Attached files

| file | filename |

|---|---|

| EX-99.1 - EX-99.1 - CPI Card Group Inc. | pmts-20210511xex99d1.htm |

| 8-K - 8-K - CPI Card Group Inc. | pmts-20210511x8k.htm |

Exhibit 99.2

| Investor Commentary First Quarter 2021 May 11, 2021 |

| Table of Contents Vision and Strategic Priorities 2 Strategic Update 3 First Quarter 2021 Financial Highlights 4 Segment Performance 6 Balance Sheet, Liquidity and Cash Flow 8 Summary 10 Appendix Cautionary Statement on Forward-Looking Statements 11 Reconciliation of Non-GAAP Financial Measures 12 Supplemental Financial Measures 15 1 The commentary that follows is issued in conjunction with the earnings release dated May 11, 2021 and Quarterly Report on form 10-Q for the period ended March 31, 2021 filed with the Securities and Exchange Commission. Certain statements and information in this document (as well as information included in our accompanying written or oral statements) may contain or constitute “forward-looking statements” within the meaning of the Private Securities Litigation Reform Act of 1995, Section 27A of the Securities Act of 1933, as amended (the “1933 Act”) and Section 21E of the Securities Exchange Act of 1934, as amended (the “1934 Act”). Please see the Cautionary Statement on Forward Looking Statements at the end of this document. The Contactless Indicator mark, consisting of four graduating arcs, is a trademark owned by and used with permission of EMVCo, LLC. |

| Vision and Strategic Priorities 2 We strive to be the trusted partner in payments and exceed expectations through high quality, collaboration and innovative products. We are committed to continually raising the bar on delivering high quality products and exceptional service while making it easy to do business with CPI®. We drive efficiency and productivity throughout our business with ongoing process improvements, operational automation, technology and equipment advancement. We collaborate with our customers to deliver unique and differentiated products and solutions that elevate their customers’ experience and enhance their brands. Our vision is to be the partner of choice by providing market-leading quality products and customer service with a market-competitive business model. Q1 2021 | Deep Customer Focus Market-Leading Quality Products and Customer Service Continuous Innovation Market-Competitive Business Model The Contactless Indicator mark, consisting of four graduating arcs, is a trademark owned by and used with permission of EMVCo, LLC. |

