Attached files

| file | filename |

|---|---|

| 10-Q - 10-Q - STERICYCLE INC | scl-20210331.htm |

| EX-32 - EX-32 - STERICYCLE INC | scl-2021331x10qex32.htm |

| EX-31.2 - EX-31.2 - STERICYCLE INC | scl-2021331x10qex312.htm |

| EX-31.1 - EX-31.1 - STERICYCLE INC | scl-2021331x10qex311.htm |

| EX-10.2 - EX-10.2 - STERICYCLE INC | exhibit102-stericyclex20.htm |

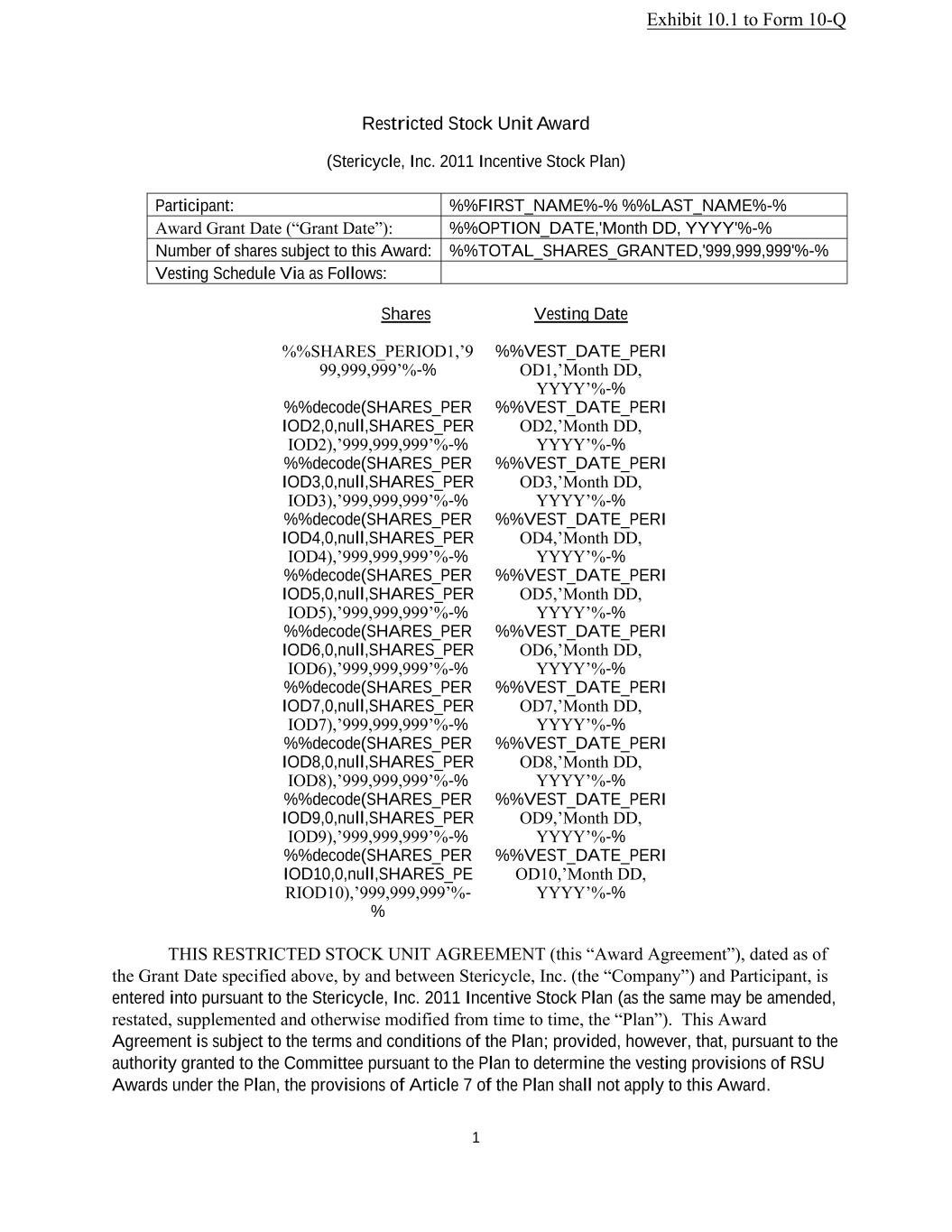

1 Restricted Stock Unit Award (Stericycle, Inc. 2011 Incentive Stock Plan) Participant: %%FIRST_NAME%-% %%LAST_NAME%-% Award Grant Date (“Grant Date”): %%OPTION_DATE,'Month DD, YYYY'%-% Number of shares subject to this Award: %%TOTAL_SHARES_GRANTED,'999,999,999'%-% Vesting Schedule Via as Follows: Shares Vesting Date %%SHARES_PERIOD1,’9 99,999,999’%-% %%VEST_DATE_PERI OD1,’Month DD, YYYY’%-% %%decode(SHARES_PER IOD2,0,null,SHARES_PER IOD2),’999,999,999’%-% %%VEST_DATE_PERI OD2,’Month DD, YYYY’%-% %%decode(SHARES_PER IOD3,0,null,SHARES_PER IOD3),’999,999,999’%-% %%VEST_DATE_PERI OD3,’Month DD, YYYY’%-% %%decode(SHARES_PER IOD4,0,null,SHARES_PER IOD4),’999,999,999’%-% %%VEST_DATE_PERI OD4,’Month DD, YYYY’%-% %%decode(SHARES_PER IOD5,0,null,SHARES_PER IOD5),’999,999,999’%-% %%VEST_DATE_PERI OD5,’Month DD, YYYY’%-% %%decode(SHARES_PER IOD6,0,null,SHARES_PER IOD6),’999,999,999’%-% %%VEST_DATE_PERI OD6,’Month DD, YYYY’%-% %%decode(SHARES_PER IOD7,0,null,SHARES_PER IOD7),’999,999,999’%-% %%VEST_DATE_PERI OD7,’Month DD, YYYY’%-% %%decode(SHARES_PER IOD8,0,null,SHARES_PER IOD8),’999,999,999’%-% %%VEST_DATE_PERI OD8,’Month DD, YYYY’%-% %%decode(SHARES_PER IOD9,0,null,SHARES_PER IOD9),’999,999,999’%-% %%VEST_DATE_PERI OD9,’Month DD, YYYY’%-% %%decode(SHARES_PER IOD10,0,null,SHARES_PE RIOD10),’999,999,999’%- % %%VEST_DATE_PERI OD10,’Month DD, YYYY’%-% THIS RESTRICTED STOCK UNIT AGREEMENT (this “Award Agreement”), dated as of the Grant Date specified above, by and between Stericycle, Inc. (the “Company”) and Participant, is entered into pursuant to the Stericycle, Inc. 2011 Incentive Stock Plan (as the same may be amended, restated, supplemented and otherwise modified from time to time, the “Plan”). This Award Agreement is subject to the terms and conditions of the Plan; provided, however, that, pursuant to the authority granted to the Committee pursuant to the Plan to determine the vesting provisions of RSU Awards under the Plan, the provisions of Article 7 of the Plan shall not apply to this Award. Exhibit 10.1 to Form 10-Q

