Attached files

| file | filename |

|---|---|

| 8-K - 8-K - US BANCORP \DE\ | d165991d8k.htm |

Deutsche Bank Global Financial Services Conference 2021 June 2, 2021 Tim Welsh Vice Chair, Consumer and Business Banking Shailesh Kotwal Vice Chair, Payment Services Exhibit 99.1

The following information appears in accordance with the Private Securities Litigation Reform Act of 1995: Today’s presentation contains forward-looking statements about U.S. Bancorp. Statements that are not historical or current facts, including statements about beliefs and expectations, are forward-looking statements and are based on the information available to, and assumptions and estimates made by, management as of the date hereof. These forward-looking statements cover, among other things, anticipated future revenue and expenses and the future plans and prospects of U.S. Bancorp. Forward-looking statements involve inherent risks and uncertainties, and important factors could cause actual results to differ materially from those anticipated. The COVID-19 pandemic is adversely affecting U.S. Bancorp, its customers, counterparties, employees, and third-party service providers, and the ultimate extent of the impacts on its business, financial position, results of operations, liquidity, and prospects is uncertain. Continued deterioration in general business and economic conditions or turbulence in domestic or global financial markets could adversely affect U.S. Bancorp’s revenues and the values of its assets and liabilities, reduce the availability of funding to certain financial institutions, lead to a tightening of credit, and increase stock price volatility. In addition, changes to statutes, regulations, or regulatory policies or practices could affect U.S. Bancorp in substantial and unpredictable ways. U.S. Bancorp’s results could also be adversely affected by changes in interest rates; further increases in unemployment rates; deterioration in the credit quality of its loan portfolios or in the value of the collateral securing those loans; deterioration in the value of its investment securities; legal and regulatory developments; litigation; increased competition from both banks and non-banks; civil unrest; changes in customer behavior and preferences; breaches in data security, including as a result of work-from-home arrangements; failures to safeguard personal information; effects of mergers and acquisitions and related integration; effects of critical accounting policies and judgments; and management’s ability to effectively manage credit risk, market risk, operational risk, compliance risk, strategic risk, interest rate risk, liquidity risk and reputation risk. For discussion of these and other risks that may cause actual results to differ from expectations, refer to U.S. Bancorp’s Annual Report on Form 10-K for the year ended December 31, 2020, on file with the Securities and Exchange Commission, including the sections entitled “Risk Factors” and “Corporate Risk Profile” contained in Exhibit 13, and all subsequent filings with the Securities and Exchange Commission under Sections 13(a), 13(c), 14 or 15(d) of the Securities Exchange Act of 1934. In addition, factors other than these risks also could adversely affect U.S. Bancorp’s results, and the reader should not consider these risks to be a complete set of all potential risks or uncertainties. Forward-looking statements speak only as of the date hereof, and U.S. Bancorp undertakes no obligation to update them in light of new information or future events. This presentation includes non-GAAP financial measures to describe U.S. Bancorp’s performance. The calculations of these measures are provided in the Appendix. These disclosures should not be viewed as a substitute for operating results determined in accordance with GAAP, nor are they necessarily comparable to non-GAAP performance measures that may be presented by other companies. Forward-looking statements and additional information

