Attached files

| file | filename |

|---|---|

| EX-5.1 - LEGAL OPINION WITH CONSENT - Nova Lifestyle, Inc. | stevenss1110609ex5.htm |

| EX-10.1 - OPTION TO PURCHASE AGREEMENT DATED SEPTEMBER 30, 2009 - Nova Lifestyle, Inc. | stevenss1110609ex10.htm |

| EX-3.2 - BY-LAWS - Nova Lifestyle, Inc. | stevenss1110609ex32.htm |

| EX-14.1 - CODE OF ETHICS - Nova Lifestyle, Inc. | stevenss1110609ex14.htm |

| EX-23.1 - CONSENT OF ACCOUNTANT - Nova Lifestyle, Inc. | stevenss1110609ex23.htm |

| EX-3.1 - ARTICLES OF INCORPORATION - Nova Lifestyle, Inc. | stevenss1110609ex3.htm |

UNITED

STATES

SECURITIES

AND EXCHANGE COMMISSION

Washington,

D.C. 20549

Form

S-1

REGISTRATION STATEMENT UNDER THE

SECURITIES ACT OF 1933

STEVENS

RESOURCES, INC.

(Name of

Small Business Issuer in its charter)

|

NEVADA

|

1090

|

75-3250686

|

|

(State

or jurisdiction of incorporation or organization)

|

(Primary

Standard Industrial Classification Code Number)

|

(I.R.S.

Employer ID No.)

|

1818 West

Francis, Ste. 196

Spokane,

Washington 99205

Phone

(509) 263.7442

(Address

and telephone number of principal executive offices)

InCorp

Services, Inc.

3155 East

Patrick Lane, Suite 1

Las

Vegas, NV 89120

702-866-2500

(Name,

address and telephone number of agent for service)

Copies

to:

Timothy

S. Orr, Esq.

4328 West

Hiawatha Drive, Suite 101

Spokane,

WA 99205

Phone:

(509) 462.2926 Fax: (509) 769.0303

1

APPROXIMATE

DATE OF PROPOSED SALE TO THE PUBLIC:

From time

to time after this Registration Statement becomes effective.

If any of the securities being

registered on this Form are to be offered on a delayed or continuous basis

pursuant to Rule 415 under the Securities Act of 1933 check the following

box: x

If this Form is filed to register

additional securities for an offering pursuant to Rule 462(b) under the

Securities Act, please check the following box and list the Securities Act

registration statement number of the earlier registration statement for the same

offering. ¨

If this Form is a post-effective

amendment filed pursuant to Rule 462(c) under the Securities Act, check the

following box and list the Securities Act registration statement number of the

earlier effective registration statement for the same offering.¨

If this Form is a post-effective

amendment filed pursuant to Rule 462(d) under the Securities Act, check the

following box and list the Securities Act registration statement number of the

earlier effective registration statement for the same offering.¨

Indicate

by check mark whether the registrant is a large accelerated filer, an

accelerated filer, a non-accelerated filer, or a smaller reporting company.

(Check one):

Large

Accelerated Filer ¨

Accelerated Filer ¨

Non-Accelerated Filer ¨ Smaller Reporting

Company x

CALCULATION OF REGISTRATION

FEE

|

Title

of each class of

securities

to be registered

|

Amount

to

be

registered

|

Proposed

maximum

offering

price per unit

|

Proposed

maximum

aggregate

offering price

|

Amount

of

registration

fee

|

||||

|

Common

|

5,000,000

|

$0.02

[1]

|

$100,000

|

$5.58

[2]

|

[1] No

exchange or over-the-counter market exists for Stevens Resources, Inc’s. common

stock. The offering price has been arbitrarily determined and bears

no relationship to assets, earnings, or any other valuation criteria. No

assurance can be given that the shares offered hereby will have a market value

or that they may be sold at this, or at any price.

[2] Fee

calculated in accordance with Rule 457(o) of the Securities Act of 1933, as

amended “Securities Act”. Estimated for the sole purpose of

calculating the registration fee.

The

Registrant hereby amends this Registration Statement on such date or dates as

may be necessary to delay its effective date until the Registrant shall file a

further amendment which specifically states that this Registration Statement

shall thereafter become effective in accordance with Section 8(a) of the

Securities Act or until the Registration Statement shall become effective on

such date as the Commission, acting pursuant to Section 8(a), may

determine.

2

The information in this prospectus is not complete and may be changed.

We may not sell these securities until the registration statement filed with the

Securities and Exchange Commission is effective. This prospectus is not an offer

to sell these securities and it is not soliciting an offer to buy these

securities in any state where the offer or sale is not

permitted.

| PROSPECTUS |

Subject

To Completion: Dated ______, 2009

STEVENS

RESOURCES, INC.

5,000,000

shares of common stock, no minimum / 5,000,000 maximum Offered at $0.02 per

share

|

Securities

Being Offered by Stevens Resources, Inc.

|

Stevens

Resources, Inc. is offering 5,000,000 shares at an offering price of $0.02

per share. There is currently no public market for the common

stock

|

|

|

Minimum

Number of Shares To Be Sold in This Offering

|

None

|

This is a

"self-underwritten" public offering, with no minimum purchase

requirement.

1.

Stevens Resources, Inc. is not using an underwriter for this

offering.

2. The

offering expenses shown do not include legal, accounting, printing and related

costs incurred in making this offering. Stevens Resources, Inc. will pay all

such costs, which it believes to be $4,500.

3. There

is no arrangement to place the proceeds from this offering in an escrow, trust

or similar account.

|

|

Per

Share

(Non

Minimum)

|

If

Maximum Sold by Stevens Resources (5,000,000)

|

||||||

|

Price

to Public

|

$

|

0.02

|

$

|

0.02

|

||||

|

Underwriting

Discounts/Commissions

|

0.00

|

0.00

|

||||||

|

Proceeds

to Registrant

|

$

|

0.02

|

$

|

100,000

|

||||

This

offering involves a high degree of risk; see "Risk Factors"

beginning on page 8 to read about factors you should consider before buying

shares of the common stock.

Stevens

Resources, Inc. is an exploration stage company and currently has no operations.

There is a high degree of risk involved with any investment in the shares

offered herein. You should only purchase shares if you can afford a loss of your

entire investment. Our independent auditor has issued an audit opinion for

Stevens Resources, Inc. which includes a statement expressing substantial doubt

as to our ability to continue as a going concern. As of the date of

this prospectus, our stock is presently not traded on any market or securities

exchange. Further, there is no assurance that a trading market for our

securities will ever develop.

These

securities have not been approved or disapproved by the Securities and Exchange

Commission or any state securities commission, nor has the Securities and

Exchange Commission or any state securities commission passed upon the accuracy

or adequacy of this prospectus. Any representation to the contrary is a criminal

offense.

