Attached files

| file | filename |

|---|---|

| EX-32.2 - EX-32.2 - Research Solutions, Inc. | rsss-20210331ex3222927e5.htm |

| EX-32.1 - EX-32.1 - Research Solutions, Inc. | rsss-20210331ex3213e2518.htm |

| EX-31.2 - EX-31.2 - Research Solutions, Inc. | rsss-20210331ex312cd77cd.htm |

| EX-31.1 - EX-31.1 - Research Solutions, Inc. | rsss-20210331ex31148db66.htm |

| EX-10.2 - EX-10.2 - Research Solutions, Inc. | rsss-20210331ex102cf67ae.htm |

| EX-10.1 - EX-10.1 - Research Solutions, Inc. | rsss-20210331ex101931524.htm |

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 10-Q

(Mark One)

⌧ QUARTERLY REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934

For the quarterly period ended: March 31, 2021

◻ TRANSITION REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934

For the transition period from _____________ to _____________

Commission File No. 001-39256

RESEARCH SOLUTIONS, INC.

(Exact name of registrant as specified in its charter)

Nevada | 11-3797644 |

(State or other jurisdiction of incorporation or organization) | (I.R.S. Employer Identification No.) |

|

|

Address not applicable1 | N/A |

(Address of principal executive offices) | (Zip Code) |

(310) 477-0354

(Registrant’s telephone number, including area code)

Securities registered pursuant to Section 12(b) of the Act:

Title of each Class |

| Trading Symbol(s) |

| Name of each Exchange on which registered |

Common stock, $0.001 par value | | RSSS | | The NASDAQ Stock Market LLC |

Indicate by check mark whether the registrant (1) has filed all reports required to be filed by Section 13 or 15(d) of the Securities Exchange Act of 1934 during the preceding 12 months (or for such shorter period that the registrant was required to file such reports), and (2) has been subject to such filing requirements for the past 90 days. Yes þ No ◻

Indicate by check mark whether the registrant has submitted electronically every Interactive Data File required to be submitted pursuant to Rule 405 of Regulation S-T (§ 232.405 of this chapter) during the preceding 12 months (or for such shorter period that the registrant was required to submit such files). Yes þ No ◻

Indicate by check mark whether the registrant is a large accelerated filer, an accelerated filer, a non-accelerated filer, a smaller reporting company or an emerging growth company. See the definitions of “large accelerated filer,” “accelerated filer,” “smaller reporting company” and “emerging growth company” in Rule 12b-2 of the Exchange Act.

Large accelerated filer ☐ | Accelerated filer ☐ |

Non-accelerated filer þ | Smaller reporting company þ |

| Emerging growth company ☐ |

If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act. ◻

Indicate by check mark whether the registrant is a shell company (as defined in Rule 12b-2 of the Exchange Act). Yes ◻ No þ

Indicate the number of shares outstanding of each of the issuer’s classes of common stock as of the latest practicable date.

Title of Class |

| Number of Shares Outstanding on May 7, 2021 |

Common Stock, $0.001 par value |

| 26,352,008 |

1 In November 2019, we became a fully remote company. Accordingly, we do not currently have principal executive offices.

2

PART 1 — FINANCIAL INFORMATION

Item 1. Condensed Consolidated Financial Statements

Research Solutions, Inc. and Subsidiaries

Condensed Consolidated Balance Sheets

|

| March 31, |

| | | | |

|

| 2021 |

| June 30, | | ||

| | (unaudited) | | 2020 | | ||

Assets | |

| | |

| | |

Current assets: |

| |

|

| |

| |

Cash and cash equivalents | | $ | 11,233,562 | | $ | 9,311,556 | |

Accounts receivable, net of allowance of $56,042 and $88,485, respectively | |

| 5,013,089 | |

| 4,449,260 | |

Prepaid expenses and other current assets | |

| 317,220 | |

| 241,747 | |

Prepaid royalties | |

| 743,513 | |

| 720,367 | |

Total current assets | |

| 17,307,384 | |

| 14,722,930 | |

| |

|

| |

|

| |

Other assets: | |

|

| |

|

| |

Property and equipment, net of accumulated depreciation of $819,607 and $804,999, respectively | |

| 15,165 | |

| 11,276 | |

Deposits and other assets | |

| 878 | |

| 6,155 | |

Right of use asset, net of accumulated amortization of $463,022 and $390,691, respectively | |

| — | |

| 72,331 | |

Total assets | | $ | 17,323,427 | | $ | 14,812,692 | |

| |

|

| |

|

| |

Liabilities and Stockholders’ Equity | |

|

| |

|

| |

Current liabilities: | |

| | |

| | |

Accounts payable and accrued expenses | | $ | 7,558,319 | | $ | 6,349,845 | |

Deferred revenue | |

| 4,601,473 | |

| 3,524,507 | |

Lease liability, current portion | |

| — | |

| 79,326 | |

Total current liabilities | |

| 12,159,792 | |

| 9,953,678 | |

| |

|

| |

|

| |

Commitments and contingencies | |

|

| |

|

| |

| |

|

| |

|

| |

Stockholders’ equity: | |

|

| |

|

| |

Preferred stock; $0.001 par value; 20,000,000 shares authorized; no shares issued and outstanding | |

| — | |

| — | |

Common stock; $0.001 par value; 100,000,000 shares authorized; 26,352,008 and 26,032,263 shares issued and outstanding, respectively | |

| 26,352 | |

| 26,032 | |

Additional paid-in capital | |

| 26,631,985 | |

| 26,134,819 | |

Accumulated deficit | |

| (21,373,012) | |

| (21,176,799) | |

Accumulated other comprehensive loss | |

| (121,690) | |

| (125,038) | |

Total stockholders’ equity | |

| 5,163,635 | |

| 4,859,014 | |

Total liabilities and stockholders’ equity | | $ | 17,323,427 | | $ | 14,812,692 | |

See notes to condensed consolidated financial statements

3

Research Solutions, Inc. and Subsidiaries

Condensed Consolidated Statements of Operations and Other Comprehensive Income (Loss)

(Unaudited)

| | Three Months Ended | | Nine Months Ended | | ||||||||

| | March 31, | | March 31, | | ||||||||

|

| 2021 |

| 2020 |

| 2021 |

| 2020 | | ||||

| | | | | | | | | | | | | |

Revenue: |

| |

|

| |

| | |

|

| |

| |

Platforms | | $ | 1,344,183 | | $ | 1,017,789 | | $ | 3,706,406 | | $ | 2,824,059 | |

Transactions | |

| 6,996,349 | |

| 7,029,617 | |

| 19,832,286 | |

| 20,348,898 | |

Total revenue | |

| 8,340,532 | |

| 8,047,406 | |

| 23,538,692 | |

| 23,172,957 | |

| |

|

| |

|

| |

|

| |

|

| |

Cost of revenue: | |

|

| |

|

| |

|

| |

|

| |

Platforms | |

| 233,696 | |

| 177,919 | |

| 654,651 | |

| 490,897 | |

Transactions | |

| 5,404,196 | |

| 5,330,473 | |

| 15,340,243 | |

| 15,552,711 | |

Total cost of revenue | |

| 5,637,892 | |

| 5,508,392 | |

| 15,994,894 | |

| 16,043,608 | |

Gross profit | |

| 2,702,640 | |

| 2,539,014 | |

| 7,543,798 | |

| 7,129,349 | |

| |

|

| |

|

| |

|

| |

|

| |

Operating expenses: | |

|

| |

|

| |

|

| |

|

| |

Selling, general and administrative | |

| 2,650,504 | |

| 2,544,659 | |

| 7,728,990 | |

| 7,956,446 | |

Depreciation and amortization | |

| 2,066 | |

| 5,510 | |

| 8,828 | |

| 19,908 | |

Total operating expenses | |

| 2,652,570 | |

| 2,550,169 | |

| 7,737,818 | |

| 7,976,354 | |

| | | | | | | | | | | | | |

Income (loss) from operations | |

| 50,070 | |

| (11,155) | |

| (194,020) | |

| (847,005) | |

| |

|

| |

|

| |

|

| |

|

| |

Other income | |

| 250 | |

| 23,662 | |

| 884 | |

| 75,738 | |

| |

|

| |

|

| |

|

| |

|

| |

Income (loss) from operations before provision for income taxes | |

| 50,320 | |

| 12,507 | |

| (193,136) | |

| (771,267) | |

Provision for income taxes | |

| (572) | |

| (561) | |

| (3,077) | |

| (7,861) | |

| |

|

| |

|

| |

|

| |

|

| |

Income (loss) from continuing operations | |

| 49,748 | |

| 11,946 | |

| (196,213) | |

| (779,128) | |

| |

|

| |

|

| |

|

| |

|

| |

Gain from sale of discontinued operations | |

| — | |

| — | |

| — | |

| 117,445 | |

| |

|

| |

|

| |

|

| |

|

| |

Net income (loss) | |

| 49,748 | |

| 11,946 | |

| (196,213) | |

| (661,683) | |

| |

| | |

| | |

| | |

| | |

Other comprehensive income (loss): | |

| | |

| | |

| | |

| | |

Foreign currency translation | |

| (3,333) | |

| (14,677) | |

| 3,348 | |

| (16,702) | |

Comprehensive income (loss) | | $ | 46,415 | | $ | (2,731) | | $ | (192,865) | | $ | (678,385) | |

| |

|

| |

|

| |

|

| |

|

| |

Basic income (loss) per common share: | |

|

| |

|

| |

|

| |

|

| |

Income (loss) per share from continuing operations | | $ | 0.00 | | $ | — | | $ | (0.01) | | $ | (0.03) | |

