Attached files

Table of Contents

United States

Securities and Exchange Commission

Washington, D.C. 20549

FORM 10-K

| x | ANNUAL REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934 |

For the fiscal year ended December 31, 2009

or

| ¨ | TRANSITION REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934 |

For the transition period from to

Commission File Number 0-21229

Stericycle, Inc.

(Exact name of registrant as specified in its charter)

| Delaware |

36-3640402 | |

| (State or other jurisdiction of incorporation or organization) |

(IRS Employer Identification Number) |

28161 North Keith Drive

Lake Forest, Illinois 60045

(Address of principal executive offices including zip code)

(847) 367-5910

(Registrant’s telephone number, including area code)

Securities registered pursuant to Section 12(b) of the Act:

| Common stock, par value $.01 per share |

NASDAQ Stock Market | |

| (Title of each class) | (Name of each exchange on which registered) |

Securities registered pursuant to Section 12(g) of the Act: None

Indicate by check mark if the registrant is a well-known seasoned issuer, as defined in Rule 405 of the Securities Act. YES x NO ¨

Indicate by check mark if the registrant is not required to file reports pursuant to Section 13 or 15(d) of the Securities Act of 1934. YES ¨ NO x

Indicate by check mark whether the registrant (1) has filed all reports required to be filed by Section 13 or 15 (d) of the Securities Exchange Act of 1934 during the preceding 12 months (or for such shorter period that the registrant was required to file reports), and (2) has been subject to such filing requirements for the past 90 days. YES x NO ¨

Indicate by check mark whether the registrant has submitted electronically and posted on its corporate Web site, if any, every Interactive Data File required to be submitted and posted pursuant to Rule 405 of Regulation S-T during the preceding 12 months (or for such shorter period that the registrant was required to submit and post such files). YES ¨ NO ¨

Indicate by check mark if disclosure of delinquent filers pursuant to Item 405 of Regulation S-K is not contained herein, and will not be contained, to the best of registrant’s knowledge, in definitive proxy or information statements incorporated by reference in Part III of this Form 10-K, or any amendment to this Form 10-K. x

Indicate by check mark whether the registrant is a large accelerated filer, an accelerated filer, a non-accelerated filer, or a smaller reporting company. See the definition of “accelerated filer”, “large accelerated filer” and “smaller reporting company” in Rule 12b-2 of the Exchange Act. (Check one)

Large accelerated filer x Accelerated filer ¨ Non-accelerated filer ¨ Smaller reporting company ¨

Indicate by check mark whether the registrant is a shell company (as defined in Exchange Act Rule 12b-2 of the Exchange Act). YES ¨ NO x

State the aggregate market value of voting and non-voting common equity held by non-affiliates computed by reference to the price at which common equity was last sold as of the last business day of the registrant’s most recently completed second fiscal quarter (June 30, 2009): $4,381,798,671.

On February 19, 2010, there were 84,781,016 shares of the Registrant’s common stock outstanding.

DOCUMENTS INCORPORATED BY REFERENCE

Information required by Items 10, 11, 12 and 13 of Part III of this Report is incorporated by reference from the Registrant’s definitive Proxy Statement for the 2010 Annual Meeting of Stockholders to be held on May 25, 2010.

Table of Contents

Stericycle, Inc.

2009 ANNUAL REPORT ON FORM 10-K

| Page No. | ||||

| PART I. | ||||

| Item 1. |

1 | |||

| Item 1A. |

9 | |||

| Item 1B. |

12 | |||

| Item 2. |

12 | |||

| Item 3. |

13 | |||

| Item 4. |

13 | |||

| 13 | ||||

| PART II. | ||||

| Item 5. |

Market Price of and Dividends on the Registrant’s Common Equity and Related Stockholder Matters |

15 | ||

| Item 6. |

18 | |||

| Item 7. |

Management’s Discussion and Analysis of Financial Condition and Results of Operations |

19 | ||

| Item 7A. |

28 | |||

| Item 8. |

30 | |||

| Item 9. |

Changes in and Disagreements with Accountants on Accounting and Financial Disclosure |

63 | ||

| Item 9A. |

63 | |||

| Item 9B. |

63 | |||

| PART III. | ||||

| Item 10. |

64 | |||

| Item 11. |

64 | |||

| Item 12. |

Security Ownership of Certain Beneficial Owners and Management and Related Stockholder Matters |

64 | ||

| Item 13. |

Certain Relationships and Related Transactions, and Director Independence |

64 | ||

| Item 14. |

65 | |||

| PART IV. | ||||

| Item 15. |

66 | |||

| Signatures | 70 | |||

Table of Contents

PART I.

Unless the context requires otherwise, “we,” “us” or “our” refers to Stericycle, Inc. and its subsidiaries on a consolidated basis.

Overview

We are in the business of managing regulated waste and providing an array of related services. We operate in the United States, Canada, Argentina, Chile, Mexico, Ireland, Portugal, Romania, and the United Kingdom.

For large-quantity generators of regulated waste such as hospitals and for pharmaceutical companies and distributors, we offer:

| • | our regulated waste management services; |

| • | our Bio Systems® sharps management services to reduce the risk of needle sticks; |

| • | a variety of products and services for infection control; and |

| • | our regulated returns management services for expired or recalled products. |

For small-quantity generators of regulated waste such as doctors’ offices and for retail pharmacies, we offer:

| • | our regulated waste management services; |

| • | our Steri-Safe® Occupational Safety and Health Act (“OSHA”) and Health Insurance Portability and Accountability Act (“HIPAA”) compliance programs; |

| • | a variety of products and services for infection control; and |

| • | our regulated returns management services for expired or recalled products. |

We operate integrated national regulated waste management networks in the United States, Canada, Argentina, Chile, Mexico, Ireland, Portugal, Romania, and the United Kingdom. Our national networks include a total of 113 processing or combined processing and collection sites and 135 additional transfer, collection or combined transfer and collection sites.

Our regulated waste processing technologies include autoclaving, our proprietary electro-thermal-deactivation system (“ETD”), chemical treatment and incineration.

We serve approximately 459,200 customers worldwide, of which approximately 11,300 are large-quantity generators, such as hospitals, blood banks and pharmaceutical manufacturers, and approximately 447,900 are small-quantity generators, such as outpatient clinics, medical and dental offices, long-term and sub-acute care facilities, veterinary offices, municipalities and retail pharmacies.

We benefit from significant customer diversification. No one customer accounts for more than 2% of our total revenues, and our top 10 customers account for approximately 7% of total revenues.

Industry Overview

Governmental legislation and regulation increasingly requires the proper handling and disposal of regulated waste which includes such items as medical waste and pharmaceutical waste. Regulated medical waste is generally any medical waste that can cause an infectious disease and includes: single-use disposable items, such as needles, syringes, gloves and other medical supplies; cultures and stocks of infectious agents; and blood and blood products. Regulated pharmaceutical waste consists of expired or recalled pharmaceuticals.

