Attached files

| file | filename |

|---|---|

| 8-K - 8-K CAMAC APA SIGNING & MOLOPO 11_20_09 FINAL[5] - Erin Energy Corp. | form8k.htm |

| EX-99.1 - PRESS RELEASE, DATED NOVEMBER 23, 2009 - Erin Energy Corp. | ex99-1.htm |

Exhibit 10.1

EXECUTION COPY

PURCHASE

AND SALE AGREEMENT

BY

AND AMONG

PACIFIC

ASIA PETROLEUM, INC.

CAMAC

ENERGY HOLDINGS LIMITED

CAMAC

INTERNATIONAL (NIGERIA) LIMITED

AND

ALLIED

ENERGY PLC

Dated:

November 18, 2009

701784886v7

|

TABLE

OF CONTENTS

|

|||

|

ARTICLE

I TRANSFER OF CONTRACT RIGHTS; RELATED TRANSACTIONS

|

2

|

||

|

Section

1.1

|

Oyo

Field

|

2

|

|

|

Section

1.2

|

Transfer

of Contract Rights

|

2

|

|

|

Section

1.3

|

Complete

Transfer.

|

3

|

|

|

Section

1.4

|

Release

and Discharge.

|

3

|

|

|

Section

1.5

|

No

Assumption of Liabilities.

|

3

|

|

|

ARTICLE

II CONSIDERATION

|

3

|

||

|

Section

2.1

|

Consideration

Shares.

|

3

|

|

|

Section

2.2

|

Cash

Consideration.

|

4

|

|

|

ARTICLE

III THE CLOSING

|

4

|

||

|

Section

3.1

|

Closing.

|

4

|

|

|

Section

3.2

|

Deliveries

of the Parties.

|

4

|

|

|

ARTICLE

IV REPRESENTATIONS AND WARRANTIES OF THE CAMAC PARTIES

|

4

|

||

|

Section

4.1

|

Organization

and Standing.

|

4

|

|

|

Section

4.2

|

Power

and Authority.

|

5

|

|

|

Section

4.3

|

No

Conflicts.

|

5

|

|

|

Section

4.4

|

Representations

Related to the Oyo Field and Oyo Related Agreements.

|

5

|

|

|

Section

4.5

|

Litigation.

|

7

|

|

|

Section

4.6

|

Consents

and Approvals.

|

7

|

|

|

Section

4.7

|

Licenses,

Permits, Etc.

|

7

|

|

|

Section

4.8

|

Material

Contracts and Commitments.

|

7

|

|

|

Section

4.9

|

Taxes.

|

7

|

|

|

Section

4.10

|

Brokers;

Schedule of Fees and Expenses.

|

8

|

|

|

Section

4.11

|

Foreign

Corrupt Practices.

|

8

|

|

|

Section

4.12

|

Money

Laundering Laws.

|

8

|

|

|

Section

4.13

|

OFAC.

|

8

|

|

|

Section

4.14

|

Environmental

Matters.

|

9

|

|

|

Section

4.15

|

Bankruptcy.

|

9

|

|

|

ARTICLE

V REPRESENTATIONS AND WARRANTIES OF PAPI

|

10

|

||

|

Section

5.1

|

Organization

and Standing.

|

10

|

|

|

Section

5.2

|

Organizational

Documents.

|

10

|

|

|

Section

5.3

|

Power

and Authority.

|

10

|

|

|

Section

5.4

|

No

Conflicts.

|

11

|

|

|

Section

5.5

|

Material

Contracts.

|

11

|

|

|

Section

5.6

|

Capitalization.

|

13

|

|

|

Section

5.7

|

Shares

Validly Issued.

|

15

|

|

|

Section

5.8

|

Litigation.

|

15

|

|

|

Section

5.9

|

Consents

and Approvals.

|

16

|

|

|

Section

5.10

|

Brokers;

Schedule of Fees and Expenses.

|

16

|

|

|

Section

5.11

|

Financial

Statements; Undisclosed Liabilities.

|

16

|

|

|

Section

5.12

|

Absence

of Certain Changes or Events.

|

17

|

|

|

Section

5.13

|

Foreign

Corrupt Practices.

|

19

|

|

|

Section

5.14

|

Money

Laundering Laws.

|

19

|

|

|

Section

5.15

|

OFAC.

|

19

|

|

i

|

Section

5.16

|

Environmental

Matters.

|

19

|

|

|

Section

5.17

|

Taxes.

|

20

|

|

|

Section

5.18

|

Title.

|

21

|

|

|

Section

5.19

|

Accounts

Receivable

|

21

|

|

|

Section

5.20

|

SEC

Reports.

|

21

|

|

|

ARTICLE

VI COVENANTS OF THE CAMAC PARTIES

|

22

|

||

|

Section

6.1

|

General

Conduct of Business.

|

22

|

|

|

Section

6.2

|

Notice

of CAMAC Material Adverse Effect.

|

22

|

|

|

Section

6.3

|

Consultation;

Compliance.

|

23

|

|

|

Section

6.4

|

PAPI

Consent Required.

|

23

|

|

|

Section

6.5

|

Related

Tax.

|

23

|

|

|

Section

6.6

|

Access

to Information.

|

24

|

|

|

Section

6.7

|

Exclusivity;

No Other Negotiations.

|

24

|

|

|

Section

6.8

|

Fulfillment

of Conditions.

|

25

|

|

|

Section

6.9

|

Regulatory

and Other Authorizations; Notices and Consents.

|

25

|

|

|

Section

6.10

|

Proxy

Statement.

|

26

|

|

|

Section

6.11

|

Certain

PSC and Oyo Field Covenants.

|

26

|

|

|

ARTICLE

VII COVENANTS OF THE PAPI PARTIES

|

26

|

||

|

Section

7.1

|

Conduct

of Business.

|

26

|

|

|

Section

7.2

|

Proxy

Statement Filing and Special Meeting.

|

29

|

|

|

Section

7.3

|

SEC

Filings.

|

30

|

|

|

Section

7.4

|

Notice

of PAPI Material Adverse Effect.

|

30

|

|

|

Section

7.5

|

CAMAC

Consent Required.

|

30

|

|

|

Section

7.6

|

Fulfillment

of Conditions.

|

31

|

|

|

Section

7.7

|

Regulatory

and Other Authorizations; Notices and Consents.

|

31

|

|

|

Section

7.8

|

Exclusivity;

No Other Negotiations.

|

31

|

|

|

Section

7.9

|

Related

Tax.

|

32

|

|

|

Section

7.10

|

Valid

Issuance of PAPI Shares.

|

32

|

|

|

Section

7.11

|

Oyo

Agreements.

|

32

|

|

|

Section

7.12

|

PAPI

Newco.

|

32

|

|

|

ARTICLE

VIII ADDITIONAL AGREEMENTS AND COVENANTS

|

33

|

||

|

Section

8.1

|

Disclosure

Schedules.

|

33

|

|

|

Section

8.2

|

Confidentiality.

|

33

|

|

|

Section

8.3

|

Public

Announcements.

|

33

|

|

|

Section

8.4

|

Board

Composition.

|

34

|

|

|

Section

8.5

|

Voting

Agreement.

|

34

|

|

|

Section

8.6

|

ROFR

Agreement.

|

35

|

|

|

Section

8.7

|

Fees

and Expenses.

|

35

|

|

|

Section

8.8

|

Certain

Disclaimers.

|

35

|

|

|

Section

8.9

|

Further

Assurances

|

36

|

|

|

ARTICLE

IX CONDITIONS TO CLOSING

|

36

|

||

|

Section

9.1

|

Joint

Conditions Precedent

|

36

|

|

|

Section

9.2

|

CAMAC

Parties Conditions Precedent

|

37

|

|

|

Section

9.3

|

PAPI

Conditions Precedent.

|

39

|

|

|

ARTICLE

X INDEMNIFICATION

|

40

|

||

|

Section

10.1

|

Survival.

|

40

|

|

ii

|

Section

10.2

|

Indemnification

by the CAMAC Parties.

