Attached files

| file | filename |

|---|---|

| EX-99.7 - EX-99.7 UNAUDITED PRO FORMA FINANCIAL INFO OF CCI AS OF 3.31.21 & 12.31.20 - Cottonwood Communities, Inc. | proforma-fullycombinedx033.htm |

| EX-99.6 - EX-99.6 FINANCIAL STATEMENTS OF CMRII 3.31.21 (UNAUDITED) - Cottonwood Communities, Inc. | cmriifinancialstatements-3.htm |

| EX-99.5 - EX-99.5 FINANCIAL STATEMENTS OF CMRI 3.31.21 (UNAUDITED) - Cottonwood Communities, Inc. | cmrifinancialstatements-33.htm |

| EX-99.4 - EX-99.4 FINANCIAL STATEMENTS OF CRII 3.31.21 (UNAUDITED) - Cottonwood Communities, Inc. | a1q21criifinancialstatemen.htm |

| EX-99.2 - EX-99.2 FINANCIAL STATEMENTS OF CMRI 12.31.20 (AUDITED) - Cottonwood Communities, Inc. | cmri20inancialstatementsau.htm |

| EX-99.1 - EX-99.1 FINANCIAL STATEMENTS OF CRII 12.31.20 (AUDITED) - Cottonwood Communities, Inc. | crii20inancialstatementsau.htm |

| 8-K/A - 8-K/A - Cottonwood Communities, Inc. | cciaauditedfsinterimfsprof.htm |

Exhibit 99.3

Cottonwood Multifamily REIT II, Inc.

Consolidated Financial Statements

Years Ended December 31, 2020 and 2019

| Table of Contents | |||||

| Independent Auditors' Report | |||||

| Consolidated Financial Statements | |||||

| Consolidated Balance Sheets as of December 31, 2020 and 2019 | |||||

| Consolidated Statements of Operations for the Years Ended December 31, 2020 and 2019 | |||||

| Consolidated Statements of Equity for the Years Ended December 31, 2020 and 2019 | |||||

| Consolidated Statements of Cash Flows for the Years Ended December 31, 2020 and 2019 | |||||

| Notes to Consolidated Financial Statements | |||||

1

Independent Auditors' Report

The Board of Directors and Stockholders

Cottonwood Multifamily REIT II, Inc.:

We have audited the accompanying consolidated financial statements of Cottonwood Multifamily REIT II, Inc. and its subsidiaries, which comprise the consolidated balance sheets as of December 31, 2020 and 2019, and the related consolidated statements of operations, equity, and cash flows for the years then ended, and the related notes to the consolidated financial statements.

Management’s Responsibility for the Financial Statements

Management is responsible for the preparation and fair presentation of these consolidated financial statements in accordance with U.S. generally accepted accounting principles; this includes the design, implementation, and maintenance of internal control relevant to the preparation and fair presentation of consolidated financial statements that are free from material misstatement, whether due to fraud or error.

Auditors’ Responsibility

Our responsibility is to express an opinion on these consolidated financial statements based on our audits. We conducted our audits in accordance with auditing standards generally accepted in the United States of America. Those standards require that we plan and perform the audit to obtain reasonable assurance about whether the consolidated financial statements are free from material misstatement.

An audit involves performing procedures to obtain audit evidence about the amounts and disclosures in the consolidated financial statements. The procedures selected depend on the auditors’ judgment, including the assessment of the risks of material misstatement of the consolidated financial statements, whether due to fraud or error. In making those risk assessments, the auditor considers internal control relevant to the entity’s preparation and fair presentation of the consolidated financial statements in order to design audit procedures that are appropriate in the circumstances, but not for the purpose of expressing an opinion on the effectiveness of the entity’s internal control. Accordingly, we express no such opinion. An audit also includes evaluating the appropriateness of accounting policies used and the reasonableness of significant accounting estimates made by management, as well as evaluating the overall presentation of the consolidated financial statements.

We believe that the audit evidence we have obtained is sufficient and appropriate to provide a basis for our audit opinion.

Opinion

In our opinion, the consolidated financial statements referred to above present fairly, in all material respects, the financial position of Cottonwood Multifamily REIT II, Inc. and its subsidiaries as of December 31, 2020 and 2019, and the results of their operations and their cash flows for the years then ended in accordance with U.S. generally accepted accounting principles.