The

Date of this Prospectus is ______________, 2009

3

TABLE

OF CONTENTS

|

Page

|

||

|

FORWARD-LOOKING

STATEMENTS

|

6

|

|

|

SUMMARY

INFORMATION

|

7

|

|

|

RISK

FACTORS AND UNCERTAINTIES

|

8

|

|

|

USE

OF PROCEEDS

|

14

|

|

|

DETERMINATION

OF OFFERING PRICE

|

15

|

|

|

DILUTION

|

15

|

|

|

PLAN

OF DISTRIBUTION

|

16

|

|

|

DESCRIPTION

OF SECURITIES

|

17

|

|

|

INTEREST

OF NAMED EXPERTS AND COUNSEL

|

17

|

|

|

DESCRIPTION

OF BUSINESS

|

18

|

|

|

DESCRIPTION

OF PROPERTY

|

20

|

|

|

LEGAL

PROCEEDINGS

|

23

|

|

|

MARKET

FOR COMMON EQUITY AND RELATED SHAREHOLDER MATTERS

|

23

|

|

|

FINANCIAL

STATEMENTS

|

24

|

|

|

MANAGEMENT’S

DISCUSSION AND ANALYSIS

|

25

|

|

|

CHANGES

IN AND DISAGREEMENTS WITH ACCOUNTANTS ON ACCOUNTING AND FINANCIAL

DISCLOSURE

|

31

|

|

|

DIRECTORS,

EXECUTIVE OFFICERS, AND CONTROL PERSONS

|

31

|

|

|

EXECUTIVE

COMPENSATION

|

32

|

|

|

SECURITY

OWNERSHIP OF CERTAIN BENEFICIAL OWNERS AND MANAGEMENT AND RELATED

STOCKHOLDER MATTERS

|

33

|

|

|

CERTAIN

RELATIONSHIPS AND RELATED TRANSACTIONS

|

33

|

|

|

DISCLOSURE

OF COMMISSION POSITION OF INDEMNIFICATION FOR SECURITIES ACT

LIABILITIES

|

34

|

|

|

CORPORATE

GOVERNANCE

|

34

|

|

|

THE

SEC’S POSITION ON INDEMNIFICATION FOR LIABILITIES

|

34

|

|

|

TRANSFER

AGENT AND REGISTRAR

|

34

|

|

|

LEGAL

MATTERS

|

35

|

|

|

WHERE

YOU CAN FIND MORE INFORMATION

|

35

|

|

|

GLOSSARY

OF CERTAIN MINING TERMS

|

35

|

4

|

PART

II - INFORMATION NOT REQUIRED IN THE PROSPECTUS

|

II-1

|

|

|

OTHER

EXPENSES OF ISSUANCE AND DISTRIBUTION

|

II-1

|

|

|

INDEMNIFICATION

OF DIRECTORS AND OFFICERS

|

II-1

|

|

|

RECENT

SALES OF UNREGISTERED SECURITIES

|

II-2

|

|

|

EXHIBITS

|

II-2

|

|

|

UNDERTAKINGS

|

II-3

|

|

|

SIGNATURES

|

II-5

|

5

FORWARD-LOOKING

STATEMENTS

This

prospectus and the exhibits attached hereto contain “forward-looking statements”

within the meaning of the Private Securities Litigation Reform Act of 1995. Such

forward-looking statements concern the Company’s anticipated results and

developments in the Company’s operations in future periods, planned exploration

and development of its properties, plans related to its business and other

matters that may occur in the future. These statements relate to analyses

and other information that are based on forecasts of future results, estimates

of amounts not yet determinable and assumptions of management.

Any

statements that express or involve discussions with respect to predictions,

expectations, beliefs, plans, projections, objectives, assumptions or future

events or performance (often, but not always, using words or phrases such as

“expects” or “does not expect”, “is expected”, “anticipates” or “does not

anticipate”, “plans”, “estimates” or “intends”, or stating that certain actions,

events or results “may”, “could”, “would”, “might” or “will” be taken, occur or

be achieved) are not statements of historical fact and may be forward-looking

statements. Forward-looking statements are subject to a variety of known

and unknown risks, uncertainties and other factors which could cause actual

events or results to differ from those expressed or implied by the

forward-looking statements, including, without limitation:

risks

related to our properties being in the exploration stage;

risks

related our mineral operations being subject to government

regulation;

risks

related to our ability to obtain additional capital to develop our resources, if

any;

risks

related to mineral exploration and development activities;

risks

related to our insurance coverage for operating risks;

risks

related to the fluctuation of prices for precious and base metals, such as gold,

silver and copper;

risks

related to the competitive industry of mineral exploration;

risks

related to our title and rights in our mineral properties;

risks

related to our limited operating history;

risks

related the possible dilution of our common stock from additional financing

activities;

risks

related to potential conflicts of interest with our management;

risks

related to our subsidiaries activities; and

risks

related to our shares of common stock.

This list

is not exhaustive of the factors that may affect our forward-looking statements.

Some of the important risks and uncertainties that could affect forward-looking

statements are described further under the section headings “Risk Factors and

Uncertainties”, “Description of the Business” and “Management’s Discussion and

Analysis” of this prospectus. Should one or more of these risks or

uncertainties materialize, or should underlying assumptions prove incorrect,

actual results may vary materially from those anticipated, believed, estimated

or expected. We caution readers not to place undue reliance on any such

forward-looking statements, which speak only as of the date made. We

disclaim any obligation subsequently to revise any forward-looking statements to

reflect events or circumstances after the date of such statements or to reflect

the occurrence of anticipated or unanticipated events.

We

qualify all the forward-looking statements contained in this prospectus by the

foregoing cautionary statements.

6

You

should rely only on the information contained in this prospectus. We have not

authorized anyone to provide you with information different from the information

contained in this prospectus. The information contained in this prospectus is

accurate only as of the date of this prospectus, regardless of when this

prospectus is delivered or when any sale of our common stock

occurs.

This

summary does not contain all of the information you should consider before

buying shares of our common stock. You should read the entire prospectus

carefully, especially the “Risk Factors and Uncertainties” section and our

consolidated financial statements and the related notes before deciding to

invest in shares of our common stock.

SUMMARY

INFORMATION

The

Offering

Stevens

Resources, Inc.'s common stock is presently not traded on any market or

securities exchange. 2,100,000 shares of restricted common stock are issued and

outstanding as of the date of this prospectus.

Stevens

is offering up to 5,000,000 shares of common stock at an offering price of $0.02

per share. There is currently no public market for the common stock. Stevens

intends to apply to have the common stock quoted on the OTC Bulletin Board

(OTCBB). Currently, there is no trading symbol assigned. Stevens'

sole Officer and Director own 2,000,000 shares of Restricted Common

Stock. A non-affiliate entity owns 100,000 shares of Restricted

Common Stock. If Stevens is unable to sell its stock and raise money, Stevens’

business would fail as it would be unable to complete its business plan and any

investment made into the Company would be lost in its entirety.

The

purchase of the securities offered through this prospectus involves a high

degree of risk. See section entitled "Risk Factors" on pages 8 -

14.

Company

History

Unless otherwise indicated, any

reference to Stevens or as “we”, “us”, or “our” refers to Stevens Resources,

Inc. Stevens Resources, Inc. is an exploration stage company that was

incorporated on September 9, 2009, under the laws of the State of Nevada. Our

fiscal year end is September 30. The principal offices are located at 1818 West

Francis, Ste 196 Spokane, WA 99205. The telephone number is (509)

263.7442 the fax number is (509) 327.9792.

Since

becoming incorporated, Stevens has not made any significant purchases or sale of

assets, nor has it been involved in any mergers, acquisitions or consolidations.

Stevens has never declared bankruptcy, it has never been in receivership, and it

has never been involved in any legal action or proceedings.

We are an

exploration stage corporation. We intend to be in the business of

mineral property exploration. We do not own any interest in any

property, but simply have the right to conduct exploration activities on one

property. The property consists of approximately 80 acres of lode mining claim

located in northwestern Stevens County, in northeastern Washington

State. We intend to explore for lead-zinc, gold, and silver on the

property. Currently, we have no further business planned if mineralized material

is not found on the property.

