXP acquired this business to expand our presence in pumping solutions in Western Canada. DXP Canada Enterprises Ltd., acquired all of the outstanding common shares of ADI for $2.7 million which was borrowed under our existing credit facility.

On July 11, 2012, DXP completed the acquisition of HSE Integrated Ltd. (“HSE"). DXP Canada Enterprises Ltd. acquired all of the outstanding common shares of HSE by way of a plan of arrangement under the Business Corporations Act (Alberta) (the "Arrangement"). Pursuant to the Arrangement, HSE shareholders received CDN $1.80 in cash per each common share of HSE held. The total transaction value was approximately $85 million, including approximately $4 million in debt and approximately $3 million in transaction costs. The purchase price was financed with borrowings under DXP’s new $325 million credit facility. DXP acquired HSE to expand our industrial health and safety services offering in Canada and the United States.

On October 1, 2012, DXP acquired substantially all of the assets of Jerzy Supply, Inc. (“Jerzy”). DXP acquired this business in the Southern U.S. to strengthen DXP's industrial and hydraulic hose offering. DXP paid approximately $5.3 million for Jerzy which was borrowed under our existing credit facility.

On April 16, 2013, DXP acquired all of the stock of National Process Equipment Inc. (“NatPro”) through its wholly owned subsidiary, DXP Canada Enterprises Ltd. DXP acquired this business to expand DXP’s geographic presence in Canada and strengthen DXP’s pump, integrated system packaging, compressor, and related equipment offering. The $40.1 million purchase price was financed with $36.6 million of borrowings under DXP's existing credit facility and 52,542 shares of DXP common stock. Additionally, the purchase agreement included an earn-out provision, which stated that former owners of NatPro may earn CDN $6.0 million based on achievement of an earnings target during the first year of DXP’s ownership. The fair value of the earn-out recorded at the acquisition date was $2.8 million. As of December 31, 2013 the $2.8 million accrued liability associated with this earn-out provision was reversed and included in 2013 operating income. See Note 8 of the financial statements regarding the 2014 impairment of NatPro assets.

On May 17, 2013, DXP acquired substantially all of the assets of Tucker Tool Company, Inc. (“Tucker Tool”). DXP acquired this business to expand DXP's geographic presence in the northern U.S. and strengthen DXP's industrial cutting tools offering. DXP paid approximately $5.0 million for Tucker Tool which was borrowed under our existing credit facility.

On July 1, 2013, DXP acquired all of the stock of Alaska Pump & Supply, Inc. (APS). DXP acquired this business to expand DXP's geographic presence in Alaska. DXP paid approximately $13.0 million for APS which was borrowed under our existing credit facility.

On July 31, 2013, DXP acquired substantially all of the assets of Tool-Tech Industrial Machine & Supply, Inc. (“Tool-Tech”). DXP acquired this business to enhance our metal working product offering in the southwest region of the United States. DXP paid approximately $7.2 million for Tool-Tech which was borrowed under our existing credit facility.

On January 2, 2014, the Company acquired all of the equity securities and units of B27, LLC (B27). DXP acquired this business to expand DXP’s pump packaging offering. The total transaction value was approximately $293.6 million, excluding approximately $1.0 million in transaction costs. The purchase price was financed with borrowings under our amended credit facility and approximately $4.0 million (36,000 shares) of DXP common stock. See Note 8 of the Notes to Consolidated Financial Statements regarding the 2014 impairment of B27 goodwill.

10

On May 1, 2014, the Company completed the acquisition of all of the equity interests of Machinery Tooling and Supply, LLC (MT&S) to expand DXP’s cutting tools offering in the North Central region of the United States. DXP paid approximately $14.7 million for MT&S, which was borrowed under our existing credit facility.

Competition

Our business is highly competitive. In the Service Centers segment we compete with a variety of industrial supply distributors, some of which may have greater financial and other resources than we do. Some of our competitors are small enterprises selling to customers in a limited geographic area. We also compete with catalog distributors, large warehouse stores and, to a lesser extent, manufacturers. While many of our competitors offer traditional distribution of some of the product groupings that we offer, we are not aware of any major competitor that offers on a non-catalog basis a variety of products and services as broad as our offering. Further, while certain catalog distributors provide product offerings as broad as ours, these competitors do not offer the product application, technical expertise and after-the-sale services that we provide. In the Supply Chain Services segment we compete with larger distributors that provide integrated supply programs and outsourcing services, some of which might be able to supply their products in a more efficient and cost-effective manner than we can provide. In the Innovative Pumping Solutions segment we compete against a variety of manufacturers, distributors and fabricators, many of which may have greater financial and other resources than we do. We generally compete on service and price in all of our segments.