|

40

|

|

|

Section

10.3

|

Indemnification

by PAPI.

|

41

|

|

|

Section

10.4

|

Limitations

on Indemnity.

|

42

|

|

|

Section

10.5

|

Defense

of Third Party Claims.

|

42

|

|

|

Section

10.6

|

Determining

Damages.

|

43

|

|

|

Section

10.7

|

Right

of Setoff.

|

44

|

|

|

Section

10.8

|

Limitation

on Recourse; No Third Party Beneficiaries.

|

44

|

|

|

ARTICLE

XI TERMINATION

|

44

|

||

|

Section

11.1

|

Methods

of Termination.

|

44

|

|

|

Section

11.2

|

Effect

of Termination.

|

45

|

|

|

Section

11.3

|

Termination

Recovery and Fee.

|

46

|

|

|

ARTICLE

XII MISCELLANEOUS

|

46

|

||

|

Section

12.1

|

Notices.

|

46

|

|

|

Section

12.2

|

Amendments;

Waivers; No Additional Consideration.

|

46

|

|

|

Section

12.3

|

Adjustments

to Payment of Purchase Price.

|

47

|

|

|

Section

12.4

|

Interpretation.

|

47

|

|

|

Section

12.5

|

Severability.

|

47

|

|

|

Section

12.6

|

Counterparts;

Facsimile Execution.

|

47

|

|

|

Section

12.7

|

Entire

Agreement; Third Party Beneficiaries.

|

47

|

|

|

Section

12.8

|

Governing

Law.

|

47

|

|

|

Section

12.9

|

Dispute

Resolution.

|

47

|

|

|

Section

12.10

|

Assignment.

|

48

|

|

|

Section

12.11

|

Publicity.

|

48

|

|

|

Section

12.12

|

Governing

Language.

|

48

|

|

ANNEX

ANNEX

A Definitions

SCHEDULES

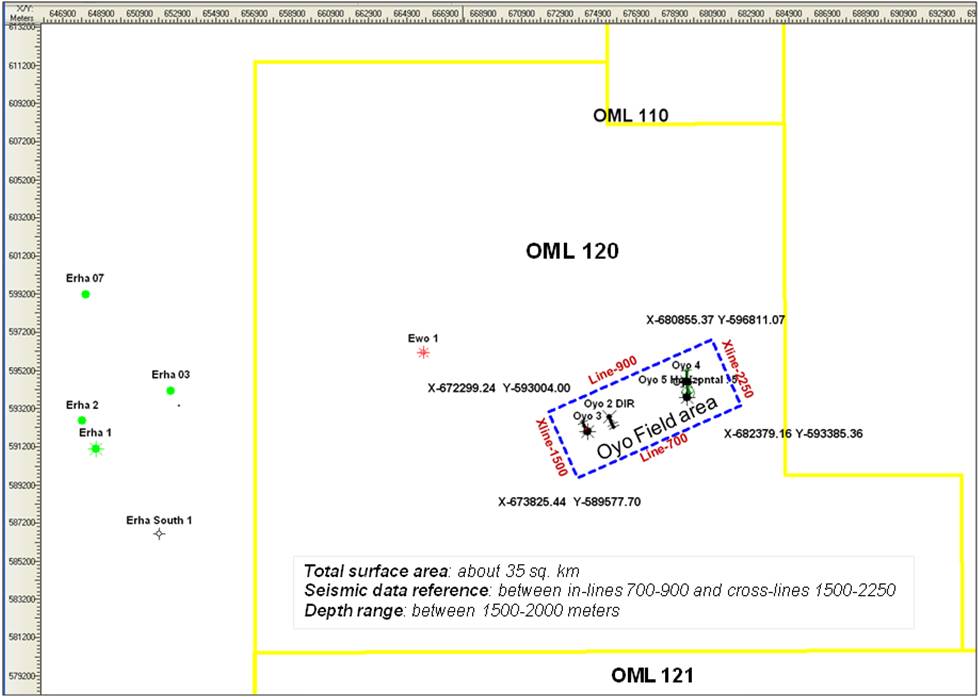

SCHEDULE

A Description

of the Oyo Field

SCHEDULE

B CAMAC

Disclosure Schedule

SCHEDULE

C PAPI

Disclosure Schedule

iii

701784886v7

PURCHASE

AND SALE AGREEMENT

THIS

PURCHASE AND SALE AGREEMENT, dated as of November 18, 2009 (this “Agreement”),

by and among PACIFIC ASIA PETROLEUM, INC., a corporation incorporated in the

State of Delaware, USA (“PAPI” and

together with the new entity to be formed by PAPI pursuant to Section 7.12

hereof (“PAPI

Newco”), the “PAPI

Parties”); CAMAC ENERGY HOLDINGS LIMITED, a Cayman Islands company

(“CEHL”);

CAMAC INTERNATIONAL (NIGERIA) LIMITED, a company incorporated in the Federal

Republic of Nigeria (“CINL”) and

a wholly-owned subsidiary of CEHL; and ALLIED ENERGY PLC (formerly, Allied

Energy Resources Nigeria Limited, a company incorporated in the Federal Republic

of Nigeria and a wholly-owned subsidiary of CEHL (“Allied,”

and together with CEHL, and CINL, the “CAMAC

Parties”). Each of the Parties to this Agreement is

individually referred to herein as a “Party” and

collectively as the “Parties.” Capitalized

terms used herein that are not otherwise defined herein shall have the meanings

ascribed to them in Annex A

hereto.

BACKGROUND

A. PAPI

and its subsidiary companies are engaged in the business of oil and gas

development, production and distribution.

B. On

June 3, 1992, Allied was awarded Oil Prospecting License 210 (“OPL

210”) by the

Federal Republic of Nigeria, 2.5% of the interest in which Allied subsequently

assigned to CINL, on September 30, 1992 pursuant to an assignment agreement by

and between Allied and CINL (the “Allied

Assignment”).

C. On

August 28, 2002, Allied and CINL were granted Oil Mining Lease 120 and Oil

Mining Lease 121 (the “OMLs”) by the Federal Republic of

Nigeria, with respect to OPL 210, for a term of 20 years commencing on February

27, 2001. Pursuant to a Deed of Assignment, dated July 22, 2005,

Allied and CINL assigned to the Nigerian AGIP Exploration Limited (the “NAE”), a

40% participating interest in the OMLs, with the remaining 60% participating

interest in the OMLs being retained by Allied and CINL (the “NAE

Assignment”).

D. On

July 22, 2005, Allied, CINL and the NAE entered into a Production Sharing

Contract (the “PSC”) setting out the terms of

agreement in relation to petroleum operations in the area covered by the

OMLs.

E. PAPI

desires to acquire from Allied and CINL, through PAPI Newco, all of the CAMAC

Parties’ interest in the PSC with respect to that certain oilfield asset known

as the Oyo Field (as such term is defined herein), that is the subject of Oil

Mining Lease 120 (“OML 120”),

as well as the joint and several obligations of CINL and Allied to the NAE under

the PSC in connection with the Oyo Field (such interest in the PSC with respect

to the Oyo Field, subject to the rights and

obligations set forth in the PSC and the Oyo Field Supplemental Agreement (as

defined herein), is referred to herein as the “Contract

Rights”), for stock consideration consisting of shares of PAPI’s common

stock, par value $0.001 per share (the “Common

Stock”), representing 62.74% of the issued and outstanding Common Stock

of the Company, and cash in the amount of USD $38.84 million. Allied

and CINL shall retain all right, title and interest in

-1-

and to

the PSC with respect to the OMLs, other than with respect to the Oyo Field, that

is subject to OML 120.

F. Concurrently

with the Closing (as described below), the Parties hereto will enter into, or

cause their affiliates to enter into, certain other agreements contemplated by

this Agreement (together, the “Transaction

Documents”), including but not limited to the Novation Agreement by and

among Allied, CINL, PAPI Newco and NAE (the “Novation

Agreement”); the right of first refusal agreement between the CAMAC

Parties and the PAPI Parties (the “ROFR

Agreement”); the technical services agreement between PAPI Newco and

Allied (the “Technical

Services Agreement”); the cost allocation and

management agreement between PAPI Newco and Allied (the “Oyo Field

Supplemental Agreement”); and the registration rights agreement with

respect to the Consideration Shares between PAPI and the CAMAC Parties (the

“Registration

Rights Agreement”).

