Attached files

Table of Contents

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

WASHINGTON, D.C. 20549

FORM 10-K

| x | ANNUAL REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934 |

For the fiscal year ended December 31, 2009

OR

| ¨ | TRANSITION REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934 |

For the transition period from to

Commission file number: 1-8966

SJW CORP.

(Exact name of registrant as specified in its charter)

| California | 77-0066628 | |

| (State or other jurisdiction of incorporation or organization) | (I.R.S. Employer Identification No.) | |

| 110 West Taylor Street, San Jose, California | 95110 | |

| (Address of principal executive offices) | (Zip Code) | |

408-279-7800

(Registrant’s telephone number, including area code)

Not Applicable

(Former name, former address and former fiscal year, if changed since last report)

Securities registered pursuant to Section 12(b) of the Act:

| Title of each class |

Name of each exchange on which registered | |

| Common Stock, $0.521 par value per share |

New York Stock Exchange |

Securities registered pursuant to Section 12(g) of the Act: None

Indicate by check mark if the registrant is a well-known seasoned issuer, as defined in Rule 405 of the Securities Act. Yes ¨ No x

Indicate by check mark if the registrant is not required to file reports pursuant to Section 13 or Section 15(d) of the Exchange Act. Yes ¨ No x

Indicate by check mark whether the registrant (1) has filed all reports required to be filed by Section 13 or 15(d) of the Securities Exchange Act of 1934 during the preceding 12 months (or for such shorter period that the registrant was required to file such reports), and (2) has been subject to such filing requirements for the past 90 days. Yes x No ¨

Indicate by check mark if disclosure of delinquent filers pursuant to Item 405 of Regulation S-K is not contained herein, and will not be contained, to the best of registrant’s knowledge, in definitive proxy or information statements incorporated by reference in Part III of this Form 10-K or any amendment to this Form 10-K. x

Indicate by check mark whether the registrant has submitted electronically and posted on its corporate Web site, if any, every Interactive Data File required to be submitted and posted pursuant to Rule 405 of Regulation S-T (§232.405 of this chapter) during the preceding 12 months (or for such shorter period that the registrant was required to submit and post such files). Yes ¨ No ¨

Indicate by check mark whether the registrant is a large accelerated filer, an accelerated filer, a non-accelerated filer, or a smaller reporting company. See definition of “large accelerated filer,” “accelerated filer,” and “smaller reporting company” in Rule 12b-2 of the Exchange Act.

Large accelerated filer ¨ Accelerated filer x Non-accelerated filer ¨ Smaller reporting company ¨

Indicate by check mark whether the registrant is a shell company (as defined in Rule 12b-2 of the Exchange Act). Yes ¨ No x

As of June 30, 2009, the aggregate market value of the registrant’s common stock held by non-affiliates of the registrant was $340,047,090 based on the closing sale price as reported on the New York Stock Exchange.

Indicate the number of shares outstanding of registrant’s common stock, as of the latest practicable date.

| Class |

Outstanding at February 8, 2010 | |

| Common Stock, $0.521 par value per share |

18,526,217 |

DOCUMENTS INCORPORATED BY REFERENCE

Portions of the registrant’s Proxy Statement relating to the registrant’s Annual Meeting of Shareholders, to be held on April 28, 2010, are incorporated by reference into Part III of this Form 10-K where indicated.

Table of Contents

| Page | ||||

| PART I | ||||

| 3 | ||||

| Item 1. |

3 | |||

| Item 1A. |

9 | |||

| Item 1B. |

15 | |||

| Item 2. |

15 | |||

| Item 3. |

16 | |||

| Item 4. |

16 | |||

| PART II | ||||

| Item 5. |

17 | |||

| Item 6. |

19 | |||

| Item 7. |

Management’s Discussion and Analysis of Financial Condition and Results of Operations |

20 | ||

| Item 7A. |

34 | |||

| Item 8. |

35 | |||

| Item 9. |

Changes in and Disagreements with Accountants on Accounting and Financial Disclosure |

67 | ||

| Item 9A. |

67 | |||

| Item 9B. |

68 | |||

| PART III | ||||

| Item 10. |

68 | |||

| Item 11. |

69 | |||

| Item 12. |

Security Ownership of Certain Beneficial Owners and Management and Related Stockholder Matters |

69 | ||

| Item 13. |

Certain Relationships and Related Transactions and Director Independence |

69 | ||

| Item 14. |

69 | |||

| PART IV | ||||

| Item 15. |

70 | |||

| 71 | ||||

| 74 | ||||

Table of Contents

PART I

This report contains forward-looking statements within the meaning of the federal securities laws relating to future events and future results of SJW Corp. and its subsidiaries that are based on current expectations, estimates, forecasts, and projections about SJW Corp. and the industries in which SJW Corp. operates and the beliefs and assumptions of the management of SJW Corp. Such forward-looking statements are identified by words such as “expect”, “estimate”, “anticipate”, “intends”, “seeks”, “plans”, “projects”, “may”, “should”, “will”, variation of such words, and similar expressions. These forward-looking statements are only predictions and are subject to risks, uncertainties, and assumptions that are difficult to predict. Therefore, actual results may differ materially and adversely from those expressed in any forward-looking statements. Important factors that could cause or contribute to such differences include, but are not limited to, those discussed in this report under Item 1A, “Risk Factors,” and Item 7, “Management’s Discussion and Analysis of Financial Condition and Results of Operations,” and elsewhere, and in other reports SJW Corp. files with the Securities and Exchange Commission (the “SEC”), specifically the most recent report on Form 10-Q and reports on Form 8-K filed with the SEC, each as it may be amended from time to time.

SJW Corp. undertakes no obligation to update or revise the information contained in this report, including the forward-looking statements for any reason.

| Item 1. | Business |

General Development of Business

SJW Corp. was incorporated in California on February 8, 1985. SJW Corp. is a holding company with four subsidiaries:

| • | San Jose Water Company, a wholly owned subsidiary of SJW Corp., with its headquarters located at 110 West Taylor Street in San Jose, California 95110, was originally incorporated under the laws of the State of California in 1866. As part of a reorganization on February 8, 1985, San Jose Water Company became a wholly owned subsidiary of SJW Corp. San Jose Water Company is a public utility in the business of providing water service to approximately 226,000 connections that serve a population of approximately one million people in an area comprising approximately 142 square miles in the metropolitan San Jose area. San Jose Water Company’s web site can be accessed via the Internet at http://www.sjwater.com. |

| • | SJW Land Company, a wholly owned subsidiary of SJW Corp., was incorporated in 1985. SJW Land Company owns undeveloped land in the states of California and Tennessee, owns and operates commercial buildings in the states of California, Florida, Connecticut, Texas, Arizona and Tennessee, and has a 70% limited partnership interest in 444 West Santa Clara Street, L.P. |

| • | SJWTX, Inc., a wholly owned subsidiary of SJW Corp., was incorporated in the State of Texas in 2005. SJWTX, Inc. is doing business as Canyon Lake Water Service Company (CLWSC). CLWSC is a public utility in the business of providing water service to approximately 9,000 connections that serve approximately 36,000 people in western Comal County and southern Blanco County. The company’s service area comprises more than 237 square miles in the growing region between San Antonio and Austin. |

| • | Texas Water Alliance Limited (“TWA”), a wholly owned subsidiary of SJW Corp., is undertaking activities that are necessary to develop a water supply project in Texas. |

Together, San Jose Water Company, CLWSC and TWA are referred to as “Water Utility Services.”

3

Table of Contents

SJW Corp. also owns 1,099,952 shares of California Water Service Group, which represents approximately 5% of that company’s outstanding shares as of December 31, 2009 and it is accounted for under Financial Accounting Standards Board (FASB) Accounting Standard Codification (ASC) Topic 320—“Investments—Debt and Equity Securities,” as an available-for-sale marketable security.

Regulation and Rates

San Jose Water Company’s rates, service and other matters affecting its business are subject to regulation by the California Public Utilities Commission (“CPUC”).

