Attached files

| file | filename |

|---|---|

| EX-32.1 - CERTIFICATION - Pony Group Inc. | f10q0321ex32-1_ponygroup.htm |

| EX-31.1 - CERTIFICATION - Pony Group Inc. | f10q0321ex31-1_ponygroup.htm |

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 10-Q

(MARK ONE)

☒ QUARTERLY REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934

For the quarter ended March 31, 2021

☐ TRANSITION REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934

For the transition period from to

Commission file number: [ ]

| Pony Group Inc. |

| (Exact Name of Registrant as Specified in Its Charter) |

| Delaware | 83-3532241 | |

| (State or other jurisdiction of incorporation or organization) |

(I.R.S. Employer Identification No.) |

Engineer Experiment Building, A202

7 Gaoxin South Avenue, Nanshan District

Shenzhen, Guangdong Province

People’s Republic of China

(Address of principal executive offices)

+86 755 86665622

(Issuer’s telephone number)

Securities registered pursuant to Section 12(b) of the Act:

| Title of each class | Trading Symbol(s) | Name of each exchange on which registered | ||

| None | N/A | N/A |

Check whether the issuer (1) filed all reports required to be filed by Section 13 or 15(d) of the Exchange Act during the past 12 months (or for such shorter period that the registrant was required to file such reports), and (2) has been subject to such filing requirements for the past 90 days. Yes ☐ No ☒

Indicate by check mark whether the registrant has submitted electronically every Interactive Data File required to be submitted pursuant to Rule 405 of Regulation S-T (§232.405 of this chapter) during the preceding 12 months (or for such shorter period that the registrant was required to submit such files). Yes ☒ No ☐

Indicate by check mark whether the registrant is a large accelerated filer, an accelerated filer, a non-accelerated filer, a smaller reporting company or an emerging growth company. See definitions of “large accelerated filer”, “accelerated filer”, “smaller reporting company”, and “emerging growth company” in Rule 12b-2 of the Exchange Act.

| Large accelerated filer | ☐ | Accelerated filer | ☐ | |

| Non-accelerated filer | ☒ | Smaller reporting company | ☒ | |

| Emerging growth company | ☒ |

If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act. ☐

Indicate by check mark whether the registrant is a shell company (as defined in Rule 12b-2 of the Exchange Act). Yes ☐ No ☒

As of May 25, 2021, there were 11,500,000 shares of common stock, par value $0.001 per share, issued and outstanding.

PONY GROUP INC.

FORM 10-Q FOR THE QUARTER ENDED March 31, 2021

TABLE OF CONTENTS

i

PART I - FINANCIAL INFORMATION

Item 1. Interim Financial Statements.

PONY GROUP INC., AND SUBSIDIARIES

| March 31, 2021 | December 31, 2020 | |||||||

| Assets | ||||||||

| Current assets | ||||||||

| Cash and cash equivalents | $ | 264,798 | $ | 286,957 | ||||

| Accounts receivables | 24,747 | 40,705 | ||||||

| Other receivables | 165 | 166 | ||||||

| Other receivables-related parties | 8,998 | 8,998 | ||||||

| Total current assets | 298,708 | 336,826 | ||||||

| Total assets | $ | 298,708 | $ | 336,826 | ||||

| Liabilities and Equity | ||||||||

| Current liabilities | ||||||||

| Accounts payable | $ | 14,384 | $ | 9,591 | ||||

| Other payable-related party | 313,577 | 300,483 | ||||||

| Other current liability | 16,089 | 27,895 | ||||||

| Total current liabilities | 344,050 | 337,969 | ||||||

| Total liabilities | $ | 344,050 | $ | 337,969 | ||||

| Equity | ||||||||

| Ordinary shares, $0.001 par value, 70,000,000 shares authorized, 11,500,000 shares issued and outstanding as of March 31 2021 and December 31, 2020, respectively* | 11,500 | 11,500 | ||||||

| Additional paid-in capital | 176,000 | 176,000 | ||||||

| Accumulated foreign currency exchange loss | (8,081 | ) | (6,323 | ) | ||||

| Accumulated deficit | (224,761 | ) | (182,320 | ) | ||||

| Total Pony Group Inc stockholders’ equity | (45,342 | ) | (1,143 | ) | ||||

| Total equity | (45,342 | ) | (1,143 | ) | ||||

| Total liabilities and equity | $ | 298,708 | $ | 336,826 | ||||

The accompanying notes are integral to these consolidated financial statements.

