Attached files

| file | filename |

|---|---|

| EX-99.1 - EX-99.1 - GRAY TELEVISION INC | d386203dex991.htm |

| 8-K - 8-K - GRAY TELEVISION INC | d386203d8k.htm |

Gray Television, Inc. Investor Presentation May 3, 2021 4370 Peachtree Road, NE, Atlanta, GA 30319 | P 404.504.9828 | F 404.261.9607 | www.gray.tv Gray to Acquire Meredith Corporation’s Local Media Group and Become the Second Largest TV Broadcast Group Exhibit 99.2

Disclaimer and Non-GAAP Financial Data This presentation contains certain forward looking statements that are based largely on Gray’s current expectations and reflect various estimates and assumptions. These statements may be identified by words such as “estimates”, “expect,” “anticipate,” “will,” “implied,” “assume” and similar expressions. Forward looking statements are subject to certain risks, trends and uncertainties that could cause actual results and achievements to differ materially from those expressed in such forward looking statements. Such risks, trends and uncertainties, which in some instances are beyond Gray’s control, include Gray’s inability to complete its pending acquisitions of Meredith Local Media Group and Quincy (as defined herein) on the terms and within the timeframe currently contemplated, any material regulatory or other unexpected requirements in connection therewith, or the inability to achieve expected synergies therefrom on a timely basis or at all, the impact of recently completed transactions, estimates of future retransmission revenue, future expenses and other future events. Gray is subject to additional risks and uncertainties described in Gray’s quarterly and annual reports filed with the Securities and Exchange Commission from time to time, including in the “Risk Factors,” and management’s discussion and analysis of financial condition and results of operations sections contained therein. Any forward looking statements in this presentation should be evaluated in light of these important risk factors. This presentation reflects management’s views as of the date hereof. Except to the extent required by applicable law, Gray undertakes no obligation to update or revise any information contained in this presentation beyond the published date, whether as a result of new information, future events or otherwise. Certain definitions, including the presentation of Combined Historical Basis (“CHB”) data, and reconciliations of the Company’s non-GAAP financial measures presented herein, including Operating Cash Flow (“OCF”) as defined in the Senior Credit Agreement, are contained in the Appendix. The financial information attributable to Meredith Local Media Group and Quincy for each of the periods presented are based on good faith estimates and assumptions of Gray management derived entirely from financial information provided by each respective entity in the due diligence process prior to our ownership and control thereof. Accordingly, although we believe such information to be accurate, such information cannot be independently verified by our management. This financial information also includes certain non-GAAP financial measures that are dependent on financial results that are not yet determinable with certainty. We are unable to present a quantitative reconciliation of the estimated non-GAAP financial measures to their most directly comparable GAAP financial measures because such information is not yet available and management cannot reliably estimate all of the necessary components of such GAAP measures without unreasonable effort or expense. In addition, we believe such reconciliation would imply a degree of precision that would be confusing or misleading to investors. This full presentation, including the Appendix, can be found at www.gray.tv under Investor Relations –Presentations.