Insurance

We maintain liability and other insurance that we believe to be customary and generally consistent with industry practice. We retain a portion of the risk for medical claims, general liability, worker’s compensation and property losses. The various deductibles of our insurance policies generally do not exceed $250,000 per occurrence. There are also certain risks for which we do not maintain insurance. There can be no assurance that such insurance will be adequate for the risks involved, that coverage limits will not be exceeded or that such insurance will apply to all liabilities. The occurrence of an adverse claim in excess of the coverage limits that we maintain could have a material adverse effect on our financial condition and results of operations. The premiums for insurance have increased significantly over the past three years. This trend could continue. Additionally, we are partially self-insured for our group health plan, worker’s compensation, auto liability and general liability insurance. The cost of claims for the group health plan has increased over the past three years. This trend is expected to continue.

Government Regulation and Environmental Matters

We are subject to various laws and regulations relating to our business and operations, and various health and safety regulations as established by the Occupational Safety and Health Administration and Canadian Occupational Health and Safety.

Certain of our operations are subject to federal, state and local laws and regulations as well as provincial regulations controlling the discharge of materials into or otherwise relating to the protection of the environment. Although we believe that we have adequate procedures to comply with applicable discharge and other environmental laws, the risks of accidental contamination or injury from the discharge of controlled or hazardous materials and chemicals cannot be eliminated completely. In the event of such a discharge, we could be held liable for any damages that result, and any such liability could have a material adverse effect on us. We are not currently aware of any situation or condition that we believe is likely to have a material adverse effect on our results of operations or financial condition.

Employees

At December 31, 2014, DXP had approximately 3,704 full-time employees. We believe that we maintain positive relationships with all of our employees. Less than one percent (1%) of our employees are unionized.

11

Background of Executive Officers

The following is a list of DXP’s executive officers, their age, positions, and a description of their business experience as of March 16, 2015. All of our executive officers hold office at the pleasure of DXP’s Board of Directors.

|

NAME

|

POSITION

|

AGE

|

|

David R. Little

|

Chairman of the Board, President and Chief Executive Officer

|

63

|

|

Mac McConnell

|

Senior Vice President/Finance, Chief Financial Officer and Secretary

|

61

|

|

David C. Vinson

|

Senior Vice President/Innovative Pumping Solutions

|

64

|

|

John J. Jeffery

|

Senior Vice President/Supply Chain Services & Marketing

|

47

|

|

Todd Hamlin

|

Senior Vice President/Service Centers

|

43

|

|

Kent Yee

|

Senior Vice President/Corporate Development

|

39

|

|

Wayne Crane

|

Senior Vice President/Information Technology

|

52

|

|

Gary Messersmith

|

Senior Vice President/General Counsel

|

66

|

David R. Little. Mr. Little has served as Chairman of the Board, President and Chief Executive Officer of DXP since its organization in 1996 and also has held these positions with SEPCO Industries, Inc., predecessor to the Company (“SEPCO”), since he acquired a controlling interest in SEPCO in 1986. Mr. Little has been employed by SEPCO since 1975 in various capacities, including Staff Accountant, Controller, Vice President/Finance and President. Mr. Little gives our Board insight and in-depth knowledge of our industry and our specific operations and strategies. He also provides leadership skills and knowledge of our local community and business environment, which he has gained through his long career with DXP and its predecessor companies.

Mac McConnell. Mr. McConnell was elected Senior Vice President/Finance and Chief Financial Officer in September 2000. From February 1998 until September 2000, Mr. McConnell served as Senior Vice President, Chief Financial Officer and a director of Transportation Components, Inc., a NYSE-listed distributor of truck parts. From December 1992 to February 1998, he served as Chief Financial Officer of Sterling Electronics Corporation, a NYSE-listed electronics parts distributor, which was acquired by Marshall Industries, Inc. in 1998. From 1990 to 1992, Mr. McConnell was Vice President-Finance of Interpak Holdings, Inc., a publicly-traded company involved in packaging and warehousing thermoplastic resins. From 1976 to 1990, he served in various capacities, including as a partner, with Ernst & Young LLP.