2 1. Defined Terms. All capitalized terms not otherwise defined in the text of this Award Agreement have the meanings attributed to them in the Plan. In addition, the following capitalized terms shall have the meaning specified for purposes of this Award Agreement (notwithstanding any definition of such term set forth in the Plan): (a) “Common Stock” means the Company’s common stock, par value $.01 per share. (b) “Change of Control” means the first to occur of the following: (i) any Person directly or indirectly acquires or otherwise becomes entitled to vote Common Stock having 51% or more of the voting power in elections for directors (other than pursuant to a transaction described in clause (iii)(z)); or (ii) there shall have been a change in the composition of the Board within a 24-month period such that a majority of the Board does not consist of directors who were serving at the beginning of such period together with directors whose initial nomination for election by the Company’s stockholders or, if earlier, initial appointment to the Board was approved by the vote of two-thirds of the directors then still in office who were in office at the beginning of the 24-month period together with the directors who were previously so approved (either by a specific vote of approval or by approval of the Company’s proxy statement in which such individual was named as a nominee for election as a director); or (iii) the consummation of a merger or consolidation of the Company with any other corporation or other entity other than (x) a merger or consolidation which would result in the voting securities of the Company outstanding immediately prior thereto continuing to represent (either by remaining outstanding or by being converted into voting securities of the surviving entity) at least seventy-five (75%) of the total voting power of the securities of the Company or the surviving entity outstanding immediately after such merger or consolidation, (y) a merger or consolidation effected to implement a recapitalization of the Company in which no Person acquires more than fifty percent (50%) of the total voting power of the Company’s then outstanding securities, or (z)(1) a merger or consolidation as a result of which the Company becomes a direct or indirect wholly-owned subsidiary of a holding company, and (2)(A) the direct or indirect holders of the voting securities of such holding company immediately following the transaction are substantially the same as the holders of the Company’s voting securities immediately prior to the transaction, or (B) immediately following the transaction no Person (other than a holding company satisfying the requirements of this clause (iii)(z)) is the beneficial owner, directly or indirectly, of more than fifty percent (50%) of the voting securities of such holding company; or (iv) the Company sells all or a substantial portion of the consolidated assets of the Company and its Subsidiaries, and the Company does not own stock in the purchaser having more than 75% of the voting power in elections for directors; or (v) the stockholders of the Company approve a plan of complete liquidation of the Company. As used in this definition, a “Person” means any “person” as that term is used in Sections 13(d)

