Attached files

| file | filename |

|---|---|

| 8-K - 8-K - FIVE STAR SENIOR LIVING INC. | fve-20210505.htm |

| EX-99.1 - EX-99.1 - FIVE STAR SENIOR LIVING INC. | a3312021-exhibit991.htm |

Investor Presentation May 2021 Nasdaq: FVE “To honor and enrich the journey of life, one experience at a time.”

2 Warning Concerning Forward-Looking Statements This presentation contains statements that constitute forward-looking statements within the meaning of the Private Securities Litigation Reform Act of 1995 and other securities laws. Whenever we use words such as “believe”, “expect”, “anticipate”, “intend”, “plan”, “estimate”, “will”, “may” and negatives or derivatives of these or similar expressions, we are making forward-looking statements. These forward- looking statements are based upon our present intent, beliefs or expectations, but forward-looking statements are not guaranteed to occur and our actual results may differ materially from those contained in, or implied by, our forward-looking statements. Forward-looking statements in this presentation relate to various aspects of our business, including the implementation and anticipated effects of our strategic plan, our ability to operate our senior living communities profitably, our ability to grow revenues at the senior living communities we manage and to increase the fees we earn from managing senior living communities, the implementation and anticipated affects of our Strategic Plan, our expectation to focus our expansion activities on internal growth from our existing senior living communities and the ancillary services that we may provide, our ability to increase the number of senior living communities we operate and residents we serve, and to grow our other sources of revenues, including rehabilitation and wellness services and other services we may provide, whether the aging U.S. population and increasing life spans of older adults will increase the demand for senior living communities, health and wellness centers and other healthcare related properties and services, and the impact of COVID-19 on our business. Forward-looking statements involve known and unknown risks, uncertainties and other factors, some of which are beyond our control, such as the impact of conditions in the economy and the capital markets on us and our residents and other customers, competition within the senior living and other health and wellness related services businesses, older adults delaying or forgoing moving into senior living communities or purchasing health and wellness services from us, increases in our labor costs or in costs we pay for goods and services, increases in tort and insurance liability costs, our operating and debt leverage, actual and potential conflicts of interest with our related parties, changes in Medicare or Medicaid policies and regulations, or the possible repeal, replacement or modification of Medicare, Medicaid or other existing or proposed legislation or regulations, which could result in reduced Medicare or Medicaid rates or a failure of such rates to cover our costs or limit the scope or funding of either or both programs, or reductions in private insurance utilization and coverage, delays or non-payments of government payments to us, compliance with, and changes to, federal, state and local laws and regulations that could affect our services or impose requirements, costs and administrative burdens that may reduce our ability to operate our business profitably, our exposure to litigation and regulatory and government proceedings, continued efforts by third party payers to reduce costs, and acts of terrorism, outbreaks of pandemics, including COVID-19, or other human made or natural disasters. For example: (a) challenging conditions in the senior living industry continue to exist and our business and our operations remain subject to substantial risks, many of which are beyond our control; as a result, our operations may not be profitable in the future and we may realize losses; (b) we may not successfully execute our strategic growth and cost rationalization initiatives, (c) we may not be able to successfully integrate, operate and profitably manage our senior living communities and rehabilitation and wellness services clinics; (d) we cannot be sure that we will enter additional management arrangements with Diversified Healthcare Trust (DHC); (e) our belief that the aging of the U.S. population and increasing life spans of older adults will increase demand for senior living communities and services may not be realized or may not result in increased demand for our services; (f) our investments in our workforce and continued focus on reducing our employee turnover level by enhancing our competitiveness in the marketplace with respect to cash compensation and other benefits may not be successful and may not result in the benefits we expect to achieve through such investments; (g) we may not be able to implement each aspect of our strategic plan within the timeframe we expect, or at all, due to a variety of factors, including that we and DHC may not identify and agree to terms with new operators for communities to be transitioned, we may not be able to close certain Ageility clinics or close and reposition certain skilled nursing facilities, or we and DHC may not agree to terms of amendments to our management agreements in a timely manner or at all; (h) the cost of implementing the strategic plan may be more than we expect and we may not realize the anticipated benefits of such plan; (i) our marketing initiatives may not succeed in increasing our occupancy and revenues, and they may cost more than any increased revenues they may generate; (j) our strategic investments to enhance efficiencies in and benefits from our purchasing of services may not be successful or generate the returns or savings we expect; (k) circumstances that adversely affect the ability of older adults or their families to pay for our services, such as economic downturns, weakening housing market conditions, higher levels of unemployment among our residents’ or potential residents’ family members, lower levels of consumer confidence, stock market volatility and/or changes in demographics generally, could affect the revenues and profitability of our senior living communities; (l) residents who pay for our services with their private resources may become unable to afford our services, resulting in decreased occupancy and decreased revenues at our senior living communities; (m) the various federal and state government agencies that pay us for the services we provide to some of our residents are experiencing budgetary constraints and may lower the Medicare, Medicaid and other rates they pay us; (n) we may be unable to repay or refinance our debt obligations when they become due; (o) certain aspects of our operations and future growth we may pursue in our business may require significant amounts of working capital and require us to make significant capital expenditures; accordingly, we may not have sufficient cash liquidity; (p) the amount of available borrowings under our credit facility is subject to our having qualified collateral, which is primarily based on the value of the assets securing our obligations under our credit facility; (q) the availability of borrowings under our credit facility is subject to our satisfying certain financial covenants and other conditions that we may be unable to satisfy; (r) insurance costs may continue to rise and our actions and approach to managing our insurance costs may not be successful and could result in our incurring significant costs and liabilities that we will be responsible for funding; (s) contingencies in any applicable acquisition or sale agreements we or DHC have entered into, or may enter into, may not be satisfied and our and DHC's applicable acquisitions or sales, and any related management arrangements we may expect to enter into, may not occur, may be delayed or the terms may change; (t) we and DHC may not be able to sell communities that we or DHC may seek to sell on acceptable terms; (u) the advantages we believe we may realize from our relationships with related parties may not materialize; (v) operating deficiencies or a license revocation at one or more of our senior living communities may have an adverse impact on our ability to operate, obtain licenses for, or attract residents to, our other communities; (w) we may be unable to meet collateral requirements related to our workers' compensation insurance program, which may result in higher costs; and (x) the COVID-19 pandemic may continue to adversely affect our business, operating results and financial condition for an indefinite period of time, including by decreasing the occupancy of our senior living communities, causing staffing and supply shortages and increasing the costs of operating our senior living communities and our efforts to mitigate the effects of the COVID-19 pandemic may be insufficient. Our Annual Report on Form 10-K for the year ended December 31, 2020, our Quarterly Report on Form 10-Q for the period ended March 31, 2021 and our other filings with the Securities and Exchange Commission (SEC) identify other important factors that could cause differences from our forward-looking statements. The filings with the SEC of Five Star Senior Living Inc. (Five Star or Five Star Senior Living) are available on the SEC’s website at www.sec.gov. You should not place undue reliance upon our forward-looking statements. Except as required by law, we do not intend to update or change any forward- looking statements as a result of new information, future events or otherwise. Non-GAAP Financial Measures This presentation contains non-GAAP financial measures, including earnings before interest, income tax, depreciation and amortization (EBITDA) and Adjusted EBITDA. Reconciliations for these metrics to the closest U.S. generally accepted accounting principles (GAAP) metrics are included later in this investor presentation. We believe the non-GAAP financial measures included in this investor presentation are meaningful supplemental disclosures because they may help investors better understand changes in our operating results and ability to meet financial obligations or service debt, make capital expenditures and expand our business. We believe that these non-GAAP financial measures are meaningful financial measures that may help investors better understand our financial performance, including by allowing investors to compare our performance between periods and to the performance of other companies. Our management uses these non-GAAP financial measures to evaluate our financial performance and compare it over time and against competitors. These measures should not be considered as alternatives to net income (loss) or operating income, as indicators of our operating performance or as measures of our liquidity. Also, EBITDA and Adjusted EBITDA as presented may not be comparable to similarly titled amounts calculated by other companies. Note: Data throughout this presentation is unaudited and as of and for the three months ended March 31, 2021, unless otherwise noted. Also, statements about the industry and demographics relate to the United States.

