Attached files

| file | filename |

|---|---|

| 8-K - KIMBALL ELECTRONICS, INC. FORM 8-K - Kimball Electronics, Inc. | ke-20210505.htm |

| EX-99.1 - KIMBALL ELECTRONICS, INC. EXHIBIT 99.1 - Kimball Electronics, Inc. | exhibit9918k03312021q310q.htm |

Financial Results Third Quarter Fiscal Year 2021 Quarter Ended March 31, 2021 Supplementary Information to May 6, 2021 Earnings Conference Call Exhibit 99.2

Kimball Electronics (Nasdaq: KE) Safe Harbor Statement Certain statements contained within this supplementary information and any statements made during our earnings conference call today may be considered forward-looking under the Private Securities Litigation Reform Act of 1995. The statements may be identified by the use of words such as “expect,” “should,” “goal,” “predict,” “will,” “future,” “optimistic,” “confident,” and “believe.” These forward-looking statements are subject to risks and uncertainties including, without limitation, global economic conditions, geopolitical environment, global health emergencies including the COVID-19 pandemic, availability or cost of raw materials and components, foreign exchange fluctuations, and our ability to convert new business opportunities into customers and revenue. Additional cautionary statements regarding other risk factors that could have an effect on the future performance of Kimball Electronics, Inc. (the “Company”) are contained in the Company’s Annual Report on Form 10-K for the fiscal year ended June 30, 2020, our earnings release, and other filings with the Securities and Exchange Commission (the “SEC”). This supplementary information contains non-GAAP financial measures. The non-GAAP financial measures contained herein include Adjusted Selling & Administrative Expenses, Adjusted Operating Income, Adjusted Net Income, Adjusted EBITDA, and Return on Invested Capital (“ROIC”). Management believes these measures are useful and allow investors to meaningfully trend, analyze, and benchmark the performance of the Company’s core operations. Many of the Company’s internal performance measures that management uses to make certain operating decisions use these and other non-GAAP measures to enable meaningful trending of core operating metrics. Reconciliations of the reported GAAP numbers to these non-GAAP financial measures are included on the Reconciliation of Non-GAAP Results slide, which is the final slide of this supplementary information. 2

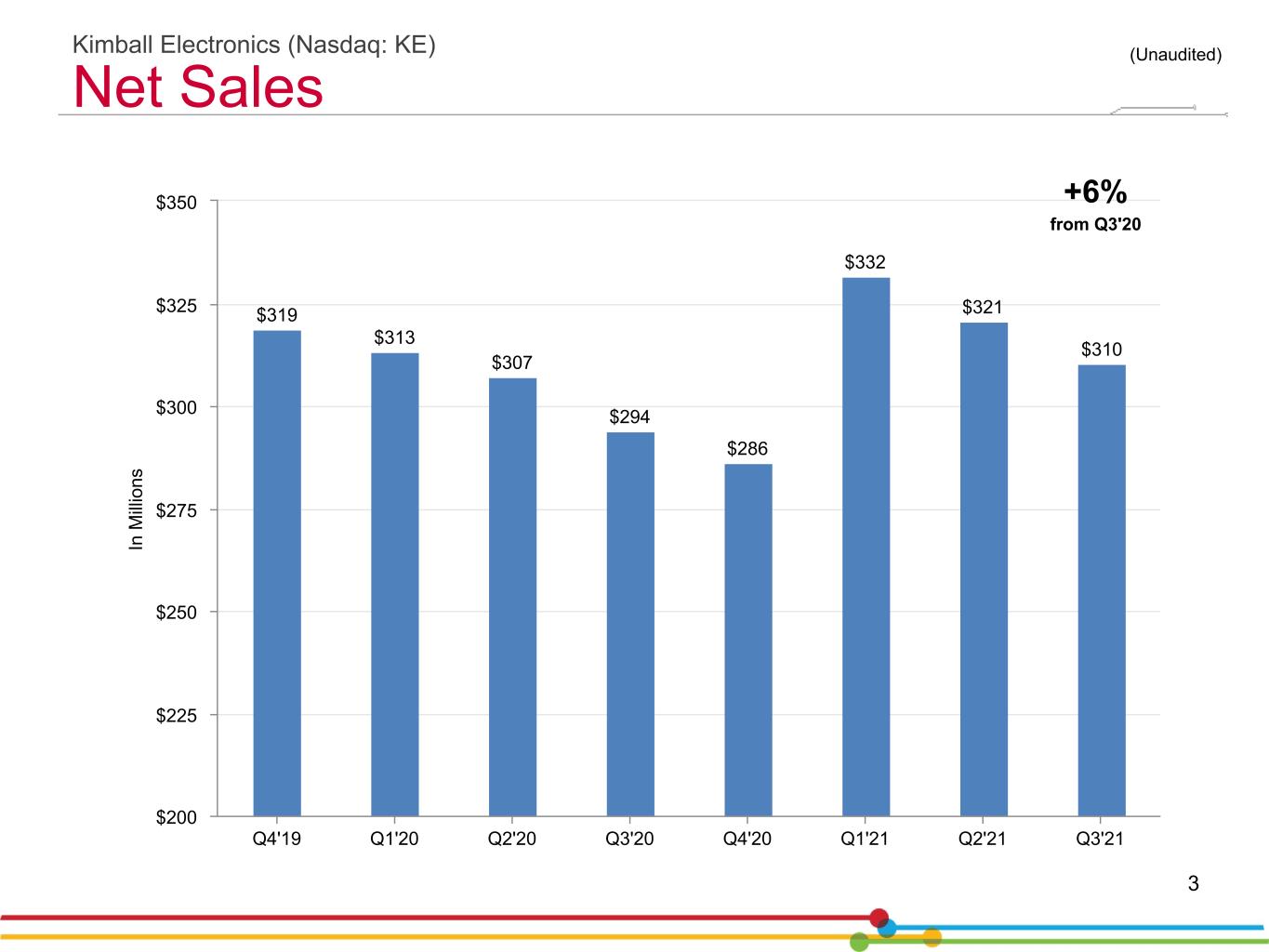

(Unaudited) In M ill io ns $319 $313 $307 $294 $286 $332 $321 $310 Q4'19 Q1'20 Q2'20 Q3'20 Q4'20 Q1'21 Q2'21 Q3'21 $200 $225 $250 $275 $300 $325 $350 +6% from Q3'20 3 Kimball Electronics (Nasdaq: KE) Net Sales

