Attached files

| file | filename |

|---|---|

| EX-99.1 - EX-99.1 - CATHAY GENERAL BANCORP | d168303dex991.htm |

| 8-K - 8-K - CATHAY GENERAL BANCORP | caty-8k_20210426.htm |

Financial Earnings Results. First Quarter 2021 April 26, 2021 Exhibit 99.2

Forward Looking Statements This presentation contains forward-looking statements about Cathay General Bancorp and its subsidiaries (collectively referred to herein as the “Company,” “we,” “us,” or “our”) within the meaning of the applicable provisions of the Private Securities Litigation Reform Act of 1995. We intend such forward-looking statements to be covered by the safe harbor provision for forward-looking statements in these provisions. Statements that are not historical or current facts, including statements about beliefs, expectations and future economic performance, are “forward-looking statements” and are based on the information available to, and estimates, beliefs, projections, and assumptions made by, management as of the date on which such statements are first made. Forward-looking statements are not guarantees of future performance and are subject to inherent risks and uncertainties that could cause actual results to differ materially from those anticipated in the statements. These risks and uncertainties include, but are not limited to: local, regional, national and international business, market and economic conditions and events and the impact they may have on us, our customers and our operations, assets and liabilities; the impact on our business, operations, financial condition, liquidity, results of operations, prospects and trading prices of our shares arising out of the COVID-19 pandemic; possible additional provisions for loan losses and charge-offs; credit risks of lending activities and deterioration in asset or credit quality; extensive laws and regulations and supervision that we are subject to, including potential supervisory action by bank supervisory authorities; increased costs of compliance and other risks associated with changes in regulation; compliance with the Bank Secrecy Act and other money laundering statutes and regulations; potential goodwill impairment; liquidity risk; fluctuations in interest rates; risks associated with acquisitions and the expansion of our business into new markets; inflation and deflation; real estate market conditions and the value of real estate collateral; environmental liabilities; our ability to generate anticipated returns from our investments and/or financings in certain tax advantaged-projects; our ability to compete with larger competitors; our ability to retain key personnel; successful management of reputational risk; natural disasters, public health crises (including the occurrence of a contagious disease or illness, such as the COVID-19 pandemic) and geopolitical events; failures, interruptions, or security breaches of our information systems; our ability to adapt our systems to the expanding use of technology in banking; adverse results in legal proceedings; changes in accounting standards or tax laws and regulations; market disruption and volatility; restrictions on dividends and other distributions by laws and regulations and by our regulators and our capital structure; capital level requirements and successfully raising additional capital, if needed, and the resulting dilution of interests of holders of our common stock; and the soundness of other financial institutions. For a discussion of these and other risks that may cause actual results to differ from expectations, please see our Annual Report on Form 10-K (at Item 1A in particular) for the year ended December 31, 2020 and all subsequent reports and filings we make with the Securities and Exchange Commission under the applicable provisions of the Securities Exchange Act of 1934. Given these risks and uncertainties, readers are cautioned not to place undue reliance on any forward-looking statements. Any forward-looking statement speaks only as of the date on which it is first made and, except as required by law, we undertake no obligation to update or review any forward-looking statements to reflect circumstances, developments or events occurring after the date on which the statement is first made or to reflect the occurrence of unanticipated events. The information in this presentation may include financial information determined by methods other than in accordance with accounting principles generally accepted in the United States of America (“GAAP”). Our management uses these non-GAAP measures in its analysis of the Company’s performance. We believe that the presentation of certain non-GAAP measures provides useful supplemental information that is essential to a proper understanding of the operating results of our businesses. These non-GAAP disclosures should not be viewed as a substitute for operating results determined in accordance with GAAP, nor are they necessarily comparable to non-GAAP performance measures that may be presented by other companies.