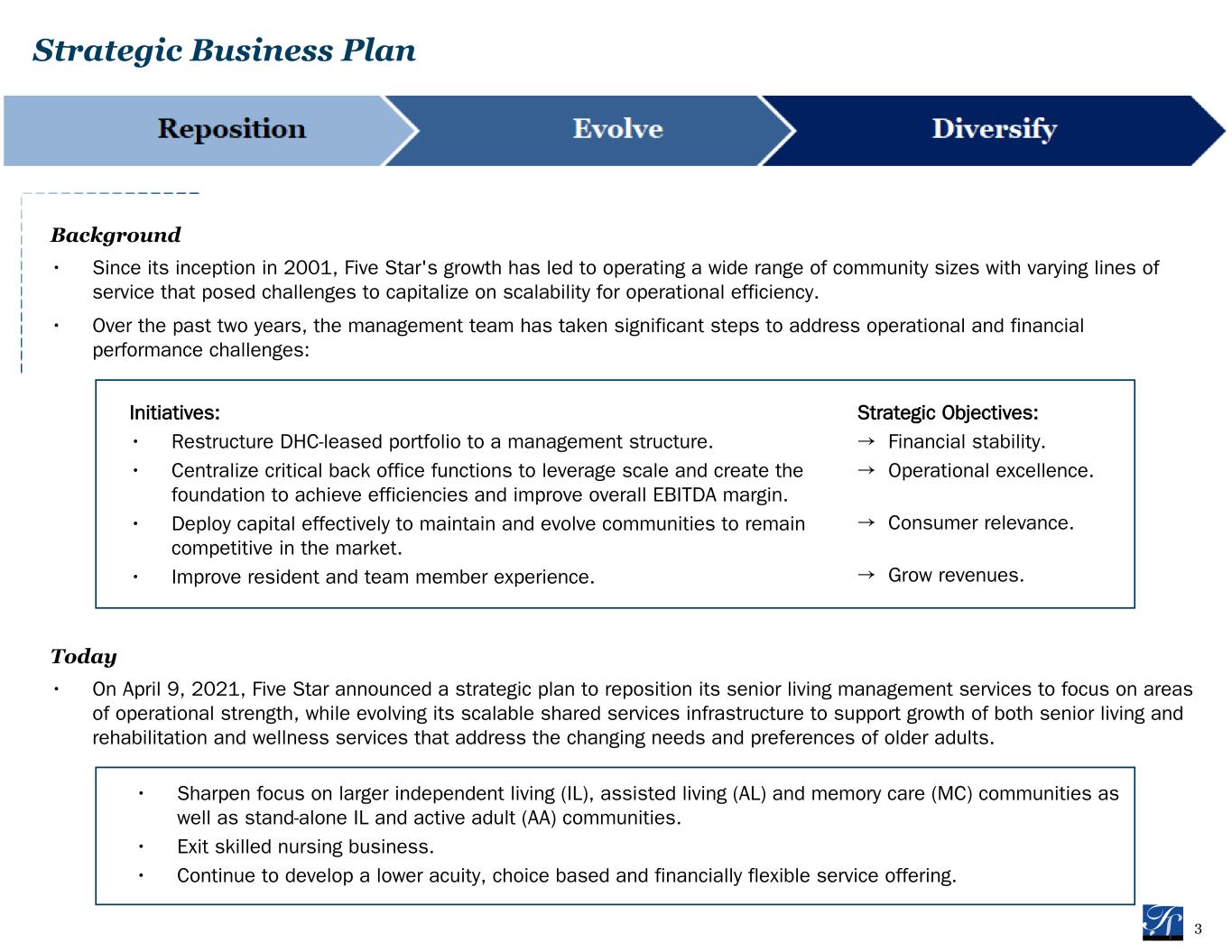

3 Strategic Business Plan Background • Since its inception in 2001, Five Star's growth has led to operating a wide range of community sizes with varying lines of service that posed challenges to capitalize on scalability for operational efficiency. • Over the past two years, the management team has taken significant steps to address operational and financial performance challenges: Today • On April 9, 2021, Five Star announced a strategic plan to reposition its senior living management services to focus on areas of operational strength, while evolving its scalable shared services infrastructure to support growth of both senior living and rehabilitation and wellness services that address the changing needs and preferences of older adults. Initiatives: • Restructure DHC-leased portfolio to a management structure. • Centralize critical back office functions to leverage scale and create the foundation to achieve efficiencies and improve overall EBITDA margin. • Deploy capital effectively to maintain and evolve communities to remain competitive in the market. • Improve resident and team member experience. Strategic Objectives: → Financial stability. → Operational excellence. → Consumer relevance. → Grow revenues. • Sharpen focus on larger independent living (IL), assisted living (AL) and memory care (MC) communities as well as stand-alone IL and active adult (AA) communities. • Exit skilled nursing business. • Continue to develop a lower acuity, choice based and financially flexible service offering.

