Attached files

| file | filename |

|---|---|

| 8-K - CITIZENS & NORTHERN CORP | v165630_8-k.htm |

| EX-99.1 - CITIZENS & NORTHERN CORP | v165630_ex99-1.htm |

CITIZENS & NORTHERN CORPORATION

Follow-on Offering of Common Shares

$20,000,000

November 2009

Ticker: CZNC

www.cnbankpa.com

Charles H. Updegraff Jr.

Chief Operating Officer

Mark A. Hughes

Chief Financial Officer

Craig G. Litchfield

Chairman, President & CEO

1

Safe Harbor Regarding Forward Looking Statements

This presentation contains forward-looking information about Citizens & Northern Corporation that is intended to be covered by the safe harbor for

forward-looking statements provided by the Private Securities

Litigation Reform Act of 1995. Forward-looking statements are statements that are not

historical facts. These statements can be identified by the use of forward-looking terminology such as “believe,” “expect,” “may,”

“will,” “should,” “project,”

“plan,” “goal,” “potential,” “pro forma,” “seek,” “intend,” or “anticipate” or the negative thereof or comparable

terminology, and include discussions of

rationales, objectives, expectations or consequences of proposed or announced transactions, and statements about the future performance, operations,

products and services of Citizens & Northern Corporation

and its subsidiaries. Citizens & Northern Corporation cautions investors not to place undue

reliance on these statements.

Citizens & Northern Corporation’s business and operation are subject to a variety of risks, uncertainties and other factors. Consequently, actual results

and experience may materially differ

from those contained in any forward-looking statements. Such risks, uncertainties and other factors that could cause

actual results and experience to differ from those projected include, but are not limited to, the effects of future economic,

business and market conditions,

domestic and foreign, including seasonality; the effects of, and changes in, governmental monetary and fiscal policies; legislative and regulatory changes,

including changes in banking, securities and tax laws and regulations

and their application by our regulators; changes in accounting policies, rules and

practices; the risk of changes in interest rates on the levels, composition and costs of deposits, loan demand, and the values and liquidity of loan

collateral, securities,

and interest sensitive assets and liabilities; the risk of decreases in the value of investment securities we own; the effects of other-

than-temporary impairment charges relating to our investment portfolio; failure to realize deferred tax assets; credit

risks of borrowers; and changes in the

availability and cost of credit and capital in the financial markets. These risks and others are described in greater detail in Citizens & Northern

Corporation’s Annual Report on Form 10-K for

the fiscal year ended December 31, 2008, as well as Citizens & Northern Corporation’s Quarterly Reports

on Form 10-Q and other documents filed by Citizens & Northern Corporation with the SEC after the date hereof, including the prospectus supplement

filed with the SEC on November 12, 2009. Citizens & Northern Corporation makes no commitment to revise or update any forward-looking statements in

order to reflect events or circumstances occurring or existing after the date any forward-looking

statement is made.

Free Writing Prospectus Statement

The Company has filed a registration statement (including a prospectus and a related prospectus supplement) with the SEC for the offering to which this

communication relates. Before you invest,

you should read the prospectus and the prospectus supplement in that registration statement and other

documents the Company has filed with the SEC for more complete information about the Company and this offering. You may get these documents

for

free by visiting EDGAR on the SEC website at www.sec.gov. Alternatively, the Company, any underwriter, or any dealer participating in the offering will

arrange to send you the prospectus if you request it by calling Sandler O’Neill

& Partners, L.P. toll-free at (866) 805-4128 or Boenning & Scattergood, Inc.

toll free at (800) 882-1212.

2

Offering Summary

Issuer:

Citizens & Northern Corporation

Type of Offering:

Follow-on Public Offering

Type of Security:

Common Stock

Ticker Symbol:

CZNC

Exchange:

The NASDAQ Capital Market

Offering Size:

Gross Proceeds of $20 Million

Over-Allotment Option:

15%

Use of Proceeds:

General corporate purposes, including continued

organic growth, potential acquisitions and the

possible repurchase of TARP Senior Preferred

Stock held by the U.S. Treasury

Sole Book-Running Manager:

Sandler O'Neill + Partners, L.P.