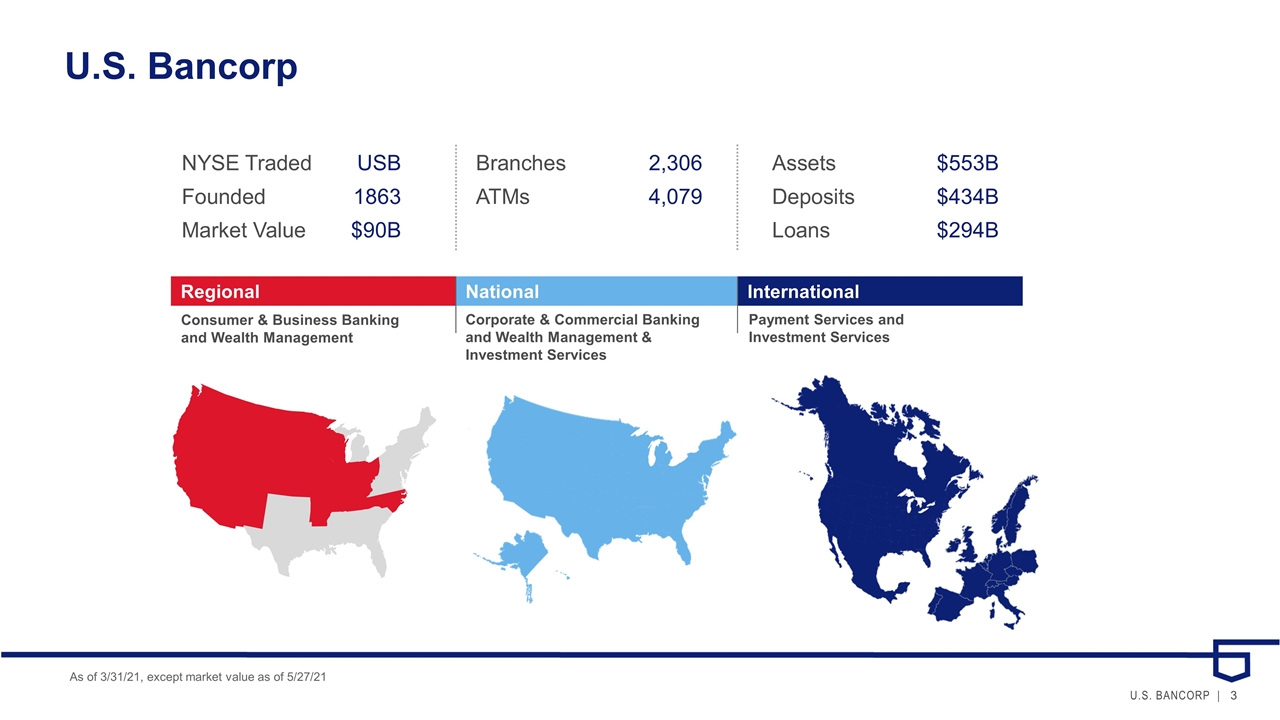

U.S. Bancorp NYSE TradedUSB Founded1863 Market Value$90B Branches 2,306 ATMs 4,079 Assets $553B Deposits $434B Loans $294B As of 3/31/21, except market value as of 5/27/21 Regional National International Consumer & Business Banking and Wealth Management Corporate & Commercial Banking and Wealth Management & Investment Services Payment Services and Investment Services

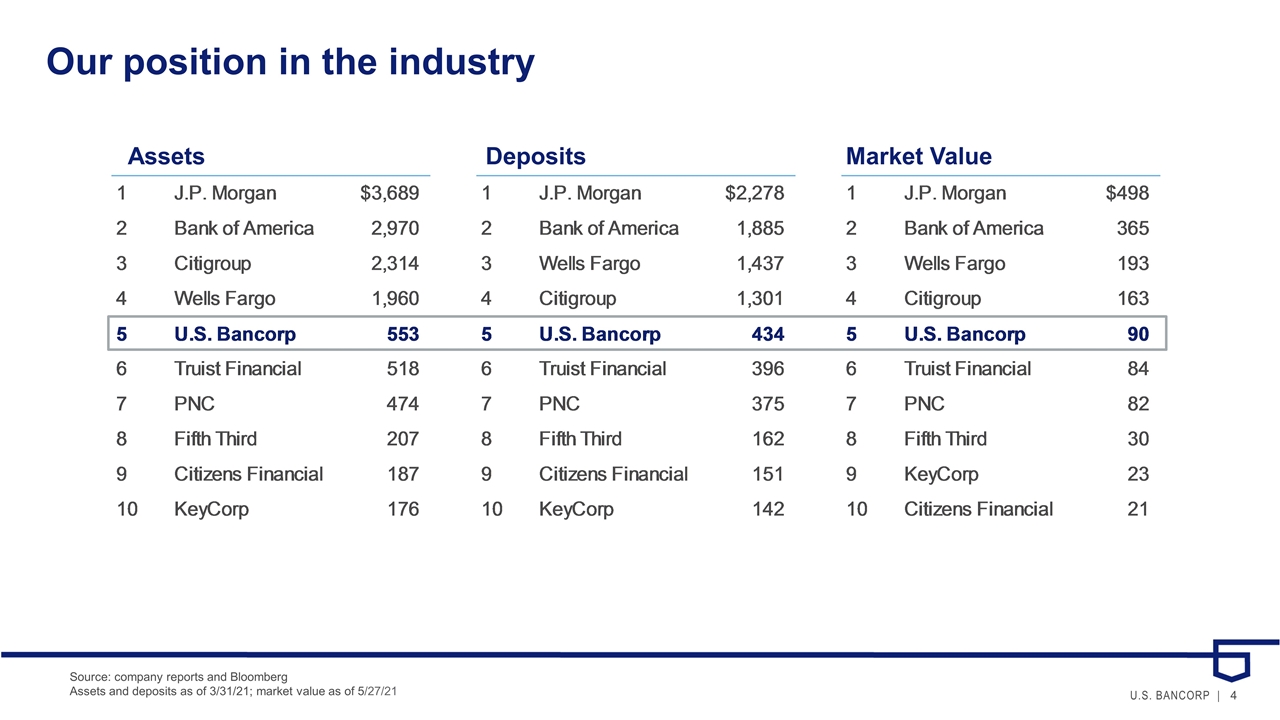

Our position in the industry Assets Deposits Market Value Source: company reports and Bloomberg Assets and deposits as of 3/31/21; market value as of 5/27/21

