Attached files

| file | filename |

|---|---|

| 8-K - 8-K - CNO Financial Group, Inc. | cno-20210513.htm |

Investor Overview May 2021 Exhibit 99.1

CNO Financial Group | Investor Overview | May 2021 2 Important Legal Information Certain statements made in this presentation should be considered forward-looking statements as defined in the Private Securities Litigation Reform Act of 1995. These include statements about future results of operations and capital plans. We caution investors that these forward-looking statements are not guarantees of future performance, and actual results may differ materially. Investors should consider the important risks and uncertainties that may cause actual results to differ, including those included in our Quarterly Reports on Form 10-Q, our Annual Report on Form 10-K and other filings we make with the Securities and Exchange Commission. We assume no obligation to update this presentation, which speaks as of today’s date. Forward-Looking Statements This presentation contains financial measures that differ from the comparable measures under Generally Accepted Accounting Principles (GAAP). Reconciliations between those non-GAAP measures and the comparable GAAP measures are included in the Appendix, or on the page such measure is presented. While management believes the measures are useful to enhance understanding and comparability of our financial results, these non-GAAP measures should not be considered substitutes for the most directly comparable GAAP measures. Additional information concerning non-GAAP measures is included in our periodic filings with the Securities and Exchange Commission that are available in the “Investors – SEC Filings” section of CNO’s website, CNOinc.com. Non-GAAP Measures

CNO Financial Group | Investor Overview | May 2021 3 Fixed index annuities 40% Fixed interest annuities 10% Other annuities 3% Long-term care 13% Supplemental health 17% Medicare supplement 1% Interest sensitive life 5% Traditional life 11% Annuities 33% Life 23% LTC 7% Med Supp 19% Supp Health 18% Health 44% CNO Financial Group Overview Manufactured products include life, fixed annuities, Medicare supplement, supplemental health and limited benefit duration long-term care (LTC) Distribution of third party products, which primarily include Medicare Advantage and Prescription Drug Plans Demonstrated growth in agents, premiums, assets and third party fees 1Q 2021 Collected Premium by Product Total: $976.6M in 1Q 2021 Collected Premiums 1Q 2021 Average Liabilities by Insurance Product* *Net insurance liabilities are equal to total insurance liabilities less: (i) amounts related to reinsured business; (ii) deferred acquisition costs; (iii) present value of future profits; and (iv) the value of unexpired options credited to insurance liabilities. Annuities 28% Life 13% LTC 17% Med Supp 24% Supp Health 18% Health 59% Focused on serving the protection needs of the fast-growing but underserved middle-income American market at or near retirement 1Q 2021 Insurance Margin by Product

CNO Financial Group | Investor Overview | May 2021 4 What Makes CNO Different Exclusive Focus on Middle- Income America Our Diverse Distribution & Integrated Approach Health and Wealth Solutions Insurance and Securities Solutions Strong Cash Flow Generation

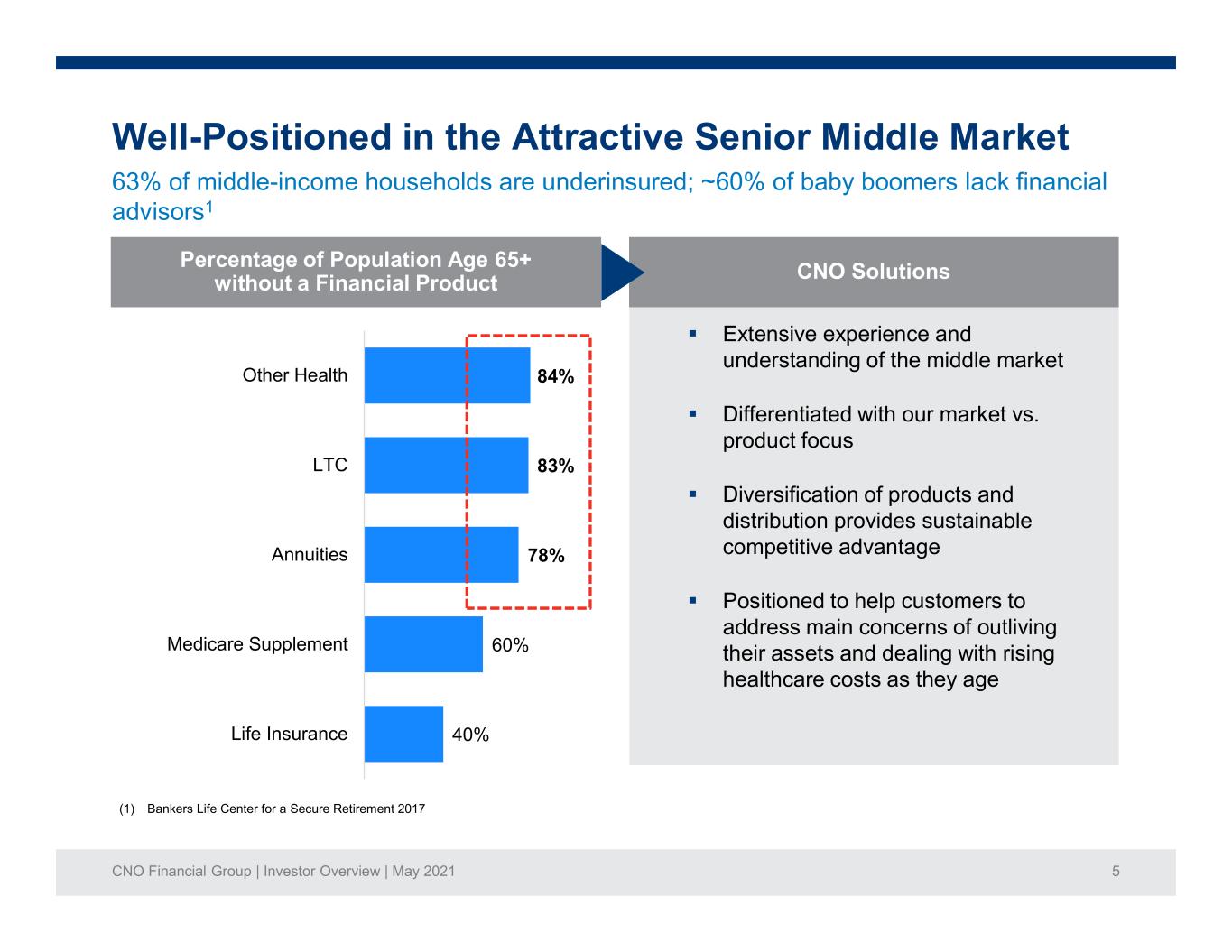

CNO Financial Group | Investor Overview | May 2021 5 Well-Positioned in the Attractive Senior Middle Market Extensive experience and understanding of the middle market Differentiated with our market vs. product focus Diversification of products and distribution provides sustainable competitive advantage Positioned to help customers to address main concerns of outliving their assets and dealing with rising healthcare costs as they age CNO Solutions Percentage of Population Age 65+ without a Financial Product (1) Bankers Life Center for a Secure Retirement 2017 40% 60% 78% 83% 84% Life Insurance Medicare Supplement Annuities LTC Other Health Solutions 63% of middle-income households are underinsured; ~60% of baby boomers lack financial advisors1

CNO Financial Group | Investor Overview | May 2021 6 Highly Diversified Product Mix Mix of protection and accumulation products to serve varied customer needs Basic products that meet the insurance needs of the middle market Attractive and predictable return characteristics Low risk long-term care products with short-duration benefit period Protection-oriented products with low face amounts and few bells and whistles Life Insurance Annuities Medicare Supplemental Health Long-Term Care Key Points 1 2 3 4 5 Product Offering Broad & balanced portfolio focused on protection needs Third Party Products / Services6 Capital-light distribution-only fee revenue

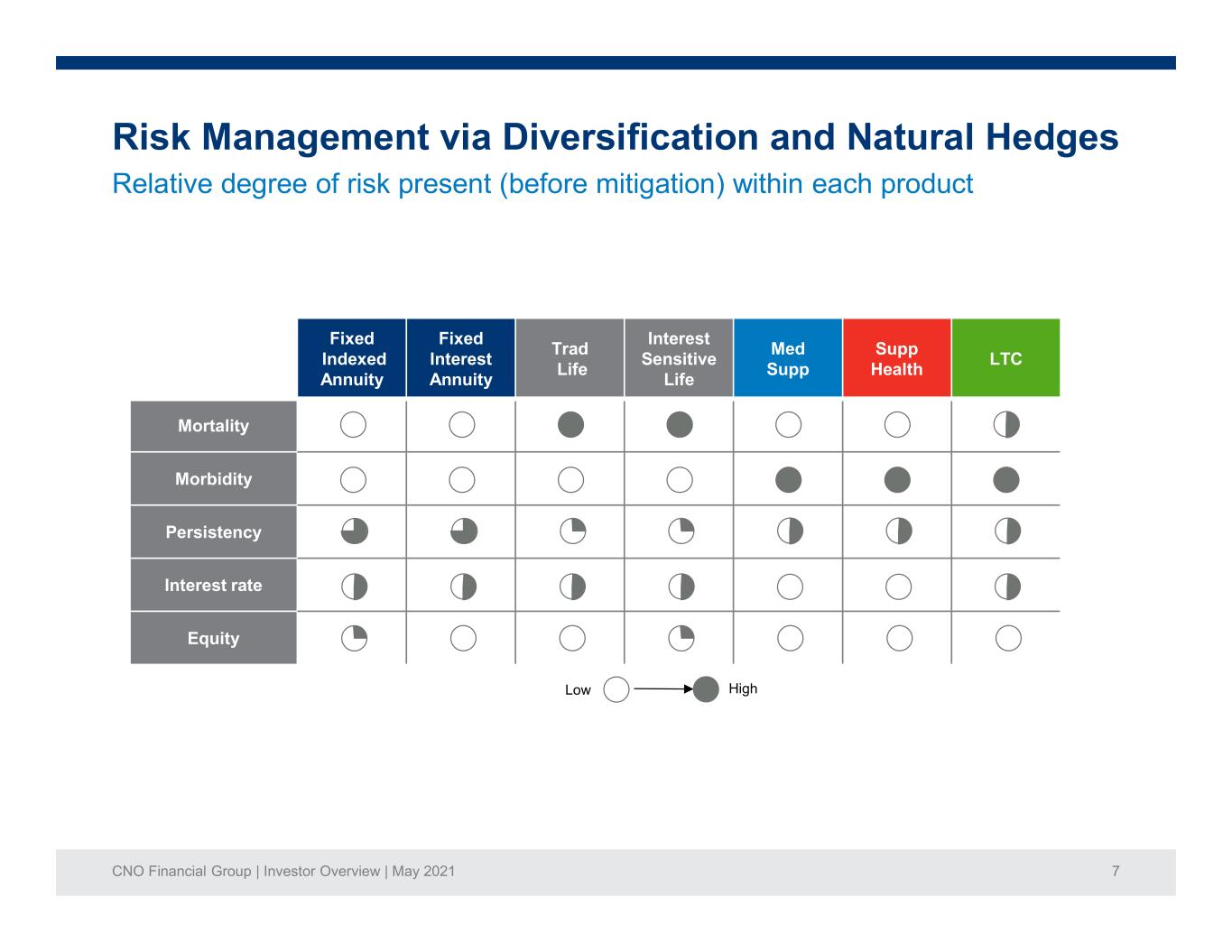

CNO Financial Group | Investor Overview | May 2021 7 Fixed Indexed Annuity Fixed Interest Annuity Trad Life Interest Sensitive Life Med Supp Supp Health LTC Mortality Morbidity Persistency Interest rate Equity Risk Management via Diversification and Natural Hedges Relative degree of risk present (before mitigation) within each product Low High

CNO Financial Group | Investor Overview | May 2021 8 Unique Multi-Channel Operating Model Consumer Division – Strong exclusive agent franchise • Top distributor of health/wealth protection products through ~5,000 exclusive producing agents and financial representatives • More than 260 locations nationwide • “Kitchen-table” sales model – Top 5 direct-to-consumer distribution – Broker-dealer and RIA offer investment and annuity products and support agent income Worksite Division – Wholly-owned distribution (PMA) & diverse network of independent marketing organizations and agencies – Web Benefits Design (WBD) digital worksite enrollment platform/benefits administrator – DirectPath employee benefits management services for employers and employees Multi-channel distribution transitioning to integrated delivery model – Recent business transformation unlocks significant growth opportunities – Leverages products, brands, leads and fulfilment across channels – Captures customers through direct engagement that leads to an integrated omnichannel buying experience – Driving toward holistic relationships including protection & retirement planning; growth in assets & fees January 2020 realignment removes barriers between brand and channels

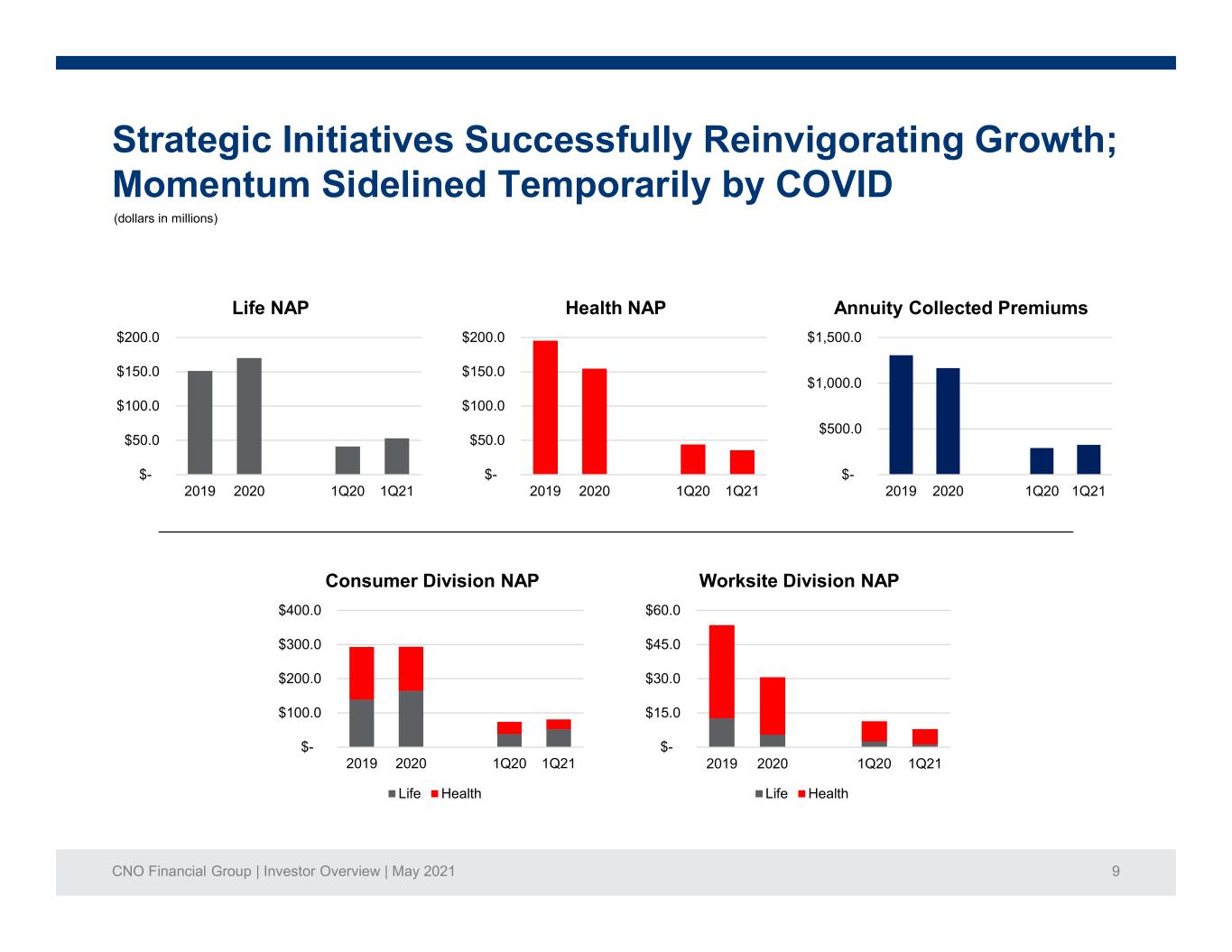

CNO Financial Group | Investor Overview | May 2021 9 Strategic Initiatives Successfully Reinvigorating Growth; Momentum Sidelined Temporarily by COVID (dollars in millions) $- $50.0 $100.0 $150.0 $200.0 2019 2020 1Q20 1Q21 Life NAP $- $50.0 $100.0 $150.0 $200.0 2019 2020 1Q20 1Q21 Health NAP $- $500.0 $1,000.0 $1,500.0 2019 2020 1Q20 1Q21 Annuity Collected Premiums $- $100.0 $200.0 $300.0 $400.0 2019 2020 1Q20 1Q21 Consumer Division NAP Life Health $- $15.0 $30.0 $45.0 $60.0 2019 2020 1Q20 1Q21 Worksite Division NAP Life Health

