Attached files

| file | filename |

|---|---|

| 8-K - 8-K - GAP INC | gps-20210826.htm |

| EX-99.1 - EX-99.1 - GAP INC | q22021eprexhibit991.htm |

Gap Inc. Fiscal 2021 Katrina O’Connell CHIEF FINANCIAL OFFICER Sonia Syngal CHIEF EXECUTIVE OFFICER SECOND QUARTER EARNINGS RESULTS Exhibit 99.2

Forward Looking Statements / Non-GAAP Financial Measures FORWARD LOOKING STATEMENTS This conference call and webcast contain forward-looking statements within the "safe harbor" provisions of the Private Securities Litigation Reform Act of 1995. All statements other than those that are purely historical are forward-looking statements. Forward-looking statements include statements identified as such in our August 26, 2021 press release. Because these forward-looking statements involve risks and uncertainties, there are important factors that could cause our actual results to differ materially from those in the forward-looking statements. Additional information regarding factors that could cause results to differ can be found in the Company's Annual Report on Form 10-K for the fiscal year ended January 30, 2021, as well as the Company’s subsequent filings with the Securities and Exchange Commission. These forward-looking statements are based on information as of August 26, 2021. We assume no obligation to publicly update or revise our forward-looking statements even if experience or future changes make it clear that any projected results expressed or implied therein will not be realized. SEC REGULATION G This presentation includes the non-GAAP measures free cash flow, adjusted operating expenses, adjusted operating income, adjusted operating margin, adjusted earnings per share, and adjusted expected earnings per share. The description and reconciliation of these measures from GAAP is included in our August 26, 2021 earnings press release, which is available on investors.gapinc.com.

We grow purpose-led, billion-dollar lifestyle brands

Power Plan 2023 Power of our Brands Grow purpose-led, billion-dollar lifestyle brands Power of our Platform Leverage our omni capabilities and scaled operations, and extend our engineered approach to cost and growth Power of our Portfolio Extend customer reach across every age, body and occasion through our collective power

Q2 2021 Financial Highlights • Record Q2 Sales of $4.2B were up 29% versus 2020 and up 5% versus 2019 o Strategic store closures and divestitures reduced net sales by ~8% and COVID-related closures resulted in an estimated 2% sales decline versus 2019 • Comparable sales up 3% versus 2020 and up 12% versus 2019 • Operating Margin of ~10% reflected improved Gross Margin and meaningful progress toward our Power Plan 2023 financial targets • Raised full year guidance for sales, operating margin, and earnings per share

Q2 2021 P&L Summary (REPORTED) Q2 2021 Q2 2020 Q2 2021 vs. Q2 2020 Q2 2019 (2) Q2 2021 vs. Q2 2019 Net Sales $4,211 $3,275 +29% $4,005 +5% Gross Profit % of Sales $1,823 43.3% $1,149 35.1% +59% +820 bps $1,556 38.9% +17% +440 bps Merchandise Margin B/(W) ROD % of Sales B/(W) +380 bps +440 bps +110 bps +330 bps Operating Expenses % of Sales $1,414 (1) 33.6% $1,076 32.9% +31% +70 bps $1,274 31.8% +11% +180 bps Operating Income (Loss) % of Sales $409 9.7% $73 2.2% +460% +750 bps $282 7.0% +45% +270 bps Net Income (Loss) Diluted EPS $258 $0.67 ($62) ($0.17) n/a n/a $168 $0.44 +54% +52% ($ Millions) (1) Includes $19 million of charges primarily related to changes in the company’s European operating model. (2) Second quarter of fiscal 2019 information provided for comparability.

Q2 2021 P&L Summary (ADJUSTED) ($ Millions) (1) The description and reconciliation of these measures from GAAP is included in our August 26, 2021 earnings press release, which is available on investors.gapinc.com. (2) Second quarter of fiscal 2019 information provided for comparability. Q2 2021 Q2 2020 Q2 2021 vs. Q2 2020 Q2 2019 (2) Q2 2021 vs. Q2 2019 Net Sales $4,211 $3,275 +29% $4,005 +5% Gross Profit % of Sales $1,823 43.3% $1,149 35.1% +59% +820 bps $1,556 38.9% +17% +440 bps Merchandise Margin B/(W) ROD % of Sales B/(W) +380 bps +440 bps +110 bps +330 bps Adjusted Operating Expenses % of Sales $1,395 (1) 33.1% (1) $1,076 32.9% +30% +20 bps $1,222 (1) 30.5% (1) +14% +260 bps Adjusted Operating Income (Loss) % of Sales $428 (1) 10.2% (1) $73 2.2% +485% +800 bps $334 (1) 8.3% (1) +28% +190 bps Adjusted Net Income (Loss) Adjusted Diluted EPS $272 (1) $0.70 (1) ($62) ($0.17) n/a n/a $238 (1) $0.63 (1) +14% +11%

+28%+27% Q2 2021 Net Sales Growth +75%+24%+29% +21% (15%)(10%)+5% +35% vs. FY20 vs. FY19 Note: Due to the significant impact of COVID-related store closures last year, comparisons for the second quarter of 2019 are also included.

