Attached files

| file | filename |

|---|---|

| EX-32.2 - CERTIFICATION - Aerkomm Inc. | f10q0321ex32-2_aerkomminc.htm |

| EX-32.1 - CERTIFICATION - Aerkomm Inc. | f10q0321ex32-1_aerkomminc.htm |

| EX-31.2 - CERTIFICATION - Aerkomm Inc. | f10q0321ex31-2_aerkomminc.htm |

| EX-31.1 - CERTIFICATION - Aerkomm Inc. | f10q0321ex31-1_aerkomminc.htm |

| EX-10.1 - MEMORANDUM OF UNDERSTANDING FOR AN INDEPENDENT CONTRACTOR AGREEMENT - Aerkomm Inc. | f10q0321ex10-1_aerkomminc.htm |

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 10−Q

(Mark One)

☒ QUARTERLY REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934

For the quarterly period ended: March 31, 2021

or

☐ TRANSITION REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934

For the transition period from ____________ to _____________

Commission File Number: 000-55925

AERKOMM INC.

(Exact name of registrant as specified in its charter)

| Nevada | 46-3424568 | |

| (State or

other jurisdiction of incorporation or organization) |

(I.R.S. Employer

Identification No.) |

44043 Fremont Blvd., Fremont, CA 94538

(Address of principal executive offices, Zip Code)

(877) 742-3094

(Registrant’s telephone number, including area code)

(Former name, former address and former fiscal year, if changed since last report)

Securities registered pursuant to Section 12(b) of the Act:

| Title of each class | Trading Symbol(s) | Name of each exchange on which registered | ||

| None | N/A | N/A |

Indicate by check mark whether the registrant (1) has filed all reports required to be filed by Section 13 or 15(d) of the Securities Exchange Act of 1934 during the preceding 12 months (or for such shorter period that the registrant was required to file such reports), and (2) has been subject to such filing requirements for the past 90 days. Yes ☒ No ☐

Indicate by check mark whether the registrant has submitted electronically every Interactive Data File required to be submitted pursuant to Rule 405 of Regulation S-T during the preceding 12 months (or for such shorter period that the registrant was required to submit such files). Yes ☒ No ☐

Indicate by check mark whether the registrant is a large accelerated filer, an accelerated filer, a non-accelerated filer, a smaller reporting company, or an emerging growth company. See the definitions of “large accelerated filer,” “accelerated filer,” “smaller reporting company” and “emerging growth company” in Rule 12b-2 of the Exchange Act.

| Large accelerated filer ☐ | Accelerated filer ☐ | ||

| Non-accelerated filer ☐ | Smaller reporting company ☒ | ||

| Emerging growth company ☒ |

If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for comply with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act. ☐

Indicate by check mark whether the registrant is a shell company (as defined in Rule 12b-2 of the Exchange Act). Yes ☐ No ☒

As of May 20, 2021, there were 9,637,051 shares of the registrant’s common stock issued and outstanding.

AERKOMM INC.

Quarterly Report on Form 10-Q

Period Ended March 31, 2021

TABLE OF CONTENTS

| PART

I FINANCIAL INFORMATION | ||

| Item 1. | Financial Statements | 1 |

| Item 2. | Management’s Discussion and Analysis of Financial Condition and Results of Operations | 27 |

| Item 3. | Quantitative and Qualitative Disclosures About Market Risk | 37 |

| Item 4. | Controls and Procedures | 37 |

| PART

II OTHER INFORMATION | ||

| Item 1. | Legal Proceedings | 38 |

| Item 1A. | Risk Factors | 38 |

| Item 2. | Unregistered Sales of Equity Securities and Use of Proceeds | 38 |

| Item 3. | Defaults Upon Senior Securities | 38 |

| Item 4. | Mine Safety Disclosures | 38 |

| Item 5. | Other Information | 38 |

| Item 6. | Exhibits | 39 |

i

FINANCIAL INFORMATION

AERKOMM INC.

CONDENSED CONSOLIDATED FINANCIAL STATEMENTS

1

Condensed Consolidated Balance Sheets

March 31, 2021 and December 31, 2020

| March 31, 2021 | December 31, 2020 | |||||||

| (Unaudited) | ||||||||

| Assets | ||||||||

| Current Assets | ||||||||

| Cash | $ | 33,632 | $ | 584,591 | ||||

| Short-term investment | 75,840 | 87,154 | ||||||

| Inventories, net | 6,657,107 | 5,211,427 | ||||||

| Prepaid expenses and other current assets | 2,259,690 | 1,637,195 | ||||||

| Total Current Assets | 9,026,269 | 7,520,367 | ||||||

| Long-term Investment | 3,634,809 | 4,305,556 | ||||||

| Property and Equipment | ||||||||

| Cost | 2,809,941 | 2,806,420 | ||||||

| Accumulated depreciation | (1,548,756 | ) | (1,414,191 | ) | ||||

| 1,261,185 | 1,392,229 | |||||||

| Prepayment for land | 35,861,589 | 35,861,589 | ||||||

| Prepayment for equipment | 86,617 | 86,617 | ||||||

| Net Property and Equipment | 37,209,391 | 37,340,435 | ||||||

| Other Assets | ||||||||

| Restricted cash | 3,211,511 | 3,210,000 | ||||||

| Intangible asset, net | 2,268,750 | 2,392,500 | ||||||

| Goodwill | 1,475,334 | 1,475,334 | ||||||

| Right-of-use assets, net | 328,564 | 353,442 | ||||||

| Deposits | 117,897 | 119,436 | ||||||

| Total Other Assets | 7,402,056 | 7,550,712 | ||||||

| Total Assets | $ | 57,272,525 | $ | 56,717,070 | ||||

| Liabilities and Stockholders’ Equity | ||||||||

| Current Liabilities | ||||||||

| Short-term loans | $ | 2,742,171 | $ | 527,066 | ||||

| Accounts payable | 1,874,339 | 1,874,339 | ||||||

| Accrued expenses and other current liabilities | 5,529,818 | 4,695,000 | ||||||

| Long-term loan - current | 10,260 | 10,171 | ||||||

| Lease liability – current | 378,659 | 357,880 | ||||||

| Total Current Liabilities | 10,535,247 | 7,464,456 | ||||||

| Long-term Liabilities | ||||||||

| Long-term bonds payable | 9,265,659 | 9,218,094 | ||||||

| Long-term loan – non-current | 25,965 | 29,034 | ||||||

| Lease liability – non-current | 160,205 | 210,443 | ||||||

| Prepayment from customer | 762,000 | 762,000 | ||||||

| Restricted stock deposit liability | 1,000 | 1,000 | ||||||

| Total Long-Term Liabilities | 10,214,829 | 10,220,571 | ||||||

| Total Liabilities | 20,750,076 | 17,685,027 | ||||||

| Commitments | ||||||||

| Stockholders’ Equity | ||||||||

| Preferred stock, $0.001 par value, 50,000,000 shares authorized, none issued and outstanding as of March 31, 2021 and December 31, 2020 | - | - | ||||||

| Common stock, $0.001 par value, 90,000,000 shares authorized, 9,487,889 shares (excluding 149,162 unvested restricted shares) issued and outstanding as of March 31, 2021 and December 31, 2020 | 9,488 | 9,488 | ||||||

| Additional paid in capital | 74,485,381 | 73,160,616 | ||||||

| Accumulated deficits | (36,611,959 | ) | (32,383,833 | ) | ||||

| Accumulated other comprehensive loss | (1,360,461 | ) | (1,754,228 | ) | ||||

| Total Stockholders’ Equity | 36,522,449 | 39,032,043 | ||||||

| Total Liabilities and Stockholders’ Equity | $ | 57,272,525 | $ | 56,717,070 | ||||

See accompanying notes to the consolidated financial statements.

2

Condensed Consolidated Statements of Operations and Comprehensive Loss

For the Three-Month Periods ended March 31, 2021 and 2020

| Three

Months Ended March 31, | ||||||||

| 2021 | 2020 | |||||||

| (Unaudited) | (Unaudited) | |||||||

| Net sales | $ | - | $ | - | ||||

| Operating expenses | 3,170,999 | 1,956,045 | ||||||

| Loss from Operations | (3,170,999 | ) | (1,956,045 | ) | ||||

| Non-operating loss | ||||||||

| Unrealized investment loss | (624,738 | ) | (80,684 | ) | ||||

| Foreign currency exchange loss | (370,504 | ) | (320,701 | ) | ||||

| Others, net | (58,590 | ) | (5,812 | ) | ||||

| Total Non-Operating Loss | (1,053,832 | ) | (407,197 | ) | ||||

| Loss Before Income Taxes | (4,224,831 | ) | (2,363,242 | ) | ||||

| Income Tax Expense | 3,295 | 3,252 | ||||||

| Net Loss | (4,228,126 | ) | (2,366,494 | ) | ||||

| Other Comprehensive Income | ||||||||

| Change in foreign currency translation adjustments | 393,767 | 343,775 | ||||||

| Total Comprehensive Loss | $ | (3,834,359 | ) | $ | (2,022,719 | ) | ||

| Net Loss Per Common Share: | ||||||||

| Basic | $ | (0.4387 | ) | $ | (0.2480 | ) | ||

| Diluted | $ | (0.4387 | ) | $ | (0.2480 | ) | ||

| Weighted Average Shares Outstanding - Basic | 9,637,051 | 9,540,891 | ||||||

| Weighted Average Shares Outstanding - Diluted | 9,637,051 | 9,540,891 | ||||||

See accompanying notes to the consolidated financial statements.

