Attached files

| file | filename |

|---|---|

| EX-31.1 - Nova Lifestyle, Inc. | v206725_ex31-1.htm |

| EX-32.1 - Nova Lifestyle, Inc. | v206725_ex32-1.htm |

UNITED

STATES

SECURITIES

AND EXCHANGE COMMISSION

Washington,

D.C. 20549

FORM

10-K

|

x

|

ANNUAL

REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF

1934

|

For

the fiscal year ended September 30, 2010

OR

|

¨

|

TRANSITION

REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF

1934

|

For

the transition period from

to

Commission

file number 333-163019

STEVENS

RESOURCES,

INC.

(Exact

name of registrant as specified in its charter)

|

Nevada

|

75-3250686

|

|

|

(State

or other jurisdiction of

incorporation

or organization)

|

(I.R.S.

Employer

Identification

No.)

|

|

|

No.

6 JieFangNan Lu, HeXi District

TianJin,

China

|

300000

|

|

|

(Address

of principal executive offices)

|

(ZIP

Code)

|

Registrant’s

telephone number, including area code:

(86)

22-25763415

Copies

to:

2360

Corporate Circle, Suite 400

Henderson,

NV 89074-7722

Tel (702)

866-2500 Fax (702) 866-2689

Securities

registered pursuant to Section 12(b) of the Act:

None

Securities

registered pursuant to Section 12(g) of the Act:

Common

stock, par value $.001 per share

Indicate

by check mark if the registrant is a well-known seasoned issuer, as defined in

Rule 405 of the Securities Act.

Yes ¨ No x

Indicate

by check mark if the registrant is not required to file reports pursuant to

Section 13 or Section 15(d) of the Act.

Yes ¨ No x

Indicate

by check mark whether the registrant (1) has filed all reports required to

be filed by Section 13 or 15(d) of the Securities Exchange Act of 1934

during the preceding 12 months (or for such shorter period that the registrant

was required to file such reports), and (2) has been subject to such filing

requirements for the past 90 days.

Yes x No ¨

Indicate

by check mark whether the registrant has submitted electronically and posted on

its corporate website, if any, every Interactive Data File required to be

submitted and posted pursuant to Rule 405 of Regulation S-T during the preceding

12 months (or for such shorter period that the registrant was required to submit

and post such files).

Yes ¨ No ¨

Indicate

by check mark if disclosure of delinquent filers pursuant to Item 405 of

Regulation S-K is not contained herein, and will not be contained, to the best

of registrant’s knowledge, in definitive proxy or information statements

incorporated by reference in Part III of this Form 10-K or any amendment to this

Form 10-K.

¨

Indicate

by check mark whether the registrant is a large accelerated filer, an

accelerated filer, a non-accelerated filer, or a smaller reporting company. See

the definitions of “large accelerated filer,” “accelerated filer,” and “smaller

reporting company” in Rule 12b-2 of the Exchange Act.

|

Large

accelerated filer o

|

Accelerated

filer o

|

|

Non-accelerated

filer o (Do

not check if smaller reporting company)

|

Smaller

reporting company x

|

Indicate

by check mark whether the registrant is a shell company (as defined in

Rule 12b-2 of the Exchange Act).

Yes x No ¨

The

aggregate market value of the voting common equity held by non-affiliates was

$0.00, based on the average bid and asked price of such common equity as of

March 31, 2010, the last business day of the registrant’s most recently

completed second fiscal quarter.

As of

December 27, 2010, there were 2,596,000 shares of the registrant’s common

stock, par value $.001 per share, issued and outstanding.

DOCUMENTS

INCORPORATED BY REFERENCE

None

TABLE

OF CONTENTS

|

Page

|

|||||

|

PART

I

|

|||||

|

Item

1.

|

Business

|

1

|

|||

|

Item

1A.

|

Risk

Factors

|

3

|

|||

|

Item

1B.

|

Unresolved

Staff Comments

|

3

|

|||

|

Item

2.

|

Property

|

3

|

|||

|

Item

3.

|

Legal

Proceedings

|

3

|

|||

|

Item

4.

|

(Removed

and Reserved)

|

3

|

|||

|

PART

II

|

|||||

|

Item

5.

|

Market

for Registrant’s Common Equity, Related Stockholder Matters and Issuer

Purchases of Equity Securities

|

3

|

|||

|

Item

6.

|

Selected

Financial Data

|

4

|

|||

|

Item

7.

|

Management’s

Discussion and Analysis of Financial Condition and Results of

Operations

|

4

|

|||

|

Item

7A.

|

Quantitative

and Qualitative Disclosures About Market Risk

|

6

|

|||

|

Item

8.

|

Financial

Statements and Supplementary Data

|

6

|

|||

|

Item

9.

|

Changes

in and Disagreements with Accountants on Accounting and Financial

Disclosure

|

6

|

|||

|

Item

9A.

|

Controls

and Procedures

|

7

|

|||

|

Item

9B.

|

Other

Information

|

7

|

|||

|

PART

III

|

|||||

|

Item

10.

|

Directors,

Executive Officers and Corporate Governance

|

8

|

|||

|

Item

11.

|

Executive

Compensation

|

9

|

|||

|

Item

12.

|

Security

Ownership of Certain Beneficial Owners and Management and Related

Stockholder Matters

|

10

|

|||

|

Item

13.

|

Certain

Relationships and Related Transactions, and Director

Independence

|

10

|

|||

|

Item

14.

|

Principal

Accounting Fees and Services

|

10

|

|||

|

PART

IV

|

|||||

|

Item

15.

|

Exhibits,

Financial Statement Schedules

|

11

|

|||

|

Index

to Financial Statements

|

F-1

|

||||

|

Signatures

|

12

|

||||

|

Exhibit

Index

|

|||||

PART

I

Unless

otherwise indicated, the terms “Stevens Resources,” the “Company,” “we,” “us,”

and “our” refer to Stevens Resources, Inc.

Item

1. Business

General

Stevens

Resources, Inc. was incorporated in the State of Nevada on September 9, 2009. We

are an exploration stage company with no revenues and no operations. We intend

to commence operations to explore for mineral properties and exploit any mineral

deposits we discover. We do not hold any investments or interests in mineral

properties or real estate, nor have any current plans to acquire new investments

or interests in mineral properties, but we may consider such acquisitions in the

future. We are evaluating other business opportunities as well, which may

include a change in control of the Company or business combination with an

operating company.

Our

principal offices are located at No. 6, JieFangNan Lu, HeXi District, TianJin,

China 300000. Our telephone number is (86) 22-25763415.

Background

Mineral

exploration is essentially a research activity that does not produce a product.

Successful exploration often results in increased project value that can be

realized through the optioning or selling of the claimed site to larger

companies. As such, we intend to acquire properties we believe have the

potential to host economic concentrations of minerals. These acquisitions have

and may take the form of unpatented mining claims on federal land, leasing

claims or private property owned by others. An unpatented mining claim is an

interest in the mineral rights on open lands of the federally owned public

domain. Claims are staked in accordance with the Mining Law of 1872 and recorded

with the federal government pursuant to laws and regulations established by the

Bureau of Land Management, or the BLM, the federal agency tasked with

administering public lands. The claim holder receives a possessory interest in

the mineral rights, subject to the paramount title of the United

States.

