Attached files

| file | filename |

|---|---|

| EX-32.1 - Synergy Empire Ltd | ex32-1.htm |

| EX-31.1 - Synergy Empire Ltd | ex31-1.htm |

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 10-K

[X] ANNUAL REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934

For The Fiscal Year Ended March 31, 2021

or

[ ] TRANSITION REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934

For the transition period from __________ to __________

Commission File Number 333-235700

SYNERGY EMPIRE LIMITED

(Exact name of registrant issuer as specified in its charter)

| Nevada | 38-4096727 | |

(State or other jurisdiction of incorporation or organization) |

(I.R.S. Employer Identification No.) |

| No.19 Jalan 12/118B, Desa Tun Razak, 56100, Kuala Lumpur, Malaysia. |

| Address of principal executive offices, including zip code |

| +(60)3 - 9171 2828 |

| Registrant’s phone number, including area code |

Securities registered pursuant to Section 12(b) of the Securities Exchange Act: None

Securities registered pursuant to Section 12(g) of the Securities Exchange Act: None

Indicate by check mark if the registrant is a well-known seasoned issuer, as defined in Rule 405 of the Securities Act.

Yes [ ] No [X]

Indicate by check mark if the registrant is not required to file reports pursuant to Section 13 or Section 15(d) of the Act.

Yes [ ] No [X]

Indicate by check mark whether the registrant (1) has filed all reports required to be filed by Section 13 or 15(d) of the Securities Exchange Act of 1934 during the preceding 12 months (or for such shorter period that the registrant was required to file such reports), and (2) has been subject to such filing requirements for the past 90 days.

YES [X] NO [ ]

Indicate by check mark whether the registrant has submitted electronically every Interactive Data File required to be submitted pursuant to Rule 405 of Regulation S-T (§ 232.405 of this chapter) during the preceding 12 months (or for such shorter period that the registrant was required to submit such files).

YES [X] NO [ ]

Indicate by check mark whether the registrant is a large accelerated filer, an accelerated filer, a non-accelerated filer, or a smaller reporting company. See the definitions of “large accelerated filer,” “accelerated filer” and “smaller reporting company” in Rule 12b-2 of the Exchange Act.

| Large accelerated filer [ ] | Accelerated filer [ ] | Non-accelerated filer [X] | Smaller reporting company [X] |

| Emerging growth company [X] |

If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act.

Yes [ ] No [X]

Indicate by check mark whether the registrant is a shell company (as defined in Rule 12b-2 of the Exchange Act).

Yes [ ] No [X]

State the aggregate market value of the voting and non-voting common equity held by non-affiliates computed by reference to the price at which the common equity was last sold, or the average bid and asked price of such common equity, as of the last business day of the registrant’s most recently completed second fiscal quarter.

Not applicable.

APPLICABLE ONLY TO REGISTRANTS INVOLVED IN BANKRUPTCY PROCEEDINGS DURING THE PRECEDING FIVE YEARS

Indicate by check mark whether the registrant has filed all documents and reports required to be filed by Section 12, 13 or 15(d) of the Securities Exchange Act of 1934 subsequent to the distribution of securities under a plan confirmed by a court.

N/A

APPLICABLE ONLY TO CORPORATE REGISTRANTS

Indicate the number of shares outstanding of each of the registrant’s classes of common stock, as of the latest practicable date.

| Class | Outstanding at June 29, 2021 | |

| Common Stock, $0.0001 par value | 1,000,000 |

DOCUMENTS INCORPORATED BY REFERENCE

No documents are incorporated by reference.

SYNERGY EMPIRE LIMITED

FORM 10-K

For the Fiscal Year Ended March 31, 2021

Index

| 3 |

CAUTIONARY NOTE REGARDING FORWARD-LOOKING STATEMENTS

This Annual Report on Form 10-K contains forward-looking statements. These forward-looking statements are not historical facts but rather are based on current expectations, estimates and projections. We may use words such as “anticipate,” “expect,” “intend,” “plan,” “believe,” “foresee,” “estimate” and variations of these words and similar expressions to identify forward-looking statements. These statements are not guarantee of future performance and are subject to certain risks, uncertainties and other factors, some of which are beyond our control, are difficult to predict and could cause actual results to differ materially from those expressed or forecasted. These risks and uncertainties include the following:

| ● | The availability and adequacy of our cash flow to meet our requirements; | |

| ● | Economic, competitive, demographic, business and other conditions in our local and regional markets; | |

| ● | Changes or developments in laws, regulations or taxes in our industry; | |

| ● | Actions taken or omitted to be taken by third parties including our suppliers and competitors, as well as legislative, regulatory, judicial and other governmental authorities; | |

| ● | Competition in our industry; | |

| ● | The loss of or failure to obtain any license or permit necessary or desirable in the operation of our business; | |

| ● | Changes in our business strategy, capital improvements or development plans; | |

| ● | The availability of additional capital to support capital improvements and development; and | |

| ● | Other risks identified in this report and in our other filings with the Securities and Exchange Commission or the SEC. |

This report should be read completely and with the understanding that actual future results may be materially different from what we expect. The forward-looking statements included in this report are made as of the date of this report and should be evaluated with consideration of any changes occurring after the date of this Report. We will not update forward-looking statements even though our situation may change in the future and we assume no obligation to update any forward-looking statements, whether as a result of new information, future events or otherwise.

| 4 |

Use of Defined Terms

Except as otherwise indicated by the context, references in this report to:

| ● | The “Company,” “we,” “us,” or “our,” “Synergy Empire” are references to Synergy Empire Limited, a Nevada corporation. | |

| ● | SEHL refers to Synergy Empire Holding Limited, a Marshall Island company which is the direct subsidiary of the Company. | |

| ● | SEHK refers to Synergy Empire Limited, a Hong Kong company which is a direct subsidiary of the SEHL. | |

| ● | “Common Stock” refers to the common stock, par value $0.0001, of the Company; | |

| ● | “U.S. dollar,” “$” and “US$” refer to the legal currency of the United States; | |

| ● | “Securities Act” refers to the Securities Act of 1933, as amended; and | |

| ● | “Exchange Act” refers to the Securities Exchange Act of 1934, as amended. |

Corporate History

Synergy Empire Limited, a Nevada corporation (“the Company”) was incorporated under the laws of the State of Nevada on October 17, 2018.

On October 17, 2018, Mr. Leong Will Liam was appointed as President, Secretary, Treasurer and a member of our Board of directors. Also, on October 17, 2018, Mr. Law Jia Ming was appointed as Chief Executive Officer and Chief Financial Officer of the Company.

On October 17, 2018, the Company sold and subsequently issued 900,000 shares of restricted common stock to Mr. Leong Will Liam, our Director, President, Secretary and Treasurer. The price paid per share was $0.30, for aggregate proceeds to the Company of $27,000. Proceed from the issuance of shares went to the Company to be used as working capital.

In regards to all of the above transactions we claim an exemption from registration afforded by Section 4(a)(2) and/or Regulation S of the Securities Act of 1933, as amended (“Regulation S”) for the above sales of the stock since the sales of the stock were made to non-U.S. persons (as defined under Rule 902 section (k)(2)(i) of Regulation S), pursuant to offshore transactions, and no directed selling efforts were made in the United States by the issuer, a distributor, any of their respective affiliates, or any person acting on behalf of any of the foregoing.

On December 31, 2018, SEHL acquired 100% of the equity interests of SEHK from our director, Leong Will Liam, in consideration of HK$1 (Equivalent to about $0.13).

On January 16, 2019, We, “Synergy Empire Limited”, acquired 100% of the equity interests of Synergy Empire Holding Limited, a company incorporated in republic of the Marshall Islands (“SEHL”), from our director, Mr. Leong Will Liam, in consideration of $1. SEHL owns 100% of Synergy Empire Limited, a company incorporated in Hong Kong (“SEHK”).

| 5 |

On February 21, 2019, SEHK acquired 100% of the equity interests of Lucky Star F&B Sdn. Bhd., (“Lucky Star”), a company incorporated in Malaysia on February 9, 2010, from CBA Capital Holdings Sdn Bhd., a Company owned and controlled by our Director, Mr. Leong Will Liam.

Lucky Star is the owner of 100% of the equity interests of SH Dessert Sdn. Bhd. (“SH Dessert”), a company incorporated in Malaysia on February 19, 2016.

On December 26, 2019, the Company has submitted initial Form S-1 Registration Statement to S.E.C registering an offering by the Company amounted up to $1,500,000 and offering by selling shareholder amounted to $500,000 respectively to Securities & Exchange Commission (“S.E.C”), which was later declared effective on March 10, 2020.

