Attached files

| file | filename |

|---|---|

| 8-K - FORM 8-K - RE/MAX Holdings, Inc. | tm2118155d1_8k.htm |

Exhibit 99.1

RE/MAX Holdings, Inc. Announces Agreement to Acquire RE/MAX INTEGRA’s North American Regions June 2021

Forward - Looking Statements This presentation includes “forward - looking statements” within the meaning of the “safe harbor” provisions of the United States Private Securities Litigation Reform Act of 1995 . Forward - looking statements are often identified by the use of words such as “believe,” “intend,” “expect,” “estimate,” “plan,” “outlook,” “project,” “anticipate,” “may,” “will,” “would” and other similar words and expressions that predict or indicate future events or trends that are not statements of historical matters . Forward - looking statements include statements related to : the acquisition of the RE/MAX INTEGRA North American regions, including statements about the closing of the acquisition and benefits of the transaction ; agent count ; franchise sales ; revenue ; operating expenses ; capital structure ; financial projections ; return of capital ; non - GAAP financial measures ; expansion of technology offerings in Canada ; and the Company’s strategic and operating plans and business models . Forward - looking statements should not be read as a guarantee of future performance or results and will not necessarily accurately indicate the times at which such performance or results may be achieved . Forward - looking statements are based on information available at the time those statements are made and/or management’s good faith belief as of that time with respect to future events and are subject to risks and uncertainties that could cause actual performance or results to differ materially from those expressed in or suggested by the forward - looking statements . These risks and uncertainties include the global COVID - 19 pandemic, which continues to pose significant and widespread risks to the Company’s business, including the Company’s agents, loan originators, franchisees, and employees, as well as home buyers and sellers . Other important risks and uncertainties include, without limitation, ( 1 ) the pending Acquisition may not be consummated on the terms described herein, if at all, ( 2 ) the Company’s ability to successfully close the Acquisition and financing of the Acquisition and to integrate the acquired regions into its business, ( 3 ) the intended benefits of the Acquisition may not be realized, ( 4 ) the global COVID - 19 pandemic, which has impacted the Company and continues to pose significant and widespread risks to the Company’s business, ( 5 ) changes in the real estate market or interest rates and availability of financing, ( 6 ) changes in business and economic activity in general, ( 7 ) the Company’s ability to attract and retain quality franchisees, ( 8 ) the Company’s franchisees’ ability to recruit and retain real estate agents and mortgage loan originators, ( 9 ) changes in laws and regulations, ( 10 ) the Company’s ability to enhance, market, and protect the RE/MAX and Motto Mortgage brands, ( 11 ) the Company’s ability to implement its technology initiatives, and ( 12 ) fluctuations in foreign currency exchange rates, and those risks and uncertainties described in the sections entitled “Risk Factors” and “Management’s Discussion and Analysis of Financial Condition and Results of Operations” in the most recent Annual Report on Form 10 - K and Quarterly Reports on Form 10 - Q filed with the Securities and Exchange Commission (“SEC”) and similar disclosures in subsequent periodic and current reports filed with the SEC, which are available on the investor relations page of the Company’s website at www . remax . com and on the SEC website at www . sec . gov . Readers are cautioned not to place undue reliance on forward - looking statements, which speak only as of the date on which they are made . Except as required by law, the Company does not intend, and undertakes no obligation, to update this information to reflect future events or circumstances . 2

RE/MAX, LLC to Acquire RE/MAX INTEGRA’s North American Regions for $235M Acquisition represents a significant growth opportunity and a key component to our long - range strategy 3 RE/MAX INTEGRA’s U.S. Operations includes 3 regions encompassing 9 states RE/MAX INTEGRA’s Canadian Operations includes 1 region encompassing 5 provinces 6,929 Agents +2.8% y/y 11,937 Agents +5.4% y/y • Agent counts as of March 31, 2021 RE/MAX INTEGRA’s North American operations is the largest collection of Independent Regions