We plan

to perform basic geological work to identify specific drill targets on any

acquired properties, and then collect subsurface samples by drilling to confirm

the presence of mineralization, which is the presence of economic minerals in a

specific area or geological formation. We may enter into joint venture

agreements with other companies to fund further exploration work. These

prospective properties may have been identified previously by third parties,

including prior owners such as exploration companies, as mineral prospects with

potential for economic mineralization. Often these properties have been sampled,

mapped and sometimes drilled, usually with indefinite results. Accordingly, such

acquired properties will either have some prior exploration history or will have

strong similarity to a recognized geologic ore deposit model. Our geographic

emphasis will be on the western United States. The focus of our activity will be

to acquire properties that we believe to be undervalued, including those that we

believe to hold previously unrecognized mineral potential.

Mineral

property exploration is typically conducted in phases. The first phase typically

consists of geochemical and soil grid sampling and prospecting. Geochemical

sampling involves gathering rock and soil samples from property areas with the

most potential to host economically significant mineralization. Prospecting

involves analyzing rocks on the property surface with a view to discovering

indications of potential mineralization. All samples gathered are sent to a

laboratory where they are crushed and analyzed for metal content. Each

subsequent phase of exploration work is recommended by a geologist based on the

results from the most recent phase of exploration. Once each phase of

exploration is completed, we will make a decision as to whether or not we

proceed with each successive phase based upon the analysis of the program

results. Our director will make this decision based upon the recommendations of

the independent geologist overseeing the program. Even if we complete our

proposed exploration programs on the claims and we are successful in identifying

a mineral deposit, we will need to spend substantial funds on further drilling

and engineering studies before we will know if we have a commercially viable

mineral deposit.

Our

strategy with properties deemed to be of higher risk or those that would require

very large exploration expenditures will be to present the properties to larger

companies for a potential joint venture. Our joint venture strategy is intended

to maximize the abilities and skills of our management group, conserve capital

and provide superior leverage for investors. If we present a property to a

company and they are not interested in forming a joint venture with us, we will

continue to seek an interested partner.

Underground

metal mines generally involve higher-grade ore bodies. Less tonnage is mined

underground, and generally the higher-grade ore is processed in a mill or other

refining facility. This process results in the accumulation of waste by-products

from the washing of the ground ore. Mills require associated tailings ponds to

capture waste by-products and treat water used in the milling process. Capital

costs for mine, mill and tailings pond construction can easily run into the

hundreds of millions of dollars. These costs are factored into the profitability

of a mining operation. Metal mining is sensitive to both cost considerations and

to the value of the metal produced. Metals prices are set on a worldwide market

and are not controlled by the operators of the mine. Changes in currency values

or exchange rates can also impact metals prices. Thus, changes in metals prices

or operating costs can have a large impact on the economic viability of a mining

operation.

1

Claims

|

On

September 30, 2009, we acquired an option to purchase mineral prospects

that we call the Young American Claim Group, or the YACG, for exploration

in Stevens County, Washington State for target commodities of lead-zinc,

gold and silver. The option conveyed exploration and development rights to

us on the YACG mineral prospects, which are unpatented mining claims

identified as the Young American Lead-Zinc Mine Property 1-4 and owned by

the American Mining Corporation. Most of these prospects have had a prior

exploration history, which is typical in the mineral exploration industry.

Most mineral prospects go through several rounds of exploration before an

economic ore body is discovered and prior work often eliminates targets or

points to new ones. Also, prior operators may have explored under a

different commodity price structure or technological regime.

Mineralization deemed uneconomic in the past may be ore grade at current

market prices when extracted and processed with modern

technology.

The

YACG is approximately 80 acres of 4 en bloc unpatented lode claims located

in northwestern Stevens County, which is located in northeastern

Washington State. The YACG was originally located in 1886 and is within

the Bossburg Mining District. In February 2008, the American Mining

Corporation of Osburn, Idaho staked the four original unpatented claims

that are located on land managed by the BLM. The four claims are in a

portion of the SW ¼ of Section 28, and NW ¼ of Section 33, both located

within Township 38N Range 38E, Willamette Meridian, Stevens County,

Washington, which is about 15 miles north of Kettle Falls, Washington.

Access is via a 2WD gravel road that crosses private property, leading

directly to the claims.

|

|

|

Young

American Mine

|

Prospectivity

is based on 15 diamond drill cores totaling 4590 feet taken between 1946-1948 by

the U.S. Bureau of Mines (USBM) (Hundhausen, 1949) on the cliff crest to the

north, east and south of the main ore body. The drilling discovered two zones of

low-grade highly disseminated lead-zinc mineralization southwest of the mine,

but failed to locate extensions of the two primary sulfide-mineralized zones of

the main mine workings. Accordingly, this report primarily concerns the

unexploited lead-zinc prospect discovered by the USBM drilling.

We let

our option to acquire an undivided 100% beneficial interest in the YACG expire

as of September 30, 2010. To maintain the YACG option, we would have needed to

incur exploration expenditures of at least $5,000 before September 30, 2010, and

then a further $25,000 in exploration expenditures prior to September 30, 2011.

Upon exercise of the option, the fee to maintain our interest in the YACG would

have been $25,000 per annum. We do not hold any other investments or interests

in mineral properties or real estate, nor have any current plans to acquire new

investments or interests in mineral properties, but we may consider such

acquisitions in the future. We are evaluating other business opportunities as

well, which may include a change in control of the Company or a business

combination with an operating company.

Governmental

and Environmental Regulation

Hard rock

mining and drilling in the United States is a closely regulated industrial

activity. The exploration, drilling and mining industries operate in a legal

environment requiring permits by local, state and federal government agencies to

conduct virtually all operations. Federal agencies that may be involved include

the BLM, U.S. Forest Service, Environmental Protection Agency, National

Institute for Occupational Safety and Health, Mine Safety and Health

Administration and Fish and Wildlife Service. Individual states may have

environmental regulatory bodies overseeing mining industries, such as

Departments of Ecology. Local authorities, usually counties, also have control

over mining activity. The various permits required for such activity address

prospecting, development, production, labor standards, taxes, occupational

health and safety, toxic substances, air quality, water use, water discharge,

water quality, noise, dust, wildlife impacts and other environmental and

socioeconomic issues.

Prior to

receiving the necessary permits to explore or mine, an operator must comply with

all regulatory requirements imposed by all governmental authorities having

jurisdiction over the project area. Very often, in order to obtain the requisite

permits, the operator must have its land reclamation, restoration or replacement

plans pre-approved, requiring the operator to present its environmental impact

plan describing how it intends to restore or replace the affected area. Any of

these requirements can cause delays or involve costly studies or alterations of

the proposed activity or time frame of operations in order to mitigate impacts.

All of these factors make it more difficult and costly to operate, and can have

a negative and sometimes fatal impact on the viability of the exploration or

mining operation. Finally, it is possible that future changes in these laws or

regulations could have a significant impact on our business, causing those

activities to be economically reevaluated at that time.

2

Mining

and exploration activities are subject to various laws and regulations governing

the protection of the environment. These laws and regulations are continually

changing and are generally becoming more restrictive. We conduct our operations

so as to protect the public health and environment and believe our operations

are in compliance with applicable laws and regulations in all material respects.

We have made, and expect to make in the future, expenditures to comply with such

laws and regulations, but cannot predict the full amount of such future

expenditures.

Environmental

protection and remediation is an increasingly important part of mineral

economics. Estimated future costs of reclamation or restoration of mined land

are based principally on legal and regulatory requirements. Reclamation of

affected areas after mining operations may cost millions of dollars. Often,

governmental permitting agencies require multi-million dollar bonds from mining

companies prior to granting permits, thereby insuring that reclamation takes

place. All environmental mitigation tends to decrease profitability of the

mining operation, but these expenses are recognized as a cost of doing business

by modern mining and exploration companies.