1

PONY GROUP INC., AND SUBSIDIARIES

CONSOLIDATED STATEMENTS OF OPERATIONS

| For The Three Months Ended | ||||||||

| March 31, | ||||||||

| 2021 | 2020 | |||||||

| Revenue | $ | 12,268 | $ | 8,732 | ||||

| Cost of revenue | 31,450 | 6,128 | ||||||

| Gross profit | (19,182 | ) | 2,604 | |||||

| Operating expenses | ||||||||

| General & administrative expenses | 23,160 | 12,579 | ||||||

| Selling expenses | - | - | ||||||

| Total operating expenses | 23,160 | 12,579 | ||||||

| Income (loss) from operation | (42,342 | ) | (9,975 | ) | ||||

| Other income (expenses) | ||||||||

| Other income (expense) | (99 | ) | 242 | |||||

| Total other income | (99 | ) | 242 | |||||

| Income (Loss) before income taxes | (42,441 | ) | (9,733 | ) | ||||

| Provision for income tax | - | - | ||||||

| Net Income (Loss) | $ | (42,441 | ) | $ | (9,733 | ) | ||

| Net Income (Loss) | (42,441 | ) | (9,733 | ) | ||||

| Other Comprehensive Income | - | - | ||||||

| Comprehensive income (loss) | $ | (42,441 | ) | $ | (9,733 | ) | ||

| Basic and diluted earnings (loss) per common share* | $ | (0.004 | ) | $ | (0.001 | ) | ||

| Weighted average number of shares outstanding* | 11,500,000 | 9,000,000 | ||||||

* The shares are presented on a retroactive basis to reflect the nominal share issuance.

The accompanying notes are integral to these consolidated financial statements.

2

PONY GROUP INC., AND SUBSIDIARIES

CONSOLIDATED STATEMENT OF CHANGE IN EQUITY

| Common stock | Additional Paid-In | Subscription received in | Accumulated Other Comprehensive Income | Accumulated Earnings | ||||||||||||||||||||||||

| Shares* | Amount | Capital | advance | (Loss) | (Deficit) | Total | ||||||||||||||||||||||

| Balance as of December 31, 2019 | 9,000,000 | $ | 9,000 | $ | - | $ | - | $ | (565 | ) | $ | (140,533 | ) | $ | (132,098 | ) | ||||||||||||

| Cumulative Foreign currency translation adjustment | - | - | - | - | (286 | ) | - | (286 | ) | |||||||||||||||||||

| Net (Loss) | - | - | - | - | - | (9,734 | ) | (9,734 | ) | |||||||||||||||||||

| Balance as of March 31, 2020 | 9,000,000 | $ | 9,000 | $ | - | $ | (851 | ) | $ | (150,267 | ) | $ | (142,118 | ) | ||||||||||||||

| Common stock issued | ||||||||||||||||||||||||||||

| 2,500,000 | 2,500 | 176,000 | - | - | - | 178,500 | ||||||||||||||||||||||

| Cumulative Foreign currency translation adjustment | - | - | - | - | (5,472 | ) | - | (5,472 | ) | |||||||||||||||||||

| Net (Loss) | - | - | $ | - | - | (32,053 | ) | (32,053 | ) | |||||||||||||||||||

| Balance as of December 31, 2020 | 11,500,000 | $ | 11,500 | $ | 176,000 | $ | - | $ | (6,323 | ) | $ | (182,320 | ) | $ | (1,143 | ) | ||||||||||||

| Cumulative Foreign currency translation adjustment | - | - | - | - | (1,758 | ) | - | (1,758 | ) | |||||||||||||||||||

| Net (Loss) | - | - | - | - | - | (42,441 | ) | (42,441 | ) | |||||||||||||||||||

| Balance as of March 31, 2021 | 11,500,000 | $ | 11,500 | $ | 176,000 | $ | - | $ | (8,081 | ) | $ | (224,761 | ) | $ | (45,342 | ) | ||||||||||||

* The shares are presented on a retroactive basis to reflect the nominal share issuance.

