Attached files

| file | filename |

|---|---|

| 8-K - 8-K - FULTON FINANCIAL CORP | d166283d8k.htm |

z Virtual Annual meeting May 25, 2021 Exhibit 99.1

E. Philip Wenger Chairman and CEO Business Meeting

Business Meeting Proposals: Election of Directors Say on Pay Resolution Ratification of appointment of KPMG, LLC as Fulton’s independent auditor Introductions Results of Voting Conclusion of Business Meeting Management Presentation Questions and Answers Today’s Agenda

Board of Directors

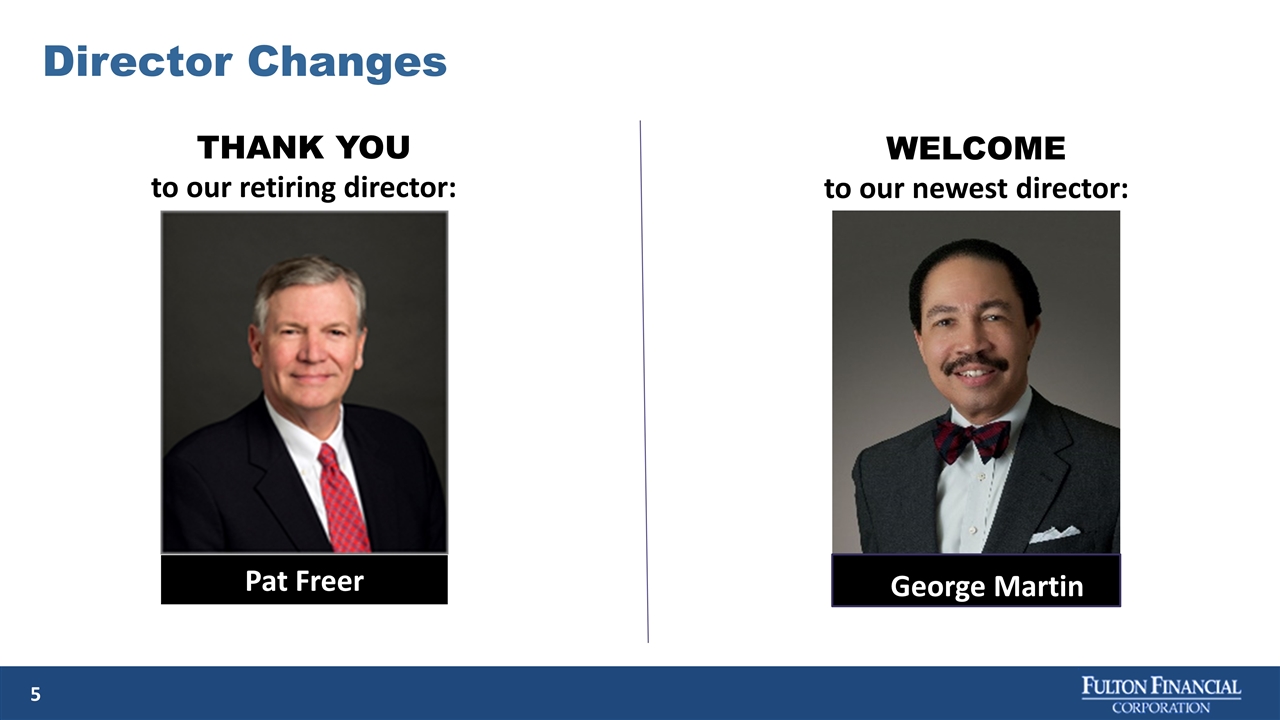

THANK YOU to our retiring director: Pat Freer George Martin WELCOME to our newest director: Director Changes

Business Meeting Proposals: Election of Directors Say on Pay Resolution Ratification of appointment of KPMG, LLC as Fulton’s independent auditor Introductions Results of Voting Conclusion of Business Meeting Management Presentation Questions and Answers Today’s Agenda