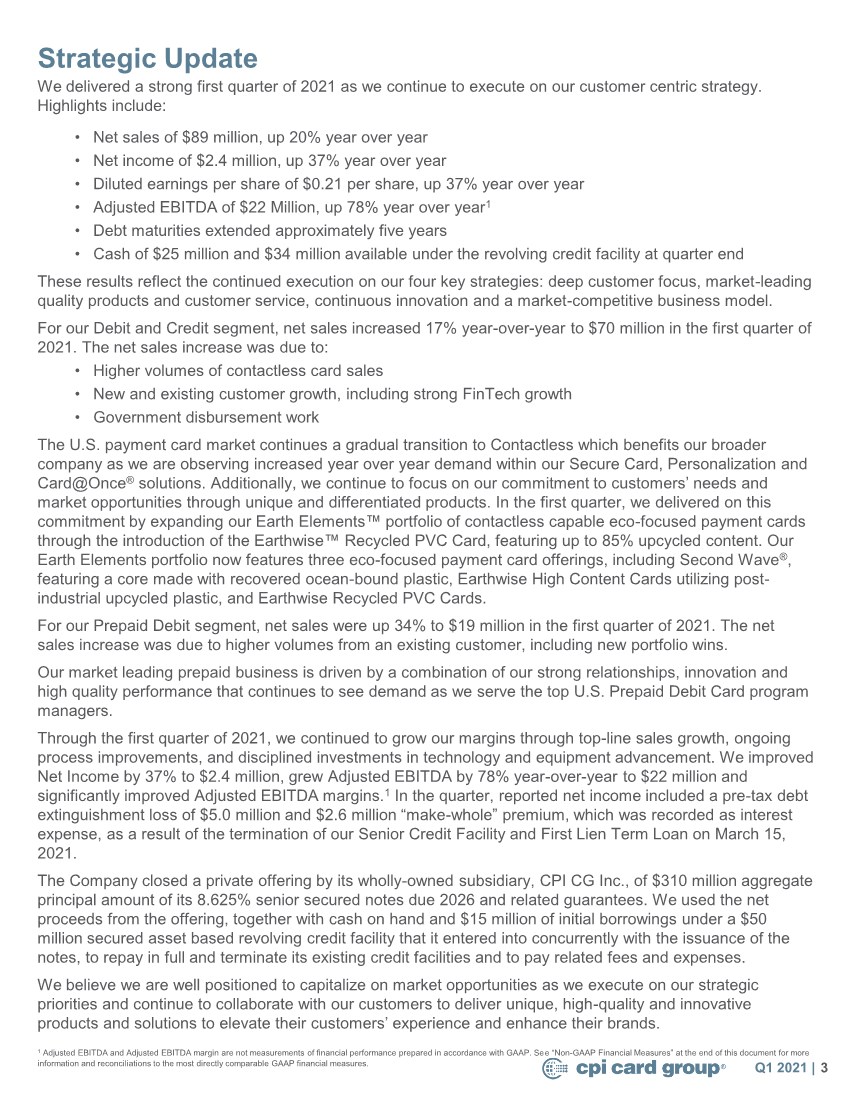

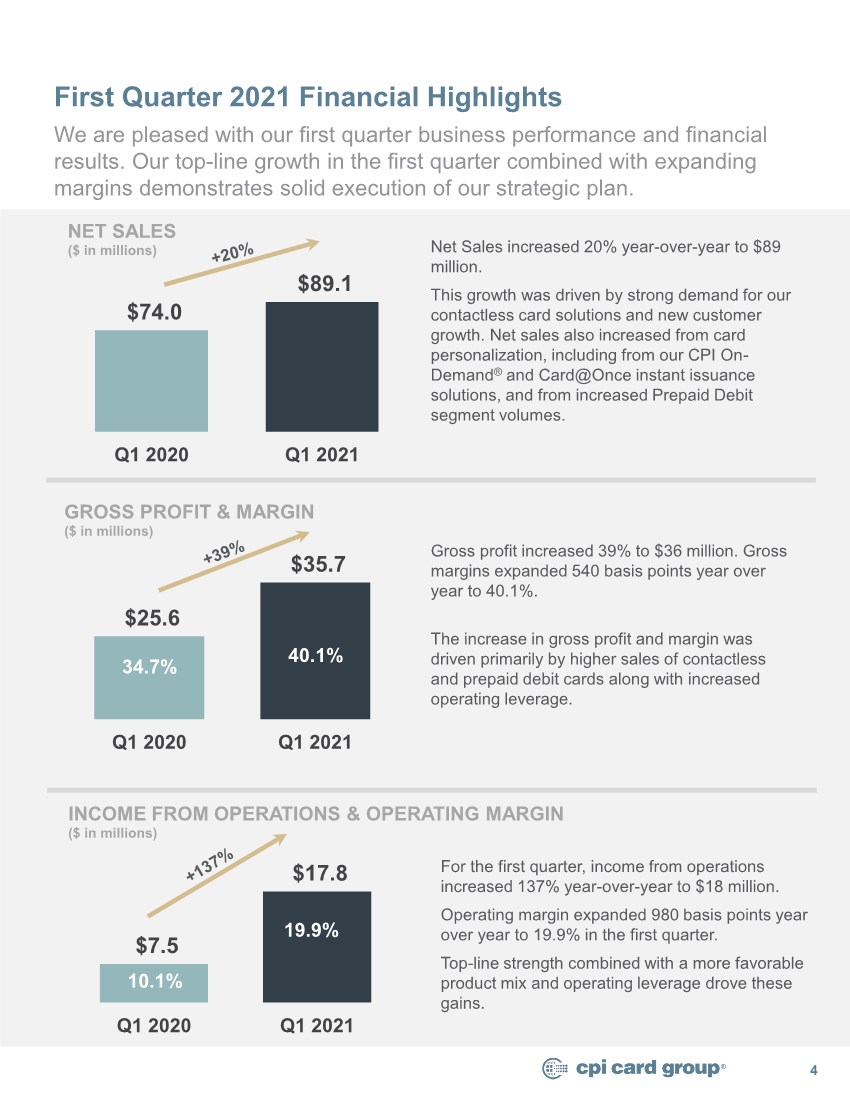

| Strategic Update 3 We delivered a strong first quarter of 2021 as we continue to execute on our customer centric strategy. Highlights include: • Net sales of $89 million, up 20% year over year • Net income of $2.4 million, up 37% year over year • Diluted earnings per share of $0.21 per share, up 37% year over year • Adjusted EBITDA of $22 Million, up 78% year over year1 • Debt maturities extended approximately five years • Cash of $25 million and $34 million available under the revolving credit facility at quarter end These results reflect the continued execution on our four key strategies: deep customer focus, market-leading quality products and customer service, continuous innovation and a market-competitive business model. For our Debit and Credit segment, net sales increased 17% year-over-year to $70 million in the first quarter of 2021. The net sales increase was due to: • Higher volumes of contactless card sales • New and existing customer growth, including strong FinTech growth • Government disbursement work The U.S. payment card market continues a gradual transition to Contactless which benefits our broader company as we are observing increased year over year demand within our Secure Card, Personalization and Card@Once® solutions. Additionally, we continue to focus on our commitment to customers’ needs and market opportunities through unique and differentiated products. In the first quarter, we delivered on this commitment by expanding our Earth Elements™ portfolio of contactless capable eco-focused payment cards through the introduction of the Earthwise™ Recycled PVC Card, featuring up to 85% upcycled content. Our Earth Elements portfolio now features three eco-focused payment card offerings, including Second Wave®, featuring a core made with recovered ocean-bound plastic, Earthwise High Content Cards utilizing post- industrial upcycled plastic, and Earthwise Recycled PVC Cards. For our Prepaid Debit segment, net sales were up 34% to $19 million in the first quarter of 2021. The net sales increase was due to higher volumes from an existing customer, including new portfolio wins. Our market leading prepaid business is driven by a combination of our strong relationships, innovation and high quality performance that continues to see demand as we serve the top U.S. Prepaid Debit Card program managers. Through the first quarter of 2021, we continued to grow our margins through top-line sales growth, ongoing process improvements, and disciplined investments in technology and equipment advancement. We improved Net Income by 37% to $2.4 million, grew Adjusted EBITDA by 78% year-over-year to $22 million and significantly improved Adjusted EBITDA margins.1 In the quarter, reported net income included a pre-tax debt extinguishment loss of $5.0 million and $2.6 million “make-whole” premium, which was recorded as interest expense, as a result of the termination of our Senior Credit Facility and First Lien Term Loan on March 15, 2021. The Company closed a private offering by its wholly-owned subsidiary, CPI CG Inc., of $310 million aggregate principal amount of its 8.625% senior secured notes due 2026 and related guarantees. We used the net proceeds from the offering, together with cash on hand and $15 million of initial borrowings under a $50 million secured asset based revolving credit facility that it entered into concurrently with the issuance of the notes, to repay in full and terminate its existing credit facilities and to pay related fees and expenses. We believe we are well positioned to capitalize on market opportunities as we execute on our strategic priorities and continue to collaborate with our customers to deliver unique, high-quality and innovative products and solutions to elevate their customers’ experience and enhance their brands. Q1 2021 | 1 Adjusted EBITDA and Adjusted EBITDA margin are not measurements of financial performance prepared in accordance with GAAP. See “Non-GAAP Financial Measures” at the end of this document for more information and reconciliations to the most directly comparable GAAP financial measures. |

| $74.0 $89.1 Q1 2020 Q1 2021 NET SALES ($ in millions) We are pleased with our first quarter business performance and financial results. Our top-line growth in the first quarter combined with expanding margins demonstrates solid execution of our strategic plan. First Quarter 2021 Financial Highlights Net Sales increased 20% year-over-year to $89 million. This growth was driven by strong demand for our contactless card solutions and new customer growth. Net sales also increased from card personalization, including from our CPI On- Demand® and Card@Once instant issuance solutions, and from increased Prepaid Debit segment volumes. Gross profit increased 39% to $36 million. Gross margins expanded 540 basis points year over year to 40.1%. The increase in gross profit and margin was driven primarily by higher sales of contactless and prepaid debit cards along with increased operating leverage. $25.6 $35.7 34.7% 40.1% Q1 2020 Q1 2021 GROSS PROFIT & MARGIN ($ in millions) 4 $7.5 $17.8 10.1% 19.9% Q1 2020 Q1 2021 INCOME FROM OPERATIONS & OPERATING MARGIN For the first quarter, income from operations increased 137% year-over-year to $18 million. Operating margin expanded 980 basis points year over year to 19.9% in the first quarter. Top-line strength combined with a more favorable product mix and operating leverage drove these gains. ($ in millions) |