On December 30, 2020, the Company resolved to close the public offering pursuant to Form S-1, resulting in 100,000 shares of common stock being sold at $5.00 per share for a total of $500,000. The proceed of $500,000 went directly to the Company and shall be utilized pursuant to the use of proceed stated in the Form S-1.

On February 26, 2021, the Company transferred the entire shareholding of Lucky Star F&B Sdn Bhd from SEHK to SEHL due to a corporate restricting reason.

On March 31, 2021, the Company dispose SEHK to Mr. Leong Will Liam, our director, at Hong Kong Dollar One (“HKD1”), equivalent to $0.13. The disposal was because of uncertain Hong Kong political and economic environment.

Synergy Empire Limited operates entirely through its wholly owned subsidiary of which involving production and sale of food products and sold our products through two restaurants that we operate in Malaysia.

The following chart shows the Group structure:

The Company’s executive office is located at No. 19 Jalan 12/118B, Desa Tun Razak, Kuala Lumpur, Malaysia, 56100.

| 6 |

Overview

We are engaging in the production and sale of food products, specifically dessert created and sold through various restaurants that we operate in Malaysia. We sell our goods under our brand name “Sweet Hut”. The Company originally through indirect subsidiary SH Dessert Sdn Bhd operates two restaurant outlets and one central kitchen in Malaysia.

On July 29, 2020, the Company decided to terminate two restaurant outlets in Setapak and Pandan Indah, 3-month notices were given to both landlords, effective on August 1, 2020 onwards. As such, both restaurant outlets tenancy agreement expired on October 31, 2020 and no longer carried any operation as of March 31, 2021.

On September 22, 2020, the Company decided to terminate restaurant outlets on Botanic and C180, 2-month notices were given to both landlords, effective on September 28, 2020 onwards. As such, both restaurant outlets tenancy agreement expired on November 30, 2020 and no longer carried any operation as of March 31, 2021.

On November 15, 2020, the Company entered into a new tenancy agreement with unrelated third party for a new shop located in C180, Cheras through indirect wholly owned subsidiary SH Dessert Sdn Bhd for a tenancy period of two years. SH Dessert Sdn Bhd were given a rent-free grace period of one month from November 15, 2020 to December 14, 2020, upon the expiration of rent-free grace period, the Company pays a rental of MYR 6,000 (approximately $1,441) on monthly basis. As of March 31, 2021, renovation was completed and the branch was in operation.

On December 1, 2020, the Company entered into another tenancy agreement with unrelated third party for a new shop located in Sri Petaling, through SH Dessert Sdn Bhd for a tenancy period of three years commencing on February 1, 2021 at a monthly rental of MYR 15,000 (approximately $3,602), expiring on January 31, 2024, with option to extend for another two years expiring on January 31, 2026 with a maximum increment of not more than 15%. As of the date of this report, renovation was completed and the branch was in operation.

|

|

| our new outlet in C180, Cheras | |

|

|

| Our new outlet in Sri Petaling | |

| 7 |

We started our business under the brand of “Sweet Hut” in 2010, the trademark for which registered and will remain valid until March 25, 2020. And we had applied to renew with Malaysia Intellectual Property Office for our trademark. We established our first outlet in Kuchai Lama, Kuala Lumpur, Malaysia. We started to manufacture various traditional Chinese desserts such as black glutinous, almond, mango desserts and peanut butter.

The name “Sweet Hut” is derived from the word ‘Sweetheart’. Since food is known as the language of love, we’ve decided to use ‘Sweetheart’ as our business’s signature – a dessert hut filled with love, passion & integrity. Sweet Hut aims to please customers by serving creative and exquisite desserts.

In 2013, our company was awarded “SME100 Award” by SME & Entrepreneurship Magazine. SME100 Awards is an annual recognition programme organized by SME Magazine, naming the fastest moving businesses of the SME sector. To promote recognition of top businesses in a lucrative and dynamic market, the SME100 Awards has served as a symbol which is believed to distinguish the best among the great.

Since 2013, we have grown into a dessert manufacturer and dessert chain under our brand name of “Sweet Hut” in Malaysia. By the end of 2020, the Company decided to shut down all four restaurants operation and re-establish two new restaurants under new concept to strengthen the Company business branding and promoting, together with the launching of menu.

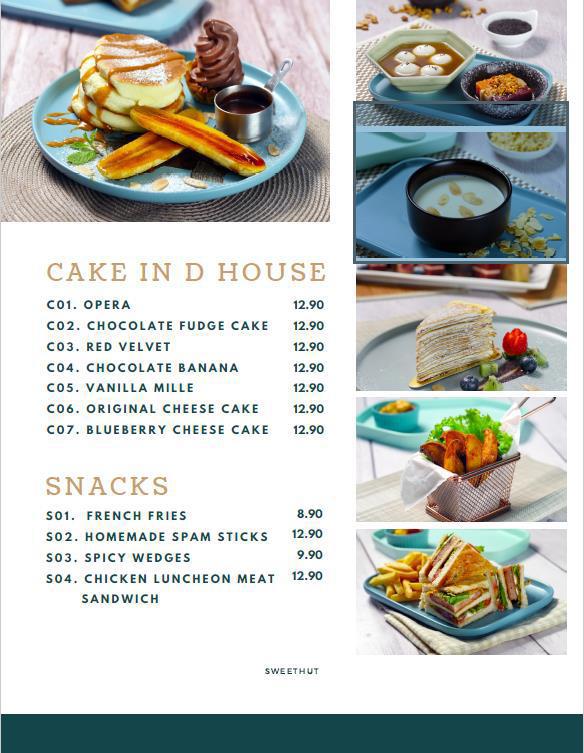

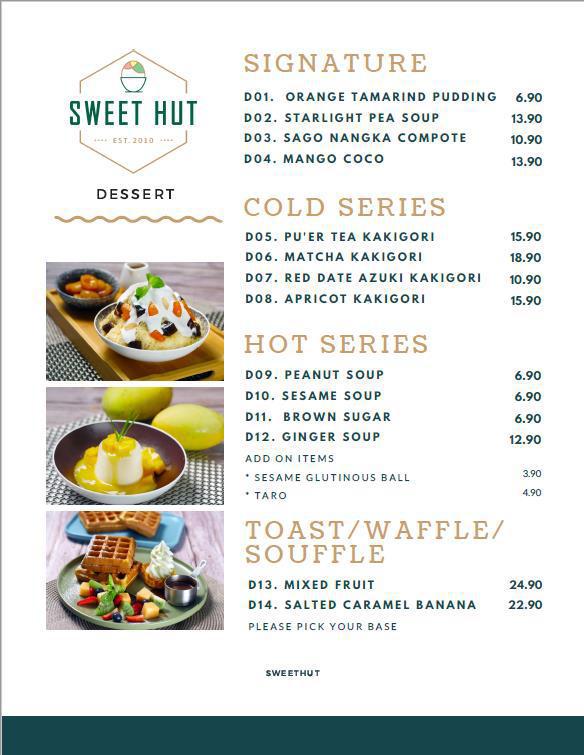

|

| |

| our new menu design (All prices are shown in Malaysia Ringgit) | ||

We currently operates one centralized kitchen and two restaurants located in Malaysia. We manufacture and process our own dessert and food in our centralized kitchen with standard procedures and recipes, in order to ensure the food quality and safety for distribution. Our suppliers, including raw material, ingredient, packaging material suppliers, are located in Malaysia. We currently have 22 suppliers for raw materials and food ingredient and 3 suppliers for packaging materials. We do not currently have a principal supplier. Currently, we do not have any agreement with any of our suppliers. To the best of our knowledge, all of our material suppliers are independent third parties and none of our suppliers are controlled by employees of the Company.

| 8 |

|

| |

| one of our refrigerator trucks | ||

| 9 |

Most of our centralized prepared dessert and food will be distributed to our restaurants through our logistic team delivery, via refrigerated trucks. Restaurant is owned and operated by the Company with an internal operational manual in order to comply with all laws applicable to operating a restaurant in Malaysia, which includes, but is not strictly limited to, the Food Act 1983, Food Regulations 1985 and Food Hygiene Regulations 2009.

In 2017, due to the increasing number of smartphone users and availability of online food delivery intermediaries, the Company decided to take advantage of such opportunities. On July 4, 2017 and September 18, 2017, the Company, through SH Dessert Sdn. Bhd., which is the restaurant operator, registered as a vendor to Honestbee food delivery and Foodpanda delivery. On November 22, 2018, the Company, through SH Dessert Sdn. Bhd., registered with Grabfood as a vendor. On July 22, 2019, Honestbee food delivery suspended its operation in Malaysia and we stopped our collaboration with Honestbee on the same day. The Company believes registering as a vendor to the aforementioned platforms enables the Company to expand the coverage of availability of all our restaurants despite these platforms charging approximately 30% commission on the total food bill on average.

