Attached files

| file | filename |

|---|---|

| 8-K - 8-K - MMA Capital Holdings, LLC | mmac-20210517x8k.htm |

| EX-99.1 - EX-99.1 - MMA Capital Holdings, LLC | mmac-20210517xex99d1.htm |

Exhibit 99.2

| Shareholder Presentation May 17, 2021 Nasdaq: MMAC www.mmacapitalholdings.com 3600 O’Donnell Street, Suite 600, Baltimore, MD 21224 (443) 263-2900 |

| Disclaimer • This presentation and any related oral statements contain forward-looking statements intended to qualify for the safe harbor contained in Section 27A of the Securities Act of 1933, as amended, and Section 21E of the Securities Exchange Act of 1934, as amended. Forward-looking statements often include words such as “anticipate,” “believe,” “continue,” “could,” “estimate,” “expect,” “focus,” “intend,” ”may,” “plan,” “potential,” “project,” “see,” “seek,” “should,” “will,” “would,” and similar words or expressions and are made in connection with discussions of future events and future operating or financial performance. • Forward-looking statements reflect our management’s expectations at the date of this presentation regarding future conditions, events or results. They are not guarantees of future performance. By their nature, forward-looking statements are subject to risks and uncertainties, including the risks and uncertain aspects of the novel strain of the coronavirus (“COVID-19”) pandemic. Our actual results and financial condition may differ materially from what is anticipated in the forward-looking statements. There are many factors that could cause actual conditions, events or results to differ from those anticipated by the forward-looking statements contained in this presentation. Readers are cautioned not to place undue reliance on forward-looking statements in this presentation or that we may make from time to time, and to consider carefully the factors discussed in Part I, Item 1A. “Risk Factors” of our Annual Report on Form 10- K for the year ended December 31, 2020, which was filed with the Securities and Exchange Commission (“SEC”) on March 31, 2021, and Part II, Item 1A. “Risk Factors” of our Quarterly Report on Form 10-Q for the quarter ended March 31, 2021, which was filed with the SEC on May 17, 2021. We do not undertake to update any forward-looking statements contained herein. • This presentation should be read in conjunction with the Company’s Quarterly Report on Form 10-Q for the quarter ended March 31, 2021. MMA Capital Holdings, Inc. 2 |

| Mission MMA Capital Holdings, Inc. (“MMAC”) focuses on infrastructure-related investments that generate positive environmental and social impacts and deliver attractive risk-adjusted total returns to our shareholders. MMA Capital Holdings, Inc. 3 |