Q2 2021 Comparable Sales +0% +41%(5%)+3% +13% +18% (5%)+3%+12% +27% vs. FY20 vs. FY19 Note: Due to the significant impact of COVID-related store closures last year, comparisons for the second quarter of 2019 are also included. North America Comp vs. FY19: +12%

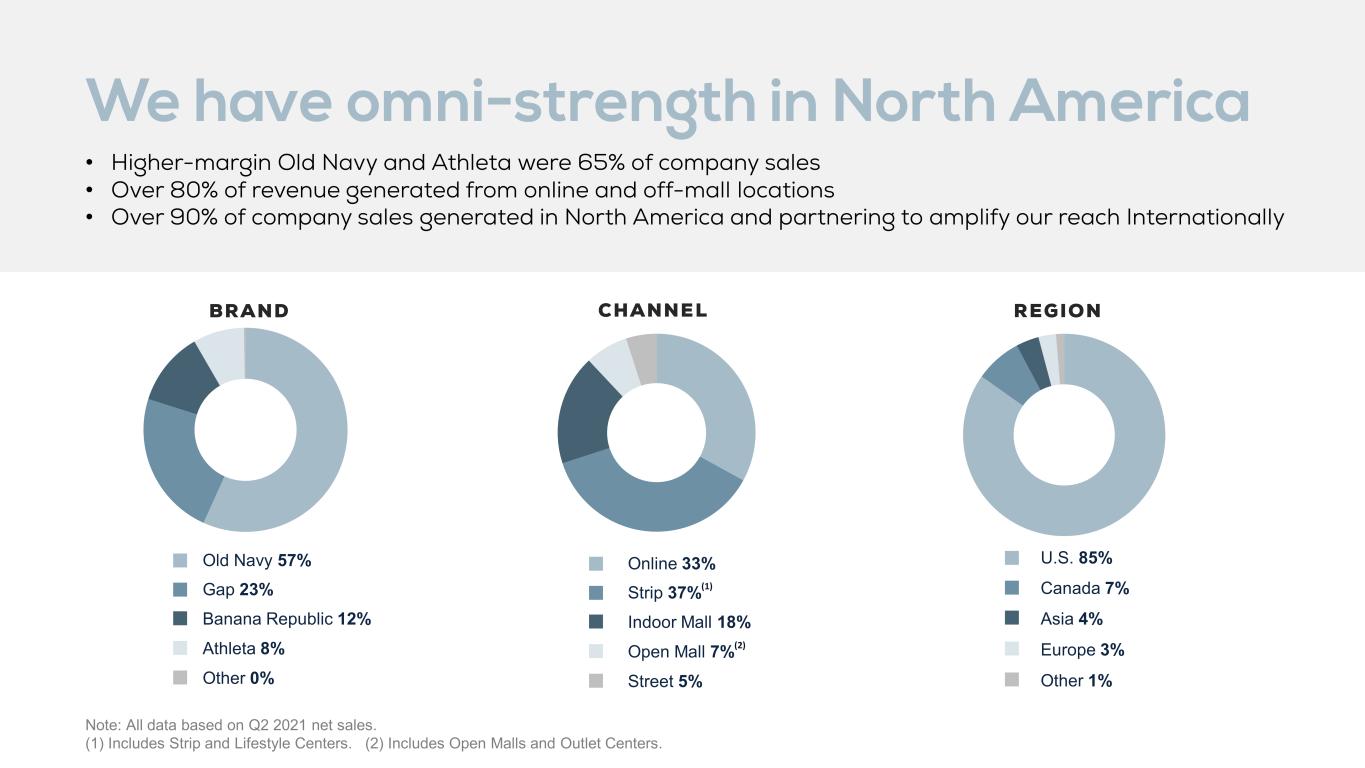

BRAND CHANNEL REGION Note: All data based on Q2 2021 net sales. (1) Includes Strip and Lifestyle Centers. (2) Includes Open Malls and Outlet Centers. • Higher-margin Old Navy and Athleta were 65% of company sales • Over 80% of revenue generated from online and off-mall locations • Over 90% of company sales generated in North America and partnering to amplify our reach Internationally ■ Old Navy 57% ■ Gap 23% ■ Banana Republic 12% ■ Athleta 8% ■ Other 0% ■ U.S. 85% ■ Canada 7% ■ Asia 4% ■ Europe 3% ■ Other 1% We have omni-strength in North America ■ Online 33% ■ Strip 37%(1) ■ Indoor Mall 18% ■ Open Mall 7%(2) ■ Street 5%