Ordinarily, there are three types of rate adjustments that affect San Jose Water Company’s revenue collection: general rate adjustments, cost of capital adjustments, and offset rate adjustments. General rate adjustments are authorized in general rate case decisions, which usually authorize an initial rate adjustment followed by two annual escalation adjustments designed to maintain the authorized return on equity over a three-year period. General rate applications are normally filed and processed during the last year covered by the most recent rate case as required by the CPUC so that regulatory lag is avoided.

Cost of capital adjustments are rate adjustments resulting from the CPUC’s tri-annual establishment of a reasonable rate of return for investments in San Jose Water Company.

The purpose of an offset rate adjustment is to compensate utilities for changes in specific pre-authorized offsettable capital investments or expenses, primarily for purchased water, groundwater extraction charges and purchased power. Pursuant to Section 792.5 of the California Public Utilities Code, a balancing account must be maintained for each expense item for which such revenue offsets have been authorized. The purpose of a balancing account is to track the under-collection or over-collection associated with expense changes and the revenue authorized by the CPUC to offset those expense changes.

On November 20, 2009, the CPUC approved the most recent general rate increase for San Jose Water Company. In summary, the decision authorizes a rate increase designed to increase revenue by $18,597,000 or 9.24% in 2010. In accordance with CPUC rules, the subsequent increases for the years 2011 and 2012 will be based upon the consumer price indices as forecasted in October of the preceding year. Current estimates of these increases are $7,558,000 or 3.43% in 2011, and $11,088,000 or 4.87% in 2012. These rate increases are designed to produce a return on common equity of 10.13%, which is comparable with recent authorized returns for water utilities in California. The stated revenue increases for 2010 to 2012 do not include additional authorized increases associated with scheduled offset filings, planned upgrades to the Montevina Treatment Plant, and the potential supplemental filings for rate recovery for investments in green energy projects and meter replacements. The new rates for 2010 became effective January 1, 2010.

CLWSC is subject to the regulation of the Texas Commission on Environmental Quality (“TCEQ”). The TCEQ authorizes rate increases after the filing of an Application for a Rate/Tariff Change. Such filings may be filed anytime but not sooner than twelve months following the acceptance of the TCEQ of the previous filing.

On November 17, 2008, CLWSC filed a general rate case with the TCEQ. The filing contained a request for an increase in rates generating a revenue increase of $773,000 or approximately 14%. In accordance with TCEQ procedures, the rates became effective on January 16, 2009. At a TCEQ preliminary hearing in the case on August 26, 2009, the company settled outstanding rate issues with several intervenors in the case. The settlement was subsequently approved by the TCEQ on December 28, 2009.

Please also see Item 1A, “Risk Factors,” and Item 7, “Management’s Discussion and Analysis of Financial Condition and Results of Operations.”

4

Table of Contents

Financial Information about Industry Segments

See Part II, Item 7 for information regarding SJW Corp.’s business segments.

Description of Business

General

The principal business of the Water Utility Services consists of production, purchase, storage, purification, distribution, wholesale, and retail sale of water. San Jose Water Company provides water service to approximately 226,000 connections that serve customers in portions of the cities of Cupertino and San Jose and in the cities of Campbell, Monte Sereno, Saratoga and the Town of Los Gatos, and adjacent unincorporated territory, all in the County of Santa Clara in the State of California. It distributes water to customers in accordance with accepted water utility methods. CLWSC provides water service to approximately 9,000 connections that serve approximately 36,000 people in a service area comprising more than 237 square miles in the growing region between San Antonio and Austin, Texas.

San Jose Water Company also provides nonregulated water related services under agreements with municipalities. These nonregulated services include full water system operations and billing and cash remittance services.

In October 1997, San Jose Water Company commenced operation of the City of Cupertino municipal water system under the terms of a 25-year lease. The system is adjacent to the existing San Jose Water Company service area and has approximately 4,500 service connections. Under the terms of the lease, San Jose Water Company paid an up-front $6.8 million concession fee to the City of Cupertino that is amortized over the contract term. San Jose Water Company is responsible for all aspects of system operation including capital improvements.

The operating results from the water business fluctuate according to the demand for water, which is often influenced by seasonal conditions, such as summer temperatures or the amount and timing of precipitation in the Water Utility Services service areas. Revenue, production costs and income are affected by the changes in water sales and availability of surface water supply. Overhead costs, such as payroll and benefits, depreciation, interest on long-term debt, and property taxes, remain fairly constant despite variations in the amount of water sold. As a result, earnings are highest in the higher demand, warm summer months and lowest in the cool winter months.

Water Supply

San Jose Water Company’s water supply consists of groundwater from wells, surface water from watershed run-off and diversion, and imported water purchased from the Santa Clara Valley Water District (“SCVWD”) under the terms of a master contract with SCVWD expiring in 2051. Purchased water provides approximately 40% to 45% of San Jose Water Company’s annual production. San Jose Water Company pumps approximately 40% to 50% of its water supply from the underground basin and pays a groundwater extraction charge to SCVWD. Surface supply, which during a year of normal rainfall satisfies about 6% to 8% of San Jose Water Company’s annual needs, provides approximately 1% of its water supply in a dry year and approximately 14% in a wet year. In dry years, the decrease in water from surface run-off and diversion, and the corresponding increase in purchased and pumped water, increases production costs substantially.

The pumps and motors at San Jose Water Company’s groundwater production facilities are propelled by electric power. Over the last few years, San Jose Water Company has installed standby power generators at 30 of its strategic water production sites. In addition, the commercial office and operations control centers are equipped with standby generators that allow critical distribution and customer service operations to continue during a power outage. SCVWD has informed San Jose Water Company that its filter plants, which deliver purchased water to San Jose Water Company, are also equipped with standby generators. In the event of a power outage, San Jose Water Company believes it will be able to prevent an interruption of service to customers for a limited period by pumping water with its standby generators and by using purchased water from SCVWD.

5

Table of Contents

In 2009, the level of water in the Santa Clara Valley groundwater basin, which is managed by the Santa Clara Valley Water District (SCVWD), remained comparable to the 30-year average level. On December 28, 2009, SCVWD’s 10 reservoirs were 42.3% full with 71,527 acre-feet of water in storage. The rainfall from July 1, 2009 to December 28, 2009 was approximately 114% of the 30-year average. In addition, the rainfall at San Jose Water Company’s Lake Elsman was measured at 22.10 inches for the period from July 1, 2009 through December 31, 2009, which is 142% of the five-year average. The delivery of California state and federal contract water to SCVWD may be reduced in 2010, resulting in comparable reductions to target deliveries to retail agencies. San Jose Water Company believes that its various sources of water supply, including an increased reliance on groundwater, will be sufficient to meet customer demand in 2010.

The continuing dry weather in California and concerns about the San Joaquin-Sacramento River Delta prompted Governor Schwarzenegger on June 3, 2008 to issue an Executive Order (S-06-08) declaring a state-wide water emergency. The order directed state agencies to take immediate action to address drought conditions and water delivery reductions that may exist by expediting grant programs, technical assistance, and water conservation outreach. The order did not mandate water use restrictions or reductions.

On December 15, 2008, the U.S. Fish and Wildlife Service issued a new Biological Opinion (BiOp) and Incidental Take Statement for the Central Valley Project (CVP) and the State Water Project (SWP) on the Delta smelt. The operating requirements of BiOp replaced the interim remedy ordered by Federal Judge Oliver Wanger in December 2007. The BiOp prescribes a range of operational criteria that are determined based on hydrology, fish distribution, abundance, and other factors. Under a “most likely” scenario, the California Department of Water Resources (DWR) and United States Bureau of Reclamation (USBR) estimate that SWP and CVP supplies to SCVWD could be reduced by approximately 17% to 18% of the supply amount they currently receive. Under a “worst case” BiOp scenario, SWP and CVP supplies to SCVWD could be reduced by approximately 32% to 33% of the current supply amount they receive. In addition, while there is some overlap with the California Fish & Game Commission’s restrictions to protect longfin smelt, the longfin pumping restrictions, if triggered, could cause significant supply impacts beyond those estimated to comply with Delta smelt requirements.

