Attached files

| file | filename |

|---|---|

| 8-K - 8-K - INTERFACE INC | tile-20210607.htm |

Investor Presentation JUNE, 2021

2 Forward Looking Statements and Non-GAAP Measures This presentation contains forward-looking statements, including, in particular, statements about Interface’s plans, strategies and prospects. These are based on the Company’s current assumptions, expectations and projections about future events. Although Interface believes that the expectations reflected in these forward-looking statements are reasonable, the Company can give no assurance that these expectations will prove to be correct or that savings or other benefits anticipated in the forward-looking statements will be achieved. The forward- looking statements set forth involve a number of risks and uncertainties that could cause actual results to differ materially from any such statement, including risks and uncertainties associated with the ongoing COVID-19 pandemic, including interruptions to our manufacturing operations and reduced demand for our products, and economic conditions in the commercial interiors industry. Additional risks and uncertainties that may cause actual results to differ materially from those predicted in forward-looking statements also include, but are not limited to the risks under the heading “Risk Factors” in the Company's Annual Report on Form 10-K for the fiscal year ended January 3, 2021, which discussions are hereby incorporated by reference. You should also consider any additional or updated information we include under the heading “Risk Factors” in our subsequent annual and quarterly reports. Forward-looking statements in this presentation include, without limitation, the information set forth on the slides titled “Investment Thesis”, “Interface is a Purpose-Driven Organization,” “Opportunities for Growth” and “Brand Leader in the Specified Channel”, and the section of this presentation titled “Growth and Value Creation”. Other forward-looking statements can be identified by words such as “may,” “expect,” “forecast,” “anticipate,” “intend,” “plan,” “believe,” “could,” “should”, “goal”, “aim”, “objective”, “seek,” “project,” “estimate,” “target,” and similar expressions. Forward-looking statements speak only as of the date made. The Company assumes no responsibility to update or revise forward-looking statements and cautions listeners and meeting attendees not to place undue reliance on any such statements. This presentation includes certain financial measures not calculated in accordance with U.S. GAAP. They may be different from similarly titled non-GAAP measures used by other companies, and should not be used as a substitute for, or considered superior to, GAAP measures. Reconciliations to the most directly comparable GAAP measures appear in the Appendix.

3 Interface at a Glance Headquartered in Atlanta, GA 7 manufacturing locations on 4 continents 3,700 global employees Sales in over 100 countries Over 1,000 Sales & Marketing professionals All products are Carbon Neutral Global Sustainability leader Americas EMEA APAC Corporate Office Non-Office * See Appendix for a reconciliation of Non-GAAP figures Note: Geographic breakdown and vertical figures represent LTM as of Q1 2021 REVENUE BY GEOGRAPHIC REGION REVENUE BY VERTICAL Interface is a leader in commercial flooring 47%53%53% 32% 15% ($ in millions, except EPS) LTM Q1 2021 Net Sales $1,068 Adj Operating Income* $101 Adj EPS (Diluted)* $0.99 Net Debt* $456 Adj EBITDA* $143 Net Debt / Adj EBITDA* 3.2x

4 Who We Are Leading global provider of commercial flooring: Carpet Tile, Modular Area Rugs, LVT, Rubber Strong brands with a history of innovation and a commitment to sustainability Engaged customer-centric culture focused on performance and galvanized around our sustainability mission Strong global sales & marketing capabilities Innovation and Design Leader in modular carpet Design and Innovation Leader Focused on Solving Customer Problems Across Multiple Segments Global sales & manufacturing footprint with industry-leading gross margins

5 Investment Thesis • Strong commercial brands that lead in growth areas of the industry • Share leader in a $39 billion global commercial flooring category: – Leading share in carpet tile and rubber – Growing share in LVT • Strong growth execution and positioned for future growth: – Selling system transformation is increasing salesforce productivity and delivering results – Segmentation strategy is further expanding opportunity in healthcare, education, hospitality, and life sciences – Geographic diversification is leveraging global account growth opportunities – Cross-selling opportunities are expanding across the Interface, nora and FLOR brands • Recognized design leader in commercial flooring • Robust innovation pipeline ‒ Carbon Neutral Floors ‒ First carbon negative carpet tile (measured cradle-to-gate) ‒ Advanced tufting technology ‒ Manufacturing efficiencies • Attractive gross profit margins • Global footprint with manufacturing on four continents to service local and global customers • Strong liquidity and healthy balance sheet

6 Interface is a Purpose-Driven Organization Grow the Carpet Tile Business Grow the Resilient Flooring Business Execute Supply Chain Productivity Optimize SG&A Resources Our Core Mission is to Lead a World-Changing Sustainability Movement Centered Around Climate Take Back While Also Executing on Four Strategic Pillars to Drive the Business

7 Positioned for Growth Consumer Presence via FLOR Product Innovation Continued Growth in Resilient Services as a Differentiator Broadloom Conversion Across Segments Enhanced Share of Dealer Discretionary