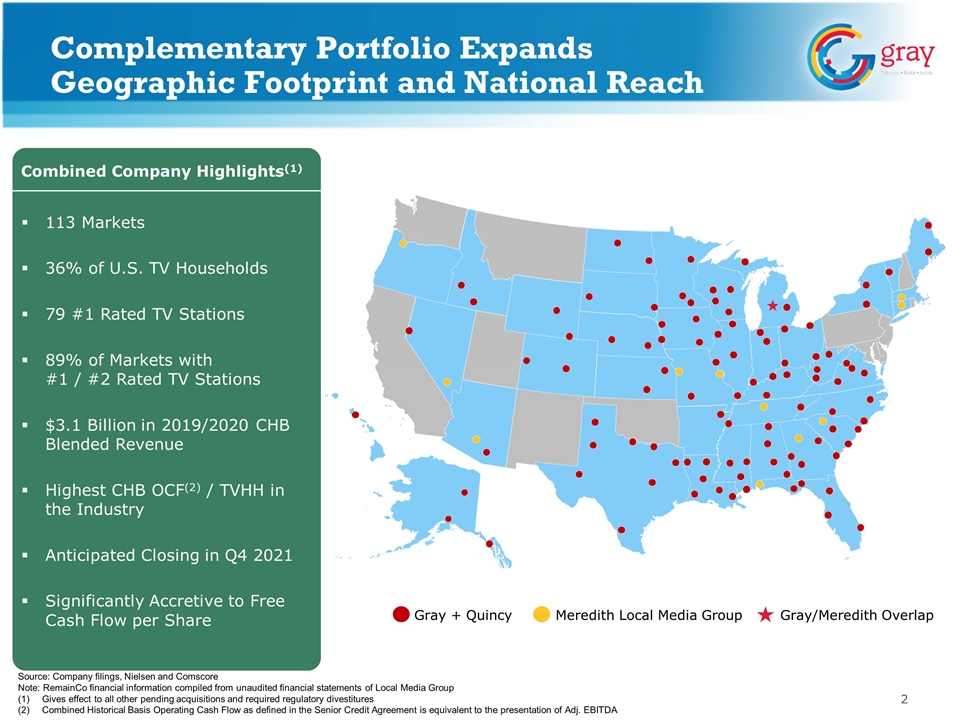

113 Markets 36% of U.S. TV Households 79 #1 Rated TV Stations 89% of Markets with #1 / #2 Rated TV Stations $3.1 Billion in 2019/2020 CHB Blended Revenue Highest CHB OCF(2) / TVHH in the Industry Anticipated Closing in Q4 2021 Significantly Accretive to Free Cash Flow per Share Complementary Portfolio Expands Geographic Footprint and National Reach Source: Company filings, Nielsen and Comscore Note: RemainCo financial information compiled from unaudited financial statements of Local Media Group Gives effect to all other pending acquisitions and required regulatory divestitures Combined Historical Basis Operating Cash Flow as defined in the Senior Credit Agreement is equivalent to the presentation of Adj. EBITDA Combined Company Highlights(1) Gray + Quincy Meredith Local Media Group Gray/Meredith Overlap

A Compelling Combination Gray to acquire Meredith’s Local Media Group (“RemainCo”) for $2.7 billion in enterprise value Adds 17 television stations (14 Big Four affiliates) across 12 markets to Gray’s portfolio Top-40 DMAs generate 92% of RemainCo’s 2019/2020 blended OCF Meredith’s National Media Group (“SpinCo”) to be spun off to Meredith shareholders along with the company’s corporate infrastructure, MNI Targeted Media and other non-broadcast assets Gray will become the second largest television broadcast group based on broadcast revenues, broadcast OCF and markets Expanded geographic footprint with presence in 113 markets(1) Increased scale and operating leverage with the pro forma company reaching 36% of TV households Gray remains the largest owner of #1 TV stations with the highest percentage (89%) of markets with #1 / #2 rated stations Financially compelling combination with immediate value creation Estimated year 1 identified annual synergies of $55 million Implied buy-side multiple of 7.9x RemainCo’s 2019/2020 blended OCF including expected year 1 annual synergies 2019/2020 CHB blended net revenue of $3.1 billion and OCF of $1.2 billion(1,2) Significantly accretive to Free Cash Flow per share Clear regulatory path to approval – anticipated closing in Q4 2021 Source: Nielsen and Comscore Note: RemainCo financial information compiled from unaudited financial statements of Local Media Group Includes television assets acquired from Quincy Media, Inc. (“Quincy”) including year 1 annual synergies of $23 million Operating Cash Flow as defined in the Senior Credit Agreement is equivalent to the presentation of Adj. EBITDA; Includes estimated Year 1 annual synergies of $55 million and impact of planned divestiture of Gray’s station in Flint, MI

Transaction Summary Debt Capital Structure Underwritten committed debt financing from Wells Fargo Estimated net debt leverage of ~5.3x at year-end 2021, including $55 million of synergies Gray’s existing term loan facilities and senior unsecured notes will remain in place Immediately prior to the transaction with Gray, Meredith will separate its operations into two companies, SpinCo and RemainCo SpinCo to be composed of Meredith’s National Media Group (publishing assets), MNI Targeted Media and all unallocated corporate overhead / personnel RemainCo to be composed of Meredith’s Local Media Group (television broadcasting assets) Gray will acquire RemainCo in an all-cash transaction for $2.7 billion Pay $14.51 in cash per Meredith share Assume / repay $1.975 billion of RemainCo net debt at close SpinCo will be spun-off to existing Meredith shareholders immediately prior to closing and therefore excluded from the transaction perimeter with Gray Transaction Overview Approvals & Timing Gray shareholder vote not required Subject to Meredith shareholder approval Subject to FCC approval and other customary closing conditions Gray will divest its existing station in Flint, MI (WJRT) Anticipated closing in Q4 2021