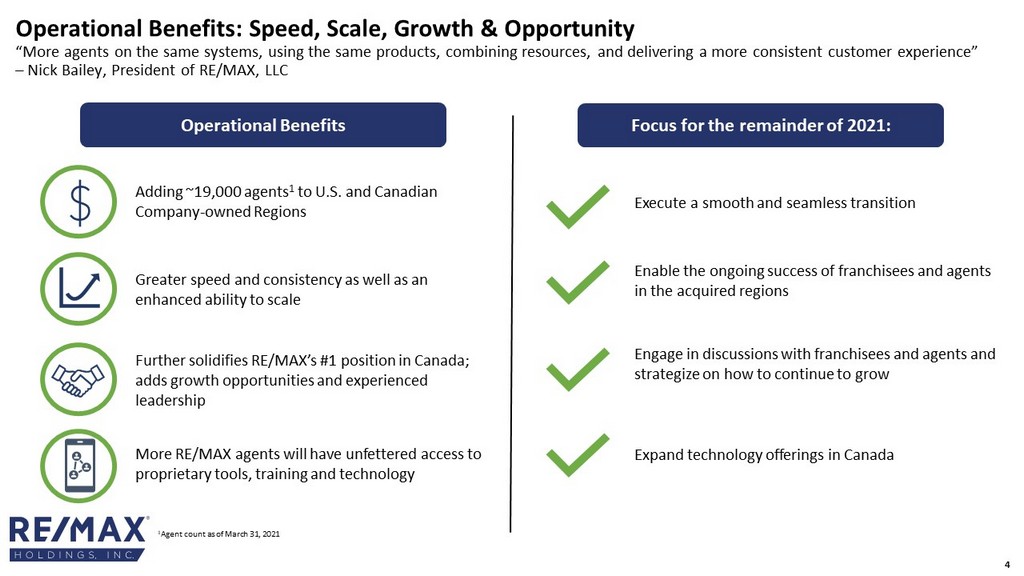

4 Operational Benefits Adding ~19,000 agents 1 to U.S. and Canadian Company - owned Regions Greater speed and consistency as well as an enhanced ability to scale Further solidifies RE/MAX’s #1 position in Canada; adds growth opportunities and experienced leadership 1 Agent count as of March 31, 2021 More RE/MAX agents will have unfettered access to proprietary tools, training and technology Operational Benefits: Speed, Scale, Growth & Opportunity “More agents on the same systems, using the same products, combining resources, and delivering a more consistent customer exp eri ence” – Nick Bailey, President of RE/MAX, LLC Focus for the remainder of 2021: Expand technology offerings in Canada Execute a smooth and seamless transition Enable the ongoing success of franchisees and agents in the acquired regions Engage in discussions with franchisees and agents and strategize on how to continue to grow