The accompanying notes are integral to these consolidated financial statements.

3

PONY GROUP INC., AND SUBSIDIARIES

CONSOLIDATED STATEMETNS OF CASH FLOWS

| For

The Three Months Ended March 31, | ||||||||

| 2021 | 2020 | |||||||

| Operating activities | ||||||||

| Net Loss | $ | (42,441 | ) | $ | (9,733 | ) | ||

| Changes in operating assets and liabilities: | ||||||||

| Accounts receivable | 15,958 | (7,410 | ) | |||||

| Other receivable | 1 | (18 | ) | |||||

| Accounts payable | 4,793 | - | ||||||

| Other payable | (11,806 | ) | - | |||||

| Cash provided (used) in operating activities | (33,495 | ) | (17,161 | ) | ||||

| Cash flow used in investing activities: | ||||||||

| Cash used in investing activities | - | - | ||||||

| Cash flow provided (used) by financing activities: | ||||||||

| Advance from (repayment to) related party | 13,094 | 10,965 | ||||||

| Cash provided by financing activities | 13,094 | 10,965 | ||||||

| Effects of currency translation on cash | (1,758 | ) | (839 | ) | ||||

| Net increase (decrease) in cash | (22,159 | ) | (7,035 | ) | ||||

| Cash at beginning of the period | 286,625 | 44,105 | ||||||

| Cash at end of period | $ | 264,466 | $ | 37,070 | ||||

The accompanying notes are integral to these consolidated financial statements.

4

PONY GROUP INC., AND SUBSIDIARIES

NOTES FOR THE CONSOLIDATED FINANCIAL STATEMENTS

FOR THE PERIOD ENDED MARCH 31, 2021

NOTE 1 - ORGANIZATIONS AND SUMMARY OF SIGNIFICANT ACCOUNTING POLICIES

Organization and Operations

PONY GROUP INC, (The “Company” or “PONY”) was incorporated on Jan 7, 2019 in the state of Delaware.

On March 7, 2019, Pony Group Inc (the “Purchaser”), and Wenxian Fan, the sole owner of PONY LIMOUSINE SERVICES LIMITED, entered into a Stock Purchase Agreement (the “Purchase Agreement”), pursuant to which Wenxian Fan (the “Seller”) would sell to the Purchaser, and the Purchaser will purchase from the Seller, 10,000 shares of the PONY LIMOUSINE SERVICES LIMITED, which represented 100% of the shares. On March 7, 2019, this transaction was completed.

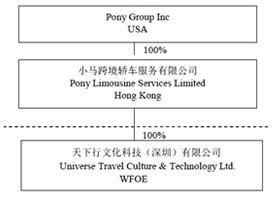

PONY LIMOUSINE SERVICES LIMITED (“PONYHK”) is a limited liability company formed under the laws of Hong Kong on April 28, 2016, which was formed by FAN WENXIAN. Its registered office is located at FLAT/RM 01 11/f, LUCKY COMM BLDG, 103 DES VOEUX RD WEST, SHEUNG WAN, HONG KONG. The business nature of the Company is to provide cross boarder limousine services to customers. On February 2, 2019, Universe Travel Culture & Technology Ltd. (“Universe Travel”) was incorporated as a wholly-owned PRC subsidiary of Pony HK.

Details of the Company’s structure as of March 31, 2021 is as follow:

Reverse Merger Accounting – Since Pony HK and Pony US were entities under Ms. Fan’s common control prior to the “Purchase Agreement” was executed, and because of certain other factors, including that the member of the Company’s executive management is from Pony HK, Pony HK is deemed to be the acquiring company for accounting purposes and the Merger was accounted for as a reverse merger and a recapitalization in accordance with generally accepted accounting principles in the United States (“GAAP”). These unaudited consolidated financial statements reflect the historical results of Pony HK prior to the Merger and that of the combined Company following the Merger, and do not include the historical financial results prior to the completion of the Merger. Common stock and the corresponding capital amounts of the Company pre-Merger have been retroactively restated as capital stock shares.

Basis of Accounting and Presentation - The accompanying financial statements have been prepared in accordance with accounting principles generally accepted in the United States of America.