/s/KPMG LLP

Denver, Colorado

April 8, 2021

2

| Cottonwood Multifamily REIT II, Inc. | |||||||||||

| Consolidated Balance Sheets | |||||||||||

| (Amounts in thousands, except share and par value data) | |||||||||||

| December 31, | |||||||||||

| 2020 | 2019 | ||||||||||

| Assets | |||||||||||

| Investments in joint ventures | $ | 37,676 | $ | 40,668 | |||||||

| Cash and cash equivalents | 169 | 141 | |||||||||

| Other assets | 87 | 38 | |||||||||

| Total assets | $ | 37,932 | $ | 40,847 | |||||||

| Liabilities and equity | |||||||||||

| Liabilities: | |||||||||||

| Accounts payable and accrued liabilities | 301 | 339 | |||||||||

| Related party payables | 1,131 | 697 | |||||||||

| Promissory note to advisor | 1,725 | — | |||||||||

| Total liabilities | $ | 3,157 | $ | 1,036 | |||||||

| Commitments and contingencies (Note 7) | |||||||||||

| Equity | |||||||||||

| Preferred stock, $0.01 par value, 100,000,000 shares authorized; no shares issued and outstanding | — | — | |||||||||

| Common stock, $0.01 par value, 1,000,000,000 shares authorized; 4,881,490 and 4,969,990 shares issued and outstanding at December 31, 2020 and 2019, respectively | 49 | 50 | |||||||||

| Additional paid in capital | 48,915 | 49,676 | |||||||||

| Accumulated distributions | (7,397) | (4,813) | |||||||||

| Accumulated deficit | (6,792) | (5,102) | |||||||||

| Total equity | 34,775 | 39,811 | |||||||||

| Total liabilities and equity | $ | 37,932 | $ | 40,847 | |||||||

| See accompanying notes to consolidated financial statements. | |||||||||||

3

| Cottonwood Multifamily REIT II, Inc. | |||||||||||

| Consolidated Statements of Operations | |||||||||||

| (Amounts in thousands, except share and per share data) | |||||||||||

| Year Ended December 31, | |||||||||||

| 2020 | 2019 | ||||||||||

| Revenues | |||||||||||

| Interest income | $ | — | $ | 14 | |||||||

| Expenses | |||||||||||

| Equity in losses of joint ventures | (262) | (2,350) | |||||||||

| Asset management fee to related party | (807) | (745) | |||||||||

| Other expenses | (621) | (522) | |||||||||

| Net loss | $ | (1,690) | $ | (3,603) | |||||||

| Net loss per basic and diluted common shares | $ | (0.34) | $ | (0.72) | |||||||

| Weighted average common shares outstanding, basic and diluted | 4,920,913 | 4,982,816 | |||||||||

| See accompanying notes to consolidated financial statements. | |||||||||||

4

| Cottonwood Multifamily REIT II, Inc | ||||||||||||||||||||

| Consolidated Statements of Equity | ||||||||||||||||||||

| (Amounts in thousands, except share data) | ||||||||||||||||||||

| Common Stock | ||||||||||||||||||||

| Shares | Amount | Additional Paid in Capital | Accumulated Distributions | Accumulated Deficit | Total Equity | |||||||||||||||

| Balance at December 31, 2018 | 4,993,600 | $ | 50 | $ | 49,891 | $ | (2,195) | $ | (1,499) | $ | 46,247 | |||||||||

| Common stock repurchases | (23,610) | — | (215) | — | — | (215) | ||||||||||||||

| Distributions to investors | — | — | — | (2,618) | — | (2,618) | ||||||||||||||

| Net loss | — | — | — | — | (3,603) | (3,603) | ||||||||||||||

| Balance at December 31, 2019 | 4,969,990 | $ | 50 | $ | 49,676 | $ | (4,813) | $ | (5,102) | $ | 39,811 | |||||||||

| Common stock repurchases | (88,500) | (1) | (761) | — | — | (762) | ||||||||||||||

| Distributions to investors | — | — | — | (2,584) | — | (2,584) | ||||||||||||||

| Net loss | — | — | — | — | (1,690) | (1,690) | ||||||||||||||

| Balance at December 31, 2020 | 4,881,490 | $ | 49 | $ | 48,915 | $ | (7,397) | $ | (6,792) | $ | 34,775 | |||||||||

| See accompanying notes to consolidated financial statements. | ||||||||||||||||||||

5

| Cottonwood Multifamily REIT II, Inc | |||||||||||

| Consolidated Statements of Cash Flows | |||||||||||

| (Amounts in thousands) | |||||||||||

| Year Ended December 31, | |||||||||||

| 2020 | 2019 | ||||||||||

| Operating activities | |||||||||||

| Net loss | $ | (1,690) | $ | (3,603) | |||||||

| Adjustments to reconcile net loss to net cash provided by operating activities: | |||||||||||

| Equity in losses of joint ventures | 262 | 2,350 | |||||||||

| Distributions of capital from joint ventures | 2,730 | 2,965 | |||||||||

| Changes in operating assets and liabilities: | |||||||||||

| Related party receivables | — | 9 | |||||||||

| Other assets | (49) | 46 | |||||||||

| Accounts payable and accrued liabilities | (34) | 101 | |||||||||

| Related party payables | 434 | 695 | |||||||||

| Net cash provided by operating activities | 1,653 | 2,563 | |||||||||

| Investing activities | |||||||||||

| Investments in joint ventures | — | (27,461) | |||||||||

| Net cash used in investing activities | — | (27,461) | |||||||||

| Financing activities | |||||||||||

| Promissory note to advisor | 1,725 | — | |||||||||

| Common stock repurchases | (762) | (215) | |||||||||

| Distributions to common stockholders | (2,588) | (2,619) | |||||||||

| Net cash used in financing activities | (1,625) | (2,834) | |||||||||

| Net increase (decrease) in cash and cash equivalents | 28 | (27,732) | |||||||||

