Attached files

| file | filename |

|---|---|

| 10-K - FIRST SOUTH BANCORP INC /VA/ | v176839_10k.htm |

| EX-21 - FIRST SOUTH BANCORP INC /VA/ | v176839_ex21.htm |

| EX-23 - FIRST SOUTH BANCORP INC /VA/ | v176839_ex23.htm |

| EX-32 - FIRST SOUTH BANCORP INC /VA/ | v176839_ex32.htm |

| EX-31.2 - FIRST SOUTH BANCORP INC /VA/ | v176839_ex31-2.htm |

| EX-31.1 - FIRST SOUTH BANCORP INC /VA/ | v176839_ex31-1.htm |

Exhibit

13

Annual

Report to Stockholders for the Fiscal Year Ended December 31,

2009

2009

Annual Report

First

South Bancorp

TABLE

OF CONTENTS

|

Letter

to Stockholders

|

2

|

|

|

Selected

Consolidated Financial Information and Other Data

|

3

|

|

|

Management's

Discussion and Analysis of Financial Condition and Results of

Operation

|

4

|

|

|

Report

of Independent Registered Public Accounting Firm

|

17

|

|

|

Consolidated

Statements of Financial Condition

|

18

|

|

|

Consolidated

Statements of Operations

|

19

|

|

|

Consolidated

Statements of Changes in Stockholders' Equity

|

20

|

|

|

Consolidated

Statements of Cash Flows

|

21

|

|

|

Notes

to Consolidated Financial Statements

|

22

|

|

|

Board

of Directors

|

41

|

|

|

Executive

Officers

|

41

|

|

|

Area

Executives and Subsidiary Executives

|

41

|

|

|

City

Executives

|

41

|

|

|

First

South Bank Office Locations

|

42

|

|

|

Stockholder

Information

|

43

|

|

|

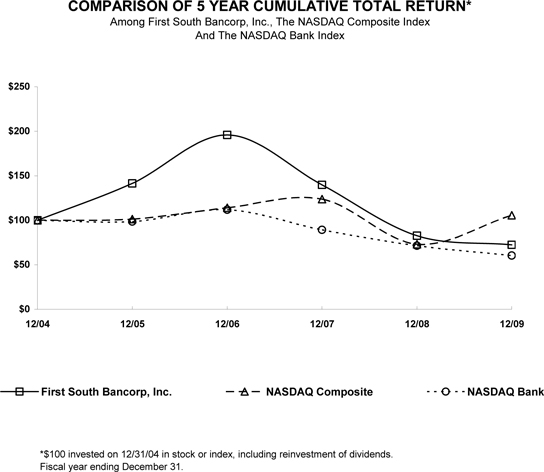

Comparative

Stock Performance Graph

|

44

|

MISSION

STATEMENT

"Our

mission is to become the premier community bank in eastern North Carolina. We

will enhance shareholder value by serving the personal and business needs of our

markets, providing superior customer service, investing in the communities that

we serve, and enriching the lives of our employees."

LETTER

TO STOCKHOLDERS

To Our

Stockholders:

On behalf

of First South Bancorp (“First South”) and its wholly owned subsidiary, First

South Bank (“Bank”), we are pleased to provide you our 2009 Annual

Report.

First

South earned net income of $7.0 million in 2009 compared to $11.0 million earned

in 2008. Diluted earnings per share were $0.72 per share for 2009

versus $1.12 per share for 2008. At December 31, 2009, our total

assets were $829.9 million; net loans and leases receivable $658.7 million; cash

and investments $127.3 million; deposits and borrowings $736.2 million;

stockholders’ equity $86.2 million and the allowance for credit losses was $13.7

million, representing 2.04% of loans outstanding. During 2009, we recorded $7.2

million of provisions for credit losses necessary to replenish net charge-offs

and strengthen the allowance for credit losses. Our net interest

margin to average earning assets of 4.12% and our efficiency ratio of 57.63% for

fiscal 2009 places us in the top portion of our peer group in margin production

and operating efficiency.

The

significance of our 2009 earnings has been the Bank’s ability of managing its

net interest margin, managing its credit risk, maintaining adequate liquidity

levels and maintaining a consistent level of fee and service charge income from

both loan and deposit products and services. We accomplished this

during one of the deepest economic recessions and lowest interest rate

environments in the banking sector’s history. We are working diligently with our

customers to assist them through these extraordinary times.

We

welcome news from economists that the current recession may begin

easing. However, the current economic environment continues to

present a challenging credit environment for both our customers and the banking

industry. As we address and manage through these challenges, we

remain focused on long-term strategies. These strategies include

remediating problem assets, maintaining adequate levels of capital and

liquidity, improving efficiency in our operations, building core customer

relationships and improving our franchise value along with shareholder

value. First South remains profitable, continues to maintain a strong

capital position in excess of the well-capitalized regulatory guidelines, and

combined with strengthening of the allowance for credit losses should enhance

our future earnings as recessionary economic conditions substantially improve.

Additionally, after careful review and consideration, First South determined not

to participate in the U.S. Treasury’s TARP program.

Based on

our strong capital position, your Board of Directors continued the quarterly

dividend payments during 2009 by declaring four quarterly cash dividends

totaling $0.80 per share. This resulted in a 111.1% dividend payout ratio to our

shareholders. Future dividends will depend upon the Company’s financial

condition, earnings, equity structure, capital needs, regulatory requirements

and economic conditions.

Each year

I compliment the performance of our dedicated and professional staff and 2009 is

no exception. We appreciate the quality of their work and are proud of their

many accomplishments achieved during this most challenging year. They are

committed to providing our customers the highest possible standards of

service. We will continue to invest in our employees, which will

ultimately result in better service to our customers and enhance both our

franchise and shareholder value.

Each

member of your Board of Directors, along with our officers and employees, join

me in thanking you for supporting First South Bancorp. As always, we

welcome your comments or suggestions and we look forward to your continued

support.

|

Sincerely,

|

|

/s/

Tom Vann

|

|

Tom

Vann

|

|

President

and

|

|

Chief

Executive Officer

|

2

SELECTED

CONSOLIDATED FINANCIAL INFORMATION AND OTHER DATA

|

At or For the Years Ended December

31,

|

|||||||||||||||||||||

|

2009

|

2008

|

2007

|

2006

|

2005

|

|||||||||||||||||

|

(dollars

in thousands, except per share data)

|

|||||||||||||||||||||

|

Selected Financial Condition

Data

|

|||||||||||||||||||||

|

Total

assets

|

$ | 829,891 | $ | 875,855 | $ | 909,288 | $ | 910,548 | $ | 834,234 | |||||||||||

|

Loans

receivable, net

|

658,656 | 744,731 | 765,083 | 761,437 | 708,929 | ||||||||||||||||

|

Cash

and investment securities

|

30,045 | 63,284 | 73,094 | 82,258 | 74,771 | ||||||||||||||||

|

Mortgage-backed

securities

|

97,239 | 32,827 | 39,120 | 36,729 | 22,702 | ||||||||||||||||

|

Deposits

|

688,511 | 716,427 | 761,370 | 800,188 | 733,753 | ||||||||||||||||

|

Borrowings

|

47,690 | 62,868 | 52,377 | 21,450 | 22,098 | ||||||||||||||||

|

Stockholders'

equity

|

86,214 | 87,821 | 86,035 | 78,797 | 68,190 | ||||||||||||||||

|

Selected Operations Data

|

|||||||||||||||||||||

|

Interest

income

|

$ | 49,060 | $ | 59,364 | $ | 70,078 | $ | 67,752 | $ | 53,176 | |||||||||||

|

Interest

expense

|

16,094 | 23,317 | 29,111 | 25,607 | 15,464 | ||||||||||||||||

|

Net

interest income

|

32,966 | 36,047 | 40,967 | 42,145 | 37,712 | ||||||||||||||||

|

Provision

for credit losses

|

7,180 | 4,044 | 350 | 933 | 1,711 | ||||||||||||||||

|

Noninterest

income

|

10,960 | 10,084 | 10,137 | 9,259 | 8,207 | ||||||||||||||||

|

Noninterest

expenses

|

25,345 | 24,165 | 22,911 | 22,207 | 21,132 | ||||||||||||||||

|

Income

before income taxes

|

11,401 | 17,922 | 27,843 | 28,264 | 23,076 | ||||||||||||||||

|

Income

taxes

|

4,365 | 6,934 | 10,840 | 11,072 | 8,947 | ||||||||||||||||

|

Net

income

|

$ | 7,036 | $ | 10,988 | $ | 17,003 | $ | 17,192 | $ | 14,129 | |||||||||||

|

Per Share Data

|

|||||||||||||||||||||

|

Earnings per share -

basic

|

(1)