5

NOTE 1 - ORGANIZATIONS AND SUMMARY OF SIGNIFICANT ACCOUNTING POLICIES (CONTINUED)

Cash and Cash Equivalents – For purpose of the statements of cash flows, the Company considers all highly liquid debt instruments purchased with a maturity of 90 days or less to be cash equivalents.

Accounts Receivable - The customers are required to make payments when they book the services, otherwise, the services will not be arranged. Sometimes, the Company extends credit to its group clients.

As of March 31, 2021 and December 31, 2020, accounts receivable were $24,747 and $40,705, respectively. The company considers accounts receivable to be fully collectible and determined that an allowance for doubtful accounts was not necessary.

The PONY LIMOUSINE SERVICES LIMITED, 100% subsidiary of the company has agreements with its two major clients that the payments for the services rendered be settled every six months. The two major clients account for 100% of the revenue for the three months ended March 31, 2021 and 97.32% for the same period 2020, respectively.

Revenue Recognition - The Company recognizes revenue in accordance with ASC 606. The core principle of ASC606 is to recognize revenue when promised goods or services are transferred to customers in an amount that reflects the consideration that is expected to be received for those goods or services. ASC 606 defines a five-step process to achieve this core principle, which includes: (1) identifying contracts with customers, (2) identifying performance obligations within those contracts, (3) determining the transaction price, (4) allocating the transaction price to the performance obligation in the contract, which may include an estimate of variable consideration, and (5) recognizing revenue when or as each performance obligation is satisfied. Our sales arrangements generally ask customers to pay in advance before any services can be arranged. The company recognizes revenue when each performance obligation is satisfied. Documents and terms and the completion of any customer acceptance requirements, when applicable, are used to verify services rendered. The Company has no returns or sales discounts and allowances because services rendered and accepted by customers are normally not returnable.

Cost of revenue – Cost of revenue includes cost of services rendered during the period, net of discounts and sales tax.

Income Taxes – Income tax expense represents current tax expense. The income tax payable represents the amounts expected to be paid to the taxation authority. Hong Kong profits tax has been provided at the rate of 16.5% on the estimated assessable profit for the period.

Foreign Currency Translation - PONY LIMOUSINE SERVICES LIMITED’s functional currency is the Hong Kong Dollar (HK$) and Universe Travel Culture & Technology Ltd.’s functional currency is the Renminbi (RMB). The reporting currency is that of the US Dollar. Assets, liabilities and owners’ contribution are translated at the exchange rates as of the balance sheet date. Income and expenditures are translated at the average exchange rate of the year.

The exchange rates used to translate amounts in HK$ and RMB into USD for the purposes of preparing the financial statements were as follows:

| March 31, 2021 | ||||

| Balance sheet | HK$7.77 to US $1.00 | RMB 6.55 to US $1.00 | ||

| Statement of operation and other comprehensive income | HK$7.76 to US $1.00 | RMB 6.48 to US $1.00 | ||

| December 31, 2020 | ||||

| Balance sheet | HK$7.75 to US $1.00 | RMB 6.53 to US $1.00 | ||

| March 31, 2020 | ||||

| Statement of operation and other comprehensive income | HK$7.77 to US $1.00 | RMB 6.98 to US $1.00 |

6

NOTE 2 - GOING CONCERN

The Company had operating losses of $42,441 and $9,733 during the three months ended March 31, 2021 and 2020, respectively.

The Company has accumulated deficit of $224,761 and $182,320 as of March 31, 2021 and December 31, 2020, respectively. The Company’s continuation as a going concern is dependent on its ability to generate sufficient cash flows from operations to meet its obligations and/or obtain additional financing, as may be required.

The accompanying financial statements have been prepared assuming the Company will continue as a going concern; however, the above condition raises substantial doubt about the Company’s ability to do so. The financial statements do not include any adjustments to reflect the possible future effects on the recoverability and classification of assets or the amounts and classification of liabilities that may result should the Company be unable to continue as a going concern.

Management’s Plan to Continue as a Going Concern

In order to continue as a going concern, the Company will need, among other things, additional capital resources. Management’s plans to obtain such resources for the Company include (1) obtaining capital from the sale of its equity securities, (2) sales of the Company’s products, (3) short-term and long-term borrowings from banks, and (4) short-term borrowings from stockholders or other related party (ies) when needed. However, management cannot provide any assurance that the Company will be successful in accomplishing any of its plans.