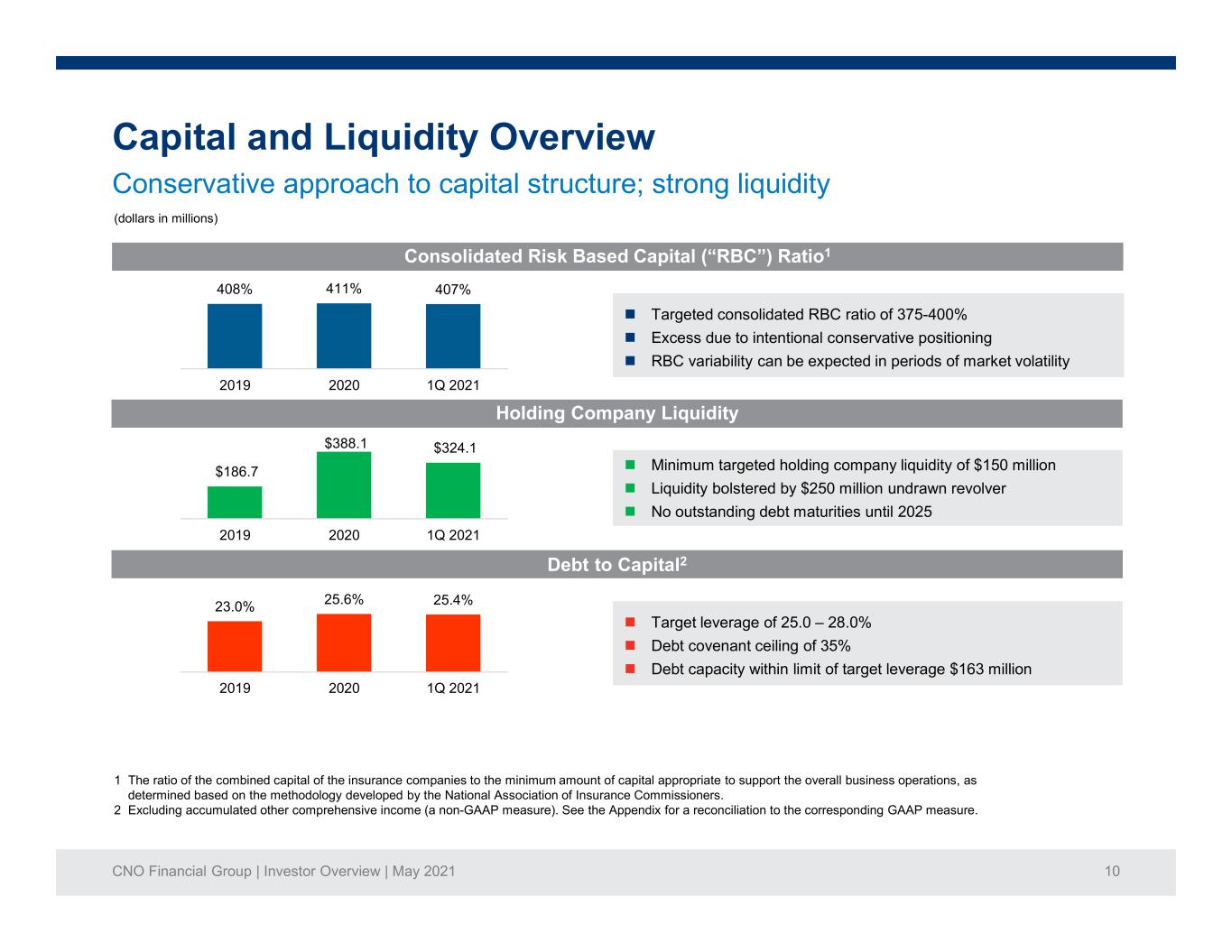

CNO Financial Group | Investor Overview | May 2021 10 Capital and Liquidity Overview 1 The ratio of the combined capital of the insurance companies to the minimum amount of capital appropriate to support the overall business operations, as determined based on the methodology developed by the National Association of Insurance Commissioners. 2 Excluding accumulated other comprehensive income (a non-GAAP measure). See the Appendix for a reconciliation to the corresponding GAAP measure. Debt to Capital2 Consolidated Risk Based Capital (“RBC”) Ratio1 Target leverage of 25.0 – 28.0% Debt covenant ceiling of 35% Debt capacity within limit of target leverage $163 million Targeted consolidated RBC ratio of 375-400% Excess due to intentional conservative positioning RBC variability can be expected in periods of market volatility Holding Company Liquidity Minimum targeted holding company liquidity of $150 million Liquidity bolstered by $250 million undrawn revolver No outstanding debt maturities until 2025 Conservative approach to capital structure; strong liquidity (dollars in millions) 408% 411% 407% 2019 2020 1Q 2021 23.0% 25.6% 25.4% 2019 2020 1Q 2021 $186.7 $388.1 $324.1 2019 2020 1Q 2021

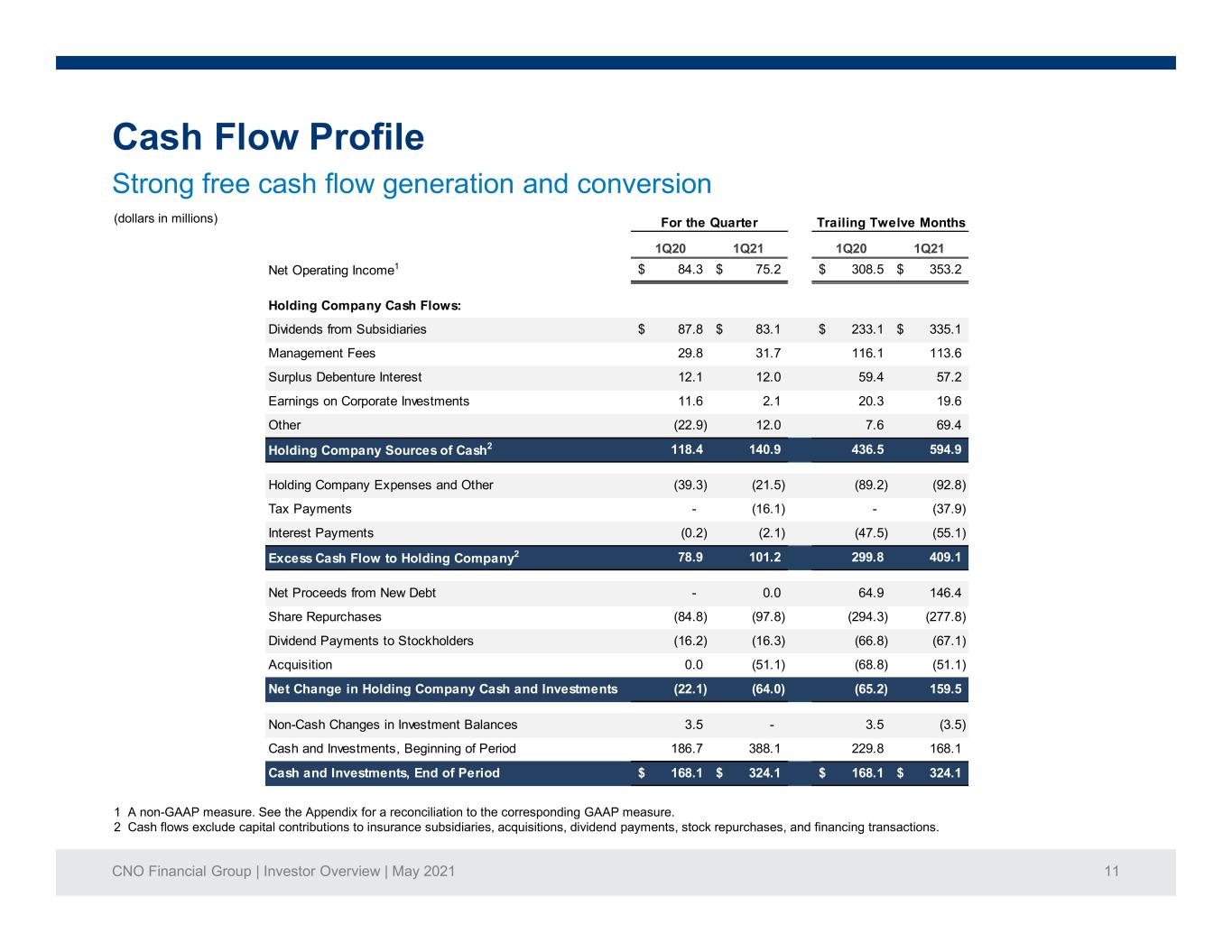

CNO Financial Group | Investor Overview | May 2021 11 Cash Flow Profile Strong free cash flow generation and conversion (dollars in millions) 1 A non-GAAP measure. See the Appendix for a reconciliation to the corresponding GAAP measure. 2 Cash flows exclude capital contributions to insurance subsidiaries, acquisitions, dividend payments, stock repurchases, and financing transactions. 1Q20 1Q21 1Q20 1Q21 Net Operating Income1 84.3$ 75.2$ 308.5$ 353.2$ Holding Company Cash Flows: Dividends from Subsidiaries 87.8$ 83.1$ 233.1$ 335.1$ Management Fees 29.8 31.7 116.1 113.6 Surplus Debenture Interest 12.1 12.0 59.4 57.2 Earnings on Corporate Investments 11.6 2.1 20.3 19.6 Other (22.9) 12.0 7.6 69.4 Holding Company Sources of Cash2 118.4 140.9 436.5 594.9 Holding Company Expenses and Other (39.3) (21.5) (89.2) (92.8) Tax Payments - (16.1) - (37.9) Interest Payments (0.2) (2.1) (47.5) (55.1) Excess Cash Flow to Holding Company2 78.9 101.2 299.8 409.1 Net Proceeds from New Debt - 0.0 64.9 146.4 Share Repurchases (84.8) (97.8) (294.3) (277.8) Dividend Payments to Stockholders (16.2) (16.3) (66.8) (67.1) Acquisition 0.0 (51.1) (68.8) (51.1) Net Change in Holding Company Cash and Investments (22.1) (64.0) (65.2) 159.5 Non-Cash Changes in Investment Balances 3.5 - 3.5 (3.5) Cash and Investments, Beginning of Period 186.7 388.1 229.8 168.1 Cash and Investments, End of Period 168.1$ 324.1$ 168.1$ 324.1$ Trailing Twelve MonthsFor the Quarter

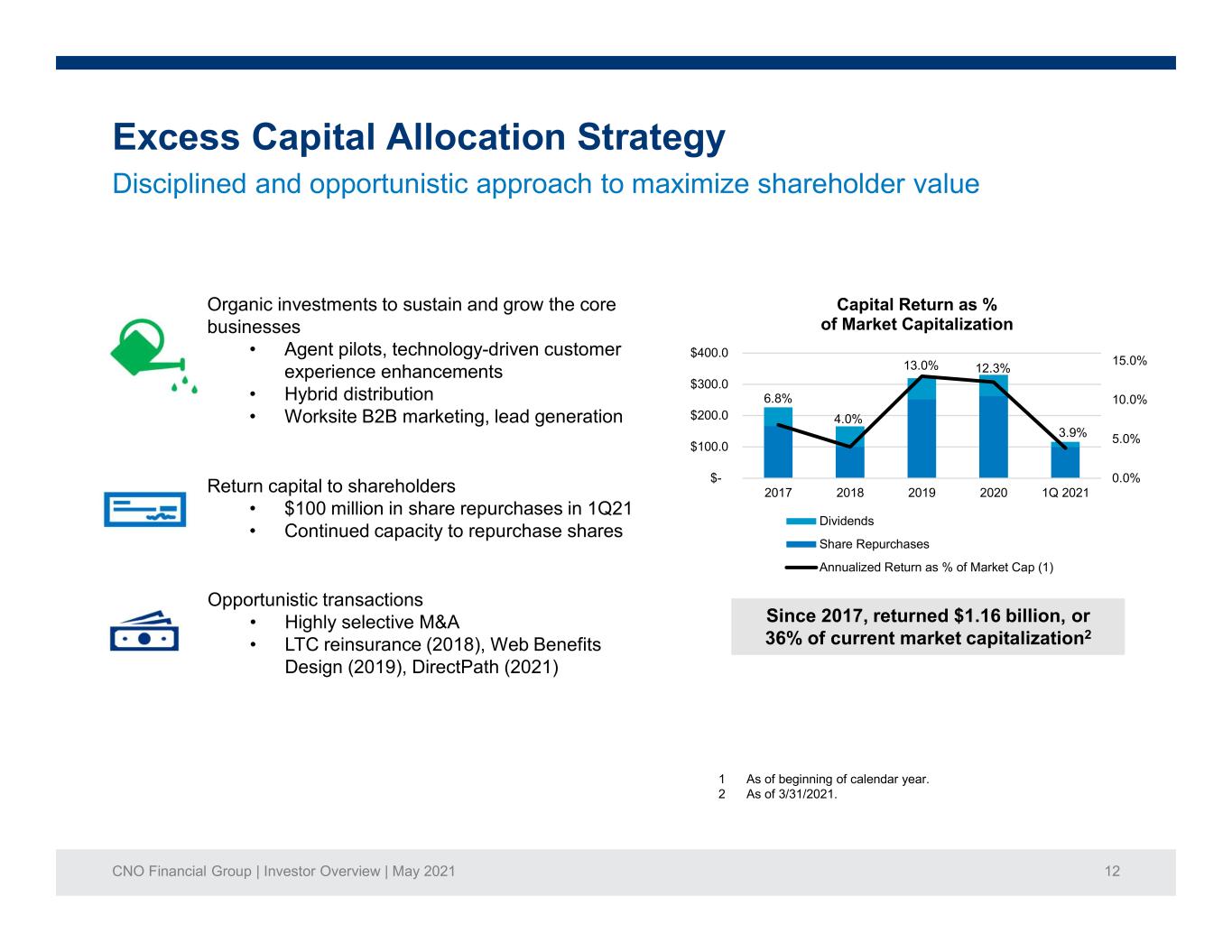

CNO Financial Group | Investor Overview | May 2021 12 Excess Capital Allocation Strategy Disciplined and opportunistic approach to maximize shareholder value Return capital to shareholders • $100 million in share repurchases in 1Q21 • Continued capacity to repurchase shares Opportunistic transactions • Highly selective M&A • LTC reinsurance (2018), Web Benefits Design (2019), DirectPath (2021) Since 2017, returned $1.16 billion, or 36% of current market capitalization2 1 As of beginning of calendar year. 2 As of 3/31/2021. Organic investments to sustain and grow the core businesses • Agent pilots, technology-driven customer experience enhancements • Hybrid distribution • Worksite B2B marketing, lead generation 6.8% 4.0% 13.0% 12.3% 3.9% 0.0% 5.0% 10.0% 15.0% $- $100.0 $200.0 $300.0 $400.0 2017 2018 2019 2020 1Q 2021 Capital Return as % of Market Capitalization Dividends Share Repurchases Annualized Return as % of Market Cap (1)