On March 24, 2009, the SCVWD board of directors unanimously passed a resolution calling for a mandatory 15% reduction in water use, which has been extended through June 2010. To effect water restrictions, SCVWD must work with other political subdivisions that possess the authority to enact and enforce drought ordinances in order to effect such restrictions. San Jose Water Company worked with the CPUC to develop its water conservation plan to comply with the call for a 15% reduction in water use. The CPUC approved the plan, which became effective on August 12, 2009 and will remain in effect through June 2010.

Except for a few isolated cases when service had been interrupted or curtailed because of power or equipment failures, construction shutdowns, or other operating difficulties, San Jose Water Company has not had any interrupted or imposed mandatory curtailment of service to any type or class of customer with the exception of the summer of 1989 through March 1993, when rationing was imposed intermittently on customers at the request of SCVWD.

California faces long-term water supply challenges. San Jose Water Company actively works with SCVWD to meet the challenges by continuing to educate customers on responsible water use practices and to conduct long-range water supply planning.

CLWSC’s water supply consists of groundwater from wells and purchased raw water from the Guadalupe-Blanco River Authority (“GBRA”). CLWSC has long-term agreements with GBRA, which expire in 2044 and 2050. The agreements provide CLWSC with 6,700 acre-feet of water per year from Canyon Lake at prices to be adjusted periodically by GBRA.

Please also see further discussion under Item 1A, “Risk Factors” and Item 7, “Management’s Discussion and Analysis of Financial Condition and Results of Operations.”

6

Table of Contents

Franchises

Franchises granted by local jurisdictions permit the Water Utility Services to construct, maintain, and operate a water distribution system within the streets and other public properties of a given jurisdiction. San Jose Water Company holds the necessary franchises to provide water in portions of the cities of San Jose and Cupertino and in the cities of Campbell, Monte Sereno and Saratoga, the town of Los Gatos and the unincorporated areas of Santa Clara County. None of the franchises have a termination date, other than the franchise for the unincorporated areas of Santa Clara County, which terminates in 2020.

Seasonal Factors

Water sales are seasonal in nature and influenced by weather conditions. The timing of precipitation and climatic conditions can cause seasonal water consumption by residential customers to vary significantly. Demand for water is generally lower during the cooler and rainy winter months. Demand increases in the spring when the temperature rises and the rain ends.

Competition

San Jose Water Company and CLWSC are public utilities regulated by the CPUC and TCEQ, respectively, and operate within a service area approved by the regulators. The statutory laws provide that no other investor-owned public utility may operate in the public utilities’ service areas without first obtaining from the regulator a certificate of public convenience and necessity. Past experience shows such a certificate will be issued only after demonstrating that service in such area is inadequate.

California law also provides that whenever a public agency constructs facilities to extend utility service to the service area of a privately-owned public utility, like San Jose Water Company, such an act constitutes the taking of property and is conditioned upon payment of just compensation to the private utility.

Under the statutory constitution, municipalities, water districts and other public agencies have been authorized to engage in the ownership and operation of water systems. Such agencies are empowered to condemn properties operated by privately-owned public utilities upon payment of just compensation and are further authorized to issue bonds (including revenue bonds) for the purpose of acquiring or constructing water systems. To the company’s knowledge, no municipality, water district or other public agency has pending any action to condemn any part of its water systems.

Environmental Matters

The Water Utility Services’ procedures produce potable water in accordance with all applicable county, state and federal environmental rules and regulations. Additionally, public utilities are subject to environmental regulation by various other state and local governmental authorities.

The Water Utility Services are currently in compliance with all of the United States Environmental Protection Agency’s (the “EPA”) surface water treatment performance standards, drinking water standards for disinfection by-products and primary maximum contaminant levels. These standards have been adopted and are enforced by the California Department of Public Health (“CDPH”) and the TCEQ for San Jose Water Company and CLWSC, respectively.

Other state and local environmental regulations apply to the Water Utility Services operations and facilities. These regulations relate primarily to the handling, storage and disposal of hazardous materials and discharges to waterways. As part of routine replacement of infrastructure, San Jose Water Company identified legacy equipment containing mercury which had leaked into the surrounding soil. San Jose Water Company has determined there is no risk of contamination to the water supply, has notified the appropriate authorities and is also working with an environmental consulting firm to remediate the effected area and assess other potential sites. SJW Corp. believes there will be no material financial impact.

7

Table of Contents

San Jose Water Company is currently in compliance with all state and local regulations governing hazardous materials, point and non-point source discharges and the warning provisions of the California Safe Drinking Water and Toxic Enforcement Act of 1986. Please also see Part II, Item 7, “Management’s Discussion and Analysis of Financial Condition and Results of Operations.”

Employees

As of December 31, 2009, SJW Corp. had 375 employees, of whom 337 were San Jose Water Company employees and 38 were CLWSC employees. At San Jose Water Company, 99 were executive, administrative or supervisory personnel, and 238 were members of unions. On October 20, 2009, San Jose Water Company reached a one-year collective bargaining agreement with the Utility Workers of America, representing the majority of all employees, and the International Union of Operating Engineers, representing certain employees in the engineering department, covering the period from January 1, 2010 through December 31, 2010. The agreements include no wage adjustment for union workers for the calendar year 2010 or benefit modifications. As of December 31, 2009, CLWSC had 38 employees, of whom 9 were exempt and 29 were non-exempt employees. Non-exempt employees are subject to overtime but are not union represented.

Officers of the Registrant

| Name |

Age | Offices and Experience | ||

| G.J. Belhumeur |

64 | San Jose Water Company—Senior Vice President, Operations. Mr. Belhumeur has served as Senior Vice President of Operations since 2004. From 1996 to 2003, Mr. Belhumeur was Vice President of Operations. Mr. Belhumeur has been with San Jose Water Company since 1970. | ||

| D. Drysdale |

54 | San Jose Water Company—Vice President, Information Systems. Mr. Drysdale has served as Vice President of Information Systems since 2000. From 1998 to 1999, Mr. Drysdale was Director of Information Systems. From 1994 to 1998, Mr. Drysdale was Data Processing Manager. Mr. Drysdale joined San Jose Water Company in 1992. | ||

| D.A. Green |

47 | SJW Corp.—Chief Financial Officer and Treasurer. Mr. Green has served as Chief Financial Officer and Treasurer since August 11, 2008. He is also Chief Financial Officer and Treasurer of San Jose Water Company, SJW Land Company, SJWTX, Inc. and Texas Water Alliance Limited. From 2006 to 2008, Mr. Green served as the Chief Financial Officer, Treasurer and Vice President for Specialized Health Products International, Inc. From 2003 to 2006, Mr. Green served as the Managing Director of Investment Banking for Duff & Phelps, LLC. | ||

| C.S. Giordano |

53 | San Jose Water Company—Officer, Chief Engineer. Mr. Giordano has served as Chief Engineer since January 2008. From June 2007 to January 2008, Mr. Giordano was Chief Engineer. From August 2000 to June 2007, Mr. Giordano was Director of Engineering and Construction. From January 1994 to August 2000, Mr. Giordano was Assistant Chief Engineer. Mr. Giordano has been with San Jose Water Company since 1994. | ||

| P. L. Jensen |

50 | San Jose Water Company—Vice President, Regulatory Affairs. Mr. Jensen has served as Vice President of Regulatory Affairs since July 2007. From 1995 to July 2007, Mr. Jensen was Director of Regulatory Affairs. Mr. Jensen has been with San Jose Water Company since 1995. | ||

| S. Papazian |

34 | SJW Corp.—Corporate Secretary and Attorney. Ms. Papazian has served as Corporate Secretary and Attorney for SJW Corp. and San Jose Water Company since February 14, 2005. She is also Corporate Secretary of SJW Land Company, SJWTX, Inc. and Texas Water Alliance Limited. She was admitted to the California State Bar in January 2000 and thereafter was an Associate Attorney at The Corporate Law Group from March 2000 until February 2005. |

