Attached files

| file | filename |

|---|---|

| 8-K - 8-K - MANITOWOC CO INC | mtw-20210818.htm |

The Manitowoc Company, Inc. August 18, 2021

Forward-Looking Statements Safe Harbor Statement Any statements contained in this presentation that are not historical facts are “forward-looking statements.” These statements are based on the current expectations of the management of the Company, only speak as of the date on which they are made, and are subject to uncertainty and changes in circumstances. The Company undertakes no obligation to update or revise forward-looking statements, whether as a result of new information, future events, or otherwise. As a general matter, forward-looking statements are those focused upon anticipated events or trends, expectations and beliefs relating to matters that are not historical in nature. The words “could,” “should,” “feel,” “anticipate,” “aim,” “preliminary,” “expect,” “believe,” “estimate,” “intend,” “intent,” “plan,” “will,” “foresee,” “project,” “forecast,” or the negative thereof or variations thereon, and similar expressions identify forward-looking statements. By their nature, forward-looking statements are not guarantees of future performance or results and involve risks and uncertainties because they relate to events and depend on circumstances that will occur in the future. There are a number of factors that could cause actual results and developments to differ materially from those expressed or implied by such forward-looking statements. For a list of factors that could cause actual results to differ materially from those discussed or implied, please see the Company’s periodic filings with the SEC, particularly those disclosed in “Risk Factors” in the Company’s Annual Report on Form 10-K for the year ended December 31, 2020. Any “forward-looking statements” in this presentation are intended to qualify for the safe harbor from liability under the Private Securities Litigation Reform Act of 1995. Non-GAAP Measures Adjusted net income (loss), adjusted diluted net income (loss) per share, adjusted EBITDA, adjusted operating income (loss) and free cash flows are financial measures that are not in accordance with GAAP. For a reconciliation to the comparable GAAP numbers please see schedule of “Non-GAAP Financial Measures.” Manitowoc believes these non-GAAP financial measures provide important supplemental information to both management and investors regarding financial and business trends used in assessing its results of operations. Manitowoc believes excluding specified items provides a more meaningful comparison to the corresponding reporting periods and internal budgets and forecasts, assists investors in performing analysis that is consistent with financial models developed by investors and research analysts, provides management with a more relevant measure of operating performance and is more useful in assessing management performance.

The Manitowoc Company For over 100 years, Manitowoc has played an integral role in building the world of tomorrow through superior lifting technology and customer engagement