David C. Vinson. Mr. Vinson was elected Senior Vice President/Innovative Pumping Solutions in January 2006. He served as Senior Vice President/Operations of DXP from October 2000 to December 2005. From 1996 until October 2000, Mr. Vinson served as Vice President/Traffic, Logistics and Inventory. Mr. Vinson has served in various capacities with DXP since his employment in 1981.

John J. Jeffery. Mr. Jeffery serves as Senior Vice President of Supply Chain Services, Marketing and Information Technology. He oversees the strategic direction for the Supply Chain Services business unit while leveraging both Marketing and Information Technology to drive innovative business development initiatives for organizational growth and visibility. He began his career with T.L. Walker, which was later acquired by DXP in 1991. During his tenure with DXP, Mr. Jeffery has served in various significant capacities including branch, area, regional and national sales management as well as sales, marketing and Service Center vice president roles. He holds a Bachelor of Science in Industrial Distribution from Texas A&M University and is also a graduate of the Executive Business Program at Rice University.

Todd Hamlin. Mr. Hamlin was elected Senior Vice President of DXP Service Centers in June of 2010. Mr. Hamlin joined the Company in 1995. From February 2006 until June 2010 he served as Regional Vice President of the Gulf Coast Region. Prior to serving as Regional Vice President of the Gulf Coast Region he served in various capacities, including application engineer, product specialist and sales representative. From April 2005 through February 2006, Mr. Hamlin worked as a sales manager for the UPS Supply Chain Services division of United Parcel Service, Inc. He holds a Bachelors of Science in Industrial Distribution from Texas A&M University and a Master in Distribution from Texas A&M University. Mr. Hamlin serves on the Advisory Board for Texas A&M’s Master in Distribution degree program. In 2014, Mr. Hamlin was elected to the Bearing Specialists Association’s Board of Directors.

12

Kent Yee. Mr. Yee currently serves as Senior Vice President Corporate Development and leads DXP's mergers and acquisitions, business integration and internal strategic project activities. During March 2011, Mr. Yee joined DXP from Stephens Inc.'s Industrial Distribution and Services team where he served in various positions and most recently as Vice President from August 2005 to February 2011. Prior to Stephens, Mr. Yee was a member of The Home Depot’s Strategic Business Development Group with a primary focus on acquisition activity for HD Supply. Mr. Yee was also an Associate in the Global Syndicated Finance Group at JPMorgan Chase. He has executed over 41 transactions including more than $1.3 billion in M&A and $3.4 billion in financing transactions primarily for change of control deals and numerous industrial and distribution acquisition and sale assignments. He holds a Bachelors of Arts in Urban Planning from Morehouse College and an MBA from Harvard University Graduate School of Business.

Wayne Crane. Wayne Crane currently serves as Senior Vice President and Chief Information Officer and leads DXP's information technology and telecommunications activities. Joining DXP in August 2011, Mr. Crane offers 25 years experience directing business and technology transformation for Fortune 1000 corporations and other technology based companies. Prior to DXP, Mr. Crane served as Chief Information Officer for CDS Global, a global technology solutions provider and wholly owned subsidiary of the Hearst Corporation. Until 2008, Mr. Crane served as CIO for the Attachmate/NetIQ, a publically traded systems and security management software company, where he was responsible for all technology efforts, including several business and product lines. Previously, Mr. Crane managed global technology efforts for BJ Services Company, a publicly traded oilfield services company. Mr. Crane holds a Master of Computer Science degree and an MBA.

Gary Messersmith. Mr. Messersmith serves as Senior Vice President and General Counsel of DXP Enterprises, Inc. Mr. Messersmith joined DXP on January 1, 2013 after practicing law for more than 38 years with Looper Reed & McGraw and prior to that with Fouts & Moore. During this period, Mr. Messersmith’s practice included corporate, real estate and oil and gas matters. From 1982 until 2001, Gary served as Managing Partner of Fouts & Moore. Since 1995, Gary has represented DXP in the acquisition of more than 27 companies and he has provided legal services to DXP in various other areas. Gary obtained his Bachelor of Science Degree in Finance from Indiana University in 1971 and his J.D. from South Texas School of Law in 1975.

All officers of DXP hold office until the regular meeting of the board of directors following the Annual Meeting of Shareholders or until their respective successors are duly elected and qualified or their earlier resignation or removal.