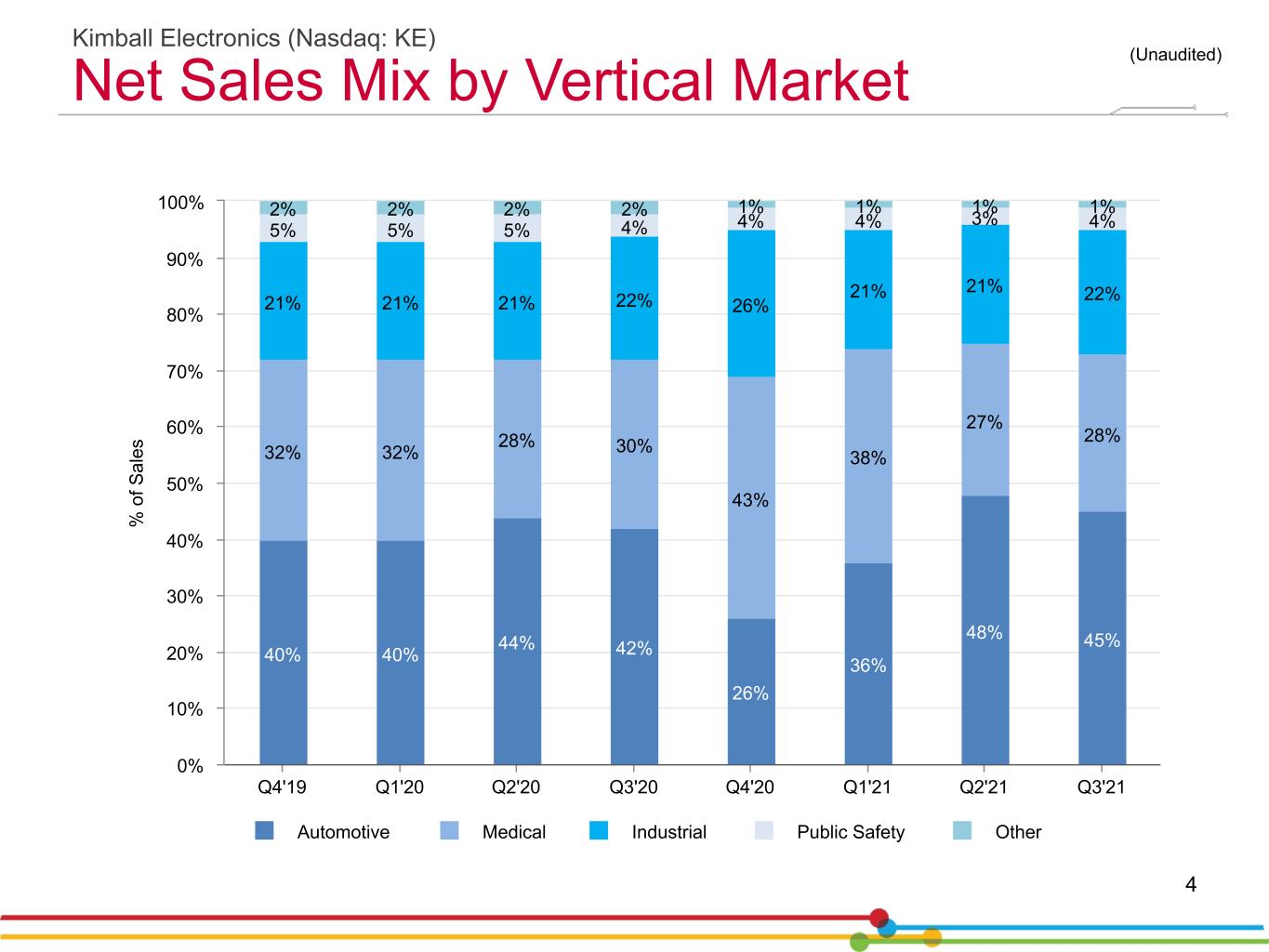

(Unaudited) % o f S al es 40% 40% 44% 42% 26% 36% 48% 45% 32% 32% 28% 30% 43% 38% 27% 28% 21% 21% 21% 22% 26% 21% 21% 22% 5% 5% 5% 4% 4% 4% 3% 4% 2% 2% 2% 2% 1% 1% 1% 1% Automotive Medical Industrial Public Safety Other Q4'19 Q1'20 Q2'20 Q3'20 Q4'20 Q1'21 Q2'21 Q3'21 0% 10% 20% 30% 40% 50% 60% 70% 80% 90% 100% 4 Kimball Electronics (Nasdaq: KE) Net Sales Mix by Vertical Market