The ability of the Company to continue as a going concern is dependent upon its ability to successfully accomplish the plans described in the preceding paragraph and eventually to secure other sources of financing and attain profitable operations.

NOTE 3 - RELATED PARTY TRANSACTIONS

PONY GROUP INC, incorporated on Jan 7, 2019 in the state of Delaware, is the sole owner of PONY LIMOUSINE SERVICES LIMITED (Pony HK), as of March 31, 2021, Pony HK has paid $160,962 on behalf of PONY GROUP INC for the US legal and audit cost incurred relevant to the OTC listing.

Amount of receivable from shareholders due to the company declared a 6,000 to 1 stock split. After the stock split, the par value of the commons stocks was $0.001 per share. The shareholders should pay the consideration of $8,998 to the company. For the company use a retroactive basis to present the nominal shares, the considerations and receivable form shareholders also should be represented.

| March 31, 2021 | December 31, 2020 | |||||||

| Receivable from shareholders | $ | 8,998 | $ | 8,998 | ||||

| Total due from related parties | $ | 8,998 | $ | 8,998 | ||||

Ms. Wenxian Fan, the director, loaned working capital to Pony HK with no interest and paid on behalf of Pony HK for the subcontracted services and employee salaries.

The Company has the following payables to Ms. Wenxian Fan:

| March 31, 2021 | December 31, 2020 | |||||||

| To Wenxian Fan | $ | 313,577 | $ | 300,483 | ||||

| Total due to related parties | $ | 313,577 | $ | 300,483 | ||||

7

NOTE 4 - MAJOR SUPPLIERS AND CUSTOMERS

The Company purchased majority of its subcontracted services from four suppliers which accounted for 100% of the total purchases during the three months ended March 31, 2021: Shenzhen Lingshang Cultural Technology Co., Ltd for 74.96%, Global Express (Hong Kong) Limited for 19.12%, YAHONG BUSINESS LIMITED for 4.15%, and FUN TRAVEL for 1.77%.

The Company had one major customer for the three months ended March 31, 2021. HENG TAI WINE LIMITED account for 100% of revenue.

NOTE 5 - COMMON STOCK

On May 23, 2019, PONY GROUP INC sold 1,500 shares of common stock to the following shareholders. On May 24, 2019, these transactions were completed, the consideration received were deposited into the company’s bank account. On June 1, 2020, the company declared a 6,000 to 1 stock split. After the stock split, the par value of the commons stocks was $0.001 per share. The shareholders and the number of shares held after the stock dividend are as following:

| Name | Shares | Consideration | ||||||

| Pony Group Ltd. | 5,580,000 | 5,580 | ||||||

| Aller Bonvoyage Inc | 360,000 | 360 | ||||||

| Capital Club Holding Limited | 360,000 | 360 | ||||||

| KERUIDA Investment Limited | 900,000 | 900 | ||||||

| Synionm Investments Limited | 900,000 | 900 | ||||||

| Wisdom travel service investments Limited | 900,000 | 900 | ||||||

In June 2020, the Company announced the closing of its initial public offering of 2,500,000 ordinary shares at a public offering price of $0.1 per share, for total gross proceeds of approximately $250,000 before deducting underwriting discounts, commissions and other related expenses.

NOTE 6 - SUBSEQUENT EVENTS

Management has evaluated subsequent events through June 22, 2021, the date which the financial statements were available to be issued. All subsequent events requiring recognition as of March 31, 2021 have been incorporated into these financial statements and there are no subsequent events that require disclosure in accordance with FASB ASC Topic 855, “Subsequent Events.”

8

Item 2. Management’s Discussion and Analysis of Financial Condition and Results of Operations

Overview

We were incorporated in the State of Delaware on January 7, 2019. We are a travel service provider. We currently provide car services to individual and group travellers. We currently offer carpooling, airport pick-up and drop-off, and personal driver services for travellers between Guangdong Province and Hong Kong. We collaborate with car fleet companies and charge a service fee by matching the traveller and the driver. We officially launched our online service through our “Let’s Go” mobile application in December 2019 to provide multi-language services to international travellers coming to visit China. Redefining user experience, we aim to provide our users with comprehensive and convenient service offerings and become a one-stop travel booking resource for travellers. While network scale is important, we recognize that transportation happens locally. We currently operate in two markets – Guangdong Province and Hong Kong and plan to expand our offering in more overseas markets.