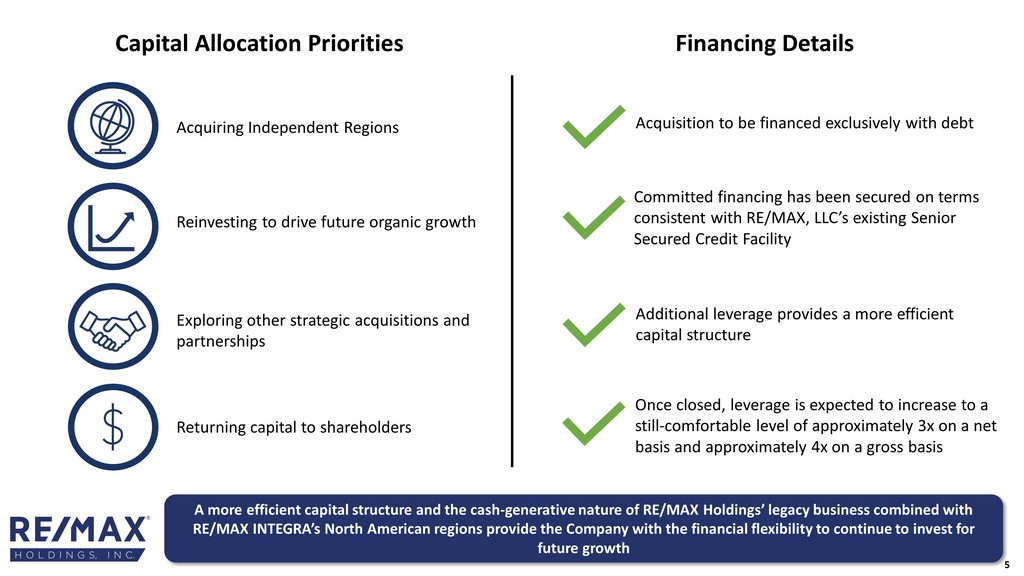

Acquiring Independent Regions Reinvesting to drive future organic growth Exploring other strategic acquisitions and partnerships Returning capital to shareholders Capital Allocation Priorities 5 Financing Details Once closed, leverage is expected to increase to a still - comfortable level of approximately 3x on a net basis and approximately 4x on a gross basis A more efficient capital structure and the cash - generative nature of RE/MAX Holdings’ legacy business combined with RE/MAX INTEGRA’s North American regions provide the Company with the financial flexibility to continue to invest for future growth Acquisition to be financed exclusively with debt Committed financing has been secured on terms consistent with RE/MAX, LLC’s existing Senior Secured Credit Facility Additional leverage provides a more efficient capital structure

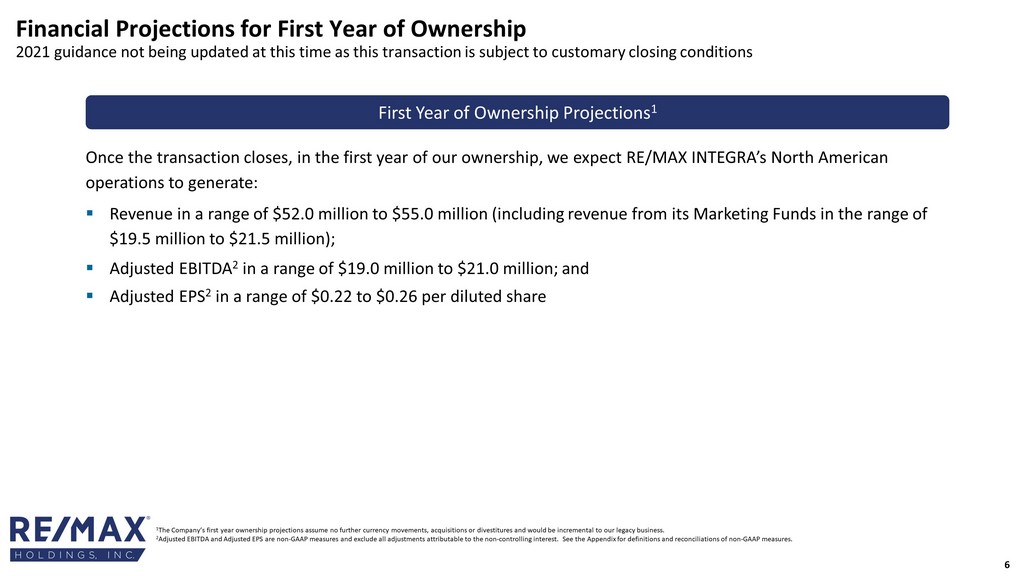

Financial Projections for First Year of Ownership 2021 guidance not being updated at this time as this transaction is subject to customary closing conditions 6 Once the transaction closes, in the first year of our ownership, we expect RE/MAX INTEGRA’s North American operations to generate: ▪ Revenue in a range of $52.0 million to $55.0 million (including revenue from its Marketing Funds in the range of $19.5 million to $21.5 million); ▪ Adjusted EBITDA 2 in a range of $19.0 million to $21.0 million; and ▪ Adjusted EPS 2 in a range of $0.22 to $0.26 per diluted share 1 The Company’s first year ownership projections assume no further currency movements, acquisitions or divestitures and would b e i ncremental to our legacy business. 2 Adjusted EBITDA and Adjusted EPS are non - GAAP measures and exclude all adjustments attributable to the non - controlling interest. See the Appendix for definitions and reconciliations of non - GAAP measures. First Y ear of Ownership Projections 1

