Attached files

| file | filename |

|---|---|

| EX-32.2 - EXHIBIT 32.2 - MANITOWOC CO INC | mtw-20161231x10kxex322.htm |

| EX-32.1 - EXHIBIT 32.1 - MANITOWOC CO INC | mtw-20161231x10kxex321.htm |

| EX-31 - EXHIBIT 31 - MANITOWOC CO INC | mtw-20161231x10kxex31.htm |

| EX-23.1 - EXHIBIT 23.1 - MANITOWOC CO INC | mtw-20161231x10kex231.htm |

| EX-21 - EXHIBIT 21 - MANITOWOC CO INC | mtw-20161231x10kex21.htm |

| EX-18.1 - EXHIBIT 18.1 - MANITOWOC CO INC | mtw-20161231x10xkex181.htm |

| EX-12.1 - EXHIBIT 12.1 - MANITOWOC CO INC | mtw-20161231x10kex121.htm |

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 10-K

ý | Annual Report Pursuant to Section 13 or 15(d) of the Securities Exchange Act of 1934 |

For the fiscal year ended December 31, 2016

or

o | Transition Report Pursuant to Section 13 or 15(d) of the Securities Exchange Act of 1934 |

For the transition period from to

Commission File Number

1-11978

The Manitowoc Company, Inc.

(Exact name of registrant as specified in its charter)

Wisconsin | 39-0448110 | |

(State or other jurisdiction | (I.R.S. Employer | |

of incorporation) | Identification Number) | |

2400 South 44th Street, | ||

Manitowoc, Wisconsin | 54220 | |

(Address of principal executive offices) | (Zip Code) | |

(920) 684-4410

(Registrant’s telephone number, including area code)

Securities Registered Pursuant to Section 12(b) of the Act:

Title of each class | Name of each exchange on which registered | |

Common Stock, $.01 Par Value | New York Stock Exchange | |

Common Stock Purchase Rights | ||

Securities Registered Pursuant to Section 12(g) of the Act: None

Indicate by check mark if the registrant is a well-known seasoned issuer, as defined in Rule 405 of the Securities Act. Yes ý No o

Indicate by check mark if the Registrant is not required to file reports pursuant to Section 13 or 15(d) of the Act. Yes o No ý

Indicate by check mark whether the Registrant: (1) has filed all reports required to be filed by Section 13 or 15(d) of the Securities Exchange Act of 1934 during the preceding 12 months (or for such shorter period that the Registrant was required to file such reports), and (2) has been subject to such filing requirements for the past 90 days. Yes ý No o

Indicate by check mark whether the registrant has submitted electronically and posted on its corporate website, if any, every Interactive Data File required to be submitted and posted pursuant to Rule 405 of Regulation S-T (§232.405 of this chapter) during the preceding 12 months (or for such shorter period that the registrant was required to submit and post such files). Yes ý No o

Indicate by check mark if disclosure of delinquent filers pursuant to Item 405 of Regulation S-K is not contained herein, and will not be contained, to the best of registrant’s knowledge, in definitive proxy or information statements incorporated by reference in Part III of this Form 10-K or any amendment to this Form 10-K. o

Indicate by check mark whether the registrant is a large accelerated filer, an accelerated filer, a non-accelerated filer or a smaller reporting Company. See the definitions of “large accelerated filer, accelerated filer, and smaller reporting Company” in Rule 12b-2 of the Exchange Act.

Large accelerated filer x | Accelerated filer o | |

Non-accelerated filer o (Do not check if a smaller reporting Company) | Smaller reporting Company o | |

Indicate by check mark whether the Registrant is a shell Company (as defined in Rule 12b-2 of the Act). Yes o No ý

The Aggregate Market Value on June 30, 2016, of the registrant’s Common Stock held by non-affiliates of the registrant was approximately $744 million based on the closing per share price of $5.45 on that date.

The number of shares outstanding of the registrant’s Common Stock as of January 31, 2017, the most recent practicable date, was 140,190,685.

DOCUMENTS INCORPORATED BY REFERENCE

Portions of the registrant’s Proxy Statement, to be prepared and filed for the 2017 Annual Meeting of Shareholders (the “2017 Proxy Statement”), are incorporated by reference in Part III of this report.

See Index to Exhibits immediately following the signature page of this report, which is incorporated herein by reference.

THE MANITOWOC COMPANY, INC.

Index to Annual Report on Form 10-K

For the Year Ended December 31, 2016

PAGE | ||

PART I | ||

PART II | ||

PART III | ||

PART IV | ||

2

Cautionary Statements Regarding Forward-Looking Information

All of the statements in this Annual Report on Form 10-K, other than historical facts, are forward-looking statements, including, without limitation, the statements made in the “Management's Discussion and Analysis of Financial Condition and Results of Operations,” particularly under the caption “Market Conditions and Outlook.” As a general matter, forward-looking statements are those focused upon anticipated events or trends, expectations and beliefs relating to matters that are not historical in nature. The words “could,” “should,” “feel,” “anticipate,” “aim,” “preliminary,” “expect,” “believer,” “estimate,” “intend,” “intent,” “plan,” “will,” “foresee,” “project,” “forecast,” or the negative thereof or variations thereon, and similar expressions identify forward-looking statements.

The Private Securities Litigation Reform Act of 1995 provides a “safe harbor” for these forward-looking statements. In order to comply with the terms of the safe harbor, The Manitowoc Company, Inc. (the “Company” or “Manitowoc”) notes that forward-looking statements are subject to known and unknown risks, uncertainties and other factors relating to the Company's operations and business environment, all of which are difficult to predict and many of which are beyond the control of the Company. These known and unknown risks, uncertainties and other factors could cause actual results to differ materially from those matters expressed in, anticipated by or implied by such forward-looking statements. These risks, uncertainties and other factors include, but are not limited to:

• | unanticipated changes in revenues, margins, costs, and capital expenditures; |

• | the ability to significantly improve profitability; |

• | potential delays or failures to implement specific initiatives within the restructuring program; |

• | issues relating to the ability to timely and effectively execute on manufacturing strategies, including issues relating to plant closings, new plant start-ups, and/or consolidations of existing facilities and operations, and its ability to achieve the expected benefits from such actions; |

• | the ability to direct resources to those areas that will deliver the highest returns; |

• | uncertainties associated with new product introductions, the successful development and market acceptance of new and innovative products that drive growth; |

• | the ability to focus on customers, new technologies, and innovation; |

• | the ability to focus and capitalize on product quality and reliability; |

• | the ability to increase operational efficiencies across Manitowoc’s businesses and to capitalize on those efficiencies; |

• | the ability to capitalize on key strategic opportunities and the ability to implement Manitowoc’s long-term initiatives; |

• | the ability to generate cash and manage working capital consistent with Manitowoc’s stated goals; |

• | the ability to convert orders and order activity into sales and the timing of those sales; |

• | pressure of financing leverage; |

• | foreign currency fluctuation and its impact on reported results and hedges in place with Manitowoc; |

• | changes in raw material and commodity prices; |

• | unexpected issues associated with the quality of materials, components and products sourced from third parties and the ability to successfully resolve those issues; |

• | unexpected issues associated with the availability and viability of suppliers; |

• | the risks associated with growth; |

• | geographic factors and political and economic conditions and risks; |

• | actions of competitors; |

• | changes in economic or industry conditions generally or in the markets served by Manitowoc; |

• | unanticipated changes in customer demand, including changes in global demand for high-capacity lifting equipment, changes in demand for lifting equipment in emerging economies, and changes in demand for used lifting equipment; |

• | global expansion of customers; |

• | the replacement cycle of technologically obsolete cranes; |

• | the ability of Manitowoc's customers to receive financing; |

• | efficiencies and capacity utilization of facilities; |

• | issues related to workforce reductions and potential subsequent rehiring; |

• | work stoppages, labor negotiations, labor rates, and temporary labor costs; |

• | government approval and funding of projects and the effect of government-related issues or developments; |

• | the ability to complete and appropriately integrate restructurings, consolidations, acquisitions, divestitures, strategic alliances, joint ventures, and other strategic alternatives; |

• | realization of anticipated earnings enhancements, cost savings, strategic options and other synergies, and the anticipated timing to realize those savings, synergies, and options; |

• | impairment of goodwill and/or intangible assets; |

• | unanticipated issues affecting the effective tax rate for the year; |

• | unanticipated changes in the capital and financial markets; |

• | risks related to actions of activist shareholders; |

3

• | changes in laws throughout the world; |

• | natural disasters disrupting commerce in one or more regions of the world; |

• | risks associated with data security and technological systems and protections; |

• | acts of terrorism; and |

• | risks and other factors cited in Manitowoc's filings with the United States Securities and Exchange Commission. |

These statements reflect the current views and assumptions of management with respect to future events. The Company does not undertake, and hereby disclaims, any duty to update these forward-looking statements, even though its situation and circumstances may change in the future. Readers are cautioned not to place undue reliance on forward-looking statements, which speak only as of the date of this report. The inclusion of any statement in this report does not constitute an admission by the Company or any other person that the events or circumstances described in such statement are material.