1

Table of Contents

We believe that in 2009 the size of the global regulated waste market for the services we provide was approximately $10.5 billion. We estimate that our global market share increased to 11.2% in 2009 from 10.3% in 2008. Industry growth is driven by a number of factors. These factors include:

| • | Aging of Population: The average age of the population in the countries we operate in is rising. As people age, they typically require more medical attention and a wider variety of tests, procedures and medications, leading to an increase in the quantity of regulated waste generated. |

| • | Pressure to Reduce Healthcare Costs: The healthcare industry is under pressure to reduce costs. We believe that our services can help healthcare providers to reduce their handling and compliance costs and to reduce their potential liability for employee exposure to blood-borne pathogens and other infectious agents. |

| • | Environmental and Safety Regulation: We believe that many businesses that are not currently using third party regulated waste services are unaware either of the need for proper training of employees or of the requirements of OSHA regarding the handling of regulated waste. These businesses include manufacturing facilities, schools, restaurants, hotels and other businesses where employees may come into contact with blood-borne pathogens or handle hazardous materials. Similarly, the proper handling of expired or recalled products requires an expertise that many businesses lack or find inefficient to provide. |

| • | Shift to Off-Site Treatment: We believe that patient care is continuing to shift from institutional higher-cost acute-care settings to less expensive, smaller, off-site treatment alternatives, with a resulting increase in the number of regulated waste generators that cannot treat their own regulated waste. |

| • | Control of Drug Diversion: The U.S. Drug Enforcement Administration (“DEA”) has recently emphasized improved control of the handling and shipment of controlled substances to prevent diversion and counterfeiting, thus increasing the utility to pharmaceutical manufacturers and distributors of a returns service for expired or recalled pharmaceuticals. |

Competitive Strengths

We believe that we benefit from the following competitive strengths, among others:

| • | Broad Range of Services: We offer our customers a broad range of services to help them develop systems and processes to manage their regulated waste safely and efficiently. For example, we have developed programs to help our customers ensure and maintain compliance with EPA, OSHA and HIPAA regulations. |

| • | Established Network of Processing and Transportation Locations in Each Country: We believe that networks like ours would be very expensive and time-consuming for a competitor to develop. |

| • | Diverse Customer Base and Revenue Stability: We have a very diverse customer base and contractual relationships in all the markets in which we operate. We are also generally protected from the cost of regulatory changes and increases in fuel, insurance and other operating costs because our regulated waste contracts typically allow us to adjust our prices to reflect these cost increases. |

| • | Strong Sales Network and Proprietary Database: We use both telemarketing and direct sales efforts to obtain new regulated waste customers. In addition, we have a large database of potential new small-quantity customers, which we believe gives us a competitive advantage in identifying and reaching this higher-margin sector. |

| • | Experienced Senior Management Team: We have experienced leadership. Our five most senior executives collectively have over 120 years of management experience in the health care, consumer and waste management industries. |

2

Table of Contents

| • | Ability to Integrate Acquisitions: Since 1993 we have completed 180 acquisitions in the United States and foreign countries and have demonstrated a consistent ability to integrate our acquisitions into our operations successfully. |

Our goals are to strengthen our position as a leading provider of regulated waste and compliance services and to continue to improve our profitability. Components of our strategy to achieve these goals include:

| • | Expand Range of Services and Products: We believe that we continue to have opportunities to expand our business by increasing the range of products and services that we offer our existing regulated waste customers. For example, through our Steri-Safe® program, we now offer OSHA compliance services to small-quantity customers, and an acquisition in 2003 enabled us to market our Bio Systems® sharps management program to large-quantity customers in new geographic areas. We have expanded our regulated waste services to pharmaceutical companies and other large-quantity generators through a series of acquisitions beginning in 2005 of nine businesses engaged in regulated returns and recall management or related services. |

| • | Improve Margins: We intend to continue working to improve our margins by increasing our base of small-quantity customers and focusing on service strategies that more efficiently meet the needs of our large-quantity customers. We have succeeded in raising the percentage of our domestic regulated waste revenues from small-quantity customers from 33% for the fourth quarter of 1996 to 63% for 2009. |

| • | Seek Complementary Acquisitions: We intend to continue to seek opportunities to acquire businesses that expand our networks in the United States and internationally and increase our customer base. We believe that selective acquisitions can enable us to improve our operating efficiencies through increased utilization of our service infrastructure. |

Acquisitions

We have substantial experience in evaluating potential acquisitions and determining whether a particular waste business can be integrated into our operations with minimal disruption. Once a business is acquired, we implement programs and procedures to improve customer service, sales, marketing, routing, equipment utilization, employee productivity, operating efficiency and overall profitability.

We completed 180 acquisitions from 1993 through 2009, with 130 in the United States and 50 internationally.

During 2009, we completed 23 acquisitions, of which 16 were regulated waste businesses in the United States and seven were regulated waste businesses in Canada, Latin America, and Europe.

Services and Operations

Collection and Transportation: In many respects, our regulated waste business is one of logistics. Efficiency of collection and transportation of regulated waste is a critical element of our operations because it represents the largest component of our operating costs.

For regulated waste, we supply specially designed reusable leak- and puncture-resistant plastic containers to most of our large-quantity customers and many of our larger small-quantity customers. To assure regulatory compliance, we will not accept regulated waste from customers unless it is properly packaged in containers that we have either supplied or approved.

We collect containers or corrugated boxes of regulated waste from our customers at intervals depending upon customer requirements, contract terms and volume of waste generated. The waste is then transported directly to one of our processing or facilities or to one of our transfer stations where it is combined with other regulated waste and transported to a processing facility.

3

Table of Contents

Transfer stations allow us to temporarily hold small loads of waste until they can be consolidated into full truckloads and transported to a processing or facility. Our use of transfer stations in a “hub and spoke” configuration improves the efficiency of our collection and transportation operations by expanding the geographic area that a particular processing facility can serve and thereby increasing utilization of the facility by increasing the volume of waste that it processes.

We collect some expired or recalled products, but more typically, customers ship them directly to our processing facilities.

Processing and Disposal: Upon arrival at a processing or facility, containers or boxes of regulated waste are typically scanned to verify that they do not contain any unacceptable substances like radioactive material. Any container or box that is discovered to contain unacceptable waste is returned to the customer and the appropriate regulatory authorities are informed.

The regulated waste is then processed using one of our various treatment or processing technologies. Upon completion of the particular process, the resulting waste or incinerator ash is transported for resource recovery, recycling or disposal in a landfill owned by an unaffiliated third party. After plastic containers such as our Steri-Tub® or Bio Systems® containers have been emptied, they are washed, sanitized and returned to customers for re-use.

Upon receipt at a processing facility, expired or recalled products are counted and logged, and controlled substances are stored securely. In accordance with the manufacturer’s instructions, expired or recalled products are then returned to the manufacturer or destroyed in compliance with applicable regulations.

Documentation: We provide complete documentation to our customers for all regulated waste that we collect in accordance with applicable regulations and customer requirements.

Marketing and Sales

Marketing Strategy: We use both telemarketing and direct sales efforts to obtain new customers. In addition, our drivers may also participate in our regulated waste marketing efforts by actively soliciting small-quantity customers they service.

Small-Quantity Customers: We target small-quantity customers as a growth area of our regulated waste business. We believe that small-quantity regulated waste customers view the potential risks of failing to comply with applicable state and federal regulated waste regulations as disproportionate to the cost of the services that we provide. We believe that this factor has been the basis for the significantly higher gross margins that we have achieved with our small-quantity customers relative to our large-quantity customers. We believe that the same potential exists in processing returns of expired products for smaller customers.

Steri-Safe®: Our domestic Steri-Safe® OSHA compliance program provides an integrated regulated waste management and compliance-assistance service for small-quantity customers who typically lack the internal personnel and systems to comply with OSHA regulations. Customers for our Steri-Safe® service pay a predetermined subscription fee in advance for regulated waste collection and processing services and can also choose from available packages of training and education services and products designed to help them to comply with OSHA regulations. Approximately 141,000 small-quantity customers are enrolled in this program. We believe that the implementation of our Steri-Safe® service provides us with an enhanced opportunity to leverage our existing customer base through the program’s prepayment structure and diversified product and service offerings.

Mail-Back Program: We also operate a domestic “mail-back” program by which we can reach small-quantity regulated waste customers located in outlying areas that would be inefficient to serve using our regular route structure. Our mail-back program has allowed us to service customers as far away as Hawaii, Alaska, Guam, and the Virgin Islands. Mail-back programs are also used in home care patient settings.