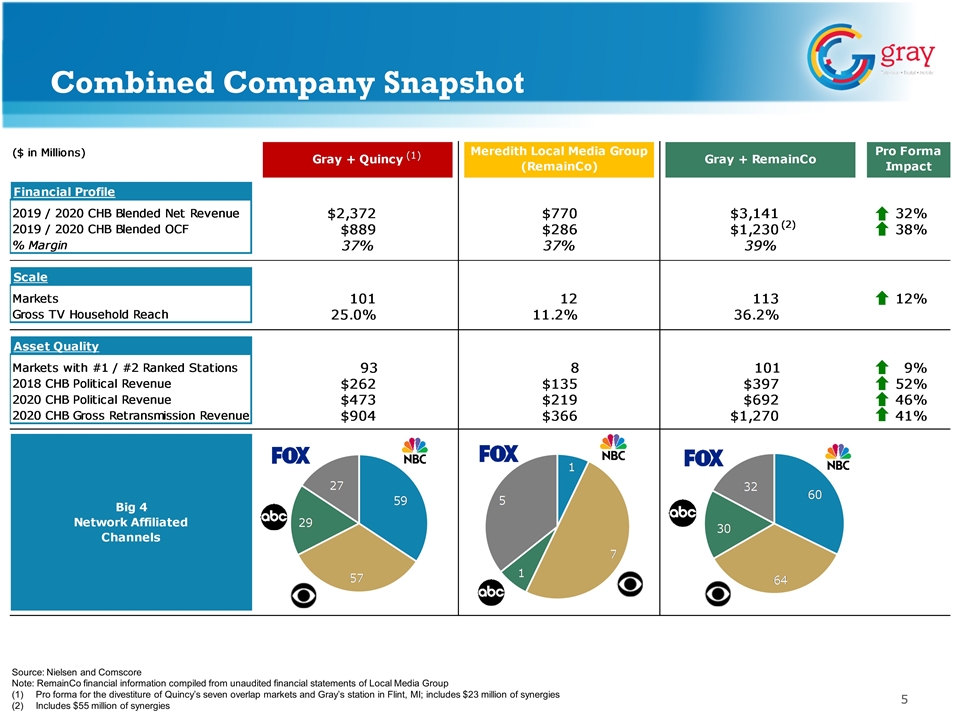

Combined Company Snapshot Source: Nielsen and Comscore Note: RemainCo financial information compiled from unaudited financial statements of Local Media Group Pro forma for the divestiture of Quincy’s seven overlap markets and Gray’s station in Flint, MI; includes $23 million of synergies Includes $55 million of synergies