Income per share from discontinued operations | | $ | — | | $ | — | | $ | — | | $ | — | |

Net income (loss) per share | | $ | 0.00 | | $ | — | | $ | (0.01) | | $ | (0.03) | |

Basic weighted average common shares outstanding | |

| 26,027,665 | |

| 24,960,394 | |

| 25,966,072 | |

| 24,411,888 | |

| | | | | | | | | | | | | |

Diluted income (loss) per common share: | |

|

| |

|

| |

|

| |

|

| |

Income (loss) per share from continuing operations | | $ | 0.00 | | $ | — | | $ | (0.01) | | $ | (0.03) | |

Income per share from discontinued operations | | $ | — | | $ | — | | $ | — | | $ | — | |

Net income (loss) per share | | $ | 0.00 | | $ | — | | $ | (0.01) | | $ | (0.03) | |

Diluted weighted average common shares outstanding | |

| 26,565,892 | |

| 25,717,403 | |

| 25,966,072 | |

| 24,411,888 | |

See notes to condensed consolidated financial statements

4

Research Solutions, Inc. and Subsidiaries

Condensed Consolidated Statements of Stockholders’ Equity

For the Three and Nine Months Ended March 31, 2021

(Unaudited)

| | | | | | | Additional | | | | | Other | | Total | |||

| | Common Stock | | Paid-in | | Accumulated | | Comprehensive | | Stockholders’ | |||||||

|

| Shares |

| Amount |

| Capital |

| Deficit |

| Loss |

| Equity | |||||

| | | | | | | | | | | | | | | | | |

Balance, December 31, 2020 |

| 26,266,008 |

| $ | 26,266 |

| $ | 26,709,401 |

| $ | (21,422,760) |

| $ | (118,357) |

| $ | 5,194,550 |

|

|

|

| |

|

| |

|

| |

|

| |

|

| |

|

Fair value of vested stock options |

| — |

| | — |

| | 85,151 |

| | — |

| | — |

| | 85,151 |

|

|

|

| |

|

| |

|

| |

|

| |

|

| |

|

Fair value of vested restricted common stock |

| 20,079 |

| | 20 |

| | 94,174 |

| | — |

| | — |

| | 94,194 |

|

|

|

| |

|

| |

|

| |

|

| |

|

| |

|

Repurchase of common stock | | (10,750) | | | (11) | | | (23,101) | | | — | | | — | | | (23,112) |

| | | | | | | | | | | | | | | | | |

Repurchase of stock options and warrants | | — | | | — | | | (308,313) | | | — | | | — | | | (308,313) |

|

|

|

| |

|

| |

|

| |

|

| |

|

| |

|

Common stock issued upon exercise of stock options | | 76,671 | | | 77 | | | 74,673 | | | — | | | — | | | 74,750 |

| |

| | |

| | |

| | |

| | |

| | | |

Net income for the period |

| — |

| | — |

| | — |

| | 49,748 |

| | — |

| | 49,748 |

|

|

|

| |

|

| |

|

| |

|

| |

|

| |

|

Foreign currency translation |

| — |

| | — |

| | — |

| | — |

| | (3,333) |

| | (3,333) |

|

|

|

| |

|

| |

|

| |

|

| |

|

| |

|

Balance, March 31, 2021 |

| 26,352,008 |

| $ | 26,352 |

| $ | 26,631,985 |

| $ | (21,373,012) |

| $ | (121,690) |

| $ | 5,163,635 |

| | | | | | | | | | | | | | | | | |

Balance, July 1, 2020 |

| 26,032,263 | | $ | 26,032 | | $ | 26,134,819 | | $ | (21,176,799) | | $ | (125,038) | | $ | 4,859,014 |

|

|

|

| |

|

| |

|

| |

|

| |

|

| |

|

Fair value of vested stock options |

| — |

| | — |

| | 504,936 |

| | — |

| | — |

| | 504,936 |

|

|

|

| |

|

| |

|

| |

|

| |

|

| |

|

Fair value of vested restricted common stock |

| 163,553 |

| | 163 |

| | 280,985 |

| | — |

| | — |

| | 281,148 |

|

|

|

| |

|

| |

|

| |

|

| |

|

| |

|

Repurchase of common stock |

| (67,417) |

| | (67) |

| | (150,319) |

| | — |

| | — |

| | (150,386) |

| | | | | | | | | | | | | | | | | |

Repurchase of stock options and warrants | | — | | | — | | | (308,313) | | | — | | | — | | | (308,313) |

|

|

|

| |

|

| |

|

| |

|

| |

|

| |

|

Common stock issued upon exercise of stock options |

| 158,609 |

| | 159 |

| | 88,691 |

| | — |

| | — |

| | 88,850 |

|

| |

| | |

| | |

| | |

| | |

| |

|

Common stock issued upon exercise of warrants | | 65,000 | | | 65 | | | 81,186 | | | — | | | — | | | 81,251 |

| | | | | | | | | | | | | | | | | |

Net loss for the period |

| — |

| | — |

| | — |

| | (196,213) |

| | — |

| | (196,213) |

|

|

|

| |

|

| |

|

| |

|

| |

|

| |

|

Foreign currency translation |

| — |

| | — |

| | — |

| | — |

| | 3,348 |

| | 3,348 |

| | | | | | | | | | | | | | | | | |

Balance, March 31, 2021 |

| 26,352,008 | | $ | 26,352 | | $ | 26,631,985 | | $ | (21,373,012) | | $ | (121,690) | | $ | 5,163,635 |

See notes to condensed consolidated financial statements

5

Research Solutions, Inc. and Subsidiaries

Condensed Consolidated Statements of Stockholders’ Equity

For the Three and Nine Months Ended March 31, 2020

(Unaudited)

| | | | | | | Additional | | | | | Other | | Total | |||

| | Common Stock | | Paid-in | | Accumulated | | Comprehensive | | Stockholders’ | |||||||

|

| Shares |

| Amount |

| Capital |

| Deficit |

| Loss |

| Equity | |||||

| | | | | | | | | | | | | | | | | |

Balance, December 31, 2019 |

| 24,475,556 |

| $ | 24,476 |

| $ | 24,098,311 |

| $ | (21,188,186) |

| $ | (111,610) |

| $ | 2,822,991 |

|

|

|

| |

|

| |

|

| |

|

| |

|

| |

|

Fair value of vested stock options |

| — |

| | — |

| | 56,712 |

| | — |

| | — |

| | 56,712 |

|

|

|

| |

|

| |

|

| |

|

| |

|

| |

|

Fair value of vested restricted common stock |

| 12,500 |

| | 13 |

| | 85,513 |

| | — |

| | — |

| | 85,526 |

|

|

|

| |

|

| |

|

| |

|

| |

|

| |

|

Repurchase of common stock | | (25,150) | | | (25) | | | (69,138) | | | — | | | — | | | (69,163) |

|

|

|

| |

|

| |

|

| |

|

| |

|

| |

|

Common stock issued upon exercise of stock options | | 71,666 | | | 71 | | | (71) | | | — | | | — | | | — |

| | | | | | | | | | | | | | | | | |

Common stock issued upon exercise of warrants | | 1,500,000 | | | 1,500 | | | 1,873,500 | | | — | | | — | | | 1,875,000 |