3

Condensed Consolidated Statements of Changes in Stockholders’ Equity

| Common Stock | Additional Paid in | Accumulated | Accumulated Other Comprehensive | Total Stockholders’ | ||||||||||||||||||||

| Shares | Amount | Capital | Deficits | Income (Loss) | Equity | |||||||||||||||||||

| Balance as of January 1, 2020 | 9,391,729 | $ | 9,392 | $ | 69,560,529 | $ | (23,271,687 | ) | $ | (482,639 | ) | $ | 45,815,595 | |||||||||||

| Stock compensation expense | - | - | 464,827 | - | - | 464,827 | ||||||||||||||||||

| Revaluation of stock warrant | - | - | (66,200 | ) | - | - | (66,200 | ) | ||||||||||||||||

| Other comprehensive income | - | - | - | - | 343,775 | 343,775 | ||||||||||||||||||

| Net loss for the period | - | - | - | (2,366,494 | ) | - | (2,366,494 | ) | ||||||||||||||||

| Balance as of March 31, 2020 (Unaudited) | 9,391,729 | $ | 9,392 | $ | 69,959,156 | $ | (25,638,181 | ) | $ | (138,864 | ) | $ | 44,191,503 | |||||||||||

| Common Stock | Additional Paid in | Accumulated | Accumulated Other Comprehensive | Total Stockholders’ | ||||||||||||||||||||

| Shares | Amount | Capital | Deficits | Income (Loss) | Equity | |||||||||||||||||||

| Balance as of January 1, 2021 | 9,487,889 | $ | 9,488 | $ | 73,160,616 | $ | (32,383,833 | ) | $ | (1,754,228 | ) | $ | 39,032,043 | |||||||||||

| Stock compensation expense | - | - | 1,680,365 | - | - | 1,680,365 | ||||||||||||||||||

| Revaluation of stock warrant | - | - | (355,600 | ) | - | - | (355,600 | ) | ||||||||||||||||

| Other comprehensive income | - | - | - | - | 393,767 | 393,767 | ||||||||||||||||||

| Net loss for the period | - | - | - | (4,228,126 | ) | - | (4,228,126 | ) | ||||||||||||||||

| Balance as of March 31, 2021 (Unaudited) | 9,487,889 | $ | 9,488 | $ | 74,485,381 | $ | (36,611,959 | ) | $ | (1,360,461 | ) | $ | 36,522,449 | |||||||||||

See accompanying notes to the consolidated financial statements.

4

Condensed Consolidated Statements of Cash Flows

For the Three-Month Period ended March 31, 2021 and 2020

| Three

Months Ended March 31, | ||||||||

| 2021 | 2020 | |||||||

| (Unaudited) | (Unaudited) | |||||||

| Cash Flows from Operating Activities | ||||||||

| Net loss | $ | (4,228,126 | ) | $ | (2,366,494 | ) | ||

| Adjustments to reconcile net loss to net cash used for operating activities: | ||||||||

| Depreciation and amortization | 258,315 | 260,789 | ||||||

| Stock-based compensation | 1,680,365 | 464,827 | ||||||

| Consulting expense adjustment to change in fair value of warrants | (355,600 | ) | (66,200 | ) | ||||

| Unrealized investment loss | 624,738 | 80,684 | ||||||

| Amortization of bonds issuance costs | 47,565 | - | ||||||

| Changes in operating assets and liabilities: | ||||||||

| Accounts receivable | - | 451,130 | ||||||

| Inventories | (1,445,680 | ) | (1,256,423 | ) | ||||

| Prepaid expenses and other current assets | (622,495 | ) | (537,262 | ) | ||||

| Deposits | 1,539 | 59,896 | ||||||

| Accounts payable | - | 862,932 | ||||||

| Accrued expenses and other current liabilities | 886,719 | 1,044,429 | ||||||

| Operating lease liability | (1,417 | ) | 23,683 | |||||

| Net Cash Used for Operating Activities | (3,154,077 | ) | (978,009 | ) | ||||

| Cash Flows from Investing Activities | ||||||||

| Proceeds from sales of short-term investment | 6,102 | - | ||||||

| Purchase of short-term investment | - | (198,239 | ) | |||||

| Purchase of property and equipment | (3,521 | ) | (6,846 | ) | ||||

| Purchase of long-term investment | (680 | ) | - | |||||

| Net Cash Provided by (Used for) Investing Activities | 1,901 | (205,085 | ) | |||||

| Cash Flows from Financing Activities | ||||||||

| Proceeds from short-term loan – related party | 2,215,105 | 2,119,669 | ||||||

| Payment on long-term loan | (2,980 | ) | (2,580 | ) | ||||

| Payment on finance lease liability | (3,164 | ) | (516 | ) | ||||

| Net Cash Provided by Financing Activities | 2,208,961 | 2,116,573 | ||||||

| Net Increase (Decrease) in Cash and Restricted Cash | (943,215 | ) | 933,479 | |||||

| Cash and Restricted Cash, Beginning of Period | 3,794,591 | 976,829 | ||||||

| Foreign Currency Translation Effect on Cash | 393,767 | 343,775 | ||||||

| Cash and Restricted Cash, End of Period | $ | 3,245,143 | $ | 2,254,083 | ||||

| Supplemental disclosures of cash flow information: | ||||||||

| Cash paid during the period for income taxes | $ | 1,695 | $ | 1,651 | ||||

| Cash paid during the period for interest | $ | 2,671 | $ | 1,833 | ||||

| Cash and Restricted Cash: | ||||||||

| Cash | $ | 33,632 | $ | 2,226,822 | ||||

| Restricted cash | 3,211,511 | 27,261 | ||||||

| Total | $ | 3,245,143 | $ | 2,254,083 | ||||

See accompanying notes to the consolidated financial statements.

5

Notes to Condensed Consolidated Financial Statements

NOTE 1 - Organization

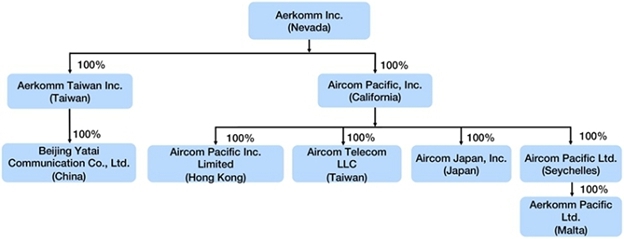

Aerkomm Inc. (formerly Maple Tree Kids Inc.) (“Aerkomm”) was incorporated on August 14, 2013 in the State of Nevada. Aerkomm was a retail distribution company selling all of its products over the internet in the United States, operating in the infant and toddler products business market. Aerkomm’s common stock is quoted for trading on the OTC Markets Group Inc. OTCQX Best Market under the symbol “AKOM.” On July 17, 2019, the French Autorité des Marchés Financiers (the “AMF”) granted visa number 19-372 on the prospectus relating to the admission of Aerkomm’s common stock to list and trade on the Professional Segment of the regulated market of Euronext Paris (“Euronext Paris”). Aerkomm’s common stock began trading on Euronext Paris on July 23, 2019 under the symbol “AKOM” and is denominated in Euros on Euronext Paris. This listing did not alter Aerkomm’s share count, capital structure, or current common stock listing on the OTCQX, where it is also traded (in US dollars) under the symbol “AKOM.”

On December 28, 2016, Aircom Pacific Inc. (“Aircom”) purchased approximately 86.3% of Aerkomm’s issued and outstanding common stock as of the closing date of purchase. As a result of the transaction, Aircom became the controlling shareholder of Aerkomm. Aircom was incorporated on September 29, 2014 under the laws of the State of California.

On February 13, 2017, Aerkomm entered into a share exchange agreement (“Exchange Agreement”) with Aircom and its shareholders, pursuant to which Aerkomm acquired 100% of the issued and outstanding capital stock of Aircom in exchange for approximately 99.7% of the issued and outstanding capital stock of Aerkomm. As a result of the share exchange, Aircom became a wholly-owned subsidiary of Aerkomm, and the former shareholders of Aircom became the holders of approximately 99.7% of Aerkomm’s issued and outstanding capital stock.

On December 31, 2014, Aircom acquired a newly incorporated subsidiary, Aircom Pacific Ltd. (“Aircom Seychelles”), a corporation formed under the laws of the Republic of Seychelles. Aircom Seychelles was formed to facilitate Aircom’s global corporate structure for both business operations and tax planning. Presently, Aircom Seychelles has no operations. Aircom is working with corporate and tax advisers in finalizing its global corporate structure and has not yet concluded its final plan.

On October 17, 2016, Aircom acquired a wholly owned subsidiary, Aircom Pacific Inc. Limited (“Aircom HK”), a corporation formed under the laws of Hong Kong. The purpose of Aircom HK is to conduct Aircom’s business and operations in Hong Kong. Presently, its primary function is business development, both with respect to airlines as well as content providers and advertisement partners based in Hong Kong. Aircom HK is also actively seeking strategic partnerships whom Aircom may leverage in order to provide more and better services to its customers. Aircom also plans to provide local supports to Hong Kong-based airlines via Aircom HK and teleports located in Hong Kong.