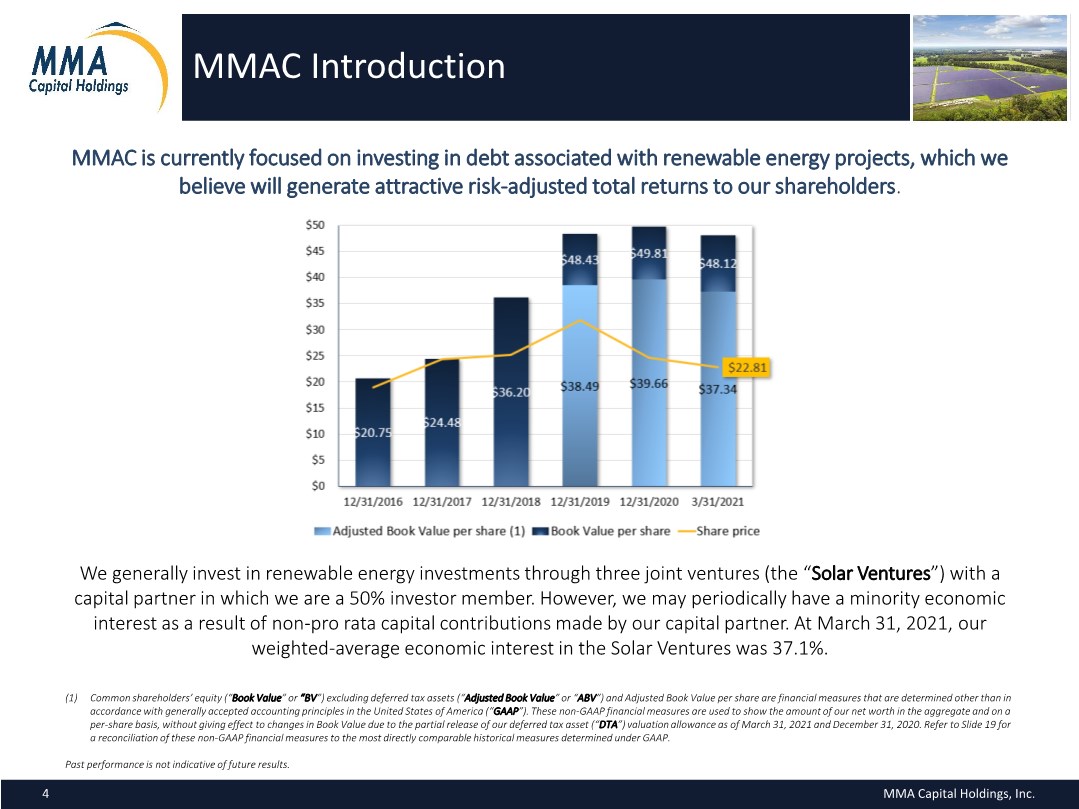

| MMAC Introduction MMAC is currently focused on investing in debt associated with renewable energy projects, which we believe will generate attractive risk-adjusted total returns to our shareholders. (1) Common shareholders’ equity (“Book Value” or “BV”) excluding deferred tax assets (“Adjusted Book Value” or “ABV”) and Adjusted Book Value per share are financial measures that are determined other than in accordance with generally accepted accounting principles in the United States of America (“GAAP”). These non-GAAP financial measures are used to show the amount of our net worth in the aggregate and on a per-share basis, without giving effect to changes in Book Value due to the partial release of our deferred tax asset (“DTA”) valuation allowance as of March 31, 2021 and December 31, 2020. Refer to Slide 19 for a reconciliation of these non-GAAP financial measures to the most directly comparable historical measures determined under GAAP. Past performance is not indicative of future results. MMA Capital Holdings, Inc. 4 We generally invest in renewable energy investments through three joint ventures (the “Solar Ventures”) with a capital partner in which we are a 50% investor member. However, we may periodically have a minority economic interest as a result of non-pro rata capital contributions made by our capital partner. At March 31, 2021, our weighted-average economic interest in the Solar Ventures was 37.1%. |

| Impact of Electric Reliability Council of Texas (“ERCOT”) Service Area Exposure • At March 31, 2021, 59.2% of the total unpaid principal balance (“UPB”) of outstanding loans of the Solar Ventures were associated with a single sponsor and were secured by three projects located in Texas’ ERCOT service area. One project was operational and two were in various phases of development and construction. One of the non-operational projects was sold and recapitalized in April 2021, which significantly reduced the Solar Ventures’ exposure to both the project and the sponsor and more broadly, to the ERCOT service area. • Our economic interest in loans related to projects in the ERCOT service area with a single sponsor is 45.0% and is expected to remain as such, based upon a non-pro rata capital contribution agreement executed with our capital partner. • During the second and third weeks of February 2021, a severe winter storm occurred in the ERCOT service area that impaired the operational capabilities of numerous fossil fuel and renewable energy generating assets in the region. Extreme cold temperatures also caused the demand for electricity to surge to unprecedented levels, driving the market price of power to the maximum price permitted by ERCOT for multiple days. • The operational project suffered a net power delivery shortfall during this weather event, resulting in a net settlement cost of $22.5 million pursuant to various energy supply and pricing agreements, which was funded by the Solar Ventures in April. • During the three months ended March 31, 2021, the Solar Ventures recognized $31.9 million of net unrealized fair value losses related to loans made to the three renewable energy projects located in the ERCOT service area. • Although we believe these loan values have stabilized and may improve with time, the ERCOT service area remains volatile and uncertain due to this weather event and resulting energy crisis. There is litigation among various participants, and potential legislative reform is being considered, all of which remain uncertain. This dynamic could lead to supply and demand imbalances in the market, impact the availability and pricing of tax equity or permanent take-out financing and result in a deterioration of the underlying project values. • Consequently, within the next 12 months, additional losses related to outstanding loans made to the projects in the ERCOT service area could be recognized by the Solar Ventures that, based on the Company’s share thereof, could be material to the Company’s financial statements. • The Solar Ventures’ concentration in the ERCOT service area could further impact when invested capital is repaid and available for reinvestment. MMA Capital Holdings, Inc. 5 |

| 1Q21 Key Updates FINANCIAL RESULTS ▪ BV decreased $9.6 million during the three months ended March 31, 2021 to $280.3 million, and BV per share decreased $1.69 during the three months ended March 31, 2021 to $48.12 ▪ This decrease was primarily driven by equity in losses of the Solar Ventures that stemmed from both net fair value losses and a reduction in the recognized amount of interest income associated with loans made to projects in the ERCOT service area ▪ BV includes $62.8 million of net DTAs at March 31, 2021 ▪ ABV decreased $13.4 million during the three months ended March 31, 2021 to $217.5 million, and ABV per share decreased $2.32 during the three months ended March 31, 2021 to $37.34, in line with the estimates provided in our Annual Report on Form 10-K for fiscal year 2020 RENEWABLE ENERGY INVESTING ▪ The Company generated an unlevered net return on investment from our renewable energy investments, as measured on a twelve-month trailing basis, of 7.1% and 10.4% for the periods ended March 31, 2021 and March 31, 2020, respectively(1) ▪ All of our investments were made through the Solar Ventures, which closed $182.7 million of commitments across nine loans during the three months ended March 31, 2021 ▪ At March 31, 2021, loans funded through the Solar Ventures had an aggregate UPB of $841.1 million and fair value (“FV”) of $811.8 million, a weighted-average (“WA”) remaining maturity of 15 months and a WA coupon of 12.6% ▪ The Company generated a leveraged net return on investment from our renewable energy investments, as measured on a twelve-month trailing basis, of 8.1% and 12.2% for the periods ended March 31, 2021 and March 31, 2020, respectively(2) DEBT CAPITALIZATION ▪ At March 31, 2021, the Company had debt with a UPB of $206.4 million, a reported carrying value of $212.9 million, an estimated FV of $181.3 million and a WA effective interest rate of 3.8% ▪ Based on reported carrying values, at March 31, 2021, senior debt to BV was 0.43x, total debt to BV was 0.76x, senior debt to ABV was 0.55x and total debt to ABV was 0.98x MMA Capital Holdings, Inc. 6 (1) Measured on a trailing four quarter basis at each reporting period by dividing total income from renewable energy investments by the average carrying value of renewable energy investments. (2) Measured on a trailing four quarter basis at each reporting period by dividing net income from renewable energy investments less the cost of funding associated with the Company’s revolving credit facility by a net average value that incorporates the carrying value of renewable energy investments, the UPB of our funding from the revolving credit facility and restricted cash associated with our credit facility (where the UPB of attributed funding partially reduces the other two components in such net value). |

