Attached files

| file | filename |

|---|---|

| 8-K - FORM 8-K - Home Federal Bancorp, Inc. of Louisiana | form8k.htm |

Exhibit 99.1

A Better way

Disclaimer This presentation includes forward-looking statements within the meaning of the Private

Securities Litigation Reform Act of 1995, including those identified by the words “may,” “will,” “should,” “could,” “anticipate,” “believe,” “continue,” “estimate,” “expect,” “forecast,” “intend,” “focused,” “plan,” “potential,” or “project” and

similar expressions. These forward-looking statements are subject to known and unknown risks, uncertainties and other factors that could cause the actual results to differ materially from the statements, including, but not limited to: (i)

deterioration in the financial condition of borrowers resulting in significant increases in loan losses and provisions for those losses; (ii) continuation of the historically low short-term interest rate environment; (iii) the inability of Home

Federal to maintain the historical growth rate with respect to its loans or deposits; (iv) changes in loan underwriting, credit review or loss reserve policies associated with economic conditions, examination conclusions, or regulatory

developments; (v) effectiveness of Home Federal’s asset management activities in improving, resolving or liquidating lower-quality assets; (vi) increased competition with other financial institutions; (vii) greater than anticipated adverse

conditions in the national or local economies including the Shreveport MSA, particularly in commercial and residential real estate markets; (viii) rapid fluctuations or unanticipated changes in interest rates on loans or deposits; (ix) the

results of regulatory examinations; (x) the ability to retain large, uninsured deposits; (xi) a merger or acquisition; (xii) risks of expansion into new geographic or product markets; (xiii) reduced ability to attract additional employees (or

failure of such employees to cause their clients to switch their banking relationship to Home Federal), to retain employees or otherwise to attract customers from other financial institutions; (xiv) further deterioration in the valuation of other

real estate owned and increased expenses associated therewith; (xv) inability to comply with regulatory capital requirements, including those resulting from changes to capital calculation methodologies and required capital maintenance levels;

(xvi) risks associated with litigation, including the applicability of insurance coverage; (xvii) the vulnerability of Home Federal network and online banking portals to unauthorized access, computer viruses, phishing schemes, spam attacks, human

error, natural disasters, power loss and other security breaches; (xviii) the possibility of increased compliance costs as a result of increased regulatory oversight; (xix) the development of additional banking products for Home Federal’s

corporate and consumer clients; and (xx) changes in state and federal legislation, regulations or policies applicable to banks and other financial service providers, including regulatory or legislative developments. Any projections of future

results of operations included herein are based on a number of assumptions, many of which are outside Home Federal’s control and should not be construed in any manner as a guarantee that such results will in fact occur. These projections are

subject to change and could differ materially from final reported results. This presentation utilizes call report data for Home Federal Bank, which is different from the consolidated financial statements of Home Federal Bancorp, Inc. of

Louisiana.Non-GAAP Financial MattersThis presentation also contains certain non-GAAP financial measures. These non-GAAP financial measures exclude other real estate owned expenses, net of sale proceeds and gains or losses on sale of securities.

The presentation of the non-GAAP financial information is not intended to be considered in isolation or as a substitute for any measure prepared in accordance with GAAP. Because non-GAAP financial measures presented in this presentation are not

measurements determined in accordance with GAAP and are susceptible to varying calculations, these non-GAAP financial measures, as presented, may not be comparable to other similarly titled measures presented by other companies. You are

encouraged to review the comparable GAAP measures included in this presentation.