On January 31, 2020, Lucky Star F&B Sdn. Bhd., which is the centralized kitchen operator, has acquired the halal certificate on the food process and production from JAKIM, also known as Department of Islamic Development Malaysia. According to the information from the Department of Statistics Malaysia, as of 2019, the population in Malaysia was approximately 32.6 million, and 69.3% of the population were Muslim adherents. With the halal certificate, we believe the Company can penetrate the Islamic food market in Malaysia, which may lead to improvement in the Company’s financial performance and position.

The Company has observed an increasingly competitive environment in the food and beverage industry due to the low barriers to entry and shift in the paradigm of consumer behaviour and preference which the Company believes it is crucial to implement strategic rebranding and marketing activities to cope with industry and consumer demand. For this purpose, in 2020, the Company has closed all of its four restaurants and re-establish two new outlets locating in C180, Cheras and Sri Petaling and engaged branding firm, to advise on our marketing approach including our brand new renovation outlook, dishes and menu with the funding from our public offering.

some of our new dishes

We strongly believe to excel in food and beverage industry, it is crucial to maintain the quality of food served to our customers, regardless of whether that is through food delivery or dine in. To grow our business and build brand awareness it is crucial to improve the Company’s exposure in terms of availability to different locations throughout different towns. Currently, the Company’s potential market is limited to the two towns in which our restaurant is located. Even with the availability of online food delivery platforms, we believe we are unable to attract customers located more than 20 kilometers away from our individual restaurants, which limits to our growth.

| 10 |

Marketing

The Company, through our subsidiary SH Dessert Sdn Bhd has been cooperating with online food delivery companies to have our desserts displayed on their platforms in order to promote that our desserts may be delivered by their companies, such as Foodpanda and Grabfood.

Our promotional materials are printed and placed on every table of our restaurants. We print new banners and update our promotional materials every month. In the future, we intend to further enhance our brand recognition by increasing our marketing efforts by placing advertisements across various media channels, including social media and internet platforms.

We plan to hire a marketing officer in order to organize our marketing campaigns and establish public awareness of the Company, however, such plans have not yet been determined in sufficient detail to outline at this time and remain under development.

Future Plan

The Company, through Lucky Star F&B Sdn Bhd, has successfully acquired a halal certificate on food processed, prepared and packaged in the central kitchen, which has allowed the Company to further structure its future plans. The Company intends to, through SH Dessert Sdn Bhd, acquire halal certificates on food prepared and served in all of our restaurants and delivered through various food delivery platforms. The Company has yet to submit the application of SH Dessert Sdn Bhd, as the Company needs further funding to renovate and acquire new equipment to meet the requirements ordained by JAKIM.

We also anticipate acquiring new equipment for the central kitchen, such as a new refrigerator, truck, and cooking equipment. This will enhance the stability of the central kitchen output, efficiency of the production lines, logistics and inventory storage. However, such acquisition will depend on the expected demand of our food.

We also intend to further expand our current restaurant network by opening two additional restaurants in strategic shopping malls and the central business district of Kuala Lumpur, Malaysia, to enlarge our market share and increase geographic coverage by the end of this upcoming fiscal year. Furthermore, we believe that hiring ten to fifteen employees will be sufficient to support our future operations, specifically Malay ethnic to comply with JAKIM requirements. However, we have yet to conclude the area we intended to venture into as we remain cautious on the decisions to be made. Furthermore, we intend to allocate funds to continue develop new dishes for boost our revenue.

| 11 |

Employees

As of date of this report, we have twenty-six full-time employees.

We are required to contribute to the Employees Provident Fund (EPF) under a defined contribution pension plan for all eligible employees in Malaysia between the ages of eighteen and seventy. We are required to contribute a specified percentage of the participant’s income based on their ages and wage level. The participants are entitled to all of our contributions together with accrued returns regardless of their length of service with the Company.

The EPF is a social security institution formed according to the Laws of Malaysia, Employees Provident Fund Act 1991 (Act 452) which provides retirement benefits for members through management of their savings in an efficient and reliable manner. The EPF also provides a convenient framework for employers to meet their statutory and moral obligations to their employees.

We intend to hire more staff to assist in the development and execution of our business operations.

We do not presently have pension, health, annuity, insurance, stock options, profit sharing, or similar benefit plans; however, we may adopt plans in the future. There are presently no personal benefits available to our employee, Officer and/or Director.

Government Regulation

The Company’s operations are subject to several laws and regulations other than the aforementioned JAKIM regulation, enacted by the Malaysia government, which includes but is not limited to:

The Food Act 1983 is an Act to protect the public against health hazards and fraud in the preparation, sale and use of food, and for matters incidental thereto or connected therewith. It outlined the authority and procedure where officers authorized by the Minister are empowered to conduct routine checks and, if necessary, sample collection to determine whether the level of hygiene of restaurants is satisfactory and whether food prepared is fit for human consumption at the discretion of officer. Part of the Food Act 1983 regulates the operation of our restaurant including but not limited following:

Pursuant to section 11 of Food Act 1983, if in the opinion of officer, the premise fails to comply with sanitary and hygienic requirements, the officer may in writing order the closure of such premise where food is prepared.

Pursuant to section 12 of Food Act 1983, notification of the name and occupation of any person who has been convicted of any offence against this Act or any regulation made thereunder together with his place or places of business, the nature of the offence and the fine, forfeiture, or other penalty inflicted shall, if the court so orders, be published in any newspaper circulating in Malaysia.

Food Regulation 1985 outlined individual ingredients requirements in terms of labeling, including additive and nutrients supplements. Any person who contravenes or fails to comply with any provisions of these Regulations commits an offence and subject to a fine not exceeding Malaysia Ringgit Five Thousand (Approximately One Thousand Two Hundred and Ten United States Dollars) or imprisonment for a term not exceeding two years.

Food Hygiene Regulations 2009 is a regulation enacted according to Section 34 of the Food Act 1983 and was enacted by the Malaysia government on February 28, 2009. Two main matters that were introduced under this regulation are the registration of food premises by category and offenses which could be compounded. Offences made either by the proprietor, owner, the occupier of food premises, food handlers, caterers, food vending machines operators, as well as a person who transports food using the vehicle shall be liable for a fine not exceeding Malaysia Ringgit Ten Thousand (Approximately Two Thousand Four Hundred and Twenty United States Dollars) or to imprisonment not exceeding 2 years or to both. Meanwhile, some of the offenses are related to food handlers’ routines, design, building and equipment used.

| 12 |

We are a smaller reporting company as defined by Rule 12b-2 of the Securities Exchange Act of 1934 and are not required to provide the information under this item.

ITEM 1B. UNRESOLVED STAFF COMMENTS

Nil.

Our principal executive office which is also our central kitchen is located at No. 19 Jalan 12/118B, Desa Tun Razak, 56100, Kuala Lumpur, Malaysia.

The following table outline the address of our two restaurants and central kitchen that we operate out of, the beginning and end date of the respective lease agreement for each location, the monthly lease payment to be paid for each location, and the party that entered into each lease agreement, as the lessee, for each location. All parties listed under “Tenant” are either subsidiaries of the Company or a related party of the Company.

| Tenant | Address | Commencement Date | Expiry Date | Monthly

Lease Payment Malaysian Ringgit (“MYR”)) |

||||||

| Lucky Star F&B Sdn Bhd | No.19, Jalan 12/118B, Desa Tun Razak, 56100 Kuala Lumpur, Malaysia. | February 1, 2019 | January 31, 2022 | *6,900.00 | ||||||

| SH Desserts Sdn Bhd | No. 125-G, Jalan Dataran Cheras 8, Dataran Perniagaan Cheras, Balakong, 43200, Selangor, Malaysia. | November 15, 2020 | November 14, 2022 | **6,000.00 | ||||||

| SH Dessert Sdn Bhd | No. 65, Jalan Radin Tengah, Bandar Baru Sri Petaling, 57000, Kuala Lumpur, Malaysia. | February 1, 2021 | January 31, 2024 | ***15,000.00 | ||||||

The exchange rate of US$1 to MYR is around MYR4.16.

*This tenancy agreement contained a renewal clause for the period from February 1, 2022 to January 31, 2025 with monthly rental of MYR7,950.