Interface Positioning

9 Carpet Tile • Industry-leading cradle-to-gate carbon negative carpet tile • Biomimicry-inspired random design (i2) • High recycled content • No glue installation (TacTiles®) • Faster, more profitable installation for contractors • Easily recycled (ReEntry® program) • Carbon neutral (Carbon Neutral Floors™) Luxury Vinyl Tile (LVT) • Creative design freedom • Complements and enhances our carpet tile portfolio − No transition strips needed − Same sizes as our carpet tiles • High acoustic value (Sound Choice™ backing) • Carbon neutral (Carbon Neutral Floors™) Rubber • norament® - modular rubber tiles • noraplan® - sheet rubber • Ideal for hygienic, safe flooring applications • Extremely durable with strong chemical resistance • Carbon neutral (Carbon Neutral Floors™) Attractive Product Portfolio

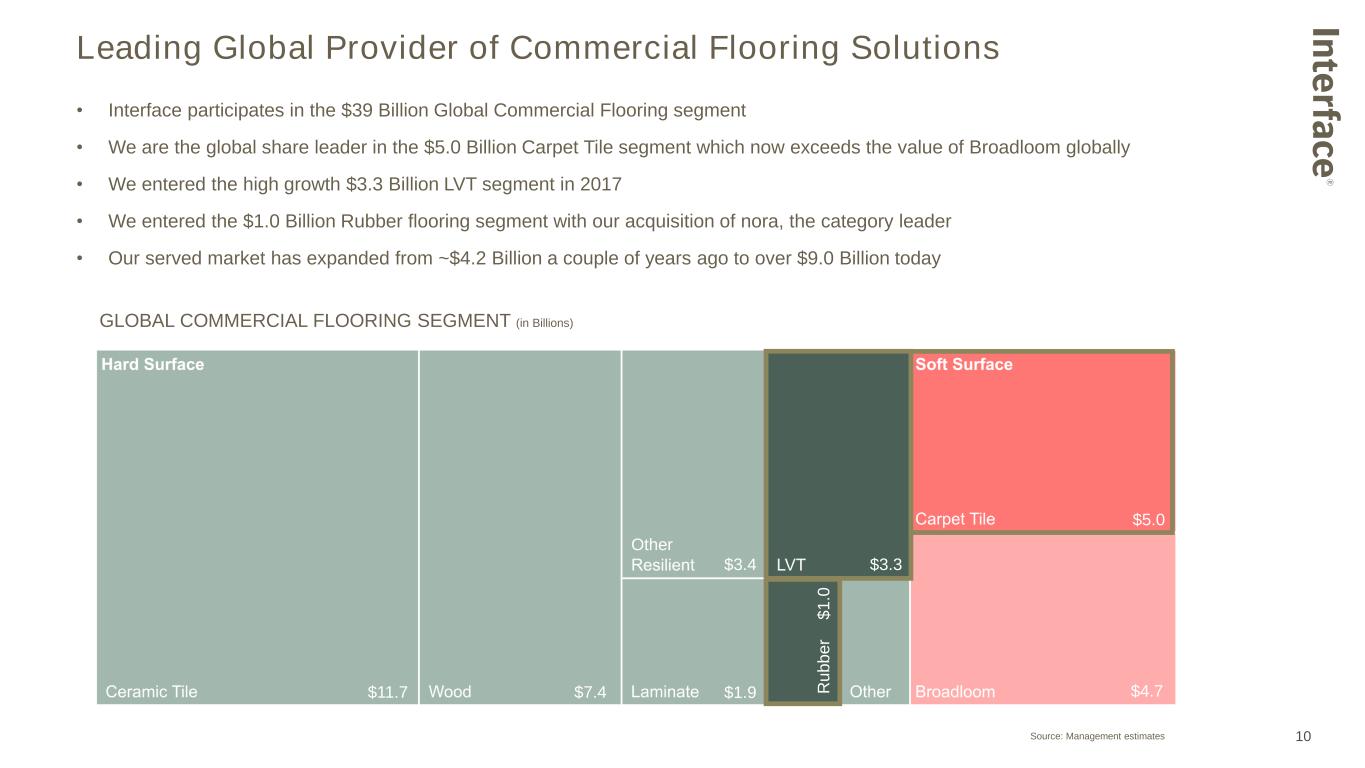

10 GLOBAL COMMERCIAL FLOORING SEGMENT (in Billions) Source: Management estimates Leading Global Provider of Commercial Flooring Solutions • Interface participates in the $39 Billion Global Commercial Flooring segment • We are the global share leader in the $5.0 Billion Carpet Tile segment which now exceeds the value of Broadloom globally • We entered the high growth $3.3 Billion LVT segment in 2017 • We entered the $1.0 Billion Rubber flooring segment with our acquisition of nora, the category leader • Our served market has expanded from ~$4.2 Billion a couple of years ago to over $9.0 Billion today $11.7 $7.4 $1.9 $ 1 .0 $3.4 $3.3 $5.0 $4.7R u b b e r Other

11 Wood Laminate LVT Other Resilient Ceramic Tile Carpet Tile Rubber Broadloom (4%) (2%) 0% 2% 4% 6% 8% 10% 12% 14% 0% 5% 10% 15% 20% 25% 30% 35% 40% 45% 50% E s ti m a te d C A G R t h ro u g h 2 0 2 4 Gross Margin Bubble size = Global commercial value of category, 2019 GLOBAL COMMERCIAL FLOORING: SEGMENT SIZE vs FORECASTED GROWTH and GROSS MARGIN Participating in Attractive Commercial Flooring Segments • Interface serves growing segments of hard and soft surface with the highest margins Source: Management estimates