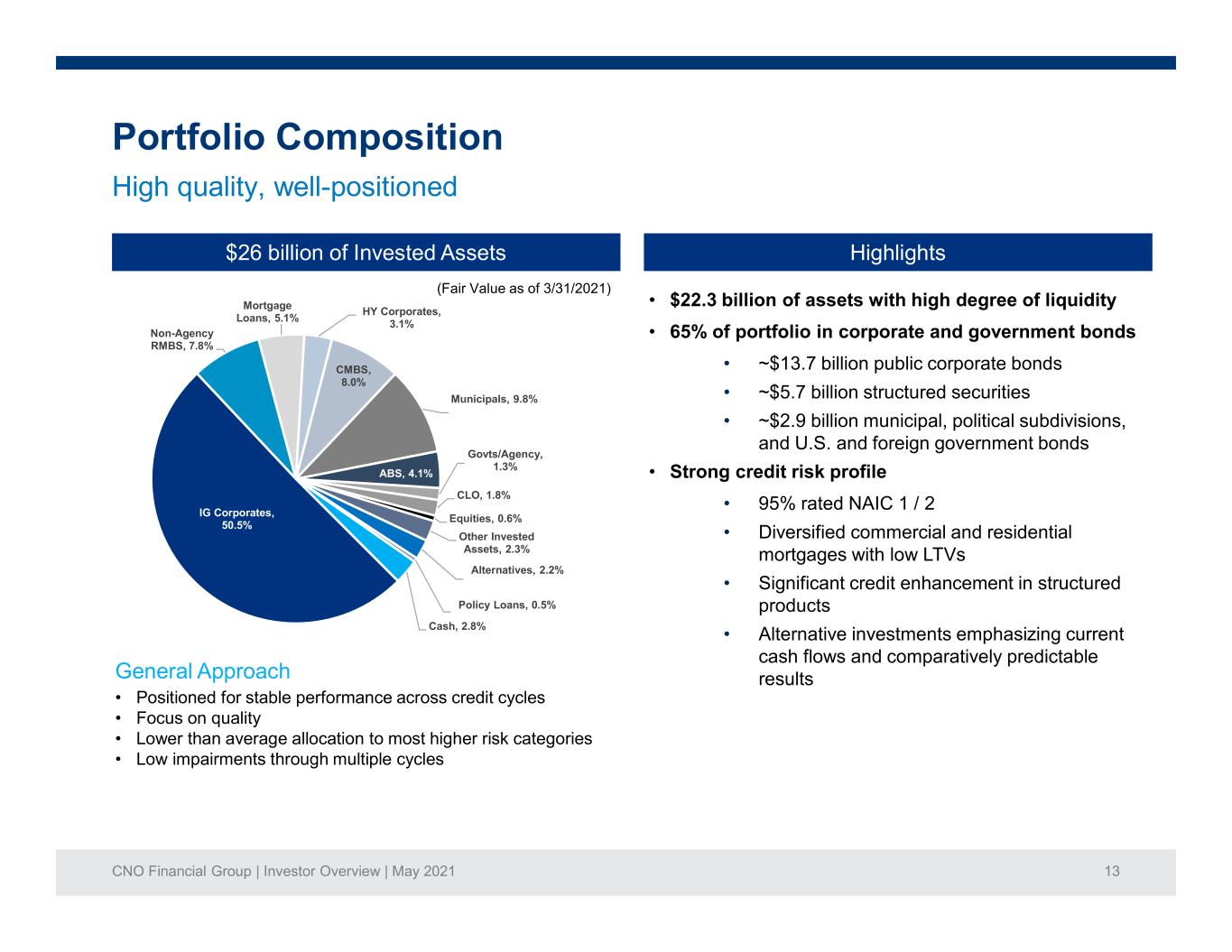

CNO Financial Group | Investor Overview | May 2021 13 IG Corporates, 50.5% Non-Agency RMBS, 7.8% Mortgage Loans, 5.1% HY Corporates, 3.1% CMBS, 8.0% Municipals, 9.8% ABS, 4.1% Govts/Agency, 1.3% CLO, 1.8% Equities, 0.6% Other Invested Assets, 2.3% Alternatives, 2.2% Policy Loans, 0.5% Cash, 2.8% Portfolio Composition High quality, well-positioned $26 billion of Invested Assets Highlights (Fair Value as of 3/31/2021) General Approach • Positioned for stable performance across credit cycles • Focus on quality • Lower than average allocation to most higher risk categories • Low impairments through multiple cycles • $22.3 billion of assets with high degree of liquidity • 65% of portfolio in corporate and government bonds • ~$13.7 billion public corporate bonds • ~$5.7 billion structured securities • ~$2.9 billion municipal, political subdivisions, and U.S. and foreign government bonds • Strong credit risk profile • 95% rated NAIC 1 / 2 • Diversified commercial and residential mortgages with low LTVs • Significant credit enhancement in structured products • Alternative investments emphasizing current cash flows and comparatively predictable results

CNO Financial Group | Investor Overview | May 2021 14 Outlook Base Case1 Adverse Case2 1 Assumes approximately 360k U.S. COVID deaths in 2021 with pandemic trailing off through 2021; economic growth and investment portfolio assumptions market consistent and in-line with base case assumptions from rating agencies. 2 Assumes approximately 480k U.S. COVID deaths in 2021; continued new cases, hospitalizations and deaths; lower level of positive morbidity impact; lower GDP and higher unemployment relative to baseline scenario; negative alternative asset returns in 2021 and higher portfolio credit migration. Sales Continued positive momentum; sales metrics approaching or exceeding pre-pandemic levels Earnings Free Cash Flow / Excess Capital Maintain target RBC and holding company liquidity / leverage / dividends Modest share repurchase capacity Manage capital and liquidity closer to target levels, reducing excess capital gradually over time COVID-related (still much uncertainty) • Modest net favorable mortality/morbidity impact for the balance of 2021 • Modest net unfavorable mortality/morbidity impact in the first half of 2022 Investment income • Allocated to products: flat to prior year – higher assets offset by lower yield (lower rates, higher quality) • Not allocated to products: return on alternatives to revert to the mean Fee income • Modestly favorable to prior year Expenses (excluding significant items) • For the balance of the year, generally consistent with the first quarter of 2021 • Total expenses for the year roughly flat to prior year

CNO Financial Group | Investor Overview | May 2021 15 Environmental, Social and Governance Significant progress Environmental • Performed GHG emissions inventory • Established GHG emissions reduction target • Earmarked $100 million for new impact investments Social • Advanced DE&I programs • Linked DE&I progress to executive compensation • Augmented associate benefits Governance • Developed responsible investment policy • Enhanced policies that promote ethical and responsible business practices • Formed CNO Council on Sustainability

CNO Financial Group | Investor Overview | May 2021 16 DirectPath Transaction Acquisition enhances Worksite Division growth outlook (as of 12/31/2020) Strategic RationaleDirectPath Description • DirectPath is a leading national provider of year- round, technology-driven employee benefits management services to employers and employees • DirectPath’s personalized services help employers reduce healthcare and benefits administration costs and assist employees to make smart, well-informed and cost-effective benefits decisions • Generates significant sales of voluntary supplemental health insurance • Significant cross-sell opportunities; creates broader distribution for CNO/WBD products • Builds unique capabilities, improves competitive positioning • Creates a one-stop-shop for employers, brokers, and groups • Helps us get deeper in employer value chain; delivers strong employer ROI • Enhances our enrollment capabilities • Source of small group leads • Diversifies revenues / enhances fee income / drives ROENumber of clients: 400 Number of broker partners: 7,000 Client employee base: 2.5 million Employee satisfaction: 95% Average Group Size: Education 5,000 Advocacy and Transparency 1,000 Communications Compliance 91,000

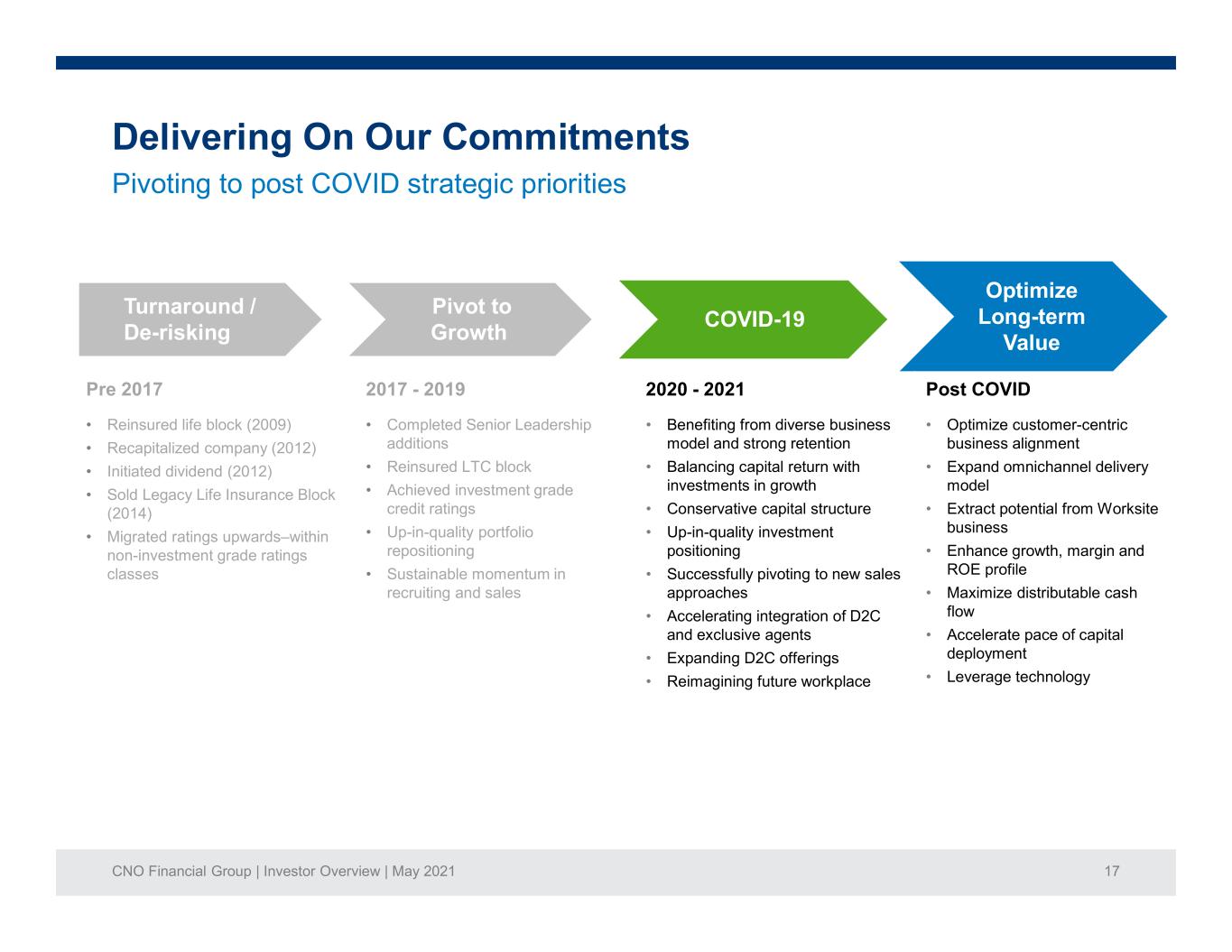

CNO Financial Group | Investor Overview | May 2021 17 Delivering On Our Commitments Turnaround / De-risking Pivot to Growth Optimize Long-term Value Pre 2017 2017 - 2019 2020 - 2021 Post COVID • Reinsured life block (2009) • Recapitalized company (2012) • Initiated dividend (2012) • Sold Legacy Life Insurance Block (2014) • Migrated ratings upwards–within non-investment grade ratings classes • Completed Senior Leadership additions • Reinsured LTC block • Achieved investment grade credit ratings • Up-in-quality portfolio repositioning • Sustainable momentum in recruiting and sales • Benefiting from diverse business model and strong retention • Balancing capital return with investments in growth • Conservative capital structure • Up-in-quality investment positioning • Successfully pivoting to new sales approaches • Accelerating integration of D2C and exclusive agents • Expanding D2C offerings • Reimagining future workplace • Optimize customer-centric business alignment • Expand omnichannel delivery model • Extract potential from Worksite business • Enhance growth, margin and ROE profile • Maximize distributable cash flow • Accelerate pace of capital deployment • Leverage technology COVID-19 Pivoting to post COVID strategic priorities

CNO Financial Group | Investor Overview | May 2021 18 Appendix 1 Strong Operational Performance • Experienced Management Team Slide 19 • Broker-Dealer/Registered Investment Advisor Slide 20 • Exclusive Agent Counts Slide 21 Building on Strong Track Record of Execution • New Money Summary Slide 22 • Portfolio Overview Slides 23-25 • Tax Asset Summary Slide 26 • 2018 Transformative LTC Reinsurance Transaction Slide 27 • Long-Term Care Insurance Slide 28

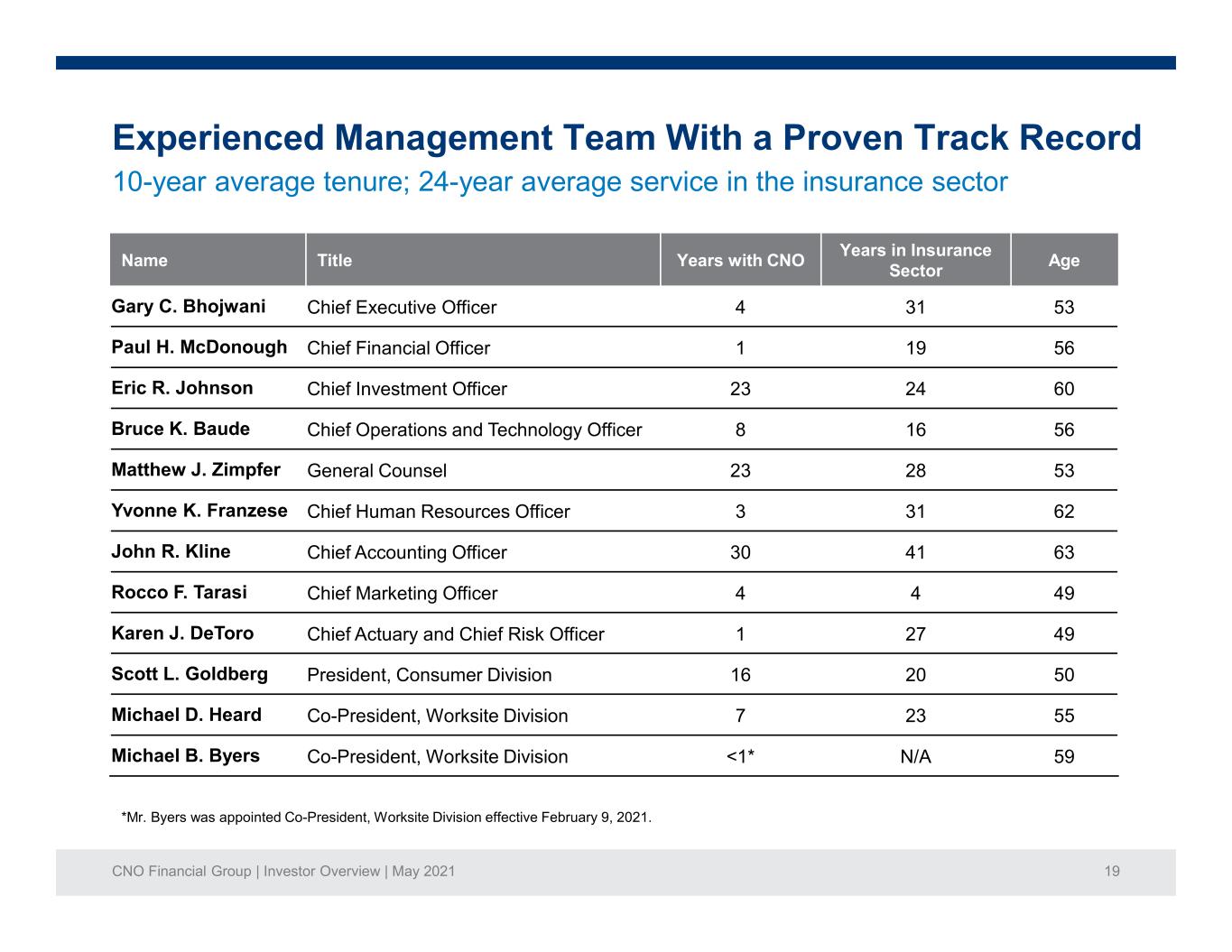

CNO Financial Group | Investor Overview | May 2021 19 Experienced Management Team With a Proven Track Record 10-year average tenure; 24-year average service in the insurance sector Name Title Years with CNO Years in Insurance Sector Age Gary C. Bhojwani Chief Executive Officer 4 31 53 Paul H. McDonough Chief Financial Officer 1 19 56 Eric R. Johnson Chief Investment Officer 23 24 60 Bruce K. Baude Chief Operations and Technology Officer 8 16 56 Matthew J. Zimpfer General Counsel 23 28 53 Yvonne K. Franzese Chief Human Resources Officer 3 31 62 John R. Kline Chief Accounting Officer 30 41 63 Rocco F. Tarasi Chief Marketing Officer 4 4 49 Karen J. DeToro Chief Actuary and Chief Risk Officer 1 27 49 Scott L. Goldberg President, Consumer Division 16 20 50 Michael D. Heard Co-President, Worksite Division 7 23 55 Michael B. Byers Co-President, Worksite Division <1* N/A 59 *Mr. Byers was appointed Co-President, Worksite Division effective February 9, 2021.