Competition

Both the

mineral exploration and drilling industries are intensely competitive in all

phases. In our mineral exploration activities, we will compete with many

companies possessing greater financial resources and technical facilities than

us for the acquisition of mineral concessions, claims, leases and other mineral

interests as well as for the recruitment and retention of qualified employees.

We must overcome significant barriers to entry in the business of mineral

exploration as a result of our limited operating history. Similarly, in our

drilling business, our competition includes many companies with significantly

greater experience, larger client bases and substantially greater financial

resources. There are significant barriers to entry in this business, including

large capital requirements and the recruitment and retention of qualified,

experienced employees. We cannot assure you that we will be able to compete in

any of our business areas effectively with current or future competitors or that

the competitive pressures faced by us will not have a material adverse effect on

our business, financial condition and operating results.

Employees

Other

than our director, we have no employees. Our director does not have an

employment agreement with us. We expect to hire additional staff and employees

as necessary to implement our business plan. We do not have pension, health,

annuity, insurance, stock options, profit sharing or similar benefit plans;

however, we may adopt such plans in the future.

Item

1A. Risk Factors

Not

required.

Item

1B. Unresolved Staff Comments

None.

Item

2. Properties

We do not

hold any investments or interests in mineral properties or real

estate.

Item

3. Legal Proceedings

We may

occasionally become involved in various lawsuits and legal proceedings arising

in the ordinary course of business. Litigation is subject to inherent

uncertainties and an adverse result in these or other matters that may arise

from time to time could have an adverse affect on our business, financial

condition or operating results. We are currently not aware of any such legal

proceedings or claims that will have, individually or in the aggregate, a

material adverse effect on our business, financial condition or operating

results.

Item

4. (Removed and Reserved)

PART

II

Item

5. Market for Registrant’s Common Equity, Related Stockholder Matters and Issuer

Purchases of Equity Securities

Our

common stock, par value $.001 per share, qualified for quotation on the OTC

Bulletin Board on April 16, 2010, under the symbol “STVS.” As of September 30,

2010, no trades of our common stock have occurred through the facilities of the

OTC Bulletin Board.

As of

December 27, 2010, there were approximately 34 holders of record of our common

stock.

3

We have

not declared any cash dividends nor do we intend to pay dividends in the

foreseeable future; instead, we plan to reinvest earnings, if any, in our

business operations.

As of

September 30, 2010, we have no formal equity compensation plan in effect nor

have we granted any equity-based compensation awards.

|

Issuer Purchases of Equity Securities

|

||||||||||||||||

|

Period

|

Total Number of

Shares Purchased

|

Average Price

Paid per Share

|

Total Number of Shares

Purchased as Part of

Publicly Announced

Plans or Programs

|

Maximum Number (or

Approximate Dollar

Value) of Shares that

May Yet Be Purchased

Under the Plans or

Programs

|

||||||||||||

|

July

1 through July 31, 2010

|

18,000 |

(1)

|

$ | 0.03 | - | $ | - | |||||||||

|

August

1 through August 31, 2010

|

- | - | - | - | ||||||||||||

|

September 1 through September 30,

2010

|

- | - | - | - | ||||||||||||

|

Total

|

18,000 | $ | 0.03 | - | ||||||||||||

(1)

Purchase consists of registered shares returned to the Company for cancellation

on July 7, 2010, by a non-U.S. stockholder in exchange for $540.00. The Company

authorized the cancellation of the shares on June 30, 2010.

Item

6. Selected Financial Data

Not

required.

Item

7. Management’s Discussion and Analysis of Financial Condition and Results of

Operation

This

Annual Report on Form 10-K includes forward-looking statements within the

meaning of Section 27A of the Securities Act of 1933, as amended (the

“Securities Act”), and Section 21E of the Securities Exchange Act of 1934, as

amended (the “Exchange Act”). We have based these forward-looking statements on

our current expectations and projections about future events. These

forward-looking statements are subject to known and unknown risks, uncertainties

and assumptions about us that may cause our actual results, levels of activity,

performance or achievements to be materially different from any future results,

levels of activity, performance or achievements expressed or implied by such

forward-looking statements. In some cases, you can identify forward-looking

statements by terminology such as “may,” “will,” “should,” “could,” “would,”

“expect,” “plan,” “anticipate,” “believe,” “estimate,” “continue,” or the

negative of such terms or other similar expressions. The following discussion

should be read in conjunction with our Financial Statements and related Notes

thereto included elsewhere in this report.

Company

History

We were

incorporated on September 9, 2009 in the State of Nevada, we have no

subsidiaries. We have not generated any revenue to date. We commenced our

operations as an exploration stage company. We will explore for mineral

properties with a view to exploiting any mineral deposits we discover. We do not

hold any investments or interests in mineral properties or real estate, nor have

any current plans to acquire new investments or interests in mineral properties,

but we may consider such acquisitions in the future. We are evaluating other

business opportunities as well, which may include a change in control of the

Company or business combination with an operating company.

Our

auditors have issued a going concern opinion. This means our auditors believe

there is substantial doubt we can continue as an on-going business for the next

12 months. Our auditors’ opinion is based on the uncertainty of our ability to

establish profitable operations. The opinion results from the fact that we have

not generated any revenues. Accordingly, we must raise cash from sources other

than operations. We must raise cash to implement our project and begin our

operations. If we do not produce sufficient cash flow to support our operations

over the next 12 months, the Company will need to raise additional capital by

issuing capital stock in exchange for cash in order to continue as a going

concern. There are no formal or informal agreements to attain such financing. We

cannot assure any investor that, if needed, sufficient financing can be obtained

or, if obtained, that it will be on reasonable terms. Without realization of

additional capital, it would be unlikely for operations to continue and any

investment made by an investor would be lost in its entirety.

4

Business

Development

To date,

our business activities have been limited to completing the registration of our

common stock on Form S-1, maintaining our reporting requirements, and securing

an option to acquire the YACG mineral prospects in Stevens County,

Washington. The option conveyed exploration and development rights to us on

the YACG mineral prospects, which are unpatented mining claims owned by the

American Mining Corporation, provided that we commence and incur certain

expenditures related to exploration on the prospects. We let the option

terminate as of September 30, 2010. We have qualified for the quotation of

our common stock on the OTCBB under the ticker symbol “STVS,” but no market

currently exists. Investors should be aware there can be no guarantee or

assurance that a market will ever develop for our common stock in the

future.

Results

of Operations from Inception through September 30, 2010

We have

not earned any revenues from our incorporation on September 9, 2009, to

September 30, 2010. We do not anticipate earning revenues unless we enter into

commercial production on a claim or we acquire other business or properties,

which is doubtful. We have not commenced the exploration stage of our business

and can provide no assurance that, should we commence the exploration stage on a

claim, we will discover economic mineralization on such claim, or if minerals

are discovered, that we will enter into commercial production.

We

incurred operating expenses of $28,260 for the period from our inception on

September 9, 2009, to September 30, 2010.

We have

not attained profitable operations and are dependent upon obtaining financing to

pursue exploration activities. For these reasons our auditors believe there is

substantial doubt we will be able to continue as a going concern.

Liquidity

and Capital Resources

On

September 28, 2009, the Company issued 2,000,000 shares of its $0.001 par value

common stock at $0.002 per share for $4,000 in cash. The Company also issued

100,000 shares at $0.02 per share for $2,000 in professional

services.