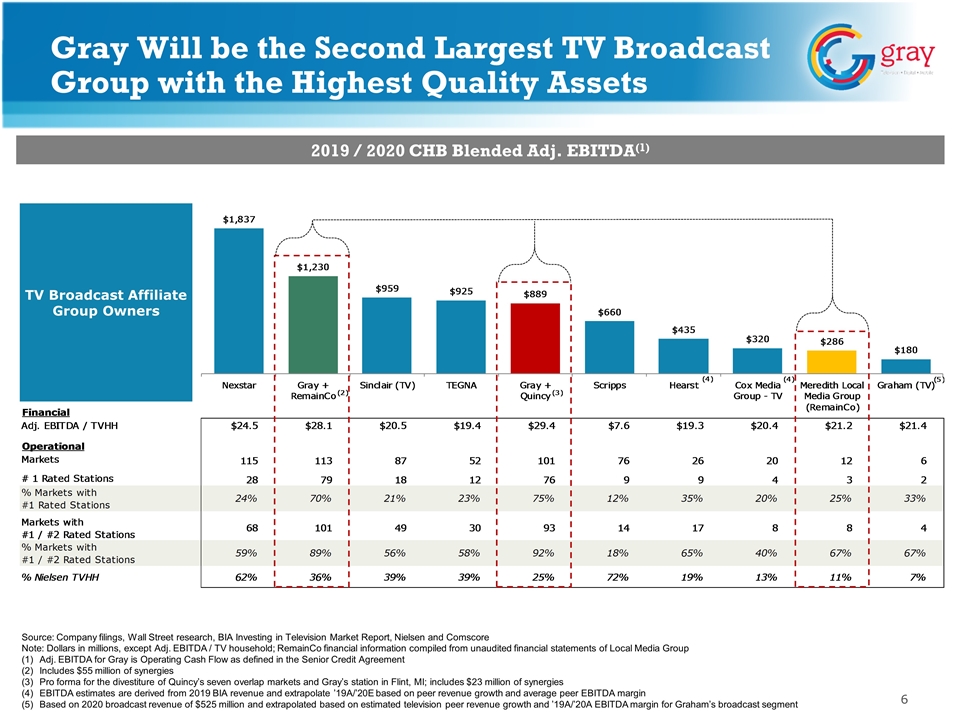

Gray Will be the Second Largest TV Broadcast Group with the Highest Quality Assets Source: Company filings, Wall Street research, BIA Investing in Television Market Report, Nielsen and Comscore Note: Dollars in millions, except Adj. EBITDA / TV household; RemainCo financial information compiled from unaudited financial statements of Local Media Group Adj. EBITDA for Gray is Operating Cash Flow as defined in the Senior Credit Agreement Includes $55 million of synergies Pro forma for the divestiture of Quincy’s seven overlap markets and Gray’s station in Flint, MI; includes $23 million of synergies EBITDA estimates are derived from 2019 BIA revenue and extrapolate ’19A/’20E based on peer revenue growth and average peer EBITDA margin Based on 2020 broadcast revenue of $525 million and extrapolated based on estimated television peer revenue growth and ’19A/’20A EBITDA margin for Graham’s broadcast segment TV Broadcast Affiliate Group Owners 2019 / 2020 CHB Blended Adj. EBITDA(1)

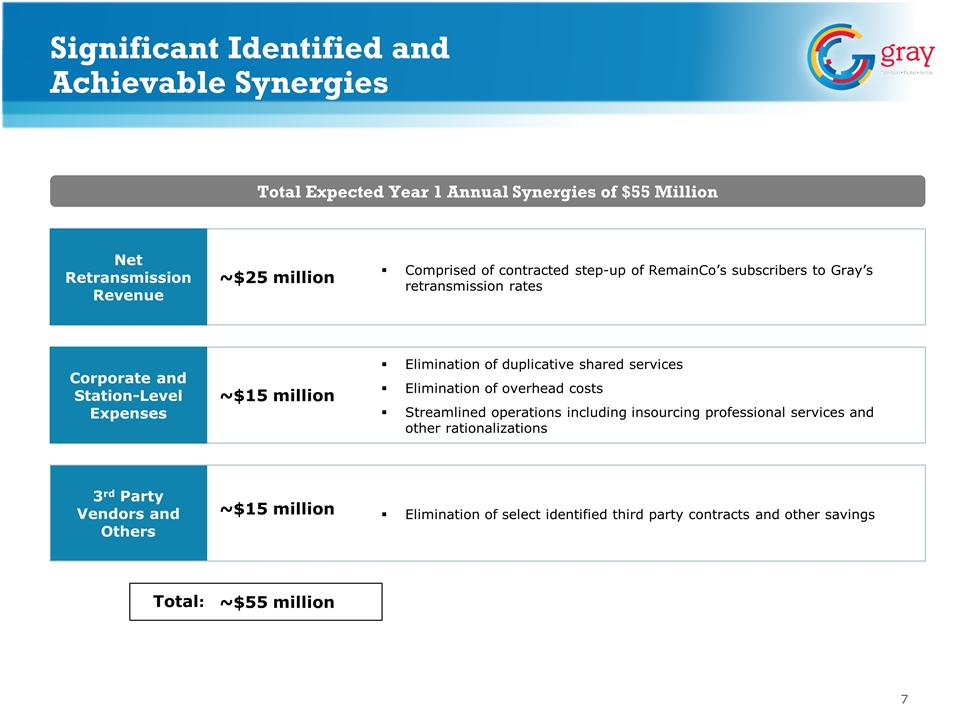

Significant Identified and Achievable Synergies Total Expected Year 1 Annual Synergies of $55 Million Comprised of contracted step-up of RemainCo’s subscribers to Gray’s retransmission rates Net Retransmission Revenue ~$25 million Elimination of duplicative shared services Elimination of overhead costs Streamlined operations including insourcing professional services and other rationalizations Corporate and Station-Level Expenses ~$15 million 3rd Party Vendors and Others Elimination of select identified third party contracts and other savings ~$15 million Total: ~$55 million