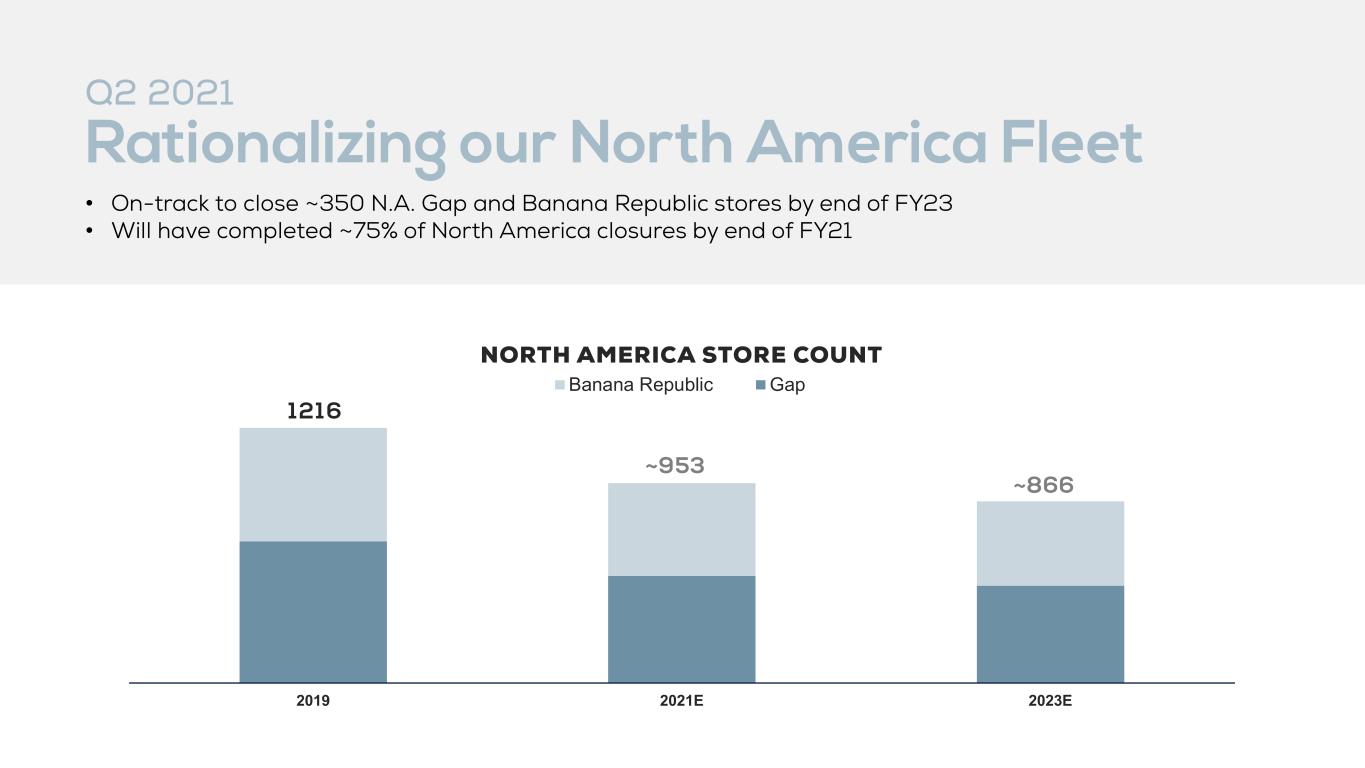

• On-track to close ~350 N.A. Gap and Banana Republic stores by end of FY23 • Will have completed ~75% of North America closures by end of FY21 Q2 2021 Rationalizing our North America Fleet 121 6 ~953 ~866 2019 2021E 2023E NORTH AMERICA STORE COUNT Banana Republic Gap