G. As

a condition precedent to the Closing, PAPI will consummate an equity financing

with certain qualified investors, on terms reasonably acceptable to the CAMAC

Parties and the PAPI Parties, resulting in gross proceeds of at least Forty-Five

Million Dollars ($45,000,000) (the “Financing”).

H. The

boards of directors of each of PAPI, CINL, Allied and PAPI Newco have considered

and have declared advisable this Agreement and the other transactions

contemplated hereby (together, the “Transactions”).

AGREEMENT

NOW,

THEREFORE, in consideration of the foregoing and the respective representations,

warranties, covenants and agreements set forth herein, and intending to be

legally bound hereby, the Parties agree as follows:

ARTICLE

I

Transfer

of Contract Rights; Related Transactions

Section

1.1 Oyo Field. The

Parties agree and acknowledge that the description set forth in Schedule A

attached hereto is the “Oyo Field”

for purposes of this Agreement, the Transaction Documents, and the transactions

contemplated hereby and thereby and the CAMAC Parties further acknowledge and

agree that the Oyo Field is an oil field subject to the provisions of the Oyo

Related Agreements.

Section

1.2 Transfer of Contract

Rights. Subject

to the terms and conditions contained herein, each of the PAPI Parties agrees to

acquire, and the CAMAC Parties agree to transfer, all of the rights, title and

interest of the CAMAC Parties’ in and to the Contract Rights. The

transfer of the Contract Rights related to the PSC shall be made by novation of

all of Allied’s and CINL’s right, title and interest in and to the PSC with

respect to the Oyo Field, together with all of Allied’s and CINL’s liabilities

and obligations to the NAE under the PSC in relation to the Oyo

Field. Such novation shall be subject to the terms of a Novation

Agreement in form and

-2-

substance

satisfactory to the Parties, which shall be effective on the effective date set

forth in the Novation Agreement (the “Novation

Date”).

Section

1.3 Complete Transfer. Each

of the CAMAC Parties expressly agrees that the transfer of the Contract Rights

pursuant to the Novation Agreement and this Agreement, constitutes a complete

transfer of all of the Contract Rights, free and clear of (a) all Liens on the

Contract Rights or the Oyo Field, and (b) any material adverse contractual

obligations other than the Oyo Related Agreements, and the CAMAC Parties reserve

no rights to market or otherwise transfer any interest in and to the Contract

Rights. For the avoidance of doubt, upon the consummation of the

Transactions neither PAPI nor PAPI Newco shall have any obligation to any of the

CAMAC Parties to support, maintain, offer, or do any other act relating to the

OMLs or the PSC other than as set forth herein or in the Transaction

Documents.

Section

1.4 Release and Discharge. At

the Novation Date, except as otherwise provided for herein, or in the

Transaction Documents, the CAMAC Parties and PAPI Newco hereby release and

discharge from further obligations to each other with respect to the Contract

Rights (other than as shareholders of PAPI) and their respective rights against

each other with respect to the Contract Rights are cancelled; provided that such release

and discharge shall not affect any rights, liabilities or obligations of any of

them with respect to claims, causes of actions, payments or other

obligations due and payable or due to be performed on or prior to the Novation

Date or related to the facts or events occurring prior to the Novation

Date.

Section

1.5 No Assumption of

Liabilities. Except

as otherwise provided for herein, in the Novation Agreement or in any of the

other Transaction Documents, this Agreement does not transfer, the PAPI Parties

do not assume, and the PAPI Parties expressly disclaim any and all liabilities,

costs, debts, claims and obligations of the CAMAC Parties relating to the

Contract Rights or otherwise. Except as otherwise provided for herein

or the Transaction Documents, neither PAPI nor PAPI Newco shall have any

obligation with respect to the CAMAC Parties arising prior to the Closing

Date.

ARTICLE

II

Consideration

Section

2.1 Consideration Shares. At

the Closing, PAPI shall issue to CEHL or its designee(s), shares of Common Stock

equal to 62.74% of the issued and outstanding Common Stock after giving effect

to the Transactions and the Financing, excluding shares issued in the Excluded

Transaction (as defined below) (the “Consideration

Shares”). The Parties agree and acknowledge that any issuances of Equity

Interests by PAPI prior to the Closing (or pursuant to any existing

agreement or arrangement, or any agreement or arrangement entered into after the

date of this Agreement but before Closing, to issue Equity Interests

before or after the Closing) shall not reduce the 62.74% post-Closing Equity

Interest in PAPI to be issued to CEHL or its designee(s) at Closing, except with

respect to: (i) the reservation or issuance of up to one million (1,000,000)

shares of the Common Stock in connection with awards granted under PAPI’s

employee stock incentive plan after the date of this Agreement and prior to

Closing; or (ii) the issuance of shares of Common Stock in connection with the

exercise of existing awards granted under PAPI’s employee stock incentive plan

prior to the date of this Agreement (the “Excluded

-3-

Transactions”).

Other than the Excluded Transactions, the Parties further agree that no other

existing agreements or arrangements, or any agreement or arrangement entered

into after the date of this Agreement but before Closing, for the issuance of

any Equity Interests in PAPI before or after Closing shall reduce the CAMAC

Parties’ 62.74% Equity Interest in PAPI, and PAPI shall issue such additional

shares Common Stock to the CAMAC Parties at the Closing (or within five (5)

business days of issuance if any such shares of PAPI Common Stock are issues

following the Closing ) as is required to preserve CAMAC’s 62.74% post-Closing

Equity Interest in PAPI.

Section

2.2 Cash Consideration. At

the Closing PAPI shall pay to CEHL, cash in the amount of thirty eight million

eight hundred forty thousand dollars ($38,840,000) in immediately available

funds to an account designated by CEHL at least two (2) business days prior to

Closing (the “Cash

Consideration”).

ARTICLE

III

The

Closing

Section

3.1 Closing. The

Closing (the “Closing”)

of the Transactions, shall take place at the offices of Pillsbury Winthrop Shaw

Pittman LLP in Houston, TX, commencing at 9:00 a.m. local time on the third

business day following the satisfaction or waiver of all conditions and

obligations of the Parties to consummate the Transactions contemplated hereby

(other than conditions and obligations with respect to actions that the

respective Parties will take at Closing), or on such other date and at such

other time as the Parties may mutually determine (the “Closing

Date”).

Section

3.2 Deliveries of the Parties. At

the Closing, (i) the CAMAC Parties shall deliver or cause to be delivered to the

PAPI Parties, the certificates, opinions, instruments, agreements and documents

required by Article IX hereof and (ii) the PAPI Parties shall deliver or cause

to be delivered to the CAMAC Parties, the Cash Consideration, the Consideration

Shares and the certificates, opinions, instruments, agreements and documents

required by Article IX hereof.

ARTICLE

IV

Representations

and Warranties of the CAMAC Parties

Subject

to the exceptions set forth in the schedule of exceptions, which shall state the

specific subsection of this Article IV to which each disclosure or exception is

made by the CAMAC Parties and attached hereto as Schedule B, each of

the CAMAC Parties jointly and severally represents and warrants to the PAPI

Parties as of the date hereof and as of the Closing as follows:

Section

4.1 Organization and Standing. Each

of the CAMAC Parties is duly organized, validly existing and in good standing

under the laws of its respective jurisdiction of incorporation or

organization. Each of the CAMAC Parties is duly qualified to do

business in each of the jurisdictions in which the property owned, leased or

operated by it or the nature of the business which it conducts requires

qualification, except where the failure to so qualify

-4-

would

not reasonably be expected, individually or in the aggregate, to result in a

CAMAC Material Adverse Effect. Each of the CAMAC Parties has all

requisite power and authority to own, lease and operate the Oyo Field and to

carry on its business as now being conducted pursuant to the Oyo Related

Agreements. The CAMAC Parties have made available to PAPI true and

complete copies of the CAMAC Constituent Instruments.

