Attached files

| file | filename |

|---|---|

| EXCEL - IDEA: XBRL DOCUMENT - Nova Lifestyle, Inc. | Financial_Report.xls |

| EX-32.1 - Nova Lifestyle, Inc. | ex32-1.htm |

| EX-21.1 - Nova Lifestyle, Inc. | ex21-1.htm |

| EX-31.1 - Nova Lifestyle, Inc. | ex31-1.htm |

| EX-31.2 - Nova Lifestyle, Inc. | ex31-2.htm |

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 10-K

(Mark One)

|

þ

|

ANNUAL REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934

|

For the fiscal year ended December 31, 2011

OR

|

¨

|

TRANSITION REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934

|

For the transition period from to

Commission file number: 333-163019

NOVA LIFESTYLE, INC.

(Exact name of registrant as specified in its charter)

|

Nevada

|

90-0746568

|

|

(State or other jurisdiction of

incorporation or organization)

|

(I.R.S. Employer

Identification No.)

|

|

6541 E. Washington Blvd.

Commerce, CA

|

90040

|

|

(Address of principal executive offices)

|

(Zip Code)

|

Registrant’s telephone number, including area code: (323) 888-9999

Securities registered pursuant to Section 12(b) of the Act:

None.

Securities registered pursuant to Section 12(g) of the Act:

Common Stock, par value $0.001 per share.

Indicate by check mark if the registrant is a well-known seasoned issuer, as defined in Rule 405 of the Securities Act.

Yes ¨ No þ

Indicate by check mark if the registrant is not required to file reports pursuant to Section 13 or Section 15(d) of the Act.

Yes ¨ No þ

Indicate by check mark whether the registrant (1) has filed all reports required to be filed by Section 13 or 15(d) of the Securities Exchange Act of 1934 during the preceding 12 months (or for such shorter period that the registrant was required to file such reports), and (2) has been subject to such filing requirements for the past 90 days.

Yes þ No ¨

Indicate by check mark whether the registrant has submitted electronically and posted on its corporate Web site, if any, every Interactive Data File required to be submitted and posted pursuant to Rule 405 of Regulation S-T (§232.405 of this chapter) during the preceding 12 months (or for such shorter period that the registrant was required to submit and post such files).

Yes þ No ¨

Indicate by check mark if disclosure of delinquent filers pursuant to Item 405 of Regulation S-K (§229.405 of this chapter) is not contained herein, and will not be contained, to the best of the registrant’s knowledge, in definitive proxy or information statements incorporated by reference in Part III of this Form 10-K or any amendment to this Form 10-K.

¨

Indicate by check mark whether the registrant is a large accelerated filer, an accelerated filer, a non-accelerated filer, or a smaller reporting company. See the definitions of “large accelerated filer,” “accelerated filer” and “smaller reporting company” in Rule 12b-2 of the Exchange Act.

|

Large accelerated filer ¨

|

Accelerated filer ¨

|

|

Non-accelerated filer ¨ (Do not check if smaller reporting company)

|

Smaller reporting company x

|

Indicate by check mark whether the registrant is a shell company (as defined in Rule 12b-2 of the Act).

Yes ¨ No þ

The aggregate market value of voting common stock held by non-affiliates computed by reference to the price at which the common stock was last sold on June 30, 2011, was $0.00.

As of March 28, 2012, there were 18,486,567 shares of common stock outstanding.

DOCUMENTS INCORPORATED BY REFERENCE:

None.

NOVA LIFESTYLE, INC.

Table of Contents

|

|

Page

|

|

|

PART I

|

||

|

Item 1.

|

1

|

|

|

Item 1A.

|

14

|

|

|

Item 1B.

|

30

|

|

|

Item 2.

|

31

|

|

|

Item 3.

|

31

|

|

|

Item 4.

|

31

|

|

|

PART II

|

||

|

Item 5.

|

32

|

|

|

Item 6.

|

32

|

|

|

Item 7.

|

33

|

|

|

Item 7A.

|

39

|

|

|

Item 8.

|

39

|

|

|

Item 9.

|

40

|

|

|

Item 9A.

|

40

|

|

|

Item 9B.

|

41

|

|

|

PART III

|

||

|

Item 10.

|

42

|

|

|

Item 11.

|

44

|

|

|

Item 12.

|

45

|

|

|

Item 13.

|

46

|

|

|

Item 14.

|

48

|

|

|

PART IV

|

||

|

Item 15.

|

49

|

|

|

F-1

|

||

NOTE ABOUT FORWARD-LOOKING STATEMENTS

This report contains forward-looking statements within the meaning of Section 27A of the Securities Act of 1933, as amended, or the Securities Act, and Section 21E of the Securities Exchange Act of 1934, as amended, or the Exchange Act, regarding our company that include, but are not limited to, any projections of earnings, revenue or other financial items; any statements of the plans, strategies and objectives of management for future operations; any statements concerning proposed new products, services or developments; any statements regarding future economic conditions or performance; any statements or belief; and any statements of assumptions underlying any of the foregoing. These forward-looking statements are based on our current expectations, estimates and projections about our industry, management’s beliefs and certain assumptions made by us. Words such as “anticipates,” “expects,” “intends,” “plans,” “predicts,” “potential,” “believes,” “seeks,” “hopes,” “estimates,” “should,” “may,” “will,” “with a view to” and variations of these words or similar expressions are intended to identify forward-looking statements. These statements are not guarantees of future performance and are subject to risks, uncertainties and assumptions that are difficult to predict.

These forward-looking statements involve various risks and uncertainties. Although we believe our expectations expressed in these forward-looking statements are reasonable, our expectations may later be found to be incorrect. Our actual results could be materially different from our expectations. Important risks and factors that could cause our actual results to be materially different from our expectations are generally set forth in “Risk Factors,” “Management’s Discussion and Analysis of Financial Condition and Results of Operations,” “Our Business” and other sections in this report. You should read this report and the documents we refer to thoroughly with the understanding that our actual future results may be materially different from and worse than what we expect. Other sections of this report include additional factors which could adversely impact our business and financial performance.

This report contains statistical data we obtained from various publicly available government publications and industry-specific third party reports. Statistical data in these publications also include projections based on a number of assumptions. The markets for our products may not grow at the rate projected by market data, or at all. The failure of these markets to grow at the projected rates may have a material adverse effect on our business and the market price of our securities. In addition, the rapidly changing nature of our customers’ industries results in significant uncertainties in any projections or estimates relating to the growth prospects or future condition of our markets. Furthermore, if any one or more of the assumptions underlying the market data is later found to be incorrect, actual results may differ from the projections based on these assumptions. You should not place undue reliance on these forward-looking statements.

Unless otherwise indicated, information in this report concerning economic conditions and our industry is based on information from independent industry analysts and publications, as well as our estimates. Except where otherwise noted, our estimates are derived from publicly available information released by third party sources, as well as data from our internal research, and are based on such data and our knowledge of our industry, which we believe to be reasonable. None of the independent industry publication market data cited in this report was prepared on our or our affiliates’ behalf.

The forward-looking statements made in this report relate only to events or information as of the date on which the statements are made in this report. Except as required by law, we undertake no obligation to update or revise publicly any forward-looking statements, whether as a result of new information, future events or otherwise, after the date on which the statements are made or to reflect the occurrence of unanticipated events. You should read this report and the documents we refer to in this report and have filed as exhibits to this report completely and with the understanding that our actual future results may be materially different from what we expect.

As used in this report, “Nova LifeStyle,” “Nova,” the “Company,” “we,” “our” and similar terms refer to Nova LifeStyle, Inc. and its subsidiaries, unless the context indicates otherwise.

