Attached files

| file | filename |

|---|---|

| EX-99.1 - EX-99.1 - ENTEGRIS INC | entgq12021ex991.htm |

| 8-K - 8-K - ENTEGRIS INC | entg-20210427.htm |

Earnings Summary April 27, 2021 First Quarter 2021 Exhibit 99.2

This presentation contains forward-looking statements. The words “believe,” “expect,” “anticipate,” “intend,” “estimate,” “forecast,” “project,” “should,” “may,” “will,” “would” or the negative thereof and similar expressions are intended to identify such forward-looking statements. These forward-looking statements include statements related to future period guidance; future net revenue, operating expenses, net income, diluted earnings per common share, non-GAAP operating expenses, non-GAAP net income, diluted non-GAAP earnings per common share, and other financial metrics; future repayments under the Company's credit facilities; the Company’s performance relative to its markets, including the drivers of such performance; the impact, financial or otherwise, of any organizational changes; market and technology trends, including the expected impact of the COVID-19 pandemic; the development of new products and the success of their introductions; the Company's capital allocation strategy, which may be modified at any time for any reason, including share repurchases, dividends, debt repayments and potential acquisitions; the impact of the acquisitions the Company has made and commercial partnerships the Company has established; the Company’s ability to execute on its strategies; and other matters. These statements involve risks and uncertainties, and actual results may differ materially from those projected in the forward-looking statements. These risks and uncertainties include, but are not limited to, risks related to the COVID-19 pandemic on the global economy and financial markets, as well as on the Company, our customers and suppliers, which may impact our sales, gross margin, customer demand and our ability to supply our products to our customers; weakening of global and/or regional economic conditions, generally or specifically in the semiconductor industry, which could decrease the demand for the Company’s products and solutions; the Company’s ability to meet rapid demand shifts; the Company’s ability to continue technological innovation and introduce new products to meet customers' rapidly changing requirements; the Company’s concentrated customer base; the Company’s ability to identify, complete and integrate acquisitions, joint ventures or other transactions; the Company’s ability to effectively implement any organizational changes; the Company’s ability to protect and enforce intellectual property rights; operational, political and legal risks of the Company’s international operations; the Company’s dependence on sole source and limited source suppliers; the increasing complexity of certain manufacturing processes; raw material shortages, supply constraints and price increases; changes in government regulations of the countries in which the Company operates; fluctuation of currency exchange rates; fluctuations in the market price of the Company’s stock; the level of, and obligations associated with, the Company’s indebtedness; and other risk factors and additional information described in the Company’s filings with the Securities and Exchange Commission, including under the heading “Risks Factors" in Item 1A of the Company’s Annual Report on Form 10-K for the fiscal year ended December 31, 2020, filed with the Securities and Exchange Commission on February 5, 2021, and in the Company’s other periodic filings. The Company assumes no obligation to update any forward-looking statements or information, which speak as of their respective dates. This presentation contains references to “Adjusted EBITDA,” “Adjusted EBITDA – as a % of Net Sales,” “Adjusted Operating Income,” “Adjusted Operating Margin,” “Adjusted Gross Profit,” “Adjusted Gross Margin – as a % of Net Sales,” “Adjusted Segment Profit,” “Adjusted Segment Profit Margin,” “Non-GAAP Operating Expenses,” "Non-GAAP Tax Rate," “Non-GAAP Net Income,” “Diluted Non-GAAP Earnings per Common Share” and "Free Cash Flow" that are not presented in accordance GAAP. The non-GAAP financial measures should not be considered in isolation or as a substitute for GAAP financial measures but should instead be read in conjunction with the GAAP financial measures. Further information with respect to and reconciliations of such measures to the most directly comparable GAAP financial measure can be found attached to this presentation. 2 Safe Harbor

+24% 1$513M REVENUE +41%$114M OPERATING INCOME +38% $0.70 DILUTED NON-GAAP EPS 2 +260 bps22.2% 3 OPERATING MARGIN 1. All growth data on this slide is year-on-year. 2. See appendix for GAAP to Non-GAAP reconciliations. 3. As a % of net sales. 3 $0.62 DILUTED GAAP EPS +27% First Quarter 2021 Financial Summary $128M ADJUSTED OPERATING INCOME 2 +29% 25.0% 3 ADJUSTED OPERATING MARGIN 2 +80 bps

4 $ in millions, except per share data 1Q21 1Q21 Guidance 4Q20 1Q20 1Q21 over 1Q20 1Q21 over 4Q20 Net Revenue $512.8 $510 - $525 $517.6 $412.3 24.4% (0.9%) Gross Margin 45.8% 44.6% 45.0% Operating Expenses $121.0 $118 - $120 $117.6 $104.7 15.6% 2.9% Operating Income $114.0 $113.2 $80.7 41.3% 0.7% Operating Margin 22.2% 21.9% 19.6% Tax Rate 13.7% 18.6% 12.4% Net Income $84.7 $83 - $90 $86.6 $61.0 38.9% (2.2%) Diluted Earnings Per Common Share $0.62 $0.61 - $0.66 $0.63 $0.45 37.8% (1.6%) Summary – Consolidated Statement of Operations (GAAP)