|

$ | 0.72 | $ | 1.13 | $ | 1.71 | $ | 1.77 | $ | 1.49 | ||||||||||

|

Earnings per share -

diluted

|

(1)

|

0.72 | 1.12 | 1.70 | 1.72 | 1.41 | |||||||||||||||

|

Dividends per

share

|

(1)

|

0.80 | 0.80 | 0.76 | 0.68 | 0.53 | |||||||||||||||

|

Selected Financial Ratios and Other

Data

|

|||||||||||||||||||||

|

Performance

Ratios:

|

|||||||||||||||||||||

|

Return

on average assets

|

0.81 | % | 1.22 | % | 1.87 | % | 1.93 | % | 1.78 | % | |||||||||||

|

Return

on average equity

|

7.98 | 12.53 | 20.34 | 23.45 | 21.92 | ||||||||||||||||

|

Interest

rate spread

|

4.04 | 4.18 | 4.63 | 4.94 | 5.04 | ||||||||||||||||

|

Net

interest margin

|

4.12 | 4.30 | 4.80 | 5.05 | 5.11 | ||||||||||||||||

|

Average

earning assets/average interest bearing liabilities

|

117.90 | 117.77 | 120.41 | 119.20 | 118.66 | ||||||||||||||||

|

Noninterest

expense/average assets

|

2.92 | 2.68 | 2.53 | 2.50 | 2.67 | ||||||||||||||||

|

Efficiency

ratio

|

57.63 | 52.31 | 44.99 | 43.14 | 45.95 | ||||||||||||||||

|

Dividend

payout ratio

|

111.11 | 70.80 | 44.44 | 38.42 | 35.87 | ||||||||||||||||

|

Quality

Ratios:

|

|||||||||||||||||||||

|

Nonperforming

assets/total assets

|

2.50 | % | 2.59 | % | 1.01 | % | 0.37 | % | 0.27 | % | |||||||||||

|

Nonperforming

loans/total loans

|

1.51 | 1.98 | 0.97 | 0.35 | 0.31 | ||||||||||||||||

|

Allowance

for credit losses/total loans

|

2.04 | 1.58 | 1.27 | 1.29 | 1.29 | ||||||||||||||||

|

Provision

for credit losses/total loans

|

1.07 | 0.53 | 0.05 | 0.12 | 0.24 | ||||||||||||||||

|

Capital

Ratios and Other Data:

|

|||||||||||||||||||||

|

Equity/total

assets, end of period

|

10.39 | % | 10.03 | % | 9.46 | % | 8.65 | % | 8.18 | % | |||||||||||

|

Average

equity/average assets

|

10.17 | 9.72 | 9.21 | 8.24 | 8.13 | ||||||||||||||||

|

Full

service offices

|

28 | 28 | 29 | 26 | 26 | ||||||||||||||||

|

Loans

serviced for others

|

$ | 289,324 | $ | 255,510 | $ | 254,671 | $ | 245,633 | $ | 260,632 | |||||||||||

(1)

Adjusted for three-for-two stock split on May 25, 2006.

3

MANAGEMENT'S

DISCUSSION AND ANALYSIS

OF

FINANCIAL CONDITION AND RESULTS OF OPERATION

General. First South

Bancorp, Inc. (the "Company") was formed to issue common stock, owning 100% of

First South Bank (the "Bank") and operating through the Bank a commercial

banking business; therefore, this discussion and analysis of consolidated

financial condition and results of operation relates primarily to the

Bank. The business of the Bank consists principally of attracting

deposits from the general public and using them to originate secured and

unsecured commercial and consumer loans, permanent mortgage and construction

loans secured by single-family residences and other loans. The Bank's

earnings depend primarily on its net interest income, the difference between

interest earned on interest earning assets and interest paid on interest-bearing

liabilities. The volume of noninterest income and noninterest

expenses also impacts the Bank’s earnings.

Prevailing

economic conditions, competition, as well as federal and state regulations,

affect the operations of the Bank. The Bank's cost of funds is

influenced by interest rates paid on competing investments, rates offered on

deposits by other financial institutions in the Bank's market area and by

general market interest rates. Lending activities are affected by the

demand for financing of real estate and various types of commercial, consumer

and mortgage loans, and by the interest rates offered on such

financing. The Bank's business emphasis is to operate as a

well-capitalized, profitable and independent community oriented financial

institution dedicated to providing quality customer service and meeting the

financial needs of the communities it serves. The Bank believes it has been

effective in serving its customers because of its ability to respond quickly and

effectively to customer needs and inquiries. The Bank's ability to

provide these services has been enhanced by the stability of the Bank's senior

management team.

The

Company's common stock is listed and trades on the NASDAQ Global Select Market

under the symbol FSBK.

Liquidity

and Capital Resources. Liquidity

generally refers to the Bank's ability to generate adequate amounts of cash to

meet its funding needs. Adequate liquidity guarantees sufficient

funds are available to meet deposit withdrawals, fund loan commitments, maintain

adequate reserve requirements, pay operating expenses, provide funds for debt

service, pay dividends to stockholders, and meet other general

commitments. The Bank maintains its liquidity position under policy

guidelines based on liquid assets in relationship to deposits and short-term

borrowings. The Bank's primary sources of funds are customer

deposits, loan principal and interest payments, proceeds from loan and

securities sales, and advances from the Federal Home Loan Bank of Atlanta (the

"FHLB"). While maturities and scheduled amortization of loans are predictable

sources of funds, deposit flows and loan prepayments are influenced by interest

rates, economic conditions and local competition. The Bank’s primary

investing activity is originating commercial, consumer and mortgage loans, lease

financing receivables and purchases and sales of investment

securities. The Bank’s primary financing activities are attracting

checking, certificate, savings deposits, repurchase agreements, obtaining FHLB

advances and payment of dividends.

The

levels of cash and cash equivalents depend on the Bank's operating, financing,

lending and investing activities during any given period. Cash and

cash equivalents increased to $29.6 million at December 31, 2009, from $26.7

million at December 31, 2008. The Bank has other sources of liquidity

if a need for additional funds arises. Investment and mortgage-backed

securities available for sale totaled $97.1 million at December 31, 2009,

compared to $68.6 million at December 31, 2008. During the years ended December

31, 2009 and 2008, the Bank sold or exchanged real estate loans of $109.8

million and $41.1 million, respectively. Borrowings consisting of

FHLB advances, junior subordinated debentures and retail repurchase agreements

were $47.7 million at December 31, 2009, compared to $62.9 million at December

31, 2008. The Bank has pledged its FHLB Atlanta stock and certain

loans as collateral for actual or potential FHLB advances. The Bank

has minimum credit availability with the FHLB of 20% of the Bank’s total

assets. The Bank had $154.0 million of credit available with the FHLB

at December 31, 2009, compared to $125.1 million at December 31,

2008.

The

Company had $10.3 million of junior subordinated debentures at December 31, 2009

and 2008, respectively, issued through a private placement pooled trust

preferred securities offering by First South Preferred Trust I, a Delaware

statutory trust. The trust preferred securities bear interest at

three-month LIBOR plus 2.95% payable quarterly. They have a 30-year

maturity and were first redeemable, in whole or in part, on or after September

30, 2008, with certain exceptions. For regulatory purposes, the $10.0

million total of trust preferred securities qualifies as Tier 1 capital for the

Company and the Bank, to the extent such proceeds have been invested in the Bank

and the Company. Proceeds from the trust preferred securities were

used by the statutory trust to purchase junior subordinated debentures issued by

the Company. See Note 20 of the “Notes to Consolidated Financial

Statements” for additional information.