THANK YOU 7

Additional Financial Details 8 1 Excludes revenue from the Marketing Funds. Additional Financial Details ▪ GAAP accounting rules will require RE/MAX INTEGRA’s North American regions’ deferred revenue balance related to franchise sales and renewals to not be recorded in the RE/MAX Holdings, Inc. financial statements at the time of acquisition ▪ RE/MAX INTEGRA had been recognizing approximately a $1 million per year related to its North American franchise sales and renewals ▪ RE/MAX Holdings typically earns more annual revenue per agent from a U.S. agent in a Company - owned region than from a Canadian agent in a Company - owned region due to legacy Independent Region agent economics and the impact of foreign - exchange rates ▪ The blended annual revenue per agent from the RE/MAX INTEGRA North American regions is expected to be ~$2,275/agent 1

The SEC has adopted rules to regulate the use in filings with the SEC and in public disclosures of financial measures that ar e n ot in accordance with U.S. GAAP, such as Adjusted EBITDA and the ratios related thereto, Adjusted net income, Adjusted basic and diluted earnings per share (Adjusted EPS) and free cash flow. These measures are derived on the basis of methodolog ies other than in accordance with U.S. GAAP. The Company defines Adjusted EBITDA as EBITDA (consolidated net income or loss before depreciation and amortization, interest ex pense, interest income and the provision for income taxes, each of which is presented in the unaudited condensed consolidated financial statements included earlier in this press release), adjusted for the impact of the following items tha t a re either non - cash or that the Company does not consider representative of its ongoing operating performance: loss or gain on sale or disposition of assets and sublease, impairment charge on leased assets, equity - based compensation expense, acquisitio n - related expense, gain on reduction in tax receivable agreement liability, expense or income related to changes in the estimated fair value measurement of contingent consideration, and other non - recurring items. Because Adjusted EBITDA and Adjusted EBITDA margin omit certain non - cash items and other non - recurring cash charges or other ite ms, the Company believes that each measure is less susceptible to variances that affect its operating performance resulting from depreciation, amortization and other non - cash and non - recurring cash charges or other items. The Company presents Adjusted EBITDA and the related Adjusted EBITDA margin because the Company believes they are useful as supplemental measures in evaluating the performance of its operating businesses and provides greater transparency into the Co mpa ny’s results of operations. The Company’s management uses Adjusted EBITDA and Adjusted EBITDA margin as factors in evaluating the performance of the business. Adjusted EBITDA and Adjusted EBITDA margin have limitations as analytical tools, and you should not consider these measures i n i solation or as a substitute for analyzing the Company’s results as reported under U.S. GAAP. Some of these limitations are: • these measures do not reflect changes in, or cash requirements for, the Company’s working capital needs; • these measures do not reflect the Company’s interest expense, or the cash requirements necessary to service interest or princ ipa l payments on its debt; • these measures do not reflect the Company’s income tax expense or the cash requirements to pay its taxes; • these measures do not reflect the cash requirements to pay dividends to stockholders of the Company’s Class A common stock an d t ax and other cash distributions to its non - controlling unitholders; • these measures do not reflect the cash requirements pursuant to the tax receivable agreements; • although depreciation and amortization are non - cash charges, the assets being depreciated and amortized will often require repla cement in the future, and these measures do not reflect any cash requirements for such replacements; • although equity - based compensation is a non - cash charge, the issuance of equity - based awards may have a dilutive impact on earni ngs per share; and • other companies may calculate these measures differently so similarly named measures may not be comparable. The Company's Adjusted EBITDA guidance does not include certain charges and costs. The adjustments to EBITDA in future period s a re generally expected to be similar to the kinds of charges and costs excluded from Adjusted EBITDA in prior quarters, such as gain on sale or disposition of assets and sublease and acquisition - related expense, among others. The exclusio n of these charges and costs in future periods will have a significant impact on the Company's Adjusted EBITDA. The Company is not able to provide a reconciliation of the Company's non - GAAP financial guidance to the corresponding U.S. GAAP meas ures without unreasonable effort because of the uncertainty and variability of the nature and amount of these future charges and costs. Non - GAAP Financial Measures 9