On December 15, 2016, Aircom acquired a wholly owned subsidiary, Aircom Japan, Inc. (“Aircom Japan”), a corporation formed under the laws of Japan. The purpose of Aircom Japan is to conduct business development and operations located within Japan. Aircom Japan is in the process of applying for, and will be the holder of, Satellite Communication Blanket License in Japan, which is necessary for Aircom to provide services within Japan. Aircom Japan will also provide local supports to airlines operating within the territory of Japan.

Aircom Telecom LLC (“Aircom Taiwan”), which became a wholly owned subsidiary of Aircom in December 2017, was organized under the laws of Taiwan on June 29, 2016. Aircom Taiwan is responsible for Aircom’s business development efforts and general operations within Taiwan.

On June 13, 2018, Aerkomm established a new wholly owned subsidiary, Aerkomm Taiwan Inc. (“Aerkomm Taiwan”), a corporation formed under the laws of Taiwan. The purpose of Aerkomm Taiwan is to purchase a parcel of land and raise sufficient fund for ground station building and operate the ground station for data processing (although that cannot be guaranteed).

On November 15, 2018, Aircom Taiwan acquired a wholly owned subsidiary, Beijing Yatai Communication Co., Ltd. (“Beijing Yatai”), a corporation formed under the laws of China. The purpose of Beijing Yatai is to conduct Aircom’s business and operations in China. Presently, its primary function is business development, both with respect to airlines as well as content providers and advertisement partners based in China as most business conducted in China requires a local registered company. Beijing Yatai is also actively seeking strategic partnerships whom Aircom may leverage in order to provide more and better services to its customers. Aircom also plans to provide local supports to China-based airlines via Beijing Yatai and teleports located in China. On November 6, 2020, 100% ownership of Beijing Yatai was transferred from Aircom Taiwan to Aerkomm Taiwan.

6

AERKOMM INC. AND SUBSIDIARIES

Notes to Condensed Consolidated Financial Statements

NOTE 1 - Organization - Continued

On October 31, 2019, Aircom Seychelles established a new a wholly owned subsidiary, Aerkomm Pacific Limited (“Aerkomm Malta”), a corporation formed under the laws of Malta. The purpose of Aerkomm Malta is to conduct Aircom’s business and operations and to engage with suppliers and potential airlines customers in the European Union.

The Company’s organization structure is as following:

Aerkomm and its subsidiaries (the “Company”) are full-service, development stage providers of in-flight entertainment and connectivity solutions with their initial market in the Asian Pacific region.

The Company has not generated significant revenues, excluding non-recurring revenues, and will incur additional expenses as a result of being a public reporting company. Currently, the Company has taken measures that management believes will improve its financial position by financing activities, including through ongoing public offerings, short-term borrowings and equity contributions. Two of the Company’s current shareholders (the “Lenders”) each committed to provide to the Company a $10 million bridge loan (together, the “Loans”) for an aggregate principal amount of $20 million, to bridge the Company’s cash flow needs prior to its obtaining a mortgage loan to be secured by a parcel of land (the “Land”) the Company purchased in Taiwan. The Lenders also agreed to an earlier closing of up to 25% of the principal amounts of the Loans upon the Company’s request prior to the time that title to the Land is vested in the Company’s subsidiary, Aerkomm Taiwan, to pay the outstanding payable to the Company’s vendors. As of May 20, 2021, the Company borrowed approximately $1.5 million (unaudited) (NT$41,984,000) (unaudited) under the Loans from one of the Lenders.

On July 29, 2020, the Company filed an amendment to the Registration Statement on Form S-1, originally filed on April 30, 2020, with the Securities and Exchange Commission, or the SEC, pursuant to Section 5 of the Securities Act of 1933 to issue and sell up to 1,951,219 shares (approximately $47,276,000) of the Company’s common stock, at a per share price of €20.50 (approximately $24.23). The Form S-1 is subsequently amended on July 29, 2020, October 21, 2020 and November 5, 2020, and was declared effective on November 6, 2020. As of December 31, 2020, the Company closed a public offering with net proceeds of $1,667,080.

With the $20 million in Loans committed by the Lenders, the remaining amount of €38 million (not including the 15% over-subscription) to be raised from the effective S-1 and future fund raising, the Company believes its working capital will be adequate to sustain its operations for the next twelve months. However, there is no assurance that management will be successful in their plan. There are a number of factors that could potentially arise that could result in shortfalls to the Company’s plan, such as the economic conditions, the competitive pricing in the connectivity industry, the Company’s operating results not continuing to deteriorate and the Company’s bank and shareholders being able to provide continued support.

7

AERKOMM INC. AND SUBSIDIARIES

Notes to Condensed Consolidated Financial Statements

NOTE 2 - Summary of Significant Accounting Policies

Unaudited Interim Financial Information

The accompanying condensed consolidated balance sheet as of March 31, 2021, and the condensed consolidated statements of operations and comprehensive loss and cash flows for the three months ended March 31, 2021 and 2020 are unaudited. The unaudited interim condensed consolidated financial statements have been prepared on the same basis as the annual consolidated financial statements and, in the opinion of management, reflect all adjustments, which include only normal recurring adjustments, necessary to present fairly the Company’s financial position as of March 31, 2021 and the results of operations and cash flows for the three months ended March 31, 2021 and 2020. The financial data and other information disclosed in these notes to the condensed consolidated financial statements related to these three-month periods are unaudited. The results of operations for the three months ended March 31, 2021 are not necessarily indicative of the results to be expected for the year ending December 31, 2021 or for any other interim period or other future year.

Principle of Consolidation

Aerkomm consolidates the accounts of its subsidiaries, Aircom, Aircom Seychelles, Aircom HK, Aircom Japan, Aircom Taiwan, Aerkomm Taiwan, Beijing Yatai and Aerkomm Malta. All significant intercompany accounts and transactions have been eliminated in consolidation.

Use of Estimates

The preparation of consolidated financial statements in conformity with accounting principles generally accepted in the United States of America requires management to make estimates and assumptions that affect the amounts reported in the consolidated financial statements and accompanying notes. Actual results may differ from these estimates.

Concentrations of Credit Risk

Financial instruments that potentially subject the Company to significant concentrations of credit risk consist primarily of cash in banks. As of March 31, 2021 and December 31, 2020, the total balance of cash in bank was fully insured by the Federal Deposit Insurance Corporation (FDIC). The balance of cash deposited in foreign financial institutions exceeding the amount insured by local insurance is approximately $3,108,000 and $3,514,000 as of March 31, 2021 and December 31, 2020, respectively.

Short-term investment

The Company’s short-term investment securities are classified as trading security. The securities are stated at fair value within current assets on the Company’s condensed balance sheets. Fair value is calculated based on publicly available market information or other estimates determined by the Company. Changes in fair value are recorded in current income.

Inventories

Inventories are recorded at the lower of weighted-average cost or net realizable value. The Company assesses the impact of changing technology on its inventory on hand and writes off inventories that are considered obsolete. Estimated losses on scrap and slow-moving items are recognized in the allowance for losses.

8

AERKOMM INC. AND SUBSIDIARIES

Notes to Condensed Consolidated Financial Statements

NOTE 2 - Summary of Significant Accounting Policies - Continued

Property and Equipment

Property and equipment are stated at cost less accumulated depreciation. When value impairment is determined, the related assets are stated at the lower of fair value or book value. Significant additions, renewals and betterments are capitalized. Maintenance and repairs are expensed as incurred.

Depreciation is computed by using the straight-line and double declining methods over the following estimated service lives: ground station equipment – 5 years, computer equipment - 3 to 5 years, furniture and fixtures - 5 years, satellite equipment – 5 years, vehicles – 5 years and lease improvement – 5 years.

Upon sale or disposal of property and equipment, the related cost and accumulated depreciation are removed from the corresponding accounts, with any gain or loss credited or charged to income in the period of sale or disposal.

The Company reviews the carrying amount of property and equipment for impairment when events or changes in circumstances indicate that the carrying amount of such assets may not be recoverable. It determined that there was no impairment loss for the three-month periods ended March 31, 2021 and 2020.

Right-of-Use Asset and Lease Liability

In February 2016, the FASB issued ASU No. 2016-02, “Leases” (Topic 842) (“ASU 2016-02”), which modifies lease accounting for both lessees and lessors to increase transparency and comparability by recognizing lease assets and lease liabilities by lessees for those leases classified as operating leases and finance leases under previous accounting standards and disclosing key information about leasing arrangements.

A lessee should recognize the lease liability to make lease payments and the right-of-use asset representing its right to use the underlying asset for the lease term. For operating leases and finance leases, a right-of-use asset and a lease liability are initially measured at the present value of the lease payments by discount rates. The Company’s lease discount rates are generally based on its incremental borrowing rate, as the discount rates implicit in the Company’s leases is readily determinable. Operating leases are included in operating lease right-of-use assets and lease liabilities in the consolidated balance sheets. Finance leases are included in property and equipment and lease liability in our consolidated balance sheets. Lease expense for operating expense payments is recognized on a straight-line basis over the lease term. Interest and amortization expenses are recognized for finance leases on a straight-line basis over the lease term.