Daniel R. Stolzer Corporate Secretary Report of the Judge of Election

This presentation may contain forward-looking statements with respect to the Corporation’s financial condition, results of operations and business. Do not unduly rely on forward-looking statements. Forward-looking statements can be identified by the use of words such as "may," "should," "will," "could," "estimates," "predicts," "potential," "continue," "anticipates," "believes," "plans," "expects," "future," "intends," “projects,” the negative of these terms and other comparable terminology. These forward-looking statements may include projections of, or guidance on, the Corporation’s future financial performance, expected levels of future expenses, including future credit losses, anticipated growth strategies, descriptions of new business initiatives and anticipated trends in the Corporation’s business or financial results. Forward-looking statements are neither historical facts, nor assurance of future performance. Instead, they are based on current beliefs, expectations and assumptions regarding the future of the Corporation’s business, future plans and strategies, projections, anticipated events and trends, the economy and other future conditions. Because forward-looking statements relate to the future, they are subject to inherent uncertainties, risks and changes in circumstances that are difficult to predict and many of which are outside of the Corporation’s control, and actual results and financial condition may differ materially from those indicated in the forward-looking statements. Therefore, you should not unduly rely on any of these forward-looking statements. Any forward-looking statement is based only on information currently available and speaks only as of the date when made. The Corporation undertakes no obligation, other than as required by law, to update or revise any forward-looking statements, whether as a result of new information, future events or otherwise. A discussion of certain risks and uncertainties affecting the Corporation, and some of the factors that could cause the Corporation’s actual results to differ materially from those described in the forward-looking statements, can be found in the sections entitled “Risk Factors” and “Management’s Discussion and Analysis of Financial Condition and Results of Operations” in the Corporation’s Annual Report on Form 10-K for the year ended December 31, 2020, Form 10-Q for the quarter ended March 31, 2021, and other current and periodic reports, which have been or will be filed with the Securities and Exchange Commission and are or will be available in the Investor Relations section of the Corporation’s website (www.fult.com) and on the Securities and Exchange Commission’s website (www.sec.gov). Forward-Looking Statements

Senior Management

Provided PPP loans to more than 10,000 customers Average deposit growth of 15.7% Diversified our fee income Asset quality remained stable Average loan growth of 11.2% Acquired BenefitWorks, Inc. Implemented cost saving initiatives expected to result in a $25 million reduction in annual operating expenses Investments in technology to benefit our customers and our team members Subordinated debt offering - March 2020 Preferred stock offering - October 2020 Net income of $175.9 million, or $1.08 per diluted share. Key Accomplishments: Comparisons are to 2019 2020 Highlights(1)

Earnings per share: $0.43 Increased the quarterly cash dividend by 7.7% over the prior quarter Continued strong PPP funding Average loan growth: (0.1)% Asset quality remained stable Average deposit growth: 1.6% Diversified revenue sources Strong mortgage business and pipeline Continued growth in Wealth Management Balance sheet restructuring to enhance net interest income 1st Quarter 2021 Performance Comparisons are to the fourth quarter of 2020

