Attached files

| file | filename |

|---|---|

| EX-32.2 - CERTIFICATION - Jialijia Group Corp Ltd | f10k2020ex32-2_jialijiagroup.htm |

| EX-32.1 - CERTIFICATION - Jialijia Group Corp Ltd | f10k2020ex32-1_jialijiagroup.htm |

| EX-31.2 - CERTIFICATION - Jialijia Group Corp Ltd | f10k2020ex31-2_jialijiagroup.htm |

| EX-31.1 - CERTIFICATION - Jialijia Group Corp Ltd | f10k2020ex31-1_jialijiagroup.htm |

| EX-24 - POWER OF ATTORNEY - Jialijia Group Corp Ltd | f10k2020ex24_jialijiagroup.htm |

| EX-21 - SUBSIDIARIES - Jialijia Group Corp Ltd | f10k2020ex21_jialijiagroup.htm |

| EX-4.2 - DESCRIPTION OF SECURITIES - Jialijia Group Corp Ltd | f10k2020ex4-2_jialijiagroup.htm |

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

WASHINGTON, D.C. 20549

FORM 10-K

(Mark One)

☒ ANNUAL REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934

For the fiscal year ended December 31, 2020

or

☐ TRANSITION REPORT UNDER SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT 1934

For the transition period from __________ to ____________

Commission file number: 333-209900

Jialijia Group Corporation Limited

(formerly known as Rizzen, Inc.)

(Exact name of registrant as specified in its charter)

| Nevada | 35-2544765 | |

| (State or Other Jurisdiction of | (I.R.S. Employer | |

| Incorporation or Organization) | Identification No.) |

Room 402, Unit B, Building 5,Guanghua Community, Guanghua Road, Tianning District, Changzhou, Jiangsu, China |

N/A | |

| (Address of Principal Executive Offices) | (Zip Code) |

Registrant's telephone number, including area code: +86 (519) 8980-1180

Securities registered pursuant to Section 12(b) of the Act: None

Securities registered pursuant to Section 12 (g) of the Act:

Common Stock, par value $0.001 per share

(Title of class)

Indicate by check mark if the registrant is a well-known seasoned issuer, as defined in Rule 405 of the Securities Act.

Yes ☐ No ☒

Indicate by check mark if the registrant is not required to file reports pursuant to Section 13 or Section 15(d) of the Act.

Yes ☐ No ☒

Indicate by check mark whether the registrant (1) has filed all reports required to be filed by Section 13 or 15(d) of the Securities Exchange Act of 1934 during the preceding 12 months (or for such shorter period that the registrant was required to file such reports), and (2) has been subject to such filing requirements for the past 90 days.

Yes ☒ No ☐

Indicate by check mark whether the registrant has submitted electronically every Interactive Data File required to be submitted pursuant to Rule 405 of Regulation S-T (§ 232.405 of this chapter) during the preceding 12 months (or for such shorter period that the registrant was required to submit such files).

Yes ☒ No ☐

Indicate by check mark if disclosure of delinquent filers pursuant to Item 405 of Regulation S-K (§229.405) is not contained herein, and will not be contained, to the best of the registrant’s knowledge, in definitive proxy or information statements incorporated by reference into Part III of this Form 10-K or any amendment to this Form 10-K. ☒

Indicate by check mark whether the registrant is a large accelerated filer, an accelerated filer, a non-accelerated filer, a smaller reporting company or emerging growth company. See the definitions of “large accelerated filer,” “accelerated filer,” “smaller reporting company” and “emerging growth company” in Rule 12b-2 of the Exchange Act.

| Large accelerated filer | ☐ | Accelerated filer | ☐ |

| Non-accelerated filer | ☒ | Smaller reporting company | ☒ |

| Emerging growth company | ☐ |

If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act. ☐

Indicate by check mark whether the registrant is a shell company (as defined in Rule 12b-2 of the Act).

Yes ☒ No ☐

Indicate the number of shares outstanding of each of the registrant’s classes of common stock, as of the latest practicable date.

| Common Stock | Outstanding at September 13, 2021 | |

| Common Stock, $.001 par value per share | 4,858,784 shares |

The aggregate market value of the 4,508,784 shares of Common Stock of the registrant held by non-affiliates on June 30, 2020, the last business day of the registrant’s second quarter, computed by reference to the closing price reported by the Over-the-Counter Bulletin Board on that date is $0.

DOCUMENTS INCORPORATED BY REFERENCE: None

CAUTIONARY NOTE CONCERNING FORWARD-LOOKING STATEMENTS

This Annual Report on Form 10-K includes "forward-looking statements" within the meaning of Section 27A of the Securities Act of 1933, as amended, and Section 21E of the Securities Exchange Act of 1934, as amended that are not historical facts, and involve risks and uncertainties that could cause actual results to differ materially from those expected and projected. All statements, other than statements of historical facts, included in this Form 10-K including, without limitation, statements in the “Market Overview” and “Management’s Discussion and Analysis of Financial Condition and Results of Operations” regarding the Company’s market projections, financial position, business strategy and the plans and objectives of management for future operations, events or developments which the Company expects or anticipates will or may occur in the future, including such things as future capital expenditures (including the amount and nature thereof); expansion and growth of the Company's business and operations; and other such matters are forward-looking statements. These statements are based on certain assumptions and analyses made by the Company in light of its experience and its perception of historical trends, current conditions and expected future developments, as well as other factors it believes are appropriate under the circumstances. However, whether actual results or developments will conform with the Company's expectations and predictions is subject to a number of risks and uncertainties, including general economic, market and business conditions; the business opportunities (or lack thereof) that may be presented to and pursued by the Company; changes in laws or regulation; and other factors, most of which are beyond the control of the Company.

These forward-looking statements can be identified by the use of predictive, future-tense or forward-looking terminology, such as "believes," "anticipates," "expects," "estimates," "plans," "may," "will," or similar terms. These statements appear in a number of places in this filing and include statements regarding the intent, belief or current expectations of the Company, and its directors or its officers with respect to, among other things: (i) trends affecting the Company's financial condition or results of operations for its limited history; (ii) the Company's business and growth strategies; and, (iii) the Company's financing plans. Investors are cautioned that any such forward-looking statements are not guarantees of future performance and involve significant risks and uncertainties, and that actual results may differ materially from those projected in the forward-looking statements as a result of various factors. Such factors that could adversely affect actual results and performance include, but are not limited to, the Company's limited operating history, potential fluctuations in quarterly operating results and expenses, government regulation, technological change and competition. For information identifying important factors that could cause actual results to differ materially from those anticipated in the forward-looking statements, please refer to the Risk Factors section of the Company’s Current Report on Form 8-K filed with the U.S. Securities and Exchange Commission (the “SEC”) on August 30, 2019.

Consequently, all of the forward-looking statements made in this Form 10-K are qualified by these cautionary statements and there can be no assurance that the actual results or developments anticipated by the Company will be realized or, even if substantially realized, that they will have the expected consequence to or effects on the Company or its business or operations. The Company assumes no obligations to update any such forward-looking statements.

TABLE OF CONTENTS

i

| Item 1. | Business. |

Overview

Corporate History and Structure

Jialijia Group Corporation Limited, formerly known as Rizzen, Inc. (the “Company”) was incorporated as a corporation under the laws of the State of Nevada on October 21, 2015. On May 16, 2018, our Articles of Incorporation were amended to change our name to Jialijia Group Corporation Limited and increase the number of authorized shares the corporation from 75,000,000 to 1,000,000,000.

Effective as of December 15, 2018, the Company appointed: (i) Mr. Dongzhi Zhang as the Chairman of the Board; (ii) Mr. Jiannan Wu as the Company’s General Manager and Director; and (iii) Ms. Weixia Hu as the Company’s Chinese Region Chief Representative. Ms. Na Jin is our CEO, CFO, Secretary and a director.