Available Information

Our Annual Report on Form 10-K, Quarterly Reports on Form 10-Q, Current Reports on Form 8-K, and amendments to those reports filed or furnished pursuant to Section 13(a) or 15(d) of the Securities Exchange Act of 1934 as amended (the “Exchange Act”), are available free of charge through our Internet website (www.dxpe.com) as soon as reasonably practicable after we electronically file such material with, or furnish it to, the Securities and Exchange Commission.

ITEM 1A. Risk Factors

Investing in DXP involves risk. In deciding whether to invest in DXP, you should carefully consider the following risk factors. Any of these risk factors could have a significant or material adverse effect on our businesses, results of operations, financial condition or liquidity. They could also cause significant fluctuations and volatility in the trading price of our securities. Readers should not consider any descriptions of these factors to be a complete set of all potential risks that could affect DXP. These factors should be considered carefully together with the other information contained in this Report and the other reports and materials filed by us with the Securities and Exchange Commission. Further, many of these risks are interrelated and could occur under similar business and economic conditions, and the occurrence of certain of them may in turn cause the emergence or exacerbate the effect of others. Such a combination could materially increase the severity of the impact of these risks on our results of operations, liquidity and financial condition.

13

Decreased capital expenditures in the energy industry can adversely impact our customers’ demand for our products and services.

A significant portion of our revenue depends upon the level of capital and operating expenditures in the oil and natural gas industry, including capital expenditures in connection with the upstream, midstream, and downstream phases in the energy industry. Therefore, a significant decline in oil or natural gas prices could lead to a decrease in our customers’ capital and other expenditures and could adversely affect our revenues.

Demand for our products could decrease if the manufacturers of those products sell them directly to end users.

Typically, MRO products have been purchased through distributors and not directly from the manufacturers of those products. If customers were to purchase our products directly from manufacturers, or if manufacturers sought to increase their efforts to sell directly to end users, we could experience a significant decrease in sales and earnings.

Changes in our customer and product mix, or adverse changes to the cost of goods we sell, could cause our gross margin percentage to fluctuate or decrease, and we may not be able to maintain historical margins.

Changes in our customer mix have resulted from geographic expansion, daily selling activities within current geographic markets, and targeted selling activities to new customers. Changes in our product mix have resulted from marketing activities to existing customers and needs communicated to us from existing and prospective customers. There can be no assurance that we will be able to maintain our historical gross margins. In addition, we may also be subject to price increases from vendors that we may not be able to pass along to our customers.

We rely upon third-party transportation providers for our merchandise shipments and are subject to increased shipping costs as well as the potential inability of our third-party transportation providers to deliver products on a timely basis.

We rely upon independent third-party transportation providers for our merchandise shipments, including shipments to and from all of our service centers. Our utilization of these delivery services for shipments is subject to risks, including increases in fuel prices, labor availability, labor strikes and inclement weather, which may impact a shipping company’s ability to provide delivery services that adequately meet our shipping needs. If we change the shipping companies we use, we could face logistical difficulties that could adversely affect deliveries and we would incur costs and expend resources in connection with such change. In addition, we may not be able to obtain favorable terms as we have with our current third-party transportation providers.

Adverse weather events or natural disasters could negatively disrupt our operations.

Certain areas in which we operate are susceptible to adverse weather conditions or natural disasters, such as hurricanes, tornadoes, floods and earthquakes. These events can disrupt our operations, result in damage to our properties and negatively affect the local economies in which we operate. Additionally, we may experience communication disruptions with our customers, vendors and employees.

We cannot predict whether or to what extent damage caused by these events will affect our operations or the economies in regions where we operate. These adverse events could result in disruption of our purchasing or distribution capabilities, interruption of our business that exceeds our insurance coverage, our inability to collect from customers and increased operating costs. Our business or results of operations may be adversely affected by these and other negative effects of these events.

The loss of or the failure to attract and retain key personnel could adversely impact our results of operations.

The loss of the services of any of the executive officers of the Company could have a material adverse effect on our financial condition and results of operations. In addition, our ability to grow successfully will be dependent upon our ability to attract and retain qualified management and technical and operational personnel. The failure to attract and retain such persons could materially adversely affect our financial condition and results of operations.

14

The loss of any key supplier could adversely affect DXP’s sales and profitability.

We have distribution rights for certain product lines and depend on these distribution rights for a substantial portion of our business. Many of these distribution rights are pursuant to contracts that are subject to cancellation upon little or no prior notice. Although we believe that we could obtain alternate distribution rights and/or sources of similar products in the event of such a cancellation, the termination or limitation by any key supplier of its relationship with the Company could result in a temporary disruption of our business and, in turn, could adversely affect our results of operations and financial condition.