5 $ in millions, except per share data 1Q21 1Q21 Guidance 4Q20 1Q20 1Q21 over 1Q20 1Q21 over 4Q20 Net Revenue $512.8 $510 - $525 $517.6 $412.3 24.4% (0.9%) Adjusted Gross Margin – as a % of Net Sales2 45.8% 44.6% 45.1% Non-GAAP Operating Expenses3 $107.0 $104 - $106 $103.9 $86.2 24.1% 3.0% Adjusted Operating Income $128.0 $126.9 $99.6 28.5% 0.9% Adjusted Operating Margin 25.0% 24.5% 24.2% Non-GAAP Tax Rate4 14.8% 19.1% 14.6% Non-GAAP Net Income5 $95.5 $94 - $101 $97.1 $75.6 26.3% (1.6%) Diluted Non-GAAP Earnings Per Common Share $0.70 $0.69 - $0.74 $0.71 $0.55 27.3% (1.4%) Summary – Consolidated Statement of Operations (Non-GAAP)1 1. See GAAP to Non-GAAP reconciliation tables in the appendix of this presentation. 2. Excludes charges for fair value write-up of acquired inventory sold. 3. Excludes amortization expense, deal and transaction costs, integration costs and severance and restructuring costs. 4. Reflects the tax effect of non-GAAP adjustments and discrete tax items to GAAP taxes. 5. Excludes the items noted in footnotes 2 and 3 and the tax effect of non-GAAP adjustments .

6 1. See GAAP to Non-GAAP reconciliation tables in the appendix of this presentation. Sales growth (YOY): primarily driven by advanced deposition materials, cleaning chemistries, specialty gases and advanced coatings. –––––– Adj. segment profit margin (SEQ): increase in operating margin was primarily related to improvement in gross margin. $ in millions 1Q21 4Q20 1Q20 1Q21 over 1Q20 1Q21 over 4Q20 Net Revenue $166.5 $168.6 $144.2 15.5% (1.2%) Segment Profit $34.6 $29.8 $32.7 5.8% 16.1% Segment Profit Margin 20.7% 17.6% 22.7% Adj. Segment Profit1 $34.6 $29.9 $33.1 4.6% 15.7% Adj. Segment Profit Margin1 20.8% 17.7% 22.9% Specialty Chemicals and Engineered Materials (SCEM) 1Q21 Highlights

7 1. See GAAP to Non-GAAP reconciliation tables in the appendix of this presentation. Microcontamination Control (MC) 1Q21 Highlights $ in millions 1Q21 4Q20 1Q20 1Q21 over 1Q20 1Q21 over 4Q20 Net Revenue $207.1 $205.6 $159.3 30.0% 0.7% Segment Profit $70.6 $71.7 $50.2 40.7% (1.6%) Segment Profit Margin 34.1% 34.9% 31.5% Adj. Segment Profit1 $70.6 $71.9 $50.5 39.9% (1.7%) Adj. Segment Profit Margin1 34.1% 34.9% 31.7% Sales growth (YOY): primarily driven by liquid filtration and gas purification. Gas filtration had best quarter in years.

