Attached files

| file | filename |

|---|---|

| 8-K - FORM 8-K - Zep Inc. | d8k.htm |

Acquisition of Amrep, Inc. January 6, 2010 Exhibit 99.1 |

Cautionary and Forward-Looking Statements Copyright 2010. Zep Inc. - All rights reserved. 2 In connection with the acquisition of Amrep, Inc., Zep Inc. has performed due diligence procedures on and

reviewed the financial results of Amrep, Inc. contained within this presentation and other

related oral and written releases of information. The financial results of Amrep, Inc.

discussed herein represent results of Amrep, Inc. for the twelve month period beginning December 1, 2008 and ended November 30, 2009. Amrep, Inc. has operated as a privately held company with no interim audit

or review requirements. Moreover, Amrep, Inc. has a December 31 fiscal year end; therefore, the

financial results of Amrep, Inc. discussed herein and in other oral and written releases of

information have been subjected to neither audit nor review procedures conducted by an independent audit firm, and pre-acquisition due diligence procedures must not be considered a

substitute for such. Because substantially all of the twelve month period reflected in the

results presented herein has been neither audited by nor subject to the review of an independent

audit firm, the financial results presented herein are preliminary and subject to adjustment. Therefore, this financial information should be considered preliminary as actual historical financial results of Amrep,

Inc. could differ materially from these disclosures. Zep Inc. intends to file the

financial statements of Amrep, Inc. required by Regulation S-X and Form 8-K as they become available for filing with the Securities and Exchange Commission. These financial statements will

not include a trailing twelve month period ended November 30, 2009. This presentation also contains “forward-looking statements” within the meaning of the

Private Securities Litigation Reform Act of 1995. Forward-looking statements are subject to

certain risks and uncertainties that could cause actual results, expectations, or outcomes to

differ materially from the historical experience of Amrep, Inc. as well as Zep Inc.’s present expectations or projections. All statements other than statements of historical fact could be deemed forward-looking, including, but

not limited to, any projections of financial information; any statements about historical

results that may suggest trends; any statements of the plans, strategies, synergies, and

objectives of management for future operations; any statements of expectation or belief regarding future events, potential markets or market size, technology developments, or enforceability of intellectual property

rights; and any statements of assumptions underlying any of the items mentioned.

The statements contained herein or implied hereby are based on unaudited estimates not yet formally

reviewed by accountants and information available to us at the time of this presentation and

are not guarantees of future performance. Actual results could differ materially from our

current expectations as a result of many factors, including but not limited to: underlying assumptions or expectations related to customer and supplier relationships and prices; competition; ability to realize

anticipated benefits from the acquisition and other initiatives and the timing of benefits to

be derived therefrom; market demand; litigation and other contingent liabilities, such as

environmental matters; and economic, political, governmental, technological, and natural disaster related factors affecting the operations of Zep Inc. and/or Amrep, Inc., tax rate, markets, products, services, and prices,

among others. For a description of additional risks and uncertainties that could affect these

statements, please refer to Zep Inc.’s filings with the Securities and Exchange Commission,

including its fiscal year 2009 Annual Report on Form 10–K. The discussion under the heading “Risk Factors” in Part I, Item 1A of Zep’s fiscal year 2009 Form 10-K is specifically incorporated

by reference into this presentation. We assume no obligation and do not intend to update

these forward-looking statements. |

3 Key Markets: • Specialty Chemical Products: • Adhesives • Air Care • Automotive Maintenance • Cleaners • Degreasers • Disinfectants • Floor Care • Greases • Herbicides • Insecticides • Oils Manufacturing Facilities: •Georgia •Texas Employees: • Approximately 200 Industry-Leading Brands Amrep Overview Copyright 2010. Zep Inc. - All rights reserved. 1 Please see appendix for reconciliation of Net Income, which totaled $0.7 million during the twelve months ended November 30, 2009, to Adjusted EBITDA. Twelve months ended November 30, 2009 Sales $106.1 million Adjusted EBITDA $9.9 million (Based on Preliminary and Unaudited Results) 1 |

4 Strategic Fit • Immediately provides a strong presence in automotive market • Increases penetration in distribution channel • Expands product portfolio with nationally recognized brands • Compliments existing customer base • Adds additional flexible aerosol manufacturing capabilities • Delivers significant private label capabilities and relationships • Existing strong management team will continue to run Amrep’s operations Benefits to Zep. . . Copyright 2010. Zep Inc. - All rights reserved. |