4

As a

North Carolina chartered commercial bank and a Federal Deposit Insurance

Corporation (the "FDIC") insured institution, the Bank is required to meet

various state and federal regulatory capital standards. The Bank's total

regulatory capital was $88.3 million at December 31, 2009, compared to $90.1

million at December 31, 2008. The North Carolina Commissioner of

Banks (the “Commissioner”) requires the Bank to maintain a capital surplus of

not less than 50% of common capital stock. The FDIC requires the Bank

to meet a minimum leverage capital requirement of Tier 1 capital (consisting of

retained earnings and common stockholders' equity, less any intangible assets)

to assets ratio of at least 4%, and a total capital to risk-weighted assets

ratio of 8%, of which 4% must be in the form of Tier 1 capital. The

Bank was in compliance with all regulatory capital requirements at December 31,

2009 and 2008. See Note 11 of the “Notes to Consolidated Financial

Statements” for a description of the Bank’s actual regulatory capital amounts

and ratios as of December 31, 2009 and 2008.

Stockholders'

equity was $86.2 million at December 31, 2009, compared to $87.8 million at

December 31, 2008. Net income was $7.0 million for fiscal 2009, compared to

$11.0 million for fiscal 2008. There were 9,742,296 shares of common

stock outstanding at December 31, 2009, net of 1,511,926 treasury

shares.

Contractual

Obligations and Commitments. In the normal

course of business there are various outstanding contractual obligations of the

Company that will require future cash outflows. In addition, there

are commitments and contingent liabilities, such as commitments to extend

credit, which may or may not require future cash outflows. Table 1

below reflects contractual obligations of the Company outstanding as of December

31, 2009.

Table

1 – Contractual Obligations and Commitments

|

Payments Due by Period

|

||||||||||||||||||||

|

Less Than

|

Over

|

|||||||||||||||||||

|

Contractual Obligations

|

Total

|

1 Year

|

1-3 Years

|

4-5 Years

|

5 Years

|

|||||||||||||||

|

(In thousands)

|

||||||||||||||||||||

|

Borrowed

money

|

$ | 37,380 | $ | 25,000 | $ | 12,380 | $ | - | $ | - | ||||||||||

|

Junior

subordinated debentures

|

10,310 | - | - | - | 10,310 | |||||||||||||||

|

Lease

obligations

|

1,535 | 482 | 747 | 284 | 22 | |||||||||||||||

|

Deposits

|

688,511 | 649,236 | 38,268 | 1,007 | - | |||||||||||||||

|

Total

contractual cash obligations

|

$ | 737,736 | $ | 674,718 | $ | 51,395 | $ | 1,291 | $ | 10,332 | ||||||||||

|

Amount of Commitment Expiration Per

Period

|

||||||||||||||||||||

|

Total

|

||||||||||||||||||||

|

Amounts

|

Less

than

|

Over

|

||||||||||||||||||

|

Other Commitments

|

Committed

|

1 Year

|

1-3 Years

|

4-5 Years

|

5 Years

|

|||||||||||||||

|

(In

thousands)

|

||||||||||||||||||||

|

Commitments

to originate loans

|

$ | 47,338 | $ | 39,162 | $ | 8,176 | $ | - | $ | - | ||||||||||

|

Undrawn

balances on lines of credit and

|

||||||||||||||||||||

|

undrawn

balances on credit reserves

|

49,756 | 1,004 | 3,654 | 6,029 | 39,069 | |||||||||||||||

|

Standby

letters of credit

|

1,007 | 1,007 | - | - | - | |||||||||||||||

|

Total

other commitments

|

$ | 98,101 | $ | 41,173 | $ | 11,830 | $ | 6,029 | $ | 39,069 | ||||||||||

In the

normal course of business, the Company may enter into purchase agreements for

goods or services. In management’s opinion, the dollar amount of such

agreements at December 31, 2009 is not material and has not been included in

Table 1 above. See Notes 5, 6, 9 and 14 of the “Notes to Consolidated Financial

Statements” for additional information.

Asset/Liability

Management. The Bank strives

to maintain consistent net interest income and reduce its exposure to adverse

changes in interest rates by matching the terms to repricing of its

interest-sensitive assets and liabilities. Factors beyond the Bank's

control, such as market interest rates and competition, may also impact interest

income and interest expense. The Bank's net interest income will

generally increase when interest rates rise over an extended period of time, and

conversely, will decrease when interest rates decline. The Bank can

significantly influence its net interest income by controlling the increases and

decreases in its interest income and interest expense, which are primarily

caused by changes in market interest rates. See Table 2 below for

additional information on the effects of net interest income caused by changes

in interest rates.

5

Interest

rate risk and trends, liquidity and capital ratio requirements are reported to

the Board of Directors (the “Board”) on a regular basis. The Board

reviews the maturities of the Bank's assets and liabilities and establishes

policies and strategies designed to regulate the flow of funds and to coordinate

the sources, uses and pricing of such funds. The first priority in

structuring and pricing assets and liabilities is to maintain an acceptable

interest rate spread while reducing the net effects of changes in interest

rates. The Bank's management is responsible for administering the

policies and determinations of the Board with respect to the Bank's asset and

liability goals and strategies.

A primary

component in managing interest rate risk is based on the volume of interest

sensitive assets such as commercial loans, consumer loans and lease financing

receivables. The Bank had $620.6 million of commercial loans,

consumer loans and lease receivables at December 31, 2009, compared to $710.4

million at December 31, 2008. The Bank had $6.5 million of loans held

for sale at December 31, 2009, compared to $5.6 million at December 31,

2008. Depending on conditions existing at a given time, the Bank may

sell fixed-rate residential mortgage loans in the secondary

market. In managing its portfolio of investment securities, a

majority of investment and mortgage-backed securities are held as

available for sale, allowing the Bank to sell a security in a timely manner

should an immediate liquidity need arise. The Bank had $97.1 million of

investment and mortgage-backed securities classified as available for sale at

December 31, 2009, compared to $68.6 million at December 31, 2008.

Market

Risk. Market risk

reflects the risk of economic loss resulting from changes in market prices and

interest rates. The risk of loss can be reflected in diminished current market

values and/or reduced potential net interest income in future periods. Market

risk arises primarily from interest rate risk inherent in lending and deposit

taking activities. The Bank does not maintain a trading account for any class of

financial instruments, nor does it engage in hedging activities or purchase

high-risk derivative instruments. The Bank is also not subject to

foreign currency exchange risk or commodity price risk.

The Bank

considers interest rate risk to be its most significant market risk, which could

potentially have the greatest impact on operating earnings. Interest

rate risk is measured by computing estimated changes in net interest income and

the net portfolio value ("NPV") of its cash flows from assets, liabilities and

off-balance sheet items in the event of a range of assumed changes in market

interest rates. The Bank's exposure to interest rates is reviewed on a quarterly

basis by management and the Board. Exposure to interest rate risk is measured

with the use of interest rate sensitivity analysis to determine the change in

NPV in the event of hypothetical changes in interest rates, while interest rate

sensitivity gap analysis is used to determine the repricing characteristics of

assets and liabilities. If estimated changes to NPV and net interest income are

not within the limits established by the Board, it may direct management to

adjust the Bank's asset and liability mix to bring interest rate risk within

Board approved limits.

NPV

represents the market value of portfolio equity and is equal to the market value

of assets minus the market value of liabilities, with adjustments made for

off-balance sheet items. The interest rate sensitivity analysis assesses the

potential loss in risk sensitive instruments in the event of sudden and

sustained 1% to 3% increases and decreases in market interest rates. With the

Federal Reserve’s current policy of continuing to hold interest rates at

historical low levels, it is not foreseeable that interest rates can decline

farther. In this extraordinary interest rate environment, rates would be driven

below zero if downward rate environment assumptions were run. Any data produced

by these assumptions would not be reliable. Therefore, the Bank will not run any

downward rate assumptions until interest rates increase. The Board has adopted

an interest rate risk policy that establishes maximum increases in NPV of 19%,

39% and 60% and maximum decreases in NPV of 19%, 37% and 54% in the event of

sudden and sustained 1% to 3% increases or decreases in market interest rates.

Table 2 below presents the Bank's projected changes in NPV and net interest

income before provision for credit losses, only in the event of sudden and

sustained increases in market interest rates for the various rate shock levels

at December 31, 2009. At December 31, 2009, the Bank's estimated changes in NPV

and net interest income were within the targets established by the

Board.