Section

4.2 Power and Authority. Each

of the CAMAC Parties has all requisite corporate power and authority to execute

and deliver this Agreement and the Transaction Documents to which it is a party

and to consummate the Transactions contemplated hereby and

thereby. The execution and delivery by the CAMAC Parties of this

Agreement and the Transaction Documents and the consummation by them of the

Transactions have been duly authorized and approved by the boards of directors

or other governing body of each of the CAMAC Parties (if an entity), such

authorization and approval remains in effect and has not been rescinded or

qualified in any respect, and no other proceedings on the part of any

such entities are necessary to authorize this Agreement, the Transaction

Documents or the consummation of the Transactions contemplated hereby and

thereby. Each of this Agreement and the Transaction Documents to

which any CAMAC Party is a party has been duly executed and delivered by such

party and constitutes the valid and binding obligation of each of the CAMAC

Parties, enforceable against the CAMAC Parties in accordance with its terms,

except as enforceability may be limited by applicable bankruptcy, insolvency,

reorganization, moratorium, fraudulent transfer or similar laws of general

application now or hereafter in effect affecting the rights and remedies of

creditors and by general principles of equity (regardless of whether enforcement

is sought in a proceeding at law or in equity).

Section

4.3 No Conflicts. The

execution and delivery of this Agreement or any of the Transaction Documents

contemplated hereby by each of the CAMAC Parties and the consummation of the

Transactions and compliance with the terms hereof and thereof will not, (a)

conflict with, or result in any violation of or Default (with or without notice

or lapse of time, or both) under, or give rise to a right of termination,

cancellation or acceleration of any obligation or to loss of a material benefit

under, or result in the creation of any Lien upon any of the Contract Rights

under any provision of: (i) any CAMAC Constituent Instrument; (ii) any

material contract to which any of the CAMAC Parties is a party or to

or by which it (or any of its assets and properties) is subject or bound; (iii)

any applicable Law or Legal requirement of and Governmental Authority; or (iv)

any Material Permit of any of the CAMAC Parties; (b) result in any material

Judgment applicable to any of the Contract Rights or (c) terminate or modify, or

give any third party the right to terminate or modify, the provisions or terms

of any of the Oyo Related Agreements.

Section

4.4 Representations Related to the Oyo Field and

Oyo Related Agreements..

(a) Oyo

Related Agreements. Each

of the OMLs, the Allied Assignment, the NAE Assignment and the PSC (the “Oyo Related

Agreements”) are valid, binding and in full force and effect in all

material respects and enforceable by and against the CAMAC Parties, as

applicable, in accordance with its terms. None of the CAMAC Parties

is in violation of, or in Default under (nor does there exist any condition

which upon the passage of time or the giving of notice would cause such a

violation of, or Default under), any of the Oyo Related Agreements to which any

CAMAC Party is a party, except for violations or Defaults that would

not,

-5-

individually

or in the aggregate, reasonably be expected to result in a CAMAC Material

Adverse Effect; and, except as set forth on Schedule 4.4, to the CAMAC Parties’

Knowledge, no other Person has violated or breached, or committed any Default

under, any Oyo Related Agreement, except for violations, breaches and Defaults

that, individually or in the aggregate, have not had and would not reasonably be

expected to have a CAMAC Material Adverse Effect. No party to an Oyo Related

Agreement has terminated or, the CAMAC Parties’ Knowledge, threatened

termination of any such agreement with any of the CAMAC Parties. To the CAMAC

Parties’ Knowledge, no other party to any of the Oyo Related Agreements is in

material Default thereunder and none of the CAMAC Parties has received any

written notice regarding any actual or possible violation or breach of, or

Default under, any Oyo Related Agreement, except in each such case for Defaults,

acceleration rights, termination rights and other rights that have not had and

would not reasonably be expected to have a CAMAC Material Adverse

Effect. No event or claim of force majeure has occurred under any of

the Oyo Related Agreements. There have been no written claims by any

Governmental Authority to terminate the Oyo Related Agreements. To the CAMAC

Parties’ Knowledge, the Oyo Related Agreements do not infringe upon the rights

of any third party.

(b) Completeness

of Oyo Related Agreements. The

OMLs contain the entirety of the obligation of the CAMAC Parties to the

Government of Nigeria with respect to the Oyo Field and the interests thereon

that are subject to the PSC. No CAMAC Party is a party to any

Contract relating to or affecting the Oyo Field or Contract Rights other than

the Oyo Related Agreements.

(c) No

Claims. There

are no claims, actions, suits, audits, demands, arbitrations, mediations, formal

investigations or proceedings pending, or, to the CAMAC Parties’ Knowledge,

threatened, before any Governmental Authority, mediator or arbitrator with

respect to the Oyo Field or the Oyo Related Agreements.

(d) Funding

and Other Obligations. No

work program or operations or funding commitment exists or has been proposed by

the CAMAC Parties or any other party to any of the Oyo Related Agreements under

such agreements, except as has been disclosed to the PAPI Parties in writing or

as set forth in the PSC. Upon the consummation of the Transactions,

neither PAPI nor PAPI Newco will be subject to any obligation to pay any other

party any net profits interests, production payments, royalties or other fixed

or contingent amounts based upon the sale, license, distribution or other use or

exploitation of the Oyo Field, except as set forth in the PSC or applicable

Law. There are no bonds, letters of credit, guarantees, deposits or

other security furnished by the CAMAC Parties or any Affiliate of CAMAC Parties

relating to the Oyo Field or the Oyo Related Agreements that will require

expenditures in excess of $100,000, other than the Oyo Debt. The

interests of the CAMAC Parties in the PSC and the OMLs are not subject to any

preferential rights to purchase, rights of first opportunity or similar rights,

or any required third party consents to assignment that may be applicable to the

Transactions other than as may be specified in the Oyo Related

Agreements.

(e) No

Limitations on Transfer. PAPI

Newco shall not be subject to any limitations, obligations or restrictions with

regard to the sale, license, distribution or other transfer or exploitation of

the Contract Rights, except as set forth in the Oyo Related Agreements,

applicable stock exchange rules or applicable Law.

-6-

(f) The

transfer of the Contract Rights pursuant to the Novation Agreement constitutes a

complete transfer of all of the CAMAC Parties’ rights, title and interest in and

to the Oyo Field, and the CAMAC Parties reserve no rights to market or otherwise

transfer any interest in the Oyo Field. For the avoidance of doubt,

neither PAPI nor PAPI Newco shall have any obligation to any of the CAMAC

Parties to support, maintain, offer, or do any other act relating to the OMLs or

the PSC other than as set forth in the Transaction Documents, and the PAPI

Parties may dispose of the Contract Rights, at their sole discretion, subject

only to any approval rights maintained by NAE, the Nigerian government,

applicable stock exchange rules, and applicable shareholder and board approval

requirements.

Section

4.5 Litigation. As

of the date of this Agreement, there is no private or governmental action, suit,

inquiry, notice of violation, claim, arbitration, audit, proceeding or

investigation (“Action”)

pending or threatened in writing against any of the CAMAC Parties or, to the

CAMAC Parties’ Knowledge, any of the other parties to the Oyo Related

Agreements, before or by any Governmental Authority which (a) adversely affects

or challenges the legality, validity or enforceability of this Agreement or the

Oyo Related Agreements (b) could, if there were an unfavorable decision,

individually or in the aggregate, have or would reasonably be expected to result

in a CAMAC Material Adverse Effect. As of the date of this Agreement,

there is no judgment imposed upon any of the CAMAC Parties or, to the CAMAC

Parties’ Knowledge, any of the parties to the Oyo Related Agreements, that would

prevent, enjoin, alter or materially delay any of the Transactions contemplated

by this Agreement, or that would reasonably be expected to have a CAMAC Material

Adverse Effect.