2.16%Dividend yield as of 9/3/2021 9.94%Deposit growth since 6/30/20 Home Federal Bancorp, Inc. (“Home

Federal” or the “Company”) is the holding company for Home Federal Bank, which was founded in 1924The Company trades on the NASDAQ under the symbol “HFBL”Home Federal has made recent strategic hires in the Shreveport-Bossier City MSA to

accelerate the commercial loan division’s growthThe Company has strong insider ownership of 18% Overview of Home Federal Bancorp, Inc. Key Stats Commentary $566MTotal Assets as of 6/30/21 118%P / TBV as of 9/3/2021 67%Loan and deposit

ratio as of 6/30/21 60.54%LTM efficiency ratio 3.31%2021 FY net interest margin $325MCore Loans as of 6/30/21 Note: Market data as of September 3, 2021Source: S&P Capital IQ Pro HFBL 1-Year Price Performance

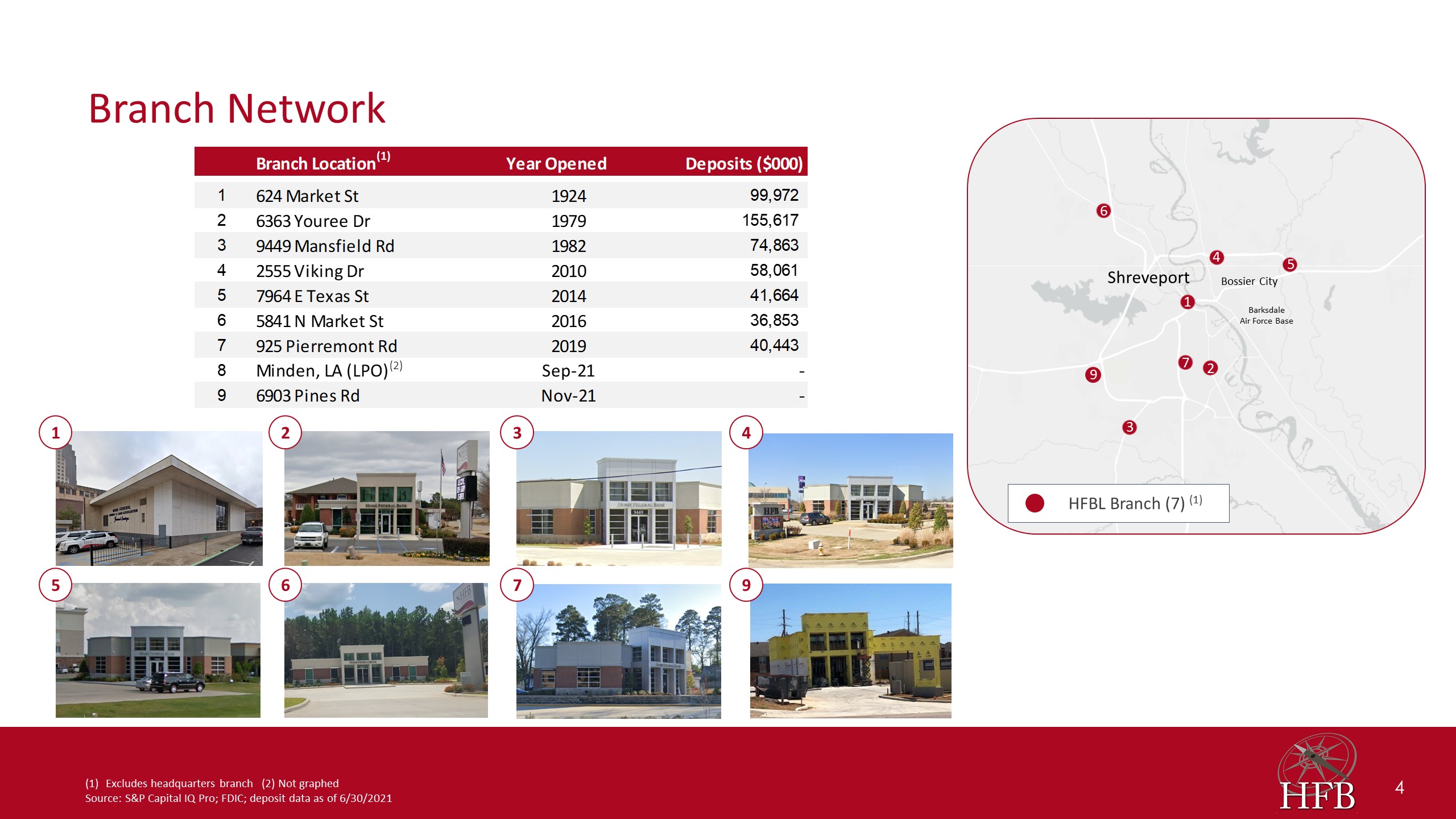

Shreveport Barksdale Air Force Base Bossier City 3 7 6 2 4 5 1 HFBL Branch (7)