Vision & Mission

Values & Behaviors

Values & Behaviors: Safety

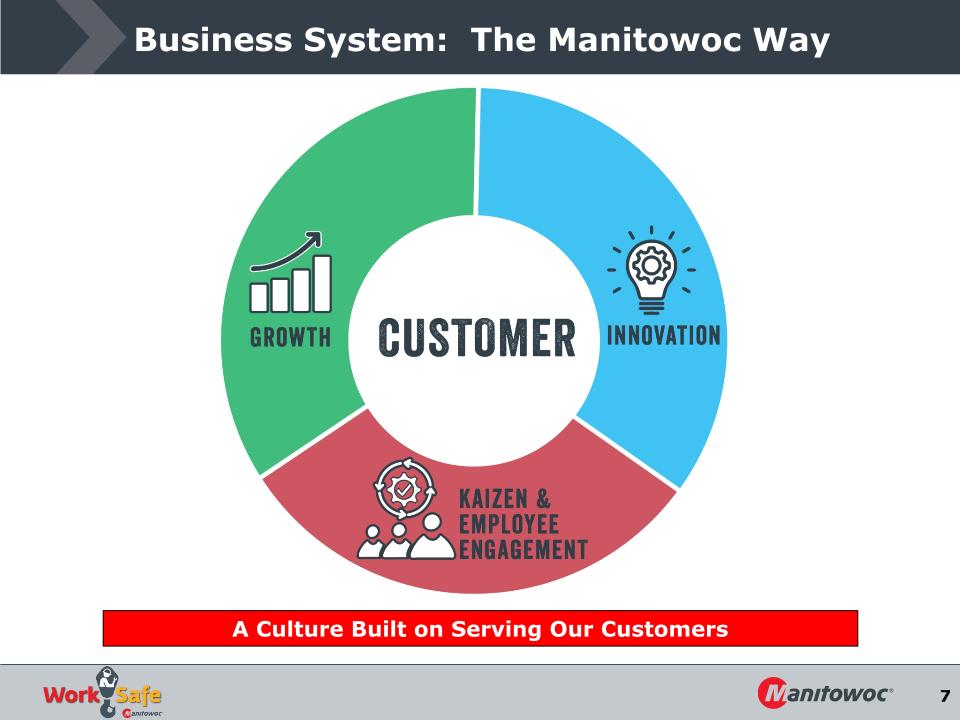

Business System: The Manitowoc Way A Culture Built on Serving Our Customers

The Manitowoc Way: Kaizen Key Initiatives: Safety Kaizen Activities Sales Training Priority Deployment ESG Mentoring & DEI Sustainability Employee Engagement through Continuous Improvement

The Manitowoc Way: Innovation Launched 60+ New Models Over Last 5 Years

The Manitowoc Way: Growth Priorities Grow Tower Crane Rental & Aftermarket business in Europe Build out China and Belt & Road Tower Crane Business Accelerate New Product Development in All-Terrain Cranes Expand Aftermarket activities in North America Investing in Future Growth

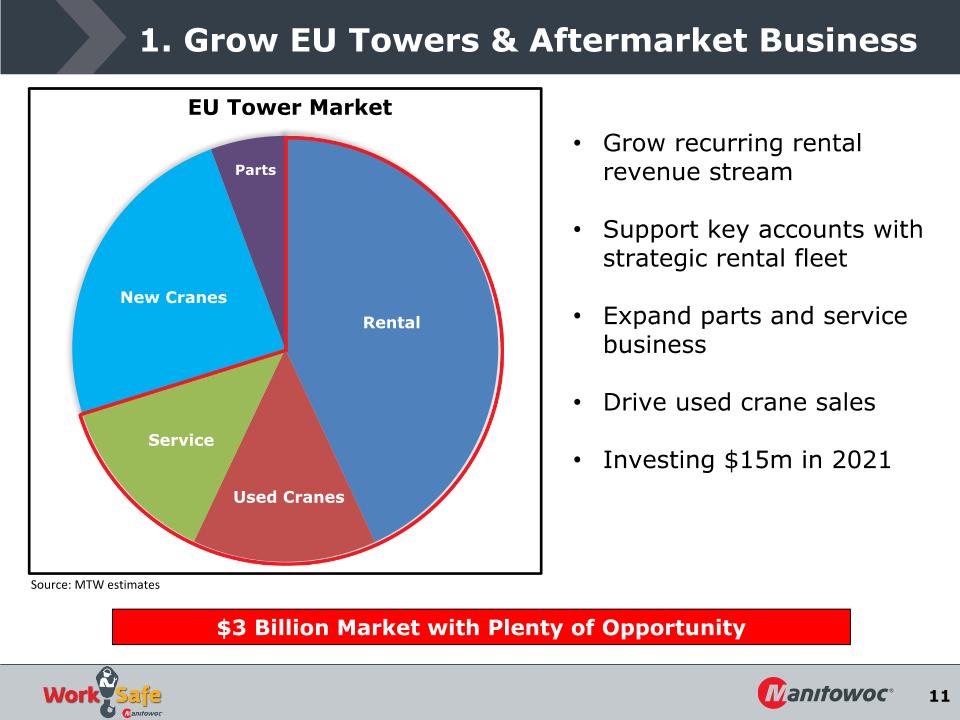

1. Grow EU Towers & Aftermarket Business Source: MTW estimates $3 Billion Market with Plenty of Opportunity Grow recurring rental revenue stream Support key accounts with strategic rental fleet Expand parts and service business Drive used crane sales Investing $15m in 2021 EU Tower Market