On

January 13, 2010, the Company filed a Prospectus pursuant to Rule 424(b)(3)

promulgated under the Securities Act of 1933, as amended, as part of the

Company’s Registration Statement on Form S-1 deemed effective by the Securities

and Exchange Commission on January 12, 2010. Pursuant to the prospectus, the

Company sold 514,000 shares at $0.02 per share for $10,280. In June 2010, the

Company purchased and cancelled 18,000 common shares at $0.03 per share for

$540.

As of

September 30, 2010, we had total cash of $0. We have a cumulative net loss of

$28,260 since inception. We have not generated any revenues and cannot provide

any assurance we will ever generate revenues. We are currently dependent upon

raising proceeds in order to continue as a going concern. There can be no

guarantee or assurance that the Company will be able to secure adequate

financing within the next three to six months and failure to do so would result

in a complete loss of any investment in the Company.

Research

and Development

The

Company has not incurred any expense for research and development since

inception and does not anticipate any costs or expenses to be incurred for

research and development within the next 12 months.

The

Company does not plan any purchase of significant equipment in the next 12

months.

Recently

Issued Accounting Pronouncements

On

September 9, 2009, the Company adopted Accounting Standards Update (“ASU”) No.

2009-01, “Topic 105 – Generally Accepted Accounting Principles – amendments

based on Statement of Financial Accounting Standards No. 168, The FASB

Accounting Standards Codification and the Hierarchy of Generally Accepted

Accounting Principles” (“ASU No. 2009-01”). ASU No. 2009-01 re-defines

authoritative US GAAP for nongovernmental entities to be only comprised of the

FASB Accounting Standards Codification (“Codification”) and, for SEC

registrants, guidance issued by the SEC. The Codification is a reorganization

and compilation of all then-existing authoritative US GAAP for nongovernmental

entities, except for guidance issued by the SEC. The Codification is amended to

effect non-SEC changes to authoritative US GAAP. Adoption of ASU No. 2009-01

only changed the referencing convention of US GAAP in the Notes to the Financial

Statements.

On

February 25, 2010, the FASB issued ASU No. 2010-09 Subsequent Events Topic 855

“Amendments to Certain Recognition and Disclosure Requirements,” effective

immediately. The amendments in the ASU remove the requirement for an SEC filer

to disclose a date through which subsequent events have been evaluated in both

issued and revised financial statements. Revised financial statements include

financial statements revised as a result of either correction of an error or

retrospective application of US GAAP. The FASB believes these amendments remove

potential conflicts with the SEC’s literature. The adoption of this ASU did not

have a material impact on the Company’s financial

statements.

5

On March

5, 2010, the FASB issued ASU No. 2010-11 Derivatives and Hedging Topic 815

“Scope Exception Related to Embedded Credit Derivatives.” This ASU clarifies the

guidance within the derivative literature that exempts certain credit related

features from analysis as potential embedded derivatives requiring separate

accounting. The ASU specifies that an embedded credit derivative feature related

to the transfer of credit risk that is only in the form of subordination of one

financial instrument to another is not subject to bifurcation from a host

contract under ASC 815-15-25, Derivatives and Hedging – Embedded Derivatives –

Recognition. All other embedded credit derivative features should be analyzed to

determine whether their economic characteristics and risks are “clearly and

closely related” to the economic characteristics and risks of the host contract

and whether bifurcation is required. The ASU was effective for the Company in

its fiscal fourth quarter of 2010. The adoption of this ASU did not have a

material impact on the Company’s financial statements.

In April

2010, the FASB codified the consensus reached in Emerging Issues Task Force

Issue No. 08-09, “Milestone Method of Revenue Recognition.” FASB ASU No. 2010-17

provides guidance on defining a milestone and determining when it may be

appropriate to apply the milestone method of revenue recognition for research

and development transactions. FASB ASU No. 2010-17 is effective for fiscal years

beginning on or after June 15, 2010, and is effective on a prospective basis for

milestones achieved after the adoption date. The Company does not expect this

ASU will have a material impact on its financial position or results of

operations when it adopts this update on October 1, 2010.

Critical

Accounting Policies

Our

financial statements and related public financial information are based on the

application of accounting principles generally accepted in the United States

(“US GAAP”). US GAAP requires the use of estimates; assumptions, judgments and

subjective interpretations of accounting principles that have an impact on the

assets, liabilities, revenue and expense amounts reported. These estimates can

also affect supplemental information contained in our external disclosures

including information regarding contingencies, risk and financial condition. We

believe our use of estimates and underlying accounting assumptions adhere to US

GAAP and are consistently and conservatively applied. We base our estimates on

historical experience and on various other assumptions that we believe to be

reasonable under the circumstances. Actual results may differ materially from

these estimates under different assumptions or conditions. We continue to

monitor significant estimates made during the preparation of our financial

statements.

Our

significant accounting policies are summarized in Note 2 of our financial

statements. While all these significant accounting policies impact our financial

condition and results of operations, we view certain of these policies as

critical. Policies determined to be critical are those policies that have the

most significant impact on our financial statements and require management to

use a greater degree of judgment and estimates. Actual results may differ from

those estimates. Our management believes that given current facts and

circumstances, it is unlikely that applying any other reasonable judgments or

estimate methodologies would cause effect on our consolidated results of

operations, financial position or liquidity for the periods presented in this

report.

Off-Balance

Sheet Arrangements

As of the

date of this Annual Report, the Company does not have any off-balance sheet

arrangements that have or are reasonably likely to have a current or future

effect on the Company's financial condition, changes in financial condition,

revenues or expenses, results of operations, liquidity, capital expenditures or

capital resources that are material to investors. The term "off-balance sheet

arrangement" generally means any transaction, agreement or other contractual

arrangement to which an entity unconsolidated with the Company is a party, under

which the Company has (i) any obligation arising under a guarantee contract,

derivative instrument or variable interest; or (ii) a retained or contingent

interest in assets transferred to such entity or similar arrangement that serves

as credit, liquidity or market risk support for such assets.

Item

7A. Quantitative and Qualitative Disclosures about Market Risk

Not

required.

Item

8. Financial Statements and Supplementary Data

The

information required for this Item is included in this Annual Report on Form

10-K on pages F-1 through F-11, inclusive, and is incorporated herein by

reference.

Item

9. Changes in and Disagreements with Accountants on Accounting and Financial

Disclosure

None.

6

Item

9A. Controls and Procedures

Disclosure

Controls and Procedures

Our

management, including the participation of our principal executive officer and

principal financial officer, positions held currently by the same officer, has

assessed the effectiveness of our disclosure controls and procedures (as defined

under Rules 13a-15(e) and 15d-15(e) of the Securities Exchange Act of 1934, as

amended, or Exchange Act). Our management concluded that, as of the end of the

period covered by this report, our disclosure controls and procedures were not

effective. Our management identified the following material weaknesses in the

design and operation of our disclosure controls and procedures:

|

|

·

|

We

have inadequate segregation of duties and effective risk assessment

because we have only one officer and

director;

|

|

|

·

|

We

have insufficient written policies and procedures outlining the duties and

accounting and financial reporting requirements with respect to the

requirements and application of both US GAAP and SEC

guidelines;

|

|

|

·

|

We

have insufficient disaster recovery plans and inadequate security and

restricted access for our computer systems;

and

|

|

|

·

|

We

have no written whistleblower

policy.

|

Our

management plans to implement appropriate disclosure controls and procedures to

remedy these material weakness, including (i) appointing and hiring additional

qualified personnel to address the inadequate segregation of duties and

ineffective risk management; (ii) adopting appropriate written policies and

procedures outlining the duties and accounting and financial reporting

requirements; (iii) implementing appropriate disaster recovery plans and

security measures for our computer systems; and (iv) adopting an appropriate

whistleblower policy.