3 and 14(d) of the Exchange Act, together with all of that person’s “affiliates” and “associates” as those terms are defined in Rule 12b-2 under the Exchange Act. Notwithstanding the foregoing, in the case of any individual who is eligible to participate in the Executive Plan, the definition of “Change in Control” for purposes of the Plan and Awards issued hereunder shall be the same as the definition of Change in Control as set forth in the Executive Plan. (c) “Executive Plan” means the Stericycle, Inc. Executive Severance and Change in Control Plan. (d) “Disability” means, in accordance with Treasury Regulations § 1.409A- 3(a), a medically determinable physical or mental impairment that can be expected to result in death or can be expected to last for a continuous period of not less than six months, where such impairment causes the Participant to be unable to perform the duties of the Participant’s position of employment or any substantially similar position of employment. (e) “Retirement” means a voluntary termination by Participant of his or her employment with the Company or any of its Subsidiaries, following attainment of (i) age 60 and five years of continuous service (at the time of termination) with the Company or any of its Subsidiaries, or (ii) age 65. (f) “Subsidiary” means any corporation, partnership, joint venture or other entity during any period in which at least a fifty percent voting or profits interest is owned, directly or indirectly, by the Company (or by any entity that is a successor to the Company), and any other business venture designated by the Committee in which the Company (or any entity that is a successor to the Company) has a significant interest, as determined in the discretion of the Committee. (g) “Termination Date” means the date on which Participant ceases to be an employee of the Company and its Subsidiaries, regardless of the reason for the termination; provided that a “Termination Date” shall not be considered to have occurred in the case of a transfer of employment from the Company to a Subsidiary or from a Subsidiary to the Company. If Participant ceases to be an employee and immediately becomes a non-employee director of the Company, the Termination Date shall not occur until the date on his or her service as a non- employee director terminates. In any event, to the extent that this Award is subject to Code Section 409A, the term “Termination Date” means a “separation from service” within the meaning of Code Section 409A. 2. Grant of Restricted Stock Units. Subject to the terms and conditions of the Plan and this Award Agreement, the Company hereby grants to Participant an RSU Award under the Plan with respect to the number of shares set forth above (“RSUs”). Except as provided in this Award Agreement, the RSUs shall vest based on Participant’s continued service with the Company and its Subsidiaries as described in Paragraph 3. Each RSU constitutes an unfunded and unsecured promise of the Company to deliver (or cause to be delivered) to Participant a share of Common Stock, or its cash equivalent, subject to the terms and conditions of the Plan and this Award Agreement and is not an actual share of Common Stock. Prior to settlement, as described in Paragraph 4, RSUs are only bookkeeping entries, either on the Company’s own records or on those of E*Trade (or any other record keeper that the Company may use in

