Attached files

| file | filename |

|---|---|

| 8-K - 8-K - PROGRESS SOFTWARE CORP /MA | prgs-20210624.htm |

| EX-99.1 - EX-99.1 - PROGRESS SOFTWARE CORP /MA | exhibit991-q22021earningsr.htm |

Q2 2021 Supplemental Data Progress Financial Results

2© 2021 Progress Software Corporation and/or its subsidiaries or affiliates. All rights reserved. Legal Notice This presentation contains statements that are “forward-looking statements” within the meaning of Section 27A of the Securities Act of 1933, as amended, and Section 21E of the Securities Exchange Act of 1934, as amended. Progress has identified some of these forward-looking statements with words like “believe,” “may,” “could,” “would,” “might,” “should,” “expect,” “intend,” “plan,” “target,” “anticipate” and “continue,” the negative of these words, other terms of similar meaning or the use of future dates. Forward-looking statements in this presentation include, but are not limited to, statements regarding Progress’s strategy; acquisitions; future revenue growth, operating margin and cost savings; strategic partnering and marketing initiatives; and other statements regarding the future operation, direction, prospects and success of Progress’s business. There are a number of factors that could cause actual results or future events to differ materially from those anticipated by the forward-looking statements, including, without limitation: ▪ Economic, geopolitical and market conditions can adversely affect our business, results of operations and financial condition, including our revenue growth and profitability, which in turn could adversely affect our stock price. ▪ We may fail to achieve our financial forecasts due to such factors as delays or size reductions in transactions, fewer large transactions in a particular quarter, fluctuations in currency exchange rates, or a decline in our renewal rates for contracts. ▪ Our ability to successfully manage transitions to new business models and markets, including an increased emphasis on a cloud and subscription strategy, may not be successful. ▪ If we are unable to develop new or sufficiently differentiated products and services, or to enhance and improve our existing products and services in a timely manner to meet market demand, partners and customers may not purchase new software licenses or subscriptions or purchase or renew support contracts. ▪ We depend upon our extensive partner channel and we may not be successful in retaining or expanding our relationships with channel partners. ▪ Our international sales and operations subject us to additional risks that can adversely affect our operating results, including risks relating to foreign currency gains and losses. ▪ If the security measures for our software, services, other offerings or our internal information technology infrastructure are compromised or subject to a successful cyber-attack, or if our software offerings contain significant coding or configuration errors, we may experience reputational harm, legal claims and financial exposure. ▪ We have made acquisitions, and may make acquisitions in the future, and those acquisitions may not be successful, may involve unanticipated costs or other integration issues or may disrupt our existing operations. ▪ Delay or failure to realize the expected synergies and benefits of the Chef acquisition could adversely impact our future results of operations and financial condition. ▪ The continuing impact of the coronavirus disease (COVID-19) outbreak on our employees, customers, partners, and the global financial markets could adversely affect our business, results of operations and financial condition For further information regarding risks and uncertainties associated with our business, please refer to our filings with the Securities and Exchange Commission. Progress undertakes no obligation to update any forward-looking statements, which speak only as of the date of this presentation, except for statements relating to Progress' projected results for the quarter ended May 31, 2021 and fiscal year ended November 30, 2021, which speak only as of June 24, 2021. Finally, during this presentation we will be referring to non-GAAP financial measures such as non-GAAP revenue, non-GAAP income from operations and operating margin, adjusted free cash flow and non-GAAP diluted earnings per share. These non-GAAP measures are not prepared in accordance with generally accepted accounting principles. A reconciliation between non-GAAP and the most directly comparable GAAP financial measures appears in our earnings press release for the fiscal quarter ended May 31, 2021 and is available in the Investor Relations section of our Web site.

3© 2021 Progress Software Corporation and/or its subsidiaries or affiliates. All rights reserved. What: Progress Q2 2021 Financial Results Conference Call When: Thursday, June 24th, 2021 Time: 5:00 p.m. ET Live Call: 1-800-458-4121, pass code 3588537 Live / Recorded Webcast: http://investors.progress.com Conference Call Details