4

Table of Contents

Large-Quantity Customers: Our marketing efforts to large-quantity customers are conducted by account executives, service specialists and healthcare compliance specialists focused on serving as a trusted advisor for our customers. In this role, our field resources provide advice, training and consultative services to assist our large-quantity customers reach their objectives of: 1) staying in compliance with local, state, and federal regulations, 2) reducing their impact on the environment, and 3) maintaining a safe work environment for their staff and patients.

We offer singular waste stream services, including regulated waste services and Sharps Management Service featuring our Bio Systems® reusable containers. Additionally, we have the ability to manage all of the waste streams generated by the facility with our Integrated Waste Stream Solutions service. Many of Stericycle’s LQ services deliver fully integrated/ turnkey solutions which include program design, clinical staff education, implementation support, onsite service personnel and the necessary service equipment to support each program.

National Accounts: As a result of our extensive geographic coverage, we are capable of servicing national account customers (i.e., customers requiring regulated waste services at various geographically dispersed locations).

Contracts: We have multi-year contracts with the majority of our customers. We negotiate individual contracts with each customer. Although we have a standard form of contract, terms may vary depending upon the customer’s service requirements and the volume of regulated waste generated and, in some jurisdictions, statutory and regulatory requirements. Substantially all of our contracts with small-quantity customers contain automatic renewal provisions.

International

We conduct regulated waste operations in Canada, Argentina, Chile, Mexico, Ireland, Portugal, Romania, and the United Kingdom. We began our operations in Canada and Mexico in 1998, Argentina in 1999, the United Kingdom in 2004, Ireland in 2006, Chile in 2008, and Romania and Portugal in 2009.

Processing Technologies

We currently use both non-incineration technologies (autoclaving, chemical treatment and our proprietary ETD technology) and incineration technologies for treating regulated waste.

Stericycle was founded on the belief that there was a need for safe, secure and environmentally responsible management of regulated medical waste. From our beginning we have championed the use of non-incineration treatment technologies such as our ETD process. While we recognize that some state regulations currently in force mandate that some types of regulated waste must be incinerated, we also know from years of experience working with our customers that there are ways to reduce the amount of regulated waste that is ultimately incinerated. The most effective strategy that we have seen involves comprehensive education of our customers in waste minimization and segregation.

Autoclaving: Autoclaving treats regulated waste with steam at high temperature and pressure to kill pathogens. Autoclaving alone does not change the appearance of waste, and some landfill operators may not accept recognizable regulated waste, but autoclaving may be combined with a shredding or grinding process to render the regulated waste unrecognizable.

ETD: Our ETD treatment process includes a system for grinding regulated waste. After grinding, ETD uses an oscillating field of low-frequency radio waves to heat regulated waste to temperatures that destroy pathogens such as viruses, bacteria, fungi and yeast without melting the plastic content of the waste. ETD does not produce regulated air or water emissions.

5

Table of Contents

Incineration: Incineration burns regulated waste at elevated temperatures and reduces it to ash. Incineration reduces the volume of waste, and it is the recommended treatment and disposal option for some types of regulated waste such as anatomical waste or residues from chemotherapy procedures. Air emissions from incinerators can contain certain byproducts that are subject to federal, state and, in some cases, local regulation. In some circumstances, the ash byproduct of incineration may be regulated.

Chem-Clave: Chemclaving treats regulated waste using high heat, pressure, and a steam auger to kill pathogens. The waste is treated in a sealed container while the auger shreds the waste, making it unrecognizable while exposing more surface area of the waste to the steam. After shredding and treatment, the waste residue is sterile and safe for landfill.

Competition

The regulated waste industry is highly competitive, and barriers to entry into the regulated waste collection and disposal business and the pharmaceutical returns business are very low. Our competitors consist of many different types of service providers, including a large number of regional and local companies. In the regulated waste industry, another major source of competition is the on-site treatment of regulated waste by some large-quantity generators, particularly hospitals.

In addition, in the regulated waste industry we face potential competition from businesses that are attempting to commercialize alternate treatment technologies or products designed to reduce or eliminate the generation of regulated waste, such as reusable or degradable medical products.

Governmental Regulation

The regulated waste industry is subject to extensive and frequently changing federal, state and local laws and regulations. This statutory and regulatory framework imposes a variety of compliance requirements, including requirements to obtain and maintain government permits. These permits grant us the authority, among other things:

| • | to construct and operate collection, transfer and processing facilities; |

| • | to transport regulated waste within and between relevant jurisdictions; and |

| • | to handle particular regulated substances. |

Our permits must be periodically renewed and are subject to modification or revocation by the issuing authority.

We are also subject to regulations that govern the definition, generation, segregation, handling, packaging, transportation, treatment, storage and disposal of regulated waste. In addition, we are subject to extensive regulations designed to minimize employee exposure to regulated waste.

Domestic Federal Regulation: Five U.S. federal agencies have authority over regulated waste. These agencies are the U.S. Environmental Protection Agency (“EPA”), OSHA, U.S. Department of Transportation (“DOT”), the U.S. Postal Service (“USPS”) and DEA. These agencies supervise regulated waste under a variety of statutes and regulations. The principal statutes and regulations are:

| • | Medical Tracking Act of 1988. In the late 1980s, the EPA outlined a two-year demonstration program pursuant to the Medical Waste Tracking Act (“MWTA”), which was added to the Resource Conservation and Recovery Act of 1976. In regulations implementing the MWTA, the EPA defined medical waste and established guidelines for its segregation, handling, containment, labeling and transport. The MWTA demonstration program expired in 1991, but the MWTA established a model followed by many states in developing their specific medical waste regulatory framework. |

6

Table of Contents

| • | Occupational Safety and Health Act of 1970. The Occupational Safety and Health Act of 1970 authorizes OSHA to issue occupational safety and health standards. Various standards apply to certain aspects of our operations and govern such matters as exposure to blood borne pathogens and other potentially infectious materials. |

| • | Resource Conservation and Recovery Act of 1976. The Resource Conservation and Recovery Act of 1976 (“RCRA”) created standards for the generation, transportation, treatment, storage and disposal of solid and hazardous wastes. Medical wastes are currently considered non-hazardous solid wastes under RCRA. However, some substances collected by us from some of our customers, including photographic fixer developer solutions, lead foils and dental amalgam, are considered hazardous wastes. |

| • | Clean Air Act Regulations. In August 1997, the EPA adopted regulations under the Clean Air Act Amendments of 1990 that limit the discharge into the atmosphere of pollutants released by regulated waste incineration. These regulations required every state to submit to the EPA for approval a plan to meet minimum emission standards for these pollutants. We currently operate seven incinerators in the United States. We believe these incinerators are in compliance with applicable state requirements. |

| • | DOT Regulations. DOT has adopted regulations under the Hazardous Materials Transportation Authorization Act of 1994 that require us to package and label regulated waste in compliance with designated standards, and which incorporate blood borne pathogens standards issued by OSHA. Under these standards, we must, among other things, identify our packaging with a “biohazard” marking on the outer packaging, and our regulated waste container must be sufficiently rigid and strong to prevent tearing or bursting. It must also be puncture-resistant, leak-resistant, properly sealed and impervious to moisture. |

Expired or recalled pharmaceuticals are subject to substantially the same DOT regulations as medical waste. We identify these products by their National Drug Code number and classify them by their handling, transportation and disposal requirements.

| • | Comprehensive Environmental Response, Compensation and Liability Act of 1980. The Comprehensive Environmental Response, Compensation and Liability Act of 1980 (“CERCLA”) established a regulatory and remedial program to provide for the investigation and cleanup of facilities that have released or threaten to release hazardous substances into the environment. CERCLA and state laws similar to it may impose strict, joint and several liability on the current and former owners and operators of facilities from which releases of hazardous substances have occurred and on the generators and transporters of the hazardous substances that come to be located at these facilities. |

| • | USPS Regulations. We have obtained permits from the USPS to conduct our “mail-back” program, pursuant to which customers mail approved containers of “sharps” (needles, knives, broken glass and the like) directly to our treatment facilities. |

| • | Controlled Substances Act. Our returns service for expired and recalled pharmaceuticals is required to comply with DEA regulations relating to the approval and permitting of processing facilities, management of employees engaged in the collection, processing and disposal of controlled substances, proper documentation and reporting to the DEA. |

Domestic State and Local Regulation: We conduct business in all 50 states and Puerto Rico. Each state has its own regulations related to the handling, treatment and storage of regulated waste. Although there are many differences among the various state laws and regulations, for regulated waste many states have followed the model under the state RCRA equivalent. In each state where we operate a processing facility or a transfer station, we are required to comply with numerous state and local laws and regulations as well as our operating plan for applicable facilities. In addition, many local governments have ordinances and regulations, such as zoning and health regulations that affect our operations.