| Cash and cash equivalents at beginning of period | 141 | 27,873 | |||||||||

| Cash and cash equivalents at end of period | $ | 169 | $ | 141 | |||||||

| See accompanying notes to consolidated financial statements. | |||||||||||

6

Cottonwood Multifamily REIT II, Inc.

Notes to Consolidated Financial Statements

(Amounts in thousands, except share data)

Note 1 - Organization and Business

Cottonwood Multifamily REIT II, Inc. (the “Company”) is a Maryland corporation formed on June 10, 2016 to invest in multifamily apartment communities and real estate related assets in the United States primarily through joint ventures with Cottonwood Residential O.P., LP (“CROP”). Substantially all of the Company’s business is conducted through Cottonwood Multifamily REIT II O.P., LP (the “Operating Partnership”), a Delaware limited partnership. The Company is a limited partner and the sole member of the general partner of the Operating Partnership. As used herein, the term “Company”, “we”, “our” or “us” includes the Company, the Operating Partnership and its subsidiaries, unless the context indicates otherwise.

A subsidiary of CROP, Cottonwood Capital Property Management II, LLC ("CCPM II" or “our sponsor”), sponsored the formation of the Company and the offering of up to $50 million in shares of common stock at a purchase price of $10.00 per share through a Tier 2 Regulation A plus offering with the SEC ("our Offering"). We completed our Offering in August 2018, raising the full $50 million.

Our sponsor paid all of the selling commissions and managing broker-dealer fees and the organizational and offering expenses related to our Offering. We have an asset management agreement whereby we pay an affiliate of our sponsor an asset management fee. Our sponsor is also the sole property manager for the properties acquired by the joint ventures.

Restructuring of Asset Manager

As a result of the determination by CROP to restructure the ownership of our asset manager, effective March 1, 2019, our asset management agreement was assigned to an affiliate of CROP, CC Advisors II, LLC (“CC Advisors II”). As our new asset manager, CC Advisors II is responsible for the asset management services rendered to us. Property management services will continue to be provided by CCPM II.

CROP continues to have an indirect ownership interest in the new asset manager, CC Advisors II; however, two additional entities in which employees of CROP and its affiliates have an ownership interest also have an indirect ownership interest in our new asset manager. As our asset manager is an affiliate of CROP, our new asset manager will rely on the expertise and experience of CROP to provide our asset management services. In addition, as part of the restructuring, a new entity, Cottonwood Communities Advisors Promote, LLC (“CC Advisors Promote”), owns the promotional interest in us previously held by CROP. The fees and services to be provided to us remain unchanged following these changes.

7

Cottonwood Multifamily REIT II, Inc.

Notes to Consolidated Financial Statements

(Amounts in thousands, except share data)

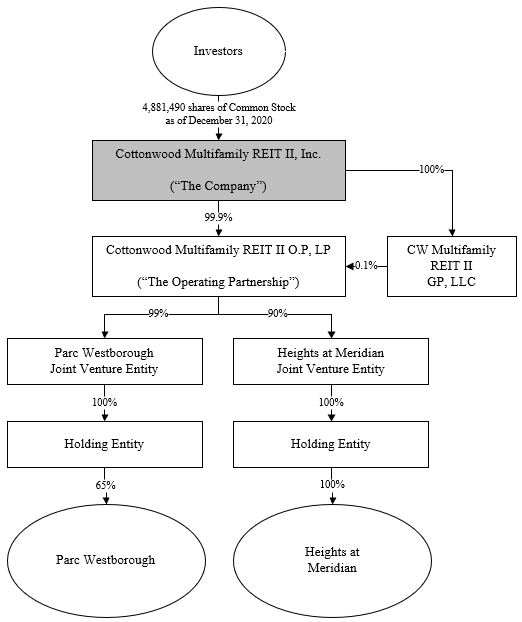

The following chart illustrates our corporate structure and ownership percentages as of December 31, 2020:

COVID-19

One of the most significant risks and uncertainties facing the real estate industry generally continues to be the effect of the ongoing public health crisis of the novel coronavirus disease (COVID-19) pandemic. During the year ended December 31, 2020, the multifamily apartment communities owned by our joint ventures did not experience significant disruptions in our operations from the COVID-19 pandemic; however we continue to closely monitor the impact of the COVID-19 pandemic on all aspects of our business, including how the pandemic will impact the tenants at the multifamily apartment communities owned by our joint ventures.