4 (1) Compound annual growth rate, compared to pro forma results. (2) Exclusive of the pending closing and repositioning of 1,500 skilled nursing facility units in 27 of the managed communities. Exclusive of COVID-19 Provider Relief Funds and other governmental grants recognized as other income. (3) Retained managed portfolio includes the remaining 120 senior living communities not part of the transitioning portfolio. (4) Transitioning managed portfolio includes 108 senior living communities, with approximately 7,500 living units that are expected to be transitioned to new operators and (ii) approximately 1,500 skilled nursing facility units that are expected be closed and repositioned in 27 CCRCs that FVE will continue to manage for DHC. (5) Earnings before interest, taxes, depreciation and amortization. Owned and Leased Portfolio Total Managed Portfolio Retained Managed Portfolio(3) Transitioning Managed Portfolio(4) Average Occupancy 68.3% 69.5% 72.7% 63.1% Wages as % of Revenue(2) 59.4% 57.2% 53.7% 65.8% Operating Margin(2) (16.6)% 5.0% 8.9% (4.8)% EBITDA Margin(2)(5) (29.1)% 1.5% 5.7% (8.7)% Senior Living Results for the three months ended March 31, 2021: Revenues Clinics 1Q20 2Q20 3Q20 4Q20 1Q21 $— $12,000 $24,000 230 240 250 260 Ageility Revenue and Clinic Growth R e ve n u e s (i n t h o u sa n d s) C lin ics Areas Where Five Star Performs Best • ~100+ unit IL/AL/MC and stand-alone IL and AA communities in primarily suburban and smaller urban markets. ◦ Higher margin, lower acuity lines of business. Steps to Focus on Operational Strength • Work with DHC to transition 108 smaller senior living communities with ~7,500 living units to new operators. • Close 27 skilled nursing units with ~1,500 living units in CCRCs and reposition to other lines of business. • Transitions/closures expected to be completed by the end of 2021. • Continue to grow Ageility outpatient footprint and expand service offerings. • Ageility Rehabilitation and Wellness Services: ◦ In 2017, Ageility began to capitalize on demands by opening new outpatient clinics outside of the Five Star senior living portfolio. ◦ Added 86 net new outpatient clinics since January 1, 2019. ◦ Clinic openings have a 5-year CAGR(1) of 16.8%.