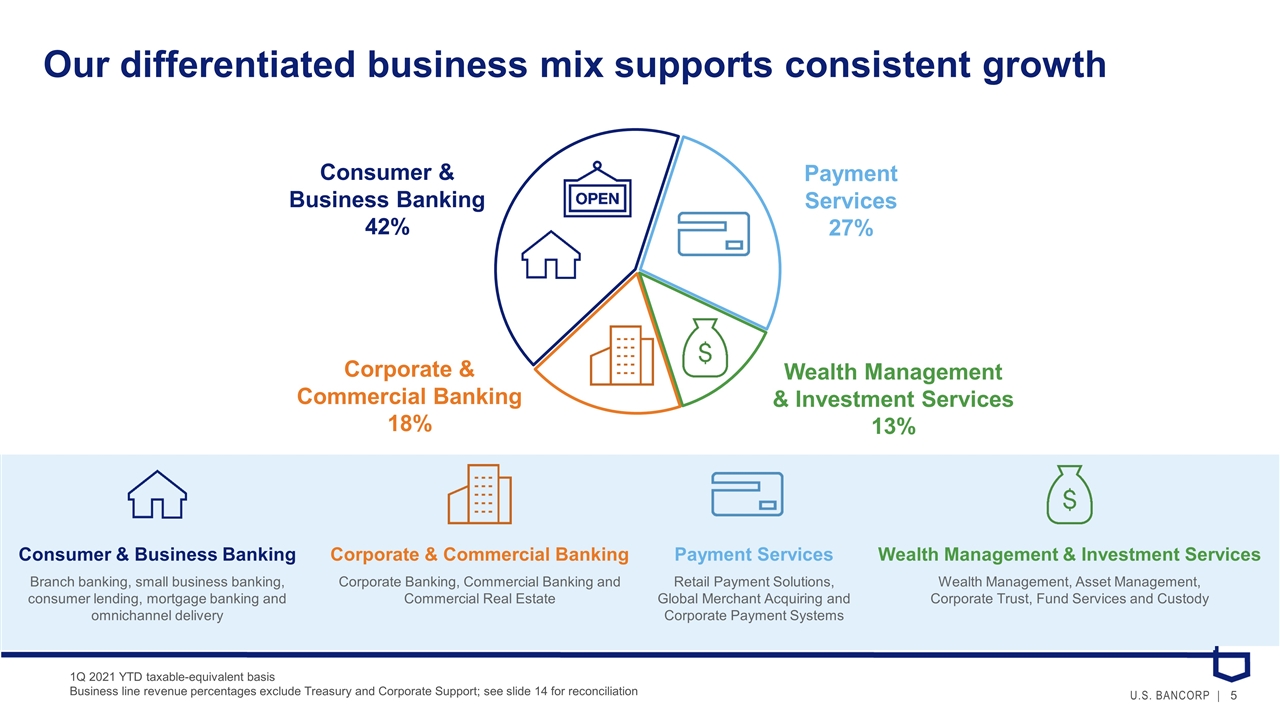

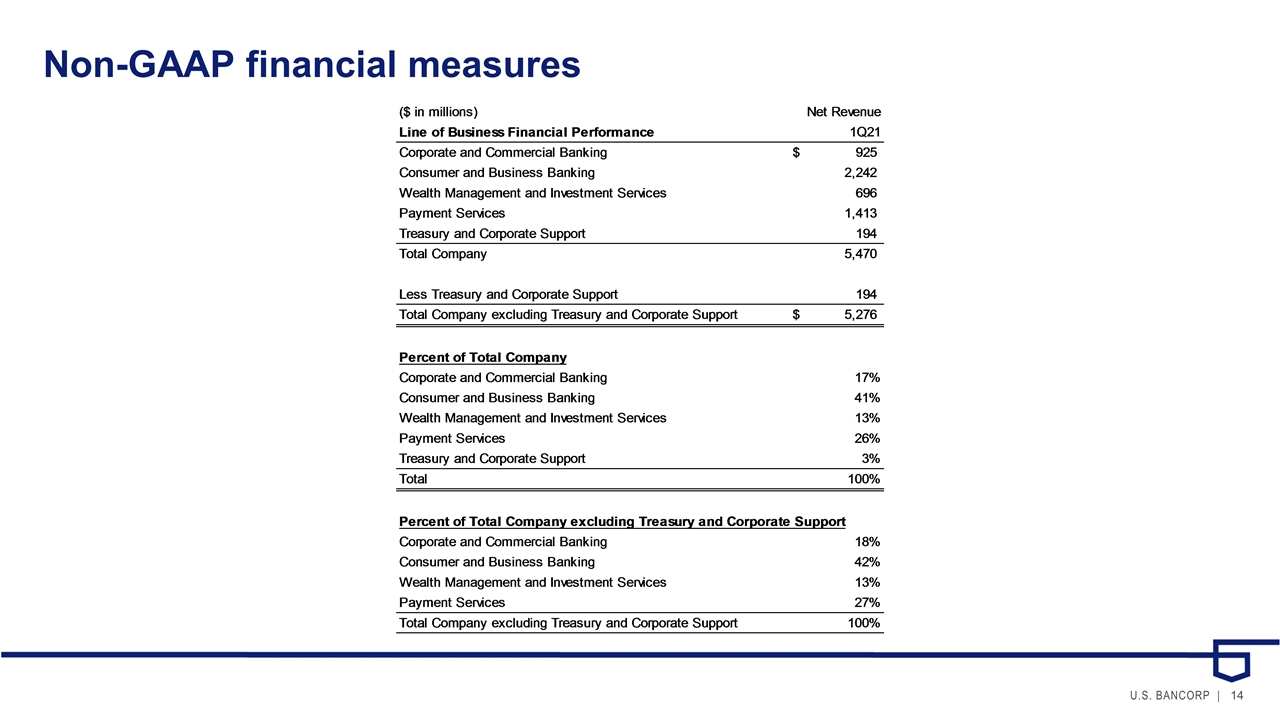

Consumer & Business Banking Branch banking, small business banking, consumer lending, mortgage banking and omnichannel delivery Corporate & Commercial Banking Corporate Banking, Commercial Banking and Commercial Real Estate Payment Services Retail Payment Solutions, Global Merchant Acquiring and Corporate Payment Systems Wealth Management & Investment Services Wealth Management, Asset Management, Corporate Trust, Fund Services and Custody Payment Services 27% Wealth Management & Investment Services 13% Corporate & Commercial Banking 18% Consumer & Business Banking 42% 1Q 2021 YTD taxable-equivalent basis Business line revenue percentages exclude Treasury and Corporate Support; see slide 14 for reconciliation Our differentiated business mix supports consistent growth