4

PART I

Item 1. BUSINESS

GENERAL

The Manitowoc Company, Inc. (“Manitowoc”, “MTW”, the “Company”, “we”, and “us”) was founded in 1902 and has over a 110-year tradition of providing high-quality, customer-focused products and support services to our markets, and for the year ended December 31, 2016, we had net sales of approximately $1.6 billion. MTW is one of the world’s leading providers of engineered lifting equipment for the global construction industry. We design, manufacture, market and support one of the most comprehensive product lines of mobile telescopic cranes, tower cranes, lattice-boom crawler cranes and boom trucks. Our Crane products are principally marketed under the Manitowoc, Grove, Potain and National Crane brand names. We support customers globally with financing and leasing options through Manitowoc Finance, utilizing third-party leasing companies. We serve a wide variety of customers, including dealers, rental companies, contractors and government entities, across the petrochemical, industrial, commercial, power and utilities, infrastructure and residential end markets. Additionally, our Manitowoc Crane Care offering leverages MTW's installed base of approximately 140,000 cranes to provide aftermarket parts and services to enable our customers to manage their fleets most effectively and improve their return on investment. Due to the ongoing and predictable maintenance needed by cranes, as well as the high cost of crane downtime, Crane Care provides us with a consistent stream of recurring aftermarket revenue. We are a Wisconsin corporation, and our principal executive offices are located at 2400 South 44th Street, Manitowoc, Wisconsin 54220.

During the first quarter of 2016, the Board of Directors of The Manitowoc Company, Inc. approved the tax-free Spin-Off of the Company’s former foodservice business (“MFS” or “Foodservice”) into an independent, public company (the “Spin-Off”). To effect the Spin-Off, the Board declared a pro rata dividend of MFS common stock to MTW’s stockholders of record as of the close of business on February 22, 2016 (the “Record Date”), and the Company paid the dividend on March 4, 2016. Each MTW stockholder received one share of MFS common stock for every share of MTW common stock held as of the close of business on the Record Date.

In these Consolidated Financial Statements, unless otherwise indicated, references to Manitowoc, MTW, the Company, we and us refer to The Manitowoc Company, Inc. and its consolidated subsidiaries after giving effect to the Spin-Off, or, in the case of information as of dates or for periods prior to the Spin-Off, the consolidated entities of the Crane business and certain other assets and liabilities that were historically held at the MTW corporate level but were specifically identifiable and attributable to the Crane business.

As a result of the Spin-Off, the Consolidated Financial Statements and related financial information reflect MFS operations, assets, liabilities and cash flows as discontinued operations for all periods presented.

See Note 3, “Discontinued Operations,” for further details concerning the Spin-Off and other transactions being reported as discontinued operations.

THE MANITOWOC WAY

The Manitowoc Way is a culture of continuous improvement which encompasses the core values and growth strategies that add value for the Company’s key stakeholders - customers, shareholders and employees. Customers are the priority of The Manitowoc Way as the Company builds strong relationships by listening to them, understanding their needs and quickly responding with creative products and services. As shareholders understand the value-driven relationship the Company shares with its customers, they continue to invest the resources the Company needs to grow.

Employee commitment to the goals and vision of The Manitowoc Way enable the Company to use those resources to create a stronger organization. The Manitowoc Way empowers employees to develop innovative products and services that meet the needs of the Company's customers. The culture of The Manitowoc Way fosters employee engagement to quickly recognize opportunities and to capitalize on them to add value. Innovation and velocity are the core of The Manitowoc Way, driving the Company's differentiation from its competitors.

PRODUCTS AND SERVICES

The Company designs, manufactures and distributes a diversified line of crawler-mounted lattice-boom cranes, which we sell under the Manitowoc brand name. We also design and manufacture a diversified line of top-slewing and self-erecting tower cranes, which we sell under the Potain brand name. We design and manufacture mobile telescopic cranes, which we sell under the Grove brand name and a comprehensive line of hydraulically powered telescopic boom trucks, which we sell under the National Crane brand name. We also provide crane product parts and services and crane rebuilding, remanufacturing and

5

training services, which are delivered under the Manitowoc Crane Care brand name. In some cases our products are manufactured for us or distributed for us under strategic alliances. Our crane products are used in a wide variety of applications throughout the world, including energy production/distribution and utilities, petrochemical and industrial projects, infrastructure applications, such as road, bridge and airport construction, plus commercial and residential construction. Many of our customers purchase one or more cranes together with several attachments to permit use of the crane in a broader range of lifting applications and other operations.

Lattice-boom cranes. Under the Manitowoc brand name we design, manufacture and distribute lattice-boom crawler cranes. Lattice-boom cranes consist of a lattice-boom, which is a fabricated, high-strength steel structure that has four chords and tubular lacings, mounted on a crawler base. Lattice-boom cranes weigh less and provide higher lifting capacities than a mobile telescopic crane of similar boom length. The lattice-boom cranes are the only category of crane that can pick and move simultaneously with a full-rated load. The lattice-boom sections, together with the crane base, are transported to and erected at a project site.

Our lattice-boom cranes are used to lift material and equipment in a wide variety of applications and end markets, including heavy construction, bridge and highway, infrastructure and energy-related projects. These cranes are also used by the value-added crane rental industry, which serves all of the above end markets. Lattice boom cranes are produced in the U.S.

We also offer our lattice-boom crawler crane customers various attachments that provide our cranes with greater capacity in terms of height, movement and lifting. Our principal attachments are: MAX-ER™ attachments, luffing jibs and RINGER™ attachments. The MAX-ER™ is a trailing counterweight, heavy-lift attachment that dramatically improves the reach, capacity and lift dynamics of the basic crane to which it is mounted. It can be transferred between cranes of the same model for maximum economy and occupies less space than competitive heavy-lift systems. A luffing jib is a fabricated structure similar to, but smaller than, a lattice-boom. Mounted at the tip of a lattice-boom, a luffing jib easily adjusts its angle of operation permitting one crane with a luffing jib to make lifts at additional locations on the project site. It can be transferred between cranes of the same model to maximize utilization. A RINGER™ attachment is a high-capacity lift attachment that distributes load reactions over a large area to minimize ground-bearing pressure. It can also be more economical than transporting and setting up a larger crane.

Tower cranes. Under the Potain brand name, we design and manufacture tower cranes utilized primarily in the energy, building and construction industries. Tower cranes offer the ability to lift and distribute material at the point of use, more quickly and accurately than other types of lifting machinery, without utilizing substantial square footage on the ground. Tower cranes include a stationary vertical mast and a horizontal jib with a counterweight, which is placed near the vertical mast. A cable runs through a trolley which is mounted on the jib, enabling the load to move along the jib. The jib rotates 360 degrees, thus increasing the crane’s work area. Unless using a remote control device, operators occupy a cabin, located where the jib and mast meet, which provides superior visibility above the worksite. We offer a complete line of tower crane products, including top slewing, luffing jib, topless, self-erecting and special cranes for dams, harbors and other large building projects. Top-slewing cranes are the most traditional form of tower cranes. Self-erecting cranes are bottom-slewing cranes which have a counterweight located at the bottom of the mast and are able to be erected, used and dismantled on job sites without assist cranes.