4 connection with the administration of the Plan), and Participant shall not have any rights as a stockholder of the Company in respect of his or her RSUs. 3. Vesting. (a) General Vesting Rules. This Award shall vest per the vesting schedule set forth above provided that Participant’s Termination Date has not occurred as of the applicable Vesting Date, except as otherwise provided in this Award Agreement. Subject to the terms and conditions of this Award Agreement, the actual number of RSUs that become earned and vested as of a Vesting Date are referred to as “Vested RSUs”. All RSUs that become Vested RSUs on a Vesting Date shall be distributed to Participant in accordance with Paragraph 4. Except as otherwise provided by the Committee or this Award Agreement, if Participant’s Termination Date occurs for any reason prior to the applicable Vesting Date, then, as of Participant’s Termination Date, all then unvested RSUs shall be cancelled and shall be forfeited, none of the unvested RSUs shall become Vested RSUs and Participant shall have no rights under or with respect to any of the unvested RSUs. (b) Special Rules for Death or Disability. Notwithstanding the provisions of subparagraph 3(a), if Participant’s Termination Date occurs prior to a Vesting Date on account of Participant’s death or Disability, then all of the then outstanding unvested RSUs shall immediately vest and such Termination Date shall be the “Vesting Date” for such RSUs for purposes of Paragraph 4. (c) Special Rules for Retirement. Notwithstanding the provisions of subparagraph 3(a), if (i) Participant’s Termination Date occurs prior to any Vesting Date due to Participant’s Retirement, (ii) Participant provided written notice to the Company of his or her intention to retire at least six months prior to Participant’s Termination Date due to Retirement, and (iii) at least six months have elapsed between the Grant Date and Participant’s Termination Date due to Retirement, then outstanding unvested RSUs will continue to vest in accordance with the vesting schedule set forth above; provided, however, that the Employee Covenant Agreement referred to in Paragraph 6 of this Award Agreement shall continue to apply to Participant following Participant’s Termination Date due to Participant’s Retirement until this Award is fully vested and settled in accordance with Paragraph 4, and if Participant violates any provision of the Employee Covenant Agreement during such period, then subparagraph (d) immediately below will apply. (d) Employee Covenant Agreement. This Award is subject to forfeiture and automatic cancellation as provided in the Employee Covenant Agreement referred to in Paragraph 6 of this Award Agreement. In addition, Participant may be required to repay the Company any cash paid in settlement of the Award, and the net proceeds from the sale of any stock issued in settlement of the Award, as also provided in the Employee Covenant Agreement. (e) Change of Control. The provisions of Article 7 of the Plan shall not apply to this Award (other than the definition of Change of Control in Article 7). In the event of a Change of Control:

5 (i) If the surviving or successor entity (or its parent company) continues, assumes or replaces this Award, then this Award or its replacement shall remain outstanding and be governed by its respective terms, subject to subsection (B) below. (A) This Award shall be considered assumed or replaced if, in connection with the Change of Control, and in a manner consistent with Code Section 409A, either (1) the contractual obligations represented by this Award are expressly assumed by the surviving or successor entity (or its parent) with appropriate adjustments to the number and type of securities subject to this Award that preserves the intrinsic value of this Award existing at the time of the Change of Control, or (2) the Participant has received a comparable equity-based award that preserves the intrinsic value of this Award existing at the time of the Change of Control and contains terms and conditions that are substantially similar to those of this Award. (B) If this Award is continued, assumed or replaced, and (1) a Change of Control occurs prior to a Vesting Date, (2) on or within 24 months following the Change of Control (the “Protected Period”), Participant’s Termination Date occurs as a result of a Qualifying Termination (as defined in subparagraph (f)), and (3) the Release Requirements (as defined in subparagraph (f)) are satisfied as of the date that is 60 days following Participant’s Termination Date, then all of the RSUs (or their equivalent) under this Award then outstanding shall become Vested RSUs (or their equivalent) and the Termination Date shall be the “Vesting Date” for purposes of Paragraph 4. (ii) If and to the extent this Award is not continued, assumed or replaced, then all of the RSUs then outstanding shall become Vested RSUs immediately prior to the effective time of the Change of Control. Further, the Committee may provide that this Award shall be canceled at or immediately prior to the effective time of the Change of Control in exchange for a payment in an amount equal to the fair market value (as determined in good faith by the Committee) of the consideration that would otherwise be received in the Change of Control for the number of shares subject to this Award. Payment of any such amount shall be made in such form, on such terms and subject to such conditions as the Committee determines in its discretion, which may or may not be the same as the form, terms and conditions applicable to payments to the Company’s stockholders in connection with the Change of Control, and may, in the Committee’s discretion, include subjecting such payments to vesting conditions comparable to those of the Award canceled, subjecting such payments to escrow or holdback terms comparable to those imposed upon the Company’s stockholders under the Change of Control, or calculating and paying the present value of payments that would otherwise be subject to escrow or holdback terms. (f) For purposes of this Award Agreement: (i) A “Qualifying Termination” means the occurrence of Participant’s Termination Date by reason of (I) termination by the Company or a Subsidiary without Cause (as defined below) or (II) termination by Participant for Good Reason (as defined below). (ii) “Cause” means a termination for (I) gross negligence, (II) personal dishonesty, (III) incompetence, (IV) willful misconduct, (V) any breach of fiduciary duty involving personal profit, (VI) intentional failure to perform stated duties, (VII) the willful violation of any law, rule or regulation (other than traffic violations or similar offenses), (VIII) the material breach of an employment