8

Table of Contents

| Name |

Age | Offices and Experience | ||

| W.R. Roth |

57 | SJW Corp.—President and Chief Executive Officer of SJW Corp., San Jose Water Company, SJW Land Company, SJWTX, Inc. and Texas Water Alliance Limited. Mr. Roth was appointed Chief Executive Officer of SJW Corp. in 1999 and President in 1996. Mr. Roth has been with San Jose Water Company since 1990. | ||

| W. Avila-Walker |

46 | San Jose Water Company—Controller. Ms. Avila-Walker has served as Controller since September 21, 2009. From August 2008 to September 2009, Ms. Avila-Walker served as Director of Compliance. From May 2005 to May 2008, Ms. Avila-Walker served as Director of Reporting and Finance. | ||

| A. Yip |

56 | SJW Corp.—Executive Vice President of Finance. Ms. Yip has served as Executive Vice President of Finance for SJW Corp. and San Jose Water Company since August 2008. From October 1996 to August 2008, Ms. Yip served as Chief Financial Officer and Treasurer of SJW Corp., and Senior Vice President of Finance, Chief Financial Officer and Treasurer of San Jose Water Company since April 2004. From January 1999 to April 2004, Ms. Yip served as Vice President of Finance, Chief Financial Officer and Treasurer of San Jose Water Company. She is also Executive Vice President, Finance of SJWTX, Inc., SJW Land Company and Texas Water Alliance Limited. Ms. Yip has been with San Jose Water Company since 1986. Ms. Yip is a certified public accountant. | ||

| R.S. Yoo |

59 | San Jose Water Company—Chief Operating Officer. Mr. Yoo has served as Chief Operating Officer since July 2005. From April 2003 to July 2005, Mr. Yoo was Senior Vice President of Administration. From April 1996 to April 2003, Mr. Yoo was Vice President of Water Quality. Mr. Yoo has served as President of Crystal Choice Water Service LLC from January 2001 to August 2005 and Manager from January 2001 to January 2007. Mr. Yoo was appointed Vice President of SJWTX, Inc. from September 2005 to April 2008. Mr. Yoo has been with San Jose Water Company since 1985. |

Financial Information about Foreign and Domestic Operations and Export Sales

SJW Corp.’s revenue and expense are derived substantially from Water Utility Services’ operations located in the County of Santa Clara in the State of California and Comal County in the State of Texas.

Website Access to Reports

SJW Corp.’s Annual Reports on Form 10-K, Quarterly Reports on Form 10-Q and Current Reports on Form 8-K, and amendments to these reports, are made available free of charge through SJW Corp.’s website at http://www.sjwater.com, as soon as reasonably practicable, after SJW Corp. electronically files such material with, or furnishs such material to, the SEC. The content of SJW Corp.’s website is not intended to be incorporated by reference or part of this report.

| Item 1A. | Risk Factors |

Investors should carefully consider the following risk factors and warnings before making an investment decision. The risks described below are not the only ones facing SJW Corp. Additional risks that SJW Corp. does not yet know of or that it currently thinks are immaterial may also impair its business operations. If any of the following risks actually occur, SJW Corp.’s business, operating results or financial condition could be materially harmed. In such case, the trading price of SJW Corp.’s common stock could decline and you may lose all or part of your investment. Investors should also refer to the other information set forth in this Form 10-K, including the financial statements and the notes thereto.

9

Table of Contents

The business of SJW Corp. and its subsidiaries may be adversely affected by new and changing legislation, policies and regulations.

New legislation and changes in existing legislation by federal, state and local governments and administrative agencies can affect the operations of SJW Corp. and its subsidiaries. San Jose Water Company and CLWSC are regulated public utilities. The operating revenue of San Jose Water Company results from the sale of water at rates authorized by the CPUC. The operating revenue of CLWSC results from the sale of water at rates authorized by the TCEQ. The CPUC and TCEQ set rates that are intended to provide revenues sufficient to recover operating expenses and produce a reasonable return on common equity. Please refer to Part I, Item 1, “Regulation and Rates” for a discussion of the most recent rate cases for San Jose Water Company, which has a three year rate case, and CLWSC, which has a one year rate case. Although the Water Utility Services believe that the rates currently in effect provide it with a reasonable rate of return, there is no guarantee such rates will be sufficient to provide a reasonable rate of return in the future. There is no guarantee that the Water Utility Service’s future rate filings will be able to obtain a satisfactory rate of return in a timely manner. If the rates for the Water Utility Services are too low, our revenues may be too low to cover the Water Utility Services’ operating expenses, capital requirements and SJW Corp.’s historical dividend rate.

In addition, the Water Utility Services rely on policies and regulations promulgated by the regulators in order to recover capital expenditures, maintain favorable treatment on gains from the sale of real property, offset its production and operating costs, recover the cost of debt, maintain an optimal equity structure without over-leveraging, and have financial and operational flexibility to engage in non-tariffed operations. If the regulators implement policies and regulations that will not allow San Jose Water Company and CLWSC to accomplish some or all of the items listed above, the Water Utility Services future operating results may be adversely affected.

Recovery of regulatory assets is subject to adjustment by the regulatory agency and could impact the operating results of the Water Utility Services.

Generally accepted accounting principles for water utilities include the recognition of regulatory assets and liabilities as permitted by FASB ASC Topic 980—“Regulated Operations.” In accordance with ASC Topic 980, the Water Utility Services record deferred costs and credits on the balance sheet as regulatory assets and liabilities when it is probable that these costs and credits will be recovered in the ratemaking process in a period different from when the costs and credits were incurred. If the assessment of the probability of recovery in the ratemaking process is incorrect and the applicable ratemaking body determines that a deferred cost is not recoverable through future rate increases, the regulatory assets or liabilities would need to be adjusted, which could have an adverse effect on our financial results.

Changes in water supply, water supply costs or the mix of water supply could adversely affect the operating results and business of the Water Utility Services.

San Jose Water Company’s supply of water primarily relies upon three main sources: water purchased from SCVWD, surface water from its Santa Cruz Mountains Watershed, and pumped underground water. Changes and variations in quantities from each of these three sources affect the overall mix of the water supply, thereby affecting the cost of the water supply. Surface water is the least costly source of water. If there is an adverse change to the mix of water supply and San Jose Water Company is not allowed by the CPUC to recover the additional or increased water supply costs, its operating results may be adversely affected.

SCVWD receives an allotment of water from state and federal water projects. If San Jose Water Company has difficulties obtaining a high quality water supply from SCVWD due to availability, environmental, legal or other restrictions (see also Part I, Item 1, “Water Supply”), it may not be able to fully satisfy customer demand in its service area and its operating results and business may be adversely affected. Additionally, the availability of water from San Jose Water Company’s Santa Cruz Mountains Watershed depends on the weather and fluctuates with each season. In a normal year, surface water supply provides 6% to 8% of the total water supply of the

10

Table of Contents

system. In a season with little rainfall, water supply from surface water sources may be low, thereby causing San Jose Water Company to increase the amount of water purchased from outside sources at a higher cost than surface water, thus increasing water production costs.

In addition, San Jose Water Company’s ability to use surface water is subject to regulations regarding water quality and volume limitations. If new regulations are imposed or existing regulations are changed or given new interpretations, the availability of surface water may be materially reduced. A reduction in surface water could result in the need to procure more costly water from other sources, thereby increasing overall water production costs and adversely affecting the operating results of San Jose Water Company.

Because the extraction of water from the groundwater basin and the operation of the water distribution system require a significant amount of energy, increases in energy prices could increase operating expenses of San Jose Water Company. In the aftermath of the attempt to deregulate the California energy market, energy costs still remain in flux, with resulting uncertainty in San Jose Water Company’s ability to contain energy costs into the future.

San Jose Water Company continues to utilize Pacific Gas & Electric’s time of use rate schedules to minimize its overall energy costs primarily for groundwater pumping. During the winter months, typically 90% or more of the groundwater is produced during off-peak hours when electrical energy is consumed at the lowest rates. Optimization and energy management efficiency is achieved through the implementation of Supervisory Control and Data Acquisition system software applications that control pumps based on demand and cost of energy. An increase in demand or a reduction in the availability of surface water or import water could result in the need to pump more water during peak hours adversely affecting the operating results of San Jose Water Company.