(1) 9 Excludes headquarters branch (2) Not graphed Source: S&P Capital IQ Pro; FDIC; deposit data as of 6/30/2021 Branch Network (2) 1 2 3 4 5 6 7 9

HFBL Executive Management James R. “Jim” Barlow – Chairman, President & Chief Executive Officer Mr.

James R. Barlow, also known as Jim, has been the Chief Executive Officer of Home Federal Bank, Inc. of Louisiana since January 1, 2013. Mr. Barlow has served as the Chairman of Home Federal Bancorp and Home Federal Bank since January 2020. He

served as Chief Operating Officer of Home Federal Bank from February 2009 until December 2012. He served as an Executive Vice President and Area Manager of the Arkansas-Louisiana-Texas area commercial real estate operations of Regions Bank from

August 2006 to February 2009. From 2005 to August 2006, Mr. Barlow served as Regions Bank City President for the Shreveport/Bossier area and from February 2003 to 2005, he served as Commercial Loan Manager for Regions Bank for the

Shreveport/Bossier area. He served on the Louisiana Banker’s Association Board of Directors from 2015-2018. He began his time at Regions Bank back in 1997. Mr. Barlow brings substantial managerial, banking and lending experience to the board, as

well as significant knowledge of the local commercial real estate market from his years of service as manager and regional President of a regional bank. Glen W. Brown – Senior Vice President & Chief Financial Officer Mr. Glen W. Brown,

C.P.A., has been the Chief Financial Officer and Senior Vice President of Home Federal Bancorp, Inc. of Louisiana and Home Federal Bank since July 2014. Mr. Brown has many years of banking experience and public company reporting experience.

Previously, he served as Vice President and Controller for Teche Federal Bank, the wholly owned subsidiary of Teche Holding Company from 1997 until 2014. Prior to joining Teche, Mr. Brown spent 19 years in various accounting and finance roles

with First Federal Bank in Lake Charles, Louisiana. Mr. Brown is a certified public accountant licensed in the state of Louisiana. He graduated from Northeast Louisiana University, earning a Bachelor of Science degree in business administration

and accounting. Source: S&P Capital IQ Pro K. Matthew “Matt” Sawrie – Senior Vice President Commercial Banking Mr. K. Matthew Sawrie has served as Senior Vice President Commercial Lending of Home Federal Bank since February 2009. Prior

thereto, Mr. Sawrie served as Vice President Commercial Real Estate, Regions Bank from 2006 to 2009, and previously, Assistant Vice President Business Banking Relationship Manager, Regions Bank from 2003 to 2006. Mr. Sawrie started in banking in

2000 with Bank One (now Chase Bank) as a Retail Banking Center Manager, until he joined Regions Bank in 2003. He graduated from Northeast Louisiana University, earning a Bachelor of Business Administration degree in management.

2021 2-for-1 stock split declared in March of 2021 2019 2021 2020 The Company announces plans to buy

back shares in November of 2020 2019The Company celebrates its 95th anniversary 2019The Company opened a state-of-the-art banking facility in the heart of Shreveport 2019The Company announces plans to buy back shares in September of

2019 2020 2020Upgraded core banking system to best in class digital platform 2020The Company crosses $500 million in assets Corporate Time Line 2011 2011The Company becomes listed on the NASDAQ exchange in May 2011 2021

The Company announces opening of a loan production office in Minden, Louisiana 2009 2009Completed transition and rebranded from a Savings & Loan to a Bank