Jialijia Group Corporation Limited, formerly known as Rizzen, Inc. (the “Company”) was incorporated as a corporation under the laws of the State of Nevada on October 21, 2015 and has been inactive since our change in control on December 30, 2016. Following our change,

On July 10, 2019, the Company entered into a share purchase/exchange agreement (the “Share Exchange Agreement”) with Huazhongyun Group Co., Limited (“Huazhongyun,” formerly known as “JLJ Group Corporation Limited”), a company formed under the laws of the Hong Kong Special Administrative Region, and Na Jin, the sole shareholder of Huazhongyun and the Chief Executive Officer and Chief Financial Officer of the Company. Na Jin, through Huazhongyun, owned 6,000,000 shares (or 300,000 post-reverse split) (the “Company Shares”) of the Company, which represented approximately 82% of the shares of the Company’s common stock, issued and outstanding, par value $0.001 per share, as of the date of execution of the Share Exchange Agreement. Na Jin owned an aggregate of 10,000 ordinary shares of Huazhongyun (“Huazhongyun Shares”), which constituted all of the issued and outstanding ordinary shares of Huazhongyun. On the date of execution of the Share Exchange Agreement, Huazhongyun owned all of the equity interests in Jialijia Jixiang Investment (Changzhou) Co., Ltd. (“WFOE”), a wholly-foreign owned entity formed under the laws of China, which in turn held seventy percent (70%) of the outstanding equity interest in Rucheng Wenchuan Gas Co., Ltd. (the “Rucheng Wenchuan”), a company formed under the laws of China.

Pursuant to the Share Exchange Agreement, on August 29, 2019 (the “Closing Date”), Na Jin sold and transferred all of the Huazhongyun Shares to the Company in exchange for all of the Company Shares and the Company received all of the outstanding Huazhongyun Shares. As a result, on the Closing Date, Na Jin directly owned Company Shares representing approximately 48% of the issued and outstanding shares of the Company’s common stock, Huazhongyun became a wholly-owned subsidiary of the Company, and the Company owned 70% of the outstanding equity interest in Rucheng Wenchuan through Huazhongyun and WFOE.

From July 22, 2019 to July 29, 2019, the Company entered into a securities subscription agreement (the “Subscription Agreement”) with fifty-four (54) investors (the “Investors”) who reside outside the United States where the Investors purchased an aggregate of 3,011,483 (or 150,574 post-reverse split) shares of the Company’s common stock, par value $0.001 per share, at a price of $0.03 ($0.60 post-reverse split) per share. Pursuant to each of the Subscription Agreements, the Company issued its shares of common stock to each Investor in the respective amounts as set forth in the Subscription Agreement and received the funds in the corresponding amounts as set forth therein. In addition, on April 20, 2019, Ms. Na Jin, the Chief Executive Officer of the Company, entered into a Subscription Agreement to purchase 1,000,000 (50,000 post-reverse split) shares of the Company’s common stock at a price of $0.01 ($0.20 post-reverse split) per share, for a total purchase price of $10,000, which purchase was consummated on July 24, 2019.

As a result of the consummation of the above merger on August 29, 2019, we entered into the business of producing and selling gases, such as oxygen and nitrogen, for industrial and medical purposes in the PRC. In 2020, the COVID-19 pandemic materially and adversely affected economic conditions and our operating results. As a result, we were unable to obtain the financing necessary to pursue this business.

1

Effective July15, 2020, we engaged in a one for twenty reverse stock split of our common stock whereby each twenty shares of common stock were reduced into one share of common stock with fractional shares rounded to one whole share. All descriptions of securities issuances occurring prior to such reverse stock split are provided on a pre-reverse and post-reverse basis

We are currently a “shell company” with no meaningful assets or operations other than our efforts to identify and merge with an operating company.

On December 26, 2020, Calico Darji Group Holdings Co., Limited ("Calico Darji”, formerly Huazhongyun) entered into a share exchange agreement with Shenzhen Lintai Biotechnology Co., Limited (“Shenzhen Lintai”), a company incorporated under the laws of PRC; pursuant to which Calico Darji agreed to exchange 26% of the Company’s common stock held by Calico Darji for 100% of the equity interest of Shenzhen Lintai. This share exchange agreement has not closed due to the required governmental procedures and documents necessary to consider the share exchange completed have not been completed and obtained by the Company.

On March 5, 2021, Calico Darji formed a wholly-owned subsidiary, Zhongtai Chunfeng Wanqi (Chengdu) Industrial Group Co., Limited, under the laws of the PRC.

On June 1, 2021, Calico Darji changed its name to Jialijia Zhongtai Chunfeng Group Co., Limited.

On July 1, 2021, our Board of Directors approved the sale and issuance of an aggregate of: (i) 2,278,373 shares of our common stock at a per share price of $0.04 to approximately 200 non-US persons for aggregate gross proceeds of approximately $91,135; (ii) 1,932,706 shares of our common stock at a per share price of $0.03 to approximately 10 non-US persons for aggregate gross proceeds of approximately $57,981. The securities, aggregating 4,211,079 shares of Common Stock, were sold and issued in July 2021, 1,847,656 shares of which were subscribed by Dongzhi Zhang, the Company’s Chairman of the Board, at a price of $0.03 per share. The securities were sold pursuant to the exemption provided by Regulation S promulgated under the Securities Act of 1933, as amended.

Our principal business is to achieve long-term growth potential through a combination with a business rather than immediate, short-term earnings. Based on proposed business activities, we are a “blank check” company. We intend to comply with the periodic reporting requirements of the Exchange Act for so long as it is subject to those requirements.

Our principal business objective for the next 12 months and beyond such time will be to achieve long-term growth potential through a combination with a business rather than immediate, short-term earnings. We will not restrict its potential candidate target companies to any specific business, industry or geographical location and, thus, may acquire any type of business. We are in active discussions with an operating company for a potential business combination. There is no assurance that we will be able to successfully consummate such an acquisition or that following such acquisition we will be eligible to trade on a national securities exchange, or be quoted on the Over-the-Counter.

The analysis of new business opportunities will be undertaken by or under the supervision of the Company’s officers. We have unrestricted flexibility in seeking, analyzing and participating in potential business opportunities. In its efforts to analyze potential acquisition targets, we will consider the following kinds of factors:

| ● | Potential for growth, indicated by new technology, anticipated market expansion or new products; |

| ● | Competitive position as compared to other firms of similar size and experience within the industry segment as well as within the industry as a whole; |

| ● | Strength and diversity of management, either in place or scheduled for recruitment; |

| ● | Capital requirements and anticipated availability of required funds from the Registrant, from operations, through the sale of additional securities, through joint ventures or similar arrangements or from other sources; |

| ● | The extent to which the business opportunity can be advanced; |

2

| ● | The accessibility of required management expertise, personnel, raw materials, services, professional assistance and other required items; and |

| ● | Other relevant factors. |

In applying the foregoing criteria, no one of which will be controlling, management will attempt to analyze all factors and circumstances and make a determination based upon reasonable investigative measures and available data. Potentially available acquisition opportunities may occur in many different industries, and at various stages of development, all of which will make the task of comparative investigation and analysis of such business opportunities extremely difficult and complex. We may not discover or adequately evaluate adverse facts about the business to be acquired. In evaluating a prospective business combination, we will conduct as extensive a due diligence review of potential targets as possible given the lack of information that may be available regarding private companies, our limited personnel and financial resources.

We expect that our due diligence will encompass, among other things, meetings with the target business’s incumbent management and inspection of its facilities, as necessary, as well as a review of financial and other information, which is made available to us. This due diligence review will be conducted either by our management or by unaffiliated third parties we may engage. Our lack of funds and the lack of full-time management will likely make it impracticable to conduct a complete and exhaustive investigation and analysis of a target business before we consummate a business combination. Management decisions, therefore, will likely be made without detailed feasibility studies, independent analysis, market surveys and the like which, if we had more funds available to us, would be desirable. We will be particularly dependent in making decisions upon information provided by the promoters, owners, sponsors or others associated with the target business seeking our participation.

The time and costs required to select and evaluate a target business and to structure and complete a business combination cannot presently be ascertained with any degree of certainty. Any costs incurred with respect to the indemnification and evaluation of a prospective business combination that is not ultimately completed will result in a loss to us.

Additionally, we are in a highly competitive market for a small number of business opportunities, which could reduce the likelihood of consummating a successful business combination. A large number of established and well-financed entities, including small public companies and venture capital firms, are active in mergers and acquisitions of companies that may be desirable target candidates for us. Nearly all these entities have significantly greater financial resources, technical expertise and managerial capabilities than we do; consequently, we will be at a competitive disadvantage in identifying possible business opportunities and successfully completing a business combination. These competitive factors may reduce the likelihood of our identifying and consummating a successful business combination.

Our offices are located at Room 402, Unit B, Building 5, Guanghua Community, Guanghua Road, Tianning District, Changzhou City, Jiangsu Province, China 213000 and our telephone number at such address is + (86-519) 8980-1180.