| | | | | | | | | | | | | | | | | |

Net loss for the period |

| — |

| | — |

| | — |

| | 11,946 |

| | — |

| | 11,946 |

|

|

|

| |

|

| |

|

| |

|

| |

|

| |

|

Foreign currency translation |

| — |

| | — |

| | — |

| | — |

| | (14,677) |

| | (14,677) |

|

|

|

| |

|

| |

|

| |

|

| |

|

| |

|

Balance, March 31, 2020 |

| 26,034,572 |

| $ | 26,035 |

| $ | 26,044,827 |

| $ | (21,176,240) |

| $ | (126,287) |

| $ | 4,768,335 |

|

|

|

| |

|

| |

|

| |

|

| |

|

| |

|

Balance, July 1, 2019 |

| 24,375,948 |

| $ | 24,376 |

| $ | 23,631,481 |

| $ | (20,514,557) |

| $ | (109,585) |

| $ | 3,031,715 |

|

|

|

| |

|

| |

|

| |

|

| |

|

| |

|

Fair value of vested stock options |

| — |

| | — |

| | 552,902 |

| | — |

| | — |

| | 552,902 |

|

|

|

| |

|

| |

|

| |

|

| |

|

| |

|

Fair value of vested restricted common stock |

| 96,478 |

| | 97 |

| | 255,543 |

| | — |

| | — |

| | 255,640 |

|

|

|

| |

|

| |

|

| |

|

| |

|

| |

|

Repurchase of common stock |

| (96,400) |

| | (95) |

| | (268,442) |

| | — |

| | — |

| | (268,537) |

|

|

|

| |

|

| |

|

| |

|

| |

|

| |

|

Common stock issued upon exercise of stock options |

| 158,546 |

| | 157 |

| | (157) |

| | — |

| | — |

| | — |

|

|

|

| |

|

| |

|

| |

|

| |

|

| |

|

Common stock issued upon exercise of warrants | | 1,500,000 | | | 1,500 | | | 1,873,500 | | | — | | | — | | | 1,875,000 |

| | | | | | | | | | | | | | | | | |

Net loss for the period |

| — |

| | — |

| | — |

| | (661,683) |

| | — |

| | (661,683) |

|

|

|

| |

|

| |

|

| |

|

| |

|

| |

|

Foreign currency translation |

| — |

| | — |

| | — |

| | — |

| | (16,702) |

| | (16,702) |

| | | | | | | | | | | | | | | | | |

Balance, March 31, 2020 |

| 26,034,572 | | $ | 26,035 | | $ | 26,044,827 | | $ | (21,176,240) | | $ | (126,287) | | $ | 4,768,335 |

See notes to condensed consolidated financial statements

6

Research Solutions, Inc. and Subsidiaries

Condensed Consolidated Statements of Cash Flows

(Unaudited)

| | | | | | | |

| | Nine Months Ended | | ||||

| | March 31, | | ||||

|

| 2021 |

| 2020 | | ||

| | | | | | | |

Cash flow from operating activities: |

| |

|

| |

| |

Net loss | | $ | (196,213) | | $ | (661,683) | |

Adjustment to reconcile net loss to net cash provided by operating activities: | |

|

| |

|

| |

Gain from sale of discontinued operations | | | — | | | (117,445) | |

Depreciation and amortization | |

| 8,828 | |

| 19,908 | |

Amortization of lease right | |

| 72,331 | |

| 89,462 | |

Fair value of vested stock options | |

| 504,936 | |

| 552,902 | |

Fair value of vested restricted common stock | |

| 281,148 | |

| 255,640 | |

Changes in operating assets and liabilities: | |

|

| |

|

| |

Accounts receivable | |

| (563,829) | |

| (618,324) | |

Prepaid expenses and other current assets | |

| (75,473) | |

| 133,871 | |

Prepaid royalties | |

| (23,146) | |

| (566,379) | |

Deposits and other assets | |

| 5,360 | |

| 8,094 | |

Accounts payable and accrued expenses | |

| 1,208,474 | |

| 1,311,842 | |

Deferred revenue | |

| 1,076,966 | |

| 991,981 | |

Lease liability | |

| (79,326) | |

| (95,738) | |

Net cash provided by operating activities | |

| 2,220,056 | |

| 1,304,131 | |

| |

|

| |

|

| |

Cash flow from investing activities: | |

|

| |

|

| |

Purchase of property and equipment | |

| (11,853) | |

| — | |

Net cash used in investing activities | |

| (11,853) | |

| — | |

| |

|

| |

|

| |

Cash flow from financing activities: | |

| | | | | |

Proceeds from the exercise of stock options | | | 88,850 | | | — | |

Proceeds from the exercise of warrants | | | 81,251 | | | 1,875,000 | |

Common stock repurchase and retirement | | | (150,386) | | | (268,537) | |

Repurchase of stock options and warrants | | | (308,313) | | | — | |

Net cash provided by (used in) financing activities | |

| (288,598) | |

| 1,606,463 | |

| |

|

| |

|

| |

Effect of exchange rate changes | |

| 2,401 | |

| (14,424) | |

Net increase in cash and cash equivalents | |

| 1,922,006 | |

| 2,896,170 | |

Cash and cash equivalents, beginning of period | |

| 9,311,556 | |

| 5,353,090 | |

Cash and cash equivalents, end of period | | $ | 11,233,562 | | $ | 8,249,260 | |

| |

|

| |

|

| |

Supplemental disclosures of cash flow information: | |

|

| |

|

| |

Cash paid for income taxes | | $ | 3,077 | | $ | 7,861 | |

See notes to condensed consolidated financial statements

7

RESEARCH SOLUTIONS, INC. AND SUBSIDIARIES

NOTES TO CONDENSED CONSOLIDATED FINANCIAL STATEMENTS

Nine Months Ended March 31, 2021 and 2020 (Unaudited)

Note 1. Organization, Nature of Business and Basis of Presentation

Organization

Research Solutions, Inc. (the “Company,” “Research Solutions,” “we,” “us” or “our”) was incorporated in the State of Nevada on November 2, 2006, and is a publicly traded holding company with two wholly owned subsidiaries: Reprints Desk, Inc., a Delaware corporation and Reprints Desk Latin America S. de R.L. de C.V, an entity organized under the laws of Mexico.

Nature of Business

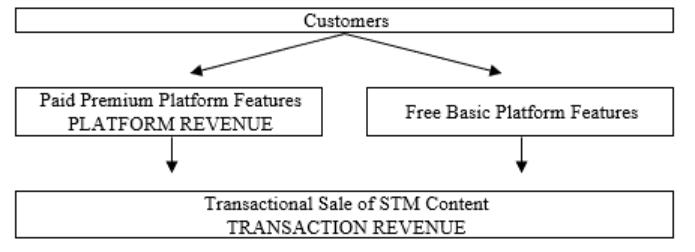

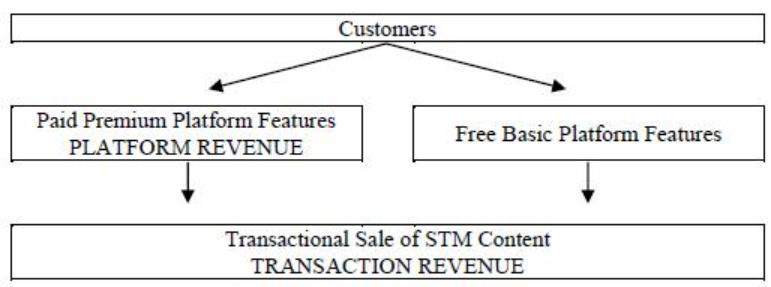

We provide two service offerings to our customers: annual licenses that allow customers to access and utilize certain premium features of our cloud based software-as-a-service (“SaaS”) research intelligence platform (“Platforms”) and the transactional sale of published scientific, technical, and medical (“STM”) content managed, sourced and delivered through the Platform (“Transactions”). Platforms and Transactions are packaged as a single solution that enable life science and other research intensive organizations to speed up research and development activities with faster, single sourced access and management of content and data used throughout the intellectual property development lifecycle.

Platforms

Our cloud-based SaaS research intelligence platform consists of proprietary software and Internet-based interfaces sold to customers for an annual subscription fee. Legacy functionality allows customers to initiate orders, route orders for the lowest cost acquisition, manage transactions, obtain spend and usage reporting, automate authentication, and connect seamlessly to in-house and third-party software systems. Customers can also enhance the information resources they already own or license and collaborate around bibliographic information.

Additional functionality has recently been added to our Platform in the form of interactive app-like gadgets. An alternative to manual data filtering, identification and extraction, gadgets are designed to gather, augment, and extract data across a variety of formats, including bibliographic citations, tables of contents, RSS feeds, PDF files, XML feeds, and web content. We are rapidly developing new gadgets in order to build an ecosystem of gadgets. Together, these gadgets will provide researchers with an “all in one” toolkit, delivering efficiencies in core research workflows and knowledge creation processes.

Our Platform is deployed as a single, multi-tenant system across our entire customer base. Customers securely access the Platform through online web interfaces and via web service APIs that enable customers to leverage Platform features and functionality from within in-house and third-party software systems. The Platform can also be configured to satisfy a customer’s individual preferences. We leverage our Platform’s efficiencies in scalability, stability and development costs to fuel rapid innovation and competitive advantage.

