Attached files

| file | filename |

|---|---|

| 8-K - 8-K - R1 RCM INC. | achi-20210504.htm |

| EX-99.1 - EX-99.1 - R1 RCM INC. | a991-q12021pressrelease.htm |

First Quarter 2021 Results Conference Call May 4, 2021 Exhibit 99.2

2 Forward-Looking Statements and Non-GAAP Financial Measures This presentation includes information that may constitute “forward-looking statements,” made pursuant to the safe harbor provisions of the Private Securities Litigation Reform Act of 1995. Forward-looking statements relate to future, not past, events and often address our expected future growth, plans and performance or forecasts. These forward-looking statements are often identified by the use of words such as “anticipate,” “believe,” “designed,” “estimate,” “expect,” “forecast,” “intend,” “may,” “plan,” “predict,” “project,” “target,” “will,” or “would,” and similar expressions or variations, although not all forward-looking statements contain these identifying words. These forward-looking statements include, among other things, statements about the potential impacts of the COVID-19 pandemic, our strategic initiatives, our capital plans, our costs, our ability to successfully deliver on our commitments to our customers, our ability to deploy new business as planned, our acquisitions, our ability to successfully implement new technologies, our future financial performance and our liquidity. Such forward-looking statements are based on management’s current expectations about future events as of the date hereof and involve many risks and uncertainties that could cause our actual results to differ materially from those expressed or implied in our forward-looking statements. Subsequent events and developments, including actual results or changes in our assumptions, may cause our views to change. We do not undertake to update our forward-looking statements except to the extent required by applicable law. Readers are cautioned not to place undue reliance on such forward-looking statements. All forward-looking statements included herein are expressly qualified in their entirety by these cautionary statements. Our actual results and outcomes could differ materially from those included in these forward-looking statements as a result of various factors, including, but not limited to, the severity, magnitude and duration of the COVID-19 pandemic; responses to the pandemic by the government and healthcare providers and the direct and indirect impacts of the pandemic on our customers and personnel; the disruption of national, state and local economies as a result of the pandemic; the impact of the pandemic on our financial results, including possible lost revenue and increased expenses; our ability to close the acquisition of and integrate the VisitPay business as planned and to realize the expected benefits of the acquisition; and the factors discussed under the heading “Risk Factors” in our annual report on Form 10-K for the year ended December 31, 2020, our quarterly reports on Form 10-Q and any other periodic reports that the Company files with the Securities and Exchange Commission. This presentation includes the following non-GAAP financial measures: adjusted EBITDA, non-GAAP cost of services, non-GAAP SG&A expense and net debt. Please refer to the Appendix located at the end of this presentation for a reconciliation of the non-GAAP financial measures to the most directly comparable GAAP financial measures.

3 Q1 Financial Highlights and Commercial Update First Quarter 2021 Results ▪ Revenue of $342.6 million, up $22.1 million or 6.9%1 compared to the same period last year ▪ GAAP net income of $25.8 million, up $7.6 million or 41.8% compared to the same period last year ▪ Adjusted EBITDA of $80.4 million, up $18.8 million or 30.5% compared to the same period last year Commercial Update ▪ Tone and quality of discussions remain very encouraging ▪ High degree of confidence in signing $4 billion in new end-to-end NPR in 2021 ▪ With Ascension extension, weighted average contract life of end-to-end contracts is 9.0 years Note1: Reflects impact of lower volumes due to Covid