3

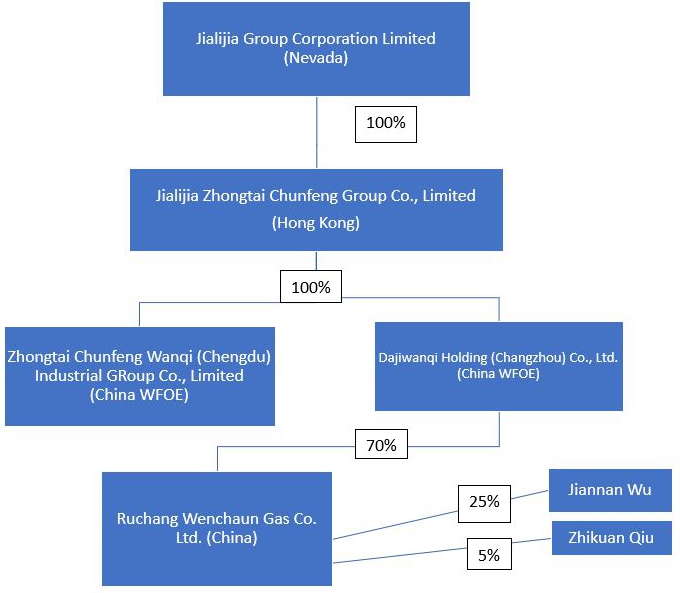

The diagram below illustrates our current corporate structure.

| (1) | Jialijia Zhongtai Chunfeng Group Co., Limited f/k/a Calico Darji Group Holdings Co., Limited , f/k/a Huazhongyun Group Co. Limited was formed on November 30, 2010 under the laws of Hong Kong Special Administrative Region (“Huazhongyun”). | |

| (2) | Dajiwanqi Holding (Changzhou) Co., Ltd, f/k/a Jialijia Jixiang Investment (Changzhou) Co., Ltd. (“WFOE”) is a company incorporated under the laws of the PRC on June 13, 2017. | |

| (3) | Rucheng Wenchuan Gas Co., Ltd. (“Rucheng Wenchuan”) was incorporated under the laws of the People’s Republic of China (the “PRC”) on March 31, 2006. Jiannan Wu, our General manager and Director, owns 25% of Ruchang Wenchuan Gas Co. Ltd. |

4

| Item 1A. | Risk Factors. |

As a smaller reporting company, we are not required to provide information pursuant to this Item..

| Item 1B. | Unresolved Staff Comments. |

As a smaller reporting company, we are not required to provide the information pursuant to this Item.

| Item 2. | Properties. |

Our offices are located at Room 402, Unit B, Building 5, Guanghua Community, Guanghua Road, Tianning District, Changzhou City, Jiangsu Province, China 213000. The premises are provided to us free of charge by our Chairman of the Board.

| Item 3. | Legal Proceedings. |

To the knowledge of the Company, there is no litigation currently pending or contemplated against us, any of our officers or directors in their capacity as such or against any of our property.

| Item 4. | Mine Safety Disclosures. |

Not applicable.

5

| Item 5. | Market for Registrants' Common Equity, Related Stockholder Matters and Issuer Purchases of Equity Securities |

(a) Market Information

Shares of our common stock are quoted on the OTC Pink under the symbol “RZZN”. As of September 13, 2021, the last closing price of our securities was $7.60, with little to no quoting activity. There is no established public trading market for our securities and a regular trading market may not develop, or if developed, may not be sustained.

The following table sets forth, for the fiscal quarters indicated, the high and low closing prices for our common stock, as reported on the Pink Sheets. The following quotations reflect inter-dealer prices, without retail mark-up, mark-down or commission and may not represent actual transactions.

| Quarterly period | High | Low | ||||||

| Fiscal year ended December 31, 2020: | ||||||||

| Fourth Quarter | $ | 7.60 | $ | 7.60 | ||||

| Third Quarter | $ | 7.60 | $ | 7.60 | ||||

| Second Quarter | $ | 7.60 | $ | 7.60 | ||||

| First Quarter | $ | 14.00 | $ | 7.60 | ||||

| Fiscal year ended December 31, 2019: | ||||||||

| Fourth Quarter | $ | 14.00 | $ | 8.520 | ||||

| Third Quarter | $ | 18.00 | $ | 10.20 | ||||

| Second Quarter | $ | 25.00 | $ | 6.60 | ||||

| First Quarter | $ | 43.00 | $ | 8.00 | ||||

(b) Approximate Number of Holders of Common Stock

As of September 13, 2021, there were approximately 313 shareholders of record of our common stock. Such number does not include any shareholders holding shares in nominee or “street name”.

(c) Dividends

Holders of our common stock are entitled to receive such dividends as may be declared by our board of directors. We paid no dividends during the periods reported herein, nor do we anticipate paying any dividends in the foreseeable future.

(d) Equity Compensation Plan Information

None.

(e) Recent Sales of Unregistered Securities

On July 1, 2021, our Board of Directors approved the sale and issuance of an aggregate of: (i) 2,278,373 shares of our common stock at a per share price of $0.04 to approximately 200 non-US persons for aggregate gross proceeds of approximately $91,135; (ii) 1,932,706 shares of our common stock at a per share price of $0.03 to approximately 10 non-US persons for aggregate gross proceeds of approximately $57,981. The securities, aggregating 4,211,079 shares of Common Stock, were sold and issued in July 2021, 1,847,656 shares of which were subscribed by Dongzhi Zhang, the Company’s Chairman of the Board, at a price of $0.03 per share. The securities were sold pursuant to the exemption provided by Regulation S promulgated under the Securities Act of 1933, as amended.

6

Where You Can Find Additional Information

We are a reporting company and file annual, quarterly and current reports, proxy statements and other information with the SEC. For further information with respect to the Company, you may read and copy its reports, proxy statements and other information, at the SEC public reference rooms at 100 F. Street, N.E., Washington, D.C. 20549. You can request copies of these documents by writing to the SEC and paying a fee for the copying cost. Please call the SEC at 1-800-SEC-0330 for more information about the operation of the public reference rooms. The Company’s SEC filings are also available at the SEC’s web site at http://www.sec.gov.

| Item 6. | Selected Financial Data. |

Not applicable to smaller reporting companies.

| Item 7. | Management's Discussion and Analysis of Financial Condition and Results of Operation |

We are currently a “shell company” with no meaningful assets or operations other than our efforts to identify and merge with an operating company.

Our principal business is to achieve long-term growth potential through a combination with a business rather than immediate, short-term earnings. Based on proposed business activities, we are a “blank check” company. We intend to comply with the periodic reporting requirements of the Exchange Act for so long as it is subject to those requirements.

We are in active discussions with an operating business affiliated with our executive officers regarding potential acquisition. There is no assurance that we will be able to successfully acquire such company or any company in the near future.

Jialijia Group Corporation Limited, formerly known as Rizzen, Inc. (the “Company”) was incorporated as a corporation under the laws of the State of Nevada on October 21, 2015. On May 16, 2018, our Articles of Incorporation were amended to change our name to Jialijia Group Corporation Limited and increase the number of authorized shares the corporation from 75,000,000 to 1,000,000,000.

Effective as of December 15, 2018, the Company appointed: (i) Mr. Dongzhi Zhang as the Chairman of the Board; (ii) Mr. Jiannan Wu as the Company’s General Manager and Director; and (iii) Ms. Weixia Hu as the Company’s Chinese Region Chief Representative. Ms. Na Jin is our CEO, CFO, Secretary and a director.

On July 10, 2019, the Company entered into a share purchase/exchange agreement (the “Share Exchange Agreement”) with Huazhongyun Group Co., Limited (“Huazhongyun,” formerly known as “JLJ Group Corporation Limited”), a company formed under the laws of the Hong Kong Special Administrative Region, and Na Jin, the sole shareholder of Huazhongyun and the Chief Executive Officer and Chief Financial Officer of the Company. Na Jin, through Huazhongyun, owned 6,000,000 shares (or 300,000 post-reverse split) (the “Company Shares”) of the Company, which represented approximately 82% of the shares of the Company’s common stock, issued and outstanding, par value $0.001 per share, as of the date of execution of the Share Exchange Agreement. Na Jin owned an aggregate of 10,000 ordinary shares of Huazhongyun (“Huazhongyun Shares”), which constituted all of the issued and outstanding ordinary shares of Huazhongyun. On the date of execution of the Share Exchange Agreement, Huazhongyun owned all of the equity interests in Jialijia Jixiang Investment (Changzhou) Co., Ltd. (“WFOE”), a wholly-foreign owned entity formed under the laws of China, which in turn held seventy percent (70%) of the outstanding equity interest in Rucheng Wenchuan Gas Co., Ltd. (the “Rucheng Wenchuan”), a company formed under the laws of China.

