Attached files

| file | filename |

|---|---|

| 10-K/A - 10-K/A - MEDICAL PROPERTIES TRUST INC | mpw-10ka_20201231.htm |

| EX-32.2 - EX-32.2 - MEDICAL PROPERTIES TRUST INC | mpw-ex322_12.htm |

| EX-32.1 - EX-32.1 - MEDICAL PROPERTIES TRUST INC | mpw-ex321_11.htm |

| EX-31.4 - EX-31.4 - MEDICAL PROPERTIES TRUST INC | mpw-ex314_59.htm |

| EX-31.3 - EX-31.3 - MEDICAL PROPERTIES TRUST INC | mpw-ex313_10.htm |

| EX-31.2 - EX-31.2 - MEDICAL PROPERTIES TRUST INC | mpw-ex312_9.htm |

| EX-31.1 - EX-31.1 - MEDICAL PROPERTIES TRUST INC | mpw-ex311_8.htm |

| EX-23.6 - EX-23.6 - MEDICAL PROPERTIES TRUST INC | mpw-ex236_86.htm |

| EX-23.5 - EX-23.5 - MEDICAL PROPERTIES TRUST INC | mpw-ex235_85.htm |

| EX-23.4 - EX-23.4 - MEDICAL PROPERTIES TRUST INC | mpw-ex234_7.htm |

| EX-23.3 - EX-23.3 - MEDICAL PROPERTIES TRUST INC | mpw-ex233_6.htm |

Exhibit 99.1

Steward Health Care System LLC

Consolidated Financial Statements

Years Ended December 31, 2020 and 2019

(With Independent Auditors’ Report Thereon)

Steward Health Care System LLC

Consolidated Financial Statements

Years ended December 31, 2020 and 2019

Contents

|

|

Page |

|

|

|

|

Independent Auditors’ Report |

1 |

|

|

|

|

Consolidated Balance Sheets |

5 |

|

|

|

|

Consolidated Statements of Operations |

6 |

|

|

|

|

Consolidated Statements of Comprehensive Income (Loss) |

7 |

|

|

|

|

Consolidated Statements of Changes in Members’ Deficit |

8 |

|

|

|

|

Consolidated Statements of Cash Flows |

9 |

|

|

|

|

Notes to Consolidated Financial Statements |

10 |

Independent Auditors’ Report

The Board of Directors

Steward Health Care System LLC:

We have audited the accompanying consolidated financial statements of Steward Health Care System LLC, which comprise the consolidated balance sheets as of December 31, 2020, and the related consolidated statements of operations, comprehensive income (loss), changes in members’ deficit, and cash flows for the year then ended, and the related notes to the consolidated financial statements.

Management’s Responsibility for the Financial Statements

Management is responsible for the preparation and fair presentation of these consolidated financial statements in accordance with U.S. generally accepted accounting principles; this includes the design, implementation, and maintenance of internal control relevant to the preparation and fair presentation of consolidated financial statements that are free from material misstatement, whether due to fraud or error.

Auditors’ Responsibility

Our responsibility is to express an opinion on these consolidated financial statements based on our audit. We conducted our audit in accordance with auditing standards generally accepted in the United States of America. Those standards require that we plan and perform the audit to obtain reasonable assurance about whether the consolidated financial statements are free from material misstatement.

An audit involves performing procedures to obtain audit evidence about the amounts and disclosures in the consolidated financial statements. The procedures selected depend on the auditors’ judgment, including the assessment of the risks of material misstatement of the consolidated financial statements, whether due to fraud or error. In making those risk assessments, the auditor considers internal control relevant to the entity’s preparation and fair presentation of the consolidated financial statements in order to design audit procedures that are appropriate in the circumstances, but not for the purpose of expressing an opinion on the effectiveness of the entity’s internal control. Accordingly, we express no such opinion. An audit also includes evaluating the appropriateness of accounting policies used and the reasonableness of significant accounting estimates made by management, as well as evaluating the overall presentation of the consolidated financial statements.

We believe that the audit evidence we have obtained is sufficient and appropriate to provide a basis for our audit opinion.

Opinion

In our opinion, the consolidated financial statements referred to above present fairly, in all material respects, the financial position of Steward Health Care System LLC as of December 31, 2020, and the results of its operations and its cash flows for the year then ended in accordance with U.S. generally accepted accounting principles.

1

Other Matter

The accompanying consolidated financial statements of the Company as of December 31, 2019 and for the year then ended were audited by other auditors whose report, dated May 29, 2020, on those financial statements was unmodified.

Dallas, Texas

June 3, 2021

2

|

|

|

|

|

Ernst & Young LLP One Victory Park Suite 2000 2323 Victory Avenue Dallas, TX 75219 |

Tel: +1 214 969 8000 Fax: +1 214 969 8587 ey.com |

Report of Independent Auditors

The Board of Directors and Members

Steward Health Care System LLC

We have audited the accompanying consolidated financial statements of Steward Health Care System LLC, which comprise the consolidated balance sheet as of December 31, 2019, and the related consolidated statements of operations, comprehensive income (loss), changes in members’ deficit and cash flows for the year then ended, and the related notes to the consolidated financial statements.

Management’s Responsibility for the Financial Statements

Management is responsible for the preparation and fair presentation of these financial statements in conformity with U.S. generally accepted accounting principles; this includes the design, implementation and maintenance of internal control relevant to the preparation and fair presentation of financial statements that are free of material misstatement, whether due to fraud or error.

Auditor’s Responsibility

Our responsibility is to express an opinion on these financial statements based on our audit. We conducted our audit in accordance with auditing standards generally accepted in the United States. Those standards require that we plan and perform the audit to obtain reasonable assurance about whether the financial statements are free of material misstatement.

An audit involves performing procedures to obtain audit evidence about the amounts and disclosures in the financial statements. The procedures selected depend on the auditor’s judgment, including the assessment of the risks of material misstatement of the financial statements, whether due to fraud or error. In making those risk assessments, the auditor considers internal control relevant to the entity’s preparation and fair presentation of the financial statements in order to design audit procedures that are appropriate in the circumstances, but not for the purpose of expressing an opinion on the effectiveness of the entity’s internal control. Accordingly, we express no such opinion. An audit also includes evaluating the appropriateness of accounting policies used and the reasonableness of significant accounting estimates made by management, as well as evaluating the overall presentation of the financial statements.

We believe that the audit evidence we have obtained is sufficient and appropriate to provide a basis for our audit opinion.

Opinion

In our opinion, the financial statement referred to above present fairly, in all material respects, the consolidated financial position of Steward Health Care Systems LLC at December 31, 2019, and the consolidated results of its operations and its cash flows for the year then ended in conformity with U.S. generally accepted accounting principles.

3

A member firm of Ernst & Young Global Limited

Adoption of ASU No. 2014-09, Revenue from Contracts with Customers (Topic 606)

As discussed in Note 2 to the consolidated financial statements, Steward Health Care System LLC changed its method of accounting for revenue as a result of the adoption of Accounting Standards Update No. 2014-09, Revenue from Contracts with Customers (Topic 606), effective January 1, 2019. Our opinion is not modified with respect to this matter.