Note 2 - Summary of Significant Accounting Policies

Principles of Consolidation and Basis of Presentation

The consolidated financial statements are presented on the accrual basis of accounting in accordance with U.S. generally accepted accounting principles (“GAAP”) and include the accounts of the Company and its subsidiaries. All intercompany balances and transactions have been eliminated in consolidation.

8

Cottonwood Multifamily REIT II, Inc.

Notes to Consolidated Financial Statements

(Amounts in thousands, except share data)

The joint ventures are variable interest entities (“VIEs”). Generally, VIEs are legal entities in which the equity investors do not have the characteristics of a controlling financial interest or the equity investors lack sufficient equity at risk for the entity to finance its activities without additional subordinated financial support. All VIEs for which we are the primary beneficiary are consolidated. Qualitative and quantitative factors are considered in determining whether we are the primary beneficiary of a VIE, including, but not limited to, which activities most significantly impact economic performance, which party controls such activities, the amount and characteristics of our investments, the obligation or likelihood for us or other investors to provide financial support, and the management relationship of the property.

The Company consolidates the Operating Partnership and control of the joint ventures is shared equally between CROP and us. We are not considered the primary beneficiary of the joint ventures as our sponsor, who is a subsidiary of CROP, is most closely associated with joint venture activities through their asset and property management agreements. As a result, our investments in joint ventures are recorded under the equity method of accounting on the consolidated financial statements.

Use of Estimates

We make estimates and assumptions that affect the reported amounts of assets and liabilities and the disclosure of contingent liabilities at the dates of the consolidated financial statements as well as the amounts of revenues and expenses during the reporting periods. Actual amounts could differ from those estimates.

Organization and Offering Costs

Organization costs include all expenses incurred in connection our formation, including but not limited to legal fees and other costs to incorporate the Company. Offering costs include all expenses incurred in connection with the offering, including managing broker-dealer fees and selling commissions. All organization and offering costs are paid by our sponsor. We will not incur any liability for or reimburse our sponsor for any of these organizational and offering costs. Total offering costs incurred by our sponsor in connection with our Offering were approximately $6,448. Organizational costs incurred by our sponsor were not significant.

Investments in Joint Ventures

Under the equity method of accounting, our investments in joint ventures are stated at cost, adjusted for our share of net earnings or losses and reduced by distributions. Equity in earnings or losses is generally recognized based on our ownership interest in the earnings or losses of the joint ventures. For the purposes of presentation in the consolidated statements of cash flows, we follow the “look through” approach for classification of distributions from unconsolidated real estate assets. Under this approach, distributions are reported under operating cash flow unless the facts and circumstances of a specific distribution clearly indicate that it is a return of capital (e.g., a liquidating dividend or distribution of the proceeds from the entity’s sale of assets), in which case it is reported as an investing activity.

We assess potential impairment of investments in joint ventures whenever events or changes in circumstances indicate that the fair value of the investment is less than its carrying value. To the extent impairment has occurred, and is not considered temporary, the impairment is measured as the excess of the carrying amount of the investment over the fair value of the investment. We have not recognized impairment on any of our joint venture investments.

Cash and Cash Equivalents

We maintain our cash in demand deposit accounts at major commercial banks. Balances in individual accounts at times exceeds FDIC insured amounts. We have not experienced any losses in such accounts.

Income Taxes

We elected to be taxed as a REIT beginning with the taxable year ending December 31, 2018. As a REIT, we are not subject to federal income tax with respect to that portion of our income that meet certain criteria and is distributed annually to shareholders. To continue to qualify as a REIT, we must meet certain organizational and operational requirements, including a requirement to distribute at least 90% of our taxable income, excluding net capital gains, to shareholders. We have adhered to, and intend to continue to adhere to, these requirements to maintain REIT status.

9

Cottonwood Multifamily REIT II, Inc.

Notes to Consolidated Financial Statements

(Amounts in thousands, except share data)

If we fail to qualify as a REIT in any taxable year, we will be subject to federal income taxes at regular corporate rates (including any applicable alternative minimum tax) and may not qualify as a REIT for four subsequent taxable years. As a qualified REIT, we are still subject to certain state and local taxes and may be subject to federal income and excise taxes on undistributed taxable income. For the years ended December 31, 2020 and 2019, 100% (unaudited) of all distributions to stockholders qualified as a return of capital.

Note 3 - Investments in Joint Ventures

On January 8, 2019, we acquired a 90% interest in a joint venture with CROP that purchased Heights at Meridian. On June 29, 2018, we acquired a 99% interest in a joint venture with CROP that owns a 65% tenant in common interest in Parc Westborough. A wholly owned subsidiary of CROP owns the remaining 35% tenant in common interest.