Internal

Control over Financial Reporting

Our

principal executive officer and principal financial officer, positions held

currently by the same officer, are responsible for establishing and maintaining

adequate internal control over financial reporting (as defined in Rule 13a-15(f)

and Rule 15d-15(f) under the Exchange Act) for the Company. As of the end of the

period covered by this report, our officer assessed the effectiveness of our

internal control over financial reporting based on the criteria for effective

internal control over financial reporting established in the “Internal

Control-Integrated Framework” issued by the Committee of Sponsoring

Organizations of the Treadway Commission, or COSO. Based on that evaluation, our

officer concluded that, during the period covered by this report, such internal

controls and procedures were not effective to detect the inappropriate

application of US GAAP rules because of deficiencies that existed in the design

or operation of our internal control over financial reporting, which adversely

affected our internal controls. These deficiencies, which may be considered to

be material weaknesses, were:

|

|

·

|

Our

lack of a functioning audit committee and independent directors on our

Board of Directors;

|

|

|

·

|

Our

inadequate segregation of duties consistent with internal control

objectives;

|

|

|

·

|

We

have insufficient written policies and procedures for accounting and

financial reporting with respect to the requirements and application of US

GAAP and SEC disclosure requirements;

and

|

|

|

·

|

Our

lack of effective controls over period-end financial disclosure and

reporting processes.

|

Our

officer believes that the material weaknesses identified above did not have an

effect on our financial results, but that the lack of a functioning audit

committee and independent directors did result in ineffective oversight of the

establishment and monitoring of required internal controls and procedures.

Accordingly, as part of our commitment to improve our financial organization, we

plan to remedy these material weaknesses when funds allow by (i) appointing one

or more independent directors to our Board of Directors and establishing an

audit committee with such independent directors to undertake the oversight in

the establishment and monitoring of required internal controls and procedures;

(ii) implementing appropriate written policies and procedures for accounting and

financial reporting with respect to the requirements and application of US GAAP

and SEC disclosure requirements and to address the lack of effective controls

over period-end financial disclosure and reporting processes; and (iii)

appointing and hiring additional qualified personnel to address the inadequate

segregation of duties and to provide additional checks and balances within the

Company.

There was

no change in our internal control over financial reporting (as defined in Rules

13a-15(f) and 15d-15(f) under the Exchange Act) that occurred during our fourth

fiscal quarter that has materially affected, or is reasonably likely to

materially affect, our internal control over financial reporting.

Our

management will continue to monitor and evaluate the effectiveness of our

disclosure controls and procedures and our internal control over financial

reporting on an ongoing basis and remains committed to taking further action and

implementing additional enhancements or improvements as necessary and as funds

allow.

As a

“smaller reporting company” and pursuant to Item 308(a)(4) of Regulation S-K,

this Annual Report does not include an attestation report of our independent

registered public accounting firm regarding internal control over financial

reporting.

Item

9B. Other Information

None.

7

PART

III

Item

10. Directors, Executive Officers and Corporate Governance

Management

Our sole

director serves until his successor is elected and qualified. Our sole officer

is elected by the Board of Directors to a term of one year and serves until his

successor is duly elected and qualified, or until he is removed from office. We

do not have an audit committee, compensation committee or nominating

committee.

Alex Li,

age 30, serves currently as our sole director and President, Chief Executive

Officer, Chief Financial Officer, Treasurer and Secretary. Mr. Li has held his

positions with us since July 13, 2010. Prior to joining us, Mr. Li was an

independent financial analyst who has been advising companies since 2009. From

2007 to 2009, Mr. Li was an Accounting Clerk for the Resort Golden Palm in

HaiNan, China. From 2005 to 2007, Mr. Li was a Project Manager for Lianhe Credit

Rating Co., Ltd., in Beijing, one of the primary rating agencies in China. From

2002 to 2005, Mr. Li was a Research Analyst for the local government of Anyang,

Henan Province, China. Mr. Li received his bachelor’s degree in Economics from

Renmin University in 2002.

There

were no arrangements or understandings between Mr. Li and any other persons

pursuant to which Mr. Li was elected as director or officer, nor are there any

transactions between Mr. Li and us in which he has a direct or indirect material

interest that we are required to report pursuant to the rules and regulations of

the SEC. There are no family relationships between Mr. Li and any director,

officer or key personnel.

Involvement

in certain legal proceedings

During

the past ten years, none of the Company’s directors and executive officers and,

during the past five years, none of the Company’s promoters and control persons,

has been:

|

|

·

|

the

subject of any bankruptcy petition filed by or against any business of

which such person was a general partner or executive officer either at the

time of the bankruptcy or within two years prior to that

time;

|

|

|

·

|

convicted

in a criminal proceeding or is subject to a pending criminal proceeding

(excluding traffic violations and other minor

offenses);

|

|

|

·

|

subject

to any order, judgment or decree, not subsequently reversed, suspended or

vacated, of any court of competent jurisdiction, permanently or

temporarily enjoining, barring, suspending or otherwise limiting his

involvement in any type of business, securities or banking

activities;

|

|

|

·

|

found

by a court of competent jurisdiction (in a civil action), the SEC or the

Commodity Futures Trading Commission to have violated a federal or state

securities or commodities law, that has not been reversed, suspended, or

vacated;

|

|

|

·

|

subject

of, or a party to, any order, judgment, decree or finding, not

subsequently reversed, suspended or vacated, relating to an alleged

violation of a federal or state securities or commodities law or

regulation, law or regulation respecting financial institutions or

insurance companies, law or regulation prohibiting mail or wire fraud or

fraud in connection with any business entity;

or

|

|

|

·

|

subject

of, or a party to, any sanction or order, not subsequently reversed,

suspended or vacated, of any self-regulatory organization, any registered

entity or any equivalent exchange, association, entity or organization

that has disciplinary authority over its members or persons associated

with a member.

|

No

director, officer or affiliate of the Company, or any beneficial owner of 5% or

more of the Company’s common stock, or any associate of such persons, is an

adverse party in any material proceeding to, or has a material interest adverse

to, the Company or any of its subsidiaries.

Section

16(a) Beneficial Ownership Reporting Compliance

Section

16(a) of the Exchange Act requires our executive officers and directors and

persons who own more than 10% of our common stock to file reports regarding

ownership of, and transactions in, our securities with the SEC and to provide us

with copies of those filings. Based solely on our review of such filings (and

any amendments thereof) received by us and on the written representations of

certain reporting persons, we believe that during our fiscal year ended

September 30, 2010, the following reporting person failed to file such reports

on a timely basis:

|

Name and principal position

|

Number of

late reports

|

Transactions not

timely reported

|

Known failures to

file a required form

|

|||

|

Justin

Miller, former President and Director(1)

|

|

0

|

|

0

|

|

2

|

(1)

Justin Miller, our former President, Chief Executive Officer, Chief Financial

Officer, Treasurer and director, resigned from the Company on July 13,

2010.

8

Code

of Ethics

We

adopted a Code of Ethics on September 30, 2009, a copy of which is included as

an exhibit to this Annual Report on Form 10-K.

Corporate

Governance

We

currently have no standing audit, compensation or nominating committees or

committees performing similar functions, nor do we have written audit,

compensation or nominating committee charters. Our director believes it

unnecessary to have such committees at this time because we have only one

director and the Board of Directors can perform the functions of such committees

adequately.