Table

2 - Projected Change in NPV and Net Interest Income

|

Net Portfolio Value

|

Net Interest Income Before PCL

|

|||||||||||||||||||||||

|

Change in Rates

|

Amount

|

Change

|

% Change

|

Amount

|

Change

|

% Change

|

||||||||||||||||||

|

(Dollars

in thousands)

|

||||||||||||||||||||||||

|

+

300 bp

|

$ | 101,140 | $ | (16,163 | ) | (13.8 | )% | $ | 38,270 | $ | (290 | ) | (1.2 | )% | ||||||||||

|

+

200 bp

|

105,092 | (12,211 | ) | (10.4 | ) | 38,391 | (169 | ) | (0.4 | ) | ||||||||||||||

|

+

100 bp

|

110,860 | (6,443 | ) | (5.5 | ) | 38,530 | (30 | ) | (0.1 | ) | ||||||||||||||

|

Base

|

117,303 | - | - | 38,560 | - | - | ||||||||||||||||||

6

The NPV

calculation is based on the net present value of discounted cash flows utilizing

market prepayment assumptions. Computations of prospective effects of

hypothetical interest rate changes are based on numerous assumptions, including

relative levels of market interest rates, loan prepayments and deposit decay

rates, and should not be relied upon as indicative of actual results. Further,

the computations do not contemplate any actions the Bank may undertake in

response to changes in interest rates.

Certain

shortcomings are inherent in the method of analysis presented in Table 2. For

example, although certain assets and liabilities may have similar maturities to

repricing, they may react in differing degrees to changes in market interest

rates. The interest rates on certain types of assets and liabilities may

fluctuate in advance of changes in market interest rates, while interest rates

on other types may lag behind changes in market rates. Certain assets, such as

adjustable-rate loans, have features that restrict changes in interest rates on

a short-term basis and over the life of the asset. In addition, the proportion

of adjustable-rate loans in the Bank's portfolio could decrease in future

periods due to refinance activity if market interest rates remain at or decrease

below current levels. Further, in the event of a change in interest rates,

prepayment and early withdrawal levels would likely deviate from those assumed

in the table. Also, the ability of many borrowers to repay their adjustable-rate

debt may decrease in the event of an increase in interest rates.

In

addition, the Bank uses interest sensitivity gap analysis to monitor the

relationship between the maturity and repricing of its interest-earning assets

and interest-bearing liabilities, while maintaining an acceptable interest rate

spread. Interest sensitivity gap is defined as the difference between the amount

of interest-earning assets maturing or repricing within a specific time period

and the amount of interest-bearing liabilities maturing or repricing within that

time period. A gap is considered positive when the amount of interest-sensitive

assets exceeds the amount of interest-sensitive liabilities, and is considered

negative when the amount of interest-sensitive liabilities exceeds the amount of

interest-sensitive assets. Generally, during a period of rising interest rates,

a negative gap would adversely affect net interest income, while a positive gap

would result in an increase in net interest income. Conversely, during a period

of falling interest rates, a negative gap would result in an increase in net

interest income, while a positive gap would negatively affect net interest

income. The Bank's goal is to maintain a reasonable balance between exposure to

interest rate fluctuations and earnings.

Rate/Volume

Analysis. Net interest income can also be analyzed in terms of

the impact of changing interest rates on average interest-earning assets and

average interest-bearing liabilities, and the changing volume or amount of these

assets and liabilities.

Table 3

below represents the extent to which changes in interest rates and changes in

the volume of average interest-earning assets and average interest-bearing

liabilities have affected the Company's interest income and interest expense

during the periods indicated. For each category of average

interest-earning asset and average interest-bearing liability, information is

provided on changes attributable to: (i) changes in volume (changes

in volume multiplied by old rate); (ii) changes in rate (change in rate

multiplied by old volume); (iii) changes in rate-volume (changes in rate

multiplied by the changes in volume); and (iv) net change (total of the previous

columns).

Analysis

of Net Interest Income. Net interest

income primarily represents the difference between income derived from

interest-earning assets and interest expense on interest-bearing

liabilities. Net interest income is affected by both the difference

between the yield on earning assets and the average cost of funds ("interest

rate spread"), and the relative volume of interest-earning assets,

interest-bearing liabilities and noninterest-bearing deposits.

Table 4

below sets forth certain information relating to the Company's Statements of

Financial Condition and Statements of Operations for the years ended December

31, 2009, 2008, and 2007, reflecting the yield on average earning assets and the

average cost of funds for the periods indicated. Average balances are

derived from month end balances. The Company does not believe that

using month end balances rather than average daily balances has caused any

material difference in the information presented.

The

decline in net interest income results primarily from the decline in market

interest rates and the decline in the volume of average earning

assets. The decline in market interest rates has been significantly

influenced by the Federal Reserve’s current policy of holding interest rates at

record low levels in efforts to stimulate current economic

conditions. The decline in the volume of earning assets has been

influenced by a slow down in loan originations due to the current recessionary

economic environment, and the current volume of nonperforming loans and other

real estate owned, as discussed below.

7

Table

3 - Rate/Volume Analysis

|

Year Ended December 31,

|

Year Ended December 31,

|

|||||||||||||||||||||||||||||||

|

2009 vs. 2008

|

2008 vs. 2007

|

|||||||||||||||||||||||||||||||

|

Increase (Decrease) Due to

|

Increase (Decrease) Due to

|

|||||||||||||||||||||||||||||||

|

(In

thousands)

|

||||||||||||||||||||||||||||||||

|

Rate/

|

Rate/

|

|||||||||||||||||||||||||||||||

|

Volume

|

Rate

|

Volume

|

Total

|

Volume

|

Rate

|

Volume

|

Total

|

|||||||||||||||||||||||||

|

Interest

income:

|

||||||||||||||||||||||||||||||||

|

Loans

receivable

|

$ | (3,650 | ) | $ | (6,769 | ) | $ | 448 | $ | (9,971 | ) | $ | (375 | ) | $ | (9,473 | ) | $ | 55 | $ | (9,793 | ) | ||||||||||

|

Investment

securities

|

(1,225 | ) | (239 | ) | 150 | (1,314 | ) | (331 | ) | (71 | ) | 10 | (392 | ) | ||||||||||||||||||

|

Mortgage-backed

securities

|

1,656 | (213 | ) | (189 | ) | 1,254 | (126 | ) | (67 | ) | 4 | (189 | ) | |||||||||||||||||||

|

Other

interest-earning assets

|

320 | (316 | ) | (277 | ) | (273 | ) | (53 | ) | (310 | ) | 23 | (340 | ) | ||||||||||||||||||

|

Total

earning assets

|

(2,899 | ) | (7,537 | ) | 132 | (10,304 | ) | (885 | ) | (9,921 | ) | 92 | (10,714 | ) | ||||||||||||||||||

|

Interest

expense:

|

||||||||||||||||||||||||||||||||

|

Deposits

|

(792 | ) | (6,072 | ) | 228 | (6,636 | ) | (1,353 | ) | (5,313 | ) | 261 | (6,405 | ) | ||||||||||||||||||

|

FHLB

advances

|

(137 | ) | (21 | ) | 2 | (156 | ) | 1,404 | (117 | ) | (357 | ) | 930 | |||||||||||||||||||

|

Other

interest-bearing liabilities

|

(186 | ) | (315 | ) | 70 | (431 | ) | 181 | (432 | ) | (68 | ) | (319 | ) | ||||||||||||||||||

|

Total

interest-bearing liabilities

|

(1,115 | ) | (6,408 | ) | 300 | (7,223 | ) | 232 | (5,862 | ) | (164 | ) | (5,794 | ) | ||||||||||||||||||

|

Change

in net interest income

|

$ | (1,784 | ) | $ | (1,129 | ) | $ | (168 | ) | $ | (3,081 | ) | $ | (1,117 | ) | $ | (4,059 | ) | $ | 256 | $ | (4,920 | ) | |||||||||

|

Year Ended December 31,

|

Year Ended December 31,

|

|||||||||||||||||||||||||||||||

|

2007 vs. 2006

|

2006 vs. 2005

|

|||||||||||||||||||||||||||||||

|

Increase (Decrease) Due to

|

Increase (Decrease) Due to

|

|||||||||||||||||||||||||||||||

|

(In

thousands)

|

||||||||||||||||||||||||||||||||

|

Rate/

|

Rate/

|

|||||||||||||||||||||||||||||||

|

Volume

|

Rate

|

Volume

|

Total

|

Volume

|

Rate

|

Volume

|

Total

|

|||||||||||||||||||||||||

|

Interest

income:

|

||||||||||||||||||||||||||||||||

|

Loans

receivable

|

$ | 609 | $ | 1,157 | $ | 11 | $ | 1,777 | $ | 4,544 | $ | 7,610 | $ | 687 | $ | 12,841 | ||||||||||||||||