Appendix

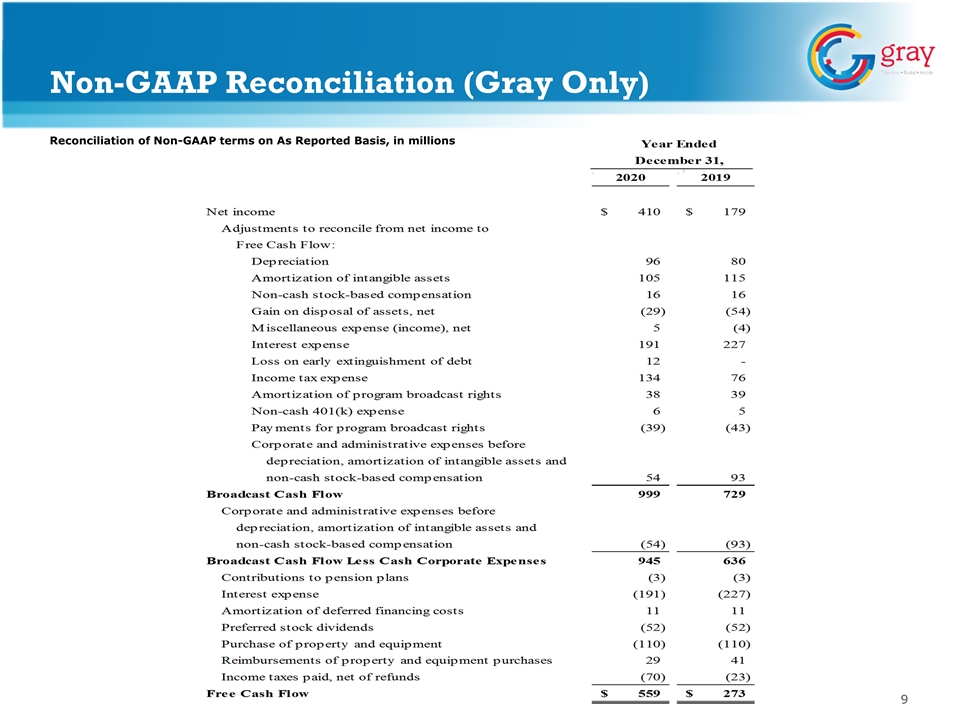

Reconciliation of Non-GAAP terms on As Reported Basis, in millions Non-GAAP Reconciliation (Gray Only)

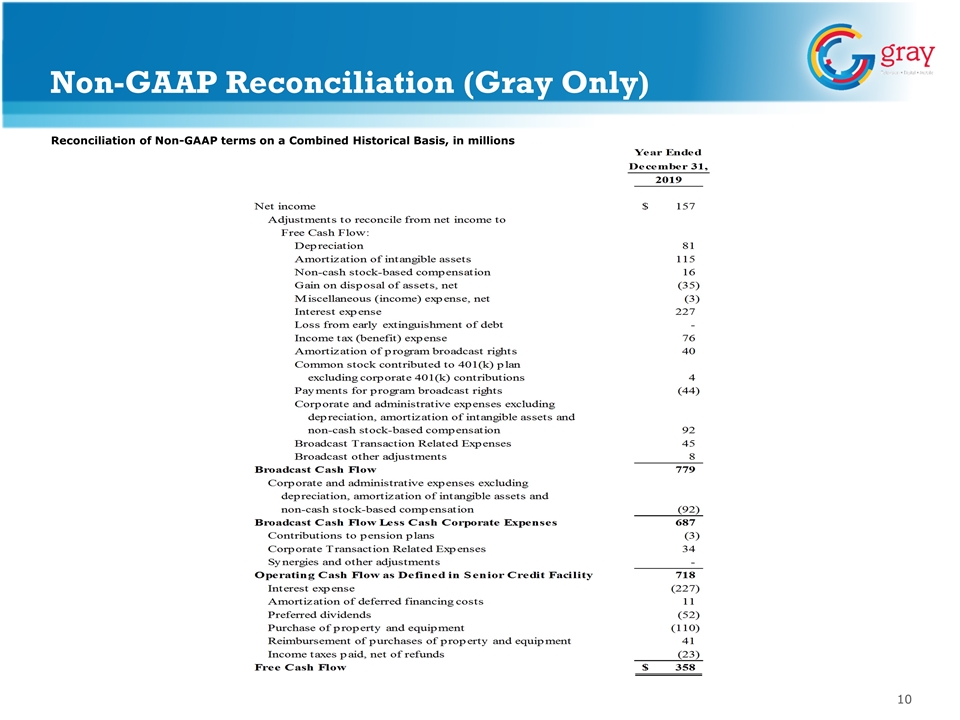

Non-GAAP Reconciliation (Gray Only) Reconciliation of Non-GAAP terms on a Combined Historical Basis, in millions

