Attached files

| file | filename |

|---|---|

| 8-K - 8-K - OPPENHEIMER HOLDINGS INC | opy-20210510.htm |

Annual Stockholders’ Meeting: Virtual New York, NY May 10, 2021 Oppenheimer Holdings Inc.

WELCOME to Oppenheimer’s 2021 Annual Stockholders’ Meeting May 10, 2021

Safe Harbor Statement 3 This presentation and other written or oral statements made from time to time by representatives of Oppenheimer Holdings Inc. (the “company”) may contain “forward-looking statements” within the meaning of Section 27A of the Securities Act of 1933, as amended, and Section 21E of the Securities Exchange Act of 1934, as amended. These forward-looking statements may relate to such matters as anticipated financial performance, future revenues or earnings, business prospects, new products or services, anticipated market performance and similar matters. The Private Securities Litigation Reform Act of 1995 provides a safe harbor for forward-looking statements. Forward-looking statements are neither historical facts nor assurances of future performance. Instead, they are based only on the company’s current beliefs, expectations and assumptions regarding the future of the company’s business, future plans and strategies, projections, anticipated events and trends, the economy and other future conditions. Because forward-looking statements relate to the future, they are subject to inherent uncertainties, risks and changes in circumstances that are difficult to predict and many of which are outside of the company’s control. The company cautions that a variety of factors could cause the company’s actual results to differ materially from the anticipated results or other expectations expressed in the company’s forwarding-looking statements. These risks and uncertainties include, but are not limited to, those risk factors discussed in Part I, “Item 1A. Risk Factors” of our Annual Report on Form 10-K for the year ended December 31, 2020 filed with the SEC on March 1, 2021 (the “2020 10-K”). In addition, important factors that could cause actual results to differ materially from those in the forward-looking statements include those factors discussed in Part I, “Item 2. Management’s Discussion & Analysis of Financial Condition and Results of Operations – Factors Affecting ‘Forward- Looking Statements’” of our Quarterly Report on Form 10-Q for the quarter ended March 31, 2021 filed with the SEC on April 30, 2021 (“2021 10-Q1”). Any forward-looking statements herein are qualified in their entirety by reference to all such factors discussed in the 2020 10-K, the 2021 10-Q1 and the company’s other SEC filings. There can be no assurance that the company has correctly or completely identified and assessed all of the factors affecting the company’s business. Therefore, you should not rely on any of these forward-looking statements. Any forward-looking statement made by the company in this presentation is based only on information currently available to the company and speaks only as of the date on which it is made. The company does not undertake any obligation to publicly update or revise any forward-looking statements, whether written or oral, that may be made from time to time, whether as a result of new information, future developments or otherwise.

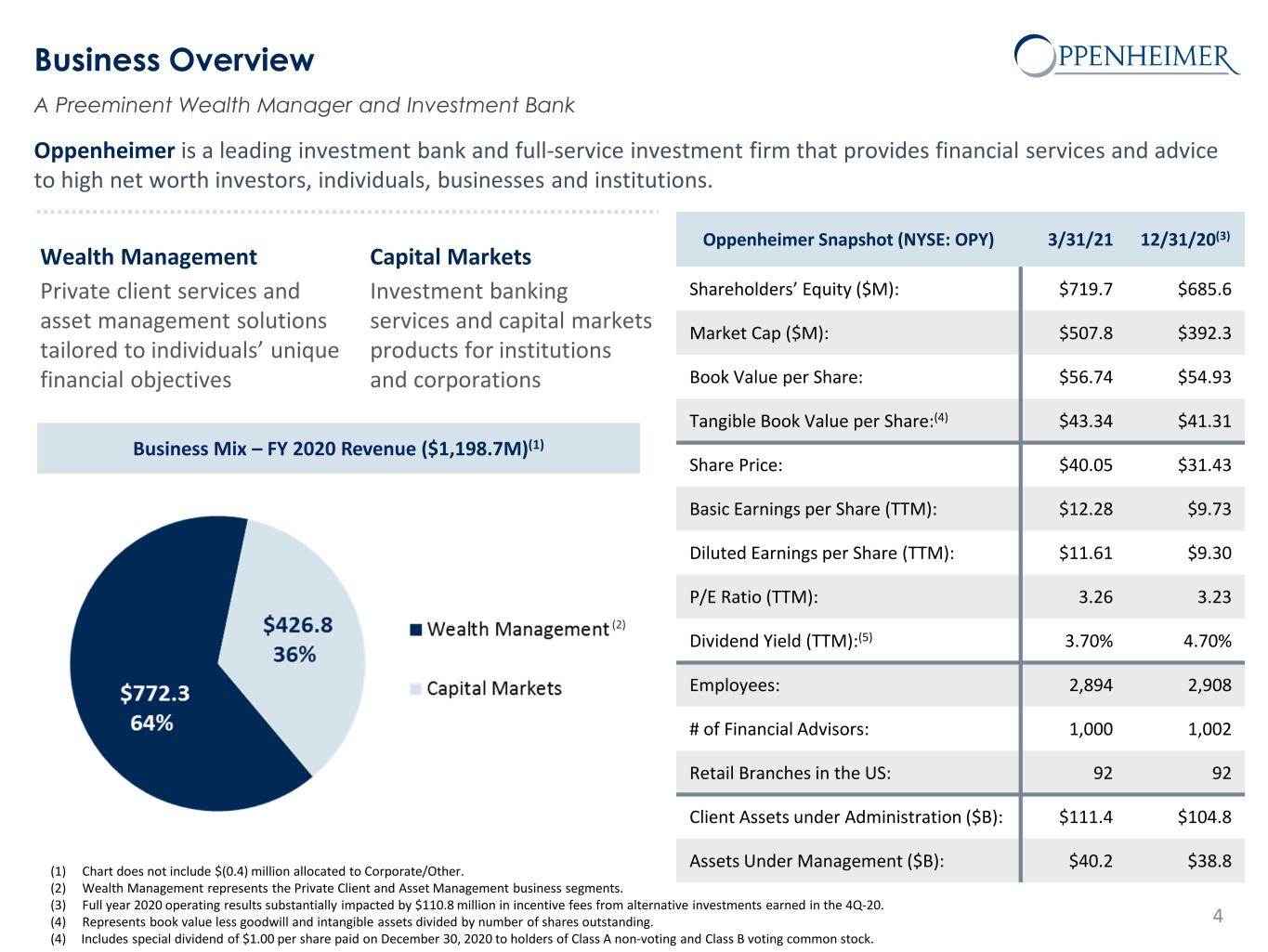

Business Overview 4 Oppenheimer is a leading investment bank and full-service investment firm that provides financial services and advice to high net worth investors, individuals, businesses and institutions. Wealth Management Private client services and asset management solutions tailored to individuals’ unique financial objectives Capital Markets Investment banking services and capital markets products for institutions and corporations Business Mix – FY 2020 Revenue ($1,198.7M)(1) (1) Chart does not include $(0.4) million allocated to Corporate/Other. (2) Wealth Management represents the Private Client and Asset Management business segments. (3) Full year 2020 operating results substantially impacted by $110.8 million in incentive fees from alternative investments earned in the 4Q-20. (4) Represents book value less goodwill and intangible assets divided by number of shares outstanding. (4) Includes special dividend of $1.00 per share paid on December 30, 2020 to holders of Class A non-voting and Class B voting common stock. Oppenheimer Snapshot (NYSE: OPY) 3/31/21 12/31/20(3) Shareholders’ Equity ($M): $719.7 $685.6 Market Cap ($M): $507.8 $392.3 Book Value per Share: $56.74 $54.93 Tangible Book Value per Share:(4) $43.34 $41.31 Share Price: $40.05 $31.43 Basic Earnings per Share (TTM): $12.28 $9.73 Diluted Earnings per Share (TTM): $11.61 $9.30 P/E Ratio (TTM): 3.26 3.23 Dividend Yield (TTM):(5) 3.70% 4.70% Employees: 2,894 2,908 # of Financial Advisors: 1,000 1,002 Retail Branches in the US: 92 92 Client Assets under Administration ($B): $111.4 $104.8 Assets Under Management ($B): $40.2 $38.8 A Preeminent Wealth Manager and Investment Bank (2)

