Attached files

| file | filename |

|---|---|

| EX-32.2 - EXHIBIT 32.2 - CNO Financial Group, Inc. | cno03312017ex322.htm |

| EX-32.1 - EXHIBIT 32.1 - CNO Financial Group, Inc. | cno03312017ex321.htm |

| EX-31.2 - EXHIBIT 31.2 - CNO Financial Group, Inc. | cno03312017ex312.htm |

| EX-31.1 - EXHIBIT 31.1 - CNO Financial Group, Inc. | cno03312017ex311.htm |

| EX-12.1 - EXHIBIT 12.1 - CNO Financial Group, Inc. | cno03312017ex121.htm |

| EX-10.3 - EXHIBIT 10.3 - CNO Financial Group, Inc. | cno03312017ex103.htm |

| EX-10.2 - EXHIBIT 10.2 - CNO Financial Group, Inc. | cno03312017ex102.htm |

| EX-10.1 - EXHIBIT 10.1 - CNO Financial Group, Inc. | cno03312017ex101.htm |

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

Form 10-Q

þ | QUARTERLY REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934 |

For the quarterly period ended March 31, 2017

o | TRANSITION REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934 |

For the transition period from ___ to ___

Commission File Number 001-31792

CNO Financial Group, Inc.

Delaware | 75-3108137 | |

State of Incorporation | IRS Employer Identification No. | |

11825 N. Pennsylvania Street | ||

Carmel, Indiana 46032 | (317) 817-6100 | |

Address of principal executive offices | Telephone | |

Indicate by check mark whether the Registrant (1) has filed all reports required to be filed by Section 13 or 15(d) of the Securities Exchange Act of 1934 during the preceding 12 months (or for such shorter period that the registrant was required to file such reports) and (2) has been subject to such filing requirements for the past 90 days: Yes [ X ] No [ ]

Indicate by check mark whether the Registrant has submitted electronically and posted on its corporate Web site, if any, every Interactive Data File required to be submitted and posted pursuant to Rule 405 of Regulation S-T (§ 232.405 of this chapter) during the preceding 12 months (or for such shorter period that the registrant was required to submit and post such files). Yes [ X ] No [ ]

Indicate by check mark whether the Registrant is a large accelerated filer, an accelerated filer, a non-accelerated filer, smaller reporting company, or an emerging growth company. See the definitions of "large accelerated filer", "accelerated filer", "smaller reporting company", and "emerging growth company" in Rule 12b-2 of the Exchange Act. Large accelerated filer [ X ] Accelerated filer [ ] Non-accelerated filer [ ] Smaller reporting company [ ] Emerging growth company [ ]

If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act. [ ]

Indicate by check mark whether the Registrant is a shell company (as defined in Rule 12b-2 of the Exchange Act): Yes [ ] No [ X ]

Shares of common stock outstanding as of April 20, 2017: 171,311,512

TABLE OF CONTENTS

PART I - FINANCIAL INFORMATION | Page | |

Item 1. | Financial Statements (unaudited) | |

Item 2. | ||

Item 3. | ||

Item 4. | ||

PART II - OTHER INFORMATION | ||

Item 1. | ||

Item 1A. | ||

Item 2. | ||

Item 6. | ||

2

PART I - FINANCIAL INFORMATION

ITEM 1. FINANCIAL STATEMENTS.

CNO FINANCIAL GROUP, INC. AND SUBSIDIARIES

CONSOLIDATED BALANCE SHEET

(Dollars in millions)

(unaudited)

ASSETS

March 31, 2017 | December 31, 2016 | ||||||

Investments: | |||||||

Fixed maturities, available for sale, at fair value (amortized cost: March 31, 2017 - $19,880.3; December 31, 2016 - $19,803.1) | $ | 21,378.4 | $ | 21,096.2 | |||

Equity securities at fair value (cost: March 31, 2017 - $571.3; December 31, 2016 - $580.7) | 587.8 | 584.2 | |||||

Mortgage loans | 1,788.5 | 1,768.0 | |||||

Policy loans | 112.4 | 112.0 | |||||

Trading securities | 341.1 | 363.4 | |||||

Investments held by variable interest entities | 1,514.5 | 1,724.3 | |||||

Other invested assets | 665.2 | 589.5 | |||||

Total investments | 26,387.9 | 26,237.6 | |||||

Cash and cash equivalents - unrestricted | 530.2 | 478.9 | |||||

Cash and cash equivalents held by variable interest entities | 354.5 | 189.3 | |||||

Accrued investment income | 258.2 | 239.6 | |||||

Present value of future profits | 388.8 | 401.8 | |||||

Deferred acquisition costs | 1,028.5 | 1,044.7 | |||||

Reinsurance receivables | 2,241.1 | 2,260.4 | |||||

Income tax assets, net | 697.8 | 789.7 | |||||

Assets held in separate accounts | 4.6 | 4.7 | |||||

Other assets | 535.8 | 328.5 | |||||

Total assets | $ | 32,427.4 | $ | 31,975.2 | |||

(continued on next page)

The accompanying notes are an integral part

of the consolidated financial statements.

3

CNO FINANCIAL GROUP, INC. AND SUBSIDIARIES

CONSOLIDATED BALANCE SHEET, continued

(Dollars in millions)

(unaudited)

LIABILITIES AND SHAREHOLDERS' EQUITY

March 31, 2017 | December 31, 2016 | ||||||

Liabilities: | |||||||

Liabilities for insurance products: | |||||||

Policyholder account balances | $ | 10,975.1 | $ | 10,912.7 | |||

Future policy benefits | 11,057.2 | 10,953.3 | |||||

Liability for policy and contract claims | 498.1 | 500.6 | |||||

Unearned and advanced premiums | 292.8 | 282.5 | |||||

Liabilities related to separate accounts | 4.6 | 4.7 | |||||

Other liabilities | 798.0 | 611.4 | |||||

Investment borrowings | 1,647.2 | 1,647.4 | |||||

Borrowings related to variable interest entities | 1,634.2 | 1,662.8 | |||||

Notes payable – direct corporate obligations | 913.4 | 912.9 | |||||

Total liabilities | 27,820.6 | 27,488.3 | |||||

Commitments and Contingencies | |||||||

Shareholders' equity: | |||||||

Common stock ($0.01 par value, 8,000,000,000 shares authorized, shares issued and outstanding: March 31, 2017 – 172,103,802; December 31, 2016 – 173,753,614) | 1.7 | 1.7 | |||||

Additional paid-in capital | 3,177.1 | 3,212.1 | |||||

Accumulated other comprehensive income | 729.6 | 622.4 | |||||

Retained earnings | 698.4 | 650.7 | |||||

Total shareholders' equity | 4,606.8 | 4,486.9 | |||||

Total liabilities and shareholders' equity | $ | 32,427.4 | $ | 31,975.2 | |||

The accompanying notes are an integral part

of the consolidated financial statements.

4

CNO FINANCIAL GROUP, INC. AND SUBSIDIARIES

CONSOLIDATED STATEMENT OF OPERATIONS

(Dollars in millions, except per share data)

(unaudited)

Three months ended | ||||||||

March 31, | ||||||||

2017 | 2016 | |||||||

Revenues: | ||||||||

Insurance policy income | $ | 663.8 | $ | 644.4 | ||||

Net investment income: | ||||||||

General account assets | 312.0 | 291.0 | ||||||

Policyholder and other special-purpose portfolios | 75.2 | 11.7 | ||||||

Realized investment gains (losses): | ||||||||

Net realized investment gains (losses), excluding impairment losses | 16.3 | 9.1 | ||||||

Impairment losses recognized (a) | (8.4 | ) | (10.0 | ) | ||||

Total realized gains (losses) | 7.9 | (.9 | ) | |||||

Fee revenue and other income | 11.8 | 14.2 | ||||||

Total revenues | 1,070.7 | 960.4 | ||||||

Benefits and expenses: | ||||||||

Insurance policy benefits | 669.3 | 619.0 | ||||||

Interest expense | 30.8 | 27.7 | ||||||

Amortization | 63.5 | 62.1 | ||||||

Other operating costs and expenses | 210.4 | 211.1 | ||||||

Total benefits and expenses | 974.0 | 919.9 | ||||||

Income before income taxes | 96.7 | 40.5 | ||||||

Income tax expense (benefit): | ||||||||

Tax expense on period income | 34.4 | 15.0 | ||||||

Valuation allowance for deferred tax assets | — | (20.0 | ) | |||||

Net income | $ | 62.3 | $ | 45.5 | ||||

Earnings per common share: | ||||||||

Basic: | ||||||||

Weighted average shares outstanding | 173,431,000 | 180,350,000 | ||||||

Net income | $ | .36 | $ | .25 | ||||

Diluted: | ||||||||

Weighted average shares outstanding | 175,065,000 | 182,128,000 | ||||||

Net income | $ | .36 | $ | .25 | ||||

______________

(a) | No portion of the other-than-temporary impairments recognized in the periods was included in accumulated other comprehensive income. |

The accompanying notes are an integral part

of the consolidated financial statements.