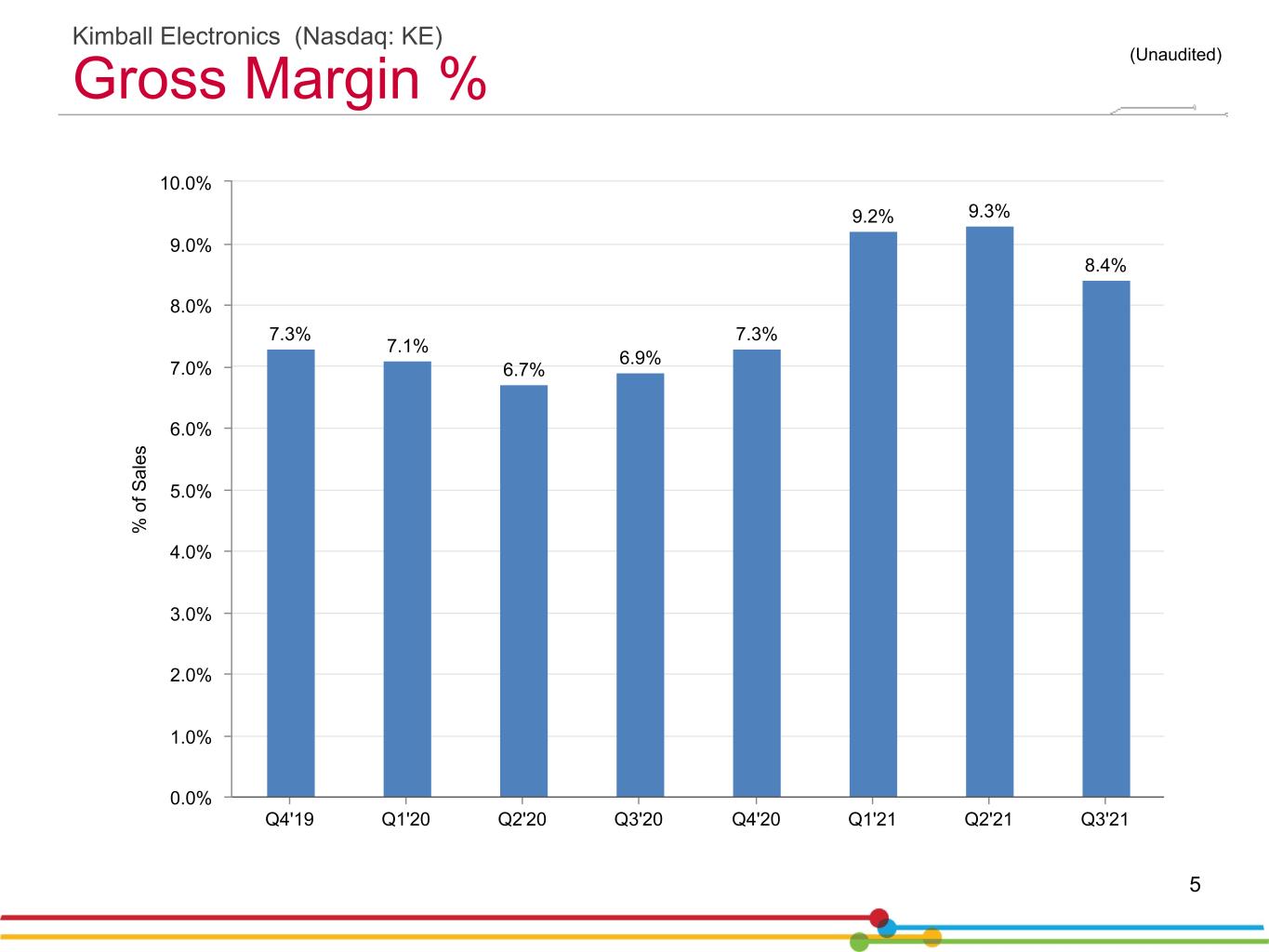

(Unaudited) % o f S al es 7.3% 7.1% 6.7% 6.9% 7.3% 9.2% 9.3% 8.4% Q4'19 Q1'20 Q2'20 Q3'20 Q4'20 Q1'21 Q2'21 Q3'21 0.0% 1.0% 2.0% 3.0% 4.0% 5.0% 6.0% 7.0% 8.0% 9.0% 10.0% 5 Kimball Electronics (Nasdaq: KE) Gross Margin %

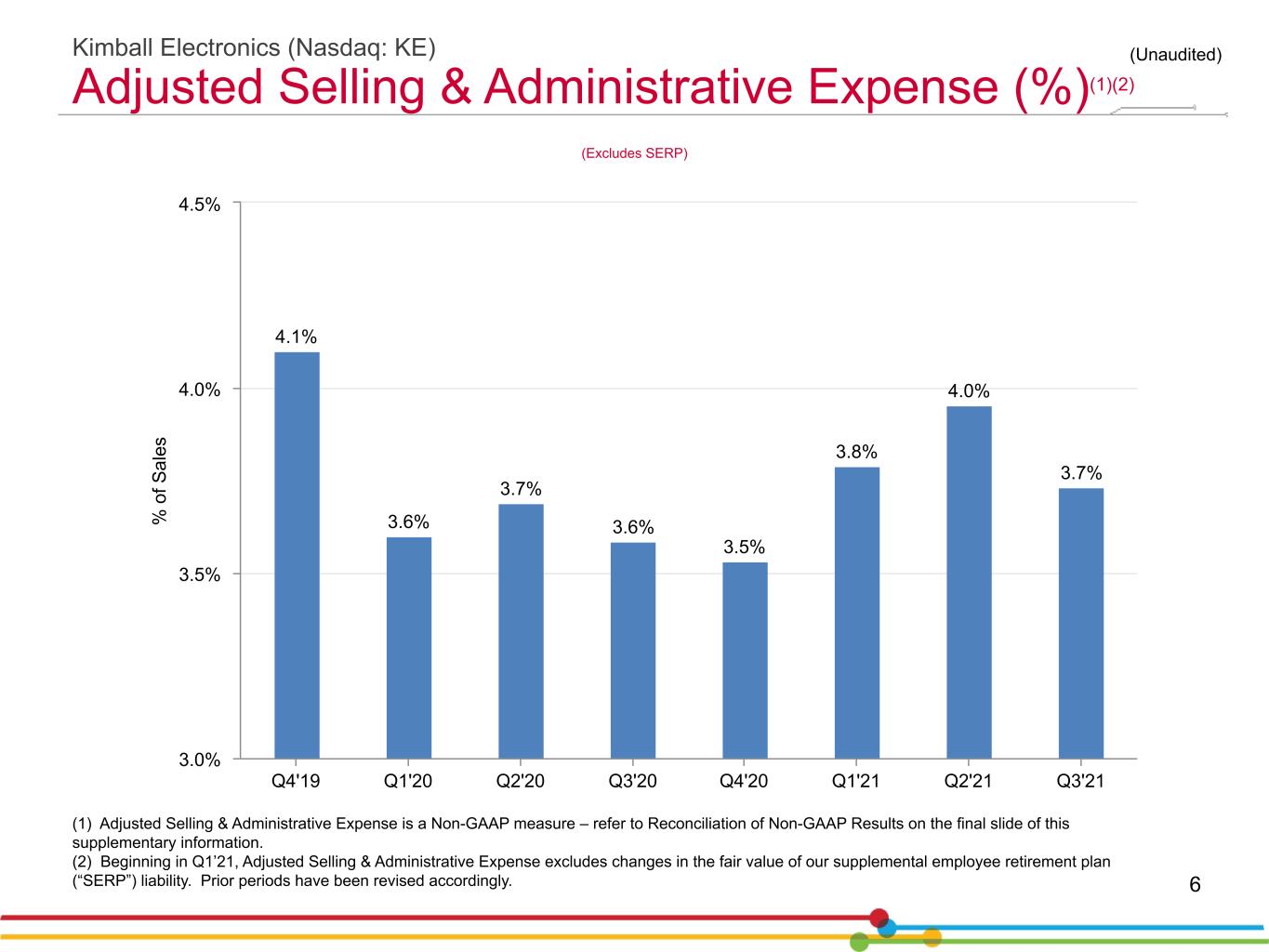

(Unaudited) % o f S al es 4.1% 3.6% 3.7% 3.6% 3.5% 3.8% 4.0% 3.7% Q4'19 Q1'20 Q2'20 Q3'20 Q4'20 Q1'21 Q2'21 Q3'21 3.0% 3.5% 4.0% 4.5% 6 Kimball Electronics (Nasdaq: KE) Adjusted Selling & Administrative Expense (%)(1)(2) (Excludes SERP) (1) Adjusted Selling & Administrative Expense is a Non-GAAP measure – refer to Reconciliation of Non-GAAP Results on the final slide of this supplementary information. (2) Beginning in Q1’21, Adjusted Selling & Administrative Expense excludes changes in the fair value of our supplemental employee retirement plan (“SERP”) liability. Prior periods have been revised accordingly.