6 agreement or any restrictive covenant agreement (or the restrictive covenant provisions of any other plan of the Company or any Subsidiary); or (IX) a material violation of a material written policy of the Company or any Subsidiary, violation of which would be grounds for immediate dismissal under applicable Company or Subsidiary policy. (iii) Participant’s Termination Date shall be considered to have terminated for “Good Reason” if (A) without Participant’s consent, one or more of the following actions or omissions occurs: (I) a material reduction in Participant’s base salary, bonus opportunity or level of incentive plan participation (without replacement of substantially equal value on an aggregated basis) as in effect immediately prior to the Change of Control, (II) the elimination (without replacement) of a material benefit provided to Participant immediately prior to the Change of Control, (III) Participant is required to be based at any office or location more than 50 miles from Participant’s office or location in effect immediately prior to the Change of Control, (IV) any material diminution in Participant’s authority, duties or responsibilities as in effect immediately prior to the Change of Control, or (V) any material breach of this Award Agreement or the Plan by the Company or the Committee, (B) Participant notifies the Company in writing of the event constituting Good Reason within 90 days after the occurrence of such event and within the Protected Period, (C) the Company has not cured the event constituting Good Reason within 30 days following receipt of the notice from Participant, and (D) Participant terminates employment within 5 days following expiration of the cure period. For the avoidance of doubt, a delay in the delivery of a notice of Good Reason or in Participant’s termination following the lapse of the cure period shall constitute a waiver of Participant’s ability to terminate for Good Reason under this Award Agreement. (iv) The “Release Requirements” will be satisfied as of any date provided that, as of such date, Participant (A) has timely delivered to the Company a general waiver and release of claims in favor of the Company and related parties (the “Release”) in such form provided by the Company in its sole discretion and with such terms and conditions (which shall include, but are not limited to, non-competition, non-solicitation, confidentiality, and other restrictive covenants, as well as the events that shall result in the forfeiture, recoupment, and/or claw-back of the benefits provided under this Award Agreement and the Plan) as are reasonably acceptable to the Company, (B) Participant does not revoke the Release, and (C) the revocation period related to such Release has expired. 4. Settlement. If any of the RSUs become Vested RSUs, the Award shall be settled with respect to such Vested RSUs as soon as practicable after the applicable Vesting Date, but no later than 45 days after the Vesting Date. Settlement of the Vested RSUs shall be made, in the sole discretion of the Committee, in (a) the form of shares of Common Stock (with one share of Common Stock distributed for each Vested RSU and cash equal in value to any fractional Vested RSU) registered in the name of Participant, (b) a lump sum cash payment equal to the Fair Market Value (determined as of the Vesting Date) of the number of shares of Common Stock