Our functional currency is the U.S. Dollar, or USD, while the functional currency of our subsidiaries in China are denominated in Chinese Yuan Renminbi, or RMB, the national currency of the People’s Republic of China, which we refer to as the PRC or China. The functional currencies of our foreign operations are translated into USD for balance sheet accounts using the current exchange rates in effect as of the balance sheet date and for revenue and expense accounts using the average exchange rate during the fiscal year. See Note 2 of the consolidated financial statements included herein.

PART I

Item 1. Business

Our Company

We are a residential furniture marketing and logistics company offering sourcing and manufacturing of modern home furniture for today’s middle class, urban consumer in diverse markets worldwide. We market and develop high quality residential furniture for the living room, dining room, bedroom and home office in distinctive styles targeted at the medium and upper-medium price ranges. Our products are sold in the U.S., China, Europe, Australia and to other markets worldwide. In China, we sell products under our brands through franchise stores to China’s growing middle class. In the U.S. and international markets, our customers principally consist of private label retailers and furniture distributors for whom we source products that are in turn offered to retailers under their own brand names. We also sell products under the Diamond Sofa brand in the U.S. market to distributors and retailers and through third party shopping portals. Our product offerings feature urban contemporary styles offering comfort and functionality in matching furniture collections and upscale luxury pieces appealing to lifestyle-conscious middle and upper middle-income consumers.

Urbanization, rising family incomes and increased living standards has spurred demand for furniture in China and other countries experiencing rapid economic growth. In order to capture this market opportunity in China, we have established distinct furniture brands and product collections over the past decade targeting segments of China’s middle class. We believe that our brands will grow significantly as the demand for quality and stylish furniture by consumers increases in China with their increased living standards. In addition to expanding our network of franchise stores in China, we have expanded our direct sales in the U.S. market through our recent acquisition of the Diamond Sofa brand. We anticipate expanding our direct sales further to retailers and chain stores in North America, Europe and Australia, and into emerging growth markets in Asia and the Middle East.

We traditionally have generated the majority of our sales serving as a trading company and vertically integrated manufacturer for global furniture distributors and large national retailers. In the U.S. and international markets, we focus on establishing and expanding long-term relationships with our customers by providing large-scale sourcing and cost-effective manufacturing through our facilities in China. Our logistics, manufacturing and delivery capabilities provide our customers with the flexibility to select from our extensive furniture collections in their respective shipments. Our experience developing products for international markets has enabled us to develop the scale, logistics, marketing, manufacturing efficiencies and design expertise that serves as the foundation for us to expand aggressively into the highly attractive U.S. and China markets.

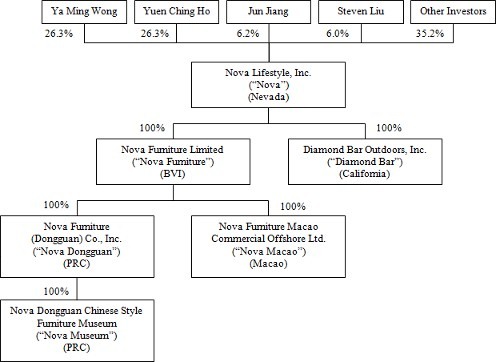

Our History

We are a U.S. holding company with no material assets other than the ownership interests of our wholly owned subsidiaries through which we market, design, manufacture and sell residential furniture worldwide: Nova Furniture (Dongguan) Co., Ltd., Nova Furniture Macao Commercial Offshore Limited, Nova Dongguan Chinese Style Furniture Museum and Diamond Bar Outdoors, Inc., which we refer to as Nova Dongguan, Nova Macao, Nova Museum and Diamond Bar, respectively. Nova Dongguan is a wholly foreign-owned enterprise, or WFOE, and was incorporated under the laws of the PRC on June 6, 2003. Nova Macao was organized under the laws of Macao on May 20, 2006. Nova Dongguan and Nova Macao are wholly owned subsidiaries of Nova Furniture Limited, which we refer to as Nova Furniture, our wholly owned subsidiary organized under the laws of the British Virgin Islands, or the BVI. Nova Dongguan organized Nova Museum on March 17, 2011, as a non-profit organization under the laws of the PRC engaged in the promotion of the culture and history of furniture in China. Diamond Bar, doing business as Diamond Sofa, was incorporated in California on June 15, 2000. Nova Dongguan markets and sells our products in China to stores in our franchise network and to wholesalers and agents for domestic retailers and exporters. Nova Dongguan also provides the design expertise and facilities to manufacture our branded products and products for international markets under original design manufacturer and original equipment manufacturer agreements, or ODM and OEM agreements. Nova Macao is a trading company, importing, marketing and selling products designed and manufactured by Nova Dongguan and third party manufacturers for the U.S. and international markets. We are expanding the operations of Nova Macao to move oversight of manufacturing operations from Nova Dongguan, and we anticipate completion of this transition process by the end of 2012. Diamond Bar markets and sells products manufactured by us and third party manufacturers under the Diamond Sofa brand to distributors and retailers principally in the U.S. market.

We were incorporated in the State of Nevada on September 9, 2009, under the name Stevens Resources, Inc., as an exploration stage company with no revenues and no operations engaged in the search for mineral deposits or reserves. On September 28, 2009, we issued 2,000,000 shares of our common stock to Justin Miller, our founder and initial president and director, for $4,000, representing Mr. Miller’s initial investment in the company. On July 13, 2010, Mr. Miller sold his 2,000,000 shares of our common stock to Alex Li for $40,000 in a private transaction exempt from registration under the Securities Act. Concurrently with this transaction, Mr. Miller resigned from his positions with the company, and Mr. Li was appointed our president and director.

Effective as of June 27, 2011, in anticipation of the Share Exchange Agreement and related transactions described below, we changed our name to Nova LifeStyle, Inc. through a merger with our wholly owned, non-operating subsidiary established solely to change our name pursuant to Nevada law. Concurrently with this action, we authorized a 5-for-1 forward split of our common stock effective June 27, 2011. Prior to the forward split, we had 2,596,000 shares of our common stock outstanding, and after giving effect to the forward split and immediately prior to the Share Exchange Agreement and related transactions described below, we had 12,980,000 shares of our common stock outstanding. We authorized the forward stock split to provide a sufficient number of shares to accommodate the trading of our common stock in the OTC marketplace after our acquisition of Nova Furniture.

Nova Furniture was incorporated on April 29, 2003, by our Chairman and Chief Executive Officer, Ya Ming Wong, and Chief Financial Officer, Yuen Ching Ho. Nova Furniture subsequently formed Nova Dongguan as a WFOE on June 6, 2003. On March 8, 2005, Messrs. Wong and Ho formed Nova Furniture Holdings Limited, which we refer to as Nova Holdings, a corporation organized under the laws of the BVI, and transferred their equity interests in Nova Furniture to Nova Holdings. As a result of this transaction, Nova Furniture became a wholly owned subsidiary of Nova Holdings. Nova Holdings subsequently formed two wholly owned subsidiaries as trading companies for Nova Dongguan products: Nova Furniture Hong Kong Limited, a company incorporated under the laws of Hong Kong on April 19, 2005, or Nova Hong Kong, and Nova Macao on May 20, 2006. Nova Hong Kong ceased doing business in October 2010 to consolidate our trading operations, and on February 28, 2011, Nova Holdings applied to the relevant Hong Kong government authorities to deregister the subsidiary. On January 3, 2011, Nova Furniture issued an additional 9,998 shares of its capital stock, of which 8,123 shares were issued to Nova Holdings and 1,875 shares were issued to St. Joyal, an unrelated California corporation engaged in business investment and development. St. Joyal, from time to time since 2009, has introduced us to prospective customers through its business contacts with U.S. domestic furniture wholesalers and retailers. Following this issuance, Nova Holdings and St. Joyal held 81.25% and 18.75%, respectively, of the equity interests in Nova Furniture. St. Joyal is committed pursuant to a shareholder agreement dated January 1, 2011, or the St. Joyal Shareholder Agreement, to pay $2.4 million by January 1, 2014, for its 18.75% equity interest in Nova Furniture, of which St. Joyal has paid $0.45 million as of December 31, 2011. The St. Joyal Shareholder Agreement also provides for St. Joyal to assist in expanding our direct sales customer base in the U.S. On January 14, 2011, Nova Holdings transferred its equity interest in Nova Macao to Nova Furniture, which was accounted for as a reorganization of entities under common control. As a result of this transaction, Nova Macao became a wholly owned subsidiary of Nova Furniture.