Our investment activity in our joint ventures is as follows:

| Parc Westborough | Heights at Meridian | Total | |||||||||

| 2018 carrying value | $ | 17,117 | $ | — | $ | 17,117 | |||||

| Investment in Heights at Meridian | — | 28,866 | 28,866 | ||||||||

| Equity in losses | (475) | (1,875) | (2,350) | ||||||||

| Distributions | (850) | (2,115) | (2,965) | ||||||||

| 2019 carrying value | $ | 15,792 | $ | 24,876 | $ | 40,668 | |||||

| Equity in losses | 116 | (378) | (262) | ||||||||

| Distributions | (1,163) | (1,567) | (2,730) | ||||||||

| 2020 carrying value | $ | 14,745 | $ | 22,931 | $ | 37,676 | |||||

Operational information for the properties owned by our joint ventures for the year ended December 31, 2020 is as follows:

| Year Ended December 31, 2020 | Parc Westborough | Heights at Meridian | Total | Equity in Earnings (Losses) (1) | |||||||||||||

| Revenues | |||||||||||||||||

| Rental and other operating income | $ | 5,751 | $ | 5,614 | $ | 11,365 | $ | 8,753 | |||||||||

| Operating expenses | |||||||||||||||||

| Rental operations expense | 2,161 | 1,861 | 4,022 | 3,065 | |||||||||||||

| Advertising and marketing | 43 | 31 | 74 | 56 | |||||||||||||

| General and administrative | 93 | 104 | 197 | 153 | |||||||||||||

| Property management fees | 201 | 197 | 398 | 307 | |||||||||||||

| Total operating expenses | 2,498 | 2,193 | 4,691 | 3,581 | |||||||||||||

| Net operating income | 3,253 | 3,421 | 6,674 | 5,172 | |||||||||||||

| Non operating expenses | |||||||||||||||||

| Interest on Fannie Mae facility | 841 | 1,628 | 2,469 | 2,006 | |||||||||||||

| Depreciation and amortization | 2,052 | 2,208 | 4,260 | 3,308 | |||||||||||||

| Mark to market adjustments on interest rate cap | 1 | — | 1 | 1 | |||||||||||||

| Other non operating expenses | 178 | 5 | 183 | 119 | |||||||||||||

| Net loss | $ | 181 | $ | (420) | $ | (239) | $ | (262) | |||||||||

(1) Represents equity in earnings (losses) attributable to our 64.35% and 90% joint venture interest in Parc Westborough and Heights at Meridian, respectively. | |||||||||||||||||

10

Cottonwood Multifamily REIT II, Inc.

Notes to Consolidated Financial Statements

(Amounts in thousands, except share data)

Operational information for the properties owned by our joint ventures for the year ended December 31, 2019 is as follows:

| Year Ended December 31, 2019 | Parc Westborough | Heights at Meridian (2) | Total | Equity in Earnings (Losses) (1) | |||||||||||||

| Revenues | |||||||||||||||||

| Rental and other operating income | $ | 5,604 | $ | 5,527 | $ | 11,131 | $ | 8,580 | |||||||||

| Operating expenses | |||||||||||||||||

| Rental operations expense | 2,176 | 1,818 | 3,994 | 3,036 | |||||||||||||

| Advertising and marketing | 48 | 28 | 76 | 56 | |||||||||||||

| General and administrative | 96 | 117 | 213 | 167 | |||||||||||||

| Property management fees | 196 | 193 | 389 | 300 | |||||||||||||

| Total operating expenses | 2,516 | 2,156 | 4,672 | 3,559 | |||||||||||||

| Net operating income | 3,088 | 3,371 | 6,459 | 5,021 | |||||||||||||

| Non operating expenses | |||||||||||||||||

| Interest on Fannie Mae facility | 1,474 | 1,593 | 3,067 | 2,382 | |||||||||||||

| Depreciation and amortization | 2,038 | 3,847 | 5,885 | 4,774 | |||||||||||||

| Mark to market adjustments on interest rate cap | 111 | — | 111 | 71 | |||||||||||||

| Other non operating expenses | 204 | 14 | 218 | 144 | |||||||||||||

| Net loss | $ | (739) | $ | (2,083) | $ | (2,822) | $ | (2,350) | |||||||||

(1) Represents equity in earnings (losses) attributable to our 64.35% and 90% joint venture interest in Parc Westborough and Heights at Meridian, respectively. | |||||||||||||||||

(2) Operational information for Heights at Meridian is for the period from January 8, 2019, the date of acquisition by the joint venture, to December 31, 2019. | |||||||||||||||||

