Attached files

| file | filename |

|---|---|

| 8-K - 8-K - ROYAL GOLD INC | rgld-20210505x8k.htm |

| EX-99.1 - EX-99.1 - ROYAL GOLD INC | rgld-20210505xex99d1.htm |

Exhibit 99.2

| Fiscal Q3 2021 Results May 6, 2021 |

| 2 ROYAL GOLD, INC. | FISCAL Q3 2021 RESULTS | MAY 6, 2021 Cautionary Statement Forward-Looking Statements: This presentation includes “forward-looking statements” within the meaning of U.S. federal securities laws. Forward-looking statements are any statements other than statements of historical fact. Forward-looking statements are not guarantees of future performance, and actual results may differ materially from these statements. Forward-looking statements are often identified by words like “will,” “may,” “could,” “should,” “would,” “believe,” “estimate,” “expect,” “anticipate,” “plan,” “forecast,” “potential,” “intend,” “continue,” “project,” or negatives of these words or similar expressions. Forward-looking statements include, among others, the following: statements about our expected financial performance, including revenue, expenses, earnings or cash flow; operators’ expected operating and financial performance, including production, deliveries, mine plans and reserves, development, cash flows and capital expenditures; planned and potential acquisitions or dispositions, including funding schedules and conditions; liquidity, financing and shareholder returns; our overall investment portfolio; macroeconomic and market conditions including the impacts of COVID-19; prices for gold, silver, copper, nickel and other metals; potential impairments; or tax changes. Factors that could cause actual results to differ materially from these forward-looking statements include, among others, the following: a lower-price environment for gold, silver, copper, nickel or other metals; operating activities or financial performance of properties on which we hold stream or royalty interests, including variations between actual and forecasted performance, operators’ ability to complete projects on schedule and as planned, changes to mine plans and reserves, liquidity needs, mining and environmental hazards, labor disputes, distribution and supply chain disruptions, permitting and licensing issues, contractual issues involving our stream or royalty agreements, or operational disruptions due to COVID-19; risks associated with doing business in foreign countries; our ability to identify, finance, value and complete acquisitions; adverse economic and market conditions; changes in laws or regulations governing us, operators or operating properties; changes in management and key employees; and other factors described in our reports filed with the Securities and Exchange Commission, including our Form 10-K for the fiscal year ended June 30, 2020, and subsequent Forms 10-Q. Most of these factors are beyond our ability to predict or control. Forward-looking statements speak only as of the date on which they are made. We disclaim any obligation to update any forward-looking statements, except as required by law. Readers are cautioned not to put undue reliance on forward-looking statements. Statement Regarding Third-party Information: Certain information provided in this presentation, including production estimates, has been provided to us by the operators of the relevant properties or is publicly available information filed by these operators with applicable securities regulatory bodies, including the Securities and Exchange Commission. Royal Gold has not verified, and is not in a position to verify, and expressly disclaims any responsibility for the accuracy, completeness or fairness of any such third-party information and refers the reader to the public reports filed by the operators for information regarding those properties. Information in this presentation concerning the Khoemacau Copper Project was provided to the Company by Cupric Canyon Capital L.P., the privately-held owner and developer of Khoemacau. Such information may not have been prepared in accordance with applicable laws, stock exchange rules or international standards governing preparation and public disclosure of technical data and information relating to mineral properties. Royal Gold has not verified, and is not in a position to verify, and expressly disclaims any responsibility for the accuracy, completeness or fairness of this third-party information, and investors are cautioned not to rely upon this information. |

| 3 ROYAL GOLD, INC. | FISCAL Q3 2021 RESULTS | MAY 6, 2021 Today’s Speakers Bill Heissenbuttel President and CEO Paul Libner CFO and Treasurer Mark Isto Executive VP and COO, Royal Gold Corp. |

