Attached files

| file | filename |

|---|---|

| 8-K - 8-K - NEW YORK COMMUNITY BANCORP INC | d147203d8k.htm |

2021 Annual Meeting of Shareholders May 26, 2021 Exhibit 99.1

Disclaimer Cautionary Note Regarding Forward-Looking Statements This presentation includes “forward-looking statements” within the meaning of the Private Securities Litigation Reform Act of 1995, Section 27A of the Securities Act of 1933, as amended, and Section 21E of the Securities Exchange Act of 1934, as amended with respect to New York Community Bancorp, Inc.’s (“NYCB”) and Flagstar Bancorp Inc.’s (“Flagstar”) beliefs, goals, intentions, and expectations regarding revenues, earnings, loan production, asset quality, capital levels, and acquisitions, among other matters; our estimates of future costs and benefits of the actions we may take; our assessments of probable losses on loans; our assessments of interest rate and other market risks; and our ability to achieve our financial and other strategic goals. Forward‐looking statements are typically identified by such words as “believe,” “expect,” “anticipate,” “intend,” “outlook,” “estimate,” “forecast,” “project,” “should,” and other similar words and expressions, and are subject to numerous assumptions, risks, and uncertainties, which change over time. These forward-looking statements include, without limitation, those relating to the terms, timing and closing of the proposed transaction. Additionally, forward‐looking statements speak only as of the date they are made; NYCB and Flagstar do not assume any duty, and do not undertake, to update such forward‐looking statements. Furthermore, because forward‐looking statements are subject to assumptions and uncertainties, actual results or future events could differ, possibly materially, from those indicated in such forward-looking statements as a result of a variety of factors, many of which are beyond the control of NYCB and Flagstar. The factors that could cause actual results to differ materially include the following: the occurrence of any event, change or other circumstances that could give rise to the right of one or both of the parties to terminate the definitive merger agreement between NYCB and Flagstar; the outcome of any legal proceedings that may be instituted against NYCB or Flagstar; the possibility that the proposed transaction will not close when expected or at all because required regulatory, shareholder or other approvals are not received or other conditions to the closing are not satisfied on a timely basis or at all, or are obtained subject to conditions that are not anticipated; the ability of NYCB and Flagstar to meet expectations regarding the timing, completion and accounting and tax treatments of the proposed transaction; the risk that any announcements relating to the proposed transaction could have adverse effects on the market price of the common stock of either or both parties to the proposed transaction; the possibility that the anticipated benefits of the proposed transaction will not be realized when expected or at all, including as a result of the impact of, or problems arising from, the integration of the two companies or as a result of the strength of the economy and competitive factors in the areas where NYCB and Flagstar do business; certain restrictions during the pendency of the proposed transaction that may impact the parties’ ability to pursue certain business opportunities or strategic transactions; the possibility that the transaction may be more expensive to complete than anticipated, including as a result of unexpected factors or events; diversion of management’s attention from ongoing business operations and opportunities; the possibility that the parties may be unable to achieve expected synergies and operating efficiencies in the merger within the expected timeframes or at all and to successfully integrate Flagstar’s operations and those of NYCB; such integration may be more difficult, time consuming or costly than expected; revenues following the proposed transaction may be lower than expected; potential adverse reactions or changes to business or employee relationships, including those resulting from the announcement or completion of the proposed transaction; NYCB’s and Flagstar’s success in executing their respective business plans and strategies and managing the risks involved in the foregoing; the dilution caused by NYCB’s issuance of additional shares of its capital stock in connection with the proposed transaction; and other factors that may affect future results of NYCB and Flagstar; [uncertainty as to the extent of the duration, scope, and impacts of the COVID-19 pandemic on Flagstar, NYCB and the proposed combination;] and the other factors discussed in the “Risk Factors” section NYCB’s Annual Report on Form 10‐K for the year ended December 31, 2020 and in other reports NYCB files with the U.S. Securities and Exchange Commission (the “SEC”), which are available at http://www.sec.gov and in the “SEC Filings” section of NYCB’s website, https://ir.mynycb.com, under the heading “Financial Information,” and in Flagstar’s Annual Report on Form 10-K for the year ended December 31, 2020 and in Flagstar’s other filings with SEC, which are available at http://www.sec.gov and in the “Documents” section of Flagstar’s website, https://www.flagstar.com//, under the heading “Investor Relations.”

Disclaimer (Cont’d) Additional Information and Where to Find It In connection with the proposed transaction, NYCB will file with the SEC a registration statement on Form S-4 to register the shares of NYCB’s capital stock to be issued in connection with the proposed transaction. The registration statement will include a joint proxy statement of NYCB and Flagstar, which will be sent to the stockholders of NYCB and shareholders of Flagstar seeking certain approvals related to the proposed transaction. Participants in Solicitation NYCB, Flagstar, and certain of their respective directors, executive officers and employees may be deemed to be participants in the solicitation of proxies in respect of the proposed transaction under the rules of the SEC. Information regarding NYCB’s directors and executive officers is available in its definitive proxy statement, which was filed with the SEC on April 16, 2021, and certain of its Current Reports on Form 8-K. Information regarding Flagstar’s directors and executive officers is available in its definitive proxy statement, which was filed with the SEC on April 15, 2021, and certain of its Current Reports on Form 8-K. Other information regarding the participants in the solicitation of proxies in respect of the proposed transaction and a description of their direct and indirect interests, by security holdings or otherwise, will be contained in the joint proxy statement/prospectus and other relevant materials to be filed with the SEC. Free copies of these documents, when available, may be obtained as described in the preceding paragraph.