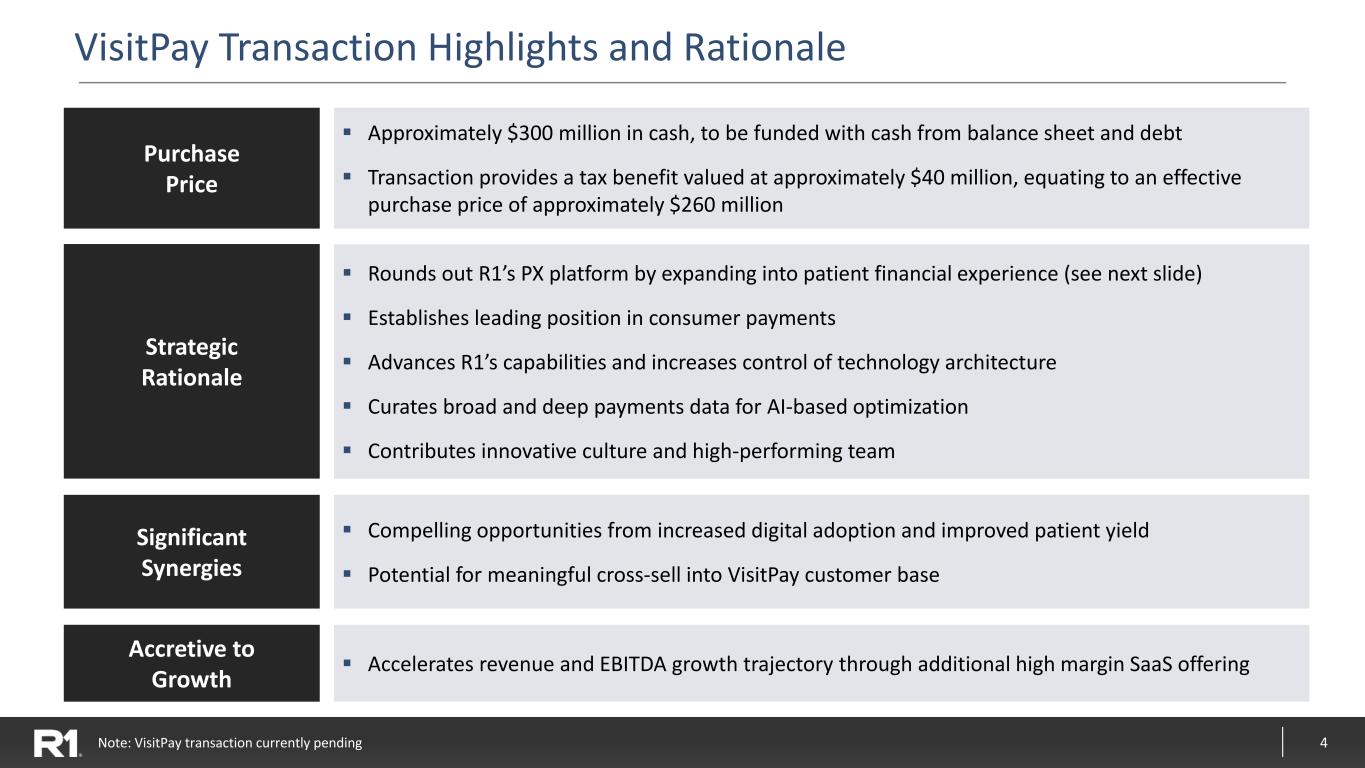

4 VisitPay Transaction Highlights and Rationale Accretive to Growth ▪ Accelerates revenue and EBITDA growth trajectory through additional high margin SaaS offering Significant Synergies ▪ Compelling opportunities from increased digital adoption and improved patient yield ▪ Potential for meaningful cross‐sell into VisitPay customer base Strategic Rationale ▪ Rounds out R1’s PX platform by expanding into patient financial experience (see next slide) ▪ Establishes leading position in consumer payments ▪ Advances R1’s capabilities and increases control of technology architecture ▪ Curates broad and deep payments data for AI‐based optimization ▪ Contributes innovative culture and high-performing team Purchase Price ▪ Approximately $300 million in cash, to be funded with cash from balance sheet and debt ▪ Transaction provides a tax benefit valued at approximately $40 million, equating to an effective purchase price of approximately $260 million Note: VisitPay transaction currently pending