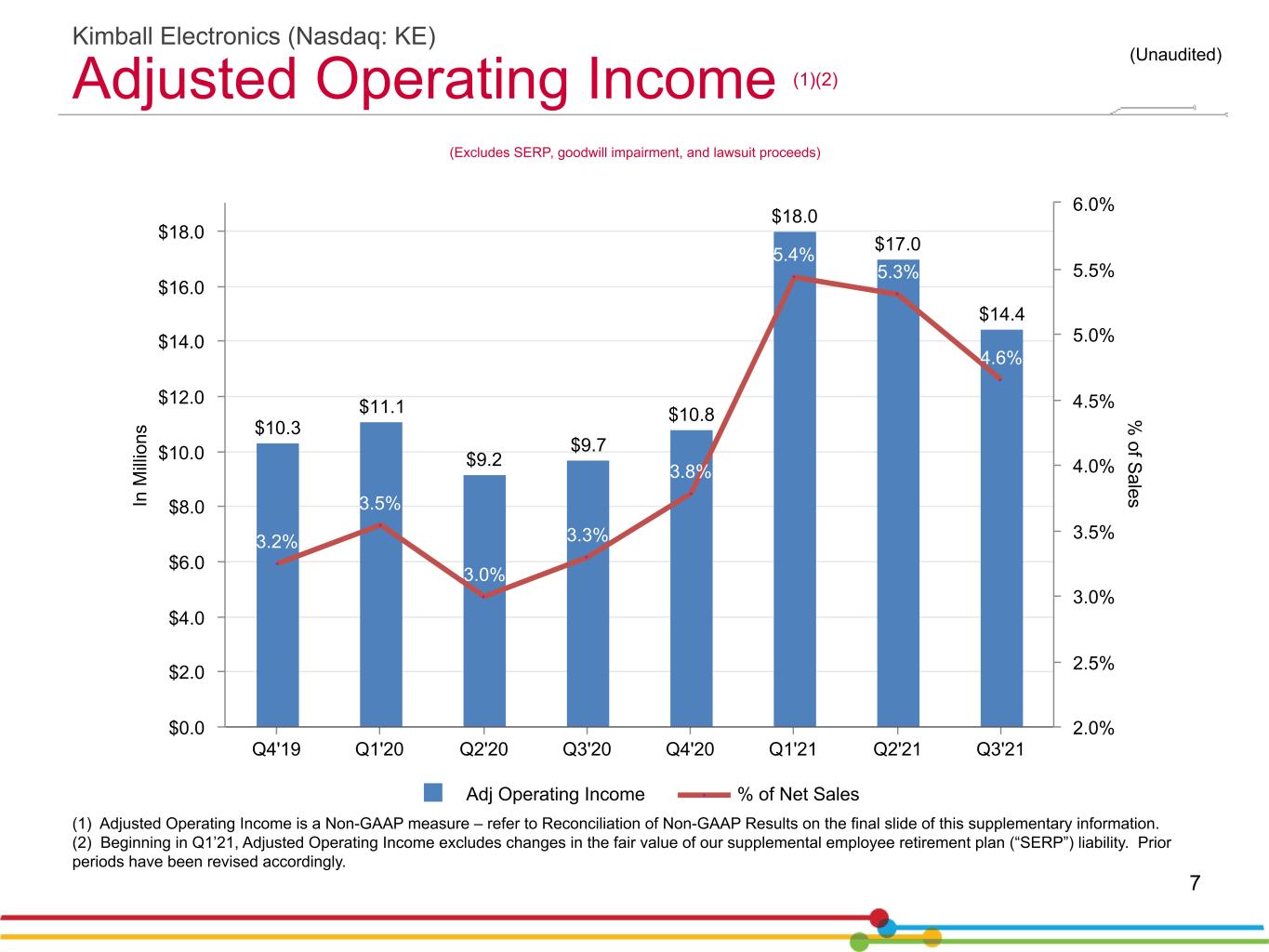

(Unaudited) In M ill io ns % of S ales $10.3 $11.1 $9.2 $9.7 $10.8 $18.0 $17.0 $14.4 3.2% 3.5% 3.0% 3.3% 3.8% 5.4% 5.3% 4.6% Adj Operating Income % of Net Sales Q4'19 Q1'20 Q2'20 Q3'20 Q4'20 Q1'21 Q2'21 Q3'21 $0.0 $2.0 $4.0 $6.0 $8.0 $10.0 $12.0 $14.0 $16.0 $18.0 2.0% 2.5% 3.0% 3.5% 4.0% 4.5% 5.0% 5.5% 6.0% (1) Adjusted Operating Income is a Non-GAAP measure – refer to Reconciliation of Non-GAAP Results on the final slide of this supplementary information. (2) Beginning in Q1’21, Adjusted Operating Income excludes changes in the fair value of our supplemental employee retirement plan (“SERP”) liability. Prior periods have been revised accordingly. 7 Kimball Electronics (Nasdaq: KE) Adjusted Operating Income (1)(2) (Excludes SERP, goodwill impairment, and lawsuit proceeds)