12 Global Sales and Manufacturing Platform • Sales & marketing offices in over 70 locations across 28 countries • Global account management • Seven manufacturing locations on four continents • Global supply chain management • Unique blend of efficiency and customization Note: Figures represent LTM Q1 2021 AMERICAS 53% of Net Sales EMEA 32% of Net Sales ASIA-PACIFC 15% of Net Sales Carpet Manufacturing Facility Rubber Manufacturing Facility LVT Supplier Facility Showroom

13 Diversified Customer Verticals CORPORATE OFFICE • Highest penetration of carpet tile vs broadloom • Global account management • Recurring renovations • Ongoing opportunity in Emerging Markets EDUCATION • K-12 and higher education • Second highest penetration of carpet tile vs broadloom • Second largest market for rubber • Significant opportunity for broadloom conversion HOSPITALITY • Guest rooms, corridors and public spaces • Named the brand standard or alternate at Hilton, Marriott, IHG and Choice Hotels properties • Significant opportunity for broadloom conversion RETAIL • Retail and bank branches • Significant opportunity for broadloom conversion • High penetration of LVT Note: Figures represent LTM Q1 2021 for Interface and nora combined, figures in chart may not sum to 100% due to rounding HEALTHCARE • Hospitals, Medical Office Building, Assisted Living, Senior Living and Life Sciences • Largest rubber market based on hygienic properties, chemical resistance, and durability • Significant opportunity for broadloom conversion REVENUE BY VERTICAL Corporate Office 47% Education 16% Healthcare 10% Government 8% Retail 4% Consumer/ Residential 3% Hospitality 3% Other 8%

Growth and Value Creation

15 Interface is a Purpose-Driven Organization Grow the Carpet Tile Business Grow the Resilient Flooring Business Execute Supply Chain Productivity Optimize SG&A Resources Our Core Mission is to Lead a World-Changing Sustainability Movement Centered Around Climate Take Back While Also Executing on Four Strategic Pillars to Drive the Business

16 Grow the Core Carpet Tile Business • Enhance salesforce productivity – Capitalize on selling system transformation • Elevate and grow segments – Drive growth in priority segments including Corporate Office, Hospitality, Living and Education • Optimize product portfolio – Expand our portfolio to increase the addressable market, participating in lower price points • Lead the market in design and innovation – introduce new products that energize and inspire • Introduce first cradle-to-gate carbon negative carpet tile to meet increasing customer demand – launched in Q4 2020 • Expanding global account presence • Continue to develop brand loyalty, by maintaining the strongest Net Promoter Score among A&D and End Users

17 Benefits of Modular Carpet Tile Driving Share Gains vs. Broadloom Architect & Designer Specifier • Virtually endless styling choices • Truly custom – design by tile • No transition strips required • Better sustainability Dealer/Installer • Easier materials access into the building • Easier to handle and install • Less waste at end of job • One trade union for multiple flooring types End User • Lower total cost of ownership • Less site down time • Virtually endless styling choices • Selective replacement extends life • Can inset rugs within LVT – no doubling up The value of commercial carpet tile and broadloom soft flooring is ~$10B globally. Ongoing conversion of broadloom represents a $4.7B market opportunity for carpet tile.