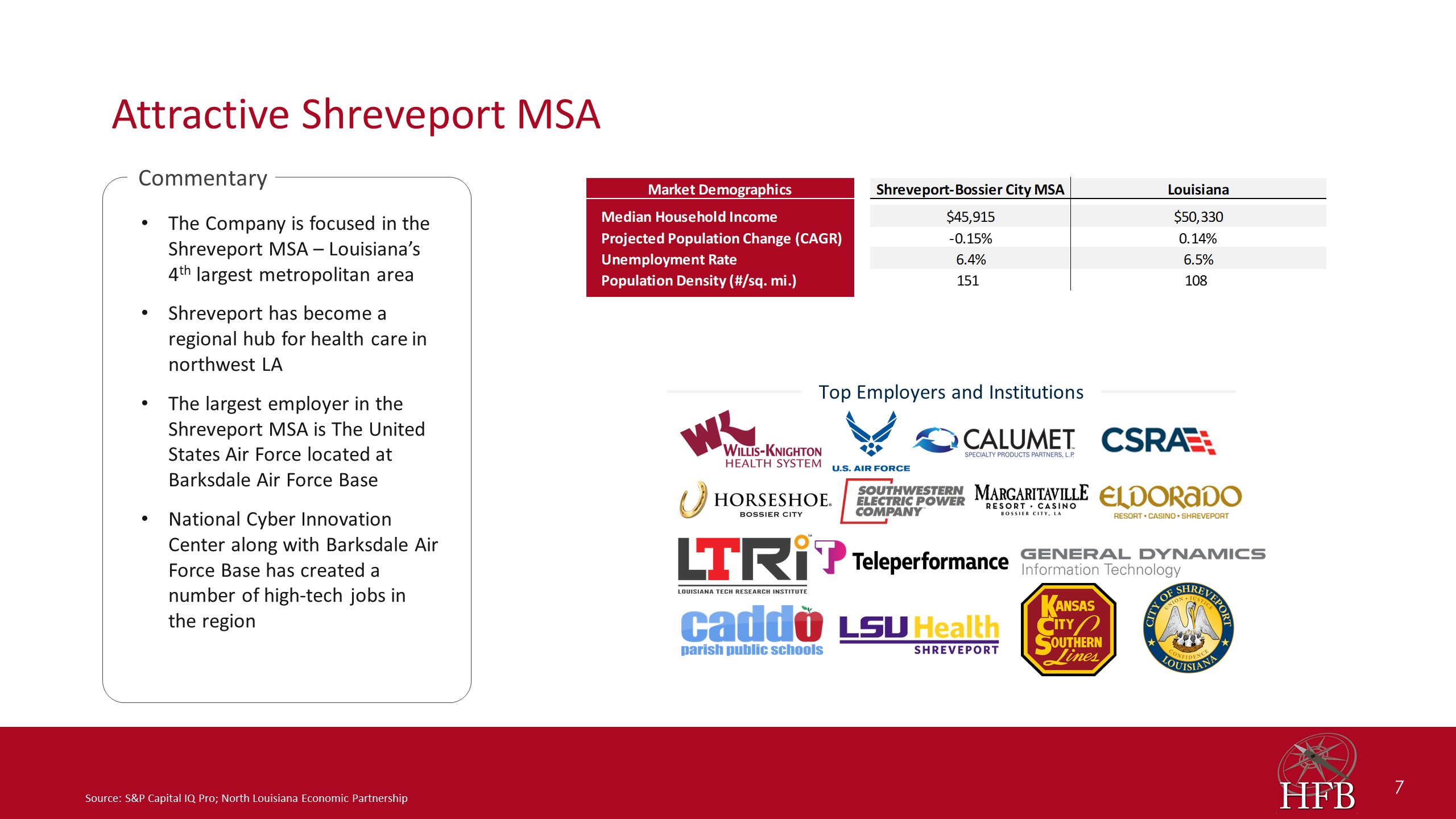

Top Employers and Institutions Attractive Shreveport MSA Commentary The Company is focused in the