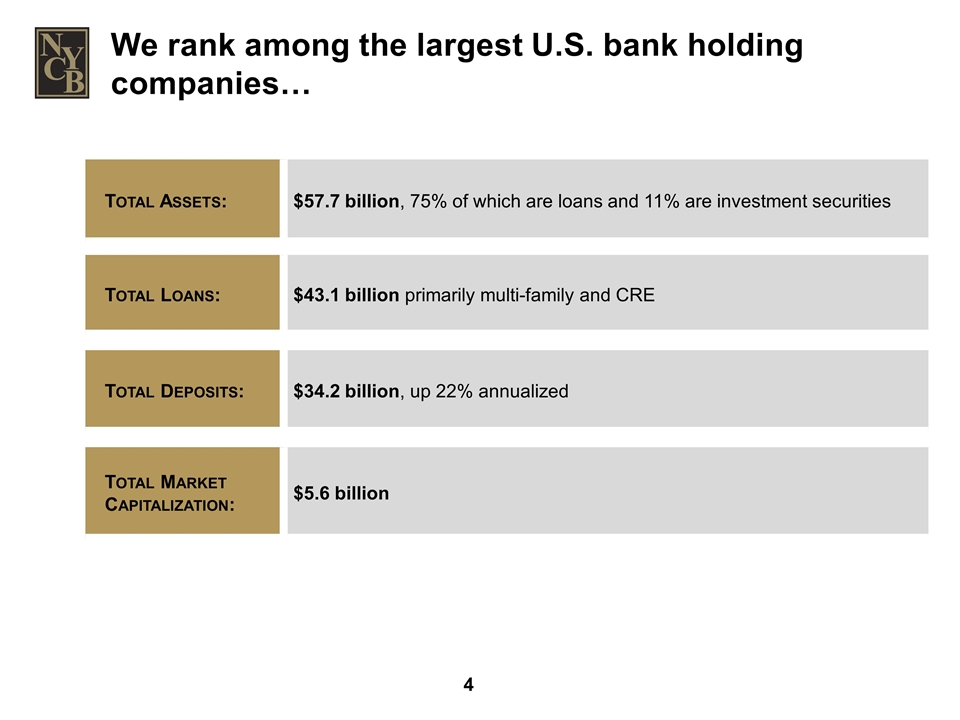

We rank among the largest U.S. bank holding companies… Total Assets: $57.7 billion, 75% of which are loans and 11% are investment securities Total Deposits: $34.2 billion, up 22% annualized Total Loans: $43.1 billion primarily multi-family and CRE Total Market Capitalization: $5.6 billion

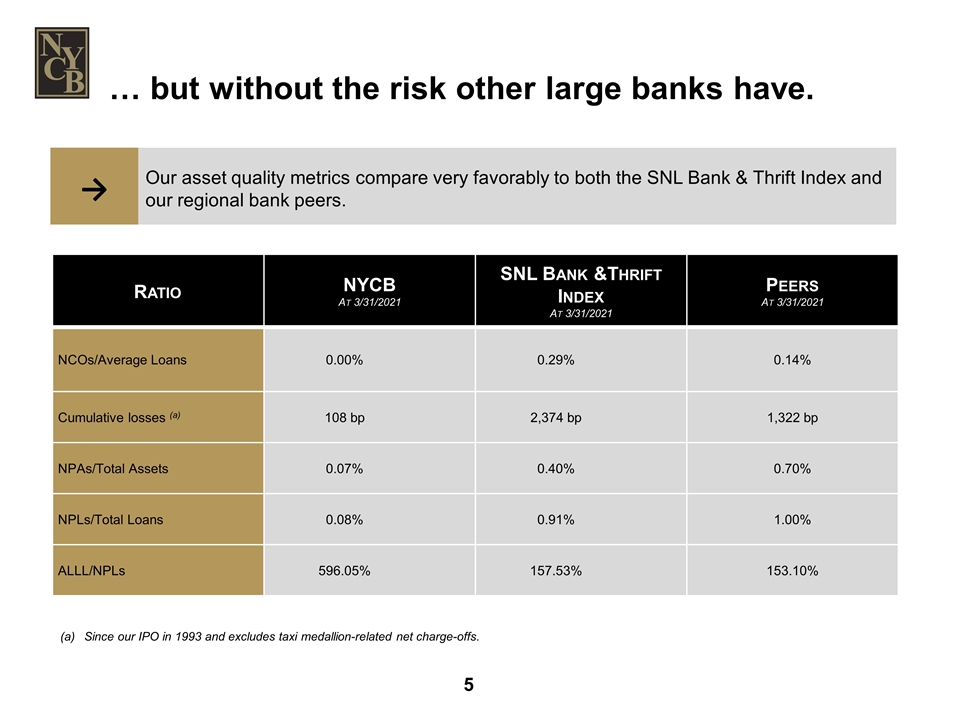

… but without the risk other large banks have. Ratio NYCB At 3/31/2021 SNL Bank &Thrift Index At 3/31/2021 Peers At 3/31/2021 NCOs/Average Loans 0.00% 0.29% 0.14% Cumulative losses (a) 108 bp 2,374 bp 1,322 bp NPAs/Total Assets 0.07% 0.40% 0.70% NPLs/Total Loans 0.08% 0.91% 1.00% ALLL/NPLs 596.05% 157.53% 153.10% → Our asset quality metrics compare very favorably to both the SNL Bank & Thrift Index and our regional bank peers. Since our IPO in 1993 and excludes taxi medallion-related net charge-offs.