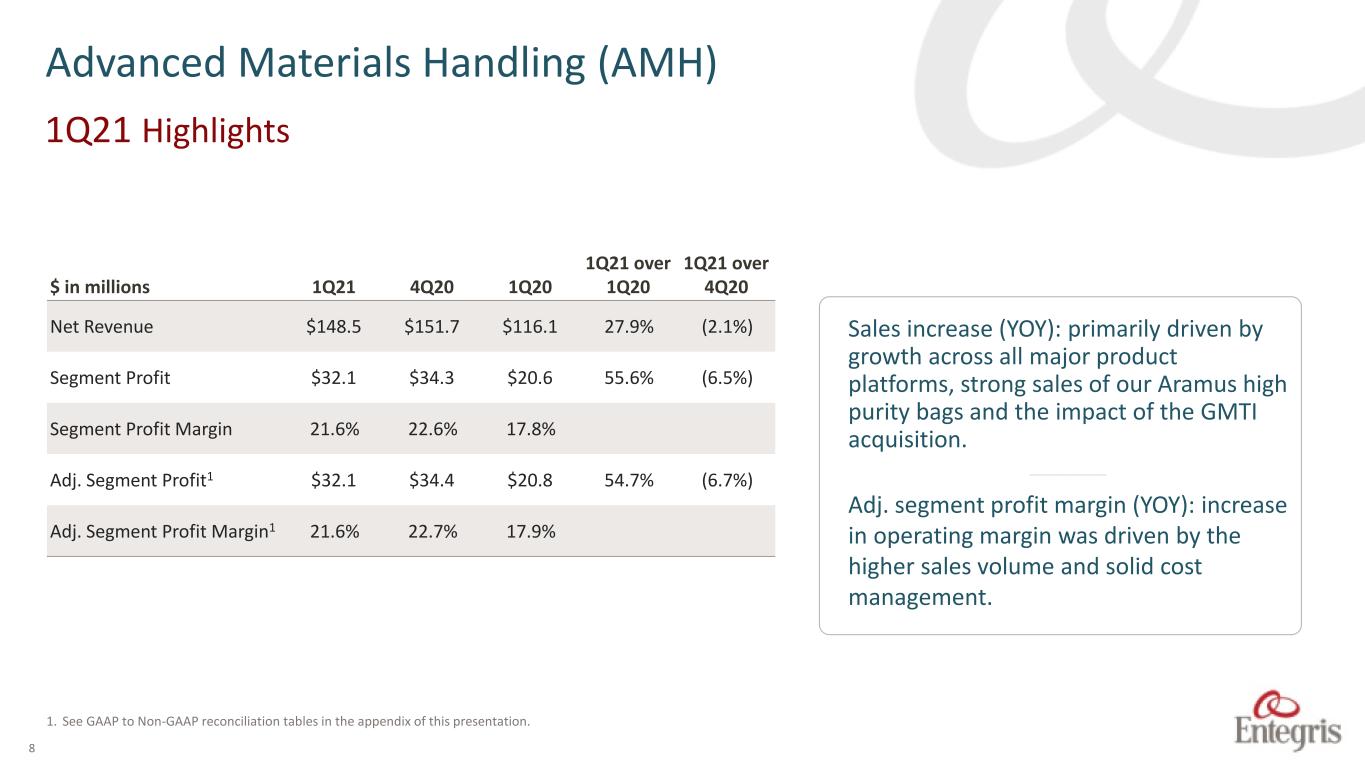

8 1. See GAAP to Non-GAAP reconciliation tables in the appendix of this presentation. Advanced Materials Handling (AMH) 1Q21 Highlights $ in millions 1Q21 4Q20 1Q20 1Q21 over 1Q20 1Q21 over 4Q20 Net Revenue $148.5 $151.7 $116.1 27.9% (2.1%) Segment Profit $32.1 $34.3 $20.6 55.6% (6.5%) Segment Profit Margin 21.6% 22.6% 17.8% Adj. Segment Profit1 $32.1 $34.4 $20.8 54.7% (6.7%) Adj. Segment Profit Margin1 21.6% 22.7% 17.9% Sales increase (YOY): primarily driven by growth across all major product platforms, strong sales of our Aramus high purity bags and the impact of the GMTI acquisition. –––––– Adj. segment profit margin (YOY): increase in operating margin was driven by the higher sales volume and solid cost management.

9 $ in millions 1Q21 4Q20 1Q20 $ Amount % Total $ Amount % Total $ Amount % Total Cash & Cash Equivalents $548.5 18.7% $580.9 19.9% $335.1 12.9% Accounts Receivable, net $282.6 9.6% $264.4 9.1% $277.8 10.7% Inventories $358.8 12.2% $323.9 11.1% $300.7 11.6% Net PP&E $542.6 18.5% $525.4 18.0% $474.8 18.3% Total Assets $2,933.5 $2,917.7 $2,598.6 Current Liabilities1 $266.3 9.1% $302.6 10.4% $202.0 7.8% Long-term Debt, Excluding Current Maturities $1,086.2 37.0% $1,085.8 37.2% $1,074.9 41.4% Total Liabilities $1,505.2 51.3% $1,538.2 52.7% $1,427.2 54.9% Total Shareholders’ Equity $1,428.3 48.7% $1,379.5 47.3% $1,171.3 45.1% AR – DSOs 50.3 46.6 61.5 Inventory Turns 3.3 3.5 3.1 Summary – Balance Sheet Items 1. Current Liabilities includes $4 million of current maturities of long term debt in 1Q20.

10 $ in millions 1Q21 4Q20 1Q20 Beginning Cash Balance $580.9 $448.0 $351.9 Cash provided by operating activities $53.1 $204.0 $11.4 Capital expenditures ($43.3) ($52.2) ($22.6) Proceeds from short-term borrowings and long-term debt — — $217.0 Payments on short-term borrowings and long-term debt — — ($75.0) Acquisition of business, net of cash — ($0.8) ($75.6) Repurchase and retirement of common stock ($15.0) ($15.0) ($29.6) Payments for dividends ($10.9) ($10.8) ($10.8) Other investing activities $0.1 $0.1 — Other financing activities ($13.5) $3.6 ($29.9) Effect of exchange rates ($2.9) $4.0 ($1.7) Ending Cash Balance $548.5 $580.9 $335.1 Free Cash Flow1 $9.8 $151.8 ($11.2) Adjusted EBITDA2 $150.1 $148.3 $120.3 Adjusted EBITDA – as a % of net sales2 29.3% 28.7% 29.2% Cash Flows 1. Free cash flow equals cash from operations less capital expenditures. 2. See GAAP to Non-GAAP reconciliation tables in the appendix of this presentation.

11 GAAP $ in millions, except per share data 2Q21 Guidance 1Q21 Actual 4Q20 Actual Net Revenue $530 - $545 $512.8 $517.6 Operating Expenses $122 - $124 $121.0 $117.6 Net Income $77 - $84 $84.7 $86.6 Diluted Earnings per Common Share $0.56 - $0.61 $0.62 $0.63 Non-GAAP $ in millions, except per share data 2Q21 Guidance 1Q21 Actual 4Q20 Actual Net Revenue $530 - $545 $512.8 $517.6 Non-GAAP Operating Expenses1 $108 - $110 $107.0 $103.9 Non-GAAP Net Income1 $106 - $113 $95.5 $97.1 Diluted non-GAAP Earnings per Common Share1 $0.77 - $0.82 $0.70 $0.71 Outlook 1. See GAAP to Non-GAAP reconciliation tables in the appendix of this presentation.