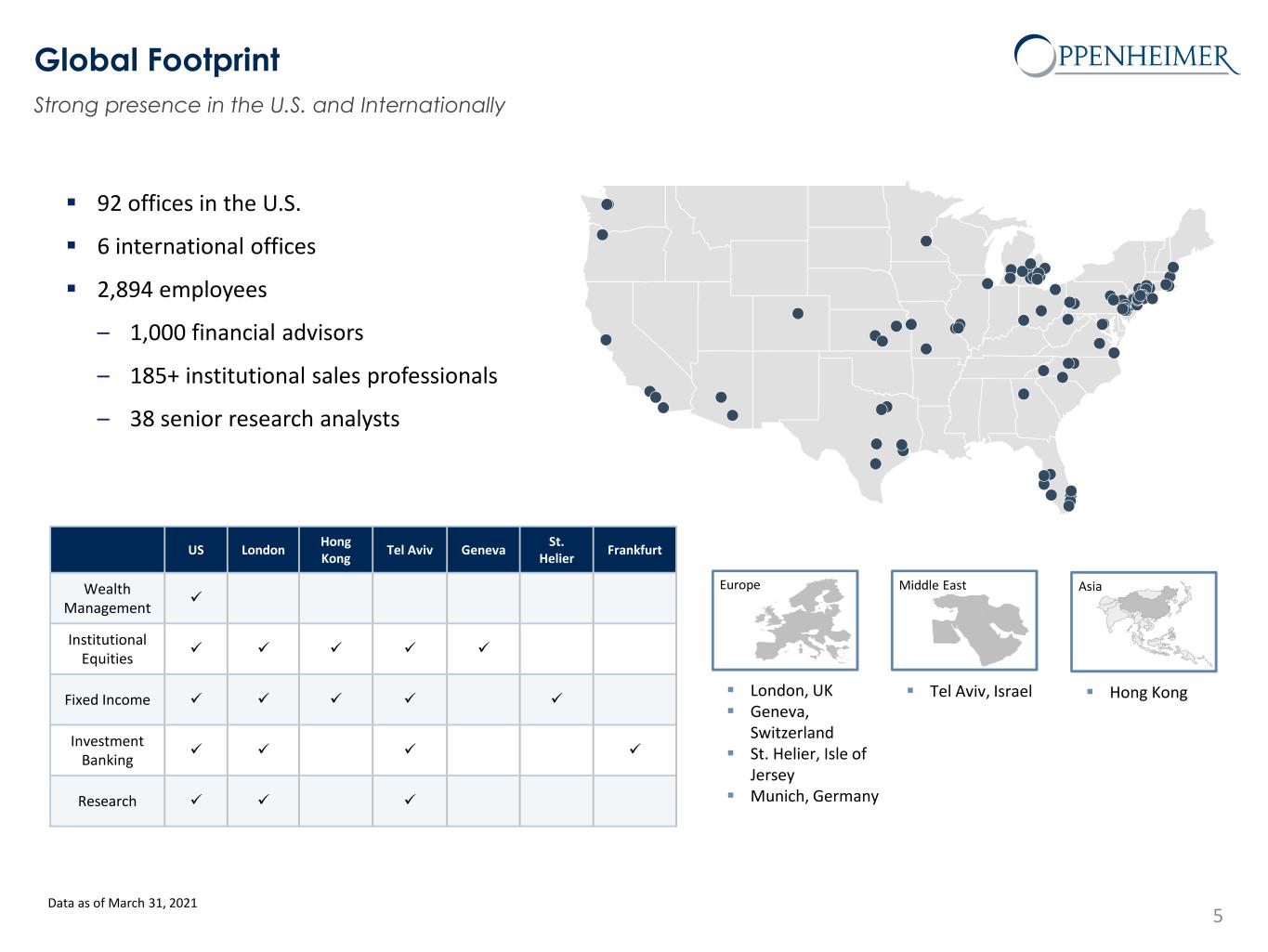

Global Footprint 5 Europe 92 offices in the U.S. 6 international offices 2,894 employees – 1,000 financial advisors – 185+ institutional sales professionals – 38 senior research analysts US London Hong Kong Tel Aviv Geneva St. Helier Frankfurt Wealth Management Institutional Equities Fixed Income Investment Banking Research Hong Kong Shanghai Beijing AsiaMiddle East Hong Kong London, UK Geneva, Switzerland St. Helier, Isle of Jersey Munich, Germany Tel Aviv, Israel Data as of March 31, 2021 Strong presence in the U.S. and Internationally

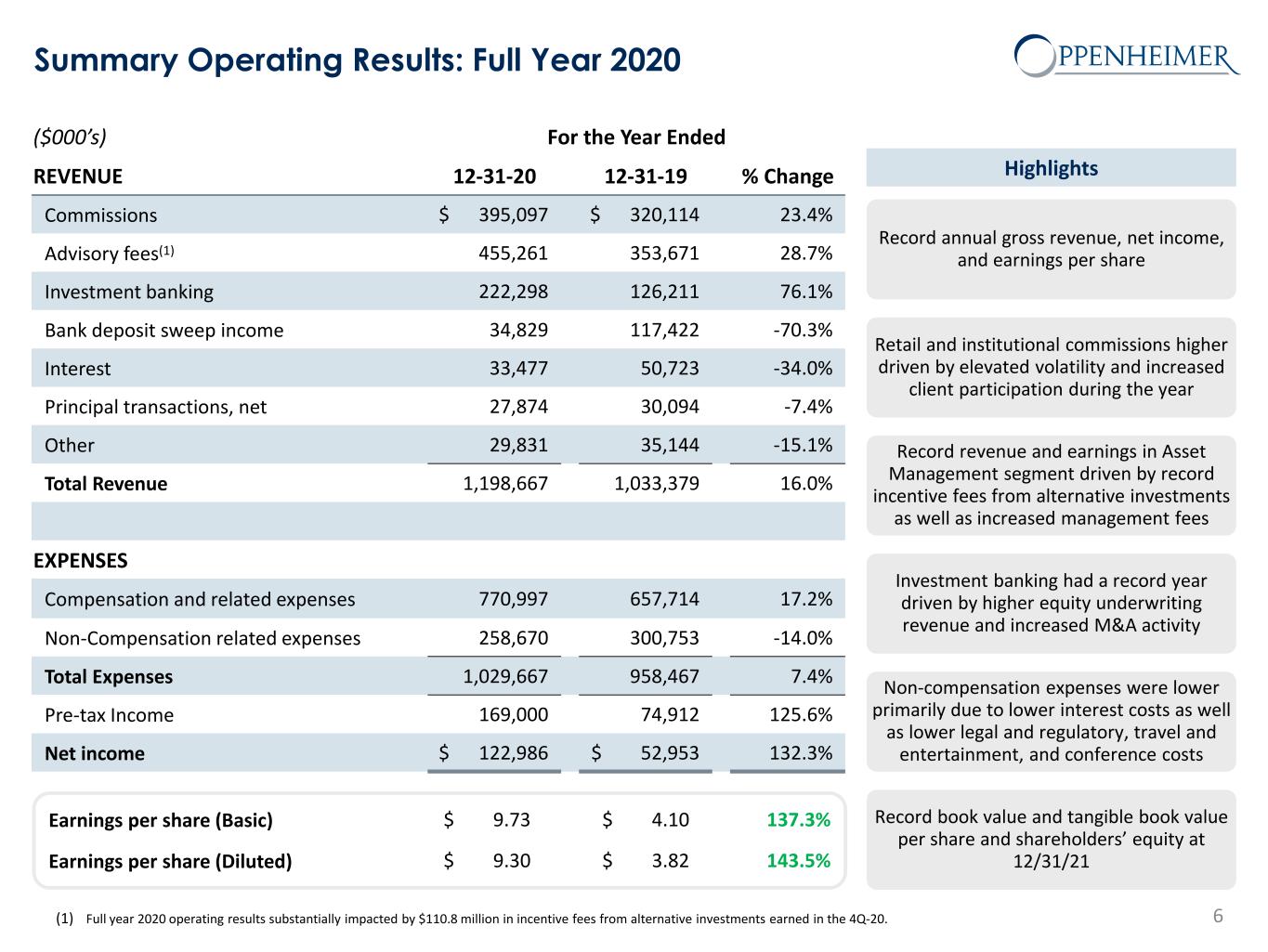

Earnings per share (Basic) $ 9.73 $ 4.10 137.3% Earnings per share (Diluted) $ 9.30 $ 3.82 143.5% Summary Operating Results: Full Year 2020 6 ($000’s) For the Year Ended REVENUE 12-31-20 12-31-19 % Change Commissions $ 395,097 $ 320,114 23.4% Advisory fees(1) 455,261 353,671 28.7% Investment banking 222,298 126,211 76.1% Bank deposit sweep income 34,829 117,422 -70.3% Interest 33,477 50,723 -34.0% Principal transactions, net 27,874 30,094 -7.4% Other 29,831 35,144 -15.1% Total Revenue 1,198,667 1,033,379 16.0% EXPENSES Compensation and related expenses 770,997 657,714 17.2% Non-Compensation related expenses 258,670 300,753 -14.0% Total Expenses 1,029,667 958,467 7.4% Pre-tax Income 169,000 74,912 125.6% Net income $ 122,986 $ 52,953 132.3% Record annual gross revenue, net income, and earnings per share Retail and institutional commissions higher driven by elevated volatility and increased client participation during the year Record revenue and earnings in Asset Management segment driven by record incentive fees from alternative investments as well as increased management fees Investment banking had a record year driven by higher equity underwriting revenue and increased M&A activity Non-compensation expenses were lower primarily due to lower interest costs as well as lower legal and regulatory, travel and entertainment, and conference costs Record book value and tangible book value per share and shareholders’ equity at 12/31/21 Highlights (1) Full year 2020 operating results substantially impacted by $110.8 million in incentive fees from alternative investments earned in the 4Q-20.