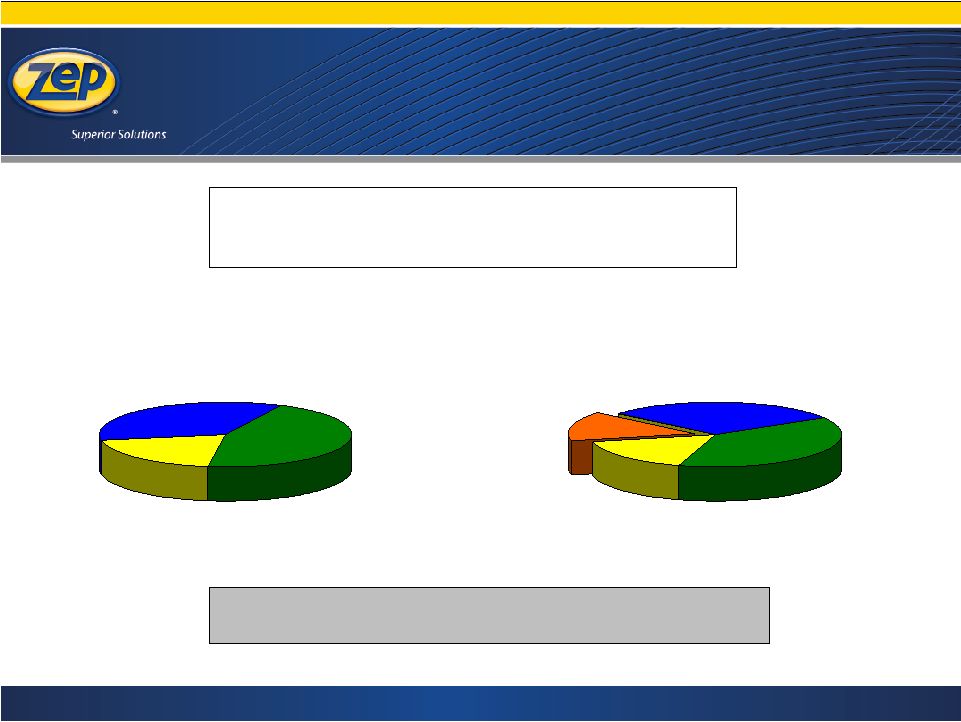

5 Market Opportunity Copyright 2010. Zep Inc. - All rights reserved. Distribution $7.3 45% Direct to Consumer $3.2 20% Retail $5.8 35% Est. $16B US Market (pre-acquisition) Distribution $7.3 38% Direct to Consumer $3.2 17% Retail $5.8 30% Est. $19B US Market (post-acquisition) Automotive $2.8 15% US Cleaning Maintenance Chemicals Market in which Zep Inc.

Competes ($ billions) Automotive opportunity increases the available market for Zep Inc. from an estimated $16.3B to $19.1B 1 Source: Information compiled by Zep Inc. based on research provided by Kline & Company and the Automotive Aftermarket Industry Association. 1 1 |

6 Market Overview Go-to-Market Channel Distribution Retail Automotive OEM Estimated U.S. Market Size $7.3 Billion $5.8 Billion $2.8 Billion Brands • Private Brand relationships • Next Dimension brand • Original Bike Works® brand • Maintenance Chemicals • Appearance Chemicals • Functional Fluids • Paint, Body, and Equipment •Misty® brand increases access to JanSan Distribution markets •I-Chem® brand increases access to MRO Distribution markets •Minimal channel overlap with established Zep Inc. brands / customers •Adds access to consumers through Advance Auto Parts and Auto Zone private brand relationships •Adds the Next Dimension and Original Bike Works® brands to retail auto channel •Current relationship with Automotive OEM customers provide access for additional Zep Inc. capability Key Market Access Enhancements Copyright 2010. Zep Inc. - All rights reserved. 1 Source: Information compiled by Zep Inc. based on research provided by Kline & Company and the Automotive Aftermarket Industry Association. 1 TM TM |

7 Amrep Revenue Breakdown for Twelve Months ended 11/30/09 Automotive 67% Jan San 16% MRO 9% Other 8% Distribution Channels . . . Top Customers Toyota Nissan Subaru Kia Corporate Express Sears AutoZone Advance Auto Lagasse Fastenal Triple S AmSan Private Label 80% Amrep Branded 20% Product Mix . . . Copyright 2010. Zep Inc. - All rights reserved. 1 Based on preliminary and unaudited financial results. 1 |

• Expands access to Jan San, MRO, and Automotive (OEM and retail aftermarket) distribution channels