Pursuant to the Share Exchange Agreement, on August 29, 2019 (the “Closing Date”), Na Jin sold and transferred all of the Huazhongyun Shares to the Company in exchange for all of the Company Shares and the Company received all of the outstanding Huazhongyun Shares. As a result, on the Closing Date, Na Jin directly owned Company Shares representing approximately 48% of the issued and outstanding shares of the Company’s common stock, Huazhongyun became a wholly-owned subsidiary of the Company, and the Company owned 70% of the outstanding equity interest in Rucheng Wenchuan through Huazhongyun and WFOE.

7

From July 22, 2019 to July 29, 2019, the Company entered into a securities subscription agreement (the “Subscription Agreement”) with fifty-four (54) investors (the “Investors”) who reside outside the United States where the Investors purchased an aggregate of 3,011,483 (or 150,574 post-reverse split) shares of the Company’s common stock, par value $0.001 per share, at a price of $0.03 ($0.60 post-reverse split) per share. Pursuant to each of the Subscription Agreements, the Company issued its shares of common stock to each Investor in the respective amounts as set forth in the Subscription Agreement and received the funds in the corresponding amounts as set forth therein. In addition, on April 20, 2019, Ms. Na Jin, the Chief Executive Officer of the Company, entered into a Subscription Agreement to purchase 1,000,000 (50,000 post-reverse split) shares of the Company’s common stock at a price of $0.01 ($0.20 post-reverse split) per share, for a total purchase price of $10,000, which purchase was consummated on July 24, 2019.

As a result of the consummation of the above merger on August 29, 2019, we entered into the business of producing and selling gases, such as oxygen and nitrogen, for industrial and medical purposes in the PRC. In 2020, the COVID-19 pandemic materially and adversely affected economic conditions and our operating results. As a result, we were unable to obtain the financing necessary to pursue this business.

Effective July15, 2020, we engaged in a one for twenty reverse stock split of our common stock whereby each twenty shares of common stock were reduced into one share of common stock with fractional shares rounded to one whole share. All descriptions of securities issuances occurring prior to such reverse stock split are provided on a pre-reverse and post-reverse basis.

On July 1, 2021, our Board of Directors approved the sale and issuance of an aggregate of: (i) 2,278,373 shares of our common stock at a per share price of $0.04 to approximately 200 non-US persons for aggregate gross proceeds of approximately $91,135; (ii) 1,932,706 shares of our common stock at a per share price of $0.03 to approximately 10 non-US persons for aggregate gross proceeds of approximately $57,981. The securities, aggregating 4,211,079 shares of Common Stock, were sold and issued in July and August 2021. The securities were sold pursuant to the exemption provided by Regulation S promulgated under the Securities Act of 1933, as amended.

Limited Operating History; Need for Additional Capital

We have had limited operations and have been issued a “going concern” opinion by our auditor, based upon our reliance on the sale of our common stock and loans from a related party, as the sole source of funds for our future operations.

There is no historical financial information about us upon which to base an evaluation of our performance. We have not generated any revenues from operations. We cannot guarantee we will be successful in our business operations. Our business is subject to risks inherent in the establishment of a new business enterprise, including limited capital resources, possible delays in the launching of our games and market or wider economic downturns. We do not believe we have sufficient funds to operate our business for the next 12 months.

We have no assurance that future financing will be available to us on acceptable terms, or at all. If financing is not available on satisfactory terms, we may be unable to continue, develop or expand our operations. Equity financing could result in additional dilution to existing shareholders. If we are unable to raise additional capital to maintain our operations in the future, we may be unable to carry out our full business plan or we may be forced to cease operations.

Going Concern

Our consolidated financial statements have been prepared on a going concern basis which assumes the Company will be able to realize its assets and discharge its liabilities in the normal course of business for the foreseeable future. As of December 31, 2020, the Company had working capital deficit of $3,330,650 and has incurred losses since its inception resulting in an accumulated deficit of $4,875,603. Further losses are anticipated in the development of the business, raising substantial doubt about the Company’s ability to continue as a going concern. The consolidated financial statements do not include any adjustment that might result from the outcome of this uncertainty.

8

The ability to continue as a going concern is dependent upon the Company generating profitable operations in the future and/or to obtain the necessary financing to meet its obligations and repay its liabilities arising from normal business operations when they come due. Management intends to finance operating costs over the next twelve months with loans from directors and/or private placements of common stock.

Results of Operations

For The Year Ended December 31, 2020 Compared to the Year Ended December 31, 2019

The following table sets forth selected financial information from our statements of comprehensive loss for the years ended December 31, 2020 and 2019:

| For the Years Ended | ||||||||

| December 31, | ||||||||

| 2020 | 2019 | |||||||

| Net Revenue | $ | - | $ | - | ||||

| Total Operating Expenses | 72,384 | 4,907,557 | ||||||

| Net Loss | $ | (72,384 | ) | $ | (4,907,557 | ) | ||

Revenues

The Company did not commence operations and did not generate any revenues for the years ended December 31, 2020 and 2019.

Operating Expenses

Operating expenses for the years ended December 31, 2020 and 2019, were $72,384 and $4,907,557, respectively. Operating expenses for the year ended December 31, 2020, consisted solely of general and administrative expenses of $72,384. Operating expenses for the year ended December 31, 2019, consisted primarily of goodwill impairment of $3,962,424 arising from the acquisition of Rucheng Wenchuan, fixed assets impairment of $341,797 and general and administrative expenses of $603,336.

Net Loss

As a result of the above factors, the Company incurred a net loss of $72,384 and $4,907,557 for the years ended December 31, 2020 and 2019, respectively.

Foreign Currency Translation Gain (Loss)

The Company had $184,762 in foreign currency translation loss during the year ended December 31, 2020 as compared to $28,502 in foreign currency translation gain during the year ended December 31, 2019, reflecting a change of $213,264. Such decrease in foreign currency translation gain was primarily caused by the currency exchange rate fluctuation.

9

Liquidity and Capital Resources

The following summarizes the key component of our cash flows for the years ended December 31, 2020 and 2019.

| For the Year Ended December 31, | ||||||||

| 2020 | 2019 | |||||||

| Net cash used in operating activities | $ | (27,879 | ) | $ | (216,088 | ) | ||

| Net cash used in investing activities | - | (135,935 | ) | |||||

| Net cash provided by financing activities | 40,649 | 352,448 | ||||||

| Net increase in cash and cash equivalents | $ | 13,538 | $ | 382 | ||||

Net cash used in operating activities was $27,879 for the year ended December 31, 2020, compared to that of $216,088 for the year ended December 31, 2019. The decrease of $188,209 or 87.1% of net cash used in operating activities was primarily due to the decrease in net loss during the year ended December 31, 2020.

Net cash used in investing activities was $0 and $135,935 for the years ended December 31, 2020 and 2019, respectively. Net cash used during the year ended December 31, 2019, was attributable to the acquisition of our subsidiary.

Net cash provided by financing activities was $40,649 and $352,448 for the year ended December 31, 2020 and 2019, respectively, representing a decrease of $311,799 or 88.5%. The decrease in net cash provided by financing activities was primarily attributable to the decrease in advances from officers for working capital purpose and the decrease in capital contribution from sale of our common stock.

Working Capital:

As of December 31, 2020 and December 31, 2019, we had cash and cash equivalent of $13,933 and $395, respectively. As of December 31, 2020, we have incurred accumulated operating losses of $4,875,603 since inception. As of December 31, 2020 and December 31, 2019, we had working capital deficit of $3,330,650 and $3,088,770, respectively.

Going Concern

We require additional funding to meet its ongoing obligations and to fund anticipated operating losses. Our auditor has expressed substantial doubt about our ability to continue as a going concern. Our ability to continue as a going concern is dependent on raising capital to fund its initial business plan and ultimately to attain profitable operations. These consolidated financial statements do not include any adjustments relating to the recoverability and classification of recorded asset amounts, or amounts and classification of liabilities that might result from this uncertainty.