Transactions

Our Platform provides our customers with a single source to the universe of published STM content that includes over 70 million existing STM articles and over one million newly published STM articles each year. STM content is sold to our customers on a transaction basis. Researchers and knowledge workers in life science and other research-intensive organizations generally require single copies of published STM journal articles for use in their research activities. These individuals are our primary users.

Our Platform allows customers to find and download digital versions of STM articles that are critical to their research. Customers submit orders for the articles they need which we source and electronically deliver to them generally in under an hour. This service is generally known in the industry as single article delivery or document delivery. We also obtain the necessary permission licenses from the content publisher or other rights holder so that our customer’s use complies with applicable copyright laws. We have arrangements with hundreds of content publishers that allow us to

8

distribute their content. The majority of these publishers provide us with electronic access to their content, which allows us to electronically deliver single articles to our customers often in a matter of minutes.

Principles of Consolidation

The accompanying financial statements are consolidated and include the accounts of the Company and its wholly-owned subsidiaries. Intercompany balances and transactions have been eliminated in consolidation.

Basis of Presentation

The accompanying condensed consolidated financial statements are unaudited. These unaudited interim condensed consolidated financial statements have been prepared in accordance with accounting principles generally accepted in the United States (“GAAP”) and applicable rules and regulations of the Securities and Exchange Commission (“SEC”) regarding interim financial reporting. Certain information and note disclosures normally included in the financial statements prepared in accordance with GAAP have been condensed or omitted pursuant to such rules and regulations. Accordingly, these interim condensed consolidated financial statements should be read in conjunction with the consolidated financial statements and notes thereto contained in the Company’s Annual Report on Form 10-K for the fiscal year ended June 30, 2020 filed with the SEC. The condensed consolidated balance sheet as of June 30, 2020 included herein was derived from the audited consolidated financial statements as of that date, but does not include all disclosures, including notes, required by GAAP.

In the opinion of management, the accompanying unaudited condensed consolidated financial statements contain all adjustments necessary to fairly present the Company’s financial position and results of operations for the interim periods reflected. Except as noted, all adjustments contained herein are of a normal recurring nature. Results of operations for the fiscal periods presented herein are not necessarily indicative of fiscal year-end results.

Note 2. Summary of Significant Accounting Policies

Use of Estimates

The preparation of financial statements in conformity with GAAP requires management to make estimates and assumptions that affect the reported amounts of assets and liabilities and disclosures of contingent assets and liabilities at the date of the financial statements and the reported amounts of revenue and expenses during the reporting periods. Actual results could differ from these estimates.

These estimates and assumptions include estimates for reserves of uncollectible accounts, accruals for potential liabilities, assumptions made in valuing equity instruments issued for services or acquisitions, and realization of deferred tax assets.

Concentration of Credit Risk

Financial instruments, which potentially subject the Company to concentrations of credit risk, consist of cash and cash equivalents and accounts receivable. The Company places its cash with high quality financial institutions and at times may exceed the FDIC $250,000 insurance limit. The Company does not anticipate incurring any losses related to these credit risks. The Company extends credit based on an evaluation of the customer’s financial condition, generally without collateral. Exposure to losses on receivables is principally dependent on each customer’s financial condition. The Company monitors its exposure for credit losses and intends to maintain allowances for anticipated losses, as required.

Cash denominated in Euros with a US Dollar equivalent of $114,525 and $134,175 at March 31, 2021 and June 30, 2020, respectively, was held by Reprints Desk in accounts at financial institutions located in Europe.

The Company has no customers that represent 10% of revenue or more for the three and nine months ended March 31, 2021 and 2020.

The Company has no customers that accounted for greater than 10% of accounts receivable at March 31, 2021 and June 30, 2020.

9

The following table summarizes vendor concentrations:

| | | | | | | | | | | | | |

| | Three Months Ended |

| | Nine Months Ended |

| | ||||||

| | March 31, |

| | March 31, |

| | ||||||

|

| 2021 |

|

| 2020 | | | 2021 |

|

| 2020 | | |

Vendor A | | 22 | % | | 19 | % | | 19 | % | | 21 | % | |

Vendor B | | 13 | % | | 13 | % | | 13 | % | | 13 | % | |

Vendor C | | * | | | * | | | * | | | * | | |

* Less than 10%

Revenue Recognition

The Company accounts for revenue in accordance ASU 2014-09, Revenue from Contracts with Customers (Topic 606), ("ASC 606"). The underlying principle of ASC 606 is to recognize revenue to depict the transfer of goods or services to customers at the amount expected to be collected. The Company adopted the guidance of ASC 606 on July 1, 2018.

Revenues are recognized when control of the promised goods or services are transferred to a customer, in an amount that reflects the consideration that the Company expects to receive in exchange for those goods or services. The Company derives its revenues from two sources: annual licenses that allow customers to access and utilize certain premium features of our cloud based SaaS research intelligence platform (“Platforms”) and the transactional sale of STM content managed, sourced and delivered through the Platform (“Transactions”).

The Company applies the following five steps in order to determine the appropriate amount of revenue to be recognized as it fulfills its obligations under each of its agreements:

| ● | identify the contract with a customer; |

| ● | identify the performance obligations in the contract; |

| ● | determine the transaction price; |

| ● | allocate the transaction price to performance obligations in the contract; and |

| ● | recognize revenue as the performance obligation is satisfied. |

Platforms

We charge a subscription fee that allows customers to access and utilize certain premium features of our Platform. Revenue is recognized ratably over the term of the subscription agreement, which is typically one year, provided all other revenue recognition criteria have been met. Billings or payments received in advance of revenue recognition are recorded as deferred revenue.

Transactions

We charge a transactional service fee for the electronic delivery of single articles, and a corresponding copyright fee for the permitted use of the content. We recognize revenue from single article delivery services upon delivery to the customer provided all other revenue recognition criteria have been met.

10

Deferred Revenue

Contract liabilities, such as deferred revenue, exist where the Company has the obligation to transfer services to a customer for which the entity has received consideration, or when the consideration is due, from the customer.

Cash payments received or due in advance of performance are recorded as deferred revenue. Deferred revenue is primarily comprised of cloud-based software subscriptions which are generally billed in advance. The deferred revenue balance is presented as a current liability on the Company's consolidated balance sheets.

Cost of Revenue

Platforms

Cost of Platform revenue consists primarily of personnel costs of our operations team, and to a lesser extent managed hosting providers and other third-party service and data providers.

Transactions

Cost of Transaction revenue consists primarily of the respective copyright fee for the permitted use of the content, less a discount in most cases, and to a much lesser extent, personnel costs of our operations team and third-party service providers.

Stock-Based Compensation

The Company periodically issues stock options and restricted stock awards to employees and non-employees for services. The Company accounts for such grants issued and vesting based on ASC 718, whereby the value of the award is measured on the date of grant and recognized as compensation expense on the straight-line basis over the vesting period. The Company recognizes the fair value of stock-based compensation within its Statements of Operations with classification depending on the nature of the services rendered.

Under ASC 718, Repurchase or Cancellation of equity awards, the amount of cash or other assets transferred (or liabilities incurred) to repurchase an equity award shall be charged to equity, to the extent that the amount paid does not exceed the fair value of the equity instruments repurchased at the repurchase date. Any excess of the repurchase price over the fair value of the instruments repurchased shall be recognized as additional compensation cost.

Foreign Currency

The accompanying condensed consolidated financial statements are presented in United States dollars, the functional currency of the Company. Capital accounts of foreign subsidiaries are translated into US Dollars from foreign currency at their historical exchange rates when the capital transactions occurred. Assets and liabilities are translated at the exchange rate as of the balance sheet date. Income and expenditures are translated at the average exchange rate of the period. Although the majority of our revenue and costs are in US dollars, the costs of Reprints Desk Latin America are in Mexican Pesos. As a result, currency exchange fluctuations may impact our revenue and the costs of our operations. We currently do not engage in any currency hedging activities.

Gains and losses from foreign currency transactions, which result from a change in exchange rates between the functional currency and the currency in which a foreign currency transaction is denominated, are included in selling, general and administrative expenses and amounted to a loss of $6,648 and $8,648 for the three months ended March 31, 2021 and 2020, respectively and a gain of $35,070 and a loss of $15,315 for the nine months ended March 31, 2021 and 2020, respectively. Cash denominated in Euros with a US Dollar equivalent of $114,525 and $134,175 at March 31, 2021 and June 30, 2020, respectively, was held in accounts at financial institutions located in Europe.