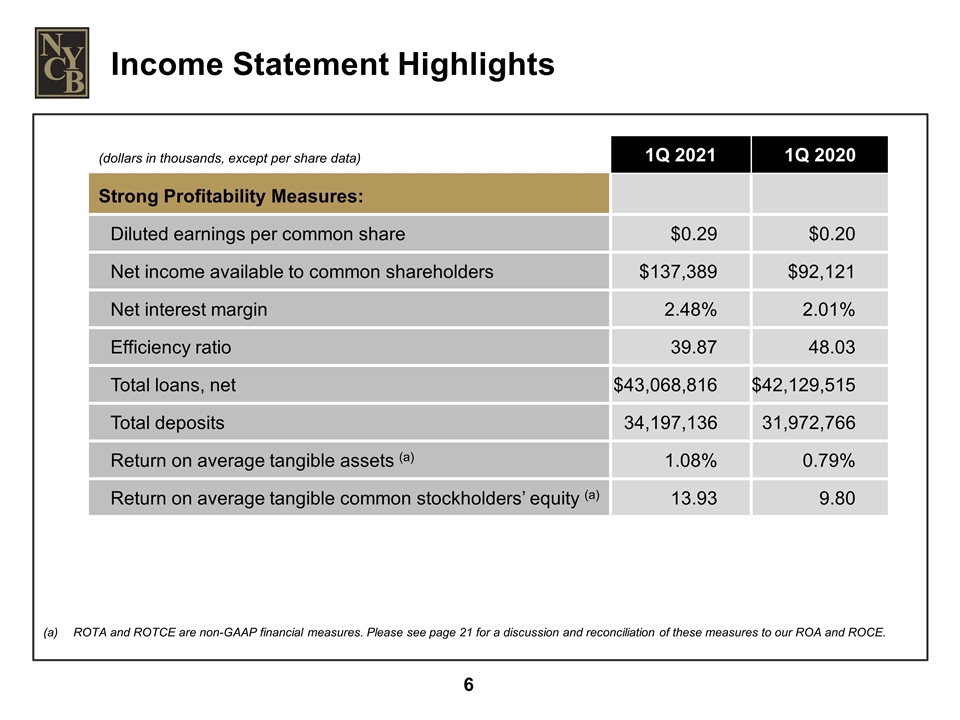

(dollars in thousands, except per share data) 1Q 2021 1Q 2020 Strong Profitability Measures: Diluted earnings per common share $0.29 $0.20 Net income available to common shareholders $137,389 $92,121 Net interest margin 2.48% 2.01% Efficiency ratio 39.87 48.03 Total loans, net $43,068,816 $42,129,515 Total deposits 34,197,136 31,972,766 Return on average tangible assets (a) 1.08% 0.79% Return on average tangible common stockholders’ equity (a) 13.93 9.80 Income Statement Highlights ROTA and ROTCE are non-GAAP financial measures. Please see page 21 for a discussion and reconciliation of these measures to our ROA and ROCE.

NYCB and Flagstar: Accelerating Our Transformation Strategy

Accelerates our transition towards building a dynamic commercial banking organization Enhancing Shareholder Value By Leveraging Two Like-Minded Organizations with Distinctive Strategic Strengths Creates a top-tier regional bank with significant scale and broader diversification Combines two strong management teams and boards Drives strong financial results and enhances capital generation Maintains each bank’s unique low credit risk model Improves funding profile and interest rate risk positioning Market-leading rent-regulated multifamily lender, mortgage originator and servicer

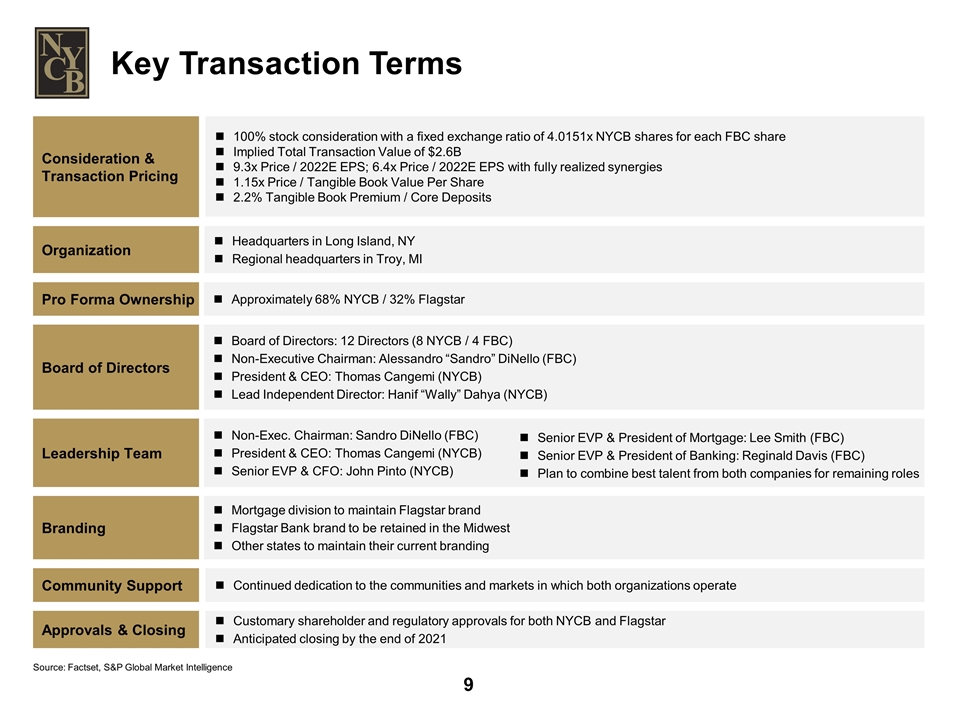

Key Transaction Terms Consideration & Transaction Pricing 100% stock consideration with a fixed exchange ratio of 4.0151x NYCB shares for each FBC share Implied Total Transaction Value of $2.6B 9.3x Price / 2022E EPS; 6.4x Price / 2022E EPS with fully realized synergies 1.15x Price / Tangible Book Value Per Share 2.2% Tangible Book Premium / Core Deposits Approvals & Closing Customary shareholder and regulatory approvals for both NYCB and Flagstar Anticipated closing by the end of 2021 Organization Headquarters in Long Island, NY Regional headquarters in Troy, MI Pro Forma Ownership Approximately 68% NYCB / 32% Flagstar Board of Directors Board of Directors: 12 Directors (8 NYCB / 4 FBC) Non-Executive Chairman: Alessandro “Sandro” DiNello (FBC) President & CEO: Thomas Cangemi (NYCB) Lead Independent Director: Hanif “Wally” Dahya (NYCB) Branding Mortgage division to maintain Flagstar brand Flagstar Bank brand to be retained in the Midwest Other states to maintain their current branding Community Support Continued dedication to the communities and markets in which both organizations operate Source: Factset, S&P Global Market Intelligence Leadership Team Non-Exec. Chairman: Sandro DiNello (FBC) President & CEO: Thomas Cangemi (NYCB) Senior EVP & CFO: John Pinto (NYCB) Senior EVP & President of Mortgage: Lee Smith (FBC) Senior EVP & President of Banking: Reginald Davis (FBC) Plan to combine best talent from both companies for remaining roles