We expect to incur marketing and professional and administrative expenses as well expenses associated with maintaining our filings with the Commission. We will require additional funds during this time and will seek to raise the necessary additional capital. If we are unable to obtain additional financing, we may be required to reduce the scope of our business development activities, which could harm our business plans, financial condition and operating results. Additional funding may not be available on favorable terms, if at all. We intend to continue to fund its business by way of equity or debt financing and advances from related parties. Any inability to raise capital as needed would have a material adverse effect on our business, financial condition and results of operations.

If we cannot raise additional funds, we will have to cease business operations. As a result, our common stock investors would lose all of their investment.

10

Critical Accounting Policies

Our financial statements and accompanying notes have been prepared in accordance with United States generally accepted accounting principles applied on a consistent basis. The preparation of financial statements in conformity with United States generally accepted accounting principles requires management to make estimates and assumptions that affect the reported amounts of assets and liabilities, the disclosure of contingent assets and liabilities at the date of the financial statements and the reported amounts of revenues and expenses during the reporting periods.

Use of estimates

The preparation of the financial statements in conformity with U.S. GAAP requires management to make estimates and assumptions that affect the reported amounts of assets and liabilities and disclosure of contingent assets and liabilities at the date of the financial statements, as well as the reported amounts of revenues and expenses during the reporting periods. Management makes these estimates using the best information available at the time the estimates are made; however actual results could differ materially from those estimates.

Income Taxes

We account for income taxes as outlined in ASC 740, “Income Taxes”. Under the asset and liability method of ASC 740, deferred tax assets and liabilities are recognized for the estimated future tax consequences attributable to differences between the financial statement carrying amounts of existing assets and liabilities and their respective tax bases. Deferred tax assets and liabilities are measured using enacted tax rates in effect for the year in which those temporary differences are expected to be recovered or settled.

Loss per Share Calculation

We comply with accounting and disclosure requirements of ASC 260, “Earnings Per Share.” Net loss per common share is computed by dividing net loss applicable to common stockholders by the weighted average number of common shares outstanding for the period. For the years ended December 31, 2020 and 2019, we did not have any dilutive securities and other contracts that could, potentially, be exercised or converted into common stock and then share in the earnings of us. As a result, diluted loss per common share is the same as basic loss per common share for the periods.

Fair values of financial instruments

ASC 820 defines fair value as the exchange price that would be received for an asset or paid to transfer a liability (an exit price) in the principal or most advantageous market for the asset or liability in an orderly transaction between market participants on the measurement date. ASC 820 also establishes a fair value hierarchy, which requires an entity to maximize the use of observable inputs and minimize the use of unobservable inputs when measuring fair value. ASC 820 describes three levels of inputs that may be used to measure fair value:

| Level 1 – | quoted prices in active markets for identical assets or liabilities. |

| Level 2 – | quoted prices for similar assets and liabilities in active markets or inputs that are observable |

| Level 3 – | inputs that are unobservable |

There were no assets or liabilities measured at fair value on a recurring basis subject to the disclosure requirements of ASC 820 as of December 31, 2020 and December 31, 2019.

Recent Accounting Pronouncements

Management has evaluated all the recently issued accounting pronouncements and does not believe that they will have a material effect on the Company’s financial position and results of operations.

11

Off-balance Sheet Arrangements

As of December 31, 2020 and December 31, 2019, there were no off-balance sheet arrangements.

| Item 7A. | Quantitative and Qualitative Disclosures about Market Risk. |

Not applicable.

| Item 8. | Financial Statements and Supplementary Data |

The audited financial statements of the Company for the fiscal years ended December 31, 2019, and 2018, and the notes thereto are set forth on page F-1 through F-15 of this Annual Report. The Company’s financial statements have been prepared in accordance with accounting principles generally accepted in the U.S., or US GAAP, and pursuant to Regulation S-K as promulgated by the SEC. The financial statements have been prepared assuming the Company will continue as a going concern.

| Item 9. | Changes in and Disagreements with Accountants on Accounting and Financial Disclosure |

As reported by the Company in its Current Report on Form 8-K filed with the SEC on January 17, 2019, our independent auditor, Fruci & Associates II, PLLC (“FRUCI”) advised our Board in writing that they resigned as auditor of the Company.

The auditor’s report of FRUCI on the Company’s consolidated financial statements as of and for the fiscal year ended January 31, 2018 did not contain an adverse opinion or a disclaimer of opinion, and was not qualified or modified as to uncertainty, audit scope or accounting principles.

A copy of the Form 8-K was furnished to FRUCI and FRUCI furnished us with a letter addressed to the SEC stating that FRUICI agreed with the statements made in the Form 8-K, a copy of which was filed with the Form 8-K as Exhibit 16.1.

On February 10, 2019, the Board approved and ratified the engagement of KCCW as its new independent registered public accounting firm. On April 9, 2019, the Company entered into an engagement with KCCW Accountancy Corp (“KCCW”) to retain KCCW as the Company’s independent public accounting firm.

From May 28, 2018 when FRUCI was engaged, through FRUCI’s resignation on January 15, 2019, neither the Company nor anyone acting on its behalf consulted KCCW regarding (1) the application of accounting principles to a specified transaction, either completed or proposed, or the type of audit opinion that might be rendered on the Company’s consolidated financial statements, and KCCW did not provide either a written report or oral advice to the Company that was an important factor considered by the Company in reaching a decision as to any accounting, auditing, or financial reporting issue, or (2) any matter that was either the subject of a disagreement with FRUCI on accounting principles or practices, financial statement disclosure or auditing scope or procedures, which, if not resolved to the satisfaction of FRUCI, would have caused FRUCI to make reference to the matter in their report, or a “reportable event” as described in Item 304(a)(1)(v) of Regulation S-K of the SEC’s rules and regulations.

| Item 9A. | Controls and Procedures |

Evaluation of Disclosure Controls and Procedures

Based on an evaluation of the Company's disclosure controls and procedures (as defined in Rules 13a-15(e) and 15d-15(e) of the Securities Exchange Act of 1934, as amended), as of December 31, 2020, the Company's Chief Executive Officer and Chief Financial Officer (its principal executive officer and principal financial and accounting officer, respectively) has concluded that the Company's disclosure controls and procedures were not effective.

12

Limitations on the Effectiveness of Controls

A control system, no matter how well conceived and operated, can provide only reasonable, not absolute, assurance that the objectives of the control system are met. Because of the inherent limitations in all controls systems, no evaluation of controls can provide absolute assurance that all control issues and instances of fraud, if any, within a company have been detected. Our disclosure controls and procedures are designed to provide reasonable assurance of achieving its objectives.

Management's Report on Internal Control over Financial Reporting

The Company's management is responsible for establishing and maintaining adequate internal control over financial reporting as such term is defined in Exchange Act Rule 13a-15(f). Internal control over financial reporting is a process used to provide reasonable assurance regarding the reliability of financial reporting and the preparation of the Company's financial statements for external reporting in accordance with U.S. GAAP. Internal control over financial reporting includes policies and procedure that pertain to the maintenance of records that in reasonable detail accurately and fairly reflect the transactions and dispositions of our assets; provide reasonable assurance that transactions are recorded as necessary to permit preparation of our financial statements in accordance with U.S. GAAP; that our receipts and expenditures are being made only in accordance with the authorization of the Company's board of directors; and provide reasonable assurance regarding prevention or timely detection of unauthorized acquisition, use or disposition of the Company's assets that could have a material effect on the Company's financial statements.

An internal control system over financial reporting has inherent limitations and may not prevent or detect misstatements. Therefore, even those systems determined to be effective can provide only reasonable assurance with respect to financial statement preparation and presentation. Also, projections of any evaluation of effectiveness to future periods are subject to the risk that controls may become inadequate because of changes in conditions, or that the degree of compliance with the policies or procedures may deteriorate. However, these inherent limitations are known features of the financial reporting process. Therefore, it is possible to design into the process safeguards to reduce, though not eliminate, the risk.

Management, under the supervision and with the participation of the Company's Chief Executive Officer and Chief Financial Officer, has assessed the effectiveness of the Company’s internal control over financial reporting as of December 31, 2020. In making this assessment, management used the criteria set forth by the Committee of Sponsoring Organizations of the Treadway Commission (COSO-2013) in Internal Control Integrated Framework. Because of the material weaknesses described in the following paragraphs, management believes that, as of December 31, 2020, the Company’s internal control over financial reporting was not effective based on those criteria.