Top-slewing tower cranes have a tower and multi-sectioned horizontal jib. These cranes rotate from the top of their mast and can increase in height with the project. Top-slewing cranes are transported in separate pieces and assembled at the construction site in one to three days depending on the height. These cranes are generally sold to medium to large energy, building and construction groups, as well as to rental companies. These cranes are produced in France, Portugal, India and China.

Topless tower cranes are a type of top-slewing crane and, unlike all others, have no cathead or jib tie-bars on the top of the mast. The cranes are utilized primarily when overhead height is constrained or in situations where several cranes are installed close together. Topless tower cranes are produced in France, Portugal, India and China.

Luffing jib tower cranes, which are a type of top-slewing crane, have an angled rather than horizontal jib. Unlike other tower cranes which have a trolley that controls the lateral movement of the load, luffing jib cranes move their load by changing the angle of the jib. The cranes are utilized primarily in urban areas where space is constrained or in situations where several cranes are installed close together. Luffing tower cranes are produced in France and China.

Self-erecting tower cranes are mounted on axles or transported on a trailer. The lower segment of the range unfolds in four sections, two for the mast and two for the jib. The smallest of our models unfolds in less than eight minutes; larger models erect in a few hours. Self-erecting cranes rotate from the bottom of their mast and are utilized primarily in low to medium rise construction and residential applications. Self-erecting tower cranes are produced in France and Italy.

6

Mobile telescopic cranes. Under the Grove brand name, we design and manufacture mobile telescopic cranes utilized primarily in industrial, commercial and construction applications, as well as in maintenance applications to lift and move material at job sites. Mobile telescopic cranes consist of a telescopic boom mounted on a wheeled carrier. Many mobile telescopic cranes have the ability to drive between sites, and some are permitted on public roadways. We currently offer the following five types of mobile telescopic cranes: rough-terrain, all-terrain, truck-mounted, telescopic crawler and industrial.

Rough-terrain cranes are designed to lift materials and equipment on rough or uneven terrain, and their versatility allows them to carry out many different lifts within the boundaries of given sites. These cranes cannot be driven on public roadways, and, accordingly, must be transported by truck to a work site and are produced in the U.S. and Italy under the Grove brand name.

All-terrain cranes are versatile cranes designed to lift materials and equipment on rough or uneven terrain and yet are highly maneuverable and capable of highway speeds. All-terrain cranes are often used for specific, one-off, heavy, high lifts requiring careful lift-planning and engineering and are produced in Germany under the Grove brand name.

Truck-mounted cranes are designed to provide simple set-up and long reach and have high capacity booms. They are capable of traveling from site to site at highway speeds. These cranes are produced in the U.S. under the Grove brand name and are suitable for urban and suburban uses.

Telescopic crawler cranes are designed to lift materials on rugged terrain. These cranes consist of a telescopic boom superstructure mounted to a crawler crane chassis. These cranes are sold under the Grove brand name and combine excellent gradeability and lift capacity with 100 percent pick and carry capabilities.

Industrial cranes are designed primarily for plant maintenance, storage yard and material handling jobs; and allow for picking up and carrying loads on a smooth, flat surface. We manufacture industrial cranes in the U.S. under the Grove brand name.

We offer our hydraulic boom truck products under the National Crane product line. A boom truck is a hydraulically powered telescopic crane mounted on a conventional truck chassis. Telescopic boom trucks are used primarily for lifting material on a job site and are mostly deployed by end users in the North American market. We currently offer telescoping boom trucks under the National Crane brand name.

Backlog and customers. The year-end backlog of crane products includes accepted orders that have been placed on a production schedule that we expect to be shipped and billed primarily within one year. Manitowoc’s backlog of unfilled orders at December 31, 2016, 2015 and 2014 was $323.8 million, $513.0 million and $738.0 million, respectively. Our backlog at the end of 2016 decreased from the end of 2015 due in part to lower customer demand for mobile hydraulic products primarily in North America and the Middle East, driven by declining oil prices and the associated impact across energy-related end markets, lower crane utilization and declining resale values, partially offset by growth in Western Europe.

The Company does not have any customers that individually comprise more than 10% of its consolidated net sales.

Manufacturing

Manitowoc operates twelve manufacturing facilities (including remanufacturing facilities) that utilize a variety of processes. In general, the Company’s manufacturing process involves the fabrication and machining of raw materials, primarily steel, which are then manufactured into sub-assemblies. Sub-assemblies are then assembled with purchased components into a complete machine. In its manufacturing operations, Manitowoc maintains advanced manufacturing, quality assurance and testing equipment and utilizes extensive process automation. The Company has also invested in Product Verification Centers at its major manufacturing facilities to support new product development, testing and qualification of sub-systems and final product designs.

The Company is training employees dedicated to leading the implementation of The Manitowoc Way, a business system that seeks to enhance customers' experiences with our products and services. The team is comprised of members with diverse backgrounds in quality, lean, finance, product and process engineering. It includes lean tools to eliminate waste from processes to provide better value for customers, and it assesses customer satisfaction and implements countermeasures to improve customer experiences. The Manitowoc Way improvement projects have contributed to manufacturing efficiency gains, materials management improvements, steady quality improvements and reduction of lead times, as well as enabled the Company to free up manufacturing space.

Raw Materials and Supplies

7

Manitowoc purchases a wide variety of raw materials to manufacture its products. The Company’s primary raw materials are structural and rolled steel, which are purchased from various domestic and international suppliers. We also purchase engines and electrical equipment and other semi- and fully-processed materials. Our policy is to maintain alternate sources of supply for our critical materials and parts wherever possible, and therefore, we are not dependent on a single source for any particular raw material or supply.

Patents, Trademarks, and Licenses

MTW utilizes patent rights to protect its intellectual property and its position as a leading provider of engineered lift solutions. We hold numerous United States and foreign patents pertaining to our products and also have pending applications for additional United States and foreign patents. In addition, we have various registered and unregistered trademarks, copyrights and licenses. We believe our patents, trademarks and copyrights are adequately protected in customary fashions under applicable laws. We actively enforce our patents, trademarks and copyrights and this intellectual property in which we have invested is collectively of material importance to our business.

Seasonality

The second and fourth quarters generally have represented the best quarters for our financial results. More recently, the traditional seasonality of our business has been slightly muted due to more diversified product and geographic end markets, as well as the unusually low customer demand for certain of our products that has been lower as compared to historical patterns. The northern hemisphere summer represents the main construction season, whereby customers require new machines, parts, and service during that season.

Competition

We sell all of our products in highly competitive industries. We compete in each of our industries based on product design, quality of products and aftermarket support services, product performance, maintenance costs, energy and resource saving and other contributions to sustainability and price. Given the potential for equipment failures to cause expensive operational disruption, the Company’s customers generally view quality and reliability as critical factors in their purchasing decision. We believe that we benefit from the following competitive advantages: strong brand names, which create customer loyalty and facilitate strong resale values, a reputation for quality products and aftermarket support and solution services, an established network of global distributors and customer relationships, broad product line offerings in the markets we serve and a commitment to engineering design and product innovation. The following table sets forth our primary competitors:

Products | Primary Competitors | ||

Lattice-boom Cranes | Hitachi Sumitomo; Kobelco; Liebherr; Sumitomo/Link-Belt; Terex; XCMG; Zoomlion; and Sany | ||

Tower Cranes | Comansa; Terex Comedil/Peiner; Liebherr; FM Gru; Jaso; Raimondi; Viccario; Saez; Benezzato; Cattaneo; Zoomlion; Yongmao; and Wolffkran | ||

Mobile Telescopic Cranes | Liebherr; Link-Belt; Terex; Tadano; XCMG; Kato; Locatelli; Broderson; Sany; and Zoomlion | ||

Boom Trucks | Terex; Manitex; Altec; Elliott; and Tadano | ||

Engineering, Research and Development

We believe our extensive engineering, research and development capabilities are key drivers of our success. We engage in research and development activities at dedicated locations. We have a staff of in-house engineers and technicians on three continents, supplemented with external engineering resources, who are responsible for improving existing products and developing new products. We incurred research and development costs of $44.5 million in 2016, $57.6 million in 2015 and $56.4 million in 2014.