Adjusted net income is calculated as Net income attributable to RE/MAX Holdings, assuming the full exchange of all outstandin g n on - controlling interests for shares of Class A common stock as of the beginning of the period (and the related increase to the provision for income taxes after such exchange), plus primarily non - cash items and other items that management does not c onsider to be useful in assessing the Company’s operating performance (e.g., amortization of acquired intangible assets, gain on sale or disposition of assets and sub - lease, impairment charge on leased assets, acquisition - related expense and equity - based compensation expense). Adjusted basic and diluted earnings per share (Adjusted EPS) are calculated as Adjusted net income (as defined above) divided by pro forma (assuming the full exchange of all outstanding non - controlling interests) basic and diluted weighted average shares, as applicable. When used in conjunction with GAAP financial measures, Adjusted net income and Adjusted EPS are supplemental measures of oper ati ng performance that management believes are useful measures to evaluate the Company’s performance relative to the performance of its competitors as well as performance period over period. By assuming the full exchange of all outsta ndi ng non - controlling interests, management believes these measures: • facilitate comparisons with other companies that do not have a low effective tax rate driven by a non - controlling interest on a pass - through entity; • facilitate period over period comparisons because they eliminate the effect of changes in Net income attributable to RE/MAX H old ings, Inc. driven by increases in its ownership of RMCO, LLC, which are unrelated to the Company’s operating performance; and • eliminate primarily non - cash and other items that management does not consider to be useful in assessing the Company’s operating performance. Free cash flow is calculated as cash flows from operations less capital expenditures and any changes in restricted cash of the Marketing Funds, all as reported under GAAP, and quantifies ho w much cash a company has to pursue opportunities that enhance shareholder value. The restricted cash of the Marketing Funds is limited in use for the benefit of franchisees and an y i mpact to free cash flow is removed. The Company believes free cash flow is useful to investors as a supplemental measure as it calculates the cash flow available for working capital needs, re - investment opportunities, potential independent r egion and strategic acquisitions, dividend payments or other strategic uses of cash. Free cash flow after tax and non - dividend distributions to RIHI is calculated as free cash flow less tax and other non - dividend distributions paid to RIHI (the non - controlling interest holder) to enable RIHI to satisfy its income tax obligations. Similar payments would be made by the Company directly to federal and state taxing authorities as a component of the Company’s consol ida ted provision for income taxes if a full exchange of non - controlling interests occurred in the future. As a result and given the significance of the Company’s ongoing tax and non - dividend distribution obligations to its non - controlling interes t, free cash flow after tax and non - dividend distributions, when used in conjunction with GAAP financial measures, provides a meaningful view of cash flow available to the Company to pursue opportunities that enhance shareholder value. Unencumbered cash generated is calculated as free cash flow after tax and non - dividend distributions to RIHI less quarterly debt principal payments less annual excess cash flow payment on debt, as applicable. Given the significance of the Company’s excess cash flow payment on debt, when applicable, unencumbered cash generated, when used in conjunction with GAAP fin ancial measures, provides a meaningful view of the cash flow available to the Company to pursue opportunities that enhance shareholder value after considering its debt service obligations. Non - GAAP Financial Measures (continued) 10