5

CNO FINANCIAL GROUP, INC. AND SUBSIDIARIES

CONSOLIDATED STATEMENT OF COMPREHENSIVE INCOME

(Dollars in millions)

(unaudited)

Three months ended | |||||||

March 31, | |||||||

2017 | 2016 | ||||||

Net income | $ | 62.3 | $ | 45.5 | |||

Other comprehensive income, before tax: | |||||||

Unrealized gains for the period | 215.8 | 431.1 | |||||

Adjustment to present value of future profits and deferred acquisition costs | 7.8 | (45.2 | ) | ||||

Amount related to premium deficiencies assuming the net unrealized gains (losses) had been realized | (52.0 | ) | (168.0 | ) | |||

Reclassification adjustments: | |||||||

For net realized investment (gains) losses included in net income | (5.1 | ) | (4.9 | ) | |||

For amortization of the present value of future profits and deferred acquisition costs related to net realized investment gains (losses) included in net income | — | .1 | |||||

Unrealized gains on investments | 166.5 | 213.1 | |||||

Change related to deferred compensation plan | — | .6 | |||||

Other comprehensive income before tax | 166.5 | 213.7 | |||||

Income tax expense related to items of accumulated other comprehensive income | (59.3 | ) | (76.0 | ) | |||

Other comprehensive income, net of tax | 107.2 | 137.7 | |||||

Comprehensive income | $ | 169.5 | $ | 183.2 | |||

The accompanying notes are an integral part

of the consolidated financial statements.

6

CNO FINANCIAL GROUP, INC. AND SUBSIDIARIES

CONSOLIDATED STATEMENT OF SHAREHOLDERS' EQUITY

(Dollars in millions)

(unaudited)

Common stock and additional paid-in capital | Accumulated other comprehensive income | Retained earnings | Total | ||||||||||||

Balance, December 31, 2015 | $ | 3,388.6 | $ | 402.8 | $ | 347.1 | $ | 4,138.5 | |||||||

Net income | — | — | 45.5 | 45.5 | |||||||||||

Change in unrealized appreciation (depreciation) of investments and other (net of applicable income tax expense of $76.0) | — | 137.7 | — | 137.7 | |||||||||||

Cost of common stock repurchased | (90.0 | ) | — | — | (90.0 | ) | |||||||||

Dividends on common stock | — | — | (12.6 | ) | (12.6 | ) | |||||||||

Stock options, restricted stock and performance units | 7.5 | — | — | 7.5 | |||||||||||

Balance, March 31, 2016 | $ | 3,306.1 | $ | 540.5 | $ | 380.0 | $ | 4,226.6 | |||||||

Balance, December 31, 2016 | $ | 3,213.8 | $ | 622.4 | $ | 650.7 | $ | 4,486.9 | |||||||

Cumulative effect of accounting change | .9 | — | (.6 | ) | .3 | ||||||||||

Net income | — | — | 62.3 | 62.3 | |||||||||||

Change in unrealized appreciation (depreciation) of investments (net of applicable income tax expense of $58.7) | — | 106.1 | — | 106.1 | |||||||||||

Change in noncredit component of impairment losses on fixed maturities, available for sale (net of applicable income tax expense of $.6) | — | 1.1 | — | 1.1 | |||||||||||

Cost of common stock repurchased | (43.0 | ) | — | — | (43.0 | ) | |||||||||

Dividends on common stock | — | — | (14.0 | ) | (14.0 | ) | |||||||||

Stock options, restricted stock and performance units | 7.1 | — | — | 7.1 | |||||||||||

Balance, March 31, 2017 | $ | 3,178.8 | $ | 729.6 | $ | 698.4 | $ | 4,606.8 | |||||||

The accompanying notes are an integral part

of the consolidated financial statements.

7

CNO FINANCIAL GROUP, INC. AND SUBSIDIARIES

CONSOLIDATED STATEMENT OF CASH FLOWS

(Dollars in millions)

(unaudited)

Three months ended | |||||||

March 31, | |||||||

2017 | 2016 | ||||||

Cash flows from operating activities: | |||||||

Insurance policy income | $ | 640.1 | $ | 617.3 | |||

Net investment income | 289.7 | 285.8 | |||||

Fee revenue and other income | 11.8 | 14.2 | |||||

Insurance policy benefits | (511.8 | ) | (487.4 | ) | |||

Interest expense | (20.5 | ) | (13.3 | ) | |||

Deferrable policy acquisition costs | (63.2 | ) | (62.2 | ) | |||

Other operating costs | (203.6 | ) | (209.7 | ) | |||

Income taxes | (1.5 | ) | (1.1 | ) | |||

Net cash from operating activities | 141.0 | 143.6 | |||||

Cash flows from investing activities: | |||||||

Sales of investments | 403.0 | 1,181.5 | |||||

Maturities and redemptions of investments | 849.3 | 349.6 | |||||

Purchases of investments | (1,166.4 | ) | (1,524.9 | ) | |||

Net sales (purchases) of trading securities | 35.6 | (21.7 | ) | ||||

Change in cash and cash equivalents held by variable interest entities | (165.2 | ) | 174.3 | ||||

Other | (12.1 | ) | (3.8 | ) | |||

Net cash provided (used) by investing activities | (55.8 | ) | 155.0 | ||||

Cash flows from financing activities: | |||||||

Issuance of common stock | 2.9 | .4 | |||||

Payments to repurchase common stock | (39.8 | ) | (96.9 | ) | |||

Common stock dividends paid | (14.0 | ) | (12.7 | ) | |||

Amounts received for deposit products | 359.5 | 340.1 | |||||

Withdrawals from deposit products | (312.9 | ) | (305.3 | ) | |||

Issuance of investment borrowings: | |||||||

Related to variable interest entities | 8.7 | 2.9 | |||||

Payments on investment borrowings: | |||||||

Federal Home Loan Bank | (.2 | ) | (.2 | ) | |||

Related to variable interest entities and other | (38.1 | ) | (23.5 | ) | |||

Net cash used by financing activities | (33.9 | ) | (95.2 | ) | |||

Net increase in cash and cash equivalents | 51.3 | 203.4 | |||||

Cash and cash equivalents, beginning of period | 478.9 | 432.3 | |||||

Cash and cash equivalents, end of period | $ | 530.2 | $ | 635.7 | |||

The accompanying notes are an integral part

of the consolidated financial statements.

8

CNO FINANCIAL GROUP, INC. AND SUBSIDIARIES

Notes to Consolidated Financial Statements

(unaudited)

___________________

BUSINESS AND BASIS OF PRESENTATION

The following notes should be read together with the notes to the consolidated financial statements included in our 2016 Annual Report on Form 10-K.

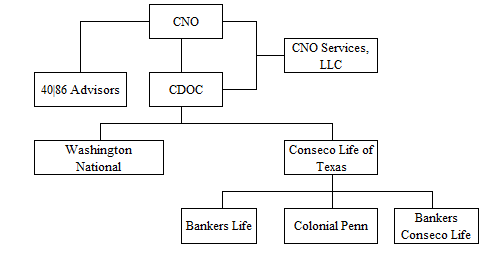

CNO Financial Group, Inc., a Delaware corporation ("CNO"), is a holding company for a group of insurance companies operating throughout the United States that develop, market and administer health insurance, annuity, individual life insurance and other insurance products. The terms "CNO Financial Group, Inc.", "CNO", the "Company", "we", "us", and "our" as used in these financial statements refer to CNO and its subsidiaries. Such terms, when used to describe insurance business and products, refer to the insurance business and products of CNO's insurance subsidiaries.

We focus on serving middle-income pre-retiree and retired Americans, which we believe are attractive, underserved, high growth markets. We sell our products through three distribution channels: career agents, independent producers (some of whom sell one or more of our product lines exclusively) and direct marketing.

Our unaudited consolidated financial statements reflect normal recurring adjustments that, in the opinion of management, are necessary for a fair statement of our financial position, results of operations and cash flows for the periods presented. As permitted by rules and regulations of the Securities and Exchange Commission (the "SEC") applicable to quarterly reports on Form 10-Q, we have condensed or omitted certain information and disclosures normally included in financial statements prepared in accordance with accounting principles generally accepted in the United States of America ("GAAP"). We have reclassified certain amounts from the prior periods to conform to the 2017 presentation. These reclassifications have no effect on net income or shareholders' equity. Results for interim periods are not necessarily indicative of the results that may be expected for a full year.

The balance sheet at December 31, 2016, presented herein, has been derived from the audited financial statements at that date but does not include all of the information and footnotes required by GAAP for complete financial statements.

When we prepare financial statements in conformity with GAAP, we are required to make estimates and assumptions that significantly affect reported amounts of various assets and liabilities and the disclosure of contingent assets and liabilities at the date of the financial statements and revenues and expenses during the reporting periods. For example, we use significant estimates and assumptions to calculate values for deferred acquisition costs, the present value of future profits, fair value measurements of certain investments (including derivatives), other-than-temporary impairments of investments, assets and liabilities related to income taxes, liabilities for insurance products, liabilities related to litigation and guaranty fund assessment accruals. If our future experience differs from these estimates and assumptions, our financial statements would be materially affected.