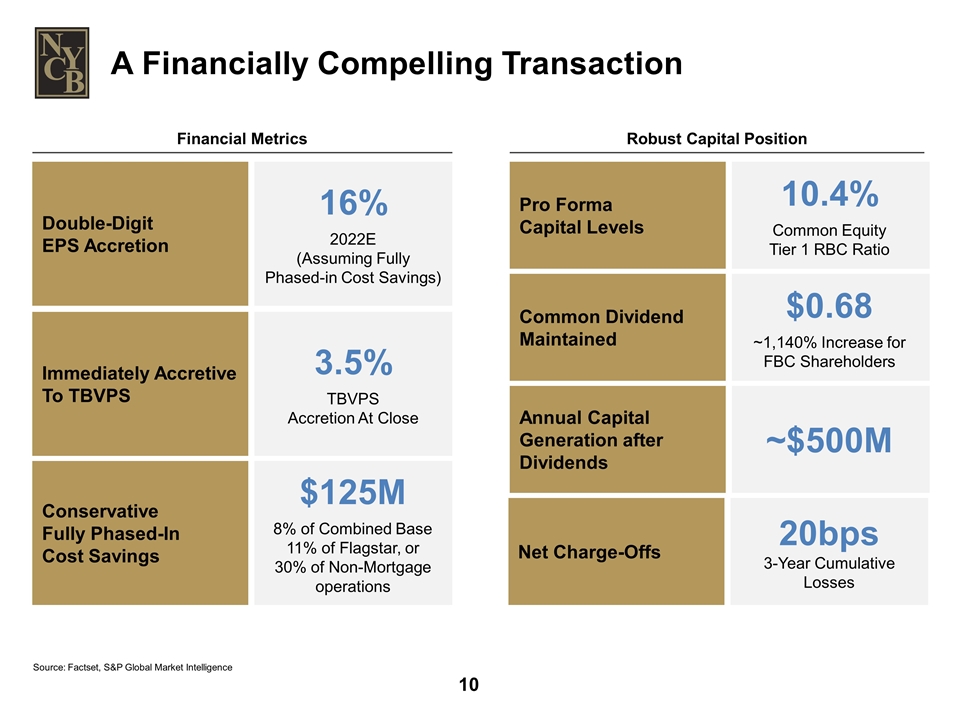

A Financially Compelling Transaction Financial Metrics Robust Capital Position Source: Factset, S&P Global Market Intelligence Double-Digit EPS Accretion Immediately Accretive To TBVPS Conservative Fully Phased-In Cost Savings 16% 2022E (Assuming Fully Phased-in Cost Savings) 3.5% TBVPS Accretion At Close $125M 8% of Combined Base 11% of Flagstar, or 30% of Non-Mortgage operations Pro Forma Capital Levels Common Dividend Maintained Annual Capital Generation after Dividends Net Charge-Offs 10.4% Common Equity Tier 1 RBC Ratio $0.68 ~1,140% Increase for FBC Shareholders ~$500M 20bps 3-Year Cumulative Losses

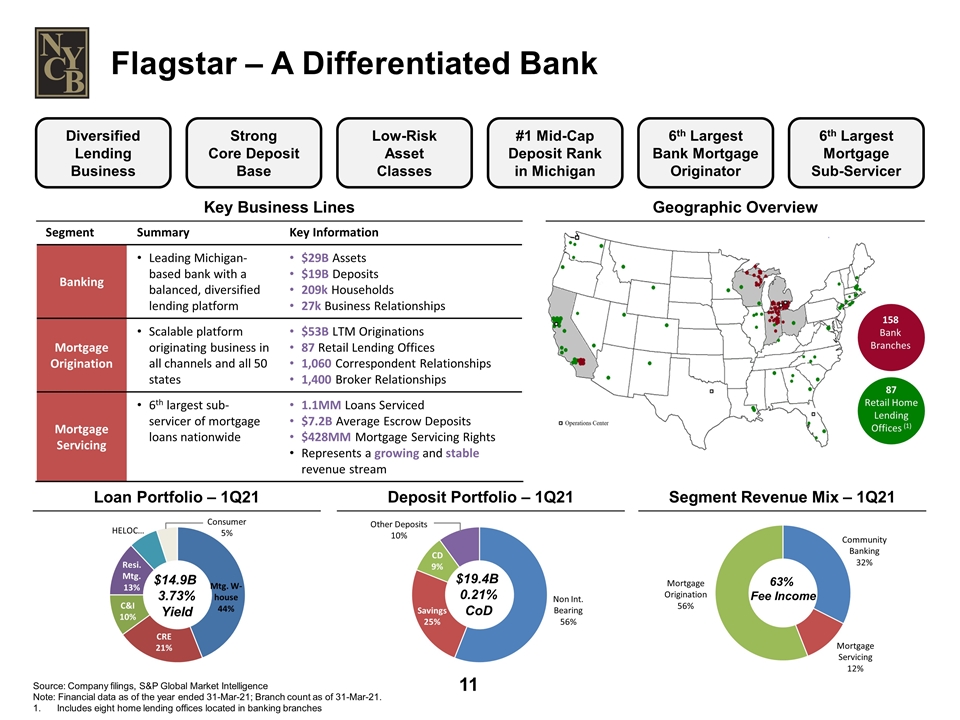

Flagstar – A Differentiated Bank 158 Bank Branches Includes eight home lending offices located in banking branches Source: Company filings, S&P Global Market Intelligence Note: Financial data as of the year ended 31-Mar-21; Branch count as of 31-Mar-21. Loan Portfolio – 1Q21 Deposit Portfolio – 1Q21 Segment Revenue Mix – 1Q21 $19.4B 0.21% CoD Diversified Lending Business Strong Core Deposit Base Low-Risk Asset Classes #1 Mid-Cap Deposit Rank in Michigan 6th Largest Bank Mortgage Originator 6th Largest Mortgage Sub-Servicer Segment Summary Key Information Banking Leading Michigan-based bank with a balanced, diversified lending platform $29B Assets $19B Deposits 209k Households 27k Business Relationships Mortgage Origination Scalable platform originating business in all channels and all 50 states $53B LTM Originations 87 Retail Lending Offices 1,060 Correspondent Relationships 1,400 Broker Relationships Mortgage Servicing 6th largest sub-servicer of mortgage loans nationwide 1.1MM Loans Serviced $7.2B Average Escrow Deposits $428MM Mortgage Servicing Rights Represents a growing and stable revenue stream Geographic Overview Key Business Lines 87 Retail Home Lending Offices (1) $14.9B 3.73% Yield 63% Fee Income