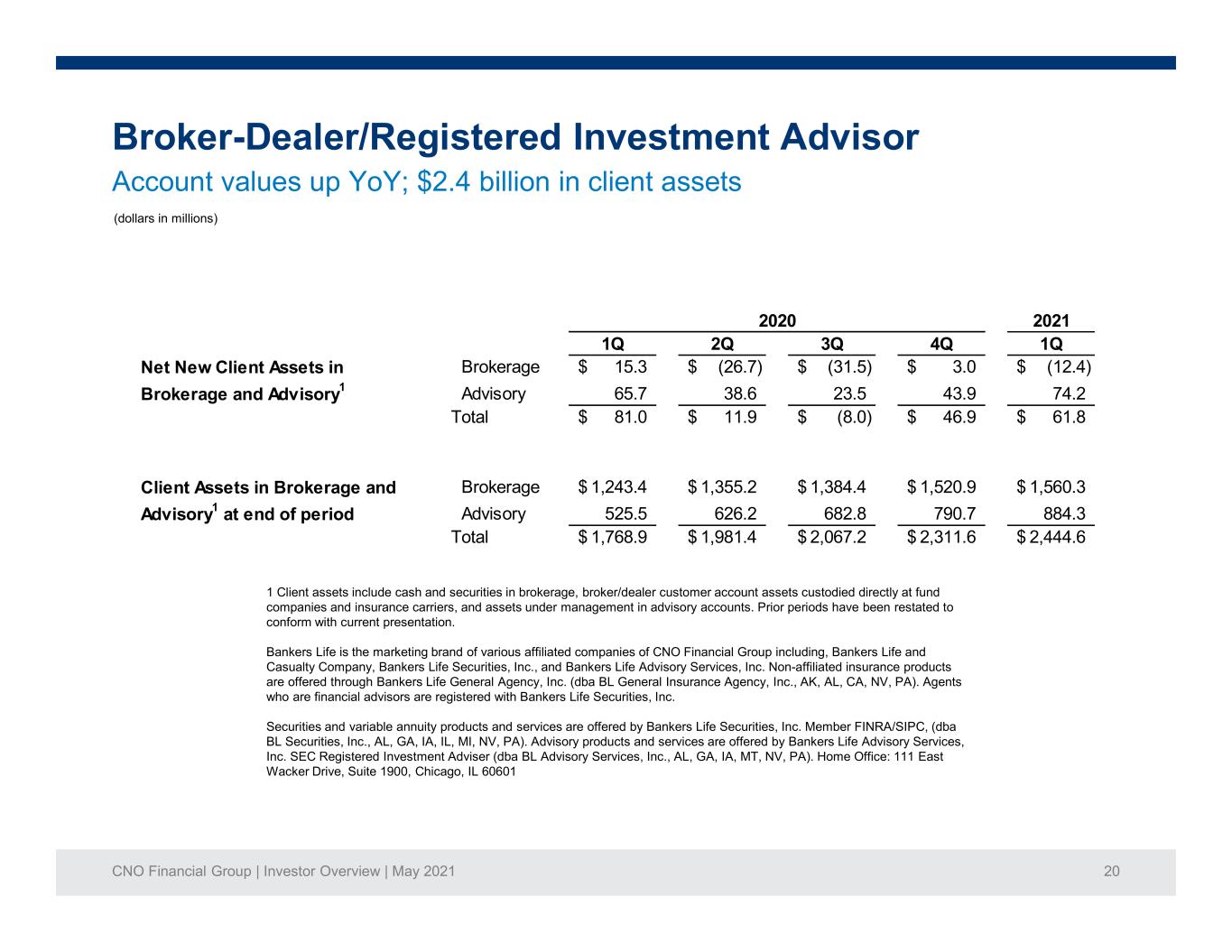

CNO Financial Group | Investor Overview | May 2021 20 Broker-Dealer/Registered Investment Advisor 1 Client assets include cash and securities in brokerage, broker/dealer customer account assets custodied directly at fund companies and insurance carriers, and assets under management in advisory accounts. Prior periods have been restated to conform with current presentation. Bankers Life is the marketing brand of various affiliated companies of CNO Financial Group including, Bankers Life and Casualty Company, Bankers Life Securities, Inc., and Bankers Life Advisory Services, Inc. Non-affiliated insurance products are offered through Bankers Life General Agency, Inc. (dba BL General Insurance Agency, Inc., AK, AL, CA, NV, PA). Agents who are financial advisors are registered with Bankers Life Securities, Inc. Securities and variable annuity products and services are offered by Bankers Life Securities, Inc. Member FINRA/SIPC, (dba BL Securities, Inc., AL, GA, IA, IL, MI, NV, PA). Advisory products and services are offered by Bankers Life Advisory Services, Inc. SEC Registered Investment Adviser (dba BL Advisory Services, Inc., AL, GA, IA, MT, NV, PA). Home Office: 111 East Wacker Drive, Suite 1900, Chicago, IL 60601 (dollars in millions) Account values up YoY; $2.4 billion in client assets 2021 1Q 2Q 3Q 4Q 1Q Net New Client Assets in Brokerage 15.3$ (26.7)$ (31.5)$ 3.0$ (12.4)$ Brokerage and Advisory 1 Advisory 65.7 38.6 23.5 43.9 74.2 Total 81.0$ 11.9$ (8.0)$ 46.9$ 61.8$ Client Assets in Brokerage and Brokerage 1,243.4$ 1,355.2$ 1,384.4$ 1,520.9$ 1,560.3$ Advisory 1 at end of period Advisory 525.5 626.2 682.8 790.7 884.3 Total 1,768.9$ 1,981.4$ 2,067.2$ 2,311.6$ 2,444.6$ 2020

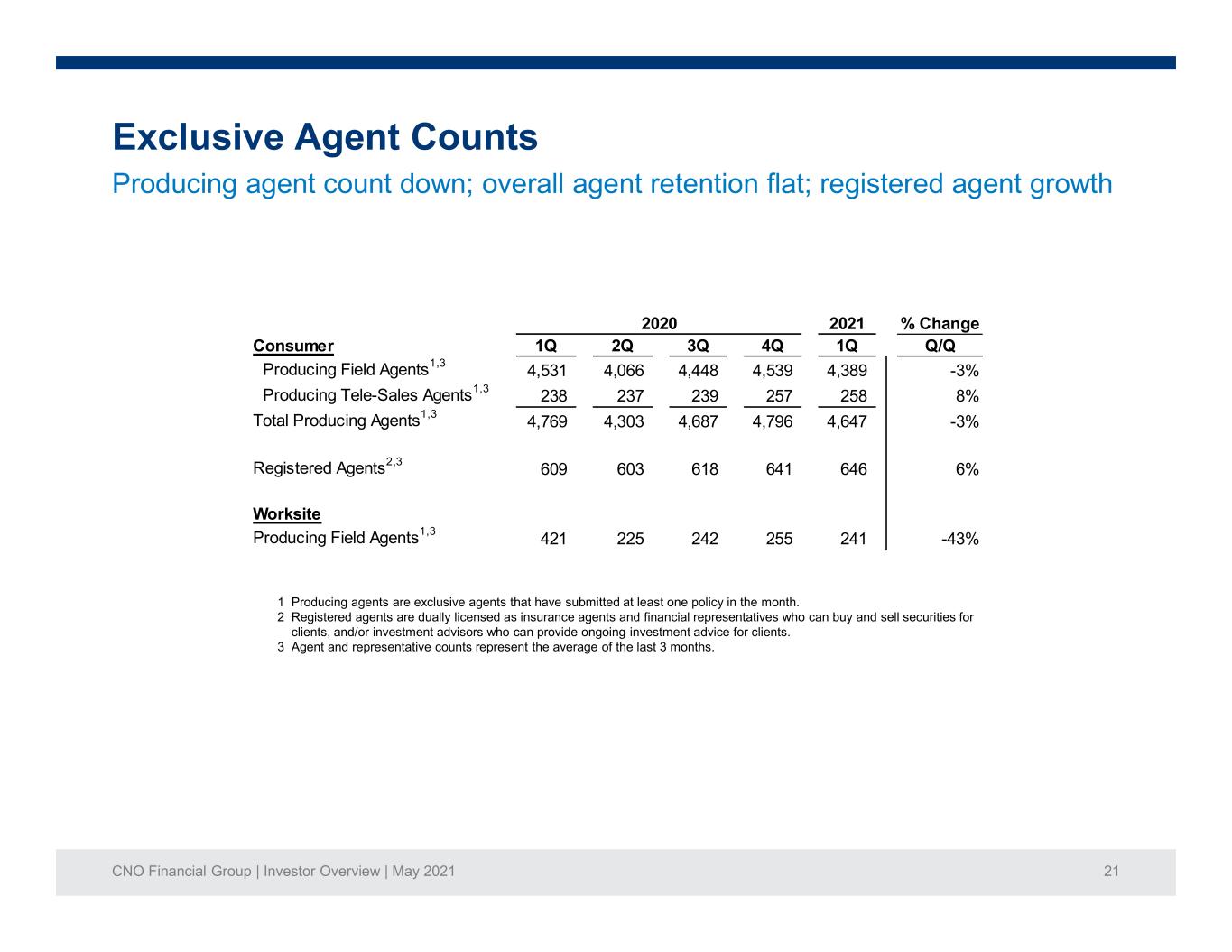

CNO Financial Group | Investor Overview | May 2021 21 2021 % Change Consumer 1Q 2Q 3Q 4Q 1Q Q/Q Producing Field Agents 1,3 4,531 4,066 4,448 4,539 4,389 -3% Producing Tele-Sales Agents 1,3 238 237 239 257 258 8% Total Producing Agents 1,3 4,769 4,303 4,687 4,796 4,647 -3% Registered Agents 2,3 609 603 618 641 646 6% Worksite Producing Field Agents 1,3 421 225 242 255 241 -43% 2020 Exclusive Agent Counts 1 Producing agents are exclusive agents that have submitted at least one policy in the month. 2 Registered agents are dually licensed as insurance agents and financial representatives who can buy and sell securities for clients, and/or investment advisors who can provide ongoing investment advice for clients. 3 Agent and representative counts represent the average of the last 3 months. Producing agent count down; overall agent retention flat; registered agent growth

CNO Financial Group | Investor Overview | May 2021 22 IG Corporates 73% Structured Securities 13% Municipals 7% HY Corporates 5% CML 2% Direct investment 0.3% New Money Summary Emphasis on up-in-quality investments during first quarter 95% Investment Grade Allocation First Quarter Investments Allocation $ Allocation% Yield Average Rating Average Duration IG Corporates 829 72.7% 3.49% A 17.6 Structured Securities 142 12.5% 3.74% BBB+ 6.5 Municipals 80 7.1% 3.26% AA 15.5 HY Corporates 59 5.2% 4.69% BB- 5.1 CML 25 2.2% 2.75% AA 7.0 Direct investment 3 0.3% 11.18% NR - Total 1,139 100% 3.57% A- 15.2

CNO Financial Group | Investor Overview | May 2021 23 AAA 11.6%AA+ 3.7% AA 50.1% A 30.2% A- 2.2% Key Portfolio Metrics Cumulative loss scenarios versus Break Points 100% AAA-A Ratings Composition Portfolio Portfolio Index AAA 11.6% - - AA 53.8% - - A 34.6% - - BBB - N/A 5.0% BB - N/A 3.0% % of Rating Downgrade Watch 11.7% 11.3% 10.9% 13.7% 13.5% 14.1%14.1% 15.1% 13.1% 33.7% 26.4% 21.9% AAA AA A Base Case NAIC Stress GFC Break Point AAA AA A Credit Support Portfolio 38% 25% 17% Market 37% 25% 19% WARF Portfolio 3,031 3,092 3,067 Market 3,062 3,071 3,106 Diversity Score Portfolio 81 82 82 Market 78 76 76 WAPx Portfolio 97.3 97.5 98.0 Market 97.5 97.5 97.3 (As of 3/31/2021) Investment Overview: CLO Debt Significant cushion against stress scenarios