2. Build out China / Belt & Road Business Transitioned our China manufacturing factory into a regional business unit Developing Cranes that meet Asia specification and cost targets Locally engineered 4 new crane models for region Sales have grown to ~300 units per year, but our market share is marginal

3. Accelerate NPD in All-Terrain Cranes Filling key product gaps & competing more aggressively on global market Planning 7 new cranes over next 5 years Homologating cranes for niche markets – Russia, South Korea, and Japan Developing Grove Connect – new telematics tools Leveraging pending acquisitions Investing incremental $4.5m in 2021

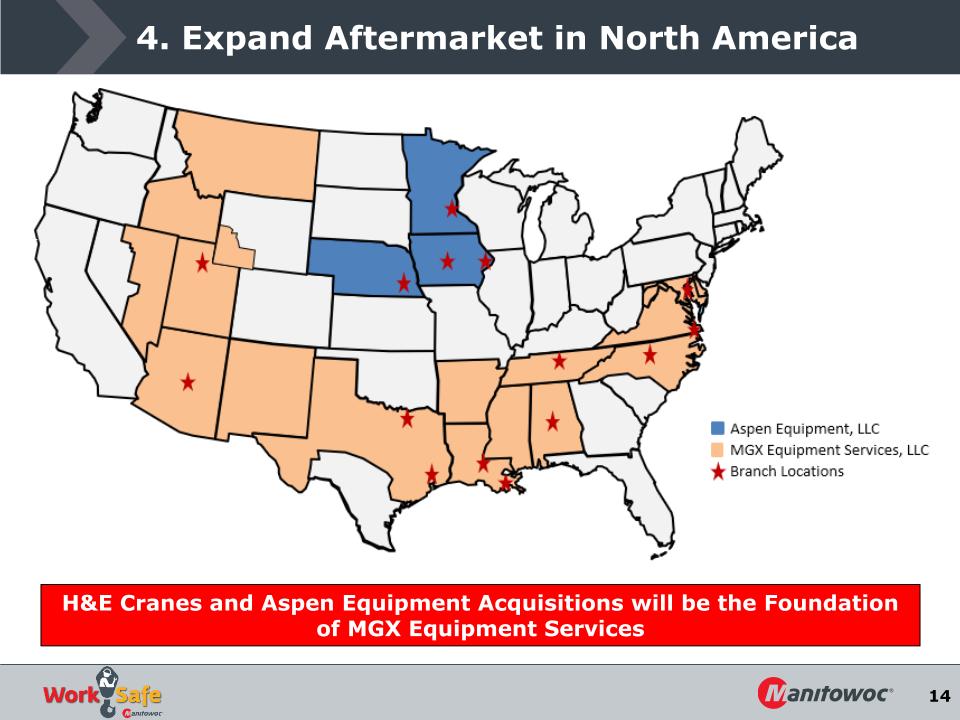

4. Expand Aftermarket in North America H&E Cranes and Aspen Equipment Acquisitions will be the Foundation of MGX Equipment Services

4. Expand Aftermarket in North America H&E Cranes + Aspen Equipment: Comprehensive aftermarket business with 15 branches ~350 team members with largest population of Grove/Manitowoc service technicians in the World Growth engine for less cyclical, high margin revenue streams (service, parts, and financing options with rentals & used sales) Greater ability to service large national accounts Upfitting capability with great synergies for National Crane boom trucks Accretive to EBITDA margins H&E Cranes and Aspen Equipment Acquisitions will be the Foundation of MGX Equipment Services

Long-Term Aspirations Strive towards a ZERO harm work environment (Achieve RIR* <1.0) $2.5 Billion in revenue Increase our aftermarket & reduce our cyclicality Active acquisition pipeline Manage liquidity and balance sheet capacity +10% EBITDA at the peak Reduce the Company’s environmental impact Foster a diverse and inclusive workforce *Recordable Injury Rate Long-term Focus on Shareholder Value