We do not

have any defined policy or procedural requirements for shareholders to submit

recommendations or nominations for directors. The Board of Directors believes

that, given the stage of our development, a specific nominating policy would be

premature until our business operations develop to a more advanced level. We

currently do not have any specific or minimum criteria for the election of

nominees to the Board of Directors and we do not have any specific process or

procedure for evaluating such nominees. The Board of Directors will assess all

candidates, whether submitted by management or shareholders, and make

recommendations for election or appointment. A shareholder who wishes to

communicate with our Board of Directors may do so by directing a written request

addressed to our director at the address on the cover of this

report.

Item

11. Executive Compensation

As a

“smaller reporting company,” we have elected to follow the scaled disclosure

requirements for smaller reporting companies with respect to the disclosures

required by Item 402 of Regulation S-K. Under the scaled disclosure obligations,

we are not required to provide a Compensation Discussion and Analysis,

Compensation Committee Report and certain other tabular and narrative

disclosures relating to executive compensation.

Summary

Compensation Table

The

following table sets forth information concerning the compensation for the

fiscal years ended September 30, 2010 and 2009, of certain of our executive

officers.

|

Summary Compensation Table

|

||||||||||||||||||||||||||||||||||

|

Name and

|

|

Salary

|

Bonus

|

Stock

Awards

|

Option

Awards

|

Nonequity

Incentive Plan

Compensation

|

Nonqualified

Deferred

Compensation

Earnings

|

All Other

Compensation

|

Total

|

|||||||||||||||||||||||||

|

Principal Position

|

Year

|

($)

|

($)

|

($)

|

($)

|

($)

|

($)

|

($)

|

($)

|

|||||||||||||||||||||||||

|

Alex

Li

|

2010(1)

|

0 | 0 | 0 | 0 | 0 | 0 | 0 | 0 | |||||||||||||||||||||||||

|

President

|

2009

|

- | - | - | - | - | - | - | - | |||||||||||||||||||||||||

|

Justin

Miller

|

2010(2)

|

0 | 0 | 0 | 0 | 0 | 0 | 0 | 0 | |||||||||||||||||||||||||

|

Former

President

|

2009

|

0 | 0 | 0 | 0 | 0 | 0 | 0 | 0 | |||||||||||||||||||||||||

(1) Alex

Li, our current President, Chief Executive Officer, Chief Financial Officer,

Treasurer and Secretary, was appointed to such offices on July 13,

2010.

(2)

Justin Miller, our former President, Chief Executive Officer, Chief Financial

Officer and Treasurer, resigned from such offices on July 13, 2010.

Narrative

Disclosure to Summary Compensation Table

We have

not nor plan to pay any salaries at this time, and we will not begin paying

salaries until we have adequate funds to do so. We have not entered into any

employment agreements with our officers. We do not have any existing

arrangements providing for payments or benefits in connection with the

resignation, retirement or other termination of our officers, or a change in

control of the Company or a change in the officers’ responsibilities following a

change in control. We have no equity incentive plan.

Outstanding

Equity Awards at Fiscal Year-End

As of

September 30, 2010, we have no formal equity compensation plan in effect nor

have we granted any equity-based awards.

Compensation

of Directors

As of

September 30, 2010, none of our directors has received any compensation from us

for serving as our director, nor do we have any plans to compensate our

directors until we have adequate funds to do so.

9

Item

12. Security Ownership of Certain Beneficial Owners and Management and Related

Stockholder Matters

The

following table sets forth information as of December 27, 2010, regarding the

number of shares of common stock beneficially owned by (i) each person that we

know beneficially owns more than 5% of our outstanding common stock, (ii) each

of our named executive officers, (iii) each of our directors and (iv) all of our

named executive officers and directors as a group. The amounts and percentages

of common stock beneficially owned are reported on the basis of SEC rules

governing the determination of beneficial ownership of securities. Under the SEC

rules, a person is deemed to be a “beneficial owner” of a security if that

person has or shares “voting power,” which includes the power to vote or to

direct the voting of such security, or “investment power,” which includes the

power to dispose of or to direct the disposition of such security. A person is

also deemed to be a beneficial owner of any securities of which that person has

the right to acquire beneficial ownership within 60 days through the exercise of

any stock option, warrant or other right. Under these rules, more than one

person may be deemed a beneficial owner of the same securities and a person may

be deemed to be a beneficial owner of securities as to which such person has no

economic interest. Unless otherwise indicated, each of the shareholders named in

the table below, or his or her family members, has sole voting and investment

power with respect to such shares of common stock. As of December 27, 2010,

there were 2,596,000 shares of our common stock issued and

outstanding.

|

Name of beneficial owner

|

Number of shares

|

Percent of class

|

||||||

|

Alex

Li, President and Director

|

2,000,000 | 77.04 | % | |||||

|

All

Directors and Officers as a Group (1 Person)

|

2,000,000 | 77.04 | % | |||||

We are

not aware of any arrangements that could result in a change in control of the

Company.

As of

September 30, 2010, we have no formal equity compensation plan in effect nor

have we granted any equity-based awards.

Item

13. Certain Relationships and Related Transactions, and Director

Independence

There

were no transactions with any related persons (as that term is defined in Item

404 in Regulation S-K) during our fiscal year ended September 30, 2009, or any

currently proposed transaction, in which we were or are to be a participant and

the amount involved exceeds $120,000 and in which any related person had a

direct or indirect material interest.

Our

current and former directors are not deemed independent for the purposes of the

listed company standards of The NASDAQ Stock Market LLC currently in effect and

approved by the SEC and all applicable rules and regulations of the

SEC.

Item

14. Principal Accounting Fees and Services

Audit

Fees

Our Board

of Directors has selected Goldman Kurland and Mohidin, LLP (“GKM”) as the

independent registered public accounting firm to audit our books and accounts

for the fiscal year ending September 30, 2010. GKM has served as our independent

accountant since July 13, 2010. Prior to July 13, 2010, we had engaged Kyle L.

Tingle, CPA, LLC (“Tingle”) as our independent accountant since September 9,

2009 (inception). The aggregate fees billed for the last two fiscal years ended

September 30, 2010 and 2009, for professional services rendered by GKM and

Tingle were as follows:

|

Year ended

September 30, 2010

|

Year ended

September 30, 2009

|

|||||||||||||||

|

GKM

|

Tingle

|

GKM

|

Tingle

|

|||||||||||||

|

Audit Fees

|

$ | 7,000 | $ | 3,275 | $ | - | $ | 2,675 | ||||||||

|

Audit-Related

Fees

|

0 | 0 | - | 0 | ||||||||||||

|

Tax

Fees

|

0 | 0 | - | 0 | ||||||||||||

|

All

Other Fees

|

0 | 0 | - | 0 | ||||||||||||

In the

above table, “audit fees” are fees billed for services provided related to the

audit of our annual financial statements, quarterly reviews of our interim

financial statements and services normally provided by the independent

accountant in connection with statutory and regulatory filings or engagements

for those fiscal periods. “Audit-related fees” are fees not included in audit

fees that are billed by the independent accountant for assurance and related

services that are reasonably related to the performance of the audit or review

of our financial statements. “Tax fees” are fees billed by the independent

accountant for professional services rendered for tax compliance, tax advice and

tax planning. “All other fees” are fees billed by the independent accountant for

products and services not included in the foregoing categories.

Our Board

of Directors pre-approves all services provided by our independent accountants.

Our Board of Directors reviewed and approved all of the above services and

fees.