Our team of engineers focuses on developing high performance, low maintenance, innovative products intended to create significant brand loyalty among customers. Design engineers work closely with our manufacturing and marketing staff, enabling us to identify changing end-user requirements, implement new technologies and effectively introduce product innovations. Closely managed relationships with dealers, distributors and end users help us identify their needs, not only for

8

products, but for the service and support that are critical to their profitable operations. As part of our ongoing commitment to provide superior products, we intend to continue our efforts to design products that meet evolving customer demands and reduce the period from product conception to product introduction.

Employee Relations

As of December 31, 2016, we employed approximately 4,900 people and had labor agreements with five local unions in North America. A large majority of our European employees belong to European trade unions. We have two trade unions in China and one trade union in India. During 2016, four of our union contracts expired and were successfully renegotiated without incident. We have ten union contracts involving an aggregate of 1,300 employees that expire in 2017.

Available Information

We make available, free of charge at our internet site (www.manitowoc.com), our Annual Reports on Form 10-K, quarterly reports on Form 10-Q, current reports on Form 8-K, our proxy statements and any amendments to those reports, as soon as reasonably practicable after we electronically file such material with, or furnish it to, the Securities and Exchange Commission (“SEC”). Our SEC reports can also be accessed through the investor relations section of our website. Although some documents available on our website are filed with the SEC, the information generally found on our website is not part of this or any other report we file with or furnish to the SEC.

The public may read and copy any materials that we file with the SEC at the SEC’s Public Reference Room located at 100 F Street NE, Washington, DC 20549. The public may obtain information on the operation of the Public Reference Room by calling the SEC at 1-800-SEC-0330. The SEC also maintains electronic versions of our reports on its website at www.sec.gov.

9

Item 1A. RISK FACTORS

The Company's financial position, results of operations and cash flows are subject to various risks, many of which are not exclusively within the Company's control, which may cause actual performance to differ materially from historical or projected future performance. Investors should consider carefully information in this Annual Report on Form 10-K in light of the risk factors described below.

Sales of our products are cyclical and/or are otherwise sensitive to volatile or variable factors. A downturn or weakness in overall economic activity or fluctuations in those other factors can have a material adverse effect on us.

Historically, sales of products that we manufacture and sell have been subject to cyclical variations caused by changes in general economic conditions and other factors. In particular, demand for our products is cyclical and is impacted by the strength of the economy, generally, the availability of financing and other factors, including crude oil prices, that may have an effect on the level of construction activity on an international, national or regional basis. During periods of expansion in construction activity, we generally have benefited from increased demand for our products; challenging conditions can continue well beyond the end of such periods. Conversely, during recessionary periods, we have been adversely affected by reduced demand for our products. Furthermore, any future economic recession may impact leveraged companies, such as Manitowoc, more than competing companies with less leverage and may have a material adverse effect on our financial condition, results of operations and cash flows.

Products also depend in part on federal, state, local and foreign governmental spending and appropriations, including infrastructure, security and defense outlays. Reductions in governmental spending can reduce demand for our products, which in turn, can negatively affect our performance. Our sales depend in part upon our customers’ replacement or repair cycles. Adverse economic conditions may cause customers to forego or postpone new purchases in favor of repairing existing machinery.

If we are unable to sufficiently adjust to market conditions, among other potential adverse effects on our financial condition, results of operations and cash flows, we could fail to deliver on planned results, fall short of analyst and investor expectations, incur high fixed costs and/or fail to benefit from higher than expected customer demand resulting in loss of market share.

Our operational results are dependent on how well we can scale our manufacturing capacity and resources to the level of our customers’ demand.

We operate in industries that require manufacturers to make highly efficient use of manufacturing capacity. Insufficient or excess capacity threatens our ability to generate competitive profit margins and may expose us to liabilities related to contractual commitments. Although from time to time we close or consolidate facilities, such as the transition that is in process of certain manufacturing operations from our Manitowoc, Wisconsin facility to our Shady Grove, Pennsylvania facility and our consolidation of certain operations in Portugal, adapting or modifying our capacity is difficult, as modifications take substantial time to execute, are inherently disruptive and costly and, in some cases, may require regulatory approval. Additionally, delivering product during process or facility modifications requires special coordination. The cost and resources required to adapt our capacity, such as through facility acquisitions, facility closings or process moves between facilities, may negate any planned cost reductions or may result in costly delays, product quality issues or material shortages, all of which could adversely affect our operational results and our reputation with our customers.

Price increases in some materials and sources of supply could affect our profitability.

We use large amounts of steel, among other items, in the manufacture of our products. Occasionally, market prices of some of our key raw materials increase significantly. If in the future we are not able to reduce product costs in other areas or pass raw material price increases on to our customers, our margins could be adversely affected. In addition, because we maintain limited raw material and component inventories, even brief unanticipated delays in delivery by suppliers - including those due to capacity constraints, labor disputes, impaired financial condition of suppliers, weather emergencies or other natural disasters - may impair our ability to satisfy our customers and could adversely affect our financial performance.

The Company purchases certain branded cranes under strategic alliances from various third-party suppliers which are then sold into our markets. If we are not able to effectively manage pricing from our suppliers, our financial performance could be adversely affected. Likewise, if our suppliers terminate these agreements and we are unable to procure alternate products at substantially similar competitive pricing, our financial performance could be adversely affected.

Our success depends on our ability to attract and retain key personnel.

Our success depends to a large extent upon our ability to attract and retain key executives, managers and skilled personnel. The loss of the services of one or more of these key employees could have an adverse effect, at least in the short to medium term, on

10

significant aspects of our business, including strategic planning and product development. Generally, our key employees are not bound by employment or non-competition agreements, and we cannot be sure that we will be able to retain our key officers and employees. If certain subject-matter experts or employees with specialized skills move to employment elsewhere, we will incur significant costs in hiring, training, developing and retaining their replacements.

Because we participate in industries that are highly competitive, our net sales and profits could decline as we respond, or fail to effectively respond, to competition.

We sell most of our products in highly competitive industries. We compete in each of those industries based on product design, quality of products, quality and responsiveness of product support services, product performance, maintenance costs and price. Some of our competitors may have greater financial, marketing, manufacturing and distribution resources than we do. We cannot be certain that our products and services will continue to compete successfully with those of our competitors or that we will be able to retain our customer base or improve or maintain our profit margins on sales to our customers, any of which could materially and adversely affect our financial condition, results of operations and cash flows.

If we do not develop new and innovative products or if customers in our markets do not accept them, our results would be negatively affected.

Our products must be kept current to meet our customers’ needs. To remain competitive, we therefore must develop new and innovative products on an on-going basis, and we invest significantly in the research and development of new products. If we do not successfully develop innovative products, it may be difficult to differentiate our products from our competitors’ products and satisfy regulatory requirements, and our sales and results would suffer.

If we do not meet customers’ product quality and reliability standards and expectations, we may experience increased or unexpected product warranty claims and other adverse consequences to our business.

Product quality and reliability are significant factors influencing customers' decisions to purchase our products. Inability to maintain the high quality of our products relative to the perceived or actual quality of similar products offered by competitors could result in the loss of market share, loss of revenue, reduced profitability, an increase in warranty costs and/or damage to our reputation.

Product quality and reliability are determined in part by factors that are not entirely within our control. We depend on our suppliers for parts and components that meet our standards. If our suppliers fail to meet those standards, we may not be able to deliver the quality of products that our customers expect, which may impair revenue and our reputation and lead to higher warranty costs.

We provide our customers a warranty covering workmanship, and in some cases materials, on products we manufacture. Our warranty generally provides that products will be free from defects for periods ranging from 12 months to 60 months. If a product fails to comply with the warranty, we may be obligated, at our expense, to correct any defect by repairing or replacing the defective product. Although we maintain warranty reserves in an amount based primarily on the number of units shipped and on historical and anticipated warranty claims, there can be no assurance that future warranty claims will follow historical patterns or that we can accurately anticipate the level of future warranty claims. An increase in the rate of warranty claims or the occurrence of unexpected warranty claims could materially and adversely affect our financial condition, results of operations and cash flows.