4© 2021 Progress Software Corporation and/or its subsidiaries or affiliates. All rights reserved. Strong Financial Results ➢ Two consecutive quarters of strong performance in our core business provide confidence to increase our full year 2021 guidance – Results driven by top-line strength across all products, most notably OpenEdge, File Transfer, Network Management and Sitefinity – Stable, durable top line reflected in ARR growth (23% on a constant currency basis and 3.1% on a pro-forma basis) and improvement in net retention rate to above 100% ➢ Chef exceeding our expectations on the top and bottom line as integration proceeds ahead of plan M&A efforts continue ➢ Convertible notes offering enhances our balance sheet allowing for nimbler M&A execution ➢ Growth in pipeline, expansion of sourcing channels and enhanced capabilities create momentum despite highly competitive environment Summary Highlights

5© 2021 Progress Software Corporation and/or its subsidiaries or affiliates. All rights reserved. Leverage the Cloud Opportunity MOVEit Sitefinity CorticonOpenEdge Chef DataDirect

6© 2021 Progress Software Corporation and/or its subsidiaries or affiliates. All rights reserved. Capital Allocation Focus • Continue to return capital to shareholders in the form of dividends • Accretive M&A that meets our disciplined criteria • Repurchase shares so that at a minimum, we offset dilution from our equity programs — Existing authorization $250M; $155M remaining — Flexibility to increase, reduce or suspend repurchases, depending on market conditions and size and timing of M&A Primary focus Share Repurchases $393 Cash Dividends $123 Debt Principal Payments $149 Capital Spending $29 Acquisitions $516 Capital Allocation 2016 – Q2 2021 Share repurchase authorization • Current total: $250M • Remaining: $155M

7© 2021 Progress Software Corporation and/or its subsidiaries or affiliates. All rights reserved. M&A Framework --- Goal is to double the size of the company in 5 years --- Accretive M&A enables us to add scale and cash flows, and generate strong shareholder returns ▪ Target acquisition profile: ➢ Complementary to our business (product, audience, and growth profile) ➢ Significant recurring revenue and excellent retention rates ➢ Cost synergistic and accretive ➢ Operating margins after synergies that are consistent with our overall margins ➢ ROIC above our weighted average cost of capital

8© 2021 Progress Software Corporation and/or its subsidiaries or affiliates. All rights reserved. ` Company Count Deal Count Capital Invested (US$ in mm) Year 2020 2,805 3,199 $34,121 2019 3,462 4,067 31,465 2018 3,537 4,179 28,522 2017 3,484 4,076 21,942 2016 3,181 3,657 17,637 2015 2,995 3,482 16,137 2014 2,717 3,106 16,215 2013 2,258 2,579 9,418 2012 1,672 1,850 7,352 2011 1,226 1,341 5,900 2010 960 1,026 4,408 2009 803 870 3,478 2008 774 835 4,542 Ingredients to Address a Massive M&A Opportunity Source: Pitchbook Best-in-Class M&A Team Well Capitalized Venture Capital Founder Led Companies Large Technology Carveouts Strong Cash Flow Private Equity Over 5 years, VCs invested over $100B in over 15,000 companies in our infrastructure software space Target Opportunities

9© 2021 Progress Software Corporation and/or its subsidiaries or affiliates. All rights reserved. Progress Investment Highlights Durable, predictable financial model High-quality revenue base, high and increasing mix of recurring revenue Accretive M&A and operational efficiencies driving margin improvement Track record of successful acquisition integration and synergy achievement Delivering meaningful earnings per share and free cash flow growth Disciplined and shareholder-friendly capital allocation strategy

10© 2021 Progress Software Corporation and/or its subsidiaries or affiliates. All rights reserved. Q2 2021 Results Q2 2021 Outlook (3/25/2021) GAAP Revenue $122 M $112 M - $116 M Non-GAAP Revenue $129 M $119 M - $123 M GAAP earnings per share (Diluted) $0.30 $0.25 - $0.27 Non-GAAP earnings per share (Diluted) $0.82 $0.72 - $0.74 GAAP Operating Margin 18% Not guided Non-GAAP Operating Margin 38% Not guided Adjusted Free Cash Flow $55 M Not guided Summary Q2 2021 Financial Results

11© 2021 Progress Software Corporation and/or its subsidiaries or affiliates. All rights reserved. $379 $432 $456 $532 $0 $150 $300 $450 $600 2018 2019 2020 2021 (F)* Revenue (non GAAP) Driving Total Growth ➢ 2021(F)* revenue growth of 17% ➢ Revenue CAGR of 12% 2018 – 2021(F)* * Represents our 2021 guidance or the mid-point of our 2021 guidance range