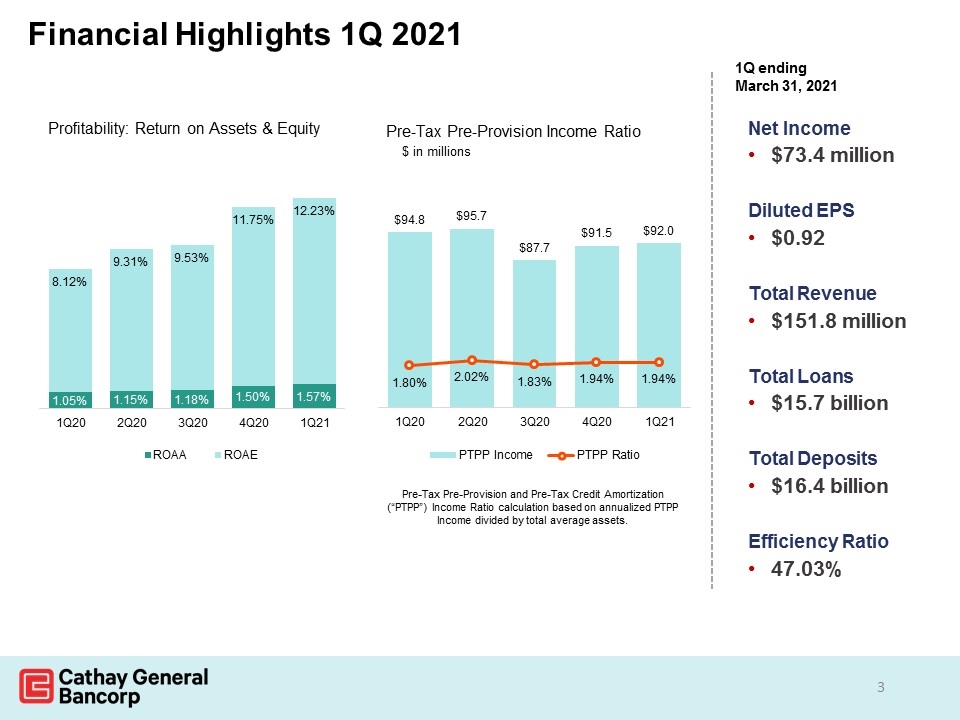

Financial Highlights 1Q 2021 1Q ending March 31, 2021 Net Income $73.4 million Diluted EPS $0.92 Total Revenue $151.8 million Total Loans $15.7 billion Total Deposits $16.4 billion Efficiency Ratio 47.03%

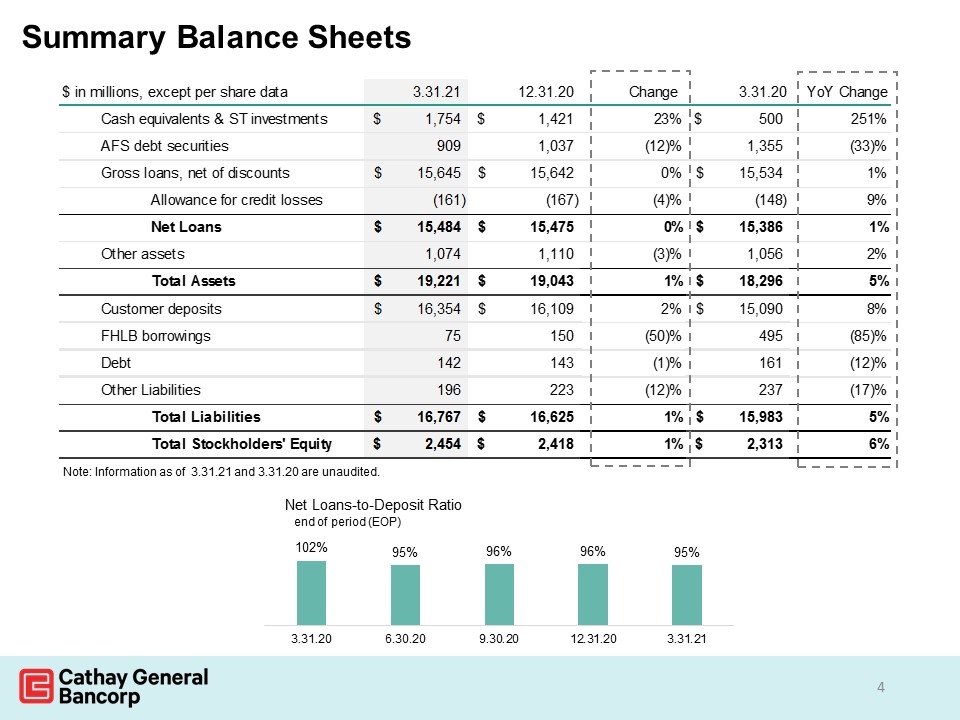

Summary Balance Sheets Note: Information as of 3.31.21 and 3.31.20 are unaudited. $ in millions, except per share data 3.31.21 12.31.20 Change 3.31.20 YoY Change Cash equivalents & ST investments $1,754 $1,421 0.23434201266713584 $500.01600000000002 2.5078877475920769 AFS debt securities 909 1037 -0.12343297974927681 1355.173 -0.32923693137333754 Gross loans, net of discounts $15,645 $15,642 1.917913310318653E-4 $15,533.934999999999 7.149830355283493E-3 Allowance for credit losses -161 -167 -3.59281437125748E-2 -148.273 8.5834912627383408E-2 Net Loans $15,484 $15,475 5.8158319870749153E-4 $15,385.662 6.3915351838614853E-3 Other assets 1074 1110 -3.2432432432432434E-2 1055.6079999999999 1.7423134345325275E-2 Total Assets $19,221 $19,043 9.3472667121776709E-3 $18,296.458999999999 5.0531143758472563E-2 Customer deposits $16,354 $16,109 1.5208889440685436E-2 $15,090 8.3764082173624965E-2 FHLB borrowings 75 150 -0.5 495 -0.84848484848484851 Debt 142 143 -6.9930069930069783E-3 161 -0.11801242236024845 Other Liabilities 196 223 -0.12107623318385652 237.25700000000001 -0.17389160277673577 Total Liabilities $16,767 $16,625 8.5413533834586275E-3 $15,983.257 4.9035249824237903E-2 Total Stockholders' Equity $2,454 $2,418 1.4888337468982549E-2 $2,313.369999999998 6.094282106166049E-2