** This tenancy agreement contained a renewal clause for the period from November 15, 2022 to November 14, 2024.

*** This tenancy agreement contained a renewal clause for the period from February 1, 2024 to January 31, 2026 with monthly rental of not exceeding MYR16,500.

As of the date hereof, we know of no material pending legal proceedings against to which we or any of our subsidiaries is a party or of which any of our property is the subject. There are no proceedings in which any of our directors, executive officers or affiliates, or any registered or beneficial shareholder, is an adverse party or has a material interest adverse to our interest. From time to time, we may be subject to various claims, legal actions and regulatory proceedings arising in the ordinary course of business.

ITEM 4. MINE SAFETY DISCLOSURES

Not applicable.

| 13 |

ITEM 5. MARKET FOR REGISTRANT’S COMMON EQUITY, RELATED STOCKHOLDER MATTERS AND ISSUER PURCHASES OF EQUITY SECURITIES

The Company sole class of common equity do not have an established public trading market and we cannot assure you that there will be any liquidity for our common stock in the future.

We have issued 1,000,000 common shares and no preferred shares since October 17, 2018. There are no outstanding options or warrants or securities that are convertible into shares of common stock.

Share Holders

As of March 31, 2021, the Company had 1,000,000 shares of our Common Stock par value, $0.0001 issued and outstanding which owned by 53 shareholders.

Transfer Agent and Registrar

The Company has appointed Globex Transfer, LLC as transfer agent, with address 780 Deltona Blvd., Suite 202 Deltona, FL 32725 and can be reached at (813) 344-4490.

Penny Stock Regulations

The Securities and Exchange Commission has adopted regulations which generally define “penny stock” to be an equity security that has a market price of less than $5.00 per share. Our Common Stock, when and if a trading market develops, may fall within the definition of penny stock and be subject to rules that impose additional sales practice requirements on broker-dealers who sell such securities to persons other than established customers and accredited investors (generally those with assets in excess of $1,000,000, or annual incomes exceeding $200,000 individually, or $300,000, together with their spouse).

For transactions covered by these rules, the broker-dealer must make a special suitability determination for the purchase of such securities and have received the purchaser’s prior written consent to the transaction. Additionally, for any transaction, other than exempt transactions, involving a penny stock, the rules require the delivery, prior to the transaction, of a risk disclosure document mandated by the Securities and Exchange Commission relating to the penny stock market. The broker-dealer also must disclose the commissions payable to both the broker-dealer and the registered representative, current quotations for the securities and, if the broker-dealer is the sole market-maker, the broker-dealer must disclose this fact and the broker-dealer’s presumed control over the market. Finally, monthly statements must be sent disclosing recent price information for the penny stock held in the account and information on the limited market in penny stocks. Consequently, the “penny stock” rules may restrict the ability of broker-dealers to sell our Common Stock and may affect the ability of investors to sell their Common Stock in the secondary market.

In addition to the “penny stock” rules promulgated by the Securities and Exchange Commission, the Financial Industry Regulatory Authority (“FINRA”) has adopted rules that require that in recommending an investment to a customer, a broker-dealer must have reasonable grounds for believing that the investment is suitable for that customer. Prior to recommending speculative low-priced securities to their non-institutional customers, broker-dealers must make reasonable efforts to obtain information about the customer’s financial status, tax status, investment objectives and other information. Under interpretations of these rules, FINRA believes that there is a high probability that speculative low-priced securities will not be suitable for at least some customers. The FINRA requirements make it more difficult for broker-dealers to recommend that their customers buy our common stock, which may limit the investors’ ability to buy and sell our stock.

| 14 |

Dividend Policy

Any future determination as to the declaration and payment of dividends on shares of our Common Stock will be made at the discretion of our board of directors out of funds legally available for such purpose. We are under no contractual obligations or restrictions to declare or pay dividends on our shares of Common Stock. In addition, we currently have no plans to pay such dividends. Our board of directors currently intends to retain all earnings for use in the business for the foreseeable future.

Purchases of Equity Securities by the Registrant and Affiliated Purchasers

We have not repurchased any shares of our common stock during the fiscal year ended March 31, 2021.

Equity Compensation Plan Information

Currently, there is no equity compensation plan in place.

ITEM 6. SELECTED FINANCIAL DATA

We are a smaller reporting company as defined by Rule 12b-2 of the Securities Exchange Act of 1934 and are not required to provide the information under this item.

ITEM 7. MANAGEMENT’S DISCUSSION AND ANALYSIS OF FINANCIAL CONDITION AND RESULTS OF OPERATIONS

The following discussion of our financial condition and results of operations should be read in conjunction with our audited consolidated financial statements and the notes to those financial statements appearing elsewhere in this Report.

Certain statements in this Report constitute forward-looking statements. These forward-looking statements include statements, which involve risks and uncertainties, regarding, among other things, (a) our projected sales, profitability, and cash flows, (b) our growth strategy, (c) anticipated trends in our industry, (d) our future financing plans, and (e) our anticipated needs for, and use of, working capital. They are generally identifiable by use of the words “may,” “will,” “should,” “anticipate,” “estimate,” “plan,” “potential,” “project,” “continuing,” “ongoing,” “expects,” “management believes,” “we believe,” “we intend,” or the negative of these words or other variations on these words or comparable terminology. In light of these risks and uncertainties, there can be no assurance that the forward-looking statements contained in this filing will in fact occur. You should not place undue reliance on these forward-looking statements.

The forward-looking statements speak only as of the date on which they are made, and, except to the extent required by federal securities laws, we undertake no obligation to update any forward-looking statements to reflect events or circumstances after the date on which the statements are made or to reflect the occurrence of unanticipated events.

| 15 |

Overview

We share the same business plan as that of our subsidiaries. We are engaged in the production and sale of food products, specifically dessert created and sold through various restaurants that we operate in Malaysia. We sell our goods under our brand name “Sweet Hut.” We have two dessert restaurants chains and one central kitchen.

Results of Operations

Revenue

For the year ended March 31, 2021 and 2020, the Company has generated a revenue of $161,132 and $340,406. This is a decrease of 52.66%. The breakdown of revenue is as following:

| Year ended March 31 | ||||||||

| 2021 | 2020 | |||||||

| Dine-In Revenue | $ | 103,404 | $ | 262,975 | ||||

| Percentage towards Total Revenue | 64.17 | % | 77.25 | % | ||||

| Delivery Revenue | $ | 57,728 | $ | 77,431 | ||||

| Percentage towards Total Revenue | 35.83 | % | 22.75 | % | ||||

| Total Revenue | $ | 161,132 | $ | 340,406 | ||||

| Total Cost of Sales | $ | 57,655 | $ | 101,771 | ||||

| Total Gross Profit | $ | 103,477 | $ | 238,635 | ||||

| Gross Profit Margin | 64.22 | % | 70.10 | % | ||||

Dine-in revenue declined from $262,975 for the year ended March 31, 2020 to $103,404 for the year ended March 31, 2021 for a decline rate of approximately 60.43%. The decline in dine-in revenue primarily due to recurrent movement control order imposed in Malaysia and the closure of our restaurants for subsequent rebranding purpose.

Delivery revenue declined from $77,431 for the year ended March 31, 2020 to $57,728 for the year ended March 31, 2021 for a decline rate of approximately 25.45%. The decline in delivery primarily due to closure of our restaurants for subsequent rebranding purpose.