We acquired the ordinary shares of Nova Furniture pursuant to the terms of a Share Exchange Agreement and Plan of Reorganization, dated June 30, 2011, or the Share Exchange Agreement, entered into by and between us, Nova Furniture and the four shareholders of Nova Holdings and St. Joyal, which were the two shareholders of Nova Furniture. Messrs. Wong and Ho are the two shareholders of Nova Holdings, and Jun Jiang and Steven Liu are the two shareholders of St. Joyal; we collectively refer to these four shareholders as the Nova Furniture Shareholders. Pursuant to the Share Exchange Agreement, we issued 11,920,000 shares of our common stock to the Nova Furniture Shareholders in exchange for their 10,000 ordinary shares of Nova Furniture, consisting of all of its issued and outstanding capital stock. Of the 11,920,000 shares of our common stock issued pursuant to the Share Exchange Agreement, Messrs. Wong and Ho each received 4,842,500 shares and Messrs. Jiang and Liu each received 1,117,500 shares. Concurrently with the Share Exchange Agreement and as a condition thereof, we entered into an agreement with Mr. Li, our former president and director, pursuant to which he returned 10,000,000 shares of our common stock to us for cancelation in exchange for $80,000. Upon completion of the foregoing transactions, we had 14,900,000 shares of our common stock issued and outstanding. For accounting purposes, the Share Exchange Agreement and concurrent transactions described above were treated as a reverse acquisition and recapitalization of Nova Furniture because, prior to the transactions, we were a non-operating public shell and, subsequent to the transactions, the Nova Furniture Shareholders owned a majority of our outstanding common stock and exercise significant influence over the operating and financial policies of the consolidated entity.

On August 31, 2011, we acquired all the outstanding capital stock of Diamond Bar from its sole shareholder, Jun Zhang, pursuant to a stock purchase agreement for $0.45 million paid in full at closing.

Our organizational structure as of the date of this report is set forth in the following diagram:

Our Products

We market and develop modern home furniture for today’s middle class, urban consumer in diverse markets worldwide. Our product offerings feature urban contemporary styles offering comfort and functionality in matching furniture collections and upscale luxury pieces appealing to lifestyle-conscious middle and upper middle-income consumers. Many of our products are part of multi-piece lifestyle collections in distinctive styles targeted at the medium and upper-medium price ranges and feature upholstered, wood and metal-based residential furniture pieces. We classify our products by room, or series, including living room, dining room, bedroom and home office, and by category, or piece, such as sofas, chairs, dining tables, beds, entertainment consoles, cabinets and cupboards. Our largest selling product categories in 2011 were sofas, dining tables and chairs, which accounted for approximately 22%, 17% and 15% of sales, respectively, whereas our largest selling product categories in 2010 were cupboards, sofas and dining tables, which accounted for 21%, 18% and 17% of sales, respectively. Our products are manufactured primarily from medium-density fiberboard, or MDF board, and particleboard covered with veneers or lacquers and combined with other materials, including steel, glass, marble, leather and fabrics.

Our product offerings consist of a mix of products designed and manufactured by us and products sourced from third party manufacturers. We operate manufacturing facilities through our wholly owned subsidiary, Nova Dongguan, and have developed a design process that we believe enables us to better manage the short product life cycle for furniture designs by anticipating and responding quickly to changing consumer preferences. Through market research, customer feedback and ongoing design development, we identify new trends and customer needs in our target markets for incorporation into new products, collections and brands. Our products and collections are designed to appeal to consumer preferences in specific markets. We develop both individual pieces and collections for entire rooms, which feature matching furniture suites, providing convenient whole-home furnishing options for lifestyle-conscious end consumers. We generally introduce new collections and styles by participating in international furniture exhibitions and through our sample rooms, and support new product launches with promotions, product brochures and online marketing. Our staff works with customers worldwide to design store and showroom layouts that highlight our matching furniture collections by displaying complete and fully accessorized room settings instead of individual furniture pieces. We believe that this style of presentation in stores encourages consumers to purchase an entire room of furniture instead of individual pieces from different brands or manufacturers. We also source finished products based on our designs or those of our customers from third party manufacturers in order to provide products we do not manufacture currently or to fulfill orders placed by customers in international markets. We believe that our products feature the quality, appearance, functionality and price points sought by today’s middle to upper middle-income consumer in China, the U.S. and international markets.

China Market

Consumer demand for furniture in China has grown rapidly in recent years, with consumption of furniture in China up 32.8% to approximately $18.29 billion in 2011 from 2010, according to the National Bureau of Statistics of China, or the NBS. The expansion of the retail furniture market in China is due, in part, to the country’s rapid economic growth. According to the China National Furniture Association, domestic consumption will be the principal development driver of furniture production in China going forward. China’s real Gross Domestic Product, or GDP, growth rate was 9.2% in 2011, and has grown an average of 10.9% annually since 2006, according to the International Monetary Fund, or the IMF, “China Economic Outlook” from February 2012, or the IMF China Outlook. China’s GDP is expected to continue to grow at a rate of 8.2% in 2012 despite the recent slowdown in global markets, according to the IMF China Outlook. China has a large population, including a rapidly expanding middle class and young, urban consumer bases, that offers a large pool of potential consumers for our products. China’s market population of middle class and affluent consumers is projected to grow to more than 400 million by 2020 from the approximately 150 million in 2010, according to the Boston Consulting Group’s “Big Prizes in Small Places; China’s Rapidly Multiplying Pockets of Growth” report from November 2010. Economic growth in China has led to greater levels of personal disposable income and increased spending among China’s expanding middle class consumer base. Furthermore, the economic and social development in China has brought about greater urbanization, with urban residents exceeding 51% of the population in 2011 compared to approximately 36% of the population in 2000, according to the NBS. This urbanization trend and expanding middle class has promoted increased investment in commercial residential buildings and new housing starts in China, which increased 30.2% and 12.9% in 2011 over 2010, respectively, according to the NBS. As apartment and homeownership continues to rise in China, we believe that sales in the furniture industry will also improve.

In order to capture this residential furniture market opportunity for the middle and upper middle-income consumer in China, we have established distinct furniture brands designed specifically for the consumer preferences of the China market. We feature a wide selection of product categories and styles under our brands, each piece part of a collection bearing a distinctive style, design theme and selection of materials and finish that draw from traditional Chinese culture and modern Hong Kong styles. We anticipate developing new collections semi-annually for each brand. Our sales to China, including sales to our franchise network and to wholesalers and agents for domestic retailers and distributors for the export market, were $10.3 million in 2011, a 24% increase over 2010, and accounted for 24% of sales in 2011 compared to 29% of sales in 2010. We expect that a significant portion of our sales will continue to come from sales to China. We intend to develop the China retail market aggressively, building awareness of our brands in China by increasing marketing efforts and expanding our franchise store network strategically located in cities across China. Sales to our network of franchise stores consisted of $5.51 million or 53% of sales to China in 2011 compared to $1.69 million or 20% of sales to China in 2010, our first year of franchise store sales. We believe that distributing our products through dedicated, single-brand stores displaying complete and fully accessorized room settings strengthens brand awareness, provides well-informed and focused sales personnel and encourages consumers to purchase an entire room of furniture. We believe that our brands and sales through our franchise store network in China will grow significantly as consumer demand for quality and stylish furniture increases in China with increased living standards.