| 4 ROYAL GOLD, INC. | FISCAL Q3 2021 RESULTS | MAY 6, 2021 Q3 2021 Overview • Highlights • Revenue of $142.6M • $54.0M net income, or $0.82/share • $0.84/share after adjustments1 • $92.2M cash flow from operations • $19.7M dividends paid • $150M of debt, $220M of net cash1, ~$1.2B total available liquidity • Notable developments • Provided $32.6M funding to Khoemacau to complete 80% base silver stream • Further $28.6M funded after quarter-end and stream increased to 84% of payable silver • Funded social initiatives with Pueblo Viejo Joint Venture and Golden Star |

| 5 ROYAL GOLD, INC. | FISCAL Q3 2021 RESULTS | MAY 6, 2021 Recent Developments • Khoemacau progress3 • Overall construction progress ~92% • $28.6M contribution made April 7 • $10.6M stream financing – increases silver stream to 84% • $18.0M debt financing • Target startup timeline: • Plant commissioning – underway • First concentrate shipment – calendar Q3 • Ramp-up to nameplate capacity – calendar Q4 • Steady state production – beginning of calendar 2022 Underground training facility |

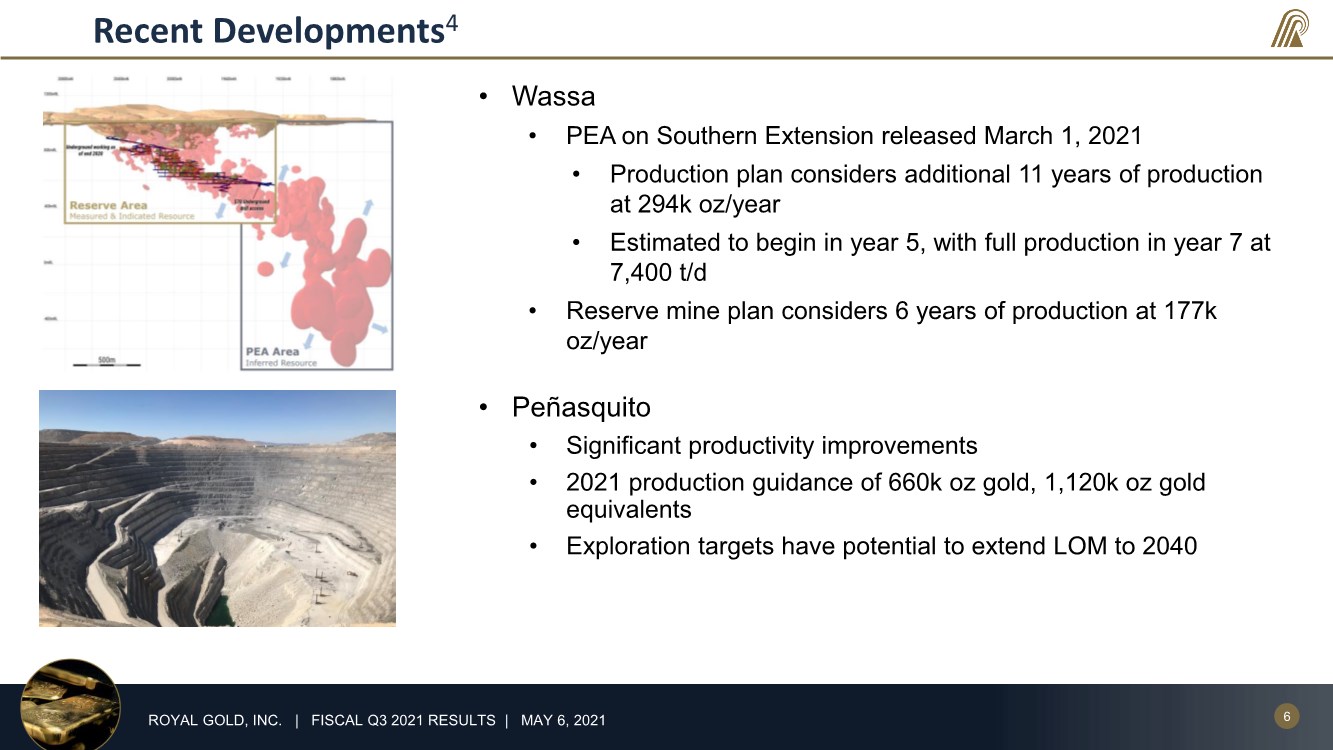

| 6 ROYAL GOLD, INC. | FISCAL Q3 2021 RESULTS | MAY 6, 2021 Recent Developments4 • Wassa • PEA on Southern Extension released March 1, 2021 • Production plan considers additional 11 years of production at 294k oz/year • Estimated to begin in year 5, with full production in year 7 at 7,400 t/d • Reserve mine plan considers 6 years of production at 177k oz/year • Peñasquito • Significant productivity improvements • 2021 production guidance of 660k oz gold, 1,120k oz gold equivalents • Exploration targets have potential to extend LOM to 2040 |