Summarized balance sheet information for the properties owned by our joint ventures, of which we are partial owners through our joint venture interests, is as follows:

| December 31, 2020 | Parc Westborough | Heights at Meridian | Total | ||||||||

| Real estate assets, net | $ | 58,848 | $ | 59,016 | $ | 117,864 | |||||

| Other assets | 1,574 | 688 | 2,262 | ||||||||

| Fannie Mae facility | 38,010 | 33,750 | 71,760 | ||||||||

| Other liabilities | 376 | 345 | 721 | ||||||||

| Equity | 22,036 | 25,609 | 47,645 | ||||||||

| December 31, 2019 | Parc Westborough | Heights at Meridian | Total | ||||||||

| Real estate assets, net | $ | 60,829 | $ | 61,168 | $ | 121,997 | |||||

| Other assets | 1,332 | 737 | 2,069 | ||||||||

| Fannie Mae facility | 38,010 | 33,750 | 71,760 | ||||||||

| Other liabilities | 488 | 385 | 873 | ||||||||

| Equity | 23,663 | 27,770 | 51,433 | ||||||||

The excess of cost over our share of net assets of our investments in joint ventures is approximately $450 at December 31, 2020 and 2019, and relates to acquisition date accounting differences.

Note 4 - Stockholders' Equity

Our charter authorizes the issuance of up to 1,000,000,000 shares of common stock at $0.01 par value per share and 100,000,000 shares of preferred stock at $0.01 par value per share.

11

Cottonwood Multifamily REIT II, Inc.

Notes to Consolidated Financial Statements

(Amounts in thousands, except share data)

Voting Common Stock

Holders of our common stock are entitled to receive dividends when authorized by the board of directors, subject to any preferential rights of outstanding preferred stock. Holders of common stock are also entitled to one vote per share on all matters submitted to a shareholder vote, including election of directors to the board, subject to certain restrictions. As of December 31, 2020, and 2019, the Company had issued 4,881,490 shares and 4,969,990 shares, respectively. Our sponsor owns 2,375 shares.

Preferred Stock

The board of directors is authorized, without approval of common shareholders, to provide for the issuance of preferred stock, in one or more classes or series, with such rights, preferences and privileges as the board of directors approves. No preferred stock was issued and outstanding as of December 31, 2020 and 2019.

Distributions

Distributions are determined by the board of directors based on the Company’s financial condition and other relevant factors. Should cash flows from operations not cover distributions, we may look to third party borrowings, including CROP or its affiliates, to fund distributions. We may also use funds from the sale of assets or from the maturity, payoff or settlement of debt investments for distributions not covered by operating cash. Distributions for the years ended December 31, 2020 and 2019 were $2,584 and $2,618, respectively.

Note 5 - Joint Venture Distributions

Cash from operations of the Company’s individual joint ventures after payment of property management fees shall be distributed to provide a preferred return of up to 8% on invested capital in the joint venture. Profits will then be allocated 50% to the Operating Partnership and CROP (in proportion to their respective interests in the joint venture) and 50% to CC Advisors Promote until CC Advisors Promote has received an amount equal to 20% of all distributions. Profits after the above distributions will be allocated 80% to the Operating Partnership and CROP (in proportion to their respective interests in the joint venture) and 20% to CC Advisors Promote.

Note 6 - Related Party Transactions

Our affiliated directors and officers hold key positions at CROP and its affiliates, including at our property manager and asset manager. They are not compensated by us but are responsible for the management and affairs of the Company.

Asset Management Fee

CC Advisors II, which certain officers and our affiliated directors have an indirect ownership interest in, provides asset management services for the Company subject to the board of directors’ supervision. As compensation for those services, CC Advisors II receives a fee of 0.75% of gross assets, defined initially as the gross book value of our assets and subsequently as gross asset value once NAV is established. For the years ended December 31, 2020 and 2019, we incurred asset management fees of $807 and $745, respectively.

Property Management Fee

Our sponsor provides property management services for the multifamily apartment communities acquired by the joint ventures and receives a fee of 3.5% of gross revenues of each property managed for these services. Our sponsor is also reimbursed for expenses incurred on behalf of their management duties in accordance with the property management agreement. During the years ended December 31, 2020 and 2019, property management fees charged to the two properties were $398 and $389, respectively.

Construction Management Fee

Our sponsor will receive for its services in supervising any renovation or construction project in excess of $5 in or about each property a construction management fee equal to 5% of the cost of the amount that is expended. Construction management fees were not significant for the years ended December 31, 2020 and 2019.

12

Cottonwood Multifamily REIT II, Inc.

Notes to Consolidated Financial Statements

(Amounts in thousands, except share data)

Property Management Corporate Service Fee

Our sponsor allocates a flat fee each month to each of the joint ventures which is intended to fairly allocate the overhead costs incurred by our sponsor and its affiliated entities with respect to the management of all assets. This fee may vary depending on the number of assets managed and the actual overhead expenses incurred. Our sponsor will have the right to retain any excess between actual costs and the amount of the fee charged. Property management corporate service fees were not significant for the years ended December 31, 2020 and 2019.

Insurance Fee

A licensed insurance broker affiliated with our sponsor receives 20% of the brokerage fee charged with respect to the placement of all insurance policies for the multifamily apartment communities. Insurance fees were not significant for the years ended December 31, 2020 and 2019.