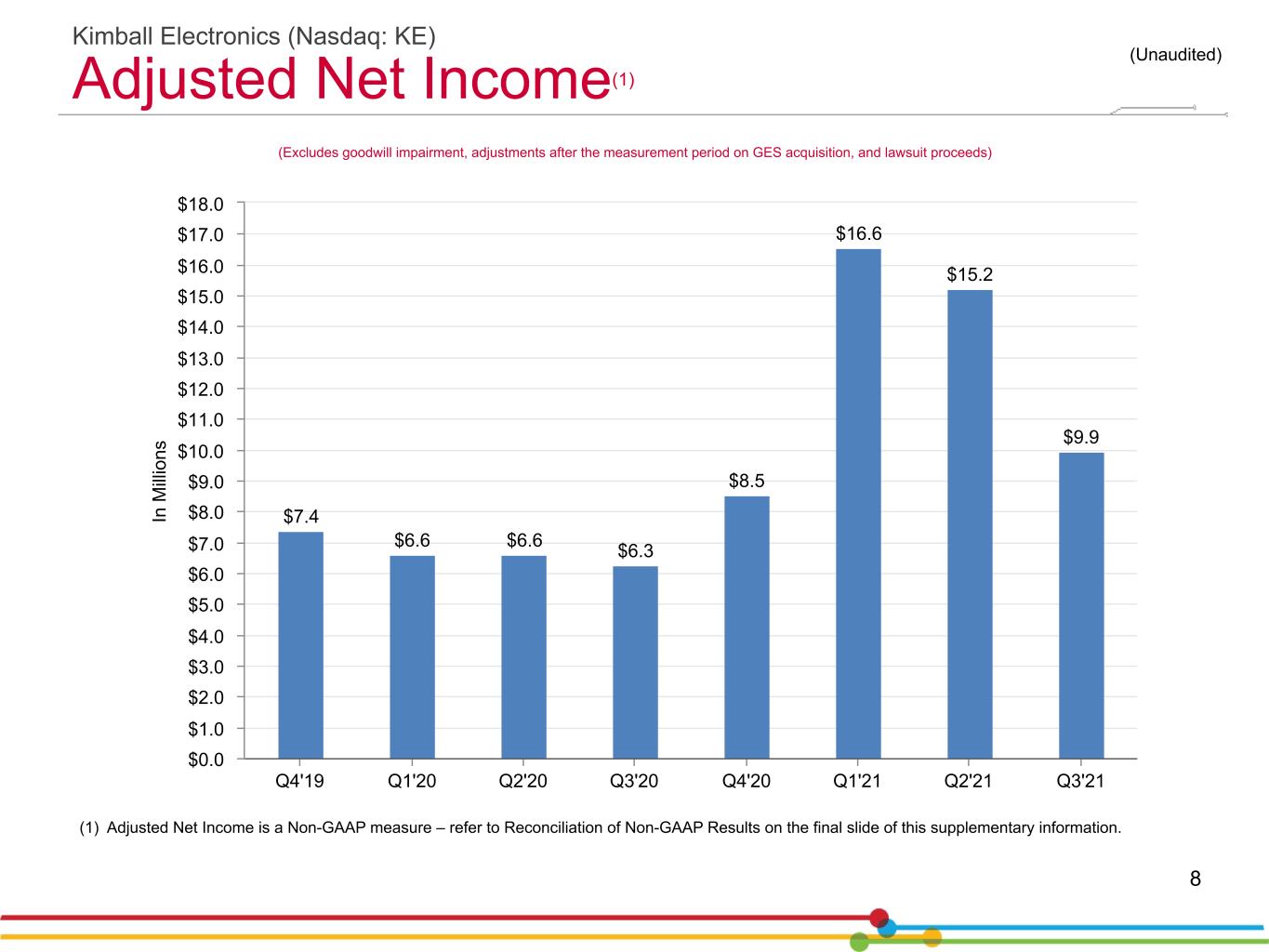

(Unaudited) In M ill io ns $7.4 $6.6 $6.6 $6.3 $8.5 $16.6 $15.2 $9.9 Q4'19 Q1'20 Q2'20 Q3'20 Q4'20 Q1'21 Q2'21 Q3'21 $0.0 $1.0 $2.0 $3.0 $4.0 $5.0 $6.0 $7.0 $8.0 $9.0 $10.0 $11.0 $12.0 $13.0 $14.0 $15.0 $16.0 $17.0 $18.0 (1) Adjusted Net Income is a Non-GAAP measure – refer to Reconciliation of Non-GAAP Results on the final slide of this supplementary information. 8 Kimball Electronics (Nasdaq: KE) Adjusted Net Income(1) (Excludes goodwill impairment, adjustments after the measurement period on GES acquisition, and lawsuit proceeds)

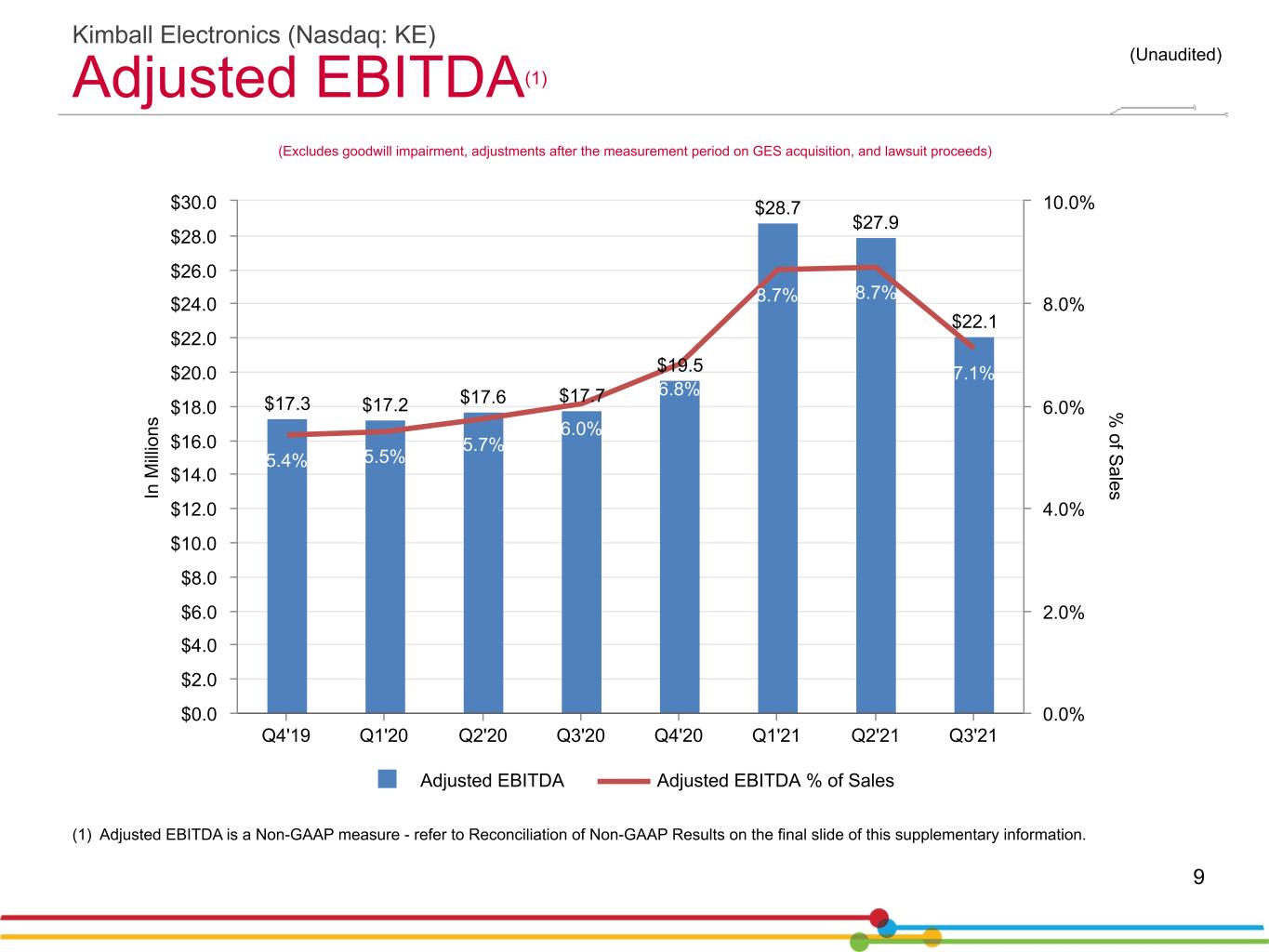

(Unaudited) In M ill io ns % of S ales $17.3 $17.2 $17.6 $17.7 $19.5 $28.7 $27.9 $22.1 5.4% 5.5% 5.7% 6.0% 6.8% 8.7% 8.7% 7.1% Adjusted EBITDA Adjusted EBITDA % of Sales Q4'19 Q1'20 Q2'20 Q3'20 Q4'20 Q1'21 Q2'21 Q3'21 $0.0 $2.0 $4.0 $6.0 $8.0 $10.0 $12.0 $14.0 $16.0 $18.0 $20.0 $22.0 $24.0 $26.0 $28.0 $30.0 0.0% 2.0% 4.0% 6.0% 8.0% 10.0% (1) Adjusted EBITDA is a Non-GAAP measure - refer to Reconciliation of Non-GAAP Results on the final slide of this supplementary information. 9 Kimball Electronics (Nasdaq: KE) Adjusted EBITDA(1) (Excludes goodwill impairment, adjustments after the measurement period on GES acquisition, and lawsuit proceeds)