Gross Profit

The Company gross profit margin has decline slightly from 70.10% for the year ended March 31, 2020 to 64.22% for the year ended March 31, 2021. As a combination of declining revenue and profit margin, the Company gross profit has declined from $238,635 for the year ended March 31, 2020 to $103,477 for the year ended March 31, 2021, approximately a decline of 56.64%.

| 16 |

General and Administrative Expenses

For the year ended March 31, 2021 and 2020, the Company incurred a general and administrative expenses of $492,433 and $460,802 respectively. This primarily consisted of salary, lease expenses, utilities, depreciation, professional fees, repair and maintenance, compliance expenses and advertising and promotion expenses.

| Year ended March 31 | ||||||||

| Primary expenses | 2021 | 2020 | ||||||

| Salary and salary related expenses | $ | 219,303 | $ | 230,272 | ||||

| Percentage towards general and administrative expenses | 44.68 | % | 49.97 | % | ||||

| Lease and rent expenses | $ | 73,865 | $ | 86,064 | ||||

| Percentage towards general and administrative expenses | 15.05 | % | 18.68 | % | ||||

| Utility expenses | $ | 29,738 | $ | 49,252 | ||||

| Percentage towards general and administrative expenses | 6.06 | % | 10.69 | % | ||||

| Professional expenses | $ | 83,599 | $ | 35,263 | ||||

| Percentage towards general and administrative expenses | 17.03 | % | 7.65 | % | ||||

| Depreciation expenses | $ | 34,181 | $ | 27,089 | ||||

| Percentage towards general and administrative expenses | 6.96 | % | 5.88 | % | ||||

| Repair and maintenance expenses | $ | 8,661 | $ | 16,952 | ||||

| Percentage towards general and administrative expenses | 1.76 | % | 3.68 | % | ||||

| Compliance expenses | $ | 6,763 | $ | 4,962 | ||||

| Percentage towards general and administrative expenses | 1.38 | % | 1.08 | % | ||||

| Advertising and promotion expenses | $ | 1,616 | $ | - | ||||

| Percentage towards general and administrative expenses | 0.33 | % | - | |||||

| Total primary expenses | $ | 457,726 | $ | 449,854 | ||||

| Percentage towards general and administrative expenses | 93.25 | % | 97.62 | % | ||||

| Miscellaneous expenses | $ | 33,108 | $ | 10,948 | ||||

| Percentage towards general and administrative expenses | 6.75 | % | 2.38 | % | ||||

Net Loss

For the year ended March 31, 2021 and 2020, the Company incurred a net loss of $11,862 and $215,815 respectively.

| 17 |

Liquidity and Capital Resources

The Company’s cash and cash equivalent has increased by $257,669, from $87,492 as of March 31, 2020 to $345,161 as of March 31, 2021 The accompanying financial statements have been prepared on a going concern basis, which contemplates the realization of assets and the settlement of liabilities and commitments in the normal course of business.

Cash Used in Operating Activities

For the year ended March 31, 2021, the Company used $251,610 in operating activities primarily from net loss from operation, gain from disposal of fixed assets, increase in prepaid expenses, decrease in account payable, repayment of lease liability and loan waiver from amount due to related parties, contra by depreciation and amortization and decrease in inventory and increase in accrued liability.

For the year ended March 31, 2020, the Company used $176,778 in operating activities primarily caused by net loss from operation, increase in accounts receivables, decrease in accrued liabilities and leased liabilities contra by depreciation and amortization and increase in account payable.

Cash Used In Investing activities

For the year ended March 31, 2021, the Company spent $211,663 in investing activity, primarily in investment in plant, equipment and renovation together with proceed from disposal of plant and equipment.

For the year ended March 31, 2020, the Company used $32,322 in renovations for both central kitchen and restaurants respectively.

Cash Provided by Financing Activities

For the year ended March 31, 2021, the Company had net proceed from financing activity $719,633 primarily from initial public offering and advance from director contra with bank loan repayment.

For the year ended March 31, 2020, the Company had net proceeds from financing cash flow of $235,943, primarily from loan and advances from director and officer contra by repayment of business loan and hire purchase.

Off-Balance Sheet Arrangement

We have no significant off-balance sheet arrangements that have or are reasonably likely to have a current or future effect on our financial condition, changes in our financial condition, revenues or expenses, results of operations, liquidity, capital expenditures or capital resources that are material to our stockholders as of March 31, 2021 and March 31, 2020.

Contractual Obligation

As a smaller reporting company we are not required to provide the aforementioned information.

| 18 |

ITEM 7A. QUANTITATIVE AND QUALITATIVE DISCLOSURES ABOUT MARKET RISK

We are a smaller reporting company as defined by Rule 12b-2 of the Securities Exchange Act of 1934 and are not required to provide the information under this item.

ITEM 8. FINANCIAL STATEMENTS AND SUPPLEMENTARY DATA

The financial statements required by this item are located following the signature page of this Annual Report.

ITEM 9. CHANGES IN AND DISAGREEMENTS WITH ACCOUNTANTS ON ACCOUNTING AND FINANCIAL DISCLOSURE

None.

ITEM 9A. CONTROLS AND PROCEDURES

Disclosure Controls and Procedures

Disclosures Control and Procedures

We maintain disclosure controls and procedures, as defined in Rule 13a-15(e) promulgated under the Securities Exchange Act of 1934 (the “Exchange Act”), that are designed to ensure that information required to be disclosed by us in the reports that we file or submit under the Exchange Act is recorded, processed, summarized and reported within the time periods specified in the Securities and Exchange Commission’s rules and forms and that such information is accumulated and communicated to our management, including our principal executive and principal financial officers, or persons performing similar functions, as appropriate, to allow timely decisions regarding required disclosure.

We carried out an evaluation, under the supervision and with the participation of our management, including our chief executive officer, of the effectiveness of our disclosure controls and procedures as of March 31, 2021. Based on the evaluation of these disclosure controls and procedures, and in light of the material weaknesses found in our internal controls over financial reporting, our chief executive officer concluded that our disclosure controls and procedures were not effective.

The matters involving internal controls and procedures that our management considered to be material weaknesses under the standards of the Public Company Accounting Oversight Board were: (1) lack of a functioning audit committee due to a lack of a majority of independent members and a lack of a majority of outside directors on our board of directors, resulting in ineffective oversight in the establishment and monitoring of required internal controls and procedures; (2) inadequate segregation of duties and effective risk assessment; (3) insufficient written policies and procedures for accounting and financial reporting with respect to the requirements and application of both US GAAP and SEC guidelines; and (4) lack of internal audit function due to the fact that the Company lacks qualified resources to perform the internal audit functions properly and that the scope and effectiveness of the internal audit function are yet to be developed. The aforementioned material weaknesses were identified by our chief executive officer in connection with the review of our financial statements as of March 31, 2021.

Internal Control over Financial Reporting

Our management is responsible for establishing and maintaining adequate internal control over financial reporting as defined in Rules 13a-15(f) and 15d-15(f) under the Exchange Act. Our internal control over financial reporting is designed to provide reasonable assurance regarding the reliability of financial reporting and the preparation of financial statements for external purposes in accordance with generally accepted accounting principles. The internal controls for the Company are provided by executive management’s review and approval of all transactions. Our internal control over financial reporting also includes those policies and procedures that:

| ● | Pertain to the maintenance of records that in reasonable detail accurately and fairly reflect the transactions and dispositions of the assets of the company; | |

| ● | Provide reasonable assurance that transactions are recorded as necessary to permit preparation of financial statements in accordance with accounting principles generally accepted in the United States of America and that receipts and expenditures of the company are being made only in accordance with authorizations of management and directors of the company; and | |

| ● | Provide reasonable assurance regarding prevention or timely detection of unauthorized acquisition, use or disposition of the company’s assets that could have a material effect on the financial statements. |

Because of its inherent limitations, internal control over financial reporting may not prevent or detect misstatements. Also, projections of any evaluation of effectiveness to future periods are subject to the risk that controls may become inadequate because of changes in conditions, or that the degree of compliance with the policies or procedures may deteriorate.

Management assessed the effectiveness of the Company’s internal control over financial reporting as of March 31, 2021. In making this assessment, management used the criteria set forth by the Committee of Sponsoring Organizations of the Treadway Commission in Internal Control-Integrated Framework. Management’s assessment included an evaluation of the design of our internal control over financial reporting and testing of the operational effectiveness of these controls.

| 19 |

As of March 31, 2021, management assessed the effectiveness of our internal control over financial reporting based on the criteria for effective internal control over financial reporting established in Internal Control—Integrated Framework issued by the Committee of Sponsoring Organizations of the Treadway Commission (“COSO”) in 2013 and SEC guidance on conducting such assessments. Based on such evaluation, the Company’s management concluded that, during the period covered by this Report, our internal control over financial reporting were not effective.

Identified Material Weaknesses

A material weakness in internal control over financial reporting is a control deficiency, or combination of control deficiencies, that results in more than a remote likelihood that a material misstatement of the financial statements will not be prevented or detected.

Management identified the following material weaknesses during its assessment of internal controls over financial reporting as of March 31, 2021.

| 1. | We do not have an Audit Committee – While not being legally obligated to have an audit committee, it is the management’s view that such a committee, including a financial expert member, is an utmost important entity level control over the Company’s financial statement. Currently the Chief Executive Officer and Director act in the capacity of the Audit Committee and does not include a member that is considered to be independent of management to provide the necessary oversight over management’s activities. |

| 2. | We do not have Written Policies & Procedures – Due to lack of written policies and procedures for accounting and financial reporting, the Company did not establish a formal process to close our books monthly and account for all transactions and thus failed to properly record the Private Placement or disclose such transactions in its SEC filings in a timely manner. |

| 3. | We did not implement appropriate information technology controls – As at March 31, 2021, the Company retains copies of all financial data and material agreements; however, there is no formal procedure or evidence of normal backup of the Company’s data or off-site storage of the data in the event of theft, misplacement, or loss due to unmitigated factors. |

Accordingly, the Company concluded that these control deficiencies resulted in a reasonable possibility that a material misstatement of the annual or interim financial statements will not be prevented or detected on a timely basis by the company’s internal controls.