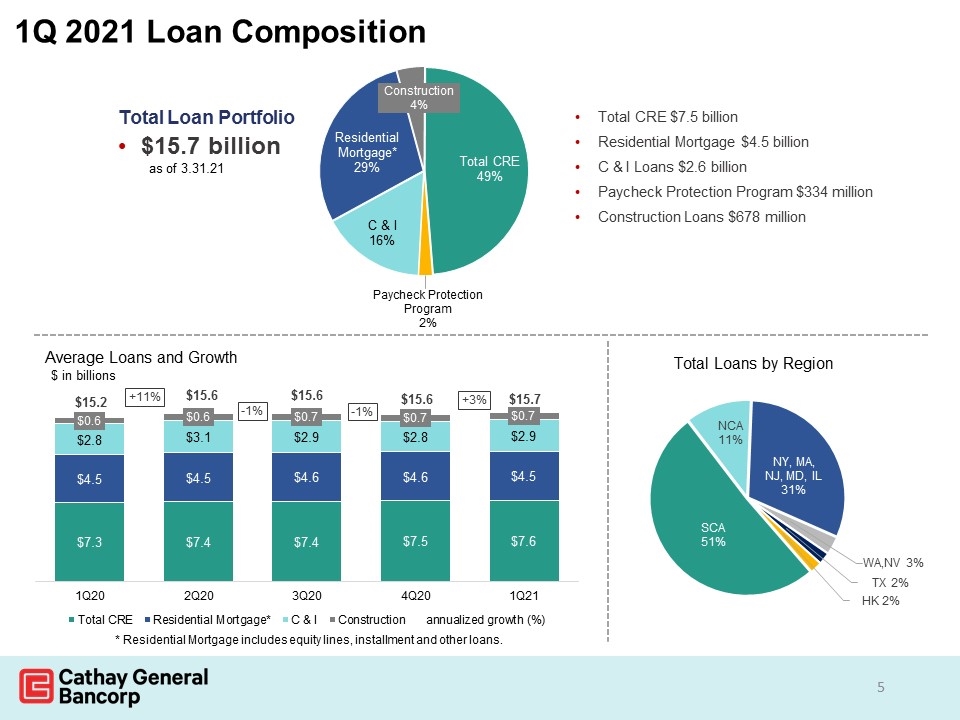

1Q 2021 Loan Composition Total Loan Portfolio $15.7 billion as of 3.31.21 * Residential Mortgage includes equity lines, installment and other loans. Total CRE $7.5 billion Residential Mortgage $4.5 billion C & I Loans $2.6 billion Paycheck Protection Program $334 million Construction Loans $678 million

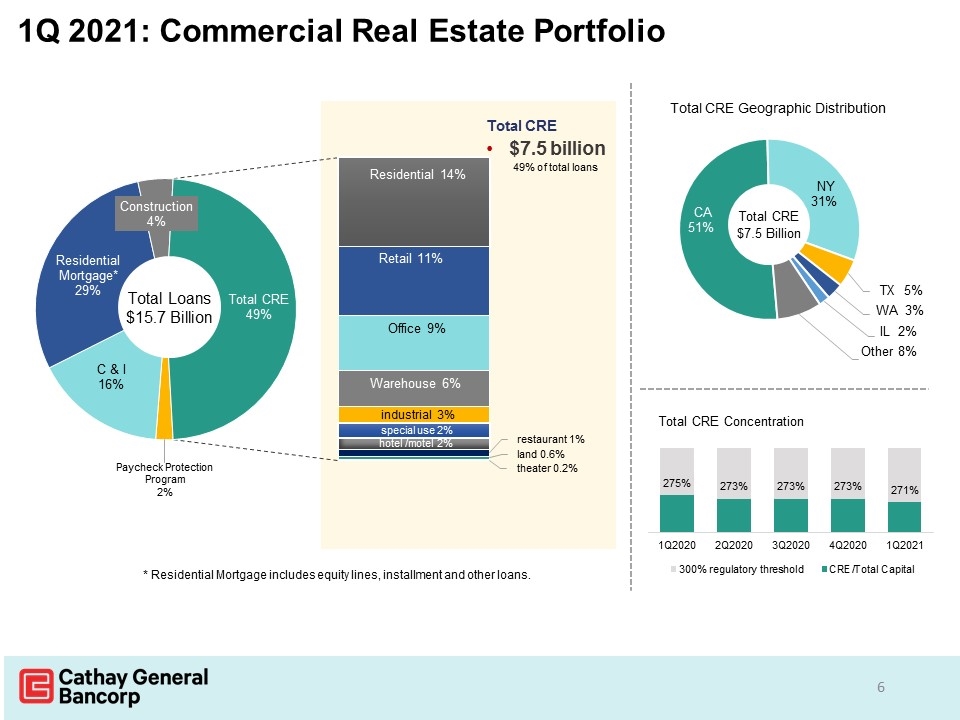

1Q 2021: Commercial Real Estate Portfolio Total CRE $7.5 billion 49% of total loans * Residential Mortgage includes equity lines, installment and other loans.