We have five current and pending brands for the China market, each of which includes pieces and matching furniture suites for the living room, dining room, bedroom and home office. Our most established and largest selling brand, Colorful World, or 花花世界, was first introduced in 2003 for the middle-income consumer with a young, clean and fashionable look designed for smaller, urban living spaces. We anticipate introducing a new Colorful World bedroom line, Sleeping Life of Colorful World, or 花花世界睡眠生活, in the second quarter of 2012, featuring beds and mattresses that incorporate memory foam and other unique features to create a comfortable sleeping space. We launched our Giorgio Mobili, or GM, brand of luxury furniture in 2010 with clean, classic living room and bedroom styles for the upper middle-income consumer. We anticipate launching our 1SOFA and Wo Zhi Bao, or 屋之宝, brands in the second quarter of 2012 through internet sales. Our 1SOFA brand features dynamic lifestyle furniture for the middle-income consumer, while our Wo Zhi Bao brand is more moderately scaled and priced for the middle-low income consumer. Our Ming Ma, or 明码, brand, expected to launch in the second quarter of 2012, reinterprets traditional Chinese designs in modern furniture styles designed for industry sales, including hotels and interior designers.

International Markets

We sell products to the U.S. and international markets under the Diamond Sofa brand and as a trading company and vertically integrated manufacturer under ODM and OEM agreements for global furniture distributors and large national retailers. Worldwide GDP increased 3.8% in 2011, according to the IMF “World Economic Outlook Update” from January 2012, or the IMF World Outlook, and global furniture production reached an estimated $376 billion in 2011, according to the Centre for Industrial Studies, or the CSIL, “World Furniture Outlook 2012,” or CSIL World Outlook. The IMF anticipates further worldwide GDP growth of 3.3% in 2012, with much of the real growth expected in emerging economies. The markets in the U.S. and Europe remain challenging because they are experiencing a slower than anticipated recovery from the recent international financial crisis and the Euro-area crisis in particular. However, real growth in furniture demand in 2012 is forecasted to grow 3.3% in the world’s top 70 countries, according to the CSIL World Outlook. We believe that discretionary purchases of furniture by middle to upper middle-income consumers, our target global consumer market, will increase along with the expected growth in the worldwide furniture trade and recovery of housing markets. Furthermore, we believe that furniture featuring modern and contemporary styling such as ours will continue to be in greater demand.

In 2011, our products were sold in over 35 countries worldwide, with North America and Europe our principal international markets. Our sales to the U.S. and international markets were $32.8 million in 2011, a 60% increase over 2010, and accounted for 76% of sales in 2011 compared to 71% of sales in 2010. We expect that a majority of our sales will continue to come from sales to customers outside of China, and in particular the North American and European markets. Sales to North America accounted for 44% and 10% of sales in 2011 and 2010, respectively, with the significant increase attributed principally to our expansion in the U.S. market and acquisition of the Diamond Sofa brand in 2011. Sales to Europe accounted for 25% and 49% of sales in 2011 and 2010, respectively, with the decrease attributed principally to the challenging Euro-area economic climate and our changing sales and marketing strategy to diversify international sales. As we continue to expand our broad network of distributors, increase direct sales and enter emerging growth markets, we believe that we are well positioned to respond to changing market conditions, allowing us to take advantage of any upturns in the global and local economies of the markets we serve.

Our logistics, manufacturing and delivery capabilities provide our customers with the flexibility to select from our extensive furniture collections in their respective shipments. We design and manufacture our products for direct sales to private label retailers worldwide and for global furniture distributors and wholesalers that in turn offer our products to retailers under their own brand names, including Actona Company (Denmark), Artemis (Australia), BUT International (France), Dongguan Metals and Minerals (China), Dormitienda (Spain) and El Dorado Furniture (U.S.). We offer a wide selection of standalone pieces across a variety of product categories and approximately 20 product collections developed exclusively for international markets, with new collections introduced annually. We also sell products under the Diamond Sofa brand, which we acquired on August 31, 2011, to distributors and retailers in North America and South America and to end consumers in the U.S. market through third party shopping portals. Our research and development team works with our customers to modify our existing product designs and create new designs and styles for their market’s particular requirements. We believe that we can continue to expand our sales in the U.S. and international markets as we integrate the Diamond Sofa brand and increase our direct sales to retailers and chain stores as we expand and explore new markets worldwide.

Sales and Marketing

Our sales and marketing strategies to reach our target middle class, urban consumer include: (1) expanding our franchise store network in China; (2) increasing direct sales in the U.S. and internationally; (3) internet sales and online marketing; (4) participation in trade exhibitions; and (5) promotion of furniture culture in China.

We sell our branded products in China primarily through our growing network of franchise stores. Each store is independently owned and operated under a product franchise agreement for a single brand in an exclusive sales region, typically designated by city or district. We believe distributing our products through dedicated, single-brand stores strengthens brand awareness, provides well-informed and focused sales personnel and encourages the purchase of multiple items per visit. The first franchise stores opened in the first quarter of 2010 under the Colorful World brand, and, as of December 31, 2011, we had 59 franchise stores in operation and strategically located in cities across China for both the Colorful World and Giorgio Mobili brands. We intend to develop this market aggressively, building awareness of our brands in China by increasing marketing efforts and expanding our franchise store network to a goal of 200 locations in 2012. We anticipate locating franchise stores in cities throughout China in order to reduce our dependence on any one region. Most of the franchise stores currently are located within furniture marketplaces or shopping malls, which is common for the retail furniture industry in China, rather than as standalone storefronts. The location of these stores also helps to market and introduce our products by creating brand awareness within the furniture marketplaces among consumers. As part of the product franchise agreement, we provide sales and marketing training to the franchisee and assist in designing store interior details such as layout, decorations and lighting to reflect the distinctive style of the representative brand, complement the quality of our products and create an inviting shopping experience with curb appeal that targets our intended middle and upper middle-income consumer. Our store layout designs include the display of complete and fully accessorized room settings instead of individual furniture pieces to encourage consumers to purchase an entire room of furniture.

We plan to increase our direct sales to retailers and chain stores in the U.S. and international markets as we continue to diversify our customer base from global furniture distributors. In August 2011, we acquired Diamond Bar, a California importer and marketer of modern home furniture in North and South America. Diamond Bar markets and sells products under the Diamond Sofa brand to distributors and retailers principally in the U.S. market. We plan to continue expanding sales of the Diamond Sofa brand in the U.S., Mexico and South America markets through Diamond Bar’s longstanding customer relationships and distribution capabilities. Through our relationship with St. Joyal, an investor in Nova Furniture and a California corporation specializing in business development and management and organizational planning, we plan to continue to expand our direct sales and marketing efforts in North America, and in particular the U.S., which historically is the largest market worldwide for sales of imported furniture. St. Joyal has extensive business contacts with U.S. domestic furniture wholesalers and retailers, through which we have been introduced to some of our customers in the U.S. In addition, we plan to expand our existing presence in the U.S. market as we integrate the business of Diamond Bar, grow our U.S.-based management and sales team and expand showrooms for our products and products sold under the Diamond Sofa brand. We intend to develop the Diamond Sofa brand and introduce new brands for our direct sales in the U.S. and international markets while continuing to supply products under private label brands to retailers and chain stores.