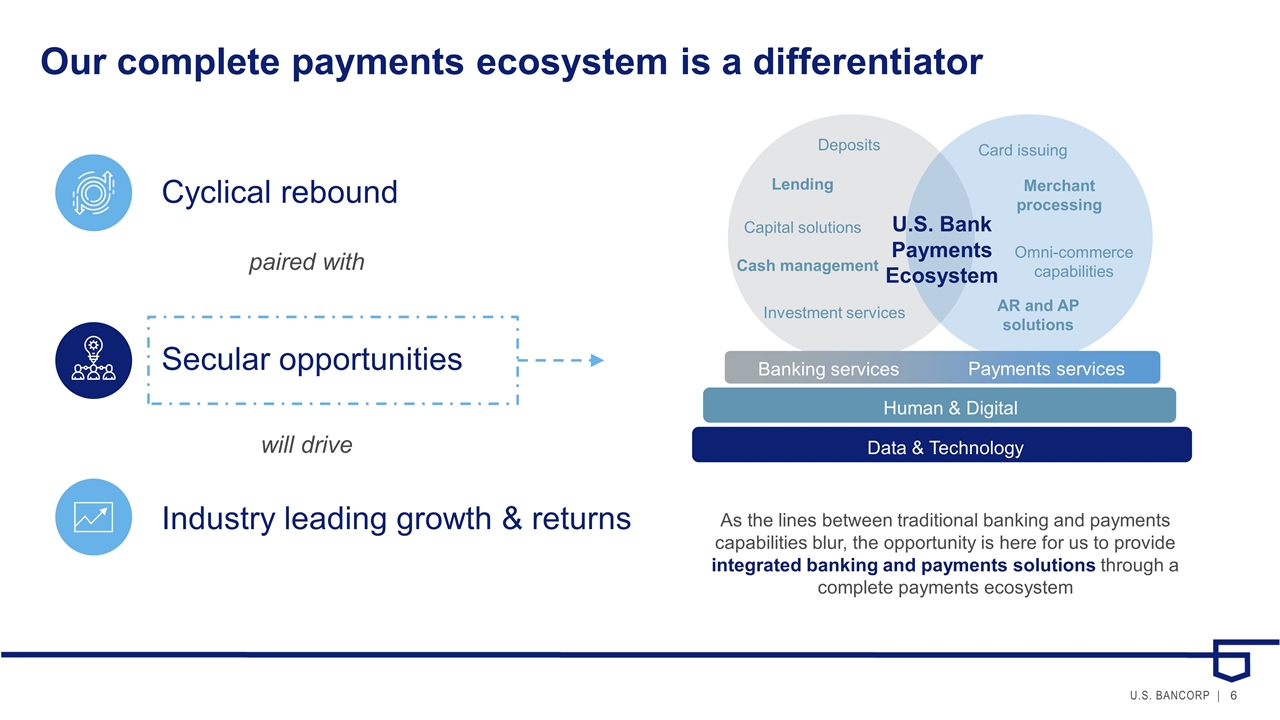

Our complete payments ecosystem is a differentiator Cyclical rebound Secular opportunities Industry leading growth & returns paired with will drive U.S. Bank Payments Ecosystem Card issuing Merchant processing AR and AP solutions Omni-commerce capabilities Lending Deposits Capital solutions Cash management Investment services Banking services Payments services Data & Technology Human & Digital As the lines between traditional banking and payments capabilities blur, the opportunity is here for us to provide integrated banking and payments solutions through a complete payments ecosystem