For the leases with a term of twelve months or less, a lessee is permitted to make an accounting policy election by class of underlying asset not to recognize lease assets and lease liabilities. If a lessee makes this election, it should recognize lease expense for such leases generally on a straight-line basis over the lease term. The Company adopted ASU 2016-02 effective January 1, 2019.

Goodwill and Purchased Intangible Assets

The Company’s goodwill represents the amount by which the total purchase price paid exceeded the estimated fair value of net assets acquired from acquisition of subsidiaries. The Company tests goodwill for impairment on an annual basis, or more often if events or circumstances indicate that there may be impairment.

Purchased intangible assets with finite life are amortized on the straight-line basis over the estimated useful lives of respective assets. Purchased intangible assets with indefinite life are evaluated for impairment when events or changes in circumstances indicate that the carrying amount of such assets may not be recoverable. Purchased intangible asset consists of satellite system software and is amortized over 10 years.

Fair Value of Financial Instruments

The Company utilizes the three-level valuation hierarchy for the recognition and disclosure of fair value measurements. The categorization of assets and liabilities within this hierarchy is based upon the lowest level of input that is significant to the measurement of fair value. The three levels of the hierarchy consist of the following:

Level 1 - Inputs to the valuation methodology are unadjusted quoted prices in active markets for identical assets or liabilities that the Company has the ability to access at the measurement date.

9

AERKOMM INC. AND SUBSIDIARIES

Notes to Condensed Consolidated Financial Statements

NOTE 2 - Summary of Significant Accounting Policies - Continued

Fair Value of Financial Instruments-Continued

Level 2 - Inputs to the valuation methodology are quoted prices for similar assets and liabilities in active markets, quoted prices in markets that are not active or inputs that are observable for the asset or liability, either directly or indirectly, for substantially the full term of the instrument.

Level 3 - Inputs to the valuation methodology are unobservable inputs based upon management’s best estimate of inputs market participants could use in pricing the asset or liability at the measurement date, including assumptions.

The carrying amounts of the Company’s cash and restricted cash, accounts receivable, other receivable, accounts payable, short-term loan and other payable approximated their fair value due to the short-term nature of these financial instruments. The Company’s short-term investment and long-term investment are classified within Level 1 of the fair value hierarchy on March 31, 2021. The Company’s long-term bonds payable, long-term loan and lease payable approximated the carrying amount as its interest rate is considered as approximate to the current rate for comparable loans and leases, respectively. There were no outstanding derivative financial instruments as of March 31, 2021.

Revenue Recognition

During 2019, the Company adopted the provisions of ASU 2014-09 “Revenue from Contracts with Customers (Topic 606)” and the principal versus agent guidance within the new revenue standard. As such, the Company identifies a contract with a customer, identifies the performance obligations in the contract, determines the transaction price, allocates the transaction price to each performance obligation in the contract and recognizes revenue when (or as) the Company satisfies a performance obligation.

Income Taxes

Income taxes are accounted for under the asset and liability method. Deferred tax assets and liabilities are computed for differences between the financial statement and tax bases of assets and liabilities that will result in taxable or deductible amounts in the future based on enacted tax laws and rates applicable to the periods in which the differences are expected to affect taxable income. Valuation allowances are established when necessary to reduce deferred tax assets to the amount expected to be realized. Income tax expense is the tax payable or refundable for the period plus or minus the change during the period in deferred tax assets and liabilities. Adjustments to prior period’s income tax liabilities are added to or deducted from the current period’s tax provision.

The Company follows FASB guidance on uncertain tax positions and has analyzed its filing positions in all the federal, state and foreign jurisdictions where it is required to file income tax returns, as well as all open tax years in those jurisdictions. The Company files income tax returns in the US federal, state and foreign jurisdictions where it conducts business. It is not subject to income tax examinations by US federal, state and local tax authorities for years before 2016. The Company believes that its income tax filing positions and deductions will be sustained on audit and does not anticipate any adjustments that will result in a material adverse effect on its consolidated financial position, results of operations, or cash flows. Therefore, no reserves for uncertain tax positions have been recorded. The Company does not expect its unrecognized tax benefits to change significantly over the next twelve months.

The Company’s policy for recording interest and penalties associated with any uncertain tax positions is to record such items as a component of income before taxes. Penalties and interest paid or received, if any, are recorded as part of other operating expenses in the consolidated statement of operations.

Foreign Currency Transactions

Foreign currency transactions are recorded in U.S. dollars at the exchange rates in effect when the transactions occur. Exchange gains or losses derived from foreign currency transactions or monetary assets and liabilities denominated in foreign currencies are recognized in current income. At the end of each period, assets and liabilities denominated in foreign currencies are revalued at the prevailing exchange rates with the resulting gains or losses recognized in income for the period.

Translation Adjustments

If a foreign subsidiary’s functional currency is the local currency, translation adjustments will result from the process of translating the subsidiary’s financial statements into the reporting currency of the Company. Such adjustments are accumulated and reported under other comprehensive income (loss) as a separate component of stockholders’ equity.

10

AERKOMM INC. AND SUBSIDIARIES

Notes to Condensed Consolidated Financial Statements

NOTE 2 - Summary of Significant Accounting Policies - Continued

Earnings (Loss) Per Share

Basic earnings (loss) per share is computed by dividing income available to common shareholders by the weighted average number of shares of common stock outstanding during the period. Diluted earnings per share is computed by dividing income available to common shareholders by the weighted-average number of shares of common outstanding during the period increased to include the number of additional shares of common stock that would have been outstanding if the potentially dilutive securities had been issued. Potentially dilutive securities include stock warrants and outstanding stock options, shares to be purchased by employees under the Company’s employee stock purchase plan.

Subsequent Events

The Company has evaluated events and transactions after the reported period up to May 20, 2021, the date on which these consolidated financial statements were available to be issued. All subsequent events requiring recognition as of March 31, 2021 have been included in these consolidated financial statements.

NOTE 3 - Recent Accounting Pronouncements

Simplifying the Accounting for Debt with Conversion and Other Options.

In June 2020, the FASB issued ASU 2020-06 to simplify the accounting in ASC 470, Debt with Conversion and Other Options and ASC 815, Contracts in Equity’s Own Entity. The guidance simplifies the current guidance for convertible instruments and the derivatives scope exception for contracts in an entity’s own equity. Additionally, the amendments affect the diluted EPS calculation for instruments that may be settled in cash or shares and for convertible instruments. This ASU will be effective beginning in the first quarter of the Company’s fiscal year 2022. Early adoption is permitted. The amendments in this update must be applied on either full retrospective basis or modified retrospective basis through a cumulative-effect adjustment to retained earnings/(deficit) in the period of adoption. The Company is currently evaluating the impact of ASU 2020-06 on its consolidated financial statements and related disclosures, as well as the timing of adoption.

Financial Instruments

In June 2016, the FASB issued ASU 2016-13, “Financial Instruments - Credit Losses (Topic 326): Measurement of Credit Losses on Financial Instruments” (“ASU 2016-13”), which modifies the measurement of expected credit losses of certain financial instruments. In February 2020, the FASB issued ASU 2020-02 and delayed the effective date of ASU 2016-13 until fiscal year beginning after December 15, 2022. The Company is currently evaluating the impact of adopting ASU 2016-13 on its consolidated financial statements.

Simplifying the Accounting for Income Taxes

In December 2019, the FASB issued ASU 2019-12 to simplify the accounting in ASC 740, “Income Taxes.” This guidance removes certain exceptions related to the approach for intra-period tax allocation, the methodology for calculating income taxes in an interim period, and the recognition of deferred tax liabilities for outside basis differences. This guidance also clarifies and simplifies other areas of ASC 740. This ASU will be effective beginning in the first quarter of the Company’s fiscal year 2021. Early adoption is permitted. Certain amendments in this update must be applied on a prospective basis, certain amendments must be applied on a retrospective basis, and certain amendments must be applied on a modified retrospective basis through a cumulative-effect adjustment to retained earnings/(deficit) in the period of adoption. The adoption of ASU 2019-12 does not have a significant impact on the Company’s consolidated financial statements as of and for the three-month period ended March 31, 2021.

Earnings Per Share

In April 2021, the FASB issued ASU 2021-04, which included Topic 260 “Earnings Per Share”. This guidance clarifies and reduces diversity in an issuer’s accounting for modifications or exchanges of freestanding equity-classified written call options due to a lack of explicit guidance in the FASB Codification. The ASU 2021-04 is effective for all entities for fiscal years beginning after December 15, 2021. Early adoption is permitted. The Company is currently evaluating the impact of adopting ASU 2021-04 on its consolidated financial statements.