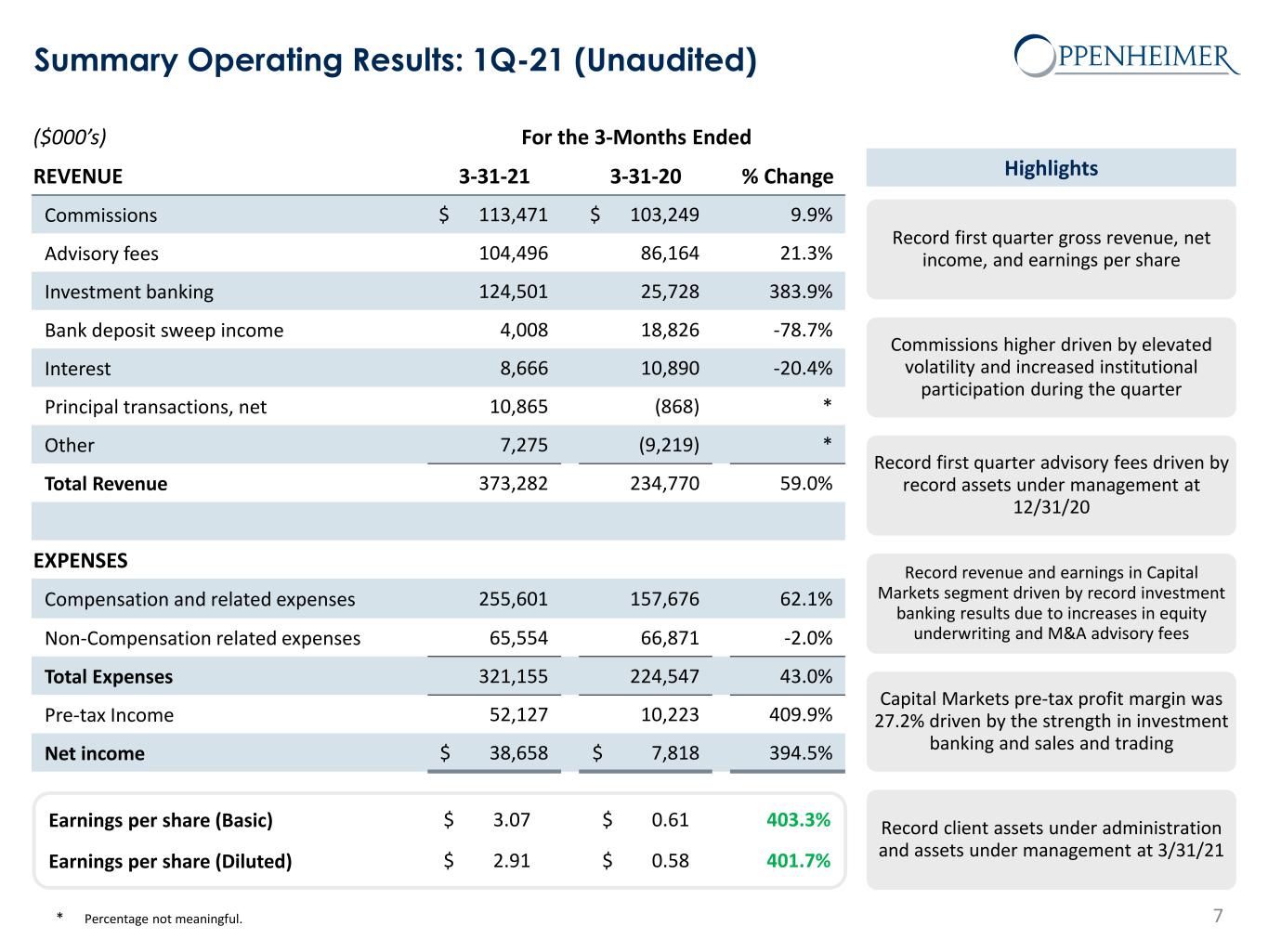

Summary Operating Results: 1Q-21 (Unaudited) 7 ($000’s) For the 3-Months Ended REVENUE 3-31-21 3-31-20 % Change Commissions $ 113,471 $ 103,249 9.9% Advisory fees 104,496 86,164 21.3% Investment banking 124,501 25,728 383.9% Bank deposit sweep income 4,008 18,826 -78.7% Interest 8,666 10,890 -20.4% Principal transactions, net 10,865 (868) * Other 7,275 (9,219) * Total Revenue 373,282 234,770 59.0% EXPENSES Compensation and related expenses 255,601 157,676 62.1% Non-Compensation related expenses 65,554 66,871 -2.0% Total Expenses 321,155 224,547 43.0% Pre-tax Income 52,127 10,223 409.9% Net income $ 38,658 $ 7,818 394.5% * Percentage not meaningful. Earnings per share (Basic) $ 3.07 $ 0.61 403.3% Earnings per share (Diluted) $ 2.91 $ 0.58 401.7% Highlights Record first quarter gross revenue, net income, and earnings per share Commissions higher driven by elevated volatility and increased institutional participation during the quarter Record first quarter advisory fees driven by record assets under management at 12/31/20 Record revenue and earnings in Capital Markets segment driven by record investment banking results due to increases in equity underwriting and M&A advisory fees Capital Markets pre-tax profit margin was 27.2% driven by the strength in investment banking and sales and trading Record client assets under administration and assets under management at 3/31/21