Some of our customers may not be able to obtain financing with third parties to purchase our products, and we may incur expenses associated with our assistance to customers in securing third-party financing.

A portion of our sales are financed by third-party finance companies on behalf of our customers. The availability of financing from third parties is affected by general economic conditions, the creditworthiness of our customers and the estimated residual value of our equipment. In certain transactions, we provide residual value guarantees and buyback commitments to our customers or to third-party financial institutions. Deterioration in the credit quality of our customers or the overall health of the banking industry could negatively impact our customer’s ability to obtain the resources needed to make purchases of our equipment or their ability to obtain third-party financing. In addition, if the actual value of the equipment for which we have provided a residual value guaranty declines below the amount of our guaranty, we may incur additional costs, which may negatively impact our financial condition, results of operations and cash flows.

We have significant manufacturing and sales of our products outside of the United States, which may present additional risks to our business.

For the years ended December 31, 2016, 2015, and 2014, approximately 60%, 58% and 59%, respectively, of our net sales were attributable to products sold outside of the United States. Expanding the Company’s international sales is part of our growth

11

strategy. International operations generally are subject to various risks, including political, military, religious and economic instability, local labor market conditions, the imposition of foreign tariffs, the effects of currency fluctuations, the impact of foreign government regulations, the effects of income and withholding tax, governmental expropriation and differences in business practices. We may incur increased costs and experience delays or disruptions in product deliveries and payments in connection with our international sales, manufacturing and the integration of new facilities that could cause loss of revenue or increased cost. Unfavorable changes in the political, regulatory and business climate and currency devaluations of various foreign jurisdictions could have a material adverse effect on our financial condition, results of operations and cash flows.

Our results of operations may be negatively impacted by product liability lawsuits.

Our business exposes us to potential product liability claims which may be alleged in connection with the design, manufacture, sale and use of our products. Certain of our businesses also have experienced claims relating to past alleged asbestos exposure. Neither we nor our affiliates have to date incurred material costs related to these asbestos claims. We vigorously defend ourselves against current claims and intend to do so against future claims. We also maintain certain insurance policies which may limit our financial exposures. We do not believe the outcome of such matters will have an adverse effect on our financial position; however, any significant liabilities which are not covered by insurance could have an adverse effect on our financial condition, results of operation and cash flows. Likewise, a substantial increase in the number of claims that are made against us or the amounts of any judgments or settlements could materially and adversely affect our reputation and our financial condition, results of operations and cash flows.

If we fail to protect our intellectual property rights or maintain our rights to use licensed intellectual property, our business could be adversely affected.

Our patents, trademarks and licenses are important in the operation of our businesses. Although we intend to protect our intellectual property rights vigorously, we cannot be certain that we will be successful in doing so. Third parties may assert or prosecute infringement claims against us in connection with the services and products that we offer, and we may or may not be able to successfully defend these claims. Litigation, either to enforce our intellectual property rights or to defend against claimed infringement of the rights of others, could result in substantial costs and in a diversion of our resources. In addition, if a third party would prevail in an infringement claim against us, then we would likely need to obtain a license from the third party on commercial terms, which would likely increase our costs. Our failure to maintain or obtain necessary licenses or an adverse outcome in any litigation relating to patent infringement or other intellectual property matters could have a material adverse effect on our financial condition, results of operations and cash flows.

Our goodwill and other intangible assets represent a material amount of our total assets; as a result future impairment may have material adverse effect on our results of operations.

At December 31, 2016, goodwill and other intangible assets totaled $413.7 million, or about 27% of our total assets. We assess annually whether there has been impairment in the value of our goodwill or indefinite-lived intangible assets. If future operating performance were to fall below current projections or if there are material changes to management’s assumptions, we could be required to recognize a non-cash charge to operating earnings for goodwill or other intangible asset impairment. Any future goodwill or intangible asset impairments may have a material adverse effect on our results of operations.

Our operations and profitability could suffer if we experience problems with labor relations.

As of December 31, 2016, we employed approximately 4,900 people and had labor agreements with five local unions in North America. A large majority of our European employees belong to European trade unions. We have two trade unions in China and one trade union in India. During 2016, four of our union contracts expired and were successfully renegotiated without incident. We have ten union contracts involving an aggregate of 1,300 employees that expire in 2017.

Any significant labor relations issues could have an adverse effect our operations, reputation, results of operations and financial condition.

Our leverage may impair our operations and financial condition.

As of December 31, 2016, our total consolidated debt was $281.5 million as compared to consolidated debt of $1,397.6 million as of December 31, 2015, including the value of related interest rate hedging instruments. Upon completion of the Spin-Off, the Company entered into a $225.0 million Asset Based Revolving Credit Facility (as amended, the “ABL Revolving Credit Facility”) by and among the Company and certain of its domestic and German subsidiaries, as borrowers, the lender party thereto, Wells Fargo Bank, N.A. as administrative agent, and Wells Fargo Bank N.A., JP Morgan Chase Bank, N.A. and Goldman Sachs Bank USA as joint lead arrangers. The ABL Revolving Credit Facility includes a $75.0 million Letter of Credit Facility, $10.0 million of which is available to the German borrower, with a term of 5 years.

12

Although actions taken in connection with the Spin-Off reduced our debt load, the amount of debt we maintain could have consequences, including increasing our vulnerability to general adverse economic and industry conditions; requiring a substantial portion of our cash flows from operations be used for the payment of interest rather than to fund working capital, capital expenditures, acquisitions and general corporate requirements; limiting our ability to obtain additional financing; and limiting our flexibility in planning for, or reacting to, changes in our business and the industries in which we operate.

The agreements governing our debt include covenants that restrict, among other matters, our ability to incur additional debt; pay dividends on or repurchase our equity; make certain investments; and consolidate, merge or transfer all or substantially all of our assets. Certain of our debt facilities require or will require us to maintain specified financial ratios and satisfy certain financial condition tests. Our ability to comply with these covenants may be affected by events beyond our control, including prevailing economic, financial and industry conditions. These covenants may also require that we take disadvantageous actions, including reducing spending on marketing, advertising and new product innovation, reducing future financing for working capital, capital expenditures and general corporate purposes, selling assets or dedicating an unsustainable level of cash flow from operations to the payment of principal and interest on our indebtedness. Our leverage could also put us at a disadvantage compared to any competitors that are less leveraged. We cannot be certain that we will meet any future financial tests or that the lenders will waive any failure to meet those tests. See additional discussion in Note 11, “Debt” to our Consolidated Financial Statements.

If we default under our debt agreements, our lenders could elect, among other potential remedies, to declare all amounts outstanding under our debt agreements to be immediately due and payable and could proceed against any collateral securing the debt. Under those circumstances, in the absence of readily-available refinancing on favorable terms, we might elect or be compelled to enter bankruptcy proceedings, in which case our shareholders could lose the entire value of their investment in our common stock.

We are exposed to the risks of changes in interest rates and foreign currency fluctuations.

Certain of our indebtedness accrues interest at a variable rate, therefore, increases in interest rates will reduce our operating cash flows and could hinder our ability to fund our operations or capital expenditures. In such cases, we may seek to reduce our exposure to fluctuations in interest rates, but hedging our exposure carries the risk that we may forego the benefits we would otherwise experience if interest rates were to change in our favor. Developing an effective strategy for dealing with movements in interest rates is complex, and no strategy is guaranteed to completely insulate us from the risks associated with such fluctuations.

Additionally, some of our operations are or will be conducted by subsidiaries in foreign countries. The results of the operations and the financial position of these subsidiaries will be reported in the relevant foreign currencies and then translated into U.S. dollars at the applicable exchange rates for inclusion in our consolidated financial statements, which are stated in U.S. dollars. The exchange rates between foreign currencies and the U.S. dollar have fluctuated significantly in recent years and may continue to fluctuate in the future. Such fluctuations may have a material effect on our results of operations and financial position and may significantly affect the comparability of our results between financial periods.