10

PART

IV

Item

15. Exhibits, Financial Statement Schedules

The

following documents are filed as part of or are included in this Annual Report

on Form 10-K:

|

|

1.

|

Financial

statements listed in the Index to Financial Statements, filed as part of

this Annual Report on Form 10-K;

and

|

|

|

2.

|

Exhibits

listed in the Exhibit Index filed as part of this Annual Report on Form

10-K.

|

11

INDEX

TO FINANCIAL STATEMENTS

|

Page

|

||

|

Reports

of Independent Registered Public Accounting Firms

|

F-2

|

|

|

Balance

Sheets as of September 30, 2010 and 2009

|

F-4

|

|

|

Statements

of Expenses for the year ended September 30, 2010 and from Inception

through September 30, 2010

|

F-5

|

|

|

Statement

of Stockholders’ Equity (Deficit) from Inception through September 30,

2010

|

F-6

|

|

|

Statements

of Cash Flows for the year ended September 30, 2010 and from Inception

through September 30, 2010

|

F-7

|

|

|

Notes

to Financial Statements

|

F-8

|

F-1

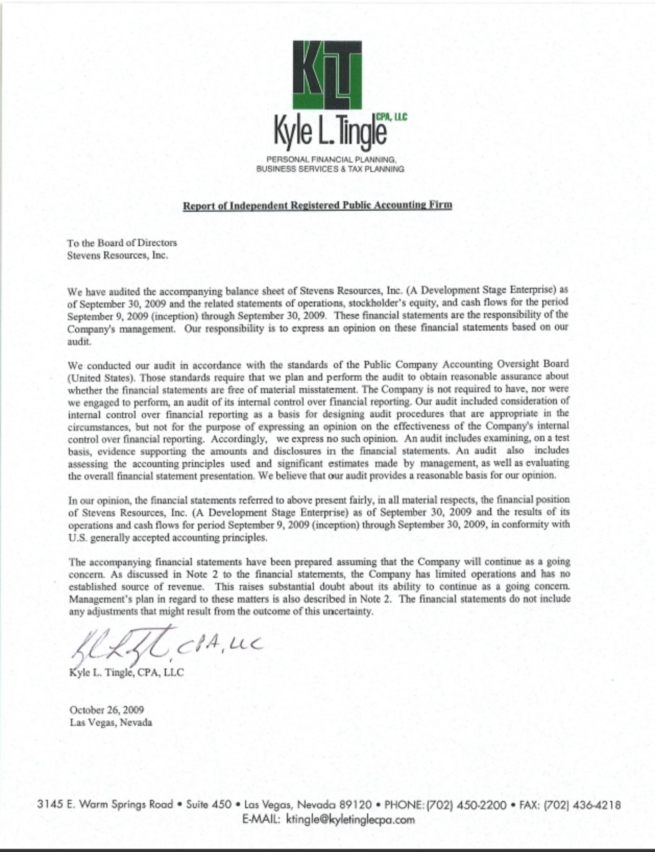

REPORT

OF INDEPENDENT REGISTERED PUBLIC ACCOUNTING FIRM

To the

Board of Directors

Stevens

Resources, Inc.

We have

audited the accompanying balance sheet of Steven Resources, Inc. (an exploration

stage company) (the “Company”) as of September 30, 2010, and the related

statements of expenses, stockholders’ equity (deficit) and cash flows for the

year then ended. The statements of expenses, stockholders’ equity (deficit)

and cash flows included in the cumulative information from inception (September

9, 2009) to September 30, 2010, have been audited by other auditors whose report

is presented separately in the Company’s 10-K filing. These financial statements

are the responsibility of the Company’s management. Our responsibility is to

express an opinion on these financial statements based on our

audit.

We

conducted our audits in accordance with the standards of the Public Company

Accounting Oversight Board (United States). Those standards require that we

plan and perform the audit to obtain reasonable assurance about whether the

financial statements are free of material misstatement. An audit includes

examining, on a test basis, evidence supporting the amounts and disclosures in

the financial statements. An audit also includes assessing the

accounting principles used and significant estimates made by management, as well

as evaluating the overall financial statement presentation. We believe that

our audit provides a reasonable basis for our opinion.

In our

opinion, based on our audit, the financial statements referred to above present

fairly, in all material respects, the financial position of the Company as of

September 30, 2010, and the results of its operations and its cash flows for the

year then ended. Further, in our opinion, based on our audit and the report of

other auditors’ as referred to above, the financial statements fairly present in

all material respects, the results of the Company’s operations and cash flows

for the period from inception (September 9, 2009) to September 30, 2010, in

conformity with the U.S. generally accepted accounting principles.

The

accompanying financial statements have been prepared assuming the Company will

continue as a going concern. As discussed in Note 2 to the financial statements,

the Company has incurred losses from operations and has an accumulated deficit

of $28,260 as of September 30, 2010. These conditions raise substantial doubt

about the Company’s ability to continue as a going concern. These financial

statements do not include any adjustments that might result from such

uncertainty.

Goldman

Kurland and Mohidin, LLP

Encino,

California

December

28, 2010

F-2

F-3

Stevens

Resources, Inc.

(An

Exploration Stage Company)

Balance

Sheets

|

September 30, 2010

|

September 30, 2009

|

|||||||

|

ASSETS

|

||||||||

|

CURRENT

ASSETS

|

||||||||

|

Cash

|

$ | - | $ | 4,000 | ||||

|

Prepaid

expenses

|

- | 2,000 | ||||||

|

TOTAL

ASSETS

|

$ | - | $ | 6,000 | ||||

|

LIABILITIES

AND STOCKHOLDERS' EQUITY (DEFICIT)

|

||||||||

|

CURRENT

LIABILITIES

|

||||||||

|

Accounts

payable & accrued liabilities

|

$ | 12,520 | $ | 525 | ||||

|

Total

current liabilities

|

12,520 | 525 | ||||||

|

COMMITMENTS

|

||||||||

|

STOCKHOLDERS'

EQUITY (DEFICIT)

|

||||||||

|

Common

stock, $0.001 par value; 75,000,000 shares authorized; 2,596,000 and

2,100,000 issued and outstanding at September 30, 2010 and

September 30, 2009, respectively

|

2,596 | 2,100 | ||||||

|

Additional

paid in capital

|

13,144 | 3,900 | ||||||

|

Deficit

accumulated during the exploration stage

|

(28,260 | ) | (525 | ) | ||||

|

Total

stockholders' equity (deficit)

|

(12,520 | ) | 5,475 | |||||

|

TOTAL

LIABILITIES AND STOCKHOLDERS' EQUITY (DEFICIT)

|

$ | - | $ | 6,000 | ||||

The

accompanying notes are an integral part of these financial

statements.

F-4

Stevens

Resources, Inc.

(An

Exploration Stage Company)

Statements

of Expenses

|

From September 9, 2009

|

||||||||

|

Year Ended

|

(inception) through

|

|||||||

|

September 30, 2010

|

September 30, 2010

|

|||||||

|

Expenses

|

||||||||

|

General

and administrative expenses

|

$ | 4,141 | $ | 4,141 | ||||

|

Professional

fees

|

23,594 | 24,119 | ||||||

|

Total

Expenses

|

27,735 | 28,260 | ||||||

|

Net

loss

|

$ | 27,735 | $ | 28,260 | ||||

|

Weighted

average number of shares outstanding

|

2,461,033 | 2,338,341 | ||||||

|

Basic

and diluted net loss per share

|

$ | 0.00 | $ | 0.00 | ||||

The

accompanying notes are an integral part of these financial

statements.

F-5

Stevens

Resources, Inc.