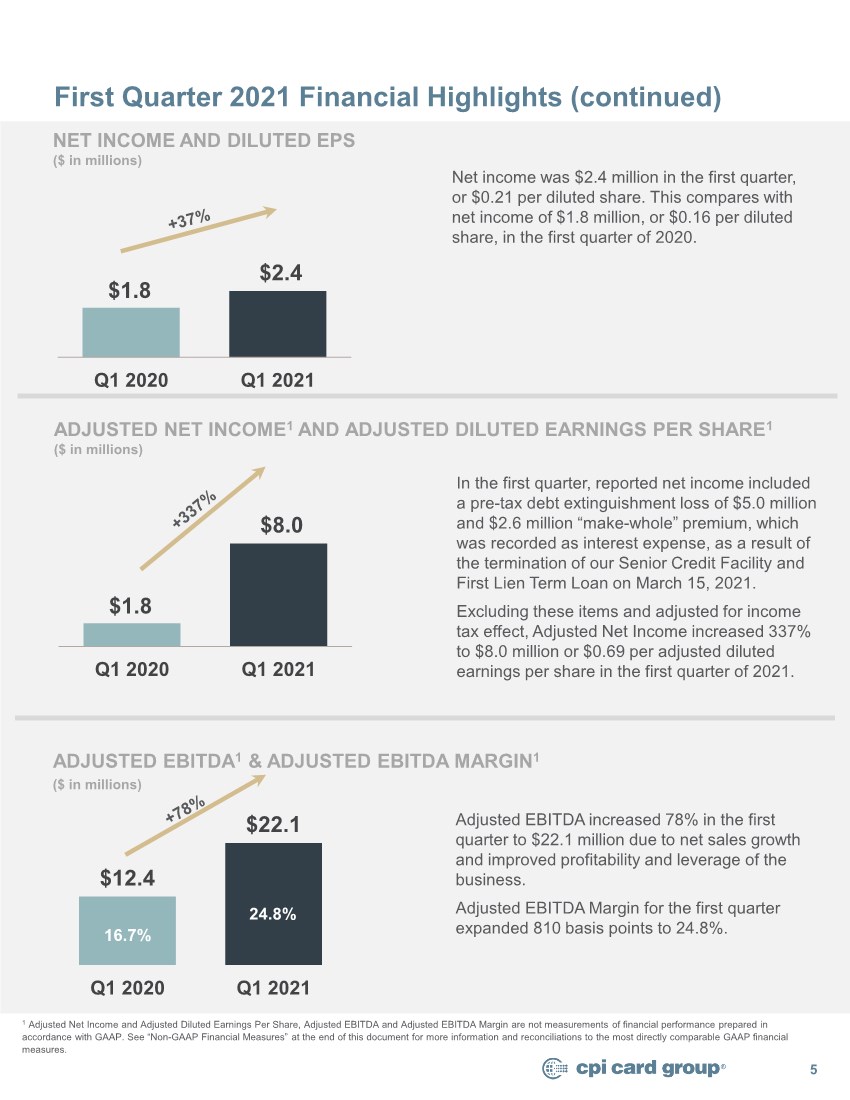

| $12.4 $22.1 16.7% 24.8% Q1 2020 Q1 2021 $1.8 $2.4 Q1 2020 Q1 2021 First Quarter 2021 Financial Highlights (continued) Net income was $2.4 million in the first quarter, or $0.21 per diluted share. This compares with net income of $1.8 million, or $0.16 per diluted share, in the first quarter of 2020. 5 NET INCOME AND DILUTED EPS ($ in millions) ADJUSTED EBITDA1 & ADJUSTED EBITDA MARGIN1 Adjusted EBITDA increased 78% in the first quarter to $22.1 million due to net sales growth and improved profitability and leverage of the business. Adjusted EBITDA Margin for the first quarter expanded 810 basis points to 24.8%. ($ in millions) 1 Adjusted Net Income and Adjusted Diluted Earnings Per Share, Adjusted EBITDA and Adjusted EBITDA Margin are not measurements of financial performance prepared in accordance with GAAP. See “Non-GAAP Financial Measures” at the end of this document for more information and reconciliations to the most directly comparable GAAP financial measures. In the first quarter, reported net income included a pre-tax debt extinguishment loss of $5.0 million and $2.6 million “make-whole” premium, which was recorded as interest expense, as a result of the termination of our Senior Credit Facility and First Lien Term Loan on March 15, 2021. Excluding these items and adjusted for income tax effect, Adjusted Net Income increased 337% to $8.0 million or $0.69 per adjusted diluted earnings per share in the first quarter of 2021. $1.8 $8.0 Q1 2020 Q1 2021 ADJUSTED NET INCOME1 AND ADJUSTED DILUTED EARNINGS PER SHARE1 ($ in millions) |

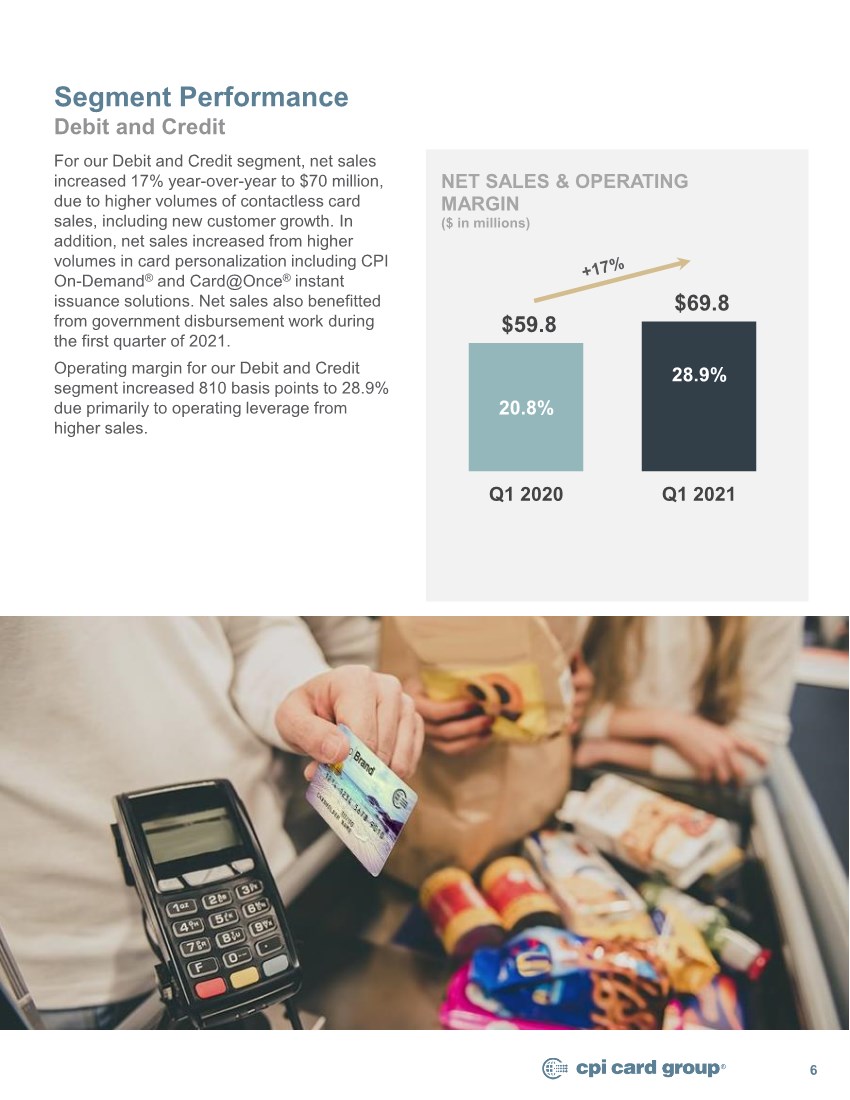

| Debit and Credit Segment Performance 6 For our Debit and Credit segment, net sales increased 17% year-over-year to $70 million, due to higher volumes of contactless card sales, including new customer growth. In addition, net sales increased from higher volumes in card personalization including CPI On-Demand® and Card@Once® instant issuance solutions. Net sales also benefitted from government disbursement work during the first quarter of 2021. Operating margin for our Debit and Credit segment increased 810 basis points to 28.9% due primarily to operating leverage from higher sales. $59.8 $69.8 20.8% 28.9% Q1 2020 Q1 2021 NET SALES & OPERATING MARGIN ($ in millions) |

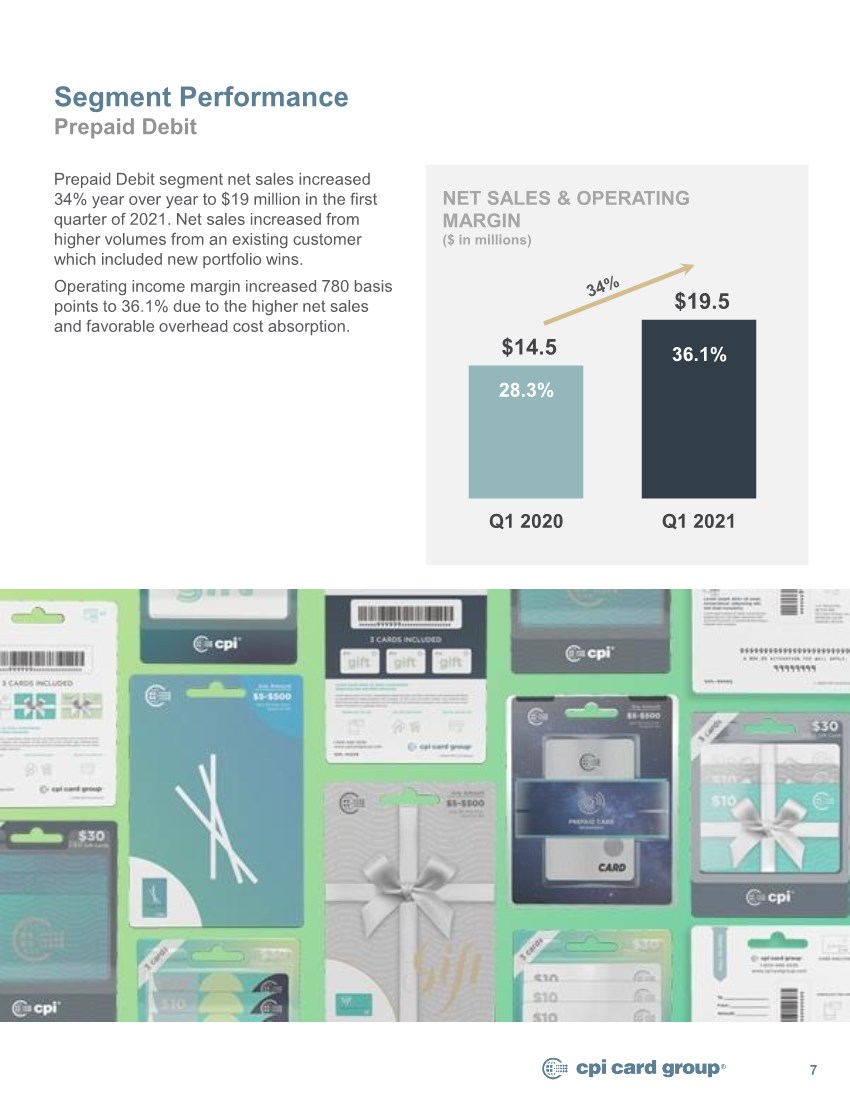

| Prepaid Debit Segment Performance Prepaid Debit segment net sales increased 34% year over year to $19 million in the first quarter of 2021. Net sales increased from higher volumes from an existing customer which included new portfolio wins. Operating income margin increased 780 basis points to 36.1% due to the higher net sales and favorable overhead cost absorption. 7 $14.5 $19.5 28.3% 36.1% Q1 2020 Q1 2021 NET SALES & OPERATING MARGIN ($ in millions) |