We also incur currency transaction risk whenever one of our operating subsidiaries enters into a transaction using a different currency than its functional currency. We attempt to reduce currency transaction risk whenever one of our operating subsidiaries enters into a material transaction using a different currency than its functional currency by:

• | matching cash flows and payments in the same currency; |

• | direct foreign currency borrowing; and |

• | entering into foreign exchange contracts for hedging purposes. |

However, we may not be able to hedge this risk completely or at an acceptable cost, which may adversely affect our results of operations, financial condition and cash flows in future periods.

Changes to tax laws or exposure to additional tax liabilities may have a negative impact on our operating results.

Tax policy reform continues to be a topic of discussion in the United States. A significant change to the tax system in the United States, including changes to the taxation of international income and/or duties on imports or exports, could have a material adverse effect upon our results of operations. We regularly undergo tax audits in various jurisdictions in which we operate. Although we believe that our tax estimates are reasonable and that we prepare our tax filings in accordance with all applicable tax laws, the final determination with respect to any tax audits, and any related litigation, could be materially different from our estimates or from our historical income tax provisions and accruals. The results of an audit or litigation could have a material adverse effect on operating results and/or cash flows in the periods for which that determination is made. In addition, future period earnings may be adversely impacted by litigation costs, settlements, penalties and/or interest assessments.

13

Our business and/or reputation could be negatively affected as a result of actions of activist shareholders, and such activism could impact the trading value of our securities.

Certain of our shareholders have publicly or privately expressed views with respect to the operation of our business, our business strategy, corporate governance considerations or other matters that may not be fully aligned with our own. Responding to actions by activist shareholders can be costly and time-consuming, disrupt our operations and divert the attention of management and our employees. Perceived uncertainties as to our future direction may result in the loss of potential business opportunities, damage to our reputation and may make it more difficult to attract and retain qualified directors, personnel and business partners. These actions could also cause our stock price to experience periods of volatility.

Activist shareholders have made, and may in the future make, strategic proposals, suggestions or requests for changes concerning the operation of our business, our business strategy, corporate governance considerations or other matters. We cannot predict, and no assurances can be given, as to the outcome or timing of any consequences arising from these actions, and any such consequences may impact the value of our securities.

Environmental liabilities that may arise in the future could be material to us.

Our operations, facilities and properties are subject to extensive and evolving laws and regulations pertaining to air emissions, wastewater discharges, the handling and disposal of solid and hazardous materials and wastes, the remediation of contamination, and otherwise relating to health, safety and the protection of the environment. As a result, we are involved from time to time in administrative or legal proceedings relating to environmental and health and safety matters and have in the past and will continue to incur capital costs and other expenditures relating to such matters.

We cannot be certain that identification of presently unidentified environmental conditions, more vigorous enforcement by regulatory authorities or other unanticipated events will not arise in the future and give rise to additional environmental liabilities, compliance costs and/or penalties that could be material. Further, environmental laws and regulations are constantly evolving, and it is impossible to predict accurately the effect they may have upon our financial condition, results of operations or cash flows.

Security breaches and other disruptions could compromise our information and expose us to liability, which would cause our business and reputation to suffer.

In the ordinary course of our business, we collect and store sensitive data, including our proprietary business information and that of our customers, suppliers and business partners, as well as personally identifiable information of our customers and employees, in our internal and external data centers, cloud services and on our networks. The secure processing, maintenance and transmission of this information is critical to our operations and business strategy. Despite our security measures, our information technology and infrastructure, and that of our partners, may be vulnerable to malicious attacks or breaches due to employee error, malfeasance or other disruptions, including as a result of rollouts of new systems. Any such breach or operational failure would compromise our networks and/or that of our partners and the information stored there could be accessed, publicly disclosed, lost or stolen. Any such access, disclosure or other loss of information could result in legal claims or proceedings and/or regulatory penalties, disrupt our operations, damage our reputation and/or cause a loss of confidence in our products and services, which could adversely affect our business.

Our inability to recover from natural or man-made disasters could adversely affect our business.

Our business and financial results may be affected by certain events that we cannot anticipate or that are beyond our control, such as natural or manmade disasters, national emergencies, significant labor strikes, work stoppages, political unrest, war or terrorist activities that could curtail production at our facilities and cause delayed deliveries and canceled orders. In addition, we purchase components and raw materials and information technology and other services from numerous suppliers, and, even if our facilities were not directly affected by such events, we could be affected by interruptions at such suppliers. Such suppliers may be less likely than our own facilities to be able to quickly recover from such events and may be subject to additional risks such as financial problems that limit their ability to conduct their operations. We cannot assure you that we will have insurance to adequately compensate us for any of these events.

Our international sales and operations are subject to applicable laws relating to trade, export controls and foreign corrupt practices, the violation of which could adversely affect our operations.

We must comply with all applicable international trade, customs, export controls and economic sanctions laws and regulations of the United States and other countries. We are also subject to the Foreign Corrupt Practices Act and other anti-bribery laws that generally bar bribes or unreasonable gifts to foreign governments or officials. The new presidential administration in the United States has taken, and make take additional, actions that may inhibit international trade by U.S.-based companies.

14

Changes in trade sanctions laws may restrict our business practices, including cessation of business activities in sanctioned countries or with sanctioned entities, and may result in modifications to compliance programs. Violation of these laws or regulations could result in sanctions or fines and could have a material adverse effect on our financial condition, results of operations and cash flows.

Item 1B. UNRESOLVED STAFF COMMENTS

None.

15

Item 2. PROPERTIES

Manitowoc maintains leased and owned manufacturing, warehouse, storage, field testing and office facilities and land throughout the world. The Company believes that its facilities currently in use are suitable and have adequate capacity to meet its present and foreseeable future demand. See Note 22, “Leases,” to the Consolidated Financial Statements included in Part II, Item 8 of this Form 10-K for additional information regarding leases. Manitowoc management continually monitors the Company’s capacity needs and makes adjustments as dictated by market and other conditions.

The following table provides information about principal facilities owned or leased by the Company (exceeding 50,000 square feet) as of December 31, 2016.

Facility Location | Type of Facility | Approximate Square Footage | Owned/Leased | |||

Americas | ||||||

Shady Grove, Pennsylvania (1) | Manufacturing/Office | 1,330,000 | Owned | |||

Manitowoc, Wisconsin (1) | Manufacturing/Office | 570,000 | Owned | |||

Port Washington, Wisconsin | Manufacturing | 81,029 | Owned | |||

Passo Fundo, Brazil ** | Manufacturing/Office | 300,000 | Owned | |||

EMEA | ||||||

Wilhelmshaven, Germany | Manufacturing/Office and Storage | 410,000 | Owned/Leased | |||

Fanzeres, Portugal (2) | Manufacturing | 362,891 | Owned | |||

Baltar, Portugal (2) | Manufacturing/Office | 241,876 | Owned | |||

Niella Tanaro, Italy | Manufacturing | 370,016 | Owned | |||

Langenfeld, Germany | Office/Storage and Field Testing | 80,300 | Leased | |||

Moulins, France | Manufacturing/Office | 355,000 | Owned | |||

Charlieu, France | Manufacturing/Office | 323,000 | Owned | |||

Dardilly, France | Office | 82,000 | Leased | |||

Dry, France | Office | 93,100 | Leased | |||

Buckingham, United Kingdom | Office/Storage | 78,000 | Leased | |||

Saint Pierre de Chandieu, France | Warehouse/Office | 434,565 | Leased | |||

APAC | ||||||

Zhangjiagang, China | Manufacturing | 800,000 | Owned | |||

Pune, India | Manufacturing | 190,000 | Leased | |||

Shirwal, India | Land | 1,560,700 | Owned | |||

Singapore * | Office/Storage | 54,000 | Leased | |||

Sydney, Australia * | Office/Storage/Workshop | 61,000 | Leased | |||

(1) | In the third quarter of 2016, the Company announced the expected mid-2017 closure of its Manitowoc, Wisconsin manufacturing facility; the Company is consolidating its Manitowoc manufacturing facility into its existing manufacturing facility in Shady Grove, Pennsylvania. |

(2) | In the third quarter of 2016, the Company announced the expected mid-2017 closure of its Fanzeres, Portugal manufacturing facility; Manitowoc is consolidating its Portugal manufacturing operations into its existing manufacturing facility in Baltar, Portugal. |

* There are multiple separate facilities within these locations.