Section

4.6 Consents and Approvals. Except

as disclosed on Schedule 4.6, no consent, approval, license, permit, order or

authorization of, or registration, declaration or filing with any Governmental

Authority (“Consent”)

to which any of the Oyo Related Agreements or the Oyo Field are subject is

required to be obtained or made by any of the CAMAC Parties, in connection with

the execution, delivery and performance of this Agreement or the consummation of

the Transactions, except for (a) such Consents as may be required under

applicable state securities laws and the securities laws of any foreign country;

and (b) such other Consents which, if not obtained or made, would not have a

CAMAC Material Adverse Effect.

Section

4.7 Licenses, Permits, Etc. The

CAMAC Parties possesses or will possess prior to the Closing all licenses,

franchises, permits and other governmental authorizations held by them that are

material in connection with business related to the Oyo Related Agreements and

the Oyo Field (the “Material

Permits”). As of the date of this Agreement, all such Material

Permits are in full force and effect.

Section

4.8 Material Contracts and

Commitments. Other

than the Oyo Related Agreements and the Transaction Documents, there are no

material contracts, agreements or other instruments to which any CAMAC Party or

any affiliate of a CAMAC Party is a party that will be binding on PAPI and PAPI

Newco after the consummation of the Transactions.

Section

4.9 Taxes. Each

of the CAMAC Parties have timely, or have caused to be timely filed on their

behalf, all Tax Returns required by any law or regulation to be filed by or with

respect to it in connection with the Contract Rights, the Oyo Related Agreements

or the Oyo Field, either separately or as a member of group of corporations,

pursuant to applicable

-7-

Legal

Requirements. All such Tax Returns filed by (or that include on a consolidated

basis) any of the CAMAC Parties were (and, as to a Tax Return not filed as of

the date hereof, will be) in all respects true, complete and accurate, except to

the extent any failure to file or any inaccuracies in any filed Tax returns,

individually or in the aggregate, have not and would not reasonably be expected

to have a CAMAC Material Adverse Effect. There are no unpaid Taxes in

respect to the Contract Rights, the Oyo Related Agreements or the Oyo Field

claimed to be due by any Governmental Authority in charge of taxation of any

jurisdiction, nor any claim for additional Taxes in respect to the Contract

Rights, the Oyo Related Agreements or the Oyo Field for any period for which Tax

Returns have been filed, except to the extent any failure to file or any

inaccuracies in any filed Tax returns, individually or in the aggregate, have

not and would not reasonably be expected to have a CAMAC Material Adverse

Effect. Any deficiencies proposed as a result of any governmental

audits or such Tax Returns have been paid or settled, and there are no present

disputes as to Taxes in respect to the Contract Rights, the Oyo Related

Agreements or the Oyo Field payable by any of the CAMAC

Parties. There are no tax liens against any of the Contract Rights

and, to the CAMAC Parties’ Knowledge, there is no basis for any such

lien.

Section

4.10 Brokers; Schedule of Fees and

Expenses. No

broker, investment banker, financial advisor or other Person is entitled to any

broker’s, finder’s, financial advisor’s or other similar fee or commission in

connection with this Agreement or the Transactions based upon arrangements made

by or on behalf of the CAMAC Parties.

Section

4.11 Foreign Corrupt Practices. Neither

the CAMAC Parties, nor to the CAMAC Parties’ Knowledge, any of their respective

Representatives, has, in the course of its actions for, or on behalf of, the

CAMAC Parties, directly or indirectly, (a) used any corporate funds for any

unlawful contribution, gift, entertainment or other unlawful expenses relating

to political activity; (b) made any direct or indirect unlawful payment to any

Governmental Authority or any foreign or domestic government official or

employee from corporate funds; (c) violated or is in violation of any provision

of the U.S. Foreign Corrupt Practices Act of 1977, as amended, and the rules and

regulations thereunder (the “FCPA”); or

(d) made any unlawful bribe, rebate, payoff, influence payment, kickback or

other unlawful payment in connection with the operations of CAMAC Parties to any

foreign or domestic government official or employee, except, in the case of

clauses (a) and (b) above, any such items that, individually or in the

aggregate, have not had and would not reasonably be expected to have a CAMAC

Material Adverse Effect.

Section

4.12 Money Laundering Laws. To

the CAMAC Parties’ Knowledge, none of the CAMAC Parties has violated any money

laundering statute or any rules and regulations relating to money laundering

statutes (collectively, the “Money Laundering

Laws”) and no proceeding involving any CAMAC Parties with respect to the

Money Laundering Laws is pending or, to the Knowledge of the officers of the

CAMAC Parties, is threatened.

Section

4.13 OFAC. None

of the CAMAC Parties, any director or officer of the CAMAC Parties, or, to the

CAMAC Parties’ Knowledge, any agent, employee, affiliate or Person acting on

behalf of the CAMAC Parties is currently identified on the specially designated

nationals or other blocked person list or otherwise currently subject to any

U.S. sanctions administered by the Office of Foreign Asset Control of the U.S.

Treasury Department

-8-

(“OFAC”);

and the CAMAC Parties have not, directly or indirectly, used any funds, or

loaned, contributed or otherwise made available such funds to any Subsidiary,

joint venture partner or other Person, in connection with any sales or

operations in Cuba, Iran, Syria, Sudan, Myanmar or any other country sanctioned

by OFAC or for the purpose of financing the activities of any Person currently

subject to, or otherwise in violation of, any U.S. sanctions administered by

OFAC.

Section

4.14 Environmental Matters. Except

as set forth on Schedule 4.14, with

respect to the Oyo Field:

(a) The

CAMAC Parties and all associated operations are and, during the relevant time

periods specified in all applicable statutes of limitations, have been in

compliance with Environmental Laws in all material respects;

(b) The

CAMAC Parties have all Environmental Authorizations required for their

operations as presently conducted, all such Environmental Authorizations are in

the name of the proper entity and in full force and effect, and the CAMAC

Parties are in compliance in all material respects with such Environmental

Authorizations;

(c) The

CAMAC Parties are not subject to any pending or, to the CAMAC Parties’

Knowledge, threatened Action pursuant to Environmental Laws, nor has any CAMAC

Party received any written notice of violation, noncompliance, or enforcement or

any written notice of investigation or remediation from any Governmental

Authority pursuant to Environmental Laws;

(d) There

has been no Release of Hazardous Materials at, on, under or from the assets or

in connection with the operations of the Acquired Entities in violation of any

Environmental Laws or in a manner that could give rise to any Environmental

Liabilities or any other remedial or corrective action obligations pursuant to

Environmental Laws;

(e) To

the CAMAC Parties’ Knowledge, there has been no exposure of any Person or

property to any Hazardous Materials that could reasonably be expected to form

the basis for any Environmental Liabilities or any Action for other Damages or

compensation; and

(f) The

CAMAC Parties have made available for inspection by the PAPI Parties complete

and correct copies of all environmental assessment and audit reports and studies

and all correspondence addressing environmental obligations that are in the

possession or control of the CAMAC Parties.

(g) Notwithstanding

any other provision of this Agreement, the representations and warranties made

in this Section 4.14 are the sole and exclusive representations and warranties

made in this Agreement by the CAMAC Parties with respect to environmental

matters.

Section

4.15 Bankruptcy. The

CAMAC Parties do not contemplate filing for relief under the provision of any

applicable bankruptcy code. The Contract Rights are not the proceeds

of, nor are they intended for, or being transferred in, the furtherance of any

concealment of assets or any effort by conspiracy or otherwise to defeat,

defraud or otherwise evade, any party or the

-9-

court

in any bankruptcy proceeding, a receiver, a custodian, a trustee, a marshall, or

any other officer of the court or government or regulatory official of any

kind.