CLWSC’s primary water supply is 6,700 acre-feet of water which is pumped from Canyon Lake at two lake intakes, in accordance with the terms of its contracts with the GBRA, which are long-term take-or-pay contracts. This supply is supplemented by groundwater pumped from wells. Texas, similar to California, faces similar operating challenges as described above and long-term water supply constraints. (See also Part I, Item 1, “Water Supply”)

Fluctuations in customer demand for water due to seasonality, restrictions of use, weather, and lifestyle can adversely affect operating results.

The Water Utility Services’ operations are seasonal. Thus, results of operations for one quarter do not indicate results to be expected in subsequent quarters. Rainfall and other weather conditions also affect the operations of the Water Utility Services. Most water consumption occurs during the third quarter of each year when weather tends to be warm and dry. In drought seasons, if customers are encouraged and required to conserve water due to a shortage of water supply or restriction of use, revenue tends to be lower. Similarly, in unusually wet seasons, water supply tends to be higher and customer demand tends to be lower, again resulting in lower revenues. Furthermore, certain lifestyle choices made by customers can affect demand for water. For example, a significant portion of residential water use is for outside irrigation of lawns and landscaping. If there is a decreased desire by customers to maintain landscaping for their homes, residential water demand could decrease, which may result in lower revenues. Conservation efforts and construction codes, which require the use of low-flow plumbing fixtures, could diminish water consumption and result in reduced revenue. (See also Part I, Item 1, “Water Supply”)

A contamination event or other decline in source water quality could affect the water supply of the Water Utility Services and therefore adversely affect the business and operating results.

The Water Utility Services are required under environmental regulations to comply with water quality requirements. Through water quality compliance programs, the Water Utility Services continually monitor for contamination and pollution of its sources of water. In addition, a Watershed Management Program provides a proactive approach to minimize potential contamination activities. There can be no assurance that SJW Corp.

11

Table of Contents

will continue to comply with all applicable water quality requirements. In the event a contamination is detected, the Water Utility Services will either have to commence treatment to remove the contaminant or procure water from an alternative source. Either of these results may be costly, may increase future capital expenditures and there can be no assurance that the regulators would approve a rate increase to enable us to recover the costs arising from these remedies.

The Water Utility Services are subject to litigation risks concerning water quality and contamination.

Although the Water Utility Services have not been and are not a party to any environmental and product-related lawsuits, such lawsuits against other water utilities have increased in frequency in recent years. If the Water Utility Services are subject to an environmental or product-related lawsuit, they might incur significant legal costs and it is uncertain whether they would be able to recover the legal costs from ratepayers or other third parties. Although the Water Utility Services have product liability insurance coverage for bodily injury and property damage, pollution is excluded from this coverage. In addition, our pollution liability policy does not extend coverage for product liability.

New or more stringent environmental regulations could increase the Water Utility Services’ operating costs and affect its business.

The Water Utility Services’ operations are subject to water quality and pollution control regulations issued by the EPA and environmental laws and regulations administered by the respective states and local regulatory agencies.

Stringent environmental and water quality regulations could increase the Water Utility Services’ water quality compliance costs, hamper the Water Utility Services’ available water supplies, and increase future capital expenditure.

Under the federal Safe Drinking Water Act, the Water Utility Services are subject to regulation by the EPA of the quality of water it sells and treatment techniques it uses to make the water potable. The EPA promulgates nationally applicable standards, including maximum contaminant levels for drinking water. The Water Utility Services are currently in compliance with all of the primary maximum contaminant levels promulgated to date. Additional or more stringent requirements may be adopted by each state. There can be no assurance that the Water Utility Services will be able to continue to comply with all water quality requirements.

The Water Utility Services have implemented monitoring activities and installed specific water treatment improvements enabling it to comply with existing maximum contaminant levels and plan for compliance with future drinking water regulations. However, the EPA and the respective state agencies have continuing authority to issue additional regulations under the Safe Drinking Water Act. It is possible that new or more stringent environmental standards could be imposed that will raise the Water Utility Services’ operating costs. Future drinking water regulations may require increased monitoring, additional treatment of underground water supplies, fluoridation of all supplies, more stringent performance standards for treatment plants and procedures to further reduce levels of disinfection by-products. The Water Utility Services continues to seek mechanisms for recovery of government-mandated environmental compliance costs. There are currently limited regulatory mechanisms and procedures available to the company for the recovery of such costs and there can be no assurance that such costs will be fully recovered.

Costs associated with security precautions may have an adverse effect on the operating results of the Water Utility Services.

Water utility companies have generally been on a heightened state of alert since the threats to the nation’s health and security in September of 2001. San Jose Water Company has taken steps to increase security at its water utility facilities and continues to implement a comprehensive security upgrade program for production and storage facilities, pump stations and company buildings. San Jose Water Company also coordinates security and planning information with SCVWD, other Bay Area water utilities and various governmental and law enforcement agencies.

12

Table of Contents

San Jose Water Company conducted a system-wide vulnerability assessment in compliance with federal regulations Public Law 107-188 imposed on all water utilities. The assessment report was filed with the EPA on March 31, 2003. San Jose Water Company has also actively participated in the security vulnerability assessment training offered by the American Water Works Association Research Foundation and the EPA.

The vulnerability assessment identified system security enhancements that impact water quality, health, safety, and continuity of service totaling approximately $2,300,000. These improvements were incorporated into the capital budgets and were completed as of December 31, 2006. San Jose Water Company has and will continue to bear costs associated with additional security precautions to protect its water utility business and other operations. While some of these costs are likely to be recovered in the form of higher rates, there can be no assurance that the CPUC will approve a rate increase to recover all or part of such costs and, as a result, the company’s operating results and business may be adversely affected.

CLWSC evaluated its security measures and has completed and implemented a new risk management plan. As a result, CLWSC replaced all building and chemical vessel locks, installed new fences at the Park Shores Water Treatment Plant and several wells, repaired fences at other well sites, improved exterior lighting at the water treatments plants and installed new network firewalls for its computer systems.

The Water Utility Services rely on information technology and systems that are key to business operations, therefore a disruption in service could adversely effect business operations.

Information technology is key to the operation of the Water Utility Services, including but not limited to bill remittance processing, providing customer service and the use of Supervisory Control and Data Acquisition systems to operate the distribution system. A disruption of a business system that supports any of these functions could significantly impact our ability to provide services to our customers and could adversely affect our operating results.

SJW Land Company’s significant increase in its real estate portfolio.

SJW Land Company owns a diversified real estate portfolio in multiple states. The risks in investing directly in real estate vary depending on the investment strategy and investment objective.

| • | Liquidity risk—real estate investment is illiquid. The lag time to build or reduce its portfolio is long. |

| • | Obsolescence risk—real estate property is location specific. Location obsolescence can occur due to a decline of a particular sub-market or neighborhood. Functional obsolescence can also occur from physical depreciation, wear and tear, and other architectural and physical features which could be curable or incurable. |

| • | Market and general economic risks—real estate investment is tied to overall domestic economic growth and, therefore, carries market risk which cannot be eliminated by diversification. Generally, all property types benefit from national economic growth, though the benefits range according to local factors, such as local supply and demand and job creation. Because real estate leases are typically staggered and last for multiple years, there is generally a lag effect in the performance of real estate in relation to the overall economy. This lag effect can insulate or deteriorate the financial impact to SJW Land Company in a downturn or an improved economic environment. |

Vacancy rates can climb and market rents can be impacted and weakened by general economic forces, therefore affecting income to SJW Land Company.

The value of real estate can drop materially due to a deflationary market, decline in rental income, market cycle of supply and demand, long lag time in real estate development, legislative and governmental actions, environmental concerns, and fluctuation of interest rates, eroding any unrealized capital appreciation and, potentially, invested capital.

13

Table of Contents

| • | Concentration/Credit risk—the risk of a tenant declaring bankruptcy and seeking relief from its contractual rental obligation could affect the income and the financial results of SJW Land Company. Diversification of many tenants across many properties may mitigate the risk, but can never eliminate it. This risk is most prevalent in a recessionary environment. |

The success of SJW Land Company’s real estate investment strategy depends largely on ongoing local, state and federal land use development activities and regulations, future economic conditions, the development and fluctuations in the sale of the undeveloped properties, the ability to identify the developer/potential buyer of the available for sale real estate, the timing of the transaction, favorable tax law, the ability to identify and acquire high quality, relatively low risk replacement property at reasonable terms and conditions, and the ability to maintain and manage the replacement property.