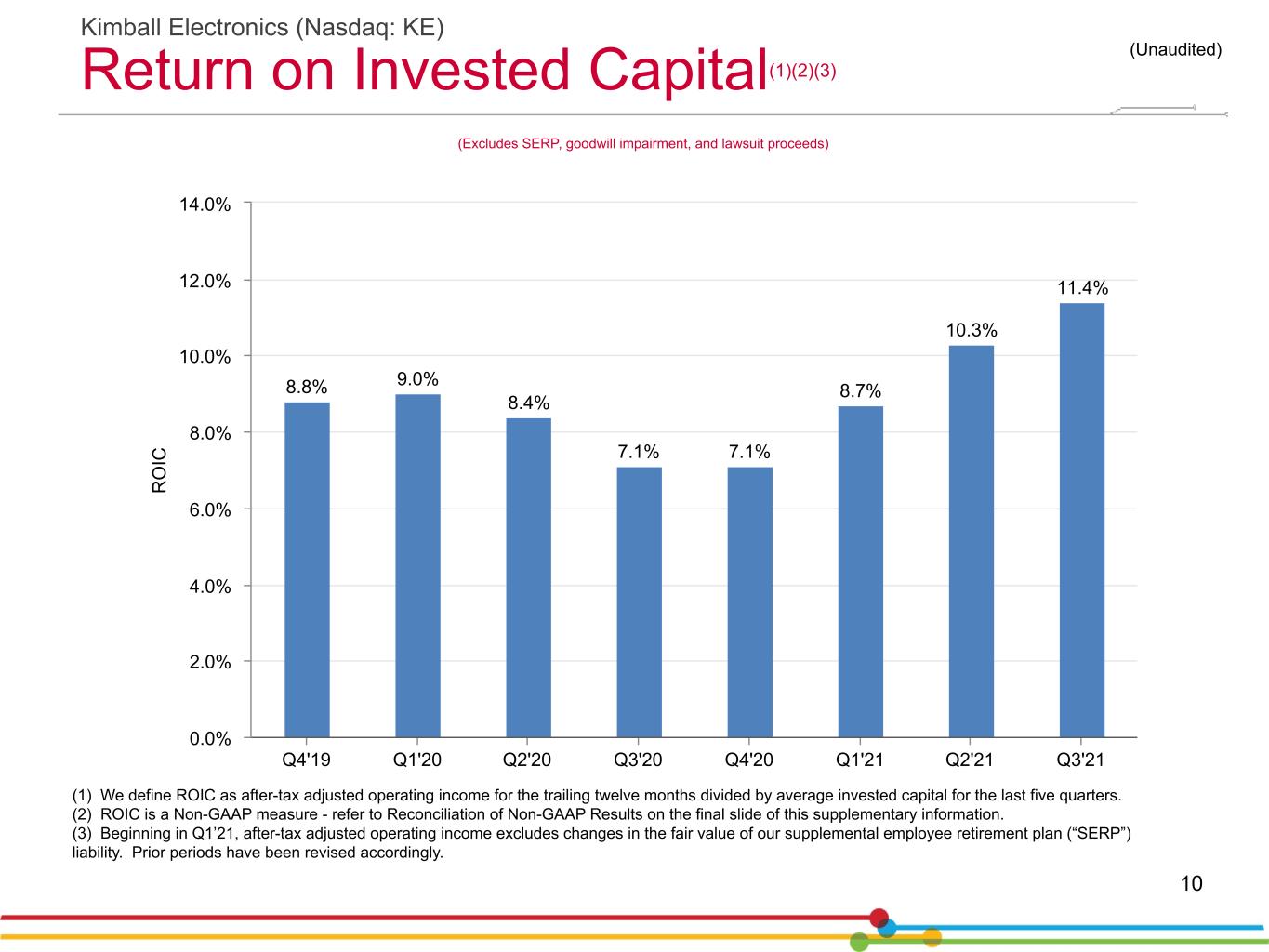

R O IC 8.8% 9.0% 8.4% 7.1% 7.1% 8.7% 10.3% 11.4% Q4'19 Q1'20 Q2'20 Q3'20 Q4'20 Q1'21 Q2'21 Q3'21 0.0% 2.0% 4.0% 6.0% 8.0% 10.0% 12.0% 14.0% (1) We define ROIC as after-tax adjusted operating income for the trailing twelve months divided by average invested capital for the last five quarters. (2) ROIC is a Non-GAAP measure - refer to Reconciliation of Non-GAAP Results on the final slide of this supplementary information. (3) Beginning in Q1’21, after-tax adjusted operating income excludes changes in the fair value of our supplemental employee retirement plan (“SERP”) liability. Prior periods have been revised accordingly. (Unaudited) 10 Kimball Electronics (Nasdaq: KE) Return on Invested Capital(1)(2)(3) (Excludes SERP, goodwill impairment, and lawsuit proceeds)