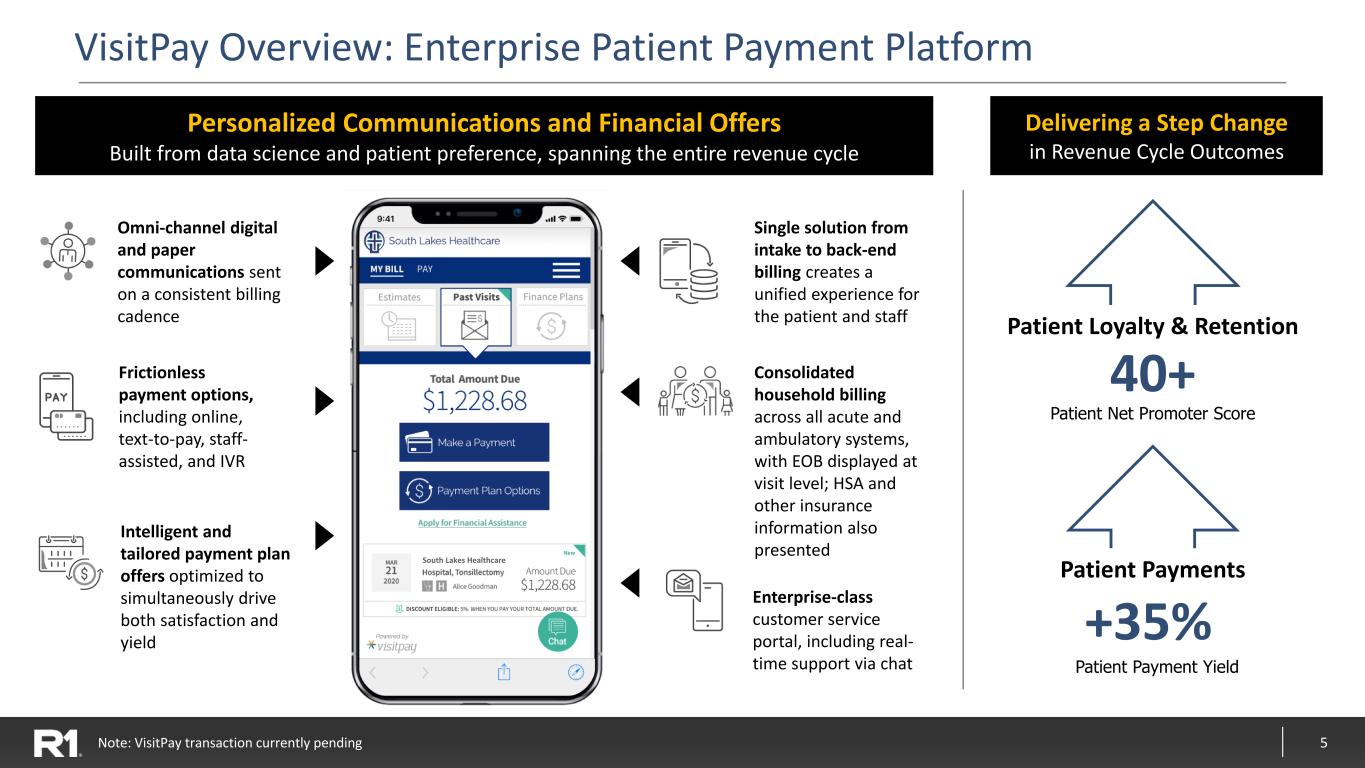

5 VisitPay Overview: Enterprise Patient Payment Platform Single solution from intake to back-end billing creates a unified experience for the patient and staff Consolidated household billing across all acute and ambulatory systems, with EOB displayed at visit level; HSA and other insurance information also presented Enterprise-class customer service portal, including real- time support via chat Omni-channel digital and paper communications sent on a consistent billing cadence Frictionless payment options, including online, text-to-pay, staff- assisted, and IVR Intelligent and tailored payment plan offers optimized to simultaneously drive both satisfaction and yield +35% Patient Payment Yield 40+ Personalized Communications and Financial Offers Built from data science and patient preference, spanning the entire revenue cycle Delivering a Step Change in Revenue Cycle Outcomes Patient Loyalty & Retention Patient Payments South Lakes Healthcare Patient Net Promoter Score Note: VisitPay transaction currently pending