Entegris®, the Entegris Rings Design®, and other product names are trademarks of Entegris, Inc. as listed on entegris.com/trademarks. All product names, logos, and company names are trademarks or registered trademarks of their respective owners. Use of them does not imply any affiliation, sponsorship, or endorsement by the trademark owner. ©2020 Entegris, Inc. All rights reserved. 12

Appendix 13

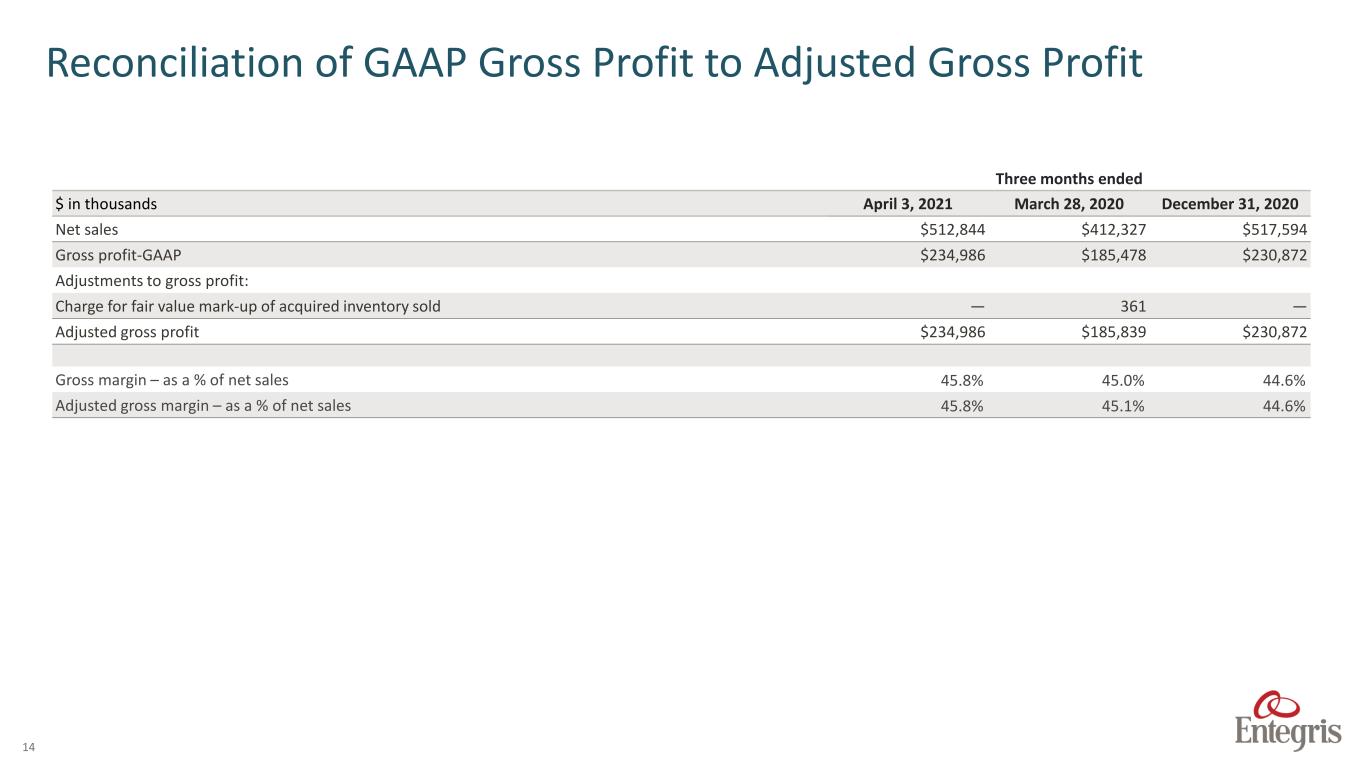

14 Reconciliation of GAAP Gross Profit to Adjusted Gross Profit Three months ended $ in thousands April 3, 2021 March 28, 2020 December 31, 2020 Net sales $512,844 $412,327 $517,594 Gross profit-GAAP $234,986 $185,478 $230,872 Adjustments to gross profit: Charge for fair value mark-up of acquired inventory sold — 361 — Adjusted gross profit $234,986 $185,839 $230,872 Gross margin – as a % of net sales 45.8% 45.0% 44.6% Adjusted gross margin – as a % of net sales 45.8% 45.1% 44.6%

15 Reconciliation of GAAP Operating Expenses and Tax Rate to Non-GAAP Operating Expenses and Tax Rate Three months ended $ in millions April 3, 2021 March 28, 2020 December 31, 2020 GAAP operating expenses $121.0 $104.7 $117.6 Adjustments to operating expenses: Deal and transaction costs — 1.4 — Integration costs 2.0 0.1 1.3 Severance and restructuring costs 0.1 0.8 0.5 Amortization of intangible assets 11.9 16.2 11.9 Non-GAAP operating expenses $107.0 $86.2 $103.9 GAAP tax rate 13.7% 12.4% 18.6% Other 1.1% 2.2% 0.5% Non-GAAP tax rate 14.8% 14.6% 19.1%