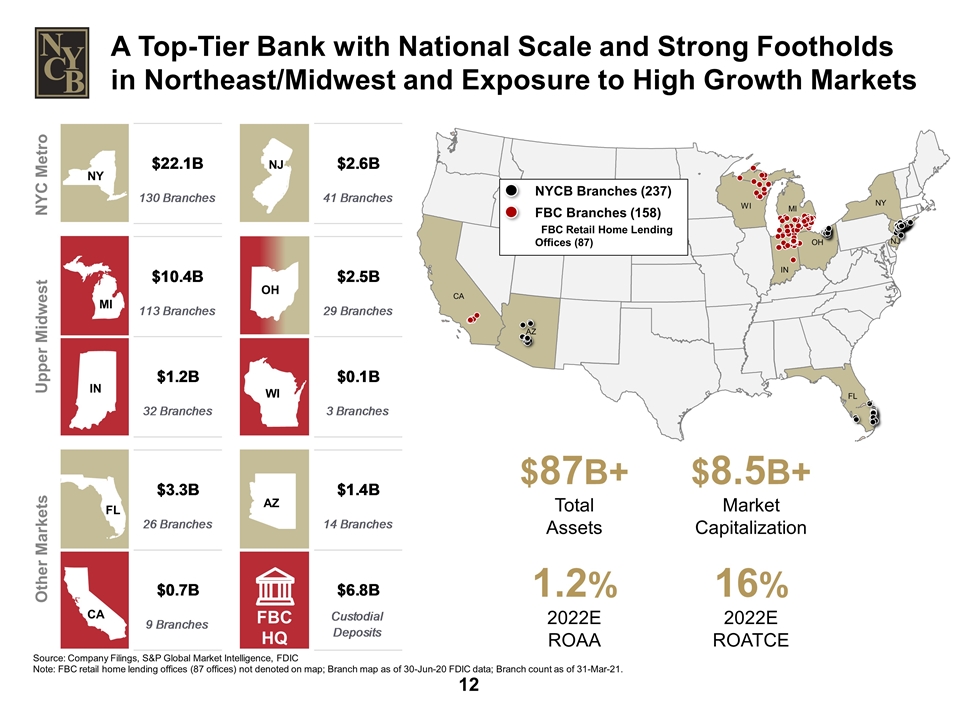

A Top-Tier Bank with National Scale and Strong Footholds in Northeast/Midwest and Exposure to High Growth Markets Source: Company Filings, S&P Global Market Intelligence, FDIC Note: FBC retail home lending offices (87 offices) not denoted on map; Branch map as of 30-Jun-20 FDIC data; Branch count as of 31-Mar-21. MI CA OH WI IN FBC HQ NY FL AZ NJ NYC Metro Upper Midwest Other Markets CA AZ FL WI MI IN NY OH NJ NYCB Branches (237) FBC Branches (158) FBC Retail Home Lending Offices (87) $87B+ Total Assets 1.2% 2022E ROAA 16% 2022E ROATCE $8.5B+ Market Capitalization

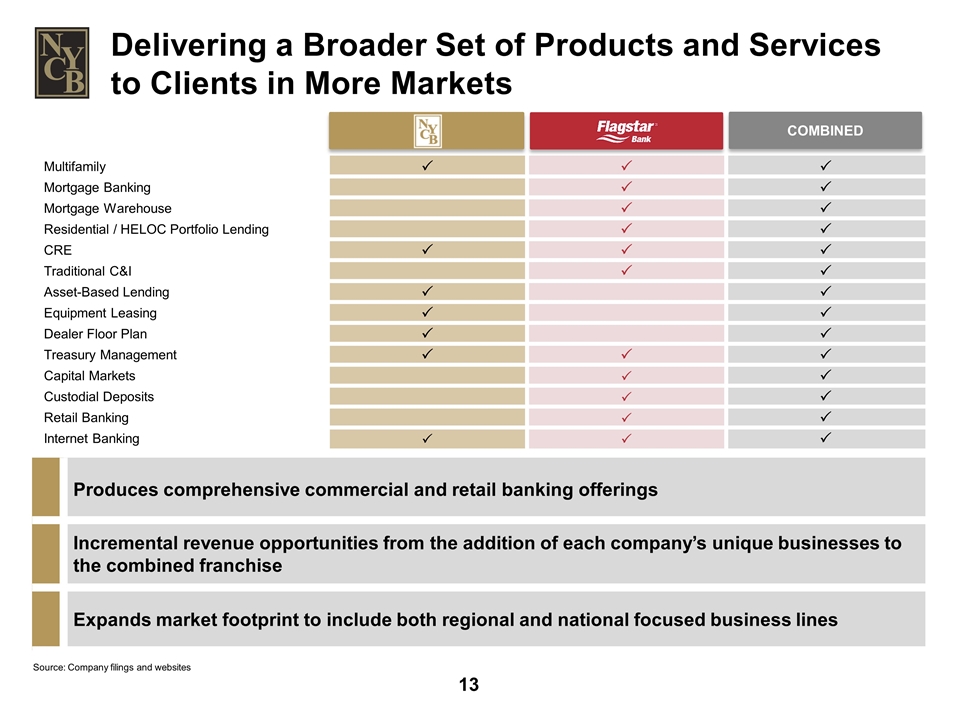

Delivering a Broader Set of Products and Services to Clients in More Markets Expands market footprint to include both regional and national focused business lines Incremental revenue opportunities from the addition of each company’s unique businesses to the combined franchise Produces comprehensive commercial and retail banking offerings Multifamily P P P Mortgage Banking P P Mortgage Warehouse P P Residential / HELOC Portfolio Lending P P CRE P P P Traditional C&I P P Asset-Based Lending P P Equipment Leasing P P Dealer Floor Plan P P Treasury Management P P P Capital Markets P P Custodial Deposits P P Retail Banking P P Internet Banking P P P Source: Company filings and websites COMBINED