6 Book Intuitive Scheduler ▪ Order & referrals integrated from the start ▪ Patients and providers book in real-time based on true capacity ▪ Built-in proprietary clinical & administrative rules & logic Patient Payments ▪ Seamless payment and billing experience across settings of care ▪ Intuitive payment options that drive highest yield ▪ Vertically integrated consumer payment capability Verify & Register ▪ Comprehensive pre- registration, financial clearance and counseling ▪ Automation for authorization, eligibility, & medical necessity ▪ Pre-service price estimation based on contract model Check-In ▪ Contactless arrival ▪ Enabled on smart-phone, tablet, or kiosk ▪ Dynamic pre-service forms and surveys Clear Arrive Pay Platform Components Analytics & Operating System Rules Engine & Work Drivers Data Management User Interface ACCESS Patient Experience (PX) Platform: Market-Leading Capability 1 Note1: VisitPay transaction currently pending

7 ▪ Expansion of agreement is across three categories: 1. Comprehensive deployment of PX across acute and ambulatory environments 2. Expansion of scheduling scope and certain patient-facing services through our global delivery centers 3. Broader application of technology and use cases for automating key functions ▪ Master services agreement with Ascension extended through April 2031, a 10-year term ▪ Phase 1 and Phase 2 onboarding underway ▪ Phase 3 expected to commence in July with goal of completing all deployment activities mid-2022 ▪ Welcomed David Dill, LifePoint’s CEO and President, to R1’s Board in April ▪ 40 million tasks automated to date, up from 30 million at year-end 2020 ▪ Modular nature of development approach allows for faster development of new routines ▪ Investments in capabilities beyond core RPA have expanded coverage of workflows Strategic Expansion and Extension of Ascension Agreement LifePoint Onboarding Progressing on Schedule Automation and Digitization Effort Continues to Advance Additional Discussion Topics

8 1Q'21 Non-GAAP Results – Q/Q and Y/Y Comparison ($ in millions) 1Q'21 4Q'20 1Q'20 Key Change Driver(s) Revenue $342.6 $328.4 $320.5 ▪ Q/Q: Continued recovery in patient volumes, higher incentive fees ▪ Y/Y: Contribution from SCI, higher incentive fees, and new customers onboarded in 2021 Adjusted Cost of Services1 $242.8 $242.9 $237.6 ▪ Q/Q: Efficiencies from automation and digitization efforts ▪ Y/Y: Costs associated with onboarding new customers, partially offset by efficiencies from automation and digitization Adjusted SG&A expense1 $19.4 $22.8 $21.3 ▪ Q/Q: Q4’20 impacted by higher payroll taxes related to vesting of employee stock awards ▪ Y/Y: Lower travel and marketing costs, and corporate costs Adjusted EBITDA1 $80.4 $62.7 $61.6 ▪ Q/Q: Higher incentive fees ▪ Y/Y: Higher revenue and lower costs due to automation and digitization Note1: Adjusted cost of services, adjusted SG&A expense and adjusted EBITDA are non-GAAP measures. A reconciliation of non-GAAP to GAAP measures is provided in the Appendix of this presentation.

9 Additional Commentary ▪ Up from $379.8 million as of 12/31/20, driven by - Use of cash for $105 million payment for the conversion of preferred shares to common - Capex of $9.6 million ▪ $130+ million in liquidity as of 3/31/21 ▪ Seeking to refinance senior credit facilities in conjunction with VisitPay acquisition to increase size, enhance liquidity, and improve pricing ▪ Revenue of $1,410 million to $1,460 million - Assumes patient volumes remain at 90-95% of pre-Covid levels over the course of 2021 ▪ Adjusted EBITDA of $315 million to $330 million ▪ Expect Q2 revenue and adjusted EBITDA of $335-$345 million and $65-75 million - Costs associated with onboarding LifePoint expected to ramp up in Q2 Note1: Net debt is a non-GAAP measure. A reconciliation of non-GAAP to GAAP measures is provided in the Appendix of this presentation. Net debt1 of $444.1 million as of 3/31/21, including restricted cash Liquidity Remains Strong 2021 Financial Outlook