Dallas, Texas

May 29, 2020

4

A member firm of Ernst & Young Global Limited

STEWARD HEALTH CARE SYSTEM LLC

Consolidated Balance Sheets

December 31, 2020 and 2019

(Amounts in thousands)

5

Steward Health Care System LLC

Consolidated Statements of Operations

Years ended December 31, 2020 and 2019

(Amounts in thousands)

6

Steward Health Care System LLC

Consolidated Statements of Comprehensive Income (Loss)

Years ended December 31, 2020 and 2019

(Amounts in thousands)

7

Steward Health Care System LLC

Consolidated Statements of Changes in Members’ Deficit

Years ended December 31, 2020 and 2019

(Amounts in thousands)

8

Steward Health Care System LLC

Consolidated Statements of Cash Flows

Years ended December 31, 2020 and 2019

(Amounts in thousands)

9

Steward Health Care System LLC

Notes to Consolidated Financial Statements

December 31, 2020 and 2019

Steward Health Care System LLC (Steward or the System) is the largest private, for‑profit physician owned healthcare network in the United States. Steward is a fully integrated health care system that focuses on maximizing efficiency as a way to deliver the lowest cost and highest quality care for patients.

As of December 31, 2020, the healthcare services owned and operated by Steward’s subsidiaries include four business units:

|

|

• |

Steward Hospital Management Company – primarily manages 35 acute care hospital campuses, two rehabilitation facilities, and one behavioral health hospital campus, driving value to patients through high‑quality healthcare services in the most cost‑effective manner, as well as operating ambulatory surgery centers, affiliated or owned urgent care providers, and post‑acute care centers. |

|

|

• |

Steward Medical Group (SMG) – a large employed multi‑specialty group practice across the entire Steward geographic footprint with over 1,800 employed physicians in approximately 600 clinic sites. In addition, SMG manages other physician‑affiliated businesses, including home care, medical oncology, and centralized electronic intensive care units (eICU). |

|

|

• |

Steward Health Care Network (SHCN) – a highly integrated physician network and managed care contracting entity comprised of more than 5,000 physicians and managed care contracting entity, which operates one of the largest accountable care organizations (ACOs) in the United States. |

|

|

• |

TRACO International Group S. DE R.L. (TRACO) – a captive insurance company incorporated and based in Panama that provides professional and general liability insurance. |

|

(2) |

Summary of Significant Accounting Policies |

|

|

(a) |

Principles of Consolidation and Basis of Presentation |

The accompanying consolidated financial statements were prepared in accordance with accounting principles generally accepted in the United States of America (U.S. GAAP) and include the accounts of subsidiaries and affiliates controlled by Steward. Significant intercompany accounts and transactions have been eliminated in preparing the consolidated financial statements.

|

|

(b) |

Use of Estimates |

The preparation of consolidated financial statements in conformity with U.S. GAAP requires management to make estimates and assumptions that affect the reported amounts of assets and liabilities and disclosure of contingent assets and liabilities at the date of the financial statements. Estimates also affect the amounts of revenues and expenses reported during the period. Actual results could differ from those estimates. Significant items subject to such estimates and assumptions include revenue recognition and the estimated transaction price, including variable consideration and the useful life of fixed assets.

|

|

(c) |

Patient Service Revenues |

Patient service revenue is reported at the amount that reflects the consideration the System expects to be entitled to for providing patient care. These amounts are due from patients, third‑party payors (including managed care payors and government programs), and others. Generally, the System bills

|

|

10 |

(Continued) |

Steward Health Care System LLC

Notes to Consolidated Financial Statements

December 31, 2020 and 2019

the patients and third‑party payors after the services are performed or shortly after discharge. Revenue is recognized as performance obligations are satisfied.

The System’s patient service performance obligations relate to contracts with a duration of less than one year, as such Steward has elected to apply the practical expedient provided in Accounting Standards Codification (ASC) 606‑10‑60‑14(a) and, therefore is not required to disclose the aggregate amount of the transaction price allocated to performance obligations that are unsatisfied or partially unsatisfied at the end of the reporting period. The unsatisfied or partially unsatisfied performance obligations referred to above are primarily related to inpatient services at the end of the reporting period. The performance obligations for these contracts are generally completed within days of the end of the reporting period.

As provided for under the guidance, Steward does not adjust the promised amount of consideration from patients and third‑party payors for the effects of a significant financing component due to the expectation that the period between the time the service is provided to a patient as the time that the patient or a third‑party payor pays for that service will be one year or less.

Performance obligations are determined based on the nature of the services provided by the System and are measured from patient admission to discharge. These services are considered to be a single performance obligation. Revenue is recognized as performance obligations are satisfied either at a point in time or over time.

Management believes that this method provides a reasonable depiction of the transfer of services over the term of the performance obligation based on the inputs needed to satisfy the obligation. Generally, performance obligations satisfied over time relate to patients receiving inpatient acute care services and performance obligations satisfied at a point in time relate to patient outpatient acute care services.

Steward is utilizing the portfolio approach practical expedient in ASC 606 for contracts related to patient service revenue. Steward accounts for the contracts within each portfolio as a collective group, rather than individual contracts, based on the payment pattern expected in each portfolio category and the similar nature and characteristics of the patients within each portfolio. The portfolios consist of major payor classes for inpatient revenue and outpatient revenue. Based on historical collection trends and other analyses, Steward has concluded that revenue for a given portfolio would not be materially different from accounting for revenue on a contract‑by‑contract basis.

The System has agreements with third‑party payors that generally provide for payments at amounts different from established rates. For uninsured patients who do not qualify for charity care, Steward recognizes revenue based on established rates, subject to certain discounts and implicit price concessions in accordance with policy. Steward determines the transaction price based on standard charges for services provided, reduced by explicit price concessions provided to third‑party payors, discounts provided to uninsured patients in accordance with policy, and implicit price concessions provided to uninsured patients. Explicit price concessions are based on contractual agreements, discount policies, and historical experience. Implicit price concessions represent differences between amounts billed and the estimated consideration Steward expects to receive from patients, which are determined based on historical collection experience, current market conditions, and other factors.

|

|

11 |

(Continued) |

Steward Health Care System LLC

Notes to Consolidated Financial Statements

December 31, 2020 and 2019

Contracts, laws, and regulations governing Medicare, Medicaid, and managed care payor arrangements are complex and subject to interpretation. Additionally, under the terms of various agreements, regulations, and statutes, certain elements of third‑party reimbursement are subject to negotiation, audit, and/or final determination by the third‑party payors. Settlements with third‑party payors for retroactive adjustments due to audits, reviews or investigations are considered variable consideration.

Estimated settlements are adjusted in the period in which the adjustment becomes known. Subsequent changes to the estimate of the transaction price are generally recorded as adjustments to patient service revenue in the period of the change. Adjustments arising from a change in the transaction price were not significant in 2020 or 2019.

The following table disaggregates the Company’s patient service revenue by payor for the years ended December 31, 2020 and 2019 (in thousands of dollars):

A summary of the payment arrangements with major third‑party payors is as follows:

|

|

(i) |

Medicare |

The System’s acute care hospitals are subject to a federal prospective payment system (PPS) for Medicare non‑capitated inpatient hospital services, inpatient psychiatric facility services, inpatient rehabilitation facility services, inpatient skilled nursing facility services, and certain outpatient services. Under these prospective payment methodologies, Medicare pays a prospectively determined rate per discharge, per day, or per visit for non‑physician services.