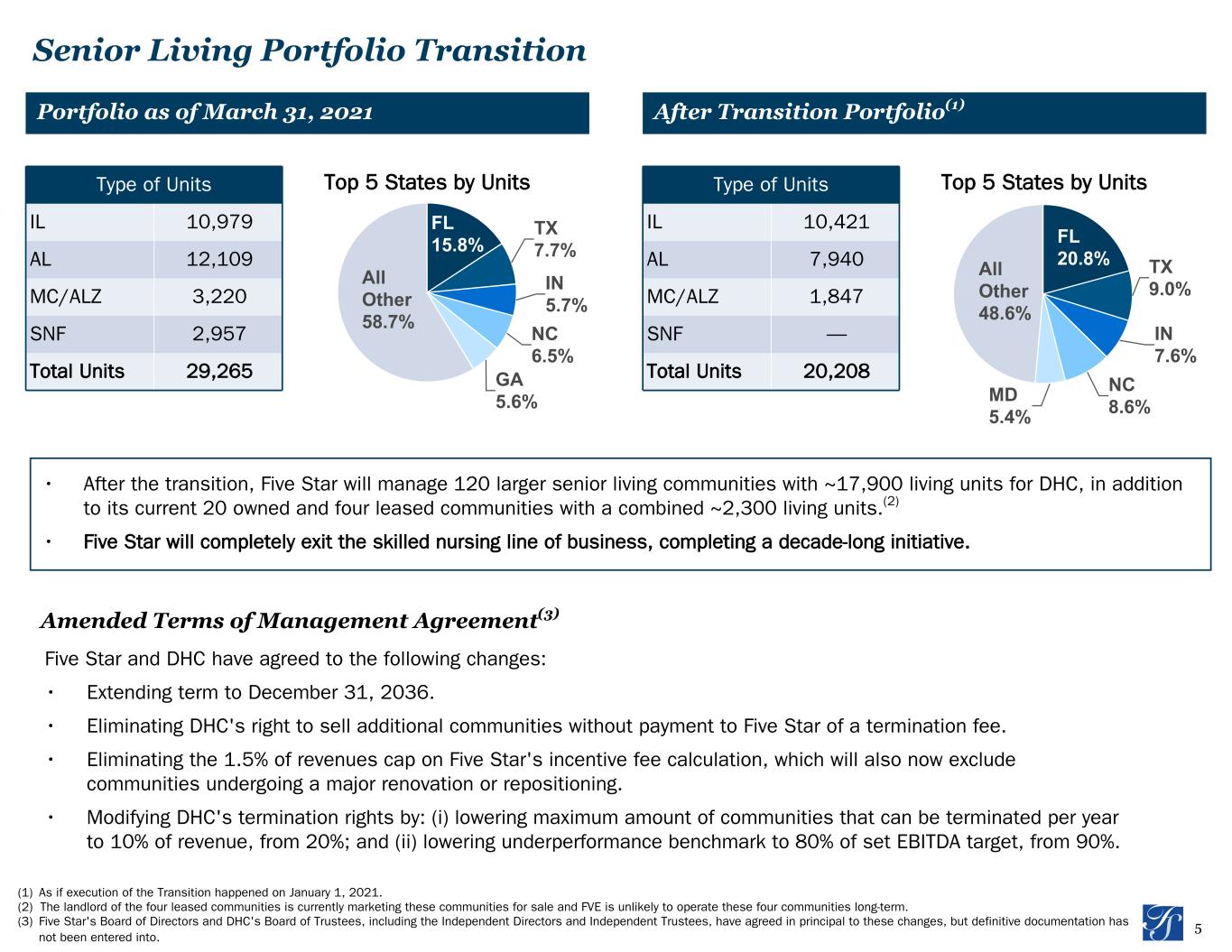

5 Senior Living Portfolio Transition Portfolio as of March 31, 2021 After Transition Portfolio(1) Type of Units IL 10,979 AL 12,109 MC/ALZ 3,220 SNF 2,957 Total Units 29,265 FL 15.8% TX 7.7% IN 5.7% NC 6.5% GA 5.6% All Other 58.7% Top 5 States by Units Type of Units IL 10,421 AL 7,940 MC/ALZ 1,847 SNF — Total Units 20,208 FL 20.8% TX 9.0% IN 7.6% NC 8.6% MD 5.4% All Other 48.6% Top 5 States by Units • After the transition, Five Star will manage 120 larger senior living communities with ~17,900 living units for DHC, in addition to its current 20 owned and four leased communities with a combined ~2,300 living units.(2) • Five Star will completely exit the skilled nursing line of business, completing a decade-long initiative. Amended Terms of Management Agreement(3) Five Star and DHC have agreed to the following changes: • Extending term to December 31, 2036. • Eliminating DHC's right to sell additional communities without payment to Five Star of a termination fee. • Eliminating the 1.5% of revenues cap on Five Star's incentive fee calculation, which will also now exclude communities undergoing a major renovation or repositioning. • Modifying DHC's termination rights by: (i) lowering maximum amount of communities that can be terminated per year to 10% of revenue, from 20%; and (ii) lowering underperformance benchmark to 80% of set EBITDA target, from 90%. (1) As if execution of the Transition happened on January 1, 2021. (2) The landlord of the four leased communities is currently marketing these communities for sale and FVE is unlikely to operate these four communities long-term. (3) Five Star's Board of Directors and DHC's Board of Trustees, including the Independent Directors and Independent Trustees, have agreed in principal to these changes, but definitive documentation has not been entered into.

6 As a % of Revenue Q1 2021 Actual(1) Normalized Target Wages & Benefits 57% 50% G&A Expense 43% 20% EBITDA —% 30% U.S. Active Adult (55+) and Assisted Living Community Market Size(3) (dollars in millions) Senior Living Communities Operated Current Portfolio vs. Normalized Targets • Develop a scalable shared service center to support operations and growth. ◦ Drive operational excellence to deliver meaningful improvement in financial and operational performance. ◦ Right-size corporate G&A. • Drive improved occupancy and RevPAR. • Accelerate growth in the core senior living portfolio to meet the demand of the active, aging adult population. Aging U.S. Population(2) • The aging of the Baby Boomer generation and increasing life expectancy are leading to a fundamental demographic shift. • From 2020 to 2030, the 65+ population will grow by 30% from 56M to 73M, and by 69% to 95M by 2060. (1) Includes community-level revenue and expenses for 24 owned and leased senior living communities and 228 managed senior living communities. Exclusive of COVID-19 Provider Relief Fund and other governmental grants recognized as other income. (2) Source: U.S. Census Bureau. (3) Source: Grand View Research. Align to Market Demographics

7 Owned and Leased - AL/IL- 43% Ageility Rehabilitation - 33% Ageility Fitness - 2% Home Health - 1% Management Fees - AL/IL - 14% Management Fees - CCRC - 7% Management Fees - SNF - 0% Owned and Leased - AL/IL- 34% Ageility Rehabilitation - 37% Ageility Fitness - 1% Home Health - 1% Management Fees - AL/IL - 16% Management Fees - CCRC - 10% Management Fees - SNF - 1% • Continue to grow Ageility Rehabilitation and Wellness Services outside the Five Star senior living operating footprint. ◦ There are nearly 29,000 assisted living communities in the U.S., offering a large pool of potential target communities for continued expansion. • Expand ancillary service offerings, including fitness, concierge services and home health, to provide a choice-based, financially flexible experience for our residents, as well as reach customers outside the senior living community. Revenue Mix as of March 31, 2021 Post-Transition Revenue Mix(1) $119 $150 $145 $203 35% growth over next 3 y ears. (1) As if execution of the Transition happened on January 1, 2021. (2) Derived from Business Insider "Future demand for elderly care services like assisted living & in-home care are rife for digital disruption" Jul 8, 2019. (3) Derived from Global Wellness Institute, "Move to be Well: The Global Economy of Physical Activity" North America - October 2019. (4) 6.6% annual growth rate was estimated through 2023, by the Global Wellness Institute. 22% growth over next 3 y ears. (4) U.S. Home Care(2) and Physical Activity(3) Market Opportunity (dollars in millions)