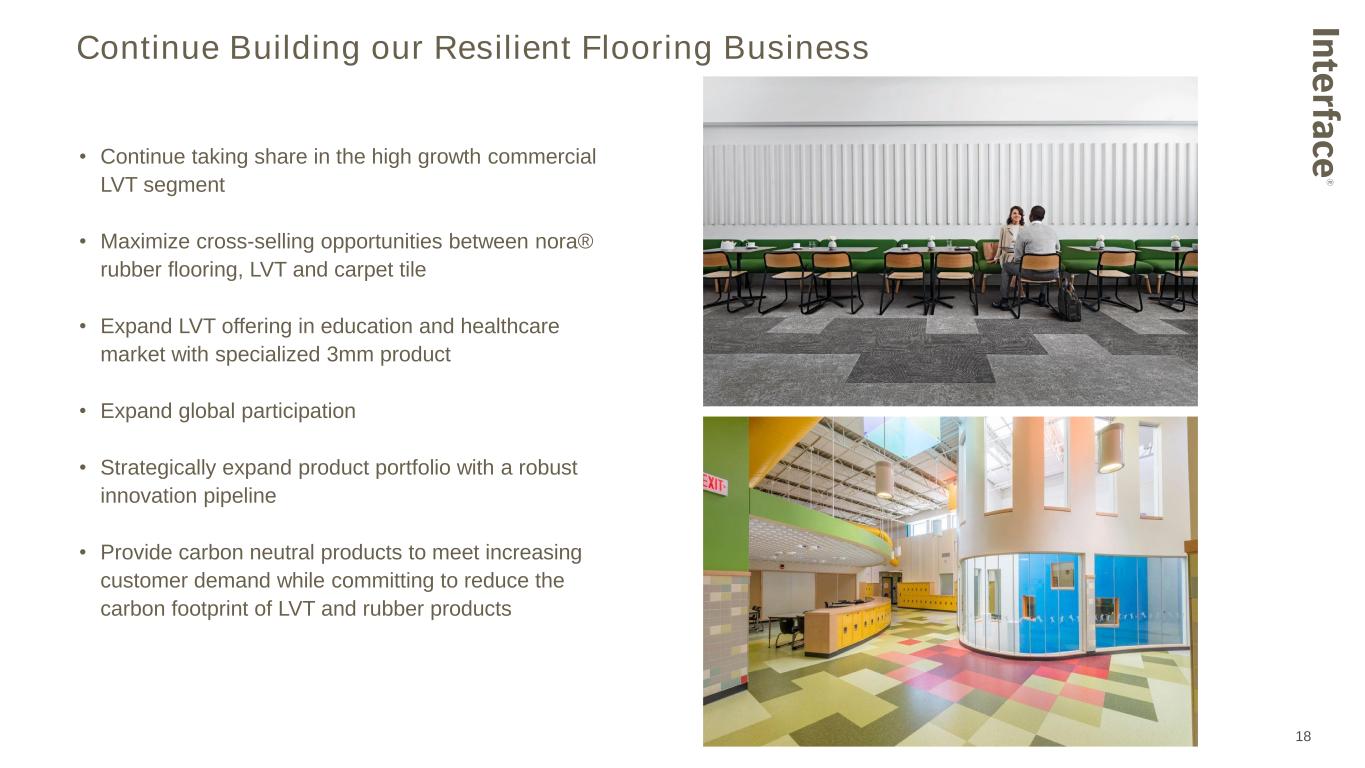

18 Continue Building our Resilient Flooring Business • Continue taking share in the high growth commercial LVT segment • Maximize cross-selling opportunities between nora® rubber flooring, LVT and carpet tile • Expand LVT offering in education and healthcare market with specialized 3mm product • Expand global participation • Strategically expand product portfolio with a robust innovation pipeline • Provide carbon neutral products to meet increasing customer demand while committing to reduce the carbon footprint of LVT and rubber products

19 Design Solutions for the Post-COVID-19 Environment Modular Flooring & Social Distancing • Architects and Designers (A&D) are re-thinking space layouts and interior design elements as the world contemplates the return to work and school • Interface modular flooring plays an integral part in design solutions that: • Control occupant flow and traffic • Create zones and enable separation • Provide a sense of safety & security • …all while providing for an aesthetically appealing environment Zoning & Wayfinding • By using modular shapes and dimensions, carpet tile, LVT and rubber can create clear and graphic zoning and traffic direction for buildings • Examples include: • Arrows • Pattern shading • Design by tile • Shape marker insets Beyond Wayfinding • Flooring impacts a space in more ways than just wayfinding: • Conveys brand identity • Can shape perception, experience and behavior • Can be used creatively with furniture to create distinct areas • Can suggest boundaries with lines, banding, color and pattern

ESG

21 GLOBESCAN SUSTAINABILITY SURVEY – 20+ YEAR HISTORY Unilever Patagonia IKEA Natura Nestle Purpose-Driven Culture Galvanized Around a Common Sustainability Mission Recent Recognition UN Global Climate Action Award Climate Neutral Now Fast Company Most Innovative Energy Companies GlobeScan SustainAbility Leaders Report Floor Covering Weekly’s GreenStep Awards Pinnacle Award Winner INEX Sustainable Product of the Year (India) Sustainable Business Awards (Singapore) Winner, Climate Changes & Best Flagship Initiative Danone Our sustainability journey began in 1994, led by our founder, Ray Anderson. Over the last 25 years, we’ve changed our business to help change the world by becoming, first and foremost, a purpose-driven company. Only company recognized consistently since survey inception 1 9 9 7 1 9 9 8 1 9 9 9 2 0 0 0 2 0 0 1 2 0 0 2 2 0 0 4 2 0 0 5 2 0 0 6 2 0 0 7 2 0 0 9 2 0 1 0 2 0 1 1 2 0 1 2 2 0 1 3 2 0 1 4 2 0 1 5 2 0 1 6 2 0 1 7 2 0 1 8 2 0 1 9 2 0 2 0 Tesla

22 Radical Reductions in Environmental Impacts Learn more about Interface’s sustainability strategy, environmental commitment and social responsibility at: https://investors.interface.com/corporate-responsibility-esg/default.aspx * Global carpet tile manufacturing sites per unit of output since 1996 Note: Data as of 2020 Fewer greenhouse gas emissions* Smaller cradle-to-gate product carbon footprint * Less waste sent to landfills* Less water used to make products* Of materials in the flooring products we sell are from recycled or bio-based sources Renewable energy used at carpet and rubber manufacturing sites 96% 88% 48% 75%76% 92%