Co-Manager:

Boenning & Scattergood, Inc.

3

Rationale For Offering

Improves strong, “well-capitalized” regulatory capital ratios

Along with the planned dividend reduction of at least fifty percent, this capital raise

will further strengthen our capital position in a volatile and challenging market

environment

Help offset negative impact of recent OTTI charges in investment portfolio

Allows Citizens & Northern to take advantage of potential competitor disruptions and

selective acquisition opportunities

Increases pro forma tangible common equity/tangible assets ratio to over 8.0% as of

September 30, 2009

Leverage organic growth opportunities

Positions Citizens & Northern to eventually repurchase TARP Capital Purchase Program

Senior Preferred Stock

4

Franchise Overview

Headquarters: Wellsboro, Pennsylvania

Founded in 1864 as "The First National Bank of

Wellsborough”

September 30, 2009 Total Assets: $1.3 Billion

Market Capitalization (Nov. 10, 2009): $108.8 Million

Locations

Pennsylvania banking services are provided by its

subsidiary, Citizens & Northern Bank, from 24

banking offices in Bradford (7), Cameron (1),

Lycoming (6), McKean (1), Potter (1), Sullivan (2)

and Tioga (6) Counties

In addition, the corporation's subsidiary, First State

Bank, operates banking offices in Canisteo (1) and

Hornell (1), NY in Steuben County

Business Lines

Banking

Wealth Management

Trust Services

Insurance

5

Summary Statistics (as of September 30, 2009)

Total Assets:

$1.3 Billion

Net Loans:

$720.3 Million

Total Deposits:

$896.9 Million

Tangible Common Equity:

$87.8 Million

Tang. Common Equity / Tang. Assets:

6.91%

Tier 1 Leverage Ratio:

7.60%

Total Risk Based Capital:

12.46%

Non-Performing Assets / Total Assets:

0.77%

Non-Performing Loans / Total Loans:

1.16%

Net Chargeoffs / Average Loans:

0.04% (Annualized for 9 Months)

0.07% (Annualized for 3 Months)

LTM Earnings Per Share:

($4.77)

LTM Core Earnings¹ Per Share:

$1.79

Note: ¹ Core Earnings is a non-GAAP financial measure. Core Earnings is an earnings performance measurement the Corporation's management has defined to exclude net impairment

losses on available-for-sale

securities and certain other revenues and expenses. Ratios and other financial measures with the word “core” in their title are computed using Core

Earnings rather than net income (loss). Please see the Appendix for reconciliations

of non-GAAP financial measures.

6

Current Footprint

7

Strong Market Share in Legacy Counties

Sources: FDIC, SNL Financial, ESRI

Notes: Including Banks & Thrifts. Data pro forma for any acquisitions. Deposit Data as of June 30, 2009

County

% of CZNC

Deposits

Market

Rank

Market

Share %

Number of

Community

Banking

Offices

Projected HHI

Growth

(2009 – 2014)

Nationwide Proj.

HHI Growth

(2009 – 2014)