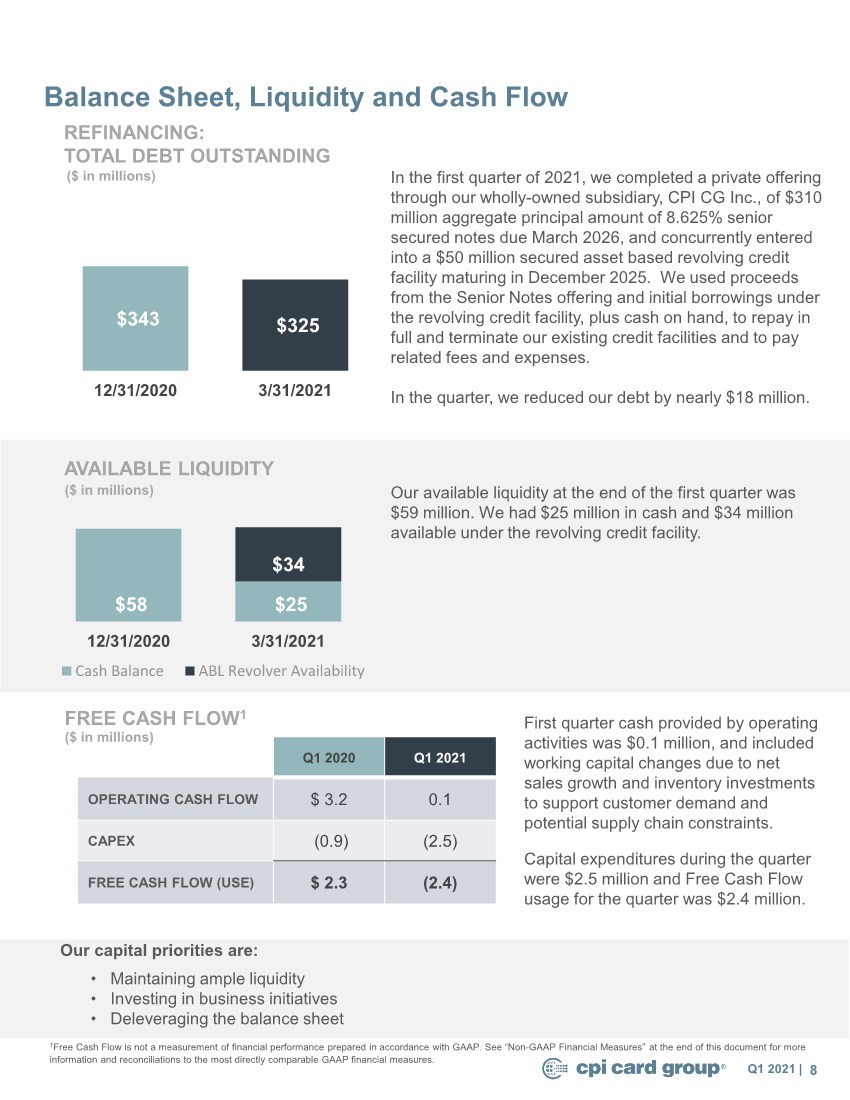

| Balance Sheet, Liquidity and Cash Flow 8 Q1 2021 | Our available liquidity at the end of the first quarter was $59 million. We had $25 million in cash and $34 million available under the revolving credit facility. $58 $25 $34 12/31/2020 3/31/2021 Cash Balance ABL Revolver Availability Q1 2020 Q1 2021 OPERATING CASH FLOW $ 3.2 0.1 CAPEX (0.9) (2.5) FREE CASH FLOW (USE) $ 2.3 (2.4) FREE CASH FLOW1 First quarter cash provided by operating activities was $0.1 million, and included working capital changes due to net sales growth and inventory investments to support customer demand and potential supply chain constraints. Capital expenditures during the quarter were $2.5 million and Free Cash Flow usage for the quarter was $2.4 million. ($ in millions) 1Free Cash Flow is not a measurement of financial performance prepared in accordance with GAAP. See “Non-GAAP Financial Measures” at the end of this document for more information and reconciliations to the most directly comparable GAAP financial measures. AVAILABLE LIQUIDITY ($ in millions) REFINANCING: TOTAL DEBT OUTSTANDING In the first quarter of 2021, we completed a private offering through our wholly-owned subsidiary, CPI CG Inc., of $310 million aggregate principal amount of 8.625% senior secured notes due March 2026, and concurrently entered into a $50 million secured asset based revolving credit facility maturing in December 2025. We used proceeds from the Senior Notes offering and initial borrowings under the revolving credit facility, plus cash on hand, to repay in full and terminate our existing credit facilities and to pay related fees and expenses. In the quarter, we reduced our debt by nearly $18 million. $343 $325 12/31/2020 3/31/2021 ($ in millions) Our capital priorities are: • Maintaining ample liquidity • Investing in business initiatives • Deleveraging the balance sheet |