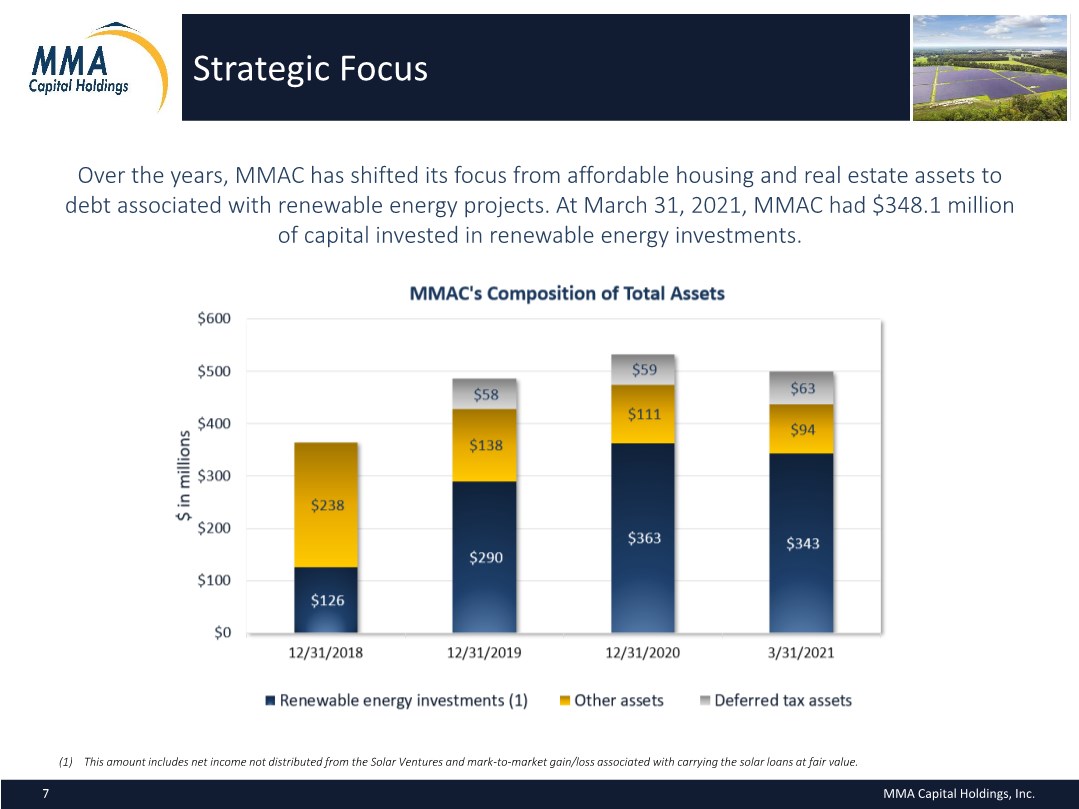

| Strategic Focus Over the years, MMAC has shifted its focus from affordable housing and real estate assets to debt associated with renewable energy projects. At March 31, 2021, MMAC had $348.1 million of capital invested in renewable energy investments. MMA Capital Holdings, Inc. 7 (1) This amount includes net income not distributed from the Solar Ventures and mark-to-market gain/loss associated with carrying the solar loans at fair value. |

| GROWING MMAC’s current objective is to produce attractive risk-adjusted returns by investing in the large, growing and fragmented renewable energy market in the United States (“U.S.”). We primarily make loans to developers, design and build contractors and system owners for the late-stage development and construction of commercial, utility or community solar scale photovoltaic (“PV”) facilities in the U.S. The Solar Ventures typically lend on a senior secured basis collateralized by solar projects but may also invest in subordinated loans, mezzanine loans and revolving loans and may finance non-solar renewable technologies, such as wind and battery storage, or provide equipment financing and other customized debt solutions for borrowers. Investment Focus (1) U.S. Solar Market Insight 2020 Year-in-Review Report. The projections factor in the impact of COVID-19. 19.2 GWdc of solar capacity was installed during 2020, up 43% from 2019. Solar is expected to quadruple from nearly 100 GWdc of capacity installed today to more than 400 GWdc installed by 2030.(1) Solar accounted for 43% of all new electricity generating capacity added in the U.S. during 2020, beating out all other generation technologies.(1) LARGE Fewer financing sources, less competition and attractive risk-adjusted returns by financing projects before they reach commercial operation. FRAGMENTED MMA Capital Holdings, Inc. 8 |