|

Investment

securities

|

(51 | ) | (213 | ) | 4 | (260 | ) | 978 | (221 | ) | (111 | ) | 646 | |||||||||||||||||||

|

Mortgage-backed

securities

|

343 | (8 | ) | (2 | ) | 333 | 1,181 | 11 | 25 | 1,217 | ||||||||||||||||||||||

|

Other

interest-earning assets

|

452 | 8 | 16 | 476 | (202 | ) | 170 | (96 | ) | (128 | ) | |||||||||||||||||||||

|

Total

earning assets

|

1,353 | 944 | 29 | 2,326 | 6,501 | 7,570 | 505 | 14,576 | ||||||||||||||||||||||||

|

Interest

expense:

|

||||||||||||||||||||||||||||||||

|

Deposits

|

446 | 3,137 | 58 | 3,641 | 1,657 | 6,877 | 783 | 9,317 | ||||||||||||||||||||||||

|

FHLB

advances

|

(162 | ) | (27 | ) | 7 | (182 | ) | 192 | 127 | 201 | 520 | |||||||||||||||||||||

|

Other

interest-bearing liabilities

|

4 | 41 | 0 | 45 | 28 | 270 | 9 | 307 | ||||||||||||||||||||||||

|

Total

interest-bearing liabilities

|

288 | 3,151 | 65 | 3,504 | 1,877 | 7,274 | 993 | 10,144 | ||||||||||||||||||||||||

|

Change

in net interest income

|

$ | 1,065 | $ | (2,207 | ) | $ | (36 | ) | $ | (1,178 | ) | $ | 4,624 | $ | 296 | $ | (488 | ) | $ | 4,432 | ||||||||||||

8

Table

4 - Yield/Cost Analysis

|

Year

Ended December 31,

|

Year

Ended December 31,

|

Year

Ended December 31,

|

||||||||||||||||||||||||||||||||||

|

2009

|

2008

|

2007

|

||||||||||||||||||||||||||||||||||

|

(Dollars

in thousands)

|

||||||||||||||||||||||||||||||||||||

|

Average

|

Average

|

Average

|

||||||||||||||||||||||||||||||||||

|

Average

|

Yield/

|

Average

|

Yield/

|

Average

|

Yield/

|

|||||||||||||||||||||||||||||||

|

Balance

|

Interest

|

Cost

|

Balance

|

Interest

|

Cost

|

Balance

|

Interest

|

Cost

|

||||||||||||||||||||||||||||

|

Interest

earning assets:

|

||||||||||||||||||||||||||||||||||||

|

Loans

receivable

|

$ | 701,466 | $ | 45,211 | 6.45 | % | $ | 751,151 | $ | 55,182 | 7.35 | % | $ | 755,502 | $ | 64,975 | 8.60 | % | ||||||||||||||||||

|

Investment

securities

|

16,204 | 634 | 3.91 | 43,685 | 1,948 | 4.46 | 50,891 | 2,340 | 4.60 | |||||||||||||||||||||||||||

|

Mortgage-backed

securities

|

65,681 | 3,123 | 4.75 | 34,827 | 1,869 | 5.37 | 37,097 | 2,058 | 5.55 | |||||||||||||||||||||||||||

|

Other

interest-earning assets

|

17,548 | 92 | 0.52 | 9,348 | 365 | 3.90 | 10,102 | 705 | 6.98 | |||||||||||||||||||||||||||

|

Total

earning assets

|

800,899 | 49,060 | 6.13 | 839,011 | 59,364 | 7.08 | 853,592 | 70,078 | 8.21 | |||||||||||||||||||||||||||

|

Nonearning

assets

|

65,605 | 63,657 | 53,741 | |||||||||||||||||||||||||||||||||

|

Total

assets

|

$ | 866,504 | $ | 902,668 | $ | 907,333 | ||||||||||||||||||||||||||||||

|

Interest

bearing liabilities:

|

||||||||||||||||||||||||||||||||||||

|

Time

deposits

|

$ | 465,913 | 14,148 | 3.04 | $ | 479,642 | 19,447 | 4.05 | $ | 505,142 | 24,343 | 4.82 | ||||||||||||||||||||||||

|

Demand

deposits

|

132,226 | 264 | 0.20 | 147,978 | 1,587 | 1.07 | 157,125 | 3,129 | 1.99 | |||||||||||||||||||||||||||

|

Savings

|

24,921 | 47 | 0.19 | 19,734 | 61 | 0.31 | 18,584 | 28 | 0.15 | |||||||||||||||||||||||||||

|

FHLB

advances

|

41,154 | 1,233 | 3.00 | 45,654 | 1,389 | 3.04 | 11,246 | 459 | 4.08 | |||||||||||||||||||||||||||

|

Junior

subordinated debentures

|

10,310 | 390 | 3.78 | 10,310 | 658 | 6.38 | 10,310 | 839 | 8.14 | |||||||||||||||||||||||||||

|

Repurchase

agreements

|

4,775 | 12 | 0.25 | 9,105 | 175 | 1.92 | 6,472 | 313 | 4.84 | |||||||||||||||||||||||||||

|

Total

interest-bearing liabilities

|

679,299 | 16,094 | 2.37 | 712,423 | 23,317 | 3.27 | 708,879 | 29,111 | 4.11 | |||||||||||||||||||||||||||

|

Noninterest

bearing demand deposits

|

90,599 | 0 | 0.00 | 92,227 | 0 | 0.00 | 103,571 | 0 | 0.00 | |||||||||||||||||||||||||||

|

Total

sources of funds

|

769,898 | 16,094 | 2.09 | 804,650 | 23,317 | 2.90 | 812,450 | 29,111 | 3.58 | |||||||||||||||||||||||||||

|

Other

liabilities and stockholders'equity:

|

||||||||||||||||||||||||||||||||||||

|

Other

liabilities

|

8,477 | 10,323 | 11,275 | |||||||||||||||||||||||||||||||||

|

Stockholders'

equity

|

88,129 | 87,695 | 83,608 | |||||||||||||||||||||||||||||||||

|

Total

liabilities and stockholders' equity

|

$ | 866,504 | $ | 902,668 | $ | 907,333 | ||||||||||||||||||||||||||||||

|

Net

interest income

|

$ | 32,966 | $ | 36,047 | $ | 40,967 | ||||||||||||||||||||||||||||||

|

Interest

rate spread (1)

|

4.04 | % | 4.18 | % | 4.63 | % | ||||||||||||||||||||||||||||||

|

Net

yield on earning assets (2)

|

4.12 | % | 4.30 | % | 4.80 | % | ||||||||||||||||||||||||||||||

|

Ratio

of earning assets to interest bearing liabilities

|

117.90 | % | 117.77 | % | 120.41 | % | ||||||||||||||||||||||||||||||

|

(1)

|

Represents

the difference between the yield on earning assets and the average cost of

funds.

|

|

(2)

|

Represents

the net interest income divided by average earning

assets.

|

9

Results of

Operations

Comparison of Financial Condition at

December 31, 2009 and 2008. Total assets declined to

$829.9 million at December 31, 2009, from $875.9 million at December 31,

2008. Average earning assets declined to $800.9 million for the year

ended December 31, 2009, from $839.0 million for the year ended December 31,

2008, reflecting the net change in the volume and mix of loan and leases

receivable and investment securities. Earning assets were 91.8% of

total assets at December 31, 2009, compared to 92.3% at December 31,

2008.

Investment

and mortgage-backed securities increased to $97.6 million at December 31, 2009,

from $69.4 million at December 31, 2008. There were $20.0 million of

maturities of investment securities available for sale during fiscal 2009,

compared to $13.0 million during fiscal 2008. The Bank purchased $5.0

million of investment securities available for sale during fiscal 2009, compared

to no purchases in fiscal 2008. During fiscal 2009, the Bank sold $20.9 million

of investment securities available for sale, compared to none sold during fiscal

2008. Proceeds from investment maturities and sales are used in daily liquidity

management activities including funding borrowing maturities, deposit

withdrawals or are reinvested into new investment securities or short-term

interest bearing overnight funds. During fiscal 2009 the Bank

securitized $75.5 million of mortgage loans held for sale into mortgage-backed

securities, compared to $3.4 million securitized during fiscal 2008. Loan

securitizations help support a more balanced sensitivity to future interest rate

changes and provide additional funds for maintaining adequate liquidity

levels. The Bank sold no mortgage-backed securities available for

sale in fiscal 2009, compared to $4.0 million sold in fiscal 2008.