As a result of the material weaknesses described above, management has concluded that the Company did not maintain effective internal control over financial reporting as of March 31, 2021 based on criteria established in Internal Control—Integrated Framework issued by COSO.

| 20 |

Management’s Remediation Initiatives

In an effort to remediate the identified material weaknesses and other deficiencies and enhance our internal controls, we have initiated, or plan to initiate, the following series of measures:

| 1. | We plan to create a position to segregate duties consistent with control objectives and will increase our personnel resources and technical accounting expertise within the accounting function when funds are available to us. The accounting personnel is responsible for reviewing the financing activities, facilitate the approval of the financing, record the information regarding the financing, and submit SEC filing related documents to our legal counsel in order to comply with the filing requirements of SEC. |

| 2. | We plan to prepare written policies and procedures for accounting and financial reporting to establish a formal process to close our books monthly on an accrual basis and account for all transactions, including equity and debt transactions. |

| 3. | We intend to add staff members to our management team for making sure that information required to be disclosed in our reports filed and submitted under the Exchange Act is recorded, processed, summarized and reported as and when required and the staff members will have segregated responsibilities with regard to these responsibilities. |

We anticipate that these initiatives will be at least partially, if not fully, implemented by the end of fiscal year 2021.

Changes in internal controls over financial reporting

There was no change in our internal controls over financial reporting that occurred during the period covered by this Report, which has materially affected, or is reasonably likely to materially affect, our internal controls over financial reporting:

This annual report does not include an attestation report of the Company’s registered independent public accounting firm regarding internal control over financial reporting. Management’s report was not subject to attestation by the Company’s registered independent public accounting firm pursuant to rules of the Securities and Exchange Commission that permit the Company to provide only management’s report in this Annual Report on Form 10-K.

None.

| 21 |

ITEM 10. DIRECTORS, EXECUTIVE OFFICERS AND CORPORATE GOVERNANCE

Biographical information regarding the officers and directors of the Company, who will continue to serve as officers and directors of the Company are provided below:

| NAME | AGE | POSITION | ||

| Law Jia Ming | 33 | Chief Executive Officer, Chief Financial Officer | ||

| Leong Will Liam | 43 | Director, President, Secretary and Treasurer |

Law Jia Ming - Chief Executive Officer (CEO), Chief Financial Officer (CFO)

Mr. Law Jia Ming has been our CEO and CFO since October 17, 2018. Mr. Law holds a bachelor’s degree of Business in Marketing from University of Queensland (Australia).

Mr. Law has been engaged in the food and beverage industry since February 2010. From February 2010, he has been the CEO of Lucky Star F&B Sdn Bhd, our wholly owned subsidiary. After working for 6 years in food production, research and development, operational finance and logistic design of food and beverage wholesale industry in Malaysia, he founded our other wholly owned subsidiary, SH Dessert Sdn Bhd in February 2016, which is mainly focused on setting up dessert outlets and receiving franchising fees from the franchisees. He acts as the CEO of SH Dessert Sdn Bhd since February 2016 and his responsibility in the company is to oversee the operation of the company and develop businesses in Asia.

Mr. Law’s experience in corporate management and business development in food and beverage industry, has led the Board of directors to reach the conclusion that he should serve as CEO and CFO of the Company.

Leong Will Liam - Director, President, Secretary and Treasurer

Mr. Leong has been our director, president, secretary and treasurer since October 17, 2018. Mr. Leong graduated from University of London with a bachelor degree in banking and finance in 2000.

From 2000 to 2002, he worked as a banking officer in Citibank Berhad, a licensed commercial bank operating in Malaysia. His responsibilities were client repayment ability evaluation in a loan application, customer relationship maintenance and oversight of daily banking operation. From 2003 to 2004, he worked in HSBC Bank Malaysia Bhd as a manager in banking consumer product division. He was responsible for develop new products with the design and engineering team, promoting and marketing the products with the marketing team and outsourced vendors. Furthermore, he performed cost and profit analysis for those financial products with the financial analysis model, and presented the management team with his analysis. From 2005 to 2008, he worked at Diligent Aspect Sdn Bhd as a general manager, where his responsibilities consisted of overseeing daily operation of outsourced banking agents, coordinating key performance goals development, and ensuring the implementation and review of sale tactical programs. From 2009 to 2014, he worked as Chief Operating Officer at Caccina Sofa Manufacturer (M) Sdn Bhd and was mainly responsible for the implementation and evaluation of key investment opportunities in equipment and infrastructure across the Asia region. From 2015 to the present, he continues to act as the director of CBA Capital Holdings Sdn Bhd. He is responsible for audit and internal control procedure of CBA Capital Holdings Sdn Bhd. Furthermore, he develops corporate fundraising strategies and models for the company and ensures the correct implementation of fundraising strategies and models.

Mr. Leong’s experience in the financial industry and corporate management, has led the Board of directors to reach the conclusion that he should serve as a director, president, secretary and treasurer of the Company.

Corporate Governance

The Company promotes accountability for adherence to honest and ethical conduct; endeavors to provide full, fair, accurate, timely and understandable disclosure in reports and documents that the Company files with the Securities and Exchange Commission and in other public communications made by the Company; and strives to be compliant with applicable governmental laws, rules and regulations. The Company has not formally adopted a written code of business conduct and ethics that governs the Company’s employees, officers and Directors as the Company is not required to do so.

In lieu of an Audit Committee, the Company’s Board of Directors, is responsible for reviewing and making recommendations concerning the selection of outside auditors, reviewing the scope, results and effectiveness of the annual audit of the Company’s financial statements and other services provided by the Company’s independent public accountants. The Board of Directors, the Chief Executive Officer and the Chief Financial Officer of the Company review the Company’s internal accounting controls, practices and policies.

| 22 |

Committees of the Board

Our Company currently does not have nominating, compensation, or audit committees or committees performing similar functions nor does our Company have a written nominating, compensation or audit committee charter. Our Directors believes that it is not necessary to have such committees, at this time, because the Directors can adequately perform the functions of such committees.

Audit Committee Financial Expert

Our Board of Directors has determined that we do not have a board member that qualifies as an “audit committee financial expert” as defined in Item 407(D)(5) of Regulation S-K, nor do we have a Board member that qualifies as “independent” as the term is used in Item 7(d)(3)(iv)(B) of Schedule 14A under the Securities Exchange Act of 1934, as amended, and as defined by Rule 4200(a)(14) of the FINRA Rules.

We believe that our Director(s) are capable of analyzing and evaluating our financial statements and understanding internal controls and procedures for financial reporting. The Director(s) of our Company does not believe that it is necessary to have an audit committee because management believes that the Board of Directors can adequately perform the functions of an audit committee. In addition, we believe that retaining an independent Director who would qualify as an “audit committee financial expert” would be overly costly and burdensome and is not warranted in our circumstances given the stage of our development and the fact that we have not generated any positive cash flows from operations to date.

Involvement in Certain Legal Proceedings

Our Directors and our Executive officers have not been involved in any of the following events during the past ten years:

| 1. | bankruptcy petition filed by or against any business of which such person was a general partner or executive officer either at the time of the bankruptcy or within two years prior to that time; |

| 2. | any conviction in a criminal proceeding or being subject to a pending criminal proceeding (excluding traffic violations and other minor offenses); |

| 3. | being subject to any order, judgment, or decree, not subsequently reversed, suspended or vacated, of any court of competent jurisdiction, permanently or temporarily enjoining, barring, suspending or otherwise limiting his/her involvement in any type of business, securities or banking activities; or |

| 4. | being found by a court of competent jurisdiction (in a civil action), the Commission or the Commodity Futures Trading Commission to have violated a federal or state securities or commodities law, and the judgment has not been reversed, suspended, or vacated. |

| 5. | Such person was found by a court of competent jurisdiction in a civil action or by the Commission to have violated any Federal or State securities law, and the judgment in such civil action or finding by the Commission has not been subsequently reversed, suspended, or vacated; |

| 23 |

| 6. | Such person was found by a court of competent jurisdiction in a civil action or by the Commodity Futures Trading Commission to have violated any Federal commodities law, and the judgment in such civil action or finding by the Commodity Futures Trading Commission has not been subsequently reversed, suspended or vacated; |

| 7. | Such person was the subject of, or a party to, any Federal or State judicial or administrative order, judgment, decree, or finding, not subsequently reversed, suspended or vacated, relating to an alleged violation of:(i) Any Federal or State securities or commodities law or regulation; or(ii) Any law or regulation respecting financial institutions or insurance companies including, but not limited to, a temporary or permanent injunction, order of disgorgement or restitution, civil money penalty or temporary or permanent cease-and-desist order, or removal or prohibition order; or(iii) Any law or regulation prohibiting mail or wire fraud or fraud in connection with any business entity; or |

| 8. | Such person was the subject of, or a party to, any sanction or order, not subsequently reversed, suspended or vacated, of any self-regulatory organization (as defined in Section 3(a)(26) of the Exchange Act (15 U.S.C. 78c(a)(26))), any registered entity (as defined in Section 1(a)(29) of the Commodity Exchange Act (7 U.S.C. 1(a)(29))), or any equivalent exchange, association, entity or organization that has disciplinary authority over its members or persons associated with a member. |

Independence of Directors

We are not required to have independent members of our Board of Directors, and do not anticipate having independent Directors until such time as we are required to do so.

