Attached files

| file | filename |

|---|---|

| EX-99.1 - EX-99.1 - OptiNose, Inc. | q221earningsrelease.htm |

| 8-K - 8-K - OptiNose, Inc. | optn-20210811.htm |

Building a Leading ENT / Allergy Specialty Company C o r p o r a t e P r e s e n t a t i o n A u g u s t 1 1 , 2 0 2 1 Exhibit 99.2

2 Forward-Looking Statements This presentation and our accompanying remarks contain “forward-looking statements” within the meaning of the U.S. Private Securities Litigation Reform Act of 1995. All statements that are not historical facts are hereby identified as forward-looking statements for this purpose and include, among others, statements relating to: potential for continued XHANCE prescription and net revenue growth and factors supporting such growth; prescription, refill and market share trends; potential effects of INS market seasonality on XHANCE prescriptions; early year effects on net revenue and prescriptions related to patient insurance; projected Company GAAP operating expenses and stock-based compensation for 2021; projected XHANCE net revenues for full year 2021; projected XHANCE net revenue per prescription for the remainder of 2021; the Company's plans to seek approval for a follow-on indication for XHANCE for the treatment of chronic sinusitis and the potential benefits of such indication; the expectation of having top-line results from one chronic sinusitis trial in the first quarter of 2022 and results from the second trial in the second quarter of 2022; our development, timing of data, and funding plans for OPN-019 and the potential benefits of OPN-019; and other statements regarding the Company’s future operations, financial performance, prospects, intentions, objectives and other future events. Forward-looking statements are based upon management’s current expectations and assumptions and are subject to a number of risks, uncertainties and other factors that could cause actual results and events to differ materially and adversely from those indicated by such forward-looking statements including, among others: impact of, and the uncertainties caused by, the COVID-19 pandemic; physician and patient acceptance of XHANCE; the Company’s ability to maintain adequate third party reimbursement for XHANCE (market access); the Company’s ability to grow XHANCE prescriptions and net revenues; market opportunities for XHANCE may be smaller than expected; uncertainties and delays relating to the initiation, enrollment, completion and results of clinical trials; unexpected costs and expenses; the Company’s ability to comply with the covenants and other terms of the Pharmakon note purchase agreement; risks and uncertainties relating to intellectual property; and the risks, uncertainties and other factors discussed in the “Risk Factors” section and elsewhere in our most recent Form 10-K and Form 10-Q filings with the Securities and Exchange Commission – which are available at http://www.sec.gov. As a result, you are cautioned not to place undue reliance on any forward-looking statements. Any forward-looking statements made in this presentation speak only as of the date of this presentation, and we undertake no obligation to update such forward-looking statements, whether as a result of new information, future developments or otherwise.

3 Key Takeaways and Q2 2021 Highlights Q2 2021 Performance Aligned with Company Guidance Multiple Factors Support Continued Revenue Growth in 2021 Enrollment Complete in First CS Trial with Data Expected in Q1 2022 Market Opportunity in CS is Significantly Larger than NP +79% XHANCE Net Revenue Growth Q2 2021/Q2 2020 $221 XHANCE Net Revenue per TRx in Q2 2021 $94M Cash and equivalents as of June 30, 2021 +33% XHANCE TRx Growth Q2 2021/Q2 2020 +55% XHANCE NRx Growth Q2 2021/Q2 2020