These rates vary according to the Diagnosis Related Group (DRG), Resource Utilization Group, or Ambulatory Payment Classification of each patient. Capital costs related to Medicare inpatient PPS services are paid based upon a standardized amount per discharge weighted by DRG. Certain outpatient services are reimbursed according to fee schedules. The hospitals are reimbursed for cost‑reimbursable items at a tentative interim rate, with final settlement determined after submission of annual cost reports, audits thereof by the Medicare fiscal intermediary, and other subsequent reviews by the applicable review boards, if deemed necessary. The System also receives Medicare supplemental payments, referred to as disproportionate share, based on the number of Medicare and similar patients it serves. Final settlements of disproportionate share payments are also determined after submission of annual cost reports, audits thereof by the Medicare fiscal intermediary, and other subsequent reviews by the applicable review boards, if deemed necessary.

|

|

12 |

(Continued) |

Steward Health Care System LLC

Notes to Consolidated Financial Statements

December 31, 2020 and 2019

As a result, there is at least a reasonable possibility that recorded estimates, including recorded patient service revenue related to disproportionate share payments, will change by a material amount in the near term. There are no known pending changes to these programs that would require revenue to be constrained as of December 31, 2020.

|

|

(ii) |

Medicaid |

Medicaid programs are jointly funded by federal and state governments and are administered by states under an approved plan that provides hospital and other healthcare benefits to qualifying individuals who cannot afford care. All of the System’s hospitals are certified as providers of Medicaid services. State Medicaid programs may use a prospective payment system, cost‑based payment system or other payment methodology for hospital services. However, Medicaid reimbursement is often less than a hospital’s cost of services.

Inpatient services rendered to Medicaid program beneficiaries are reimbursed on an interim prospectively determined fee schedule. Outpatient services rendered to Medicaid program beneficiaries are reimbursed on an interim prospectively determined per‑visit amount. The variable consideration and amounts reimbursed related to the Medicaid programs are subject to review and settlement by appropriate governmental authorities or their agents. There are no known pending changes to these programs that would require revenue to be constrained as of December 31, 2020.

Laws and regulations governing the Medicare and Medicaid programs, including the variable consideration related to the disproportionate share formula and the requirements for inclusion of certain types of patient days, are complex and subject to interpretation. As a result, there is a possibility that recorded estimates will change by a material amount. Management believes it is in compliance with applicable laws and regulations governing the Medicare and Medicaid programs and that adequate provisions have been made for any adjustments that may result from final settlements.

|

|

(iii) |

Texas Supplemental Medicaid Programs |

All of the acute care hospitals in Texas currently receive supplemental Medicaid reimbursement. Programs approved by Centers for Medicare and Medicaid Services (CMS) have expanded the community healthcare safety net by providing indigent healthcare services. Under the Medicaid waiver, funds are distributed to participating hospitals based upon both the costs associated with providing care to individuals without third‑party coverage and the investment made to support coordinating care and quality improvements that transform the local communities’ care delivery systems. The responsibility to coordinate and develop plans that address the concerns of the local delivery care systems, including improved access, quality, cost effectiveness, and coordination, will be controlled primarily by public hospitals or local government entities that serve the surrounding geographic areas.

The underlying methodologies in determining the funding for the state’s Medicaid supplemental reimbursement programs are complex and, as a result, there is a possibility that recorded estimates will change by a material amount. Management believes it is in compliance with the Medicaid reimbursement programs and that adequate provisions have been made for any adjustments that may result from final settlements.

|

|

13 |

(Continued) |

Steward Health Care System LLC

Notes to Consolidated Financial Statements

December 31, 2020 and 2019

As of December 31, 2020 and 2019, respectively, the System has $41.6 million and $35.4 million in receivables in connection with these supplemental reimbursement programs. Revenue recognized under these Texas private supplemental programs, including Texas Medicaid DSH, totaled $76.3 million and $83.4 million in 2020 and 2019, respectively.

|

|

(iv) |

Other Payor Arrangements |

The System has entered into other payment agreements with various other health maintenance organizations (HMOs) and preferred provider organizations. The basis for payment under these agreements includes prospectively determined rates per discharge and per day; discounts from established charges; fee screens; and capitation fees earned on a per‑member, per‑month basis.

|

|

(d) |

Premium Revenue, Capitation Arrangements and Other Managed Care Revenue |

Certain of the System’s subsidiaries have agreements with various health maintenance organizations (HMOs) to provide medical services to subscribing participants. These revenues related to these agreements are recognized in the period in which the obligation to provide patient care for the underlying population of enrolled members is satisfied. Under these agreements, the subsidiaries receive monthly capitation payments based on the number of covered participants, regardless of services actually performed by the subsidiaries, which are recorded as premium revenue in the accompanying statement of operations. Variable consideration is generally estimated using the expected value method.

|

|

(e) |

Other Revenue |

In certain third‑party payor contracts, revenues also include variable consideration for performance incentives, performance guarantees, risk pool measures and risk shares, which are recorded as other revenue in the accompanying consolidated statement of operations. Under these managed care contracts, the System can earn revenue by providing care to participating patient members more efficiently than contractual cost benchmarks and can earn revenue for achieving certain quality of care scores, based upon contractual metrics. Revenues recorded related to these contracts were $184.2 million and $248.9 million as of December 31, 2020, and 2019, including $125.9 million and $194.7 million of risk contract revenue as of December 31, 2020, and 2019, respectively.

Settlement of these revenues occurs subsequent to the end of the fiscal year and the final revenue earned under these arrangements is subject to final determination by the third‑party payors. As a result, there is at least a reasonable possibility that recorded estimates will change by a material amount in the near term. Variable consideration is generally estimated using the expected value method, and variances between preliminary estimates of revenue earned under these arrangements are included in other revenue in the years in which the change in estimate occurs. During the years ended December 31, 2020 and 2019, Steward recognized a decrease of $29.7 million and an increase of $22.1 million, respectively, to other revenue under these managed care contracts as a result of changes in prior year estimates due to final settlements with the third‑party payors. Along with revenue realized under various risk contracts, other revenue includes certain investment income, rental income, parking and cafeteria revenue, and other non‑patient revenue.

|

|

14 |

(Continued) |

Steward Health Care System LLC

Notes to Consolidated Financial Statements

December 31, 2020 and 2019

Monthly capitation payments made by the System’s managed care organizations to physicians and other healthcare providers are expensed in the month services are contracted to be performed. Claims expense for non‑capitated arrangements is accrued as services are rendered by hospitals, physicians, and other healthcare providers during the year.

Medical claims payable related to the System’s managed care organizations includes an estimate of claims received but not paid and an estimate of claims incurred but not received. These claims are estimated using a combination of historical claims experience (including severity and payment lag time) and other actuarial analysis, including number of enrollees, age of enrollees, and certain enrollee health indicators, to predict the cost of healthcare services provided to enrollees during any given period. During 2019, the System recognized approximately $12.5 million in net favorable claims development related to positive runout experience on claims payable balances. While management believes that its estimation methodology effectively captures trends in medical claims costs, actual payments could differ significantly from estimates given changes in the healthcare cost structure or adverse or favorable experience.

The System has various reinsurance contracts with third‑party reinsurers. Reinsurance is received for claims expense incurred in excess of contracted attachment points. Reinsurance recoveries are recorded as a component of medical claims expense in the accompanying consolidated statements of operations, while reinsurance receivables are included in other current assets in the accompanying consolidated balance sheets. Reinsurance recoveries and receivables are calculated based on a combination of claims paid in excess of contracted attachment points and an estimation of reinsurance recoveries on incurred but not reported claims.

The following table shows the components of the change in medical claims payable for fiscal 2019 (in thousands of dollars):

|

|

15 |

(Continued) |

Steward Health Care System LLC

Notes to Consolidated Financial Statements

December 31, 2020 and 2019

During fiscal 2020, the System sold Health Choice Utah, a portion of its managed care operations. This sale resulted in reducing medical claims payable to zero as of December 31, 2020.