| Hunt Investment Management(1) (“External Manager”) is part of Hunt Companies, Inc. (“Hunt”), which was founded in 1947 and is privately owned. Hunt is dedicated to fostering long-term partnerships through the development, investment, management and financing of real estate and infrastructure. Our External Manager, which also does business as MMA Energy Capital (“MEC”), has an investment origination team with extensive experience in the renewable energy and project development industry with $3.6 billion of originations for the Solar Ventures since their inception in 2015. External Manager Economic Alignment with Shareholders Hunt, together with MMAC directors and executive officers, own approximately 17% of MMAC’s common shares (1) Additional information about Hunt Investment Management, LLC is described in its brochure (Part 2A of Form ADV) available at www.adviserinfo.sec.gov. Senior management team responsible for MMAC has an average of 25 years of relevant experience Experienced Management Team with Proven Track Record MMA Capital Holdings, Inc. 9 |

| Our Competitive Advantage Has typically reviewed approximately $2 billion of directly sourced opportunities annually No reliance on brokers Typical pipeline has been approximately $800 million $2.3 billion of investments fully repaid with a WA internal rate of return (“IRR”)(1) of 19.6%(2), which, on average, exceeded the WA underwritten IRR Strong reputation and relationship with seasoned developers in the renewable energy industry Ability to execute and deliver underwritten returns $182.7 million of originations during the three months ended March 31, 2021, of which approximately 99% were with repeat customers $3.6 billion of originations life-to-date 115+ years of collective experience in the renewable energy and project development industry Comprehensive credit analysis, underwriting and loan structuring In-house underwriting, credit analysis and diligence Through March 31, 2021, no loss of principal on any of the 164 repaid project- based loans originated for the Solar Ventures Through our External Manager, MMAC has access to a renewable energy loan origination platform built off of extensive relationships and credit expertise gathered through years of experience. (1) WA IRR is measured as the total return in dollars of all repaid loans divided by the total commitment amount associated with such loans, where (i) the total return for each repaid loan was calculated as the product of each loan’s IRR and its commitment amount and (ii) IRR for each repaid loan was established by solving for a discount rate that made the net present value of all loan cash flows equal zero. (2) As noted in our Annual Report on Form 10-K for the year ended December 31, 2020, the WA IRR was disproportionately increased during 2020 by one loan that provided an extraordinary IRR. Excluding this loan, the WA IRR would have been 15.3%. All figures are estimated and unaudited. Past performance is not indicative of future results. MMA Capital Holdings, Inc. 10 |