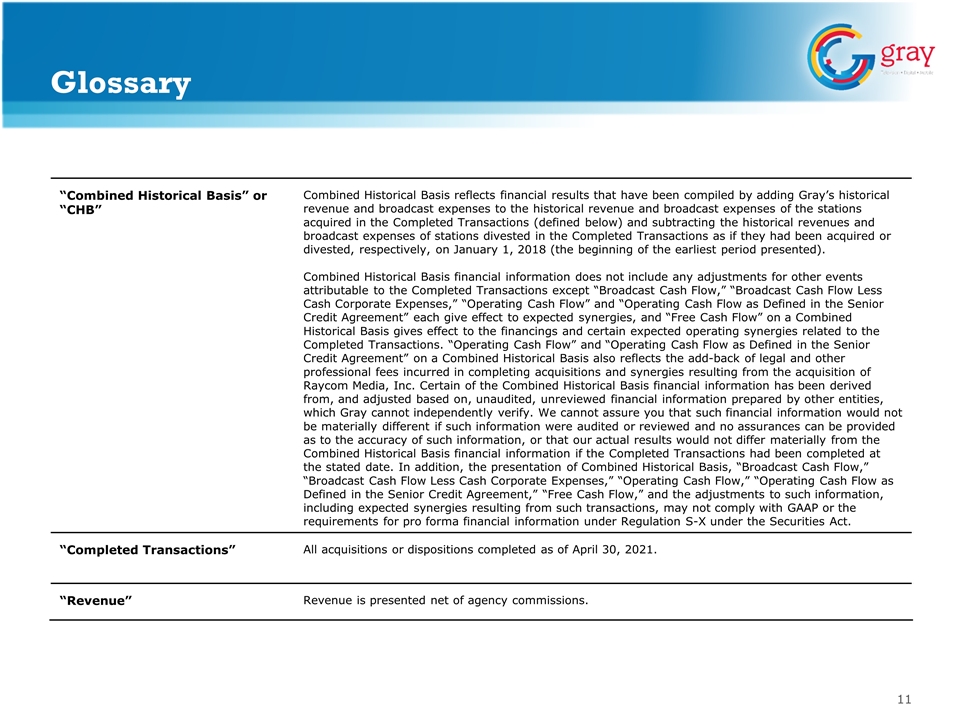

Glossary “Combined Historical Basis” or “CHB” Combined Historical Basis reflects financial results that have been compiled by adding Gray’s historical revenue and broadcast expenses to the historical revenue and broadcast expenses of the stations acquired in the Completed Transactions (defined below) and subtracting the historical revenues and broadcast expenses of stations divested in the Completed Transactions as if they had been acquired or divested, respectively, on January 1, 2018 (the beginning of the earliest period presented). Combined Historical Basis financial information does not include any adjustments for other events attributable to the Completed Transactions except “Broadcast Cash Flow,” “Broadcast Cash Flow Less Cash Corporate Expenses,” “Operating Cash Flow” and “Operating Cash Flow as Defined in the Senior Credit Agreement” each give effect to expected synergies, and “Free Cash Flow” on a Combined Historical Basis gives effect to the financings and certain expected operating synergies related to the Completed Transactions. “Operating Cash Flow” and “Operating Cash Flow as Defined in the Senior Credit Agreement” on a Combined Historical Basis also reflects the add-back of legal and other professional fees incurred in completing acquisitions and synergies resulting from the acquisition of Raycom Media, Inc. Certain of the Combined Historical Basis financial information has been derived from, and adjusted based on, unaudited, unreviewed financial information prepared by other entities, which Gray cannot independently verify. We cannot assure you that such financial information would not be materially different if such information were audited or reviewed and no assurances can be provided as to the accuracy of such information, or that our actual results would not differ materially from the Combined Historical Basis financial information if the Completed Transactions had been completed at the stated date. In addition, the presentation of Combined Historical Basis, “Broadcast Cash Flow,” “Broadcast Cash Flow Less Cash Corporate Expenses,” “Operating Cash Flow,” “Operating Cash Flow as Defined in the Senior Credit Agreement,” “Free Cash Flow,” and the adjustments to such information, including expected synergies resulting from such transactions, may not comply with GAAP or the requirements for pro forma financial information under Regulation S-X under the Securities Act. “Completed Transactions” All acquisitions or dispositions completed as of April 30, 2021. “Revenue” Revenue is presented net of agency commissions.