7

As of

September 30, 2009, the date of company's last audited financial statements,

Stevens has raised $4,000 through the sale of common stock. This sale

was a purchase of 2,000,000 shares by the Company’s sole officer and director

Justin Miller. We also issued 100,000 shares of common stock at an estimated

value of $2,000 for services relating to this offering.

Stevens’

current liabilities from inception to September 30, 2009 are $525. This expense

is relating to corporate start-up fees. The Company anticipates

expense of $4,000 relating to bookkeeping/auditing fees for this filing. As of

the date of this prospectus, we have not yet generated or realized any revenues

from our business operations. The following financial information summarizes the

more complete historical financial information as indicated on the audited

financial statements of Stevens filed with this prospectus.

Management

Currently,

Stevens has one Officer/Director, Justin Miller. Our sole Officer/Director has

assumed responsibility for all planning, development and operational duties, and

will continue to do so throughout the beginning stages of the business plan.

Other than the Officer/Director, there are no employees at the present time and

there are no plans to hire employees during the next twelve months.

Summary of Financial

Data

|

As

of

September

30, 2009

|

||||

|

Revenues

|

$

|

0

|

||

|

Operating

Expenses including Liabilities

|

$

|

525

|

||

|

Earnings

(Loss)

|

$

|

525

|

||

|

Total

Assets

|

$

|

4,200

|

||

|

Working

Capital

|

$

|

3,675

|

||

|

Shareholder’s

Equity

|

$

|

4,200

|

||

RISK

FACTORS AND UNCERTAINTIES

An

investment in an exploration stage mining company with no history of operations

such as ours involves an unusually high amount of risk, unknown and known,

present and potential, including, but not limited to the risks enumerated below.

Our

failure to successfully address the risks and uncertainties described below

would have a material adverse effect on our business, financial condition and/or

results of operations, and the trading price of our common stock may decline and

investors may lose all or part of their investment. We cannot assure you

that we will successfully address these risks or other unknown risks that may

affect our business.

8

Estimates

of mineralized material are forward-looking statements inherently subject to

error. Although resource estimates require a high degree of assurance in the

underlying data when the estimates are made, unforeseen events and

uncontrollable factors can have significant adverse or positive impacts on the

estimates. Actual results will inherently differ from estimates. The unforeseen

events and uncontrollable factors include: geologic uncertainties including

inherent sample variability, metal price fluctuations, variations in mining and

processing parameters, and adverse changes in environmental or mining laws and

regulations. The timing and effects of variances from estimated values cannot be

accurately predicted.

RISKS ASSOCIATED WITH

STEVENS RESOURCES, INC:

Because

our auditors have issued a going concern opinion, there is substantial

uncertainty we will continue activities in which case you could lose your

investment.

Our

auditors have issued a going concern opinion. This means that there is

substantial doubt that we can continue as an ongoing business for the next

twelve months. As such we may have to cease activities and you could lose your

entire investment.

There

is no assurance that we can establish the existence of any mineral reserve in

commercially exploitable quantities. Until we can do so, we cannot earn any

revenues from this property and if we do not do so we will lose all of the funds

that we expend on exploration. If we do not discover any mineral reserve in a

commercially exploitable quantity, our business would fail and any investment

made would be lost in its entirety.

We have

not established any mineral reserve according to recognized reserve guidelines

on any property we intend to explore, nor can there be any assurance that we

will be able to do so. [A mineral reserve is defined by the Securities and

Exchange Commission in its Industry Guide

(http://www.sec.gov/divisions/corpfin/forms/industry.htm#secguide7) as that part

of a mineral deposit, which could be economically and legally extracted or

produced at the time of the reserve determination.]

The

probability of an individual prospect ever having a "reserve" that meets the

requirements of the Securities and Exchange Commission's Industry Guide 7 is

extremely remote; in all probability our mineral property does not contain any

'reserve' and any funds that we spend on exploration will probably be lost. Even

if we do eventually discover a mineral reserve on one or more of our properties,

there can be no assurance that they can be developed into producing mines and

extract those minerals. Both mineral exploration and development involve a high

degree of risk and few properties, which are explored, are ultimately developed

into producing mines.

The

commercial viability of an established mineral deposit will depend on a number

of factors including, by way of example, the size, grade and other attributes of

the mineral deposit, the proximity of the mineral deposit to infrastructure such

as a smelter, roads and a point for shipping, government regulation and market

prices. Most of these factors will be beyond our control, and any of them could

increase costs and make extraction of any identified mineral deposit

unprofitable.

Mineral

operations are subject to applicable law and government regulation. Even if we

discover a mineral reserve in a commercially exploitable quantity, these laws

and regulations could restrict or prohibit the exploitation of that mineral

reserve. If we cannot exploit any mineral reserve that we might discover on our

properties, our business may fail.

9

Both

mineral exploration and extraction require permits from various foreign,

federal, state, provincial and local governmental authorities and are governed

by laws and regulations, including those with respect to prospecting, mine

development, mineral production, transport, export, taxation, labor standards,

occupational health, waste disposal, toxic substances, land use, environmental

protection, mine safety and other matters. Regarding our future ground

disturbing activity on federal land, we will be required to obtain a permit from

the US Forest Service or the Bureau of Land Management prior to commencing

exploration. There can be no assurance that we will be able to

obtain or maintain any of the permits required for the continued exploration of

our mineral properties or for the construction and operation of a mine on our

properties at economically viable costs. If we cannot accomplish these

objectives, our business could face difficulty and/or fail.

We

believe that we are in compliance with all material laws and regulations that

currently apply to our activities but there can be no assurance that we can

continue to do so. Current laws and regulations could be amended and we might

not be able to comply with them, as amended. Further, there can be no assurance

that we will be able to obtain or maintain all permits necessary for our future

operations, or that we will be able to obtain them on reasonable terms. To the

extent such approvals are required and are not obtained, we may be delayed or

prohibited from proceeding with planned exploration or development of our

mineral properties.

Environmental

hazards unknown to us, which have been caused by previous or existing owners or

operators of the properties, may exist on the properties in which we hold an

interest. At the date of this Prospectus, the Company is not aware of any

environmental issues or litigation relating to any of its current or former

properties.

Future

legislation and administrative changes to the mining laws could prevent us from

exploring our properties.

New state

and U.S. federal laws and regulations, amendments to existing laws and

regulations, administrative interpretation of existing laws and regulations, or

more stringent enforcement of existing laws and regulations, could have a

material adverse impact on our ability to conduct exploration and mining

activities. Any change in the regulatory structure making it more

expensive to engage in mining activities could cause us to cease

operations.

If

we establish the existence of a mineral reserve on our property in a

commercially exploitable quantity, we will require additional capital in order

to develop the property into a producing mine. If we cannot raise this

additional capital, we will not be able to exploit the reserve, and our business

could fail.

If we do

discover mineral reserves in commercially exploitable quantities on our

property, we will be required to expend substantial sums of money to establish

the extent of the reserve, develop processes to extract it and develop

extraction and processing facilities and infrastructure. Although we may derive

substantial benefits from the discovery of a major deposit, there can be no

assurance that such a resource will be large enough to justify commercial

operations, nor can there be any assurance that we will be able to raise the

funds required for development on a timely basis. If we cannot raise the

necessary capital or complete the necessary facilities and infrastructure, our

business may fail.