The accompanying financial statements include the accounts of the Company and its subsidiaries. Our consolidated financial statements exclude transactions between us and our consolidated affiliates, or among our consolidated affiliates.

INVESTMENTS

We classify our fixed maturity securities into one of two categories: (i) "available for sale" (which we carry at estimated fair value with any unrealized gain or loss, net of tax and related adjustments, recorded as a component of shareholders' equity); or (ii) "trading" (which we carry at estimated fair value with changes in such value recognized as net investment income (classified as investment income from policyholder and other special-purpose portfolios)).

Our trading securities include: (i) investments purchased with the intent of selling in the near term to generate income; (ii) investments supporting certain insurance liabilities (including investments backing the market strategies of our multibucket annuity products); and (iii) certain fixed maturity securities containing embedded derivatives for which we have elected the fair value option. The change in fair value of the income generating investments and investments supporting insurance liabilities is recognized in income from policyholder and other special-purpose portfolios (a component of net investment income). The change in fair value of securities with embedded derivatives is recognized in realized investment gains (losses). Investment income related to investments supporting certain insurance liabilities is substantially offset by the change in insurance policy benefits related to certain products.

9

CNO FINANCIAL GROUP, INC. AND SUBSIDIARIES

Notes to Consolidated Financial Statements

(unaudited)

___________________

Accumulated other comprehensive income is primarily comprised of the net effect of unrealized appreciation (depreciation) on our investments. These amounts, included in shareholders' equity as of March 31, 2017 and December 31, 2016, were as follows (dollars in millions):

March 31, 2017 | December 31, 2016 | ||||||

Net unrealized appreciation (depreciation) on fixed maturity securities, available for sale, on which an other-than-temporary impairment loss has been recognized | $ | .8 | $ | (1.1 | ) | ||

Net unrealized gains on all other investments | 1,520.7 | 1,311.9 | |||||

Adjustment to present value of future profits (a) | (104.9 | ) | (106.2 | ) | |||

Adjustment to deferred acquisition costs | (253.7 | ) | (223.5 | ) | |||

Adjustment to insurance liabilities | (28.8 | ) | (13.5 | ) | |||

Deferred income tax liabilities | (404.5 | ) | (345.2 | ) | |||

Accumulated other comprehensive income | $ | 729.6 | $ | 622.4 | |||

________

(a) | The present value of future profits is the value assigned to the right to receive future cash flows from contracts existing at September 10, 2003, the date Conseco, Inc., an Indiana corporation, emerged from bankruptcy. |

At March 31, 2017, adjustments to the present value of future profits, deferred acquisition costs, insurance liabilities and deferred tax assets included $(93.2) million, $(134.0) million, $(28.8) million and $91.0 million, respectively, for premium deficiencies that would exist on certain blocks of business (primarily long-term care products) if unrealized gains on the assets backing such products had been realized and the proceeds from the sales of such assets were invested at then current yields.

10

CNO FINANCIAL GROUP, INC. AND SUBSIDIARIES

Notes to Consolidated Financial Statements

(unaudited)

___________________

At March 31, 2017, the amortized cost, gross unrealized gains and losses, estimated fair value, other-than-temporary impairments in accumulated other comprehensive income of fixed maturities, available for sale, and equity securities were as follows (dollars in millions):

Amortized cost | Gross unrealized gains | Gross unrealized losses | Estimated fair value | Other-than-temporary impairments included in accumulated other comprehensive income | |||||||||||||||

Corporate securities | $ | 12,688.6 | $ | 1,203.6 | $ | (90.1 | ) | $ | 13,802.1 | $ | (3.6 | ) | |||||||

United States Treasury securities and obligations of United States government corporations and agencies | 173.1 | 20.7 | — | 193.8 | — | ||||||||||||||

States and political subdivisions | 1,844.6 | 193.7 | (9.4 | ) | 2,028.9 | (3.0 | ) | ||||||||||||

Debt securities issued by foreign governments | 44.3 | 1.5 | (.1 | ) | 45.7 | — | |||||||||||||

Asset-backed securities | 2,692.4 | 113.2 | (11.3 | ) | 2,794.3 | — | |||||||||||||

Collateralized debt obligations | 212.6 | 1.8 | — | 214.4 | — | ||||||||||||||

Commercial mortgage-backed securities | 1,411.1 | 34.2 | (21.7 | ) | 1,423.6 | — | |||||||||||||

Mortgage pass-through securities | 2.3 | .2 | — | 2.5 | — | ||||||||||||||

Collateralized mortgage obligations | 811.3 | 63.4 | (1.6 | ) | 873.1 | (1.3 | ) | ||||||||||||

Total fixed maturities, available for sale | $ | 19,880.3 | $ | 1,632.3 | $ | (134.2 | ) | $ | 21,378.4 | $ | (7.9 | ) | |||||||

Equity securities | $ | 571.3 | $ | 21.1 | $ | (4.6 | ) | $ | 587.8 | ||||||||||

The following table sets forth the amortized cost and estimated fair value of fixed maturities, available for sale, at March 31, 2017, by contractual maturity. Actual maturities will differ from contractual maturities because certain borrowers may have the right to call or prepay obligations with or without penalties. Structured securities (such as asset-backed securities, collateralized debt obligations, commercial mortgage-backed securities, mortgage pass-through securities and collateralized mortgage obligations, collectively referred to as "structured securities") frequently include provisions for periodic principal payments and permit periodic unscheduled payments.

Amortized cost | Estimated fair value | ||||||

(Dollars in millions) | |||||||

Due in one year or less | $ | 332.1 | $ | 337.5 | |||

Due after one year through five years | 2,242.9 | 2,400.7 | |||||

Due after five years through ten years | 1,539.0 | 1,625.6 | |||||

Due after ten years | 10,636.6 | 11,706.7 | |||||

Subtotal | 14,750.6 | 16,070.5 | |||||

Structured securities | 5,129.7 | 5,307.9 | |||||

Total fixed maturities, available for sale | $ | 19,880.3 | $ | 21,378.4 | |||

11

CNO FINANCIAL GROUP, INC. AND SUBSIDIARIES

Notes to Consolidated Financial Statements

(unaudited)

___________________

Net Realized Investment Gains (Losses)

The following table sets forth the net realized investment gains (losses) for the periods indicated (dollars in millions):

Three months ended | |||||||

March 31, | |||||||

2017 | 2016 | ||||||

Fixed maturity securities, available for sale: | |||||||

Gross realized gains on sale | $ | 7.0 | $ | 98.5 | |||

Gross realized losses on sale | (2.7 | ) | (81.0 | ) | |||

Impairments: | |||||||

Total other-than-temporary impairment losses | (3.2 | ) | (6.3 | ) | |||

Other-than-temporary impairment losses recognized in accumulated other comprehensive income | — | — | |||||

Net impairment losses recognized | (3.2 | ) | (6.3 | ) | |||

Net realized investment gains (losses) from fixed maturities | 1.1 | 11.2 | |||||

Equity securities | 1.9 | .1 | |||||

Commercial mortgage loans | 1.0 | — | |||||

Impairments of other investments | (5.2 | ) | (3.7 | ) | |||

Other (a) | 9.1 | (8.5 | ) | ||||

Net realized investment gains (losses) | $ | 7.9 | $ | (.9 | ) | ||

_________________

(a) | Changes in the estimated fair value of trading securities that we have elected the fair value option (and are still held as of the end of the respective periods) was $3.0 million and $(3.4) million for the three months ended March 31, 2017 and 2016, respectively. |

During the first three months of 2017, we recognized net realized investment gains of $7.9 million, which were comprised of: (i) $12.9 million of net gains from the sales of investments; (ii) the increase in fair value of certain fixed maturity investments with embedded derivatives of $2.7 million; (iii) the increase in fair value of embedded derivatives related to a modified coinsurance agreement of $.7 million; and (iv) $8.4 million of writedowns of investments for other than temporary declines in fair value recognized through net income.

During the first three months of 2016, we recognized net realized investment losses of $.9 million, which were comprised of: (i) $10.9 million of net gains from the sales of investments; (ii) the decrease in fair value of certain fixed maturity investments with embedded derivatives of $3.6 million; (iii) the increase in fair value of embedded derivatives related to a modified coinsurance agreement of $1.8 million; and (iv) $10.0 million of writedowns of investments for other than temporary declines in fair value recognized through net income.

Our fixed maturity investments are generally purchased in the context of various long-term strategies, including funding insurance liabilities, so we do not generally seek to generate short-term realized gains through the purchase and sale of such securities. In certain circumstances, including those in which securities are selling at prices which exceed our view of their underlying economic value, or when it is possible to reinvest the proceeds to better meet our long-term asset-liability objectives, we may sell certain securities.

