Attached files

| file | filename |

|---|---|

| 8-K - 8-K - IMMERSION CORP | immr-20210601.htm |

IMMERSION Corporation Investor Relations Presentation

© 2021 Immersion Forward-Looking Statements 2 All statements, other than the statements of historical fact, are statements that may be deemed forward-looking statements, including any statements of the plans, strategies, and objectives of management for future operations, and statements regarding projected future financial results. Because forward-looking statements relate to the future, they are subject to inherent uncertainties, risks and changes in circumstances that are difficult to predict and many of which are outside of our control. Actual results could differ materially from those projected in the forward-looking statements, therefore we caution you not to place undue reliance on these forward- looking statements. Important factors that could cause our actual results and financial condition to differ materially from those indicated in the forward- looking statements include, among others, the following: the effects of the COVID-19 global pandemic on us and our business, and on the business of our suppliers and customers; unanticipated changes in the markets in which we operate; the effects of the current macroeconomic climate (especially in light of the ongoing adverse effects of the COVID-19 global pandemic); delay in or failure to achieve adoption of or commercial demand for our products or third party products incorporating our technologies; the inability of Immersion to renew existing licensing arrangements, or enter into new licensing arrangements for our patents and other technologies on favorable terms; the loss of a major customer; the ability of Immersion to protect and enforce our intellectual property rights; unanticipated difficulties and challenges in developing or acquiring successful innovations and our ability to patent those innovations; changes in patent law; confusion as to our licensing model or agreement terms; the ability of Immersion to return to consistent profitability in the future; the inability of Immersion to retain or recruit necessary personnel; the commencement, by others or by us, of legal or administrative action; risks related to our international operations and other factors. For a more detailed discussion of these factors, and other factors that could cause actual results to vary materially, interested parties should review the risk factors listed in Immersion’s most recent Form 10-K and Form 10-Q, which are on file with the U.S. Securities and Exchange Commission and available at www.sec.gov. The forward-looking statements in this presentation reflect Immersion’s beliefs and predictions as of the date of this presentation. Immersion does not intend to update these forward-looking statements as a result of financial, business, or any other developments occurring after the date of this presentation. In addition, the use of the word “partner” or “partnership” does not imply a legal partnership between Immersion and any other company. Use of Non-GAAP Financial Information. In this presentation the Company will be discussing non-GAAP measures of adjusted operating expenses and adjusted net income, which are adjusted from results based on GAAP. These non-GAAP financial measures are provided to enhance the user's overall understanding of the Company’s current financial performance and the Company’s prospects for the future and are not comprehensive of the Company’s financial results. Such measures should not be viewed as a substitute for the Company’s financial statements prepared in accordance with GAAP. You can find a reconciliation of these metrics to the reported GAAP results in the reconciliation tables provided in the appendix to this presentation. A reconciliation of non-GAAP measures to corresponding GAAP measures on a forward-looking basis is not available due to high variability and low visibility with respect to the charges which are excluded from these non-GAAP measures.

© 2021 Immersion Our mission is to develop and expand the use of haptic technology to improve people’s interactions with their digital environment, making it intuitive, engaging, and helpful. We invent, accelerate, and scale haptic experiences across markets where we can provide value. • We build and demonstrate system solutions • We create new haptic applications and use cases • We provide essential technologies and new techniques for improving the performance and functionality of haptic systems • We offer expertise in touch to enable customers to bring new experiences to market • We enable broad adoption by working across the ecosystem 3 SAN FRANCISCO Headquarters ~50 Employees ~2,000 Patents 90+ Licensed customers 3B+ Devices 25+ YEARS of Innovation in Haptics IMMR 22 years on NASDAQ MULTIPLE Markets

© 2021 Immersion Immersion Management Team Francis Jose General Counsel and SVP, IP Licensing & Legal Affairs Deputy General Counsel and VP of Legal Affairs, Immersion John Griffin VP, Products & Marketing VP, Digital & Interactive Entertainment, Dolby Board Member, Minnetonka Audio Software Chris Ullrich Chief Technology Officer VP, Technology, Immersion CTO, Haptify.com Aaron Akerman CFO CFO, Hypertec Group CFO, Lasik MD Group Jared Smith Interim CEO and VP, Worldwide Sales VP, Strategic Alliances, ARM Ltd VP, Licensing & Business Development, Rambus 4