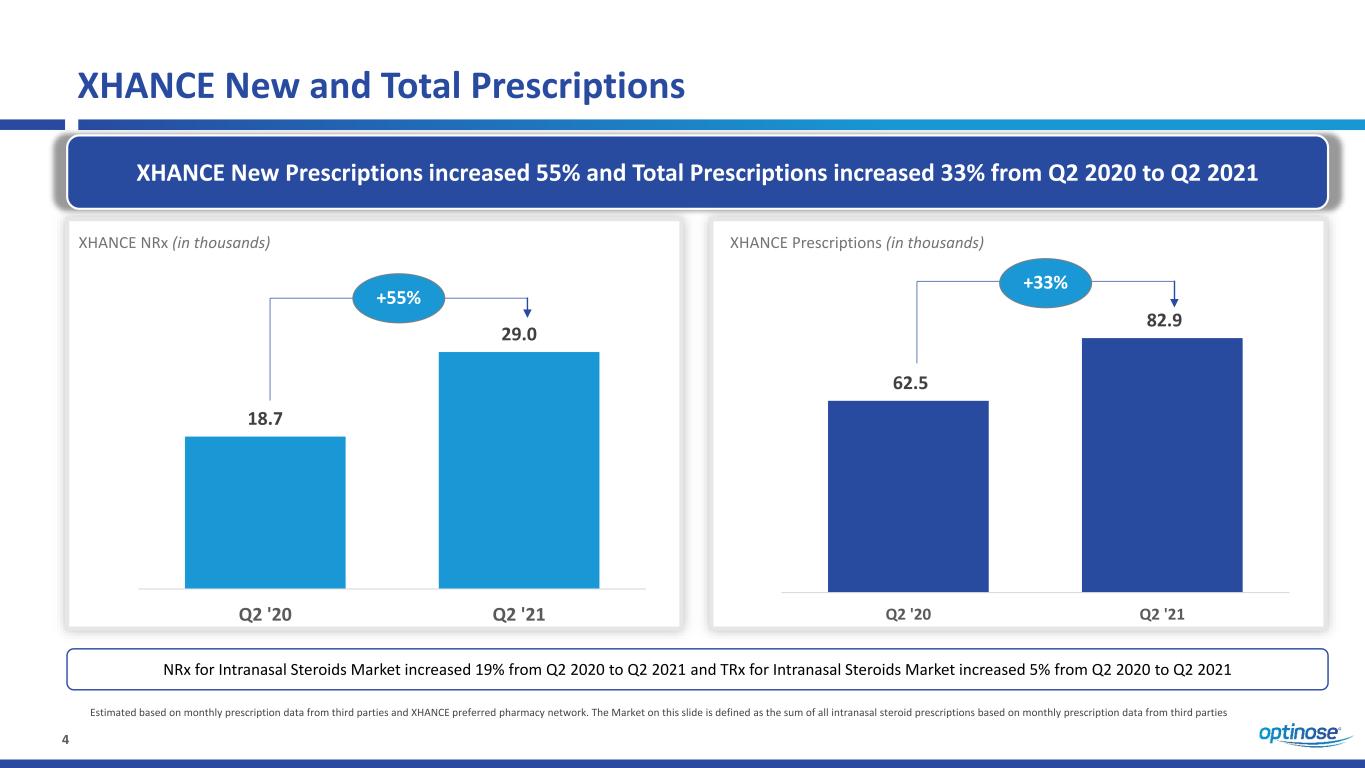

4 XHANCE New and Total Prescriptions XHANCE New Prescriptions increased 55% and Total Prescriptions increased 33% from Q2 2020 to Q2 2021 Estimated based on monthly prescription data from third parties and XHANCE preferred pharmacy network. The Market on this slide is defined as the sum of all intranasal steroid prescriptions based on monthly prescription data from third parties 18.7 29.0 Q2 '20 Q2 '21 XHANCE NRx (in thousands) +55% NRx for Intranasal Steroids Market increased 19% from Q2 2020 to Q2 2021 and TRx for Intranasal Steroids Market increased 5% from Q2 2020 to Q2 2021 62.5 82.9 Q2 '20 Q2 '21 XHANCE Prescriptions (in thousands) +33%