During the first three months of 2017, the $2.7 million of gross realized losses on sales of $95.3 million of fixed maturity securities, available for sale included: (i) $1.5 million related to various corporate securities; (ii) $.9 million related to commercial mortgage-backed securities; and (iii) $.3 million related to various other investments. Securities are generally sold at a loss following unforeseen issue-specific events or conditions or shifts in perceived risks. These reasons include but are not limited to: (i) changes in the investment environment; (ii) expectation that the market value could deteriorate further; (iii) desire to reduce our exposure to an asset class, an issuer or an industry; (iv) prospective or actual changes in credit quality; or (v) changes in expected portfolio cash flows.

12

CNO FINANCIAL GROUP, INC. AND SUBSIDIARIES

Notes to Consolidated Financial Statements

(unaudited)

___________________

During the first three months of 2017, we recognized $8.4 million of impairment losses recorded in earnings which included: (i) $3.2 million of writedowns on fixed maturities of a single issuer in the energy sector; and (ii) $5.2 million of writedowns related to a real estate investment. Factors considered in determining the writedowns of investments in the first three months of 2017 included changes in the estimated recoverable value of the assets related to each investment and the timing of and complexities related to the recovery process.

During the first three months of 2016, we recognized $10.0 million of impairment losses recorded in earnings which included: (i) $6.3 million of writedowns on fixed maturities of a single issuer in the energy sector; and (ii) $3.7 million of writedowns on a direct loan due to borrower specific events.

We regularly evaluate all of our investments with unrealized losses for possible impairment. Our assessment of whether unrealized losses are "other than temporary" requires significant judgment. Factors considered include: (i) the extent to which fair value is less than the cost basis; (ii) the length of time that the fair value has been less than cost; (iii) whether the unrealized loss is event driven, credit-driven or a result of changes in market interest rates or risk premium; (iv) the near-term prospects for specific events, developments or circumstances likely to affect the value of the investment; (v) the investment's rating and whether the investment is investment-grade and/or has been downgraded since its purchase; (vi) whether the issuer is current on all payments in accordance with the contractual terms of the investment and is expected to meet all of its obligations under the terms of the investment; (vii) whether we intend to sell the investment or it is more likely than not that circumstances will require us to sell the investment before recovery occurs; (viii) the underlying current and prospective asset and enterprise values of the issuer and the extent to which the recoverability of the carrying value of our investment may be affected by changes in such values; (ix) projections of, and unfavorable changes in, cash flows on structured securities including mortgage-backed and asset-backed securities; (x) our best estimate of the value of any collateral; and (xi) other objective and subjective factors.

Future events may occur, or additional information may become available, which may necessitate future realized losses in our portfolio. Significant losses could have a material adverse effect on our consolidated financial statements in future periods.

Impairment losses on equity securities are recognized in net income. The manner in which impairment losses on fixed maturity securities, available for sale, are recognized in the financial statements is dependent on the facts and circumstances related to the specific security. If we intend to sell a security or it is more likely than not that we would be required to sell a security before the recovery of its amortized cost, the security is other-than-temporarily impaired and the full amount of the impairment is recognized as a loss through earnings. If we do not expect to recover the amortized cost basis, we do not plan to sell the security, and if it is not more likely than not that we would be required to sell a security before the recovery of its amortized cost, less any current period credit loss, the recognition of the other-than-temporary impairment is bifurcated. We recognize the credit loss portion in net income and the noncredit loss portion in accumulated other comprehensive income.

We estimate the amount of the credit loss component of a fixed maturity security impairment as the difference between amortized cost and the present value of the expected cash flows of the security. The present value is determined using the best estimate of future cash flows discounted at the effective interest rate implicit to the security at the date of purchase or the current yield to accrete an asset-backed or floating rate security. The methodology and assumptions for establishing the best estimate of future cash flows vary depending on the type of security.

For most structured securities, cash flow estimates are based on bond specific facts and circumstances that may include collateral characteristics, expectations of delinquency and default rates, loss severity, prepayment speeds and structural support, including excess spread, subordination and guarantees. For corporate bonds, cash flow estimates are derived from scenario-based outcomes of expected corporate restructurings or the disposition of assets using bond specific facts and circumstances. The previous amortized cost basis less the impairment recognized in net income becomes the security's new cost basis. We accrete the new cost basis to the estimated future cash flows over the expected remaining life of the security, except when the security is in default or considered nonperforming.

The remaining noncredit impairment, which is recorded in accumulated other comprehensive income, is the difference between the security's estimated fair value and our best estimate of future cash flows discounted at the effective interest rate prior to impairment. The remaining noncredit impairment typically represents changes in the market interest rates, current

13

CNO FINANCIAL GROUP, INC. AND SUBSIDIARIES

Notes to Consolidated Financial Statements

(unaudited)

___________________

market liquidity and risk premiums. As of March 31, 2017, other-than-temporary impairments included in accumulated other comprehensive income totaled $7.9 million (before taxes and related amortization).

The following table summarizes the amount of credit losses recognized in earnings on fixed maturity securities, available for sale, held at the beginning of the period, for which a portion of the other-than-temporary impairment was also recognized in accumulated other comprehensive income for the three months ended March 31, 2017 and 2016 (dollars in millions):

Three months ended | |||||||

March 31, | |||||||

2017 | 2016 | ||||||

Credit losses on fixed maturity securities, available for sale, beginning of period | $ | (5.5 | ) | $ | (2.6 | ) | |

Add: credit losses on other-than-temporary impairments not previously recognized | — | — | |||||

Less: credit losses on securities sold | .1 | — | |||||

Less: credit losses on securities impaired due to intent to sell (a) | — | — | |||||

Add: credit losses on previously impaired securities | — | — | |||||

Less: increases in cash flows expected on previously impaired securities | — | — | |||||

Credit losses on fixed maturity securities, available for sale, end of period | $ | (5.4 | ) | $ | (2.6 | ) | |

__________

(a) | Represents securities for which the amount previously recognized in accumulated other comprehensive income was recognized in earnings because we intend to sell the security or we more likely than not will be required to sell the security before recovery of its amortized cost basis. |

Gross Unrealized Investment Losses

Our investment strategy is to maximize, over a sustained period and within acceptable parameters of quality and risk, investment income and total investment return through active investment management. Accordingly, we may sell securities at a gain or a loss to enhance the projected total return of the portfolio as market opportunities change, to reflect changing perceptions of risk, or to better match certain characteristics of our investment portfolio with the corresponding characteristics of our insurance liabilities.

14

CNO FINANCIAL GROUP, INC. AND SUBSIDIARIES

Notes to Consolidated Financial Statements

(unaudited)

___________________

The following table summarizes the gross unrealized losses and fair values of our investments with unrealized losses that are not deemed to be other-than-temporarily impaired, aggregated by investment category and length of time that such securities have been in a continuous unrealized loss position, at March 31, 2017 (dollars in millions):

Less than 12 months | 12 months or greater | Total | ||||||||||||||||||||||

Description of securities | Fair value | Unrealized losses | Fair value | Unrealized losses | Fair value | Unrealized losses | ||||||||||||||||||

United States Treasury securities and obligations of United States government corporations and agencies | $ | 17.7 | $ | — | $ | — | $ | — | $ | 17.7 | $ | — | ||||||||||||

States and political subdivisions | 185.4 | (6.8 | ) | 18.5 | (2.6 | ) | 203.9 | (9.4 | ) | |||||||||||||||

Debt securities issued by foreign governments | 10.4 | (.1 | ) | — | — | 10.4 | (.1 | ) | ||||||||||||||||

Corporate securities | 1,395.2 | (39.2 | ) | 486.9 | (50.9 | ) | 1,882.1 | (90.1 | ) | |||||||||||||||

Asset-backed securities | 599.3 | (7.0 | ) | 219.8 | (4.3 | ) | 819.1 | (11.3 | ) | |||||||||||||||

Collateralized debt obligations | 15.5 | — | 9.0 | — | 24.5 | — | ||||||||||||||||||

Commercial mortgage-backed securities | 406.0 | (14.1 | ) | 123.0 | (7.6 | ) | 529.0 | (21.7 | ) | |||||||||||||||

Collateralized mortgage obligations | 37.9 | (.5 | ) | 36.9 | (1.1 | ) | 74.8 | (1.6 | ) | |||||||||||||||

Total fixed maturities, available for sale | $ | 2,667.4 | $ | (67.7 | ) | $ | 894.1 | $ | (66.5 | ) | $ | 3,561.5 | $ | (134.2 | ) | |||||||||

Equity securities | $ | 108.8 | $ | (4.6 | ) | $ | — | $ | — | $ | 108.8 | $ | (4.6 | ) | ||||||||||

The following table summarizes the gross unrealized losses and fair values of our investments with unrealized losses that are not deemed to be other-than-temporarily impaired, aggregated by investment category and length of time that such securities have been in a continuous unrealized loss position, at December 31, 2016 (dollars in millions):

Less than 12 months | 12 months or greater | Total | ||||||||||||||||||||||

Description of securities | Fair value | Unrealized losses | Fair value | Unrealized losses | Fair value | Unrealized losses | ||||||||||||||||||