Cash and cash equivalents include investments in highly liquid debt instruments with maturities of three months or less when purchased. The System places its temporary cash investments with high‑credit‑quality financial institutions. At times, such investments may be in excess of the Federal Deposit Insurance Corporation insurance limit.

|

|

(h) |

Fair Value Measurements |

The carrying amount of cash and cash equivalents approximates fair value due to the short maturities of these instruments.

|

|

(i) |

Property and Equipment |

Property and equipment balances acquired in connection with acquisitions are adjusted to estimated fair value at the acquisition date. All other property and equipment additions and major improvements are capitalized and are stated at cost. Internal‑use software costs are expensed in the preliminary project stage. Certain direct costs incurred at later stages and associated with the development and purchase of internal‑use software, including external costs for services and internal payroll costs related to the software project, are capitalized within property plant and equipment in the accompanying consolidated balance sheets. Property and equipment balances are depreciated using the straight‑line method over the estimated useful lives of the related assets ranging from 1 to 40 years. Equipment under capital leases is amortized using the straight‑line method over the shorter period of the lease term or the estimated useful life of the equipment. Such amortization is included within depreciation and amortization expense in the accompanying consolidated statements of operations. Depreciation expense, including amortization of assets capitalized under capital leases, is computed using the straight‑line method and was $201.7 million and $173.8 million for the years ended December 31, 2020 and 2019, respectively. Minor improvements, maintenance, and repairs are charged to operations as incurred.

Property and equipment balances are reviewed for impairment whenever circumstances indicate that the carrying amount of an asset may not be recoverable. No impairment of long‑term assets was recognized during the years ended December 31, 2020 or 2019.

|

|

(j) |

Goodwill and Other Intangible Assets |

Goodwill is not amortized but is instead tested at least annually for impairment, or more frequently when events or changes in circumstances indicate that the balance might be impaired. This impairment test is performed annually on the first day of the fourth quarter at the reporting unit level. Steward assesses goodwill for impairment annually as of October 1st and has the option to perform a qualitative or quantitative assessment of goodwill in evaluating goodwill for impairment.

When testing goodwill for impairment qualitatively, if Steward assesses it is more likely than not that the fair value of the reporting unit substantially exceeds its carrying value than no further quantitative analysis is required. When testing goodwill for impairment quantitatively, goodwill is considered to be impaired if the carrying value of the reporting unit, including goodwill, exceeds the reporting unit’s fair

|

|

16 |

(Continued) |

Steward Health Care System LLC

Notes to Consolidated Financial Statements

December 31, 2020 and 2019

value. The reporting unit’s fair value is estimated using the income approach (discounted cash flow). The discounted cash flow approach requires the use of assumptions and judgments, including estimates of future cash flows and the selection of discount rates.

Other intangible assets consist of amortizable intangible assets and indefinite‑lived intangible assets. Amortizable intangible assets include member relationships, contracts and licenses and are amortized over three to fifteen years. Amortizable and indefinite‑lived intangible assets are reviewed for impairment whenever circumstances indicate that the carrying amount of an asset may not be recoverable.

The Company’s annual goodwill impairment analysis, which we performed quantitatively, did not result in an impairment charge. As of December 31, 2020, all goodwill was associated with reporting units with negative carrying values.

The Company’s reporting units and allocated goodwill is as follows as of December 31, 2020 (in thousands of dollars):

|

|

(k) |

Income Taxes |

The System accounts for income taxes under the provisions of ASC Topic 740, Income Taxes, which requires the System to utilize the asset and liability method of accounting for income taxes. Under this method, deferred tax liabilities and assets are determined based on the difference between the financial statement and tax basis of the assets and liabilities using enacted tax rates in effect for the year in which the difference is expected to reverse. The System reduces its deferred tax assets by a valuation allowance if, based upon the weight of available evidence, it is more likely than not that the System will not realize some portion or all of the deferred tax assets. The System considers relevant evidence, both positive and negative, to determine the need for a valuation allowance. Information evaluated includes its financial position and results of operations for the current and preceding years, the availability of deferred tax liabilities, and tax carrybacks, as well as an evaluation of currently available information about future years.

The System recognizes and measures uncertain tax positions and records tax benefits when it is more likely than not that the tax position will be sustained on examination by the taxing authorities, based on the technical merits of the position. The tax benefits recognized in the financial statements from such positions are then measured based on the largest benefit that has a greater than 50% likelihood of being realized upon ultimate settlement. At each period‑end, it is necessary for the System to make certain estimates and assumptions to compute the provision for income taxes, including allocations of certain transactions to different tax jurisdictions, amounts of permanent and temporary differences, the likelihood of deferred tax assets being recovered and the outcome of contingent tax risks. These

|

|

17 |

(Continued) |

Steward Health Care System LLC

Notes to Consolidated Financial Statements

December 31, 2020 and 2019

estimates and assumptions are revised as new events occur, more experience is acquired, and additional information is obtained. The effect of these revisions is recorded in income tax expense or benefit in the period in which they become known.

|

|

(l) |

Inventories |

Inventories are recorded at the lower of cost (first‑in, first‑out method) or market.

|

|

(m) |

Non‑controlling Interests in Consolidated Entities |

Non‑controlling interests represent the portion of equity in a subsidiary not attributable, directly or indirectly, to a parent. The System’s accompanying consolidated financial statements include all assets, liabilities, revenues, and expenses at their consolidated amounts, which include the amounts attributable to the System and the non‑controlling interests. The System recognizes as a separate component of equity and earnings the portion of income or loss attributable to non‑controlling interests based on the portion of each entity not owned by the System.

The System applies the provisions of ASC 810, Consolidation, which requires the System to clearly identify and present ownership interests in subsidiaries held by parties other than the System in the consolidated financial statements within the equity section.

It also requires the amounts of consolidated net earnings attributable to the System and to the non‑controlling interests to be clearly identified and presented on the face of the consolidated statements of operations.

|

|

(n) |

Redeemable Non‑controlling Interest in Consolidated Entities |

The System consolidates eight subsidiaries with non‑controlling interests that include third‑party partners that own limited partnership units with certain redemption features. The redeemable limited partnership units require the System to buy back the units upon the occurrence of certain events at the stated redemption value of the units. In addition, the limited partnership agreements for certain of the limited partnerships provide the limited partners with put rights that allow the units to be sold back to the System, subject to certain limitations, at the redemption value of the units.

According to the limited partnership agreements, the redemption value of the units for this repurchase purpose is generally calculated as the product of the most current audited fiscal period’s EBITDA (earnings before interest, taxes, depreciation, amortization and management fees) and a fixed multiple, less any long‑term debt of the entity. In the event of a redemption, the agreed‑upon value shall be determined by Steward, as the General Partner, in good faith and an independent third‑party valuation may be obtained. The majority of these put rights require an initial holding period of six years after purchase, at which point the holder of the redeemable limited partnership units may put back to the System 20 percent of such holder’s units. Each succeeding year, the number of vested redeemable units will increase by 20 percent until the end of the tenth year after the initial investment, at which point 100 percent of the units may be put back to the System. The limited partnership agreements also provide that under no circumstances shall the System be required to repurchase more than 25 percent of the total vested redeemable limited partnership units in any fiscal year. The equity attributable to these interests has been classified as non‑controlling interests with redemption rights, recorded as temporary equity in the accompanying consolidated balance sheets.

|

|

18 |

(Continued) |

Steward Health Care System LLC

Notes to Consolidated Financial Statements

December 31, 2020 and 2019

Other comprehensive loss includes amounts related to pension plans and is reported in the consolidated statements of comprehensive loss. The FASB issued ASU 2016‑01, Financial Instruments – Overall (Subtopic 825‑10), Recognition and Measurement of Financial Assets and Financial Liabilities, which eliminates the classification categories of equity investments and their differing treatments.

|

|

(p) |

Recently Issued Accounting Pronouncements |

In February 2016, the FASB issued ASU 2016‑02, Leases (Topic 842), which supersedes FASB ASC Topic 840, Leases, and makes other conforming amendments to U.S. GAAP. ASU 2016‑02 requires, among other changes to the lease accounting guidance, lessees to recognize most leases on the balance sheet via a right‑of‑use asset and lease liability, and additional qualitative and quantitative disclosures. ASU 2016‑02 is effective for the System for annual periods beginning after December 15, 2020. The System expects ASU 2016‑02 to add material right‑of‑use assets and lease liabilities to the consolidated balance sheets. The System is evaluating other effects that the new standard will have on its consolidated financial statements and disclosures.