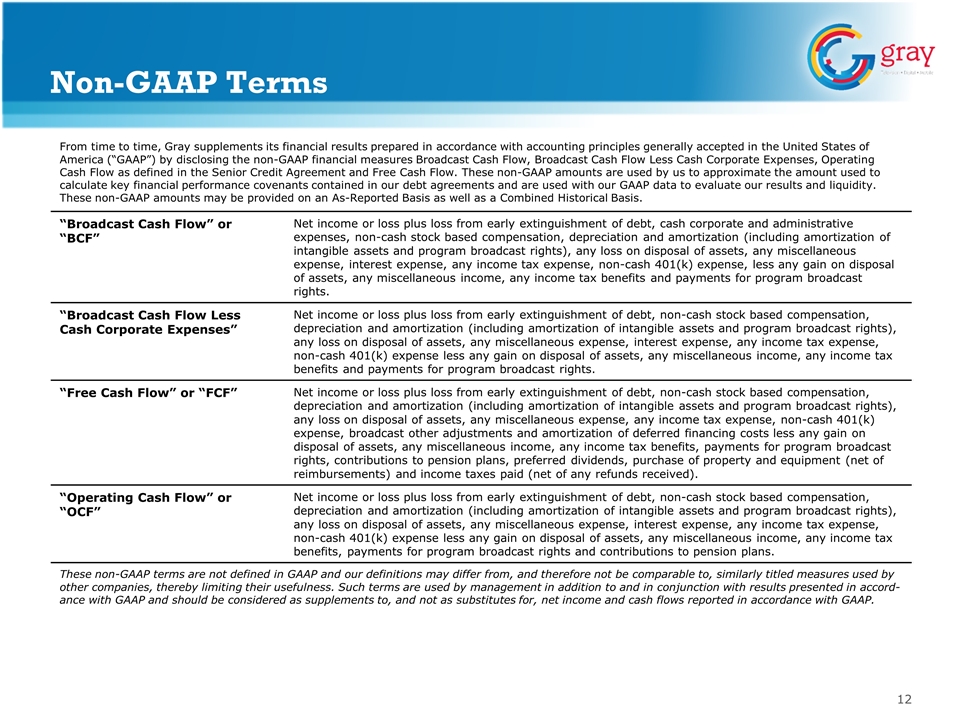

Non-GAAP Terms From time to time, Gray supplements its financial results prepared in accordance with accounting principles generally accepted in the United States of America (“GAAP”) by disclosing the non-GAAP financial measures Broadcast Cash Flow, Broadcast Cash Flow Less Cash Corporate Expenses, Operating Cash Flow as defined in the Senior Credit Agreement and Free Cash Flow. These non-GAAP amounts are used by us to approximate the amount used to calculate key financial performance covenants contained in our debt agreements and are used with our GAAP data to evaluate our results and liquidity. These non-GAAP amounts may be provided on an As-Reported Basis as well as a Combined Historical Basis. “Broadcast Cash Flow” or “BCF” Net income or loss plus loss from early extinguishment of debt, cash corporate and administrative expenses, non-cash stock based compensation, depreciation and amortization (including amortization of intangible assets and program broadcast rights), any loss on disposal of assets, any miscellaneous expense, interest expense, any income tax expense, non-cash 401(k) expense, less any gain on disposal of assets, any miscellaneous income, any income tax benefits and payments for program broadcast rights. “Broadcast Cash Flow Less Cash Corporate Expenses” Net income or loss plus loss from early extinguishment of debt, non-cash stock based compensation, depreciation and amortization (including amortization of intangible assets and program broadcast rights), any loss on disposal of assets, any miscellaneous expense, interest expense, any income tax expense, non-cash 401(k) expense less any gain on disposal of assets, any miscellaneous income, any income tax benefits and payments for program broadcast rights. “Free Cash Flow” or “FCF” Net income or loss plus loss from early extinguishment of debt, non-cash stock based compensation, depreciation and amortization (including amortization of intangible assets and program broadcast rights), any loss on disposal of assets, any miscellaneous expense, any income tax expense, non-cash 401(k) expense, broadcast other adjustments and amortization of deferred financing costs less any gain on disposal of assets, any miscellaneous income, any income tax benefits, payments for program broadcast rights, contributions to pension plans, preferred dividends, purchase of property and equipment (net of reimbursements) and income taxes paid (net of any refunds received). “Operating Cash Flow” or “OCF” Net income or loss plus loss from early extinguishment of debt, non-cash stock based compensation, depreciation and amortization (including amortization of intangible assets and program broadcast rights), any loss on disposal of assets, any miscellaneous expense, interest expense, any income tax expense, non-cash 401(k) expense less any gain on disposal of assets, any miscellaneous income, any income tax benefits, payments for program broadcast rights and contributions to pension plans. These non-GAAP terms are not defined in GAAP and our definitions may differ from, and therefore not be comparable to, similarly titled measures used by other companies, thereby limiting their usefulness. Such terms are used by management in addition to and in conjunction with results presented in accord-ance with GAAP and should be considered as supplements to, and not as substitutes for, net income and cash flows reported in accordance with GAAP.