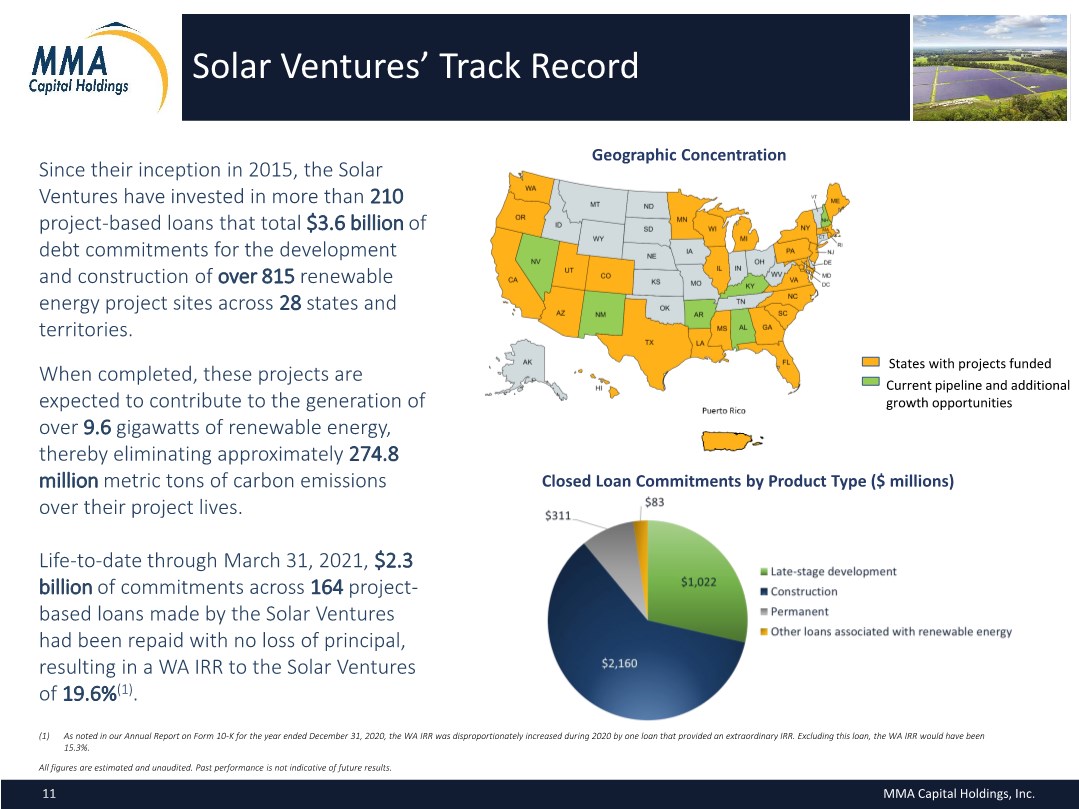

| Solar Ventures’ Track Record Since their inception in 2015, the Solar Ventures have invested in more than 210 project-based loans that total $3.6 billion of debt commitments for the development and construction of over 815 renewable energy project sites across 28 states and territories. When completed, these projects are expected to contribute to the generation of over 9.6 gigawatts of renewable energy, thereby eliminating approximately 274.8 million metric tons of carbon emissions over their project lives. Life-to-date through March 31, 2021, $2.3 billion of commitments across 164 project- based loans made by the Solar Ventures had been repaid with no loss of principal, resulting in a WA IRR to the Solar Ventures of 19.6%(1). (1) As noted in our Annual Report on Form 10-K for the year ended December 31, 2020, the WA IRR was disproportionately increased during 2020 by one loan that provided an extraordinary IRR. Excluding this loan, the WA IRR would have been 15.3%. All figures are estimated and unaudited. Past performance is not indicative of future results. Geographic Concentration Closed Loan Commitments by Product Type ($ millions) States with projects funded Current pipeline and additional growth opportunities MMA Capital Holdings, Inc. 11 |