** This facility is inactive as of December 31, 2016.

16

Item 3. LEGAL PROCEEDINGS

Our global operations are governed by laws addressing the protection of the environment and employee safety and health. Under various circumstances, these laws impose civil and criminal penalties and fines, as well as injunctive and remedial relief, for noncompliance. They also may require remediation at sites where Company related substances have been released into the environment.

We have expended substantial resources globally, both financial and managerial, to comply with the applicable laws and regulations, and to protect the environment and our workers. We believe we are in substantial compliance with such laws and regulations and we maintain procedures designed to foster and ensure compliance. However, we have been and may in the future be subject to formal or informal enforcement actions or proceedings regarding noncompliance with such laws or regulations, whether or not determined to be ultimately responsible in the normal course of business. Historically, these actions have been resolved in various ways with the regulatory authorities without material commitments or penalties to the Company.

For information concerning other contingencies and uncertainties, see Note 18, “Contingencies and Significant Estimates,” to the Consolidated Financial Statements included in Part II, Item 8 of this Form 10-K.

Item 4. MINE SAFETY DISCLOSURE

Not Applicable.

17

EXECUTIVE OFFICERS OF THE REGISTRANT

Each of the following executive officers of the Company has been elected by the Board of Directors. The information presented below is as of February 24, 2017.

Name | Age | Position With The Registrant | Principal Position Held Since | |||

Barry L. Pennypacker | 55 | President and Chief Executive Officer | 2016 | |||

David J. Antoniuk | 59 | Senior Vice President and Chief Financial Officer | 2016 | |||

Thomas G. Musial | 65 | Senior Vice President of Human Resources and Administration | 2000 | |||

Louis F. Raymond | 50 | Vice President, General Counsel and Secretary | 2016 | |||

Larry J. Weyers | 54 | Executive Vice President of Tower Cranes | 2016 | |||

Aaron H. Ravenscroft | 38 | Executive Vice President of Mobile Cranes | 2016 | |||

The following paragraphs provide further information as to our executive officers’ duties and their employment history:

Barry L. Pennypacker was appointed to the position of President and Chief Executive Officer of the Company’s cranes business in December 2015 and became the Company’s President and Chief Executive Officer following the Spin-Off. Mr. Pennypacker served, since 2013, as founder, President and Chief Executive Officer of Quantum Lean LLC, a privately held manufacturer and supplier of precision components. He previously served as president and chief executive officer, as well as a director, of Gardner Denver, Inc., a manufacturer and marketer of engineered industrial machinery and related parts and services (2008-2012). Prior to joining Gardner Denver, Inc., Mr. Pennypacker served in positions with increasing responsibility at Westinghouse Air Brake Technologies Corporation, a worldwide provider of technology-based equipment and services for the rail industry (1999-2008), with his last position being vice president-group executive. He previously served as director, Worldwide Operations, Stanley Fastening Systems, an operating unit of The Stanley Works, a worldwide producer of tools and security products, and held a number of senior management positions with increasing responsibility with Danaher Corporation, a manufacturer and marketer of professional, medical, industrial and commercial products and services.

David J. Antoniuk has served as Senior Vice President and Chief Financial Officer since May 2016, responsible for directing teams in accounting, financial reporting, investor relations, global tax, information services and treasury. Prior to joining Manitowoc, Mr. Antoniuk served as Vice President and Chief Financial Officer at Colorcon, Inc. (2015-2016), a leader in the development, supply and technical support of formulated coatings and functional excipients for the pharmaceutical and dietary/food/nutritional supplement industries, and Vice President and Corporate Controller at Gardner Denver (2005-2014). Prior to Gardner Denver, Mr. Antoniuk served in positions of increasing responsibility at Davis-Standard Corp., Pirelli Cables, Johnson & Johnson and KPMG.

Thomas G. Musial has been Senior Vice President of Human Resources and Administration since 2000. Previously, he was Vice President of Human Resources and Administration and held various roles within human resources.

Louis F. Raymond has served as Vice President, General Counsel and Secretary since March 2016. Prior to his current role, Mr. Raymond served as Associate General Counsel, and was Senior Litigation Counsel since joining Manitowoc in 2004. Prior to joining Manitowoc, Mr. Raymond worked in private practice and was a shareholder in the law firm of Davis & Kuelthau, S.C., Milwaukee, WI, practicing there since 1991.

Larry J. Weyers has served as Executive Vice President of Tower Cranes since March 2016. Mr. Weyers previously served as executive vice president of the Company's prior cranes segment (2015-2016), senior vice president of the Company, president of the cranes segment (2015) and executive vice president of Cranes America (2007-2014). He has held various other executive management positions with the Company since joining the Company in 1998, including executive vice president of Crane Care from (2004-2007). Prior to joining the Company, Mr. Weyers was General Manager Sales and Marketing for Woods Equipment Company and held various positions in Kubota Tractor Corporation.

Aaron H. Ravenscroft has served as the Company’s Executive Vice President of Mobile Cranes since March 2016, focusing on safety, quality, delivery and cost of the mobile cranes business. Prior to joining Manitowoc, Mr. Ravenscroft served as Regional

18

Managing Director of the North American Minerals business for the Weir Group (2013-2016), an engineering company, President of Process & Flow Control Group of Robbins & Myers (2011-2013), a manufacturer of engineered equipment, and Regional Vice President of Industrial Products Group for Gardner Denver, Inc. (2008-11). Prior to that, he held a series of positions with increasing responsibility at Westinghouse Air Brake Technologies (2003-2008) and Janney Montgomery Scott (2000-2003).

19

PART II

Item 5. MARKET FOR REGISTRANT’S COMMON EQUITY AND RELATED STOCKHOLDER MATTERS

The Company’s common stock is traded on the New York Stock Exchange (“NYSE”) under the symbol MTW. At December 31, 2016, the approximate number of record shareholders of common stock was 1,900.

The amount and timing of any dividends are determined by the Board of Directors at its regular meetings each year, subject to limitations within the Company’s Senior Notes indenture and ABL Revolving Credit Facility described below. In the year ended December 31, 2016, no cash dividends were declared or paid. In each of the years ended December 31, 2015 and December 31, 2014, the Company paid an annual dividend of $0.08 per share in the fourth quarter.

The quarterly stock prices of the common stock were as follows for the years indicated. The prices on and before March 4, 2016 include the value of MFS, which was spun-off on that date.

2016 | 2015 | 2014 | |||||||||||||||||||||||||||||||||

High | Low | Close | High | Low | Close | High | Low | Close | |||||||||||||||||||||||||||

1st Quarter - Pre Spin-Off | $ | 17.40 | $ | 11.73 | $ | 16.94 | $ | 22.91 | $ | 17.30 | $ | 21.56 | $ | 32.80 | $ | 22.68 | $ | 31.45 | |||||||||||||||||

1st Quarter - Post Spin-Off | 4.59 | 4.00 | 4.33 | n/a | n/a | n/a | n/a | n/a | n/a | ||||||||||||||||||||||||||

2nd Quarter | 6.15 | 4.21 | 5.45 | 22.67 | 18.79 | 19.60 | 33.46 | 26.87 | 32.86 | ||||||||||||||||||||||||||

3rd Quarter | 5.84 | 4.27 | 4.79 | 19.83 | 14.47 | 14.93 | 33.50 | 23.42 | 23.45 | ||||||||||||||||||||||||||

4th Quarter | 6.30 | 3.65 | 5.98 | 17.68 | 13.86 | 15.35 | 23.36 | 16.24 | 22.10 | ||||||||||||||||||||||||||

Our ABL Revolving Credit Facility and Senior Secured Second Lien Notes due 2021 limit or restrict the amount of certain payments we can make; including the purchase or retirement of Company stock, prepayment of debt principal and distribution of dividends to holders of Company stock. These so-called “Restricted Payments” are currently constrained by a provision requiring a minimal fixed charge coverage ratio after giving effect to the Restricted Payment. Additionally, we must consider all previous Restricted Payments when we calculate the capacity for future Restricted Payments.