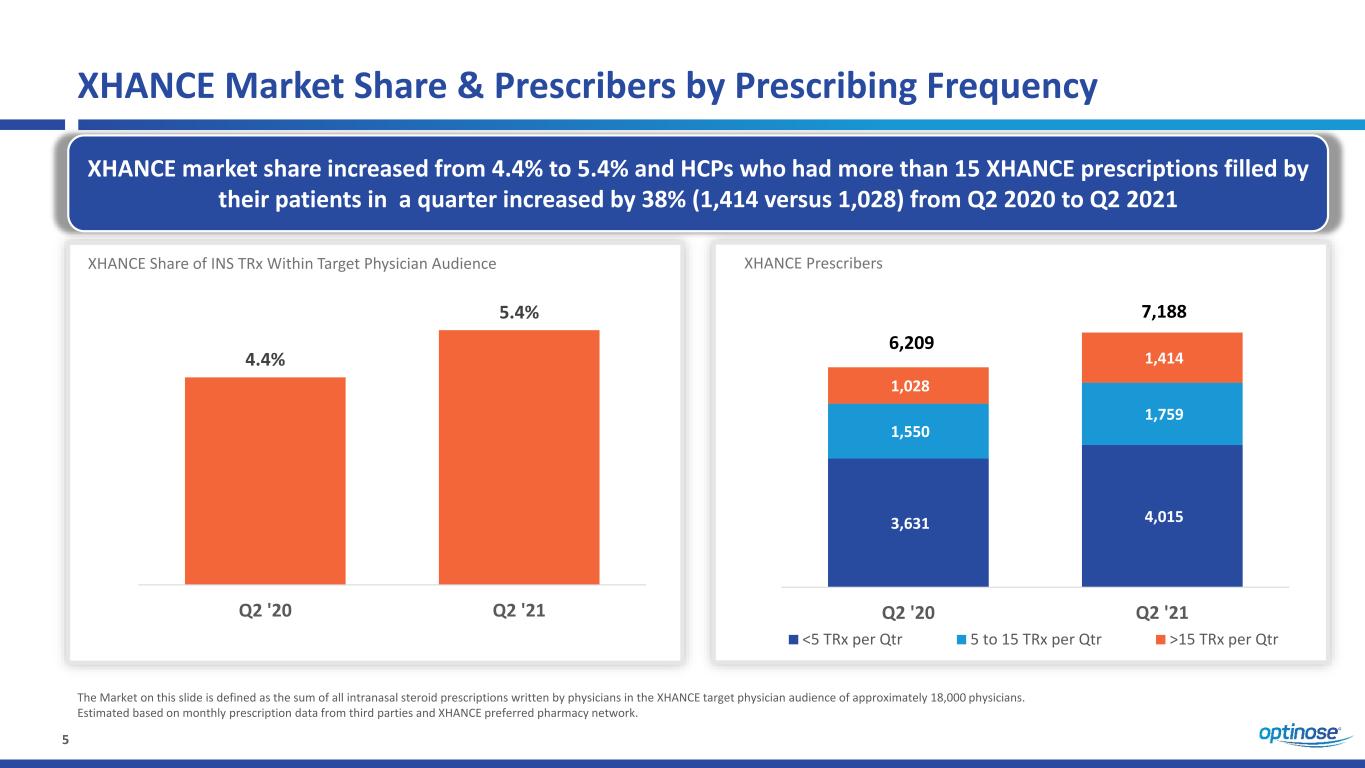

5 XHANCE Market Share & Prescribers by Prescribing Frequency The Market on this slide is defined as the sum of all intranasal steroid prescriptions written by physicians in the XHANCE target physician audience of approximately 18,000 physicians. Estimated based on monthly prescription data from third parties and XHANCE preferred pharmacy network. 4.4% 5.4% Q2 '20 Q2 '21 XHANCE Share of INS TRx Within Target Physician Audience 3,631 4,015 1,550 1,759 1,028 1,414 Q2 '20 Q2 '21 <5 TRx per Qtr 5 to 15 TRx per Qtr >15 TRx per Qtr XHANCE Prescribers 7,188 6,209 XHANCE market share increased from 4.4% to 5.4% and HCPs who had more than 15 XHANCE prescriptions filled by their patients in a quarter increased by 38% (1,414 versus 1,028) from Q2 2020 to Q2 2021