11

AERKOMM INC. AND SUBSIDIARIES

Notes to Condensed Consolidated Financial Statements

NOTE 4 - Inventories

As of March 31, 2021 and December 31, 2020, inventories consisted of the following:

| March

31, 2021 | December 31, 2020 | |||||||

| (Unaudited) | ||||||||

| Satellite equipment for sale under construction | $ | 6,476,397 | $ | 4,669,297 | ||||

| Supplies | 5,193 | 5,317 | ||||||

| 6,481,590 | 4,674,614 | |||||||

| Allowance for inventory loss | (5,193 | ) | (5,317 | ) | ||||

| Net | 6,476,397 | 4,669,297 | ||||||

| Prepayment for inventory | 180,710 | 542,130 | ||||||

| Total | $ | 6,657,107 | $ | 5,211,427 | ||||

NOTE 5 - Property and Equipment

As of March 31, 2021 and December 31, 2020, the balances of property and equipment were as follows:

| March

31, 2021 | December 31, 2020 | |||||||

| (Unaudited) | ||||||||

| Ground station equipment | $ | 1,876,458 | $ | 1,876,458 | ||||

| Computer software and equipment | 339,229 | 335,708 | ||||||

| Satellite equipment | 275,410 | 275,410 | ||||||

| Vehicle | 198,741 | 198,741 | ||||||

| Leasehold improvement | 83,721 | 83,721 | ||||||

| Furniture and fixture | 36,382 | 36,382 | ||||||

| 2,809,941 | 2,806,420 | |||||||

| Accumulated depreciation | (1,548,756 | ) | (1,414,191 | ) | ||||

| Net | 1,261,185 | 1,392,229 | ||||||

| Prepayments - land | 35,861,589 | 35,861,589 | ||||||

| Prepaid equipment | 86,617 | 86,617 | ||||||

| Net | $ | 37,209,391 | $ | 37,340,435 | ||||

On May 1, 2018, the Company and Aerkomm Taiwan entered into a binding memorandum of understanding with Tsai Ming-Yin (the “Seller”) with respect to the acquisition by Aerkomm Taiwan of a parcel of land located in Taiwan. The land is expected to be used to build a satellite ground station and data center. On July 10, 2018, the Company, Aerkomm Taiwan and the Seller entered into a certain real estate sales contract regarding this acquisition. Pursuant to the terms of the contract, and subsequent amendments on July 30, 2018, September 4, 2018, November 2, 2018 and January 3, 2019, the Company paid to the seller in installments refundable prepayments of $33,850,000 as of December 31, 2018. On July 2, 2019, the Company paid the remaining purchase price balance of $624,462. As of March 31, 2021 and December 31, 2020, the estimated commission payable for the land purchase in the amount of $1,387,127 was recorded to the cost of land and the payment to be paid after the full payment of the Land acquisition price no later than December 31, 2021.

Depreciation expense was $134,565 (unaudited) and $137,039 (unaudited) for the three-month periods ended March 31, 2021 and 2020, respectively.

NOTE 6 – Long-term Investment

On December 3, 2020, the Company entered into three separate stock purchase agreements (or “Stock Purchase Agreement”) from three individuals to purchase an aggregate of 6,000,000 restricted shares of one of the Company’s related party, YuanJiu Inc. (YuanJiu) in a total amount of NT$141,175,000. YuanJiu is a listed company in Taiwan Stock Exchange and the stock title transfer is subject to certain restriction.

In the Stock Purchase Agreement, there was the restriction on the stock title transfer until May 13, 2021. As of May 20, 2021, the restriction on the stock transfer was released and the stock title transfer process is under review of Taiwan government and subject to the approval of Taiwan government. The parties agreed to transfer the title once approved. As of March 31, 2021 and December 31, 2020, the investment was recorded as prepayment for long-term investment and was approximately 10% ownership of YuanJiu. The Company intends to hold the investment for long-term purpose.

12

AERKOMM INC. AND SUBSIDIARIES

Notes to Condensed Consolidated Financial Statements

NOTE 6 – Long-term Investment - Continued

As of March 31, 2021 and December 31, 2020, the fair value of the investment was as follows:

| March

31, 2021 | December 31, 2020 | |||||||

| (Unaudited) | ||||||||

| Investment cost | $ | 4,956,987 | $ | 5,027,600 | ||||

| Less: Allowance for value decline | (1,322,858 | ) | (722,044 | ) | ||||

| Net | $ | 3,634,129 | $ | 4,305,556 | ||||

On March 24, 2021, the Company purchased additional 1,000 shares of YuanJiu’s common stock in a total amount of $680 (unaudited) from a related party.

NOTE 7 - Intangible Asset, Net

As of March 31, 2021 and December 31, 2020, the cost and accumulated amortization for intangible asset were as follows:

| March

31, 2021 | December 31, 2020 | |||||||

| (Unaudited) | ||||||||

| Satellite system software | $ | 4,950,000 | $ | 4,950,000 | ||||

| Accumulated amortization | (2,681,250 | ) | (2,557,500 | ) | ||||

| Net | $ | 2,268,750 | $ | 2,392,500 | ||||

Amortization expense was $123,750 (unaudited) for each of the three-month periods ended March 31, 2021 and 2020.

NOTE 8 – Short-term Investment and Restricted Cash

On September 9, 2019, the Company entered into a liquidity agreement with a security company (“the Liquidity Provider”) in France, which is consistent with customary practice in the French securities market. The liquidity agreement complies with applicable laws and regulations in France and authorizes the Liquidity Provider to carry out market purchases and sales of shares of the Company’s common stock on the Euronext Paris market. To enable the Liquidity Provider to carry out the interventions provided for in the contract, the Company contributed approximately $225,500 (200,000 euros) into the account. The transaction was initiated from the beginning of 2020, and the Company will pay the compensation of 20,000 euros in advance by semi-annual installments at the beginning of the semi-annual period of the agreement. The liquidity agreement has a term of one year and will be renewed automatically unless otherwise terminated by either party. As of March 31, 2021, the Company purchased 11,135 shares (unaudited) of its common stock with the fair value of $75,840 (unaudited). The securities were recorded as short-term investment with accumulated unrealized loss of $151,232. The remaining cash balance of $1,511 (€1,287) (unaudited) was recorded under restricted cash.

NOTE 9 - Operating and Finance Leases

| A. | Lease term and discount rate: |

The weighted-average remaining lease term and discount rate related to the leases were as follows:

| 2021 | 2020 | |||||||

| Weighted-average remaining lease term | (Unaudited) | |||||||

| Operating lease | 1.73 Years | 2.01 Years | ||||||

| Finance lease | 3.60 Years | 3.84 Years | ||||||

| Weighted-average discount rate | ||||||||

| Operating lease | 6.00 | % | 6.00 | % | ||||

| Finance lease | 3.82 | % | 3.82 | % | ||||

13

AERKOMM INC. AND SUBSIDIARIES

Notes to Condensed Consolidated Financial Statements

NOTE 9 - Operating and Finance Leases - Continued

| B. | The balances for the operating and finance leases are presented as follows within the consolidated balance sheets as of March 31, 2021 and December 31, 2020: |

Operating Leases

| March

31, 2021 | December 31, 2020 | |||||||

| (Unaudited) | ||||||||

| Right-of-use assets | $ | 328,564 | $ | 353,442 | ||||

| Lease liability – current | $ | 367,700 | $ | 346,870 | ||||

| Lease liability – non-current | $ | 126,370 | $ | 173,308 | ||||

Finance Leases

| March

31, 2021 | December 31, 2020 | |||||||

| (Unaudited) | ||||||||

| Property and equipment, at cost | $ | 56,770 | $ | 56,770 | ||||

| Accumulated depreciation | (16,121 | ) | (13,098 | ) | ||||

| Property and equipment, net | $ | 40,649 | $ | 43,672 | ||||

| Lease liability - current | $ | 10,959 | $ | 11,010 | ||||

| Lease liability – non-current | 33,835 | 37,135 | ||||||

| Total finance lease liabilities | $ | 44,794 | $ | 48,145 | ||||

The components of lease expense are as follows within the consolidated statements of operations and comprehensive loss for the three-month periods ended March 31, 2021 and 2020:

Operating Leases

| March

31, 2021 | March 31, 2020 | |||||||

| (Unaudited) | (Unaudited) | |||||||

| Lease expense | $ | 57,932 | $ | 111,997 | ||||

| Sublease rental income | (2,826 | ) | (2,754 | ) | ||||

| Net lease expense | $ | 55,106 | $ | 109,243 | ||||

Finance Leases

| March

31, 2021 | March 31, 2020 | |||||||

| (Unaudited) | (Unaudited) | |||||||

| Amortization of right-of-use asset | $ | 3,023 | $ | 3,090 | ||||

| Interest on lease liabilities | 451 | 516 | ||||||

| Total finance lease cost | $ | 3,474 | $ | 3,606 | ||||

Supplemental cash flow information related to leases for the three-month periods ended March 31, 2021 and 2020 is as follows:

| March

31, 2021 | March 31, 2020 | |||||||

| (Unaudited) | (Unaudited) | |||||||

| Cash paid for amounts included in the measurement of lease liabilities: | ||||||||

| Operating cash outflows from operating leases | $ | 45,085 | $ | 65,420 | ||||

| Operating cash outflows from finance lease | $ | 2,713 | $ | 2,952 | ||||

| Financing cash outflows from finance lease | $ | 451 | $ | 516 | ||||

| Leased assets obtained in exchange for lease liabilities: | ||||||||

| Operating leases | $ | 27,288 | $ | 15,441 | ||||

14

AERKOMM INC. AND SUBSIDIARIES

Notes to Condensed Consolidated Financial Statements

NOTE 9 - Operating and Finance Leases - Continued

Maturity of lease liabilities:

Operating Leases

| Related

Party | Others | Total | ||||||||||

| (Unaudited) | (Unaudited) | (Unaudited) | ||||||||||

| April 1, 2021 – March 31, 2022 | $ | 47,848 | $ | 333,719 | $ | 381,567 | ||||||

| April 1, 2022 – March 31, 2023 | 11,962 | 103,609 | 115,571 | |||||||||

| April 1, 2023 – March 31, 2024 | - | 14,876 | 14,876 | |||||||||

| Total lease payments | $ | 59,810 | $ | 452,204 | $ | 512,014 | ||||||

| Less: Imputed interest | (2,326 | ) | (15,618 | ) | (17,944 | ) | ||||||

| Present value of lease liabilities | $ | 57,484 | $ | 436,586 | $ | 494,070 | ||||||

| Current portion | (45,641 | ) | (322,059 | ) | (367,700 | ) | ||||||

| Non-current portion | $ | 11,843 | $ | 114,527 | $ | 126,370 | ||||||

Finance Leases

| Total | ||||

| (Unaudited) | ||||

| April 1, 2021 – March 31, 2022 | $ | 12,480 | ||

| April 1, 2022 – March 31, 2023 | 12,480 | |||

| April 1, 2023 – March 31, 2024 | 12,480 | |||

| April 1, 2024 – March 31, 2025 | 10,791 | |||

| Total lease payments | $ | 48,231 | ||

| Less: Imputed interest | (3,437 | ) | ||

| Present value of lease liabilities | $ | 44,794 | ||

| Current portion | (10,959 | ) | ||

| Non-current portion | $ | 33,835 | ||

NOTE 10 - Short-term Loan

In 2021, the Company entered into a loan agreement in the amount of $423,225 with one of the Company’s insurance service provider in order to pay the Company’s insurance premium. The loan matures on September 25, 2021 with annual interest rate of 3.3%. The Company is required to make the installment payment monthly. Future installment payments as of March 31, 2021 are $297,476.

NOTE 11 - Long-term Loan

The Company has a car loan credit line of NT$1,500,000 (approximately US$48,371), which matures on May 21, 2024, from a Taiwan financing company with annual interest rate of 9.7%. The installment payment plan is 60 months to pay off the balance on the 21st of each month. Future installment payments as of March 31, 2021 are as follows:

| Twelve months ending March 31, | (Unaudited) | |||

| 2022 | $ | 13,336 | ||

| 2023 | 13,336 | |||

| 2024 | 13,336 | |||

| 2025 | 2,223 | |||

| Total installment payments | 42,231 | |||

| Less: Imputed interest | (6,006 | ) | ||

| Present value of long-term loan | 36,225 | |||

| Current portion | (10,260 | ) | ||

| Non-current portion | $ | 25,965 | ||

15

AERKOMM INC. AND SUBSIDIARIES

Notes to Condensed Consolidated Financial Statements

NOTE 12 – Long-term Bonds Payable and Restricted Cash

On December 3, 2020, the Company closed a private placement offering consisting of US$10,000,000 in aggregate principal amount of its Credit Enhanced Zero Coupon Convertible Bonds (the “Zero Coupon Bonds”) and US$200,000 in aggregate principal amount of its 7.5% convertible bonds (the “Coupon Bonds”), both due on December 2, 2025 (collectively the “Bonds”). Unless previously redeemed, converted or repurchased and cancelled, the Zero-Coupon Bonds will be redeemed on December 2, 2025 at 105.11% of their principal amount and the Coupon Bonds will be redeemed on December 2, 2025 at 100% of their principal amount plus any accrued and unpaid interest. The Coupon Bonds will bear interest from and including December 2, 2020 at the rate of 7.5% per annum. Interest on the Coupon Bonds is payable semi-annually in arrears on June 1 and December 1 each year, commencing on June 1, 2021.

The Company has the option to redeem the Bonds at a redemption amount equal to the Early Redemption Amount, as defined in the Offering Memorandum, at any time on or after December 2, 2023 and prior to the Maturity Date, if the Closing Price of the Company’s Common Stock listed on the Euronext Paris for 20 trading days in any period of 30 consecutive trading days, the last day of which occurs not more than fifteen trading days prior to the date on which notice of such redemption is given, is greater than 130% of the Conversion Price on each applicable trading day or (ii) in whole or in part of the Bonds on the second anniversary of the issue date or (iii) where 90% or more in principal amount of the Bonds issued have been redeemed, converted or repurchased and cancelled.

Unless previously redeemed, converted or repurchased and cancelled, the Bonds may be converted at any time on or after December 3, 2020 up to November 20, 2025 into shares of Common Stock of the Company with a par value of $0.001 each. The initial conversion price for the Bonds is $13.30 per share and is subject to adjustment in specified circumstances.

Holders of the Bonds may also require the Company to repurchase all or part of the Bonds on the third anniversary of the Issue Date, at the Early Redemption Amount. Unless the Bonds have been previously redeemed, converted or repurchased and cancelled, Holders of the Bonds will also have the right to require the Company to repurchase the Bonds for cash at the Early Redemption Amount if an event of delisting or a change of control occurs.

Pursuant to the agreements of Bonds, Bank of Panhsin Co., Ltd. (the “BG Bank”) committed to issue a bank guarantee for the benefit of the holders of the Bonds. The Bank Guarantee is intended to provide a source of funds for the principal, premium, interest (if any) and any other payment obligations of the Company which shall include the default interest under the Bonds upon the Company’s failure to pay amounts pursuant to the Indenture or upon the Bonds being declared due and payable on the occurrence of an Event of Default pursuant to this Indenture. In order to obtain the guarantee from BG Bank, the Company entered into a line of credit in the amount of $10,700,000 with BG Bank on December 1, 2020. The line of credit will be expired on December 2, 2025. The annual fee is based on 1% of the line of credit amount and due quarterly. The line of credit is guaranteed by one of the Company’s shareholder with his personal property, and the Company’s time deposit of $3,210,000 (the “Deposit”) at BG Bank is pledged as collateral as of March 31, 2021 and December 31, 2020, and the Deposit was recorded as restricted cash.

As of March 31, 2021 and December 31, 2020, the long-term bonds payable consisted of the following:

| March

31, 2021 | December

31, 2020 | |||||||

| (Unaudited) | ||||||||

| Credit Enhanced Zero Coupon Convertible Bonds | $ | 10,000,000 | $ | 10,000,000 | ||||

| Coupon Bonds | 200,000 | 200,000 | ||||||

| 10,200,000 | 10,200,000 | |||||||

| Unamortized loan fee | (934,341 | ) | (981,906 | ) | ||||

| Net | $ | 9,265,659 | $ | 9,218,094 | ||||

NOTE 13 - Prepayment from Customer

On March 9, 2015, the Company entered into a 10-year purchase agreement with Klingon Aerospace, Inc. (“Klingon”), which was formerly named as Luxe Electronic Co., Ltd. In accordance with the terms of this agreement, Klingon agreed to purchase from the Company an initial order of onboard equipment comprising an onboard system for a purchase price of $909,000, with payments to be made in accordance with a specific milestones schedule. As of March 31, 2021 and December 31, 2020, the Company received $762,000 from Klingon in milestone payments towards the equipment purchase price. As of March 31, 2021, the project is still ongoing.

16

AERKOMM INC. AND SUBSIDIARIES

Notes to Condensed Consolidated Financial Statements

NOTE 14 - Income Taxes

Income tax expense for the three-month periods ended March 31, 2021 and 2020 consisted of the following:

| Three

Months Ended March 31, | ||||||||

| 2021 | 2020 | |||||||

| Current: | (Unaudited) | (Unaudited) | ||||||

| Federal | $ | - | $ | - | ||||

| State | 1,600 | 1,600 | ||||||

| Foreign | 1,695 | 1,652 | ||||||

| Total | $ | 3,295 | $ | 3,252 | ||||

The following table presents a reconciliation of the Company’s income tax at statutory tax rate and income tax at effective tax rate for the three-month periods ended March 31, 2021 and 2020.

| Three

Months Ended March 31, | ||||||||

| 2021 | 2020 | |||||||

| (Unaudited) | (Unaudited) | |||||||

| Tax benefit at statutory rate | $ | (1,091,340 | ) | $ | (615,289 | ) | ||

| Net operating loss carryforwards (NOLs) | (113,227 | ) | 237,659 | |||||

| Foreign investment losses | 451,534 | 135,438 | ||||||

| Stock-based compensation expense | 357,400 | 97,600 | ||||||

| Amortization expense | 22,630 | 12,716 | ||||||

| Accrued payroll | 61,900 | 45,100 | ||||||

| Unrealized exchange losses | 299,703 | 80,676 | ||||||

| Others | 14,695 | 9,352 | ||||||

| Tax expense at effective tax rate | $ | 3,295 | $ | 3,252 | ||||

Deferred tax assets (liability) as of March 31, 2021 and December 31, 2020 consist approximately of:

| March

31, 2021 | December 31, 2020 | |||||||

| (Unaudited) | ||||||||

| Net operating loss carryforwards (NOLs) | $ | 8,302,000 | $ | 8,018,000 | ||||

| Stock-based compensation expense | 2,500,000 | 2,024,000 | ||||||

| Accrued expenses and unpaid expense payable | 382,000 | 309,000 | ||||||

| Tax credit carryforwards | 68,000 | 68,000 | ||||||

| Unrealized investment loss | 266,000 | 144,000 | ||||||

| Unrealized exchange losses (gain) | 80,000 | (193,000 | ) | |||||

| Excess of tax amortization over book amortization | (505,000 | ) | (577,000 | ) | ||||

| Others | (140,000 | ) | (173,000 | ) | ||||

| Gross | 10,953,000 | 9,620,000 | ||||||

| Valuation allowance | (10,953,000 | ) | (9,620,000 | ) | ||||

| Net | $ | - | $ | - | ||||

17

AERKOMM INC. AND SUBSIDIARIES

Notes to Condensed Consolidated Financial Statements

NOTE 14 - Income Taxes - Continued

Management does not believe the deferred tax assets will be utilized in the near future; therefore, a full valuation allowance is provided. The net change in deferred tax assets valuation allowance was an increase of approximately $1,333,000 (unaudited) for the three months ended March 31, 2021.