In June 2016, the FASB issued ASU 2016‑13, Measurement of Credit Losses on Financial Instruments, which will change how entities account for credit losses for most financial assets, trade receivables, and reinsurance receivables. The standard will replace the existing incurred loss impairment model with a new current expected credit loss model that generally will result in earlier recognition of credit losses. The standard will apply to financial assets subject to credit losses, including loans measured at amortized cost, reinsurance receivables, and certain off‑balance sheet credit exposures.

|

|

(q) |

Liquidity |

The Company has incurred operating losses, has an accumulated members’ deficit of $1.524 billion and has adjusted negative working capital of $133.9 million as of December 31, 2020. In addition to the liquid assets, the Company has access to $254.0 million on its line of credit as of December 31, 2020.

The Company evaluated whether there are any conditions and events, considered in the aggregate, that raise substantial doubt about its ability to continue as a going concern within one year beyond the release date of these financial statements. Based on such evaluation and the Company’s current operational plans, the Company believes that it has adequate liquid assets, along with access to credit and capital to satisfy its operating cash needs for the period referenced above.

|

|

(r) |

Credit Concentration |

Financial instruments that potentially subject Steward and its subsidiaries to concentrations of credit risk consist primarily of cash and cash equivalents, investments, and accounts receivable. Steward and its subsidiaries’ investments are managed by investment managers based upon guidelines established by the Board.

|

|

(i) |

Labor Concentration |

As of December 31, 2020, approximately 28% of Steward’s employees were covered by collective bargaining agreements.

|

|

19 |

(Continued) |

Steward Health Care System LLC

Notes to Consolidated Financial Statements

December 31, 2020 and 2019

In January 2020, the Secretary of the U.S. Department of Health and Human Services (“HHS”) declared a national public health emergency due to a novel strain of coronavirus. In March 2020, the World Health Organization declared the outbreak of COVID‑19, a disease caused by this coronavirus, a pandemic. The resulting measures to contain the spread and impact of COVID‑19 and other developments related to COVID‑19 have materially affected the System’s results of operations during 2020. Where applicable, the impact resulting from the COVID‑19 pandemic during the year ended December 31, 2020, has been considered, including updated assessments of the recoverability of assets and evaluation of potential credit losses. As a result of the COVID‑19 pandemic, federal and state governments have passed legislation, promulgated regulations and taken other administrative actions intended to assist healthcare providers in providing care to COVID‑19 and other patients during the public health emergency. Sources of relief include the Coronavirus Aid, Relief and Economic Security Act (the “CARES Act”), which was enacted on March 27, 2020, the Paycheck Protection Program and Health Care Enhancement Act (the “PPPHCE Act”), which was enacted on April 24, 2020, and the Consolidated Appropriations Act, 2021 (the “CAA”), which was enacted on December 27, 2020. In total, the CARES Act, PPPHCE Act and the CAA authorize $178 billion in funding to be distributed to hospitals and other healthcare providers through the Public Health and Social Services Emergency Fund (the “PHSSEF”). In addition, the CARES Act provided for an expansion of the Medicare Accelerated and Advance Payment Program whereby inpatient acute care hospitals and other eligible providers were able to request accelerated payment of up to 100% of their Medicare payment amount for a six‑month period to be repaid through withholding of future Medicare fee‑for‑service payments. Various other state and local programs also exist to provide relief, either independently or through distribution of monies received via the CARES Act. During the year ended December 31, 2020, the Company was a beneficiary of these stimulus measures, including the Medicare Accelerated and Advance Payment Program. The Company’s accounting policies for the recognition of these stimulus monies is as follows:

Pandemic Relief Funds

During the year ended December 31, 2020, the Company received approximately $441.7 million in payments through the PHSSEF and various state and local programs. Approximately $389.5 million of the PHSSEF payments were recognized as revenue during the year ended December 31, 2020, which is denoted by the caption “provider relief funds” within the consolidated statement of operations. The recognition of amounts received is conditioned upon the provision of care for individuals with possible or actual cases of COVID‑19 after January 31, 2020, certification that payment will be used to prevent, prepare for and respond to coronavirus and shall reimburse the recipient only for healthcare‑related expenses or lost revenues, as defined by HHS, that are attributable to coronavirus, as well as receipt of the funds. Amounts are recognized as revenue only to the extent the System is reasonably assured that underlying conditions have been met.

The System’s assessment of whether the terms and conditions for amounts received are reasonably assured of having been met considers, among other things, the CARES Act, the CAA and all frequently asked questions and other interpretive guidance issued by HHS, including the Post‑Payment Notice of Reporting Requirements issued on January 15, 2021 (the “January 15, 2021 Notice”) and frequently asked questions issued by HHS on January 28, 2021 and updated through April 2021 which clarified previously issued guidance, as well as expenses incurred attributable to the coronavirus and the System’s results of operations during such period as compared to the System’s budget. Such guidance, specifically the various

|

|

20 |

(Continued) |

Steward Health Care System LLC

Notes to Consolidated Financial Statements

December 31, 2020 and 2019

Post‑Payment Notice of Reporting Requirements and frequently asked questions issued by HHS, set forth the allowable methods for quantifying eligible healthcare related expenses and lost revenues. Only healthcare related expenses attributable to coronavirus that another source has not reimbursed and is not obligated to reimburse are eligible to be claimed. On the basis of guidance available at the time, the System’s estimate of lost revenues for 2020 was first based on the negative change in year‑over‑year net patient care operating revenue (year‑to‑date June 2020), then on the negative change in year‑over‑year net patient care operating income (year‑to‑date September 2020) and finally on the difference between budgeted and actual revenue for calendar year 2020 (year‑to‑date December 2020). The calculation as of December 31, 2020 is in accordance with the CAA which indicates that lost revenues may be calculated pursuant to guidance published by HHS in June 2020, including the difference between a provider’s budgeted and actual revenue if such budget had been established prior to March 27, 2020.

The CARES Act also provides for a deferral of payments of the employer portion of social security payroll tax incurred during the pandemic, allowing half of such payroll taxes to be deferred until December 2021 and the remaining half until December 2022. The System has deferred payroll taxes of $74.4 million and recorded the deferral as a component of accounts payable and accrued expenses and other liabilities on the consolidated balance sheet at December 31, 2020.

Medicare Accelerated Payments

Medicare accelerated payments of approximately $440.1 million were received by the System in April 2020. No additional Medicare accelerated payments have been received by the System. Effective October 8, 2020, CMS is no longer accepting new applications for accelerated payments. Accordingly, the System does not expect to receive additional Medicare accelerated payments. Payments under the Medicare Accelerated and Advance Payment program are advances that must be recouped through future payments.