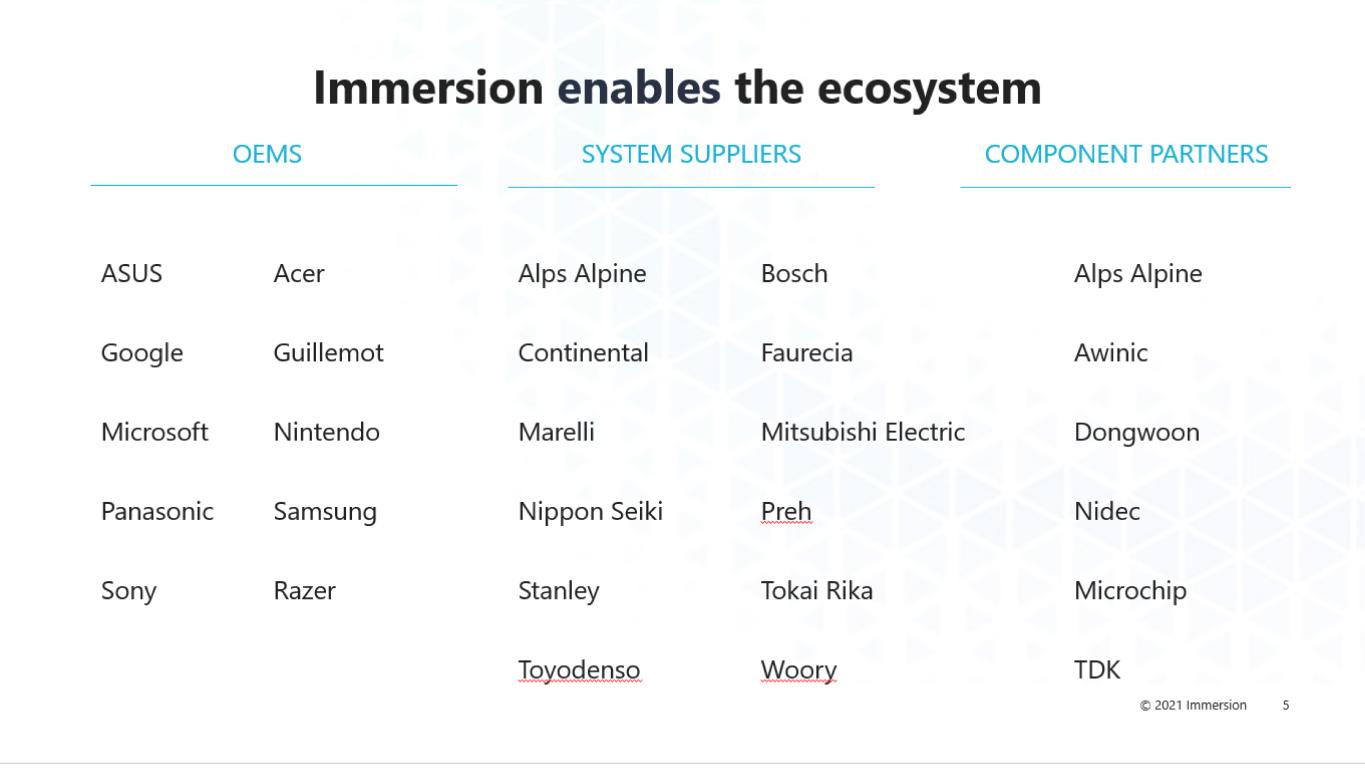

© 2021 Immersion 5

© 2021 Immersion Our Target Markets 6 GAMING / VRAUTOMOTIVE MOBILE

© 2021 Immersion Automotive Use Cases Touchscreen Center Console HVAC Control Arm Rest Seat Pedal Steering Wheel Opportunity to scale intuitive touch experiences in automotive HMI and enhance safety Investing in reference designs, firmware, and support to: • Accelerate market adoption of advanced haptic experiences • Expand use of haptics to multiple interfaces in cars • Deliver solutions to Tier 1 and OEMs © 2021 Im er i 2023 TAM* is ~90M+ vehicles with touch surfaces Jeep Wagoneer climate & seats 2022 Nissan Ariya, center console and driver mode 2021 Mercedes MBUX touchscreen 2021/2022 Audi line, MMI touch response system & haptic pedals, 2020 models & beyond *Source: Light Vehicle Production Forecast, Q1 2020, IHS Markit, Inc. 7