We are subject to various government regulations.

We are subject to laws and regulations in every jurisdiction where we operate. Compliance with laws and regulations increases our cost of doing business. We are subject to a variety of laws and regulations, including without limitation import and export requirements, the Foreign Corrupt Practices Act, tax laws (including U.S. taxes on our foreign subsidiaries), data privacy requirements, labor laws and anti-competition regulations. We are also subject to audits and inquiries in the ordinary course of business. Changes to the legal and regulatory environments could increase the cost of doing business, and such costs may increase in the future as a result of changes in these laws and regulations or in their interpretation. Although we have implemented policies and procedures designed to comply with laws and regulations, there can be no assurance that employees, contractors or agents will not violate such laws and regulations. Any such violations could individually or in the aggregate materially adversely affect our financial condition or results of operations.

We are subject to environmental, health and safety laws and regulations.

We are subject to federal, state, local, foreign and provincial environmental, health and safety laws and regulations. Fines and penalties may be imposed for non-compliance with applicable environmental, health and safety requirements and the failure to have or to comply with the terms and conditions of required permits. The failure by us to comply with applicable environmental, health and safety requirements could result in fines, penalties, enforcement actions, third party claims for property damage and personal injury, requirements to clean up property or to pay for the costs of cleanup, or regulatory or judicial orders requiring corrective measures.

A general slowdown in the economy could negatively impact DXP’s sales growth.

Economic and industry trends affect DXP’s business. Demand for our products is subject to economic trends affecting our customers and the industries in which they compete in particular. Many of these industries, such as the oil and gas industry, are subject to volatility while others, such as the petrochemical industry, are cyclical and materially affected by changes in the economy. As a result, demand for our products could be adversely impacted by changes in the markets of our customers. We traditionally do not enter into long-term contracts with our customers.

Risks Associated With Conducting Business in Foreign Countries

We conduct a meaningful amount of business outside of the United States of America. We could be adversely affected by economic, legal, political and regulatory developments in countries that we conduct business in. We have meaningful operations in Canada in which the functional currency is denominated in Canadian dollars. As the value of currencies in foreign countries in which we have operations increases or decreases related to the U.S. dollar, the sales, expenses, profits, losses assets and liabilities of our foreign operations, as reported in our consolidated financial statements, increase or decrease, accordingly.

The trading price of our common stock may be volatile.

The market price of our common stock could be subject to wide fluctuations in response to, among other things, the risk factors described in this and other periodic reports, and other factors beyond our control, such as fluctuations in the valuation of companies perceived by investors to be comparable to us. Furthermore, the stock markets have experienced price and volume fluctuations that have affected and continue to affect the market prices of equity securities of many companies. These fluctuations often have been unrelated or disproportionate to the operating performance of those companies. These broad market and industry fluctuations, as well as general economic, political, and market conditions, such as recessions, interest rate changes or international currency fluctuations, may negatively affect the market price of our common stock. In the past, many companies that have experienced volatility in the market price of their stock have been subject to securities class action litigation. We may be the target of this type of litigation in the future. Securities litigation against us could result in substantial costs and divert our management's attention from other business concerns, which could adversely affect our business.

15

Our future results will be impacted by our ability to implement our internal growth strategy.

Our future results will depend in part on our success in implementing our internal growth strategy, which includes expanding our existing geographic areas, selling additional products to existing customers and adding new customers. Our ability to implement this strategy will depend on our success in selling more products and services to existing customers, acquiring new customers, hiring qualified sales persons, and marketing integrated forms of supply management such as those being pursued by us through our SmartSourceSM program. Although we intend to increase sales and product offerings to existing customers, there can be no assurance that we will be successful in these efforts. Additionally, we sell products and services in very competitive markets. We could experience a material adverse effect to the extent that our competitors are successful in reducing our customers’ purchases of products and services from us. Competition could also cause us to lower our prices, which could reduce our margins and profitability. Consolidation in our industry could heighten the impacts of competition on our business and results of operations discussed above. The fact that we do not traditionally enter into long-term contracts with our suppliers or customers may provide opportunities for our competitors.

We are subject to personal injury and product liability claims involving allegedly defective products.

A variety of products we distribute are used in potentially hazardous applications that can result in personal injury and product liability claims. A catastrophic occurrence at a location where the products we distribute are used may result in us being named as a defendant in lawsuits asserting potentially large claims, even though we did not manufacture the products, and applicable law may render us liable for damages without regard to negligence or fault.