12© 2021 Progress Software Corporation and/or its subsidiaries or affiliates. All rights reserved. $355 98.3% 100.2% 55.0% 65.0% 75.0% 85.0% 95.0% 105.0% $250 $300 $350 $400 $450 $500 Q2'20 Q1'21 ARR Chef Net $ Retention TTM Growth in Annualized Recurring Revenue (amounts reported in constant currency) $437 Note: ARR is a Non-GAAP operating metric and does not have a standardized definition. It is therefore unlikely to be comparable to similarly titled measures presented by other companies. ARR should be viewed independently of revenue and deferred revenue and is not intended to be combined with or to replace either of those items. ARR is not a forecast and the active contracts at the end of a reporting period used in calculating ARR may or may not be extended or renewed by our customers. $424 $437 98.2% 100.2% 55.0% 65.0% 75.0% 85.0% 95.0% 105.0% $250 $300 $350 $400 $450 $500 Q1'20 Q1'21 ARR Net $ Retention TTM “As Reported” Chef adds less than $80M of ARR ARR growth = 23 % year-over-year Net Retention Rate has ranged between 97%-100% “Pro Forma” Chef ARR included in both periods presented ARR growth = 3 % year-over-year Net Retention Rate has ranged between 97%-100%

13© 2021 Progress Software Corporation and/or its subsidiaries or affiliates. All rights reserved. $134 $162 $183 $207 $0 $50 $100 $150 $200 $250 2018 2019 2020 2021 (F)* Operating Income (non GAAP) Growing Profitability ➢ Consistent growth in operating income CAGR 16% 2018 – 2021(F)* ➢ Best-in-class operating margins consistently above 35% * Represents our 2021 guidance or the mid-point of our 2021 guidance range

14© 2021 Progress Software Corporation and/or its subsidiaries or affiliates. All rights reserved. Convertible Notes Offering Key Terms Total Offering Amount (including overallotment option) $360 million Interest Rate 1.00% Maturity 5-years (April 15, 2026) Conversion Premium 27.5% Capped Call (increases conversion premium) 100% or $89.88 Net Proceeds (Net of issuance costs and capped call) $306.1 million Low-cost, unsecured capital Limited risk of dilution Better positioned to execute our Total Growth Strategy