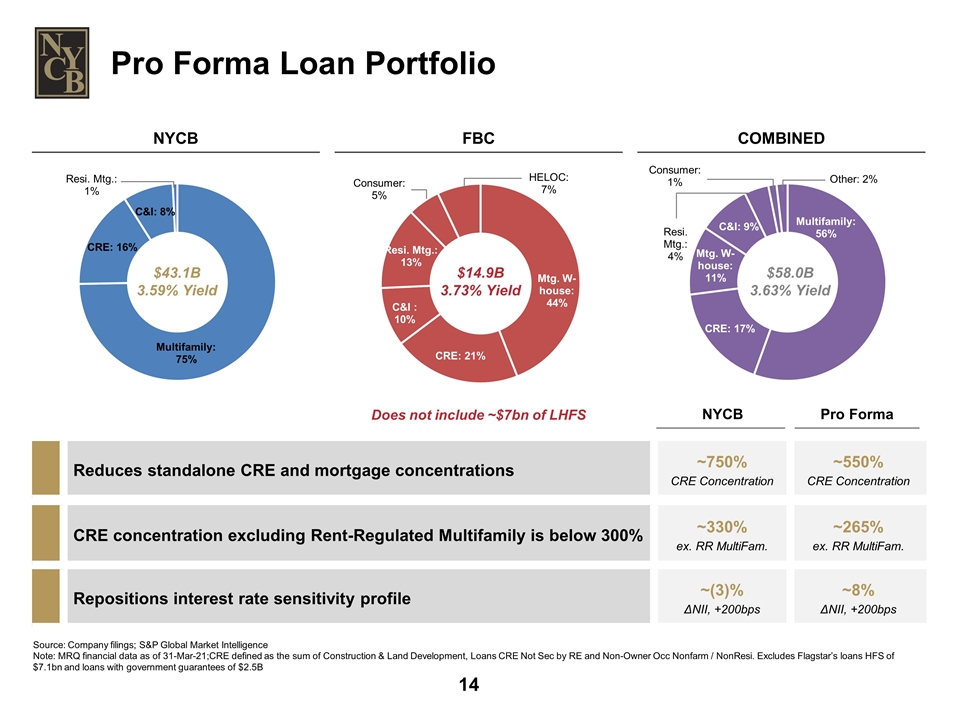

Pro Forma Loan Portfolio NYCB FBC COMBINED NYCB Pro Forma Repositions interest rate sensitivity profile ~(3)% ΔNII, +200bps ~8% ΔNII, +200bps Source: Company filings; S&P Global Market Intelligence Note: MRQ financial data as of 31-Mar-21;CRE defined as the sum of Construction & Land Development, Loans CRE Not Sec by RE and Non-Owner Occ Nonfarm / NonResi. Excludes Flagstar’s loans HFS of $7.1bn and loans with government guarantees of $2.5B Does not include ~$7bn of LHFS 180 151 90 184 44 54 36 56 102 134 134 134 $14.9B 3.73% Yield $58.0B 3.63% Yield $43.1B 3.59% Yield CRE concentration excluding Rent-Regulated Multifamily is below 300% ~330% ex. RR MultiFam. ~265% ex. RR MultiFam. Reduces standalone CRE and mortgage concentrations ~750% CRE Concentration ~550% CRE Concentration

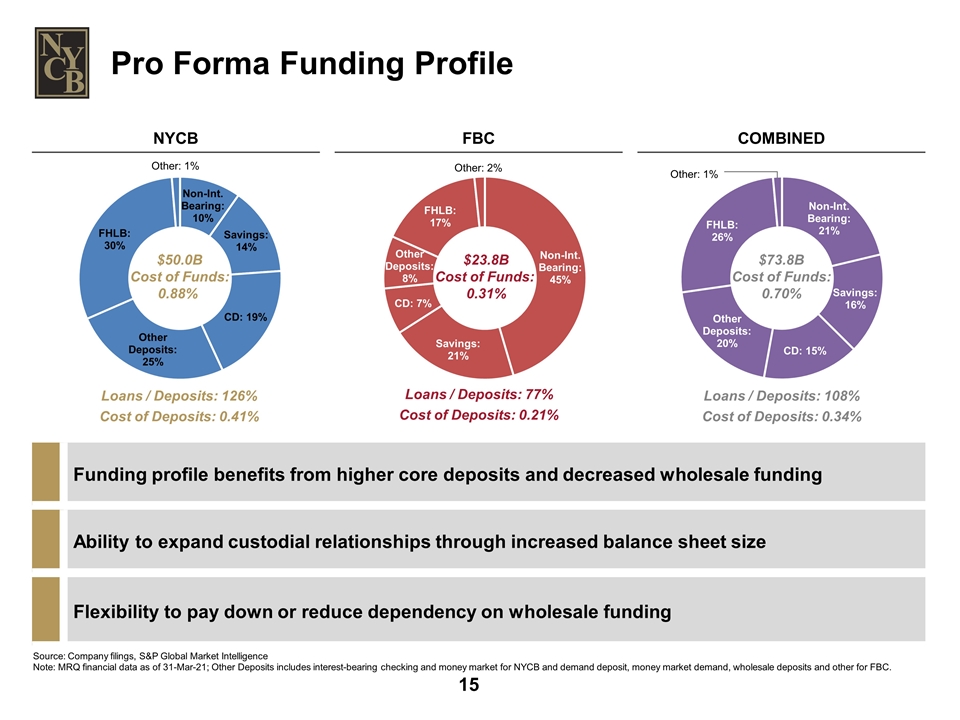

Pro Forma Funding Profile NYCB FBC COMBINED Flexibility to pay down or reduce dependency on wholesale funding Ability to expand custodial relationships through increased balance sheet size Funding profile benefits from higher core deposits and decreased wholesale funding Source: Company filings, S&P Global Market Intelligence Note: MRQ financial data as of 31-Mar-21; Other Deposits includes interest-bearing checking and money market for NYCB and demand deposit, money market demand, wholesale deposits and other for FBC. Loans / Deposits: 126% Loans / Deposits: 77% Cost of Deposits: 0.41% Cost of Deposits: 0.21% $50.0B Cost of Funds: 0.88% $23.8B Cost of Funds: 0.31% $73.8B Cost of Funds: 0.70% Loans / Deposits: 108% Cost of Deposits: 0.34%