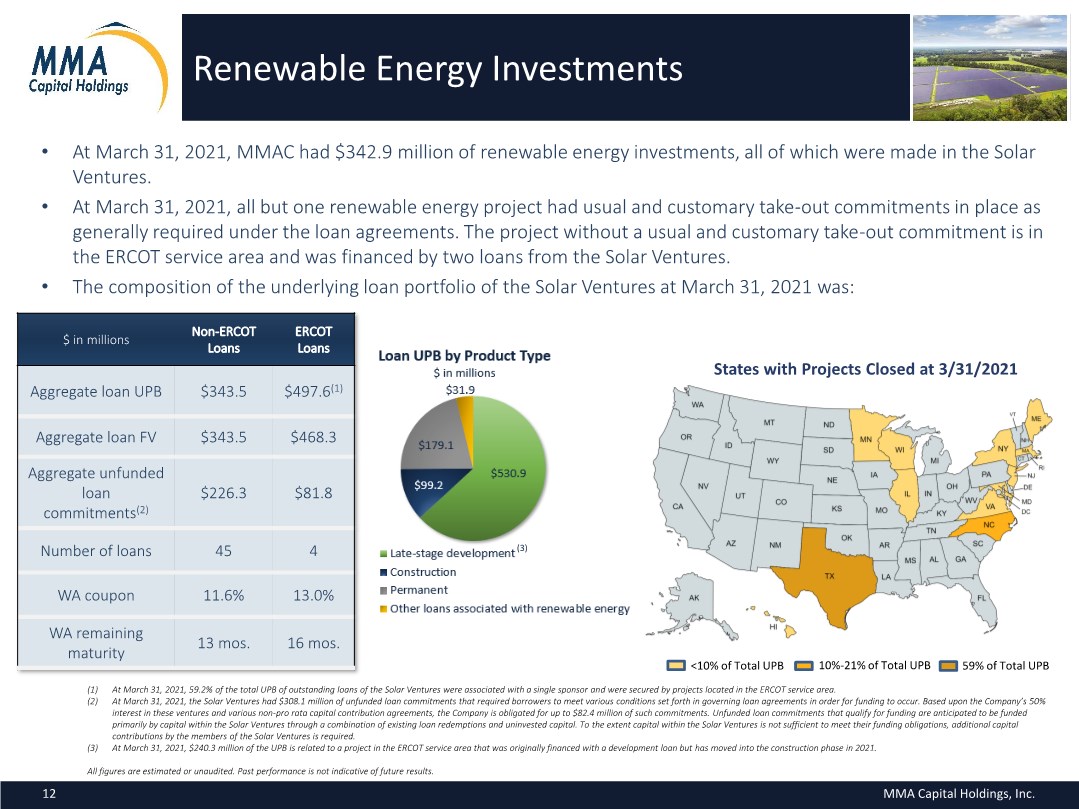

| Renewable Energy Investments • At March 31, 2021, MMAC had $342.9 million of renewable energy investments, all of which were made in the Solar Ventures. • At March 31, 2021, all but one renewable energy project had usual and customary take-out commitments in place as generally required under the loan agreements. The project without a usual and customary take-out commitment is in the ERCOT service area and was financed by two loans from the Solar Ventures. • The composition of the underlying loan portfolio of the Solar Ventures at March 31, 2021 was: $ in millions Non-ERCOT Loans ERCOT Loans Aggregate loan UPB $343.5 $497.6(1) Aggregate loan FV $343.5 $468.3 Aggregate unfunded loan commitments(2) $226.3 $81.8 Number of loans 45 4 WA coupon 11.6% 13.0% WA remaining maturity 13 mos. 16 mos. (1) At March 31, 2021, 59.2% of the total UPB of outstanding loans of the Solar Ventures were associated with a single sponsor and were secured by projects located in the ERCOT service area. (2) At March 31, 2021, the Solar Ventures had $308.1 million of unfunded loan commitments that required borrowers to meet various conditions set forth in governing loan agreements in order for funding to occur. Based upon the Company’s 50% interest in these ventures and various non-pro rata capital contribution agreements, the Company is obligated for up to $82.4 million of such commitments. Unfunded loan commitments that qualify for funding are anticipated to be funded primarily by capital within the Solar Ventures through a combination of existing loan redemptions and uninvested capital. To the extent capital within the Solar Ventures is not sufficient to meet their funding obligations, additional capital contributions by the members of the Solar Ventures is required. (3) At March 31, 2021, $240.3 million of the UPB is related to a project in the ERCOT service area that was originally financed with a development loan but has moved into the construction phase in 2021. All figures are estimated or unaudited. Past performance is not indicative of future results. States with Projects Closed at 3/31/2021 MMA Capital Holdings, Inc. 12 <10% of Total UPB 10%-21% of Total UPB 59% of Total UPB (3) |

| Other Assets ▪ Investments in a mixed-use development and land in Spanish Fort, AL ▪ A tax-exempt infrastructure bond secured by sales and land taxes with a reported carrying value of $24.7 million at March 31, 2021 ▪ A total return swap on the above-mentioned bond that was treated as a secured borrowing with a reported carrying value of $23.2 million at March 31, 2021 ▪ An 80% equity investment in a joint venture that owns the Spanish Fort Town Center and land with a reported carrying value of $11.4 million at March 31, 2021 ▪ Land development project in Winchester, VA with a reported carrying value of $15.5 million at March 31, 2021 ▪ A cash defeased bond with a reported carrying value of $4.1 million at March 31, 2021 ▪ In the second quarter of 2021, the bond was sold to a third party ▪ Limited partnership interest in the South Africa Workforce Housing Fund with a reported carrying value of $1.5 million at March 31, 2021 ▪ The Fund matured in April 2020, but it does not anticipate fully exiting its remaining investments until December 31, 2022 ▪ 7.2 million common shares of a residential real estate investment trust listed on the Johannesburg Stock Exchange with a reported carrying value of $2.4 million at March 31, 2021 NOL CARRY FORWARDS ▪ At December 31, 2020, the Company had pretax federal NOLs of $358.9 million that were available to reduce future federal income taxes ▪ Most of our NOLs expire between 2028 and 2035 ▪ At March 31, 2021, the reported carrying value of the Company’s net DTA was $62.8 million ▪ At March 31, 2021, a valuation allowance was maintained in connection with the portion of federal and state NOL carryforwards that were expected as of such reporting date to expire prior to utilization NON-CORE REAL ESTATE-RELATED INVESTMENTS In addition to our infrastructure investments, we continue to own a limited number of other assets, which remain the focus of our recycling efforts. MMA Capital Holdings, Inc. 13 |

| Capitalization ▪ At March 31, 2021, the facility had $120.0 million of total commitments across five participants. The UPB and reported carrying value of amounts borrowed under this facility was $79.1 million. The facility bears an interest rate of one-month LIBOR (subject to a 1.50% floor, which is currently in effect) + 2.75% on drawn balances until maturity in September 2022. ▪ Obligations are guaranteed by the Company and secured by a pledge of the entities that hold MMAC’s interests in the Solar Ventures. The facility carries financial covenants and collateral performance tests which are customary for facilities of this type. ▪ We have other asset-backed senior debt with aggregate UPBs and reported carrying values of $41.4 million and $41.1 million, respectively, that bear a WA interest rate of 3.9%. LIBOR-BASED LONG- TERM SUBORDINATED DEBT ▪ Our subordinated debt, which is senior only to shareholders’ equity and has limited financial covenants, has a UPB of $85.9 million, bears an interest rate of three-month LIBOR plus a 2.0% spread and amortizes 2.0% annually until a balloon payment at maturity in 2035. At March 31, 2021, the reported carrying value was $92.7 million, while the fair value was estimated to be $61.1 million. ▪ The interest rate risk associated with this debt is partially hedged until October 2026 with interest rate swaps, which effectively fix $35 million of LIBOR exposure at 1.61%, and a $35 million 3.0% interest rate cap. RENEWABLE ENERGY REVOLVER OTHER DEBT We utilize on-balance sheet leverage to support our investments and increase total returns to our shareholders. We have worked to expand our access to the capital markets and have entered into debt transactions with capital partners to finance our renewable energy investments. We expect to continuously evaluate ways to optimize the Company’s capitalization, with a focus on prudently deploying debt. MMA Capital Holdings, Inc. 14 |

| Future • Staying true to our mission Moving forward, we expect MMAC to grow its BV, ABV and Share Price by: • Recycling equity out of lower yielding investments • Leveraging our investments prudently • Lowering our overhead in total and as a percentage of equity • Exploring opportunities in other infrastructure-related investments MMA Capital Holdings, Inc. 15 |

| Appendix – Selected Financial Data The selected financial data provided in this Appendix can be found in MMAC’s Quarterly Report on Form 10-Q for the quarter ended March 31, 2021, which was filed on May 17, 2021. MMA Capital Holdings, Inc. 16 |