Promotional Interest

CC Advisors Promote, which certain officers and our affiliated directors have an indirect ownership interest in, and will receive a 20% promotional interest after an 8% preferred return on invested capital.

Promissory Note to Advisor

On April 20, 2020, we borrowed $945 from Cottonwood Communities Advisors, LLC, the parent entity of CC Advisors II, LLC, our asset manager. In connection with the borrowing, we executed a promissory note in favor of Cottonwood Communities Advisors, LLC. Pursuant to the promissory note, we agreed to repay any advances, up to an aggregate principal amount of $1,600, plus any interest on the unpaid principal advanced under the note, by September 30, 2020. On June 30, 2020, we amended and restated our promissory note and agreed to repay any advances, up to an aggregate principal amount of $2,600, plus any interest on the unpaid principal advanced under the note, by December 31, 2020. On December 30, 2020, we again amended and restated our promissory note to update the maturity date to June 30, 2021. The other terms of the note were unchanged in this amended agreement. The unpaid principal under the promissory note bears simple interest from the date advanced at the rate of 6% per annum, or the maximum amount of interest allowed under the laws of the State of Utah, whichever is less. We may prepay the unpaid principal balance under the promissory note, in whole or in part, together with all interest then accrued under the note, at any time, without premium or penalty. Cottonwood Communities Advisors, LLC may upon written demand require us to prepay outstanding amounts under the promissory note, in whole or in part, provided that funds are available from the Fannie Mae facility. The promissory note is unsecured. As of December 31, 2020, the outstanding principal balance on the promissory note was $1,725 plus accrued interest of $63. Effective January 1, 2021, Cottonwood Communities Advisors, LLC assigned this note to CROP. If the CMRII Merger discussed in Note 8 is not consummated prior to the maturity date, we expect to either extend the maturity date with CROP or refinance the promissory note.

Note 7 - Commitments and Contingencies

Economic Dependency

Under various agreements, we have engaged or will engage our sponsor or affiliates of our sponsor to provide certain services that are essential to us, including asset management services and other administrative responsibilities that include accounting services and investor relations. As a result of these relationships, we are dependent upon our sponsor. In the event that our sponsor is unable to provide us with the respective services, we would be required to find alternative providers of these services.

Liquidity Strategy

Our board of directors will try to determine which liquidity strategy would result in the greatest value for shareholders. A liquidity event will occur no later than December 31, 2024, which may be extended for two one-year periods in the sole discretion of our board of directors and an additional two one-year periods by a majority vote of the shareholders. If no extension is approved, an orderly sale of the Company’s assets will begin within a one-year period from the decision not to extend. If all extensions are approved, the final termination date would be December 31, 2028. The precise timing of sales would take account of the prevailing real estate finance markets and the debt markets generally as well as the federal income tax consequences to shareholders.

13

Cottonwood Multifamily REIT II, Inc.

Notes to Consolidated Financial Statements

(Amounts in thousands, except share data)

In the event that a listing occurs on or before the termination date, we will continue perpetually unless dissolved pursuant to a vote of the shareholders or any applicable provision of the Maryland General Corporation Law. A listing shall mean the commencement of trading of our common stock on any securities exchange registered as a national securities exchange under Section 6 of the Securities Exchange Act of 1934, as amended, any over the counter exchange or, as determined in the sole discretion of the board of directors, any similar exchange that offers sufficient trading to offer similar liquidity to the shareholders. A listing shall also be deemed to occur on the effective date of a merger in which the consideration received by the shareholders is securities of another entity that are listed on any securities exchange registered as a national securities exchange under Section 6 of the Securities Exchange Act of 1934, as amended, any over the counter exchange or, as determined in the sole discretion of our board of directors, any similar exchange that offers sufficient trading to offer similar liquidity to the shareholders.

Right of First Refusal

If we or CROP desire to transfer all or a portion of membership interests in a joint venture, the non-transferring member shall have the option to purchase the transferring member’s membership interest on the same terms the transferring member intends to sell its interest to a third-party.

Share Repurchase Program

We have a share repurchase program that may enable stockholders to sell back to us up to 3% of the weighted average number of shares of common stock outstanding during the prior calendar year at the sole discretion and option of the board of directors. The board of directors may amend, suspend, or terminate the repurchase plan at any time in its sole discretion, upon 30 days’ written notice to the shareholders, if it believes that such action is in the best interest of the shareholders. In connection with the evaluation of the CMRII Merger (as defined below), the board of directors determined not to repurchase any shares during the fourth quarter of 2020 and suspended the share repurchase program upon entry into the CMRII Merger Agreement. If the CMRII Merger is not consummated, we expect our board of directors to resume the share repurchase program. Following the CMRII Merger, we expect that holders of our common stock may participate in the share repurchase program adopted by the board of directors of the acquiring company.