| 7 ROYAL GOLD, INC. | FISCAL Q3 2021 RESULTS | MAY 6, 2021 Recent Developments4 • Pueblo Viejo • Process plant expansion: • Overall engineering 65% complete, procurement contracts and purchase orders being placed • Tailings expansion: • Social, environmental and technical studies advancing • Cortez • 3.5M oz Proven & Probable Reserves, Dec. 31, 2020 • Gold production attributable to Royal Gold royalty areas: • 2021: 350-375k oz • 2022-2026 (inclusive): 415k oz/year • Royal Gold interest equivalent to ~8% gross smelter royalty (above $470/oz gold price, assuming relevant deductions) |

| 8 ROYAL GOLD, INC. | FISCAL Q3 2021 RESULTS | MAY 6, 2021 Fiscal Q3 Financial Results • $142.6M revenue • Volume of 79,500 GEOs2 • Strong contribution from royalty segment • Higher gold, silver, copper prices compared to prior year quarter • $54.0M net income, or $0.82/share • $0.84/share, adjusted to exclude1: • $0.04/share discrete tax expense related to realizability of deferred tax assets • $0.02/share gain on fair value of equity securities (net of $0.01/share tax) • $92.2M cash flow from operations • Guidance: • Fiscal Q4 2021 stream segment: • 60,000-65,000 GEO sales • 31,000-36,000 GEO ending inventory • Full year fiscal 2021: • Decreased to $540-590/GEO DD&A2 • 19-23% effective tax rate |