The water utility business requires significant capital expenditures that are dependent on our ability to secure appropriate funding. If SJW Corp. is unable to obtain sufficient capital or if the rates at which we borrow increase, there would be a negative impact on our results of operations.

The water utility business is capital-intensive. In 2009 and 2008, we spent $57,300,000 and $68,900,000, respectively, for additions to, or replacements of, property, plant and equipment for our Water Utility Services and we plan to spend $91,500,000 in 2010. SJW Corp. funds these expenditures through a variety of sources, including cash received from operations, funds received from developers as contributions or advances and borrowing. SJW Corp. relies upon a line of credit, which will expire on June 1, 2010, to fund capital expenditures in the short term and has historically issued long-term debt to refinance the short-term debt. We cannot provide any assurance that the historical sources of funds for capital expenditures will continue to be adequate or that the cost of funds will remain at levels permitting us to earn a reasonable rate of return. A significant change in any of the funding sources could impair the ability of the Water Utility Services to fund its capital expenditures, which could impact our ability to grow our utility asset base and earnings. Any increase in the cost of capital through higher interest rates or otherwise could adversely affect our results of operations.

Our ability to borrow funds may be affected by the ongoing national and international financial crisis. Disruptions in the capital and credit markets or further deteriorations in the strength of financial institutions could adversely affect SJW Corp.’s ability to draw on its line of credit, replace the line of credit following its expiration or place long-term debt. In addition, government policies, the state of the credit markets and other factors could result in increased interest rates, which would increase SJW Corp.’s cost of capital.

Other factors that could affect operating results.

Other factors that could adversely affect the operating results of SJW Corp. and its subsidiaries include the following:

| • | SJW Corp.’s growth strategy depends on its ability to acquire water systems in order to broaden its service areas, SJW Land Company’s ability to continue to develop and invest in real estate investments at favorable terms, and San Jose Water Company’s ability to continue to broaden and expand its nonregulated contract services in the metropolitan San Jose area. The execution of SJW Corp.’s growth strategy will expose it to different risks than those associated with the current utility operations. Costs are incurred in connection with the execution of the growth strategy and risks are involved in potential integration of acquired businesses/properties which could require significant costs and cause diversion of management’s time and resources. Any future acquisition SJW Corp. decides to undertake may involve risks and have a material adverse effect on SJW Corp.’s core business, impact SJW Corp.’s ability to finance its business and affect its compliance with regulatory requirements. Any businesses SJW Corp. acquires may not achieve sales, customer growth and projected profitability that would justify the investment. Any difficulties SJW Corp. encounters in the integration process, including the integration of controls necessary for internal control and financial reporting, could interfere with its operations, reduce its operating margins and adversely affect its internal controls. |

14

Table of Contents

| • | The level of labor and non-labor operating and maintenance expenses as affected by inflationary forces and collective bargaining power could adversely affect the operating and maintenance expenses of SJW Corp. |

| • | The City of Cupertino lease operation could be adversely affected by: (1) the level of capital requirements, (2) the ability of San Jose Water Company to raise rates through the Cupertino City Council, and (3) the level of operating and maintenance expenses. |

| Item 1B. | Unresolved Staff Comments |

None.

| Item 2. | Properties |

The properties of San Jose Water Company consist of a unified water production system located in the County of Santa Clara in the State of California. In general, the property is comprised of franchise rights, water rights, necessary rights-of-way, approximately 7,000 acres of land held in fee (which is primarily non-developable watershed), impounding reservoirs with a capacity of approximately 2.256 billion gallons, diversion facilities, wells, distribution storage of approximately 250 million gallons, and all water facilities, equipment, office buildings and other property necessary to supply its customers.

San Jose Water Company maintains all of its properties in good operating condition in accordance with customary practice for a water utility. San Jose Water Company’s groundwater pumping stations have a production capacity of approximately 256 million gallons per day and the present capacity for taking purchased water is approximately 172 million gallons per day. The surface water collection system has a physical delivery capacity of approximately 35 million gallons per day. During 2009, a maximum and average of 179 million gallons and 124 million gallons of water per day, respectively, were delivered to the system.

The Water Utility Services hold all its principal properties in fee, subject to current tax and assessment liens, rights-of-way, easements, and certain minor defects in title which do not materially affect their use.

SJW Land Company owns approximately 92 acres of property in the states of Connecticut, Florida, Texas, Arizona and Tennessee and approximately five undeveloped acres of land and two acres of land with commercial properties primarily in the San Jose metropolitan area. One of the two commercial buildings in San Jose, California is owned by SJW Land Company, which has a 70% limited partnership interest in 444 West Santa Clara Street, L.P., a real estate limited partnership that owns and operates an office building. SJW Land Company consolidates its limited partnership interest in 444 West Santa Clara Street, L.P. as a variable interest entity within the scope of FASB ASC Topic 810—“Consolidation.” The following table is a summary of SJW Land Company properties described above:

| Percentage as of December 31, 2009 of SJW Land Company |

||||||||||||

| Description |

Location |

Acreage | Square Footage | Revenue | Expense | |||||||

| 2 Commercial buildings |

San Jose, California | 2 | 28,000 | 23 | % | 12 | % | |||||

| Warehouse building |

Windsor, Connecticut | 17 | 170,000 | 20 | % | 10 | % | |||||

| Warehouse building |

Orlando, Florida | 8 | 147,000 | 11 | % | 6 | % | |||||

| Retail building |

El Paso, Texas | 2 | 14,000 | 8 | % | 1 | % | |||||

| Warehouse building |

Phoenix, Arizona | 11 | 176,000 | 22 | % | 9 | % | |||||

| Warehouse building |

Knoxville, Tennessee | 29 | 346,000 | 10 | % | 39 | % | |||||

| Commercial building |

Knoxville, Tennessee | 15 | 135,000 | 6 | % | 23 | % | |||||

| Undeveloped land |

Knoxville, Tennessee | 10 | N/A | N/A | N/A | |||||||

| Undeveloped land |

San Jose, California | 5 | N/A | N/A | N/A | |||||||

15

Table of Contents

| Item 3. | Legal Proceedings |

SJW Corp. is subject to litigation incidental to its business. However, there are no pending legal proceedings to which SJW Corp. or any of its subsidiaries is a party or to which any of its properties is the subject that are expected to have a material effect on SJW Corp.’s financial position, results of operations or cash flows.

| Item 4. | Reserved |

16

Table of Contents

PART II

| Item 5. | Market for Registrant’s Common Equity, Related Stockholder Matters and Issuer Purchases of Equity Securities |

Market Information

SJW Corp.’s common stock is traded on the New York Stock Exchange under the symbol SJW. Information as to the high and low sales prices for SJW Corp.’s common stock for each quarter in the 2009 and 2008 fiscal years is contained in the section captioned “Market price range of stock” in the tables set forth in Note 16 of “Notes to Consolidated Financial Statements” in Part II, Item 8.

As of December 31, 2009, there were 503 record holders of SJW Corp.’s common stock.

Dividends

Dividends have been paid on SJW Corp.’s and its predecessor’s common stock for 265 consecutive quarters and the annual dividend amount has increased in each of the last 42 years. Additional information as to the cash dividends paid on common stock in 2009 and 2008 is contained in the section captioned “Dividend per share” in the tables set forth in Note 16 of “Notes to Consolidated Financial Statements” in Part II, Item 8. Future dividends will be determined by the Board of Directors after consideration of various financial, economic and business factors.

17

Table of Contents

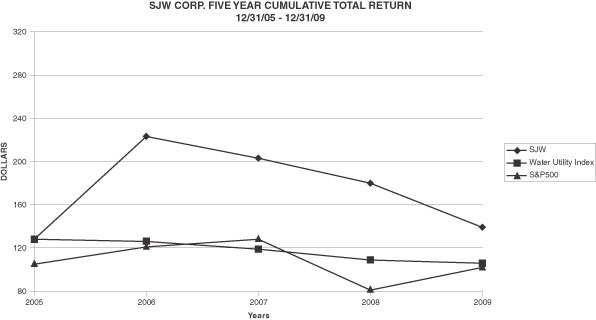

Five-Year Performance Graph

The following performance graph compares the changes in the cumulative shareholder return on SJW Corp.’s common stock with the cumulative total return on the Water Utility Index and the Standard & Poor’s 500 Index during the last five years ended December 31, 2009. The comparison assumes $100 was invested on December 31, 2004 in SJW Corp.’s common stock and in each of the foregoing indices and assumes reinvestment of dividends.