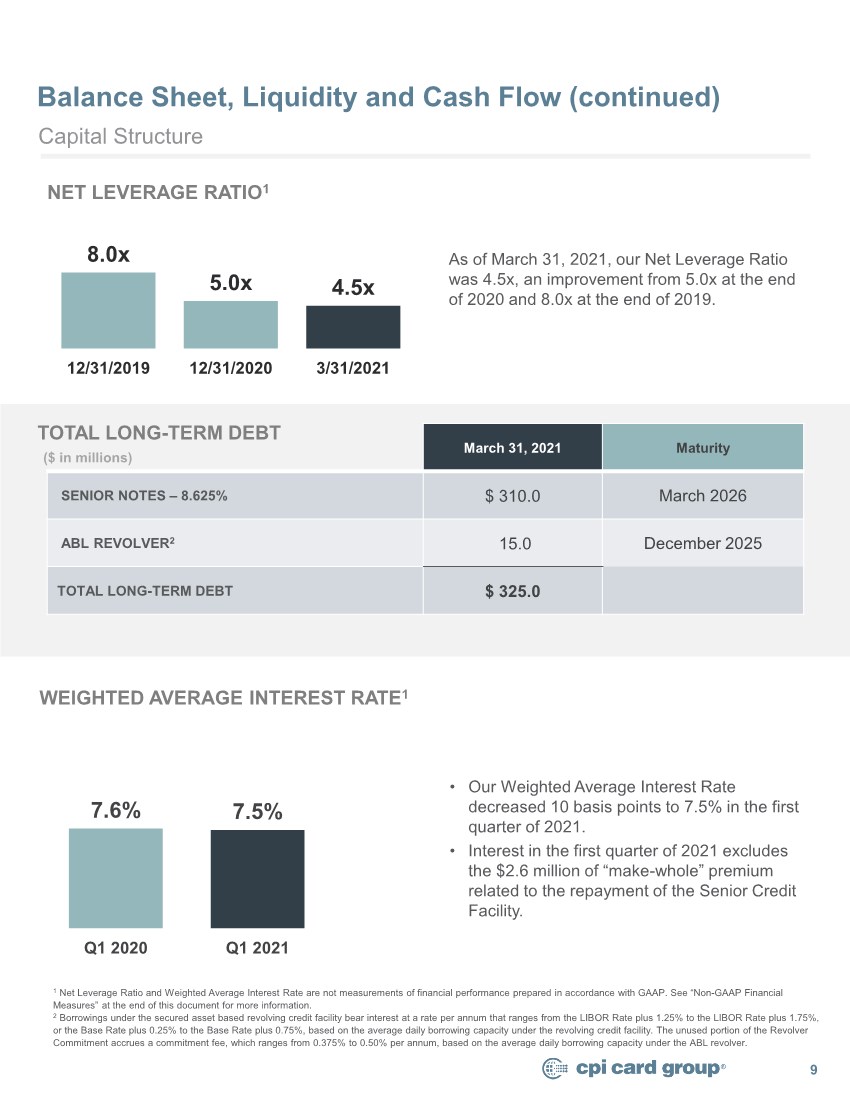

| Balance Sheet, Liquidity and Cash Flow (continued) 9 March 31, 2021 Maturity SENIOR NOTES – 8.625% $ 310.0 March 2026 ABL REVOLVER2 15.0 December 2025 TOTAL LONG-TERM DEBT $ 325.0 TOTAL LONG-TERM DEBT 7.6% 7.5% Q1 2020 Q1 2021 8.0x 5.0x 4.5x 12/31/2019 12/31/2020 3/31/2021 NET LEVERAGE RATIO1 1 Net Leverage Ratio and Weighted Average Interest Rate are not measurements of financial performance prepared in accordance with GAAP. See “Non-GAAP Financial Measures” at the end of this document for more information. 2 Borrowings under the secured asset based revolving credit facility bear interest at a rate per annum that ranges from the LIBOR Rate plus 1.25% to the LIBOR Rate plus 1.75%, or the Base Rate plus 0.25% to the Base Rate plus 0.75%, based on the average daily borrowing capacity under the revolving credit facility. The unused portion of the Revolver Commitment accrues a commitment fee, which ranges from 0.375% to 0.50% per annum, based on the average daily borrowing capacity under the ABL revolver. As of March 31, 2021, our Net Leverage Ratio was 4.5x, an improvement from 5.0x at the end of 2020 and 8.0x at the end of 2019. WEIGHTED AVERAGE INTEREST RATE1 • Our Weighted Average Interest Rate decreased 10 basis points to 7.5% in the first quarter of 2021. • Interest in the first quarter of 2021 excludes the $2.6 million of “make-whole” premium related to the repayment of the Senior Credit Facility. Capital Structure ($ in millions) |

| 10 Summary We are proud of the way our organization has demonstrated an unwavering commitment to the health and safety of our employees while exhibiting extraordinary agility to continue to support our customers. We aim to scale our solutions, diversify our offerings and expand our customer base through continued execution of our strategies. Our goals remain focused on leveraging and building upon the market- leading and innovative solutions CPI is known for, including contactless secure cards, eco-focused solutions, SaaS-based instant issuance, personalization and prepaid solutions. As we look ahead, our objective is to profitably gain overall market share by continued focus on our four strategic priorities. We believe we are well-equipped to build upon our position as a partner of choice. Next quarter we plan to host an earnings call to report Q2 2021 results. We look forward to continuing to update you on the business. Q1 2021 | |

| Certain statements and information in this presentation (as well as information included in other written or oral statements we make from time to time) may contain or constitute “forward-looking statements” within the meaning of the Private Securities Litigation Reform Act of 1995, Section 27A of the Securities Act of 1933, as amended, and Section 21E of the Securities Exchange Act of 1934, as amended. The words “believe,” “estimate,” “project,” “expect,” “anticipate,” “plan,” “intend,” “foresee,” “should,” “would,” “could,” “continue,” “committed,” “guides,” “provides guidance,” “provides outlook” or other similar expressions are intended to identify forward-looking statements, which are not historical in nature. These forward-looking statements, including statements about our strategic initiatives and market opportunities, are based on our current expectations and beliefs concerning future developments and their potential effect on us and other information currently available. Such forward-looking statements, because they relate to future events, are by their very nature subject to many important risks and uncertainties that could cause actual results or other events to differ materially from those contemplated. These risks and uncertainties include, but are not limited to: the potential effects of COVID-19 on our business, including our supply-chain, customer demand, workforce, operations and ability to comply with certain covenants in our credit facilities; our lack of eligibility to participate in government relief programs related to COVID-19 or inability to realize material benefits from such programs; our substantial indebtedness, including inability to make debt service payments or refinance such indebtedness; the restrictive terms of our credit facilities and covenants of future agreements governing indebtedness and the resulting restraints on our ability to pursue our business strategies; our limited ability to raise capital in the future; a disruption or other failure in our supply chain; the effects of current or additional U.S. government tariffs as well as economic downturns or disruptions, including delays or interruptions in our ability to source raw materials and components used in our products; system security risks, data protection breaches and cyber-attacks; interruptions in our operations, including our information technology systems, or in the operations of the third parties that operate the data centers or computing infrastructure on which we rely; failure to comply with regulations, customer contractual requirements and evolving industry standards regarding consumer privacy and data use and security; disruptions in production at one or more of our facilities; our failure to retain our existing customers or identify and attract new customers; our inability to recruit, retain and develop qualified personnel, including key personnel; our inability to adequately protect our trade secrets and intellectual property rights from misappropriation, infringement claims brought against us and risks related to open source software; defects in our software; problems in production quality, materials and process; a loss of market share or a decline in profitability resulting from competition; our inability to develop, introduce and commercialize new products; new and developing technologies that make our existing technology solutions and products obsolete or less relevant or our failure to introduce new products and services in a timely manner; costs and impacts to our financial results relating to the obligatory collection of sales tax and claims for uncollected sales tax in states that impose sales tax collection requirements on out-of-state businesses, as well as new U.S. tax legislation increasing the corporate income tax rate and challenges to our income tax positions; failure to meet the continued listing standards of the Toronto Stock Exchange or the rules of the OTCQX® Best Market; a decrease in the value of our common stock combined with our common stock not being traded on a United States national securities exchange, which may prevent investors or potential investors from investing or achieving a meaningful degree of liquidity; quarterly variation in our operating results; our inability to realize the full value of our long-lived assets; our failure to operate our business in accordance with the Payment Card Industry Security Standards Council security standards or other industry standards; a decline in U.S. and global market and economic conditions and resulting decreases in consumer and business spending; costs relating to product defects and any related product liability and/or warranty claims; our dependence on licensing arrangements; risks associated with international operations; non-compliance with, and changes in, laws in the United States and in foreign jurisdictions in which we operate and sell our products and services; the effect of legal and regulatory proceedings; our ability to comply with a wide variety of environmental, health and safety laws and regulations and the exposure to liability for any failure to comply; risks associated with the majority stockholders’ ownership of our stock; the influence of securities analysts over the trading market for and price of our common stock; our inability to sell, exit, reconfigure or consolidate businesses or facilities that no longer meet with our strategy; potential conflicts of interest that may arise due to our board of directors being comprised in part of directors who are principals of our majority stockholders; certain provisions of our organizational documents and other contractual provisions that may delay or prevent a change in control and make it difficult for stockholders other than our majority stockholders to change the composition of our board of directors; and other risks that are described in Part I, Item 1A – Risk Factors in our Annual Report on Form 10-K for the year ended December 31, 2020 filed with the SEC on February 25, 2021 and our other reports filed from time to time with the Securities and Exchange Commission (the “SEC”). We caution and advise readers not to place undue reliance on forward-looking statements, which speak only as of the date hereof. These statements are based on assumptions that may not be realized and involve risks and uncertainties that could cause actual results or other events to differ materially from the expectations and beliefs contained herein. We undertake no obligation to publicly update or revise any forward-looking statements after the date they are made, whether as a result of new information, future events or otherwise. Cautionary Statement on Forward-Looking Statements 11 Non-GAAP Financial Measures In addition to financial results reported in accordance with U.S. generally accepted accounting principles (“GAAP”), we have provided the following non-GAAP financial measures in this presentation, all reported on a continuing operations basis: Adjusted Net Income, Adjusted Diluted Earnings Per Share, EBITDA, Adjusted EBITDA, Adjusted EBITDA margin, and Free Cash Flow. These non-GAAP financial measures are utilized by management in comparing our operating performance on a consistent basis between fiscal periods. We believe that these financial measures are appropriate to enhance an overall understanding of our underlying operating performance trends compared to historical and prospective periods and our peers. Management also believes that these measures are useful to investors in their analysis of our results of operations and provide improved comparability between fiscal periods. Non-GAAP financial measures should not be considered in isolation from, or as a substitute for, financial information calculated in accordance with GAAP. Our non-GAAP measures may be different from similarly titled measures of other companies. Additional information relating to certain financial measures, including our non-GAAP financial measures, is available in our most recent earnings release and on our website at http://investor.cpicardgroup.com. Q1 2021 | |