Shreveport MSA – Louisiana’s 4th largest metropolitan areaShreveport has become a regional hub for health care in northwest LAThe largest employer in the Shreveport MSA is The United States Air Force located at Barksdale Air Force BaseNational

Cyber Innovation Center along with Barksdale Air Force Base has created a number of high-tech jobs in the region Source: S&P Capital IQ Pro; North Louisiana Economic Partnership

Recent Transactions in Market Louisiana bank sale announcements Recent Market Disruption Source: S&P

Capital IQ Pro Target Acquirer Commentary There have been several significant bank mergers in Home Federal’s marketsThe sale of IberiaBank to First Horizon is the most significant, and the bank signs are due to change in 2022Capital One

has also been closing branches, creating another growth opportunity

Balance Sheet Growth Home Federal is looking to create more loan diversity in their portfolio by pursuing

less interest sensitive verticalsThis has led to an increase in origination of higher yielding commercial loansRecent deposit growth has been boosted by PPP loans from the COVID-19 pandemic Source: S&P Capital IQ Pro CAGR: 8.2% c 9

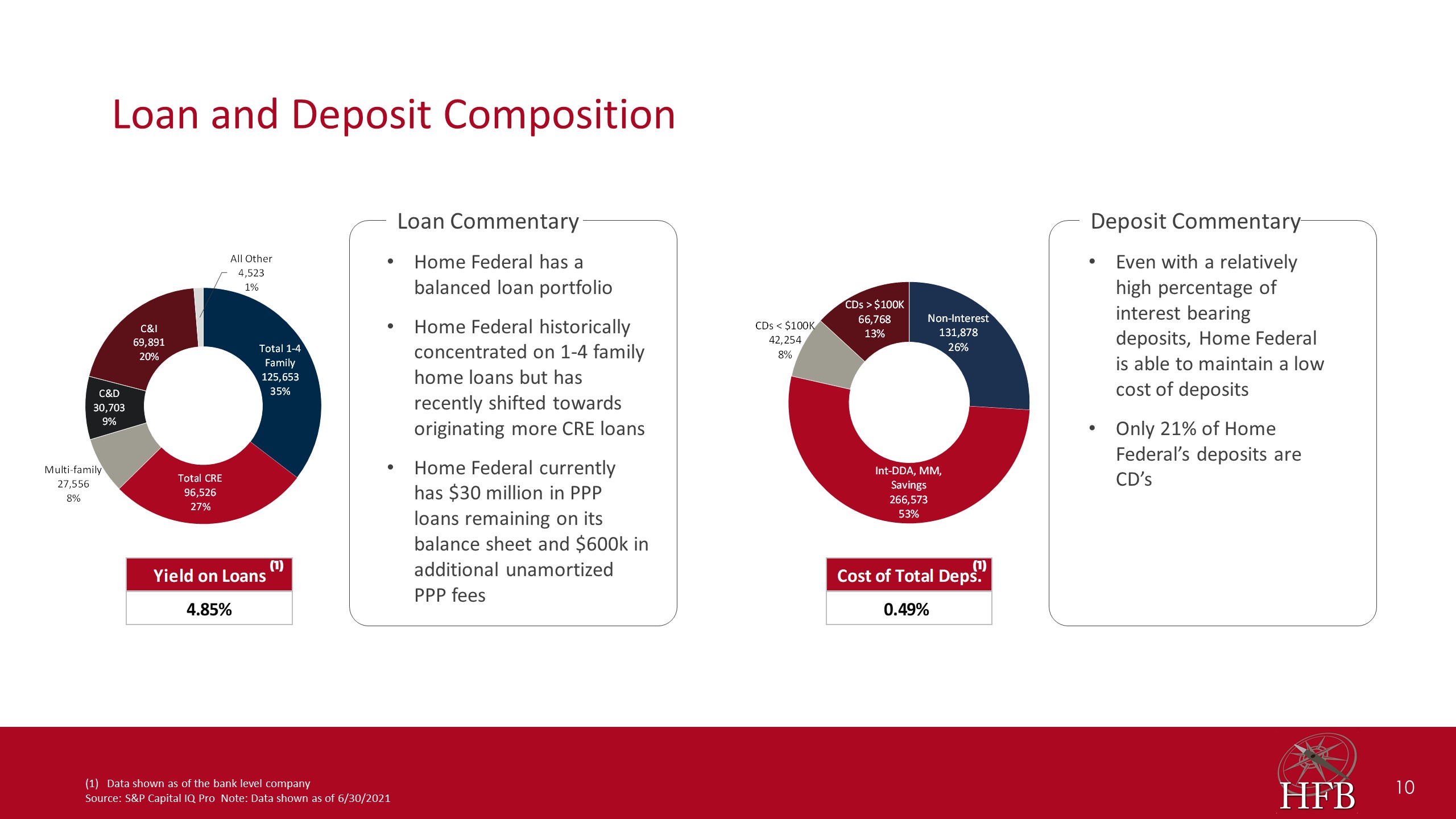

d Loan and Deposit Composition Loan Commentary Deposit Commentary Home Federal has a balanced loan

portfolioHome Federal historically concentrated on 1-4 family home loans but has recently shifted towards originating more CRE loansHome Federal currently has $30 million in PPP loans remaining on its balance sheet and $600k in additional

unamortized PPP fees Even with a relatively high percentage of interest bearing deposits, Home Federal is able to maintain a low cost of depositsOnly 21% of Home Federal’s deposits are CD’s (1) Data shown as of the bank level companySource:

S&P Capital IQ Pro Note: Data shown as of 6/30/2021 (1) (1)