23 Product Innovation The First Cradle-to-Gate Carbon Negative Carpet Tile ▪ Our goal is to make products with the lowest carbon footprint possible – products that go beyond neutral to help restore the health of the planet ▪ We’ve innovated ways to work with recycled content and bio-based materials – which has led us to make carpet tiles that store carbon, preventing its release into the atmosphere ▪ When we stop seeing carbon as the enemy and start using it as a resource, great things can happen. Taking our cue from nature, we can learn to work with carbon, using it as a building block to engineer better products Raw Material Acquisition Disposal Use Manufacturing The carbon life cycle In the life of almost any product, carbon dioxide is released into the atmosphere. This release of carbon happens in two stages: the embodied carbon stage and the operational carbon stage Operational carbon The carbon emitted after our product is installed. This phase includes customer use through end-of-life. Also known as "gate to end-of-life", this phase is much harder for us to control. So we purchase offsets and we reclaim and recycle our products at the end of their useful life OPERATIONAL CARBON Embodied carbon The carbon dioxide emitted by making our products. This phase covers raw material creation, growth and extraction, through manufacture, until a product is ready for sale. Also known as "cradle to gate", this is the most exciting phase for us because we can engineer our embodied carbon footprint to negative EMBODIED CARBON CQuestTMGB Backing A new-and-improved version of our GlasBacTM backing. It features the same superior performance with a construction of post-consumer carpet tiles, bio-based additives, and pre-consumer recycled materials, which are net carbon negative CQuestTMBio Backing A non-vinyl backing made with biopolymers, and bio-based and recycled fillers which are net carbon negative CQuestTM BioX Backing Our most carbon negative backing. It's the same material make-up as CQuestTMBio with a higher concentration of carbon negative materials

Financial Performance

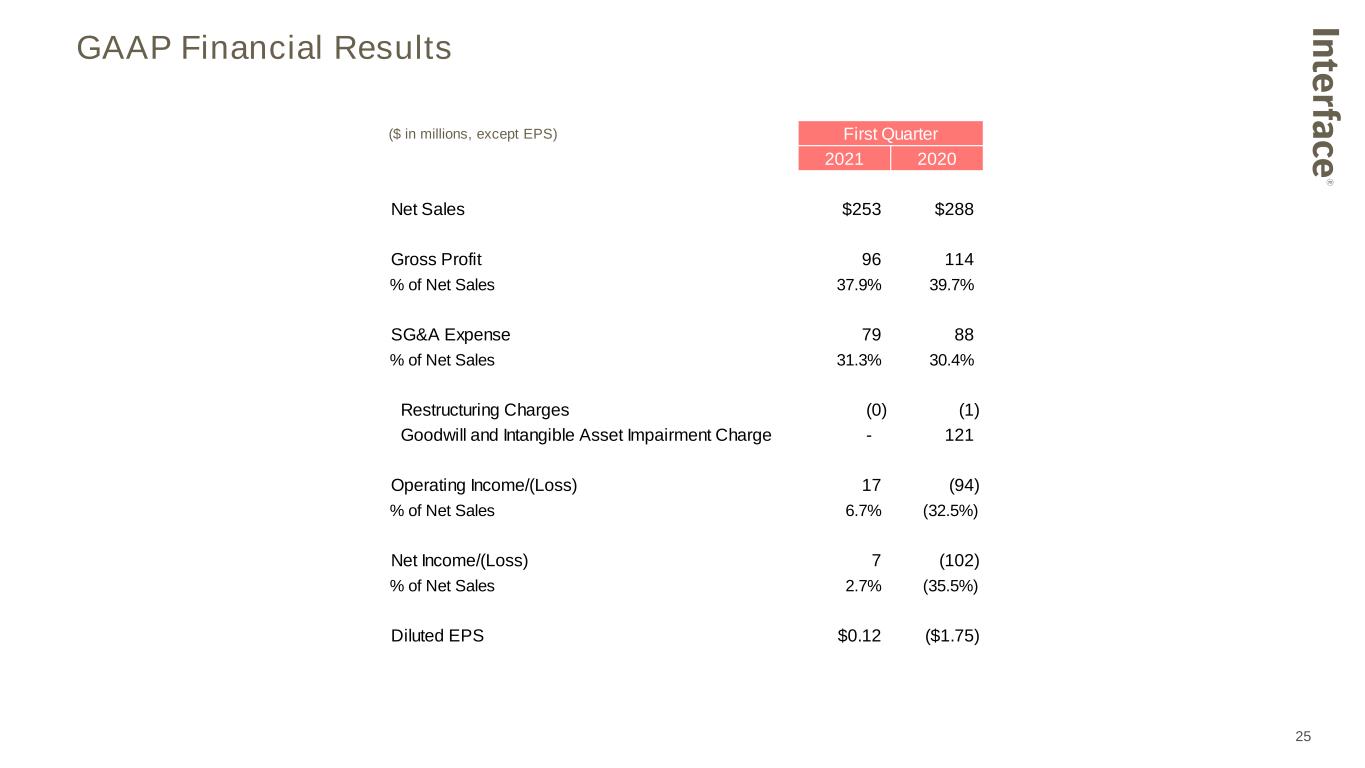

25 GAAP Financial Results ($ in millions, except EPS) 2021 2020 Net Sales $253 $288 Gross Profit 96 114 % of Net Sales 37.9% 39.7% SG&A Expense 79 88 % of Net Sales 31.3% 30.4% Restructuring Charges (0) (1) Goodwill and Intangible Asset Impairment Charge - 121 Operating Income/(Loss) 17 (94) % of Net Sales 6.7% (32.5%) Net Income/(Loss) 7 (102) % of Net Sales 2.7% (35.5%) Diluted EPS $0.12 ($1.75) First Quarter