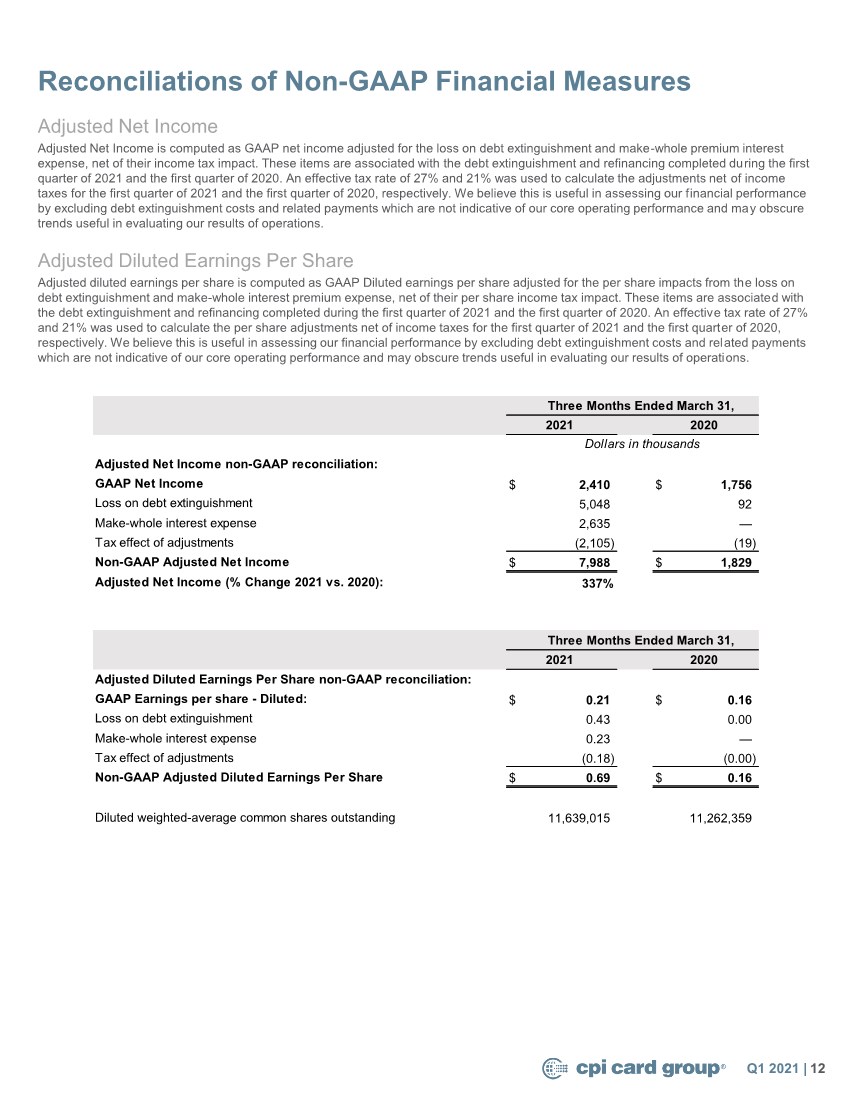

| Reconciliations of Non-GAAP Financial Measures 12 Adjusted Net Income Adjusted Net Income is computed as GAAP net income adjusted for the loss on debt extinguishment and make-whole premium interest expense, net of their income tax impact. These items are associated with the debt extinguishment and refinancing completed during the first quarter of 2021 and the first quarter of 2020. An effective tax rate of 27% and 21% was used to calculate the adjustments net of income taxes for the first quarter of 2021 and the first quarter of 2020, respectively. We believe this is useful in assessing our financial performance by excluding debt extinguishment costs and related payments which are not indicative of our core operating performance and may obscure trends useful in evaluating our results of operations. Adjusted Diluted Earnings Per Share Adjusted diluted earnings per share is computed as GAAP Diluted earnings per share adjusted for the per share impacts from the loss on debt extinguishment and make-whole interest premium expense, net of their per share income tax impact. These items are associated with the debt extinguishment and refinancing completed during the first quarter of 2021 and the first quarter of 2020. An effective tax rate of 27% and 21% was used to calculate the per share adjustments net of income taxes for the first quarter of 2021 and the first quarter of 2020, respectively. We believe this is useful in assessing our financial performance by excluding debt extinguishment costs and related payments which are not indicative of our core operating performance and may obscure trends useful in evaluating our results of operations. Q1 2021 | Adjusted Net Income non-GAAP reconciliation: GAAP Net Income $ 2,410 $ 1,756 Loss on debt extinguishment 5,048 92 Make-whole interest expense 2,635 — Tax effect of adjustments (2,105) (19) Non-GAAP Adjusted Net Income $ 7,988 $ 1,829 Adjusted Net Income (% Change 2021 vs. 2020): 337% Adjusted Diluted Earnings Per Share non-GAAP reconciliation: GAAP Earnings per share - Diluted: $ 0.21 $ 0.16 Loss on debt extinguishment 0.43 0.00 Make-whole interest expense 0.23 — Tax effect of adjustments (0.18) (0.00) Non-GAAP Adjusted Diluted Earnings Per Share $ 0.69 $ 0.16 Diluted weighted-average common shares outstanding 11,639,015 11,262,359 Three Months Ended March 31, 2021 2020 Dollars in thousands Three Months Ended March 31, 2021 2020 |