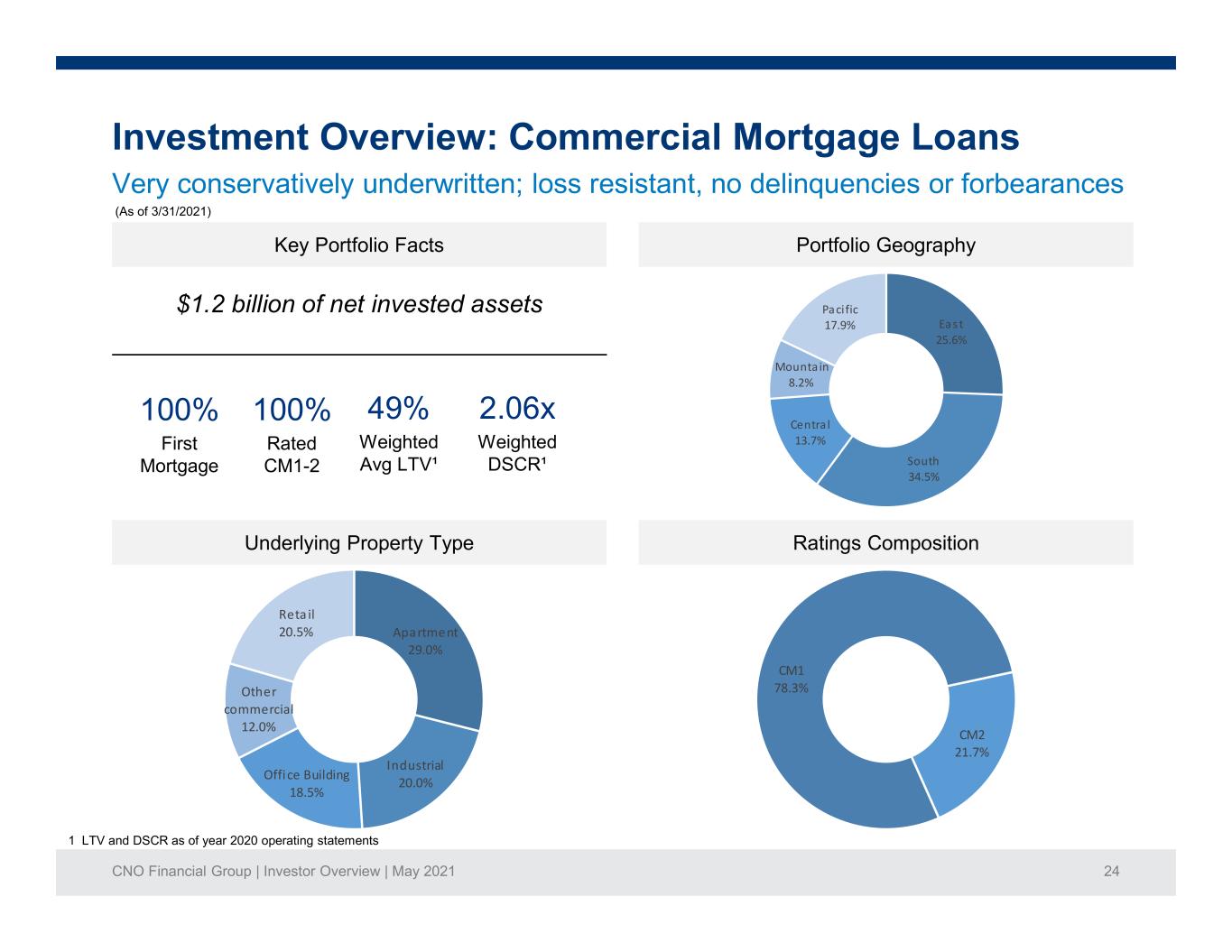

CNO Financial Group | Investor Overview | May 2021 24 Eas t 25.6% South 34.5% Centra l 13.7% Mounta in 8.2% Pacific 17.9% CM1 78.3% CM2 21.7% Apartment 29.0% Industrial 20.0% Offi ce Building 18.5% Other commercial 12.0% Reta il 20.5% Key Portfolio Facts Portfolio Geography Underlying Property Type Ratings Composition $1.2 billion of net invested assets 100% First Mortgage 100% Rated CM1-2 49% Weighted Avg LTV¹ 2.06x Weighted DSCR¹ 1 LTV and DSCR as of year 2020 operating statements (As of 3/31/2021) Investment Overview: Commercial Mortgage Loans Very conservatively underwritten; loss resistant, no delinquencies or forbearances

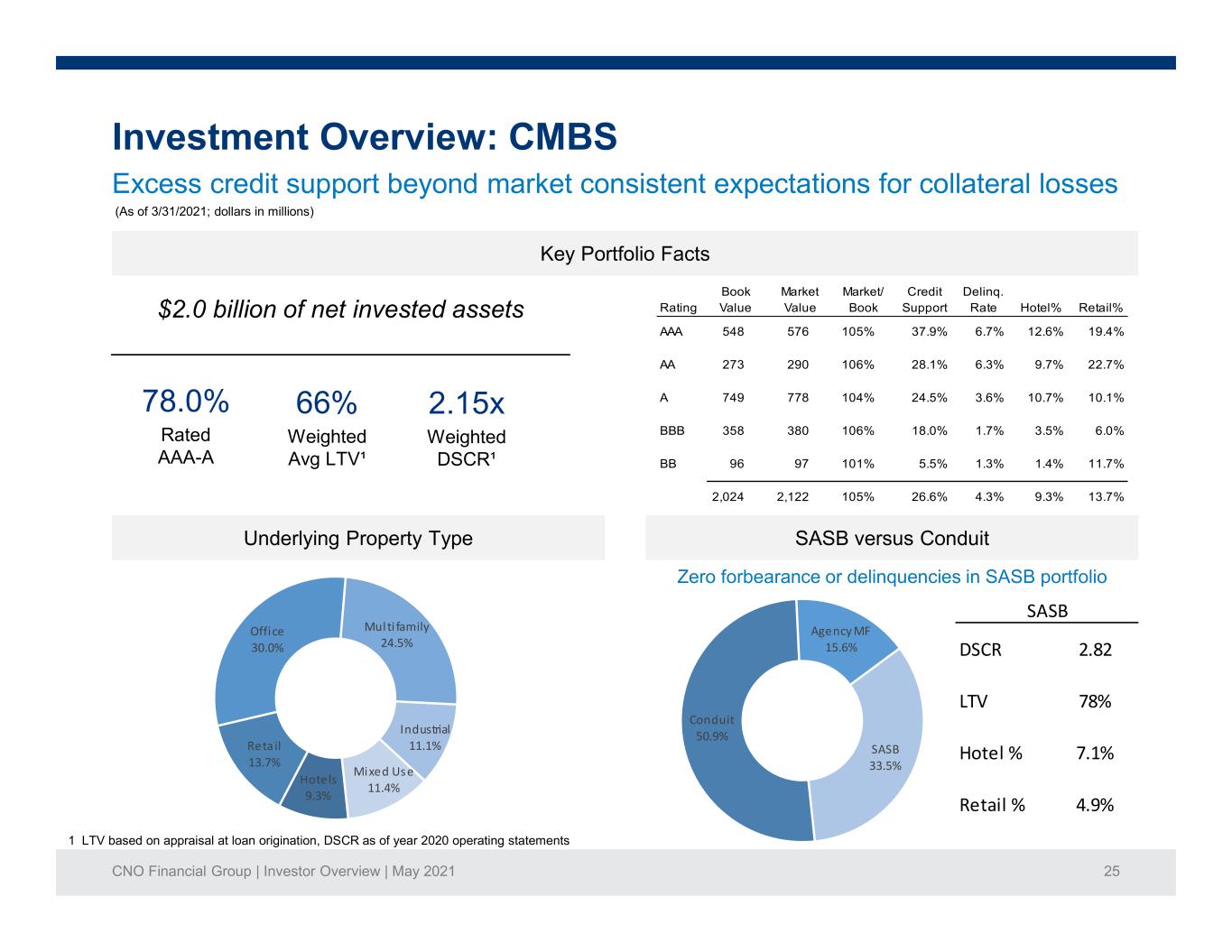

CNO Financial Group | Investor Overview | May 2021 25 Conduit 50.9% Agency MF 15.6% SASB 33.5% Hotels 9.3% Retail 13.7% Office 30.0% Multi family 24.5% Industrial 11.1% Mixed Use 11.4% Key Portfolio Facts Underlying Property Type SASB versus Conduit $2.0 billion of net invested assets 78.0% Rated AAA-A 66% Weighted Avg LTV¹ 2.15x Weighted DSCR¹ Zero forbearance or delinquencies in SASB portfolio Rating Book Value Market Value Market/ Book Credit Support Delinq. Rate Hotel% Retail% AAA 548 576 105% 37.9% 6.7% 12.6% 19.4% AA 273 290 106% 28.1% 6.3% 9.7% 22.7% A 749 778 104% 24.5% 3.6% 10.7% 10.1% BBB 358 380 106% 18.0% 1.7% 3.5% 6.0% BB 96 97 101% 5.5% 1.3% 1.4% 11.7% 2,024 2,122 105% 26.6% 4.3% 9.3% 13.7% DSCR 2.82 LTV 78% Hotel % 7.1% Retail % 4.9% SASB (As of 3/31/2021; dollars in millions) Investment Overview: CMBS Excess credit support beyond market consistent expectations for collateral losses 1 LTV based on appraisal at loan origination, DSCR as of year 2020 operating statements

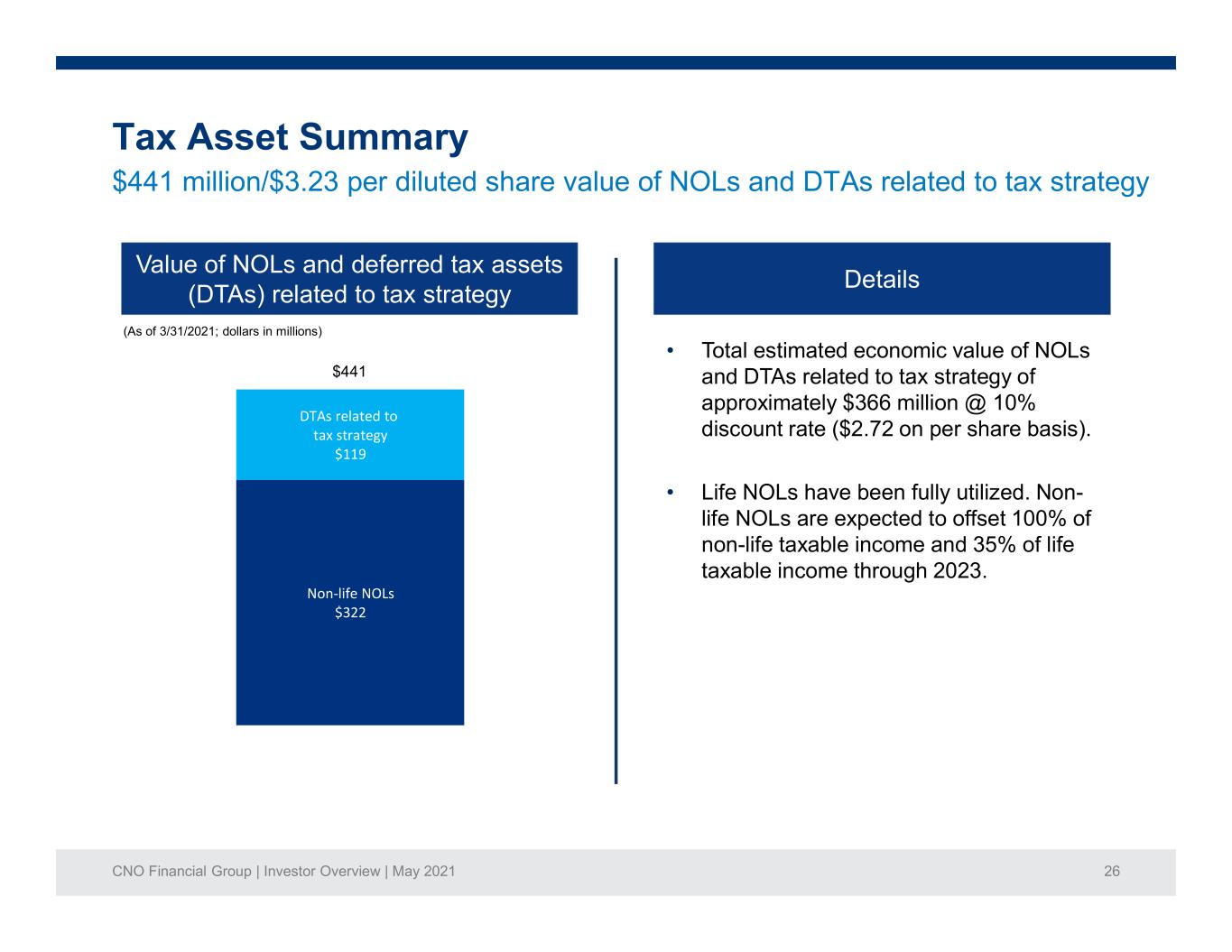

CNO Financial Group | Investor Overview | May 2021 26 Non-life NOLs $322 DTAs related to tax strategy $119 Value of NOLs and deferred tax assets (DTAs) related to tax strategy Details • Total estimated economic value of NOLs and DTAs related to tax strategy of approximately $366 million @ 10% discount rate ($2.72 on per share basis). • Life NOLs have been fully utilized. Non- life NOLs are expected to offset 100% of non-life taxable income and 35% of life taxable income through 2023. $441 (As of 3/31/2021; dollars in millions) Tax Asset Summary $441 million/$3.23 per diluted share value of NOLs and DTAs related to tax strategy

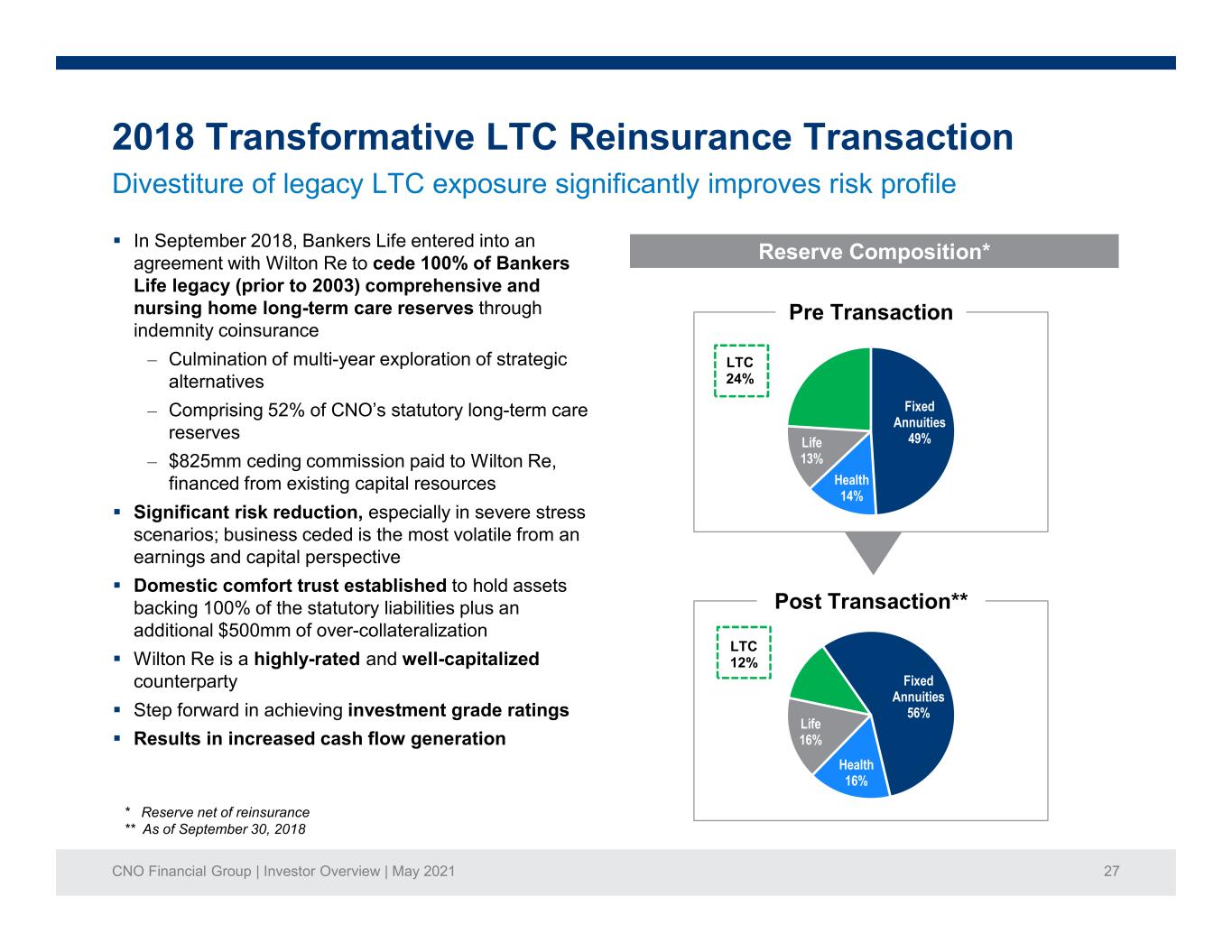

CNO Financial Group | Investor Overview | May 2021 27 2018 Transformative LTC Reinsurance Transaction Divestiture of legacy LTC exposure significantly improves risk profile Fixed Annuities 49% Health 14% Life 13% LTC 24% In September 2018, Bankers Life entered into an agreement with Wilton Re to cede 100% of Bankers Life legacy (prior to 2003) comprehensive and nursing home long-term care reserves through indemnity coinsurance – Culmination of multi-year exploration of strategic alternatives – Comprising 52% of CNO’s statutory long-term care reserves – $825mm ceding commission paid to Wilton Re, financed from existing capital resources Significant risk reduction, especially in severe stress scenarios; business ceded is the most volatile from an earnings and capital perspective Domestic comfort trust established to hold assets backing 100% of the statutory liabilities plus an additional $500mm of over-collateralization Wilton Re is a highly-rated and well-capitalized counterparty Step forward in achieving investment grade ratings Results in increased cash flow generation Fixed Annuities 56% Health 16% Life 16% LTC 12% Reserve Composition* * Reserve net of reinsurance ** As of September 30, 2018 Post Transaction** Pre Transaction