7

Table of Contents

We maintain numerous governmental permits, registrations, and licenses to conduct our business. Our permits vary from state to state based upon our activities within that state and on the applicable state and local laws and regulations.

Foreign Regulation: We are subject to substantial regulation by the governments of the foreign jurisdictions in which we conduct regulated waste operations. The statutory and regulatory requirements vary from jurisdiction to jurisdiction.

Patents and Proprietary Rights

We consider the protection of our ETD technology to be relevant to our business. Our policy is to protect our technology by a variety of means, including applying for patents in the United States and in other foreign countries.

We hold seven current United States patents relating to the ETD treatment process and other aspects of processing regulated waste. We have filed or have been assigned patent applications in several foreign countries and we have received patents in Australia, Canada, Denmark, France, Ireland, Italy, Japan, Mexico, South Africa, South Korea, Spain, Sweden, and the United Kingdom.

The term of the first-to-end of our existing United States patents relating to our ETD treatment process ended in May 2009 and the term of the last-to-end will currently end in January 2019.

We own federal registrations of the trademarks “Steri-Fuel®”, “Steri-Plastic®”, “Steri-Tub®”, “Direct Return®”, “Steri-Safe®”, the service mark Stericycle® and a service mark consisting of a nine-circle design.

Potential Liability and Insurance

The regulated waste industry involves potentially significant risks of statutory, contractual, tort and common law liability claims. Potential liability claims could involve, for example:

| • | cleanup costs; |

| • | personal injury; |

| • | damage to the environment; |

| • | employee matters; |

| • | property damage; or |

| • | alleged negligence or professional errors or omissions in the planning or performance of work. |

We could also be subject to fines or penalties in connection with violations of regulatory requirements.

We carry $35 million of liability insurance (including umbrella coverage), and under a separate policy, $10 million of aggregate pollution and legal liability insurance ($5 million per incident), which we consider sufficient to meet regulatory and customer requirements and to protect our employees, assets and operations.

Employees

As of December 31, 2009, we had 7,784 full-time and 415 part-time employees, of which 5,524 were employed in the United States and 2,675 internationally. Approximately 300 of our U.S. drivers, transportation helpers and plant workers are covered by a total of five collective bargaining agreements with local unions of the International Brotherhood of Teamsters. These agreements expire at various dates through November 2011. We also have approximately 658 employees in Latin America under various collective bargaining agreements. We consider our employee relations to be satisfactory.

8

Table of Contents

Website Access

We maintain an Internet website, www.stericycle.com, providing a variety of information about us. Our annual reports on Form 10-K, quarterly reports on Form 10-Q and current reports on Form 8-K that we file with the Securities and Exchange Commission are available, as soon as practicable after filing, at the investors’ page on our website, or by a direct link to our filings on the SEC’s free website, www.sec.gov.

We are subject to extensive governmental regulation, which is frequently difficult, expensive and time-consuming to comply with.

The regulated waste management industry is subject to extensive federal, state and local laws and regulations relating to the collection, transportation, packaging, labeling, handling, documentation, reporting, treatment and disposal of regulated waste. Our business requires us to obtain many permits, authorizations, approvals, certificates and other types of governmental permission from every jurisdiction where we operate. We believe that we currently comply in all material respects with all applicable permitting requirements. State and local regulations change often, however, and new regulations are frequently adopted. Changes in the regulations could require us to obtain new permits or to change the way in which we operate under existing permits. We might be unable to obtain the new permits that we require, and the cost of compliance with new or changed regulations could be significant.

Many of the permits that we require, especially those to build and operate processing plants and transfer facilities, are difficult and time-consuming to obtain. They may also contain conditions or restrictions that limit our ability to operate efficiently, and they may not be issued as quickly as we need them (or at all). If we cannot obtain the permits that we need when we need them, or if they contain unfavorable conditions, it could substantially impair our operations and reduce our revenues.

The handling and treatment of regulated waste carries with it the risk of personal injury to employees and others.

Our business requires us to handle materials that may be infectious or hazardous to life and property in other ways. While we try to handle such materials with care and in accordance with accepted and safe methods, the possibility of accidents, leaks, spills, and acts of God always exists. Examples of possible exposure to such materials include:

| • | truck accidents; |

| • | damaged or leaking containers; |

| • | improper storage of regulated waste by customers; |

| • | improper placement by customers of materials into the waste stream that we are not authorized or able to process, such as certain body parts and tissues; or |

| • | malfunctioning treatment plant equipment. |

Human beings, animals or property could be injured, sickened or damaged by exposure to regulated waste. This in turn could result in lawsuits in which we are found liable for such injuries, and substantial damages could be awarded against us.

While we carry liability insurance intended to cover these contingencies, particular instances may occur that are not insured against or that are inadequately insured against. An uninsured or underinsured loss could be substantial and could impair our profitability and reduce our liquidity.

9

Table of Contents

The handling of regulated waste exposes us to the risk of environmental liabilities, which may not be covered by insurance.

As a company engaged in regulated waste management, we face risks of liability for environmental contamination. The federal Comprehensive Environmental Response, Compensation and Liability Act of 1980, or CERCLA, and similar state laws impose strict liability on current or former owners and operators of facilities that release hazardous substances into the environment as well as on the businesses that generate those substances and the businesses that transport them to the facilities. Responsible parties may be liable for substantial investigation and clean-up costs even if they operated their businesses properly and complied with applicable federal and state laws and regulations. Liability under CERCLA may be joint and several, which means that if we were found to be a business with responsibility for a particular CERCLA site, we could be required to pay the entire cost of the investigation and clean-up even though we were not the party responsible for the release of the hazardous substance and even though other companies might also be liable.

Our pollution liability insurance excludes liabilities under CERCLA. Thus, if we were to incur liability under CERCLA and if we could not identify other parties responsible under the law whom we are able to compel to contribute to our expenses, the cost to us could be substantial and could impair our profitability and reduce our liquidity. Our customer service agreements make clear that the customer is responsible for making sure that only appropriate materials are disposed of. If there were a claim against us that a customer might be legally liable for, we might not be successful in recovering our damages from the customer.

The level of governmental enforcement of environmental regulations has an uncertain effect on our business and could reduce the demand for our services.

We believe that the government’s strict enforcement of laws and regulations relating to regulated waste collection and treatment has been good for our business. These laws and regulations increase the demand for our services. A relaxation of standards or other changes in governmental regulation of regulated waste could increase the number of competitors or reduce the need for our services.

If we are unable to acquire other regulated waste businesses, our revenue and profit growth may be slowed.