Bradford, PA

34.9%

1

35.18%

7

4.59%

4.06%

Tioga, PA

28.6%

1

42.46%

6

4.97%

Lycoming, PA

14.2%

7

7.29%

6

8.78%

Sullivan, PA

8.3%

1

59.05%

2

2.42%

Potter, PA

5.8%

3

22.14%

1

2.88%

Steuben, NY

4.7%

6

5.23%

2

5.88%

Cameron, PA

2.5%

2

34.17%

1

4.39%

McKean, PA

0.9%

6

1.17%

1

7.95%

8

Experienced Management Team

Name

Position

Years of Financial

Service Experience

Years with Citizens &

Northern

Relevant Experience or

Education

Craig Litchfield

Chairman, President &

CEO

37

37

MBA – Syracuse

Charles Updegraff

Chief Operating Officer

35

2½

CEO Citizens Trust

Company

Mark Hughes, CPA

Chief Financial Officer

& Treasurer

10

9

CPA, Parente

Randolph

Deborah Scott

Senior Trust Officer

20

12

Master of Financial

Planning

Dawn Besse

EVP Credit

Administration

40

9

Key Bank, PNC

9

Investment Considerations

Leading market share among community banks in Northern Central Pennsylvania

Experienced management team

Insider commitment: 100% of Board and senior management team will invest in offering

Strong core profitability, with diverse revenue sources

Disciplined credit culture and risk management profile

Opportunity for growth in existing and new markets organically and through market

dislocation

Marcellus Shale Natural Gas likely to provide economic boost to local economy

Effective cost control culture based on recent restructuring

Improved balance sheet: pooled and single-issuer trust preferred securities written down

and losses taken during Q3 2009, removing vast majority of credit quality issues in

investment portfolio

10

Marcellus Shale Natural Gas Economic Boost

The Marcellus Shale formation can be found beneath about 60 percent of Pennsylvania’s total land mass, where it is buried to depths of up to

9,000 feet. The most prospective areas for natural gas production

are where the shale is present at least 5,000 feet below ground surface. The

thickness of the shale formation in regions where drilling may be feasible range between 50-250 feet. Geologists use a number of tools to

determine where the formation may

have the best potential to produce natural gas, and how to best extract it.

Wealth Management

Opportunities

Improved Economy and

Employment

Improved Business

Opportunities

11

Strong Core Earnings¹ Generation

Core Earnings Per Share

Core Return on Average Equity

Core Return on Average Assets

Efficiency Ratio

Note: ¹ See note on Page 6 regarding Non-GAAP financial measures

12

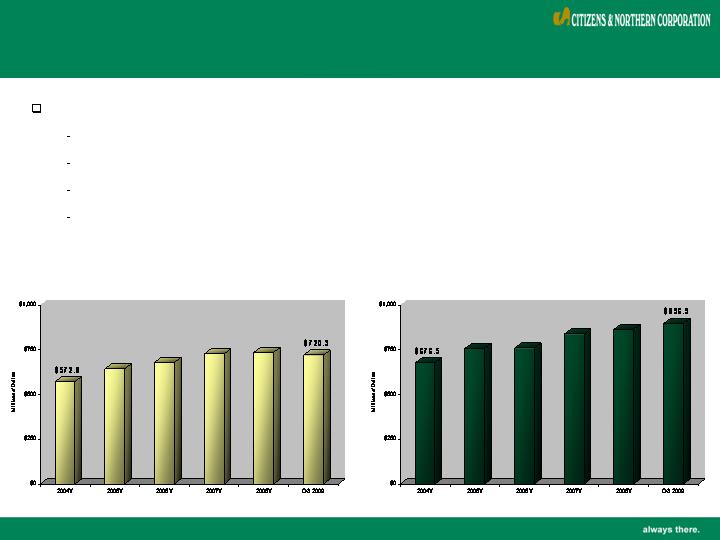

Historical Loan & Deposit Growth

Total Deposits

Net Loans

Historical loan and deposit growth a combination of:

Organic growth

De-novo branching

Market dislocation

Acquisitions of Citizens Bancorp, Inc. (May 2007) and Canisteo Valley Corp. (Sept. 2005)

13

Loan Portfolio Diversification

Loans slightly decreased in 2009 due to the challenging economic environment, as Citizens &

Northern has experienced contraction in the balance of its mortgage and consumer loan

portfolios, with slight

growth in average commercial and tax-exempt loan balances

14

(Dollars in Thousands)