Loans and

lease receivables, net of allowance for loan and lease losses and deferred loan

fees, declined to $658.7 million at December 31, 2009 from $744.7 million at

December 31, 2008. The Bank originates both secured and unsecured

commercial and consumer loans and adjustable rate mortgage loans to take

advantage of shorter terms to maturity and the ability to better manage exposure

to market and interest rate risk due to changes in interest

rates. The Bank also sells selected mortgage loans in the secondary

mortgage market in order to reduce its exposure to interest rate and credit

risk, while retaining servicing to generate additional fee

income. Loans serviced for others increased to $289.3 million at

December 31, 2009 from $255.5 million serviced at December 31,

2008.

Commercial

loans declined to $521.2 million at December 31, 2009, from $597.0 million at

December 31, 2008, reflecting the current economic slow down and a reduction in

the volume of new loan originations. During 2009, certain commercial loans were

the subject of foreclosure and transferred to other real estate owned, as

discussed below. The Bank has severely restricted originating any new

acquisition and development loans, lot loans or land loans. The Bank

has restricted the origination of speculative construction loans, and has

limited most new construction lending to those with contracts or pre-sales

only. Consumer loans declined to $89.6 million at December 31, 2009

from $101.8 million at December 31, 2008; while lease receivables declined to

$9.8 million at December 31, 2009 from $11.6 million at December 31, 2008.

Commercial loan, consumer loan and lease receivables originations declined to

$99.2 million during fiscal 2009, compared to $280.3 million originated during

fiscal 2008.

Residential

mortgage loans increased to $53.0 million at December 31, 2009 from $47.0

million at December 31, 2008, reflecting the net effect of principal repayments,

originations, sales and securitizations. The Bank originated $133.6

million of held for sale residential mortgage loans during fiscal 2009, compared

to $48.9 million originated during fiscal 2008. The Bank also

originated $31.1 million of residential mortgage loans for investors during both

fiscal 2009 and 2008, respectively. The Bank sold $34.3 million of loans held

for sale during fiscal 2009, compared to $37.7 million sold during fiscal 2008.

Loan sales also helps reduce exposure to future interest rate changes, provides

funds for new loan originations and deposit withdrawals, and supports daily

liquidity management activities.

Nonperforming

loans, including restructured loans, declined to $10.2 million at December 31,

2009, from $15.0 million at December 31, 2008. The current level of

nonperforming and restructured loans, consisting primarily of residential and

commercial real estate loans, is attributable to the current economic

environment. Downward pressure has impacted the market values of housing and

other real estate, significantly impacting property values in the Bank’s market

area and credit quality of certain borrowers. Management believes it has

thoroughly evaluated all nonperforming and restructured loans and they are

either well collateralized or adequately reserved. However, there can be no

assurance in the future that regulators, increased credit risks in the loan

portfolio, further declines in economic conditions and other factors will not

require additional fair value adjustments to the nonperforming loans. As a

result of the volume of nonperforming loans, the Bank’s unrecognized interest

declined to $471,000 at December 31, 2009, from $624,000 at December 31,

2008. The ratio of non-performing loans to total loans was 1.5% at

December 31, 2009, compared to 2.0% at December 31, 2008.

10

Other

real estate owned increased to $10.6 million at December 31, 2009 from $7.7

million at December 31, 2008, reflecting foreclosures of certain real estate

properties, net of sales. Other real estate owned consists of

residential and commercial properties, developed building lots and a developed

residential subdivision. Based on fair value analysis, the Bank

believes the adjusted carrying values of these properties are representative of

their fair market values, although there can be no assurances that the ultimate

sales will be equal to or greater than the carrying values. The

Bank recorded $2.2 million of fair value adjustments to other real estate owned

in fiscal 2009, compared to $772,000 in fiscal 2008.

Goodwill

related to prior period acquisitions was $4.2 million at December 31, 2009 and

2008, respectively, and is not amortized according to provisions of financial

accounting standards. The unamortized balance of the Company’s

goodwill is tested for impairment annually. The Company has performed annual

impairment testing and determined there was no impairment of goodwill as of

December 31, 2009 or December 31, 2008.

Total

deposits declined to $688.5 million at December 31, 2009 from $716.4 million at

December 31, 2008. The Bank continues to compete in its market area

for lower costing core demand deposits. During 2009 and amid intense

competition, demand accounts increased to $224.5 million at December 31, 2009

from $223.4 million at December 31, 2008. Certificates of deposit

declined to $440.9 million at December 31, 2009 from $466.5 million at December

31, 2008. The Bank attempts to manage its cost of deposits by

monitoring the volume and rates paid on maturing certificates of deposits in

relationship to current funding needs and market interest

rates. During fiscal 2009, the Bank did not renew certain maturing

high rate time deposits and began repricing new and maturing time deposits at

lower rates. The Bank has also used lower costing FHLB borrowings as

a funding source, providing an effective means of managing its overall cost of

funds, as discussed below.

Total

borrowings declined to $47.7 million at December 31, 2009 from $62.9 million at

December 31, 2008. FHLB advances declined to $35.0 million at

December 31, 2009 from $45.0 million at December 31, 2008, as the Bank repaid

$10.0 million of fixed rate FHLB advances, which the Bank has used as a

long-term funding source. Junior subordinated debentures were $10.3

million at December 31, 2009 and 2008, respectively. Repurchase

agreements representing funds held in cash management accounts for commercial

banking customers declined to $2.4 million at December 31, 2009 from $7.6

million at December 31, 2008.

Stockholders'

equity declined to $86.2 million at December 31, 2009, from $87.8 million at

December 31, 2008, reflecting the net effect of annual earnings, dividend

payments, changes in accumulated other comprehensive income and a decline in the

volume of total assets. The Company’s equity to assets ratio

increased to 10.4% at December 31, 2009, from 10.0% at December 31,

2008. Accumulated other comprehensive income declined to $322,000 at

December 31, 2009, from $1.2 million at December 31, 2008, reflecting reduced

unrealized gains on available for sale securities, net of deferred income taxes,

primarily due to lower market interest rates.

The

Company declared a $0.20 per share quarterly cash dividend each quarter during

fiscal 2009 and 2008, totaling $0.80 per share per year,

respectively. These cash dividend payments reflect dividend payout

ratios on basic earnings of 111.1% for fiscal 2009 and 70.8% for fiscal

2008. Future quarterly dividends will be determined at the discretion

of the Board of Directors based upon earnings, the capital, liquidity and

financial condition of the Company, and general economic

conditions.

The

Company did not purchase any shares of its common stock during fiscal 2009,

compared to 140,241 shares purchased in fiscal 2008 through open market and

private purchases. Shares purchased are held as treasury stock, at

cost. Treasury shares were 1,511,926 totaling $32.2 million at

December 31, 2009, compared to 1,516,126 shares totaling $32.2 million at

December 31, 2008. Treasury shares are used for general corporate

purposes including the exercise of stock options and funding shares for

potential future stock splits. There were 4,200 shares issued on the

exercise of stock options during fiscal 2009, compared to 90,499 shares issued

during fiscal 2008. No shares were tendered to pay the exercise price

of stock options exercised during fiscal 2009, compared to 20,817 shares

tendered during fiscal 2008 to pay the exercise price and income taxes incident

to stock option exercises.

Comparison

of Operating Results for the Years Ended December 31, 2009 and

2008.

General. Net

income was $7.0 million for the year ended December 31, 2009, compared to $11.0

million for the year ended December 31, 2008. Diluted earnings per

share were $0.72 per share for the year ended December 31, 2009, compared to

$1.12 per share for the year ended December 31, 2008.

11

The

decline in net earnings during the year ended December 31, 2009 results

primarily from a reduction in net interest income which has been significantly

impacted by lower interest rates during the comparative reporting periods;

changes in the volume of earning and non-earning assets between the respective

reporting periods; the volume of provisions for credit losses required to

replenish net charge-offs and strengthen the allowance for credit losses; and

increased FDIC insurance premiums related to increased risk-based assessment

rates and an industry wide mandatory special assessment; while being partially

offset by a decline in the cost of funds and a consistent level of non-interest

income.