ARTICLE

V

Representations

and Warranties of PAPI

Subject

to the exceptions set forth in the schedule of exceptions, which shall state the

specific subsection of this Article V to which each disclosure or exception is

made by the PAPI Parties with respect to themselves and their respective

Subsidiaries, and attached hereto as Schedule C (the

“PAPI

Disclosure Schedule”), each of the PAPI Parties jointly and severally

represents and warrants to the CAMAC Parties as of the date hereof and as of the

Closing Date as follows:

Section

5.1 Organization and Standing. Each

of the PAPI Parties and their respective Subsidiaries is duly organized, validly

existing and in good standing under the laws of its respective jurisdiction of

incorporation. Each of the PAPI Parties and their respective

Subsidiaries is duly qualified to do business in each of the jurisdictions in

which the property owned, leased or operated by it or the nature of the business

which it conducts requires qualification, except where the failure to so qualify

would not reasonably be expected, individually or in the aggregate, to result in

a PAPI Material Adverse Effect. Each of the PAPI Parties and their

respective Subsidiaries has all requisite power and authority to own, lease and

operate its tangible assets and properties and to carry on its business as now

being conducted. The PAPI Parties have delivered to the CAMAC Parties

true and complete copies of the PAPI Constituent Instruments.

Section

5.2 Organizational Documents. The

PAPI Parties have made available to the CAMAC Parties true, complete and correct

copies of the PAPI Constituent Instruments, in each case as amended or restated

to date and presently in effect. Except as set forth on Schedule 5.2, neither

PAPI nor any of its Subsidiaries is in violation of any of the provisions of its

PAPI Constituent Instruments. The minute books and stock records of

PAPI heretofore made available to the CAMAC Parties correctly and completely

reflect in all material respects all actions taken at all meetings of, or by

written consents of, directors, managers and holders of equity interests of PAPI

(including any analogous governing bodies thereof or committees of governing

bodies thereof).

Section

5.3 Power and Authority. Each

of the PAPI Parties and their respective Subsidiaries (and their respective

nominees) has all requisite corporate power and authority to execute and deliver

this Agreement and the Transaction Documents to which it is a party and to

consummate the Transactions contemplated hereby and thereby. The

execution and delivery by the PAPI Parties of this Agreement and the

consummation by them of the Transactions have been duly authorized and approved

by the boards of directors or other governing body of each of the PAPI Parties

and their respective Subsidiaries (if an entity), such authorization and

approval remains in effect and has not been rescinded or qualified in any way,

and no other proceedings on the part of any such entities are necessary to

authorize this Agreement and the Transactions. Each of this Agreement

and the Transaction Documents to which any PAPI Party is a party has been duly

executed and delivered by such party and constitutes the valid, binding,

and

-10-

enforceable

obligation of each of them, enforceable in accordance with its terms, except as

enforceability may be limited by applicable bankruptcy, insolvency,

reorganization, moratorium, fraudulent transfer or similar laws of general

application now or hereafter in effect affecting the rights and remedies of

creditors and by general principles of equity (regardless of whether enforcement

is sought in a proceeding at law or in equity).

Section

5.4 No Conflicts. Neither

the execution nor delivery by the PAPI Parties of this Agreement nor compliance

by any of them with the terms and provisions hereof will conflict with, or

result in a breach of (a) the terms, conditions or provisions of, or constitute

a Default under, or result in any violation of, any PAPI Constituent Instrument

or any Material Contract to which any PAPI Party or their respective

Subsidiaries is a party, which would prevent any of the transactions

contemplated under this Agreement or any of the Transaction Documents

contemplated hereby and thereby, or (b) any regulation, law, judgment, order or

the like to which any such PAPI Party or their respective Subsidiaries is

subject, the Default or violation of which would prevent any of the transactions

contemplated under this Agreement or any of the Transaction Documents

contemplated hereby and thereby.

Section

5.5 Material Contracts. Except

as set forth in the SEC Reports and on Schedule 5.5, none of the PAPI Parties or

their respective Subsidiaries is a party to any of the following (each such

Contract, a “Material

Contract”):

(a) any

Contract involving payments by or to a PAPI Party or any of their respective

Subsidiaries in excess of $100,000;

(b) any

Contract that constitutes a purchase order or other Contract relating to the

sale, purchase, lease or provision by a PAPI Party or any of their respective

Subsidiaries of goods or services in excess of $100,000 in any 12 month

period;

(c) any

Contract pursuant to which any party is required to purchase or sell a stated

portion of its requirements or output from or to another party;

(d) any

Contract under which a PAPI Party or any of their respective Subsidiaries has

agreed to indemnify any third Person in any manner, other than such Contracts

that were made in the ordinary course of business consistent with past practice,

or to share the Tax liability of any third Person;

(e) any

Contract pursuant to which a PAPI Party or any of their respective Subsidiaries

is required to make on or after the date of the Latest Balance Sheet a capital

expenditure, capital addition or betterment in excess of $100,000 in the

aggregate;

(f) any

power of attorney (other than powers of attorney given in the ordinary course of

business with respect to routine export, Tax or securities

matters);

(g) any

Contract in respect of Intellectual Property involving a license granted, title

conveyed or royalty payment to or by a PAPI Party or any of their respective

Subsidiaries;

-11-

(h) any

bond, indenture, note, loan or credit agreement or other Contract relating to

indebtedness for borrowed money, any Contract creating a capital lease

obligation, any Contract for the sale of accounts receivable, any Contract

relating to the direct or indirect guarantee or assumption of the obligations of

any other Person or any Contract requiring a PAPI Party or any of their

respective Subsidiaries to maintain the financial position of any other

Person;

(i) any

outstanding loan or advance by a PAPI Party or any of their respective

Subsidiaries to, or investment by such Person in, any Person, or any Contract or

commitment relating to the making of any such loan, advance or investment

(excluding trade receivables and advances to employees for normally incurred

business expenses each arising in the ordinary course of business consistent

with past practice);

(j) any

Contract involving interest rate swaps, cap or collar agreements, commodity or

financial future or option contracts or similar derivative or hedging

Contracts;

(k) any

Contract providing for the deferred payment of any purchase price (other than

trade payables incurred in the ordinary course of business consistent with past

practice) including any “earn out” or other contingent fee

arrangement;

(l) any

Contract creating a Lien, other than any Permitted Lien, on any of the PAPI

Parties or any of their respective Subsidiaries that will not be discharged at

or prior to the Closing;

(m) any

Contract purporting to limit or restrict the freedom of a PAPI Party or any of

their respective Subsidiaries or, to the PAPI Parties’ Knowledge, any of their

respective officers, directors or key employees (A) to engage in any line of

business, (B) to own, operate, sell, transfer, pledge or otherwise dispose of or

encumber any asset, (C) to compete with any Person or (D) to engage in any

business or activity in any geographic region;

(n) any

(A) distributorship agreement or (B) Contract that grants any Person the

exclusive right to sell products or provide services within any geographical

region other than a Contract that (1) is terminable by any party thereto giving

notice of termination to the other party thereto not more than 30 days in

advance of the proposed termination date and (2) even if so terminable, contains

no post-termination obligations (other than payment obligations for

pre-termination sales or services), termination penalties, buy-back obligations

or similar obligations;

(o) any

Contract under which a PAPI Party or any of their respective Subsidiaries is the

lessor of, or makes available for use by any third Person, any tangible personal

property owned by a PAPI Party or any of their respective Subsidiaries, in each

case for an annual rent in excess of $100,000;

(p) any

Contract constituting a partnership, joint venture or other similar

Contract;

(q) any

Contract that contains restrictions with respect to the payment of any dividends

in respect of a PAPI Party or any of their respective Subsidiaries or the

purchase, redemption or other acquisition of any such Equity

Interests;

-12-

(r) any

Contract relating to the acquisition or divestiture by a PAPI Party or any of

their respective Subsidiaries of Equity Interests, assets or business of any

Person, which provides for consideration or payments in excess of $100,000 and

is not made in the ordinary course of business;

(s) any

Contract between a PAPI Party or any of their respective Subsidiaries, on the

one hand, and the present or former officers, directors, stockholders, other

equity holders of a PAPI or other Affiliates of a PAPI Party or any of their

respective Subsidiaries on the other hand;

(t) any

Contract containing provisions applicable upon a change of control of a PAPI

Party or any of their respective Subsidiaries;

(u) any

Contract granting to any Person a right of first refusal, first offer or other

right to purchase any of the assets of a PAPI Party or any of their respective

Subsidiaries;

(v) any

Contract requiring a PAPI Party or any of their respective Subsidiaries to make

a payment as a result of the consummation of the Transactions contemplated

hereby; and

(w) any

other agreement which is material to the PAPI Parties or any of their respective

Subsidiaries taken as a whole.