CNO Financial Group | Investor Overview | May 2021 28 New sales (~$25 million annually) focused on short duration products – 98% of new sales for policies with 2 years or less in benefits – Average benefit period of 11 months – New business 25% reinsured since 2008 Reserve assumptions informed by historical experience – No morbidity improvement – No mortality improvement – Minimal future rate increases – New money rates reflect a low for long environment Favorable economic profile – 2020 Loss Recognition Testing margin increased to $302 million or ~12% of Net GAAP Liabilities driven by margin from new business and favorable pre-COVID morbidity trends – Statutory reserves ~$180 million higher than GAAP net liabilities – Total LTC is just 13% of overall CNO reserves – Potential adverse impact from severe stress scenarios is significantly reduced Long-Term Care Insurance Highly differentiated in-force block; prudently managed

CNO Financial Group | Investor Overview | May 2021 29 Appendix 2: Financial Exhibits • Non-GAAP Financial Measures Slides 30-39

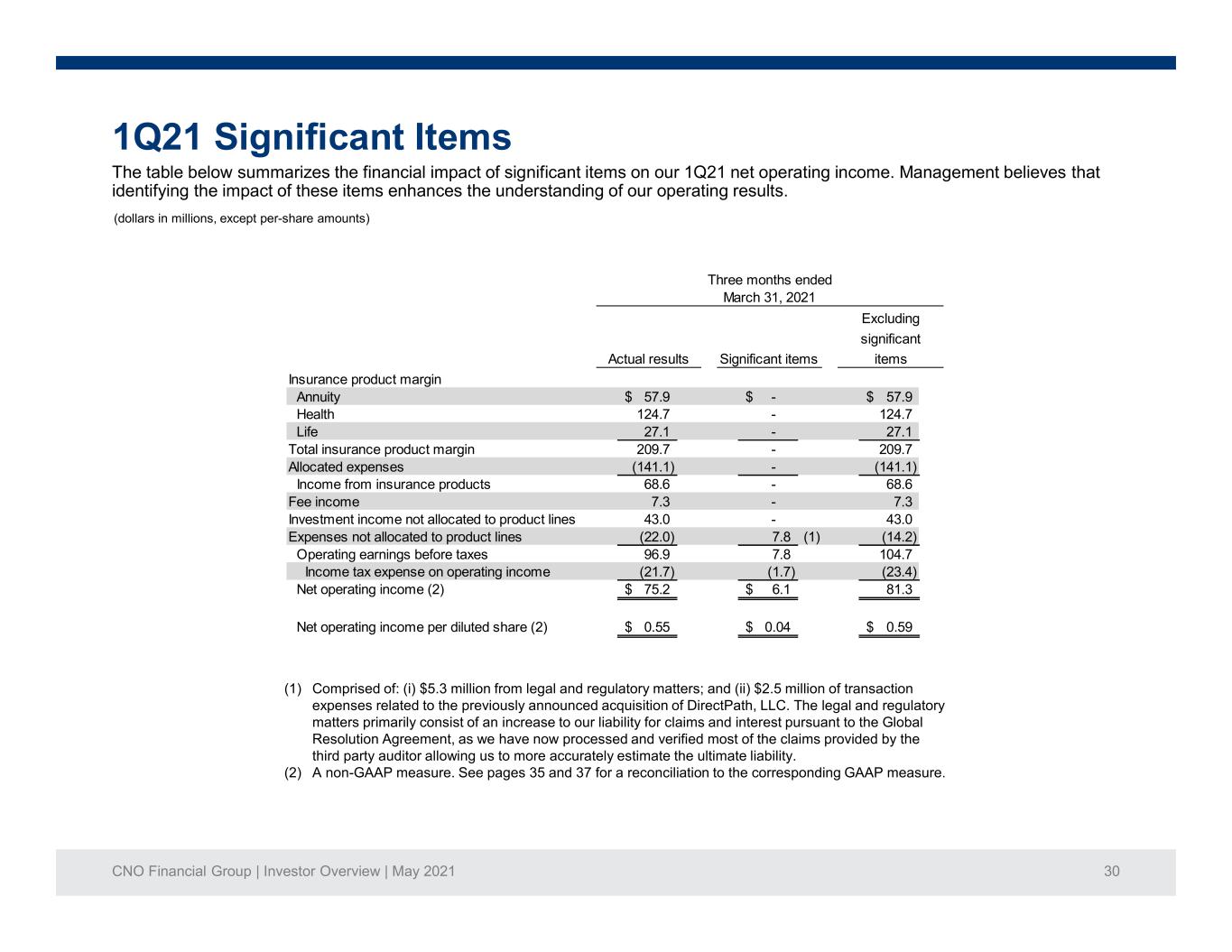

CNO Financial Group | Investor Overview | May 2021 30 The table below summarizes the financial impact of significant items on our 1Q21 net operating income. Management believes that identifying the impact of these items enhances the understanding of our operating results. 1Q21 Significant Items (dollars in millions, except per-share amounts) (1) Comprised of: (i) $5.3 million from legal and regulatory matters; and (ii) $2.5 million of transaction expenses related to the previously announced acquisition of DirectPath, LLC. The legal and regulatory matters primarily consist of an increase to our liability for claims and interest pursuant to the Global Resolution Agreement, as we have now processed and verified most of the claims provided by the third party auditor allowing us to more accurately estimate the ultimate liability. (2) A non-GAAP measure. See pages 35 and 37 for a reconciliation to the corresponding GAAP measure. Insurance product margin Annuity 57.9$ -$ 57.9$ Health 124.7 - 124.7 Life 27.1 - 27.1 Total insurance product margin 209.7 - 209.7 Allocated expenses (141.1) - (141.1) Income from insurance products 68.6 - 68.6 Fee income 7.3 - 7.3 Investment income not allocated to product lines 43.0 - 43.0 Expenses not allocated to product lines (22.0) 7.8 (1) (14.2) Operating earnings before taxes 96.9 7.8 104.7 Income tax expense on operating income (21.7) (1.7) (23.4) Net operating income (2) 75.2$ 6.1$ 81.3 Net operating income per diluted share (2) 0.55$ 0.04$ 0.59$ Three months ended March 31, 2021 Actual results Significant items Excluding significant items

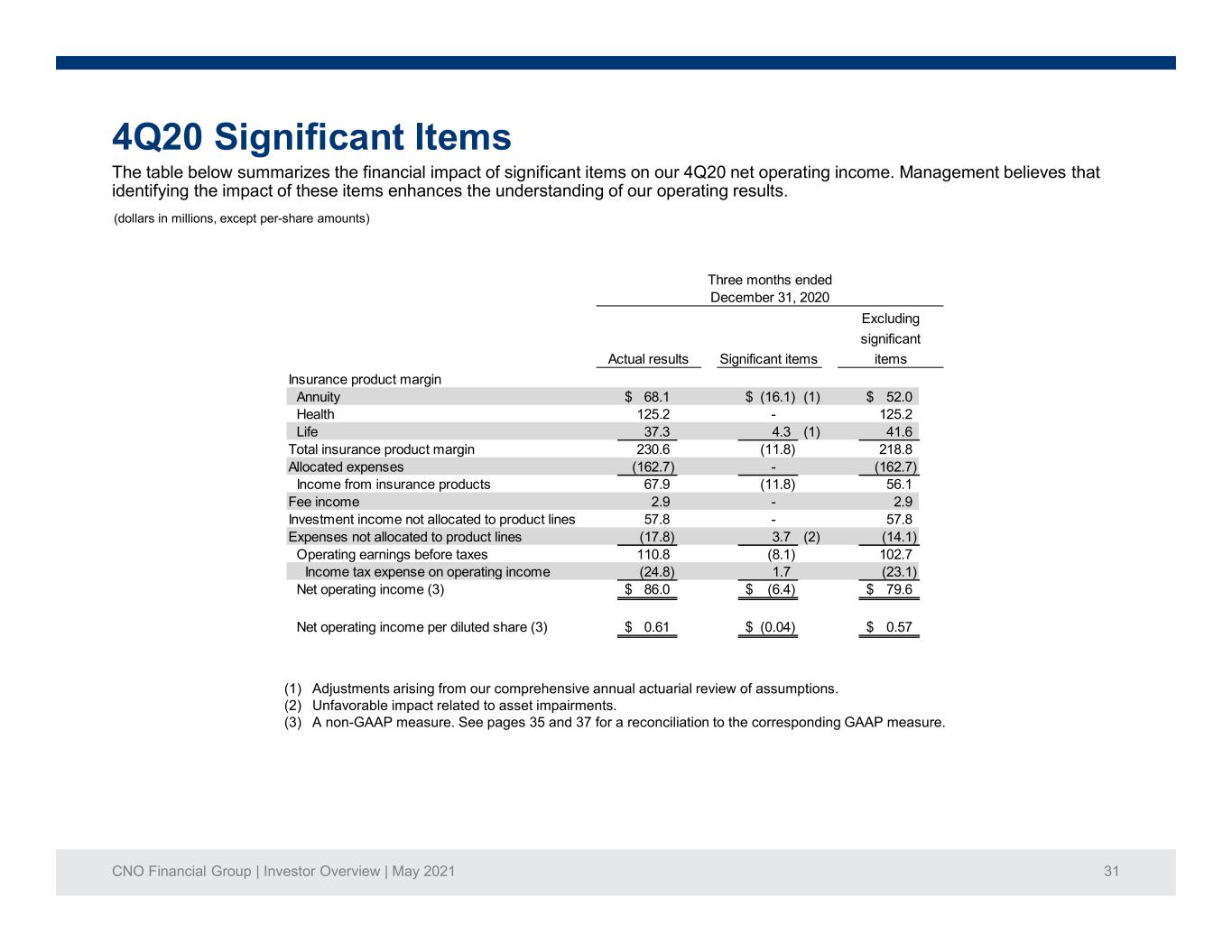

CNO Financial Group | Investor Overview | May 2021 31 The table below summarizes the financial impact of significant items on our 4Q20 net operating income. Management believes that identifying the impact of these items enhances the understanding of our operating results. 4Q20 Significant Items (dollars in millions, except per-share amounts) (1) Adjustments arising from our comprehensive annual actuarial review of assumptions. (2) Unfavorable impact related to asset impairments. (3) A non-GAAP measure. See pages 35 and 37 for a reconciliation to the corresponding GAAP measure. Insurance product margin Annuity 68.1$ (16.1)$ (1) 52.0$ Health 125.2 - 125.2 Life 37.3 4.3 (1) 41.6 Total insurance product margin 230.6 (11.8) 218.8 Allocated expenses (162.7) - (162.7) Income from insurance products 67.9 (11.8) 56.1 Fee income 2.9 - 2.9 Investment income not allocated to product lines 57.8 - 57.8 Expenses not allocated to product lines (17.8) 3.7 (2) (14.1) Operating earnings before taxes 110.8 (8.1) 102.7 Income tax expense on operating income (24.8) 1.7 (23.1) Net operating income (3) 86.0$ (6.4)$ 79.6$ Net operating income per diluted share (3) 0.61$ (0.04)$ 0.57$ Three months ended December 31, 2020 Actual results Significant items Excluding significant items

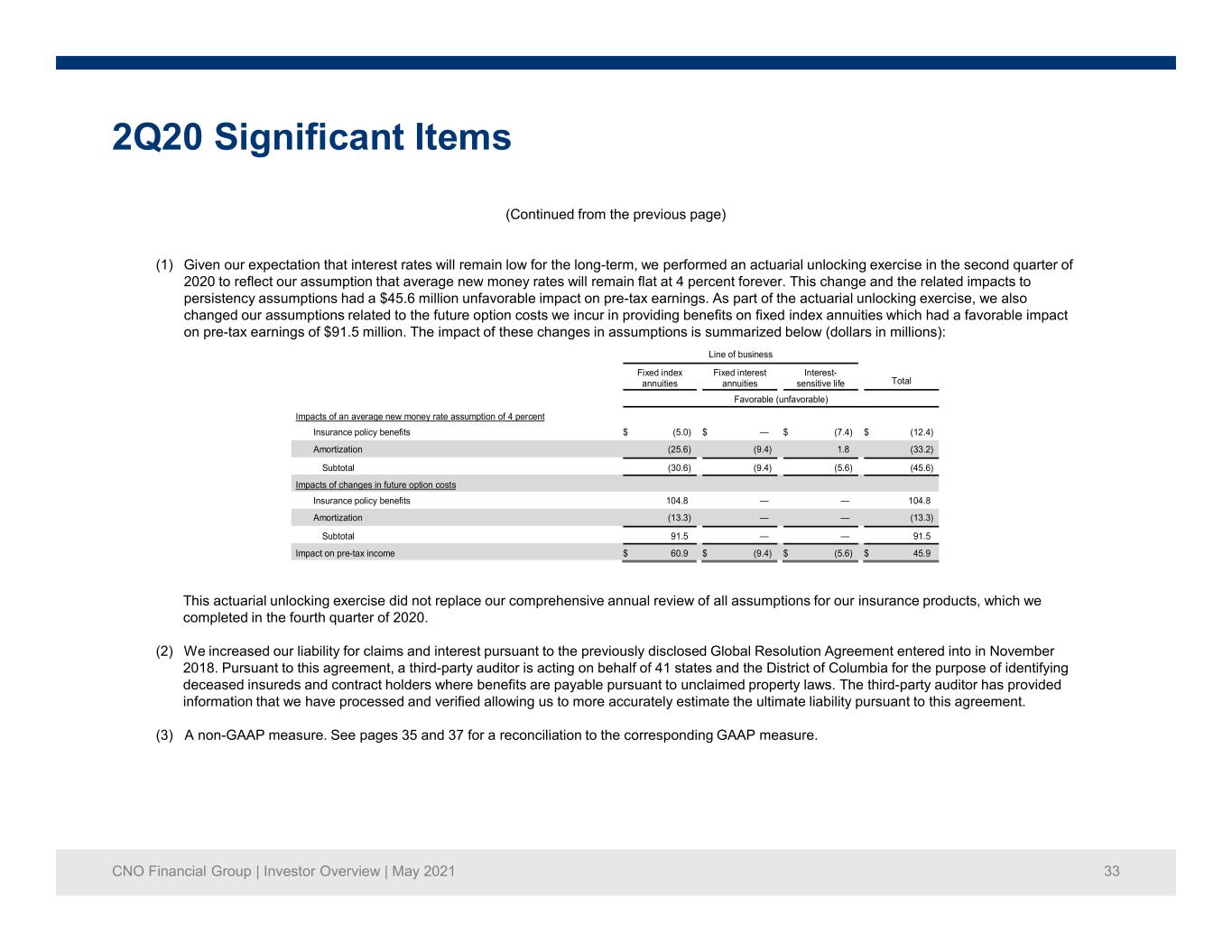

CNO Financial Group | Investor Overview | May 2021 32 The table below summarizes the financial impact of significant items on our 2Q20 net operating income. Management believes that identifying the impact of these items enhances the understanding of our operating results. 2Q20 Significant Items (dollars in millions, except per-share amounts) Insurance product margin Annuity 123.8$ 40.0$ (1) 72.3$ (91.5) (1) Health 95.5 - 95.5 Life 36.1 5.6 (1) 41.7 Total insurance product margin 255.4 (45.9) 209.5 Allocated expenses (128.1) - (128.1) Income from insurance products 127.3 (45.9) 81.4 Fee income 5.2 - 5.2 Investment income not allocated to product lines 8.2 - 8.2 Expenses not allocated to product lines (38.5) 23.5 (2) (15.0) Operating earnings before taxes 102.2 (22.4) 79.8 Income tax expense on operating income (22.8) 4.7 (18.1) Net operating income (3) 79.4$ (17.7)$ 61.7$ Net operating income per diluted share (3) $0.55 (0.12)$ 0.43$ Three months ended June 30, 2020 Actual results Significant items Excluding significant items The footnotes to the above table are on the following page.