The Bank

continues to face challenges resulting from the impact of the current economy on

the housing and real estate markets. The Bank continues to monitor and evaluate

all significant loans in its portfolio, and will continue to manage its credit

risk exposure in anticipation of future stabilization of the real estate market.

Management believes competition and pricing pressures will continue on both

deposits and loans into 2010. The amount and timing of any future Federal

Reserve rate adjustment remain uncertain, and may further impact the Bank if

those adjustments are significant.

Key

performance ratios are return on average assets (ROA), return on average equity

(ROE), and efficiency. ROA was .8% for fiscal 2009, compared to 1.2% for fiscal

2008, and ROE was 8.0% for fiscal 2009, compared to 12.5% for fiscal 2008. The

efficiency ratio (noninterest expenses as a percentage of net interest income

plus noninterest income) was 57.6% for fiscal 2009, compared to 52.3% for fiscal

2008. The efficiency ratio measures the proportion of net operating revenues

that are absorbed by overhead expenses.

Interest Income. Interest

income declined to $49.1 million for fiscal 2009 from $59.4 million for fiscal

2008. The decline in interest income for fiscal 2009 was significantly impacted

by current economic conditions and by lower interest rates during fiscal 2009

and 2008. It was also influenced by the decline in the volume of average earning

assets attributable to a slow down of loan originations during the comparative

periods, and the volume of nonperforming loans and other real estate owned. The

average balance of interest-earning assets declined to $800.9 million for fiscal

2009, from $839.0 million for fiscal 2008. The yield on average interest-earning

assets declined to 6.1% for fiscal 2009 from 7.1% for fiscal 2008.

Interest Expense. Interest

expense declined to $16.1 million for fiscal 2009 from $23.3 million for fiscal

2008. The decline in interest expense reflects the decline in interest rates

previously discussed and a decline in the volume of average interest-bearing

liabilities. The average balance of interest-bearing liabilities declined to

$679.3 million for fiscal 2009, from $712.4 million for fiscal 2008. The average

balance of noninterest-bearing demand deposits declined to $90.6 million for

fiscal 2009 from $92.2 million for fiscal 2008. The average cost of funds,

including noninterest-bearing deposits, declined to 2.1% for fiscal 2009, from

2.9% for fiscal 2008, reflecting the lower interest rate environment during

these reporting periods, combined with management’s efforts to control the

Bank’s funding cost.

Net Interest Income. Net

interest income declined to $33.0 million for fiscal 2009, from $36.0 million

for fiscal 2008. The decline in net interest income during fiscal 2009 is

primarily attributable to lower market interest rates and the decline in earning

assets as previously discussed. The net yield on interest-earning assets (net

interest income divided by average interest-earning assets) was 4.1% for fiscal

2009, compared to 4.3% for fiscal 2008. The Bank's interest rate spread (the

difference between the effective yield on average interest-earning assets and

the effective average cost of funds) was 4.0% for fiscal 2009, compared to 4.2%

for fiscal 2008. See “Table 3 - Rate/Volume Analysis” and “Table 4 - Yield/Cost

Analysis” above for additional information on interest income, interest expense,

net interest income, average balances and yield/cost ratios.

Provision for Credit Losses.

During fiscal 2009, the Bank provided $7.2 million for credit losses, compared

to $4.0 million in fiscal 2008. These provisions were necessary to replenish net

charge-offs of $5.4 million and $2.0 million, respectively, during fiscal 2009

and 2008, and to bring the allowance for credit losses to an appropriate level

in light of the risk inherent in the loan and lease portfolio and provide

support to the current volume of nonperforming loans as previously

discussed.

Allowance for Credit Losses.

The Bank maintains general and specific allowances for loan and lease

losses and unfunded loan commitments (collectively the “allowance for credit

losses”) at levels it believes are appropriate in light of the risk inherent in

the loan and lease portfolio and in unfunded loan commitments. The Bank has

developed policies and procedures for assessing the adequacy of the allowance

for credit losses that reflect the assessment of credit risk and impairment

analysis. This assessment includes an analysis of qualitative and quantitative

trends in the levels of classified loans. In developing this analysis, the Bank

relies on estimates and exercises judgment in assessing credit risk. Future

assessments of credit risk may yield different results, depending on changes in

the qualitative and quantitative trends, which may require increases or

decreases in the allowance for credit losses.

12

The Bank

uses a variety of modeling and estimation tools for measuring credit risk and

performing impairment analysis, which is the basis used in developing the

allowance for credit losses. The Bank’s principal focus is on the adequacy of

the total allowance for credit losses. Based on the overall credit quality of

the loan and lease receivable portfolio, the Bank believes it has established

the allowance for credit losses pursuant to generally accepted accounting

principles, and has taken into account the views of its regulators and the

current economic environment. Management evaluates the information upon which it

bases the allowance for credit losses quarterly and believes their accounting

decisions remain accurate. However, there can be no assurance in the future that

regulators, increased risks in its loans and leases portfolio, changes in

economic conditions and other factors will not require additional adjustments to

the allowance for credit losses.

The

allowance for credit losses was $13.7 million at December 31, 2009, compared to

$12.0 million at December 31, 2008. The ratio of the allowance for credit losses

to total loans and leases was 2.0% at December 31, 2009, compared to 1.6% at

December 31, 2008, which the Bank believes is appropriate. See Note 1 and Note 4

of the “Notes to Consolidated Financial Statements” for additional information

about the allowance for credit losses.

Noninterest Income.

Noninterest income increased to $11.0 million for fiscal 2009, from $10.1

million for fiscal 2008. Other income consists of fees, service charges and

servicing fees earned on loans, service charges and insufficient funds fees

collected on deposit accounts, gains from loan and securities sales and other

miscellaneous income. The Bank continues to maintain a consistent level of other

income across both loan and deposit service offerings. Fees and service charges were

$7.4 million for fiscal 2009, compared to $7.8 million for fiscal 2008. Fees,

service charges earned and insufficient funds fees collected during the

respective periods are attributable to the volume of loan and deposit account

transactions and insufficient funds transactions processed during each period,

and the collection of related fees and service charges.

Gains

from mortgage loan sales increased to $1.2 million for fiscal 2009 from $587,000

for fiscal 2008. Proceeds from the sale of loans held for sale was $34.3 million

for fiscal 2009, compared to $37.7 million sold for fiscal 2008. The Bank sells

certain held for sale mortgage loans to reduce its exposure to interest rate and

credit risk, while retaining certain other held for sale mortgage loans for

future securitization into available for sale mortgage-backed securities. In

addition, the sale of mortgage loans also provides liquidity necessary to

support the Bank’s operating, financing and lending activities.

Servicing

fee income on loans serviced for others increased to $680,000 for fiscal 2009

from $658,000 for fiscal 2008. Loans serviced for others increased to $289.3

million at December 31, 2009 from $255.5 million at December 31, 2008. Gains

from the sale of investment securities held for sale was $918,000 for fiscal

2009, compared to none for fiscal 2008. The Bank sold $20.9 million of

investment securities available for sale during fiscal 2009, compared to none

sold during fiscal 2008. The Bank recorded losses from the sales of other real

estate owned of $201,000 for fiscal 2009, compared to $81,000 for fiscal 2008,

in its best efforts to convert these nonperforming assets into earning assets.

The Bank sold $10.5 million of other real estate owned during fiscal 2009,

compared to $3.9 sold during fiscal 2008.

Noninterest Expenses.

Noninterest expenses increased to $25.3 million for fiscal 2009 from $24.2

million in fiscal 2008. The largest single component of these expenses,

compensation and fringe benefits, increased to $14.1 million for fiscal 2009,

from $13.8 million in fiscal 2008. The Bank’s full-time equivalent employees

increased to 278 at December 31, 2009, from 273 at December 31, 2008. This

increase is due to converting a loan production office into a full service

branch office and the addition of key associates in the credit administration

support function.

FDIC

insurance premiums increased to $1.3 million for fiscal 2009, from $280,000 for

fiscal 2008, reflecting a mandatory $400,000 special assessment and increased

risk based assessment rates. In addition, one-time FDIC insurance assessment

credits received under the Federal Deposit Reform Act of 2005 were exhausted in

the quarter ended June 30, 2008.

Expenses

attributable to other real estate owned were $905,000 for fiscal 2009, compared

to $936,000 for fiscal 2008. Other noninterest expenses including premises and

equipment, advertising, data processing, repairs and maintenance, office

supplies, professional fees, taxes and insurance, etc., have remained relatively

flat during the respective periods.