11

The following table summarizes the exchange rates used:

| | Nine Months Ended |

| Year Ended | ||||

| | March 31, |

| June 30, | ||||

|

| 2021 |

| 2020 |

| 2020 |

| 2019 |

Period end Euro : US Dollar exchange rate | | 1.17 | | 1.10 | | 1.12 | | 1.14 |

Average period Euro : US Dollar exchange rate |

| 1.18 |

| 1.11 | | 1.14 |

| 1.14 |

|

| |

| | | |

| |

Period end Mexican Peso : US Dollar exchange rate |

| 0.05 |

| 0.04 | | 0.04 |

| 0.05 |

Average period Mexican Peso : US Dollar exchange rate |

| 0.05 |

| 0.05 | | 0.05 |

| 0.05 |

Net Income (Loss) Per Share

Basic net income (loss) per share is computed by dividing net income (loss) by the weighted average number of common shares outstanding for the period, excluding shares of unvested restricted common stock. Shares of restricted stock are included in the basic weighted average number of common shares outstanding from the time they vest. Diluted earnings per share is computed by dividing the net income applicable to common stockholders by the weighted average number of common shares outstanding plus the number of additional common shares that would have been outstanding if all dilutive potential common shares had been issued, using the treasury stock method. Shares of restricted stock are included in the diluted weighted average number of common shares outstanding from the date they are granted. Potential common shares are excluded from the computation when their effect is antidilutive. At March 31, 2021 potentially dilutive securities include options to acquire 3,261,203 shares of common stock, warrants to acquire 220,000 shares of common stock and unvested restricted common stock of 241,197. At March 31, 2020 potentially dilutive securities include options to acquire 3,324,580 shares of common stock, warrants to acquire 385,000 shares of common stock and unvested restricted common stock of 219,926. The dilutive effect of potentially dilutive securities is reflected in diluted net income per share if the exercise prices were lower than the average fair market value of common shares during the reporting period.

Basic and diluted net loss per common share is the same for the nine months ended March 31, 2021 and 2020 because all stock options, warrants, and unvested restricted common stock are anti-dilutive. For the three months ended March 31, 2021 and 2020, the calculation of diluted earnings per share includes unvested restricted common stock, stock options and warrants, calculated under the treasury stock method.

Recently Issued Accounting Pronouncements

In June 2016, the FASB issued ASU 2016-13, Measurement of Credit Losses on Financial Instruments. ASU 2016-13 requires entities to use a forward-looking approach based on current expected credit losses (“CECL”) to estimate credit losses on certain types of financial instruments, including trade receivables. This may result in the earlier recognition of allowances for losses. ASU 2016-13 is effective for the Company beginning January 1, 2023, and early adoption is permitted. The Company does not believe the potential impact of the new guidance and related codification improvements will be material to its financial position, results of operations and cash flows.

Other recent accounting pronouncements issued by the FASB, including its Emerging Issues Task Force, the American Institute of Certified Public Accountants, and the Securities and Exchange Commission did not or are not believed by management to have a material impact on the Company’s present or future consolidated financial statements.

Note 3. Line of Credit

The Company entered into a Loan and Security Agreement with Silicon Valley Bank (“SVB”) on July 23, 2010, which, as amended, provides for a revolving line of credit for the lesser of $2,500,000, or 80% of eligible accounts receivable. The line of credit matures on February 14, 2022, and is subject to certain financial and performance covenants with which we were in compliance as of March 31, 2021. Financial covenants include maintaining an adjusted quick ratio of unrestricted cash and net accounts receivable, divided by current liabilities plus debt less deferred revenue of at least 1.15 to 1.0, and maintaining tangible net worth of $1,500,000, plus 50% of net income for the fiscal quarter ended from and after December 31, 2017, plus 50% of the dollar value of equity issuances after October 1, 2017 and the principal amount of subordinated debt. The line of credit bears interest at an annual rate equal to the greater of 1% above the prime

12

rate and 5.5%. The interest rate on the line of credit was 5.5% as of March 31, 2021. The line of credit is secured by the Company’s consolidated assets.

There were no outstanding borrowings under the line as of March 31, 2021 and June 30, 2020, respectively. As of March 31, 2021, there was approximately $1,888,000 of available credit.

Note 4. Lease Obligations

On December 30, 2016, the Company entered into a 48 month non-cancellable lease for its office facilities that will require monthly payments ranging from $10,350 to $11,475 through January 2021. In accounting for the lease, the Company adopted ASU 2016-02, Leases which requires a lessee to record a right-of-use asset and a corresponding lease liability at the inception of the lease initially measured at the present value of the lease payments. The Company classified the lease as an operating lease and determined that the value of the lease assets and liability at the inception of the lease was $463,000 using a discount rate of 3.75%. During the nine months ended March 31, 2021, the Company made payments of $79,326 towards the lease liability. As of March 31, 2021 and June 30, 2020, lease liability amounted to $0 and $79,326, respectively. ASU 2016-02 requires recognition in the statement of operations of a single lease cost, calculated so that the cost of the lease is allocated over the lease term, generally on a straight-line basis. Rent expense, including real estate taxes, for the nine months ended March 31, 2021 and 2020 was $35,065 and $97,275, respectively. The right of use asset at June 30, 2020 was $72,331. During the nine months ended March 31, 2021, the Company reflected amortization of right of use asset of $72,331 related to this lease, resulting in a net asset balance of $0 as of March 31, 2021.

On October 8, 2019, the Company entered into an agreement to sublease its office facilities from November 1, 2019 through January 31, 2021, the end of the lease term, for $8,094 per month with one month of abated rent. The Company recorded rent income of $56,658 during the nine months ended March 31, 2021. This amount is reflected as an offset to rent expense that is included in general and administrative expenses in the accompanying statements of operations.

Note 5. Stockholders’ Equity

Stock Options

In December 2007, we established the 2007 Equity Compensation Plan (the “2007 Plan”) and in November 2017 we established the 2017 Omnibus Incentive Plan (the “2017 Plan”), collectively (the “Plans”). The Plans were approved by our board of directors and stockholders. The purpose of the Plans is to grant stock and options to purchase our common stock, and other incentive awards, to our employees, directors and key consultants. On November 10, 2016, the maximum number of shares of common stock that may be issued pursuant to awards granted under the 2007 Plan increased from 5,000,000 to 7,000,000. On November 21, 2017, the Company’s stockholders approved the adoption of the 2017 Plan (previously adopted by our board of directors on September 14, 2017), which authorized a maximum of 1,874,513 shares of common stock that may be issued pursuant to awards granted under the 2017 Plan. On November 17, 2020, the Company's stockholders approved an increase in the maximum number of shares of common stock that may be issued pursuant to awards granted under the 2017 Omnibus Incentive Plan from 2,374,513 to 3,374,513. Upon adoption of the 2017 Plan we ceased granting incentive awards under the 2007 Plan and commenced granting incentive awards under the 2017 Plan. The shares of our common stock underlying cancelled and forfeited awards issued under the 2017 Plan may again become available for grant under the 2017 Plan. Cancelled and forfeited awards issued under the 2007 Plan that were cancelled or forfeited prior to November 21, 2017 became available for grant under the 2007 Plan. As of March 31, 2021, there were 1,129,483 shares available for grant under the 2017 Plan, and no shares were available for grant under the 2007 Plan. All incentive stock award grants prior to the adoption of the 2017 Plan on November 21, 2017 were made under the 2007 Plan, and all incentive stock award grants after the adoption of the 2017 Plan on November 21, 2017 were made under the 2017 Plan.

The majority of awards issued under the Plan vest immediately or over three years, with a one year cliff vesting period, and have a term of ten years. Stock-based compensation cost is measured at the grant date, based on the fair value of the awards that are ultimately expected to vest, and recognized on a straight-line basis over the requisite service period, which is generally the vesting period.

13

The following table summarizes vested and unvested stock option activity:

| | | | | | | | | | | | | | | |

| | All Options | | Vested Options | | Unvested Options | |||||||||

|

| |

| Weighted |

| |

| Weighted |

| |

| Weighted | |||

| | | | Average | | | | Average | | | | Average | |||

| | | | Exercise | | | | Exercise | | | | Exercise | |||

| | Shares | | Price | | Shares | | Price | | Shares | | Price | |||

Outstanding at June 30, 2020 |

| 3,327,580 |

| $ | 1.56 |

| 3,081,745 |

| $ | 1.50 |

| 245,835 |

| $ | 2.34 |

Granted |

| 478,143 |

| | 2.27 |

| 250,000 |

| | 2.13 |

| 228,143 |

| | 2.43 |

Options vesting |

| — |

| | — |

| 136,749 |

| | 2.27 |

| (136,749) |

| | 2.27 |

Exercised |

| (274,520) |

| | 1.34 |

| (274,520) |

| | 1.34 |

| — |

| | — |

Forfeited/Repurchased |

| (270,000) |

| | 1.38 |

| (246,250) |

| | 1.32 |

| (23,750) |

| | 1.99 |

Outstanding at March 31, 2021 |

| 3,261,203 | | $ | 1.70 |

| 2,947,724 | | $ | 1.62 |

| 313,479 | | $ | 2.47 |

The weighted average remaining contractual life of all options outstanding as of March 31, 2021 was 5.64 years. The remaining contractual life for options vested and exercisable at March 31, 2021 was 5.27 years. Furthermore, the aggregate intrinsic value of options outstanding as of March 31, 2021 was $2,328,000, and the aggregate intrinsic value of options vested and exercisable at March 31, 2021 was $2,318,659, in each case based on the fair value of the Company’s common stock on March 31, 2021.