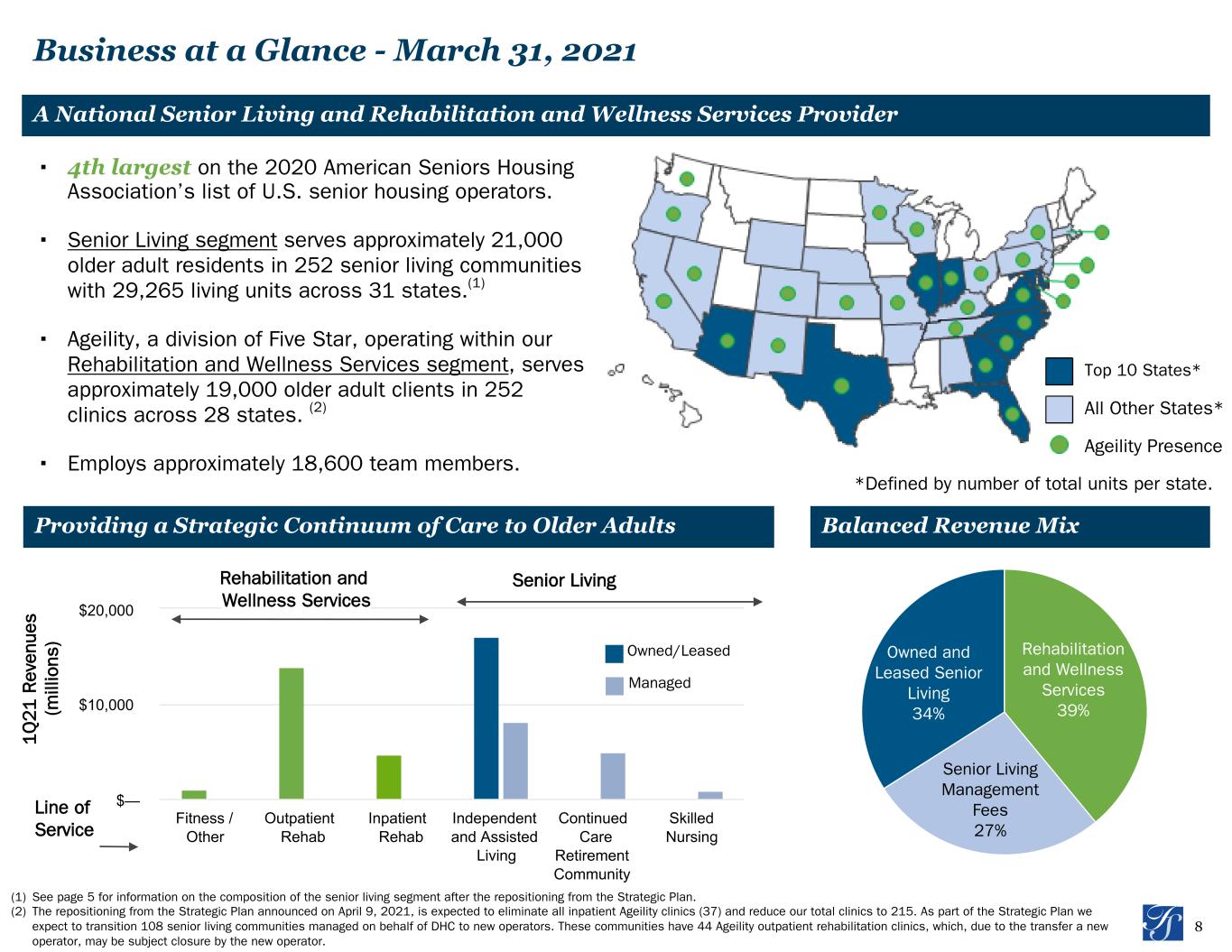

8 Fitness / Other Outpatient Rehab Inpatient Rehab Independent and Assisted Living Continued Care Retirement Community Skilled Nursing $— $10,000 $20,000 Business at a Glance - March 31, 2021 A National Senior Living and Rehabilitation and Wellness Services Provider ▪ 4th largest on the 2020 American Seniors Housing Association’s list of U.S. senior housing operators. ▪ Senior Living segment serves approximately 21,000 older adult residents in 252 senior living communities with 29,265 living units across 31 states.(1) ▪ Ageility, a division of Five Star, operating within our Rehabilitation and Wellness Services segment, serves approximately 19,000 older adult clients in 252 clinics across 28 states. (2) ▪ Employs approximately 18,600 team members. Balanced Revenue MixProviding a Strategic Continuum of Care to Older Adults Top 10 States* All Other States* Ageility Presence *Defined by number of total units per state. Owned and Leased Senior Living 34% Rehabilitation and Wellness Services 39% Senior Living Management Fees 27% Line of Service 1 Q 2 1 R e ve n u e s (m ill io n s) Owned/Leased Managed Rehabilitation and Wellness Services Senior Living (1) See page 5 for information on the composition of the senior living segment after the repositioning from the Strategic Plan. (2) The repositioning from the Strategic Plan announced on April 9, 2021, is expected to eliminate all inpatient Ageility clinics (37) and reduce our total clinics to 215. As part of the Strategic Plan we expect to transition 108 senior living communities managed on behalf of DHC to new operators. These communities have 44 Ageility outpatient rehabilitation clinics, which, due to the transfer a new operator, may be subject closure by the new operator.

9 Five Star COVID-19 Response and Leadership During the Pandemic (1) In at least one service line of business (IL, AL, ALZ, CCRC or SNF). (2) Spot occupancy represents occupancy on the final day of the month for comparable managed communities, which includes 120 managed senior living communities that FVE has continuously managed since January 1, 2020, exclusive of 108 senior living communities currently managed for DHC that are expected to be transitioned to new operators and approximately 1,500 skilled nursing facility units which are expected to be closed and repositioned in 27 CCRCs that we will continue to manage for DHC. Vaccine Distribution ▪ We have hosted COVID-19 vaccination clinics at all our 252 senior living communities, free of charge, for eligible residents and team members, including team members at our Ageility clinics, in accordance with CDC, federal and state guidelines. ▪ Over 85% of residents were vaccinated as of May 1, 2021. Operations Update ▪ We are welcoming new residents in all of our communities(1) as of May 1, 2021. ▪ Resident COVID-19 cases on a trailing two week basis have declined 99% from the peak in early December. ▪ Spot occupancy(2) as of May 1, 2021 was 73.8%, up 60 basis points (bps) from March 31, 2021. ▪ Due to increased focus on generating higher quality leads, our lead volume has declined over the past several weeks; however, our conversion rate in April 2021 has increased 710 bps to 12.8% from a low in January 2021. Monthly Moves and Tours

10 (1) Includes all communities operated by FVE as of and for the period ended March 31, 2021. (2) AL includes 2,878 Memory Care (MC)/Alzheimer's (ALZ) living units and our CCRC's include 342 MC/ALZ living units that utilize our Bridge to RediscoveryTM Program. (3) Managed on behalf of DHC. (4) Leased from Healthpeak Properties Inc. (NYSE: PEAK). (5) Includes one active adult (AA) community with 167 units. (6) CCRCs consist of 4,310 IL living units, 1,866 AL living units, 342 MC/ALZ living units and 2,055 SNF living units Senior Living Segment Senior Living Unit Mix at March 31, 2021 — Strategically Focused on Choice Based Product(1) Favorable Senior Living Payer Mix — Provides Operational Flexibility(1) Independent Living (IL) and Active Adult (AA) Assisted Living (AL)(2) Continued Care Retirement Community (CCRC)(2)(6) Skilled Nursing (SNF) Total Units % of Total Units Managed(3) 6,104(5) 11,384 8,573 902 26,963 92% Leased(4) — 203 — — 203 1% Owned 565 1,534 — — 2,099 7% Total Units 6,669 13,121 8,573 902 29,265 100% % of Total Units 23% 45% 29% 3% 100% • Five Star's private pay focused senior living segment is less constrained by government rate regulation. • Five Star has been strategically decreasing its exposure to skilled nursing over the past several years: Private Pay and Other Medicare Medicaid 1Q21 Percent of Revenues 4,449 4,305 3,024 2,957 2,957 2017 2018 2019 2020 1Q21 2,500 3,000 3,500 4,000 4,500 5,000 Number of SNF Units Operated