Effective October 1, 2020, the program was amended such that providers are required to repay accelerated payments beginning one year after the payment was issued. After such one‑year period, Medicare payments owed to providers will be recouped according to the repayment terms. The repayment terms specify that for the first 11 months after repayment begins, repayment will occur through an automatic recoupment of 25% of Medicare fee‑for‑service payments otherwise owed to the provider. At the end of the eleven‑month period, recoupment will increase to 50% for six months. At the end of the six months (or 29 months from the receipt of the initial accelerated payment), Medicare will issue a letter for full repayment of any remaining balance, as applicable. In such event, if payment is not received within 30 days, interest will accrue at the annual percentage rate of four percent (4%) from the date the letter was issued, and will be assessed for each full 30‑day period that the balance remains unpaid. As of December 31, 2020, approximately $165.1 million of Medicare accelerated payments are reflected within Medicare accelerated payments – current portion in the consolidated balance sheet while the remaining approximately $275.0 million are included within Medicare accelerated payments – long‑term. The System’s estimate of the current liability is a function of historical cash receipts from Medicare and the repayment terms set forth above.

|

|

21 |

(Continued) |

Steward Health Care System LLC

Notes to Consolidated Financial Statements

December 31, 2020 and 2019

|

(4) |

Executory Contract Assumed Through Acquisition and Contemplated by System, Seller and Advisors as Part of Determining Purchase Price |

Executory Information Technology (IT) Contract

The System has incurred significant operating expenses, capital costs and cash losses associated with an executory IT contract for a new electronic health record and revenue cycle system that was assumed as part of its 2017 acquisition of IASIS Healthcare Corp. The impact of the executory IT contract was contemplated by the System, its advisors, and IASIS as part of determining the purchase price for the IASIS net assets acquired.

The System believes these costs are not reflective of go‑forward operating performance and began implementation of a replacement IT service with a new vendor during fiscal 2020.

One of the significant financial impacts of the executory IT contract on the System is the impact on timely cash collections of patient accounts receivable balances. The delay in collections led to an increase of related days revenue in accounts receivable outstanding, which has been running consistently higher in the facilities operating under the IT contract as compared to the System’s other hospitals operating under a different IT contract.

The System has made significant investments to remedy the implementation issues associated with the IT contract, including implementing a replacement IT system during fiscal year 2020. The System expects the replacement contract with the new vendor will mitigate future degradation in collections.

In 2019, the System filed suit against the provider of the executory IT contract assumed as part of the IASIS transaction for “serious and continuing breaches of its obligation to provide a safe and efficient…billing system.” As stated in the complaint, “the defective…system has been plagued with errors and workflow problems that have disrupted…billing, delayed accounts receivable, resulted in untimely claims, necessitated thousands of hours of extra work by Steward, and hampered internal communication and reporting.” As part of the complaint, the System asserts that it has identified and seeks to recover over $200 million in damages as a result of errors associated with the IT system. The complaint states that, “Since implementing [the product associated with the executory IT contract, the System] has incurred over $210 million in cash losses, including expenditures of over $130 million to implement [the IT system] and roughly $80 million in lost collections.” No potential recoveries associated with this claim have been recognized in the accompanying financial statements.

|

(5) |

Acquisitions and Divestitures |

2019 Divestitures

On December 31, 2019, the System sold a portion of its managed care operations under Health Choice. Prior to the sale, Health Choice had pretax income of $20.0 million during the period. Total assets sold were $270.7 million. Total liabilities sold were $241.4 million. Cash consideration received was $416.6 million, resulting in a gain on the sale of $387.3 million.

With the Health Choice sale, the System sold the separately identifiable intangible assets in Health Choice’s contract with AHCCCS valued at $5.2 million and amortized over 15 years and member relationships valued at $64.1 million and amortized over 8 years.

|

|

22 |

(Continued) |

Steward Health Care System LLC

Notes to Consolidated Financial Statements

December 31, 2020 and 2019

On May 11, 2020, there was a related party transaction involving Steward Health Care International Holdings Ltd (“Steward International”), the System’s international operations. Steward International was transferred to a company owned by certain of the System’s management equity holders and Medical Properties Trust, Inc. (MPT). The System received $200.0 million in cash for the sale of Steward International. Total assets sold by the System were approximately $27.0 million, resulting in a net cash contribution from the management equity holders of $173.0 million to the System. The transaction has been accounted for as a related party transaction and is shown as a contribution to equity on the accompanying consolidated statement of changes in members’ deficit of $130.5 million after taking into account the tax impact of the contribution.

|

(7) |

Property and Equipment |

Property and equipment as of December 31, 2020 and 2019, consisted of the following (in thousands of dollars):

|

|

23 |

(Continued) |

Steward Health Care System LLC

Notes to Consolidated Financial Statements

December 31, 2020 and 2019

The table below shows the System’s long‑term debt as of December 31, 2020 and 2019, (in thousands of dollars):

Future payments related to the System’s long‑term debt at December 31, 2020, are as follows for the years indicated (in thousands of dollars):

Real Estate Loan Agreement and Sale of Property

At December 31, 2019, the System held mortgage agreements with MPT related to the real property of two acute care hospital campuses. On July 2, 2020, the System sold the real property of the two acute care hospital campuses to a joint venture, of which MPT is the majority owner. The System subsequently leased the property from the joint venture. Due to specified forms of continuing involvement, under the provisions of Accounting Standards Codification Topic 840‑40, Leases – Sale‑Leaseback Transactions, the System is required to continue to capitalize the real estate and to recognize an obligation for the sales proceeds received. The System recognized an initial obligation of $937.2 million, which included the former mortgage obligations of $737.2 million as well as $200.0 million in sale proceeds. The obligation will be amortized

|

|

24 |

(Continued) |

Steward Health Care System LLC

Notes to Consolidated Financial Statements

December 31, 2020 and 2019

over the remaining life of the lease agreement. At December 31, 2020, the balance of the deferred financing obligation was $905.4 million, with the current portion of $79.1 million included in current portion of other long‑term obligation on the accompanying consolidated balance sheet. The long‑term portion of $826.2 million is included in other long‑term obligations on the accompanying consolidated balance sheet.

Future payments related to the System’s other long‑term obligation at December 31, 2020, are as follows for the years indicated (in thousands of dollars):

Revolving Credit Agreement

On June 20, 2011, Steward and certain of its subsidiaries and affiliates (as co‑borrowers) and Steward Health Care Holdings LLC, a controlled affiliate of Steward’s parent (as guarantor), entered into a Credit Agreement (Revolver) with three financial institutions as lenders. On February 1, 2019, Steward entered into the Sixteenth Amendment and on February 12, 2019, Steward entered into a FILO Commitment Increase Agreement, which extended $65 million of the FILO credit facility to September 29, 2022, coterminous with the System’s other revolving commitments. On April 5, 2019, Steward entered into a FILO Commitment Increase Agreement, which increased the FILO facility by $45 million, also coterminous with the System’s other revolving commitments. Collectively, the Credit Agreement and the Amendments are referred to hereinafter as the Revolver.

As of December 31, 2020, the System had an outstanding balance, issued letters of credit, and borrowing availability on the Revolver of approximately $279.5 million, $20.1 million, and $253.5 million, respectively. The borrowing rate at December 31, 2020, was 2.4375% for Eurodollar loans. Interest expense under the Revolver for the years ended December 31, 2020 and 2019, was approximately $15.7 million and $31.3 million, respectively. Under the Revolver, the System may request Letters of Credit at any time, and from time to time prior to the Maturity Date, up to an aggregate amount of $75.0 million.