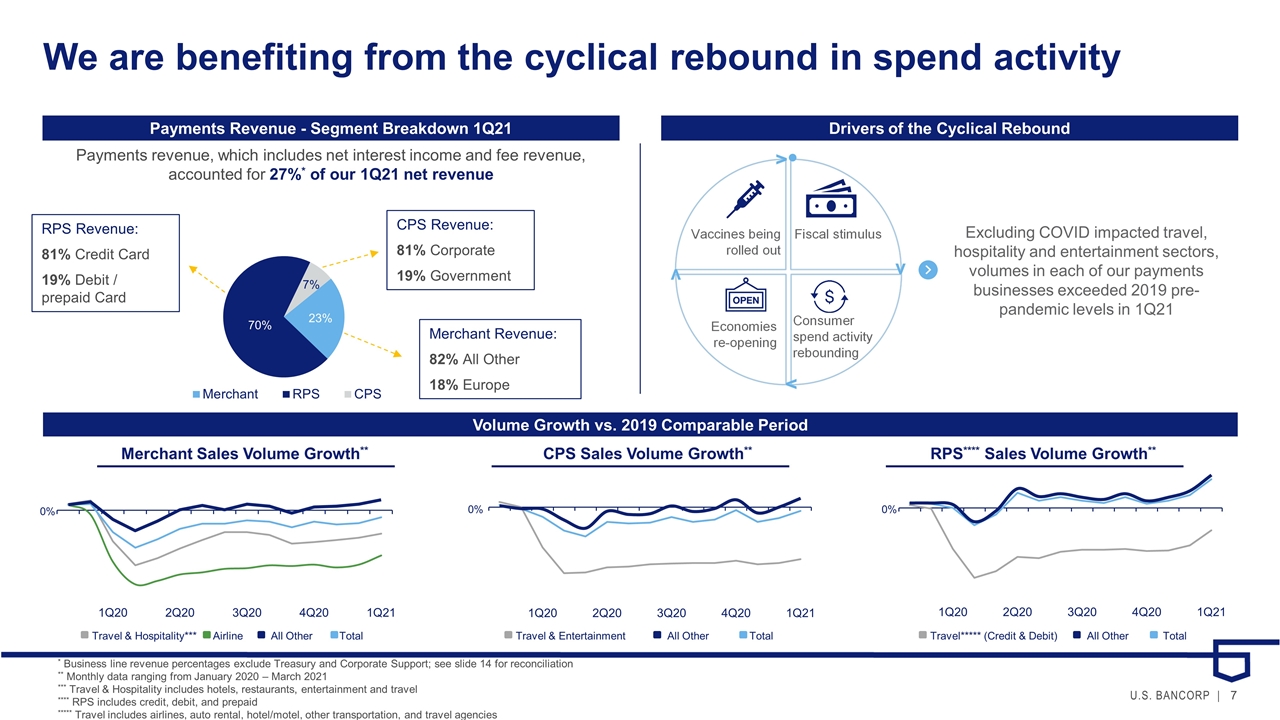

We are benefiting from the cyclical rebound in spend activity Merchant Sales Volume Growth** 0% CPS Sales Volume Growth** 0% RPS**** Sales Volume Growth** 0% Travel & Hospitality*** All Other Total Airline Travel & Entertainment Total All Other Travel***** (Credit & Debit) All Other Total Volume Growth vs. 2019 Comparable Period * Business line revenue percentages exclude Treasury and Corporate Support; see slide 14 for reconciliation ** Monthly data ranging from January 2020 – March 2021 *** Travel & Hospitality includes hotels, restaurants, entertainment and travel **** RPS includes credit, debit, and prepaid ***** Travel includes airlines, auto rental, hotel/motel, other transportation, and travel agencies Payments Revenue - Segment Breakdown 1Q21 Drivers of the Cyclical Rebound Excluding COVID impacted travel, hospitality and entertainment sectors, volumes in each of our payments businesses exceeded 2019 pre-pandemic levels in 1Q21 RPS Revenue: 81% Credit Card 19% Debit / prepaid Card CPS Revenue: 81% Corporate 19% Government Merchant Revenue: 82% All Other 18% Europe Payments revenue, which includes net interest income and fee revenue, accounted for 27%* of our 1Q21 net revenue