Material weakness

Management identified two material weaknesses in the design and operation of its internal controls: (i) the failure to retain sufficient qualified accounting personnel to prepare financial statements in accordance with accounting principles generally accepted in the United States (including a qualified Chief Financial Officer); and (ii) the Company’s accounting department personnel has limited knowledge and experience in U.S. GAAP.

To remediate the material weaknesses identified in internal control over financial reporting, the Company intends to: (i) hire additional personnel with sufficient knowledge and experience in U.S. GAAP; and (ii) provide ongoing training courses in U.S. GAAP to existing personnel, as sufficient capital permits. The Company will continue to monitor and assess our remediation initiatives to ensure that the aforementioned material weaknesses are remediated.

Changes in Internal Control over Financial Reporting

There have not been any changes in the Company's internal controls over financial reporting that occurred during the Company's fiscal quarter ended December 31, 2020, that has materially affected, or is reasonably likely to materially affect, the Company's internal control over financial reporting.

| Item 9B. | Other Information. |

None.

13

| Item 10. | Directors, Executive Officers and Corporate Governance. |

Directors and Executive Officers

Our director and executive officers are as follows:

| Name | Age | Position | ||

| Na Jin | 38 | CEO, CFO, Secretary and director | ||

| Dongzhi Zhang | 59 | Chairman of the Board | ||

| Jiannan Wu | 58 | General Manager, director | ||

| Weixia Hu | 50 | Chinese Region Chief Representative |

Ms. Jin, age 38, has been serving as our Director, CEO, CFO and Secretary since December 2016. Currently, she also serves as the Legal Representative for Changzhou Biekaishengmian E-commerce Co., Ltd. From March 2010 to September 2014, she served as Marketing Director for Hunan Resgreen Ecological Textile Inc. and was responsible for marketing operations. From September 2014 to February 2015 she worked as General Commander of Education Department for Beijing Zhangxin Communication Technology Co., Ltd. where she was responsible for training marketing teams. From February 2015 to May 2016, Ms. Jin served as Marketing Director for Shandong Weikang Biotechnology Co., Ltd. where she was responsible for marketing operations. She received her High School Diploma from Henan Runan County High School.

Mr. Dongzhi Zhang, age 59, has been serving as our Chairman since December 2018 and the Chairman of Jialijia Group Co., Ltd, a limited liability company incorporated under the laws of the PRC, since 2010. Over the years, Mr. Dongzhi Zhang has devoted himself to enterprise management and has abundant corporate management experience. From January 2007 to July 2012, Mr. Wang served as the Senior Manager of Crowe CPA Group. From 2002 to 2010, he served as a General Manager of Beijing Jianghong Investment Co., Ltd. From 1997 to 2001, Mr. Zhang served as a General Manager of Jiangsu Changzhou Nanyuan Trading Company. From 1979 to 1996, Mr. Zhang served as a Chairman of Jiangsu Changzhou Wujin Tangyangjiu Company. He received his Associate Degree from Jiangsu Changzhou Commercial Bureau Internal College in 1981.

Mr. Jiannan Wu, age 58, has been serving as our General Manager and Director since December 2018 and has been serving as a Director of Guangdong Provincial Health Care Association since March 2013. Since May 2014, Mr. Xu has been serving as the Chairman of Shenzhen Xiude Medical Nursing Group. Since December 2015, he has been serving as the Honorary President of Meizhou Surname Culture Research Association of Guangdong Province. Since 2017, he has been serving as the Executive Director of Smart Medical Research Center of the World City Smart Engineering Technology (Beijing) Research Institute. Since December 2017, he has been serving as the President of Shenzhen Expert Federation. Since 2018, he has been serving as the Chairman of the Shenzhen Science and Technology Economic Promotion Association, Qianhai Division. Mr. Wu received his Bachelor in Applied Chemical Technology from Zhengzhou Institute of Technology in July 2002. He received his Master’s Degree in Business Administration from United University of Hong Kong in 2007.

Ms. Weixia Hu, age 50, has been serving as our Chinese Region Chief Representative since December 2018 and has been serving as the legal representative, Chairman of the Board of Supervisors, Marketing Director and Sales Representative of Zhongyun Management and Management Partnership (Limited Partnership) from 2018 until the present. From 2007 to 2012, Mr. Zhou founded Laoxiangzhang Food Chain Co., Ltd. and served as its General Manager. From 2007 to 2010, she served as a Marketing Director for Amway (China) Daily Necessities Co., Ltd. From 2004 to 2006, she served as a General Manager of Wuhan Xinyida Company. From 1994 to 2003, she served as a sales member for Shiyan Dongfeng Motor Company. Ms. Hu received her specialist degree from Dongfeng Motor Vehicle College.

There have been no related party transactions between the Company and any of Ms. Na Jin, Mr. Dongzhi Zhang, Mr. Jiannan Wu, or Ms. Weixia Hu reportable under Item 404(a) of Regulation S-K.

14

There are no formal compensation agreements with our directors and officers at this time.

Involvement in Certain Legal Proceedings

To the best of our knowledge, each of our directors and executive officers has not, during the past ten years:

| ☐ | been convicted in a criminal proceeding or been subject to a pending criminal proceeding (excluding traffic violations and other minor offenses); | |

| ☐ | had any bankruptcy petition filed by or against the business or property of the person, or of any partnership, corporation or business association of which he was a general partner or executive officer, either at the time of the bankruptcy filing or within two years prior to that time; | |

| ☐ | been subject to any order, judgment, or decree, not subsequently reversed, suspended or vacated, of any court of competent jurisdiction or federal or state authority, permanently or temporarily enjoining, barring, suspending or otherwise limiting, his involvement in any type of business, securities, futures, commodities, investment, banking, savings and loan, or insurance activities, or to be associated with persons engaged in any such activity; | |

| ☐ | been found by a court of competent jurisdiction in a civil action or by the SEC or the Commodity Futures Trading Commission to have violated a federal or state securities or commodities law, and the judgment has not been reversed, suspended, or vacated; | |

| ☐ | been the subject of, or a party to, any federal or state judicial or administrative order, judgment, decree, or finding, not subsequently reversed, suspended or vacated (not including any settlement of a civil proceeding among private litigants), relating to an alleged violation of any federal or state securities or commodities law or regulation, any law or regulation respecting financial institutions or insurance companies including, but not limited to, a temporary or permanent injunction, order of disgorgement or restitution, civil money penalty or temporary or permanent cease-and-desist order, or removal or prohibition order, or any law or regulation prohibiting mail or wire fraud or fraud in connection with any business entity; or | |

| ☐ | been the subject of, or a party to, any sanction or order, not subsequently reversed, suspended or vacated, of any self-regulatory organization (as defined in Section 3(a)(26) of the Exchange Act), any registered entity (as defined in Section 1(a)(29) of the Commodity Exchange Act), or any equivalent exchange, association, entity or organization that has disciplinary authority over its members or persons associated with a member. |

Board Committees and Audit Committee Financial Expert

We do not currently have a standing audit, nominating or compensation committee of the board of directors, or any committee performing similar functions. Our board of directors performs the functions of audit, nominating and compensation committees. As of the date of this report, no member of our board of directors qualifies as an “audit committee financial expert” as defined in Item 407(d)(5) of Regulation S-K promulgated under the Securities Act. We do not believe it is necessary for our Board to appoint such committees because the volume of matters that come before our Board for consideration permits the directors to give sufficient time and attention to such matters to be involved in all decision making. Additionally, because our Common Stock is not listed for trading or quotation on a national securities exchange, we are not required to have such committees.

Role in Risk Oversight

Our Board is primarily responsible for overseeing our risk management processes. Our Board receives and reviews periodic reports from management, auditors, legal counsel, and others, as considered appropriate regarding our company’s assessment of risks. Our Board focuses on the most significant risks facing our company and our company’s general risk management strategy, and also ensures that risks undertaken by our company are consistent with the board’s appetite for risk.

15

Section 16(a) Beneficial Ownership Reporting Compliance

Section 16(a) of the Securities Exchange Act of 1934 requires that our executive officers and directors, and persons who own more than 10% of a registered class of our equity securities, file reports of ownership and changes in ownership with the SEC. Executive officers, directors and greater-than-ten percent stockholders are required by SEC regulations to furnish us with all Section 16(a) forms they file. Based solely on our review of the copies of the forms received by us and written representations from certain reporting persons, we believe that, during the year ended December 31, 2019, our executive officers, directors and greater-than-ten percent stockholders have not complied with Section 16(a) filing requirements.