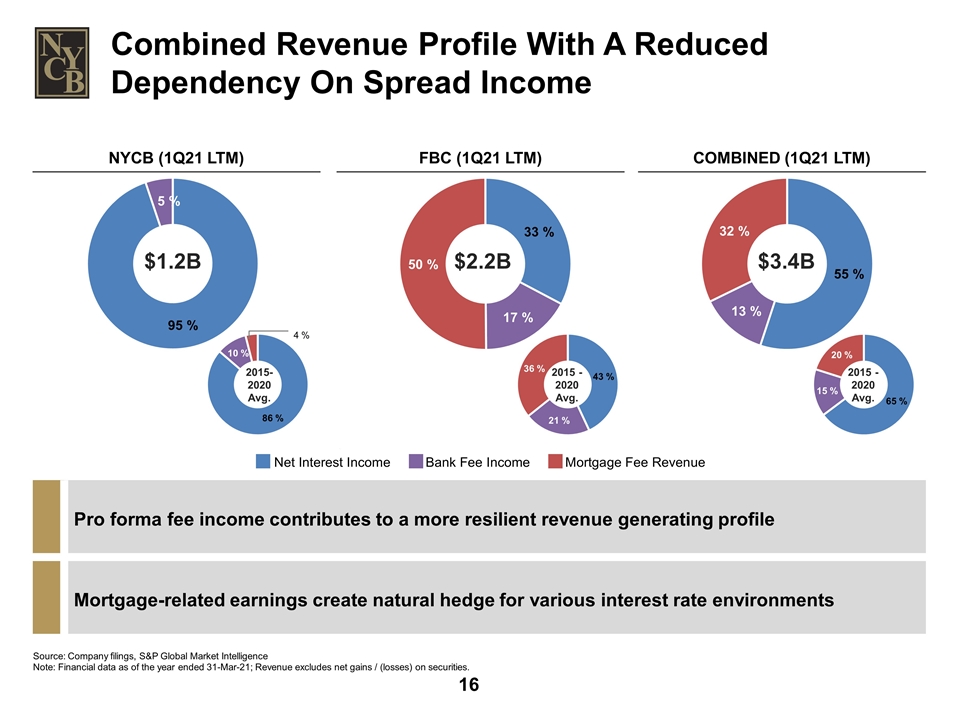

Combined Revenue Profile With A Reduced Dependency On Spread Income NYCB (1Q21 LTM) FBC (1Q21 LTM) COMBINED (1Q21 LTM) $1.2B Mortgage-related earnings create natural hedge for various interest rate environments Pro forma fee income contributes to a more resilient revenue generating profile Source: Company filings, S&P Global Market Intelligence Note: Financial data as of the year ended 31-Mar-21; Revenue excludes net gains / (losses) on securities. 2015 - 2020 Avg. 2015 - 2020 Avg. 2015- 2020 Avg. $2.2B $3.4B

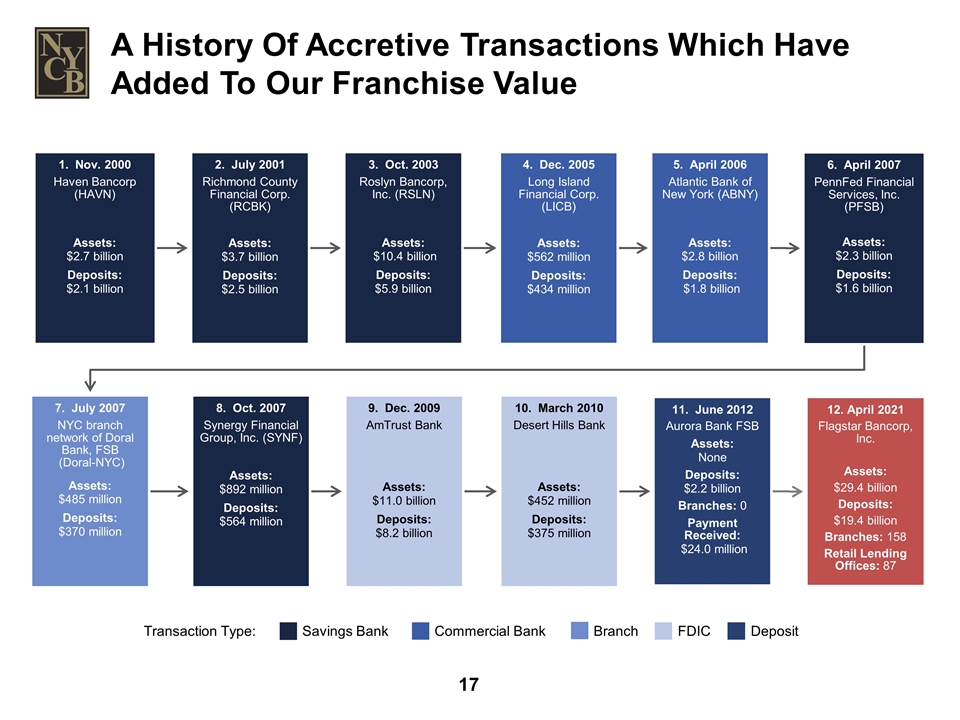

Transaction Type: Savings Bank Commercial Bank Branch FDIC Deposit A History Of Accretive Transactions Which Have Added To Our Franchise Value 1. Nov. 2000 Haven Bancorp (HAVN) Assets: $2.7 billion Deposits: $2.1 billion 3 . Oct. 2003 Roslyn Bancorp, Inc. (RSLN) Assets: $10.4 billion Deposits: $5.9 billion 4. Dec. 2005 Long Island Financial Corp. (LICB) Assets: $562 million Deposits: $434 million 2. July 2001 Richmond County Financial Corp. (RCBK) Assets: $3.7 billion Deposits: $2.5 billion 5. April 2006 Atlantic Bank of New York (ABNY) Assets: $2.8 billion Deposits: $1.8 billion 6. April 2007 PennFed Financial Services, Inc. (PFSB) Assets: $2.3 billion Deposits: $1.6 billion 7. July 2007 NYC branch network of Doral Bank, FSB (Doral-NYC) Assets: $485 million Deposits: $370 million 8. Oct. 2007 Synergy Financial Group, Inc. (SYNF) Assets: $892 million Deposits: $564 million 9. Dec. 2009 AmTrust Bank Assets: $11.0 billion Deposits: $8.2 billion 10. March 2010 Desert Hills Bank Assets: $452 million Deposits: $375 million 11. June 2012 Aurora Bank FSB Assets: None Deposits: $2.2 billion Branches: 0 Payment Received: $24.0 million 12. April 2021 Flagstar Bancorp, Inc. Assets: $29.4 billion Deposits: $19.4 billion Branches: 158 Retail Lending Offices: 87