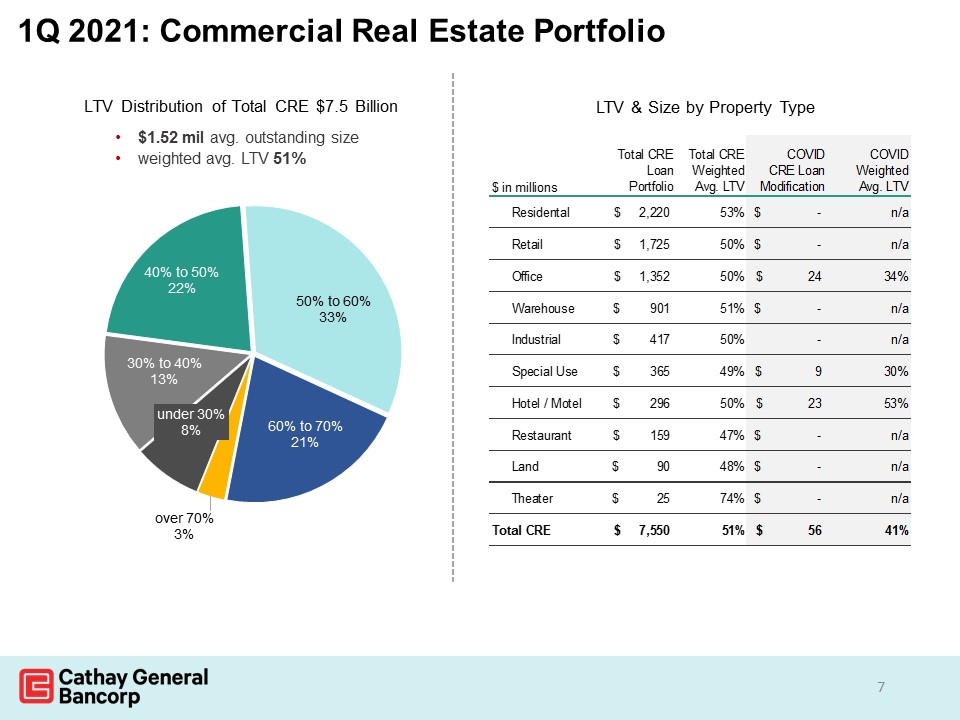

LTV & Size by Property Type 1Q 2021: Commercial Real Estate Portfolio $ in millions Total CRE Loan Portfolio Total CREWeighted Avg. LTV COVID CRE Loan Modification COVID Weighted Avg. LTV Residental $2,220 0.53300000000000003 $0 n/a Retail $1,725 0.496 $0 n/a Office $1,352 0.495 $24 0.33900000000000002 Warehouse $901 0.505 $0 n/a Industrial $417 0.502 - n/a Special Use $365 0.48599999999999999 $9 0.3 Hotel / Motel $296 0.495 $23 0.52900000000000003 Restaurant $159 0.47099999999999997 $0 n/a Land $90 0.48 $0 n/a Theater $25 0.73899999999999999 $0 n/a Total CRE $7,550 0.50700000000000001 $56 0.40899999999999997

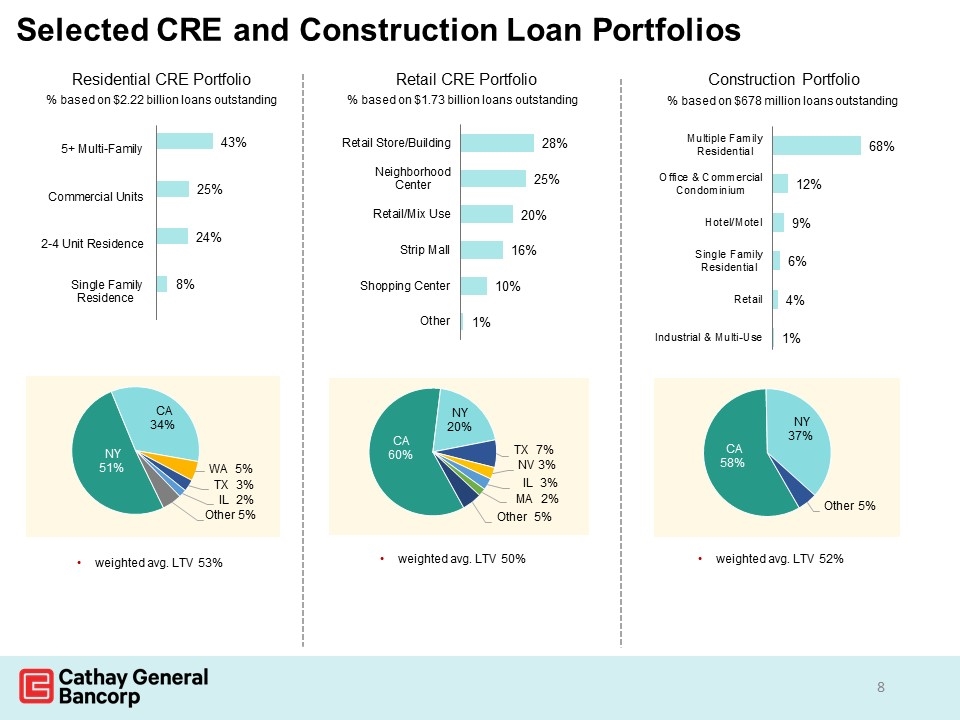

Selected CRE and Construction Loan Portfolios weighted avg. LTV 53% weighted avg. LTV 50% weighted avg. LTV 52%