Appendix

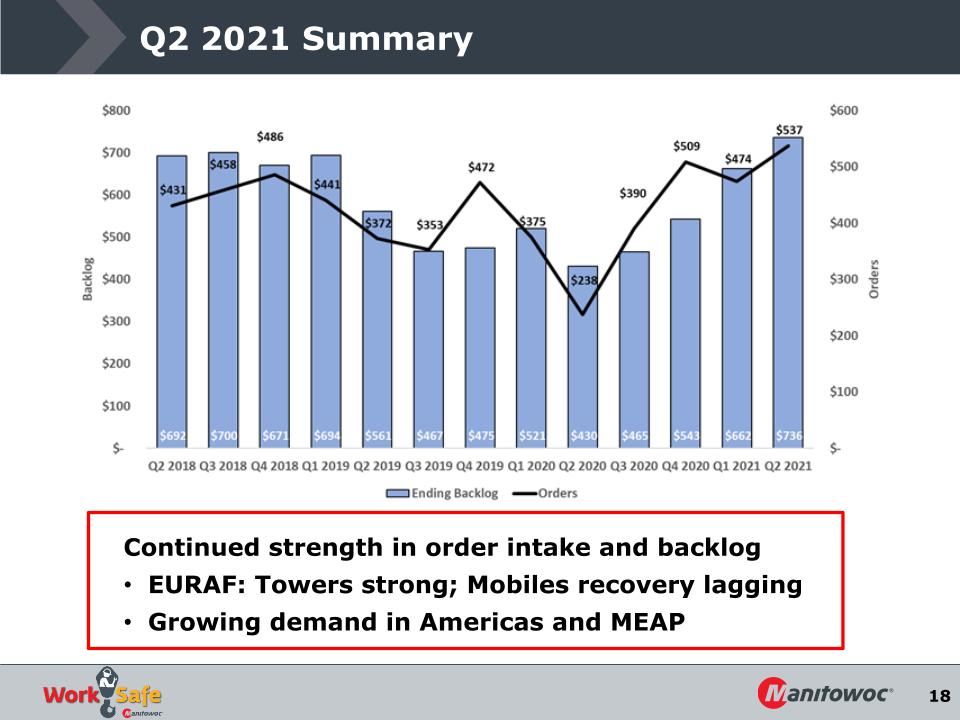

Q2 2021 Summary Continued strength in order intake and backlog EURAF: Towers strong; Mobiles recovery lagging Growing demand in Americas and MEAP