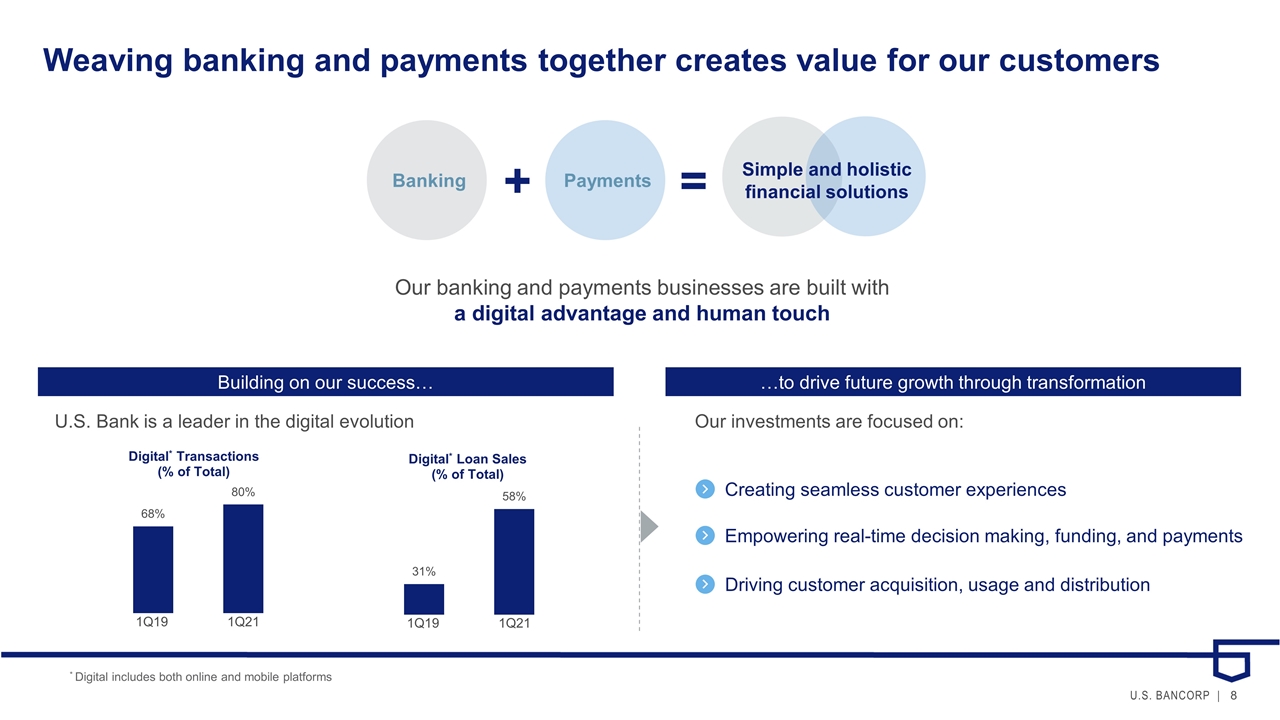

Weaving banking and payments together creates value for our customers Our investments are focused on: U.S. Bank is a leader in the digital evolution Building on our success… …to drive future growth through transformation 1Q19 1Q21 1Q21 Banking Payments Simple and holistic financial solutions + = Our banking and payments businesses are built with a digital advantage and human touch Creating seamless customer experiences Empowering real-time decision making, funding, and payments Driving customer acquisition, usage and distribution 1Q19 * Digital includes both online and mobile platforms

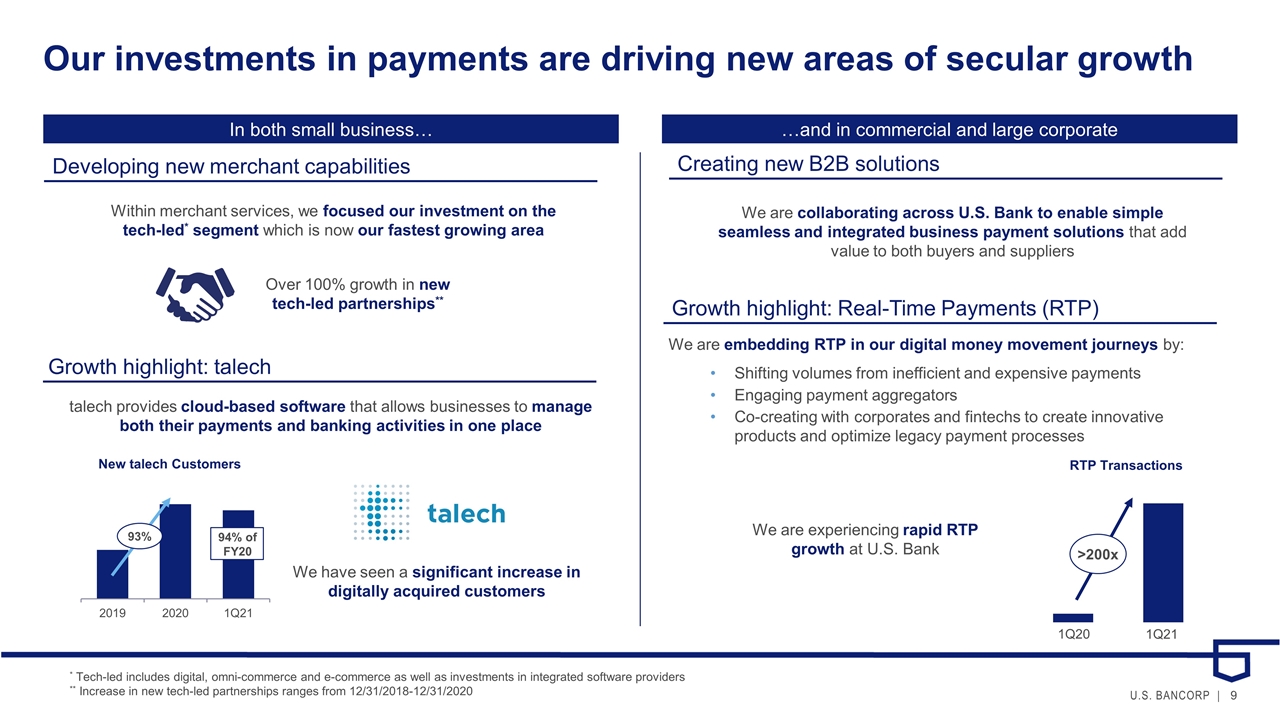

Growth highlight: Real-Time Payments (RTP) Our investments in payments are driving new areas of secular growth Over 100% growth in new tech-led partnerships** Within merchant services, we focused our investment on the tech-led* segment which is now our fastest growing area Shifting volumes from inefficient and expensive payments Engaging payment aggregators Co-creating with corporates and fintechs to create innovative products and optimize legacy payment processes >200x * Tech-led includes digital, omni-commerce and e-commerce as well as investments in integrated software providers ** Increase in new tech-led partnerships ranges from 12/31/2018-12/31/2020 1Q20 1Q21 We are experiencing rapid RTP growth at U.S. Bank We have seen a significant increase in digitally acquired customers talech provides cloud-based software that allows businesses to manage both their payments and banking activities in one place We are embedding RTP in our digital money movement journeys by: We are collaborating across U.S. Bank to enable simple seamless and integrated business payment solutions that add value to both buyers and suppliers Developing new merchant capabilities Creating new B2B solutions In both small business… …and in commercial and large corporate Growth highlight: talech 93% 94% of FY20