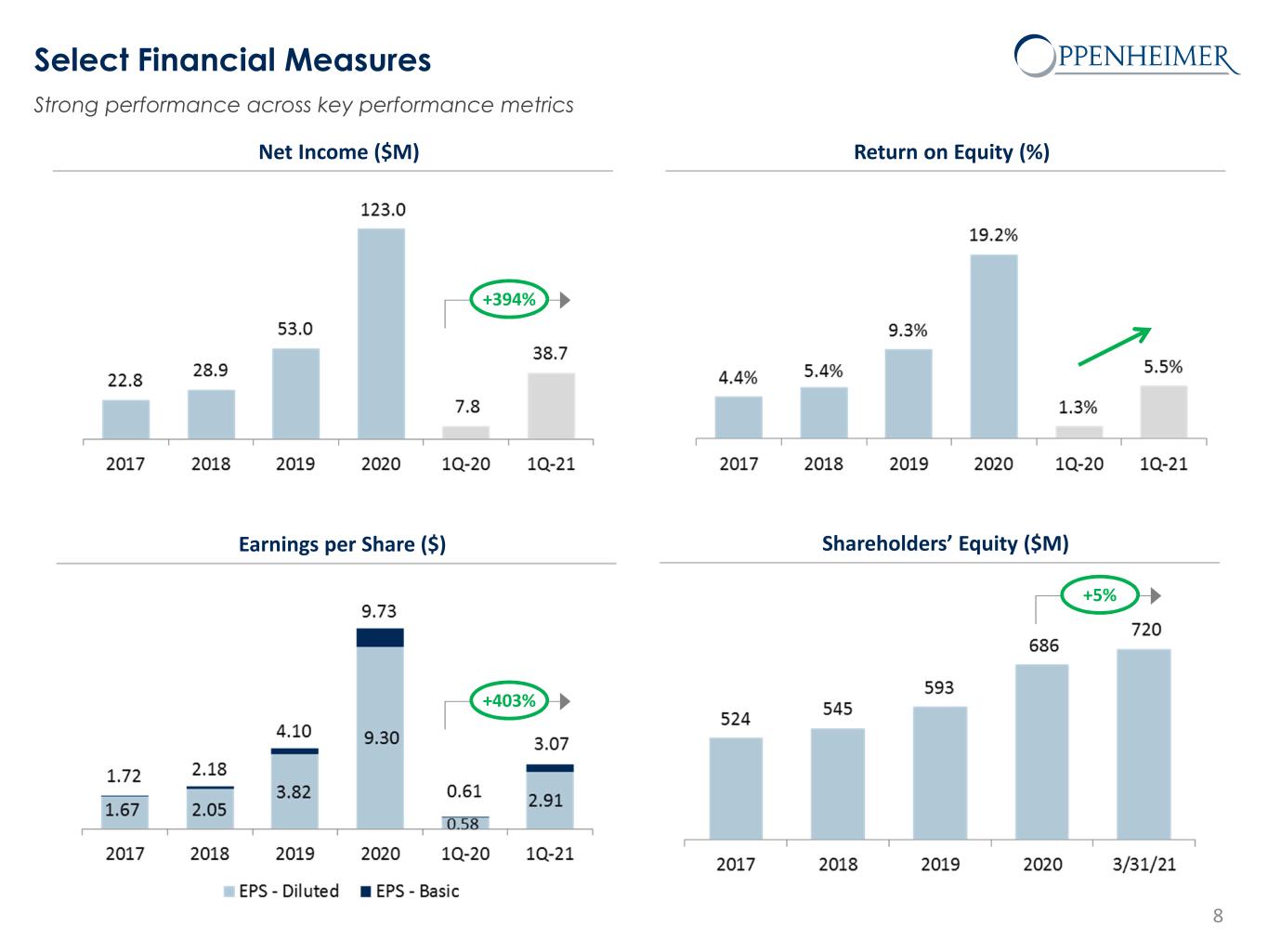

Select Financial Measures 8 Shareholders’ Equity ($M)Earnings per Share ($) Return on Equity (%)Net Income ($M) +394% +403% +5% Strong performance across key performance metrics

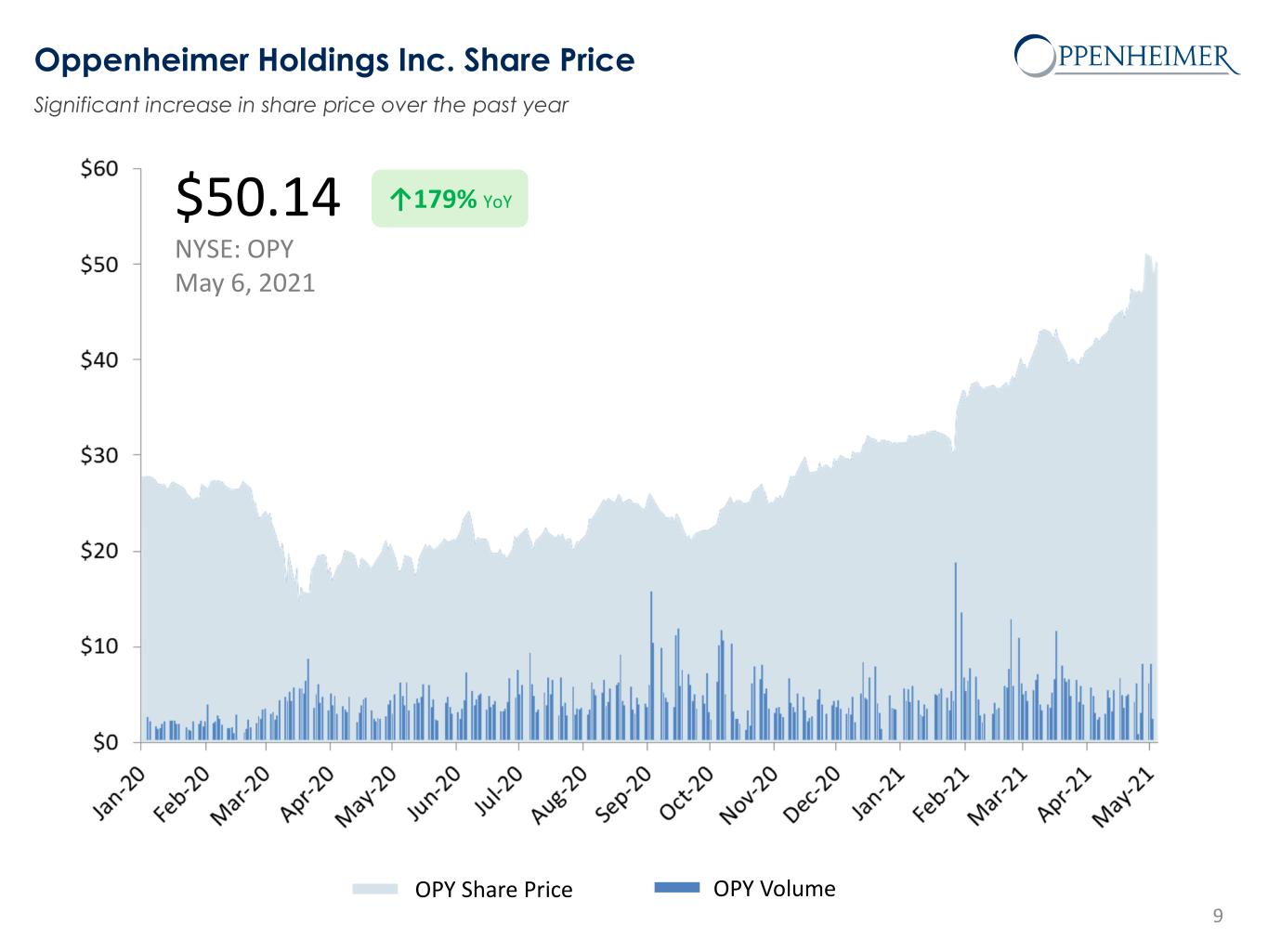

$50.14 NYSE: OPY May 6, 2021 Oppenheimer Holdings Inc. Share Price 9 ↑179% YoY Significant increase in share price over the past year OPY Share Price OPY Volume