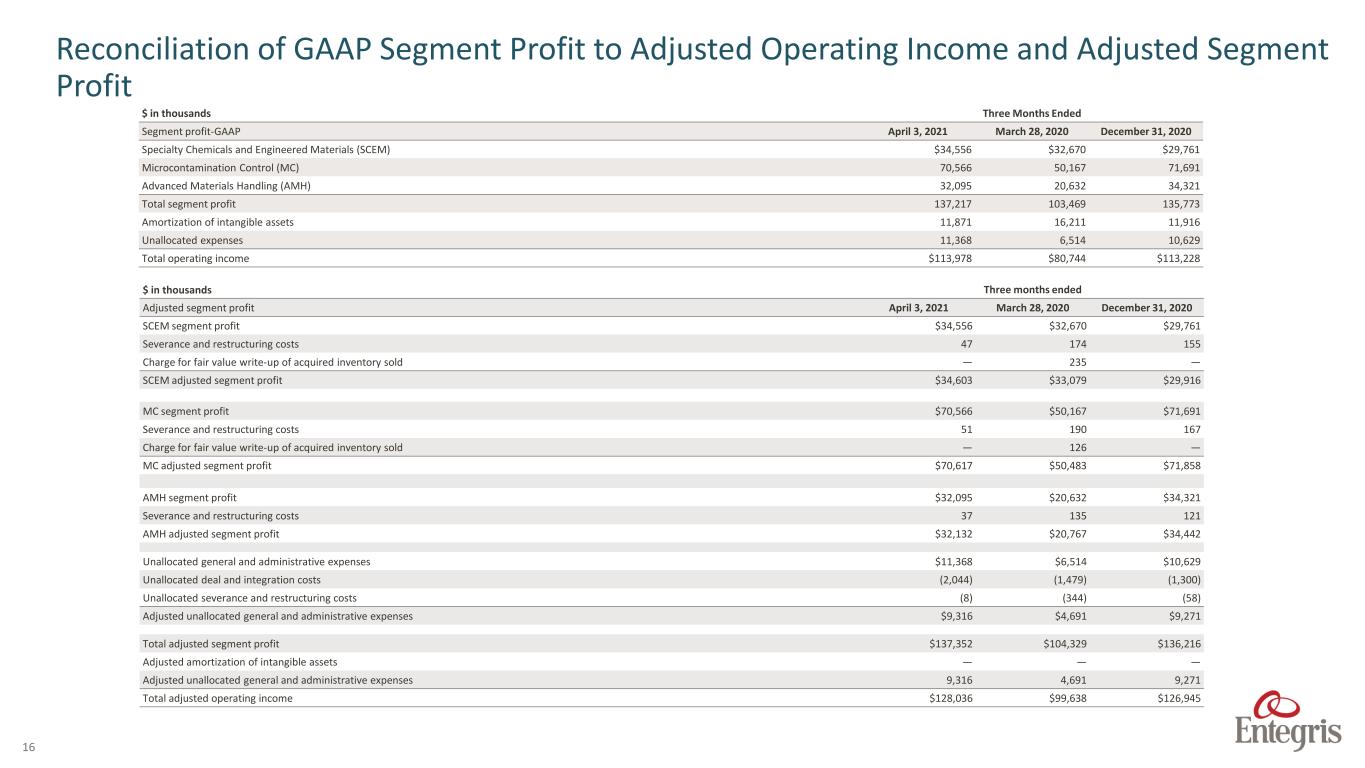

16 $ in thousands Three months ended Adjusted segment profit April 3, 2021 March 28, 2020 December 31, 2020 SCEM segment profit $34,556 $32,670 $29,761 Severance and restructuring costs 47 174 155 Charge for fair value write-up of acquired inventory sold — 235 — SCEM adjusted segment profit $34,603 $33,079 $29,916 MC segment profit $70,566 $50,167 $71,691 Severance and restructuring costs 51 190 167 Charge for fair value write-up of acquired inventory sold — 126 — MC adjusted segment profit $70,617 $50,483 $71,858 AMH segment profit $32,095 $20,632 $34,321 Severance and restructuring costs 37 135 121 AMH adjusted segment profit $32,132 $20,767 $34,442 Unallocated general and administrative expenses $11,368 $6,514 $10,629 Unallocated deal and integration costs (2,044) (1,479) (1,300) Unallocated severance and restructuring costs (8) (344) (58) Adjusted unallocated general and administrative expenses $9,316 $4,691 $9,271 Total adjusted segment profit $137,352 $104,329 $136,216 Adjusted amortization of intangible assets — — — Adjusted unallocated general and administrative expenses 9,316 4,691 9,271 Total adjusted operating income $128,036 $99,638 $126,945 $ in thousands Three Months Ended Segment profit-GAAP April 3, 2021 March 28, 2020 December 31, 2020 Specialty Chemicals and Engineered Materials (SCEM) $34,556 $32,670 $29,761 Microcontamination Control (MC) 70,566 50,167 71,691 Advanced Materials Handling (AMH) 32,095 20,632 34,321 Total segment profit 137,217 103,469 135,773 Amortization of intangible assets 11,871 16,211 11,916 Unallocated expenses 11,368 6,514 10,629 Total operating income $113,978 $80,744 $113,228 Reconciliation of GAAP Segment Profit to Adjusted Operating Income and Adjusted Segment Profit