During the nine months ended March 31, 2021, the Company granted 478,143 options to employees with a fair value of $571,170 which amount will be amortized over the vesting period. The total fair value of options that vested during the nine months ended March 31, 2021 was $504,936 and is included in selling, general and administrative expenses in the accompanying statement of operations. As of March 31, 2021, the amount of unvested compensation related to stock options was $351,799 which will be recorded as an expense in future periods as the options vest. During the nine months ended March 31, 2021, the Company issued 158,609 net shares of common stock upon the exercise of options underlying 274,520 shares of common stock, resulting in net cash proceeds of $88,850.

On March 31, 2021 the Company repurchased options underlying 243,750 shares of stock from a former director for $213,312.50. The entire amount was charged to equity.

The following table presents the assumptions used to estimate the fair values based upon a Black-Scholes option pricing model of the stock options granted during the nine months ended March 31, 2021 and 2020.

| | Nine Months Ended |

| | ||

| | March 31, | | | ||

|

| 2021 |

| 2020 | | |

Expected dividend yield |

| 0 | % | 0 | % | |

Risk-free interest rate |

| 0.37% - 0.73 | % | 1.37% - 1.69 | % | |

Expected life (in years) |

| 5 - 6 |

| 5 - 6 | | |

Expected volatility |

| 57 - 63 | % | 62 - 64 | % | |

14

Additional information regarding stock options outstanding and exercisable as of March 31, 2021 is as follows:

| Option |

| |

| Remaining |

| |

| Exercise | | Options | | Contractual | | Options |

| Price | | Outstanding | | Life (in years) | | Exercisable |

$ | 0.59 |

| 8,150 |

| 1.25 |

| 8,150 |

| 0.60 |

| 5,000 |

| 1.25 |

| 5,000 |

| 0.65 |

| 6,150 |

| 1.25 |

| 6,150 |

| 0.70 |

| 225,000 |

| 4.68 |

| 225,000 |

| 0.77 |

| 49,500 |

| 2.33 |

| 49,500 |

| 0.80 |

| 16,000 |

| 4.39 |

| 16,000 |

| 0.90 |

| 25,667 |

| 3.06 |

| 25,667 |

| 0.97 |

| 6,000 |

| 1.25 |

| 6,000 |

| 1.00 |

| 28,249 |

| 2.68 |

| 28,249 |

| 1.02 |

| 2,000 |

| 1.25 |

| 2,000 |

| 1.05 |

| 315,529 |

| 5.26 |

| 315,529 |

| 1.07 |

| 33,898 |

| 1.54 |

| 33,898 |

| 1.09 |

| 75,000 |

| 4.37 |

| 75,000 |

| 1.10 |

| 105,000 |

| 4.25 |

| 105,000 |

| 1.15 |

| 128,400 |

| 1.85 |

| 128,400 |

| 1.20 |

| 274,000 |

| 6.30 |

| 274,000 |

| 1.25 |

| 32,000 |

| 1.87 |

| 32,000 |

| 1.30 |

| 243,000 |

| 0.93 |

| 243,000 |

| 1.50 |

| 185,000 |

| 1.73 |

| 185,000 |

| 1.59 |

| 25,000 |

| 7.12 |

| 25,000 |

| 1.80 |

| 94,050 |

| 2.38 |

| 94,050 |

| 1.85 |

| 17,800 |

| 2.05 |

| 17,800 |

| 1.95 |

| 200,000 |

| 7.26 |

| 183,332 |

| 2.13 | | 216,708 | | 9.64 | | 200,000 |

| 2.40 |

| 388,667 |

| 7.63 |

| 364,166 |

| 2.45 | | 173,000 | | 9.35 | | — |

| 2.49 | | 88,435 | | 9.09 | | 29,167 |

| 2.50 | | 20,000 | | 8.13 | | 13,333 |

| 2.99 | | 8,000 | | 9.12 | | — |

| 3.13 | | 258,000 | | 8.62 | | 254,000 |

| 3.50 | | 8,000 | | 8.87 | | 3,333 |

| Total | | 3,261,203 | | | | 2,947,724 |

Warrants

The following table summarizes warrant activity:

| | | | | |

|

| |

| Weighted | |

| | | | Average | |

| | Number of | | Exercise | |

| | Warrants | | Price | |

Outstanding, June 30, 2020 |

| 385,000 | | $ | 1.24 |

Granted |

| — | |

| — |

Exercised |

| (65,000) | |

| 1.25 |

Repurchased |

| (100,000) | |

| 1.25 |

Expired/Cancelled |

| — | |

| — |

Outstanding, March 31, 2021 |

| 220,000 | | $ | 1.24 |

Exercisable, June 30, 2020 |

| 385,000 | | $ | 1.24 |

Exercisable, March 31, 2021 |

| 220,000 | | $ | 1.24 |

15

The intrinsic value for all warrants outstanding as of March 31, 2021 was $238,400, based on the fair value of the Company’s common stock on March 31, 2021.

During the nine months ended March 31, 2021, certain holders of warrants to purchase shares of the Company's common stock at a per share exercise price of $1.25 exercised those warrants to purchase 65,000 shares of common stock, generating gross proceeds to the Company of $81,251.

On March 31, 2021 the Company repurchased warrants underlying 100,000 shares of stock from a former director for $95,000. The entire amount was charged to equity.

Additional information regarding warrants outstanding and exercisable as of March 31, 2021 is as follows:

| | | | | | | |

| |

| |

| Remaining |

| |

| Warrant | | Warrants | | Contractual | | Warrants |

| Exercise Price | | Outstanding | | Life (in years) | | Exercisable |

$ | 1.19 |

| 50,000 |

| 0.73 |

| 50,000 |

| 1.25 |

| 170,000 |

| 0.23 |

| 170,000 |

| Total |

| 220,000 |

|

|

| 220,000 |

Restricted Common Stock

Prior to July 1, 2020, the Company issued 2,277,366 shares of restricted common stock to employees valued at $2,709,318, of which 1,871,187 shares have vested, 214,324 shares with fair value of $188,203 have been forfeited, and $1,785,857 has been recognized as an expense. The balance of the non-vested shares of restricted common stock was 191,855 at June 30, 2020.

During the nine months ended March 31, 2021, the Company issued an additional 163,553 shares of restricted stock to employees. These shares vest over a three year period, with a one year cliff vesting period, and remain subject to forfeiture if vesting conditions are not met. The aggregate fair value of the stock awards was $393,996 based on the market price of our common stock price of $2.41 per share on the date of grant, which will be amortized over the three-year vesting period.

The total fair value of restricted common stock vesting during the nine months ended March 31, 2021 was $281,148 and is included in selling, general and administrative expenses in the accompanying statements of operations. As of March 31, 2021, the amount of unvested compensation related to issuances of restricted common stock was $507,145, which will be recognized as an expense in future periods as the shares vest. When calculating basic net income (loss) per share, these shares are included in weighted average common shares outstanding from the time they vest. When calculating diluted net income per share, these shares are included in weighted average common shares outstanding as of their grant date.

The following table summarizes restricted common stock activity:

|

| |

| | |

| Weighted | |

| | | | | | | Average | |

| | Number of | | | | | Grant Date | |

| | Shares | | Fair Value | | Fair Value | ||

Non-vested, June 30, 2020 |

| 191,855 | | $ | 394,297 | | $ | 2.51 |

Granted |

| 163,553 | |

| 393,996 | |

| 2.41 |

Vested |

| (114,211) | |

| (281,148) | |

| 2.34 |

Forfeited |

| — | |

| — | |

| — |

Non-vested, March 31, 2021 |

| 241,197 | | $ | 507,145 | | $ | 2.52 |

16

Common Stock Repurchase and Retirement

Effective as of February 9, 2021, the Compensation Committee of our Board of Directors authorized the repurchase, during calendar year 2021 on the last day of each trading window and otherwise in accordance with our insider trading policies, of up to $400,000 of outstanding common stock (at prices no greater than $4.00 per share) from our employees to satisfy their tax obligations in connection with the vesting of stock incentive awards. The actual number of shares repurchased will be determined by applicable employees in their discretion, and will depend on their evaluation of market conditions and other factors.