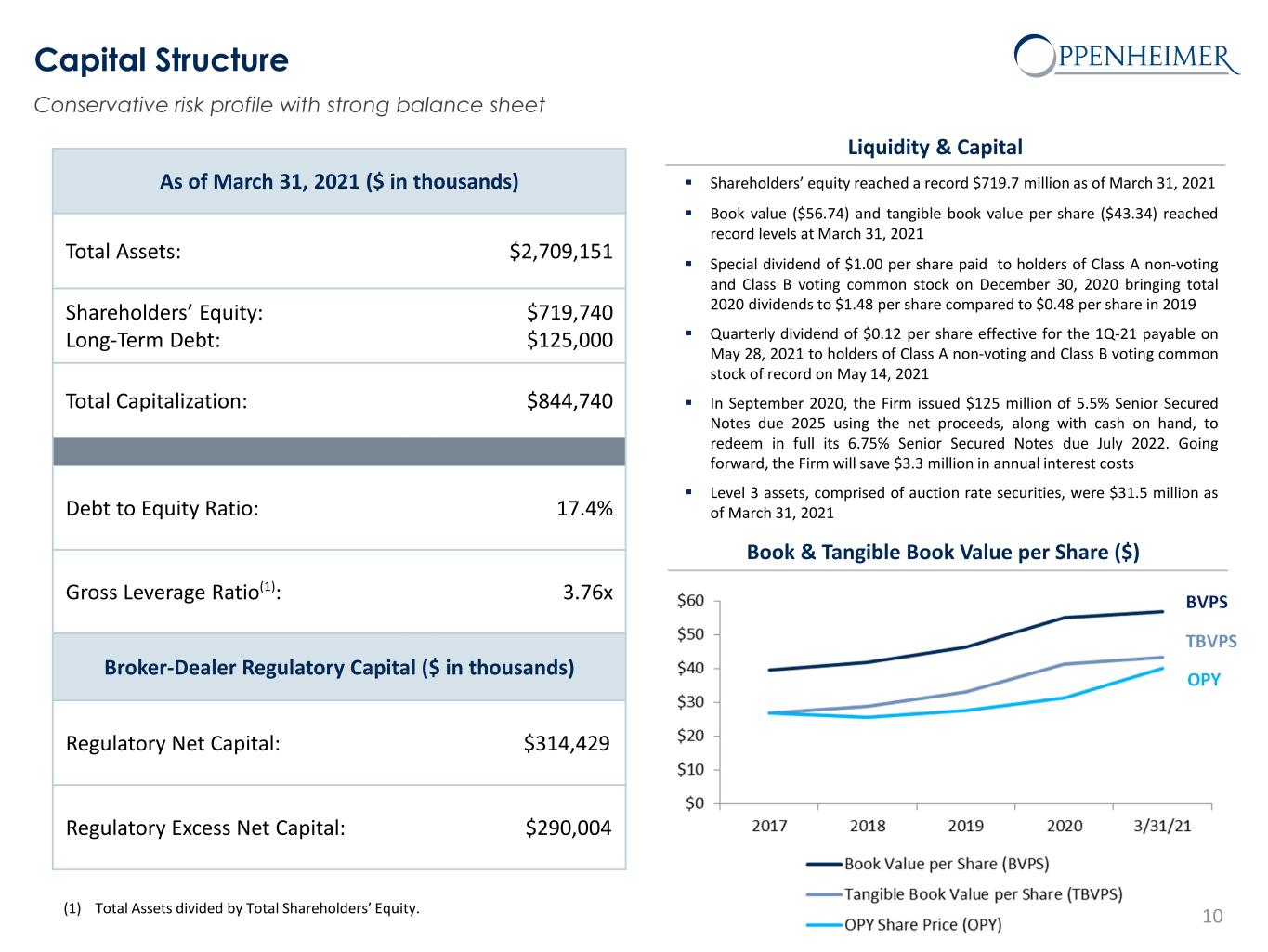

Capital Structure 10 Liquidity & Capital Book & Tangible Book Value per Share ($) Conservative risk profile with strong balance sheet (1) Total Assets divided by Total Shareholders’ Equity. As of March 31, 2021 ($ in thousands) Total Assets: $2,709,151 Shareholders’ Equity: Long-Term Debt: $719,740 $125,000 Total Capitalization: $844,740 Debt to Equity Ratio: 17.4% Gross Leverage Ratio(1): 3.76x Broker-Dealer Regulatory Capital ($ in thousands) Regulatory Net Capital: $314,429 Regulatory Excess Net Capital: $290,004 Shareholders’ equity reached a record $719.7 million as of March 31, 2021 Book value ($56.74) and tangible book value per share ($43.34) reached record levels at March 31, 2021 Special dividend of $1.00 per share paid to holders of Class A non-voting and Class B voting common stock on December 30, 2020 bringing total 2020 dividends to $1.48 per share compared to $0.48 per share in 2019 Quarterly dividend of $0.12 per share effective for the 1Q-21 payable on May 28, 2021 to holders of Class A non-voting and Class B voting common stock of record on May 14, 2021 In September 2020, the Firm issued $125 million of 5.5% Senior Secured Notes due 2025 using the net proceeds, along with cash on hand, to redeem in full its 6.75% Senior Secured Notes due July 2022. Going forward, the Firm will save $3.3 million in annual interest costs Level 3 assets, comprised of auction rate securities, were $31.5 million as of March 31, 2021 BVPS TBVPS OPY

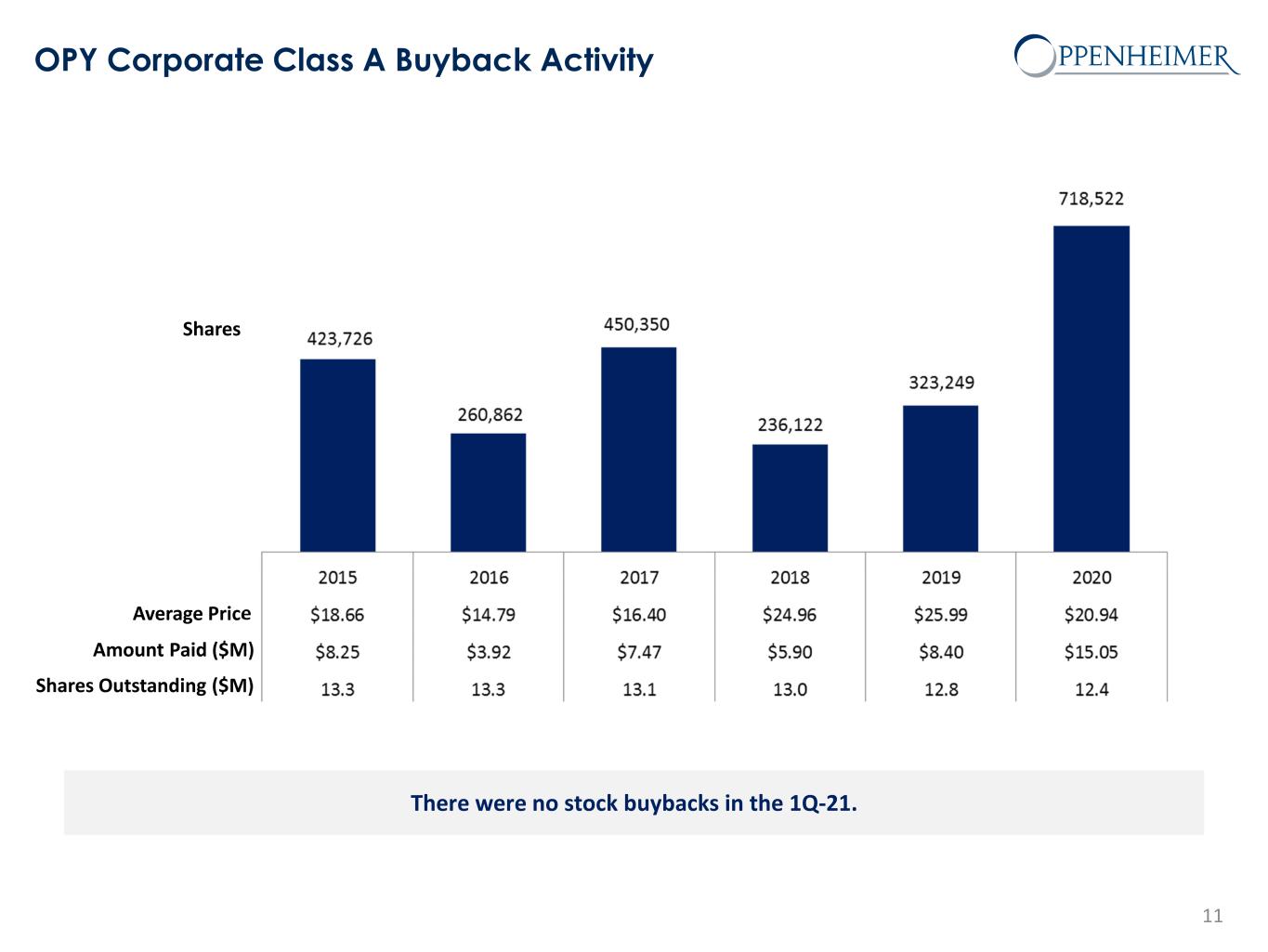

OPY Corporate Class A Buyback Activity 11 Average Price Amount Paid ($M) Shares There were no stock buybacks in the 1Q-21. Shares Outstanding ($M)