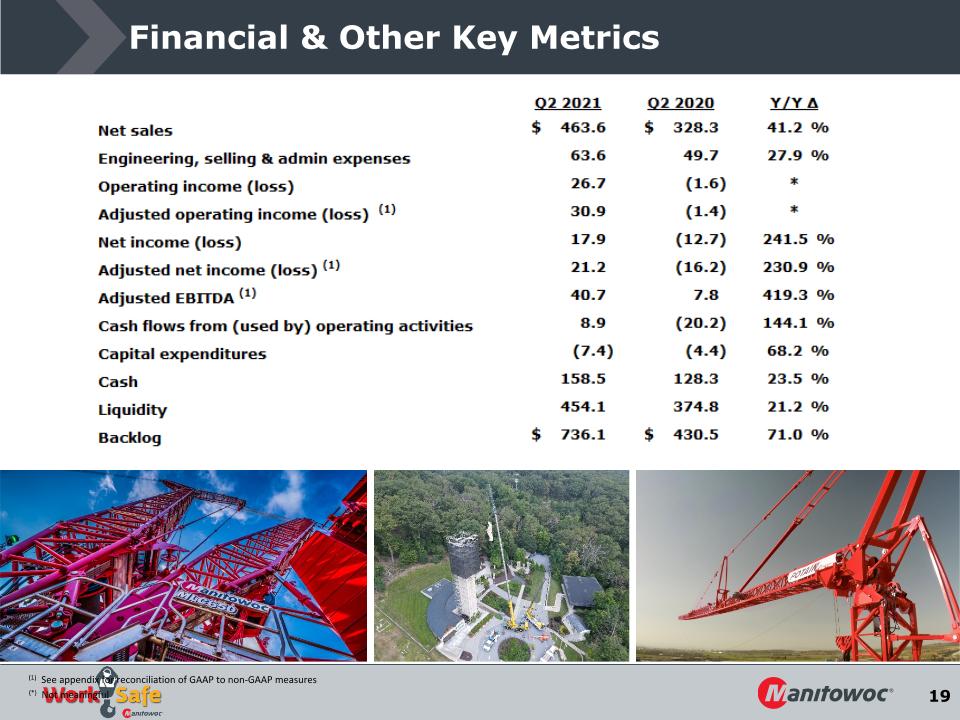

Financial & Other Key Metrics (1) See appendix for reconciliation of GAAP to non-GAAP measures (*) Not meaningful

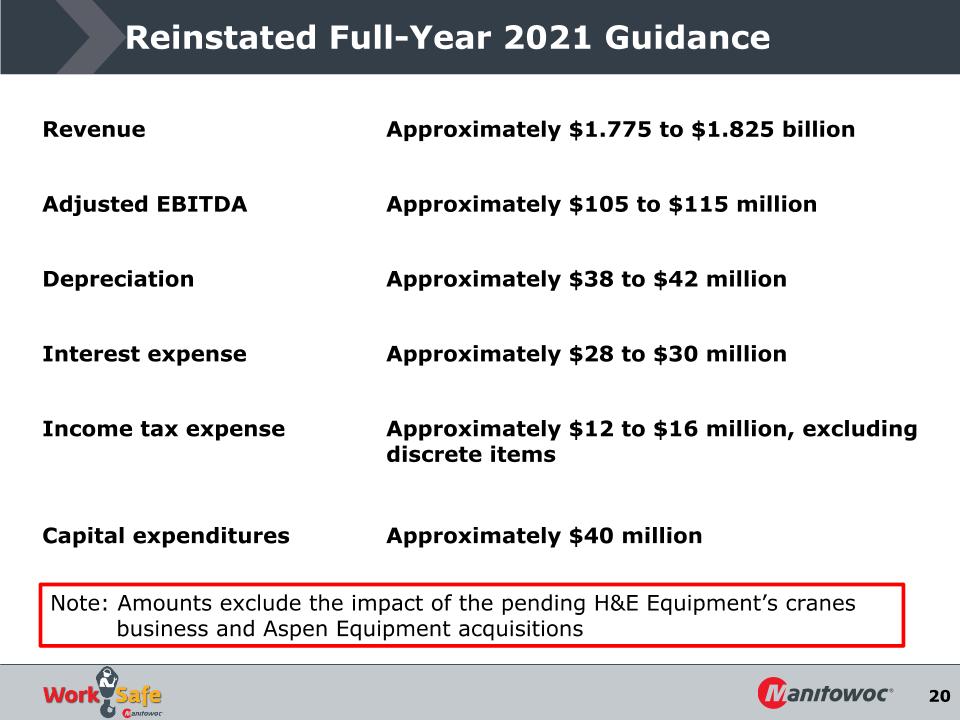

Revenue Approximately $1.775 to $1.825 billion Adjusted EBITDA Approximately $105 to $115 million Depreciation Approximately $38 to $42 million Interest expense Approximately $28 to $30 million Income tax expense Approximately $12 to $16 million, excluding discrete items Capital expenditures Approximately $40 million Note: Amounts exclude the impact of the pending H&E Equipment’s cranes business and Aspen Equipment acquisitions Reinstated Full-Year 2021 Guidance