Income Taxes. Income taxes

declined to $4.4 million for fiscal 2009, from $6.9 million for fiscal 2008. The

decline in income taxes is a direct result of the decline of pretax earnings to

$11.4 million for fiscal 2009 from $17.9 million for fiscal 2008. Changes in the

amount of income tax expense reflect changes in pretax income and expenses, the

application of permanent and temporary differences, and the income tax rates in

effect during each period. The effective income tax rate was 38.3% for fiscal

2009 and 38.7% for fiscal 2008.

13

Comparison

of Operating Results for the Years Ended December 31, 2008 and

2007.

General. Net income was $11.0

million for the year ended December 31, 2008, compared to $17.0 million for the

year ended December 31, 2007. Diluted earnings per share were $1.12 per share

for the year ended December 31, 2008 and $1.70 per share for the year ended

December 31, 2007. Return on average assets and return on average equity for

fiscal 2008 were 1.2% and 12.5%, respectively, compared to 1.9% and 20.3% for

fiscal 2007. The efficiency ratio was 52.3% for fiscal 2008, compared to 45.0%

for fiscal 2007.

Interest Income. Interest

income declined to $59.4 million for fiscal 2008 from $70.1 million for fiscal

2007. The decline in interest income during 2008 was significantly influenced by

the Federal Reserve’s 400 basis point rate cuts since December 2007. It was also

influenced by the decline in the volume of average earning assets attributable

to a slow down of loan originations in the current recessionary economy, and the

increased level of nonperforming loans and other real estate owned. The average

balance of interest-earning assets declined to $839.0 million for fiscal 2008,

from $853.6 million for fiscal 2007. The yield on average interest-earning

assets declined 7.1% for fiscal 2008 from 8.2% for fiscal 2007.

Interest Expense. Interest

expense declined to $23.3 million for fiscal 2008 from $29.1 million for fiscal

2007. The decline in interest expense also reflects the decline in interest

rates discussed above, and a decline in the volume of average interest-bearing

deposits, offset by an increase in the average volume of borrowings. The average

balance of interest-bearing liabilities increased to $712.4 million for fiscal

2008 from $708.9 million for fiscal 2007. The average balance of

noninterest-bearing demand deposits declined to $92.2 million for fiscal 2008

from $103.6 million for fiscal 2007. The average cost of funds, including

noninterest-bearing deposits, declined to 2.9% for 2008, from 3.6% for 2007,

reflecting the declining interest rate environment during fiscal 2008 and

management’s efforts to control the Bank’s funding cost.

Net Interest Income. Net

interest income declined to $36.0 million for fiscal 2008 from $41.0 million for

fiscal 2007. The decline in net interest income during 2008 is primarily

attributable to the decline in market interest rates also influenced by the

Federal Reserve’s 400 basis point rate cuts since December 2007, and the decline

in earning assets as previously discussed. The net yield on interest-earning

assets was 4.3% for fiscal 2008, compared to 4.8% for fiscal 2007. The Bank's

interest rate spread was 4.2% for fiscal 2008, compared to 4.6% for fiscal

2007.

Provision for Credit Losses.

The Bank provided $4.0 million for credit losses during fiscal 2008, compared to

$350,000 in fiscal 2007. These provisions were necessary to replenish net

charge-offs of $2.0 million and $383,000, respectively, during fiscal 2008 and

2007, and to maintain the allowance for credit losses to an appropriate level in

light of the risk inherent in the loan and lease portfolio, to support the

current volume of nonperforming loans as previously discussed and to support the

inherent risks associated with the growth of the commercial and consumer loan

and lease receivable portfolio in recent years.

The Bank

maintains both general and specific allowances for loan and lease losses and

unfunded loan commitments (collectively the “allowance for credit losses”) based

upon management's evaluation of risk in the loan and lease receivable portfolio

and past loss experience. The allowance for credit losses was $12.0 million at

December 31, 2008, compared to $9.9 million at December 31, 2007. The ratio of

the allowance for credit losses to total loans and leases was 1.6% at December

31, 2008, compared to 1.3% at December 31, 2007, which the Bank believes is

appropriate.

Nonperforming

loans were $10.7 million at December 31, 2008, compared to $7.6 million at

December 31, 2007. The increase in nonperforming loans consisted primarily of

residential and commercial real estate credits. Restructured loans were $4.3

million at December 31, 2008, compared to none at December 31, 2007. Due to the

volume of nonperforming loans, the Bank’s unrecognized interest increased to

$624,000 at December 31, 2008, from $506,000 at December 31, 2007. The ratio of

non-performing loans to total loans was 2.0% at December 31, 2008, compared to

1.0% at December 31, 2007.

Noninterest Income.

Noninterest income was $10.1 million for both fiscal 2008 and 2007,

respectively. During fiscal 2008 and 2007, the Bank maintained a consistent

level of noninterest income across loan and deposit service offerings. Fees and service charges

increased to $7.8 million for fiscal 2008 from $7.3 million for fiscal 2007.

Fees and service charges earned and collected during these periods is

attributable to the volume of loan and deposit account transactions processed

during each period, and the ultimate collection of related fees and service

charges. Servicing fee income on loans serviced for others increased to $658,000

for fiscal 2008 from $651,000 for fiscal 2007. Loans serviced for others

increased to $255.5 million at December 31, 2008 from $254.7 million at December

31, 2007.

Gains

from mortgage loan sales increased to $587,000 for fiscal 2008 from $519,000 for

fiscal 2007. Proceeds from the sale of loans held for sale was $37.7 million for

fiscal 2008, compared $35.4 million sold for fiscal 2007. Net proceeds from loan

sales provide additional liquidity necessary to support the Bank’s operating,

financing and lending activities.

14

Noninterest Expenses.

Noninterest expenses increased to $24.2 million for fiscal 2008 from $22.9

million in fiscal 2007. The largest single component of these expenses,

compensation and fringe benefits, declined to $13.8 million for fiscal 2008 from

$14.0 million for fiscal 2007. In managing its compensation expense, the Bank

has reduced its full-time equivalent employees to 273 at December 31, 2008 from

287 at December 31, 2007. Non-interest expense in fiscal 2008 also includes

$772,000 fair value adjustments on other real estate owned and increased FDIC

insurance premiums. One-time FDIC insurance assessment credits available from

the Federal Deposit Reform Act of 2005 were used through June 2008, resulting in

FDIC insurance premiums increasing to $280,000 for fiscal 2008 from $94,000 for

fiscal 2007.

Data

processing expense has grown proportionately with the number of loan and deposit

customer accounts and the volume of transaction activity they generate. Other

noninterest expenses including advertising, premises and equipment, payroll and

other taxes, repairs and maintenance, and office expenses remained relatively

constant during fiscal 2008 and 2007.

Income Taxes. Income taxes

declined to $6.9 million for fiscal 2008 from $10.8 million for fiscal 2007. The

decline in income taxes is a direct result of the decline of pretax earnings to

$17.9 million for fiscal 2008 from $27.8 million for fiscal 2007. Changes in the

amount of income tax expense reflect changes in pretax income and expenses, the

application of permanent and temporary differences, and the income tax rates in

effect during each period. The effective income tax rate was 38.7% for fiscal

2008 and 38.9% for fiscal 2007.

Forward Looking

Statements

This

Annual Report, including the Letter to Stockholders and Management's Discussion

and Analysis of Financial Condition and Results of Operation, contains forward

looking statements that involve risk and uncertainty. The Private Securities

Litigation Reform Act of 1995 states that the disclosure of forward looking

information is desirable for investors and encourages such disclosure by

providing a safe harbor for forward looking statements by corporate

management.

In order

to comply with the terms of the safe harbor, the Company notes that its actual

results and experience may differ materially from anticipated results or other

expectations expressed in the Company's forward looking statements. Words such

as “expects”, “believes”, “estimated”, “adequate”, “scheduled” or similar

expressions are intended to identify forward looking statements. These

statements are not guarantees of future performance and involve certain risks

and uncertainties that may affect the operations, performance, development,

growth projections and results of the Company's business. Therefore, actual

future results and trends may differ materially from what may be forecast in

forward looking statements due to a variety of factors, including, but not

limited to, regional and national economic conditions, changes in levels of

market interest rates, credit and other risks of lending and investing

activities, timely development of technology enhancements for product delivery,

services and pricing, the impact of competition, customer requirements,