10

Mineral

exploration and development is subject to extraordinary operating risks. We do

not currently insure against these risks. In the event of a cave-in or similar

occurrence, our liability may exceed our resources, which would have an adverse

impact on our Company.

Mineral

exploration, development and production involve many risks, which even a

combination of experience, knowledge and careful evaluation may not be able to

overcome. Our operations will be subject to all the hazards and risks inherent

in the exploration, development and production of resources, including liability

for pollution, cave-ins or similar hazards against which we cannot insure or

against which we may elect not to insure. Any such event could result in work

stoppages and damage to property, including damage to the environment. We do not

currently maintain any insurance coverage against these operating hazards. The

payment of any liabilities that arise from any such occurrence would have a

material, adverse impact on our Company.

Third

parties may challenge our rights to our mineral properties or the agreements

that permit us to explore our properties may expire if we fail to timely renew

them and pay the required fees.

In

connection with the acquisition of our mineral properties, we sometimes conduct

only limited reviews of title and related matters, and obtain certain

representations regarding ownership. These limited reviews do not

necessarily preclude third parties from challenging our title and, furthermore,

our title may be defective. Consequently, there can be no assurance that

we hold good and marketable title to all of our mining concessions and mining

claims. If any of our concessions or claims were challenged, we could

incur significant costs and lose valuable time in defending such a challenge.

These costs or an adverse ruling with regards to any challenge of our

titles could have a material adverse affect on our financial position or results

of operations. There can be no assurance that any such disputes or

challenges will be resolved in our favor.

We are

not aware of challenges to the location or area of any of our mining claims.

There is, however, no guarantee that title to the claims will not be challenged

or impugned in the future.

Our

management has no technical training and no experience in mineral activities and

consequently our activities, earnings and ultimate financial success could be

irreparably harmed.

Our

management has no technical training and experience with exploring for,

starting, and operating a mine. With no direct training or experience in these

areas, management may not be fully aware of many of the specific requirements

related to working within the industry. Management's decisions and choices may

not take into account standard engineering or managerial approaches mineral

exploration companies commonly use. Consequently, our activities, earnings and

ultimate financial success could suffer irreparable harm due to management's

lack of experience in the industry.

Our

success is dependent on current management, who may be unable to devote

sufficient time to the development of our business; this potential limitation

could cause the business to fail.

Stevens

is heavily dependent on the experience that our sole Officer and Director,

Justin Miller. If something were to happen to him, it would greatly

delay its daily operations until further industry contacts could be established.

Furthermore, there is no assurance that suitable people could be found to

replace Mr. Miller. In that instance, Stevens may be unable to further its

business plan.

11

Additionally,

Mr. Miller is employed outside of Stevens. Mr. Miller has been and

continues to expect to be able to commit approximately 10 hours per week of his

time, to the development of our business for the next twelve months. If

management is required to spend additional time with his outside employment, he

may not have sufficient time to devote to Stevens, and as a result Stevens would

be unable to develop its business plan.

Because title to the property is

held in the name of another person, if he transfers the property to someone

other than us, we will cease activities.

Title to

the property upon which we intend to conduct exploration activities is not held

in our name. Title to the property is recorded in the name of American Mining

Corporation whom has an agreement with Mr. Miller for exploration upon the

property. If the owner transfers the property to a third person, the third

person will obtain good title and we will have nothing. If this should occur, we

will subsequently not own any property and we will have to cease all exploration

activities.

RISKS ASSOCIATED WITH THIS

OFFERING:

Because

we have only one officer and director who is responsible for our managerial and

organizational structure, in the future, there may not be effective disclosure

and accounting controls to comply with applicable laws and regulations which

could result in fines, penalties and assessments against the

Company.

We

currently have only one officer and director, Justin Miller. As such,

he is solely responsible for our managerial and organizational structure which

will include preparation of disclosure and accounting controls under the

Sarbanes-Oxley Act of 2002. When these controls are implemented, he will be

responsible for the administration of the controls. Should he not have

sufficient experience, he may be incapable of creating and implementing the

controls which may cause the Company to be subject to sanctions and fines by the

Securities Exchange.

If

we complete a financing through the sale of additional shares of our common

stock in the future, then shareholders will experience dilution.

The most

likely source of future financing presently available to us is through the sale

of shares of our common stock. Any sale of common stock will result in dilution

of equity ownership to existing shareholders. This means that if we sell shares

of our common stock, more shares will be outstanding and each existing

shareholder will own a smaller percentage of the shares then outstanding. To

raise additional capital we may have to issue additional shares, which may

substantially dilute the interests of existing shareholders. Alternatively, we

may have to borrow large sums, and assume debt obligations that require us to

make substantial interest and capital payments.

Because there is no public trading

market for our common stock, you may not be able to resell your

stock.

There is

currently no public trading market for our common stock. Therefore there is no

central place, such as stock exchange or electronic trading system to resell

your shares.

12

There

is currently no market for Stevens’ common stock, but if a market for our common

stock does develop, our stock price may be volatile.

There is

currently no market for Stevens' common stock and there is no assurance that a

market will develop. If a market develops, it is anticipated that the market

price of Stevens' common stock will be subject to wide fluctuations in response

to several factors including:

|

·

|

The

ability to complete the development of Stevens’ anticipated exploration

plan;

|

|

|

·

|

The

market price of the commodities Stevens’ anticipates exploring and mining;

and

|

|

|

·

|

The

ability to hire and retain competent personal in the

future.

|

While

Stevens expects to apply for listing on the OTC Bulletin Board (OTCBB), we may

not be approved, and even if approved, we may not be approved for trading on the

OTCBB; therefore shareholders may not have a market to sell their shares, either

in the near term or in the long term, or both.

We can

provide no assurance to investors that our common stock will be traded on any

exchange or electronic quotation service. While we expect to apply to the OTC

Bulletin Board, we may not be approved to trade on the OTCBB, and we may not

meet the requirements for listing on the OTCBB. If we do not meet the

requirements of the OTCBB, our stock may then be traded on the "Pink Sheets,"

and the market for resale of our shares would decrease dramatically, if not be

eliminated.

Stevens has limited financial

resources at present, and proceeds from the offering may not be used to fully

develop its business.

Stevens

has limited financial resources at present; as of September 30th it

had $4,000 of cash on hand with liabilities of $525. If it is unable

to develop its business plan, it may be required to divert certain proceeds from

the sale of Stevens' stock to general administrative functions. If Stevens is

required to divert some or all of proceeds from the sale of stock to areas that

do not advance the business plan, it could adversely affect its ability to

continue by restricting the Company's ability to become listed on the OTCBB;

advertise and promote the Company and its products; travel to develop new

marketing, business and customer relationships; and retaining and/or

compensating professional advisors.

Because our securities are subject

to penny stock rules, you may have difficulty reselling your

shares.

Our

shares are penny stocks are covered by section 15(g) of the Securities Exchange

Act of 1934 which imposes additional sales practice requirements on

broker/dealers who sell the Company's securities including the delivery of a

standardized disclosure document; disclosure and confirmation of quotation

prices; disclosure of compensation the broker/dealer receives; and, furnishing

monthly account statements. For sales of our securities, the broker/dealer must

make a special suitability determination and receive from its customer a written

agreement prior to making a sale. The imposition of the foregoing additional

sales practices could adversely affect a shareholder's ability to dispose of his

stock.