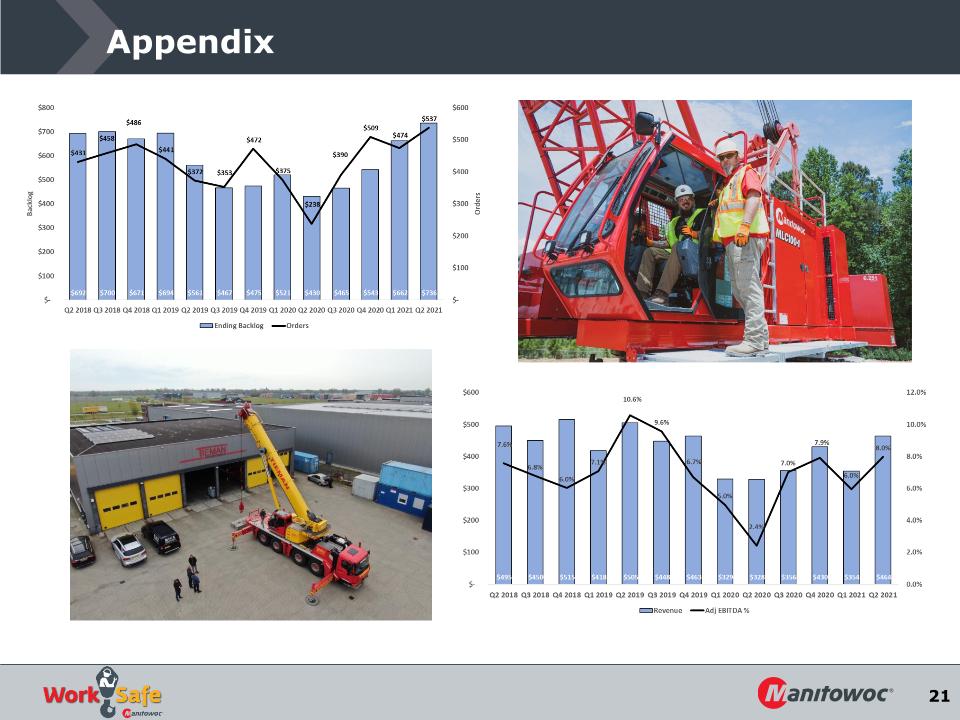

Appendix

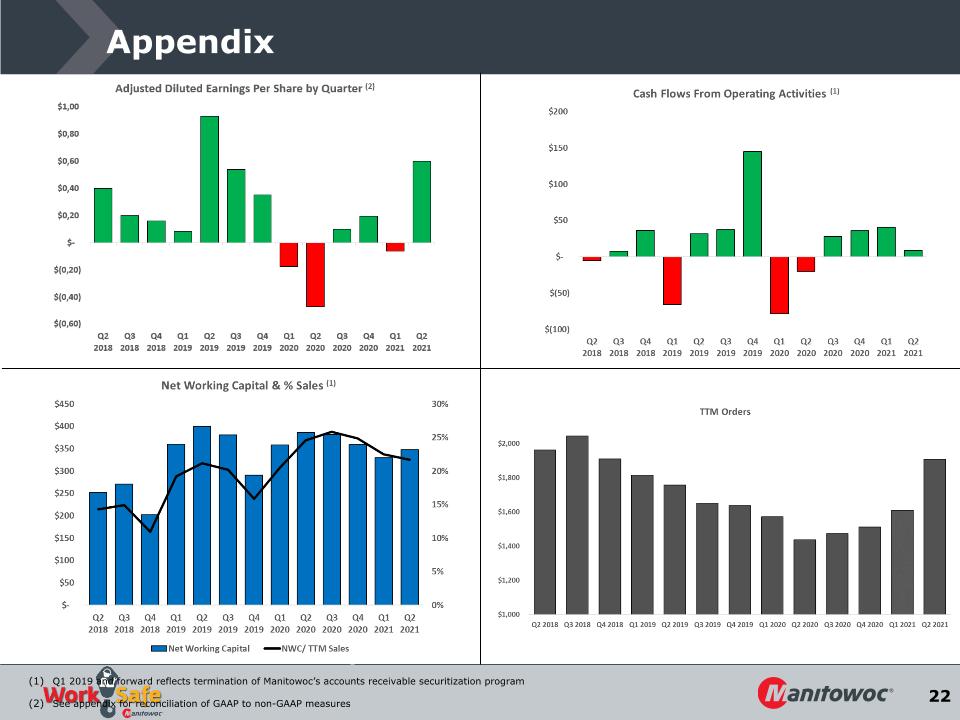

Appendix Q1 2019 and forward reflects termination of Manitowoc’s accounts receivable securitization program See appendix for reconciliation of GAAP to non-GAAP measures