The following descriptive data is supplied in accordance with Rule 304(d) of Regulation S-T:

| 2004 | 2005 | 2006 | 2007 | 2008 | 2009 | |||||||

| SJW Corp. |

100 | 128 | 223 | 203 | 180 | 139 | ||||||

| Water Utility Index |

100 | 128 | 126 | 119 | 109 | 106 | ||||||

| S&P500 |

100 | 105 | 121 | 128 | 81 | 102 |

The Water Utility Index is the 12 water company Water Utility Index prepared by Wells Fargo.

18

Table of Contents

| Item 6. | Selected Financial Data |

FIVE YEAR STATISTICAL REVIEW

SJW Corp. and Subsidiaries

| 2009 | 2008 | 2007 | 2006 | 2005 | |||||||||||

| CONSOLIDATED RESULTS OF OPERATIONS (in thousands) |

|||||||||||||||

| Operating revenue |

$ | 216,097 | 220,347 | 206,601 | 189,238 | 180,105 | |||||||||

| Operating expense: |

|||||||||||||||

| Purchased water |

45,317 | 48,291 | 48,596 | 44,896 | 44,953 | ||||||||||

| Power |

6,582 | 7,559 | 7,532 | 5,170 | 4,318 | ||||||||||

| Groundwater extraction charges |

31,635 | 34,368 | 30,141 | 18,737 | 17,362 | ||||||||||

| Administrative and general |

27,658 | 23,688 | 22,334 | 21,108 | 20,697 | ||||||||||

| Other |

17,861 | 16,390 | 14,907 | 15,095 | 14,183 | ||||||||||

| Maintenance |

13,172 | 13,123 | 11,628 | 10,189 | 9,475 | ||||||||||

| Property taxes and other nonincome taxes |

8,549 | 6,793 | 6,307 | 5,893 | 5,673 | ||||||||||

| Depreciation and amortization |

25,643 | 24,043 | 22,854 | 21,299 | 19,654 | ||||||||||

| Income taxes |

10,280 | 13,198 | 12,549 | 15,298 | 14,773 | ||||||||||

| Total operating expense |

186,697 | 187,453 | 176,848 | 157,685 | 151,088 | ||||||||||

| Operating income |

29,400 | 32,894 | 29,753 | 31,553 | 29,017 | ||||||||||

| Interest expense, other income and deductions |

(14,229 | ) | (11,433 | ) | (10,430 | ) | 7,028 | (7,177 | ) | ||||||

| Net income |

15,171 | 21,461 | 19,323 | 38,581 | 21,840 | ||||||||||

| Dividends paid |

12,202 | 11,875 | 11,089 | 10,549 | 9,777 | ||||||||||

| Invested in the business |

$ | 2,969 | 9,586 | 8,234 | 28,032 | 12,063 | |||||||||

| CONSOLIDATED PER SHARE DATA (BASIC) |

|||||||||||||||

| Net income |

$ | 0.82 | 1.17 | 1.05 | 2.11 | 1.20 | |||||||||

| Dividends paid |

$ | 0.66 | 0.65 | 0.60 | 0.57 | 0.53 | |||||||||

| Shareholders’ equity at year-end |

$ | 13.67 | 13.81 | 12.92 | 12.48 | 10.73 | |||||||||

| CONSOLIDATED BALANCE SHEET (in thousands) |

|||||||||||||||

| Utility plant and intangible assets |

$ | 944,026 | 878,743 | 816,310 | 740,419 | 664,117 | |||||||||

| Less accumulated depreciation and amortization |

298,921 | 272,562 | 255,025 | 234,173 | 208,909 | ||||||||||

| Net utility plant |

645,105 | 606,181 | 561,285 | 506,246 | 455,208 | ||||||||||

| Net real estate investment |

80,812 | 82,489 | 84,195 | 40,565 | 34,850 | ||||||||||

| Total assets |

878,474 | 850,877 | 767,326 | 705,864 | 587,709 | ||||||||||

| Capitalization: |

|||||||||||||||

| Shareholders’ equity |

252,756 | 254,326 | 236,934 | 228,182 | 195,908 | ||||||||||

| Long-term debt |

246,879 | 216,613 | 216,312 | 163,648 | 145,279 | ||||||||||

| Total capitalization |

$ | 499,635 | 470,939 | 453,246 | 391,830 | 341,187 | |||||||||

| OTHER STATISTICS—WATER UTILITY SERVICES |

|||||||||||||||

| Average revenue per customer |

$ | 919.95 | 914.46 | 860.23 | 809.56 | 792.08 | |||||||||

| Investment in utility plant per customer |

$ | 4,019 | 3,751 | 3,499 | 3,196 | 2,986 | |||||||||

| Unaudited |

|||||||||||||||

| Customers at year-end |

234,900 | 234,300 | 233,300 | 231,700 | 222,400 | ||||||||||

| Miles of main at year-end |

2,881 | 2,814 | 2,743 | 2,739 | 2,447 | ||||||||||

| Water production (million gallons) |

47,900 | 51,961 | 51,922 | 49,302 | 48,198 | ||||||||||

| Maximum daily production (million gallons) |

192 | 204 | 205 | 229 | 201 | ||||||||||

| Population served (estimate) |

1,058,800 | 1,056,100 | 1,051,600 | 1,044,400 | 1,002,400 | ||||||||||

19

Table of Contents

| Item 7. | Management’s Discussion and Analysis of Financial Condition and Results of Operations |

Description of Business

SJW Corp. is a publicly traded company and is a holding company with four subsidiaries:

San Jose Water Company, a wholly owned subsidiary, is a public utility in the business of providing water service to approximately 226,000 connections that serve a population of approximately one million people in an area comprising approximately 142 square miles in the metropolitan San Jose, California area. The United States water utility industry is largely fragmented and is dominated by municipal-owned water systems. The water industry is regulated, and provides a life-sustaining product. This makes water utilities subject to lower business cycle risks than nonregulated industries.

SJW Land Company, a wholly owned subsidiary, owns undeveloped land in the states of California and Tennessee, owns and operates commercial buildings in the states of California, Florida, Connecticut, Texas, Arizona and Tennessee and has a 70% limited partnership interest in 444 West Santa Clara Street, L.P.

SJWTX, Inc., a wholly owned subsidiary of SJW Corp., was incorporated in the State of Texas in 2005. SJWTX, Inc. is doing business as Canyon Lake Water Service Company (CLWSC). CLWSC is a public utility in the business of providing water service to approximately 9,000 connections that serve approximately 36,000 people in western Comal County and southern Blanco County. The company’s service area comprises more than 237 square miles in the growing region between San Antonio and Austin.

TWA, a wholly owned subsidiary of SJW Corp., is undertaking activities that are necessary to develop a water supply project in Texas.

SJW Corp. also owns 1,099,952 shares or approximately 5% of California Water Service Group as of December 31, 2009.

Business Strategy

SJW Corp. focuses its business initiatives in four strategic areas:

| (1) | Regional regulated water utility operations. |

| (2) | Regional nonregulated water utility related services provided in accordance with the guidelines established by the CPUC. |

| (3) | Out-of-region water and utility related services, primarily in the Western United States. |

| (4) | Real estate investment activities in SJW Land Company. |

SJW Corp. cannot be certain it will be successful in consummating any strategic business acquisitions relating to such opportunities noted above. In addition, any transaction will involve numerous risks. Some of the risks include the possibility of paying more than the value derived from the acquisition, the assumption of certain known and unknown liabilities related to the acquired assets, the risk of diverting management’s attention from day-to-day operations of the business, the potential for a negative impact to SJW Corp.’s financial position and operating results, the risks of entering markets in which SJW Corp. has no or limited direct prior experience and the potential loss of key employees of any acquired company. SJW Corp. cannot be certain that any transaction will be successful and will not materially harm its operating results or financial condition.