Because

we do not have an Escrow or Trust Account for Investor’s Subscriptions, if we

file for Bankruptcy Protection or are forced into Bankruptcy Protection,

Investors will lose their entire investment.

13

Invested

funds for this offering will not be placed in an escrow or trust account.

Accordingly, if we file for bankruptcy protection or a petition for involuntary

bankruptcy is filed by creditors against us, your funds will become part of the

bankruptcy estate and administered according to the bankruptcy laws. As such,

you will lose your investment and your funds will be used to pay creditors and

will not be used for the sourcing and sale of promotional

products.

These

risk factors, individually or occurring together, would likely have a

substantially negative effect on Stevens' business and would likely cause it to

fail.

USE

OF PROCEEDS

Our

offering is being made on a self-underwritten basis - no minimum of shares must

be sold in order for the offering to proceed. The offering price per share is

$0.02. There is no assurance that we will raise the full $100,000 as

anticipated.

The

following table below sets forth the uses of proceeds assuming the sale of 25%,

50%, 75% and 100% of the securities offered for sale in this offering by the

company. For further discussion see Plan of Operation.

|

If

25% of

|

If

50% of

|

If

75% of

|

If

100% of

|

|||||||||||||

|

Shares

Sold

|

Shares

Sold

|

Shares

Sold

|

Shares

Sold

|

|||||||||||||

|

GROSS

PROCEEDS FROM THIS OFFERING

|

$

|

25,000

|

$

|

50,000

|

$

|

75,000

|

$

|

100,000

|

||||||||

|

Less:

OFFERING EXPENSES

|

||||||||||||||||

|

SEC

Filing Expenses

|

$

|

1,500

|

$

|

1,500

|

$

|

1,500

|

$

|

1,500

|

||||||||

|

Printing

|

$

|

500

|

$

|

500

|

$

|

500

|

$

|

500

|

||||||||

|

Transfer

Agent

|

$

|

2,500

|

$

|

2,500

|

$

|

2,500

|

$

|

2,500

|

||||||||

|

SUB-TOTAL

|

$

|

4,500

|

$

|

4,500

|

$

|

4,500

|

$

|

4,500

|

||||||||

|

Less: PHASE

I

|

||||||||||||||||

|

Soil

Geochem./soil grid samples

|

$

|

5,000

|

$

|

7,000

|

$

|

9,000

|

$

|

11,000

|

||||||||

|

Geologist

|

$

|

7,500

|

$

|

10,500

|

$

|

15,000

|

$

|

20,000

|

||||||||

|

Geo-technician

|

$

|

2,500

|

$

|

5,500

|

$

|

7,500

|

$

|

10,000

|

||||||||

|

Assays

|

$

|

500

|

$

|

1,000

|

$

|

3,500

|

$

|

7,000

|

||||||||

|

Travel

|

$

|

1,000

|

$

|

1,000

|

$

|

2,000

|

$

|

3,000

|

||||||||

|

Reports

|

$

|

500

|

$

|

500

|

$

|

1,500

|

$

|

2,500

|

||||||||

|

SUB-TOTAL

|

$

|

17,000

|

$

|

20,000

|

$

|

38,500

|

$

|

53,000

|

||||||||

|

|

||||||||||||||||

|

Less: PHASE

II

|

||||||||||||||||

|

Geological

Interpretation/Mapping

|

$

|

0

|

$

|

7,500

|

$

|

10,000

|

$

|

12,500

|

||||||||

|

MAG-VLF

Survey

|

$

|

0

|

$

|

11,500

|

$

|

12,500

|

$

|

17,000

|

||||||||

|

Data

Reduction Report

|

$

|

0

|

$

|

1,500

|

$

|

2,500

|

$

|

3,500

|

||||||||

|

SUB-TOTAL

|

$

|

0

|

$

|

20,500

|

$

|

25,000

|

$

|

33,000

|

||||||||

|

Less:

ADMINISTRATION EXPENSES

|

||||||||||||||||

|

Office,

Telephone, Internet

|

$

|

0

|

$

|

0

|

$

|

1,000

|

$

|

2,000

|

||||||||

|

Legal

and Accounting

|

$

|

3,500

|

$

|

5,000

|

$

|

6,000

|

$

|

7,500

|

||||||||

|

SUB-TOTAL

|

$

|

3,500

|

$

|

5,000

|

$

|

7,000

|

$

|

9,500

|

||||||||

|

TOTALS

|

$

|

25,000

|

$

|

50,000

|

$

|

75,000

|

$

|

100,000

|

||||||||

The

above figures represent only estimated costs.

14

Legal and

accounting fees refer to the normal legal and accounting costs associated with

filing this Registration Statement under the 1933 Act as amended and maintaining

the status of a Reporting Company under the 1934 Act.

A total

of $4,000 has been raised from the sale of stock to our sole Officer and

Director - this stock is restricted and is not being registered in this

offering. The offering expenses associated with this offering are believed to be

$4,500. As of September 30, 2009, Stevens had a balance (less outstanding

checks) of $4,000 in cash with liabilities of $525. Some services related to

this offering were paid for in common stock rather than cash payment. This will

allow Stevens to pay the entire expenses of this offer from cash on

hand.

One of

the purposes of the offering is to create an equity market, which allows Stevens

to more easily raise capital, since a publicly traded company has more

flexibility in its financing offerings than one that does not.

DETERMINATION

OF OFFERING PRICE

There is

no established market for the Registrant's stock. Stevens’ offering price for

shares sold pursuant to this offering is set at $0.02. Our existing shareholder,

our Officer /Director, paid $0.002 per share. The additional factors that were

included in determining the sales price are the lack of liquidity (since there

is no present market for Stevens’ stock) and the high level of risk considering

the lack of operating history of Stevens.

DILUTION

"Dilution"

represents the difference between the offering price of the shares of common

stock and the net book value per share of common stock immediately after

completion of the offering. "Net book value" is the amount that results

from subtracting total liabilities from total assets. In this offering,

the level of dilution is increased as a result of the relatively low book value

of our issued and outstanding stock. Assuming all shares offered

herein are sold, and given effect to the receipt of the maximum estimated

proceeds of this offering from shareholders net of the offering expenses, our

net book value will be $100,000 or $0.014 per share. Therefore, the purchasers

of the common stock in this offering will incur an immediate dilution of

approximately $0.006 per share while our present stockholders will receive an

increase of $0.012 per share in the net tangible book value of the shares they

hold. This will result in a 30% dilution for purchasers of stock in this

offering.

15

The

following table illustrates the dilution to the purchasers of the common stock

in this offering. While this offering has no minimum, the table below

includes an analysis of the dilution that will occur if only 25% of the shares

are sold, as well as the dilution if all shares are sold:

|

25%

of

|

Maximum

|

|||||||

|

Offering

|

Offering

|

|||||||

|

Offering

Price Per Share

|

$

|

0.02

|

$

|

0.02

|

||||

|

Book

Value Per Share Before the Offering

|

$

|

0.002

|

$

|

0.002

|

||||

|

Book

Value Per Share After the Offering

|

$

|

0.007

|

$

|

0.014

|

||||

|

Net

Increase to Original Shareholders

|

$

|

0.005

|

$

|

0.012

|

||||

|

Decrease

in Investment to New Shareholders

|

$

|

0.013

|

$

|

0.006

|

||||

|

Dilution

to New Shareholders (%)

|

35

|

%

|

30

|

%

|

||||

PLAN

OF DISTRIBUTION

The

offering consists of a maximum number of 5,000,000 common shares being offered

by Stevens at $.02 per share with no minimum offering requirement.