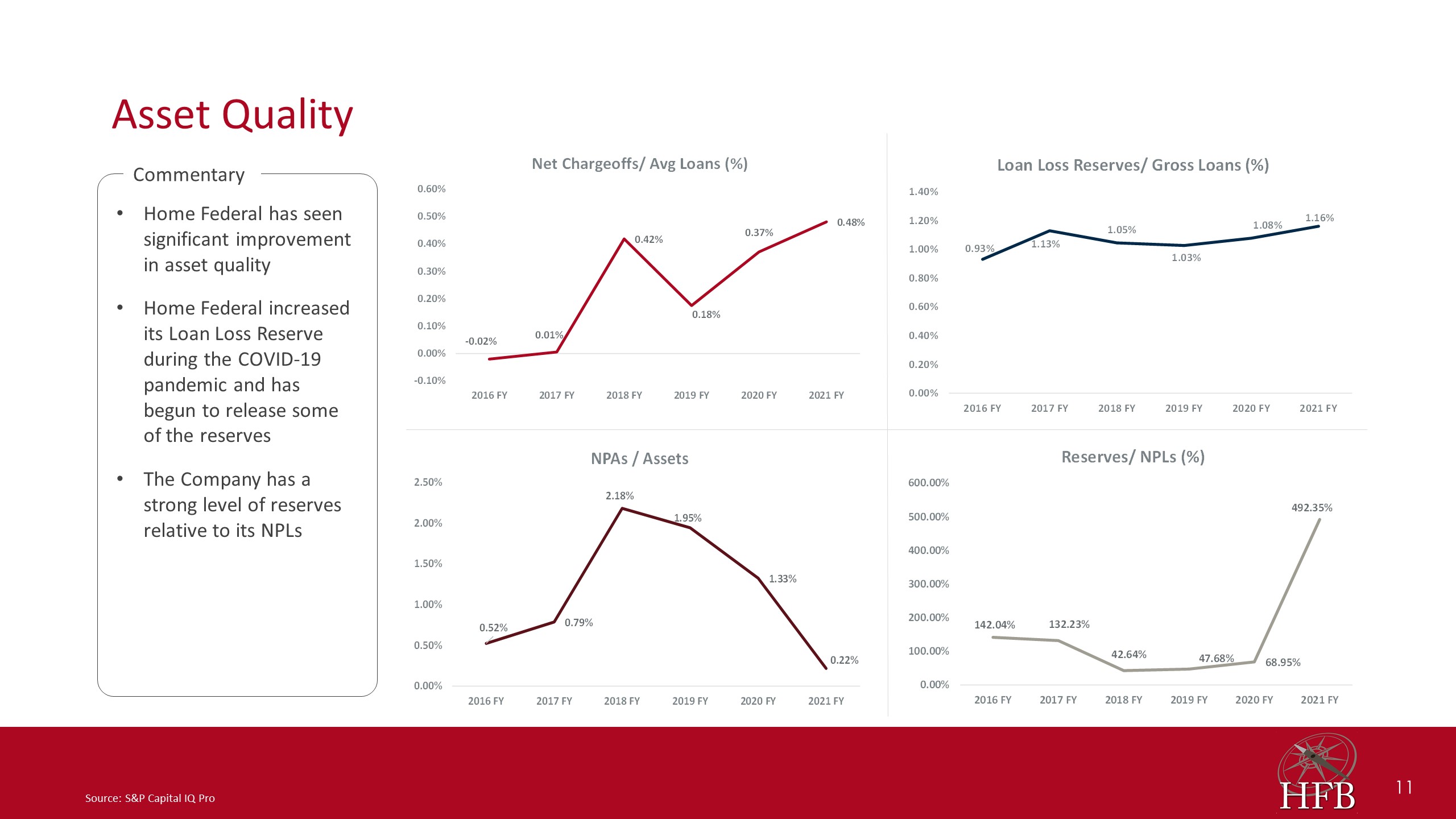

Asset Quality Source: S&P Capital IQ Pro Commentary Home Federal has seen significant improvement

in asset quality Home Federal increased its Loan Loss Reserve during the COVID-19 pandemic and has begun to release some of the reservesThe Company has a strong level of reserves relative to its NPLs