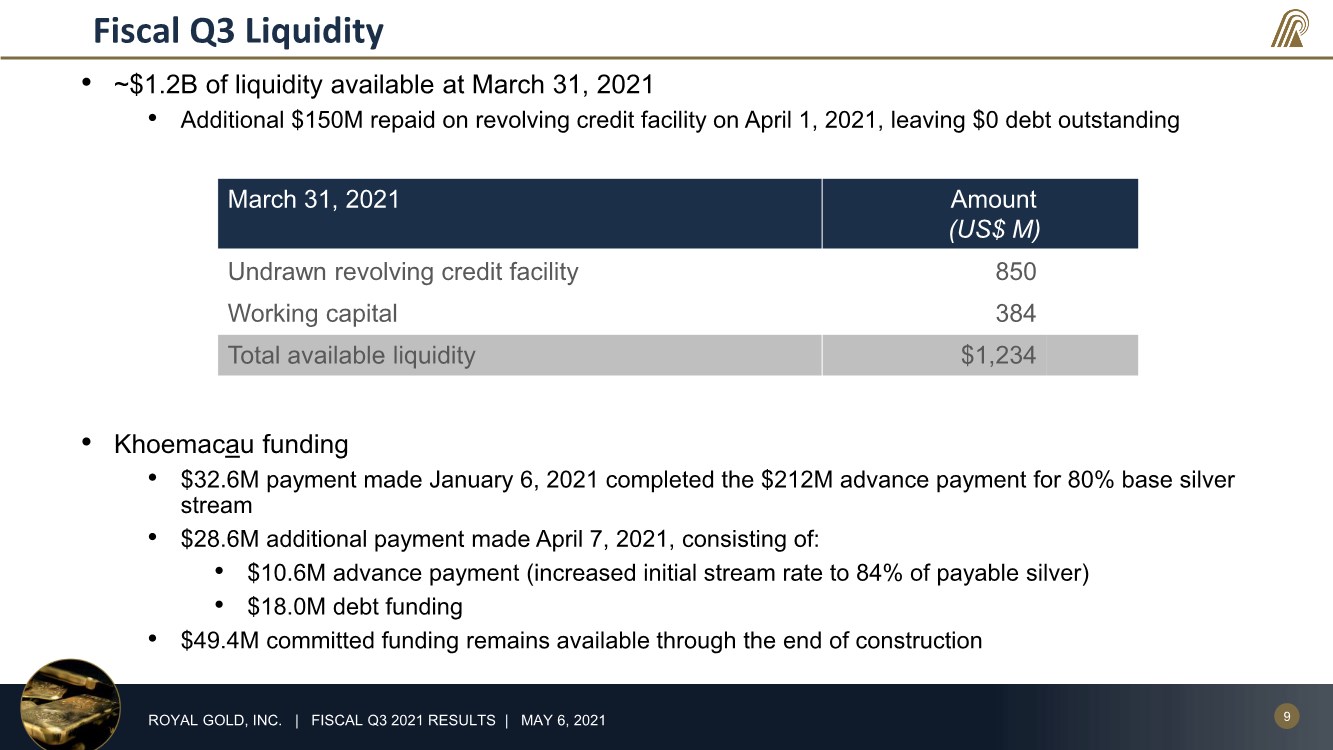

| 9 ROYAL GOLD, INC. | FISCAL Q3 2021 RESULTS | MAY 6, 2021 Fiscal Q3 Liquidity • ~$1.2B of liquidity available at March 31, 2021 • Additional $150M repaid on revolving credit facility on April 1, 2021, leaving $0 debt outstanding • Khoemacau funding • $32.6M payment made January 6, 2021 completed the $212M advance payment for 80% base silver stream • $28.6M additional payment made April 7, 2021, consisting of: • $10.6M advance payment (increased initial stream rate to 84% of payable silver) • $18.0M debt funding • $49.4M committed funding remains available through the end of construction March 31, 2021 Amount (US$ M) Undrawn revolving credit facility 850 Working capital 384 Total available liquidity $1,234 |

| 10 ROYAL GOLD, INC. | FISCAL Q3 2021 RESULTS | MAY 6, 2021 Endnotes 1. Adjusted net income, adjusted net income per share and net cash/debt are non-GAAP financial measures. See Schedule A to the accompanying press release dated May 5, 2021 for more information. 2. Gold Equivalent Ounces (“GEOs”) are calculated as reported revenue (in total or by reportable segment) for a period divided by the average gold price for that same period. DD&A per GEO is calculated as reported depreciation, depletion and amortization for a period divided by GEOs for that same period. 3. Certain information on this slide was provided to the Company by Khoemacau Copper Mining (Pty.) Limited, the majority owner and developer of the Khoemacau Project. The production, design, engineering, construction and equipment information, and other technical and economic information provided to the Company and presented here, or forming the basis of information presented here, is not publicly available. This information may not have been prepared in accordance with applicable laws, stock exchange rules or international standards governing preparation and public disclosure of technical data and information relating to mineral properties. The Company has not verified, and is not in a position to verify, and expressly disclaims any responsibility for the accuracy, completeness, or fairness of this third-party information, and investors are cautioned not to rely on this information. 4. Unless noted otherwise, all information on this slide has been provided by the operators of these properties or is publicly available information disclosed by the operators. |

| Tel. 303.573.1660 investorrelations@royalgold.com www.royalgold.com |