Upon the occurrence of an event of default, including payment defaults; breaches of covenants; and certain levies, attachments, and other restraints on the System’s business, the commitments under the Revolver may terminate and all outstanding obligations will become immediately due and payable. Borrowings under the Revolver are secured by tangible assets of the System, excluding real property assets.

|

(9) |

Leases |

The System leases various buildings, office space, and equipment under capital and operating lease agreements. These leases expire at various times and have various renewal options. Rent expense amounted to approximately $385.2 million and $383.8 million for the years ended December 31, 2020 and 2019, respectively.

|

|

25 |

(Continued) |

Steward Health Care System LLC

Notes to Consolidated Financial Statements

December 31, 2020 and 2019

On October 26, 2018, Steward entered into an amendment of the MPT Master Lease Agreement which removed provisions that implied continuing involvement for the majority of the underlying properties. Previously, these transactions were accounted for under the guidance as sale‑leaseback financing obligations, as the System was deemed to have continuing involvement in the assets on their respective date of transaction that was technically prohibited per the guidance in ASC Subtopic 840‑40, Leases – Sale‑Leaseback Transactions.

Therefore, Steward recorded current and long‑term sale‑leaseback financing obligations for these properties. The System recorded interest expense of approximately $15.8 million and $4.1 million related to these financing obligations during the years ended December 31, 2020 and 2019, respectively. The Master Lease Agreement has three five‑year options to extend and contains a rent escalator that is adjusted annually.

Future minimum lease payments as of December 31, 2020, are as follows (in thousands of dollars):

|

(10) |

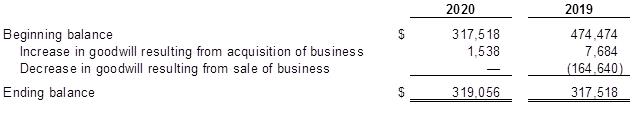

Goodwill |

The following table provides information on changes in the carrying amount of goodwill, which is included in the accompanying consolidated balance sheets as of December 31, 2020 and 2019 (in thousands of dollars):

|

|

26 |

(Continued) |

Steward Health Care System LLC

Notes to Consolidated Financial Statements

December 31, 2020 and 2019

Deferred gain liabilities at December 31, 2020 and 2019, consisted of the following (in thousands of dollars):

|

(12) |

Members’ Equity |

The System has two authorized classes of membership interests in the form of common membership interests and preferred membership interests.

As of December 31, 2020 and 2019, there were 100 common membership interests authorized and outstanding. All of the System’s outstanding common membership interests are held by Steward Health Care Holdings LLC.

The System may issue additional common membership interests only by the vote or written consent of the members holding a majority of the membership interests. Each membership interest represents the holder’s interest in the net profits, losses, and distributions of the System.

On October 3, 2016, the System issued 5.1424 preferred membership interests. These interests were issued in exchange for consideration of $50 million. On September 29, 2017, the System issued 5.84539 preferred membership interests. These interests were issued in exchange for consideration of $100 million. These interests in total remain authorized and outstanding as of December 31, 2020. The preferred interests are held by MPT Sycamore OPCO LLC and were purchased as part of the MPT sale leaseback transaction in 2016 and the acquisition of IASIS transaction in 2017. The preferred membership interests, with respect to rights upon liquidation, dissolution, or winding up of the affairs of the System, rank senior and prior to the common membership interests. These preferred interests are not redeemable, and are convertible into common membership interests based on the conversion ratio in effect at the time of conversion. Dividends are payable when, as, and if declared by the Management Board.

Equity Incentive Plan

Certain of the System’s management have been awarded Class B Interests in Steward Health Care Investors LLC (Investors), which is the holder of all of the outstanding membership interests of Steward Health Care Holdings LLC. The Class B Interests typically vest over a four year period subject to meeting the time based and performance based requirements defined in the individual award agreements.

|

|

27 |

(Continued) |

Steward Health Care System LLC

Notes to Consolidated Financial Statements

December 31, 2020 and 2019

For Class B Interests, vested and unvested interests are forfeited without payment of any consideration when an employee is terminated for cause, resigns or materially breaches certain obligations of such employee. If the employee ceases to provide services to the System for any other reason, then the unvested interests are forfeited and any vested interests are retained, subject to Investors and certain of its affiliates exercising their right to repurchase the vested interests at fair value as provided for in the award agreement.

|

(13) |

Employees’ Retirement Plans |

|

|

(a) |

Defined Contribution Plans |

Matching contributions by Steward are discretionary. Participants in the Steward Health Care 401(k) Retirement Savings Plan have to complete 1,000 hours of service during the year and be employed as of the last day of the year to be eligible to receive any discretionary matching contributions that may be made. No contributions were made for the year ended December 31, 2020.

|

|

(b) |

Deferred Compensation Plans |

Certain of the System’s employees participate in a deferred compensation plan whereby the participant can elect to defer up to 50% of his or her annual base salary and bonus compensation. Contributions related to salary and bonus compensation are 100% vested. The System has purchased a group life insurance contract in which the employees’ contributions are invested. The cash surrender value of the insurance contract totaled $42.0 million and $33.8 million as of December 31, 2020 and 2019, respectively, and the balances are recorded as a component of other assets in the consolidated balance sheets. Steward has also recorded an obligation representing the value of the employee contributions of $41.3 million and $34.3 million as of December 31, 2020 and 2019, respectively, recorded as a component of other liabilities in the consolidated balance sheets.

The deferred compensation plan previously maintained by IASIS was frozen. The assets under this plan totaled $14.9 million at both December 31, 2020 and 2019, and the balances are recorded as a component of other assets in the consolidated balance sheet. Steward has also recorded an obligation representing the value of these employee contributions of $14.9 million and $17.3 million as of December 31, 2020 and 2019, respectively, recorded as a component of other liabilities in the consolidated balance sheets.

|

|

(c) |

Multiemployer Plan |

On December 15, 2015, Steward entered into an Agreement of Merger and a Participation Agreement whereby it merged the Norwood, Good Samaritan, Morton, and Caritas Plan defined benefit plans (collectively, the Legacy Plans) into the Nurses and Local 813 IBT Retirement Fund (the Plan), a tax‑qualified multiemployer defined benefit plan pursuant to Section 3(37)(A) of the Employee Income Security Act of 1974, as amended (ERISA) and U.S. Department of Labor Regulation 2510.3‑37, which was established on January 1, 1962, and includes more than 160 contributing employers (the Merger).

As a result of the Merger, the Legacy Plans were terminated and the related assets and obligations were transferred to and assumed by the Plan and Steward became a contributing employer to the Plan.

|

|

28 |

(Continued) |

Steward Health Care System LLC

Notes to Consolidated Financial Statements

December 31, 2020 and 2019

The risks of participating in multiemployer plans are different from single‑employer plans in the following aspects:

|

|

• |

All plan assets are available to satisfy all plan liabilities, and therefore assets, contributed by Steward to the Plan, including those assets contributed in connection with the Merger, can be used to satisfy the liabilities associated with the other participating employers. |

|

|

• |

If a participating employer stops contributing to the Plan, the unfunded obligations of the Plan may be borne by the remaining participating employers. |

|

|

• |

If Steward opts to stop participating in the Plan, Steward can be assessed a withdrawal liability based on the underfunded status of the Plan and the System’s history of participation in the Plan prior to its cessation from the Plan. |

Under the terms of the Participation Agreement entered into between Steward and the Plan in connection with the Merger, Steward will be responsible to make contributions to the Plan as required under the applicable collective bargaining agreements between Steward and certain of its employees who, as a result of the Merger, are participating employees in the Plan.

In addition, Steward may be required to make additional contributions pursuant to an Allocation Policy provided for in the Participation Agreement. The Allocation Policy will provide for an allocation of expenses, losses, and gains for the Plan as a whole, as specified in the Participation Agreement, based on the ratio of the accrued liability for the Legacy Plan segment of the Plan (determined on a notional basis) to the total accrued liability of the Plan.