The repurchase price is subject to the following discounts, depending upon when the shares are repurchased:

| Share Purchase Anniversary | Repurchase Price As a Percentage of Estimated Value (1) | ||||

| Less than 1 year | No repurchase allowed | ||||

| 1 year | 80% | ||||

| 2 years | 85% | ||||

| 3 years | 90% | ||||

| 4 years and thereafter | 95% | ||||

| In the event of a shareholder’s death or complete disability | 95% | ||||

(1) Estimated value equals Net Asset Value (“NAV”) as determined and disclosed by the board of directors. On December 13, 2019, the board of directors determined the value of our shares of common stock at $10.46 per share as of September 30, 2019, based on our net asset value. See the Form 1-U filed with the SEC on December 17, 2019 for additional information on our most recent NAV. Prior to December 2019, our estimated value per share was equal to the purchase price of shares in our offering. Due to the negotiations and subsequent entry into the merger agreement discussed below in Note 8, the board of directors determined not to update our September 30, 2019 NAV. If the proposed merger is not consummated, our board of directors intends to update our NAV as of a more recent date.

The purchase price will further be reduced by amounts distributed to shareholders as a result of the sale of one or more of assets constituting a return of capital. During the year ended December 31, 2020, we repurchased 88,500 shares of our common stock for an average purchase price of approximately $8.61.

14

Cottonwood Multifamily REIT II, Inc.

Notes to Consolidated Financial Statements

(Amounts in thousands, except share data)

Note 8 - Subsequent Events

We have evaluated subsequent events up until the date the consolidated financial statements are issued for recognition or disclosure and have determined there are none to be reported or disclosed in the consolidated financial statements other than as mentioned below.

Pending Merger

On January 26, 2021, we (Cottonwood Multifamily REIT II, Inc. (“CMRII”)), Cottonwood Multifamily REIT II O.P., LP (“CMRII OP”), Cottonwood Communities, Inc. (“CCI”), Cottonwood Communities O.P., LP (“CCOP”) and Cottonwood Communities GP Subsidiary, LLC, a wholly owned subsidiary of CCI (“Merger Sub”), entered into an Agreement and Plan of Merger (the “CMRII Merger Agreement”).

Subject to the terms and conditions of the Merger Agreement, (i) we will merge with and into Merger Sub, with Merger Sub surviving as a direct, wholly owned subsidiary of CCI (the “Company Merger”) and (ii) CMRII OP will merge with and into CCOP or its successor, with CCOP or its successor surviving (the “OP Merger” and, together with the Company Merger referred to as the “Merger”). At such time, the separate existence of us and our operating partnership will cease.

At the effective time of the Company Merger, each issued and outstanding share of our common stock (the “CMRII Common Stock”) will be converted into the right to receive 1.072 shares of common stock of CCI (the "CCI Common Stock").

At the effective time of the OP Merger, each partnership unit of CMRII OP outstanding immediately prior to the effective time of the OP Merger will be split so that the total number of partnership units of CMRII OP then outstanding equals the number of shares of CMRII Common Stock that were outstanding immediately prior to the effective time of the OP Merger (the “CMRII OP Unit Split”). Immediately following the CMRII OP Unit Split, each partnership unit of CMRII OP outstanding immediately prior to the effective time of the OP Merger will convert into the right to receive 1.072 common limited partner units in CCOP (“CCOP Common Units”). As described below, CCI is also party to a merger agreement to acquire Cottonwood Residential II, Inc. (“CRII”) by merger, which we refer to as the CRII Merger. If the CRII Merger closes before the Merger, as is expected, CMRII OP will merge with and into CROP, the operating partnership of CRII, with CROP surviving, and the holders of CMRII OP partnership units will receive common limited partner units in CROP at the same exchange ratio.

On January 26, 2021, CCI, CCOP and Merger Sub also entered into merger agreements to acquire each of CRII and Cottonwood Multifamily REIT I, Inc. (“CMRI”). All of the mergers are stock-for-stock transactions whereby each of CMRII, CRII and CMRI will be merged into a wholly owned subsidiary of CCI (collectively, the “Mergers”). None of the Mergers are contingent upon the closing of any of the other Mergers; however, under certain circumstances, CMRII may opt not to close if the CRII merger does not occur. CMRI has a similar option. Each of the Mergers is intended to qualify as a “reorganization” under, and within the meaning of, Section 368(a) of the Internal Revenue Code of 1986, as amended.

If approved by the stockholders of each of CMRII, CRII and CMRI and, in the case of CRII, the unitholders of its operating partnership, and the other closing conditions are met or waived, the Mergers will combine four portfolios of multifamily apartment communities and other real estate-related investments located predominantly in growth markets across the United States.

See the Form 1-U filed with the SEC on February 1, 2021 for additional information regarding the CMRII Merger Agreement.

There is no guarantee that the Mergers will be consummated.

Suspension of Share Repurchase Program

In connection with our entry into the CMRII Merger Agreement, our board of directors suspended our share repurchase program.

15