United States Treasury securities and obligations of United States government corporations and agencies | $ | 8.0 | $ | — | $ | — | $ | — | $ | 8.0 | $ | — | ||||||||||||

States and political subdivisions | 176.3 | (7.8 | ) | 18.3 | (1.8 | ) | 194.6 | (9.6 | ) | |||||||||||||||

Debt securities issued by foreign governments | 18.9 | (.4 | ) | — | — | 18.9 | (.4 | ) | ||||||||||||||||

Corporate securities | 1,907.6 | (75.5 | ) | 559.6 | (63.5 | ) | 2,467.2 | (139.0 | ) | |||||||||||||||

Asset-backed securities | 692.9 | (8.5 | ) | 262.5 | (7.0 | ) | 955.4 | (15.5 | ) | |||||||||||||||

Collateralized debt obligations | 38.3 | (.1 | ) | 30.8 | (.2 | ) | 69.1 | (.3 | ) | |||||||||||||||

Commercial mortgage-backed securities | 525.2 | (16.6 | ) | 154.0 | (11.3 | ) | 679.2 | (27.9 | ) | |||||||||||||||

Collateralized mortgage obligations | 73.6 | (.6 | ) | 34.6 | (1.0 | ) | 108.2 | (1.6 | ) | |||||||||||||||

Total fixed maturities, available for sale | $ | 3,440.8 | $ | (109.5 | ) | $ | 1,059.8 | $ | (84.8 | ) | $ | 4,500.6 | $ | (194.3 | ) | |||||||||

Equity securities | $ | 239.4 | $ | (8.0 | ) | $ | — | $ | — | $ | 239.4 | $ | (8.0 | ) | ||||||||||

Based on management's current assessment of investments with unrealized losses at March 31, 2017, the Company believes the issuers of the securities will continue to meet their obligations (or with respect to equity-type securities, the

15

CNO FINANCIAL GROUP, INC. AND SUBSIDIARIES

Notes to Consolidated Financial Statements

(unaudited)

___________________

investment value will recover to its cost basis). While we do not have the intent to sell securities with unrealized losses and it is not more likely than not that we will be required to sell securities with unrealized losses prior to their anticipated recovery, our intent on an individual security may change, based upon market or other unforeseen developments. In such instances, if a loss is recognized from a sale subsequent to a balance sheet date due to these unexpected developments, the loss is recognized in the period in which we had the intent to sell the security before its anticipated recovery.

EARNINGS PER SHARE

A reconciliation of net income and shares used to calculate basic and diluted earnings per share is as follows (dollars in millions and shares in thousands):

Three months ended | |||||||

March 31, | |||||||

2017 | 2016 | ||||||

Net income for basic and diluted earnings per share | $ | 62.3 | $ | 45.5 | |||

Shares: | |||||||

Weighted average shares outstanding for basic earnings per share | 173,431 | 180,350 | |||||

Effect of dilutive securities on weighted average shares: | |||||||

Stock options, restricted stock and performance units | 1,634 | 1,778 | |||||

Weighted average shares outstanding for diluted earnings per share | 175,065 | 182,128 | |||||

Basic earnings per common share is computed by dividing net income by the weighted average number of common shares outstanding for the period. Restricted shares (including our performance units) are not included in basic earnings per share until vested. Diluted earnings per share reflect the potential dilution that could occur if outstanding stock options were exercised and restricted stock was vested. The dilution from options and restricted shares is calculated using the treasury stock method. Under this method, we assume the proceeds from the exercise of the options (or the unrecognized compensation expense with respect to restricted stock and performance units) will be used to purchase shares of our common stock at the average market price during the period, reducing the dilutive effect of the exercise of the options (or the vesting of the restricted stock and performance units).

16

CNO FINANCIAL GROUP, INC. AND SUBSIDIARIES

Notes to Consolidated Financial Statements

(unaudited)

___________________

BUSINESS SEGMENTS

The Company manages its business through the following operating segments: Bankers Life, Washington National and Colonial Penn, which are defined on the basis of product distribution; and corporate operations, comprised of holding company activities and certain noninsurance company businesses. In the fourth quarter of 2016, we began reporting the long-term care block recaptured from Beechwood Re Ltd ("BRe") effective September 30, 2016, as an additional business segment.

We measure segment performance by excluding net realized investment gains (losses), fair value changes in embedded derivative liabilities (net of related amortization), fair value changes in the agent deferred compensation plan, income taxes and other non-operating items consisting primarily of earnings attributable to variable interest entities ("VIEs") ("pre-tax operating earnings") because we believe that this performance measure is a better indicator of the ongoing business and trends in our business. Our primary investment focus is on investment income to support our liabilities for insurance products as opposed to the generation of net realized investment gains (losses), and a long-term focus is necessary to maintain profitability over the life of the business.

The net realized investment gains (losses), fair value changes in embedded derivative liabilities (net of related amortization), fair value changes in the agent deferred compensation plan and other non-operating items consisting primarily of earnings attributable to VIEs depend on market conditions or represent unusual items that do not necessarily relate to the underlying business of our segments. Net realized investment gains (losses) and fair value changes in embedded derivative liabilities (net of related amortization) may affect future earnings levels since our underlying business is long-term in nature and changes in our investment portfolio may impact our ability to earn the assumed interest rates needed to maintain the profitability of our business.

17

CNO FINANCIAL GROUP, INC. AND SUBSIDIARIES

Notes to Consolidated Financial Statements

(unaudited)

___________________

Operating information by segment was as follows (dollars in millions):

Three months ended | |||||||

March 31, | |||||||

2017 | 2016 | ||||||

Revenues: | |||||||

Bankers Life: | |||||||

Insurance policy income: | |||||||

Annuities | $ | 6.0 | $ | 4.8 | |||

Health | 311.6 | 311.1 | |||||

Life | 101.5 | 97.3 | |||||

Net investment income (a) | 272.9 | 214.2 | |||||

Fee revenue and other income (a) | 10.6 | 6.6 | |||||

Total Bankers Life revenues | 702.6 | 634.0 | |||||

Washington National: | |||||||

Insurance policy income: | |||||||

Annuities | .6 | .5 | |||||

Health | 159.8 | 155.5 | |||||

Life | 6.7 | 6.1 | |||||

Net investment income (a) | 67.4 | 60.6 | |||||

Fee revenue and other income (a) | .3 | .3 | |||||

Total Washington National revenues | 234.8 | 223.0 | |||||

Colonial Penn: | |||||||

Insurance policy income: | |||||||

Health | .6 | .7 | |||||

Life | 72.4 | 68.4 | |||||

Net investment income (a) | 10.9 | 11.0 | |||||

Fee revenue and other income (a) | .2 | .4 | |||||

Total Colonial Penn revenues | 84.1 | 80.5 | |||||

Long-term care in run-off: | |||||||

Insurance policy income - health | 4.6 | — | |||||

Net investment income (a) | 9.7 | — | |||||

Total Long-term care in run-off revenues | 14.3 | — | |||||

Corporate operations: | |||||||

Net investment income | 10.4 | 4.0 | |||||

Fee and other income | 2.4 | 2.5 | |||||

Total corporate revenues | 12.8 | 6.5 | |||||

Total revenues | 1,048.6 | 944.0 | |||||

(continued on next page)

18

CNO FINANCIAL GROUP, INC. AND SUBSIDIARIES

Notes to Consolidated Financial Statements

(unaudited)

___________________

(continued from previous page)

Three months ended | |||||||

March 31, | |||||||

2017 | 2016 | ||||||

Expenses: | |||||||

Bankers Life: | |||||||

Insurance policy benefits | $ | 451.2 | $ | 397.0 | |||

Amortization | 46.3 | 51.5 | |||||

Interest expense on investment borrowings | 4.2 | 2.9 | |||||

Other operating costs and expenses | 111.2 | 105.0 | |||||

Total Bankers Life expenses | 612.9 | 556.4 | |||||

Washington National: | |||||||

Insurance policy benefits | 146.7 | 133.5 | |||||

Amortization | 14.3 | 15.1 | |||||

Interest expense on investment borrowings | 1.3 | .8 | |||||

Other operating costs and expenses | 49.0 | 47.3 | |||||

Total Washington National expenses | 211.3 | 196.7 | |||||

Colonial Penn: | |||||||

Insurance policy benefits | 52.7 | 50.5 | |||||

Amortization | 4.0 | 3.9 | |||||

Interest expense on investment borrowings | .2 | .1 | |||||

Other operating costs and expenses | 27.5 | 32.8 | |||||

Total Colonial Penn expenses | 84.4 | 87.3 | |||||

Long-term care in run-off: | |||||||

Insurance policy benefits | 13.2 | — | |||||

Other operating costs and expenses | .7 | — | |||||

Total Long-term care in run-off expenses | 13.9 | — | |||||

Corporate operations: | |||||||

Interest expense on corporate debt | 11.5 | 11.4 | |||||

Other operating costs and expenses | 21.7 | 14.6 | |||||

Total corporate expenses | 33.2 | 26.0 | |||||

Total expenses | 955.7 | 866.4 | |||||

Pre-tax operating earnings by segment: | |||||||

Bankers Life | 89.7 | 77.6 | |||||

Washington National | 23.5 | 26.3 | |||||

Colonial Penn | (.3 | ) | (6.8 | ) | |||

Long-term care in run-off | .4 | — | |||||

Corporate operations | (20.4 | ) | (19.5 | ) | |||

Pre-tax operating earnings | $ | 92.9 | $ | 77.6 | |||

___________________

(a) | It is not practicable to provide additional components of revenue by product or services. |