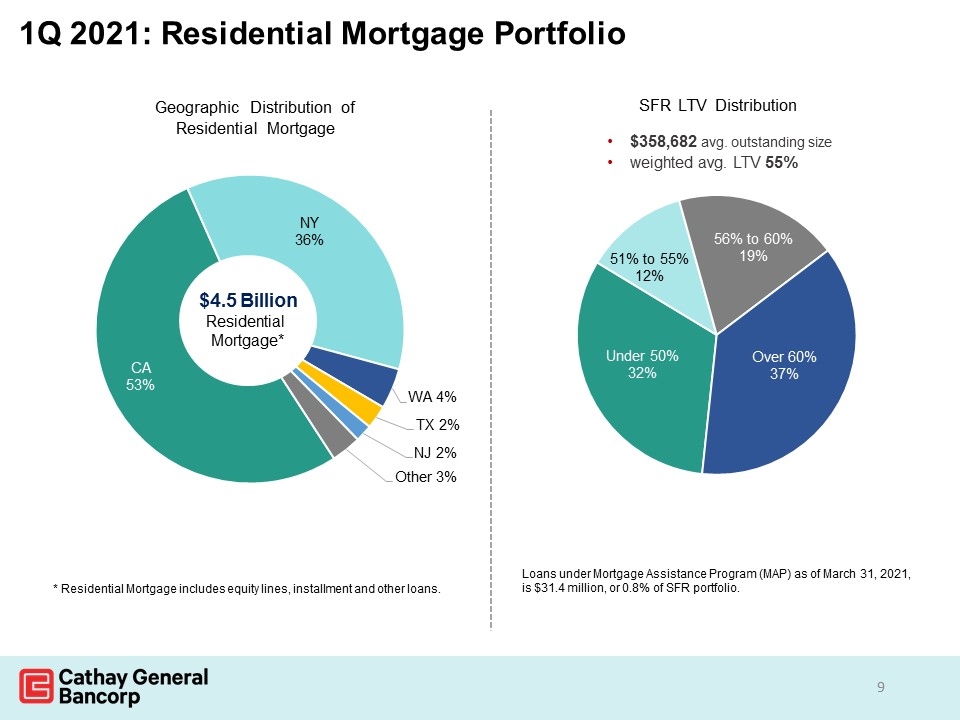

Geographic Distribution of Residential Mortgage 1Q 2021: Residential Mortgage Portfolio * Residential Mortgage includes equity lines, installment and other loans. Loans under Mortgage Assistance Program (MAP) as of March 31, 2021, is $31.4 million, or 0.8% of SFR portfolio.