(An

Exploration Stage Company)

Statement

of Changes in Stockholders’ Equity (Deficit)

From

September 9, 2009 (Inception) to September 30, 2010

|

Additional

|

Deficit Accumulated

|

|||||||||||||||||||

|

Common stock

|

Paid in capital

|

During the exploration stage

|

Total

|

|||||||||||||||||

|

Numbers of shares

|

Amount

|

|||||||||||||||||||

|

Balance,

September 9, 2009 (Inception)

|

- | $ | - | $ | - | $ | - | $ | - | |||||||||||

|

Common

stock issued for cash, September 28, 2009, $0.002 per

share

|

2,000,000 | 2,000 | 2,000 | - | 4,000 | |||||||||||||||

|

Common

stock issued for services, September 28, 2009, $0.002 per

share

|

100,000 | 100 | 1,900 | - | 2,000 | |||||||||||||||

|

Net

loss

|

- | - | - | (525 | ) | (525 | ) | |||||||||||||

|

Balance at September 30,

2009

|

2,100,000 | 2,100 | 3,900 | (525 | ) | 5,475 | ||||||||||||||

|

Common

stock issued for cash at $0.02, January 13, 2010

|

514,000 | 514 | 9,766 | - | 10,280 | |||||||||||||||

|

Purchase

and cancellation of common stock at $0.03 per share

|

(18,000 | ) | (18 | ) | (522 | ) | - | (540 | ) | |||||||||||

|

Net

loss for the year

|

- | - | - | (27,735 | ) | (27,735 | ) | |||||||||||||

|

Balance at September 30,

2010

|

2,596,000 | $ | 2,596 | $ | 13,144 | $ | (28,260 | ) | $ | (12,520 | ) | |||||||||

The

accompanying notes are an integral part of these financial

statements.

F-6

Stevens

Resources, Inc.

(An

Exploration Stage Company)

Statements

of Cash Flows

|

Period from September 9, 2009

|

||||||||

|

Year ended

|

(inception) through

|

|||||||

|

September 30, 2010

|

September 30, 2010

|

|||||||

|

CASH

FLOWS FROM OPERATING ACTIVITIES:

|

||||||||

|

Net

loss

|

$ | (27,735 | ) | $ | (28,260 | ) | ||

|

Adjustments

to reconcile net loss to net cash used in operating

activities

|

||||||||

|

Common

stock issued for services

|

- | 2,000 | ||||||

|

Changes

in

|

||||||||

|

Prepaid

Expenses

|

2,000 | - | ||||||

|

Accounts

payable and accrued liabilities

|

11,995 | 12,520 | ||||||

|

Net

cash used in operating activities

|

(13,740 | ) | (13,740 | ) | ||||

|

CASH

FLOWS FROM FINANCING ACTIVITIES:

|

||||||||

|

Purchase

and cancellation of treasury stock

|

(540 | ) | (540 | ) | ||||

|

Proceeds

from issuance of common stock

|

10,280 | 14,280 | ||||||

|

Net

cash provided by financing activities

|

9,740 | 13,740 | ||||||

|

(DECREASE)

IN CASH

|

(4,000 | ) | - | |||||

|

CASH,

BEGINNING OF PERIOD

|

4,000 | - | ||||||

|

CASH,

END OF PERIOD

|

$ | - | $ | - | ||||

|

Supplemental

Cash flow data:

|

||||||||

|

Income

tax paid

|

$ | - | $ | - | ||||

|

Interest

paid

|

$ | - | $ | - | ||||

The

accompanying notes are an integral part of these financial

statements.

F-7

Stevens

Resources, Inc.

(An

Exploration Stage Company)

Notes

to Financial Statements

September

30, 2010

NOTE 1 –

FINANCIAL STATEMENTS

Stevens

Resources, Inc. (the “Company” or “Stevens Resources”) was incorporated in the

State of Nevada on September 9, 2009. The Company currently has no operations

and, in accordance with ASC 915 “Development Stage Entities,” is considered an

Exploration Stage Enterprise. The Company has been in the exploration stage

since its formation and has not yet realized any revenues from its planned

operations.

In the

opinion of management, all adjustments (which include only normal recurring

adjustments) necessary to present fairly the financial position, results of

operations and cash flows as of and for the year ended September 30, 2010, and

for all periods presented were made.

NOTE 2 –

SIGNIFICANT ACCOUNTING POLICIES

Cash

For the

Statements of Cash Flows, all highly liquid investments with maturity of three

months or less are considered cash equivalents.

Use of

Estimates

The

preparation of financial statements in conformity with United States Generally

Accepted Accounting Principles (“US GAAP”) requires management to make estimates

and assumptions that affect the reported amounts of assets and liabilities and

disclosure of contingent assets and liabilities at the date of the financial

statements and the reported amounts of revenues and expenses during the

reporting period. Actual results could differ from those estimates.

Income

Taxes

The

Company utilizes Financial Accounting Standards Board (“FASB”) Accounting

Standards Codification (“ASC”) Topic 740, which requires recognition of deferred

tax assets and liabilities for the expected future tax consequences of events

that were included in the financial statements or tax returns. Under this

method, deferred income taxes are recognized for the tax consequences in future

years of differences between the tax bases of assets and liabilities and their

financial reporting amounts at each period end based on enacted tax laws and

statutory tax rates applicable to the periods in which the differences are

expected to affect taxable income. Valuation allowances are established, when

necessary, to reduce deferred tax assets to the amount expected to be

realized.

The

Company adopted the provisions of FASB Interpretation No. 48, “Accounting for

Uncertainty in Income Taxes,” (“FIN 48”), codified in FASB ASC Topic 740, on

September 9, 2009. As a result of the implementation of FIN 48, the Company made

a comprehensive review of its portfolio of tax positions in accordance with

recognition standards established by FIN 48. As a result of the implementation

of FIN 48, the Company recognized no material adjustments to liabilities or

stockholders’ equity. When tax returns are filed, it is highly certain that some

positions taken would be sustained upon examination by the taxing authorities,

while others are subject to uncertainty about the merits of the position taken

or the amount of the position that would be ultimately sustained. The benefit of

a tax position is recognized in the financial statements in the period during

which, based on all available evidence, management believes it is more likely

than not that the position will be sustained upon examination, including

the resolution of appeals or litigation processes, if any. Tax positions taken

are not offset or aggregated with other positions. Tax positions that meet the

more-likely-than-not recognition threshold are measured as the largest

amount of tax benefit that is more than 50 percent likely of being realized upon

settlement with the applicable taxing authority. The portion of the benefits

associated with tax positions taken that exceeds the amount measured as

described above is reflected as a liability for unrecognized tax benefits in the

accompanying balance sheets along with any associated interest and penalties

that would be payable to the taxing authorities upon examination. Interest

associated with unrecognized tax benefits are classified as interest expense and

penalties are classified in selling, general and administrative expenses in the

statements of income. At September 30, 2010, the Company did not take any

uncertain positions that would necessitate recording of tax related

liability.

Statement of Cash

Flows

In

accordance with SFAS No. 95, “Statement of Cash Flows,” (codified in FASB ASC

Topic 230), cash flows from the Company's operations are calculated based upon

the local currencies. As a result, amounts related to assets and liabilities

reported on the statement of cash flows may not necessarily agree with changes

in the corresponding balances on the balance sheet.

F-8

Stevens

Resources, Inc.

(An

Exploration Stage Company)

Notes

to Financial Statements

September

30, 2010

Basic and Diluted Loss per

Share (EPS)

Basic EPS

(Loss) is computed by dividing income (loss) available to common shareholders by

the weighted average number of common shares outstanding for the period. Diluted