Code of Ethics

We have not yet adopted a code of ethics that applies to our principal executive officer, principal financial officer principal accounting officer or controller in light of our Company’s current stage of development. We expect to adopt a code of ethics in the near future.

| Item 11. | Executive Compensation. |

The following compensation discussion addresses all compensation awarded to, earned by, or paid to the Company's named executive officer. The Company's officers and directors have not received any cash or other compensation since they became the Company’s officers and directors. No compensation of any nature has been paid for on account of services rendered by our directors in such capacity.

No retirement, pension, profit sharing, stock option or insurance programs or other similar programs have been adopted by the Company for the benefit of its employees.

There are no understandings or agreements regarding compensation our management will receive after a business combination.

The Company does not have a standing compensation committee or a committee performing similar functions, since the Board of Directors has determined not to compensate the officers and directors until such time that the Company completes a reverse merger or business combination.

16

| Item 12. | Security Ownership of Certain Beneficial Owners and Management and Related Stockholder Matters |

The following table sets forth certain information concerning the number of shares of our common stock owned beneficially as of September 13, 2021, by: (i) each person (including any group) known to us to own more than five percent (5%) of any class of our voting securities, (ii) each of our directors and each of our named executive officers (as defined under Item 402(m)(2) of Regulation S-K), and (iii) officers and directors as a group. Unless otherwise indicated, the shareholders listed possess sole voting and investment power with respect to the shares shown except to the extent voting power may be shared with a spouse. Unless otherwise indicated, the address for each director and executive officer listed is: c/o Jialijia Group Corporation Limited, Room 402, Unit B, Building 5, Guanghua Community, Guanghua Road, Tianning District, Changzhou City, Jiangsu Province, China 213000.

| Common Stock Beneficially Owned | ||||||||

| Name and Address of Beneficial Owner | Number of Shares and Nature of Beneficial Ownership | Percentage of Total Common Equity (1) | ||||||

| NA Jin (2) | 350,000 | 7.72 | % | |||||

| Dongzhi Zhang | - | - | ||||||

| Jiannan Wu | - | - | ||||||

| Weixia Hu | - | - | ||||||

| All executive officers and directors as a Group (4 persons) | 350,000 | 7.2 | % | |||||

| 5% or Greater Stockholders: | ||||||||

| JLJ Group Corporation Limited (2) | 300,000 | 6.174 | % | |||||

| (1) | Beneficial ownership is determined in accordance with SEC rules and generally includes voting or investment power with respect to securities. For purposes of this table, a person or group of persons is deemed to have “beneficial ownership” of any shares of common stock that such person has the right to acquire within 60 days of September 13, 2021. Applicable percentage ownership is based on 4,858,784 shares of common stock outstanding as of September 13, 2021, and any shares that such person or persons has the right to acquire within 60 days of September 13, 2021, is deemed to be outstanding for such person, but is not deemed to be outstanding for the purpose of computing the percentage ownership of any other person. The inclusion herein of any shares listed as beneficially owned does not constitute an admission of beneficial ownership. |

| (2) | Na Jin holds 50,000 shares of our common stock. He also serves as the interim CEO and CFO of JLJ Group Corporation Limited and, in that capacity, has the authority to direct voting and investment decisions with regard to its common stock. |

There are no current arrangements known to the company, the operation of which may, at a subsequent date, result in a further change in control of the registrant.

| Item 13. | Certain Relationships and Related Transactions, and Director Independence. |

Transactions with Related Persons

In support of the Company’s nominal operation and cash requirements, we rely on advances from related parties until when we can support our operations or attain adequate financing through sales of our equity or traditional debt financing. There is no formal written commitment for continued support by officers, directors, or shareholders. The advances from related party represent the amounts paid by related party on behalf of the Company in satisfaction of liabilities. The advances are considered temporary in nature and have not been formalized by a promissory note.

17

The related parties of the company with whom transactions are reported in these consolidated financial statements are as follows:

| Name of entity or Individual | Relationship with the Company | |

| Shenzhen Wenchuan Gas Co., Ltd. | Mr. Jiannan Wu is the legal representative and president of this entity | |

| Rucheng County Minhang Special Gas Co., Ltd | Mr. Jiannan Wu is the legal representative and president of this entity | |

| Jiannan Wu | Major shareholder of Rucheng Wenchuan | |

| Dongzhi Zhang | Chairman of the Board | |

| Na Jin | Shareholder, director, Chief Executive Officer (“CEO”) and Chief Financial Officer (“CFO”) |

Due to related parties:

| December 31, | December 31, | |||||||

| 2020 | 2019 | |||||||

| Shenzhen Wenchuan Gas Co., Ltd. | $ | 2,610,542 | $ | 2,446,750 | ||||

| Dongzhi Zhang | 433,034 | 414,714 | ||||||

| Rucheng County Minhang Special Gas Co., Ltd. | 53,138 | 49,804 | ||||||

| Na Jin | 121,892 | 100,376 | ||||||

| Jiannan Wu | 17,165 | 16,089 | ||||||

| $ | 3,235,771 | $ | 3,027,733 | |||||

Due to related parties were advances from its related parties for the Company’s purchase of equipment and daily operating expenses. The balances are unsecured, non-interest bearing, and payable on demand.

We have not adopted policies or procedures for approval of related person transactions but review them on a case-by-case basis. We believe that all related party transactions were on terms at least as favorable as we would have secured in arm’s-length transactions with third parties. Except as set forth above, we have not entered into any material transactions with any director, executive officer, and promoter, beneficial owner of five percent or more of our common stock, or family members of such persons.

Director Independence

We have not adopted a standard of independence nor do we have a policy with respect to independence requirements for our board members or that a majority of our board be comprised of “independent directors.” We will review the independence standard established by the OTC Markets Group in the future. Under Nasdaq Rule 5605(a)(2)(A), a director is not considered to be independent if he or she also is an executive officer or employee of the corporation. Under such definition, our directors would not be considered independent directors.

Except as otherwise indicated herein, there have been no other related party transactions, or any other transactions or relationships required to be disclosed pursuant to Item 404 and Item 407(a) of Regulation S-K.

18

| Item 14. | Principal Accounting Fees and Services |

On January 17, 2019, our independent auditor, Fruci & Associates II, PLLC (“FRUCI”) advised our Board in writing that they resigned as auditor of the Company.

On February 10, 2019, the Board approved and ratified the engagement of KCCW Accountancy Corp (“KCCW”) as its new independent registered public accounting firm. On April 9, 2019, the Company entered into an engagement with KCCW to retain KCCW as the Company’s independent public accounting firm.

For the fiscal year ended January 31, 2019, KCCW was our principal accountant. For the fiscal year ended January 31, 2018, FRUCI was our principal accountant.

The functions customarily delegated to an audit committee are performed by our full board of directors. Our board of directors approves in advance, all services performed by WWC, but have not adopted pre-approval policies or procedures. Our board of directors has considered whether the provision of non-audit services is compatible with maintaining the principal accountant’s independence, and has approved such services.

The following table sets forth fees billed by our auditors during the last two fiscal years for services rendered for the audit of our annual financial statements and the review of our quarterly financial statements, services by our auditors that are reasonably related to the performance of the audit or review of our financial statements and that are not reported as audit fees, services rendered in connection with tax compliance, tax advice and tax planning, and all other fees for services rendered.

| December 31, 2020 | December 31, 2019 | |||||||

| Audit fees | $ | 8,000 | $ | 40,000 | ||||

| Audit related fees | 15,000 | 11,800 | ||||||

| Tax fees | - | - | ||||||

| All other fees | - | - | ||||||

| Total | $ | 23,000 | $ | 51,800 | ||||

19

| Item 15. | Exhibits, Financial Statement Schedules. |

The following documents are filed as part of this report:

| (1) | Financial Statements |

Financial Statements are included in Part II, Item 8 of this report.

| (2) | Financial Statement Schedules |

No financial statement schedules are included because such schedules are not applicable, are not required, or because required information is included in the financial statements or notes thereto.

| (3) | Exhibits |

| * | Filed herewith. |

| ** | In accordance with Item 601(b)(32)(ii) of Regulation S-K and SEC Release No. 34-47986, the certifications furnished in Exhibits 32.1 and 32.2 herewith are deemed to accompany this Form 10-K and will not be deemed filed for purposes of Section 18 of the Exchange Act. Such certifications will not be deemed to be incorporated by reference into any filings under the Securities Act or the Exchange Act. |

| (1) | Incorporated by reference to the exhibits to the Registration Statement on Form S-1 filed with the Securities and Exchange Commission on March 3, 2016. |

| (2) | Incorporated by reference to Exhibit 3.1 to Current Report on Form 8-K filed with the Securities and Exchange Commission on May 25, 2018. |

| (3) | Incorporated by reference to Exhibit 4.1 to Annual Report on Form 10-K filed with the Securities and Exchange Commission on April 26, 2021. |

| (4) | Incorporated by reference to Exhibit 16.1 to Current Report on Form 8-K filed with the Securities and Exchange Commission on January 17, 2019. |

| ITEM 16. | FORM 10-K SUMMARY |

None.