September 30, 2009

Loan Type

Amount

% of Total

Real Estate - Residential Mortgage

420,754

$

57.76%

Real Estate - Commercial Mortgage

163,406

22.43%

Real Estate - Construction

26,036

3.57%

Consumer

21,033

2.89%

Agricultural

3,755

0.52%

Commercial

49,413

6.79%

Other

1,213

0.16%

Political Subdivisions

42,869

5.88%

Total

728,479

$

100.00%

Strong Credit Quality

15

Disciplined credit culture and risk management profile resulting in impressive asset quality,

especially given the current operating environment

(Dollars in Thousands)

6/30/2008

9/30/2008

12/31/2008

3/31/2009

6/30/2009

9/30/2009

30 - 89 Days Past Due

9,465

$

10,925

$

9,875

$

10,775

$

9,433

$

9,557

$

90 Days Past Due and Still Accruing

2,883

1,378

1,305

856

281

370

Non-Accrual Loans

5,813

7,782

7,200

7,051

9,637

8,091

Total Non-Performing Loans and Leases

8,696

9,160

8,505

7,907

9,918

8,461

ORE and Repossessed Assets

202

312

298

1,057

922

1,408

Total Non-Performing Assets

8,898

$

9,472

$

8,803

$

8,964

$

10,840

$

9,869

$

Non-Performing Loans/Total Loans

1.16%

1.21%

1.14%

1.08%

1.36%

1.16%

Non-Performing Assets/Total Assets

0.69%

0.73%

0.69%

0.69%

0.84%

0.77%

Allowance for Credit Losses

8,446

$

8,498

$

7,857

$

7,651

$

7,681

$

8,188

$

Allowance/Total Loans

1.13%

1.12%

1.06%

1.05%

1.06%

1.12%

Allowance/Non-Performing Loans

97%

93%

92%

97%

77%

97%

Net Charge-Offs

126

$

89

$

881

$

33

$

63

$

127

$

Net Charge-Offs/Average Loans

0.07%

0.05%

0.47%

0.02%

0.03%

0.07%

Provision/Net Charge-Offs

NM

158%

27%

NM

148%

499%

Analysis for the Allowance for Loan Losses

16

(Dollars in Thousands)

Quarter Ending,

Year Ending,

9/30/2009

6/30/2009

3/31/2009

12/31/2008

12/31/2007

Balance, beginning of year

7,681

7,651

7,857

8,859

8,201

Charge-offs:

Real estate loans

88

1

5

1,457

196

Installment loans

60

103

73

254

216

Credit cards and related plans

-

(8)

8

5

5

Commercial and other loans

1

5

6

323

127

Total Charge-offs:

149

101

92

2,039

544

Recoveries:

Real estate loans

6

-

-

20

8

Installment loans

15

32

43

83

41

Credit cards and related plans

-

-

-

4

9

Commercial and other loans

1

6

16

21

28

Total Recoveries:

22

38

59

128

86

Net Charge-offs:

127

63

33

1,911

458

ALL recorded in acquisitions

0

0

0

0

587

(Credit) provision for loan losses

634

93

(173)

909

529

Balance, end of period

8,188

7,681

7,651

7,857

8,859

Investment Portfolio

Significant OTTI charges have dramatically impacted earnings for the first nine months of 2009

Based on the relatively small ($1.6 million) remaining cost basis of mezzanine pooled trust-

preferred securities as of September 30, 2009, management currently believes the vast majority

of the losses

in the investment portfolio have been realized

The current investment portfolio is approximately $400 million, with the majority being made up of

municipal bonds and mortgage-backed securities

17

Deposit Composition

The 2009 increase in deposits has come mainly in interest checking, money market, and individual

retirement accounts and is partially offset by a reduction in the balance in certificates of deposit

Consistent with substantial reductions in short-term global interest rates, the average rates incurred on

deposit accounts have decreased significantly in 2009 as compared to 2008

18

September 30, 2009

Deposit Type

Amount

% of Total

Non Interest Bearing Demand

127,805

$

14.53%

Interest Bearing Demand

100,809

11.46%

Savings Accounts

69,111

7.86%

Money Market

200,960

22.85%

Jumbo CDs (Greater Than $100K)

115,334

13.12%

Retail CDs (Less Than $100K)

265,305

30.18%

Brokered CDs

-

0.00%

Total

879,324

$

100.00%

Average Daily Balances (Dollars in Thousands)

Pro Forma Consolidated Capital Ratios

Note: Pro forma ratios based on Company balance sheet as of September 30, 2009 with additional $20 million, less estimated expenses and

underwriting discount, of common equity. Risk-based

ratio assumes all $20 million immediately invested in 100% risk-weighted assets.