Code of Ethics

We have not adopted a formal Code of Ethics. The Board of Directors evaluated the business of the Company and the number of employees and determined that since the business is operated by a small number of persons, general rules of fiduciary duty and federal and state criminal, business conduct and securities laws are adequate ethical guidelines. In the event our operations, employees and/or Directors expand in the future, we may take actions to adopt a formal Code of Ethics.

Shareholder Proposals

Our Company does not have any defined policy or procedural requirements for shareholders to submit recommendations or nominations for Directors. The Board of Directors believes that, given the stage of our development, a specific nominating policy would be premature and of little assistance until our business operations develop to a more advanced level. Our Company does not currently have any specific or minimum criteria for the election of nominees to the Board of Directors and we do not have any specific process or procedure for evaluating such nominees. The Board of Directors will assess all candidates, whether submitted by management or shareholders, and make recommendations for election or appointment.

A shareholder who wishes to communicate with our Board of Directors may do so by directing a written request addressed to our President, at the address appearing on the first page of this Information Statement.

| 24 |

SECTION 16(A) BENEFICIAL OWNERSHIP REPORTING COMPLIANCE

Section 16(a) of the Securities Exchange Act requires our executive officers and directors, and persons who own more than 10% of our common stock, to file reports regarding ownership of, and transactions in, our securities with the Securities and Exchange Commission and to provide us with copies of those filings. Based solely on our review of the copies of such forms furnished to us and written representations by our officers and directors regarding their compliance with applicable reporting requirements under Section 16(a) of the Exchange Act, we believe that all Section 16(a) filing requirements for our executive officers, directors and 10% stockholders were met during the year ended March 31, 2021.

ITEM 11. EXECUTIVE COMPENSATION

*The below figures are in relation to our most recent fiscal year end.

| Summary Compensation Table | ||||||||||||||||||||||||||||||||||||

Name (a) | Year ended March 31 (b) | Salary

($) (c) | Bonus

($) (d) | Stock

Compensation ($) (e) | Option Awards ($) (f) | Non-Equity Incentive Plan Compensation ($) (g) | Nonqualified Deferred Compensation Earnings ($) (h) | All

Other Compensation ($) (i) | Total

($) (j) | |||||||||||||||||||||||||||

| Law Jia Ming, Chief Executive Officer, | 2021 | 14,407 | - | - | - | - | - | - | $ | 14,407 | ||||||||||||||||||||||||||

| Chief Financial Officer | 2020 | 14,389 | - | - | - | - | - | - | $ | 14,389 | ||||||||||||||||||||||||||

| Leong Will Liam, | 2021 | - | - | - | - | - | - | - | $ | - | ||||||||||||||||||||||||||

| Director | 2020 | - | - | - | - | - | - | - | $ | - | ||||||||||||||||||||||||||

| 25 |

Summary of Compensation

Stock Option Grants

We have not granted any stock options to our executive officers since our incorporation.

Employment Agreements

We do not have an employment or consulting agreement with any officers or Directors.

Compensation Discussion and Analysis

Director Compensation

Our Board of Directors does not currently receive any consideration for their services as members of the Board of Directors. The Board of Directors reserves the right in the future to award the members of the Board of Directors cash or stock-based consideration for their services to the Company, which awards, if granted shall be in the sole determination of the Board of Directors.

Executive Compensation Philosophy

Our Board of Directors determines the compensation given to our executive officers in their sole determination. Our Board of Directors reserves the right to pay our executive or any future executives a salary, and/or issue them shares of common stock in consideration for services rendered and/or to award incentive bonuses which are linked to our performance, as well as to the individual executive officer’s performance. This package may also include long-term stock-based compensation to certain executives, which is intended to align the performance of our executives with our long-term business strategies. Additionally, while our Board of Directors has not granted any performance base stock options to date, the Board of Directors reserves the right to grant such options in the future, if the Board in its sole determination believes such grants would be in the best interests of the Company.

Incentive Bonus

The Board of Directors may grant incentive bonuses to our executive officer and/or future executive officers in its sole discretion, if the Board of Directors believes such bonuses are in the Company’s best interest, after analyzing our current business objectives and growth, if any, and the amount of revenue we are able to generate each month, which revenue is a direct result of the actions and ability of such executives.

Long-term, Stock Based Compensation

In order to attract, retain and motivate executive talent necessary to support the Company’s long-term business strategy we may award our executive and any future executives with long-term, stock-based compensation in the future, at the sole discretion of our Board of Directors, which we do not currently have any immediate plans to award.

| 26 |

ITEM 12. SECURITY OWNERSHIP OF CERTAIN BENEFICIAL OWNERS AND MANAGEMENT AND RELATED STOCKHOLDER MATTERS

As of March 31, 2021, the Company has 1,000,000 shares of common stock issued and outstanding, which number of issued and outstanding shares of common stock have been used throughout this report.

| Name and Address of Beneficial Owner | Shares of Common Stock Beneficially Owned | Common Stock Voting Percentage Beneficially Owned | Voting Shares of Preferred Stock | Preferred Stock Voting Percentage Beneficially Owned | Total Voting Percentage Beneficially Owned | |||||||||||||||

| Executive Officers and Directors | ||||||||||||||||||||

| Law Jia Ming, Chief Executive Officer, Chief Financial Officer | - | - | - | - | - | |||||||||||||||

| Leong Will Liam, Director, President, Secretary and Treasurer | 900,000 | 100 | % | - | - | 100 | % | |||||||||||||

| Officers and Directors as a Group (2 people) | 900,000 | 100 | % | 100 | % | |||||||||||||||

| 5% Shareholders | - | - | - | - | - | |||||||||||||||

*Officers and or Directors who may hold a 5% or greater controlling interest in the Company are included above, but only under the subtitle, “Executive Officers and Directors.”

Beneficial ownership has been determined in accordance with Rule 13d-3 under the Exchange Act. Under this rule, certain shares may be deemed to be beneficially owned by more than one person (if, for example, persons share the power to vote or the power to dispose of the shares). In addition, shares are deemed to be beneficially owned by a person if the person has the right to acquire shares (for example, upon exercise of an option or warrant) within 60 days of the date as of which the information is provided. In computing the percentage ownership of any person, the amount of shares is deemed to include the amount of shares beneficially owned by such person by reason of such acquisition rights. As a result, the percentage of outstanding shares of any person as shown in the following table does not necessarily reflect the person’s actual voting power at any particular date.

ITEM 13. CERTAIN RELATIONSHIPS AND RELATED TRANSACTIONS, DIRECTOR INDEPENDENCE

On October 17, 2018, the Company sold and subsequently issued 900,000 shares of restricted common stock to Mr. Leong Will Liam, our Director, President, Secretary and Treasurer. The price paid per share was $0.30, for aggregate proceeds to the Company of $27,000. Monies from the aforementioned sale of shares went to the Company to be used as working capital.

Regards to all of the above transactions we claim an exemption from registration afforded by Section 4(a)(2) and/or Regulation S of the Securities Act of 1933, as amended (“Regulation S”) for the above sales of the stock since the sales of the stock were made to non-U.S. persons (as defined under Rule 902 section (k)(2)(i) of Regulation S), pursuant to offshore transactions, and no directed selling efforts were made in the United States by the issuer, a distributor, any of their respective affiliates, or any person acting on behalf of any of the foregoing.