11 Senior Living Rate and Occupancy Details Comparable Community RevPAR and Avg. Occupancy(1)(3)(4) Comparable Community RevPOR(2)(3)(4) $2,930 $2,813 $2,665 $2,596 $2,479 $3,471 $3,301 $3,164 $3,054 $2,946 Owned/Leased RevPAR Managed RevPAR Owned/Leased Avg. Occupancy Managed Avg. Occupancy Q1 2020 Q2 2020 Q3 2020 Q4 2020 Q1 2021 $2,000 $2,500 $3,000 $3,500 $4,000 65% 70% 75% 80% 85% 90% $3,565 $3,555 $3,492 $3,550 $3,630 $3,991 $3,953 $3,942 $3,954 $4,051 Owned/Leased RevPOR Managed RevPOR Q1 2020 Q2 2020 Q3 2020 Q4 2020 Q1 2021 $2,000 $2,500 $3,000 $3,500 $4,000 $4,500 Comparable Community Data by Community Type(5) Owned/Leased 1Q20 2Q20 3Q20 4Q20 1Q21 IL/AL Spot Occupancy 80.3% 76.3% 73.0% 69.7% 68.2% RevPAR $ 2,930 $ 2,813 $ 2,665 $ 2,596 $ 2,479 RevPOR $ 3,565 $ 3,555 $ 3,492 $ 3,550 $ 3,630 Managed 1Q20 2Q20 3Q20 4Q20 1Q21 IL/AL Spot Occupancy 83.8% 79.2% 75.3% 72.2% 71.3% RevPAR $ 3,442 $ 3,266 $ 3,128 $ 3,023 $ 2,891 RevPOR $ 4,034 $ 3,999 $ 3,981 $ 4,003 $ 4,088 CCRC Spot Occupancy 89.5% 84.9% 80.3% 78.2% 76.9% RevPAR $ 3,529 $ 3,373 $ 3,237 $ 3,119 $ 3,058 RevPOR $ 3,908 $ 3,864 $ 3,865 $ 3,861 $ 3,982 (1) RevPAR is defined by us as resident fee revenues for the portfolio for the period divided by the average number of available units for the period, divided by the number of months in the period. Average number of available units for the period includes only living units categorized as in service. Amounts for Q2 2020, Q4 2020 and Q1 2021 exclude income received by communities under the Provider Relief Funds under the Coronavirus Aid, Relief, and Economic Security Act, or CARES Act, and other governmental grants. (2) RevPOR is defined by us as resident fee revenues for the portfolio divided by the average number of occupied units for the period, divided by the number of months in the period. Amounts for Q2 2020, Q4 2020 and Q1 2021 exclude income received under the CARES Act and other governmental grants. (3) Comparable community data represents financial data for 24 owned and leased senior living communities and 120 managed senior living communities that we continuously owned, continuously leased or continuously managed since January 1, 2020, exclusive of 108 senior living communities with approximately 7,500 living units, that we currently manage on behalf of DHC that are expected to be transitioned to new operators and approximately 1,500 skilled nursing facility units which are expected to be closed and repositioned in 27 CCRC's that we will continue to manage. (4) On March 11, 2020, the World Health Organization declared COVID-19 a global pandemic. Q1 2021 and the 2020 quarterly metrics reflect the impact COVID-19 has had on the operations of comparable communities. (5) Spot occupancy represents occupancy on the final day of the month for comparable communities, which includes 24 owned and leased senior living communities and 120 managed senior living communities that FVE has continuously owned, continuously leased or continuously managed since January 1, 2020, exclusive of 108 senior living communities currently managed for DHC that are expected to be transitioned to new operators and approximately 1,500 skilled nursing facility units which are expected to be closed and repositioned in 27 CCRCs that we will continue to manage. R a te R a te A ve ra ge O ccu p a n cy

12 Segment Historical Growth (dollars in thousands) • The Rehabilitation and Wellness Services segment reported continued revenue growth in each quarter of 2020, supporting Five Star's cash flow and net income despite the challenging operating environment. Rehabilitation and Wellness Services Segment A growth engine to diversify revenues and differentiate Five Star's offering. Ageility Physical Therapy Solutions Financial Stability Through Pandemic • Ageility, a division of Five Star, contributes 95% of the Rehabilitation and Wellness Services segment revenues. • Operates 215 outpatient clinics and 37 inpatient clinics.(3) • Clinic openings have a 5-year CAGR(1) of 16.8% Clinics and Affiliations Inpatient and Outpatient Visits (2) (amounts in thousands) (1) Compound annual growth rate, or CAGR, represents the annualized growth rate of the number of Ageility clinics determined by net new clinics for the period from January 1, 2016 through March 31, 2021. (2) On March 11, 2020, the World Health Organization declared COVID-19 a global pandemic. The metrics for Q1-Q4 2020 reflect the impact COVID-19 on the operations of Ageility clinics. (3) As part of the Strategic Plan the 37 Ageility inpatient clinics are expected to be closed. As part of the Strategic Plan, 108 senior living communities managed on behalf of DHC are expected to be transitioned to new operators. These communities have 44 Ageility outpatient rehabilitation clinics, which, due to the transfer to a new operator, may be subject closure by the new operator. (4) Q1 2021 Rehabilitation and Wellness Services revenue totaling $19,553 were annualized for comparative purposes. (4) $30,256 $33,296 $37,703 $48,686 $82,032 $78,212