19

Main Considerations Going Forward

Opportunistic capital raise viewed as a means to take advantage of growth both

organically and through market dislocation

Will also strengthen our position as an acquirer of attractive, well-priced targets

that are either in or contiguous to our current footprint

Stronger and improved pro forma balance sheet through capital raise and OTTI

securities write-downs

Continued focus on a disciplined credit culture and risk management profile

Maintaining effective cost controls while improving profitability through net interest

margin and increased fee income

Strong management team with the experience and knowledge to execute on

strategy

20

APPENDIX

21

Reconciliation of Non-GAAP Financial Measures

Notes:

Core Earnings is a non-GAAP earnings performance measurement the Corporation's management has defined to exclude net impairment losses on available-for-sale securities and certain

other revenues and expenses.

Ratios and other financial measures with the word “core” in their title are computed using Core Earnings rather than net income (loss). This non-GAAP

information should not be viewed as a substitute for results of operations determined

in accordance with GAAP, nor is it necessarily comparable to non-GAAP performance measures that

may be presented by other companies. Management believes this information is meaningful for shareholders to evaluate the Corporation's operating performance,

because it excludes

some of the impact of market volatility as it relates to investments in pooled trust-preferred securities and other securities in our investment portfolio.

Income tax has been allocated to non-core gains and losses at 34%, adjusted for a valuation allowance on deferred tax assets associated with losses from securities classified as capital

assets for federal income

tax reporting purposes. The valuation allowance, which was recorded in the third quarter 2009, increased the income tax provision allocated to non-core gains and

losses by $886,000.

22

Annual Dividend Reduction

Citizens & Northern’s Board of Directors approved a reduction in our quarterly

dividend of at least fifty percent (from $0.24 per share to no more than $0.12 per

share) commencing in the fourth

quarter of 2009, subject to regulatory approval

No determination has been made by our Board of Directors regarding whether

or what amount of dividends will be paid in future quarters. Additionally, there

can be no assurance that regulatory approval

will be granted by the Federal

Reserve Board to pay the reduced dividend

Based on 9,236,744 shares of common stock outstanding as of November 9, 2009,

a fifty percent dividend reduction will save Citizens & Northern approximately $4.4

million annually

23

Pre-Tax OTTI Charges

Pre-tax OTTI charges in the first nine months of 2009 totaled $84,407,000, including

$47,947,000 in the third quarter 2009. A summary of pre-tax OTTI charges for the 3-

month and 9-month periods

ended September 30, 2009 and 2008 is as follows:

After the impact of the impairment charges, the Corporation’s cost basis in pooled trust-

preferred securities at September 30, 2009 totaled $13.3 million, including senior tranche

assets of $11.7

million and mezzanine tranche assets of $1.6 million

24

2007 – 2008 Organizational Restructuring

15.9% reduction in workforce

Approximately $2.5 Million in after-tax annual improvement from revenue

enhancements and cost reductions and efficiencies

Improved customer service and cross-sell opportunities with addition of call center

25

Wealth Management Division

Largest Locally-Based Wealth Management Department with

Integrated Broker/Dealer and Insurance Sales

Team is comprised of over 30 professionals

$592.8 million in Assets Under Management as of September 30, 2009

$2.4 million in Revenue for nine months ending September 30, 2009

$3.4 million of Revenue for 2008 and $3.4 million for 2007

26