Plan of Operations

In January 2019, we started our Research and Development (“R&D”) project mobile Lets Go App (“App”) designed to have multi-language interface to attract users from the world, focusing on providing one-stop travel services to foreigners traveling in China, for both leisure and business.

In April 2019, we rolled out basic version which supports carpooling, car rental, Airport Pick-up and/or Drop-off, etc., ready for download at Apple App store; the basic version has an interface in Chinese language only. In May 2019, we rolled out second version which has an enhanced interface in both Chinese and English language, supporting payment through PayPal. By the end of 2021, we plan to roll out third version which has multi-language interface to attract users from all-over the world.

We intend to attract users from outside of China to use our App and expand our offerings on the App to serve as a one-stop shop to book tickets, reserve hotels, rent a car and hire an English speaking driver.

Our goal is to grow to an international player in the travel service market. To accomplish such goal, we will cooperate with other businesses which have capital, marketing and technology resources or products. We expect to recruit more workforce and talents, and develop new technologies and products.

Results of Operations

For the three months ended March 31, 2021 Compared to March 31, 2020

Revenue

For the three months ended March 31, 2021 and 2020, revenues were $12,268 and $8,732, respectively, with an increase of $3,536 over the same period in 2020. The increase mainly due to the company provided transportation services for HENG TAI WINE LIMITED during this quarter; this part revenue was USD10,000. The increase was offset by travel service business, due to the effect of COVID-19, the number of travellers between Guangdong province and Hong Kong decease a lot. Thus the orders of our travel service business decrease in the three months ended March 31, 2021.

Cost of Revenue

Cost of Revenue for the three months ended March 31, 2021 and 2020 were $31,450 and $6,128, respectively, with an increase of $25,322 over the same period in 2020. The increase of cost of revenue mainly due to Universe Travel Culture & Technology Ltd. (“Universe Travel”). “Universe Travel” developed the active planning and other service since last year, the cost of new business is growing rapidly.

Gross Profit

Gross profits were negative $19,182 for the three months ended March 31, 2021 when it was $2,604 for the same period of 2020. The decrease of gross profit mainly due to “Universe Travel” developed the active planning and other service since last year, the cost of new business is growing rapidly.

9

Operating Expenses

Operating expenses for the three months ended March 31, 2021 and 2020 were $23,160 and $12,579 respectively for an increase of $10,581. The increase mainly due to the effect of COVID-19 the Company temporarily closed all offices in China and ceased operations from January 19, 2020 to February 10, 2020. There was no such item during the three months ended March 31, 2021.

Other Income (Expense)

Other income (Expense) consists of interest income and exchange gain (loss) for the three months ended March 31, 2021 the net other expense were $99 when it was net income of $242 for the same period in 2020.The change of other Income (expense) mainly due to the change of exchange rate.

Liquidity and Capital Resources

We suffered recurring losses from operations and have an accumulated deficit of $224,761 at March 31, 2021. We had a cash balance of $264,798 and working capital deficit of $45,342 as of March 31, 2021. The Company has incurred losses of $42,441 and $9,733 for the three months ended March 31, 2021 and 2020, respectively. The Company has not continually generated significant gross margins. Unless our operations generate a significant increase in gross margins and cash flows from operating activities, our continued operations will depend on whether we are able to raise additional funds through various sources, such as equity and debt financing, other collaborative agreements and/or strategic alliances. Our management is actively engaged in seeking additional capital to fund our operations in the short to medium term. Such additional funds may not become available on acceptable terms and there can be no assurance that any additional funding that we do obtain will be sufficient to meet our needs in the long term. As of March 31, 2021, we had enough cash to last approximately six months.

Net cash used in operating activities for the three months ended March 31, 2021, amounted to $33,495, compared to $17,161 net cash used in operating activities for the three months ended March 31, 2020. The increase of net cash used in operating activities was primarily due to the net loss. The net loss for the three months ended March 31, 2021 was $42,441 when it was $9,733 in the same period 2020.

There were $0 cash used by investment activities for the three months ended March 31, 2021 and 2020.