During the nine months ended March 31, 2021, the Company repurchased 67,417 shares of our common stock from employees at an average market price of approximately $2.23 per share for an aggregate amount of $150,386.

As of December 31, 2020, the 2020 plan has expired. The shares of common stock were surrendered by employees to cover tax withholding obligations with respect to the vesting of restricted stock. Shares repurchased are retired and deducted from common stock for par value and from additional paid in capital for the excess over par value.

Note 6. Contingencies

COVID-19

The Company is subject to risks and uncertainties as a result of the COVID-19 pandemic. The extent of the impact of the COVID-19 pandemic on the Company’s business is highly uncertain and difficult to predict, as the responses that the Company, other businesses and governments are taking continue to evolve. Furthermore, capital markets and economies worldwide have also been negatively impacted by the COVID-19 pandemic, and it is possible that it could cause a local and/or global economic recession. Policymakers around the globe have responded with fiscal policy actions to support the healthcare industry and economy as a whole. The magnitude and overall effectiveness of these actions remain uncertain.

To date, we have not experienced any significant changes in our business that would have a significant negative impact on our consolidated statements of operations or cash flows.

The severity of the impact of the COVID-19 pandemic on the Company’s business will depend on a number of factors, including, but not limited to, the duration and severity of the pandemic and the extent and severity of the impact on the Company’s customers, service providers and suppliers, all of which are uncertain and cannot be predicted. As of the date of issuance of Company’s financial statements, the extent to which the COVID-19 pandemic may in the future materially impact the Company’s financial condition, liquidity or results of operations is uncertain.

17

Item 2. Management’s Discussion and Analysis of Financial Condition and Results of Operations

Cautionary Notice Regarding Forward-Looking Statements

The following discussion and analysis of our financial condition and results of operations for the three and nine months ended March 31, 2021 and 2020 should be read in conjunction with our consolidated financial statements and related notes to those financial statements that are included elsewhere in this report. Our discussion includes forward-looking statements based upon current expectations that involve risks and uncertainties, such as our plans, objectives, expectations and intentions. Actual results and the timing of events could differ materially from those anticipated in these forward-looking statements as a result of a number of factors, including those set forth under “Risk Factors” in our Annual Report on Form 10-K for the fiscal year ended June 30, 2020.

We use words such as “anticipate,” “estimate,” “plan,” “project,” “continuing,” “ongoing,” “expect,” “believe,” “intend,” “may,” “will,” “should,” “could,” and similar expressions to identify forward-looking statements. All forward-looking statements included in this report are based on information available to us on the date hereof and, except as required by law, we assume no obligation to update any such forward-looking statements.

Overview

Research Solutions was incorporated in the State of Nevada on November 2, 2006, and is a publicly traded holding company with two wholly owned subsidiaries at June 30, 2020: Reprints Desk, Inc., a Delaware corporation and Reprints Desk Latin America S. de R.L. de C.V, an entity organized under the laws of Mexico.

We provide two service offerings to our customers: annual licenses that allow customers to access and utilize certain premium features of our cloud based software-as-a-service (“SaaS”) research intelligence platform (“Platforms”) and the transactional sale of published scientific, technical, and medical (“STM”) content managed, sourced and delivered through the Platform (“Transactions”). Platforms and Transactions are packaged as a single solution that enable life science and other research intensive organizations to speed up research and development activities with faster, single sourced access and management of content and data used throughout the intellectual property development lifecycle.

Platforms

Our cloud-based SaaS research intelligence platform consists of proprietary software and Internet-based interfaces sold to customers for an annual subscription fee. Legacy functionality allows customers to initiate orders, route orders for the lowest cost acquisition, manage transactions, obtain spend and usage reporting, automate authentication, and connect seamlessly to in-house and third-party software systems. Customers can also enhance the information resources they already own or license and collaborate around bibliographic information.

Additional functionality has recently been added to our Platform in the form of interactive app-like gadgets. An alternative to manual data filtering, identification and extraction, gadgets are designed to gather, augment, and extract data across a variety of formats, including bibliographic citations, tables of contents, RSS feeds, PDF files, XML feeds, and web content. We are rapidly developing new gadgets in order to build an ecosystem of gadgets. Together, these gadgets will provide researchers with an “all in one” toolkit, delivering efficiencies in core research workflows and knowledge creation processes.

Our Platform is deployed as a single, multi-tenant system across our entire customer base. Customers securely access the Platform through online web interfaces and via web service APIs that enable customers to leverage Platform features and functionality from within in-house and third-party software systems. The Platform can also be configured to satisfy a customer’s individual preferences. We leverage our Platform’s efficiencies in scalability, stability and development costs to fuel rapid innovation and competitive advantage.

18

Transactions

Our Platform provides our customers with a single source to the universe of published STM content that includes over 70 million existing STM articles and over one million newly published STM articles each year. STM content is sold to our customers on a transaction basis. Researchers and knowledge workers in life science and other research-intensive organizations generally require single copies of published STM journal articles for use in their research activities. These individuals are our primary users.

Our Platform allows customers to find and download digital versions of STM articles that are critical to their research. Customers submit orders for the articles they need which we source and electronically deliver to them generally in under an hour. This service is generally known in the industry as single article delivery or document delivery. We also obtain the necessary permission licenses from the content publisher or other rights holder so that our customer’s use complies with applicable copyright laws. We have arrangements with hundreds of content publishers that allow us to distribute their content. The majority of these publishers provide us with electronic access to their content, which allows us to electronically deliver single articles to our customers often in a matter of minutes.

COVID-19

We are subject to risks and uncertainties as a result of the COVID-19 pandemic. The extent of the impact of the COVID-19 pandemic on our business is highly uncertain and difficult to predict, as the responses that we, other businesses and governments are taking continue to evolve. Furthermore, capital markets and economies worldwide have also been negatively impacted by the COVID-19 pandemic, and it is possible that it could cause a local and/or global economic recession. Policymakers around the globe have responded with fiscal policy actions to support the healthcare industry and economy as a whole. The magnitude and overall effectiveness of these actions remain uncertain.

To date, we have not experienced any significant changes in our business that would have a significant negative impact on our consolidated statements of operations or cash flows.

The severity of the impact of the COVID-19 pandemic on our business will depend on a number of factors, including, but not limited to, the duration and severity of the pandemic and the extent and severity of the impact on our customers, service providers and suppliers, all of which are uncertain and cannot be predicted. As of the date of issuance of our financial statements, the extent to which the COVID-19 pandemic may in the future materially impact our financial condition, liquidity or results of operations is uncertain.

Critical Accounting Policies and Estimates

The preparation of our consolidated financial statements in conformity with accounting principles generally accepted in the United States, or GAAP, requires us to make estimates and assumptions that affect the reported amounts of assets, liabilities, revenue and expenses, and related disclosure of contingent assets and liabilities. When making these estimates and assumptions, we consider our historical experience, our knowledge of economic and market factors and various other factors that we believe to be reasonable under the circumstances. Actual results may differ under different estimates and assumptions.

The accounting estimates and assumptions discussed in this section are those that we consider to be the most critical to an understanding of our financial statements because they inherently involve significant judgments and uncertainties.

Revenue Recognition

In May 2014, the Financial Accounting Standards Board (“FASB”) issued ASU 2014-09, Revenue from Contracts with Customers (Topic 606), ("ASC 606"). The underlying principle of ASC 606 is to recognize revenue to depict the transfer of goods or services to customers at the amount expected to be collected. We adopted the guidance of ASC 606 on July 1, 2018. The implementation of ASC 606 had no impact on the condensed consolidated financial statements and no cumulative effect adjustment was recognized.

19

Revenues are recognized when control of the promised goods or services are transferred to a customer, in an amount that reflects the consideration that we expect to receive in exchange for those goods or services. We derive our revenues from two sources: annual licenses that allow customers to access and utilize certain premium features of our cloud based SaaS research intelligence platform (“Platforms”) and the transactional sale of STM content managed, sourced and delivered through the Platform (“Transactions”).

We apply the following five steps in order to determine the appropriate amount of revenue to be recognized as we fulfill our obligations under each of our agreements:

| ● | identify the contract with a customer; |

| ● | identify the performance obligations in the contract; |

| ● | determine the transaction price; |

| ● | allocate the transaction price to performance obligations in the contract; and |

| ● | recognize revenue as the performance obligation is satisfied. |

Platforms

We charge a subscription fee that allows customers to access and utilize certain premium features of our Platform. Revenue is recognized ratably over the term of the subscription agreement, which is typically one year, provided all other revenue recognition criteria have been met. Billings or payments received in advance of revenue recognition are recorded as deferred revenue.