© 2021 Immersion Success of the PlayStation 5 is a driving force behind a resurgence of advanced haptic feedback “The PS5’s new controller is amazing” “The haptics steal the show” “Forget better loading speeds, shiny graphics, and more processing power, the DualSense PS5 controller is what makes the PS5 feel truly next-gen” Gaming + VR/AR Gaming across multiple endpoints with quad, multi-channel and multi-modal haptics Build an ecosystem of haptic capabilities for gaming peripherals to come 8 2023 TAM* is ~150M peripherals Investing in product development kits, designs, standards to: • Accelerate market adoption across multiple endpoints • Create haptic system solutions for new controllers, peripherals and accessories • Grow developer community design capabilities for haptics *Source: Internal estimate based on data from multiple sources

© 2021 Immersion Mobile Grow revenue and future opportunity in China through partner program and mobile standards for haptics 9 • Established low friction license channel with haptic component suppliers • Standards being developed by MPEG, IEEE, ATSC will drive proliferation of haptics • Interest from developer community is growing demand for advanced haptic capabilities Mobile OEM adoption of haptics driven by gaming, AR and entertainment applications. 2023 TAM* is ~1.6B Smartphones Smartphone shipments around the world surged by more than 25% in Q1 2021, an ongoing sign of recovery from the effects of the coronavirus outbreak. For the quarter, shipments rose by 27% to 347 million units, and by 25.5% to 346 million - Canalys, IDC “Great haptics elevate the quality of a phone and encourage companies to think holistically about design.” © 2021 Immersion 9 *Source: Forecast: PCs, Ultramobiles and Mobile Phones, Worldwide, 2019-2025, 1Q21 Update, Gartner.

© 2021 Immersion Financial overview

© 2021 Immersion Recent quarterly performance Streamlined cost structure positions us for improved profitability • Q1-2021 revenues grew 14% over Q1-2020 revenues. (Q1 seasonally lowest revenues) • Recurring revenues trending above 95% • Non-GAAP Opex down 76% from Q2-2019 to Q1-2021 • On track to deliver YoY double digit % growth in revenue and profitability 11 Note - Please refer to Appendix for reconciliation of Non-GAAP financial information to GAAP financial information. $(10) $(5) $- $5 $10 $15 $20 $M U SD Recent Quarterly Performance Revenues Non-GAAP Opex Non-GAAP NI(L)

Thank You

APPENDIX

© 2021 Immersion Q2 2019 Q3 2019 Q4 2019 Q1 2020 Q2 2020 Q3 2020 Q4 2020 Q1 2021 GAAP net income (loss) $ (8,620) $ (1,387) $ 979 $ (4,828) $ (712) $ 2,855 $ 8,086 $ 2,036 Add: (Provision) benefit for income taxes (3) 88 271 52 41 (96) (2,239) 141 Less: Non-GAAP provision for income taxes (13) (90) (72) (42) (5) (56) (26) (29) Add: Stock-based compensation 1,081 1,187 1,093 729 1,365 1,339 1,323 531 Add: Restructuring expense - 250 844 524 66 29 827 101 Add: Depreciation and amortization of property and equipment 200 183 702 963 40 26 23 24 Non-GAAP net income (loss) $ (7,355) $ 231 $ 3,817 $ (2,602) $ 795 $ 4,097 $ 7,994 $ 2,804 RECONCILIATION OF GAAP NET INCOME (LOSS) TO NON-GAAP NET INCOME(LOSS) 14

© 2021 Immersion RECONCILIATION OF GAAP OPERATING EXPENSES TO NON-GAAP OPERATING EXPENSES 15 Q2 2019 Q3 2019 Q4 2019 Q1 2020 Q2 2020 Q3 2020 Q4 2020 Q1 2021 GAAP operating expenses $ 17,858 $ 11,837 $ 10,933 $ 10,761 $ 6,665 $ 4,979 $ 5,663 $ 4,637 Adjustments to non-GAAP operating expenses: Stock-based compensation expense - S&M (173) (207) (247) (45) (343) (205) (254) (224) Stock-based compensation expense - R&D (190) (234) (250) (168) (251) (233) (216) (318) Stock-based compensation expense - G&A (718) (746) (596) (516) (771) (901) (853) 11 Restructuring expense - (250) (844) (524) (66) (29) (23) (101) Depreciation and amortization of property and equipment (200) (183) (702) (963) (40) (26) (827) (24) Non-GAAP operating expense $ 16,577 $ 10,217 $ 8,294 $ 8,545 $ 5,194 $ 3,585 $ 3,490 $ 3,981