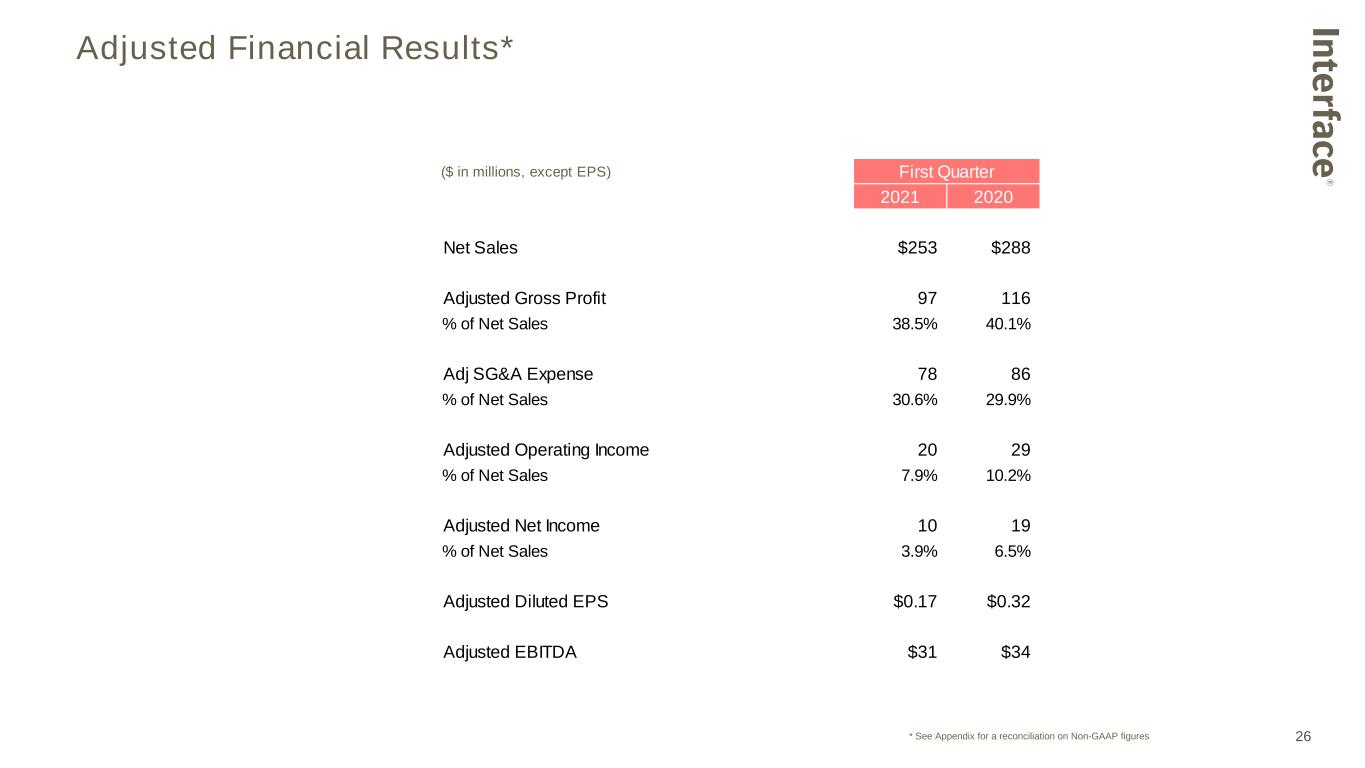

26 Adjusted Financial Results* * See Appendix for a reconciliation on Non-GAAP figures ($ in millions, except EPS) 2021 2020 Net Sales $253 $288 Adjusted Gross Profit 97 116 % of Net Sales 38.5% 40.1% Adj SG&A Expense 78 86 % of Net Sales 30.6% 29.9% Adjusted Operating Income 20 29 % of Net Sales 7.9% 10.2% Adjusted Net Income 10 19 % of Net Sales 3.9% 6.5% Adjusted Diluted EPS $0.17 $0.32 Adjusted EBITDA $31 $34 First Quarter

27 Adjusted EBITDA ADJUSTED EBITDA* ($ in millions) * See Appendix for a reconciliation on Non-GAAP figures $141 $152 $185 $197 $146 $143 $0 $50 $100 $150 $200 $250 2016 2017 2018 2019 2020 LTM Q1 2021

28 Adjusted Earnings Per Share ADJUSTED EARNINGS PER SHARE (DILUTED)* * See Appendix for a reconciliation on Non-GAAP figures $1.03 $1.18 $1.49 $1.59 $1.15 $0.99 $0.00 $0.20 $0.40 $0.60 $0.80 $1.00 $1.20 $1.40 $1.60 $1.80 2016 2017 2018 2019 2020 LTM Q1 2021

29 TOTAL DEBT ($ in millions) NET DEBT ($ in millions) NET DEBT / ADJUSTED EBITDA* Capitalization and Liquidity * See Appendix for a reconciliation on Non-GAAP figures ADJUSTED EBITDA* ($ in millions) $270 $230 $619 $596 $577 $563 $0 $175 $350 $525 $700 2016 2017 2018 2019 2020 Q1 2021 $105 $143 $538 $515 $474 $456 $0 $175 $350 $525 $700 2016 2017 2018 2019 2020 Q1 2021 $141 $152 $185 $197 $146 $143 $0 $50 $100 $150 $200 $250 2016 2017 2018 2019 2020 LTM Q1 2021 0.7x 0.9x 2.9x 2.6x 3.2x 3.2x 0.0x 0.5x 1.0x 1.5x 2.0x 2.5x 3.0x 3.5x 2016 2017 2018 2019 2020 LTM Q1 2021