• Enhanced brand portfolio provides new marketing opportunities • Cross-selling opportunities for existing product portfolio 8 Synergies Operational and Supply Chain Synergies . . . Revenue Synergies . . . • Increased productivity resulting from Amrep’s Aerosol manufacturing capabilities and Zep Inc.’s liquids / powders manufacturing capabilities • Common supplier base • Increased economies of scale (raw materials and logistics) Copyright 2010. Zep Inc. - All rights reserved. Administrative Synergies . . . • Leverage back office functions |

9 Financing Overview • Cash purchase price: $64.4 million • Financed with 100% debt; utilizing existing debt capacity (Revolving Credit Facility and Receivables Facility) • Zep has approximately $40 million of debt capacity post-acquisition (as of 11/30/09) • Zep Inc. total debt/credit agreement adjusted EBITDA (1) (as of 11/30/09) : • Pre-acquisition - < 0.9x • Post-acquisition - < 2.3x Copyright 2010. Zep Inc. - All rights reserved. 1 As defined in Zep Inc.’s credit agreement, which states that adjusted EBITDA is equal to EBITDA plus certain non-cash items. See appendices for further discussion.

|

10 Looking Ahead • Amrep’s existing management team will continue to lead Amrep’s business with ability to leverage Zep Inc.’s shared services platform Operational Outlook Financial Outlook Copyright 2010. Zep Inc. - All rights reserved. • Deal is EPS accretive immediately, excluding transaction costs, opening Amrep balance sheet adjustments and restructuring costs • Estimated annualized cost savings of $3-4 million expected as we enter F’11 and up to $7 million

within 24 months • Restructuring charges expected to be incurred as Zep implements integration plan beginning in Q2 of FY2010 |

11 Questions Copyright 2010. Zep Inc. - All rights reserved. |

Appendices |

13 Amrep, Inc. Preliminary and Unaudited Adjusted EBITDA Reconciliation Copyright 2010. Zep Inc. - All rights reserved. ($ millions) Twelve Months Ended 11/30/09 Net Income $0.7 Interest Expense, net 2.4 Provisions for Income Taxes 0.4 Depreciation and Amortization 2.0 EBITDA $5.5 Environmental charges 4.4 Adjusted EBITDA $9.9 |

Non-GAAP Disclosures • This presentation includes the following supplemental non-GAAP financial measures of

Amrep, Inc.: EBITDA and adjusted EBITDA. GAAP means generally accepted

accounting principles in the United States. This presentation contains

reconciliations of each of these non-GAAP financial measures to the most

directly comparable GAAP financial measure, net income. • EBITDA is equal to net income plus (a) interest expense, net; (b) provision for income taxes; and (c) depreciation and amortization. In this presentation, adjusted EBITDA is calculated by

adding to EBITDA certain charges recorded during December 2008 in

recognition of estimated environmental remediation costs associated with

efforts currently underway at one of Amrep, Inc.’s owned manufacturing

facilities. • We believe EBITDA and adjusted EBITDA and the ratios derived from these measures are

useful to an investor in evaluating the performance of Amrep, Inc. We

believe these measures adjust for items which we understand are generally

not indicative of Amrep, Inc.’s core operating performance, and therefore should serve to enhance period-to-period comparability of operations

and financial performance. We also believe that analysts and investors

utilize EBITDA and adjusted EBITDA as supplemental measures to evaluate the

overall operating performance of companies in our industry. Management’s use for these measure is not unlike those in the investment

community. • EBITDA and adjusted EBITDA, and the ratios derived from these measures, as calculated by

us are not necessarily comparable to similarly titled measures used by other

companies. In addition, these measures: (a) do not represent net income or cash flows from operating activities as defined by

GAAP; (b) are not necessarily indicative of cash available to fund our cash flow needs; and (c) should not be considered in isolation of, as alternatives to, or more meaningful measures than

operating profit, net income, cash provided by operating activities, or our

other financial information as determined under GAAP. Copyright 2010. Zep Inc. - All rights reserved. 14 |

Debt Covenant Disclosure • Pre- and post-acquisition maximum leverage ratio computations are provided on the

“Financing Overview” slide of this presentation. The maximum leverage ratio is a restrictive debt

covenant associated with Zep Inc.’s Revolving Credit Facility (the

“credit agreement”), which is the Company’s primary borrowing

facility. This credit agreement allows for a maximum leverage ratio of 3.25. Failure to comply with this debt covenant represents an event of default under this credit agreement. Copyright 2010. Zep Inc. - All rights reserved. 15 |