20

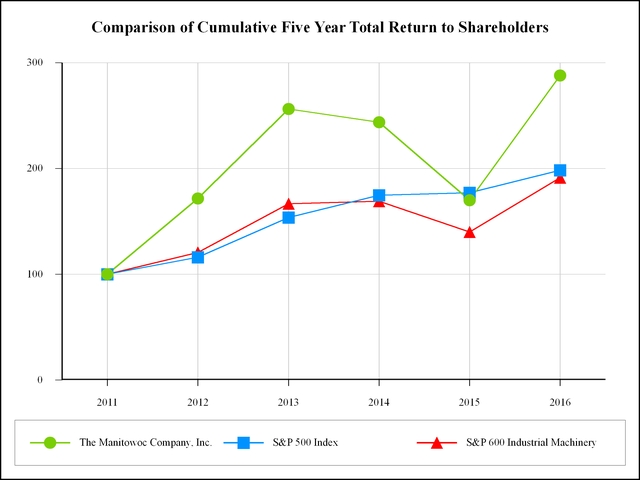

Total Return to Shareholders

(Includes reinvestment of dividends)

Annual Return Percentages | ||||||||||||||

Years Ending December 31, | ||||||||||||||

2012 | 2013 | 2014 | 2015 | 2016 | ||||||||||

The Manitowoc Company, Inc. | 71.53 | % | 49.30 | % | (4.86 | )% | (30.21 | )% | 69.23 | % | ||||

S&P 500 Index | 16.00 | % | 32.39 | % | 13.69 | % | 1.38 | % | 11.96 | % | ||||

S&P 600 Industrial Machinery | 20.56 | % | 38.22 | % | 1.36 | % | (17.22 | )% | 36.69 | % | ||||

Indexed Returns | |||||||||||||||||

Years Ending December 31, | |||||||||||||||||

2011 | 2012 | 2013 | 2014 | 2015 | 2016 | ||||||||||||

The Manitowoc Company, Inc. | 100.00 | 171.53 | 256.10 | 243.66 | 170.04 | 287.77 | |||||||||||

S&P 500 Index | 100.00 | 116.00 | 153.57 | 174.60 | 177.01 | 198.18 | |||||||||||

S&P 600 Industrial Machinery | 100.00 | 120.56 | 166.64 | 168.91 | 139.82 | 191.13 | |||||||||||

21

Item 6. SELECTED FINANCIAL DATA

The following selected historical financial data has been derived from the Consolidated Financial Statements of The Manitowoc Company, Inc. The data should be read in conjunction with the Company's Consolidated Financial Statements and related notes and Item 7, “Management’s Discussion and Analysis of Financial Condition and Results of Operations.” Results of the prior Foodservice segment and Manitowoc Dong Yue business in the years presented have been classified as discontinued operations to exclude those results from continuing operations. In addition, the income (loss) from discontinued operations includes the impact of adjustments to certain retained liabilities for operations sold or closed in periods prior to those presented. Amounts are in millions except share and per share data.

2016 | 2015 | 2014 | 2013 | 2012 | ||||||||||||||||

Net sales | $ | 1,613.1 | $ | 1,865.7 | $ | 2,305.2 | $ | 2,506.3 | $ | 2,427.1 | ||||||||||

Gross Profit | 253.3 | 332.2 | 467.2 | 508.1 | 456.1 | |||||||||||||||

Total operating costs and expenses | 406.6 | 344.6 | 360.1 | 355.5 | 353.3 | |||||||||||||||

Operating (loss) income | (153.3 | ) | (12.4 | ) | 107.1 | 152.6 | 102.8 | |||||||||||||

Total other expense | (114.8 | ) | (98.6 | ) | (127.5 | ) | (138.8 | ) | (149.8 | ) | ||||||||||

(Loss) income from continuing operations before taxes | (268.1 | ) | (111.0 | ) | (20.4 | ) | 13.8 | (47.0 | ) | |||||||||||

Provision (benefit) for taxes on income | 100.5 | (41.1 | ) | (17.8 | ) | (22.0 | ) | (14.8 | ) | |||||||||||

(Loss) income from continuing operations | (368.6 | ) | (69.9 | ) | (2.6 | ) | 35.8 | (32.2 | ) | |||||||||||

Discontinued operations: | ||||||||||||||||||||

(Loss) income from discontinued operations, net of income taxes | (7.2 | ) | 135.4 | 161.4 | 134.5 | 128.0 | ||||||||||||||

Loss on sale of discontinued operations, net of income taxes | — | — | (11.0 | ) | (2.7 | ) | — | |||||||||||||

Net (loss) income | (375.8 | ) | 65.5 | 147.8 | 167.6 | 95.8 | ||||||||||||||

Less: Net income (loss) attributable to noncontrolling interest, net of tax | — | — | 3.9 | 25.8 | (9.1 | ) | ||||||||||||||

Net (loss) income attributable to Manitowoc common shareholders | $ | (375.8 | ) | $ | 65.5 | $ | 143.9 | $ | 141.8 | $ | 104.9 | |||||||||

Amounts attributable to the Manitowoc common shareholders: | ||||||||||||||||||||

(Loss) income from continuing operations | $ | (368.6 | ) | $ | (69.9 | ) | $ | (6.9 | ) | $ | 1.5 | $ | (14.8 | ) | ||||||

(Loss) income from discontinued operations, net of income taxes | (7.2 | ) | 135.4 | 161.8 | 143.0 | 119.7 | ||||||||||||||

Loss on sale of discontinued operations, net of income taxes | — | — | (11.0 | ) | (2.7 | ) | — | |||||||||||||

Net (loss) income attributable to Manitowoc common shareholders | $ | (375.8 | ) | $ | 65.5 | $ | 143.9 | $ | 141.8 | $ | 104.9 | |||||||||

Basic (loss) income per common share: | ||||||||||||||||||||

(Loss) income from continuing operations attributable to Manitowoc common shareholders | $ | (2.68 | ) | $ | (0.51 | ) | $ | (0.05 | ) | $ | 0.01 | $ | (0.11 | ) | ||||||

(Loss) income from discontinued operations attributable to Manitowoc common shareholders | (0.05 | ) | 1.00 | 1.20 | 1.08 | 0.91 | ||||||||||||||

Loss on sale of discontinued operations, net of income taxes | — | — | (0.08 | ) | (0.02 | ) | — | |||||||||||||

Basic (loss) income per share attributable to Manitowoc common shareholders | $ | (2.73 | ) | $ | 0.48 | $ | 1.07 | $ | 1.07 | $ | 0.80 | |||||||||

Diluted (loss) income per common share: | ||||||||||||||||||||

(Loss) income from continuing operations attributable to Manitowoc common shareholders | $ | (2.68 | ) | $ | (0.51 | ) | $ | (0.05 | ) | $ | 0.01 | $ | (0.11 | ) | ||||||

(Loss) income from discontinued operations attributable to Manitowoc common shareholders | (0.05 | ) | 1.00 | 1.20 | 1.04 | 0.91 | ||||||||||||||

Loss on sale of discontinued operations, net of income taxes | — | — | (0.08 | ) | (0.02 | ) | — | |||||||||||||

Diluted (loss) income per share attributable to Manitowoc common shareholders | $ | (2.73 | ) | $ | 0.48 | $ | 1.07 | $ | 1.05 | $ | 0.80 | |||||||||

Cash dividends per share | $ | — | $ | 0.08 | $ | 0.08 | $ | 0.08 | $ | 0.08 | ||||||||||

Average shares outstanding: | ||||||||||||||||||||

Basic | 137,767,109 | 136,036,192 | 134,934,892 | 132,894,179 | 131,447,895 | |||||||||||||||

Diluted | 137,767,109 | 136,036,192 | 134,934,892 | 135,330,193 | 131,447,895 | |||||||||||||||

22

PROPERTY, PLANT AND EQUIPMENT | |||||||||||||||||||

Property, plant and equipment - net | $ | 308.8 | $ | 410.7 | $ | 456.7 | $ | 438.5 | $ | 411.9 | |||||||||