Q2 2021 Financial Update

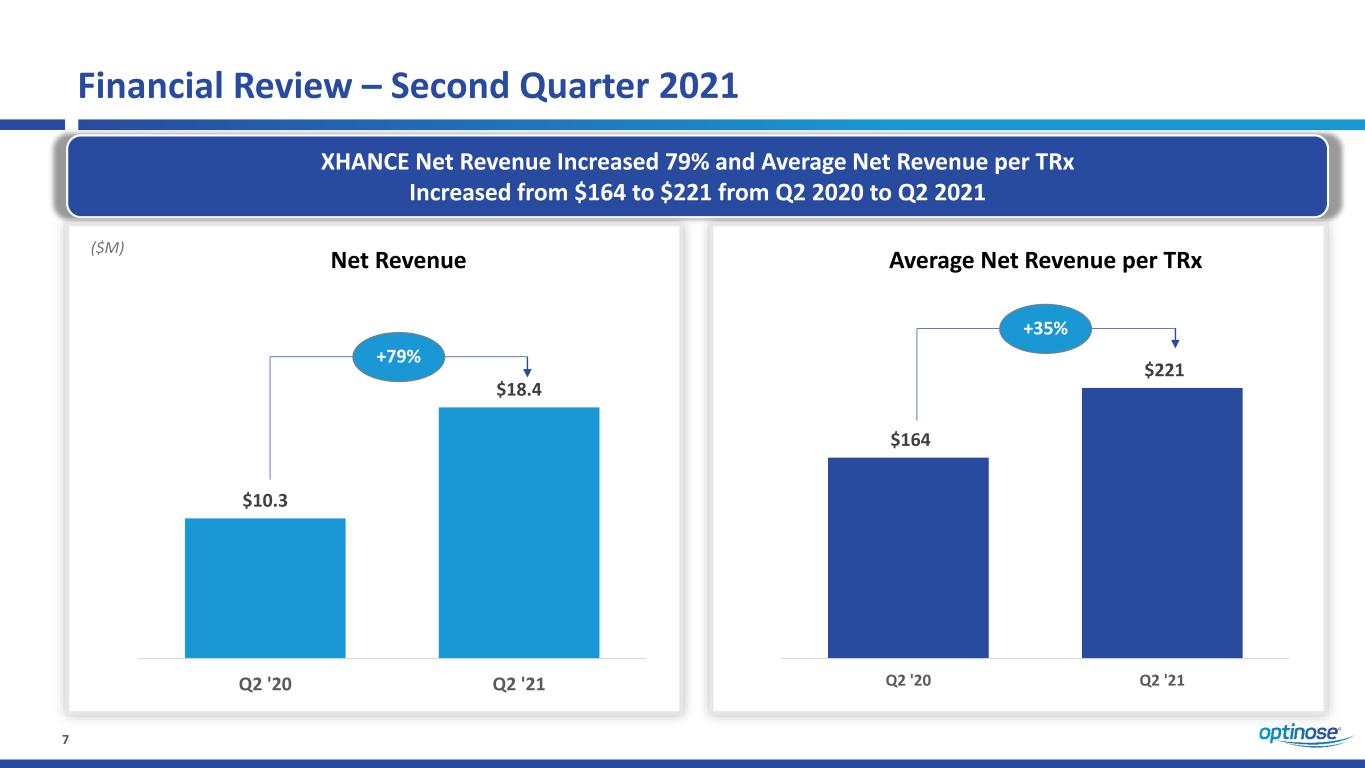

7 Financial Review – Second Quarter 2021 XHANCE Net Revenue Increased 79% and Average Net Revenue per TRx Increased from $164 to $221 from Q2 2020 to Q2 2021 $10.3 $18.4 Q2 '20 Q2 '21 ($M) +79% $164 $221 Q2 '20 Q2 '21 +35% Net Revenue Average Net Revenue per TRx