True and

complete copies (including all amendments) of each Material Contract have been

made available to the CAMAC Parties. Each Material Contract is the

legal, valid obligation of each PAPI Party or any of their respective

Subsidiaries, as the case may be, and to the PAPI Parties’ Knowledge, any other

Person party thereto, binding and enforceable against each such PAPI Party or

any of their respective Subsidiaries, as the case may be and, to the PAPI

Parties’ Knowledge, any other Person party thereto, in accordance with its terms

subject to, except as enforcement may be limited by applicable bankruptcy,

insolvency, fraudulent transfer, reorganization, moratorium or other similar

Laws relating to or affecting the enforcement of creditors’ rights generally and

subject, as to enforceability, to legal principles of general applicability

governing the availability of equitable remedies (whether enforcement is sought

in a proceeding in equity or at law); (ii) no Material Contract has been

terminated, and neither a PAPI Party or any of their respective Subsidiaries,

nor, to the PAPI Parties’ Knowledge, any other Person is in material breach or

Default thereunder, and to the PAPI Parties’ Knowledge no event has occurred

that with notice or lapse of time, or both, would constitute a material breach

or Default, or permit termination, modification in any manner materially adverse

to a PAPI Party or any of their respective Subsidiaries, as the case may be, or

acceleration thereunder; (iii) no party has asserted or has any right to offset,

discount or otherwise abate any amount owing under any Material Contract; and

(iv) there are no material waivers regarding any Material Contract that have not

been disclosed in writing to the CAMAC Parties.

Section

5.6 Capitalization. Schedule

5.6 sets forth a correct and complete description of the following: (i) all of

the authorized Equity Interests of the PAPI Parties and each of its Subsidiaries

and (ii) the amount of outstanding Equity Interests of the PAPI Parties and each

of

-13-

its

Subsidiaries. Except as described in Schedule 5.6 no Equity Interests

of any PAPI Party or any of its Subsidiaries are issued or outstanding or

reserved for any purpose.

All of

the outstanding Equity Interests of the PAPI Parties and their respective

Subsidiaries are duly authorized, validly issued and fully paid and

nonassessable, and have not been issued in violation of (nor are any of the

authorized Equity Interests of a PAPI Party or any of their respective

Subsidiaries is subject to) any preemptive or similar rights created by the PAPI

Constituent Instruments or any Contract to which a PAPI Party or their

respective Subsidiary is a party or bound.

There are

no outstanding securities, options, warrants or other rights (including

registration rights), agreements, arrangements or other Contracts to which a

PAPI Party or any of their respective Subsidiaries is a party or is bound

relating to the issued or unissued Equity Interests of a PAPI Party or any of

their respective Subsidiaries or obligating a PAPI Party or any of their

respective Subsidiaries to grant, issue, deliver or sell, or cause to be

granted, issued, delivered or sold, any Equity Interests of a PAPI Party or any

of their respective Subsidiaries, by sale, lease, license or

otherwise. Except as set forth on Schedule 5.6, there are no

obligations, contingent or otherwise, of a PAPI Party or any of their respective

Subsidiaries to (i) repurchase, redeem or otherwise acquire any Equity Interests

of a PAPI Party or any of their respective Subsidiaries, (ii) dispose of any

Equity Interests of a PAPI Party or any of their respective Subsidiaries or

(iii) provide funds to, or make any investment in (in the form of a loan,

capital contribution or purchase of Equity Interests or otherwise), or provide

any guarantee with respect to the obligations of, any other

Person. No PAPI Party or any of their respective Subsidiaries

directly or indirectly owns, has agreed to purchase or otherwise acquire or

holds any interest convertible into or exchangeable or exercisable for, Equity

Interests of any Person. There are no agreements, arrangements or

other Contracts (contingent or otherwise) to which a PAPI Party or any of their

respective Subsidiaries is a party or otherwise bound pursuant to which any

Person is or may be entitled to receive any payment based on the revenues or

earnings, or calculated in accordance therewith, of a PAPI Party or any of their

respective Subsidiaries. Except as set forth on Schedule 5.6, are no

voting trusts, proxies or other agreements or understandings with respect to the

voting of any Equity Interests of a PAPI Party or any of their respective

Subsidiaries. There are no bonds, debentures, notes or other

indebtedness of a PAPI Party or any of their respective Subsidiaries having the

right to vote (or convertible into, or exchangeable for, securities having the

right to vote) on any matters on which holders of Equity Interests of a PAPI

Party or any of their respective Subsidiaries may vote.

(a) Rights; Liens;

Encumbrances. Except as disclosed in

Schedule 5.6 of the PAPI Disclosure Schedule, (i) none of the capital stock

of the PAPI Parties or their Subsidiaries is subject to preemptive rights or any

other similar rights or any liens or encumbrances suffered or permitted by any

of them; (ii) there are no outstanding options, warrants, scrip, rights to

subscribe to, calls or commitments of any character whatsoever relating to, or

securities or rights convertible into, or exercisable or exchangeable for, any

capital stock of any of the PAPI Parties or their Subsidiaries, or contracts,

commitments, understandings or arrangements by which any of the PAPI Parties or

their Subsidiaries is or may become bound to issue additional capital stock of

any of the PAPI Parties or their Subsidiaries or options, warrants, scrip,

rights to subscribe to, calls or commitments of any character whatsoever

relating to, or securities or rights convertible into, or exercisable or

exchangeable for, any capital stock of any of the PAPI Parties or their

-14-

Subsidiaries;

(iii) there are no outstanding debt securities, notes, credit agreements, credit

facilities or other agreements, documents or instruments evidencing indebtedness

of any of the PAPI Parties or their Subsidiaries or by which any of them is or

may become bound which are required to be disclosed in any SEC Report (as

defined below) but not so disclosed in the SEC Reports, (iv) there are no

agreements or arrangements under which any of the PAPI Parties or their

Subsidiaries is obligated to register the sale of any of their securities under

the Securities Act; (v) there are no outstanding securities or instruments of

any of the PAPI Parties or their Subsidiaries which contain any redemption or

similar provisions, and there are no contracts, commitments, understandings or

arrangements by which any of them is or may become bound to redeem a security of

any of the PAPI Parties or their Subsidiaries; (vi) there are no securities or

instruments containing anti-dilution or similar provisions that will be

triggered by the issuance or reservation of the Consideration Shares; (vii) PAPI

does not have any stock appreciation rights or “phantom stock” plans or

agreements or any similar plan or agreement; (viii) none of the PAPI Parties or

their Subsidiaries have any liabilities or obligations required to be disclosed

in the SEC Reports but not so disclosed in the SEC Reports, other than those

incurred in the ordinary course of the their respective businesses and which,

individually or in the aggregate, do not or would not have a PAPI Material

Adverse Effect; and (ix) there are no financing statements securing obligations

in any material amounts, either singly or in the aggregate, filed in connection

with any of the PAPI Parties or their Subsidiaries. PAPI has filed in

its SEC Reports with the SEC true, correct and complete copies of its

Certificate of Incorporation and its Bylaws, both as amended and as in effect on

the date hereof, and the form of all securities convertible into, or exercisable

or exchangeable for, shares of Common Stock.

(b) Effect of Consideration

Shares. The Consideration Shares

shall equal 62.74% of PAPI’s issued and outstanding Common Stock after giving

effect to the consummation of the Transactions and the Financing, excluding

shares issued in the Excluded Transaction.

Section

5.7 Shares Validly Issued. When

issued in compliance with the provisions of this Agreement, the Consideration

Shares will be validly issued, fully paid and nonassessable, and will be free of

any liens or encumbrances; provided, however, that the

Consideration Shares may be subject to restrictions on transfer under state

and/or federal securities laws as set forth herein or as otherwise required by

such laws.