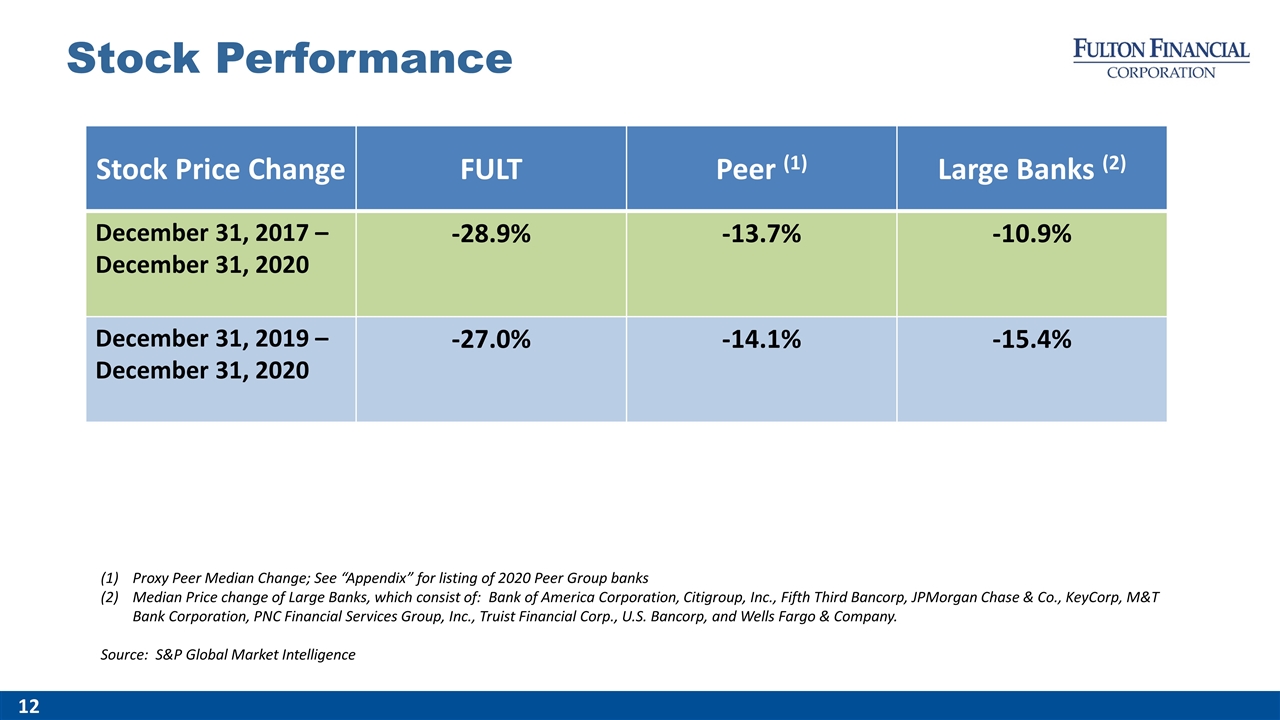

Stock Price Change FULT Peer (1) Large Banks (2) December 31, 2017 – December 31, 2020 -28.9% -13.7% -10.9% December 31, 2019 – December 31, 2020 -27.0% -14.1% -15.4% Proxy Peer Median Change; See “Appendix” for listing of 2020 Peer Group banks Median Price change of Large Banks, which consist of: Bank of America Corporation, Citigroup, Inc., Fifth Third Bancorp, JPMorgan Chase & Co., KeyCorp, M&T Bank Corporation, PNC Financial Services Group, Inc., Truist Financial Corp., U.S. Bancorp, and Wells Fargo & Company. Source: S&P Global Market Intelligence Stock Performance

Boenning & Scattergood, Inc.Neutral D.A. Davidson & Co.Neutral Hovde Group, LLCMarket Perform Jefferies LLCHold Keefe, Bruyette & Woods, Inc.Market Perform Raymond James & Associates, Inc.Market Perform Piper Sandler Neutral StephensEqual Weight Hold = Neutral = Market Perform = Equal Weight Analysts’ Recommendations (as of May 11, 2021)

E. Philip Wenger Chairman and CEO

Appendix

Atlantic Union Bankshares Corp. BancorpSouth Bank Commerce Bancshares, Inc. First Midwest Bancorp, Inc. F.N.B. Corp. Hancock Whitney Corporation Investors Bancorp, Inc. Northwest Bancshares, Inc. Old National Bancorp Prosperity Bancshares Provident Financial Services, Inc. Trustmark Corp. UMB Financial Corp. Umpqua Holdings Corp. United Bankshares, Inc. United Community Banks, Inc. Valley National Bancorp Webster Financial Corp. Wintrust Financial Corp. 2020 Peer Group

z Virtual Annual meeting May 25, 2021