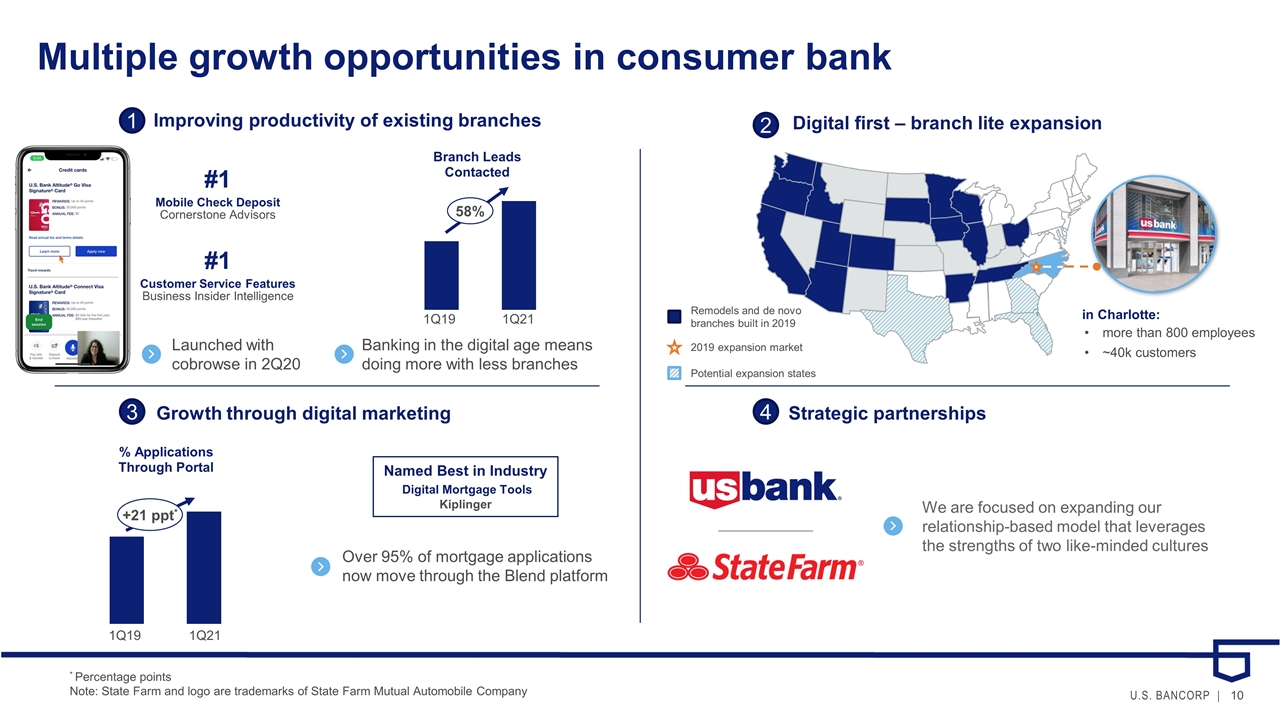

Multiple growth opportunities in consumer bank Improving productivity of existing branches 1 Digital first – branch lite expansion 2 Growth through digital marketing 3 Strategic partnerships 4 Launched with cobrowse in 2Q20 58% 1Q19 1Q21 We are focused on expanding our relationship-based model that leverages the strengths of two like-minded cultures Banking in the digital age means doing more with less branches Named Best in Industry Digital Mortgage Tools Kiplinger #1 Customer Service Features #1 Mobile Check Deposit Cornerstone Advisors Business Insider Intelligence +21 ppt* Over 95% of mortgage applications now move through the Blend platform 1Q19 1Q21 in Charlotte: more than 800 employees ~40k customers Remodels and de novo branches built in 2019 Potential expansion states 2019 expansion market * Percentage points Note: State Farm and logo are trademarks of State Farm Mutual Automobile Company