Historically our growth strategy has been based in substantial part on our ability to acquire other regulated waste businesses. We do not know whether in the future we will be able to:

| • | identify suitable businesses to buy; |

| • | complete the purchase of those businesses on terms acceptable to us; |

| • | improve the operations of the businesses that we do buy and successfully integrate their operations into our own; or |

| • | avoid or overcome any concerns expressed by regulators. |

We compete with other potential buyers for the acquisition of other regulated waste companies. This competition may result in fewer opportunities to purchase companies that are for sale. It may also result in higher purchase prices for the businesses that we want to purchase.

We also do not know whether our growth strategy will continue to be effective. Our business is significantly larger than before, and new acquisitions may not have the desired benefits that we have obtained in the past.

The implementation of our acquisition strategy could be affected in certain instances by the concerns of state regulators, which could result in our not being able to realize the full synergies or profitability of particular acquisitions.

We may become subject to inquiries and investigations by state antitrust regulators from time to time in the course of completing acquisitions of other regulated waste businesses. In order to obtain regulatory clearance for

10

Table of Contents

a particular acquisition, we could be required to modify certain operating practices of the acquired business or to divest ourselves of one or more assets of the acquired business. Changes in the terms of our acquisitions required by regulators or agreed to by us in order to settle regulatory investigations could impede our acquisition strategy or reduce the anticipated synergies or profitability of our acquisitions. The likelihood and outcome of inquiries and investigations from state regulators in the course of completing acquisitions cannot be predicted.

Aggressive pricing by existing competitors and the entrance of new competitors could drive down our profits and slow our growth.

The regulated waste industry is very competitive because of low barriers to entry, among other reasons. This competition has required us in the past to reduce our prices, especially to large account customers, and may require us to reduce our prices in the future. Substantial price reductions could significantly reduce our earnings.

We face direct competition from a large number of small, local competitors. Because it requires very little money or technical know-how to compete with us in the collection and transportation of regulated waste, there are many regional and local companies in the industry. We face competition from these businesses, and competition from them is likely to exist in the new locations to which we may expand in the future. In addition, large national companies with substantial resources may decide to enter the regulated waste industry. For example, in the U.S., Waste Management, Inc., a major solid waste company, has begun offering regulated waste management services to hospitals and possibly other large quantity generators of regulated waste.

Our competitors could take actions that would hurt our growth strategy, including the support of regulations that could delay or prevent us from obtaining or keeping permits. They might also give financial support to citizens’ groups that oppose our plans to locate a treatment or transfer facility at a particular location.

Restrictions in our senior unsecured credit facility may limit our ability to pay dividends, incur additional debt, make acquisitions and make other investments.

Our senior unsecured credit facility contains covenants that restrict our ability to make distributions to stockholders or other payments unless we satisfy certain financial tests and comply with various financial ratios.

It also contains covenants that limit our ability to incur additional indebtedness, acquire other businesses and make capital expenditures, and imposes various other restrictions. These covenants could affect our ability to operate our business and may limit our ability to take advantage of potential business opportunities as they arise.

The loss of our senior executives could affect our ability to manage our business profitably.

We depend on a small number of senior executives. Our future success will depend upon, among other things, our ability to keep these executives and to hire other highly qualified employees at all levels. We compete with other potential employers for employees, and we may not be successful in hiring and keeping the executives and other employees that we need. We do not have written employment agreements with any of our executive officers, and officers and other key employees could leave us with little or no prior notice, either individually or as part of a group. Our loss of or inability to hire key employees could impair our ability to manage our business and direct its growth.

11

Table of Contents

Our expansion into foreign countries exposes us to unfamiliar regulations and may expose us to new obstacles to growth.

We plan to grow both in the United States and in foreign countries. We have established operations in the United States, Canada, Mexico, Argentina, Chile, the United Kingdom, Ireland, Portugal, and Romania. Foreign operations carry special risks. Although our business in foreign countries has not yet been affected, our business in the countries in which we currently operate and those in which we may operate in the future could be limited or disrupted by:

| • | exchange rate fluctuations; |

| • | government controls; |

| • | import and export license requirements; |

| • | political or economic instability; |

| • | trade restrictions; |

| • | changes in tariffs and taxes; |

| • | our unfamiliarity with local laws, regulations, practices and customs; |

| • | restrictions on repatriating foreign profits back to the United States or movement of funds to other countries; |

| • | difficulties in staffing and managing international operations. |

Foreign governments and agencies often establish permit and regulatory standards different from those in the United States. If we cannot obtain foreign regulatory approvals, or if we cannot obtain them when we expect, our growth and profitability from international operations could be limited. Fluctuations in currency exchange could have similar effects.

Our earnings could decline if we write-off intangible assets, such as goodwill.

As a result of acquisition accounting for our various acquisitions, our balance sheet at December 31, 2009 contains goodwill of $1.394 billion and other intangible assets, net of accumulated amortization, of $269.5 million (including indefinite lived intangibles of $71.1 million). In accordance with Accounting Standards Codification (“ASC”) Topic 350 “Intangibles—Goodwill and Other,” we evaluate on an ongoing basis whether facts and circumstances indicate any impairment of the value of indefinite-lived intangible assets such as goodwill. As circumstances after an acquisition can change, we may not realize the value of these intangible assets. If we were to determine that a significant impairment has occurred, we would be required to incur non-cash write-offs of the impaired portion of goodwill and other unamortized intangible assets, which could have a material adverse effect on our results of operations in the period in which the write-off occurs.

Item 1B. Unresolved Staff Comments

None.

We lease office space for our corporate offices in Lake Forest, Illinois. Domestically, we own or lease two ETD processing facilities, 54 facilities that provide autoclave or incineration processing, and four facilities that use other processing technologies. All of our processing facilities also serve as collection sites. We own or lease 108 additional transfer and collection sites and nine additional sales/administrative sites. Internationally, we own or lease two ETD processing facilities, 44 facilities that provide autoclave or incineration processing, and seven facilities that use other processing technologies. We also lease or own 27 transfer and collection sites, 15 additional sales/administrative sites, and lease two landfills. We believe that these processing and other facilities are adequate for our present and anticipated future needs.

12

Table of Contents

We operate in a highly regulated industry and must deal with regulatory inquiries or investigations from time to time that may be instituted for a variety of reasons. We are also involved in a variety of civil litigation from time to time.

On November 30, 2009, we entered into an agreement with the United States Department of Justice (“DOJ”) and the States of Missouri and Nebraska providing clearance under the Hart-Scott-Rodino Antitrust Improvements Act of 1976 that allowed us to complete our pending acquisition of MedServe, Inc., which we closed on December 4, 2009.

Our agreement with the DOJ and the States of Missouri and Nebraska agreement requires us to divest certain assets that we acquired from MedServe consisting of an autoclave treatment facility in Newton, Kansas, four transfer stations in Kansas, Oklahoma, Nebraska and Missouri and certain large customer accounts and associated assets related to these facilities. We are in the process of complying with the required divestiture. In addition, our agreement requires us for a period of ten years to notify the DOJ and the States of Missouri and Nebraska before acquiring any business that is engaged in both the collection and treatment of infectious waste in Kansas, Missouri, Nebraska or Oklahoma.

Item 4. Submission of Matters to a Vote of Security Holders

No matter was submitted to a vote of our stockholders during the fourth quarter of 2009.

Executive Officers of the Registrant

The following table contains certain information regarding our five current executive officers:

| Name |

Position |

Age | ||

| Mark C. Miller |

Chairman, President and Chief Executive Officer | 54 | ||

| Richard T. Kogler |

Executive Vice President and Chief Operating Officer | 50 | ||

| Frank J.M. ten Brink |

Executive Vice President and Chief Financial Officer | 53 | ||

| Richard L. Foss |

Executive Vice President, President International | 55 | ||

| Michael J. Collins |

President, Return Management Services | 53 |

Mark C. Miller has served as our Chairman, President and Chief Executive Officer since joining us in May 1992. From May 1989 until he joined us, Mr. Miller served as vice president for the Pacific, Asia and Africa in the International Division of Abbott Laboratories, which he joined in 1976 and where he held a number of management and marketing positions. Mr. Miller received a B.S. degree in computer science from Purdue University, where he graduated Phi Beta Kappa.