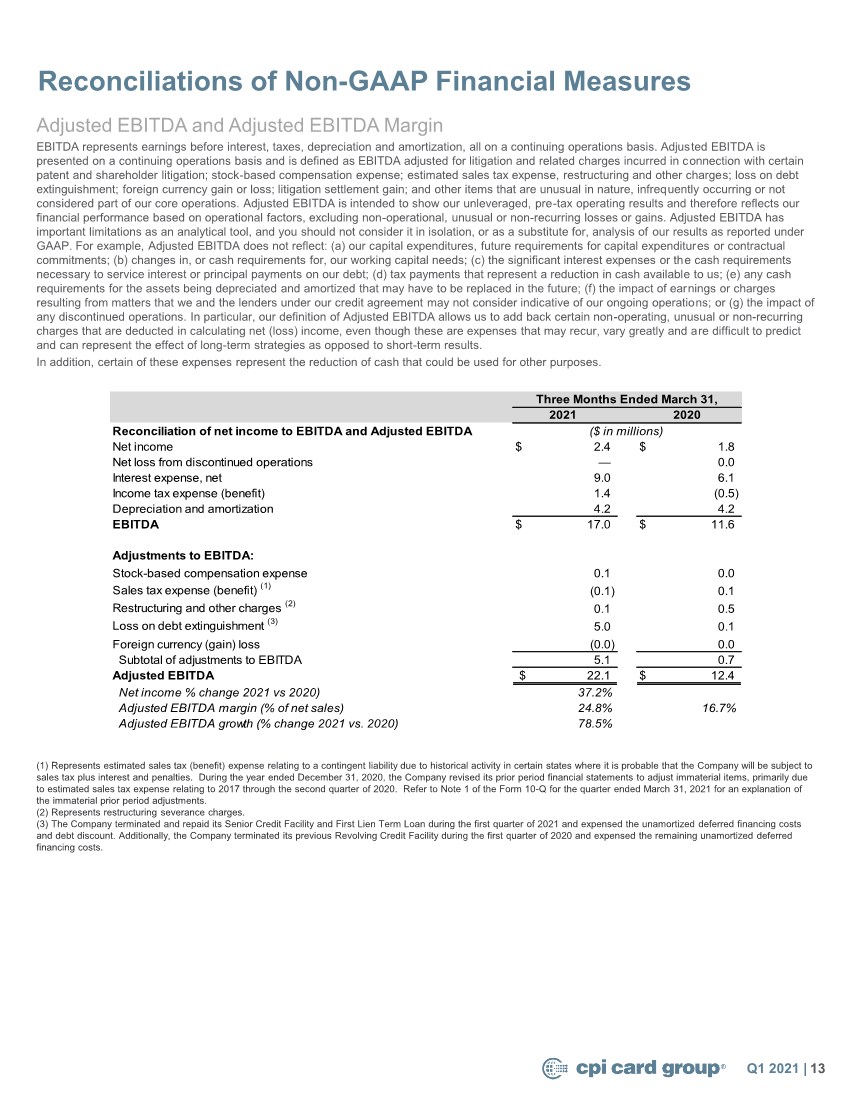

| Reconciliations of Non-GAAP Financial Measures 13 Adjusted EBITDA and Adjusted EBITDA Margin EBITDA represents earnings before interest, taxes, depreciation and amortization, all on a continuing operations basis. Adjusted EBITDA is presented on a continuing operations basis and is defined as EBITDA adjusted for litigation and related charges incurred in connection with certain patent and shareholder litigation; stock-based compensation expense; estimated sales tax expense, restructuring and other charges; loss on debt extinguishment; foreign currency gain or loss; litigation settlement gain; and other items that are unusual in nature, infrequently occurring or not considered part of our core operations. Adjusted EBITDA is intended to show our unleveraged, pre-tax operating results and therefore reflects our financial performance based on operational factors, excluding non-operational, unusual or non-recurring losses or gains. Adjusted EBITDA has important limitations as an analytical tool, and you should not consider it in isolation, or as a substitute for, analysis of our results as reported under GAAP. For example, Adjusted EBITDA does not reflect: (a) our capital expenditures, future requirements for capital expenditures or contractual commitments; (b) changes in, or cash requirements for, our working capital needs; (c) the significant interest expenses or the cash requirements necessary to service interest or principal payments on our debt; (d) tax payments that represent a reduction in cash available to us; (e) any cash requirements for the assets being depreciated and amortized that may have to be replaced in the future; (f) the impact of earnings or charges resulting from matters that we and the lenders under our credit agreement may not consider indicative of our ongoing operations; or (g) the impact of any discontinued operations. In particular, our definition of Adjusted EBITDA allows us to add back certain non-operating, unusual or non-recurring charges that are deducted in calculating net (loss) income, even though these are expenses that may recur, vary greatly and are difficult to predict and can represent the effect of long-term strategies as opposed to short-term results. In addition, certain of these expenses represent the reduction of cash that could be used for other purposes. Q1 2021 | (1) Represents estimated sales tax (benefit) expense relating to a contingent liability due to historical activity in certain states where it is probable that the Company will be subject to sales tax plus interest and penalties. During the year ended December 31, 2020, the Company revised its prior period financial statements to adjust immaterial items, primarily due to estimated sales tax expense relating to 2017 through the second quarter of 2020. Refer to Note 1 of the Form 10-Q for the quarter ended March 31, 2021 for an explanation of the immaterial prior period adjustments. (2) Represents restructuring severance charges. (3) The Company terminated and repaid its Senior Credit Facility and First Lien Term Loan during the first quarter of 2021 and expensed the unamortized deferred financing costs and debt discount. Additionally, the Company terminated its previous Revolving Credit Facility during the first quarter of 2020 and expensed the remaining unamortized deferred financing costs. Reconciliation of net income to EBITDA and Adjusted EBITDA Net income $ 2.4 $ 1.8 Net loss from discontinued operations — 0.0 Interest expense, net 9.0 6.1 Income tax expense (benefit) 1.4 (0.5) Depreciation and amortization 4.2 4.2 EBITDA $ 17.0 $ 11.6 Adjustments to EBITDA: Stock-based compensation expense 0.1 0.0 Sales tax expense (benefit) (1) (0.1) 0.1 Restructuring and other charges (2) 0.1 0.5 Loss on debt extinguishment (3) 5.0 0.1 Foreign currency (gain) loss (0.0) 0.0 Subtotal of adjustments to EBITDA 5.1 0.7 Adjusted EBITDA $ 22.1 $ 12.4 Net income % change 2021 vs 2020) 37.2% Adjusted EBITDA margin (% of net sales) 24.8% 16.7% Adjusted EBITDA growth (% change 2021 vs. 2020) 78.5% Three Months Ended March 31, 2021 2020 ($ in millions) |