Company

Offering

Stevens

is offering for sale common stock. If Stevens is unable to sell its stock and

raise money, it will not be able to complete its business plan and will

fail.

There

will be no underwriters used, no dealer's commissions, no finder's fees, and no

passive market making for the shares being offered by Stevens. All of these

shares will be issued to business associates, friends, and family of the

management of the Company. The Officer and Director, Justin Miller, will not

register as broker-dealers in connection with this offering. Mr. Miller will not

be deemed to be a broker pursuant to the safe harbor provisions of Rule 3a4-1 of

the Securities and Exchange Act of 1934, since he is not subject to statutory

disqualification, will not be compensated directly or indirectly from the sale

of securities, is not an associated person of a broker or dealer, nor has he

been so associated within the previous twelve months, and primarily performs

substantial duties as Officer and Director that are not in connection with the

sale of securities, and has not nor will not participate in the sale of

securities more than once every twelve months.

Our

Common Stock is currently considered a "penny stock" under federal securities

laws (Penny Stock Reform Act, Securities Exchange Act Section 3a (51(A)) since

its market price is below $5.00 per share. Penny stock rules generally impose

additional sales practice and disclosure requirements on broker-dealers who sell

or recommend such shares to certain investors.

Broker-dealers

who sell penny stock to certain types of investors are required to comply with

the SEC's regulations concerning the transfer of penny stock. If an exemption is

not available, these regulations require broker-dealers to: make a suitability

determination prior to selling penny stock to the purchaser; receive the

purchaser's written consent to the transaction; and, provide certain written

disclosures to the purchaser. These rules may affect the ability of

broker-dealers to make a market in, or trade our shares. In turn, this may make

it very difficult for investors to resell those shares in the public

market.

16

DESCRIPTION

OF SECURITIES

General

The

authorized capital stock consists of 75,000,000 shares of common stock at a par

value of $0.001 per share. We plan to offer 5,000,000 common shares

at a price of $0.02 per share. We will not sell any of the 5,000,000

common shares until the registration statement is deemed effective.

Common

Stock

As of

September 30, 2009, there are 2,100,000 shares of common stock issued and

outstanding. 2,000,000 shares are held by our Officer / Director,

Justin Miller. Jameson Capital, LLC was issued 100,000 shares in lieu

of services rendered in September 2009.

Holders

of common stock are entitled to one vote for each share on all matters submitted

to a stockholder vote. Holders of common stock do not have cumulative voting

rights. Therefore, holders of a majority of the shares of common stock voting

for the election of directors can elect all of the directors. Holders of common

stock representing a majority of the voting power of Stevens’ capital stock

issued and outstanding and entitled to vote, represented in person or by proxy,

are necessary to constitute a quorum at any meeting of company stockholders. A

vote by the holders of a majority of the outstanding shares is required to

effectuate certain fundamental corporate changes such as liquidation, merger or

an amendment to the articles of incorporation.

Holders

of common stock are entitled to share in all dividends that the board of

directors, in its discretion, declares from legally available funds. In the

event of liquidation, dissolution or winding up, each outstanding share entitles

its holder to participate pro rata in all assets that remain after payment of

liabilities and after providing for each class of stock, if any, having

preference over the common stock. Holders of the common stock have no

pre-emptive rights, no conversion rights and there are no redemption provisions

applicable to the common stock.

Shareholders

Each

shareholder has sole investment power and sole voting power over the shares

owned by such shareholder.

INTERESTS

OF NAMED EXPERTS AND COUNSEL

No expert

or counsel named in this prospectus as having prepared or certified any part of

this prospectus or having given an opinion upon the validity of the securities

being registered or upon other legal matters in connection with the registration

or offering of the common stock was employed on a contingency basis, or had, or

is to receive, in connection with the offering, a substantial interest, direct

or indirect, in the registrant or any of its parents or subsidiaries. Nor was

any such person connected with the registrant or any of its parents or

subsidiaries as a promoter, managing or principal underwriter, voting trustee,

director, officer, or employee.

Timothy

S. Orr, Esquire, of Spokane, Washington, an independent legal counsel, has

provided an opinion on the validity of Stevens Resources, Inc.’s issuance of

common stock and is presented as an exhibit to this filing.

17

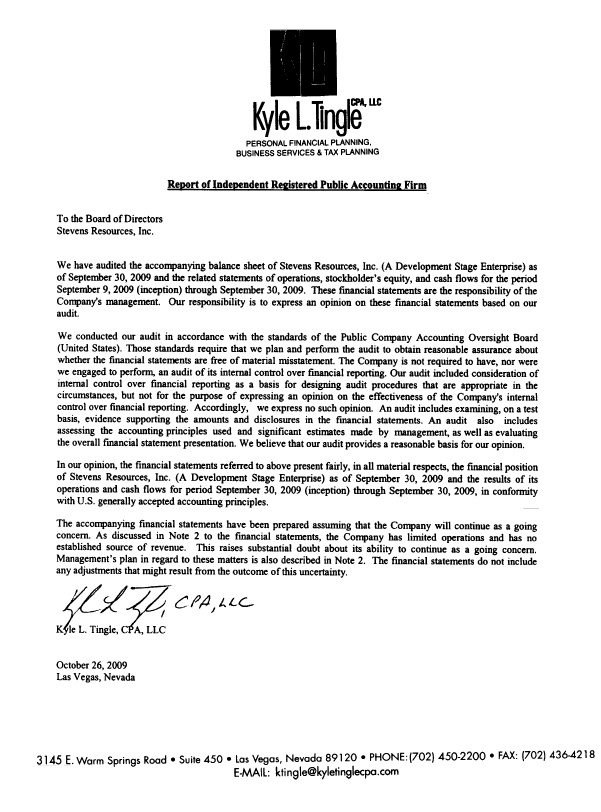

The

financial statements included in this Prospectus and in the Registration

Statement have been audited by Kyle L. Tingle, CPA, LLC, 3145 East Warm Springs

Road, Suite 450, Las Vegas, NV 89120 to the extent and for the period set forth

in their report (which contains an explanatory paragraph regarding Stevens'

ability to continue as a going concern) appearing elsewhere herein and in the

Registration Statement, and are included in reliance upon such report given upon

the authority of said firm as experts in auditing and accounting.

DESCRIPTION

OF BUSINESS

General

Stevens

Resources, Inc. was incorporated on September 9, 2009, in the state of Nevada.

Stevens has never declared bankruptcy, it has never been in receivership, and it

has never been involved in any legal action or proceedings. Since becoming

incorporated, Stevens has not made any significant purchase or sale of assets,

nor has it been involved in any mergers, acquisitions or consolidations. Stevens

is not a blank check registrant as that term is defined in Rule 419(a)(2) of

Regulation C of the Securities Act of 1933, since it has a specific business

plan or purpose.

We intend

to commence operations as an exploration stage company. We will be engaged in

the exploration of mineral properties with a view to exploiting any mineral

deposits we discover. We own an option to acquire an undivided 100%

beneficial interest in a mineral claim in located in Stevens County, Washington

State; known as the Young American Claim Group. The claims are about

80 acres of lode claims. The property is located in northwestern Stevens County,

northeastern Washington. Young America is 4 en bloc unpatented claims

originally located in 1886 and is within the Bossburg Mining District. Young

America is a lead (Pb)-zinc (Zn) prospect with minor silver and gold potential.