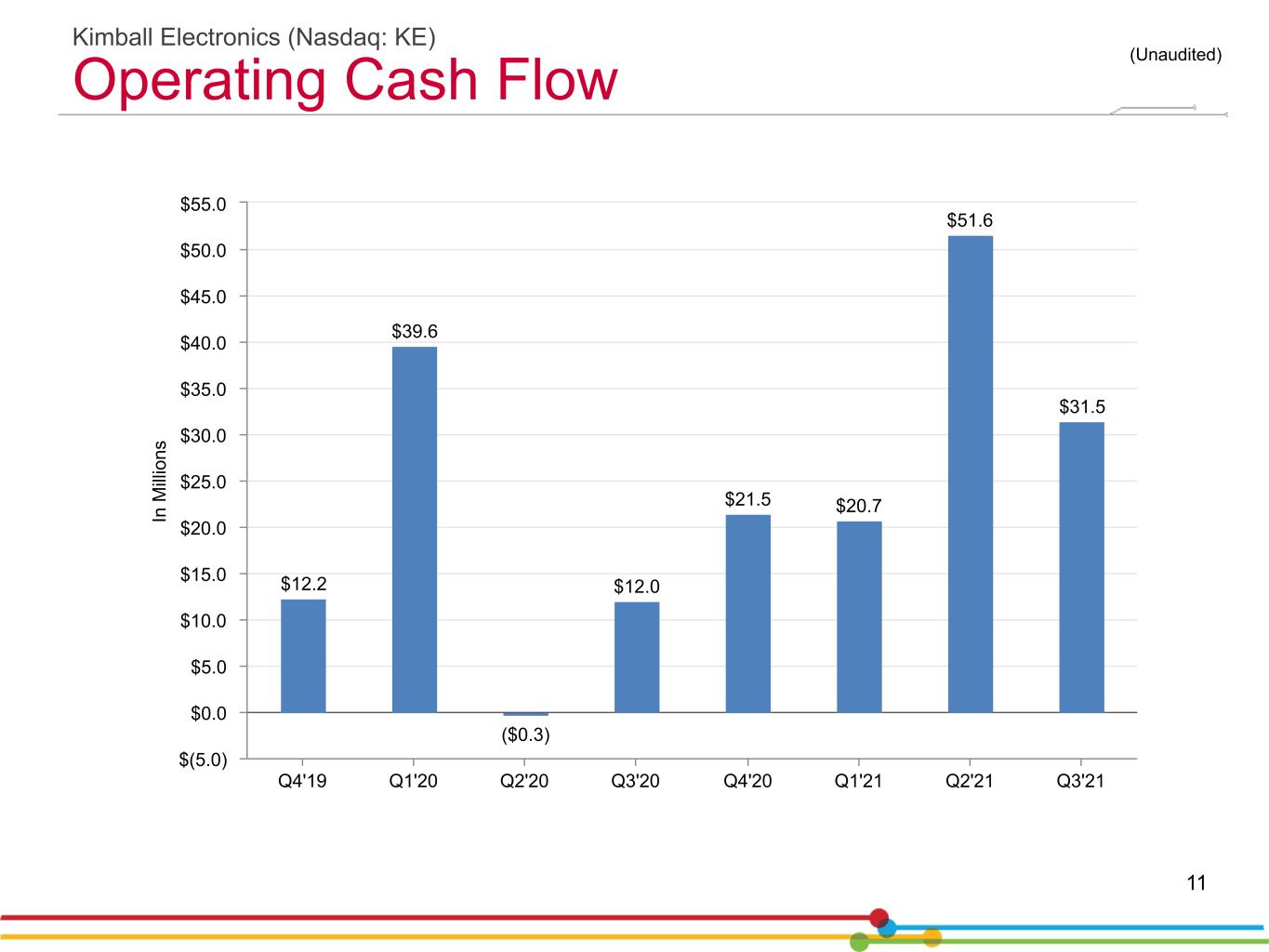

(Unaudited) In M ill io ns $12.2 $39.6 ($0.3) $12.0 $21.5 $20.7 $51.6 $31.5 Q4'19 Q1'20 Q2'20 Q3'20 Q4'20 Q1'21 Q2'21 Q3'21 $(5.0) $0.0 $5.0 $10.0 $15.0 $20.0 $25.0 $30.0 $35.0 $40.0 $45.0 $50.0 $55.0 11 Kimball Electronics (Nasdaq: KE) Operating Cash Flow

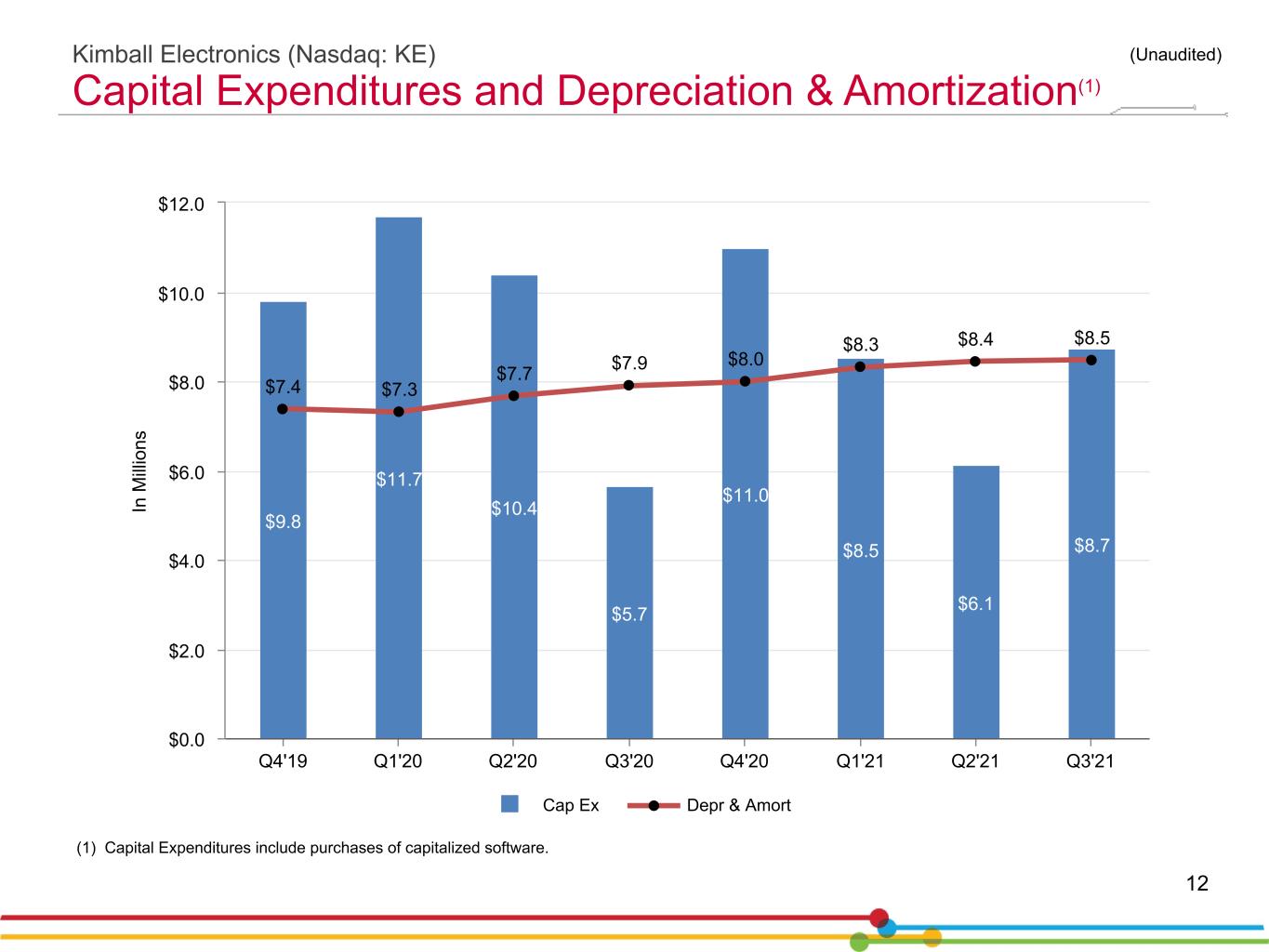

(Unaudited) In M ill io ns $9.8 $11.7 $10.4 $5.7 $11.0 $8.5 $6.1 $8.7 $7.4 $7.3 $7.7 $7.9 $8.0 $8.3 $8.4 $8.5 Cap Ex Depr & Amort Q4'19 Q1'20 Q2'20 Q3'20 Q4'20 Q1'21 Q2'21 Q3'21 $0.0 $2.0 $4.0 $6.0 $8.0 $10.0 $12.0 (1) Capital Expenditures include purchases of capitalized software. 12 Kimball Electronics (Nasdaq: KE) Capital Expenditures and Depreciation & Amortization(1)