Risks Associated With Acquisition Strategy

Our future results will depend in part on our ability to successfully implement our acquisition strategy. We may not be able to consummate acquisitions at rates similar to the past, which could adversely impact our growth rate and stock price. This strategy includes taking advantage of a consolidation trend in the industry and effecting acquisitions of businesses with complementary or desirable product lines, strategic distribution locations, attractive customer bases or manufacturer relationships. Promising acquisitions are difficult to identify and complete for a number of reasons, including high valuations, competition among prospective buyers, the need for regulatory (including antitrust) approvals and the availability of affordable funding in the capital markets. In addition, competition for acquisitions in our business areas is significant and may result in higher purchase prices. Changes in accounting or regulatory requirements or instability in the credit markets could also adversely impact our ability to consummate acquisitions. In addition, acquisitions involve a number of special risks, including possible adverse effects on our operating results, diversion of management’s attention, failure to retain key personnel of the acquired business, difficulties in integrating operations, technologies, services and personnel of acquired companies, potential loss of customers of acquired companies, preserving business relationships of the acquired companies, risks associated with unanticipated events or liabilities, and expenses associated with obsolete inventory of an acquired business, some or all of which could have a material adverse effect on our business, financial condition and results of operations. Our ability to grow at or above our historic rates depends in part upon our ability to identify and successfully acquire and integrate companies and businesses at appropriate prices and realize anticipated cost savings.

Risks Related to Acquisition Financing

We may need to finance acquisitions by using shares of Common Stock for a portion or all of the consideration to be paid. In the event that the Common Stock does not maintain a sufficient market value, or potential acquisition candidates are otherwise unwilling to accept Common Stock as part of the consideration for the sale of their businesses, we may be required to use more of our cash resources, if available, to maintain our acquisition program. These cash resources may include borrowings under our credit agreement or equity or debt financings. Our current credit agreement with our bank lenders contains certain restrictions that could adversely affect our ability to implement and finance potential acquisitions. Such restrictions include provisions which limit our ability to merge or consolidate with, or acquire all or a substantial part of the properties or capital stock of, other entities without the prior written consent of the lenders. There can be no assurance that we will be able to obtain the lenders’ consent to any of our proposed acquisitions. If we do not have sufficient cash resources, our growth could be limited unless we are able to obtain additional capital through debt or equity financings.

16

Ability to Comply with Financial Covenants of Credit Facility

Our credit facility requires the Company to comply with certain specified covenants, restrictions, financial ratios and other financial and operating tests. The Company’s ability to comply with any of the foregoing restrictions will depend on its future performance, which will be subject to prevailing economic conditions and other factors, including factors beyond the Company’s control. A failure to comply with any of these obligations could result in an event of default under the credit facility, which could permit acceleration of the Company’s indebtedness under the credit facility. The Company from time to time has been unable to comply with some of the financial covenants contained in the credit facility (relating to, among other things, the maintenance of prescribed financial ratios) and has, when necessary, obtained waivers or amendments to the covenants from its lenders. Although the Company expects to be able to comply with the covenants, including the financial covenants, of the credit facility, there can be no assurance that in the future the Company will be able to do so or, if is not able to do so, that its lenders will be willing to waive such compliance or further amend such covenants.

Ability to Refinance

We may not be able to refinance existing debt or the terms of any refinancing may not be as favorable as the terms of our existing debt. If principal payments due at maturity cannot be refinanced, extended or repaid with proceeds from other sources, such as new equity capital, our cash flow may not be sufficient to repay all maturing debt in years when significant payments come due.

Goodwill and intangible assets recorded as a result of our acquisitions could become impaired.

Goodwill represents the difference between the purchase price of acquired companies and the related fair values of net assets acquired. We test goodwill for impairment annually and whenever events or changes in circumstances indicate that impairment may have occurred. Goodwill and intangibles represent a significant amount of our total assets. As of December 31, 2014, our combined goodwill and intangible assets amounted to $383.6 million, net of accumulated amortization. To the extent we do not generate sufficient cash flows to recover the net amount of any investments in goodwill and other intangible assets recorded, the investment could be considered impaired and subject to write-off which would directly impact earnings. We expect to record additional goodwill and other intangible assets as a result of future business acquisitions. Future amortization of such other intangible assets or impairments, if any, of goodwill or intangible assets would adversely affect our results of operations in any given period. See Note 8 of the Notes to Consolidated Financial Statements regarding the 2014 impairment of B27 and NatPro goodwill and intangible assets.