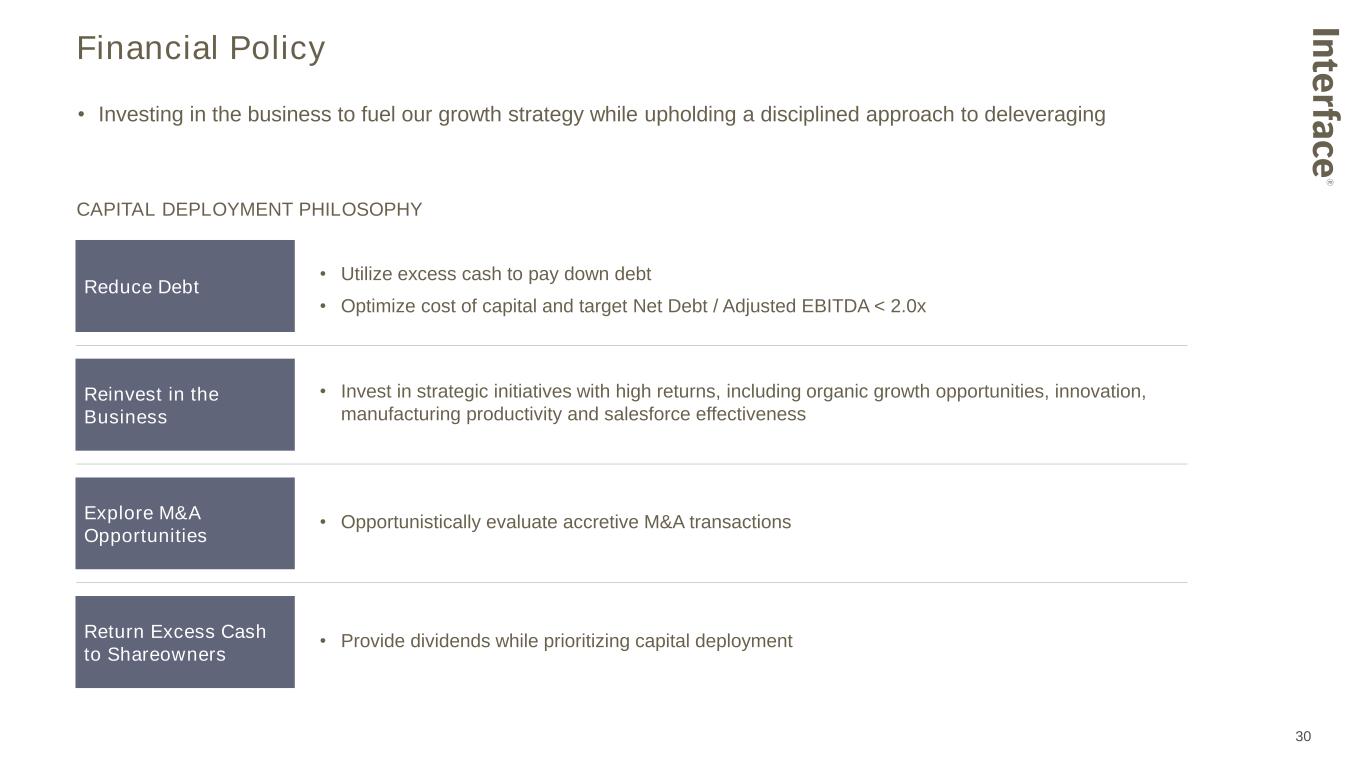

30 Financial Policy Reduce Debt Reinvest in the Business Explore M&A Opportunities Return Excess Cash to Shareowners • Utilize excess cash to pay down debt • Optimize cost of capital and target Net Debt / Adjusted EBITDA < 2.0x • Invest in strategic initiatives with high returns, including organic growth opportunities, innovation, manufacturing productivity and salesforce effectiveness • Opportunistically evaluate accretive M&A transactions • Provide dividends while prioritizing capital deployment • Investing in the business to fuel our growth strategy while upholding a disciplined approach to deleveraging CAPITAL DEPLOYMENT PHILOSOPHY

Appendix

32 Appendix: Reconciliation of Non-GAAP Figures Note: Sum of reconciling items may differ from total due to rounding of individual components ($ in millions) Q1 2020 Q1 2021 Net Sales as Reported (GAAP) $288.2 $253.3 Impact of Changes in Currency - (11.8) Organic Sales $288.2 $241.5 Gross Profit as Reported (GAAP) $114.3 $96.0 Purchase Accounting Amortization 1.3 1.4 Adjusted Gross Profit $115.6 $97.5 SG&A Expense as Reported (GAAP) $87.7 $79.3 Impact of Change in Equity Award Forfeiture Accounting (1.4) - Restructuring, Asset Impairment, Severance and Other Charges - (1.8) Adjusted SG&A Expense $86.3 $77.5 LTM Q1 2020 Q1 2021 Q1 2021 Operating Income as Reported (GAAP) ($93.5) $16.9 $71.1 Purchase Accounting Amortization 1.3 1.4 5.6 Goodwill and Intangible Asset Impairment 121.3 - - Impact of Change in Equity Award Forfeiture Accounting 1.4 - - Restructuring, Asset Impairment, Severance and Other Charges (1.1) 1.6 19.4 SEC Fine - - 5.0 Adjusted Operating Income* $29.4 $19.9 $101.1