As of March 31, 2021 and December 31, 2020, the Company had federal NOLs of approximately $8,243,000 available to reduce future federal taxable income, expiring in 2037, and additional federal NOLs of approximately $17,107,000 (unaudited) and $16,743,000, respectively, were generated and will be carried forward indefinitely to reduce future federal taxable income. As of March 31, 2021 and December 31, 2020, the Company had State NOLs of approximately $26,363,000 (unaudited) and $27,461,000 respectively, available to reduce future state taxable income, expiring in 2041.

As of March 31, 2021 and December 31, 2020, the Company has Japan NOLs of approximately $369,000 (unaudited) and $392,000, respectively, available to reduce future Japan taxable income, expiring in 2031.

As of March 31, 2021 and December 31, 2020, the Company has Taiwan NOLs of approximately $1,433,000 (unaudited) and $2,405,000, respectively, available to reduce future Taiwan taxable income, expiring in 2031.

As of March 31, 2021 and December 31, 2020, the Company had approximately $37,000 (unaudited) and $37,000 of federal research and development tax credit, available to offset future federal income tax. The credit begins to expire in 2034 if not utilized. As of March 31, 2021 and December 31, 2020, the Company had approximately $39,000 (unaudited) and $39,000 of California state research and development tax credit available to offset future California state income tax. The credit can be carried forward indefinitely.

The Company’s ability to utilize its federal and state NOLs to offset future income taxes is subject to restrictions resulting from its prior change in ownership as defined by Internal Revenue Code Section 382. The Company does not expect to incur the limitation on NOLs utilization in future annual usage.

NOTE 15 - Capital Stock

| 1) | Preferred Stock: |

The Company is authorized to issue 50,000,000 shares of preferred stock, with par value of $0.001. As of March 31, 2021, there were no preferred stock shares outstanding. The Board of Directors has the authority to issue preferred stock in one or more series, and in connection with the creation of any such series, by resolutions providing for the issuance of the shares thereof, to determine dividends, voting rights, conversion rights, redemption privileges and liquidation preferences.

| 2) | Common Stock: |

The Company is authorized to issue 90,000,000 shares of common stock with par value of $0.001.

On February 13, 2017, all of Aircom’s 5,513,334 restricted shares were converted to 2,055,947 shares of Aerkomm’s restricted stock at the ratio of 2.681651 to 1, pursuant to the Exchange Agreement (see Note 1). As of March 31, 2021 and December 31, 2020, the restricted shares consisted of the following:

| March 31, 2021 | December 31, 2020 | |||||||

| (Unaudited) | ||||||||

| Restricted stock - vested | 1,802,373 | 1,802,373 | ||||||

| Restricted stock - unvested | 149,162 | 149,162 | ||||||

| Total restricted stock | 1,951,535 | 1,951,535 | ||||||

The unvested shares of restricted stock were recorded under a deposit liability account awaiting future conversion to common stock when they become vested.

18

AERKOMM INC. AND SUBSIDIARIES

Notes to Condensed Consolidated Financial Statements

NOTE 15 - Capital Stock – Continued

| 3) | Stock Warrant: |

In connection with the Underwriting Agreement with Boustead Securities, LLC, or Boustead, the Company agreed to issue to Boustead warrants to purchase a number of the Company’s shares equal to 6% of the gross proceeds of the public offering, which shall be exercisable, in whole or in part, commencing on April 13, 2018 and expiring on the five-year anniversary at an initial exercise price of $53.125 per share, which is equal to 125% of the offering price paid by investors. As of December 31, 2019, the Company issued total warrants to Boustead to purchase 77,680 shares of the Company’s stock.

For the three-month periods ended March 31, 2021 and 2020, the Company recorded decrease of $355,600 and $66,200, respectively, in additional paid-in capital as adjustment for the issuance costs of these stock warrants.

NOTE 16 - Major Vendor

The Company has one unrelated major vendor, which represents 10% or more of the total purchases of the Company for the three-month periods ended March 31, 2021 and 2020. Purchase from the vendor was $0 and $1,256,423 for the three-month periods ended March 31, 2021 and 2020, respectively, and account payable to the vendor was $1,874,339 and $1,775,662 as of March 31, 2021 and December 31, 2020, respectively.

NOTE 17 - Significant Related Party Transactions

In addition to the information disclosed in other notes, the Company has significant related party transactions as follows:

| A. | Name of related parties and relationships with the Company: |

| Related Party | Relationship | |

| Well Thrive Limited (“WTL”) | Major stockholder | |

| Yuan Jiu Inc. (“Yuan Jiu”) | Stockholder; Albert Hsu, a Director of Aerkomm, is the Chairman | |

| AA Twin Associates Ltd. (“AATWIN”) | Georges Caldironi, COO of Aerkomm, is the sole owner | |

| EESquare Japan (“EESquare JP”) | Yih Lieh (Giretsu) Shih, President Aircom Japan, is the Director | |

| Wealth Wide Int’l Ltd. (“WWI”) | Bummy Wu, a stockholder, is the Chairman |

| B. | Significant related party transactions: |

The Company has extensive transactions with its related parties. It is possible that the terms of these transactions are not the same as those which would result from transactions among wholly unrelated parties.

| a. | As of March 31, 2021 and December 31, 2020: |

| March

31, 2021 | December 31, 2020 | |||||||

| (Unaudited) | ||||||||

| Inventory prepayment to Yuan Jiu1 | $ | 180,710 | $ | 542,130 | ||||

| Loan from WTL2 | $ | 2,444,695 | $ | 527,066 | ||||

| Other payable to: | ||||||||

| AATWIN3 | $ | 201,061 | $ | 146,673 | ||||

| Interest payable to WTL2 | 25,225 | 7,623 | ||||||

| Others4 | 355,103 | 296,890 | ||||||

| Total | $ | 581,389 | $ | 451,186 | ||||

| Lease liability to WWI5 | $ | 57,484 | $ | 68,661 | ||||

19

AERKOMM INC. AND SUBSIDIARIES

Notes to Condensed Consolidated Financial Statements

NOTE 17 - Related Party Transactions - Continued

| 1. | Represents inventory prepayment paid to Yuan Jiu. On May 11, 2020, the Company entered into a product purchase agreement (PO1) with Yuan Jiu to purchase 100 sets of the AirCinema Cube to be installed on aircraft of commercial airline customers. The total purchase amount under this agreement was $1,807,100 and the Company paid 20% of the total amount, or $361,420, as an initial deposit. On July 15, 2020, the Company signed a second product purchase agreement (PO2) of $1,807,100 with Yuan Jiu for an additional 100 sets of the AirCinema Cube for the same purchase amount and paid a 10% initial deposit of $180,710 on this agreement as well. In February 2021, the Company paid the remaining balance of PO1 and received the inventory with aggregate value of $1,807,100. |

| 2. | The Company has loans from WTL due to operational needs under the Loans (Note 1). The original loan amount was approximately $2.64M (NTD 80,000,000). The loan agreement, with an interest rate of 5% per annum, will terminate on December 31, 2021. The Company has repaid approximately $0.24M (NTD 10,375,000) of the outstanding loan amount as of March 31, 2021. As of May 20, 2021, the Company borrowed approximately additional $1.5M (unaudited) (NTD 41,984,000) (unaudited) from WTL under the loans. |

| 3. | Represents payable to AATWIN due to consulting agreement on January 1, 2019. The monthly consulting fee is EUR 15,120 (approximately $17,000) and will be expired December 31, 2021. |

| 4. | Represents payable to employees as a result of regular operating activities. |

| 5. | Aircom Hong Kong has a lease agreement with WWI for the warehouse with a monthly rental cost of $450. The lease term was from July 1, 2020 to June 30, 2022. Aircom Hong Kong has another lease agreement with WWI for its office space in Hong Kong. The original lease term was from June 28, 2018 to June 27, 2020 with a monthly rental cost of HKD 29,897 (approximately $3,847). The Company renewed the lease on June 27, 2020 and the current lease term is from June 28, 2020 to June 27, 2022 with a monthly rental cost of HKD 30,000 (approximately $3,829). |

| b. | For the three-month periods ended March 31, 2021 and 2020: |

| Three

Months Ended March 31, | ||||||||

| 2021 | 2020 | |||||||

| (Unaudited) | (Unaudited) | |||||||

| Purchase from Yuan Jiu1 | $ | 1,807,100 | $ | - | ||||

| Consulting expense charged by AATWIN3 | 54,388 | 50,111 | ||||||

| Interest expense charged by WTL2 | 17,951 | 3,987 | ||||||

| Rental expense charged by WWI5 | 11,988 | 11,542 | ||||||

| Rental income from EESqaure JP6 | (2,826 | ) | (2,754 | ) | ||||

| 6. | Aircom Japan entered into a sublease agreement with EESquare JP for the period between March 5, 2019 and March 4, 2021. Pursuant to the terms of this lease agreement, EESquare JP pays Aircom Japan a rental fee of approximately $920 per month. |

NOTE 18 - Stock Based Compensation

In March 2014, Aircom’s Board of Directors adopted the 2014 Stock Option Plan (the “Aircom 2014 Plan”). The Aircom 2014 Plan provided for the granting of incentive stock options and non-statutory stock options to employees, consultants and outside directors of Aircom. On February 13, 2017, pursuant to the Exchange Agreement, Aerkomm assumed the options of Aircom 2014 Plan and agreed to issue options for an aggregate of 1,088,882 shares to Aircom’s stock option holders.