Our business has substantial competition that could adversely affect our results.

Our business is highly competitive. We compete with a variety of industrial supply distributors, some of which may have greater financial and other resources than us. Although many of our traditional distribution competitors are small enterprises selling to customers in a limited geographic area, we also compete with larger distributors that provide integrated supply programs such as those offered through outsourcing services similar to those that are offered by our SCS segment. Some of these large distributors may be able to supply their products in a more timely and cost-efficient manner than us. Our competitors include catalog suppliers, large warehouse stores and, to a lesser extent, certain manufacturers. Competitive pressures could adversely affect DXP’s sales and profitability.

17

Interruptions in the proper functioning of our information systems could disrupt operations and cause increases in costs and/or decreases in revenues.

The proper functioning of DXP’s information systems is critical to the successful operation of our business. Although DXP’s information systems are protected through physical and software safeguards and remote processing capabilities exist, our information systems are still vulnerable to natural disasters, power losses, telecommunication failures and other problems. If critical information systems fail or are otherwise unavailable, DXP’s ability to procure products to sell, process and ship customer orders, identify business opportunities, maintain proper levels of inventories, collect accounts receivable and pay accounts payable and expenses could be adversely affected.

Risks Associated with Insurance

In the ordinary course of business we at times may become the subject of various claims, lawsuits or administrative proceedings seeking damages or other remedies concerning our commercial operations, the products we distribute, employees and other matters, including potential claims by individuals alleging exposure to hazardous materials as a result of the products we distribute or our operations. Some of these claims may relate to the activities of businesses that we have acquired, even though these activities may have occurred prior to acquisition. The products we distribute are subject to inherent risks that could result in personal injury, property damage, pollution, death or loss of production. Any defects in the products we distribute could result in personal injury, death, property damage, pollution or loss of production.

We maintain insurance to cover potential losses, and we are subject to various deductibles and caps under our insurance. It is possible, however, that judgments could be rendered against us in cases in which we would be uninsured and beyond the amounts that we currently have reserved or anticipate incurring for such matters. Even a partially uninsured claim, if successful and of significant size, could have a material adverse effect on our business, results of operations and financial condition. Furthermore, we may not be able to continue to obtain insurance on commercially reasonable terms in the future, and we may incur losses from interruption of our business that exceed our insurance coverage. In cases where we maintain insurance coverage, our insurers may raise various objections and exceptions to coverage which could make uncertain the timing and amount of any possible insurance recovery.

Risks Associated with Cyber-Security

Through our sales channels and electronic communications with customers generally, we collect and maintain confidential information that customers provide to us in order to purchase products or services. We also acquire and retain information about suppliers and employees in the normal course of business. Computer hackers may attempt to penetrate our information systems or our vendors' information systems and, if successful, misappropriate confidential customer, supplier, employee or other business information. In addition, one of our employees, contractors or other third party may attempt to circumvent security measures in order to obtain such information or inadvertently cause a breach involving such information. Loss of information could expose us to claims from customers, suppliers, financial institutions, regulators, payment card associations, employees and other persons, any of which could have an adverse effect on our financial condition and results of operations.

ITEM 1B. Unresolved Staff Comments

None.

ITEM 2. Properties

We own our headquarters facility in Houston, Texas, which has approximately 48,000 square feet of office space. At December 31, 2014, we had approximately 185 facilities which contained 177 services centers, 8 distribution centers and 12 fabrication facilities.

At December 31, 2014, the Service Centers segment owned or leased 177 service center facilities. Of these facilities, 141 were located in the U.S. in 35 states, 34 were located in 9 Canadian provinces, one was located in Sonora, Mexico and one was located in Dubai. All of the distribution centers were located in the U.S., specifically in California, Georgia, Illinois, Massachusetts, Montana, Nebraska, and Texas. At December 31, 2014, the Innovative Pumping Solutions segment operated out of 12 fabrication facilities located in 5 states in the U.S. and two provinces in Canada. At December 31, 2014, the Supply Chain Services segment operated supply chain installations in 74 of our customers’ facilities in 27 U.S. states.