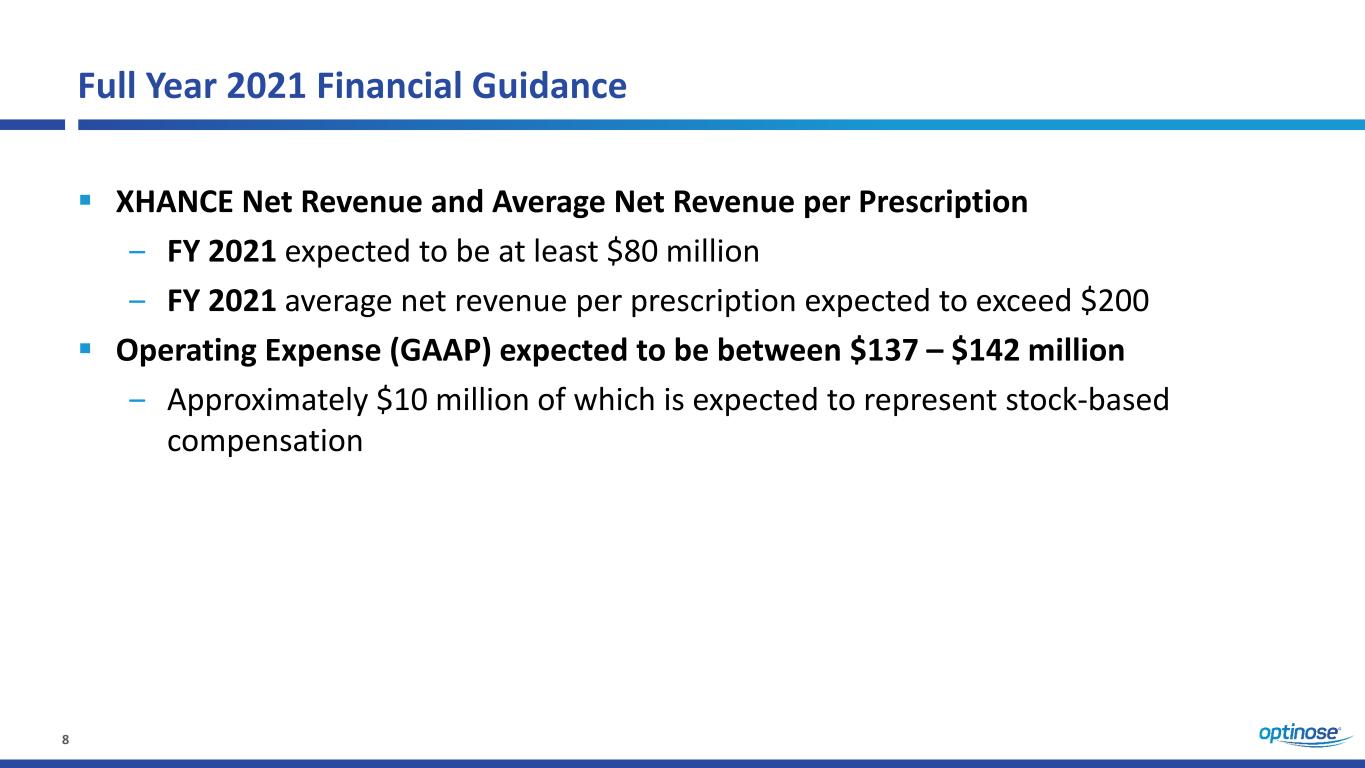

8 Full Year 2021 Financial Guidance XHANCE Net Revenue and Average Net Revenue per Prescription ‒ FY 2021 expected to be at least $80 million ‒ FY 2021 average net revenue per prescription expected to exceed $200 Operating Expense (GAAP) expected to be between $137 – $142 million ‒ Approximately $10 million of which is expected to represent stock-based compensation