We do not have any current plans to acquire interests in additional mineral

properties, though we may consider such acquisitions in the future.

Unless

otherwise indicated, any reference to Stevens, or “we”, “us”, “our”, etc. refers

to Stevens Resources, Inc.

Our

Competition

Both the

mineral exploration and drilling industries are intensely competitive in all

phases. In our mineral exploration activities, we will compete with many

companies possessing greater financial resources and technical facilities than

us for the acquisition of mineral concessions, claims, leases and other mineral

interests as well as for the recruitment and retention of qualified employees.

We must overcome significant barriers to enter into the business of

mineral exploration as a result of our limited operating history.

Similarly,

in our drilling business, our competition includes many companies with

significantly greater experience, larger client bases, and substantially greater

financial resources. There are significant barriers to entry including large

capital requirements and the recruitment and retention of qualified, experienced

employees.

We cannot

assure you that we will be able to compete in any of our business areas

effectively with current or future competitors or that the competitive pressures

faced by us will not have a material adverse effect on our business, financial

condition and operating results.

18

Our

Office

The

principal offices are located at 1818 West Francis, Ste 196 Spokane, WA

99205. The telephone number is (509) 263.7442 the fax number is (509)

327.9792.

Our

Employees

Other

than our officer and director, Justin Miller, we have no

employees. Assuming financing can be obtained, management expects to

hire additional staff and employees as necessary as implement of our business

plan requires.

Regulation

The

exploration, drilling and mining industries operate in a legal environment that

requires permits to conduct virtually all operations. Thus permits are

required by local, state and federal government agencies. Federal agencies

that may be involved include: The U.S. Forest Service (USFS), Bureau of Land

Management (BLM), Environmental Protection Agency (EPA), National Institute for

Occupational Safety and Health (NIOSH), the Mine Safety and Health

Administration (MSHA) and the Fish and Wildlife Service (FWS). Individual states

also have various environmental regulatory bodies, such as Departments of

Ecology and so on. Local authorities, usually counties, also have control

over mining activity. The various permits address such issues as

prospecting, development, production, labor standards, taxes, occupational

health and safety, toxic substances, air quality, water use, water discharge,

water quality, noise, dust, wildlife impacts, as well as other environmental and

socioeconomic issues.

Prior to

receiving the necessary permits to explore or mine, the operator must comply

with all regulatory requirements imposed by all governmental authorities having

jurisdiction over the project area. Very often, in order to obtain the

requisite permits, the operator must have its land reclamation, restoration or

replacement plans pre-approved. Specifically, the operator must present its plan

as to how it intends to restore or replace the affected area. Often all or any

of these requirements can cause delays or involve costly studies or alterations

of the proposed activity or time frame of operations, in order to mitigate

impacts. All of these factors make it more difficult and costly to operate

and have a negative and sometimes fatal impact on the viability of the

exploration or mining operation. Finally, it is possible that future changes in

these laws or regulations could have a significant impact on our business,

causing those activities to be economically reevaluated at that

time.

Mineral

property exploration is typically conducted in phases. Each subsequent

phase of exploration work is recommended by a geologist based on the results

from the most recent phase of exploration. We have not yet commenced the

initial phase of exploration on the claims. Once we have completed each

phase of exploration, we will make a decision as to whether or not we proceed

with each successive phase based upon the analysis of the results of that

program. Our director will make this decision based upon the

recommendations of the independent geologist who oversees the program and

records the results. Even if we complete our proposed exploration programs on

the claims and we are successful in identifying a mineral deposit, we will have

to spend substantial funds on further drilling and engineering studies before we

will know if we have a commercially viable mineral deposit.

19

Overview

of Our Mineral Exploration Business

Mineral

exploration is essentially a research activity that does not produce a product.

Successful exploration often results in increased project value that can

be realized through the optioning or selling of the claimed site to larger

companies. As such, we intend to acquire properties which we believe have

potential to host economic concentrations of minerals. These acquisitions

have and may take the form of unpatented mining claims on federal land, or

leasing claims, or private property owned by others. An unpatented mining

claim is an interest that can be acquired to the mineral rights on open lands of

the federally owned public domain. Claims are staked in accordance with

the Mining Law of 1872, recorded with the federal government pursuant to laws

and regulations established by the Bureau of Land Management (the Federal agency

that administers America’s public lands), and grant the holder of the claim a

possessory interest in the mineral rights, subject to the paramount title of the

United States.

We plan

to perform basic geological work to identify specific drill targets on the

properties, and then collect subsurface samples by drilling to confirm the

presence of mineralization (the presence of economic minerals in a specific area

or geological formation). We may enter into joint venture agreements with

other companies to fund further exploration work. By such prospects, we

mean properties that may have been previously identified by third parties,

including prior owners such as exploration companies, as mineral prospects with

potential for economic mineralization. Often these properties have been

sampled, mapped and sometimes drilled, usually with indefinite results.

Accordingly, such acquired projects will either have some prior

exploration history or will have strong similarity to a recognized geologic ore

deposit model. Geographic emphasis will be placed on the western United

States. The focus of our activity will be to acquire properties that we believe

to be undervalued; including those that we believe to hold previously

unrecognized mineral potential.

Our

current mineral property (Young American Lead-Zinc Mine Property) is owned by

third parties, with an option to purchase in the future. This agreement is

held by Justin Miller and the Company with American Mining Corporation.

Our strategy with properties deemed to be of higher risk or those that

would require very large exploration expenditures is to present them to larger

companies for joint venture. Our joint venture strategy is intended to

maximize the abilities and skills of the management group, conserve capital, and

provide superior leverage for investors. If we present a property to a

major company and they are not interested, we will continue to seek an

interested partner.

DESCRIPTION

OF PROPERTY

The

principal offices are located at 1818 West Francis, Ste 196 Spokane, WA

99205. The telephone number is (509) 263.7442 the fax number is (509)

327.9792. Stevens’ management does not currently have policies regarding the

acquisition or sale of real estate assets primarily for possible capital gain or

primarily for income. Stevens does not presently hold any investments or

interests in real estate, investments in real estate mortgages or securities of

or interests in persons primarily engaged in real estate

activities.

We own an

option to the mineral exploration rights relating to the three mineral claims in

the Young America Mine claim group. We do not own any real property

interest in the claims or any other property.

20

Summary

of Stevens’ Mineral Exploration Prospects

As of

October 2009, Stevens has acquired mineral prospects for exploration in the

State of Washington, Stevens County for target commodities of lead-zinc, gold

and silver. The prospects are held by unpatented mining claims owned by American

Mining Company through legal agreements conveying exploration and development

rights to the Company. Most of our prospects have had a prior exploration

history and this is typical in the mineral exploration industry. Most

mineral prospects go through several rounds of exploration before an economic

ore body is discovered and prior work often eliminates targets or points to new

ones. Also, prior operators may have explored under a completely different

commodity price structure or technological regime. Mineralization which was

uneconomic in the past may be ore grade at current market prices when extracted

and processed with modern technology.

Young

America Mine Property-Washington State, Stevens County

Stevens

Claim Purchase/Option Agreement

On

September 30, 2009, we entered into an Option to Purchase Agreement with America

Mining Corporation, who is the sole beneficial owner of 100% of the mineral

claims identified as YAM 1-4.