Transactions

We charge a transactional service fee for the electronic delivery of single articles, and a corresponding copyright fee for the permitted use of the content. We recognize revenue from single article delivery services upon delivery to the customer provided all other revenue recognition criteria have been met.

Stock-Based Compensation

The fair value of our stock options is estimated using the Black-Scholes-Merton Option Pricing model, which uses certain assumptions related to risk-free interest rates, expected volatility, expected life of the stock options or restricted stock, and future dividends. Compensation expense is recorded based upon the value derived from the Black-Scholes-Merton Option Pricing model and based on actual experience. The assumptions used in the Black-Scholes-Merton Option Pricing model could materially affect compensation expense recorded in future periods.

20

Recent Accounting Pronouncements

Please refer to footnote 2 to the condensed consolidated financial statements contained elsewhere in this Form 10-Q for a discussion of Recent Accounting Pronouncements.

Quarterly Information (Unaudited)

The following table sets forth unaudited and quarterly financial data for the most recent eight quarters:

|

| Mar. 31, | | Dec. 31, |

| Sept. 30, | | June 30, |

| Mar. 31, |

| Dec. 31, |

| Sept. 30, |

| June 30, |

| ||||||||

| | 2021 |

| 2020 |

| 2020 |

| 2020 |

| 2020 |

| 2019 |

| 2019 |

| 2019 | | ||||||||

Revenue: |

| |

| | |

|

| |

| | |

|

| |

|

| |

|

| |

|

| |

|

|

Platforms | | $ | 1,344,183 | | $ | 1,220,535 | | $ | 1,141,688 | | $ | 1,066,630 | | $ | 1,017,789 | | $ | 949,825 | | $ | 856,445 | | $ | 803,917 | |

Transactions | |

| 6,996,349 | |

| 6,229,200 | |

| 6,606,737 | |

| 6,819,150 | |

| 7,029,617 | |

| 6,580,613 | |

| 6,738,668 | |

| 6,670,685 | |

Total revenue | |

| 8,340,532 | |

| 7,449,735 | |

| 7,748,425 | |

| 7,885,780 | |

| 8,047,406 | |

| 7,530,438 | |

| 7,595,113 | |

| 7,474,602 | |

| | | | | | | | | | | | | | | | | | | | | | | | | |

Cost of revenue: | |

|

| |

|

| |

|

| |

|

| |

|

| |

|

| |

|

| |

|

| |

Platforms | |

| 233,696 | |

| 217,003 | |

| 203,952 | |

| 153,241 | |

| 177,919 | |

| 162,508 | |

| 150,470 | |

| 142,368 | |

Transactions | |

| 5,404,196 | |

| 4,841,150 | |

| 5,094,897 | |

| 5,224,006 | |

| 5,330,473 | |

| 5,094,130 | |

| 5,128,108 | |

| 5,104,629 | |

Total cost of revenue | |

| 5,637,892 | |

| 5,058,153 | |

| 5,298,849 | |

| 5,377,247 | |

| 5,508,392 | |

| 5,256,638 | |

| 5,278,578 | |

| 5,246,997 | |

| | | | | | | | | | | | | | | | | | | | | | | | | |

Gross profit: | |

|

| |

|

| |

|

| |

|

| |

|

| |

|

| |

|

| |

|

| |

Platforms | |

| 1,110,487 | |

| 1,003,532 | |

| 937,736 | |

| 913,389 | |

| 839,870 | |

| 787,317 | |

| 705,975 | |

| 661,549 | |

Transactions | |

| 1,592,153 | |

| 1,388,050 | |

| 1,511,840 | |

| 1,595,144 | |

| 1,699,144 | |

| 1,486,483 | |

| 1,610,560 | |

| 1,566,056 | |

Total gross profit | |

| 2,702,640 | |

| 2,391,582 | |

| 2,449,576 | |

| 2,508,533 | |

| 2,539,014 | |

| 2,273,800 | |

| 2,316,535 | |

| 2,227,605 | |

| | | | | | | | | | | | | | | | | | | | | | | | | |

Operating expenses: | |

|

| |

|

| |

|

| |

|

| |

|

| |

|

| |

|

| |

|

| |

Sales and marketing | |

| 566,713 | |

| 487,571 | |

| 498,374 | |

| 692,096 | |

| 626,956 | |

| 638,837 | |

| 550,349 | |

| 659,108 | |

Technology and product dev. | |

| 664,195 | |

| 624,747 | |

| 622,961 | |

| 537,830 | |

| 536,238 | |

| 548,719 | |

| 499,191 | |

| 549,198 | |

General and administrative | |

| 1,233,603 | |

| 1,118,750 | |

| 1,161,061 | |

| 1,132,483 | |

| 1,230,580 | |

| 1,270,375 | |

| 1,231,345 | |

| 1,060,269 | |

Depreciation and amortization | |

| 2,066 | |

| 3,039 | |

| 3,723 | |

| 3,746 | |

| 5,510 | |

| 6,840 | |

| 7,558 | |

| 8,351 | |

Stock-based comp. expense | |

| 179,345 | |

| 435,949 | |

| 170,791 | |

| 143,054 | |

| 142,237 | |

| 523,632 | |

| 142,672 | |

| 126,903 | |

Foreign currency transaction loss (gain) | |

| 6,648 | |

| (17,469) | |

| (24,249) | |

| 4,214 | |

| 8,648 | |

| (5,456) | |

| 12,123 | |

| 7,193 | |

Total operating expenses | |

| 2,652,570 | |

| 2,652,587 | |

| 2,432,661 | |

| 2,513,423 | |

| 2,550,169 | |

| 2,982,947 | |

| 2,443,238 | |

| 2,411,022 | |

Other income (expenses and income taxes) | |

| (322) | |

| 399 | |

| (2,270) | |

| 4,331 | |

| 23,101 | |

| 25,721 | |

| 19,055 | |

| 27,289 | |

Income (loss) from continuing operations | |

| 49,748 | |

| (260,606) | |

| 14,645 | |

| (559) | |

| 11,946 | |

| (683,426) | |

| (107,648) | |

| (156,128) | |

Gain on sale of discontinued operations | |

| — | |

| — | |

| — | |

| — | |

| — | |

| 91,254 | |

| 26,191 | |

| 84,275 | |

Net income (loss) | |

| 49,748 | |

| (260,606) | |

| 14,645 | |

| (559) | |

| 11,946 | |

| (592,172) | |

| (81,457) | |

| (71,853) | |

| | | | | | | | | | | | | | | | | | | | | | | | | |

Basic income (loss) per common share: | |

|

| |

|

| |

|

| |

|

| |

|

| |

|

| |

|

| |

|

| |

Income (loss) per share from continuing operations | | $ | — | | $ | (0.01) | | $ | — | | $ | — | | $ | — | | $ | (0.03) | | $ | — | | $ | — | |

Income per share from discontinued operations | | $ | — | | $ | — | | $ | — | | $ | — | | $ | — | | $ | — | | $ | — | | $ | — | |

Net income (loss) per share | | $ | — | | $ | (0.01) | | $ | — | | $ | — | | $ | — | | $ | (0.03) | | $ | — | | $ | — | |

Basic weighted average common shares outstanding | |

| 26,027,665 | |

| 25,988,117 | |

| 25,898,900 | |

| 25,815,163 | |

| 24,960,394 | |

| 24,185,966 | |

| 24,095,266 | |

| 23,987,137 | |

| | | | | | | | | | | | | | | | | | | | | | | | | |

Diluted income (loss) per common share: | |

|

| |

|

| |

|

| |

|

| |

|

| |

|

| |

|

| |

|

| |

Income (loss) per share from continuing operations | | $ | — | | $ | (0.01) | | $ | — | | $ | — | | $ | — | | $ | (0.03) | | $ | — | | $ | — | |

Income per share from discontinued operations | | $ | — | | $ | — | | $ | — | | $ | — | | $ | — | | $ | — | | $ | — | | $ | — | |

Net income (loss) per share | | $ | — | | $ | (0.01) | | $ | — | | $ | — | | $ | — | | $ | (0.03) | | $ | — | | $ | — | |

Diluted weighted average common shares outstanding | |

| 26,565,892 | |

| 25,988,117 | |

| 26,511,180 | |

| 25,815,163 | |

| 25,717,403 | |

| 24,185,966 | |

| 24,095,266 | |

| 23,987,137 | |

21

Comparison of the Three and Nine Months Ended March 31, 2021 and 2020

Results of Operations

| | Three Months Ended March 31, |

| |||||||||

|

| 2021 |

| 2020 |

| $ Change |

| % Change |

| |||

| | | | | | | | | | | | |

Revenue: |

| |

|

| |

|

| |

|

|

| |