A Shared Commitment We expect to maintain continuous commitment to our constituencies as well as support additional important community initiatives across our nationwide footprint Greater capabilities and expanded product suite Diversified client base and scope Increased technology spending and capabilities Larger balance sheet and increased capital to support client growth Shared values and company missions Strong focus on diversity, inclusion and employee development Strong risk management cultures and aligned corporate focus Larger company provides additional career opportunities and mobility Committed to a diverse, inclusive and culturally rich corporate environment Focus on promoting cultural awareness to bridge gaps and enhance team performance Recurring self-assessment of D&I positioning to remediate identified gaps and improve culture of diversity and inclusion Continued commitment to community reinvestment and maintaining solid CRA ratings Corporate, social, environmental and governance responsibility is a focus for both organizations Support for local communities through multiple foundations and donation of employees’ time Employees Diversity, Equity and Inclusion Our Customers Our Community Source: Company Management

Visit our website: ir.myNYCB.com E-mail requests to: ir@myNYCB.com Call Investor Relations at: (516) 683-4420 Write to: Investor Relations New York Community Bancorp, Inc. 615 Merrick Avenue Westbury, NY 11590 For More Information

Appendix

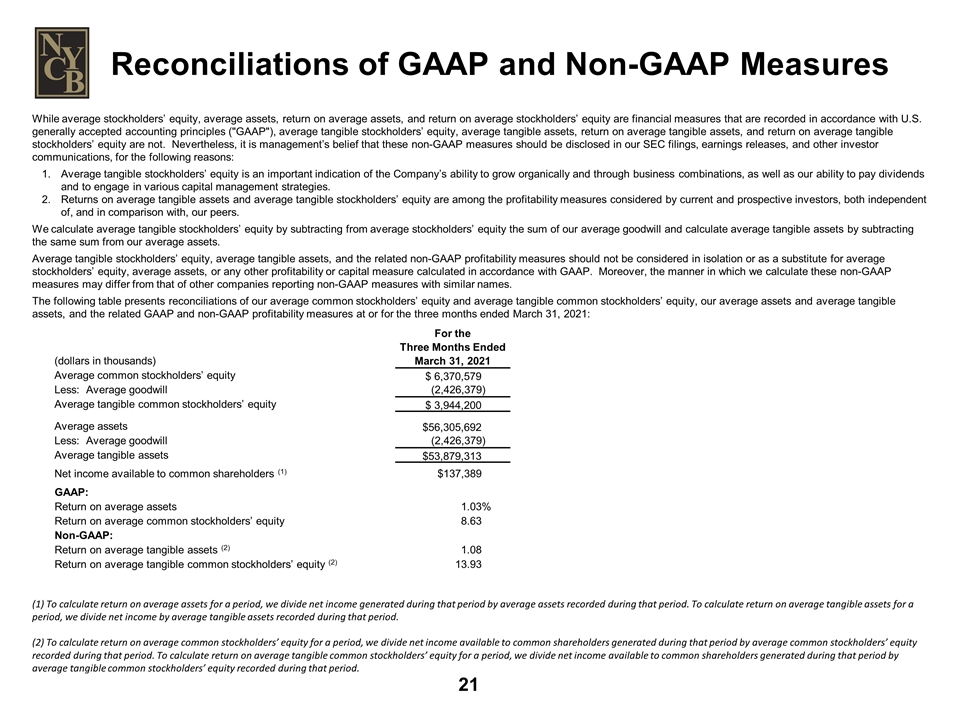

While average stockholders’ equity, average assets, return on average assets, and return on average stockholders’ equity are financial measures that are recorded in accordance with U.S. generally accepted accounting principles ("GAAP"), average tangible stockholders’ equity, average tangible assets, return on average tangible assets, and return on average tangible stockholders’ equity are not. Nevertheless, it is management’s belief that these non-GAAP measures should be disclosed in our SEC filings, earnings releases, and other investor communications, for the following reasons: Average tangible stockholders’ equity is an important indication of the Company’s ability to grow organically and through business combinations, as well as our ability to pay dividends and to engage in various capital management strategies. Returns on average tangible assets and average tangible stockholders’ equity are among the profitability measures considered by current and prospective investors, both independent of, and in comparison with, our peers. We calculate average tangible stockholders’ equity by subtracting from average stockholders’ equity the sum of our average goodwill and calculate average tangible assets by subtracting the same sum from our average assets. Average tangible stockholders’ equity, average tangible assets, and the related non-GAAP profitability measures should not be considered in isolation or as a substitute for average stockholders’ equity, average assets, or any other profitability or capital measure calculated in accordance with GAAP. Moreover, the manner in which we calculate these non-GAAP measures may differ from that of other companies reporting non-GAAP measures with similar names. The following table presents reconciliations of our average common stockholders’ equity and average tangible common stockholders’ equity, our average assets and average tangible assets, and the related GAAP and non-GAAP profitability measures at or for the three months ended March 31, 2021: (1) To calculate return on average assets for a period, we divide net income generated during that period by average assets recorded during that period. To calculate return on average tangible assets for a period, we divide net income by average tangible assets recorded during that period. (2) To calculate return on average common stockholders’ equity for a period, we divide net income available to common shareholders generated during that period by average common stockholders’ equity recorded during that period. To calculate return on average tangible common stockholders’ equity for a period, we divide net income available to common shareholders generated during that period by average tangible common stockholders’ equity recorded during that period. Reconciliations of GAAP and Non-GAAP Measures (dollars in thousands) For the Three Months Ended March 31, 2021 Average common stockholders’ equity $ 6,370,579 Less: Average goodwill (2,426,379) Average tangible common stockholders’ equity $ 3,944,200 Average assets $56,305,692 Less: Average goodwill (2,426,379) Average tangible assets $53,879,313 Net income available to common shareholders (1) $137,389 GAAP: Return on average assets 1.03% Return on average common stockholders’ equity 8.63 Non-GAAP: Return on average tangible assets (2) 1.08 Return on average tangible common stockholders’ equity (2) 13.93