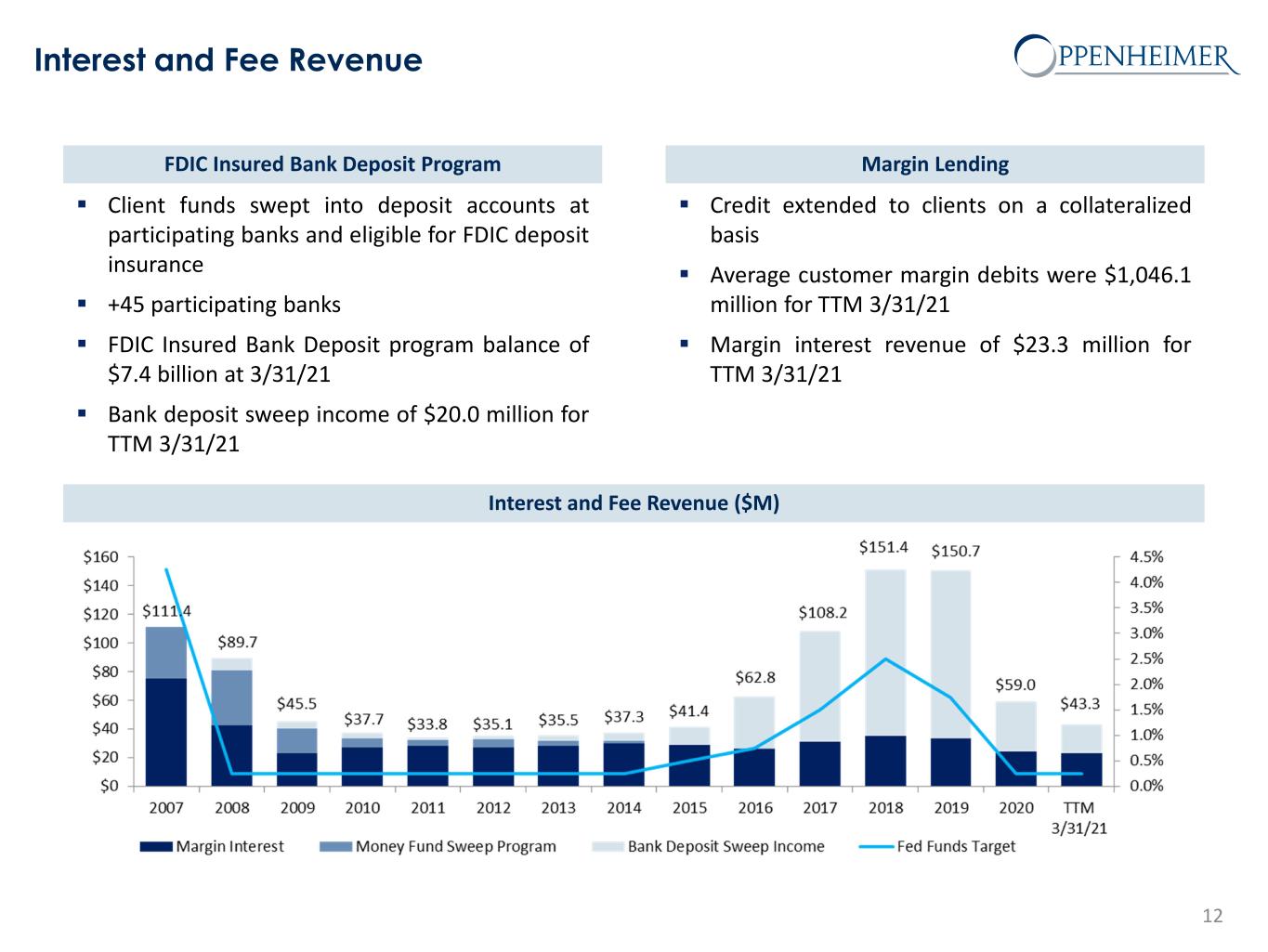

Interest and Fee Revenue 12 Interest and Fee Revenue ($M) Margin LendingFDIC Insured Bank Deposit Program Credit extended to clients on a collateralized basis Average customer margin debits were $1,046.1 million for TTM 3/31/21 Margin interest revenue of $23.3 million for TTM 3/31/21 Client funds swept into deposit accounts at participating banks and eligible for FDIC deposit insurance +45 participating banks FDIC Insured Bank Deposit program balance of $7.4 billion at 3/31/21 Bank deposit sweep income of $20.0 million for TTM 3/31/21

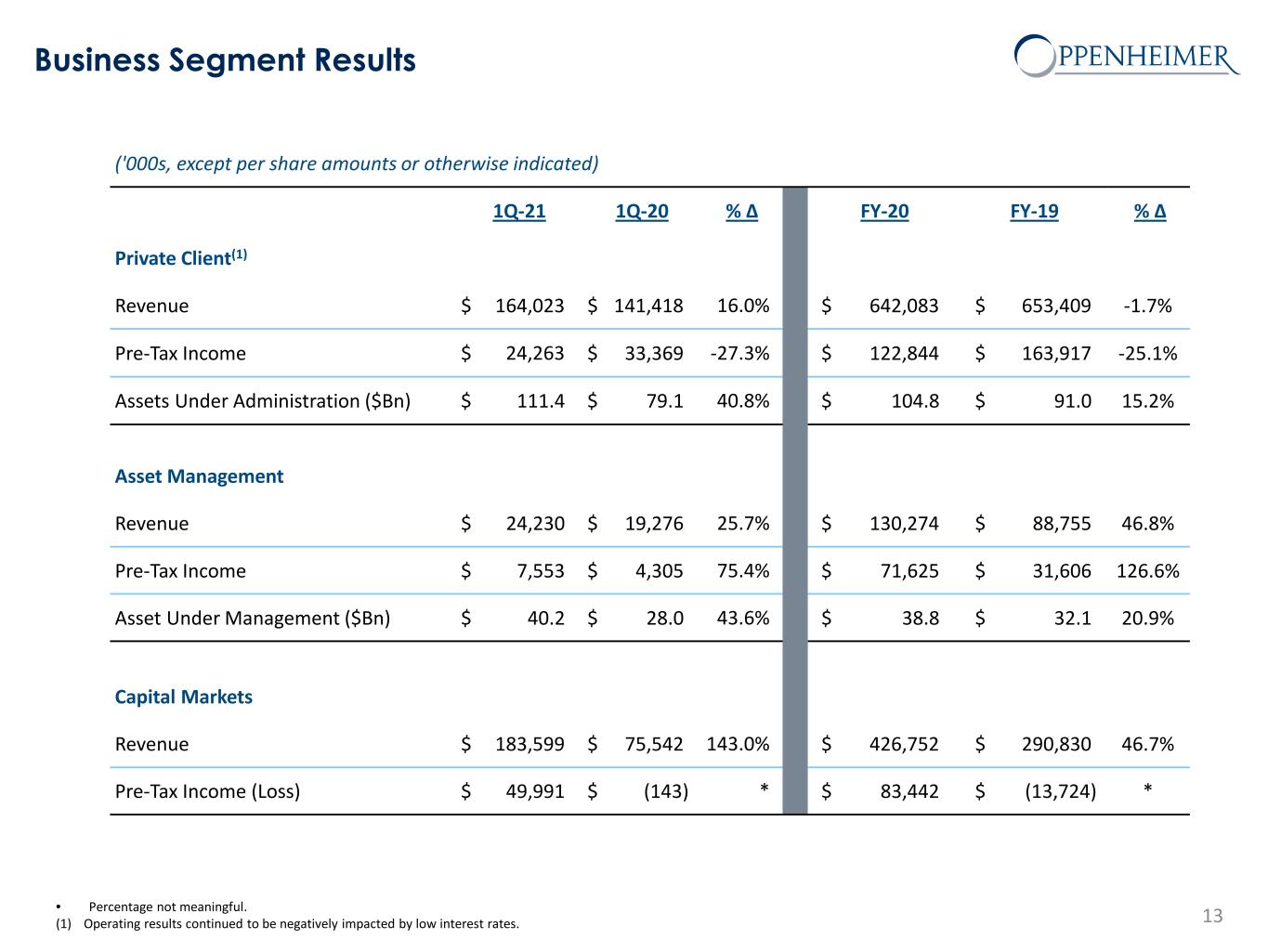

Business Segment Results 13 ('000s, except per share amounts or otherwise indicated) 1Q-21 1Q-20 % Δ FY-20 FY-19 % Δ Private Client(1) Revenue $ 164,023 $ 141,418 16.0% $ 642,083 $ 653,409 -1.7% Pre-Tax Income $ 24,263 $ 33,369 -27.3% $ 122,844 $ 163,917 -25.1% Assets Under Administration ($Bn) $ 111.4 $ 79.1 40.8% $ 104.8 $ 91.0 15.2% Asset Management Revenue $ 24,230 $ 19,276 25.7% $ 130,274 $ 88,755 46.8% Pre-Tax Income $ 7,553 $ 4,305 75.4% $ 71,625 $ 31,606 126.6% Asset Under Management ($Bn) $ 40.2 $ 28.0 43.6% $ 38.8 $ 32.1 20.9% Capital Markets Revenue $ 183,599 $ 75,542 143.0% $ 426,752 $ 290,830 46.7% Pre-Tax Income (Loss) $ 49,991 $ (143) * $ 83,442 $ (13,724) * • Percentage not meaningful. (1) Operating results continued to be negatively impacted by low interest rates.