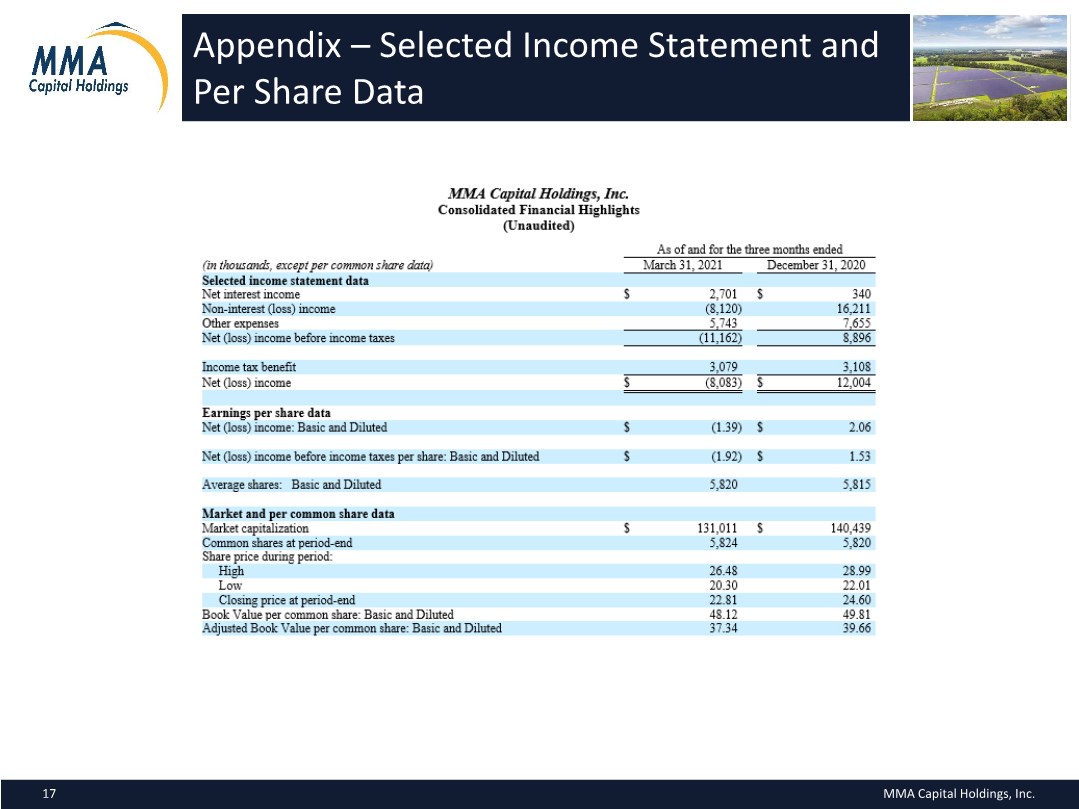

| Appendix Appendix – Selected Income Statement and Per Share Data MMA Capital Holdings, Inc. 17 |