19

CNO FINANCIAL GROUP, INC. AND SUBSIDIARIES

Notes to Consolidated Financial Statements

(unaudited)

___________________

A reconciliation of segment revenues and expenses to consolidated revenues and expenses and net income (loss) is as follows (dollars in millions):

Three months ended | |||||||

March 31, | |||||||

2017 | 2016 | ||||||

Total segment revenues | $ | 1,048.6 | $ | 944.0 | |||

Net realized investment gains (losses) | 7.9 | (.9 | ) | ||||

Revenues related to certain non-strategic investments and earnings attributable to VIEs | 14.2 | 12.3 | |||||

Fee revenue related to transition and support services agreements | — | 5.0 | |||||

Consolidated revenues | 1,070.7 | 960.4 | |||||

Total segment expenses | 955.7 | 866.4 | |||||

Insurance policy benefits - fair value changes in embedded derivative liabilities | 5.5 | 38.0 | |||||

Amortization related to fair value changes in embedded derivative liabilities | (1.1 | ) | (8.5 | ) | |||

Amortization related to net realized investment gains | — | .1 | |||||

Expenses related to certain non-strategic investments and expenses attributable to VIEs | 13.9 | 12.9 | |||||

Fair value changes related to agent deferred compensation plan | — | 6.0 | |||||

Expenses related to transition and support services agreements | — | 5.0 | |||||

Consolidated expenses | 974.0 | 919.9 | |||||

Income before tax | 96.7 | 40.5 | |||||

Income tax expense (benefit): | |||||||

Tax expense on period income | 34.4 | 15.0 | |||||

Valuation allowance for deferred tax assets | — | (20.0 | ) | ||||

Net income | $ | 62.3 | $ | 45.5 | |||

20

CNO FINANCIAL GROUP, INC. AND SUBSIDIARIES

Notes to Consolidated Financial Statements

(unaudited)

___________________

ACCOUNTING FOR DERIVATIVES

Our freestanding and embedded derivatives, which are not designated as hedging instruments, are held at fair value and are summarized as follows (dollars in millions):

Fair value | ||||||||

March 31, 2017 | December 31, 2016 | |||||||

Assets: | ||||||||

Other invested assets: | ||||||||

Fixed index call options | $ | 132.1 | $ | 111.9 | ||||

Reinsurance receivables | (3.5 | ) | (4.2 | ) | ||||

Total assets | $ | 128.6 | $ | 107.7 | ||||

Liabilities: | ||||||||

Future policy benefits: | ||||||||

Fixed index products | $ | 1,159.2 | $ | 1,092.3 | ||||

Total liabilities | $ | 1,159.2 | $ | 1,092.3 | ||||

Our fixed index annuity products provide a guaranteed minimum rate of return and a higher potential return that is based on a percentage (the "participation rate") of the amount of increase in the value of a particular index, such as the Standard & Poor's 500 Index, over a specified period. Typically, on each policy anniversary date, a new index period begins. We are generally able to change the participation rate at the beginning of each index period during a policy year, subject to contractual minimums. The Company accounts for the options attributed to the policyholder for the estimated life of the contract as embedded derivatives. These accounting requirements often create volatility in the earnings from these products. We typically buy call options (including call spreads) referenced to the applicable indices in an effort to offset or hedge potential increases to policyholder benefits resulting from increases in the particular index to which the policy's return is linked. The notional amount of these options was $2.6 billion and $2.5 billion at March 31, 2017 and December 31, 2016, respectively.

From time to time, we utilize United States Treasury interest rate futures primarily to hedge interest rate risk related to anticipated mortgage loan transactions.

We are required to establish an embedded derivative related to a modified coinsurance agreement pursuant to which we assume the risks of a block of health insurance business. The embedded derivative represents the mark-to-market adjustment for approximately $130 million in underlying investments held by the ceding reinsurer.

We purchase certain fixed maturity securities that contain embedded derivatives that are required to be held at fair value on the consolidated balance sheet. We have elected the fair value option to carry the entire security at fair value with changes in fair value reported in net income.

21

CNO FINANCIAL GROUP, INC. AND SUBSIDIARIES

Notes to Consolidated Financial Statements

(unaudited)

___________________

The following table provides the pre-tax gains (losses) recognized in net income for derivative instruments, which are not designated as hedges for the periods indicated (dollars in millions):

Three months ended | ||||||||

March 31, | ||||||||

2017 | 2016 | |||||||

Net investment income from policyholder and other special-purpose portfolios: | ||||||||

Fixed index call options | $ | 44.5 | $ | (9.0 | ) | |||

Net realized gains (losses): | ||||||||

Interest rate futures | — | (1.0 | ) | |||||

Embedded derivative related to modified coinsurance agreement | .7 | 1.8 | ||||||

Total | .7 | .8 | ||||||

Insurance policy benefits: | ||||||||

Embedded derivative related to fixed index annuities | 2.3 | (34.9 | ) | |||||

Total | $ | 47.5 | $ | (43.1 | ) | |||

Derivative Counterparty Risk

If the counterparties to the call options fail to meet their obligations, we may recognize a loss. We limit our exposure to such a loss by diversifying among several counterparties believed to be strong and creditworthy. At March 31, 2017, all of our counterparties were rated "A-" or higher by S&P Global Ratings ("S&P").

We also enter into exchange-traded interest rate future contracts. The contracts are marked to market and margined on a daily basis. The Company has minimal exposure to credit-related losses in the event of nonperformance.

The Company and its subsidiaries are parties to master netting arrangements with its counterparties related to entering into various derivative contracts. Exchange-traded derivatives require margin accounts which we offset.

The following table summarizes information related to derivatives with master netting arrangements or collateral as of March 31, 2017 and December 31, 2016 (dollars in millions):

Gross amounts not offset in the balance sheet | |||||||||||||||||||||||||

Gross amounts recognized | Gross amounts offset in the balance sheet | Net amounts of assets presented in the balance sheet | Financial instruments | Cash collateral received | Net amount | ||||||||||||||||||||

March 31, 2017: | |||||||||||||||||||||||||

Fixed index call options | $ | 132.1 | $ | — | $ | 132.1 | $ | — | $ | — | $ | 132.1 | |||||||||||||

December 31, 2016: | |||||||||||||||||||||||||

Fixed index call options | 111.9 | — | 111.9 | — | — | 111.9 | |||||||||||||||||||

22

CNO FINANCIAL GROUP, INC. AND SUBSIDIARIES

Notes to Consolidated Financial Statements

(unaudited)

___________________

REINSURANCE

The cost of reinsurance ceded totaled $26.3 million and $33.6 million in the first quarters of 2017 and 2016, respectively. We deduct this cost from insurance policy income. Reinsurance recoveries netted against insurance policy benefits totaled $24.1 million and $40.4 million in the first quarters of 2017 and 2016, respectively.

From time-to-time, we assume insurance from other companies. Any costs associated with the assumption of insurance are amortized consistent with the method used to amortize deferred acquisition costs. Reinsurance premiums assumed totaled $8.0 million and $8.8 million in the first quarters of 2017 and 2016, respectively.