20

Pursuant to the requirements of Section 13 or 15(d) of the Exchange Act, the Company has duly caused this report to be signed on its behalf by the undersigned, thereunto duly authorized.

| Dated: September 16, 2021 | Jialijia Group Corporation Limited. | |

| By: | /s/ Na Jin | |

| Name: | Na Jin | |

| Title: | Chief

Executive Officer, Chief Financial Officer and Director (Principal Executive and Financial Officer) | |

Pursuant to the requirements of the Securities Exchange Act of 1934, this report has been signed below by the following persons on behalf of the registrant and in the capacities and on the dates indicated.

| /s/ Na Jin | Director, Chief Executive Officer and | September 16, 2021 | ||

| Na Jin | Chief Financial Officer (Principal Executive Officer) |

|||

| /s/ Dongzhi Zhang | Chairman of the Board | September 16, 2021 | ||

| Dongzhi Zhang | ||||

| /s/ Jiannan Wu | Director | September 16, 2021 | ||

| Jiannan Wu |

21

F-1

REPORT OF INDEPENDENT REGISTERED PUBLIC ACCOUNTING FIRM

To the Board of Directors and Stockholders of

Jialijia Group Corporation Limited

Opinion on the Financial Statements

We have audited the accompanying consolidated balance sheets of Jialijia Group Corporation Limited (the “Company”) as of December 31, 2020 and 2019, the related consolidated statements of operations and comprehensive loss, changes in deficit, and cash flows for the years then ended, and the related notes (collectively referred to as the "consolidated financial statements"). In our opinion, the consolidated financial statements present fairly, in all material respects, the financial position of the Company at December 31, 2020 and 2019, and the results of its operations and its cash flows for the years ended December 31, 2020 and 2019, in conformity with the U.S. generally accepted accounting principles in the United States of America.

Going Concern

The accompanying consolidated financial statements have been prepared assuming that Jialijia Group Corporation Limited will continue as a going concern. As described in Note 4 to the consolidated financial statements, the Company has had accumulated deficit and is in need of additional capital to sustain its operations until it can become profitable. These factors raise substantial doubt about the Company’s ability to continue as a going concern. Management’s plans with regard to these matters are described in Note 4. The accompanying consolidated financial statements do not include any adjustments that might result from the outcome of this uncertainty.

Basis for Opinion

These consolidated financial statements are the responsibility of the Company’s management. Our responsibility is to express an opinion on the Company’s consolidated financial statements based on our audits. We are a public accounting firm registered with the Public Company Accounting Oversight Board (United States) (“PCAOB”) and are required to be independent with respect to the Company in accordance with the U.S. federal securities laws and the applicable rules and regulations of the Securities and Exchange Commission and the PCAOB.

We conducted our audits in accordance with the standards of the PCAOB. Those standards require that we plan and perform the audit to obtain reasonable assurance about whether the consolidated financial statements are free of material misstatement, whether due to error or fraud. The Company is not required to have, nor were we engaged to perform, an audit of its internal control over financial reporting. As part of our audits, we are required to obtain an understanding of internal control over financial reporting but not for the purpose of expressing an opinion on the effectiveness of the Company’s internal control over financial reporting. Accordingly, we express no such opinion.

Our audits included performing procedures to assess the risks of material misstatement of the consolidated financial statements, whether due to error or fraud, and performing procedures that respond to those risks. Such procedures included examining, on a test basis, evidence regarding the amounts and disclosures in the consolidated financial statements. Our audits also included evaluating the accounting principles used and significant estimates made by management, as well as evaluating the overall presentation of the consolidated financial statements. We believe that our audits provide a reasonable basis for our opinion.

Critical Audit Matters

Critical audit matters are matters arising from the current period audit of the consolidated financial statements that were communicated or required to be communicated to the audit committee and that: (1) relate to accounts or disclosures that are material to the consolidated financial statements and (2) involved our especially challenging, subjective, or complex judgments. We determined that there are no critical audit matters.

/s/ KCCW Accountancy Corp.

We have served as the Company’s auditor since 2019.

Diamond Bar, California

September 13, 2021

F-2

JIALIJIA GROUP CORPORATION LIMITED

CONSOLIDATED BALANCE SHEETS

| December 31, | December 31, | |||||||

| 2020 | 2019 | |||||||

| Assets | ||||||||

| Current Assets | ||||||||

| Cash and cash equivalents | $ | 13,933 | $ | 395 | ||||

| Advance to suppliers, net | - | - | ||||||

| Prepaid expenses and other current assets | 2,943 | 2,873 | ||||||

| Total Current Assets | 16,876 | 3,268 | ||||||

| Property, plant, and equipment, net | - | - | ||||||

| Total Assets | $ | 16,876 | $ | 3,268 | ||||

| Liabilities and Stockholders’ Deficit | ||||||||

| Current Liabilities | ||||||||

| Accrued expenses | $ | 108,903 | $ | 61,818 | ||||

| Due to related parties | 3,235,771 | 3,027,733 | ||||||

| Other current liabilities | 2,852 | 2,487 | ||||||

| Total Current Liabilities | 3,347,526 | 3,092,038 | ||||||

| Total Liabilities | 3,347,526 | 3,092,038 | ||||||

| Deficit | ||||||||

| Common stock, $.001 par value, 1,000,000,000 shares authorized, 647,705 and 635,296 shares issued and outstanding at December 31, 2020 and 2019, respectively | 647 | 635 | ||||||

| Additional paid-in capital | 2,609,532 | 2,602,099 | ||||||

| Subscription receivable | - | (7,821 | ) | |||||

| Treasury stock | (120,000 | ) | (120,000 | ) | ||||

| Accumulated deficit | (4,875,603 | ) | (4,806,088 | ) | ||||

| Accumulated other comprehensive (loss) income | (112,951 | ) | 19,615 | |||||

| Total Stockholders’ Deficit | (2,498,375 | ) | (2,311,560 | ) | ||||

| Noncontrolling interests | (832,275 | ) | (777,210 | ) | ||||

| Total Deficit | (3,330,650 | ) | (3,088,770 | ) | ||||

| Total Liabilities and Deficit | $ | 16,876 | $ | 3,268 | ||||

The accompanying notes are an integral part of these financial statements

F-3

JIALIJIA GROUP CORPORATION LIMITED

CONSOLIDATED STATEMENTS OF OPERATIONS AND COMPREHENSIVE LOSS

| For the Year Ended | ||||||||

| December 31, | ||||||||

| 2020 | 2019 | |||||||

| Net revenue | $ | - | $ | - | ||||

| Cost of revenue | - | - | ||||||

| Gross profit | - | - | ||||||

| General and administrative expenses | 72,384 | 603,336 | ||||||

| Goodwill impairment | - | 3,962,424 | ||||||

| Fixed assets impairment | - | 341,797 | ||||||

| Total operating expense | 72,384 | 4,907,557 | ||||||

| Loss from operations | (72,384 | ) | (4,907,557 | ) | ||||

| Provision for income tax | - | - | ||||||

| Net loss | (72,384 | ) | (4,907,557 | ) | ||||

| Net loss attributable to noncontrolling interest | (2,869 | ) | (192,293 | ) | ||||

| Net loss attributable to the Jialijia Group Corporation Ltd. | (69,515 | ) | (4,715,264 | ) | ||||

| Net loss | (72,384 | ) | (4,907,557 | ) | ||||

| Other comprehensive income (loss): | ||||||||