CNO Financial Group | Investor Overview | May 2021 33 2Q20 Significant Items (Continued from the previous page) (1) Given our expectation that interest rates will remain low for the long-term, we performed an actuarial unlocking exercise in the second quarter of 2020 to reflect our assumption that average new money rates will remain flat at 4 percent forever. This change and the related impacts to persistency assumptions had a $45.6 million unfavorable impact on pre-tax earnings. As part of the actuarial unlocking exercise, we also changed our assumptions related to the future option costs we incur in providing benefits on fixed index annuities which had a favorable impact on pre-tax earnings of $91.5 million. The impact of these changes in assumptions is summarized below (dollars in millions): This actuarial unlocking exercise did not replace our comprehensive annual review of all assumptions for our insurance products, which we completed in the fourth quarter of 2020. (2) We increased our liability for claims and interest pursuant to the previously disclosed Global Resolution Agreement entered into in November 2018. Pursuant to this agreement, a third-party auditor is acting on behalf of 41 states and the District of Columbia for the purpose of identifying deceased insureds and contract holders where benefits are payable pursuant to unclaimed property laws. The third-party auditor has provided information that we have processed and verified allowing us to more accurately estimate the ultimate liability pursuant to this agreement. (3) A non-GAAP measure. See pages 35 and 37 for a reconciliation to the corresponding GAAP measure. Line of business Fixed index annuities Fixed interest annuities Interest- sensitive life Total Favorable (unfavorable) Impacts of an average new money rate assumption of 4 percent Insurance policy benefits $ (5.0) $ — $ (7.4) $ (12.4) Amortization (25.6) (9.4) 1.8 (33.2) Subtotal (30.6) (9.4) (5.6) (45.6) Impacts of changes in future option costs Insurance policy benefits 104.8 — — 104.8 Amortization (13.3) — — (13.3) Subtotal 91.5 — — 91.5 Impact on pre-tax income $ 60.9 $ (9.4) $ (5.6) $ 45.9

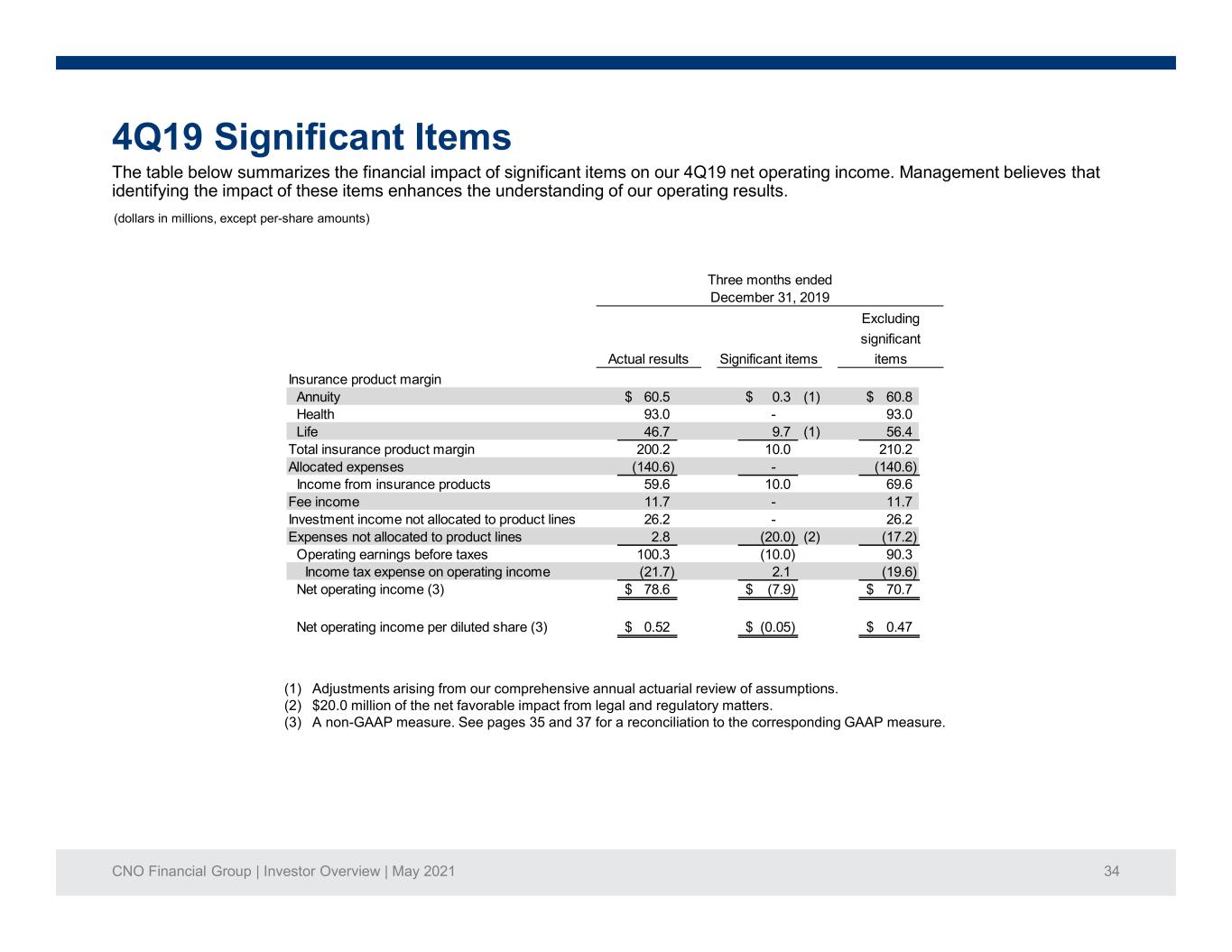

CNO Financial Group | Investor Overview | May 2021 34 The table below summarizes the financial impact of significant items on our 4Q19 net operating income. Management believes that identifying the impact of these items enhances the understanding of our operating results. 4Q19 Significant Items (dollars in millions, except per-share amounts) (1) Adjustments arising from our comprehensive annual actuarial review of assumptions. (2) $20.0 million of the net favorable impact from legal and regulatory matters. (3) A non-GAAP measure. See pages 35 and 37 for a reconciliation to the corresponding GAAP measure. Insurance product margin Annuity 60.5$ 0.3$ (1) 60.8$ Health 93.0 - 93.0 Life 46.7 9.7 (1) 56.4 Total insurance product margin 200.2 10.0 210.2 Allocated expenses (140.6) - (140.6) Income from insurance products 59.6 10.0 69.6 Fee income 11.7 - 11.7 Investment income not allocated to product lines 26.2 - 26.2 Expenses not allocated to product lines 2.8 (20.0) (2) (17.2) Operating earnings before taxes 100.3 (10.0) 90.3 Income tax expense on operating income (21.7) 2.1 (19.6) Net operating income (3) 78.6$ (7.9)$ 70.7$ Net operating income per diluted share (3) 0.52$ (0.05)$ 0.47$ Three months ended December 31, 2019 Actual results Significant items Excluding significant items

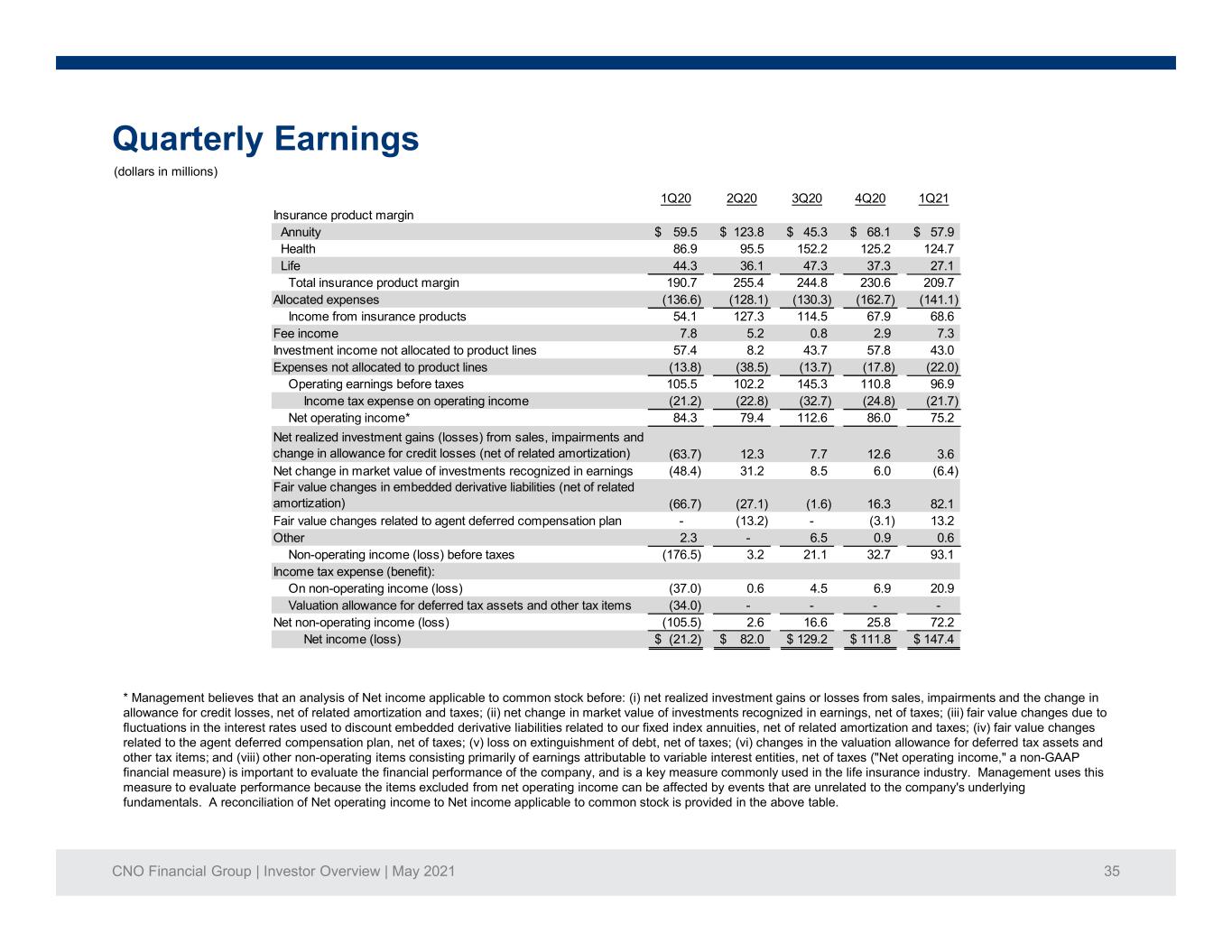

CNO Financial Group | Investor Overview | May 2021 35 Quarterly Earnings (dollars in millions) * Management believes that an analysis of Net income applicable to common stock before: (i) net realized investment gains or losses from sales, impairments and the change in allowance for credit losses, net of related amortization and taxes; (ii) net change in market value of investments recognized in earnings, net of taxes; (iii) fair value changes due to fluctuations in the interest rates used to discount embedded derivative liabilities related to our fixed index annuities, net of related amortization and taxes; (iv) fair value changes related to the agent deferred compensation plan, net of taxes; (v) loss on extinguishment of debt, net of taxes; (vi) changes in the valuation allowance for deferred tax assets and other tax items; and (viii) other non-operating items consisting primarily of earnings attributable to variable interest entities, net of taxes ("Net operating income," a non-GAAP financial measure) is important to evaluate the financial performance of the company, and is a key measure commonly used in the life insurance industry. Management uses this measure to evaluate performance because the items excluded from net operating income can be affected by events that are unrelated to the company's underlying fundamentals. A reconciliation of Net operating income to Net income applicable to common stock is provided in the above table. 1Q20 2Q20 3Q20 4Q20 1Q21 Insurance product margin Annuity 59.5$ 123.8$ 45.3$ 68.1$ 57.9$ Health 86.9 95.5 152.2 125.2 124.7 Life 44.3 36.1 47.3 37.3 27.1 Total insurance product margin 190.7 255.4 244.8 230.6 209.7 Allocated expenses (136.6) (128.1) (130.3) (162.7) (141.1) Income from insurance products 54.1 127.3 114.5 67.9 68.6 Fee income 7.8 5.2 0.8 2.9 7.3 Investment income not allocated to product lines 57.4 8.2 43.7 57.8 43.0 Expenses not allocated to product lines (13.8) (38.5) (13.7) (17.8) (22.0) Operating earnings before taxes 105.5 102.2 145.3 110.8 96.9 Income tax expense on operating income (21.2) (22.8) (32.7) (24.8) (21.7) Net operating income* 84.3 79.4 112.6 86.0 75.2 Net realized investment gains (losses) from sales, impairments and change in allowance for credit losses (net of related amortization) (63.7) 12.3 7.7 12.6 3.6 Net change in market value of investments recognized in earnings (48.4) 31.2 8.5 6.0 (6.4) Fair value changes in embedded derivative liabilities (net of related amortization) (66.7) (27.1) (1.6) 16.3 82.1 Fair value changes related to agent deferred compensation plan - (13.2) - (3.1) 13.2 Other 2.3 - 6.5 0.9 0.6 Non-operating income (loss) before taxes (176.5) 3.2 21.1 32.7 93.1 Income tax expense (benefit): On non-operating income (loss) (37.0) 0.6 4.5 6.9 20.9 Valuation allowance for deferred tax assets and other tax items (34.0) - - - - Net non-operating income (loss) (105.5) 2.6 16.6 25.8 72.2 Net income (loss) (21.2)$ 82.0$ 129.2$ 111.8$ 147.4$