7 determined under subparagraph (a), or (c) a combination of the payment forms described in subparagraphs (a) and (b). Participant shall be entitled to settlement only with respect to Vested RSUs. 5. Withholding. This Award and the delivery of shares of the Common Stock or the payment of cash in settlement of the Award pursuant to Paragraph 4 shall be conditioned upon the satisfaction of any applicable withholding tax obligation. Participant hereby authorizes the Company to withhold from payroll or other amounts payable to Participant any sums required to satisfy withholding tax obligations related to this Award, and otherwise agree to satisfy such obligations. To the extent that any shares are eligible for settlement at the time of taxation, Participant may elect to satisfy such withholding tax obligations by having the Company withhold a number of shares that would otherwise be issued to Participant in settlement of the RSUs and that have a fair market value equal to the amount of such withholding tax obligations by notifying the Company of such election prior to the Vesting Date. 6. Employee Covenant Agreement. This Award Agreement and the grant of RSUs to Participant are subject to Participant’s acceptance of and agreement to be bound by the Employee Covenant Agreement which has been provided or made available to Participant with this Award Agreement. The Company would not have granted the Award to Participant without Participant’s acceptance of and agreement to be bound by the Employee Covenant Agreement. 7. Transferability. None of the RSUs may be transferred, assigned or pledged (whether by operation of law or otherwise), except as provided by will or the applicable laws of intestacy. The Award shall not be subject to execution, attachment or similar process. 8. Interpretation/Administration. This Award Agreement is subject to the terms of the Plan, as the Plan may be amended, but except as required by applicable law, no amendment of the Plan after the Grant Date shall adversely affect Participant’s rights in respect of the RSUs without Participant’s consent. If there is a conflict or inconsistency between this Award Agreement and the Plan, the terms of the Plan shall control, provided that it shall not be deemed a conflict or inconsistency to the extent a term of this Award Agreement explicitly provides for a different treatment than in the Plan, and in those cases, this Award Agreement shall control. The Committee’s interpretation of this Award Agreement and the Plan shall be final and binding. The authority to manage and control the operation and administration of this Award shall be vested in the Committee, and the Committee shall have all powers with respect to the Award and this Award Agreement as it has with respect to the Plan. Any interpretation of this Award Agreement by the Committee and any decision made by it with respect to the Award or this Award Agreement is final and binding on all persons. 9. No Employment Rights. Nothing in this Award Agreement shall be considered to confer on Participant any right to continue in the employ of the Company or a Subsidiary or to limit the right of the Company or a Subsidiary to terminate Participant’s employment.

8 10. No Stockholder Rights. Participant shall not have any rights as a stockholder of the Company in respect of any of RSUs unless and until this Award vests and is settled in shares of Common Stock. 11. Governing Law. This Award Agreement shall be governed in accordance with the laws of the State of Illinois. 12. Binding Effect. This Award Agreement shall be binding on the Company and Participant and on Participant’s heirs, legatees and legal representatives. 13. Effective Date. This Award shall not become effective until Participant’s acceptance of this Award and agreement to be bound by the Employee Covenant Agreement. Upon such acceptance and agreement, this Award shall become effective, retroactive to the Grant Date, without the necessity of further action by either the Company or Participant. If, within 90 days of the Grant Date, this Award is not accepted and/or if the Employee Covenant Agreement is not signed and returned to the Company, this Award may, if so determined by the Company in its discretion, be forfeited and cancelled, in which case Participant shall have no further rights under or with respect thereto. 14. Adjustment. This Award, and the shares of Common Stock subject hereto, shall be subject to adjustment by the Committee in accordance with the terms of the Plan. 15. Code Section 409A. It is intended that any amounts payable or benefits provided under this Award Agreement shall either be exempt from or comply with Section 409A of the Code and all regulations, guidance and other interpretive authority issued thereunder (“Code Section 409A”) so as not to subject Participant to payment of any additional tax, penalty or interest imposed under Code Section 409A and any ambiguities herein shall be interpreted to so comply. Neither the Company nor any of the Subsidiaries, however, makes any representation regarding the tax consequences of this Award. Notwithstanding any other provision of this Award Agreement to the contrary, if any payment or benefit hereunder is subject to Code Section 409A, the following shall apply: (a) if such payment or benefit is to be paid or provided on account of Participant’s Termination Date (or other separation from service or termination of employment) to a Participant who is a specified employee (within the meaning of section 409A(a)(2)(B) of the Code) and if any such payment or benefit is required to be made or provided prior to the first day of the seventh month following Participant’s separation from service or termination of employment, such payment or benefit shall be delayed until the first day of the seventh month following Participant’s separation from service; (b) if such payment or benefit is to be paid or provided on account of Participant’s Termination Date (or other separation from service or termination of employment), the determination as to whether Participant has had a termination of employment (or separation from service) shall be made in accordance with the provisions of Code Section 409A and the guidance issued thereunder without application of any alternative levels of reductions of bona fide services permitted thereunder; and

9 (c) notwithstanding anything in Section 3(e) to the contrary, for any Change of Control that qualifies as a change in control under Treasury Regulations §1.409A- 3(i)(5), all of the RSUs then outstanding shall become Vested RSUs immediately prior to the effective time of the Change of Control and settle within 30 days following the Change of Control, provided that payments may be delayed in accordance with the provisions of Treasury Regulations §1.401A-3(i)(5)(iv).