Pipeline Updates

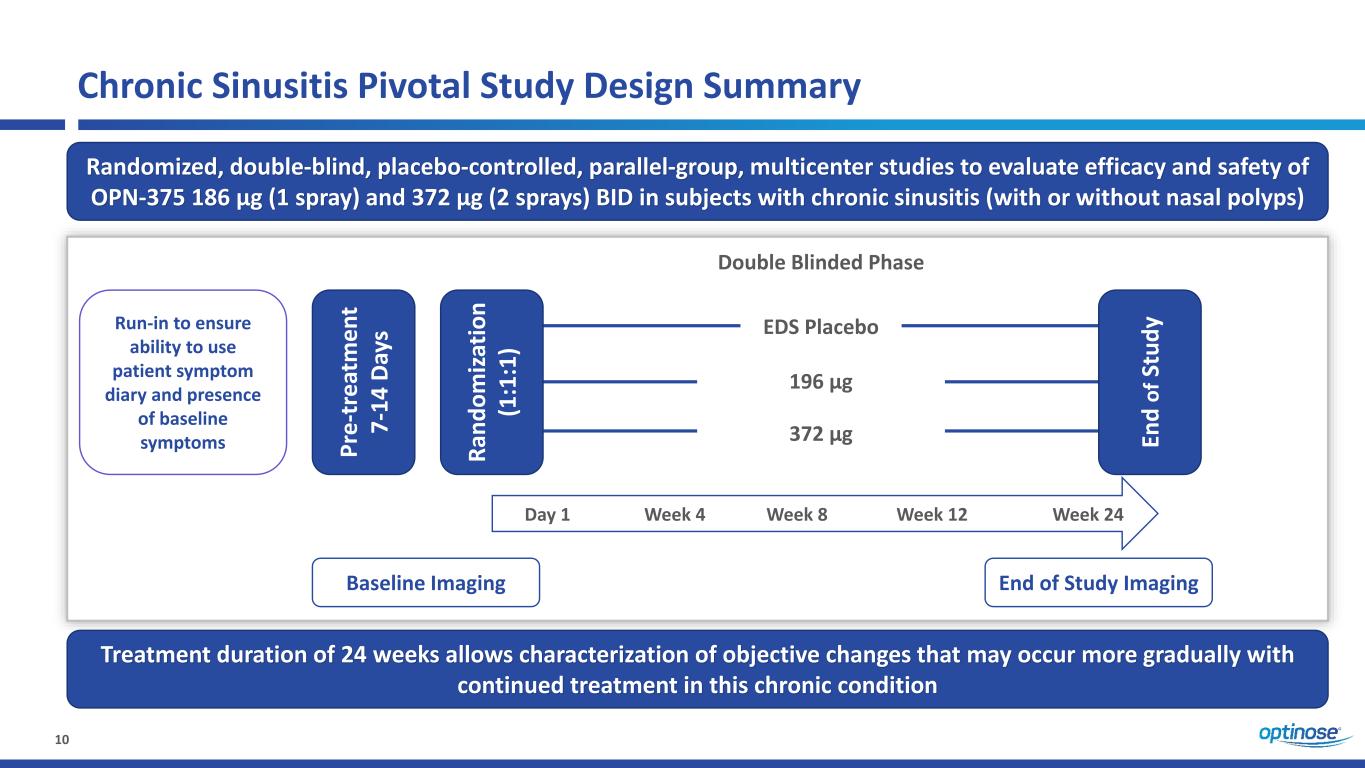

10 EDS Placebo 372 μg Run-in to ensure ability to use patient symptom diary and presence of baseline symptoms Day 1 Week 24 Double Blinded Phase En d of St ud y Week 12Week 8 Chronic Sinusitis Pivotal Study Design Summary Randomized, double-blind, placebo-controlled, parallel-group, multicenter studies to evaluate efficacy and safety of OPN-375 186 μg (1 spray) and 372 μg (2 sprays) BID in subjects with chronic sinusitis (with or without nasal polyps) Week 4 Treatment duration of 24 weeks allows characterization of objective changes that may occur more gradually with continued treatment in this chronic condition 196 μg Ra nd om iza tio n (1 :1 :1 ) Pr e- tr ea tm en t 7- 14 D ay s Baseline Imaging End of Study Imaging