One-third of stock option shares will be vested as of the first anniversary of the time the option shares are granted or the employee’s acceptance to serve the Company, and 1/36th of the shares will be vested each month thereafter. Option price is determined by the Board of Directors. The Aircom 2014 Plan became effective upon its adoption by the Board and shall continue in effect for a term of 10 years unless sooner terminated under the terms of Aircom 2014 Plan.

On May 5, 2017, the Board of Directors of Aerkomm adopted the Aerkomm Inc. 2017 Equity Incentive Plan (the “Aerkomm 2017 Plan” and together with the Aircom 2015 Plan, the “Plans”) and the reservation of 1,000,000 shares of common stock for issuance under the Aerkomm 2017 Plan. On June 23, 2017, the Board of Directors voted to increase the number of shares of common stock reserved for issuance under the Aerkomm 2017 Plan to 2,000,000 shares. The Aerkomm 2017 Plan provides for the granting of incentive stock options and non-statutory stock options to employees, consultants and outside directors of the Company, as determined by the Compensation Committee of the Board of Directors (or, prior to the establishment of the Compensation Committee on January 23, 2018, the Board of Directors).

20

AERKOMM INC. AND SUBSIDIARIES

Notes to Condensed Consolidated Financial Statements

NOTE 18 - Stock Based Compensation - Continued

On June 23, 2017, the Board of Directors agreed to issue options for an aggregate of 291,000 shares under the Aerkomm 2017 Plan to certain officers and directors of the Company. The option agreements are classified into three types of vesting schedule, which includes, 1) 1/6 of the shares subject to the option shall vest commencing on the vesting start date and the remaining shares shall vest at the rate of 1/60 for the next 60 months on the same day of the month as the vesting start date; 2) 1/4 of the shares subject to the option shall vest commencing on the vesting start date and the remaining shares shall vest at the rate of 1/36 for the next 36 months on the same day of the month as the vesting start date; 3) 1/3 of the shares subject to the option shall vest commencing on the first anniversary of vesting start date and the remaining shares shall vest at the rate of 50% each year for the next two years on the same day of the month as the vesting start date.

On July 31, 2017, the Board of Directors approved to issue options for an aggregate of 109,000 shares under the Aerkomm 2017 Plan to 11 of its employees. 1/3 of these shares subject to the option shall vest commencing on the first anniversary of vesting start date and the remaining shares shall vest at the rate of 50% each year for the next two years on the same day of the month as the vesting start date.

On December 29, 2017, the Board of Directors approved to issue options for an aggregate of 12,000 shares under the Aerkomm 2017 Plan to three of the Company’s independent directors, 4,000 shares each. All of these options were vested immediately upon issuance.

On June 19, 2018, the Compensation Committee approved to issue options for 32,000 and 30,000 shares under the Aerkomm 2017 Plan to two of the Company executives. One-fourth of the 32,000 shares subject to the option shall vest on May 1, 2019, 2020, 2021 and 2022, respectively. One-third of the 30,000 shares subject to the option shall vest on May 29, 2019, 2020 and 2021, respectively.

On September 16, 2018, the Compensation Committee approved to issue options for 4,000 shares under the Aerkomm 2017 Plan to one of the Company’s independent directors. These options shall be vested immediately.

On December 29, 2018, the Compensation Committee approved to issue options for an aggregate of 12,000 shares under the Aerkomm 2017 Plan to three of the Company’s independent directors, 4,000 shares each. All of these options were vested immediately upon issuance.

On July 2, 2019, the Board of Directors approved the grant of options to purchase an aggregate of 339,000 shares under the Aerkomm 2017 Plan to 22 of its directors, officers and employees. 25% of the shares vested on the grant date, 25% of the shares vested on July 17, 2019, 25% of the shares will vest on the first anniversary of the grant date, and 25% of the shares will vest upon the second anniversary of the grant date.

On October 4, 2019, the Board of Directors approved the grant of options to purchase an aggregate of 85,400 shares under the Aerkomm 2017 Plan to three (3) of its employees. 25% of the shares vested on the grant date, and 25% of the shares will vest on each of October 4, 2020, October 4, 2021 and October 4, 2022, respectively.

On December 29, 2019, the Board of Directors approved to issue options for an aggregate of 12,000 shares under the Aerkomm 2017 Plan to three of the Company’s independent directors, 4,000 shares each. All of these options shall vest at the date of 1/12th each month for the next 12 months on the same day of December 2019.

On February 19, 2020, the Board of Directors approved to issue options for 2,000 shares under the Aerkomm 2017 Plan to one of the Company’s consultants for service provided in 2019. These options shall be vested immediately.

On September 17, 2020, the Board of Directors approved to issue options for 4,000 shares under the Aerkomm 2017 Plan to one of the Company’s independent directors. These options shall be vested at the date of 1/12th each month for the next 12 months on the same day of September 2020.

On December 11, 2020, the Board of Directors approved the grant of options to purchase an aggregate of 284,997 shares under the Aerkomm 2017 Plan to 37 of its directors, officers, employees and consultants. Shares shall be vested in full on the earlier of the filing date of the Company’s Form 10-K for the year ended December 31, 2020 or March 31, 2021.

On January 23, 2021, the Board of Directors approved to issue options for an aggregate of 12,000 shares under the Aerkomm 2017 Plan to three of the Company’s independent directors, 4,000 shares each. All of these options shall vest 1/12th each month for the next 12 months at the end of each month up to December 2021. On January 23, 2021, the Board of Directors approved to issue options for 2,000 shares under the Aerkomm 2017 Plan to one of the Company’s consultants for service provided in 2020. These options vested immediately.

21

AERKOMM INC. AND SUBSIDIARIES

Notes to Condensed Consolidated Financial Statements

NOTE 18 - Stock Based Compensation - Continued

Option price is determined by the Compensation Committee. The Aerkomm 2017 Plan has been adopted by the Board and shall continue in effect for a term of 10 years unless sooner terminated under the terms of Aerkomm 2017 Plan. The Aerkomm 2017 Plan was approved by the Company’s stockholders on March 28, 2018.

Valuation and Expense Information

Measurement and recognition of compensation expense based on estimated fair values is required for all share-based payment awards made to its employees and directors including employee stock options. The Company recognized compensation expense of $1,680,365 and $464,827 for the three-month periods ended March 31, 2021 and 2020, respectively, related to such employee stock options.

Determining Fair Value

Valuation and amortization method

The Company uses the Black-Scholes option-pricing-model to estimate the fair value of stock options granted on the date of grant or modification and amortizes the fair value of stock-based compensation at the date of grant on a straight-line basis for recognizing stock compensation expense over the vesting period of the option.

Expected term

The expected term is the period of time that granted options are expected to be outstanding. The Company uses the SEC’s simplified method for determining the option expected term based on the Company’s historical data to estimate employee termination and options exercised.

Expected dividends

The Company does not plan to pay cash dividends before the options are expired. Therefore, the expected dividend yield used in the Black-Scholes option valuation model is zero.

Expected volatility

Since the Company has no historical volatility, it used the calculated value method which substitutes the historical volatility of a public company in the same industry to estimate the expected volatility of the Company’s share price to measure the fair value of options granted under the Plans.

Risk-free interest rate

The Company based the risk-free interest rate used in the Black-Scholes option valuation model on the market yield in effect at the time of option grant provided in the Federal Reserve Board’s Statistical Releases and historical publications on the Treasury constant maturities rates for the equivalent remaining terms for the Plans.

Forfeitures

The Company is required to estimate forfeitures at the time of grant and revises those estimates in subsequent periods if actual forfeitures differ from those estimates. The Company uses historical data to estimate option forfeitures and records share-based compensation expense only for those awards that are expected to vest.

The Company used the following assumptions to estimate the fair value of options granted in three-month period ended March 31, 2021 and year ended December 31, 2020 under the Plans as follows:

| Assumptions | ||||