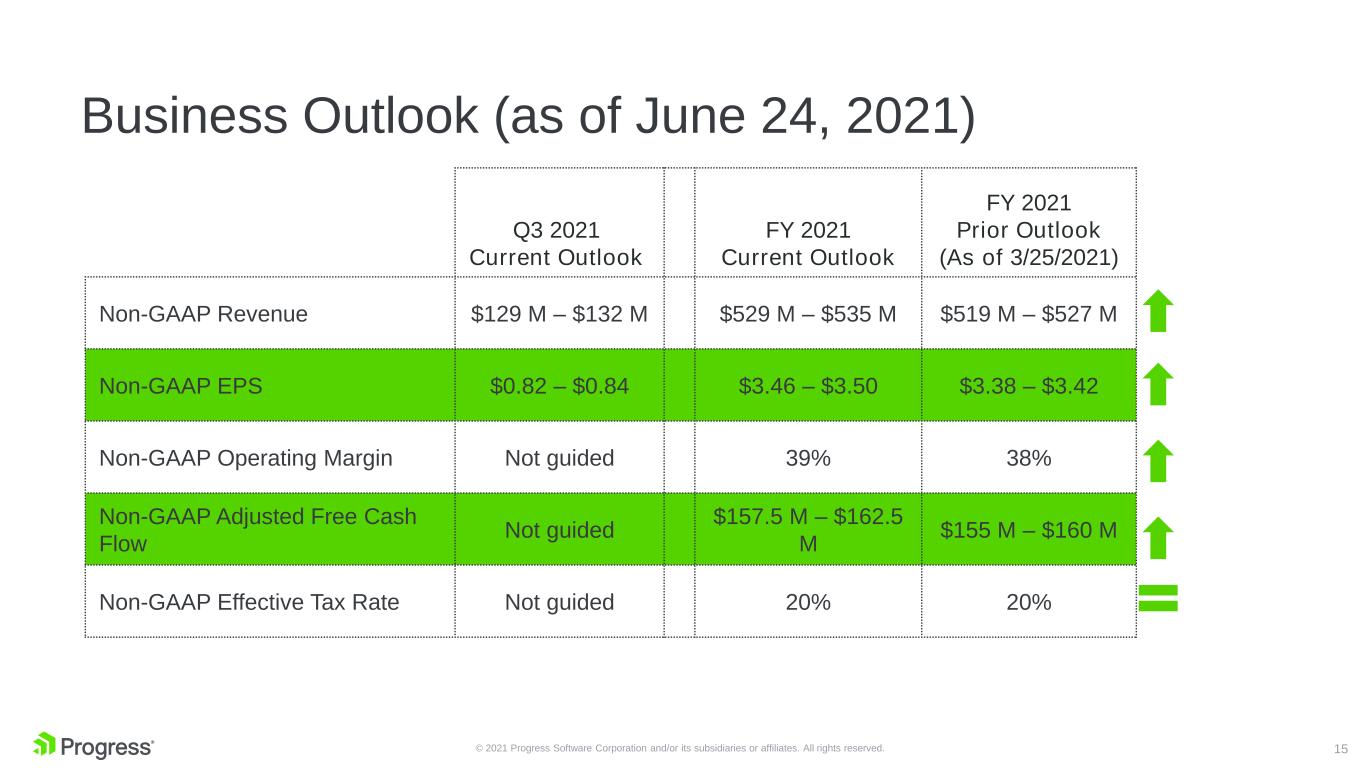

15© 2021 Progress Software Corporation and/or its subsidiaries or affiliates. All rights reserved. Business Outlook (as of June 24, 2021) Q3 2021 Current Outlook FY 2021 Current Outlook FY 2021 Prior Outlook (As of 3/25/2021) Non-GAAP Revenue $129 M – $132 M $529 M – $535 M $519 M – $527 M Non-GAAP EPS $0.82 – $0.84 $3.46 – $3.50 $3.38 – $3.42 Non-GAAP Operating Margin Not guided 39% 38% Non-GAAP Adjusted Free Cash Flow Not guided $157.5 M – $162.5 M $155 M – $160 M Non-GAAP Effective Tax Rate Not guided 20% 20%

Supplemental Financial Information * * The following supplemental financial information is presented on a GAAP basis. A reconciliation of non-GAAP financial measures to the most directly comparable GAAP numbers can be found in the financial results press release that we issued today.

17© 2021 Progress Software Corporation and/or its subsidiaries or affiliates. All rights reserved. Supplemental Revenue Information (Unaudited) (in thousands) Q1 2020 Q2 2020 Q3 2020 Q4 2020 Q1 2021 Q2 2021 Revenue by Type License 30,629 19,663 27,514 37,443 33,317 30,107 Maintenance 70,056 71,686 72,764 74,381 76,977 80,069 Services 8,998 9,034 9,421 10,561 10,986 12,312 Total Revenue 109,683$ 100,383$ 109,699$ 122,385$ 121,280$ 122,488$ Revenue by Region North America 65,413 56,564 62,927 76,094 71,505 71,094 EMEA 34,988 34,157 37,447 37,162 40,240 41,321 Latin America 4,000 3,346 3,547 3,681 3,493 3,753 Asia Pacific 5,282 6,316 5,778 5,448 6,042 6,320 Total Revenue 109,683$ 100,383$ 109,699$ 122,385$ 121,280$ 122,488$ QTD GAAP Basis

18© 2021 Progress Software Corporation and/or its subsidiaries or affiliates. All rights reserved. Other NON-GAAP Financial Measures (Unaudited) QTD QTD QTD GAAP Non-GAAP Non-GAAP (in thousands) Q2 2021 Adjustment Revenue Revenue by Type License 30,107 192 30,299 Maintenance 80,069 6,468 86,537 Services 12,312 50 12,362 Total Revenue 122,488$ 6,710$ 129,198$ Revenue by Region North America 71,094 4,956 76,050 EMEA 41,321 1,363 42,684 Latin America 3,753 29 3,782 Asia Pacific 6,320 362 6,682 Total Revenue 122,488$ 6,710$ 129,198$

19© 2021 Progress Software Corporation and/or its subsidiaries or affiliates. All rights reserved. Other NON-GAAP Financial Measures (Unaudited) YTD YTD GAAP Non-GAAP Non-GAAP (in thousands) Q2 2021 Adjustment Q2 2021 Revenue by Type License 63,424 2,758 66,182 Maintenance 157,046 14,318 171,364 Services 23,298 138 23,436 Total Revenue 243,768$ 17,214$ 260,982$ Revenue by Region North America 142,599 11,442 154,041 EMEA 81,561 4,872 86,433 Latin America 7,246 82 7,328 Asia Pacific 12,362 818 13,180 Total Revenue 243,768$ 17,214$ 260,982$