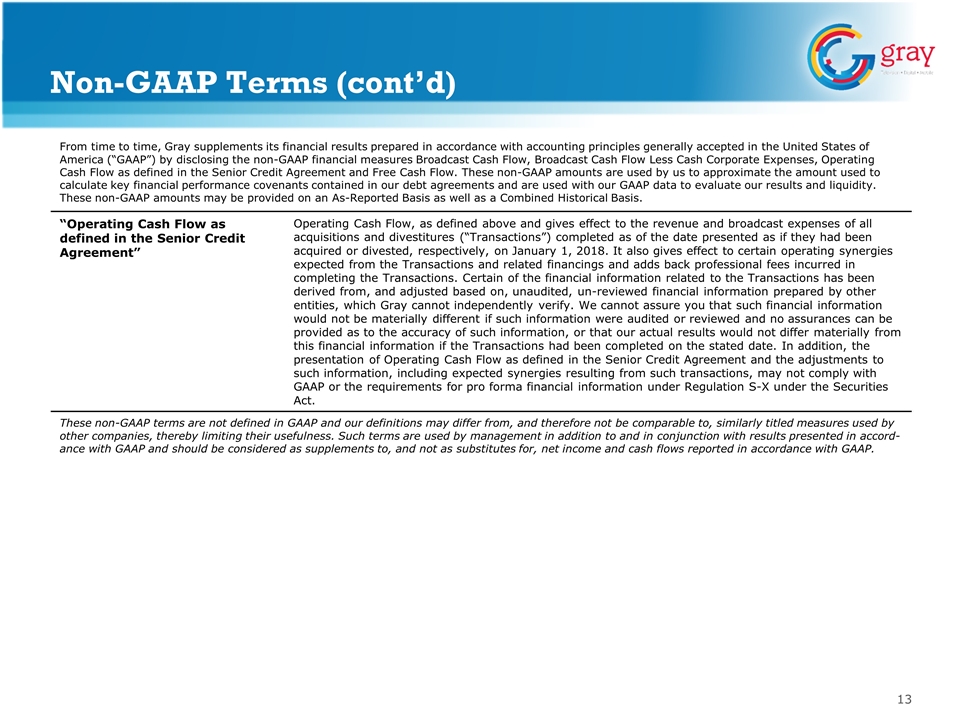

Non-GAAP Terms (cont’d) From time to time, Gray supplements its financial results prepared in accordance with accounting principles generally accepted in the United States of America (“GAAP”) by disclosing the non-GAAP financial measures Broadcast Cash Flow, Broadcast Cash Flow Less Cash Corporate Expenses, Operating Cash Flow as defined in the Senior Credit Agreement and Free Cash Flow. These non-GAAP amounts are used by us to approximate the amount used to calculate key financial performance covenants contained in our debt agreements and are used with our GAAP data to evaluate our results and liquidity. These non-GAAP amounts may be provided on an As-Reported Basis as well as a Combined Historical Basis. “Operating Cash Flow as defined in the Senior Credit Agreement” Operating Cash Flow, as defined above and gives effect to the revenue and broadcast expenses of all acquisitions and divestitures (“Transactions”) completed as of the date presented as if they had been acquired or divested, respectively, on January 1, 2018. It also gives effect to certain operating synergies expected from the Transactions and related financings and adds back professional fees incurred in completing the Transactions. Certain of the financial information related to the Transactions has been derived from, and adjusted based on, unaudited, un-reviewed financial information prepared by other entities, which Gray cannot independently verify. We cannot assure you that such financial information would not be materially different if such information were audited or reviewed and no assurances can be provided as to the accuracy of such information, or that our actual results would not differ materially from this financial information if the Transactions had been completed on the stated date. In addition, the presentation of Operating Cash Flow as defined in the Senior Credit Agreement and the adjustments to such information, including expected synergies resulting from such transactions, may not comply with GAAP or the requirements for pro forma financial information under Regulation S-X under the Securities Act. These non-GAAP terms are not defined in GAAP and our definitions may differ from, and therefore not be comparable to, similarly titled measures used by other companies, thereby limiting their usefulness. Such terms are used by management in addition to and in conjunction with results presented in accord-ance with GAAP and should be considered as supplements to, and not as substitutes for, net income and cash flows reported in accordance with GAAP.

Gray Television, Inc. 4370 Peachtree Rd., NE Atlanta, Georgia 30319 www.gray.tv