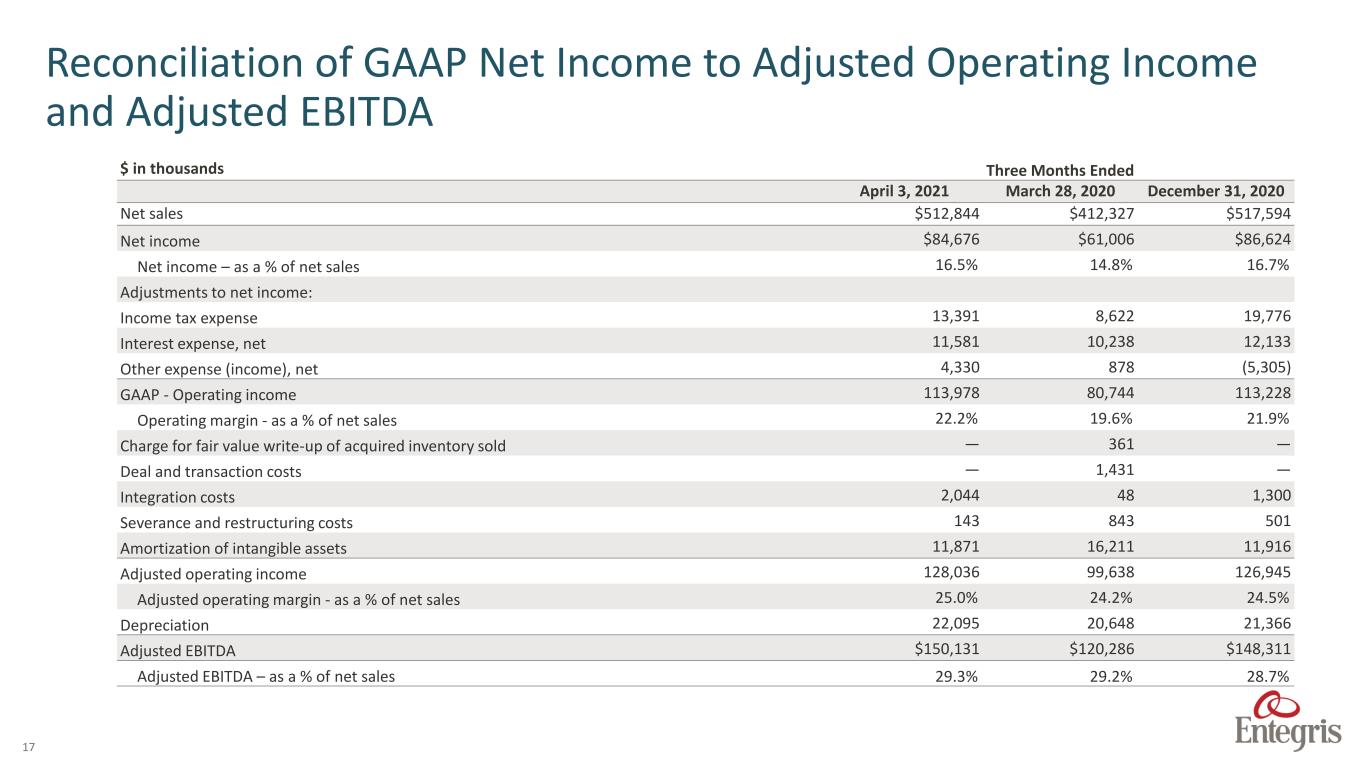

17 $ in thousands Three Months Ended April 3, 2021 March 28, 2020 December 31, 2020 Net sales $512,844 $412,327 $517,594 Net income $84,676 $61,006 $86,624 Net income – as a % of net sales 16.5% 14.8% 16.7% Adjustments to net income: Income tax expense 13,391 8,622 19,776 Interest expense, net 11,581 10,238 12,133 Other expense (income), net 4,330 878 (5,305) GAAP - Operating income 113,978 80,744 113,228 Operating margin - as a % of net sales 22.2% 19.6% 21.9% Charge for fair value write-up of acquired inventory sold — 361 — Deal and transaction costs — 1,431 — Integration costs 2,044 48 1,300 Severance and restructuring costs 143 843 501 Amortization of intangible assets 11,871 16,211 11,916 Adjusted operating income 128,036 99,638 126,945 Adjusted operating margin - as a % of net sales 25.0% 24.2% 24.5% Depreciation 22,095 20,648 21,366 Adjusted EBITDA $150,131 $120,286 $148,311 Adjusted EBITDA – as a % of net sales 29.3% 29.2% 28.7% Reconciliation of GAAP Net Income to Adjusted Operating Income and Adjusted EBITDA

18 $ in thousands, except per share data Three months ended April 3, 2021 March 28, 2020 December 31, 2020 GAAP net income $84,676 $61,006 $86,624 Adjustments to net income: Charge for fair value write-up of inventory acquired — 361 — Deal and transaction costs — 1,431 — Integration costs 2,044 48 1,300 Severance and restructuring costs 143 843 501 Amortization of intangible assets 11,871 16,211 11,916 Tax effect of adjustments to net income and discrete items1 (3,221) (4,329) (3,218) Non-GAAP net income $95,513 $75,571 $97,123 Diluted earnings per common share $0.62 $0.45 $0.63 Effect of adjustments to net income $0.08 $0.11 $0.08 Diluted non-GAAP earnings per common share $0.70 $0.55 $0.71 Weighted average diluted shares outstanding 136,502 136,369 136,438 Reconciliation of GAAP Net Income and Diluted Earnings per Common Share to Non-GAAP Net Income and Diluted Non-GAAP Earnings per Common Share 1. The tax effect of pre-tax adjustments to net income was calculated using the applicable marginal tax rate during the respective years.

19 $ in millions Second-Quarter Outlook Reconciliation GAAP net income to non-GAAP net income GAAP net income $77 - $84 Adjustments to net income: Restructuring costs 2 Amortization of intangible assets 12 Loss on extinguishment of debt 23 Income tax effect (8) Non-GAAP net income $106 - $113 Second-Quarter Outlook Reconciliation GAAP diluted earnings per share to non-GAAP diluted earnings per share Diluted earnings per common share $0.56 - $0.61 Adjustments to diluted earnings per common share: Restructuring costs 0.01 Amortization of intangible assets 0.09 Loss on extinguishent of debt 0.17 Income tax effect (0.06) Diluted non-GAAP earnings per common share $0.77 - $0.82 $ in millions Second-Quarter Outlook Reconciliation GAAP operating expenses to non-GAAP operating expenses GAAP operating expenses $122 - $124 Adjustments to net income: Restructuring costs 2 Amortization of intangible assets 12 Non-GAAP operating expenses $108 - $110 Reconciliation of GAAP Outlook to Non-GAAP Outlook