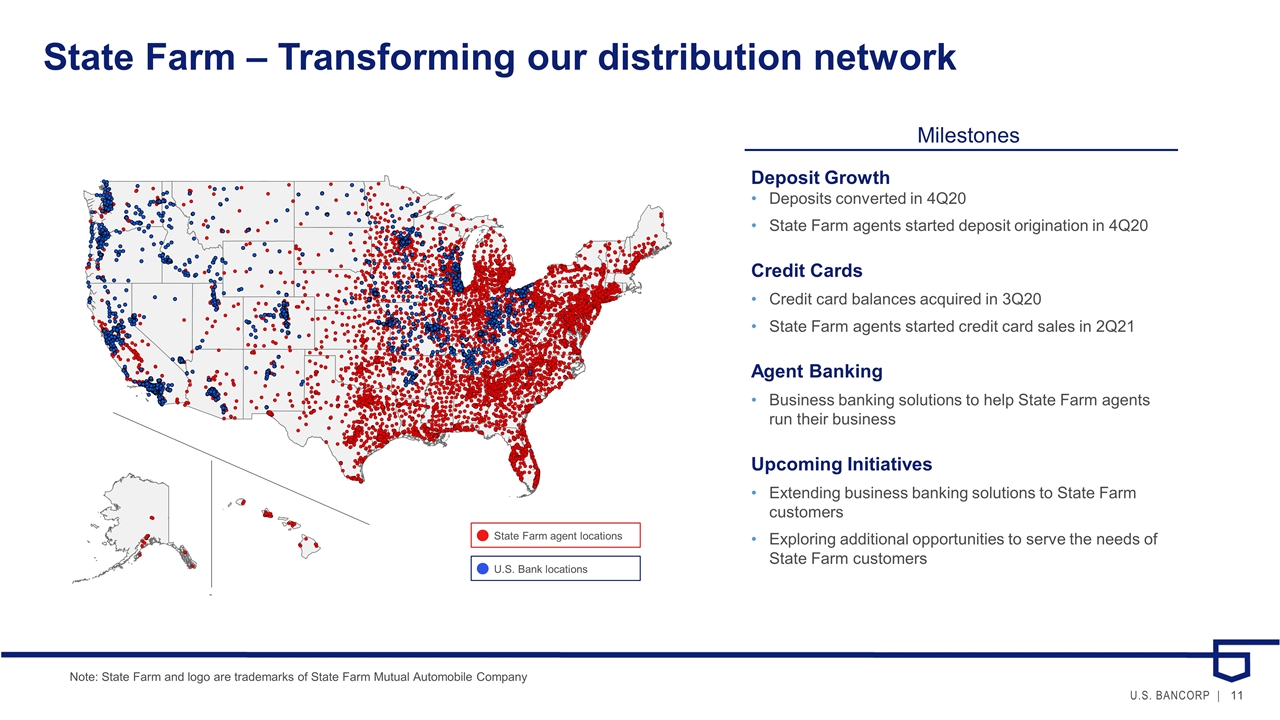

Milestones Deposit Growth Deposits converted in 4Q20 State Farm agents started deposit origination in 4Q20 Credit Cards Credit card balances acquired in 3Q20 State Farm agents started credit card sales in 2Q21 Agent Banking Business banking solutions to help State Farm agents run their business Upcoming Initiatives Extending business banking solutions to State Farm customers Exploring additional opportunities to serve the needs of State Farm customers State Farm – Transforming our distribution network State Farm agent locations U.S. Bank locations Note: State Farm and logo are trademarks of State Farm Mutual Automobile Company

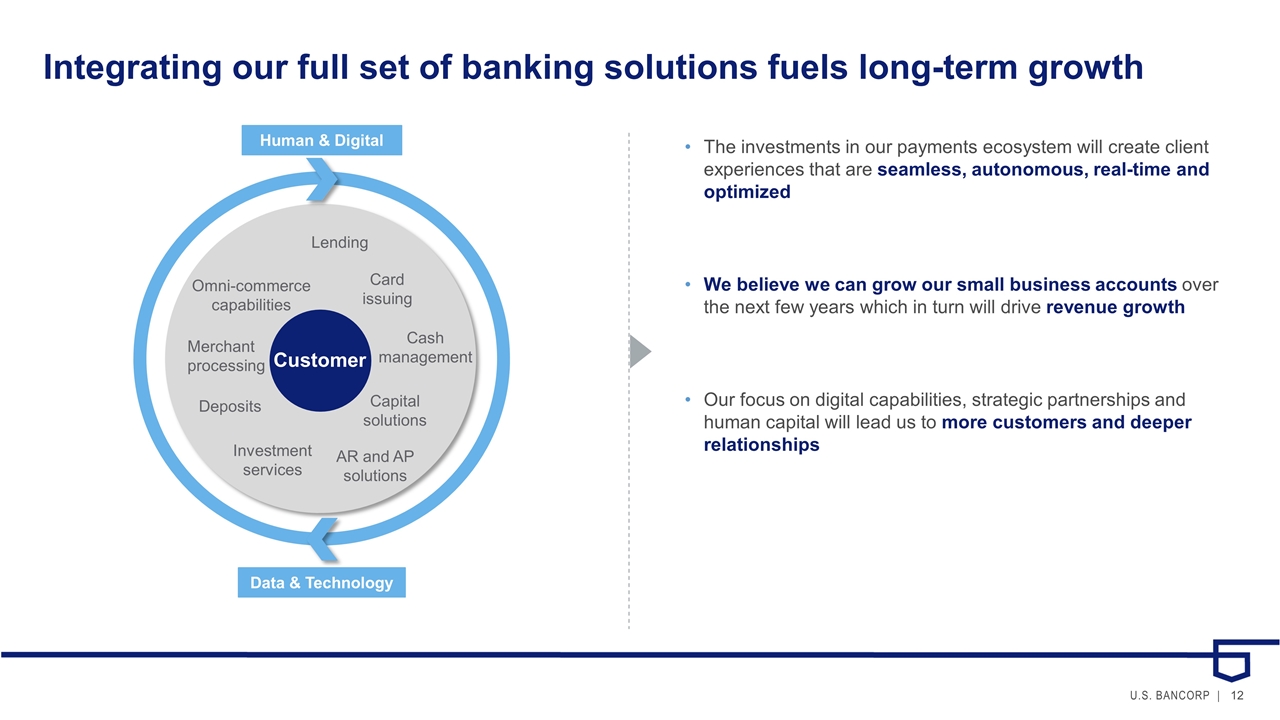

Integrating our full set of banking solutions fuels long-term growth The investments in our payments ecosystem will create client experiences that are seamless, autonomous, real-time and optimized We believe we can grow our small business accounts over the next few years which in turn will drive revenue growth Our focus on digital capabilities, strategic partnerships and human capital will lead us to more customers and deeper relationships Card issuing Merchant processing Omni-commerce capabilities AR and AP solutions Investment services Capital solutions Deposits Customer Lending Cash management Human & Digital Data & Technology

Appendix

Non-GAAP financial measures