Richard T. Kogler joined us as Chief Operating Officer in December 1998. From May 1995 through October 1998, Mr. Kogler was vice president and chief operating officer of American Disposal Services, Inc., a solid waste management company. From October 1984 through May 1995, Mr. Kogler served in a variety of management positions with Waste Management, Inc. Mr. Kogler received a B.A. degree in chemistry from St. Louis University.

Frank J.M. ten Brink has served as our Executive Vice President, Finance and Chief Financial Officer since June 1997. From 1991 until 1996 he served as chief financial officer of Hexacomb Corporation, and from 1996 until joining us, he served as chief financial officer of Telular Corporation. Prior to 1991, he held various financial management positions with Interlake Corporation and Continental Bank of Illinois. Mr. ten Brink received a B.B.A. degree in international business and a M.B.A. degree in finance from the University of Oregon.

13

Table of Contents

Richard L. Foss has served as Executive Vice President of Corporate Development since March 2003 and became Executive Vice President, President International in July 2008. From 1999 to 2002, Mr. Foss was a corporate vice president and director of worldwide product marketing in the personal communication sector at Motorola Inc., and from 1977 until 1999, he held a number of management and marketing positions at The Procter & Gamble Company, including vice president and general manager of U.S. oral care products and general manager of U.S. respiratory and gastrointestinal products. Mr. Foss received a B.S. degree in chemistry and an M.B.A degree from Rensselaer Polytechnic Institute.

Michael J. Collins has served as President of our Return Management Services Division since June 2006. Prior to joining us, he served at Abbott Laboratories, a diversified health care company, which he joined in 1982 and where he held a number of management and marketing positions, most recently as vice president, medical products group health systems. Mr. Collins received a B.A. degree in business and education from the University of New Haven and a M.B.A. degree in business administration from National University.

14

Table of Contents

PART II.

Item 5. Market Price of and Dividends on the Registrant’s Common Equity and Related Stockholder Matters

As of February 19, 2010, we had 164 stockholders of record. The Company’s stock trades on the NASDAQ National Market under the ticker symbol SRCL.

The following table provides the high and low sales prices of our Common Stock for each calendar quarter during our two most recent fiscal years:

| Quarter |

High | Low | ||||

| First quarter 2008 |

$ | 62.13 | $ | 50.38 | ||

| Second quarter 2008 |

58.91 | 50.82 | ||||

| Third quarter 2008 |

64.77 | 49.72 | ||||

| Fourth quarter 2008 |

$ | 61.13 | $ | 48.83 | ||

| First quarter 2009 |

$ | 52.66 | $ | 45.82 | ||

| Second quarter 2009 |

52.54 | 46.11 | ||||

| Third quarter 2009 |

53.18 | 47.46 | ||||

| Fourth quarter 2009 |

$ | 58.10 | $ | 47.58 | ||

We did not pay any cash dividends during 2009 and have never paid any dividends on our common stock. We currently expect that we will retain future earnings for use in the operation and expansion of our business and do not anticipate paying any cash dividends in the foreseeable future. See Item 7, “Management’s Discussion and Analysis of Financial Condition and Results of Operations.”

Under resolutions that our Board of Directors adopted in May 2002, February 2005, February 2007, May 2007 and May 2008, we have been authorized to purchase a cumulative total of 16,224,578 shares of our common stock on the open market. As of December 31, 2009, we had purchased a cumulative total of 13,186,117 shares.

15

Table of Contents

The following table provides information about our purchases of shares of our common stock during the year ended December 31, 2009:

Issuer Purchases of Equity Securities

| Period |

Total Number of Shares (or Units) Purchased |

Average Price Paid per Share (or Unit) |

Number of Shares (or Units) Purchased as Part of Publicly Announced Plans or Programs |

Maximum Number (or Approximate Dollar Value) of Shares (or Units) that May Yet Be Purchased Under the Plans or Programs | |||||

| January 1 - January 31, 2009 |

340,965 | $ | 48.11 | 340,965 | 4,215,843 | ||||

| February 1 - February 28, 2009 |

143,998 | 46.59 | 143,998 | 4,071,845 | |||||

| March 1 - March 31, 2009 |

51,383 | 46.90 | 51,383 | 4,020,462 | |||||

| April 1 - April 30, 2009 |

39,862 | 48.52 | 39,862 | 3,980,600 | |||||

| May 1 - May 31, 2009 |

300 | 46.53 | 300 | 3,980,300 | |||||

| June 1 - June 30, 2009 |

— | — | — | 3,980,300 | |||||

| July 1 - July 31, 2009 |

— | — | — | 3,980,300 | |||||

| August 1 - August 31, 2009 |

126,578 | 49.41 | 126,578 | 3,853,722 | |||||

| September 1 - September 30, 2009 |

721,591 | 48.47 | 721,591 | 3,132,131 | |||||

| October 1 - October 31, 2009 |

93,665 | 47.83 | 93,665 | 3,038,466 | |||||

| November 1 - November 30, 2009 |

5 | 54.04 | 5 | 3,038,461 | |||||

| December 1 - December 31, 2009 |

— | — | — | 3,038,461 | |||||

| Total |

1,518,347 | $ | 48.20 | 1,518,347 | 3,038,461 | ||||

Equity Compensation Plans

The following table summarizes information as of December 31, 2009 relating to our equity compensation plans pursuant to which stock option grants, restricted stock awards or other rights to acquire shares of our common stock may be made or issued:

Equity Compensation Plan Information

| Plan Category |

Number of Securities to be Issued Upon Exercise of Outstanding Options, Warrants and Rights (a) |

Weighted-Average Exercise Price of Outstanding Options, Warrants and Rights (b) |

Number of Securities Remaining Available for Future Issuance Under Equity Compensation Plans (Excluding Securities Reflected in Column (a)) (c) | ||||

| Equity compensation plans approved by our security holders(1) |

5,705,060 | $ | 39.04 | 3,768,689 | |||

| Equity compensation plans not approved by our security holders(2) |

1,682,693 | $ | 23.18 | 414,317 | |||

| (1) | These plans consist of our 2008 Incentive Stock Plan, 2005 Incentive Stock Plan, 1997 Stock Option Plan, Directors Stock Option Plan, 1995 Incentive Compensation Plan and the Employee Stock Purchase Plan. |

| (2) | The only plan in this category is our 2000 Nonstatutory Stock Option Plan. |

In 2000, our Board of Directors approved the 2000 Nonstatutory Stock Option Plan (the “2000 Plan”), which authorized the granting of nonstatutory stock options for 7,000,000 shares of our common stock to employees (but not to officers or directors). See Note 13 to the Consolidated Financial Statements for a description of this plan.

16

Table of Contents

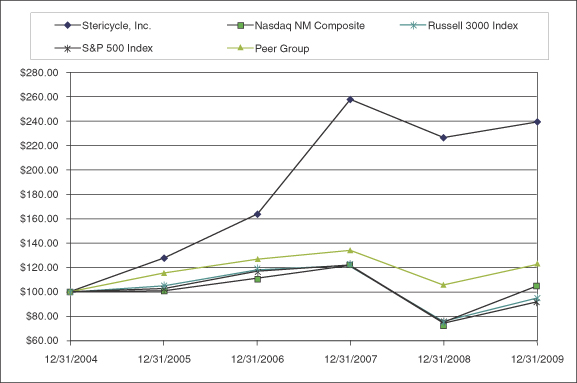

Performance Graph

The following graph compares the cumulative total return (i.e., stock price appreciation plus dividends) on our common stock over the five-year period ending December 31, 2009 with the cumulative total return for the same period on the NASDAQ National Market Composite Index, the S&P 500 Index and an index of a peer group of companies that we selected consisting of Republic Services, Inc., SRI/Surgical Express, Inc. (formerly Sterile Recoveries, Inc.), Steris Corporation, and Waste Management, Inc. The graph assumes that $100 was invested on December 31, 2004 in our common stock and in the stock represented by each of the three indexes, and that all dividends were reinvested.