We anticipate launching a dedicated online store in China in the second quarter of 2012 for the introduction of our 1SOFA and Wo Zhi Bao brand products. Sales and marketing of the site will be direct to consumers and we plan to manage shipping logistics principally through our existing facilities in China. Diamond Bar currently sells products under the Diamond Sofa brand in the U.S. through third party shopping portals, shipping orders received online direct to the end customer. We believe that our planned direct-to-consumer online sales and marketing will complement our retail franchise network in China and increase our sales in the U.S. by building our brand awareness and acting as an effective advertising vehicle. We also support new product collections and brand launches with print and online advertising campaigns, participation in furniture exhibitions and offering of product brochures and samples. We provide samples and brochures of new products for international markets to distributors and buyers, as is common in the furniture industry. Stores in our franchise network in China individually market and advertise our products through local media, and we coordinate large-scale promotions for new product collections in China with affiliated stores.

We generally gain new customers in the international markets and introduce new product collections and styles by participating in and attending international furniture exhibitions throughout the year. We believe this marketing process gives us greater insight into developing tastes and trends in the marketplace and helps us better understand the challenges facing the distributors and buyers with whom we do the majority of our international business. We have exhibited our products at the International Famous Furniture Fair (3F) in Dongguan, China and the China International Furniture Exhibition in Shanghai, China. We have also shown our products under the Diamond Sofa brand at the Las Vegas Market (U.S.) and High Point Market (U.S.) and at furniture exhibitions worldwide in connection with our customers Actona Company at IMM Cologne (Germany) and Yeh Brothers at Interiors Birmingham (United Kingdom). We anticipate attending and exhibiting at additional furniture exhibitions to meet new distributors and buyers as we expand and explore emerging international markets, such as the Middle East. We maintain showrooms to highlight our latest collections at our Nova Dongguan facilities, at Diamond Bar’s headquarters in California and at High Point Market and Las Vegas Market.

We established Nova Museum in Dongguan, Guangdong Province, China, in 2011 to promote the culture and history of furniture in China. Visitors to the furniture museum learn about interior design and furnishings as they developed in China over the past centuries, including the different styles and changing materials used in traditional Chinese furniture from which we have drawn inspiration for our products. In addition to furniture gallery installations, Nova Museum hosts community programs and connects to an exhibition hall showcasing our brands and new product collections.

Manufacturing and Sourcing

Our manufacturing strategy includes a mix of internal production and sourcing of products from third party manufacturers. We operate manufacturing facilities through our wholly owned subsidiary, Nova Dongguan, in Dongguan, Guangdong Province, China, with an estimated annual production capacity of approximately 316,000 units, including approximately 20,000 sofas and 25,000 dining tables. We commenced operations at our new factory in 2011 and anticipate completing construction of a new plant at our Nova Dongguan facilities in the second half of 2012. The manufacturing capacity provided by these new plants will help Nova Dongguan maintain current and anticipated levels of production on pace with our anticipated expansion and increase in sales to China. We also source finished products based on our designs or those of our customers from third party manufacturers in order to provide products we do not manufacture currently or to fulfill orders placed by customers in international markets. When outsourcing production of our branded products, we design and engineer the products for manufacturing to our specifications by third party manufacturers in China. We have informal strategic relationships with Dongguan Metals and Minerals, a large state-owned distributor in China, whereby Nova Macao sources products manufactured in China for customers in the U.S. and international markets, and with other third party manufacturers in the U.S., China and Hong Kong whereby Diamond Bar sources products designed for the U.S. market.

Our Nova Dongguan manufacturing facilities are fully integrated, with in-house capabilities to design, produce and finish upholstered, wood and metal-based furniture. We have implemented multiple, comprehensive quality control procedures throughout our product development and manufacturing processes that are designed to ensure product quality and safety. Our quality control staff oversees production beginning from the receipt of raw materials from our suppliers to the final inspection conducted with buyer representatives at the time products are shipped. We provide a one-year warranty on products sold to retailers and distributors for manufacturing defects, during which period we will give credit or replace defective parts. We believe that our vertically integrated manufacturing process provides us with a competitive advantage, as it enables us to produce quality and stylish products at lower cost while contributing to our ability to generate and maintain attractive gross margins. Furthermore, our manufacturing capabilities allow us to update designs and change production quickly based on customer and consumer demands.

We base our production schedule on customer orders and schedule deliveries on a just-in-time basis; accordingly, our finished product inventory and backlog generally are very low. We typically have a production period of 15 to 20 days on orders for the China retail market, which we believe makes our products more attractive to retailers in China. We maintain raw material inventory for the purpose of decreasing the production period on orders for the China retail market. On orders for the U.S. and international markets, our production period typically is 35 to 45 days from receipt of order, which includes the sourcing and purchasing of raw materials specific to the order. Products ordered under ODM or OEM agreements are manufactured unlabeled or with the branding of the end retailer.

Suppliers and Raw Materials

We source finished goods from Nova Dongguan and third party manufacturers to provide products we do not manufacture currently or to fulfill orders placed by customers through Nova Macao and Diamond Bar for the U.S. and international markets. Our major raw material purchases for our manufacturing business include MDF board, particleboard, stainless and carbon steel, leather, glass and lacquers. The majority of our raw materials are sourced in China through suppliers with whom we have long-standing relationships and that are located in Guangdong, Jiangsu, Shanghai and Zhejiang Provinces. Our principal suppliers of finished goods and raw materials in 2011 were Prosperton Ltd., Shen Bang and Alliance Furniture, accounting for approximately 11%, 10% and 10% of our purchases, respectively.

As our major raw material purchases consist of common and readily available materials, we seek to maintain multiple quality suppliers for each type of raw material purchased. By maintaining relationships with multiple suppliers, we benefit from a more stable supply chain and more competitive prices. If a change of suppliers is necessary, we believe that we can quickly fulfill our requirements from other suppliers without impacting production. We do not maintain fixed supply contracts nor do we engage in hedging transactions to protect against raw material price fluctuations. Instead, we attempt to negotiate pricing commitments from suppliers for three to six month-long periods. We normally can pass through raw material cost increases to our customers, but there may be a time lag as we renegotiate pricing with our customers on existing products and introduce new product collections. We typically order raw materials according to our customer purchase orders for international markets to minimize our inventory, but we may attempt to mitigate short-term risks of raw material price swings in between customer price negotiations by purchasing some raw materials in advance based on forecasted production needs. In addition, we are less susceptible to these short-term raw material pricing risks in the China retail market because we reserve the right under our product franchise agreements to adjust our wholesale and retail product pricing based on raw material price fluctuations, providing franchisees with at least one month’s notice prior to price adjustment. Accordingly, we are able to maintain MDF board, steel and leather inventory for the purpose of decreasing the production period on customer orders for the China retail market.

We hold our suppliers to strict quality and delivery specifications. Our quality control procedures include quality assurance of raw materials used in the production of our products, which includes an evaluation and selection of established and reputable suppliers. We require our suppliers of MDF board, particleboard, polyurethane lacquer, or PU lacquer, and nitrocellulose lacquer, or NC lacquer, to provide raw materials in compliance with all PRC, U.S. and European formaldehyde emission standards, and we regularly test for their compliance.