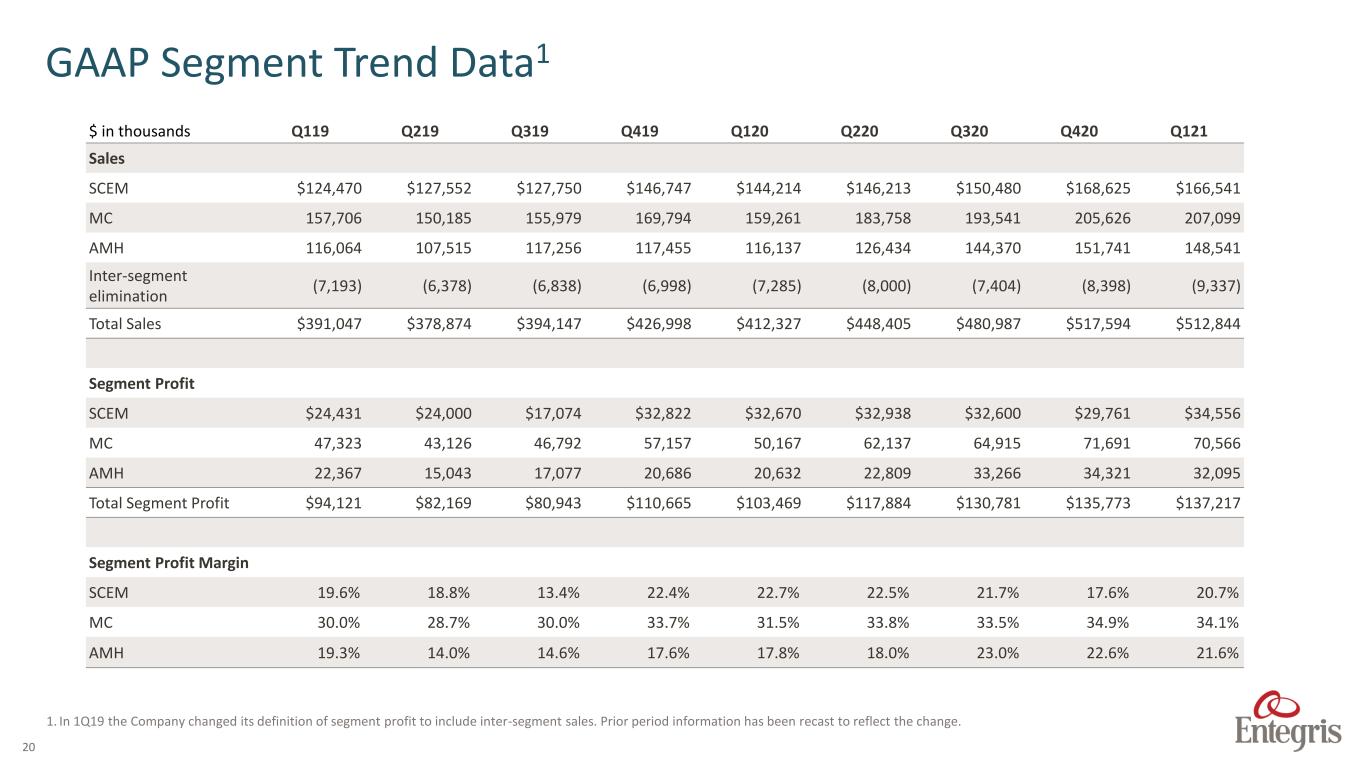

20 $ in thousands Q119 Q219 Q319 Q419 Q120 Q220 Q320 Q420 Q121 Sales SCEM $124,470 $127,552 $127,750 $146,747 $144,214 $146,213 $150,480 $168,625 $166,541 MC 157,706 150,185 155,979 169,794 159,261 183,758 193,541 205,626 207,099 AMH 116,064 107,515 117,256 117,455 116,137 126,434 144,370 151,741 148,541 Inter-segment elimination (7,193) (6,378) (6,838) (6,998) (7,285) (8,000) (7,404) (8,398) (9,337) Total Sales $391,047 $378,874 $394,147 $426,998 $412,327 $448,405 $480,987 $517,594 $512,844 Segment Profit SCEM $24,431 $24,000 $17,074 $32,822 $32,670 $32,938 $32,600 $29,761 $34,556 MC 47,323 43,126 46,792 57,157 50,167 62,137 64,915 71,691 70,566 AMH 22,367 15,043 17,077 20,686 20,632 22,809 33,266 34,321 32,095 Total Segment Profit $94,121 $82,169 $80,943 $110,665 $103,469 $117,884 $130,781 $135,773 $137,217 Segment Profit Margin SCEM 19.6% 18.8% 13.4% 22.4% 22.7% 22.5% 21.7% 17.6% 20.7% MC 30.0% 28.7% 30.0% 33.7% 31.5% 33.8% 33.5% 34.9% 34.1% AMH 19.3% 14.0% 14.6% 17.6% 17.8% 18.0% 23.0% 22.6% 21.6% GAAP Segment Trend Data1 1. In 1Q19 the Company changed its definition of segment profit to include inter-segment sales. Prior period information has been recast to reflect the change.