18

At December 31, 2014, our owned facilities ranged from 5,000 square feet to 48,000 square feet in size. We leased facilities for terms generally ranging from one to fifteen years. The leased facilities ranged from approximately 300 square feet to 170,000 square feet in size. The leases provide for periodic specified rental payments and certain leases are renewable at our option. We believe that our facilities are suitable and adequate for the needs of our existing business. We believe that if the leases for any of our facilities were not renewed, other suitable facilities could be leased with no material adverse effect on our business, financial condition or results of operations.

ITEM 3. Legal Proceedings

From time to time, the Company is a party to various legal proceedings arising in the ordinary course of business. While DXP is unable to predict the outcome of these lawsuits, it believes that the ultimate resolution will not have, either individually or in the aggregate, a material adverse effect on DXP’s business, consolidated financial position, cash flows, or results of operations.

ITEM 4. Mine Safety Disclosures

Not applicable.

PART II

|

ITEM 5.

|

Market for the Registrant's Common Equity, Related Shareholder Matters and Issuer Purchases of Equity Securities

|

Our common stock trades on The NASDAQ Global Select Market under the stock symbol "DXPE".

The following table sets forth on a per share basis the high and low sales prices for our common stock as reported by NASDAQ for the periods indicated:

|

High

|

Low

|

|

|

2014

|

||

|

Fourth Quarter

|

$ 73.30

|

$ 44.74

|

|

Third Quarter

|

$ 82.81

|

$ 69.12

|

|

Second Quarter

|

$ 113.21

|

$ 64.58

|

|

First Quarter

|

$ 112.00

|

$ 91.07

|

|

2013

|

||

|

Fourth Quarter

|

$ 116.88

|

$ 78.44

|

|

Third Quarter

|

$ 78.98

|

$ 63.49

|

|

Second Quarter

|

$ 75.00

|

$ 54.50

|

|

First Quarter

|

$ 76.91

|

$ 49.65

|

On March 4, 2015, we had approximately registered 408 holders of record for outstanding shares of our common stock. This number does not include shareholders for whom shares are held in “nominee” or “street name”.

We anticipate that future earnings will be retained to finance the continuing development of our business. In addition, our bank credit facility prohibits us from declaring or paying any cash dividends or other distributions on our capital stock, except for the monthly $0.50 per share dividend on our Series B convertible preferred stock, which amounts to $90,000 in the aggregate per year. Accordingly, we do not anticipate paying cash dividends on our common stock in the foreseeable future. The payment of any future dividends will be at the discretion of our Board of Directors and will depend upon, among other things, future earnings, the success of our business activities, regulatory and capital requirements, lenders, and general financial and business conditions.

19

Stock Performance

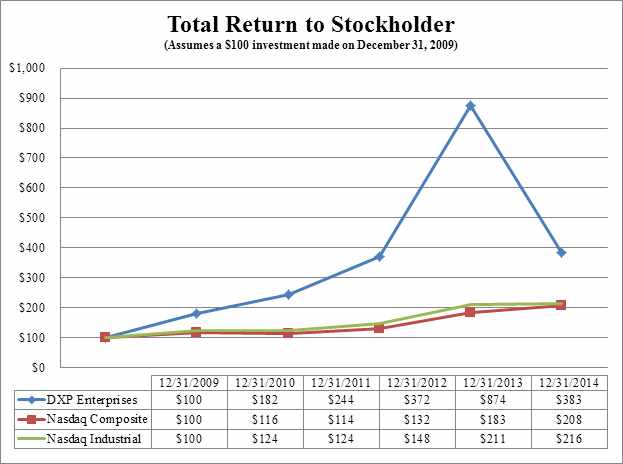

The following performance graph compares the performance of DXP Common Stock to the NASDAQ Industrial Index and the NASDAQ Composite (US). The graph assumes that the value of the investment in DXP Common Stock and in each index was $100 at December 31, 2009 and that all dividends were reinvested.

Investors are cautioned against drawing conclusions from the data contained in the graph above as past results are not necessarily indicative of future performance.

20

Equity Compensation Table

The following table provides information regarding shares covered by the Company’s equity compensation plans as of December 31, 2014:

|

Plan category

|

Number

of Securities

to be issued

upon exercise of outstanding options

|

Weighted

average

exercise price of outstanding options

|

Non-vested restricted shares outstanding

|

Weighted average

grant price

|

Number of securities remaining available for future issuance under equity compensation

plans

|

|

Equity compensation plans approved by shareholders

|

N/A

|

N/A

|

179,942

|

$52.71

|

85,643(1)

|

|