Customers

Our target end customer is the middle and upper middle-income consumer of residential furniture. In China, we currently sell our products through stores in our franchise network and to unaffiliated retail stores and distributors. We anticipate initiating internet sales of our products direct to consumers in China through our own online store in the second quarter of 2012. In the U.S. and international markets, our sales principally are to furniture distributors and retailers who in turn offer our products under their own brand names or under our Diamond Sofa brand. Our largest customer historically is Actona Company A/S, a global furniture distributor, which accounted for 24% of our sales in 2011. In 2010, our largest customers were Actona Company and Dongguan Metals and Minerals Import and Export Company (Dongguan Wu Jin Kuang Chang), also a global furniture distributor, accounting for 43% and 21% of our sales in 2010, respectively. No other customer accounted for greater than 10% of our sales in 2011 or 2010. We plan to increase direct sales to retailers and chain stores worldwide as we continue to diversify our customer base from global furniture distributors.

Our sales to customers in China, which includes sales to stores in our franchise network and to wholesalers and agents for domestic retailers and exporters, increased 24% to $10.3 million, up from $8.35 million in 2010, accounting for 24% and 29% of sales in 2011 and 2010, respectively. Prior to 2010, sales to customers in China consisted solely of sales to wholesalers and agents for domestic retailers made pursuant to supplier agreements executed in the ordinary course of business with individual orders made on standard purchase orders. In 2010, we began selling products in China under our brands through our newly established network of franchise stores strategically located in cities across China. We expect that a significant portion of our sales will continue to come from our sales to China. Sales to our network of franchise stores consisted of approximately $5.51 million, or approximately 53% of sales to China in 2011 compared to $1.69 million or 20% of sales to China in 2010, our first year of franchise store sales. Franchisees agree to sell products from one of our Colorful World and Giorgio Mobili brands pursuant to a product franchise agreement for a period of one year and guarantee to purchase a minimum amount of goods from us. The product franchise agreement is renewable and we retain the right to terminate the agreement should the franchisee fail to meet the minimum purchase amount requirements or our quality standards. We believe that consumers in China seek quality and stylish furniture designed as standalone pieces and whole furniture suites. We believe that our sales in China will grow significantly as we continue to expand our franchise store network for our distinctive brands and initiate internet-based sales of our new brands.

In the U.S. and international markets, we focus on establishing and growing long-term relationships with our customers. We believe that the majority of our customers view us as a strategic long-term supplier and value the quality of our products, our timely delivery and design capabilities. We generally negotiate renewable supplier agreements with firm pricing on our products, typically for a term of one year, as is customary in the furniture industry, with individual orders made on standard purchase orders. Our sales to customers outside of China increased 60% to $32.8 million in 2011, up from $20.47 million in 2010, accounting for 76% and 71% of sales in 2011 and 2010, respectively. In 2011, we sold products into over 35 countries worldwide, with North America and Europe as our principal international markets. Sales to North America accounted for 44% and 10% of sales in 2011 and 2010, respectively, with the significant increase attributed principally to our expansion in the U.S. market and acquisition of the Diamond Sofa brand in 2011. Sales to Europe accounted for 25% and 49% of sales in 2011 and 2010, respectively, with the decrease attributed principally to the challenging Euro-area economic climate and our changing sales and marketing strategy to diversify international sales. We expect that a majority of our sales will continue to come from our sales to the U.S. and international markets. We acquired Diamond Bar in August 2011, which we believe will expand our sales to the U.S., Mexico and South America through Diamond Bar’s longstanding customer relationships and distribution capabilities. In addition, we anticipate increasing internet sales under the Diamond Sofa brand through third party shopping portals. We believe that as we expand our broad network of distributors and increase direct sales, our exposure to regional recessions will be reduced and allow us to better capitalize on emerging market trends.

We typically experience stronger fourth and first calendar quarters as our product sales are subject to the seasonality and fluctuations typical of the furniture industry. This industry-based seasonality generally is caused by shipping lead-times to international markets combined with the real estate market slowdown and decrease in furniture consumption commonly experienced during the summer months in the Northern Hemisphere markets in which the majority of our customers are located and our products sell at retail. In addition, we believe that consumer demand for furniture generally reflects sensitivity to overall economic conditions, including, but not limited to, unemployment rates, housing market conditions and consumer confidence.

Competition

The residential furniture industry is highly competitive, consisting of a large number of manufacturers, distributors and retailers, none of which dominates the fragmented and diverse market. Our products principally compete in the U.S., China, Europe and Australia. The primary competitive factors in these markets for our product price points and target consumers are price, quality, style, marketing, functionality and availability.

In China, we compete against importers of premium-priced foreign brands and other manufacturers and furniture franchisers located in China. Imported furniture in China mainly consists of luxury and specialty pieces priced significantly higher than domestically produced furniture. Our principal competitors that manufacture and franchise products for the China retail market include Steel-land (Jinfushi Group), Kuka Sofa, Zuoyou Furniture, SOHOME, Kinetic and Lixing, whose products are priced comparably with our products. We believe that our experience developing products for the U.S. and international markets has enabled us to develop the scale, logistics, manufacturing efficiencies and design expertise that serves as the foundation for us to compete and expand aggressively into the China retail market. We develop and market our brands to target multiple segments of China’s rapidly growing middle class based on style and price points. We design complete lifestyle-based furniture suites for middle and upper middle-income consumers in China to simplify the process of furnishing residences with a matching collection of quality and stylish furniture. We anticipate introducing new collections semi-annually for each of our brands in China, incorporating consumer feedback and preferences in our new products that are designed to be attractive to consumers both as individual furniture pieces and as whole-home collections. Our manufacturing and distribution capabilities on orders for the China retail market enable us to offer rapid turnaround on production and delivery of our latest designs, which we believe makes our product offerings more attractive to retailers and franchisees compared to other manufacturers.

In the U.S. and international markets, we compete against other furniture distributors and ODM and OEM manufacturers, most of which are located in China and other Southeast Asian countries, and against traditional manufacturing centers and distributors in North America and Europe. We believe that we are competitive with North American and European manufacturers because we have a history of prompt delivery of quality products and offer approximately 20 distinct product collections that we developed for international markets at comparable prices and with styles and functionality similar to those offered by our competitors. We coordinate the efforts of our sales and marketing team to receive feedback from customers as part of our ongoing research and design of products. This research process allows us to develop and modify products to meet the varied and changing stylistic and functional demands of our customers worldwide. Our in-house production process is vertically integrated, allowing us to achieve greater product standardization and quality control on our products designed for international markets while capturing higher profit margins and enabling better management of delivery times than if we sourced these products externally. We believe that our experience and proven performance provides us with a competitive edge over other manufacturers for the U.S. and international markets. In addition to our design and manufacturing capabilities, we believe that our ability and experience at sourcing products for distributors to the U.S. and international markets are significant competitive advantages. We have expanded our presence in the U.S. market through our acquisition of the Diamond Sofa brand in August 2011, whereby we anticipate increasing our direct sales to U.S. retailers through Diamond Bar’s longstanding customer relationships and distribution capabilities.

Intellectual Property

We rely on the patent and trademark protection laws in the U.S. and China to protect our intellectual property and maintain our competitive position in the marketplace. We and our subsidiaries own or have licenses to use 113 design patents and 6 utility patents issued in China for furniture pieces. Nova Dongguan historically has licensed the right to use the 113 design patents from our Chairman and Chief Executive Officer, Mr. Wong, who is the sole owner and registrant of these patents. Mr. Wong agreed to transfer his ownership of the licensed design patents to Nova Dongguan and entered into an agreement in January 2011, as amended, to grant Nova Dongguan a perpetual, exclusive, worldwide, royalty-free and irrevocable license to use the design patents registered in his name until the State Intellectual Property Office of the PRC, or the SIPO, approves of the ownership transfer to Nova Dongguan. As of December 31, 2011, SIPO has approved the ownership transfer to Nova Dongguan of 30 of the licensed design patents. The 30 design patents Nova Dongguan now holds of record will expire in 2019. Of the design patents Nova Dongguan has licenses to use from Mr. Wong, 7 will expire in 2018, 70 in 2019 and 6 in 2020. Nova Dongguan is the registrant and holder of record of the 6 utility patents, which will expire in 2020. We assess the materiality of each patent annually in consideration of whether to maintain its registration. We intend to apply for additional patents in China to protect our core product designs.