33 Appendix: Reconciliation of Non-GAAP Figures Note: Sum of reconciling items may differ from total due to rounding of individual components LTM ($ in millions) Q1 2020 Q1 2021 Q1 2021 Net Income as Reported (GAAP) ($102.2) $6.9 $37.2 Purchase Accounting Amortization 0.9 1.0 3.9 Goodwill and Intangible Asset Impairment 119.8 - - Impact of Change in Equity Award Forfeiture Accounting 1.1 - - Restructuring, Asset Impairment, Severance and Other Charges (0.9) 1.2 15.3 Warehouse Fire Loss - - 3.2 SEC Fine - - 5.0 Loss on Extinguishment of Debt - - 2.8 Loss on Discontinuance if Interest Rate Swaps - 0.8 3.7 FIN 48 Release on Discontinued Operations - - (12.7) Adjusted Net Income $18.7 $10.0 $58.4 LTM 2016 2017 2018 2019 2020 Q1 2020 Q1 2021 Q1 2021 Diluted EPS as Reported (GAAP) $0.83 $0.86 $0.84 $1.34 ($1.23) ($1.75) $0.12 $0.64 Purchase Accounting Amortization - - 0.38 0.08 0.07 0.02 0.02 0.07 Transaction Related Expenses - - 0.12 - - - - - Goodwill and Intangible Asset Impairment - - - - 2.05 2.05 - (0.00) Impact of Change in Equity Award Forfeiture Accounting - - - - 0.02 0.02 - 0.00 Restructuring, Asset Impairment, Severance and Other Charges 0.20 0.08 0.26 0.17 0.23 (0.02) 0.02 0.26 Tax Act Expense (Benefit) - 0.25 (0.11) - - - - - Warehouse Fire Loss - - - - 0.05 - - 0.05 SEC Fine - - - - 0.09 - - 0.09 Loss on Extinguishment of Debt - - - - 0.05 - - 0.05 Loss on Discontinuance if Interest Rate Swaps - - - - 0.05 - 0.01 0.06 FIN 48 Release on Discontinued Operations - - - - (0.22) - - (0.22) Adjusted Diluted EPS* $1.03 $1.18 $1.49 $1.59 $1.15 $0.32 $0.17 $0.99

34 Appendix: Reconciliation of Non-GAAP Figures Note: Sum of reconciling items may differ from total due to rounding of individual components * Historical AEBITDA figures have been updated to reflect a change in depreciation and amortization values used to calculate AEBITDA. ($ in millions) Q1 2020 Q1 2021 Net Income as Reported (GAAP) ($102.2) $6.9 Income Tax Expense (Benefit) 1.5 2.0 Interest Expense (including debt issuance cost amortization) 5.6 7.3 Depreciation and Amortization (excluding debt issuance cost amortization) 10.5 11.4 Stock Compensation Amortization (Benefit) (2.9) 0.9 Purchase Accounting Amortization 1.3 1.4 Goodwill and Intangible Asset Impairment 121.3 - Restructuring, Asset Impairment, Severance and Other Charges (1.1) 1.5 Adjusted Earnings before Interest, Taxes, Depreciation and Amortization (AEBITDA)* $34.0 $31.5 LTM ($ in millions) 2016 2017 2018 2019 2020 Q1 2021 Net Income as Reported (GAAP) $54.2 $53.2 $50.3 $79.2 ($71.9) $37.2 Income Tax Expense (Benefit) 25.0 47.3 4.7 22.6 (7.5) (7.1) Transaction Related Other Expense - - 4.2 - - - Interest Expense (includiing debt issuance cost amortization) 6.1 7.1 15.4 25.7 29.2 30.9 Depreciation and Amortization (excluding debt issuance cost amortization) 30.1 29.8 37.9 42.0 43.8 44.8 Stock Compensation Amortization 5.9 7.2 14.5 8.7 (0.5) 3.4 Purchase Accounting Amortization - - 32.1 5.9 5.5 5.6 Transaction and Integration Related Expenses - - 5.3 - - - Goodwill and Intangible Asset Impairment - - - - 121.3 - Restructuring, Asset Impairment, Severance and Other Charges 19.8 7.3 20.5 12.9 16.7 19.3 Warehouse Fire Loss - - - - 4.2 4.2 SEC Fine - - - - 5.0 5.0 Adjusted Earnings before Interest, Taxes, Depreciation and Amortization (AEBITDA)* $141.1 $152.0 $184.9 $197.0 $145.7 $143.2 ($ in millions) 2016 2017 2018 2019 2020 Q1 2021 Total Debt $270 $230 $619 $596 $577 $563 Less: Cash (166) (87) (81) (81) (103) (107) Net Debt $105 $143 $538 $515 $474 $456 Total Debt / LTM Net Income as Reported (GAAP) 5.0x 4.3x 12.3x 7.5x (8.0x) 15.1x Net Debt / LTM Adjusted EBITDA 0.7x 0.9x 2.9x 2.6x 3.2x 3.2x