10 Appendix Reconciliation of GAAP to Non-GAAP Financials

11 Use of Non-GAAP Financial Measures ▪ In order to provide a more comprehensive understanding of the information used by R1’s management team in financial and operational decision making, the Company supplements its GAAP consolidated financial statements with certain non-GAAP financial performance measures, including adjusted EBITDA, adjusted cost of services, adjusted SG&A expense and net debt. Adjusted EBITDA is defined as GAAP net income before net interest income/expense, income tax provision/benefit, depreciation and amortization expense, share-based compensation expense, severance and related employee benefits, strategic initiatives costs, certain COVID-19 related expenses, and certain other items. Adjusted cost of services is defined as GAAP cost of services before share-based compensation expense and depreciation and amortization expense. Adjusted SG&A expense is defined as GAAP SG&A expense before share-based compensation expense and depreciation and amortization expense. Net debt is defined as total debt less cash and cash equivalents, and restricted cash. ▪ Our board of directors and management team use adjusted EBITDA as (i) one of the primary methods for planning and forecasting overall expectations and for evaluating actual results against such expectations and (ii) a performance evaluation metric in determining achievement of certain executive incentive compensation programs, as well as for incentive compensation programs for employees. ▪ A reconciliation of GAAP net income to non-GAAP adjusted EBITDA, GAAP cost of services to non-GAAP cost of services, GAAP SG&A expense to non-GAAP SG&A expense and total debt to net debt is provided on the following slides. Adjusted EBITDA, adjusted cost of services, adjusted SG&A expense and net debt should be considered in addition to, but not as a substitute for, the information presented in accordance with GAAP.

12 Reconciliation of GAAP to Non-GAAP Financials Note (1): Other expenses are comprised of reorganization-related costs, strategic initiatives costs, and certain other costs. Three Months Ended March 31, Three Months Ended December 31, 2021 2020 2020 Net income $ 25.8 $ 18.2 $ 78.6 Net interest expense 3.9 3.8 4.3 Income tax provision (benefit) 7.1 10.4 (15.3) Depreciation and amortization expense 17.9 15.7 17.8 Share-based compensation expense 12.7 4.8 8.1 Gain on business disposition — — (55.7) Other expenses 13.0 8.7 24.9 Adjusted EBITDA (non-GAAP) $ 80.4 $ 61.6 $ 62.7 Three Months Ended March 31, Three Months Ended December 31, 2021 2020 2020 Cost of services $ 267.2 $ 253.9 $ 263.7 Less: Share-based compensation expense 7.3 1.9 3.8 Depreciation and amortization expense 17.1 14.4 17.0 Non-GAAP cost of services $ 242.8 $ 237.6 $ 242.9 Three Months Ended March 31, Three Months Ended December 31, 2021 2020 2020 Selling, general and administrative $ 25.6 $ 25.5 $ 27.9 Less: Share-based compensation expense 5.4 2.9 4.3 Depreciation and amortization expense 0.8 1.3 0.8 Non-GAAP selling, general and administrative $ 19.4 $ 21.3 $ 22.8 Reconciliation of GAAP SG&A to Non-GAAP SG&A Reconciliation of GAAP Cost of Services to Non-GAAP Cost of Services Reconciliation of GAAP Net Income to Non-GAAP Adjusted EBITDA$ in millions

13 Reconciliation of GAAP to Non-GAAP Financials Reconciliation of GAAP Operating Income Guidance to Non-GAAP Adjusted EBITDA Guidance 2021 GAAP Operating Income Guidance $135-155 Plus: Depreciation and amortization expense $70-80 Share-based compensation expense $55-60 Strategic initiatives, severance and other costs $50-55 Adjusted EBITDA Guidance $315-330 Reconciliation of Total Debt to Net Debt March 31, December 31, 2021 2020 Senior Revolver $ 70.0 $ 70.0 Senior Term Loan 478.1 484.6 Total debt 548.1 554.6 Less: Cash and cash equivalents 103.5 173.8 Non-current portion of restricted cash equivalents 0.5 1.0 Net Debt $ 444.1 $ 379.8 $ in millions