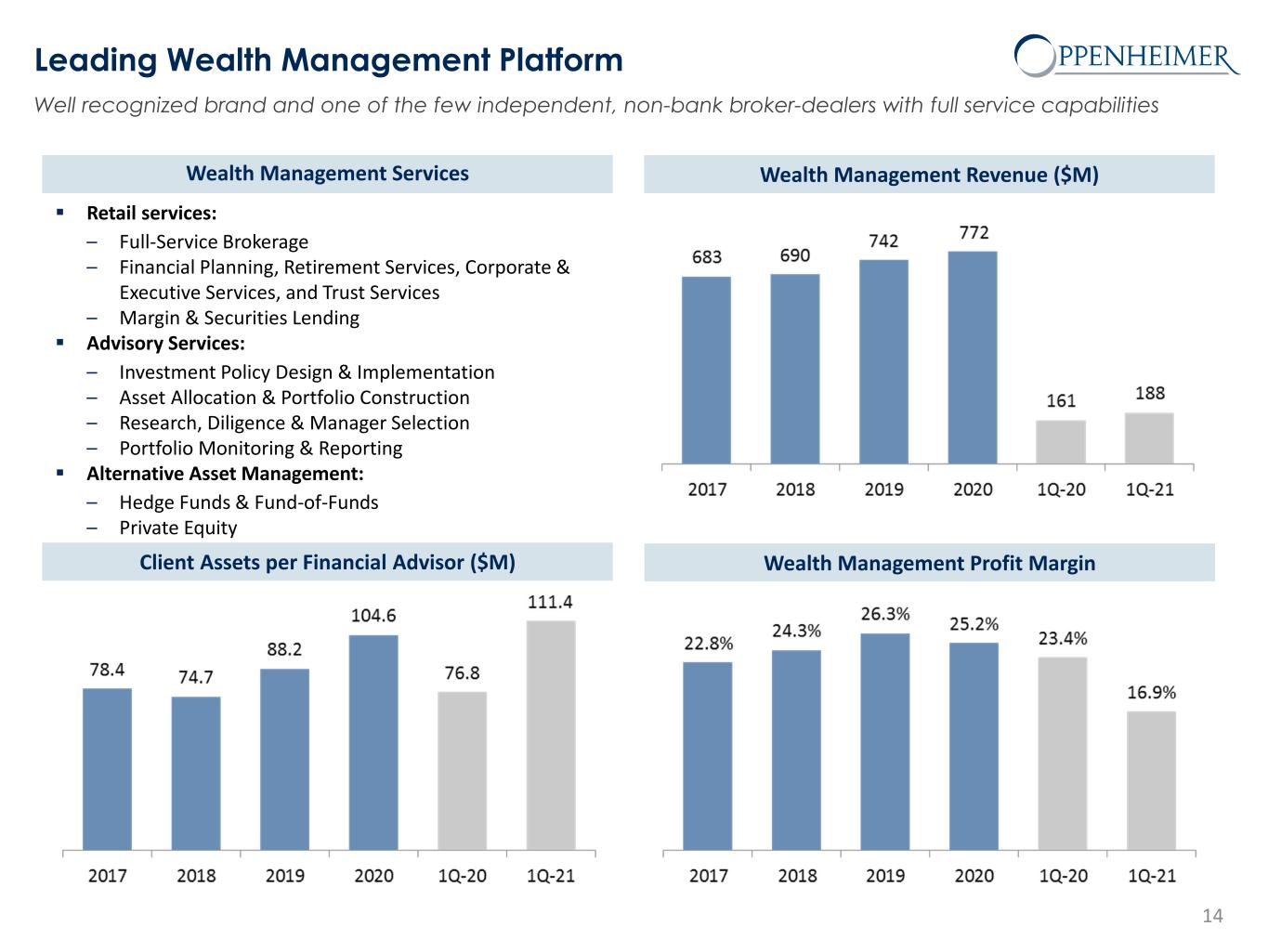

Leading Wealth Management Platform 14 Wealth Management Services Retail services: – Full-Service Brokerage – Financial Planning, Retirement Services, Corporate & Executive Services, and Trust Services – Margin & Securities Lending Advisory Services: – Investment Policy Design & Implementation – Asset Allocation & Portfolio Construction – Research, Diligence & Manager Selection – Portfolio Monitoring & Reporting Alternative Asset Management: – Hedge Funds & Fund-of-Funds – Private Equity Wealth Management Revenue ($M) Wealth Management Profit MarginClient Assets per Financial Advisor ($M) Well recognized brand and one of the few independent, non-bank broker-dealers with full service capabilities

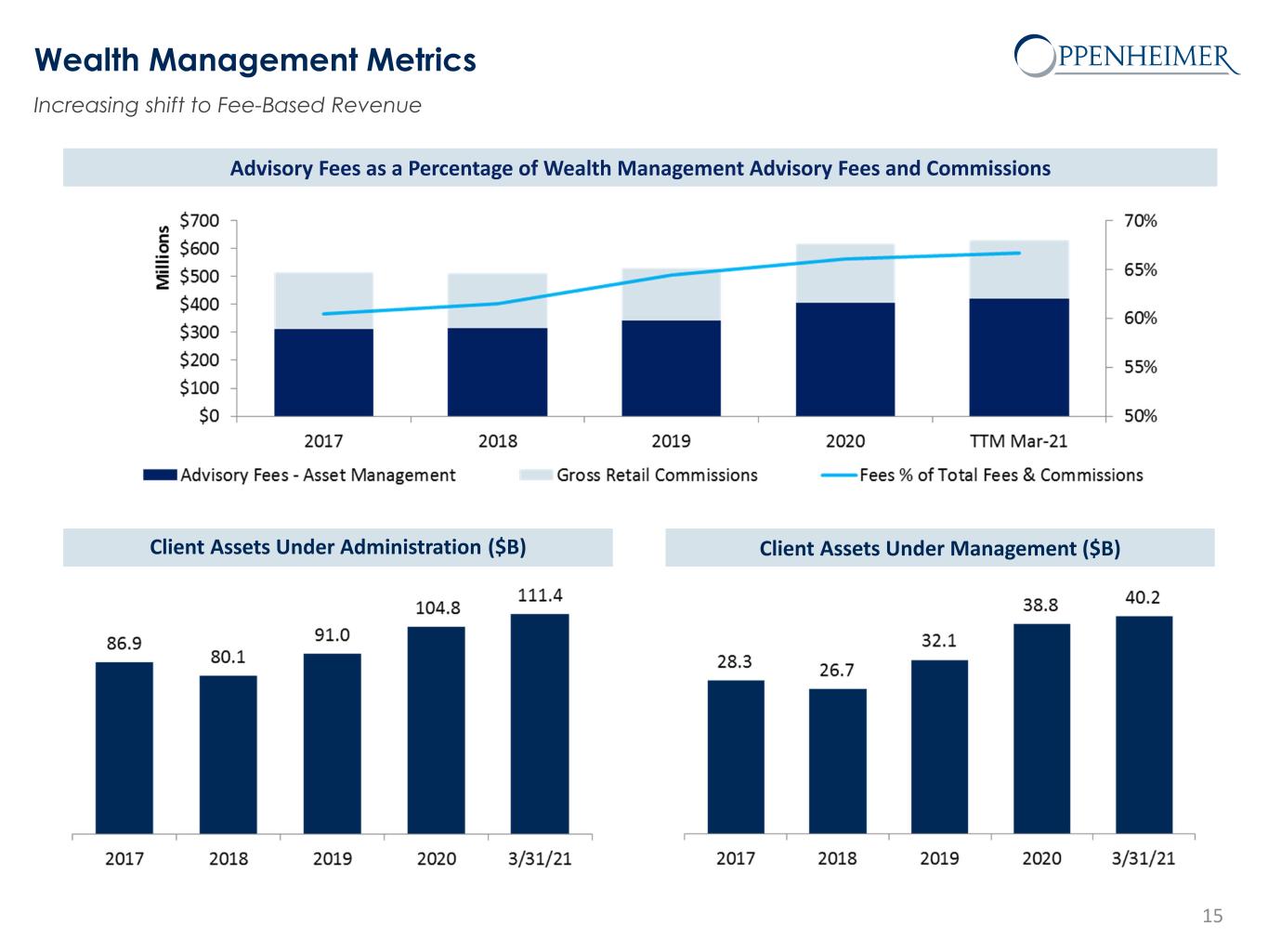

Wealth Management Metrics 15 Client Assets Under Administration ($B) Client Assets Under Management ($B) Advisory Fees as a Percentage of Wealth Management Advisory Fees and Commissions Increasing shift to Fee-Based Revenue