Although an accrued liability is determined for the Legacy Plans to facilitate the calculation of any additional contributions by Steward to the Plan in accordance with the Participation Agreement, the accrued liability is determined on a notional basis solely for purposes of determining any additional contributions and is not indicative of a segregation of assets or obligations. The Plan is a multiemployer plan as previously described, and the Plan’s Trust Agreement explicitly provides that all Plan assets are available to satisfy all Plan liabilities.

Additional contributions, if any, pursuant to the Allocation Policy are determined based on the expenses, losses, and gains for the Plan as a whole. As a result, the nature of the Allocation Policy reflects a pooling of risks in that any expenses, gains, and losses that may be attributable to the notional Legacy Plan segment may be offset by the expenses, gains, and losses incurred in the remainder of the Plan.

Accordingly, additional contributions, if any, are not solely attributable to the experience of the notional Legacy Plan segment but are based on the experience of the Plan as a whole.

Steward’s participation in the Plan for the years ended December 31, 2020 and 2019, is outlined in the table below. The “EIN Plan Number” column provides the Employer Identification Number (EIN) and the three‑digit plan number. The most recent Pension Protection Act zone status available is for the Plan’s year beginning January 1, 2020.

|

|

29 |

(Continued) |

Steward Health Care System LLC

Notes to Consolidated Financial Statements

December 31, 2020 and 2019

The zone status is based on information that Steward received from the Plan and is certified by the Plan’s actuary. Among other factors, plans in the red zone are generally less than 65% funded, plans in the yellow zone are less than 80% funded, and plans in the green zone are at least 80% funded. The “FIP/RP Status” column indicates plans for which a financial improvement plan (FIP) or a rehabilitation plan (RP) is either pending or has been implemented. The last column lists the expiration dates of the collective‑bargaining agreements to which the Plan is subject.

|

(14) |

Income Taxes |

On December 22, 2017, the U.S. government enacted comprehensive tax legislation, referred to as the Tax Cuts and Jobs Act (the Tax Act). The Tax Act makes broad and complex changes to the U.S. tax code, including, but not limited to: (1) reducing the U.S. federal corporate tax rate from 35% to 21%; (2) elimination of the corporate alternative minimum tax (AMT) and changing how existing AMT credits can be realized; and (3) changing rules related to the usage and limitation of net operating loss carryforwards created in tax years beginning after December 31, 2017.

The Coronavirus Aid, Relief, and Economic Security Act (the “CARES Act”), was signed into law on March 27, 2020 and contained important tax changes intended to deliver relief to businesses struggling due to the COVID‑19 pandemic.

Provisions of the CARES Act that impact Steward’s income taxes include changes to the interest expense deduction limitation for the 2019 and 2020 tax years, allowing businesses to take a larger deduction as well as the temporary ability to carry net operating losses back to prior years.

The provision for income taxes for the years December 31, 2020 and 2019 consists of the following (in thousands of dollars):

|

|

30 |

(Continued) |

Steward Health Care System LLC

Notes to Consolidated Financial Statements

December 31, 2020 and 2019

The difference between the tax provision computed at the statutory rate and the tax provision recorded by Steward for the years ended December 31, 2019 and 2020, primarily relates to changes in the reserve under ASC 740‑10, as well as changes to the valuation allowance.

The System’s deferred tax assets and liabilities as of December 31, 2020 and 2019, are as follows:

For the years ended December 31, 2020 and 2019, significant components of deferred tax assets include uncertain tax positions (benefit), net operating losses, REIT financing obligations, and deferred gains. Deferred tax liabilities relate primarily to fixed assets.

Steward has maintained a valuation allowance to recognize only the portion of deferred tax assets more likely than not to be realized. The valuation allowance increased by approximately $71.4 million during the year ended December 31, 2020, primarily because of an increase in deferred tax assets.

As of December 31, 2020, Steward had federal net operating loss carryforwards of approximately $10.3 million available to reduce future taxable income, which have no expiration under the new rules under the Tax Act. Steward had state net operating loss carryforwards available to offset future taxable income of approximately $1,146.0 million, which are expected to expire between 2027 and 2040. There are no credit carryforwards available to offset future federal income tax.

The statute of limitations for assessment by the Internal Revenue Service and most state tax authorities is open for tax years ended December 31, 2016 and subsequent for Steward Health Care System LLC and for tax years ended September 30, 2017 and subsequent for the entity acquired in connection with the IASIS Merger. Steward Health Care System LLC is currently under audit by the IRS for the years ended December 31, 2016 and 2017. Steward Health Care System LLC and the entity acquired in the IASIS Merger are also under audit by the State of Texas and the state of Utah.

The System records interest and penalties as a component of income tax expense. As of December 31, 2020 and 2019 the System had liabilities of $75.4 million and $59.3 million of interest and penalties, of which $16.1 million and $28.4 million were recorded for the years ended December 31, 2020 and 2019, respectively.

|

|

31 |

(Continued) |

Steward Health Care System LLC

Notes to Consolidated Financial Statements

December 31, 2020 and 2019

|

|

(a) |

TRACO Malpractice Insurance |

Steward and certain of its affiliates and associated physicians secure medical malpractice, comprehensive general liability coverage from TRACO, a captive insurance company domiciled in the Country of Panama. TRACO provides insurance coverage on a modified claims‑made basis through the issuance of two separate policies: a claims‑made policy that covers claims made during its term, but not those occurrences for which claims may be made after expiration of the policy; and an IBNR policy that covers those claims that arose during the term of the policy but were not known or reported until after the policy term expired. The TRACO premium is a fixed annual premium and is actuarially determined.

The amount of professional and comprehensive general liability insurance expense is based upon estimates prepared by independent actuaries. The accrual for professional and comprehensive general liability costs includes a provision for asserted and unasserted claims and is recorded on an expected, undiscounted basis. TRACO’s estimate of malpractice and other insurance liabilities is based upon complex actuarial calculations that utilize factors such as historical claims experience for TRACO and related industry factors, trending models, estimates for the payment patterns of future claims, and present value discount factors.

As a result, there is at least a reasonable possibility that recorded estimates will change by a material amount in the near term. Revisions of estimated amounts resulting from actual experience differing from projected expectations are recorded in the period the information becomes known or when changes are anticipated. The System’s net professional and general liability accrual totaled $128.9 million and $125.3 million as of December 31, 2020 and 2019, respectively. TRACO participates in two layers of excess liability coverage above the policy limits on its primary policies. TRACO’s limits of liability under the first layer are $25.0 million each claim/$25.0 million annual aggregate in excess of the primary policies’ limits relative to medical professional and hospital professional liability, and $25.0 million each claim/$25.0 million annual aggregate in excess of the primary policies’ limits relative to general liability, including personal injury and advertising injury.

Under the second layer, TRACO’s limits of liability are $25.0 million each claim/$25.0 million annual aggregate relative to medical professional and hospital professional liability, and $25.0 million each claim/$25.0 million annual aggregate relative to general liability on claims exceeding the limits of the first layer. The System reinsures 100% of the excess liability coverage, subject to the same limits of liability as the excess coverage.

|

|

(b) |

Workers’ Compensation Liability Risks |

The System is subject to claims and legal actions in the ordinary course of business relative to workers’ compensation. To cover these types of claims, the System maintains workers’ compensation insurance coverage with a self‑insured retention. The System accrues costs of workers’ compensation claims based upon estimates derived from its claims experience.

|

|

32 |

(Continued) |

Steward Health Care System LLC

Notes to Consolidated Financial Statements

December 31, 2020 and 2019