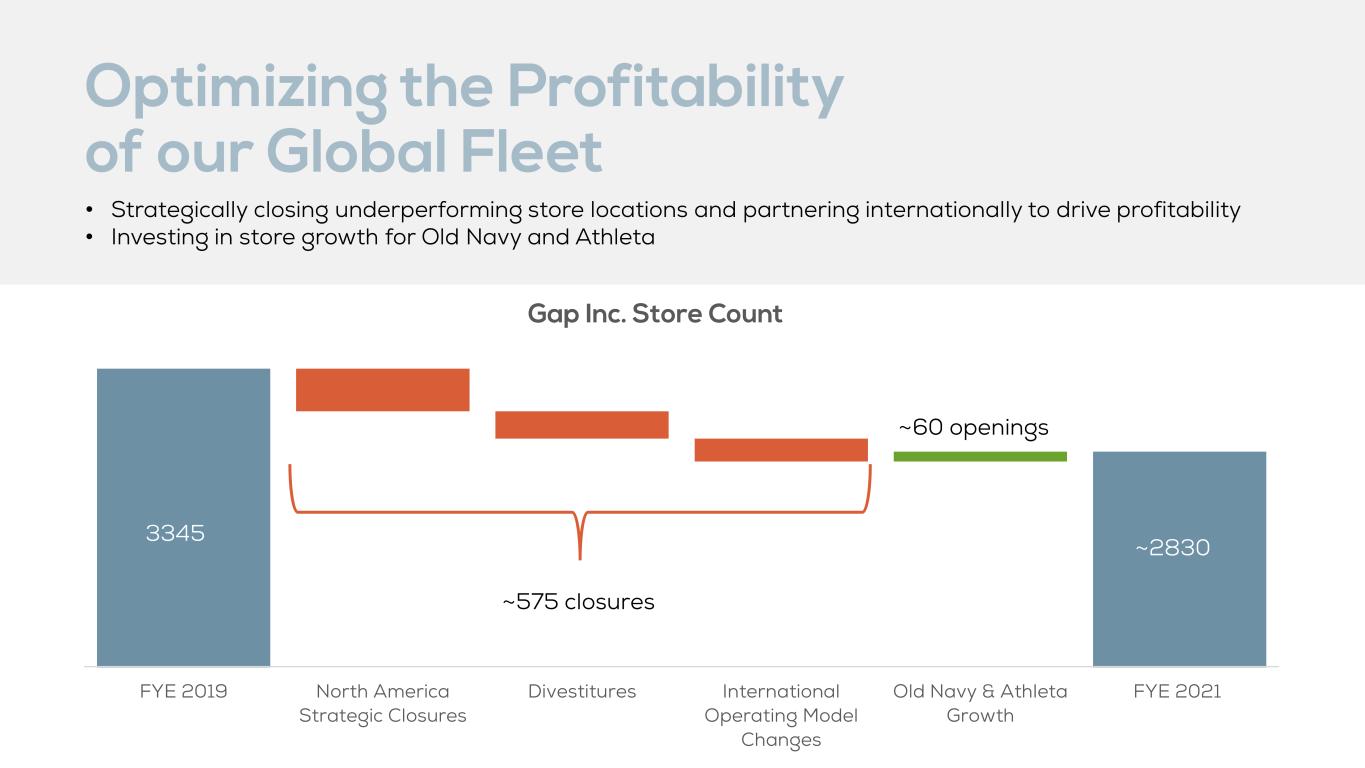

Optimizing the Profitability of our Global Fleet FYE 2019 North America Strategic Closures Divestitures International Operating Model Changes Old Navy & Athleta Growth FYE 2021 Gap Inc. Store Count 3345 ~2830 ~575 closures ~60 openings • Strategically closing underperforming store locations and partnering internationally to drive profitability • Investing in store growth for Old Navy and Athleta

Improving Value by Turning Customers into Lifetime Loyalists members of our integrated loyalty program (2) ~65 active customers globally as of the end of Q2 2021 (1) (1) Refers to total number of customers who have made a purchase in the past 12 months. (2) Includes credit card holders. MILLION 40+ MILLION

11.2B liters of water saved in manufacturing since 2017 65% diversion rate of plastic waste across stores and distribution centers 59% cotton sourced from more sustainable sources in 2020 E N V I R O N M E N T A L Commitment to Environmental, Social & Governance Performance S O C I A L 1st Gap Inc. Equality + Belonging Report released to share progress on 2025 Commitments Annual Global Sustainability Report with SASB disclosure since 2018 Regular Board & Committee Oversight including Governance and Sustainability Committee G O V E R N A N C E 5 of 12 Directors are women >800k Women & Girls reached through P.A.C.E. program 10K jobs provided to underserved youth through This Way ONward; halfway to the goal of 20K jobs by 2025

Accelerating Growth Through: • Strategic Category Expansion • Building Customer Lifetime Value • Digital Transformation Fueling our Future

AS OF AUG. 26, 2021 Diluted Earnings per Share $1.90 - $2.05 Adjusted Diluted Earnings per Share (1) $2.10 - $2.25 Net Sales Growth (2) About 30% Operating Margin About 7% Adjusted Operating Margin (1) About 7.5% Effective Tax Rate About 25% Adjusted Effective Tax Rate (1) About 26% Capital Expenditures About $800 million (1) Excludes one-time charges associated with divestiture activity related to Janie & Jack and Intermix, as well as estimated charges related to strategic changes in the company’s European business. (2) This outlook reflects lost revenue related to the company’s decision to change its European operating model, as well as the completed divestitures of its Janie & Jack and Intermix businesses. Q2 2021 Fiscal 2021 Outlook