Attached files

| file | filename |

|---|---|

| EX-1.1 - EX-1.1 - Sabre Corp | d169865dex11.htm |

| 8-K - 8-K - Sabre Corp | d169865d8k.htm |

Exhibit 5.1

D: +1 212 225 2632

dlopez@cgsh.com

August 19, 2021

Sabre Corporation

3150 Sabre Drive

Southlake, Texas 76092

Ladies and Gentlemen:

We have acted as special counsel to Sabre Corporation, a Delaware corporation (the “Company”), in connection with its proposed offering pursuant to a registration statement on Form S-3 (No. 333-255669), as amended as of its most recent effective date (August 19, 2021), insofar as it relates to the Securities (as defined below) (as determined for purposes of Rule 430B(f)(2) under the Securities Act of 1933, as amended (the “Securities Act”)) (as so amended, including the documents incorporated by reference therein, the “Registration Statement”), and the prospectus, dated April 30, 2021 (the “Base Prospectus”), as supplemented by the prospectus supplement thereto, dated August 19, 2021 (the “Prospectus Supplement” and, together with the Base Prospectus, the “Prospectus”), of up to $300,000,000 aggregate gross sales price, representing up to 30,000,000 shares, of the Company’s common stock, par value $0.01 per share (the “Securities”), under an “at-the-market” program (the “Program”).

In arriving at the opinion expressed below, we have reviewed the following documents:

| (a) | the Registration Statement; |

| (b) | the Prospectus; |

| (c) | an executed copy of the sales agreement relating to the Program dated August 19, 2021 (the “Sales Agreement”), among the Company and BofA Securities, Inc., Citigroup Global Markets Inc. and Mizuho Securities USA LLC, respectively; |

| (d) | copies of the Company’s Fourth Amended and Restated Certificate of Incorporation and Sixth Amended and Restated By-Laws certified by the Secretary of State of the State of Delaware and the corporate secretary of the Company, respectively. |

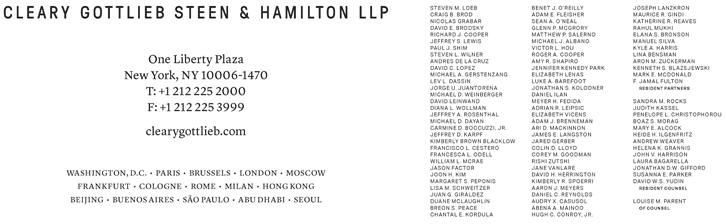

Cleary Gottlieb Steen & Hamilton LLP or an affiliated entity has an office in each of the cities listed above.

Recipient 2, p. 2

In addition, we have reviewed the originals or copies certified or otherwise identified to our satisfaction of all such corporate records of the Company and such other documents, and we have made such investigations of law, as we have deemed appropriate as a basis for the opinion expressed below.

In rendering the opinion expressed below, we have assumed the authenticity of all documents submitted to us as originals and the conformity to the originals of all documents submitted to us as copies. In addition, we have assumed and have not verified the accuracy as to factual matters of each document we have reviewed.

Based on the foregoing, and subject to the further assumptions and qualifications set forth below, it is our opinion that when issued, sold and paid for in accordance with the terms of the Sales Agreement, the Securities will be validly issued by the Company and fully paid and nonassessable.

In rendering the foregoing opinion, we have assumed the accuracy of, and compliance with, the representations, warranties and covenants contained in the Sales Agreement relating to the offer and sale of the Securities.

The foregoing opinion is limited to the General Corporation Law of the State of Delaware.

We hereby consent to the use of our name in the Prospectus Supplement under the heading “Legal Matters” as counsel for the Company that has passed on the validity of the Securities and to the filing of this opinion letter as Exhibit 5.1 to the Company’s Current Report on Form 8-K dated August 19, 2021. In giving such consent, we do not thereby admit that we are within the category of persons whose consent is required under Section 7 of the Securities Act or the rules and regulations of the Securities and Exchange Commission thereunder.

The opinion expressed herein is rendered on and as of the date hereof, and we assume no obligation to advise you or any other person, or to make any investigations as to any legal developments or factual matters arising subsequent to the date hereof that might affect the opinion expressed herein.

| Very truly yours, | ||

| CLEARY GOTTLIEB STEEN & HAMILTON LLP | ||

| By: | /s/ David Lopez | |

| David Lopez, a Partner | ||