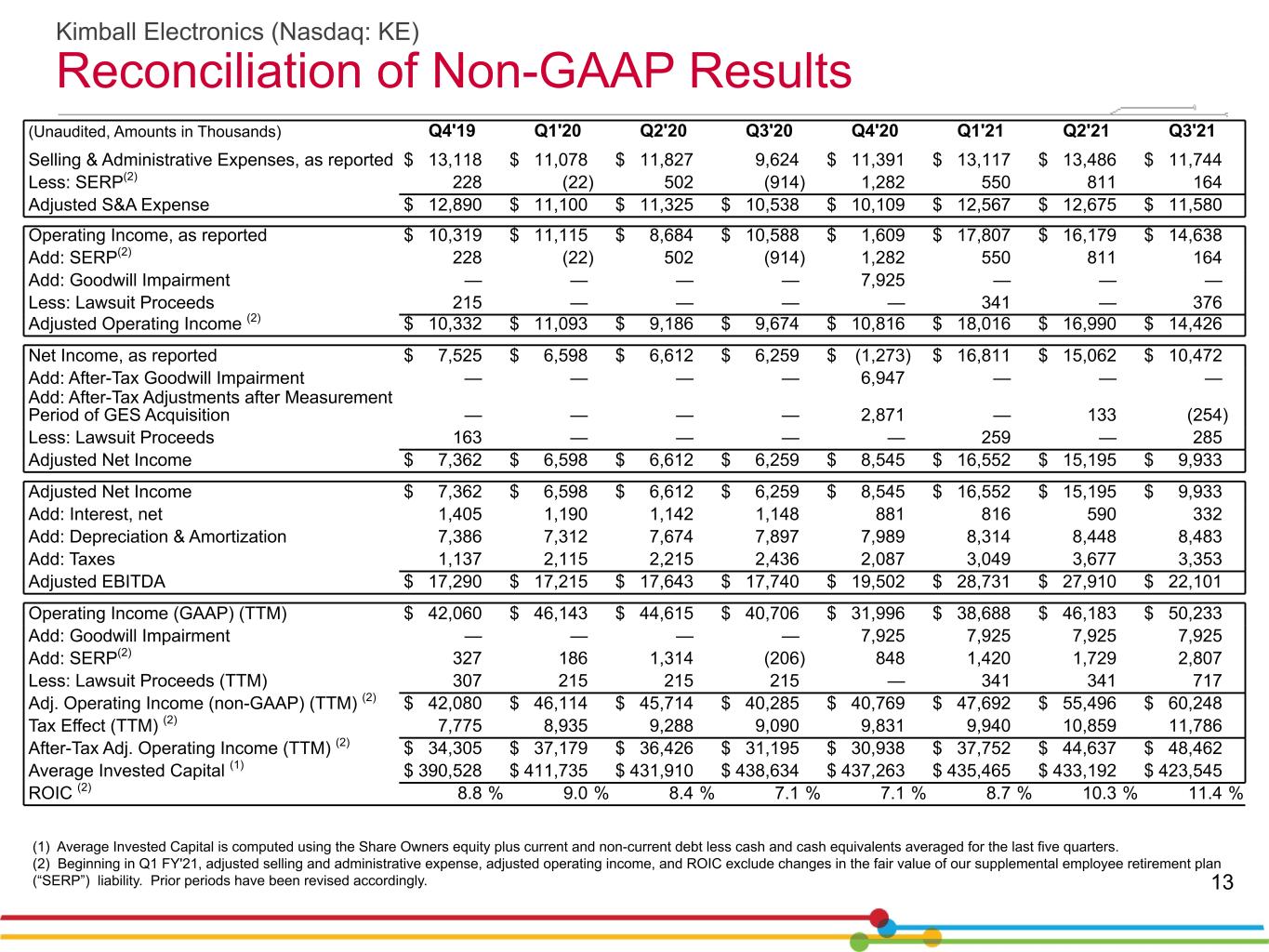

(Unaudited, Amounts in Thousands) Q4'19 Q1'20 Q2'20 Q3'20 Q4'20 Q1'21 Q2'21 Q3'21 Selling & Administrative Expenses, as reported $ 13,118 $ 11,078 $ 11,827 9,624 $ 11,391 $ 13,117 $ 13,486 $ 11,744 Less: SERP(2) 228 (22) 502 (914) 1,282 550 811 164 Adjusted S&A Expense $ 12,890 $ 11,100 $ 11,325 $ 10,538 $ 10,109 $ 12,567 $ 12,675 $ 11,580 Operating Income, as reported $ 10,319 $ 11,115 $ 8,684 $ 10,588 $ 1,609 $ 17,807 $ 16,179 $ 14,638 Add: SERP(2) 228 (22) 502 (914) 1,282 550 811 164 Add: Goodwill Impairment — — — — 7,925 — — — Less: Lawsuit Proceeds 215 — — — — 341 — 376 Adjusted Operating Income (2) $ 10,332 $ 11,093 $ 9,186 $ 9,674 $ 10,816 $ 18,016 $ 16,990 $ 14,426 Net Income, as reported $ 7,525 $ 6,598 $ 6,612 $ 6,259 $ (1,273) $ 16,811 $ 15,062 $ 10,472 Add: After-Tax Goodwill Impairment — — — — 6,947 — — — Add: After-Tax Adjustments after Measurement Period of GES Acquisition — — — — 2,871 — 133 (254) Less: Lawsuit Proceeds 163 — — — — 259 — 285 Adjusted Net Income $ 7,362 $ 6,598 $ 6,612 $ 6,259 $ 8,545 $ 16,552 $ 15,195 $ 9,933 Adjusted Net Income $ 7,362 $ 6,598 $ 6,612 $ 6,259 $ 8,545 $ 16,552 $ 15,195 $ 9,933 Add: Interest, net 1,405 1,190 1,142 1,148 881 816 590 332 Add: Depreciation & Amortization 7,386 7,312 7,674 7,897 7,989 8,314 8,448 8,483 Add: Taxes 1,137 2,115 2,215 2,436 2,087 3,049 3,677 3,353 Adjusted EBITDA $ 17,290 $ 17,215 $ 17,643 $ 17,740 $ 19,502 $ 28,731 $ 27,910 $ 22,101 Operating Income (GAAP) (TTM) $ 42,060 $ 46,143 $ 44,615 $ 40,706 $ 31,996 $ 38,688 $ 46,183 $ 50,233 Add: Goodwill Impairment — — — — 7,925 7,925 7,925 7,925 Add: SERP(2) 327 186 1,314 (206) 848 1,420 1,729 2,807 Less: Lawsuit Proceeds (TTM) 307 215 215 215 — 341 341 717 Adj. Operating Income (non-GAAP) (TTM) (2) $ 42,080 $ 46,114 $ 45,714 $ 40,285 $ 40,769 $ 47,692 $ 55,496 $ 60,248 Tax Effect (TTM) (2) 7,775 8,935 9,288 9,090 9,831 9,940 10,859 11,786 After-Tax Adj. Operating Income (TTM) (2) $ 34,305 $ 37,179 $ 36,426 $ 31,195 $ 30,938 $ 37,752 $ 44,637 $ 48,462 Average Invested Capital (1) $ 390,528 $ 411,735 $ 431,910 $ 438,634 $ 437,263 $ 435,465 $ 433,192 $ 423,545 ROIC (2) 8.8 % 9.0 % 8.4 % 7.1 % 7.1 % 8.7 % 10.3 % 11.4 % 13 (1) Average Invested Capital is computed using the Share Owners equity plus current and non-current debt less cash and cash equivalents averaged for the last five quarters. (2) Beginning in Q1 FY'21, adjusted selling and administrative expense, adjusted operating income, and ROIC exclude changes in the fair value of our supplemental employee retirement plan (“SERP”) liability. Prior periods have been revised accordingly. Kimball Electronics (Nasdaq: KE) Reconciliation of Non-GAAP Results