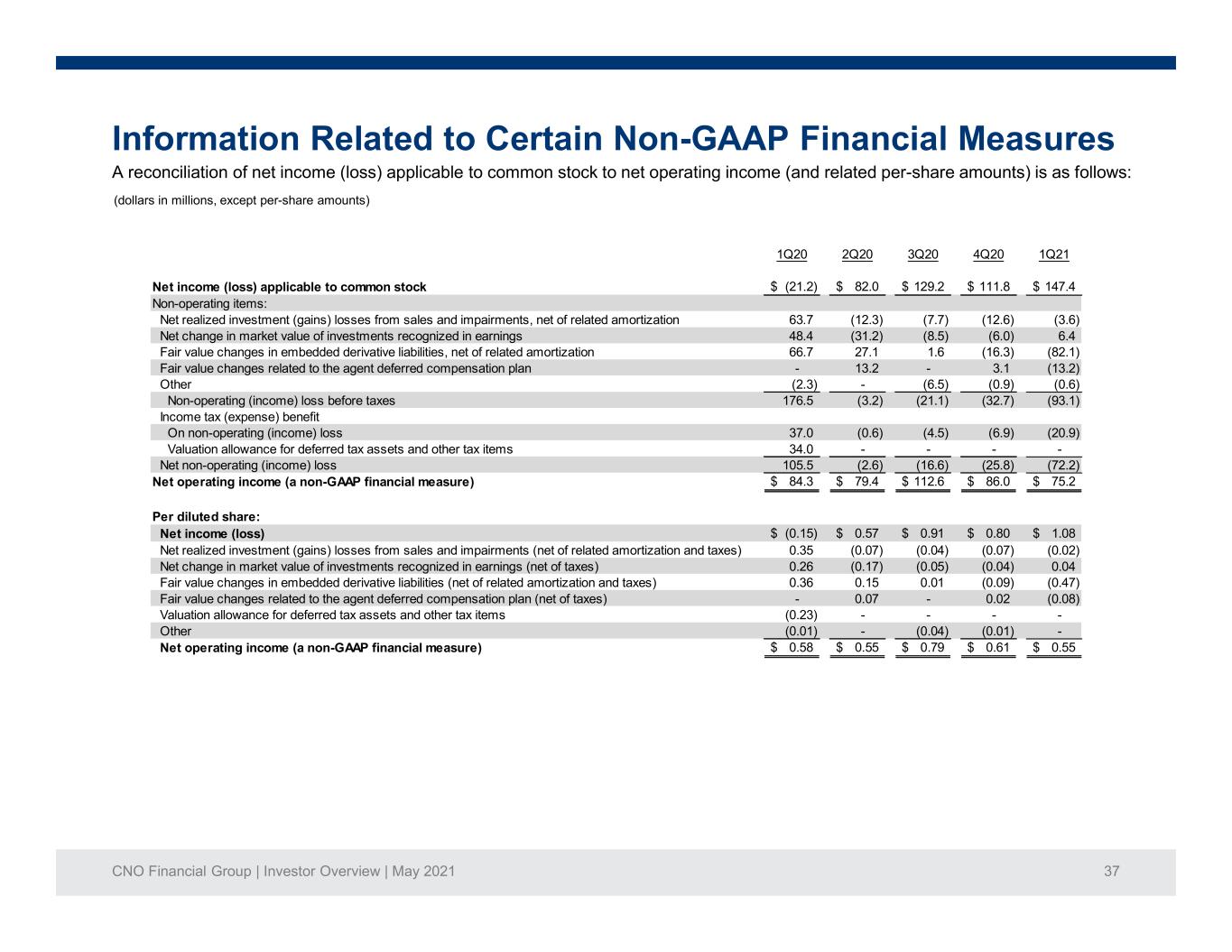

CNO Financial Group | Investor Overview | May 2021 36 Information Related to Certain Non-GAAP Financial Measures The following provides additional information regarding certain non-GAAP measures used in this presentation. A non-GAAP measure is a numerical measure of a company’s performance, financial position, or cash flows that excludes or includes amounts that are normally excluded or included in the most directly comparable measure calculated and presented in accordance with GAAP. While management believes these measures are useful to enhance understanding and comparability of our financial results, these non-GAAP measures should not be considered as substitutes for the most directly comparable GAAP measures. Additional information concerning non-GAAP measures is included in our periodic filings with the Securities and Exchange Commission that are available in the “Investors – SEC Filings” section of CNO’s website, www.CNOinc.com. Operating earnings measures Management believes that an analysis of net income applicable to common stock before net realized investment gains or losses from sales, impairments and change in allowance for credit losses, net change in market value of investments recognized in earnings, fair value changes due to fluctuations in the interest rates used to discount embedded derivative liabilities related to our fixed index annuities, fair value changes related to the agent deferred compensation plan, loss on extinguishment of debt, changes in the valuation allowance for deferred tax assets and other tax items and other non-operating items consisting primarily of earnings attributable to variable interest entities (“net operating income,” a non- GAAP financial measure) is important to evaluate the financial performance of the Company and is a key measure commonly used in the life insurance industry. Management uses this measure to evaluate performance because the items excluded from net operating income can be affected by events that are unrelated to the Company’s underlying fundamentals.

CNO Financial Group | Investor Overview | May 2021 37 Information Related to Certain Non-GAAP Financial Measures A reconciliation of net income (loss) applicable to common stock to net operating income (and related per-share amounts) is as follows: (dollars in millions, except per-share amounts) 1Q20 2Q20 3Q20 4Q20 1Q21 Net income (loss) applicable to common stock (21.2)$ 82.0$ 129.2$ 111.8$ 147.4$ Non-operating items: Net realized investment (gains) losses from sales and impairments, net of related amortization 63.7 (12.3) (7.7) (12.6) (3.6) Net change in market value of investments recognized in earnings 48.4 (31.2) (8.5) (6.0) 6.4 Fair value changes in embedded derivative liabilities, net of related amortization 66.7 27.1 1.6 (16.3) (82.1) Fair value changes related to the agent deferred compensation plan - 13.2 - 3.1 (13.2) Other (2.3) - (6.5) (0.9) (0.6) Non-operating (income) loss before taxes 176.5 (3.2) (21.1) (32.7) (93.1) Income tax (expense) benefit On non-operating (income) loss 37.0 (0.6) (4.5) (6.9) (20.9) Valuation allowance for deferred tax assets and other tax items 34.0 - - - - Net non-operating (income) loss 105.5 (2.6) (16.6) (25.8) (72.2) Net operating income (a non-GAAP financial measure) 84.3$ 79.4$ 112.6$ 86.0$ 75.2$ Per diluted share: Net income (loss) (0.15)$ 0.57$ 0.91$ 0.80$ 1.08$ Net realized investment (gains) losses from sales and impairments (net of related amortization and taxes) 0.35 (0.07) (0.04) (0.07) (0.02) Net change in market value of investments recognized in earnings (net of taxes) 0.26 (0.17) (0.05) (0.04) 0.04 Fair value changes in embedded derivative liabilities (net of related amortization and taxes) 0.36 0.15 0.01 (0.09) (0.47) Fair value changes related to the agent deferred compensation plan (net of taxes) - 0.07 - 0.02 (0.08) Valuation allowance for deferred tax assets and other tax items (0.23) - - - - Other (0.01) - (0.04) (0.01) - Net operating income (a non-GAAP financial measure) 0.58$ 0.55$ 0.79$ 0.61$ 0.55$

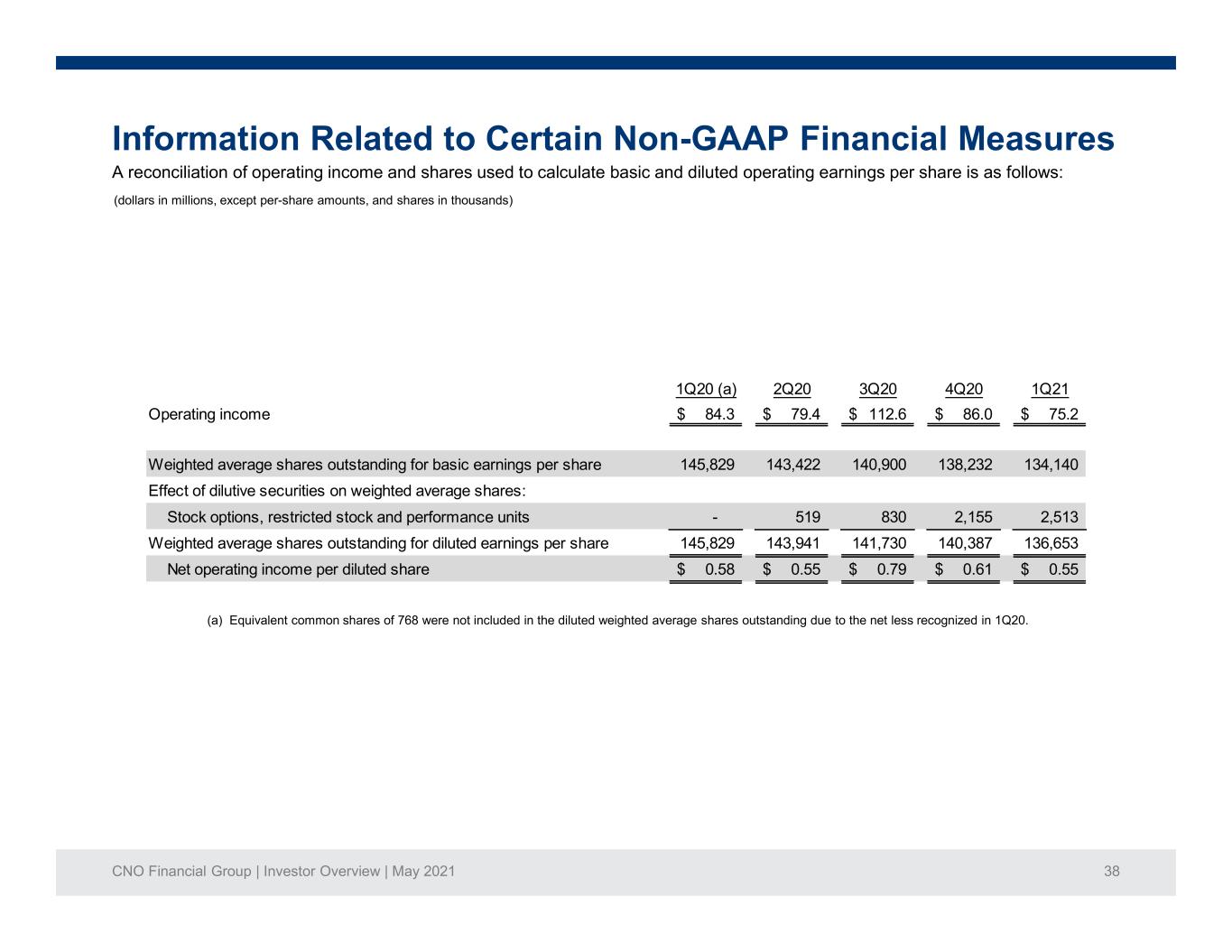

CNO Financial Group | Investor Overview | May 2021 38 Information Related to Certain Non-GAAP Financial Measures A reconciliation of operating income and shares used to calculate basic and diluted operating earnings per share is as follows: (dollars in millions, except per-share amounts, and shares in thousands) (a) Equivalent common shares of 768 were not included in the diluted weighted average shares outstanding due to the net less recognized in 1Q20. 1Q20 (a) 2Q20 3Q20 4Q20 1Q21 Operating income 84.3$ 79.4$ 112.6$ 86.0$ 75.2$ Weighted average shares outstanding for basic earnings per share 145,829 143,422 140,900 138,232 134,140 Effect of dilutive securities on weighted average shares: Stock options, restricted stock and performance units - 519 830 2,155 2,513 Weighted average shares outstanding for diluted earnings per share 145,829 143,941 141,730 140,387 136,653 Net operating income per diluted share 0.58$ 0.55$ 0.79$ 0.61$ 0.55$

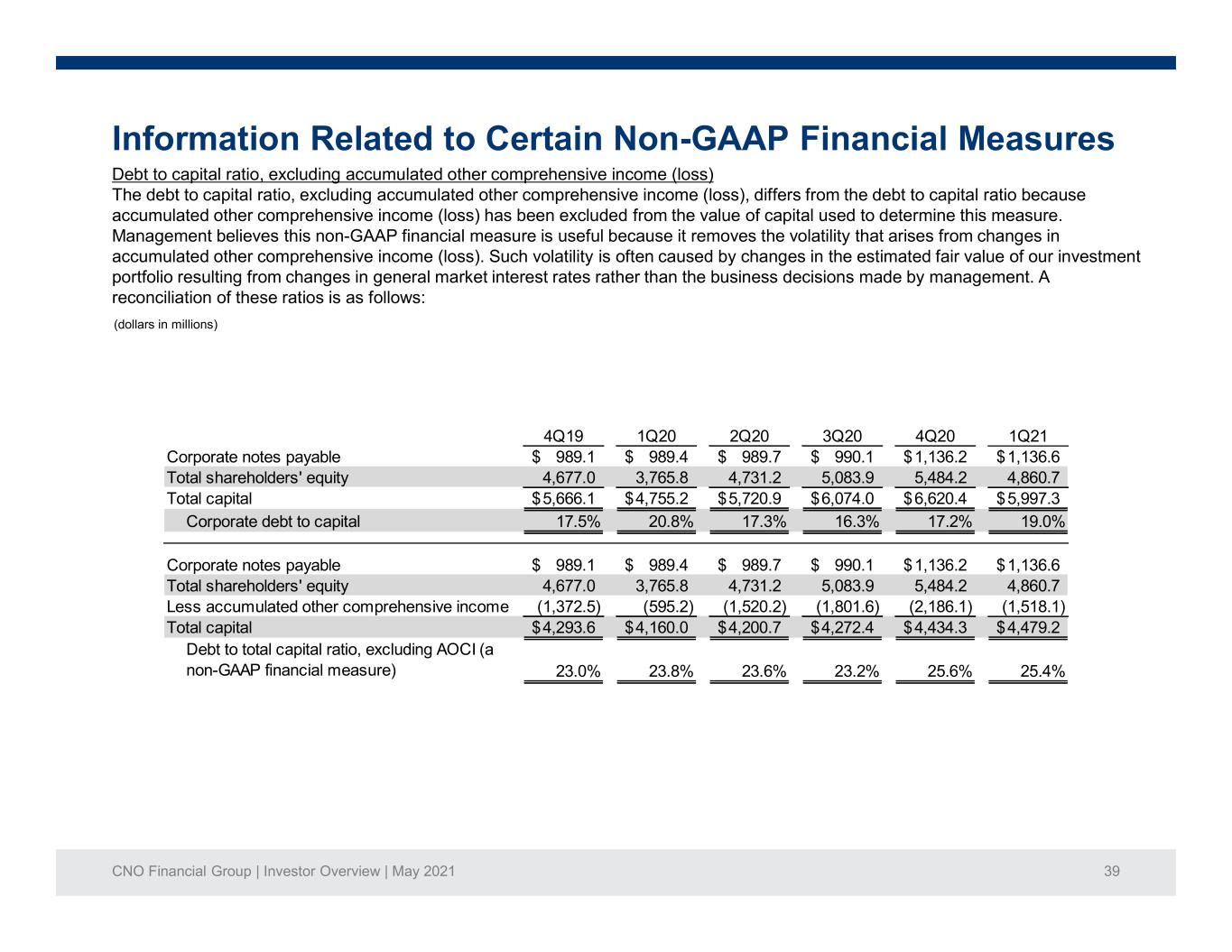

CNO Financial Group | Investor Overview | May 2021 39 Information Related to Certain Non-GAAP Financial Measures Debt to capital ratio, excluding accumulated other comprehensive income (loss) The debt to capital ratio, excluding accumulated other comprehensive income (loss), differs from the debt to capital ratio because accumulated other comprehensive income (loss) has been excluded from the value of capital used to determine this measure. Management believes this non-GAAP financial measure is useful because it removes the volatility that arises from changes in accumulated other comprehensive income (loss). Such volatility is often caused by changes in the estimated fair value of our investment portfolio resulting from changes in general market interest rates rather than the business decisions made by management. A reconciliation of these ratios is as follows: (dollars in millions) 4Q19 1Q20 2Q20 3Q20 4Q20 1Q21 Corporate notes payable 989.1$ 989.4$ 989.7$ 990.1$ 1,136.2$ 1,136.6$ Total shareholders' equity 4,677.0 3,765.8 4,731.2 5,083.9 5,484.2 4,860.7 Total capital 5,666.1$ 4,755.2$ 5,720.9$ 6,074.0$ 6,620.4$ 5,997.3$ Corporate debt to capital 17.5% 20.8% 17.3% 16.3% 17.2% 19.0% Corporate notes payable 989.1$ 989.4$ 989.7$ 990.1$ 1,136.2$ 1,136.6$ Total shareholders' equity 4,677.0 3,765.8 4,731.2 5,083.9 5,484.2 4,860.7 Less accumulated other comprehensive income (1,372.5) (595.2) (1,520.2) (1,801.6) (2,186.1) (1,518.1) Total capital 4,293.6$ 4,160.0$ 4,200.7$ 4,272.4$ 4,434.3$ 4,479.2$ Debt to total capital ratio, excluding AOCI (a non-GAAP financial measure) 23.0% 23.8% 23.6% 23.2% 25.6% 25.4%