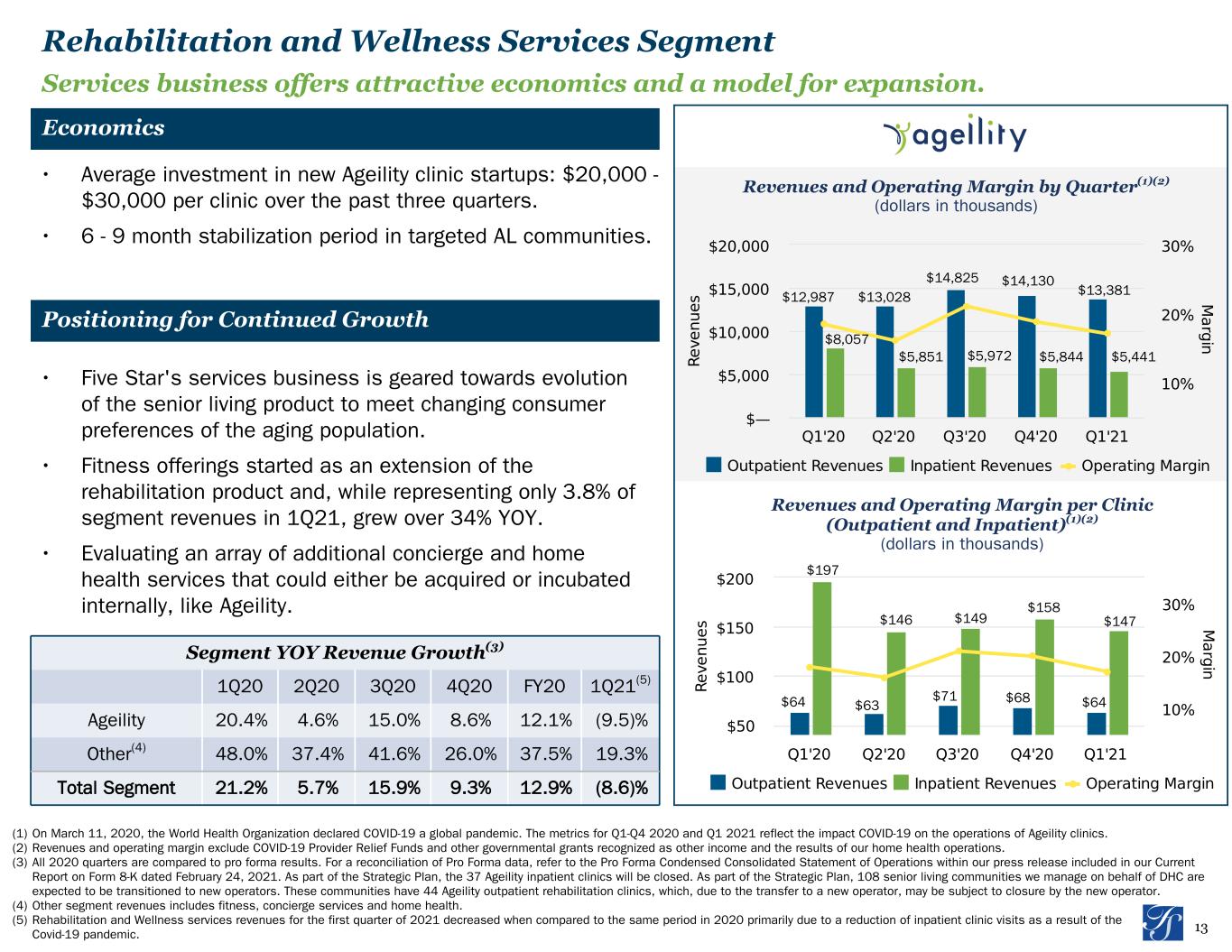

13 • Five Star's services business is geared towards evolution of the senior living product to meet changing consumer preferences of the aging population. • Fitness offerings started as an extension of the rehabilitation product and, while representing only 3.8% of segment revenues in 1Q21, grew over 34% YOY. • Evaluating an array of additional concierge and home health services that could either be acquired or incubated internally, like Ageility. Economics Positioning for Continued Growth • Average investment in new Ageility clinic startups: $20,000 - $30,000 per clinic over the past three quarters. • 6 - 9 month stabilization period in targeted AL communities. Revenues and Operating Margin per Clinic (Outpatient and Inpatient)(1)(2) (dollars in thousands) (1) On March 11, 2020, the World Health Organization declared COVID-19 a global pandemic. The metrics for Q1-Q4 2020 and Q1 2021 reflect the impact COVID-19 on the operations of Ageility clinics. (2) Revenues and operating margin exclude COVID-19 Provider Relief Funds and other governmental grants recognized as other income and the results of our home health operations. (3) All 2020 quarters are compared to pro forma results. For a reconciliation of Pro Forma data, refer to the Pro Forma Condensed Consolidated Statement of Operations within our press release included in our Current Report on Form 8-K dated February 24, 2021. As part of the Strategic Plan, the 37 Ageility inpatient clinics will be closed. As part of the Strategic Plan, 108 senior living communities we manage on behalf of DHC are expected to be transitioned to new operators. These communities have 44 Ageility outpatient rehabilitation clinics, which, due to the transfer to a new operator, may be subject to closure by the new operator. (4) Other segment revenues includes fitness, concierge services and home health. (5) Rehabilitation and Wellness services revenues for the first quarter of 2021 decreased when compared to the same period in 2020 primarily due to a reduction of inpatient clinic visits as a result of the Covid-19 pandemic. Revenues and Operating Margin by Quarter(1)(2) (dollars in thousands) Rehabilitation and Wellness Services Segment Segment YOY Revenue Growth(3) 1Q20 2Q20 3Q20 4Q20 FY20 1Q21(5) Ageility 20.4% 4.6% 15.0% 8.6% 12.1% (9.5)% Other(4) 48.0% 37.4% 41.6% 26.0% 37.5% 19.3% Total Segment 21.2% 5.7% 15.9% 9.3% 12.9% (8.6)% Services business offers attractive economics and a model for expansion. $12,987 $13,028 $14,825 $14,130 $13,381 $8,057 $5,851 $5,972 $5,844 $5,441 $64 $63 $71 $68 $64 $197 $146 $149 $158 $147

14 ▪ Generated net income of $3.3 million and Adjusted EBITDA(2) of $6.9 million. • Net income and Adjusted EBITDA includes $7.8 million received and recognized under the Provider Relief Fund of the CARES Act primarily related to our independent and assisted living communities. ▪ Liquidity as of March 31, 2021: ◦ $109.5 million of unrestricted cash and cash equivalents on hand. ◦ $7.1 million of outstanding debt in one mortgage note maturing 2032. ◦ No borrowings outstanding under $65.0 million(1) revolving credit facility secured by 11 communities with a net book value of $95.8 million. ◦ Own eight unencumbered AL/IL communities with 742 living units and a net book value of $40.3 million. Financial Highlights Strong Balance Sheet First Quarter 2021 Performance Revenue Mix Uses of Cash 1. Owned portfolio — average $1,800-$2,200 per unit in maintenance capex annually → drive competitiveness. 2. Rehabilitation and Wellness services segment — expansion of Ageility with 2-4 net new clinics quarterly in 2021 → diversify and grow revenues. 3. Shared services platform — investment in people and technologies → support efficiency and growth. (1) The amount of available borrowings under our revolving credit facility is subject to qualifying collateral and is reduced by issued letters of credit. At March 31, 2021, we had letters of credit issued under the credit facility and outstanding of $2.4 million and $14.9 million available for borrowings under our revolving credit facility. (2) See slide 18 for calculation of adjusted EBITDA. (2 )