The stock price performance of our common stock reflected in the following graph is not necessarily indicative of future performance.

17

Table of Contents

Item 6. Selected Consolidated Financial Data

In thousands, except per share data

| Years Ended December 31, | ||||||||||||||||||||

| 2009 | 2008 | 2007 | 2006(3) | 2005 | ||||||||||||||||

| Statement of Income Data(1) |

||||||||||||||||||||

| Revenues |

$ | 1,177,736 | $ | 1,083,679 | $ | 932,767 | $ | 789,637 | $ | 609,457 | ||||||||||

| Income from operations |

315,189 | 274,239 | 224,544 | 201,762 | 166,532 | |||||||||||||||

| Net income attributable to Stericycle, Inc. |

175,691 | 148,708 | 118,378 | 105,270 | 67,154 | |||||||||||||||

| Earnings per share – Diluted(2) |

2.03 | 1.68 | 1.32 | 1.16 | 0.74 | |||||||||||||||

| Depreciation and amortization |

39,990 | 34,148 | 31,137 | 27,036 | 21,431 | |||||||||||||||

| Statements of Cash Flow Data |

||||||||||||||||||||

| Net cash flow provided by/(used for): |

||||||||||||||||||||

| Operating activities |

$ | 277,246 | $ | 210,555 | $ | 174,042 | $ | 160,162 | $ | 94,327 | ||||||||||

| Investing activities |

(350,189 | ) | (132,930 | ) | (135,261 | ) | (201,425 | ) | (156,001 | ) | ||||||||||

| Financing activities |

81,772 | (77,882 | ) | (32,635 | ) | 52,547 | 59,500 | |||||||||||||

| Balance Sheet Data(1) |

||||||||||||||||||||

| Cash, cash equivalents and short-term investments |

$ | 16,898 | $ | 10,503 | $ | 18,364 | $ | 16,040 | $ | 8,545 | ||||||||||

| Total assets |

2,182,803 | 1,759,298 | 1,608,159 | 1,327,906 | 1,047,660 | |||||||||||||||

| Long-term debt, net of current portion |

922,919 | 753,846 | 613,781 | 443,115 | 348,841 | |||||||||||||||

| Stericycle, Inc. shareholders’ equity |

$ | 845,695 | $ | 670,480 | $ | 714,075 | $ | 625,081 | $ | 521,634 | ||||||||||

| (1) | See Note 4 to the Consolidated Financial Statements for information concerning our acquisitions during the three years ended December 31, 2009. |

| (2) | See Note 12 to the Consolidated Financial Statements for information concerning the computation of net income per common share. |

| • | In 2009, net income includes the effects of $6.8 million of after-tax transactional expenses related to acquisitions that in prior years was allowed to be capitalized, and $1.0 million of after-tax restructuring costs for our regulated returns management services business. These costs were partially offset by $1.8 million benefit due to a net release of the prior years’ tax reserves. The net effect of these transactions negatively impacted diluted earnings per share (“EPS”) by $0.06. |

| • | In 2008, net income includes nonrecurring costs (net of tax) of $3.5 million related to a business dispute settlement and related costs, and a fixed asset write-down of equipment of $0.3 million. These costs negatively impacted diluted EPS by $0.05. |

| • | In 2007, net income includes nonrecurring costs (net of tax) of $9.3 million, of which $7.7 million were net non-cash items. These costs negatively impacted EPS by $0.10, related to the following: |

| i. | We recognized legal settlement expense related to the arbitration award in Australia, including expected arbitration cost reimbursements to be paid in 2008; |

| ii. | We wrote down our investment in Medam, B.A., an Argentine joint venture. The write down of our investment in Argentina was a result of the legal restructuring of the business operations; |

| iii. | We wrote down the White Rose Environmental tradename as a result of the name change of our subsidiary in the United Kingdom; |

| iv. | We wrote down the permit intangible for a treatment facility in the United Kingdom that was no longer being used; |

| v. | We wrote down equipment that had been permanently idled; |

| vi. | We recorded a gain on the divestiture of selected assets of Sterile Technologies, Ltd., one of our subsidiaries in the United Kingdom; |

| vii. | We received proceeds from two of our insurance carriers for coverage related to the 3CI Complete Compliance Corporation (“3CI”) class action litigation settlement; |

| viii. | We divested the over the counter products portion of our Scherer Labs assets which resulted in a gain. |

18

Table of Contents

| • | In 2006, net income includes costs (net of tax) related to a fixed asset write-down of equipment of $0.2 million, write-down of an investment in securities of $0.6 million, partially offset by income recorded from insurance proceeds related to the 3CI settlement of $0.6 million. The net amount of $0.2 million did not affect EPS. |

| • | In 2005, net income includes costs (net of tax) related to the 3CI preliminary settlement of class action litigation of $23.4 million, South Africa note receivable write-down of $1.5 million, fixed asset impairments of $0.5 million, settlement of licensing litigation of $1.1 million, and items related to debt restructuring of $0.3 million which negatively impacted EPS by $0.30 per share. Of the total of $26.8 million of such items, $3.4 million were non-cash items. |

| (3) | On January 1, 2006, we adopted new accounting standards for share-based payments using the modified prospective method to account for stock compensation costs. The standard requires the measurement and recognition of compensation expense for all stock-based payment awards made to our employees and directors. During the years ended December 31, 2009, 2008, 2007 and 2006, we recognized stock compensation expense (net of tax) of $9.3, $7.3 million, $6.6 million and $6.5 million, respectively. See Note 13 to the Consolidated Financial Statements for additional information related to stock compensation expense. |

Item 7. Management’s Discussion and Analysis of Financial Condition and Results of Operations

The following discussion of our financial condition and results of operations should be read in conjunction with our Consolidated Financial Statements and related notes in Item 8 of this Report.

Introduction

We are in the business of managing regulated waste and providing an array of related services. We operate in the United States, Canada, Argentina, Chile, Mexico, Ireland, Portugal, Romania, and the United Kingdom.

For large-quantity generators of regulated waste such as hospitals and for pharmaceutical companies and distributors, we offer our institutional regulated waste management services; our Bio Systems® sharps management services to reduce the risk of needle sticks; a variety of products and services for infection control; and our regulated returns and waste management services for expired or recalled products.

For small-quantity generators of regulated waste such as doctors’ offices and for retail pharmacies, we offer: our medical and regulated waste management services; our Steri-Safe® OSHA and HIPAA compliance programs; a variety of products and services for infection control; and our regulated returns services for expired or recalled products.

We operate integrated national regulated waste management networks in the United States, Canada, Argentina, Chile, Mexico, Ireland, Portugal, Romania, and the United Kingdom. Our national networks include a total of 113 processing or combined processing and collection sites and 135 additional transfer, collection or combined transfer and collection sites.

Our regulated waste processing technologies include autoclaving, our proprietary ETD, chemical treatment, and incineration.

As of December 31, 2009, we served approximately 459,200 customers worldwide, of which approximately 447,900 were small quantity customers and 11,300 were large quantity customers.