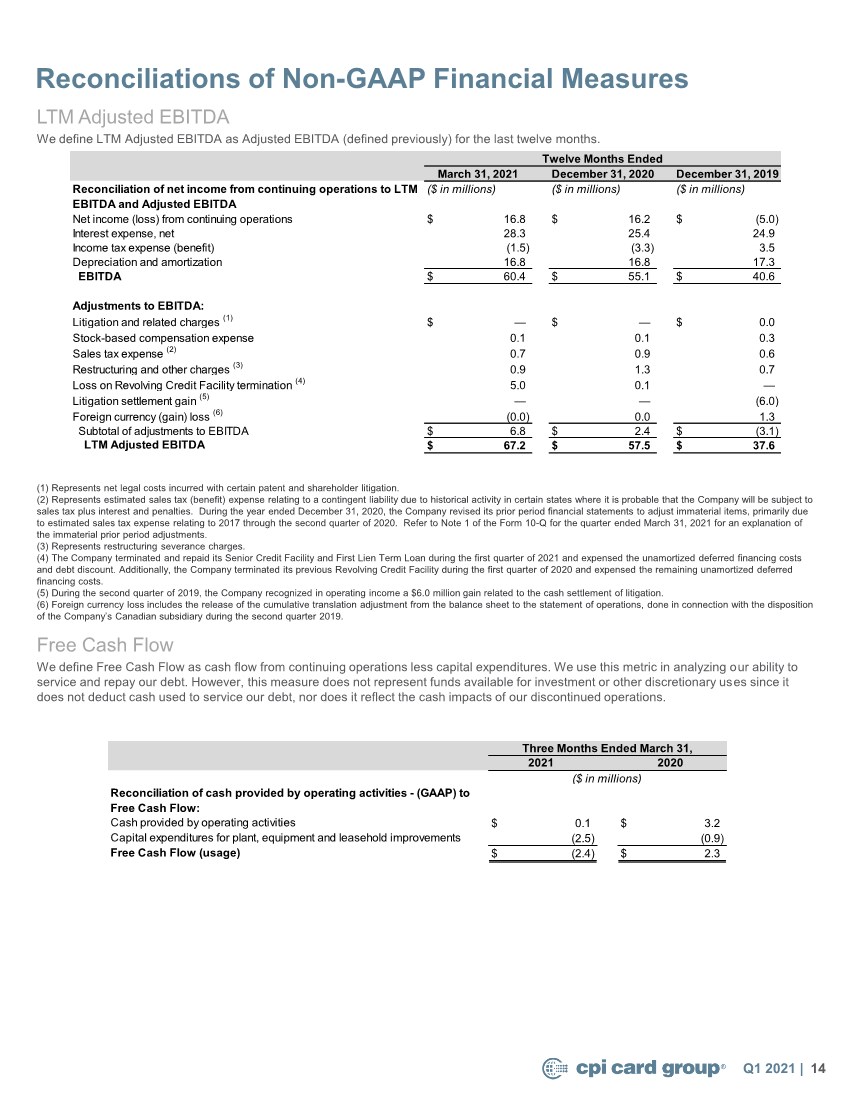

| 14 Reconciliations of Non-GAAP Financial Measures LTM Adjusted EBITDA We define LTM Adjusted EBITDA as Adjusted EBITDA (defined previously) for the last twelve months. Q1 2021 | Free Cash Flow We define Free Cash Flow as cash flow from continuing operations less capital expenditures. We use this metric in analyzing our ability to service and repay our debt. However, this measure does not represent funds available for investment or other discretionary uses since it does not deduct cash used to service our debt, nor does it reflect the cash impacts of our discontinued operations. (1) Represents net legal costs incurred with certain patent and shareholder litigation. (2) Represents estimated sales tax (benefit) expense relating to a contingent liability due to historical activity in certain states where it is probable that the Company will be subject to sales tax plus interest and penalties. During the year ended December 31, 2020, the Company revised its prior period financial statements to adjust immaterial items, primarily due to estimated sales tax expense relating to 2017 through the second quarter of 2020. Refer to Note 1 of the Form 10-Q for the quarter ended March 31, 2021 for an explanation of the immaterial prior period adjustments. (3) Represents restructuring severance charges. (4) The Company terminated and repaid its Senior Credit Facility and First Lien Term Loan during the first quarter of 2021 and expensed the unamortized deferred financing costs and debt discount. Additionally, the Company terminated its previous Revolving Credit Facility during the first quarter of 2020 and expensed the remaining unamortized deferred financing costs. (5) During the second quarter of 2019, the Company recognized in operating income a $6.0 million gain related to the cash settlement of litigation. (6) Foreign currency loss includes the release of the cumulative translation adjustment from the balance sheet to the statement of operations, done in connection with the disposition of the Company’s Canadian subsidiary during the second quarter 2019. Reconciliation of cash provided by operating activities - (GAAP) to Free Cash Flow: Cash provided by operating activities $ 0.1 $ 3.2 Capital expenditures for plant, equipment and leasehold improvements (2.5) (0.9) Free Cash Flow (usage) $ (2.4) $ 2.3 Three Months Ended March 31, 2021 2020 ($ in millions) Reconciliation of net income from continuing operations to LTM EBITDA and Adjusted EBITDA ($ in millions) ($ in millions) ($ in millions) Net income (loss) from continuing operations $ 16.8 $ 16.2 $ (5.0) Interest expense, net 28.3 25.4 24.9 Income tax expense (benefit) (1.5) (3.3) 3.5 Depreciation and amortization 16.8 16.8 17.3 EBITDA $ 60.4 $ 55.1 $ 40.6 Adjustments to EBITDA: Litigation and related charges (1) $ — $ — $ 0.0 Stock-based compensation expense 0.1 0.1 0.3 Sales tax expense (2) 0.7 0.9 0.6 Restructuring and other charges (3) 0.9 1.3 0.7 Loss on Revolving Credit Facility termination (4) 5.0 0.1 — Litigation settlement gain (5) — — (6.0) Foreign currency (gain) loss (6) (0.0) 0.0 1.3 Subtotal of adjustments to EBITDA $ 6.8 $ 2.4 $ (3.1) LTM Adjusted EBITDA $ 67.2 $ 57.5 $ 37.6 Twelve Months Ended March 31, 2021 December 31, 2020 December 31, 2019 |

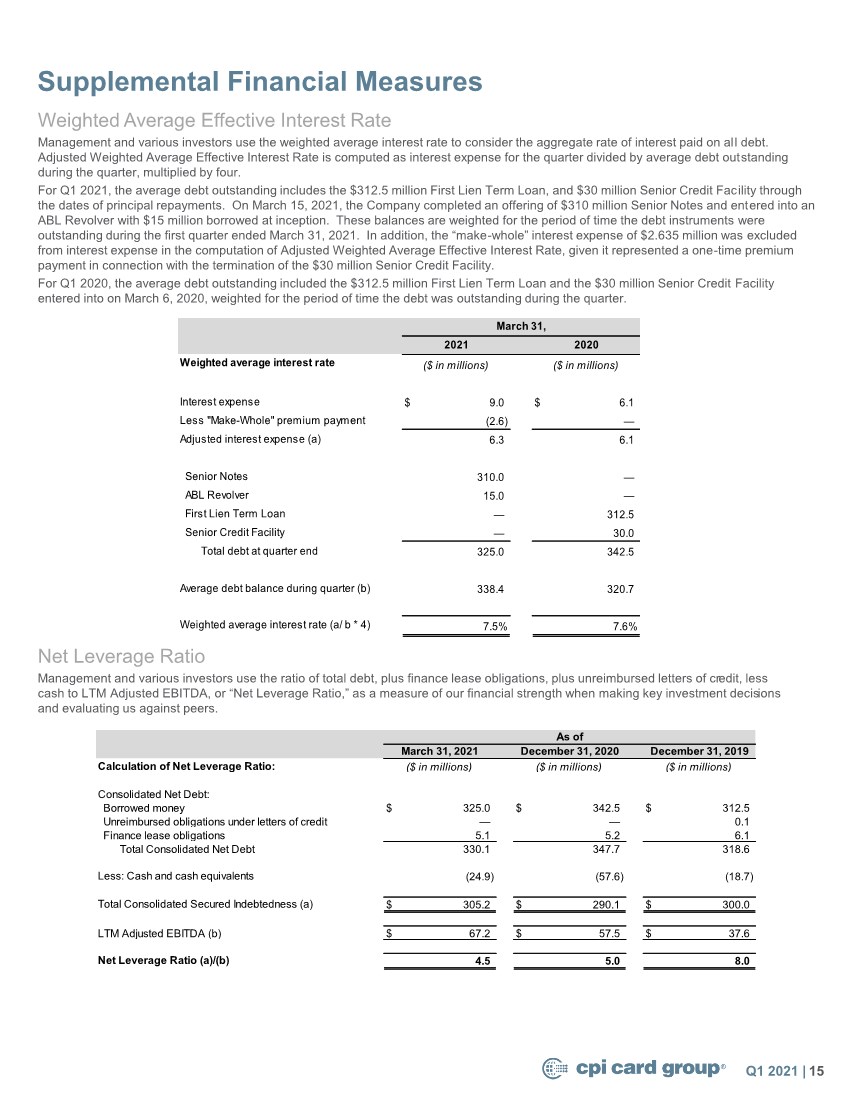

| Weighted average interest rate Interest expense $ 9.0 $ 6.1 Less "Make-Whole" premium payment (2.6) — Adjusted interest expense (a) 6.3 6.1 Senior Notes 310.0 — ABL Revolver 15.0 — First Lien Term Loan — 312.5 Senior Credit Facility — 30.0 Total debt at quarter end 325.0 342.5 Average debt balance during quarter (b) 338.4 320.7 Weighted average interest rate (a/ b * 4) 7.5% 7.6% ($ in millions) ($ in millions) March 31, 2021 2020 Supplemental Financial Measures 15 Weighted Average Effective Interest Rate Management and various investors use the weighted average interest rate to consider the aggregate rate of interest paid on all debt. Adjusted Weighted Average Effective Interest Rate is computed as interest expense for the quarter divided by average debt outstanding during the quarter, multiplied by four. For Q1 2021, the average debt outstanding includes the $312.5 million First Lien Term Loan, and $30 million Senior Credit Facility through the dates of principal repayments. On March 15, 2021, the Company completed an offering of $310 million Senior Notes and entered into an ABL Revolver with $15 million borrowed at inception. These balances are weighted for the period of time the debt instruments were outstanding during the first quarter ended March 31, 2021. In addition, the “make-whole” interest expense of $2.635 million was excluded from interest expense in the computation of Adjusted Weighted Average Effective Interest Rate, given it represented a one-time premium payment in connection with the termination of the $30 million Senior Credit Facility. For Q1 2020, the average debt outstanding included the $312.5 million First Lien Term Loan and the $30 million Senior Credit Facility entered into on March 6, 2020, weighted for the period of time the debt was outstanding during the quarter. Q1 2021 | Net Leverage Ratio Management and various investors use the ratio of total debt, plus finance lease obligations, plus unreimbursed letters of credit, less cash to LTM Adjusted EBITDA, or “Net Leverage Ratio,” as a measure of our financial strength when making key investment decisions and evaluating us against peers. Calculation of Net Leverage Ratio: Consolidated Net Debt: Borrowed money $ 325.0 $ 342.5 $ 312.5 Unreimbursed obligations under letters of credit — — 0.1 Finance lease obligations 5.1 5.2 6.1 Total Consolidated Net Debt 330.1 347.7 318.6 Less: Cash and cash equivalents (24.9) (57.6) (18.7) Total Consolidated Secured Indebtedness (a) $ 305.2 $ 290.1 $ 300.0 LTM Adjusted EBITDA (b) $ 67.2 $ 57.5 $ 37.6 Net Leverage Ratio (a)/(b) 4.5 5.0 8.0 December 31, 2019 ($ in millions) March 31, 2021 ($ in millions) As of December 31, 2020 ($ in millions) |