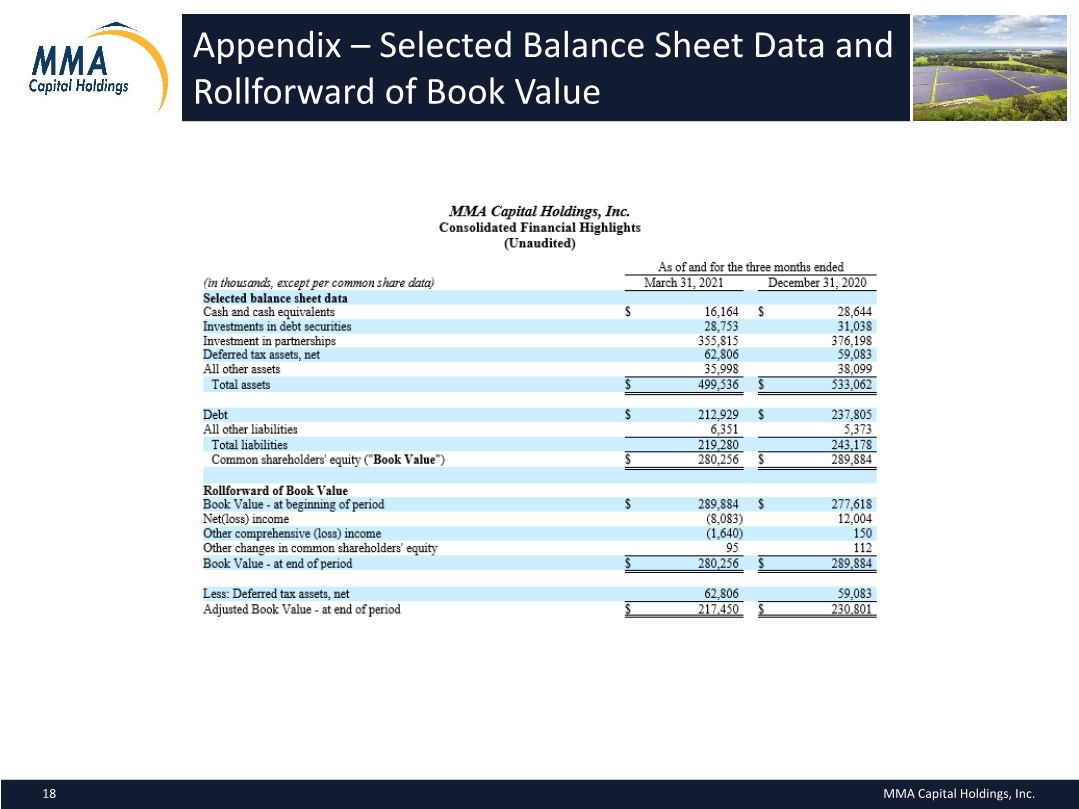

| Appendix Appendix – Selected Balance Sheet Data and Rollforward of Book Value MMA Capital Holdings, Inc. 18 |

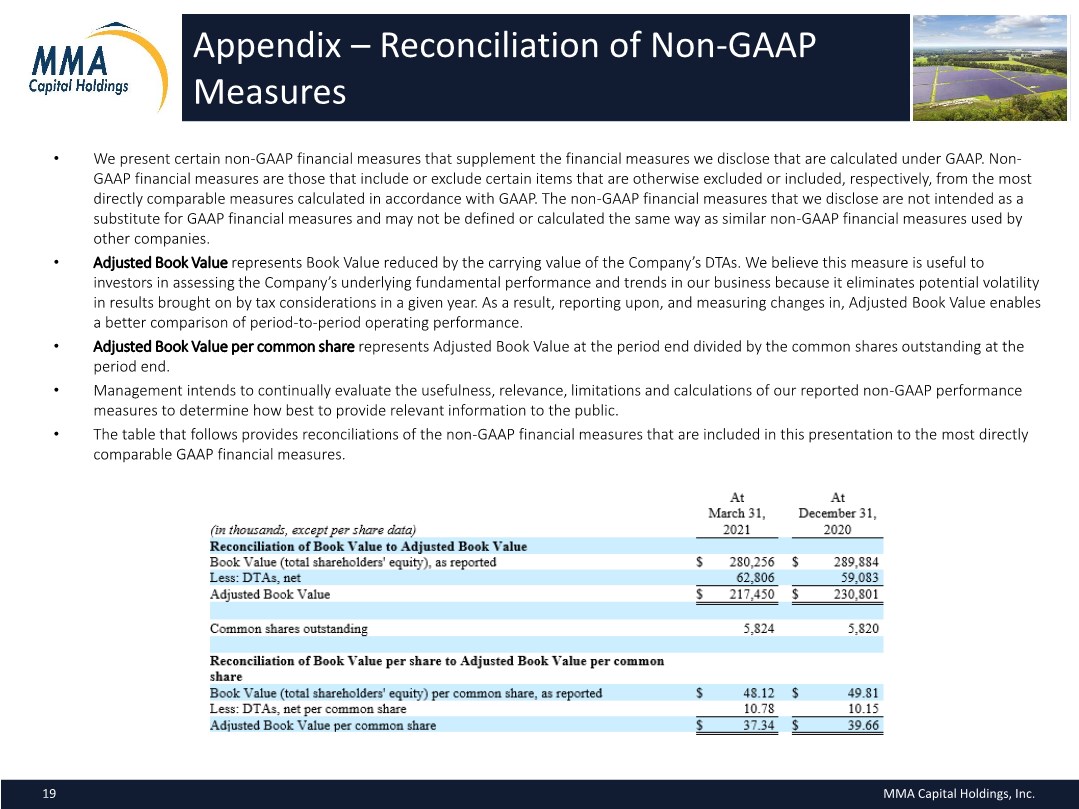

| Appendix Appendix – Reconciliation of Non-GAAP Measures MMA Capital Holdings, Inc. 19 • We present certain non-GAAP financial measures that supplement the financial measures we disclose that are calculated under GAAP. Non- GAAP financial measures are those that include or exclude certain items that are otherwise excluded or included, respectively, from the most directly comparable measures calculated in accordance with GAAP. The non-GAAP financial measures that we disclose are not intended as a substitute for GAAP financial measures and may not be defined or calculated the same way as similar non-GAAP financial measures used by other companies. • Adjusted Book Value represents Book Value reduced by the carrying value of the Company’s DTAs. We believe this measure is useful to investors in assessing the Company’s underlying fundamental performance and trends in our business because it eliminates potential volatility in results brought on by tax considerations in a given year. As a result, reporting upon, and measuring changes in, Adjusted Book Value enables a better comparison of period-to-period operating performance. • Adjusted Book Value per common share represents Adjusted Book Value at the period end divided by the common shares outstanding at the period end. • Management intends to continually evaluate the usefulness, relevance, limitations and calculations of our reported non-GAAP performance measures to determine how best to provide relevant information to the public. • The table that follows provides reconciliations of the non-GAAP financial measures that are included in this presentation to the most directly comparable GAAP financial measures. |

| Nasdaq: MMAC For more information, please visit our website at www.mmacapitalholdings.com Or, contact Investor Relations directly at 443-263-2900 | 855-650-6932 info@mmacapitalholdings.com MMA Capital Holdings, Inc. 20 |