Net cash provided by financing activities for the three months ended March 31 2021 amounted to $13,094, compared to net cash provided by financing activities of $10,965 in the same period 2020. The cash provided by financing activities was loan from related party, the shareholder of the company.

10

COVID-19

In January 2020, the World Health Organization declared a global health emergency as the novel coronavirus (“COVID-19”) outbreak continues to spread beyond China. In an effort to contain COVID-19, the Chinese authorities have suspended air, road, and rail travel in the area around Wuhan and placed restrictions on travel and other activities throughout China, including Guangdong Province and Hong Kong, the key market in which we operate. In compliance with the government health emergency rules in place, the Company temporarily closed all offices in China and ceased operations from January 19, 2020 to February 10, 2020. At the end of this period, management reopened our business.

As of the date of this prospectus, the Hong Kong government has reported cases of COVID-19 in the region, has upgraded its response level to emergency, its highest response level, and is taking other steps to manage the outbreak. On February 8, 2020, the Hong Kong government began enforcing a compulsory 14-day quarantine for anyone, regardless of nationality, arriving in Hong Kong who has visited mainland China within a 14-day period. This quarantine does not apply to individuals transiting Hong Kong International Airport and certain exempted groups such as flight crews. However, health screening measures are in place at all of Hong Kong’s borders and the Hong Kong authorities will quarantine individual travelers, including passengers transiting the Hong Kong International Airport, if the Hong Kong authorities determine the traveler to be a health risk. On January 30, 2020, the Hong Kong government closed certain transportation links and border checkpoints connecting Hong Kong with mainland China (all located in Guangdong Province) until further notice, and on February 3, 2020 suspended ferry services from Macau (which has border checkpoints connecting Macau with Guangdong Province).

The effects of the COVID-19 pandemic, including the travel restrictions described above, have resulted in a dramatic reduction in the number of people travelling from Guangdong Province to Hong Kong and a similar reduction in the number of our customers and have, severely impacted our operating results during the first quarter of 2020. For example, compared to the first quarter of 2019, the first quarter of 2020’s revenue, cost of revenue and operating expenses decreased by 33.2%, 43.8% and 76.6%, respectively, and gross profit and other income increased by 19.9% and 240.8%, respectively. We believe the decreases, including the decrease in cost of revenue, are primarily attributable to the fact that we ceased car services for individual and group travelers between Guangdong Province and Hong Kong in the first quarter of 2020, resulting in a decrease of customers. In the same period, we started to provide express, small-package delivery services for customers in the same region in cities including Shenzhen, Guangzhou, Zhuhai and Zhongshan, which brought in an estimated $8,700 of revenue. We expect that after our offices reopened on February 11, 2020 and as the travel restrictions started to ease, our business will gradually return to normal levels, although we are unable to predict as of the date of this prospectus the speed of the recovery.

We expect the COVID-19 outbreak may materially affect our financial condition and results of operations going forward. Our business operations and activities in many regions (including Hong Kong and Guangdong Province) may be subject to quarantines, “shelter-in-place” rules, and various other restrictions for the foreseeable future. Due to the uncertainty of the future impacts of the COVID-19 pandemic, the extent of the financial impact cannot be reasonably estimated at this time. Without limited the generality of the foregoing sentence, any significant disruption to travel, including travel restrictions and other potential protective quarantine measures against COVID-19 by governmental agencies, may increase the difficulty and could make it difficult for the Company to provide its services to its customers. Travel restrictions and protective measures against COVID-19 could cause the Company to incur additional unexpected costs and expenses. The extent to which COVID-19 impacts the Company’s business, sales and results of operations will depend on future developments, which are highly uncertain and cannot be predicted.

11

Going Concern

The accompanying consolidated financial statements have been prepared assuming the Company will continue as a going concern; however, the above condition raises substantial doubt about the Company’s ability to do so. The financial statements do not include any adjustments to reflect the possible future effects on the recoverability and classification of assets or the amounts and classification of liabilities that may result should the Company be unable to continue as a going concern.