Section

5.8 Litigation. As

of the date of this Agreement, there is no private or governmental Action

pending or threatened in writing against any of the PAPI Parties or their

respective Subsidiaries, or, to the PAPI Parties’ Knowledge, any of their

respective executive officers or directors (in their capacities as such) or any

of their respective properties before or by any Governmental

Authority. As of the date of this Agreement, there is no Judgment

imposed upon any of the PAPI Parties or their respective Subsidiaries or any of

their respective properties, that would prevent, enjoin, alter or materially

delay any of the Transactions contemplated by this Agreement. Neither

the PAPI Parties, nor any director or executive officer of any of them (in his

or her capacity as such), is or has been the subject of any Action involving a

material claim or material violation of or material liability under the

securities laws of any Governmental Authority or a material claim of breach of

fiduciary duty.

-15-

Section

5.9 Consents and Approvals. Except

as disclosed on Schedule 5.9 of the

PAPI Disclosure Schedule, no Consent to which any of the PAPI Parties or any of

their respective Subsidiaries are subject is required to be obtained or made by

or with respect to any of the PAPI Parties or any of their respective

Subsidiaries, in connection with the execution, delivery and performance of this

Agreement or the consummation of the Transactions, except for (a) such Consents

as may be required under applicable state securities laws and the securities

laws of any foreign country; and (b) such other Consents which, if not obtained

or made, would not have a PAPI Material Adverse Effect and would not prevent or

materially alter or delay any of the Transactions.

Section

5.10 Brokers; Schedule of Fees and

Expenses. There are

no broker, investment banker, financial advisor or other Person is entitled to

any broker’s, finder’s, financial advisor’s or other similar fee or commission

in connection with this Agreement or the Transactions based upon arrangements

made by or on behalf of PAPI Parties.

Section

5.11 Financial Statements; Undisclosed

Liabilities.

(a) The

SEC Reports contain true and complete copies of the combined financial

statements of PAPI consisting of (i) audited combined balance sheets of PAPI as

of December 31, 2007 and 2008, and the related audited combined statements of

income and stockholder’s equity and cash flows for the years then ended

(including the notes or other supplementary information thereto) (collectively,

the “Year-End

Financial Statements”) and (ii) an unaudited balance sheet of PAPI as of

September 30, 2009 (the “Latest Balance

Sheet”), and the related unaudited combined statements of income and

stockholders’ equity and cash flows for the nine-month period then ended (the

“Interim

Financial Statements,” and, collectively with the Year-End Financial

Statements, the “Financial

Statements”).

(b) Each

of the Financial Statements (including the notes or other supplementary

information thereto) (i) has been prepared in accordance with GAAP applied on a

consistent basis throughout the periods involved and (ii) present fairly, in all

material respects, the financial position of PAPI as of the respective dates

thereof and the results of each such entity’s operations and cash flows for the

periods indicated, subject, however, in the case of the Interim Financial

Statements, to normal year-end audit adjustments and to the absence of notes and

other textual disclosure required by GAAP. The books and records of

PAPI have been and are being maintained in all material respects in accordance

with applicable legal and accounting requirements to permit preparation of the

financial statements in accordance with GAAP and to maintain asset

accountability.

(c) No

PAPI Party has any liability (and, to the PAPI Parties’

Knowledge, there is no reasonable basis for any action, suit,

proceeding, hearing, investigation, charge, complaint, claim or demand against a

PAPI Party or any of their respective Subsidiaries giving rise to any

liability), other than (i) liabilities reserved or disclosed on the face of the

Latest Balance Sheet, (ii) liabilities which have arisen after the date of

Latest Balance Sheet in the ordinary course of business of the PAPI (none of

which results from, arises out of, relates to, is in the nature of or was caused

by any breach of contract, breach of warranty, tort, infringement or violation

of Laws), (iii) liabilities which have been discharged or paid in full after the

date of the Latest Balance Sheet in the ordinary course of business of PAPI

(none of which results from,

-16-

arises

out of, relates to, is in the nature of or was caused by any breach of contract,

breach of warranty, tort, infringement or violation of Laws) or (iv) liabilities

that are obligations to perform pursuant to the terms of any Contract binding on

the PAPI Parties or any of their respective Subsidiaries.

Section

5.12 Absence of Certain Changes or

Events. Except

as set forth in the SEC Reports or on Schedule 5.12,

since December 31, 2008, PAPI has conducted its businesses only in the ordinary

course and in a manner consistent with past practice and there has not

been:

(a) any

PAPI Material Adverse Effect;

(b) any

damage, destruction or loss (whether or not covered by insurance) with respect

to a PAPI Party or any of their respective Subsidiaries, having a replacement

cost of more than $50,000 for any single loss or $200,000 for all such

losses;

(c) except

as required by changes in GAAP or any Law regarding Taxes, any material change

by a PAPI Party or any of their respective Subsidiaries in their accounting or

Tax reporting methods, principles or practices;

(d) any

declaration, setting aside or payment of any dividends on or dividends in

respect of any Equity Interests of a PAPI Party;

(e) any

(A) issuance of any Equity Interests in a PAPI Party or any of their respective

Subsidiaries, (B) redemption, purchase or other acquisition by a PAPI Party or

any of their respective Subsidiaries of any Equity Interests of a PAPI Party or

any of their respective Subsidiaries or (C) any split, combination or

reclassification of any Equity Interests of a PAPI Party or any of their

respective Subsidiaries;

(f) any

entry into, or amendment of, any employment, consulting, severance, change in

control or indemnification agreement or any agreement with respect to any

retention bonus with any employee of a PAPI Party or any of their respective

Subsidiaries or any other Person, or any incurrence of, entry into or amendment

of any collective bargaining agreement or obligation to any labor

organization;

(g) any

increase or acceleration of the benefits under, or the establishment or

amendment of, any bonus, insurance, severance, deferred compensation, pension,

retirement, profit sharing, option (including the granting of equity options,

equity appreciation rights, performance awards or restricted equity awards),

equity purchase or other employee benefit plan, or any increase in the

compensation payable or to become payable to partners, members, directors,

officers, employees or contractors of a PAPI Party or any of their respective

Subsidiaries, except for (A) increases in salaries or wages payable or to become

payable in the ordinary course of business and consistent with past

practice;

(h) any

making by a PAPI Party or any of their respective Subsidiaries of any material

election relating to Taxes, the rescission by a PAPI Party or any of their

respective Subsidiaries of any material election relating to Taxes or the

settlement or compromise of any material claim relating to Taxes;

-17-

(i) any

entry by a PAPI Party or any of their respective Subsidiaries into any

commitment, arrangement or transaction with any director, officer, member,

partner or holder of any Equity Interest in a PAPI Party or any of their

respective Subsidiaries;

(j) any

revaluation by a PAPI Party or any of their respective Subsidiaries of any of

its assets or properties, including the writing down of the value of inventory

or the writing down or off of notes or accounts receivable, other than in the

ordinary course of business and consistent with past practices;

(k) any

material acquisition of any assets, business or Person (other than the purchase

of assets from suppliers or vendors in the ordinary course of business

consistent with past practice);

(l) any

sale, transfer, lease, exchange or other disposition of any material assets or

properties owned or leased by a PAPI Party or any of their respective

Subsidiaries (other than in the ordinary course of business consistent with past

practice);

(m) any

pending order for, any capital expenditures, or capital additions or betterments

made by or on behalf of a PAPI Party or any of their respective Subsidiaries in

excess of $100,000 in the aggregate;

(n) any

waiver, release, discharge, transfer or cancellation by a PAPI Party or any of

their respective Subsidiaries of any debt or claim or the amendment,

cancellation, termination, relinquishment, waiver or release of any Contract or

right, other than such actions in the ordinary course of business consistent

with past practice and, in the aggregate, not material to a PAPI Party and their

respective Subsidiaries;

(o) any

commencement or settlement of any material legal actions, suits or other legal

proceedings;

(p) the

creation of any Lien, other than Permitted Liens, on any assets or properties

owned or leased by a PAPI Party or any of their respective

Subsidiaries;

(q) any

discharge or satisfaction of any Lien, or payment of any obligation or liability