We and our subsidiaries hold two trademarks registered in the U.S. related to the Diamond Sofa brand and nine trademarks registered in China for our brands and related to our “Nova” business name. We acquired all rights, title and interest in the two registered U.S. trademarks pursuant to a trademark purchase and assignment agreement dated August 31, 2011, from St. Joyal for $0.2 million paid in full at the closing. Of the trademarks issued in China and registered in our name, four expire in 2020 and five expire in 2021. We have applied for additional trademarks in China to protect our brands. In addition, we have registered and maintain numerous internet domain names related to our business, including “novalifestyle.com” and “diamondsofa.com”. Collectively, the trademarks and domain names that we and our subsidiaries hold are of material importance to us.

Research and Development

We believe that the development of new product designs and functionality is important to our continued success. We actively seek to protect our product designs and brand names under the patent and trademark protection laws in the U.S. and China, but the copying of a product’s appearance is a common and ongoing issue in the furniture industry as manufacturers seek to capitalize on popular designs and features by copying those of their competitors and making subtle changes to avoid infringement claims. To remain competitive, we believe that we must innovate continuously, and we have developed a design process that we believe enables us to better manage the short product life cycle for furniture designs by anticipating and responding quickly to changing consumer preferences. We attend furniture exhibitions worldwide, conduct market research and solicit customer feedback to help us identify new trends and customer needs in our target markets for incorporation into new product designs. In China, we further support new product and brand launches by tailoring the designs of franchise stores to reflect the unique style of its respective brand. We plan to introduce new product collections annually for the U.S. and international markets and semi-annually for each of our brands in China. We anticipate introducing new products under the Diamond Sofa brand on a quarterly basis for the U.S. market. We assess the success of each product and product collection at least annually in consideration of whether to continue production.

We currently perform all design and development work for our products in-house using computer-aided modeling systems. We have used independent designers in the past for product design work, from which we build prototype furniture pieces for further refinement and testing. In 2011 and 2010, we invested $164,720 and $77,654, respectively, on research and development expense. We may increase future investments in research and development based on our growth and available capital.

Governmental and Environmental Regulation

Our business and company registrations are in compliance in all material respects with the laws and regulations of their respective governing municipal and provincial authorities. Our subsidiaries and manufacturing facilities in China are subject to the national and local laws of the PRC. Other than as described following for our product lines, we are not subject to any other government regulations that would require us to obtain a special license or approval from the PRC government to operate our business or manufacturing facilities in China.

Furniture Industry Regulations and Standards

We and our products are subject to PRC, U.S. and international regulations related to the furniture industry.

China has a series of national standards, or the GB and QB standards, that govern certain technical, safety and quality requirements for furniture manufactured in and exported from China. The Standardization Administration of the PRC, or SAC, and the China Chamber of Commerce for Import and Export of Light Industrial Products and Art-Crafts, or the CCCLA, develop and revise these national standards relating to the structure, material, size and quality requirements for the many varied categories and classifications of upholstered, wood and metal-based furniture. Many of these standards are not compulsory, but manufacturers typically follow all applicable recommended standards.

Our products are also subject to the mandatory and voluntary furniture test standards of the U.S. and international markets in which our products are distributed to end consumers, including those developed by the American National Standards Institute, or ANSI, Business and Institutional Furniture Manufacturer’s Association, or BIFMA, ASTM International, California Air Resources Board, or CARB, Furniture Industry Research Association, or FIRA, and the International Organization for Standardization, or ISO. These environmental, ecological and formaldehyde emission standards and source of origin labeling requirements are national or international, with the U.S. and European Union typically having the strictest standards for their markets. We manufacture all products to customer specifications and we believe that our products meet all currently applicable national and international furniture test standards.

As an ODM and OEM manufacturer, we occasionally need to reproduce trademarks owned or licensed by our customers when producing labeled products bearing trademarked brand names and imagery. Consequently, we are subject to the Trademark Printing Administration Measures of the PRC, which require us to examine the trademark registration certificates and other relevant documents of our customers to verify trademark ownership or licensing. We believe that we are in material compliance with such requirement.

Environmental Regulations

Our manufacturing facilities in China are subject to the national environmental regulations of the PRC as well as local laws regarding pollutant discharge, air, water and noise pollution, including the Environmental Protection Law of the PRC, the Environmental Impact Appraisal Law of the PRC, the Law of the PRC on the Prevention and Control of Water Pollution, the Law of the PRC on Prevention and Control of Environmental Pollution Caused by Solid Waste, the Law of the PRC on Prevention and Control of Air Pollution and the Law of the PRC on Prevention and Control of Environmental Noise Pollution. The Environmental Protection Law of the PRC sets out the legal framework for environmental protection in the PRC. The Ministry of Environmental Protection of the PRC, or the MEP, is primarily responsible for the supervision and administration of environmental protection work nationwide and formulating national waste discharge limits and standards. Local environmental protection authorities at the county level and above are responsible for environmental protection in their jurisdictions. Companies that discharge contaminants must report and register with the MEP or the relevant local environmental protection authorities. Companies discharging contaminants in excess of the discharge limits prescribed by the central or local authorities must pay discharge fees for the excess in accordance with applicable regulations and are also responsible for the treatment of the excessive discharge. Companies that directly or indirectly discharge industrial wastewater into the water or are required by law to obtain the pollutant discharge permit before discharging wastewater or sewage shall also obtain the pollutant discharge permit.

In May 2011, the Guangdong Environmental Protection Agency renewed the certification of Nova Dongguan for a term of five years, indicating that its business operations are in material compliance with the relevant PRC environmental laws and regulations. Our production processes mainly generate noise, wastewater and solid wastes. We currently do not incur any material costs in connection with our compliance with the applicable PRC environmental laws as our manufacturing processes generate minimal discharge. Furthermore, the cost of maintaining compliance has not, and we believe, in the future, will not, have a material adverse effect on our business, consolidated results of operations and consolidated financial condition.

We are an ISO 9001 quality management and ISO 14001 environmental management systems certified manufacturer, which together recognize our development and implementation of procedures that demonstrate our ability to consistently manufacture products meeting customer specifications, environmental standards and applicable statutory and regulatory requirements. We have invested in specialized equipment for our manufacturing facilities to help ensure our compliance with employee safety and environmental protection standards. We manufacture to customer specifications for their respective end markets, and products incorporating MDF board, particleboard, PU lacquer and NC lacquer use materials complying with all U.S. and European formaldehyde emission standards.

Export Laws and Regulations

We are subject to various PRC governmental regulations related to exportation, including the Customs Law of the PRC and the Regulation of the PRC on the Administration of the Import and Export of Goods. These laws and regulations set out standards and requirements for various aspects of the export and import of goods, customs registration, sanitary registration and inspection. Failure to comply with these laws and regulations may result in the confiscation of our products for export and proceeds from the sales of non-compliant products, orders for correction, fines, revocation of licenses and, in extreme cases, criminal liability. We believe we are in material compliance with all applicable PRC laws and regulations related to the export of our products.