In order to continue as a going concern, the Company will need, among other things, additional capital resources. Management’s plans to obtain such resources for the Company include (1) obtaining capital from the sale of its equity securities, (2) sales of the Company’s services, (3) short-term and long-term borrowings from banks, and (4) short-term borrowings from stockholders or other related party(ies) when needed. However, management cannot provide any assurance that the Company will be successful in accomplishing any of its plans. The ability of the Company to continue as a going concern is dependent upon its ability to successfully accomplish the plans described in the preceding paragraph and eventually to secure other sources of financing and attain profitable operations.

Critical Accounting Policies

The discussion and analysis of the Company’s financial condition and results of operations are based upon the Company’s consolidated financial statements, which have been prepared in accordance with accounting principles generally accepted in the United States of America. We continually evaluate our estimates, including those related to bad debts, the useful life of property and equipment and intangible assets, and the valuation of equity transactions. We base our estimates on historical experience and on various other assumptions that we believed to be reasonable under the circumstances, the results of which form the basis for making judgments about the carrying values of assets and liabilities that are not readily apparent from other sources. Any future changes to these estimates and assumptions could cause a material change to our reported amounts of revenues, expenses, assets and liabilities. Actual results may differ from these estimates under different assumptions or conditions. We believe the following critical accounting policies affect our significant judgments and estimates used in the preparation of the financial statements.

Accounts Receivable - The customers are required to make payments when they book the services, otherwise, the services will not be arranged. Sometimes, the Company extends credit to its group clients. The company considers accounts receivable to be fully collectible at year-end. Accordingly, no allowance for doubtful accounts has been recorded.

Revenue Recognition - The Company recognizes revenue in accordance with ASC 606. The core principle of ASC606 is to recognize revenue when promised goods or services are transferred to customers in an amount that reflects the consideration that is expected to be received for those goods or services. ASC 606 defines a five-step process to achieve this core principle, which includes: (1) identifying contracts with customers, (2) identifying performance obligations within those contracts, (3) determining the transaction price, (4) allocating the transaction price to the performance obligation in the contract, which may include an estimate of variable consideration, and (5) recognizing revenue when or as each performance obligation is satisfied. Our sales arrangements generally ask customers to pay in advance before any services can be arranged. The company recognizes revenue when each performance obligation is satisfied. Documents and terms and the completion of any customer acceptance requirements, when applicable, are used to verify services rendered. The Company has no returns or sales discounts and allowances because services rendered and accepted by customers are normally not returnable

Off-Balance Sheet Arrangements

As of March 31, 2021, we did not have any off-balance sheet arrangements as defined in Item 303(a)(4)(ii) of Regulation S-K.

12

Item 3. Quantitative and Qualitative Disclosures about Market Risk

As a smaller reporting company, we are not required to make disclosures under this item.

Item 4. Controls and Procedures

Under the supervision and with the participation of our management, including our principal executive officer and principal financial and accounting officer, we conducted an evaluation of the effectiveness of our disclosure controls and procedures, as such term is defined in Rules 13a-15(e) and 15d-15(e) under the Exchange Act. Based on this evaluation, our principal executive officer and principal financial and accounting officer have concluded that as of March 31, 2021, our disclosure controls and procedures were effective.

Disclosure controls and procedures are designed to ensure that information required to be disclosed by us in our Exchange Act reports is recorded, processed, summarized, and reported within the time periods specified in the SEC’s rules and forms, and that such information is accumulated and communicated to our management, including our principal executive officer and principal financial officer or persons performing similar functions, as appropriate to allow timely decisions regarding required disclosure.

Changes in Internal Control over Financial Reporting

There have been no changes in our internal control over financial reporting during the quarter ended March 31, 2021 that have materially affected, or are reasonably likely to materially affect, our internal control over financial reporting

13

Item 2. Unregistered Sales of Equity Securities and Use of Proceeds.

Item 3. Defaults Upon Senior Securities.

Item 4. Mine Safety Disclosures

The following exhibits are filed as part of, or incorporated by reference into, this Quarterly Report on Form 10-Q.

| * | Filed herewith. |

| ** | Furnished. |

14

In accordance with the requirements of the Exchange Act, the registrant caused this report to be signed on its behalf by the undersigned, thereunto duly authorized.

| PONY GROUP INC. | ||

| Date: August 3, 2021 | By: | /s/ Wenxian Fan |

| Name: | Wenxian Fan | |

| Title: | Chief Executive Officer | |

15