11 XHANCE Chronic Sinusitis Program Enrollment in trial -3205 is complete In June we conducted a planned, blinded, interim analysis (IA) to assess variance in APOV (the CT scan co-primary endpoint) in trial -3205 – The observed variance in the IA is less than the variance assumed for the purpose of sample size estimation during the initial design of the study – Given this result, and the previously reported similar result for variance in the symptom co-primary endpoint, we reduced sample size while maintaining statistical power for the final analysis – Final enrollment of ~330 compared to original target enrollment of 378 We have planned to allow a similar blinded IA for trial -3206 when sufficient data, including 6-month follow up CT scan data, is available Top-line results expected from the first trial in Q1 2022 and the second trial in Q2 2022

12 OPN-019 Pilot Study In early July we received approval from regulatory authorities in Mexico to proceed with conduct of a randomized, adaptive proof of concept single-dose study to evaluate change in viral load after use of OPN-019 by adults with COVID-19 Study drug was made available in Mexico before the end of July and the study is open for enrollment Up to three cohorts of 10 patients are planned Assessments will include reduction in viral load by qRT-PCR and in number of infectious viral particles by culture Recent news concerning variants and breakthrough infections in vaccinated people suggests value for a product like OPN-019 in the evolving pandemic Proof-of-concept clinical data is expected to support pursuit of grants, partnerships, and/or other sources of capital that will be necessary to fund future development