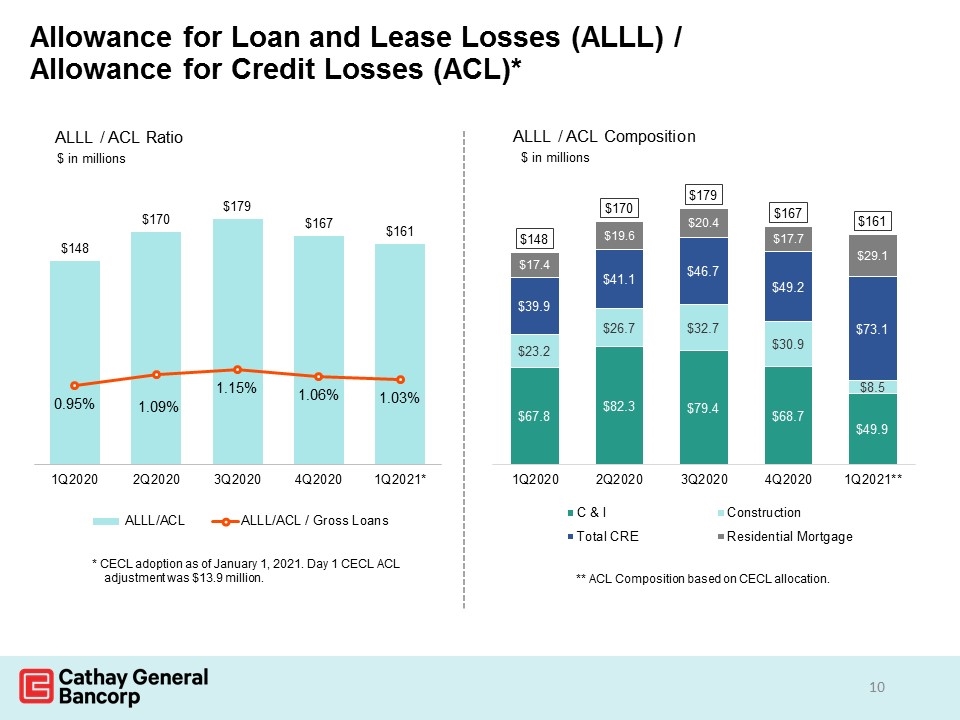

Allowance for Loan and Lease Losses (ALLL) / Allowance for Credit Losses (ACL)*

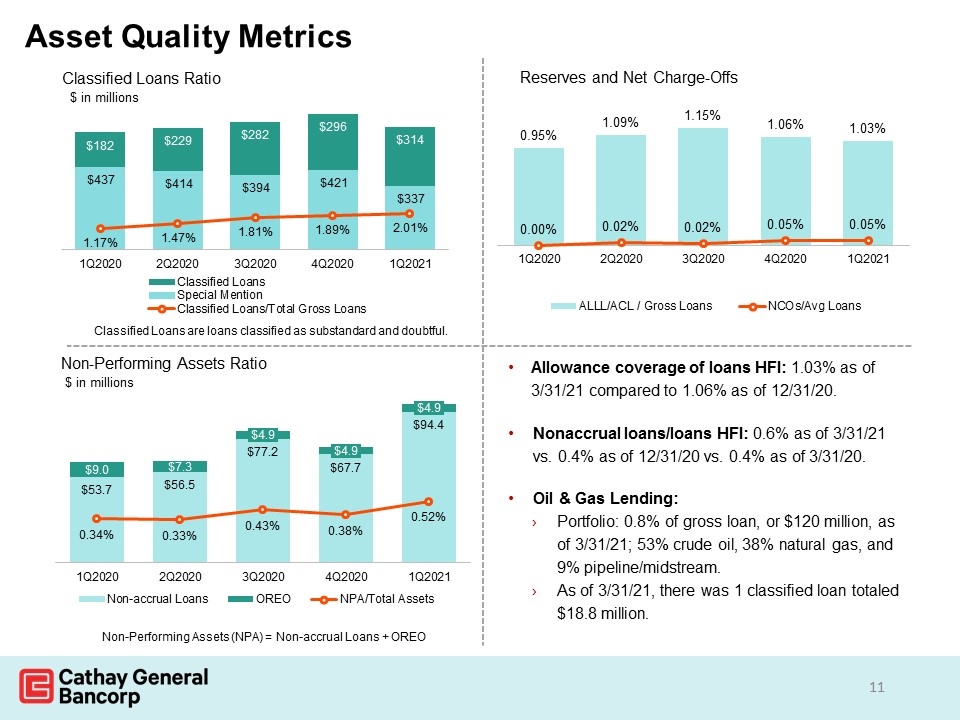

Asset Quality Metrics Allowance coverage of loans HFI: 1.03% as of 3/31/21 compared to 1.06% as of 12/31/20. Nonaccrual loans/loans HFI: 0.6% as of 3/31/21 vs. 0.4% as of 12/31/20 vs. 0.4% as of 3/31/20. Oil & Gas Lending: Portfolio: 0.8% of gross loan, or $120 million, as of 3/31/21; 53% crude oil, 38% natural gas, and 9% pipeline/midstream. As of 3/31/21, there was 1 classified loan totaled $18.8 million. Classified Loans are loans classified as substandard and doubtful. Non-Performing Assets (NPA) = Non-accrual Loans + OREO