Labor Protection Regulations

The Labor Contract Law of the PRC, effective on January 1, 2008, governs the establishment of employment relationships between employers and employees, and the conclusion, performance, termination of and the amendment to employment contracts. To establish an employment relationship, a written employment contract must be signed by the employer and employee. In the event that no written employment contract was signed at the time of establishment of an employment relationship, a written employment contract must be signed within one month after the date on which the employer first engaged the employee. The Labor Contract Law also imposes greater liabilities on employers and significantly affects the cost of an employer’s decision to reduce its workforce. Further, it requires that certain terminations be based upon seniority and not merit. We believe that we are in material compliance with the requirements of this law.

On June 29, 2002, the Work Safety Law of the PRC was adopted by the Standing Committee of the 9th National People’s Congress and came into effect on November 1, 2002, as amended on August 27, 2009. The Work Safety Law provides general work safety requirements for entities engaging in manufacturing and business activities within the PRC. We believe we are in material compliance with all applicable laws and regulations related to work safety.

Foreign Currency Regulations

The principal regulations governing foreign currency exchange in China are the Foreign Exchange Administration Regulations promulgated by the State Council, as amended on August 5, 2008, or the Foreign Exchange Regulations. Under the Foreign Exchange Regulations, the RMB, the national currency of the PRC, is freely convertible for current account items, including the distribution of dividends, interest payments, trade and service-related foreign exchange transactions, but not for capital account items, such as direct investments, loans, repatriation of investments and investments in securities outside of China, unless the prior approval of the State Administration of Foreign Exchange, or the SAFE, is obtained and prior registration with the SAFE is made.

On October 21, 2005, the SAFE issued Circular 75, the Relevant Issues Concerning Foreign Exchange Control on Domestic Residents’ Corporate Financing and Roundtrip Investment through Offshore Special Purpose Vehicles, which became effective as of November 1, 2005. Please refer to “Risk Factors – Risks Related to Business in China – PRC regulations relating to the registration requirements for PRC resident shareholders owning shares in offshore companies may subject our PRC resident shareholders to personal liability and limit our ability to acquire companies in China or to inject capital into our operating subsidiaries in China, limit our subsidiaries’ ability to distribute profits to us or otherwise materially and adversely affect our business” for a discussion of Circular 75.

On August 29, 2008, the SAFE promulgated Circular 142, the Notice on Perfecting Practices Concerning Foreign Exchange Settlement Regarding the Capital Contribution by Foreign-invested Enterprises, regulating the conversion by a foreign-invested company of foreign currency into RMB by restricting how the converted RMB may be used. Please refer to “Risk Factors – Risks Related to Business in China – Restrictions on currency exchange may limit our ability to receive and use our revenues effectively” for a discussion of Circular 142.

Dividend Distribution

Our ability to pay dividends may be affected by the complex currency and capital transfer regulations in China that restrict the payment of dividends to us by our PRC subsidiaries. PRC regulations currently permit payment of dividends only out of accumulated profits as determined in accordance with accounting standards and regulations in China. Our PRC subsidiaries also are required to set aside at least 10% of net income after taxes based on PRC accounting standards each year to statutory surplus reserves until the cumulative amount of such reserves reaches 50% of registered capital. These reserves are not distributable as cash dividends. Our PRC subsidiaries also may allocate a portion of their after-tax profits to their staff welfare and bonus funds, which may not be distributed to equity owners except in the event of liquidation. If any of our subsidiaries incur debt, the instruments governing the debt may restrict their ability to pay dividends or make other distributions to us.

Capital Contribution

Under PRC laws, shareholders of a foreign-invested enterprise, or FIE, are required to contribute capital to satisfy the registered capital requirement of the FIE within a period of not more than two years from the date when a requested increase in registered capital requirement is approved by the relevant PRC government agencies. The relevant PRC government agencies may extend the contribution period for an additional six months without penalty, and, upon application by the FIE, grant a further three-month grace period without penalty. If the shareholders are unable to complete the capital contribution within the grace period, the FIE may apply to the relevant PRC government agencies for a reduction of the registered capital requirement. If the reduction of the registered capital requirement is not approved and the capital contribution remains incomplete after the grace periods have been exhausted or denied, the FIE may be required to pay a negotiated penalty, typically 3% to 5% of the unsatisfied contribution of capital remaining outstanding. If the shareholders remain unable to complete the capital contribution within a six-month period following payment of the penalty, the FIE may reduce its increased registered capital request to the amount contributed with the amount remaining outstanding waived by the relevant PRC government agencies without risk of revocation to its business license. Until such contribution of capital is satisfied, however, the FIE is not allowed to repatriate profits to its shareholders, unless otherwise approved by the SAFE.

On November 16, 2009, the Foreign Trade and Economic Cooperation Bureau of Dongguan approved an increase in the registered capital of Nova Dongguan from $8 million to $20 million, with the additional contribution of capital to be paid within two years, for which we received an extension. As of December 31, 2011, Nova Dongguan has received additional capital contributions of $2.9 million from its shareholders and $0.99 million from Nova LifeStyle, its U.S. parent company. We may need to fund the remaining capital requirement through financing activities, including cash flow provided by operations and funds raised through offerings of our securities, if and when we determine such offerings are required. If we are unable to fund the remaining $8.11 million in additional contribution to capital by June 30, 2012, we may apply to the relevant PRC government agencies for another extension or reduction of the registered capital requirement. If the capital contribution remains incomplete after the extensions and grace periods have been exhausted or denied, Nova Dongguan may be required to pay a negotiated penalty, typically 3% to 5% of the unsatisfied contribution of registered capital remaining outstanding, or up to $405,000 based on the amount remaining outstanding as of December 31, 2011. After a six-month period following payment of any such penalty, Nova Dongguan may request a reduction of its registered capital to the amount already contributed with the outstanding balance waived without risk of business license revocation. Until the contribution of capital is satisfied or the registered capital requirement is reduced to the amount already contributed, however, Nova Dongguan may not be allowed to repatriate profits or dividends to us, unless otherwise approved by the SAFE.

Taxation

China’s Corporate Income Tax Law, or the CIT Law, together with its Implementation Regulations, effective as of January 1, 2008, introduced a set of anti-avoidance measures under its special tax adjustments regulations and, in January 2009, the PRC State Administration of Taxation, or the SAT, issued the Circular of the State Administration of Taxation on the Issuance of the Implementation Measure of Special Tax Adjustments, or Circular 2. This regulation is applied retrospectively for tax years beginning after January 1, 2008. Article 3 of Circular 2 provides for the relevant PRC tax authorities to examine business transactions between enterprises and their related parties in respect to transfer pricing administration and evaluate whether they are conducted on an arm’s-length basis, in addition to conducting investigations and making adjustments, as required under the CIT Law and Article 36 of the Tax Collection Law. If the relevant PRC tax authorities determine that transactions between related parties do not represent arm’s-length prices, the PRC tax authorities may adjust any of the income in the form of a transfer pricing adjustment, which could, among other things, result in a reduction of expense deductions or an increase in taxable income for the related parties. In addition, the PRC tax authorities may impose late payment fees and other penalties for underpaid taxes by the related parties subject to such regulations. We also are subject to transfer pricing regulations in the U.S. because we are subject to income taxes in the U.S. and conduct operations worldwide through our PRC subsidiaries. We assess our potential transfer pricing-related liabilities arising from transactions between Nova Dongguan and Nova Macao on a quarterly basis, and we have taken an additional income tax expense as a reserve based on management’s analysis for estimated tax principle, interest and penalties under both PRC and U.S. transfer pricing regulations.

Employees