Critical Accounting Policies and Estimates

Our discussion and analysis of our financial condition and results of operations are based upon our consolidated financial statements, which have been prepared in accordance with accounting principles generally accepted in the United States. The preparation of these financial statements requires that we make estimates and

19

Table of Contents

judgments that affect the reported amounts of assets, liabilities, revenues and expenses, and the related disclosure of contingent assets and liabilities. We believe that of our significant accounting policies (see Note 2 to the Consolidated Financial Statements), the following ones may involve a higher degree of judgment on our part and greater complexity of reporting.

Revenue Recognition: We recognize revenues for our regulated waste services at the time of waste collection. Payments received in advance are deferred and recognized as services are provided. Revenues from regulated returns management services are recorded at the time services are performed. Revenues from product sales are recognized at the time the goods are shipped to the customer. Software licensing revenues are recognized on a prorated basis over the term of the license agreement. We do not have any contracts in a loss position. Losses would be recorded when known and estimable for any contracts that should go into a loss position.

Goodwill and Other Identifiable Intangible Assets: Goodwill associated with the excess purchase price over the fair value of assets acquired is not amortized. We have determined that our permits have indefinite lives and, accordingly, are not amortized (see Note 10 to the Consolidated Financial Statements for additional information).

Our balance sheet at December 31, 2009 contains goodwill of $1.394 billion. In accordance with accounting standards, we evaluate on at least an annual basis, using the fair value of reporting units, whether goodwill is impaired. If we were to determine that a significant impairment has occurred, we would be required to incur non-cash write-offs of the impaired portion of goodwill that could have a material adverse effect on our results of operations in the period in which the write-off occurs. We use the market value of our stock compared to book as the current measurement of total fair value of our company. The performance of each of our reporting units is compared to that fair value ratio, and any unforeseen material drop in our stock price may be an indicator of a potential impairment of goodwill. The results of the 2009 impairment test conducted in June 2009 did not show any impairment of goodwill, and no events have occurred since that time that indicates that an impairment situation exists.

Our permits are tested for impairment annually at December 31 or more frequently if circumstances indicate that they may be impaired. We use a discounted income approach model as the current measurement of the fair value of the permits. The estimate of income is based upon, among other things, certain assumptions about expected future operating performance and an appropriate discount rate determined by management. Our estimates of discounted income may differ from actual income due to, among other things, inaccuracies in economic estimates. The results of the 2009 impairment test did not show any impairment of our permits and no events have occurred since that time that would indicate an impairment situation exists.

Other identifiable intangible assets, such as customer relationships, tradenames, and covenants not-to-compete, are currently amortized using the straight-line method over their estimated useful lives. We have determined that our regulated waste customer relationships have between 15-year and 40-year lives based on the specific type of relationship. This determination was based on an independent study performed on our customer relationships. Although the regulated waste management business is highly competitive, we have been able to maintain high customer retention through contracts with automatic renewal provisions and excellent customer service.

The valuation of our contractual customer relationships was derived using a discounted income approach valuation model similar to the method used for permit impairment testing mentioned earlier. These assets are reviewed for impairment whenever events or changes in circumstances indicate that the carrying amount of an asset may be less than its undiscounted estimated future cash flows. There have been no indicators of impairment of these intangibles (see Note 10 to the Consolidated Financial Statements).

20

Table of Contents

Income Taxes: We are subject to income taxes in both the U.S. and numerous foreign jurisdictions. We compute our provision for income taxes using the asset and liability method, under which deferred tax assets and liabilities are recognized for the expected future tax consequences of temporary differences between the financial reporting and tax bases of assets and liabilities and for operating loss and tax credit carry-forwards. Deferred tax assets and liabilities are measured using the currently enacted tax rates that are expected to apply to taxable income for the years in which those tax assets and liabilities are expected to be realized or settled. Significant judgments are required in order to determine the realizability of these deferred tax assets. In assessing the need for a valuation allowance, we evaluate all significant available positive and negative evidence, including historical operating results, estimates of future taxable income and the existence of prudent and feasible tax planning strategies. Changes in the expectations regarding the realization of deferred tax assets could materially impact income tax expense in future periods. To provide for certain potential tax exposures, we maintain a reserve for specific tax contingencies, the balance of which management believes is adequate.

Accounts Receivable: Accounts receivable consist primarily of amounts due to us from our normal business activities. Accounts receivable balances are determined to be delinquent when the amount is past due based on the contractual terms with the customer. We maintain an allowance for doubtful accounts to reflect the expected uncollectibility of accounts receivable based on past collection history and specific risks identified among uncollected accounts. Accounts receivable are charged to the allowance for doubtful accounts when we have determined that the receivable will not be collected and/or when the account has been referred to a third party collection agency. No single customer accounts for more than 2% of our revenues.

Insurance: Our insurance for workers’ compensation, vehicle liability and physical damage, and employee-related health care benefits is obtained using high deductible insurance policies. A third-party administrator is used to process all such claims. We require all workers’ compensation, vehicle liability and physical damage claims to be reported within 24 hours. As a result, we accrue our workers’ compensation, vehicle and physical damage liability based upon the claim reserves established by the third-party administrator at the end of each reporting period. Our employee health insurance benefit liability is based on our historical claims experience rate. Our earnings would be impacted to the extent that actual claims vary from historical experience. We review our accruals associated with the exposure to these liabilities for adequacy at the end of each reporting period.

Litigation: We operate in a highly regulated industry and deal with regulatory inquiries or investigations from time to time that may be instituted for a variety of reasons. We are also involved in a variety of civil litigation from time to time. Settlements from litigation would be recorded when known, probable and estimable.

Stock Option Plans: We have issued stock options to employees and directors as an integral part of our compensation programs. Stock-based compensation cost is measured at the grant date based on the value of the award and is recognized as expense over the vesting period. Determining the fair value of stock-based awards at the grant date requires considerable judgment, including estimating expected volatility, expected term and risk-free rate. Our expected volatility is based upon historical experience. The expected term of the stock options is based upon a measure of historical volatility of our stock price. The risk-free interest rate assumption is based upon the U.S. Treasury yield rates of a comparable period. If factors change and we employ different assumptions, stock-based compensation expense may differ significantly from what we have recorded in the past.

New Accounting Pronouncements: For information about recently issued accounting pronouncements (see Note 2 to the Consolidated Financial Statements).

Fair Value Considerations: Financial assets and liabilities are classified in their entirety based on the lowest level of input that is significant to the fair value measurement. Our assessment of the significance of a particular input to the fair value measurement requires judgment, and may affect the valuation of assets and liabilities and their placement within the fair value hierarchy levels. The impact of our creditworthiness has been considered in the fair value measurements noted below. In addition, the fair value measurement of a liability must reflect the nonperformance risk of an entity.

21

Table of Contents

At December 31, 2009, we have $15.8 million in cash and cash equivalents and $1.1 million of short-term investments that we carry on our books at fair value using Level 1 inputs.

At December 31, 2009, we have two interest rate swap contracts, covering $100 million of our borrowings outstanding under our term loan facility. The objective of the swap is to reduce the risk of volatile interest expense by fixing the rate. The fair value of the hedge is calculated using Level 2 inputs and is recorded as a current liability of $1.2 million. The fair value was determined using market data inputs to calculate expected future interest rates. The cash streams attributable to the difference between expected future rates and the fixed rate payable is discounted to arrive at the fair value of the two hedges.

As part of our acquisition accounting, we assign fair values to identifiable intangible assets; primarily customer relationships and operating permits. We use a discounted income approach whereby the expected after tax cash flows of the acquired entity are present valued. We use the financial information provided by the acquired company, and management assumptions related to future growth to determine expected future cash flows. We use data provided by unaffiliated external parties as well as internal financial information to calculate a weighted average cost of capital (“WACC”) for the acquired company. The expected cash flows and the calculated WACC are significant inputs in determining the fair value of our intangibles. During 2009, we assigned $70.0 million to customer relationships and $21.0 million to facility environmental permits using Level 3 inputs.