Regional Regulated Activities

SJW Corp.’s regulated utility operation is conducted through San Jose Water Company and CLWSC. SJW Corp. plans and applies a diligent and disciplined approach to maintaining and improving its water system infrastructure. It also seeks to acquire regulated water systems adjacent to or near its existing service territory.

20

Table of Contents

Regional Nonregulated Activities

Operating in accordance with guidelines established by the CPUC, San Jose Water Company provides nonregulated water services under agreements with municipalities and other utilities. Nonregulated services include full water system operations and billing and cash remittance services.

San Jose Water Company also seeks appropriate nonregulated business opportunities that complement its existing operations or that allow it to extend its core competencies beyond existing operations. San Jose Water Company seeks opportunities to fully utilize its capabilities and existing capacity by providing services to other regional water systems, benefiting its existing regional customers through increased efficiencies.

Out-of-Region Opportunities

SJW Corp. also from time to time pursues opportunities to participate in out-of-region water and utility related services, particularly regulated water businesses, in the Western United States. SJW Corp. evaluates out-of-region and out-of-state opportunities that meet SJW Corp.’s risk and return profile.

The factors SJW Corp. considers in evaluating such opportunities include:

| • | regulatory environment; |

| • | synergy potential; |

| • | general economic conditions; |

| • | potential profitability; |

| • | additional growth opportunities within the region; |

| • | water supply, water quality and environmental issues; and |

| • | capital requirements. |

Real Estate Investment

SJW Land Company’s real estate investments diversify SJW Corp.’s asset base and balances SJW Corp.’s concentration in regulated assets. SJW Land Company implements its real estate investment strategy by exchanging selected real estate assets for investments with a capital structure that is consistent with SJW Corp.’s consolidated capital structure.

Critical Accounting Policies

SJW Corp. has identified accounting policies delineated below as the policies critical to its business operations and the understanding of the results of operations. The preparation of financial statements requires management to make estimates and assumptions that affect the reported amounts of assets and liabilities at the date of the financial statements and revenues and expenses during the reporting period. SJW Corp. bases its estimates on historical experience and other assumptions that are believed to be reasonable under the circumstances. For a detailed discussion on the application of these and other accounting policies, see Note 1 of “Notes to Consolidated Financial Statements.” SJW Corp.’s critical accounting policies are as follows:

Revenue Recognition

SJW Corp. recognizes its regulated and nonregulated revenue when services have been rendered, in accordance with FASB ASC Topic 605—“Revenue Recognition.”

Metered revenue of the Water Utility Services includes billing to customers based on meter readings plus an estimate of water used between the customers’ last meter reading and the end of the accounting period. The Water Utility Services read the majority of its customers’ meters on a bi-monthly basis and records its revenue

21

Table of Contents

based on its meter reading results. Unbilled revenue from the last meter reading date to the end of the accounting period is estimated based on the most recent usage patterns, production records and the effective tariff rates. Actual results could differ from those estimates, which would result in adjusting the operating revenue in the period which the revision to the Water Utility Services’ estimates are determined. As of December 31, 2009 and 2008, accrued unbilled revenue was $12,435,000 and $12,896,000, respectively.

Unaccounted-for water for 2009 and 2008 approximated 7.8% and 7.4%, respectively, as a percentage of production. The estimate is based on the results of past experience, the trend and efforts in reducing the Water Utility Services’ unaccounted-for water through main replacements and lost water reduction programs.

Revenues also include a surcharge collected from regulated customers that is paid to the CPUC. This surcharge is recorded both in operating revenues and administrative and general expenses. For the years ended December 31, 2009, 2008 and 2007, the surcharge was $3,303,000, $2,999,000 and $2,708,000, respectively.

SJW Corp. recognizes its nonregulated revenue based on the nature of the nonregulated business activities. Revenue from San Jose Water Company’s nonregulated utility operations and billing or maintenance agreements are recognized when services have been rendered. Revenue from SJW Land Company properties is generally recognized ratably over the term of the leases.

Recognition of Regulatory Assets and Liabilities

Generally accepted accounting principles for water utilities include the recognition of regulatory assets and liabilities as permitted by FASB ASC Topic 980—“Regulated Operations.” In accordance with ASC Topic 980, the Water Utility Services, to the extent applicable, record deferred costs and credits on the balance sheet as regulatory assets and liabilities when it is probable that these costs and credits will be recognized in the ratemaking process in a period different from when the costs and credits are incurred. Accounting for such costs and credits is based on management’s judgment and prior historical ratemaking practices, and it occurs when management determines that it is probable that these costs and credits will be recognized in the future revenue of the Water Utility Services through the ratemaking process. The regulatory assets and liabilities recorded by the Water Utility Services, in particular, San Jose Water Company, primarily relate to the recognition of deferred income taxes for ratemaking versus tax accounting purposes, and the postretirement pension benefits, medical costs, accrued benefits for vacation and asset retirement obligation that have not been passed through rates. The disallowance of any asset in future ratemaking, including deferred regulatory assets, would require San Jose Water Company to immediately recognize the impact of the costs for financial reporting purposes. No disallowances were recognized for the years ending December 31, 2009, 2008 and 2007. The net regulatory assets recorded by San Jose Water Company were $78,525,000 and $73,778,000 as of December 31, 2009 and 2008, respectively.

Pension Accounting

San Jose Water Company offers a defined benefit plan, an Executive Supplemental Retirement Plan and certain postretirement benefits other than pensions to employees retiring with a minimum level of service. Accounting for pensions and other postretirement benefits requires an extensive use of assumptions about the discount rate applied to expected benefit obligations, expected return on plan assets, the rate of future compensation increases received by the employees, mortality, turnover and medical costs. See assumptions and disclosures detailed in Note 10 of “Notes to Consolidated Financial Statements.”

The Pension Plan is administered by a committee that is composed of an equal number of company and union representatives (the “Committee”). Investment decisions have been delegated by the committee to an Investment Manager, presently Wachovia Securities, LLC. Investment guidelines provided to the Investment Manager require that at least 25% of plan assets be invested in bonds or cash. As of December 31, 2009, the plan assets consist of approximately 37% bonds, 4% cash and 59% equities. Furthermore, equities are to be diversified by industry groups and selected to achieve preservation of capital coupled with long-term growth

22

Table of Contents

through capital appreciation and income. They may not invest in commodities and futures contracts, private placements, options, letter stock, speculative securities, or hold more than 5% of assets of any one private corporation. They may only invest in bonds, commercial paper, and money market funds with acceptable ratings by Moody’s or Standard & Poor’s. The Investment Manager is reviewed regularly regarding performance by the Investment Consultant who provides quarterly reports to the Committee for review.

The market values of the plan assets are marked to market at the measurement date of December 31, 2009. The investment trust assets incur unrealized market gains or losses from time to time. As a result, the pension expense in 2009 included the amortization of unrealized market losses on pension assets. Both unrealized market gains and losses on pension assets are amortized over 12.93 years for actuarial expense calculation purposes. Market losses in 2008 increased pension expense by approximately $2,313,000 in 2009 and market losses in 2007 increased pension expense by approximately $142,000 in 2008.

Income Taxes

SJW Corp. estimates its federal and state income taxes as part of the process of preparing the financial statements. The process involves estimating the actual current tax exposure together with assessing temporary differences resulting from different treatment of items for tax and accounting purposes, including the evaluation of the treatment acceptable in the water utility industry and regulatory environment. These differences result in deferred tax assets and liabilities, which are included on the balance sheet. If actual results, due to changes in the regulatory treatment, or significant changes in tax-related estimates or assumptions or changes in law, differ materially from these estimates, the provision for income taxes will be materially impacted.

Balancing Account

Pursuant to Section 792.5 of the California Public Utilities Code, a balancing account must be maintained for each expense item for which revenue offsets have been authorized. The purpose of a balancing account is to track the under-collection or over-collection associated with expense changes and the revenue authorized by the CPUC to offset those expense changes.