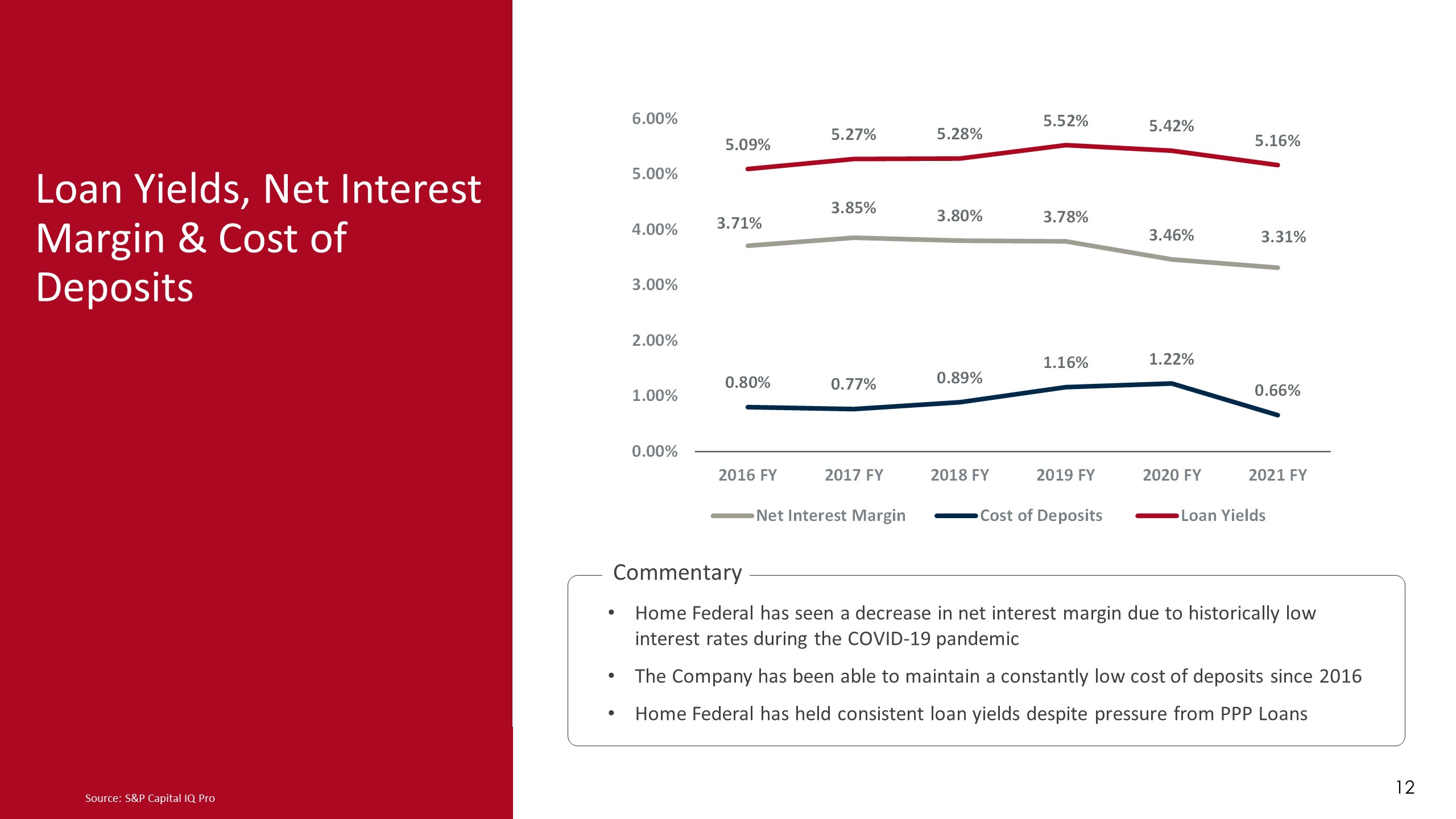

Loan Yields, Net Interest Margin & Cost of Deposits Source: S&P Capital IQ Pro 12

Commentary Home Federal has seen a decrease in net interest margin due to historically low interest rates during the COVID-19 pandemicThe Company has been able to maintain a constantly low cost of deposits since 2016Home Federal has held

consistent loan yields despite pressure from PPP Loans

Profitability – ROAA, ROATCE & PPNR / AA Commentary Home Federal has maintained relatively stable

levels of profitability throughout the pandemic Note: PPNR and Tangible Common Equity are non-GAAP metrics, see Appendix for reconciliationSource: S&P Capital IQ Pro

Profitability – EPS, TBV & Dividends Per Share Commentary Tangible book value per share has

continued to growEPS is at record levelsHome Federal recently increased their quarterly dividend from $0.08 to $0.10, driving stronger shareholder returnsHome Federal has had 16 years of annual dividends with dividend increases in 7 consecutive

years Note: Tangible Book Value Per Share is a non-GAAP metric, see Appendix for reconciliationSource: S&P Capital IQ Pro

c Capital Position Home Federal maintains a strong capital position Home Federal currently has no

subordinated debt or trust preferred securities in their capital structure 15

Key Investment Considerations Home Federal is continuing to reposition its loan portfolio to pursue higher

yield commercial loans in order to achieve higher profitability The Company is entrenched in the Shreveport community, creating a strong core customer baseHome Federal’s commitment to opening new branches in the Shreveport MSA will allow for

continued growth in future periodsStrong alignment with shareholders evidenced by high inside ownership Home Federal has a solid track record of returning capital to shareholders through dividends and repurchasesHome Federal’s recent expansion

into Minden and recent hires in Shreveport-Bossier should accelerate loan growth c 16

Appendix Draft – Not for External Distribution Appendix

Summary Financials Source: S&P Capital IQ Pro c 18 Summary Financials

Non-GAAP Reconciliation Source: S&P Capital IQ Pro