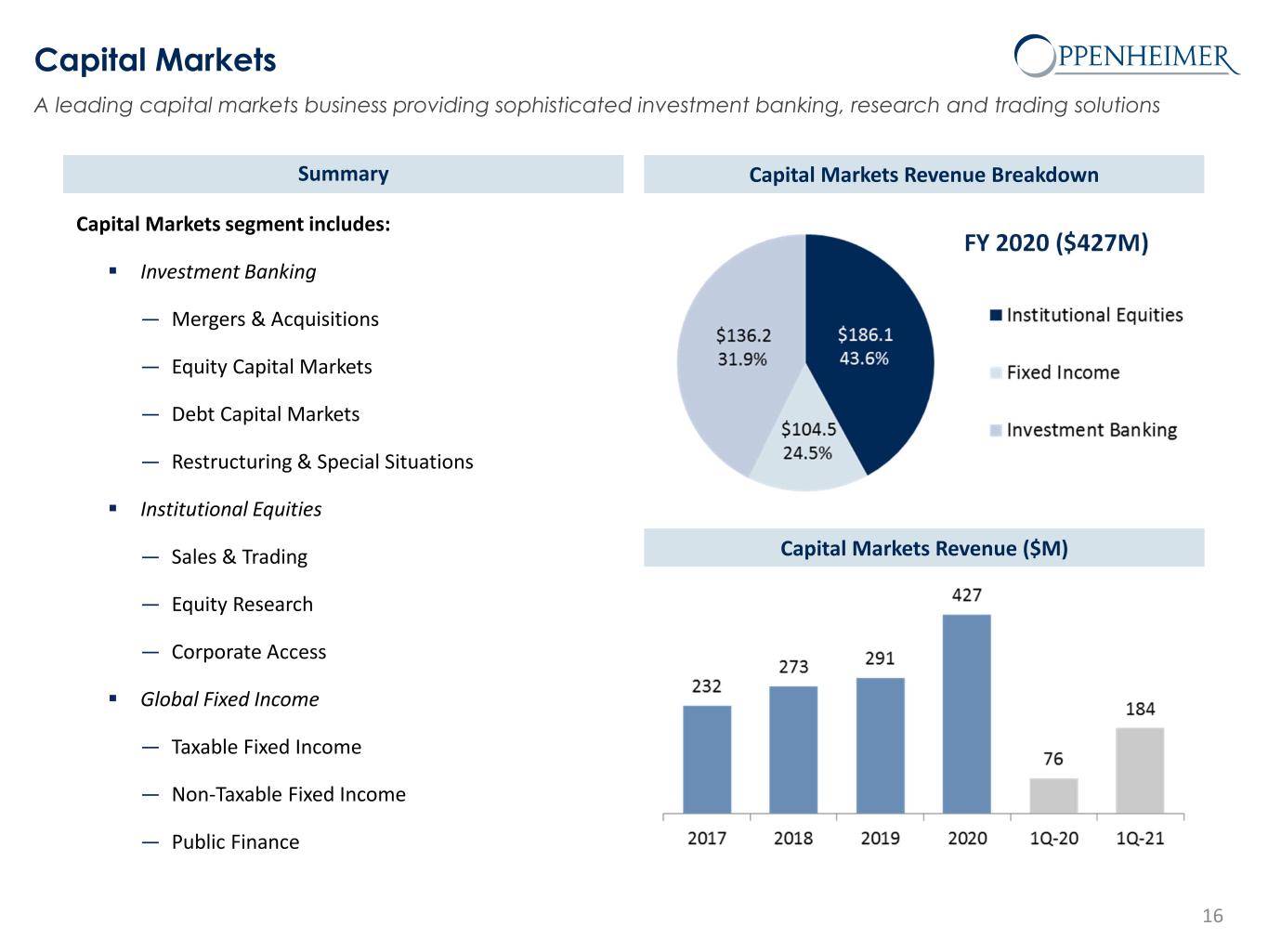

Capital Markets 16 Capital Markets segment includes: Investment Banking — Mergers & Acquisitions — Equity Capital Markets — Debt Capital Markets — Restructuring & Special Situations Institutional Equities — Sales & Trading — Equity Research — Corporate Access Global Fixed Income — Taxable Fixed Income — Non-Taxable Fixed Income — Public Finance Capital Markets Revenue ($M) Capital Markets Revenue BreakdownSummary A leading capital markets business providing sophisticated investment banking, research and trading solutions FY 2020 ($427M)

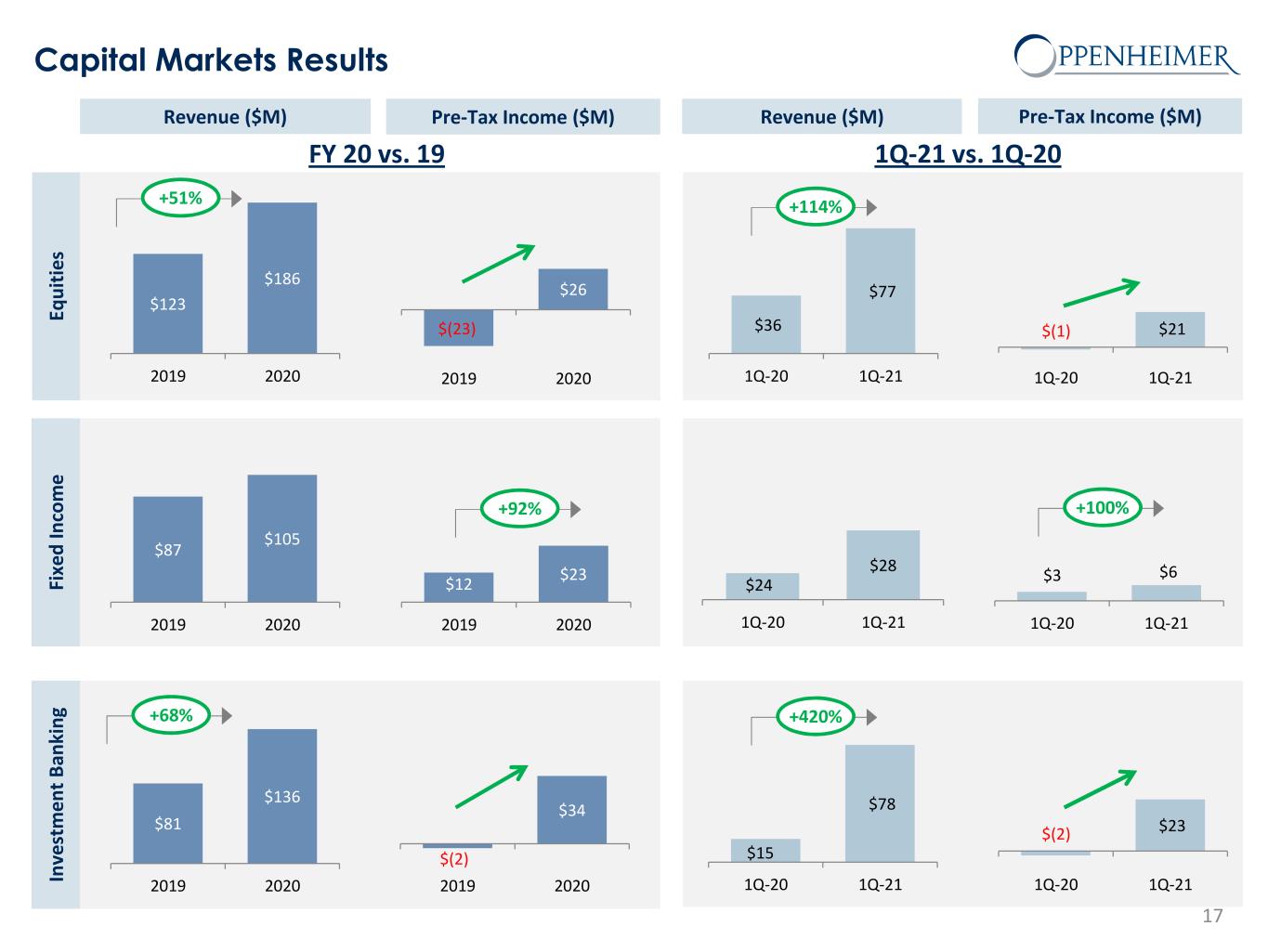

Capital Markets Results 17 Revenue ($M) Pre-Tax Income ($M) E q u it ie s In v e st m e n t B a n k in g F ix e d I n c o m e +413% 1Q20 1Q21 Revenue ($M) Pre-Tax Income ($M) $123 $186 2019 2020 $(23) $26 2019 2020 $81 $136 2019 2020 $87 $105 2019 2020 $12 $23 2019 2020 $(2) $34 2019 2020 $36 $77 1Q-20 1Q-21 $(1) $21 1Q-20 1Q-21 $15 $78 1Q-20 1Q-21 $(2) $23 1Q-20 1Q-21 $24 $28 1Q-20 1Q-21 $3 $6 1Q-20 1Q-21 +51% +420% +92% +100% +68% +114% FY 20 vs. 19 1Q-21 vs. 1Q-20

Summary 18 Investing in our future and poised for growth Balance sheet is stronger than ever with record shareholders’ equity, liquid balance sheet, and more favorable long-term financing terms Interest rate sensitive businesses poised to do well in a rising interest rate environment Record client assets under administration and assets under management in Wealth Management business Will continue to pursue organic and inorganic growth opportunities in core businesses while looking to enter independent channel Four consecutive quarters of > $100 million in revenues for Capital Markets business Record operating results for 2020 and 1Q-21 due to the strength in the performance of Wealth Management and Capital Markets businesses Well positioned to continue taking market share in Capital Markets while continuing to deliver strong results in Wealth Management Looking ForwardIn Review Will continue to opportunistically purchase outstanding shares in the open market (Remaining authorization: 401,013 shares)

19