Chronic Sinusitis and the Primary Care Opportunity

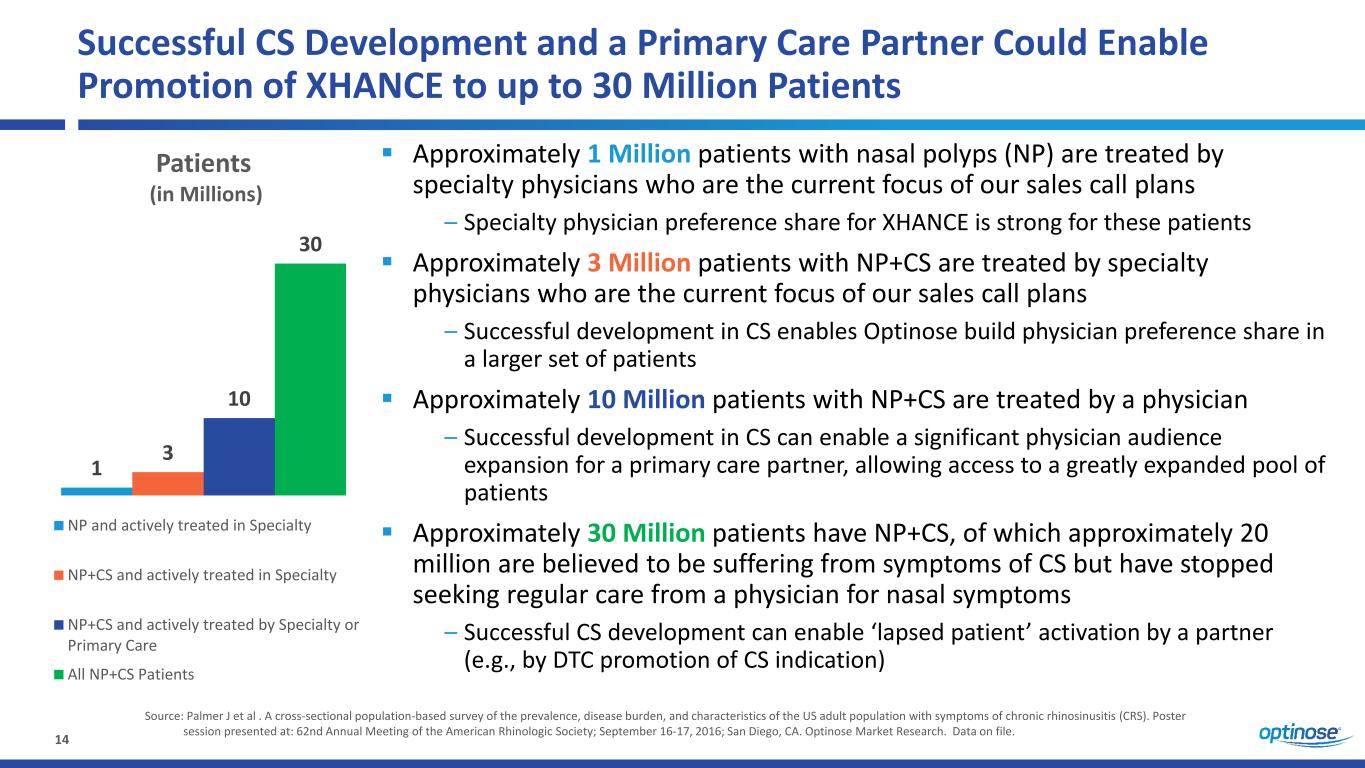

14 Successful CS Development and a Primary Care Partner Could Enable Promotion of XHANCE to up to 30 Million Patients Approximately 1 Million patients with nasal polyps (NP) are treated by specialty physicians who are the current focus of our sales call plans – Specialty physician preference share for XHANCE is strong for these patients Approximately 3 Million patients with NP+CS are treated by specialty physicians who are the current focus of our sales call plans – Successful development in CS enables Optinose build physician preference share in a larger set of patients Approximately 10 Million patients with NP+CS are treated by a physician – Successful development in CS can enable a significant physician audience expansion for a primary care partner, allowing access to a greatly expanded pool of patients Approximately 30 Million patients have NP+CS, of which approximately 20 million are believed to be suffering from symptoms of CS but have stopped seeking regular care from a physician for nasal symptoms – Successful CS development can enable ‘lapsed patient’ activation by a partner (e.g., by DTC promotion of CS indication) 1 3 10 30 Patients (in Millions) NP and actively treated in Specialty NP+CS and actively treated in Specialty NP+CS and actively treated by Specialty or Primary Care All NP+CS Patients Source: Palmer J et al . A cross-sectional population-based survey of the prevalence, disease burden, and characteristics of the US adult population with symptoms of chronic rhinosinusitis (CRS). Poster session presented at: 62nd Annual Meeting of the American Rhinologic Society; September 16-17, 2016; San Diego, CA. Optinose Market Research. Data on file.

Closing Remarks

16 Key Takeaways and Q2 2021 Highlights Q2 2021 Performance Aligned with Company Guidance Multiple Factors Support Continued Revenue Growth in 2021 Enrollment Complete in First CS Trial with Data Expected in Q1 2022 Market Opportunity in CS is Significantly Larger than NP +79% XHANCE Net Revenue Growth Q2 2021/Q2 2020 $221 XHANCE Net Revenue per TRx in Q2 2021 $94M Cash and equivalents as of June 30, 2021 +33% XHANCE TRx Growth Q2 2021/Q2 2020 +55% XHANCE NRx Growth Q2 2021/Q2 2020

17 Investor Relations – NASDAQ: OPTN Optinose Investor Contact Jonathan Neely, VP, Investor Relations and Business Development 267-521-0531 Investors@optinose.com At 30 June 2021: – $94 million in cash – Long-term debt: $130 million – 53.1 million common shares o/s – 11.4 million options, warrants & RSUs o/s 1 - Optinose is followed by the analysts listed above. Please note that any opinions, estimates or forecasts regarding the Company’s performance made by these analysts are theirs alone and do not represent opinions, forecasts or predictions of Optinose or its management. Optinose does not by its reference above or distribution imply its endorsement of or concurrence with such information, conclusions or recommendations. investors@optinose.com www.optinose.com @optinose Analyst Coverage 1 BMO: Gary Nachman Cantor Fitzgerald: Brandon Folkes Cowen: Ken Cacciatore Jefferies: David Steinberg Piper Sandler: David Amsellem RBC: Daniel Busby

Building a Leading ENT / Allergy Specialty Company C o r p o r a t e P r e s e n t a t i o n A u g u s t 1 1 , 2 0 2 1