Appendix

16 Condensed Consolidated Statement of Operations Compared to Q1 2020 Results (in thousands) (unaudited) Appendix Three Months Ended March 31, 2021 March 31, 2020 Revenues Rehabilitation and wellness services $ 19,553 $ 21,384 Senior living 17,057 20,997 Management fees 13,850 17,051 Total management and operating revenues 50,460 59,432 Reimbursed community-level costs incurred on behalf of managed communities 213,160 232,016 Other reimbursed expenses 5,480 5,997 Total revenues 269,100 297,445 Other operating income(1) 7,793 — Operating expenses Rehabilitation and wellness services expenses 16,210 17,501 Senior living wages and benefits 12,013 9,800 Other senior living operating expenses 6,266 3,938 Community-level costs incurred on behalf of managed communities 213,160 232,016 General and administrative 22,641 22,865 Depreciation and amortization 2,940 2,701 Total operating expenses 273,230 288,821 Other income (expense) (148) (24,425) Income (loss) before income taxes 3,515 (15,801) Provision for income taxes (200) (1,408) Net income (loss) $ 3,315 $ (17,209) (1) Other operating income includes income recognized under the Provider Relief Fund of the CARES Act and other governmental grants, primarily related to our independent and assisted living communities.

17 (1) CapEx spend by segment represents amounts paid related to the acquisition of property and equipment of Five Star and does not reflect amounts paid for the acquisition of property and equipment on behalf of and reimbursed by DHC. (2) During 2020 we closed six rehabilitation and wellness services outpatient clinics and four inpatient clinics, primarily as a result of being located in senior living communities that were operated in communities we managed on behalf of DHC that were sold or closed. CapEx Spend by Segment(1) (dollars in thousands, except per unit and clinic data) (unaudited) Three Months Ended March 31, 2021 March 31, 2020 Senior living: Development, redevelopment and other activities $ 149 $ 136 Building improvements 1,792 1,449 Total senior living 1,941 1,585 Rehabilitation and wellness services: New clinic opening 57 169 Recurring clinic investment 20 43 Total rehabilitation and wellness services 77 212 Corporate and other 118 216 Total CapEx spend $ 2,136 $ 2,013 Senior living: Number of units 2,302 2,312 Development, redevelopment and other activities spend per unit $ 65 $ 59 Building improvements spend per unit $ 778 $ 627 Rehabilitation and wellness services: Number of clinics 252 244 Number of new clinics opened 8 13 Number of clinics closed(2) — — Number of net new clinics 8 13 New clinic opening spend per clinic $ 7,125 $ 13,000 Recurring investment per clinic $ 82 $ 186 Appendix

18 (1) Includes funds received under the Provider Relief Fund of the CARES Act and other governmental grants. (2) Represents the excess of the fair value of the shares issued to DHC as of January 1, 2020 of $97,899 compared to the consideration of $75,000 paid by DHC as part of the transaction agreement to restructure Five Star's business arrangements with DHC, or the Restructuring Transactions. (3) Includes costs incurred related to the Strategic Plan announced on April 9, 2021 for the quarter ended March 31, 2021 and the Restructuring Transactions for the quarter ended March 31, 2020. EBITDA and Adjusted EBITDA (in thousands) (unaudited) Three Months Ended March 31, 2021(1) March 31, 2020 Net income (loss) $ 3,315 $ (17,209) Add (less): Interest and other expense 463 382 Interest, dividend and other income (84) (339) Provision (benefit) for income taxes 200 1,408 Depreciation and amortization 2,940 2,701 EBITDA $ 6,834 $ (13,057) Add (less): Unrealized (gain) loss on equity investments (135) 1,462 Loss on termination of leases(2) — 22,899 Transaction costs(3) 250 1,095 Adjusted EBITDA $ 6,949 $ 12,399 Appendix

19 (1) Net cash provided by (used in) operating activities, net cash provided by (used in) investing activities and acquisition of property and equipment for the three months ended March 31, 2020 reflect reclassification adjustments of certain DHC reimbursements from the prior period to conform to the current period presentation. Condensed Consolidated Statements of Cash Flows (in thousands) (unaudited) Three Months Ended March 31, 2021 March 31, 2020 CASH FLOW FROM OPERATING ACTIVITIES: Net (loss) income $ 3,315 $ (17,209) Adjustments to reconcile net (loss) income to cash provided by operating activities Non-cash income and expense adjustments, net 3,201 27,742 Changes in assets and liabilities(1) 20,310 (5,066) Net cash provided by operating activities 26,826 5,467 CASH FLOW FROM INVESTING ACTIVITIES: Acquisition of property and equipment(1) (2,136) (2,013) Purchases of debt and equity investments (130) (1,588) Proceeds from sale of property and equipment — 2,725 Distributions in excess of earnings from Affiliates Insurance Company — — Proceeds from sale of debt and equity investments 337 1,453 Net cash (used in) provided by investing activities (1,929) 577 CASH FLOW FROM FINANCING ACTIVITIES: Costs related to issuance of common stock — (559) Repayments of mortgage note payable (103) (95) Payment of employee tax obligations on withheld shares — — Targeted SNF distribution funds received on behalf of others — — Net cash (used in) provided by financing activities (103) (654) Increase (decrease) in cash and cash equivalents and restricted cash and restricted cash equivalents 24,794 5,390 Cash and cash equivalents and restricted cash and restricted cash equivalents at beginning of period 109,597 56,979 Cash and cash equivalents and restricted cash and restricted cash equivalents at end of period $ 134,391 $ 62,369 Reconciliation of cash and cash equivalents and restricted cash and cash equivalents: Cash and cash equivalents $ 109,485 $ 36,641 Current restricted cash and cash equivalents 23,717 24,290 Other restricted cash and cash equivalents 1,189 1,438 Cash and cash equivalents and restricted cash and cash equivalents at end of period $ 134,391 $ 62,369 Appendix

Nasdaq: FVE fivestarseniorliving.com ir@5ssl.com