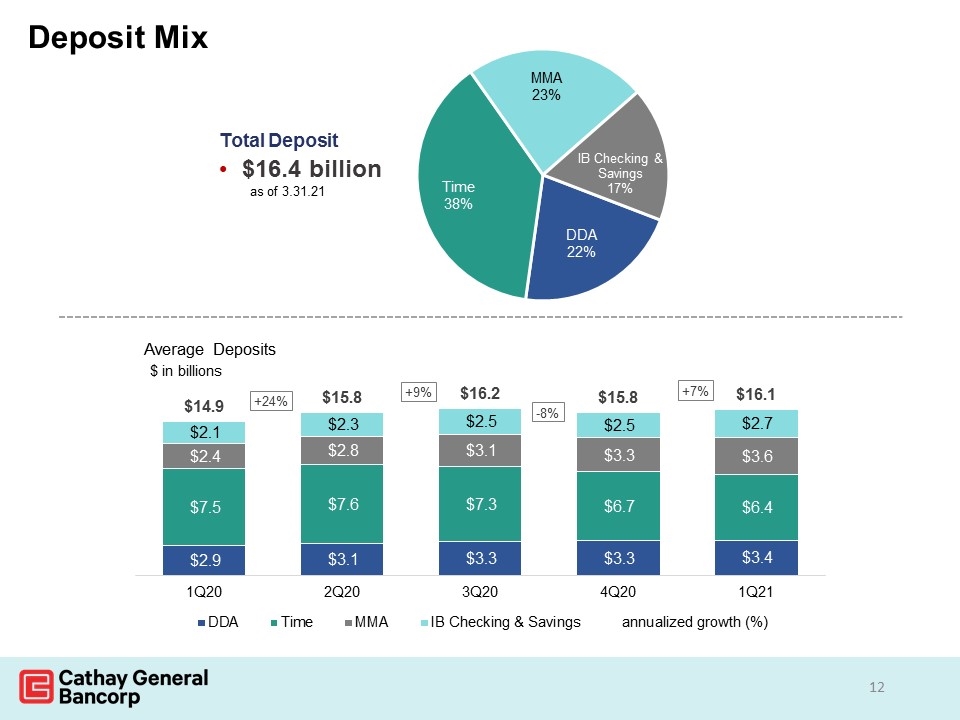

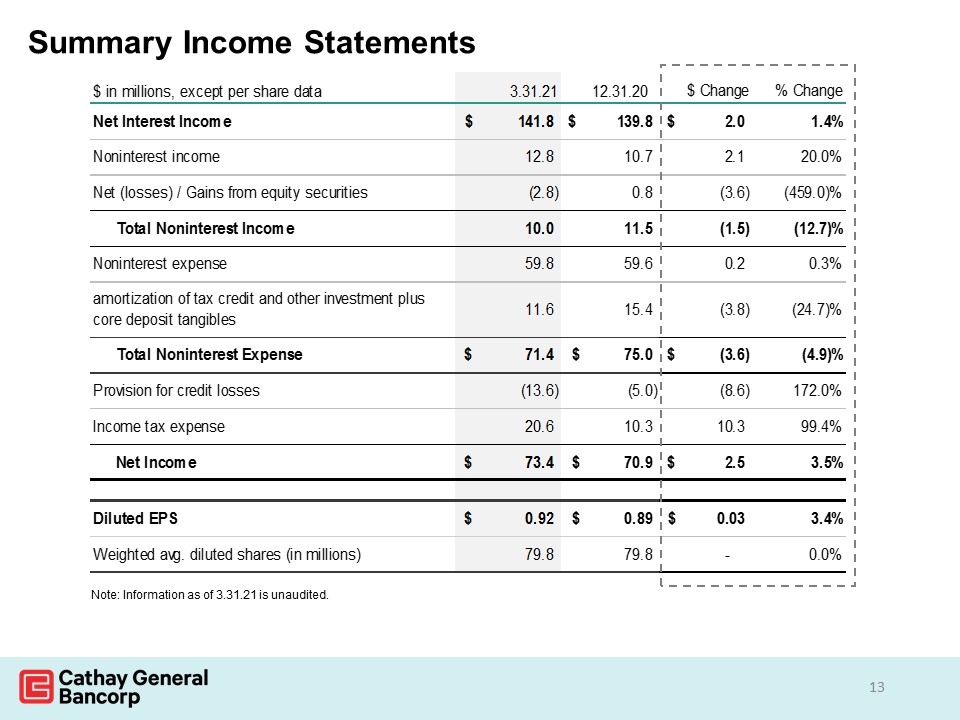

Deposit Mix Total Deposit $16.4 billion as of 3.31.21

Summary Income Statements Note: Information as of 3.31.21 is unaudited. $ in millions, except per share data 3.31.21 12.31.20 $ Change % Change Net Interest Income $141.80000000000001 $139.82 $1.9800000000000182 1.4161064225% Noninterest income 12.8 10.67 2.1300000000000008 0.19962511715089043 Net (losses) / Gains from equity securities -2.8 0.78 -3.58 -4.5897435897435894 Total Noninterest Income 10 11.45 -1.4499999999999993 -0.12663755458515277 Noninterest expense 59.800000000000004 59.645000000000003 0.15500000000000114 .2598709028% amortization of tax credit and other investment plus core deposit tangibles 11.6 15.4 -3.8000000000000007 -0.24675324675324678 Total Noninterest Expense $71.400000000000006 $75.045000000000002 $-3.644999999999996 -4.8570857486% Provision for credit losses -13.6 -5 -8.6 1.72 Income tax expense 20.6 10.332000000000001 10.268000000000001 0.99380565234223772 Net Income $73.400000000000006 $70.892999999999972 $2.5070000000000334 3.5363152921% Diluted EPS $0.92 $0.89 $3.0000000000000027E-2 3.3707865169% Weighted avg. diluted shares (in millions) 79.834149999999994 79.834149999999994 0 0.0000000000%

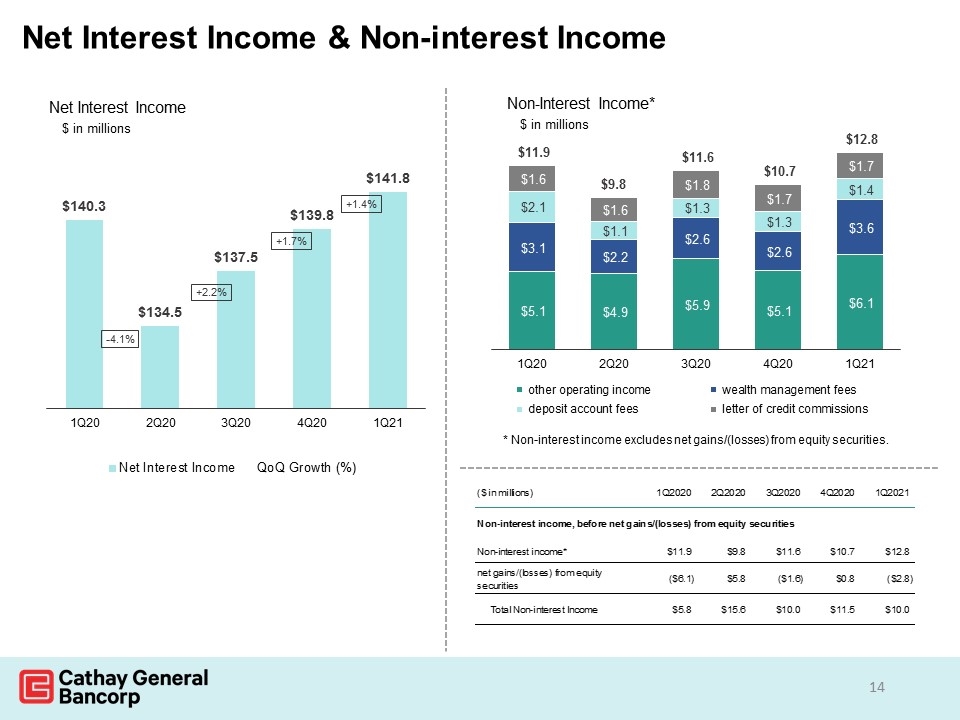

Net Interest Income & Non-interest Income $ in millions Non-Interest Income* * Non-interest income excludes net gains/(losses) from equity securities. Amortization Expense ($ in millions) 1Q2020 2Q2020 3Q2020 4Q2020 1Q2021 Non-interest income, before net gains/(losses) from equity securities Non-interest income* $11.888 $9.827 $11.6 $10.7 $12.8 net gains/(losses) from equity securities $-6.1020000000000003 $5.7789999999999999 $-1.6 $0.8 $-2.8 Total Non-interest Income $5.7859999999999996 $15.606 $10 $11.5 $10