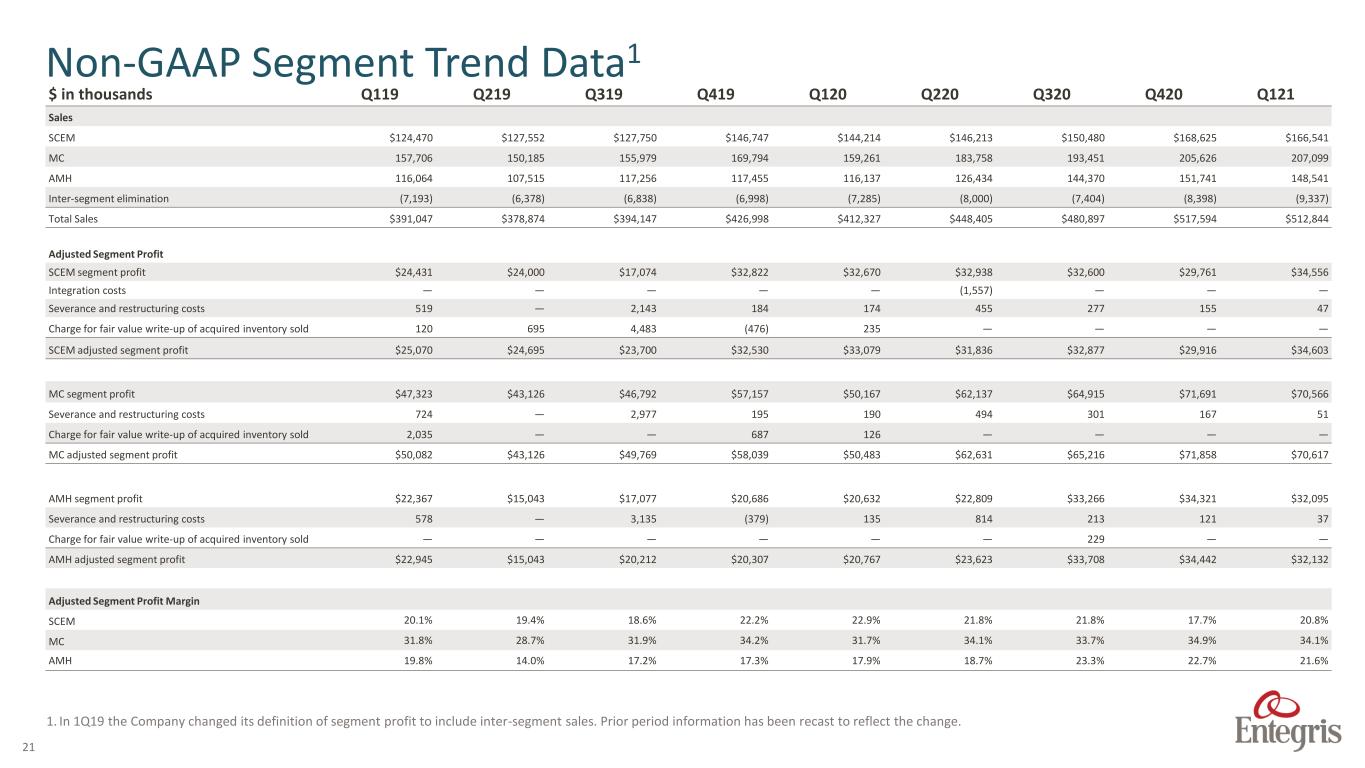

21 $ in thousands Q119 Q219 Q319 Q419 Q120 Q220 Q320 Q420 Q121 Sales SCEM $124,470 $127,552 $127,750 $146,747 $144,214 $146,213 $150,480 $168,625 $166,541 MC 157,706 150,185 155,979 169,794 159,261 183,758 193,451 205,626 207,099 AMH 116,064 107,515 117,256 117,455 116,137 126,434 144,370 151,741 148,541 Inter-segment elimination (7,193) (6,378) (6,838) (6,998) (7,285) (8,000) (7,404) (8,398) (9,337) Total Sales $391,047 $378,874 $394,147 $426,998 $412,327 $448,405 $480,897 $517,594 $512,844 Adjusted Segment Profit SCEM segment profit $24,431 $24,000 $17,074 $32,822 $32,670 $32,938 $32,600 $29,761 $34,556 Integration costs — — — — — (1,557) — — — Severance and restructuring costs 519 — 2,143 184 174 455 277 155 47 Charge for fair value write-up of acquired inventory sold 120 695 4,483 (476) 235 — — — — SCEM adjusted segment profit $25,070 $24,695 $23,700 $32,530 $33,079 $31,836 $32,877 $29,916 $34,603 MC segment profit $47,323 $43,126 $46,792 $57,157 $50,167 $62,137 $64,915 $71,691 $70,566 Severance and restructuring costs 724 — 2,977 195 190 494 301 167 51 Charge for fair value write-up of acquired inventory sold 2,035 — — 687 126 — — — — MC adjusted segment profit $50,082 $43,126 $49,769 $58,039 $50,483 $62,631 $65,216 $71,858 $70,617 AMH segment profit $22,367 $15,043 $17,077 $20,686 $20,632 $22,809 $33,266 $34,321 $32,095 Severance and restructuring costs 578 — 3,135 (379) 135 814 213 121 37 Charge for fair value write-up of acquired inventory sold — — — — — — 229 — — AMH adjusted segment profit $22,945 $15,043 $20,212 $20,307 $20,767 $23,623 $33,708 $34,442 $32,132 Adjusted Segment Profit Margin SCEM 20.1% 19.4% 18.6% 22.2% 22.9% 21.8% 21.8% 17.7% 20.8% MC 31.8% 28.7% 31.9% 34.2% 31.7% 34.1% 33.7% 34.9% 34.1% AMH 19.8% 14.0% 17.2% 17.3% 17.9% 18.7% 23.3% 22.7% 21.6% Non-GAAP Segment Trend Data1 1. In 1Q19 the Company changed its definition of segment profit to include inter-segment sales. Prior period information has been recast to reflect the change.