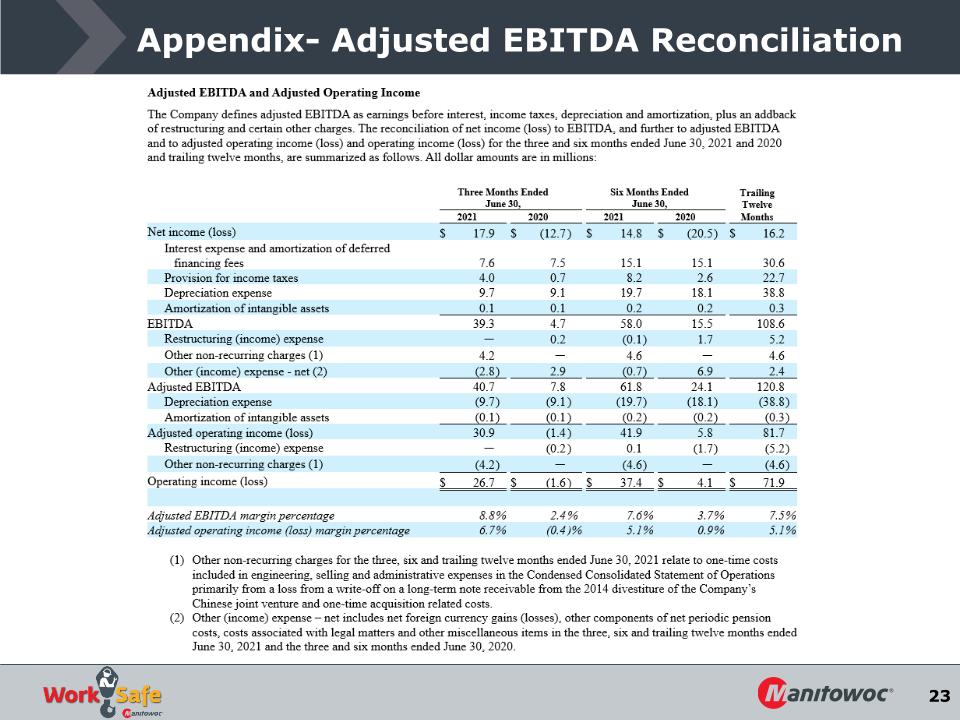

Appendix- Adjusted EBITDA Reconciliation

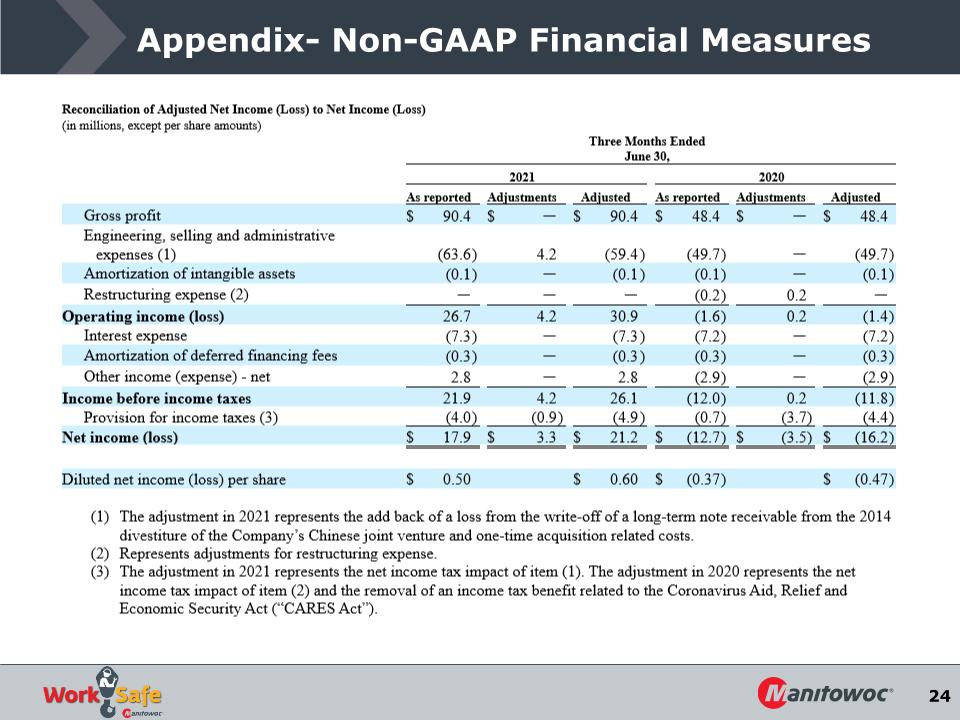