INCOME TAXES

The Company's interim tax expense is based upon the estimated annual effective tax rate for the respective period. Under authoritative guidance, certain items are required to be excluded from the estimated annual effective tax rate calculation. Such items include changes in judgment about the realizability of deferred tax assets resulting from changes in projections of income expected to be available in future years, and items deemed to be unusual, infrequent, or that can not be reliably estimated. In these cases, the actual tax expense or benefit applicable to that item is treated discretely and is reported in the same period as the related item. The components of income tax expense are as follows (dollars in millions):

Three months ended | |||||||

March 31, | |||||||

2017 | 2016 | ||||||

Current tax expense | $ | 20.6 | $ | 4.1 | |||

Deferred tax expense | 13.8 | 10.9 | |||||

Income tax expense calculated based on estimated annual effective tax rate | 34.4 | 15.0 | |||||

Income tax expense on discrete items: | |||||||

Change in valuation allowance | — | (20.0 | ) | ||||

Total income tax expense (benefit) | $ | 34.4 | $ | (5.0 | ) | ||

A reconciliation of the U.S. statutory corporate tax rate to the estimated annual effective rate, before discrete items, reflected in the consolidated statement of operations is as follows:

Three months ended | |||||

March 31, | |||||

2017 | 2016 | ||||

U.S. statutory corporate rate | 35.0 | % | 35.0 | % | |

Non-taxable income and nondeductible benefits, net | (1.1 | ) | .8 | ||

State taxes | 1.7 | 1.2 | |||

Estimated annual effective tax rate | 35.6 | % | 37.0 | % | |

23

CNO FINANCIAL GROUP, INC. AND SUBSIDIARIES

Notes to Consolidated Financial Statements

(unaudited)

___________________

The components of the Company's income tax assets and liabilities are summarized below (dollars in millions):

March 31, 2017 | December 31, 2016 | ||||||

Deferred tax assets: | |||||||

Net federal operating loss carryforwards | $ | 884.5 | $ | 882.9 | |||

Net state operating loss carryforwards | 12.2 | 12.3 | |||||

Tax credits | .3 | .7 | |||||

Investments | 15.9 | 17.8 | |||||

Insurance liabilities | 675.8 | 668.4 | |||||

Other | 59.9 | 65.6 | |||||

Gross deferred tax assets | 1,648.6 | 1,647.7 | |||||

Deferred tax liabilities: | |||||||

Present value of future profits and deferred acquisition costs | (275.9 | ) | (277.8 | ) | |||

Accumulated other comprehensive income | (403.9 | ) | (344.1 | ) | |||

Gross deferred tax liabilities | (679.8 | ) | (621.9 | ) | |||

Net deferred tax assets before valuation allowance | 968.8 | 1,025.8 | |||||

Valuation allowance | (255.9 | ) | (240.2 | ) | |||

Net deferred tax assets | 712.9 | 785.6 | |||||

Current income taxes prepaid (accrued) | (15.1 | ) | 4.1 | ||||

Income tax assets, net | $ | 697.8 | $ | 789.7 | |||

Our income tax expense includes deferred income taxes arising from temporary differences between the financial reporting and tax bases of assets and liabilities and net operating loss carryforwards ("NOLs"). Deferred tax assets and liabilities are measured using enacted tax rates expected to apply in the years in which temporary differences are expected to be recovered or paid. The effect of a change in tax rates on deferred tax assets and liabilities is recognized in earnings in the period when the changes are enacted.

A reduction of the net carrying amount of deferred tax assets by establishing a valuation allowance is required if, based on the available evidence, it is more likely than not that such assets will not be realized. In assessing the need for a valuation allowance, all available evidence, both positive and negative, shall be considered to determine whether, based on the weight of that evidence, a valuation allowance for deferred tax assets is needed. This assessment requires significant judgment and considers, among other matters, the nature, frequency and severity of current and cumulative losses, forecasts of future profitability, the duration of carryforward periods, our experience with operating loss and tax credit carryforwards expiring unused, and tax planning strategies. We evaluate the need to establish a valuation allowance for our deferred income tax assets on an ongoing basis. The realization of our deferred tax assets depends upon generating sufficient future taxable income of the appropriate type during the periods in which our temporary differences become deductible and before our NOLs expire.

Based on our assessment, it appears more likely than not that $712.9 million of our net deferred tax assets of $968.8 million will be realized through future taxable earnings. Accordingly, we have established a deferred tax valuation allowance of $255.9 million at March 31, 2017 ($245.9 million of which relates to our net federal operating loss carryforwards and $10.0 million relates to state operating loss carryforwards). We will continue to assess the need for a valuation allowance in the future. If future results are less than projected, an increase to the valuation allowance may be required to reduce the deferred tax asset, which could have a material impact on our results of operations in the period in which it is recorded.

We use a deferred tax valuation model to assess the need for a valuation allowance. Our model is adjusted to reflect changes in our projections of future taxable income including changes resulting from investment strategies, the impact of the sale or reinsurance of business and the recapture of business previously ceded. Our estimates of future taxable income are based on evidence we consider to be objective and verifiable.

24

CNO FINANCIAL GROUP, INC. AND SUBSIDIARIES

Notes to Consolidated Financial Statements

(unaudited)

___________________

Our projection of future taxable income for purposes of determining the valuation allowance is based on our adjusted average annual taxable income which is assumed to increase by 3 percent for the next five years, and level taxable income is assumed thereafter. In the projections used for our analysis, our adjusted average taxable income of approximately $335 million consisted of $85 million of non-life taxable income and $250 million of life taxable income.

Recovery of our deferred tax asset is dependent on achieving the level of future taxable income projected in our deferred tax valuation model and failure to do so could result in an increase in the valuation allowance in a future period. Any future increase in the valuation allowance may result in additional income tax expense and reduce shareholders' equity, and such an increase could have a significant impact upon our earnings in the future.

The Internal Revenue Code (the "Code") limits the extent to which losses realized by a non-life entity (or entities) may offset income from a life insurance company (or companies) to the lesser of: (i) 35 percent of the income of the life insurance company; or (ii) 35 percent of the total loss of the non-life entities (including NOLs of the non-life entities). There is no similar limitation on the extent to which losses realized by a life insurance entity (or entities) may offset income from a non-life entity (or entities). This limitation is the primary reason a valuation allowance for NOLs is required.

Section 382 of the Code imposes limitations on a corporation's ability to use its NOLs when the company undergoes an ownership change. Future transactions and the timing of such transactions could cause an ownership change for Section 382 income tax purposes. Such transactions may include, but are not limited to, additional repurchases under our securities repurchase program, issuances of common stock and acquisitions or sales of shares of CNO stock by certain holders of our shares, including persons who have held, currently hold or may accumulate in the future five percent or more of our outstanding common stock for their own account. Many of these transactions are beyond our control. If an additional ownership change were to occur for purposes of Section 382, we would be required to calculate an annual restriction on the use of our NOLs to offset future taxable income. The annual restriction would be calculated based upon the value of CNO's equity at the time of such ownership change, multiplied by a federal long-term tax exempt rate (2.09 percent at March 31, 2017), and the annual restriction could limit our ability to use a substantial portion of our NOLs to offset future taxable income. We regularly monitor ownership change (as calculated for purposes of Section 382) and, as of March 31, 2017, we were below the 50 percent ownership change level that would trigger further impairment of our ability to utilize our NOLs.

As of March 31, 2017, we had $2.5 billion of federal NOLs (all of which were non-life NOLs). The following table summarizes the expiration dates of our loss carryforwards (dollars in millions):

Net operating loss | ||||

Year of expiration | carryforwards | |||

2023 | $ | 1,940.4 | ||

2025 | 85.2 | |||

2026 | 149.9 | |||

2027 | 10.8 | |||

2028 | 80.3 | |||

2029 | 213.2 | |||

2030 | .3 | |||

2031 | .2 | |||

2032 | 44.4 | |||

2033 | .6 | |||

2034 | .9 | |||

2035 | .8 | |||

Total federal NOLs | $ | 2,527.0 | ||

We also had deferred tax assets related to NOLs for state income taxes of $12.2 million and $12.3 million at March 31, 2017 and December 31, 2016, respectively. The related state NOLs are available to offset future state taxable income in certain states through 2025.

25

CNO FINANCIAL GROUP, INC. AND SUBSIDIARIES

Notes to Consolidated Financial Statements

(unaudited)

___________________

All of the additional life NOLs were utilized by December 31, 2016. Accordingly, we began making estimated federal tax payments equal to the prescribed federal tax rate applied to 65 percent of our life insurance company taxable income due to the limitations on the extent to which we can use non-life NOLs to offset life insurance company taxable income. We will continue to pay tax on 65 percent of our life insurance company taxable income until all non-life NOLs are utilized or expire.

The Internal Revenue Service ("IRS") is also conducting an examination of 2011 through 2014. In connection with this exam, we have agreed to extend the statute of limitations for 2011 through 2013 to September 30, 2018. The Company’s various state income tax returns are generally open for tax years beginning in 2013, based on individual state statutes of limitation. Generally, for tax years which generate NOLs, capital losses or tax credit carryforwards, the statute remains open until the expiration of the statute of limitations for the tax year in which such carryforwards are utilized. The outcome of tax audits cannot be predicted with certainty. If the Company’s tax audits are not resolved in a manner consistent with management’s expectations, the Company may be required to adjust its provision for income taxes.

Effective January 1, 2017, the Company adopted new authoritative guidance related to several aspects of the accounting for share-based payment transactions, including the income tax consequences. Under the new guidance, any excess tax benefits are recognized as an income tax benefit in the income statement. The new guidance is applied on a modified retrospective basis through a cumulative-effect adjustment to retained earnings for all tax benefits that were not previously recognized because the related tax deduction had not reduced taxes payable. The Company had NOL carryforwards of $15.7 million related to deductions for stock options and restricted stock on the date of adoption. However, a corresponding valuation allowance of $15.7 million was recognized as a result of adopting this guidance. Therefore, there was no impact to our consolidated financial statements related to this provision of the new guidance.