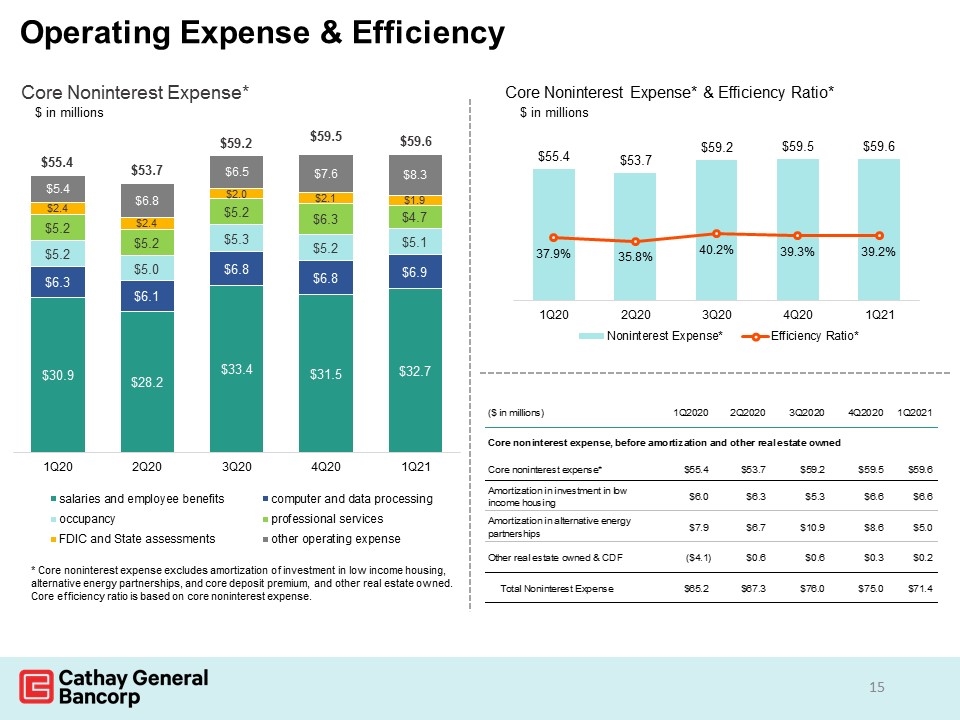

Operating Expense & Efficiency Amortization Expense ($ in millions) 1Q2020 2Q2020 3Q2020 4Q2020 1Q2021 Core noninterest expense, before amortization and other real estate owned Core noninterest expense* $55.4 $53.7 $59.2 $59.5 $59.6 Amortization in investment in low income housing $5.9805679999999999 $6.3 $5.3 $6.6 $6.6 Amortization in alternative energy partnerships $7.9090870000000004 $6.6656490000000002 $10.9 $8.6 $5 Other real estate owned & CDF $-4.0999999999999996 $0.623 $0.623 $0.3 $0.2 Total Noninterest Expense $65.189655000000002 $67.288649000000007 $76.02300000000001 $74.999999999999986 $71.400000000000006

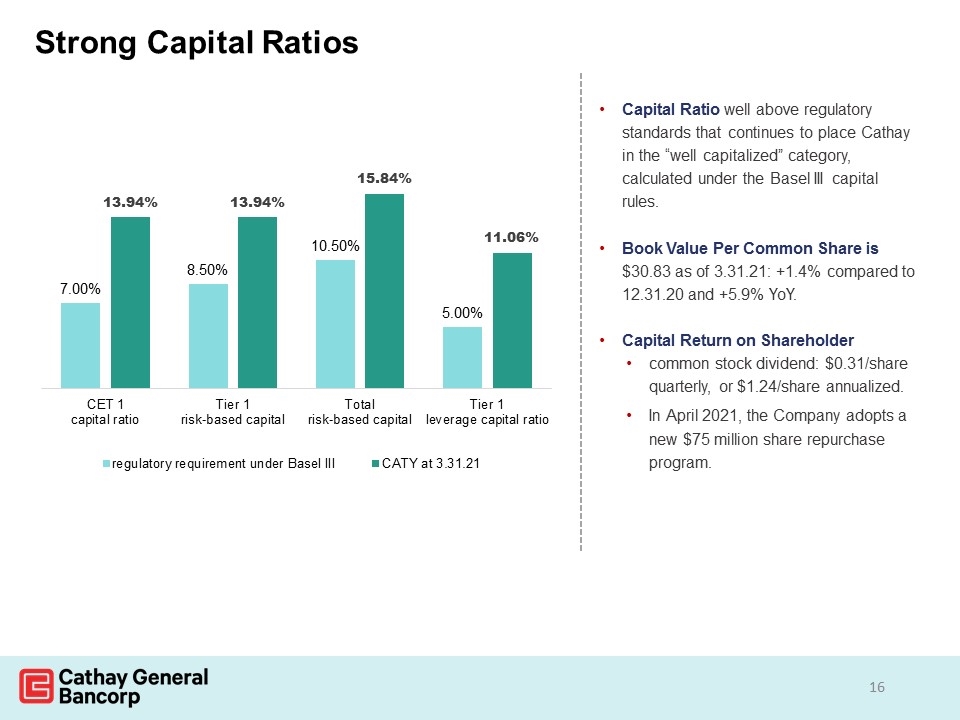

Strong Capital Ratios Capital Ratio well above regulatory standards that continues to place Cathay in the “well capitalized” category, calculated under the Basel III capital rules. Book Value Per Common Share is $30.83 as of 3.31.21: +1.4% compared to 12.31.20 and +5.9% YoY. Capital Return on Shareholder common stock dividend: $0.31/share quarterly, or $1.24/share annualized. In April 2021, the Company adopts a new $75 million share repurchase program.