Appendix- Non-GAAP Financial Measures

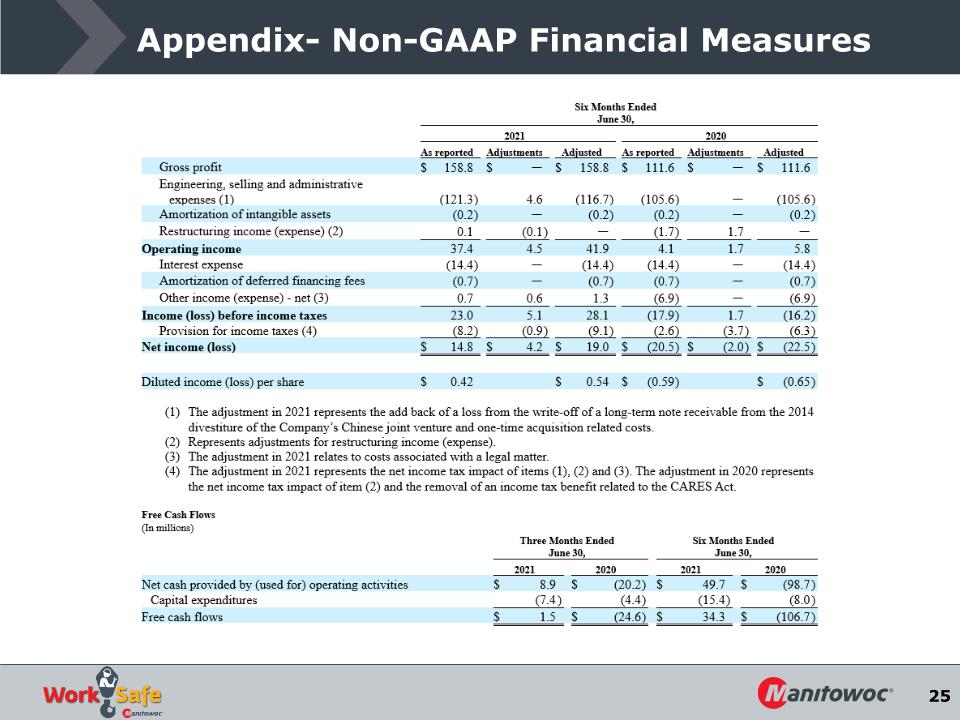

Appendix- Non-GAAP Financial Measures