Location,

Access and Description

The Young

American claim group is approximately 80 acres of lode claims 100% owned by

American Mining Corporation. The property is located in northwestern Stevens

County, northeastern Washington. Young America is 4 en bloc unpatented claims

originally located in 1886 and is within the Bossburg Mining

District. In February 2008 American Mining Corporation (AMC) of

Osburn, Idaho staked the four original unpatented claims that are located on BLM

managed land. The four claims are in a portion of the SW ¼ of Section 28, and NW

¼ of Section 33, both Township 38N Range 38E, Willamette Meridian, Stevens

County, Washington about 15 miles north of Kettle Falls, Washington. Access is

via a 2WD gravel road that crosses private property, leading directly to the

claims.

21

Prospectivity

is based on 15 diamond drill cores totaling 4590 feet taken 1946-1948 by the

U.S. Bureau of Mines (USBM) (Hundhausen, 1949) on the cliff crest to the north,

east, and south of the main ore body. The drilling discovered two zones of

low-grade highly disseminated lead-zinc mineralization southwest of the mine,

but failed to locate extensions of the two primary sulfide-mineralized zones of

the main mine workings. Thus this report primarily concerns the unexploited

lead-zinc prospect discovered by USBM drilling.

Overview

of Regulatory, Economic and Environmental Issues

Hard rock

mining and drilling in the United States is a closely regulated industrial

activity. Mining and drilling operations are subject to review and

approval by a wide variety of agencies at the federal, state and local level.

Each level of government requires applications for permits to conduct

operations. The approval process always involves consideration of many

issues including but not limited to air pollution, water use and discharge,

noise issues, and wildlife impacts. Mining operations always involve

preparation of an environmental impact statement that examines the probable

effect of the proposed site development. Federal agencies that may be

involved include: The U.S. Forest Service (USFS), Bureau of Land Management

(BLM), Environmental Protection Agency (EPA), National Institute for

Occupational Safety and Health (NIOSH), the Mine Safety and Health

Administration (MSHA) and the Fish and Wildlife Service (FWS). Individual

states also have various environmental regulatory bodies, such as Departments of

Ecology and so on. Local authorities, usually counties, also have control

over mining activity.

Underground

metal mines generally involve higher grade ore bodies. Less tonnage is

mined underground, and generally the higher grade ore is processed in a mill or

other refining facility. This process results in the accumulation of waste

by-products from the washing of the ground ore. Mills require associated

tailings ponds to capture waste by-products and treat water used in the milling

process.

Capital

costs for mine, mill and tailings pond construction can easily run into the

hundreds of millions of dollars. These costs are factored into the profitability

of a mining operation. Metal mining is sensitive to both cost considerations and

to the value of the metal produced. Metals prices are set on a world-wide

market and are not controlled by the operators of the mine. Changes in

currency values or exchange rates can also impact metals prices. Thus changes in

metals prices or operating costs can have a huge impact on the economic

viability of a mining operation.

Environmental

protection and remediation is an increasingly important part of mineral

economics. Estimated future costs of reclamation or restoration of mined

land are based principally on legal and regulatory requirements. Reclamation of

affected areas after mining operations may cost millions of dollars. Often

governmental permitting agencies are requiring multi-million dollar bonds from

mining companies prior to granting permits, to insure that reclamation takes

place. All environmental mitigation tends to decrease profitability of the

mining operation, but these expenses are recognized as a cost of doing business

by modern mining and exploration companies.

Mining

and exploration activities are subject to various laws and regulations governing

the protection of the environment. These laws and regulations are continually

changing and are generally becoming more restrictive. We conduct our operations

so as to protect the public health and environment and believe our operations

are in compliance with applicable laws and regulations in all material respects.

We have made, and expect to make in the future, expenditures to comply with such

laws and regulations, but cannot predict the full amount of such future

expenditures.

22

Every

mining activity has an environmental impact. In order for a proposed mining

project to be granted the required governmental permits, mining companies are

required to present proposed plans for mitigating this impact. In the United

States, where our properties are located, no mine can operate without obtaining

a number of permits. These permits address the social, economic, and

environmental impacts of the operation and include numerous opportunities for

public involvement and comment.

LEGAL

PROCEEDINGS

Stevens

Resources, Inc. is not currently a party to any legal proceedings. Stevens'

agent for service of process in Nevada is: InCorp Services, 3155 East Patrick

Lane, Suite 1, Las Vegas Nevada 89120.

MARKET

FOR COMMON EQUITY AND RELATED STOCKHOLDER MATTERS

No

Public Market for Common Stock

There is

presently no public market for the common stock. Stevens anticipates applying

for trading of the common stock on either the OTCBB upon the effectiveness of

the registration statement of which this prospectus forms a part. However,

Stevens can provide no assurance that the shares will be traded on the OTCBB or,

if traded, that a public market will materialize.

Purchases

of Equity Securities by the Small Business Issuer and Affiliates

There

were no purchases of our equity securities by us or any of our affiliates during

the year ended September 30, 2009.

Holders

of the Common Stock

As of the

date of this registration statement, Stevens had two (2) registered

shareholders. Justin Miller, sole Officer and Director currently own

2,000,000 common shares, which represent 95.2% of the issued and outstanding

common stock. In September 2009 100,000 shares were issued to Jameson

Capital, LLC for services relating to the completion of this registration

statement.

Dividend

Policy

We

anticipate that we will retain any earnings to support operations and to finance

the growth and development of our business. Therefore, we do not expect to pay

cash dividends in the foreseeable future. Any further determination to pay cash

dividends will be at the discretion of our board of directors and will be

dependent on the financial condition, operating results, capital requirements

and other factors that our board deems relevant. We have never declared a

dividend.

Equity

Compensation Plan

To date,

Stevens has no equity compensation plan, has not granted any stock options and

has not granted registration rights to any person(s).

23

FINANCIAL

STATEMENTS

STEVENS

RESOURCES, INC.

(A

Development Stage Enterprise)

Financial

Statements

September

30, 2009

24

STEVENS

RESOURCES, INC.

(A

Development Stage Enterprise)

Financial

Statements

September

30, 2009

CONTENTS

|

Page(s)

|

|||

|

Report

of Independent Registered Public Accounting Firm

|

F-1

|

||

|

Balance

Sheet as of September 30, 2009

|

F-2

|

||

|

Statement

of Operations for the period of September 9, 2009 (inception) to September

30, 2009

|

F-3

|

||

|

Statement

of Changes in Stockholders' Equity cumulative from September 9, 2009

(inception) to September 30, 2009

|

F-4

|

||

|

Statement

of Cash Flows for the period of September 9, 2009 (inception) to September

30, 2009

|

F-5

|

||

|

Notes

to the Financial Statements

|

F-6-10

|

||

F-1

|

STEVENS

RESOURCES, INC.

|

||||

|

(A

Development Stage Enterprise)

|

||||

|

Balance

Sheet

|

||||

|

September

30, 2009

|

||||

|

ASSETS

|

||||

|

Current

assets

|

||||

|

Cash

|

$ | 4,000 | ||

|

Prepaid

expenses

|

200 | |||

|

Total

current assets

|

4,200 | |||

|

Total

assets

|

$ | 4,200 | ||

|

LIABILITIES

AND STOCKHOLDERS' EQUITY

|