On January 16, 2019, We, “Synergy Empire Limited,” acquired 100% of the equity interests of Synergy Empire Holding Limited, a company incorporated in republic of the Marshall Islands (“SEHL”), from our director, Mr. Leong Will Liam, in consideration of $1.

SEHL owns 100% of Synergy Empire Limited, a company incorporated in Hong Kong (“SEHK”).

| 27 |

On December 31, 2018, SEHL acquired 100% of the equity interests of SEHK from our director, Leong Will Liam, in consideration of HK$1 (Equivalent to about $0.13).

On February 21, 2019, SEHK acquired 100% of the equity interests of Lucky Star F&B Sdn. Bhd., (“Lucky Star”), a company incorporated in Malaysia on February 9, 2010, from CBA Capital Holdings Sdn Bhd., a Company owned and controlled by our Director, Mr. Leong Will Liam.

Lucky Star is the owner of 100% of the equity interests of SH Dessert Sdn. Bhd. (“SH Dessert”), a company incorporated in Malaysia on February 19, 2016.

As of March 31, 2019, the Company has an outstanding loan payable to our CEO, Mr. Law Jia Ming, in the amount of $216,911. For the year ended March 31, 2020, Mr. Law Jia Ming has advanced the Company an additional $77,487 to be used for working capital. The Company has a total outstanding loan payable to our CEO, in the amount of $280,180, the difference is caused by foreign currency translation for accounting purpose. For the year ended March 31, 2021, our CEO and CFO, Mr. Law Jia Ming decided to waive all outstanding loan payable.

Mr. Law Jia Ming was a director of our subsidiaries, Lucky Star F&B Sdn. Bhd. and SH Desserts Sdn Bhd., until February 21, 2019 and July 1, 2019 respectively. He has been our CEO and CFO since October 17, 2018.

As of March 31, 2019, the Company has an outstanding loan payable to Mr. Leong Will Liam, our President and Director, in the amount of $499,261. This is inclusive of an amount due to CBA Capital Holdings Sdn. Bhd, a company owned and controlled solely by Mr. Leong Will Liam. The portion of the above total owed directly to CBA Capital Holdings Sdn. Bhd. is $24,822. For the year ended March 31, 2020, Mr. Leong Will Liam has advanced the Company an additional $173,862 to be used for working capital. As of March 31, 2020, the Company has an outstanding loan payable to our President and Director, in the amount of $644,072, the difference is caused by foreign currency translation for accounting purpose.

On February 26, 2021, Synergy Empire Marshall acquire 100% of Lucky Star F&B Sdn. Bhd. from Synergy Empire HK at a consideration of MYR 100,000, equivalent to HK$ 192,370 or US$ 24,822. Consideration has yet to settle between Synergy Empire Marshall and Synergy Empire HK, give rise to a receivable asset for Synergy Empire HK and a payable liability for Synergy Empire Marshall. On March 31, 2021, Mr. Leong Will Liang acquire Synergy Empire HK for HK$1, in exchange deficit book value of HK$19,918.

For the year ended March 31, 2021, Mr. Leong Will Liam has further advanced $225,817 to the Company for working capital purpose. As of March 31, 2021, the Company has an outstanding loan payable to Mr. Leong Will Liam amount $869,658 and an outstanding loan payable to Synergy Empire HK amount $ 24,822, totaled $894,480.

All aforementioned loans and advancement are non-interest bearing and payable on demand. The difference in aforementioned figures are caused by foreign translation difference.

| 28 |

Review, Approval and Ratification of Related Party Transactions

Given our small size and limited financial resources, we have not adopted formal policies and procedures for the review, approval or ratification of transactions, such as those described above, with our executive officer(s), Director(s) and significant stockholders. We intend to establish formal policies and procedures in the future, once we have sufficient resources and have appointed additional Directors, so that such transactions will be subject to the review, approval or ratification of our Board of Directors, or an appropriate committee thereof. On a moving forward basis, our Directors will continue to approve any related party transaction.

ITEM 14. PRINCIPAL ACCOUNTING FEES AND SERVICES

Audit Fees

The following table sets forth the aggregate fees billed to the Company by its independent registered public accounting firms for the fiscal years ended March 31, 2021 and 2020. We have engaged Total Asia Associates as our principal accountant since March 31, 2018.

| ACCOUNTING FEES AND SERVICES | 2021 | 2020 | ||||||

| Audit fees | $ | 24,000 | $ | 21,000 | ||||

| Audit-related fees | - | - | ||||||

| Tax fees | - | - | ||||||

| All other fees | - | - | ||||||

| Total | $ | 24,000 | $ | 21,000 | ||||

The category of “Audit fees” includes fees for our annual audit, quarterly reviews and services rendered in connection with regulatory filings with the SEC, such as the issuance of comfort letters and consents.

The category of “Audit-related fees” includes employee benefit plan audits, internal control reviews and accounting consultation.

All of the professional services rendered by principal accountants for the audit of our annual financial statements that are normally provided by the accountant in connection with statutory and regulatory filings or engagements for last two fiscal years were approved by our board of directors.

| 29 |

ITEM 15. EXHIBITS AND FINANCIAL STATEMENT SCHEDULES

(a) Financial Statements

The following are filed as part of this report:

Financial Statements

The following financial statements of Synergy Empire Limited and Report of Independent Registered Public Accounting Firm are presented in the “F” pages of this Report:

| Page | |

| Audited Financial Statements | |

| REPORT OF INDEPENDENT REGISTERED PUBLIC ACCOUNTING FIRM | F-2 |

| CONSOLIDATED BALANCE SHEETS | F-3 |

| CONSOLIDATED STATEMENTS OF OPERATIONS AND COMPREHENSIVE LOSS | F-4 |

| CONSOLIDATED STATEMENTS OF SHAREHOLDERS’ EQUITY | F-5 |

| CONSOLIDATED STATEMENTS OF CASH FLOWS | F-6 |

| NOTES TO CONSOLIDATED FINANCIAL STATEMENTS | F-7 – F-18 |

(b) Exhibits

The following exhibits are filed herewith:

| 30 |

Pursuant to the requirements of the Securities Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by the undersigned, thereunto duly authorized.

| Synergy Empire Limited | ||

| (Name of Registrant) | ||

| Date: June 29, 2021 | By: | /s/ Law Jia Ming |

| Title: | (Principal Executive Officer and Principal Accounting Officer) | |

| 31 |

INDEX TO FINANCIAL STATEMENTS

| Page | |

| Audited Financial Statements | |

| REPORT OF INDEPENDENT REGISTERED PUBLIC ACCOUNTING FIRM | F-2 |

| CONSOLIDATED BALANCE SHEETS | F-3 |

| CONSOLIDATED STATEMENTS OF OPERATIONS AND COMPREHENSIVE LOSS | F-4 |

| CONSOLIDATED STATEMENTS OF SHAREHOLDERS’ EQUITY | F-5 |

| CONSOLIDATED STATEMENTS OF CASH FLOWS | F-6 |

| NOTES TO CONSOLIDATED FINANCIAL STATEMENTS | F-7 – F-18 |

| F-1 |

|

TOTAL ASIA ASSOCIATES PLT (AF002128 & LLP0016837-LCA) A Firm registered with US PCAOB and Malaysian MIA Block C-3-1, Megan Avenue 1, 189, Off Jalan Tun Razak, 50400, Kuala Lumpur. Tel: (603) 2733 9989 |

REPORT OF INDEPENDENT REGISTERED PUBLIC ACCOUNTING FIRM

The Board of Directors and Stockholders of

Synergy Empire Limited

No. 19 Jalan 12/118B

Desa Tun Razak, 56100

Kuala Lumpur, Malaysia

Opinion on the Financial Statements

We have audited the accompanying consolidated balance sheets of Synergy Empire Limited (the ‘Company’) as of March 31, 2021 and 2020, and the related consolidated statements of operations and comprehensive income, stockholders’ equity, and cash flows for the each of two years in the year ended of March 31, 2021 and 2020, and the related notes (collectively referred to as the “financial statements”). In our opinion, the financial statements present fairly, in all material respects, the financial position of the Company as of March 31, 2021 and 2020, and the results of its operations and its cash flows for each of two years in the year ended March 31, 2021 and 2020, in conformity with accounting principles generally accepted in the United States of America.

Going Concern

The financial statements have been prepared assuming that the Company will continue as a going concern. As discussed in Note 3 to the financial statements, for the year ended March 31, 2021 the Company has net capital and working capital deficit. These conditions raise substantial doubt about the Company’s ability to continue as a going concern. Management’s plans in regard to these matters are also described in Note 3. The financial statements do not include any adjustments that might result from the outcome of this uncertainty.

Basis for Opinion