26

CNO FINANCIAL GROUP, INC. AND SUBSIDIARIES

Notes to Consolidated Financial Statements

(unaudited)

___________________

NOTES PAYABLE - DIRECT CORPORATE OBLIGATIONS

The following notes payable were direct corporate obligations of the Company as of March 31, 2017 and December 31, 2016 (dollars in millions):

March 31, 2017 | December 31, 2016 | ||||||

4.500% Senior Notes due May 2020 | $ | 325.0 | $ | 325.0 | |||

5.250% Senior Notes due May 2025 | 500.0 | 500.0 | |||||

Revolving Credit Agreement (as defined below) | 100.0 | 100.0 | |||||

Unamortized debt issue costs | (11.6 | ) | (12.1 | ) | |||

Direct corporate obligations | $ | 913.4 | $ | 912.9 | |||

Revolving Credit Agreement

On May 19, 2015, the Company entered into a revolving credit agreement, with KeyBank National Association, as administrative agent (the "Agent"), and the lenders from time to time party thereto (the "Revolving Credit Agreement"). On May 19, 2015, the Company made an initial drawing of $100.0 million under the Revolving Credit Agreement, resulting in $50.0 million available for additional borrowings. The Revolving Credit Agreement matures on May 19, 2019.

The interest rates with respect to loans under the Revolving Credit Agreement are based on, at the Company's option, a floating base rate (defined as a per annum rate equal to the highest of: (i) the federal funds rate plus 0.50%; (ii) the "prime rate" of the Agent; and (iii) the eurodollar rate for a one-month interest period plus an applicable margin of initially 1.00% per annum), or a eurodollar rate plus an applicable margin of initially 2.00% per annum. At March 31, 2017, the interest rate on the amounts outstanding under the Revolving Credit Agreement was 2.98 percent. In addition, the daily average undrawn portion of the Revolving Credit Agreement accrues a commitment fee payable quarterly in arrears. The applicable margin for, and the commitment fee applicable to, the Revolving Credit Agreement, will be adjusted from time-to-time pursuant to a ratings based pricing grid.

The Revolving Credit Agreement requires the Company to maintain (each as calculated in accordance with the Revolving Credit Agreement): (i) a debt to total capitalization ratio of not more than 30.0 percent (such ratio was 19.5 percent at March 31, 2017); (ii) an aggregate ratio of total adjusted capital to company action level risk-based capital for the Company's insurance subsidiaries of not less than 250 percent (such ratio was estimated to be 446 percent at March 31, 2017); and (iii) a minimum consolidated net worth of not less than the sum of (x) $2,674 million plus (y) 50.0% of the net equity proceeds received by the Company from the issuance and sale of equity interests in the Company (the Company's consolidated net worth was $3,877.2 million at March 31, 2017 compared to the minimum requirement of $2,682.2 million).

Scheduled Repayment of our Direct Corporate Obligations

The scheduled repayment of our direct corporate obligations was as follows at March 31, 2017 (dollars in millions):

Year ending March 31, | |||

2018 | $ | — | |

2019 | — | ||

2020 | 100.0 | ||

2021 | 325.0 | ||

2022 | — | ||

Thereafter | 500.0 | ||

$ | 925.0 | ||

27

CNO FINANCIAL GROUP, INC. AND SUBSIDIARIES

Notes to Consolidated Financial Statements

(unaudited)

___________________

INVESTMENT BORROWINGS

Three of the Company's insurance subsidiaries (Washington National Insurance Company ("Washington National"), Bankers Life and Casualty Company ("Bankers Life") and Colonial Penn Life Insurance Company ("Colonial Penn")) are members of the Federal Home Loan Bank ("FHLB"). As members of the FHLB, our insurance subsidiaries have the ability to borrow on a collateralized basis from the FHLB. We are required to hold certain minimum amounts of FHLB common stock as a condition of membership in the FHLB, and additional amounts based on the amount of the borrowings. At March 31, 2017, the carrying value of the FHLB common stock was $71.2 million. As of March 31, 2017, collateralized borrowings from the FHLB totaled $1.6 billion and the proceeds were used to purchase fixed maturity securities. The borrowings are classified as investment borrowings in the accompanying consolidated balance sheet. The borrowings are collateralized by investments with an estimated fair value of $2.0 billion at March 31, 2017, which are maintained in a custodial account for the benefit of the FHLB. Substantially all of such investments are classified as fixed maturities, available for sale, in our consolidated balance sheet.

28

CNO FINANCIAL GROUP, INC. AND SUBSIDIARIES

Notes to Consolidated Financial Statements

(unaudited)

___________________

The following summarizes the terms of the borrowings from the FHLB by our insurance subsidiaries (dollars in millions):

Amount | Maturity | Interest rate at | ||||

borrowed | date | March 31, 2017 | ||||

$ | 50.0 | January 2018 | Variable rate – 1.365% | |||

50.0 | January 2018 | Variable rate – 1.381% | ||||

50.0 | February 2018 | Variable rate – 1.344% | ||||

50.0 | February 2018 | Variable rate – 1.127% | ||||

22.0 | February 2018 | Variable rate – 1.384% | ||||

100.0 | May 2018 | Variable rate – 1.433% | ||||

50.0 | July 2018 | Variable rate – 1.509% | ||||

50.0 | August 2018 | Variable rate – 1.159% | ||||

10.0 | December 2018 | Variable rate – 1.421% | ||||

50.0 | January 2019 | Variable rate – 1.443% | ||||

50.0 | February 2019 | Variable rate – 1.127% | ||||

100.0 | March 2019 | Variable rate – 1.423% | ||||

21.8 | July 2019 | Variable rate – 1.466% | ||||

15.0 | October 2019 | Variable rate – 1.550% | ||||

50.0 | May 2020 | Variable rate – 1.432% | ||||

21.8 | June 2020 | Fixed rate – 1.960% | ||||

25.0 | September 2020 | Variable rate – 1.782% | ||||

100.0 | September 2020 | Variable rate – 1.642% | ||||

50.0 | September 2020 | Variable rate – 1.643% | ||||

75.0 | September 2020 | Variable rate – 1.272% | ||||

100.0 | October 2020 | Variable rate – 1.109% | ||||

50.0 | December 2020 | Variable rate – 1.530% | ||||

100.0 | July 2021 | Variable rate – 1.572% | ||||

100.0 | July 2021 | Variable rate – 1.542% | ||||

28.2 | August 2021 | Fixed rate – 2.550% | ||||

57.7 | August 2021 | Variable rate - 1.564% | ||||

125.0 | August 2021 | Variable rate – 1.462% | ||||

50.0 | September 2021 | Variable rate – 1.592% | ||||

25.2 | March 2023 | Fixed rate – 2.160% | ||||

20.5 | June 2025 | Fixed rate – 2.940% | ||||

$ | 1,647.2 | |||||

The variable rate borrowings are pre-payable on each interest reset date without penalty. The fixed rate borrowings are pre-payable subject to payment of a yield maintenance fee based on prevailing market interest rates. At March 31, 2017, the aggregate yield maintenance fee to prepay all fixed rate borrowings was $3.4 million.

Interest expense of $5.7 million and $3.8 million in the first three months of 2017 and 2016, respectively, was recognized related to total borrowings from the FHLB.

29

CNO FINANCIAL GROUP, INC. AND SUBSIDIARIES

Notes to Consolidated Financial Statements

(unaudited)

___________________

CHANGES IN COMMON STOCK

Changes in the number of shares of common stock outstanding were as follows (shares in thousands):

Balance, December 31, 2016 | 173,754 | ||

Treasury stock purchased and retired | (2,086 | ) | |

Stock options exercised | 320 | ||

Restricted and performance stock vested | 116 | (a) | |

Balance, March 31, 2017 | 172,104 | ||

____________________

(a) | Such amount was reduced by 62 thousand shares which were tendered to the Company for the payment of required federal and state tax withholdings owed on the vesting of restricted and performance stock. |

In the first three months of 2017, we repurchased 2.1 million shares of common stock for $43.0 million under our securities repurchase program (including $4.5 million of repurchases settled in the second quarter of 2017). The Company had remaining repurchase authority of $209.7 million as of March 31, 2017.

In the first three months of 2017, dividends declared on common stock totaled $14.0 million ($0.08 per common share).

SALES INDUCEMENTS

Certain of our annuity products offer sales inducements to contract holders in the form of enhanced crediting rates or bonus payments in the initial period of the contract. Certain of our life insurance products offer persistency bonuses credited to the contract holders balance after the policy has been outstanding for a specified period of time. These enhanced rates and persistency bonuses are considered sales inducements in accordance with GAAP. Such amounts are deferred and amortized in the same manner as deferred acquisition costs. Sales inducements deferred totaled $.5 million and $1.0 million during the three months ended March 31, 2017 and 2016, respectively. Amounts amortized totaled $2.1 million and $1.7 million during the three months ended March 31, 2017 and 2016, respectively. The unamortized balance of deferred sales inducements was $47.8 million and $49.4 million at March 31, 2017 and December 31, 2016, respectively. The balance of insurance liabilities for persistency bonus benefits was $.5 million and $.5 million at March 31, 2017 and December 31, 2016, respectively.

RECENTLY ISSUED ACCOUNTING STANDARDS

Pending Accounting Standards